The following table provides information, for each of the named executive officers, regarding the exercise of options during 2004 and unexercised options held as of December 31, 2004.

The following table provides information as of December 31, 2004 with respect to the Company's equity compensation plans.

The equity plans set forth below have not been approved by the Company's shareholders. The Second Amended and Restated 1998 Stock Option Plan was implemented in connection with the Company's initial public offering in November 1998. The 1999 Stock Option Plan and Harbourton Employee Options are broad-based plans that were not required by rules applicable at the time the plans were put in place to be approved by the shareholders.

Committee resolution, all option grants after November 3, 2004 vest in tranches with one-third vesting on each of the first three anniversaries of the date of grant. The participants' options agreements may provide for accelerated vesting of options upon a change in control of the Company. Options granted under the plan have a maximum term of 10 years.

The plan is administered by the Compensation Committee. The plan may be amended or terminated at any time, but no termination of the plan may adversely affect the rights of participants under prior awards. The plan provides that the exercise price and number of shares subject to outstanding options will be appropriately adjusted upon a stock split, stock dividend, recapitalization, combination, merger, consolidation, liquidation, or similar transaction involving a change in the Company's capitalization. The maximum number of shares that could be issued under the plan is 1,600,000 shares.

1999 Stock Option Plan. The plan became effective December 20, 1999. The plan provides for grants of nonqualified stock options to officers, employees, directors, advisors and consultants of the Company and its subsidiaries. The plan provides for automatic annual grants of 2,000 nonqualified stock options to non-employee directors. Grants to other participants are made at the discretion of the Compensation Committee. The plan requires that options be granted at not less than fair market value on the date of grant. Except with respect to the automatic grants to non-employee directors, which are fully vested at grant, options under the plan originally vested in tranches with one-third vesting on each of the first three anniversaries of the date of grant. Pursuant to a Compensation Committee resolution, all option granted between January 1, 2002 and November 3, 2004 vest in tranches with one-fifth vesting on each of the first five anniversaries of the date of grant. Pursuant to a Compensation Committee resolution, all option grants after November 3, 2004 vest in tranches with one-third vesting on each of the first three anniversaries of the date of grant. The participants' options agreements may provide for accelerated vesting of options upon a change in control of the Company. Options granted under the plan have a maximum term of 10 years.

The plan is administered by the Compensation Committee. The plan may be amended or terminated at any time, but no termination of the plan may adversely affect the rights of participants under prior awards. The plan provides that the exercise price and number of shares subject to outstanding options will be appropriately adjusted upon a stock split, stock dividend, recapitalization, combination, merger, consolidation, liquidation, or similar transaction involving a change in the Company's capitalization. The maximum number of shares that could be issued under the plan is 750,000 shares.

Harbourton Employee Options. The plan became effective December 20, 1999. The plan provides for grants of nonqualified stock options to officers, employees, directors, advisors and consultants of the Company and its subsidiaries. These options originally vested in tranches with one-third vesting on each of the first three anniversaries of the date of grant, provided that vesting is accelerated upon a change in control (as defined in the option agreements). Pursuant to a Compensation Committee resolution, all option granted between January 1, 2002 and November 3, 2004 vest in tranches with one-fifth vesting on each of the first five anniversaries of the date of grant. Pursuant to a Compensation Committee resolution, all option grants after November 3, 2004 vest in tranches with one-third vesting on each of the first three anniversaries of the date of grant. The options generally expire seven years from the date of grant, although they may expire earlier if the employee dies, retires, becomes permanently disabled or otherwise leaves the employ of the Company (in which case the options expire at various times ranging from 60 days to 2 years). The option agreements provide that the exercise price and number of shares subject to outstanding options will be appropriately adjusted upon a stock split, stock dividend, recapitalization, combination, merger, consolidation, liquidation, or similar transaction involving a change in the Company's capitalization.

The Plan is administered by the Compensation Committee. The plan may be amended or terminated at any time, unless such termination would adversely effect the rights of the participants under prior awards. The plan provides that the exercise price and number of shares, subject to outstanding options will be appropriately adjusted upon a stock split, stock dividend, recapitalization, combination, merger, consolidation, liquidation or similar transactions involving a change in the Company's capitalization. The maximum number of shares that could be issued under the plan is 750,000.

19

Compensation of Directors

Directors who are also our employees are not paid any fees or additional compensation for services as members of our Board or any committee thereof. In 2004, non-employee directors received cash in the amount of $25,000 per annum and $3,000 per Board or committee meeting attended. The chairman of the Audit Committee received a fee of $5,000 per meeting and the chairman of each of the other committees received a fee of $3,500 per meeting. Pursuant to internal policies at Pacific Life, which forbid its officers from being compensated for taking Board positions in companies in which Pacific Life has an ownership interest, the compensation of Mr. Schafer is paid directly to Pacific Life. On May 5, 2004, each non-employee director was granted an option to purchase 2,000 ordinary shares pursuant to our Second Amended and Restated 1998 Stock Option Plan with an exercise price per share equal to the fair market value of $21.70.

