UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F/A

(Amendment No. 1)

(Mark One)

| £ | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| £ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| £ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| S | | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. Date of event requiring this shell company report: August 31, 2011 |

Commission file number: 000-29884

R.V.B. HOLDINGS LTD.

(Exact name of Registrant as specified in its charter)

| R.V.B. Holdings Ltd. | Israel |

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

Platinum House, 21 Ha'a'rba'ah St., Tel Aviv, 64739, Israel

(Address of principal executive offices)

Ofer Naveh, +972-3-684-5500, +972-3-684-5500, Platinum House, 21 Ha'a'rba'ah St., Tel Aviv, 64739, Israel

(Name, Telephone, E-mail and/or Facsimile number and Address of the Registrant’s Contact Person)

With a copy to:

Dr. Shachar Hadar

Gross, Kleinhendler, Hodak, Halevy, Greenberg & Co.

One Azrieli Center, Round Building, Tel Aviv 67021, Israel

Phone Number: +972-3-607-4444; Fax Number: +972-3-607-4422

Securities registered or to be registered pursuant to Section 12(b) of the Act: None.

Securities registered or to be registered pursuant to Section 12(g) of the Act: Ordinary Shares, par value NIS 1.00 per share.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: N/A.

Indicate by check mark if the registrant is a well known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes o No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of accelerated filer and large accelerated filer in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer x

Indicate by check mark which basis of accounting the Registrant has used to prepare the financial statements included in this filing:

U.S. GAAP o

International Financial Reporting Standards as issued by the International Accounting Standards Board x

Other o

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the Registrant elected to follow.

Item 17 o Item 18 o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No o

EXPLANATORY NOTICE

This Amendment No. 1 (this “Amendment”) amends the shell company report on Form 20-F, originally filed with the Securities and Exchange Commission on September 7, 2011 (the “Shell Company Report”) and is being filed solely to: (i) revise “Item 16F. Change in Registrant’s Certifying Accountant” appearing on page 51 of the Shell Company Report; (ii) revise “Item 18. Financial statements” appearing on page 52 of the Shell Company Report; and (iii) revise the Exhibit index in the Shell Company Report to include exhibits 15.1 and 15.2 and (iv) attach the financial statements of E.E.R. Environmental Energy Resources (Israel) Ltd. as of, and for the year ended December 31, 2010.

No other changes have been made to the Shell Company Report. This Amendment speaks as of the date of the initial filing of the Shell Company Report. Other than as described above, this Amendment does not, and does not purport to, amend, update or restate any other information or disclosure included in the Shell Company Report or reflect any events that have occurred after the date of the initial filing of the Shell Company Report.

TABLE OF CONTENTS

| | | Page |

| 1 |

| 2 |

| | 2 |

| | 2 |

| | 2 |

| | 11 |

| | 19 |

| | 26 |

| | 33 |

| | 35 |

| | 36 |

| | 37 |

| | 50 |

| | 50 |

| | | |

| 51 |

| | 51 |

| | 51 |

| | 51 |

| | 51 |

| | 51 |

| | 51 |

| | 51 |

| | 51 |

| | 51 |

| | 51 |

| | 51 |

| | | |

| 52 |

| | 52 |

| | 52 |

| | 52 |

| | | |

| 53 |

R.V.B. Holdings Ltd., (RVB) (Formerly B.V.R. Systems (1998) Ltd.), is an Israeli company that was formed in January 1998 to receive all of the assets and liabilities of the defense-related business of BVR Technologies Ltd. in accordance with the terms of a reorganization plan. RVB (then, BVR) commenced operations as an independent company effective as of January 1, 1998. In November 2009, RVB sold substantially all of its assets and liabilities, including the brand name "B.V.R.", to Elbit Systems Ltd. ("Elbit") and, subsequent to the sale, in January 2010 changed its name to R.V.B. Holdings Ltd. RVB was controlled by Mr. Aviv Tzidon until March 2010, when Greenstone Industries Ltd. ("Greenstone"), purchased from A.O. Tzidon (1999) Ltd. and Aviv Tzidon the control of RVB. In August 2011, RVB acquired all of E.E.R. Environmental Energy Resources (Israel) Ltd.'s ("EER") shares held by Greenstone and by S.R. Accord Ltd. ("Accord"), and, as of the date of this shell company report, holds 38.5% of EER's share capital (34.3% on a fully-diluted basis) and 60.2% of EER's voting rights.