On May 4, 2005, non-employee directors will receive a cash retainer per annum of $65,000 and will be required to own a minimum of 8,000 of the Company's ordinary shares. The non-employee directors will have a period of either five or seven years to obtain the 8,000 ordinary shares. Non-employee directors will no longer receive an annual option to purchase 2,000 ordinary shares. Board, committee meeting and chairman payments have not changed. Pursuant to internal policies at The Cypress Group, the compensation of Mr. Spiegel is paid directly to him and then transferred to The Cypress Group.

Employment and Change of Control Agreements

Michael C. French. Under his employment agreement, Mr. French agreed to serve as Chief Executive Officer for a term commencing on February 10, 2003 and ending on February 10, 2006, to be automatically extended on each February 10 for an additional one year term, subject to 90 days advance written notice by either the Company or Mr. French of an intention not to renew the employment agreement. On January 1, 2005, Mr. French agreed to step aside as Chief Executive Officer and now serves in other capacities as an executive of the Company. The primary terms of his employment agreement have not been modified.

Scott E. Willkomm. Under his employment agreement, Mr. Willkomm has agreed to serve as President for a term commencing on July 8, 2002 and ending on July 8, 2005, to be automatically extended on each July 8 for an additional one year term, subject to 90 days' advance written notice by either the Company or Mr. Willkomm of an intention not to renew the employment agreement. On January 1, 2005, Mr. Willkomm was appointed as Chief Executive Officer of the Company. No other terms of his employment agreement were modified.

Clifford J. Wagner. Under his employment agreement, Mr. Wagner has agreed to serve as Executive Vice President and Chief Actuary for a term commencing on June 1, 2002 and ending on June 1, 2005, to be automatically extended on each June 1 for an additional one year term, subject to 90 days' advance written notice by either the Company or Mr. Wagner of an intention not to renew the employment agreement.

Seth W. Vance. Under his employment agreement, Mr. Vance agreed to serve as Chief Executive Officer of Scottish Holdings, Inc., for a term commencing on April 21, 2004 and ending on April 21, 2007, to be automatically extended on each April 21 for an additional one year term, subject to 90 days' advance written notice by either the Company or Mr. Vance of an intention not to renew the employment agreement.

Elizabeth A. Murphy. Under her employment agreement, Ms. Murphy has agreed to serve as Executive Vice President and Chief Financial Officer for an initial term commencing on April 1, 2002 and ending on April 1, 2005, to be automatically extended on each April 1 for an additional one year term, subject to 90 days' advance written notice by either the Company or Ms. Murphy of an intention not to renew the employment agreement.

Confidentiality. Each employment agreement provides that the executive will maintain in confidence all confidential matters and that the executive will not:

20

|  |

| • | during employment or, upon receipt of severance compensation upon termination of employment, for one year thereafter, participate in the management of any business enterprise that engages in substantial and direct competition with us; or |

|  |

| • | during employment or for one year thereafter, attempt to influence, persuade or induce (or assist any other person in so persuading or inducing) any employee to leave us. |

Severance. In addition, each executive is entitled to severance compensation in the event of:

|  |

| • | termination by us of the executive's employment in any case other than death, disability or cause; |

|  |

| • | termination by the executive of employment for "good reason" which shall mean |

|  |

| (A) | prior to a change in control: |

|  |  |

| (i) | the Company's failure to comply with any material provision of the employment agreement; |

|  |  |

| (ii) | liquidations, dissolution, merger, consolidation or reorganization of the Company or all of its business and/or assets, unless a successor assumes all duties and obligations under the executive's employment agreement; or |

|  |  |

| (iii) | upon our notification to the executive of our intent not to renew the executive's employment agreement at the expiration of the initial term or any anniversary thereafter. |

|  |

| (B) | on or after a change in control: |

|  |  |

| (i) | any of the events referenced above; |

|  |  |

| (ii) | any material and adverse change to the executive's duties or authority inconsistent with the executive's title; |

|  |  |

| (iii) | diminution of executive's title or positions; |

|  |  |

| (iv) | the relocation of executive's office; |

|  |  |

| (v) | a reduction of executive's base salary; or |

|  |  |

| (vi) | a mutual reduction of executive's benefits. |

In the case of Mr. French, good reason prior to a change in control shall also be for any reason or without reason after the expiration of March 23, 2008 and November 29, 2009, respectively.

In the case of Messrs. French and Willkomm and Ms. Murphy, good reason after a change of control shall also be for any reason or without reason.

The severance compensation that Mr. French will be entitled to upon any termination referred to above includes a lump sum payment equal to three times the sum of his annual base salary and incentive compensation at the highest respective rates in effect for any year prior to the termination.

The minimum severance compensation that each executive, excluding Mr. French, will be entitled to upon any such termination includes a lump sum payment equal to either one (Mr. Wagner) or two (Mr. Vance and Ms. Murphy) times the sum of:

|  |

| • | the executive's respective annual base pay at the highest rate in effect for any year prior to the termination; and |

|  |

| • | the annual incentive compensation at the highest rate in effect for any year prior to the termination. |

For both Mr. Wagner and Ms. Murphy, the sum listed above also includes the housing allowance at the highest rate in effect for any year prior to termination.

Change of Control. In the instance of a change of control, each executive will be entitled to a lump sum payment equal to three times the sum of:

|  |

| • | the executive's respective annual base pay at the highest rate in effect for any year prior to the termination; and |

21

|  |

| • | the annual incentive compensation at the highest rate in effect for any year prior to termination. |

For both Mr. Wagner and Ms. Murphy, the sum listed above also includes the housing allowance at the highest rate in effect for any year prior to termination.

Compensation Committee Interlocks and Insider Participation

During fiscal year 2004, the Compensation Committee had responsibility for our executive compensation practices and policies. No officer or employee of the Company or its subsidiaries is a member of the Compensation Committee.

REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board had responsibility for our executive compensation practices and policies in 2004. The four directors on the Compensation Committee were independent, outside directors. Of the nine directors on the Board at the end of 2004, seven were independent, outside directors who were not officers or employees.

Executive Pay Policy and Objectives

Our compensation is intended to attract, retain and motivate the key people necessary to lead us to achieve our strategic objective of increased shareholder value over the long term, reflecting our belief that executive compensation should seek to align the interests of our executives with those of our shareholders.

In addition, we believe compensation should be determined within a competitive framework based on overall financial results, teamwork and individual contributions that help build shareholder value. The primary objectives of our compensation program are to:

|  |

| • | provide a direct link between pay and performance; |

|  |

| • | allocate a larger percentage of executive compensation to pay that is conditional or contingent in order to positively influence behavior and support accountability; |

|  |

| • | offer total compensation opportunities that are fully competitive with external markets in design and pay level; and |

|  |

| • | emphasize the need to focus on shareholder value, in addition to providing competitive value to our customers. |

Our compensation program utilizes four components to meet our compensation objectives: base salary, bonuses, short-term incentives and long-term compensation in the form of restricted shares and stock options.

In establishing base salaries, we have adopted a strategy of setting executive salaries at or above market to retain and attract key executives, while providing incentive compensation pay opportunities, based on performance achievement. We set the salary ranges in this manner to ensure that our base salary practices do not put us at a competitive disadvantage in retaining and attracting key executives while ensuring an appropriate cost structure.

Annual bonus compensation is based on individual and corporate performance during the prior fiscal year in relationship to performance targets. Under their respective employment contracts, each executive is eligible to receive a cash bonus at the sole discretion of the Board. Factors taken into consideration include, but are not limited to, ordinary share performance relative to our industry peer group, revenue and earnings growth, investment management results, return on shareholder equity and other key financial and operational measures. The bonuses awarded in 2004 were based on the aforementioned factors and were consistent with the level of accomplishment and appropriately reflected individual and Company performance in 2004.

We believe that our current program of a base salary, bonuses and long- and short- term performance-based compensation that can be earned by our executive officers will increase long-term shareholder value.

22

Base Salary and Bonuses

The Board has reviewed and adjusted the salaries of its named executive officers for 2005. Messrs. Willkomm's, Wagner's and Ms. Murphy's 2005 annual base salary was increased to $750,000, $350,000 and $350,000, respectively. Messrs. French's and Vance's annual base salary for 2005 was not increased. In February 2005 the Company paid Messrs. French, Willkomm, Wagner, and Vance and Ms. Murphy a bonus in the amount of $400,000, $750,000, $175,000, $250,000 and $175,000, respectively, in recognition of the performance and contribution of each to our business in 2004.

The base salary adjustments for Messrs. Willkomm, Wagner and Ms. Murphy for 2005 were determined by the Compensation Committee's evaluation of their individual contributions toward the creation of shareholder value and the competitive market for the services of individuals possessing their skills and experience. Bonuses awarded to the above named executives were determined upon the same factors used for all executive management of the Company, including but not limited to our ordinary share performance, revenue and business growth, investment management results, return on shareholders' equity and growth of our operating income.

Compensation of Chief Executive Officer

Mr. French served as the Company's Chairman of the Board and Chief Executive Officer during 2004. The Compensation Committee approved all components of Mr. French's 2004 compensation. The compensation reported for Mr. French in the compensation tables and discussed in this report represents amounts paid for Mr. French's services in 2004.