The following is the shell company report on Form 20-F of R.V.B. Holdings Ltd. The terms “we”, “us”, “our”, “the Company” and “RVB”, as used in this annual report, mean R.V.B. Holdings Ltd. (formerly B.V.R. Systems (1998) Ltd.) unless otherwise indicated.

All references herein to “dollars” or “US$” are to United States Dollars, and all references to “Shekels” or “NIS” are to New Israeli Shekels.

FORWARD LOOKING STATEMENTS

In addition to historical information, this shell company report on Form 20-F contains forward-looking statements. Some of the statements discussed in "Item 3.D. Risk Factors" and elsewhere in this report contain forward-looking statements. Statements that use the terms “believe”, “anticipate”, “expect”, “plan”, “intend”, “estimate”, “project” and similar expressions in the affirmative and the negative are intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on current assumptions, expectations, estimates and projections with respect to, among others, the financial conditions and business results of EER and RVB and the benefits of the EER Transaction. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by us or any other person that our objectives or plans will be achieved. Factors that could cause actual results to differ from our expectations or projections include the risks and uncertainties relating to our business described in this shell company report under "Item 3.D. Risk Factors," "Item 5. Operating and Financial Review and Prospects" and elsewhere in this shell company report. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management's analysis as of the date hereof. We undertake no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof, except as required by applicable law. In addition to the disclosure contained herein, readers should carefully review any disclosure of risks and uncertainties contained in other documents that we file from time to time with the Securities and Exchange Commission (the "SEC").

To the extent that this shell company report contains forward-looking statements (as distinct from historical information), we desire to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and we are therefore including this statement for the express purpose of availing ourselves of the protections of the safe harbor with respect to all forward-looking statements.

1A. Directors and Senior Management

For a description of the names and functions of our directors and senior management, please see “Item 6A. Directors and Senior Management” of this shell company report. The business address of all of our directors and senior management is Platinum House, 21 Ha'a'rba'ah St., Tel Aviv, 64739, Israel.

1B. Advisers

Our Israeli and U.S. legal counsel is Gross, Kleinhendler, Hodak, Halevy, Greenberg & Co., with offices at One Azrieli Center (Round Building), Tel Aviv, 67021, Israel.

1C. Auditors

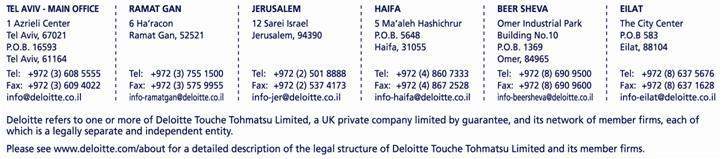

For the last two years our independent auditors have been Somekh Chaikin, a member firm of KPMG International, with offices at 17 Ha'a'rba'ah St., Tel Aviv, 61006, Israel. On August 22, 2011, our shareholders approved the appointment of Brightman Almagor Zohar & Co., a member of Deloitte Touche Tohmatsu, with offices at One Azrieli Center (Round Building), Tel Aviv, 67021, Israel, as our independent auditors for the 2011 fiscal year and the period ending at the close of the next annual general meeting.

ITEM 2. Offer Statistics and Expected Timetable

In July 2011, we entered into the following agreements, in connection with the purchase of EER shares by RVB: (i) a share purchase agreement, dated as of July 3, 2011, by and among RVB, Greenstone, Accord Mazal Resources B.V. ("Mazal") and EER (the "EER Share Purchase Agreement"); (ii) an option agreement between RVB and Mazal, dated July 3, 2011 (the "Option Agreement"); (iii) a voting agreement between Greenstone and Mazal, dated July 3, 2011 (the "Voting Agreement"); (iv) a shareholders' agreement between RVB and Mazal, dated July 3, 2011 (the "Shareholders Agreement"); (v) a services agreement between RVB, Mr. Moshe Stern and M. Stern Holding Ltd. ("Stern Holding"), a company under Mr. Stern's control, dated July 3, 2011 (the "Services Agreement"); and (vii) a management agreement between RVB and Greenstone, dated July 14, 2011 (the "Management Agreement") (collectively, the "EER Transaction").