Mr. French's 2004 compensation was determined pursuant to the same policy and philosophy used for all executive officers. In determining Mr. French's total compensation for 2004, the Compensation Committee reviewed the strong financial results of the Company, Mr. French's superior leadership during his tenure, his industry experience, his role in the continued strategic positioning of the Company and achievement of operational goals.

Equity Compensation

Prior to February 11, 2002, the Option Committee oversaw the administration of the Equity Compensation Plans. The Equity Compensation Plans are designed to provide incentive compensation to our directors, executive officers, and other key employees, consultants and advisors. Since February 11, 2002 the Compensation Committee has overseen the administration of the Option Plans.

The foregoing report on executive compensation is provided by the Compensation Committee of the Board of Directors of the Company during 2004:

Bill Caulfeild-Browne – Chairman

Michael Austin

Lord Norman Lamont

Glenn Schafer

Code of Ethics

We have adopted a Code of Ethics applicable to our Chief Executive Officer, Chief Financial Officer, senior officers of the Company and certain other financial executives, which is a "code of ethics" as defined by applicable rules of the SEC. We have also adopted a Business Code of Conduct applicable to all officers, directors and employees of the Company. A copy of our Code of Ethics and/or our Business Code of Conduct may be obtained without charge by written request to the attention of the Secretary of Scottish Re Group Limited, P.O. Box HM 2939, Crown House, Third Floor, 4 Par-la-Ville Road, Hamilton HM 08, Bermuda.

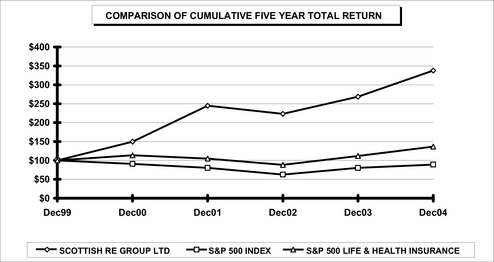

Performance Graph

The following graph compares the cumulative shareholder return on our ordinary shares with the Standard & Poor's 500 Stock Index, Standard & Poor's (Life/Health) Index. The indices are included for

23

comparative purposes only, do not necessarily reflect management's opinion that such indices are an appropriate measure of relative performance of the Company's ordinary shares, and are not intended to forecast or be indicative of future performance of the ordinary shares. The comparison assumes $100 was invested as of November 24, 1998 (the date our ordinary shares began trading on a "when issued" basis) and the reinvestment of all dividends. The closing market price of the Company's ordinary shares on December 31, 2004 was $25.90 per share.

Comparison of Cumulative Shareholder Return

Total Return To Shareholders

(Includes reinvestment of dividends)

ANNUAL RETURN PERCENTAGE

Years Ending

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Company / Index |  | Dec 00 |  | Dec 01 |  | Dec 02 |  | Dec 03 |  | Dec 04 |

| SCOTTISH RE GROUP LTD |  | | 49.74 | |  | | 63.46 | |  | | -8.77 | |  | | 20.29 | |  | | 25.75 | |

| S&P 500 INDEX |  | | -9.10 | |  | | -11.89 | |  | | -22.10 | |  | | 28.68 | |  | | 10.88 | |

| S&P 500 LIFE & HEALTH INSURANCE |  | | 13.81 | |  | | -7.73 | |  | | -16.23 | |  | | 27.09 | |  | | 22.15 | |

|

INDEXED RETURNS

Years Ending

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Company / Index |  | Base

Period

Dec 99 |  | Dec 00 |  | Dec 01 |  | Dec 02 |  | Dec 03 |  | Dec 04 |

| SCOTTISH RE GROUP LTD |  | | 100 | |  | | 149.74 | |  | | 244.76 | |  | | 223.30 | |  | | 268.60 | |  | | 337.78 | |

| S&P 500 INDEX |  | | 100 | |  | | 90.90 | |  | | 80.09 | |  | | 62.39 | |  | | 80.29 | |  | | 89.03 | |

| S&P 500 LIFE & HEALTH INSURANCE |  | | 100 | |  | | 113.81 | |  | | 105.01 | |  | | 87.96 | |  | | 111.80 | |  | | 136.55 | |

|

24

PROPOSAL FOR RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

(Proposal No. 3)

On February 8, 2005, the Audit Committee selected, and the Board unanimously approved the selection, subject to ratification by the Company's shareholders, of Ernst & Young LLP to continue to serve as independent registered public accounting firm for the Company and its subsidiaries for the fiscal year ending December 31, 2005. Ernst & Young LLP has served as the Company's independent registered public accounting firm since 1998.

Representatives of Ernst & Young LLP are expected to be present at the Annual General Meeting and will have the opportunity to make statements and to respond to appropriate questions raised at the Annual General Meeting.

Ratification of the independent registered public accounting firm requires the affirmative vote by ordinary resolution of the holders of at least a majority of the issued and outstanding ordinary shares of the Company present and voting in person or by proxy at the Annual General Meeting. Abstentions and broker non-votes will be deemed present and entitled to vote but will not be counted as a vote for or against ratification of the independent registered public accounting firm, and therefore will not have the effect of a vote against ratification of the independent registered public accounting firm. The Company intends to conduct all voting at the Annual General Meeting by poll.

Audit Committee Report

On May 31, 2002, the Board adopted an Audit Committee Charter, which was last reviewed and amended on February 8, 2005. A copy of this amended Audit Committee Charter is included as Annex B to this Proxy Statement. The Audit Committee is currently composed of five outside directors who are not officers of employees of the Company or its subsidiaries. All members of the Audit Committee are independent as defined by Section 303 of the New York Stock Exchange Listed Company Manual.

As more fully described in the Audit Committee Charter, the Audit Committee reviews the Company's financial reporting process on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting process. The Company's independent registered public accounting firm is responsible for performing an audit of the Company's consolidated financial statements in accordance with generally accepted auditing standards and expressing an opinion on the conformity of the financial statements to generally accepted accounting principles. Additionally, the independent registered public accounting firm is responsible for performing an audit of management's assessment of internal control over financial reporting and an audit of the effectiveness of the internal control over financial reporting. The internal auditors are responsible to the Audit Committee for testing the integrity of the financial accounting and reporting control systems and such other matters as the Audit Committee determines.

The Audit Committee has reviewed and discussed with the Company's management and Ernst & Young LLP, the Company's independent registered public accounting firm, the audited financial statements and the report on the audit of internal control over financial reporting contained in the Company's Annual Report to Shareholders on Form 10-K for the year ended December 31, 2004. The Audit Committee has also discussed with the Company's independent registered public accounting firm the matters required to be discussed pursuant to SAS No. 61 and SAS No. 90 (Codification of Statements on Auditing Standards, Communication with Audit Committees).

The Audit Committee has received and reviewed the written disclosures and the letter from Ernst & Young LLP required by Independence Standards Board Standard No. 1 ("Independence Discussions with Audit Committees"), and has discussed with Ernst & Young LLP their independence. The Audit Committee has also considered whether the provision of non-audit services to the Company by Ernst & Young LLP is compatible with maintaining their independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2004.

25

The foregoing report is provided by the following independent directors who constitute the Audit Committee:

|  |  |  |  |  |  |  |  |  |  |

Michael Austin

Chairman |  | Bill Caulfeild-Browne |  | Robert Chmely |

| Jean Claude Damerval |  | Hazel O'Leary |  |

|

Fees Billed to the Company by Ernst & Young LLP

The following is a description of the fees billed to the Company by Ernst & Young LLP during the years ended December 31, 2003 and 2004:

Audit Fees. Audit fees include fees paid in connection with the annual audit of the Company's financial statements and internal control, audits of subsidiary financial statements and review of interim financial statements. Audit fees also include fees for services that are closely related to the audit and in many cases could only be provided by our independent registered public accounting firm. Such services include comfort letters and consents related to Securities and Exchange Commission registration statements and other capital raising activities and certain reports relating to regulatory filings. The aggregate fees billed to the Company by Ernst & Young LLP for audit services for the years ended December 31, 2003 and December 31, 2004 totaled approximately $907,000 and $2,498,000, respectively.

Audit-Related Fees. Fees for audit related services include due diligence services related to mergers and acquisitions and accounting consultations. The aggregate fees billed to the Company by Ernst & Young LLP for audit relating services for the years ended December 31, 2003 and December 31, 2004 totaled approximately $12,000 and $1,184,000, respectively.

Tax Fees. Tax fees include corporate tax compliance, counsel and advisory services, and tax planning. The aggregate fees billed to the Company by Ernst & Young LLP for tax related services for the years ended December 31, 2003 and December 31, 2004 totaled approximately $465,000 and $1,004,000, respectively.

All Other Fees. Fees billed to the Company by Ernst & Young LLP for all non-audit services rendered to the Company during the years ended December 31, 2003 and December 31, 2004 totaled approximately $19,000 and $305 respectively.

The Audit Committee has considered whether the provision of non-audit services by Ernst & Young LLP is compatible with maintaining Ernst & Young LLP's independence with respect to the Company and has determined that the provision of non-audit services is consistent with and compatible with Ernst & Young LLP maintaining its independence.

Pre-Approval Policy for Ernst & Young Services

The policy of the Audit Committee is to pre-approve all audit and non-audit services of Ernst & Young LLP during the fiscal year. The Audit Committee pre-approves such services by authorizing specific projects and categories of services, subject to a specific budget for each category. The Audit Committee Chairman has the authority to address specific requests for pre-approval of services between Audit Committee meetings, and must report any pre-approval decisions to the Audit Committee at its next scheduled meeting.