On August 22, 2011, our shareholders approved the EER Transaction (following an approval by our audit committee and board of directors), together with a form of additional share purchase agreement, to be entered into between RVB and certain EER shareholders who elect to join the EER Transaction and sell their holdings in EER to RVB, in exchange for RVB shares (the "Additional SPA"). On August 31, 2011, we completed the EER Transaction and purchased a total of 7,996,210 EER shares from Greenstone, our controlling shareholder, and Accord. The closing of the Additional SPA is expected during September or October 2011, at which time we expect to issue a total of up to 96,100,358 RVB shares, in exchange for the EER shares of those additional EER shareholders who elected to become parties to the Additional SPA.

For information regarding the EER Transaction and the Additional SPA, see "Item 7.B. Related Party Transactions – EER Transaction" in this shell company report.

A. Selected Consolidated Financial Data

You should read the following selected consolidated financial data in conjunction with the section of this shelf company report entitled “Item 5 - Operating and Financial Review and Prospects” and our consolidated financial statements and the notes thereto included elsewhere in this shell company report.

The selected data presented below under the captions “Statement of Operations Data,” and “Statements of Financial Position Data” as of and for each of the years in the five-year period ended December 31, 2010, are derived from the audited consolidated financial statements of RVB Holdings Ltd. The consolidated financial statements as of December 31, 2010 and 2009, and for each of the years in the three-year period ended December 31, 2010, are included elsewhere in this shell company report. The selected data should be read in conjunction with the consolidated financial statements and the related notes. The 2006 selected data was derived from consolidated financial statements that have been prepared in accordance with Israeli GAAP. The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards as issued by The International Accounting Standards Board (IFRS).

In November 2009, we sold our business to Elbit Systems Ltd. (Elbit) pursuant to an asset purchase agreement executed on July 19, 2009 (the "Asset Purchase Agreement"), as more fully described below under Item 10.C. "Material Contracts." The sale of our business to Elbit was completed on November 19, 2009 (the "Elbit Transaction"). On August 31, 2011, we completed the EER Transaction, following which we became the controlling shareholder of EER. For additional information, see "Item 7.B. Related Party Transactions – EER Transaction" in this shell company report.

You should read the selected consolidated financial data together with the section entitled “Item 5. Operating and Financial Review and Prospects” and our consolidated financial statements included elsewhere in this shell company report.

| | | | |

| | | | |

| | | | |

| Statement of Operations Data: | | | |

| In accordance with Israeli GAAP | | | |

| Revenues | | US$ 10,103 | |

| Cost of revenues | | | (7,866 | ) |

| Gross profit | | | 2,237 | |

| Operating expenses: | | | | |

| Research and development | | | 615 | |

| Selling and marketing | | | 1,430 | |

| General and administrative | | | 2,155 | |

| Total operating expenses | | | 4,200 | |

| Operating loss | | | (1,963 | ) |

| Financial expenses, net | | | (185 | ) |

| Other expenses, net | | | - | |

| Loss before taxes on income | | | (2,148 | ) |

| Income tax expense | | | (75 | ) |

| Net loss for the year | | | (2,223 | ) |

| Basic and diluted loss per share | | | (0.02 | ) |

Weighted- average number of ordinary shares of nominal NIS 1.00 par value outstanding (in thousands) used in calculation of the basic and diluted earnings (loss) per share | | | 112,361 | |

| | | | |

| | | | |

| | | | |

| Reconciliation to U.S. GAAP: | | | |

| Net loss under Israeli GAAP | | | (2,223 | ) |

| | | | | |

Compensation expense for all stock-based awards using the modified prospective method | | | (596 | ) |

| Loss under U.S. GAAP | | | (2,819 | ) |

| Basic and diluted net loss per share under U.S. GAAP | | | (0.03 | ) |

Weighted average number of ordinary shares outstanding (in thousands) used in basic loss per share calculation according to U.S. GAAP | | | 112,361 | |

| Weighted average number of ordinary shares outstanding (in thousands) used in diluted loss per share calculation according to U.S. GAAP | | | 112,361 | |