Vote Required

The required vote for the ratification of the independent registered public accounting firm is the affirmative vote by ordinary resolution of the holders of at least a majority of the issued and outstanding ordinary shares of the Company present and voting in person or by proxy at the Annual General Meeting. The Company intends to conduct all voting at the Annual General Meeting by poll.

THE BOARD RECOMMENDS A VOTE "FOR" RATIFICATION OF THE APPOINTMENT OF

ERNST & YOUNG LLP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

26

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's officers and directors and persons who own more than 10% of a registered class of the Company's equity securities to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission (the "SEC"). Such persons are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based solely on our review of the copies of such forms received by it with respect to fiscal year 2004, or written representations from certain reporting persons, during the year ended December 31, 2004, all Section 16(a) filing requirements applicable to the directors, officers and greater than 10% shareholders were complied with by such persons, except as hereinafter described. Seth W. Vance filed a Form 3 and a Form 4 late due to a delay in receiving EDGAR codes.

ANNUAL REPORT

The Annual Report on Form 10-K of the Company, accompanies this proxy statement. The Annual Report on Form 10-K is not to be deemed part of this Proxy Statement. Upon written request of a shareholder, the Company will furnish, without charge, a copy of the Company's Annual Report on Form 10-K, as filed with the SEC. If you would like a copy of this Annual Report, please contact Scottish Re Group Limited, P.O. Box HM 2939, Crown House, Third Floor, 4 Par-la-Ville Road, Hamilton HM 08, Bermuda, Attn: Secretary.

By Order of the Board of Directors,

Scott E. Willkomm

President and Chief Executive Officer

Hamilton, Bermuda

April 1, 2005

27

Annex A

Scottish Re Group Limited

Corporate Governance Committee Charter

A-1

CORPORATE GOVERNANCE COMMITTEE CHARTER

ORGANIZATION AND RESPONSIBILITIES

Committee's Purpose

The Corporate Governance/Nominating Committee (the "Committee") is appointed by the Board of Directors of Scottish Re Group Limited (the "Board"), in consultation with the Chairman/CEO, to (a) identify and make recommendations to the Board on individuals qualified to serve as Board members of Scottish Re Group Limited ("Company"); (b) develop and recommend to the Board a set of Corporate Governance Guidelines applicable to the Company; (c) take a leadership role in shaping the corporate governance of the Company; (d) review and recommend the renomination of incumbent directors; (e) review and recommend committee appointments; (f) lead the Board in its annual review of the Board's performance; and (g) perform other related tasks, such as studying the size, committee structure, or meeting frequency of the Board.

Committee Organization and Membership

The Company's Board shall select three or more of its members to the Committee. All members of the Committee shall meet the "independence" requirements of the New York Stock Exchange ("NYSE"). The members of the Committee shall be appointed by the Board of Directors in consultation with the Chairman/CEO.

Committee Chairman

The Chairman of the Committee shall (a) chair all meetings of the Committee; (b) coordinate an annual performance evaluation of the Board; and (c) perform such other activities as from time to time are requested by the other directors or as circumstances indicate.

Meetings

The Committee will meet, when reasonably practicable, at least four times a year. The agenda of each meeting will be, whenever reasonably practicable, circulated to each member prior to the meeting date.

Committee's Goals and Responsibilities

|  |

| 1. | The Committee shall establish the Board's criteria for selecting new directors. |

|  |

| 2. | The Committee shall provide oversight of the evaluation of the Board, the committees and management. |

|  |

| 3. | The Committee shall provide an annual performance evaluation of the Board and the committees. |

|  |

| 4. | The Committee shall make regular reports to the Board. |

|  |

| 5. | The Committee shall review Committee member qualifications, appointment and removal and Committee structure and operations (including authority to delegate to subcommittees). |

|  |

| 6. | The Committee shall have sole authority to retain and terminate any search firm to be used to identify director candidates and shall have sole authority to approve the search firm's fees and other retention terms. |

|  |

| 7. | The Committee shall lead the Board in its annual performance evaluation, including, soliciting comments from all directors, preparing a report to the Board with an assessment of the performance of the Board and making recommendations for improvements of the Board's operations. |

|  |

| 8. | The Committee shall lead the Board in its annual review of the skills and characteristics of individual Board members as well as the composition of the Board as a whole, including assessments of independence of nonmanagement directors, and shall take action to effect changes in incumbent directors if deemed appropriate. |

A-2

|  |

| 9. | The Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board for approval. |

Procedural Matters

One-third of the members, but not less than two, will constitute a quorum. A majority of the members present at any meeting at which a quorum is present may act on behalf of the Committee. The Committee will meet at such times as shall be determined by its Chairperson, or upon the request of any two of its members. The Chairperson will preside, when present, at all meetings of the Committee. The Committee will keep a record of its meetings and report on them to the Board. The Committee may meet by telephone or video conference and may take action by written consent.

A-3

Annex B

Scottish Re Group Limited

Audit Committee Charter

B-1

AUDIT COMMITTEE CHARTER

INDEX

|  |  |  |  |  |  |

| |  | Page |

| Mission Statement |  | | B-3 | |

| Organization |  | | B-3 | |

| • Size of Committee |  | | B-3 | |

| • Membership Qualifications |  | | B-3 | |

| • Frequency of Meetings |  | | B-4 | |

| • Appointment of Committee |  | | B-4 | |

| • External Auditor |  | | B-4 | |

| • Internal Auditor |  | | B-4 | |

| Members of the Audit Committee |  | | B-4 | |

| Audit Committee Roles and Responsibilities |  | | B-4 | |

| Reporting Responsibilities |  | | B-6 | |

| Procedural Matters |  | | B-6 | |

|

B-2

Mission Statement

The Audit Committee ("Committee") is established to assist the Board of Directors ("Board") of Scottish Re Group Limited (the "Company") in fulfilling its oversight responsibilities relating to (a) the integrity of the accounting for the Company's financial position and results of operations, (b) compliance with legal and regulatory requirements, (c) the external auditor's qualifications and independence, (d) performance of the Company's internal audit function and external auditors, and (e) preparation of all necessary reports the Securities and Exchange Commission (the "SEC") may require to be included in the Company's annual proxy statement as well as such other matters as may from time to time be specifically delegated to the Committee by the Board.

While the Committee has the powers and responsibilities set forth in this Charter and the Company's Memorandum and Articles of Association, it is not the responsibility of the Committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate or are in compliance with generally accepted accounting principles, which is the responsibility of management and the external auditor. Likewise, it is not the responsibility of the Committee to conduct investigations or to resolve disputes, if any, between management and the external auditor. Management has the responsibility for preparing financial statements and internal controls and the external auditor has the responsibility for auditing the financial statements.

In performing its duties, the Committee will maintain effective working relationships with the Board, management, and the internal and external auditors. In carrying out its responsibilities, the Committee will maintain flexible policies and procedures in order to best react to a changing environment. To effectively perform his or her role, each Committee member will obtain an understanding of the responsibilities of Committee membership as well as the Company's business operations and risks.

Organization

Size of Committee

The Committee will initially be comprised of at least three directors, but this number will be subject to future review. The Committee will elect one of its members to serve as Chairman of the Committee (the "Chairman") on an annual basis. The retiring Chairman may, however, be re-elected.

Membership Qualifications

The Committee Members shall meet the following requirements:

|  |

| (i) | Shall be independent of management and free from any relationship with the Company that would interfere with the exercise of independent judgment as a Committee member. In determining independence, the Board will observe the requirements of Sections 303.01 and 303.02 of the NYSE Listed Company Manual. |

|  |

| (ii) | Shall be financially literate or must become financially literate within a reasonable period of time after appointment to the Committee. The Board will determine, in its business judgment, whether a director meets the financial literacy requirement. (See Section 303.01 (B)(2)(b)). |

|  |

| (iii) | At least one member of the Committee must have accounting or related financial management expertise, as determined by the Board in its business judgment (See Section 303.01(B)(2)(c)). |

|  |

| (iv) | A director who meets the definition of independence mandated for a Committee member but who also holds 20% or more of the Company's stock (or who is a general partner, controlling shareholder or officer of any such holder) shall not chair, or be a voting member of, the Committee. |

|  |

| (v) | Committee Members are prohibited from receiving any consulting, advisory or compensation fees from the Company. |

In addition, one member of the Committee shall qualify as a "financial expert," subject to the SEC's definition of "financial expert" when those regulations are published.

B-3

Frequency of Meetings

The Committee shall meet at least four times a year or more frequently as it may determine necessary, to comply with its responsibilities as set forth herein. The Committee may request any officer or employee of the Company or the Company's outside legal counsel or external auditor to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee. The Committee may meet with management, the external auditors and others in separate private sessions to discuss any matter that the Committee, management, the external auditor or such other persons believe should be discussed privately.

Appointment of Committee

The Board will appoint the members of the Committee. The Board will, or will delegate to the members of the Committee the responsibility to, appoint a Chairman. The Chairman will, in consultation with the other members of the Committee, the Company's external auditor and the appropriate officers of the Company, be responsible for calling the meetings of the Committee, establishing agenda therefore and supervising the conduct thereof.

External Auditor

The external auditor for the Company is ultimately accountable to the Board and the Committee. The Committee and the Board have the ultimate authority and responsibility to select, evaluate and, where appropriate, replace the external auditor. Alternatively, the Committee and the Board may nominate the external auditor to be proposed for shareholder approval in any proxy statement.

Internal Auditor

The internal auditor for the Company is ultimately accountable to the Board and the Committee. The Committee has the ultimate authority and responsibility to direct, select, evaluate, and where appropriate, replace the internal auditor.

Members of the Audit Committee

The Committee members appointed by the Board are as follows:

Michael Austin1

Bill Caulfeild-Browne

Robert M. Chmely

Jean Claude Damerval

Hazel R. O'Leary

Audit Committee Roles and Responsibilities

|  |

| • | Review and confirm the independence of the external auditor by reviewing, among other things, information related to the non-audit services provided and expected to be provided as well as the external auditor's assertion of independence in accordance with professional standards. The Committee is responsible for (1) ensuring the external auditor submits on a periodic basis to the Committee a formal written statement affirming its independence and delineating all relationships between the external auditor and the Company, (2) actively engaging in dialogue with the external auditor with respect to any disclosed relationship or services that may impact the objectivity and independence of the external auditor, and (3) taking, or recommending that the Board take, appropriate action to oversee the independence of the external auditor. |

|  |

| • | Review the audit fee, the external auditor's non-audit services and facts related to the independence of the external auditor such as the extent to which non-audit services have been performed. |

|  |

| (1) | Michael Austin was elected Chairman of the Audit Committee on 28th April 1999. |

B-4

|  |

| • | Select, evaluate and where appropriate, replace the external auditor. The Committee shall have sole authority to approve the audit engagement fees and terms as well as all significant non-audit related engagements of the external auditor. |

|  |

| • | Nominate the external auditor for shareholder approval in any Company proxy statement. |

|  |

| • | Gain an understanding of whether internal control recommendations made by the external auditor has been implemented by management. |

|  |

| • | Review with management, the external auditor, the senior internal auditing executive (if any), the General Counsel and, if to the extent deemed appropriate by the Chairman, members of their respective staffs, the adequacy and effectiveness of the Company's internal accounting controls, the Company's financial, auditing and accounting organizations and personnel and the Company's policies and compliance procedures with respect to business practices. |

|  |

| • | Elicit recommendations, if any, from the external auditor for improvements or additions to the Company's internal control procedures. |

|  |

| • | Ensure that the external auditor keeps the Committee informed about the results of their procedures relating to fraud, illegal acts, and deficiencies in internal control. |

|  |

| • | Review, after consultation with the external auditor and management, the audit plan, scope and procedures. |

|  |

| • | Review the financial statements contained in the annual report with management and the external auditor to determine if the external auditor is satisfied with the disclosures and content to be presented to shareholders. |

|  |

| • | Meet with the external auditor, internal auditor (if any) or management privately to discuss any matters that the Committee, the external auditor, internal auditor or management believe should be discussed privately. |

|  |

| • | Review and reassess the Committee's Charter on an annual basis. |

|  |

| • | Set clear hiring policies for employees or former employees of the external auditors. |

|  |

| • | Be satisfied that all regulatory compliance matters have been considered in the preparation of the financial statements. |

|  |

| • | Require the Company to set up and maintain an internal audit function. |

|  |

| • | Conduct an annual performance evaluation of the Committee. The Committee shall review: (a) major issues regarding accounting principles and financial statement presentations, including any significant changes in the Company's selection or application of accounting principles, and major issues as to the adequacy of the Company's internal controls and any special audit steps adopted in light of material control deficiencies; (b) analyses prepared by management and/or the independent auditor setting forth significant financial reporting issues and judgments made in connection with the preparation of the financial statements, including analyses of the effects of alternative GAAP methods on the financial statements; (c) the effect of regulatory and accounting initiatives, as well as off-balance sheet structures on the financial statements of the Company; and (d) earnings press releases (paying particular attention to any use of "pro forma," or "adjusted" non-GAAP, information). |

|  |

| • | Review such other matters in relation to the accounting, auditing and financial reporting practices and procedures of the Company as the Committee may, in its own discretion, deem desirable. |

|  |

| • | Obtain advice and assistance, as appropriate, from outside legal, accounting and other advisors to review any matter under its responsibility. The Committee shall have full authority and funding for such engagements. |

|  |

| • | Make recommendations to the Board on any such matters within the scope of its function, as the Committee believes warrant consideration by the Board. |

|  |

| • | Establish procedures for handling complaints regarding the Company's accounting practices and for confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. |

B-5

Reporting Responsibilities

Regularly update the Board about Committee activities and make appropriate recommendations.

The Committee will prepare, with the assistance of management, the external auditor and legal counsel, a report for inclusion in the Company's proxy or information statement relating to the annual meeting of security holders at which directors are to be elected that complies with the requirements of the federal securities laws.

Procedural Matters

One-third of the members, but not less than two, will constitute a quorum. A majority of the members present at any meeting at which a quorum is present may act on behalf of the Committee. The Committee will meet as such times as shall be determined by its Chairperson, or upon the request of any two of its members. The Chairperson will preside, when present, at all meetings of the Committee. The Committee will keep a record of its meetings and report on them to the Board. The Committee may meet by telephone or videoconference and may take action by written consent.

B-6