| | | | |

| | | | | | | | | | | | | |

| | | | |

| Statement of Operations Data: | | | | | | | | | | | | |

| Revenues | | | - | | | US$ 37,113 | | | US$ 31,566 | | | US$ 13,106 | |

| Cost of revenues | | | - | | | | (28,293 | ) | | | (23,282 | ) | | | (10,746 | ) |

| Inventory write off | | | - | | | | - | | | | - | | | | (699 | ) |

| Gross profit | | | - | | | | 8,820 | | | | 8,284 | | | | 1,661 | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Research and development | | | - | | | | 1,499 | | | | 1,213 | | | | 959 | |

| Selling and marketing | | | - | | | | 1,852 | | | | 2,128 | | | | 2,240 | |

| General and administrative | | | 693 | | | | 4,041 | | | | 2,773 | | | | 2,508 | |

| Total operating expenses | | | 693 | | | | 7,392 | | | | 6,114 | | | | 5,707 | |

| Other income (Elbit Transaction) | | | 867 | | | | 30,206 | | | | - | | | | - | |

| Operating profit (loss) | | | 174 | | | | 31,634 | | | | 2,170 | | | | (4,046 | ) |

| Financial income | | | 275 | | | | 28 | | | | 219 | | | | 231 | |

| Financial expenses | | | (8 | ) | | | (2,255 | ) | | | (766 | ) | | | (249 | ) |

| Financial income (expenses), net | | | 267 | | | | (2,227 | ) | | | (547 | ) | | | (18 | ) |

| Profit (loss) before taxes on income | | | 441 | | | | 29,407 | | | | 1,623 | | | | (4,064 | ) |

| Income tax expense | | | - | | | | - | | | | - | | | | - | |

| Net profit (loss) for the year | | | 441 | | | | 29,407 | | | | 1,623 | | | | (4,064 | ) |

| | | | | | | | | | | | | | | | | |

| Earnings (loss) per share: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Basic earnings (loss) per share (in US$) | | | 0.0037 | | | | 0.25 | | | | 0.01 | | | | (0.03 | ) |

| | | | | | | | | | | | | | | | | |

| Diluted earnings (loss) per share (in US$) | | | 0.0037 | | | | 0.25 | | | | 0.01 | | | | (0.03 | ) |

| Weighted- average number of ordinary shares of nominal NIS 1.00 par value outstanding (in thousands) used in calculation of the basic earnings (loss) per share | | | 117,971 | | | | 117,069 | | | | 116,952 | | | | 116,861 | |

| Weighted- average number of ordinary shares of nominal NIS 1.00 par value outstanding (in thousands) used in calculation of diluted earnings (loss) per share | | | 117,971 | | | | 117,098 | | | | 116,958 | | | | 116,861 | |

| | | Year ended December 31, | |

| | | 2006 | |

| | | (In thousands) | |

| Consolidated Statement of Position Data: | | | |

| In accordance with Israeli GAAP | | | |

| Cash and cash equivalents | | US$ 3,421 | |

| Total assets | | | 13,293 | |

| Short-term bank credit and loans | | | 636 | |

| Share capital | | | 25,861 | |

| Shareholders' equity | | | 5,406 | |

| U.S. GAAP: | | | | |

| Total assets | | | 14,604 | |

| Shareholders' equity | | US$ 5,406 | |

| | | | |

| | | | | | | | | | | | | |

| | | | |

| Consolidated statement of position: | | | | | | | | | | | | |

| Cash and cash equivalents | | US$ 23,094 | | | US$ 29,886 | | | US$ 4,249 | | | US$ 1,520 | |

| Bank deposit | | | 10,537 | | | | - | | | | - | | | | - | |

| Total assets | | | 34,421 | | | | 35,585 | | | | 21,412 | | | | 10,160 | |

| Short-term bank credit and loans | | | 120 | | | | 120 | | | | 120 | | | | 1,086 | |

| Share capital | | | 26,406 | | | | 26,157 | | | | 25,891 | | | | 25,861 | |

| Shareholders' equity | | | 33,583 | | | | 33,142 | | | | 3,388 | | | | 1,711 | |

B. Capitalization and Indebtedness

The following table shows the capitalization of the Company as of December 31, 2011, (i) on an actual basis, and (ii) on a pro forma basis, adjusted to give effect to the EER Transaction, the Additional SPA as if the EER Transaction and the Additional SPA (with all additional EER shareholders that are not parties to the EER Share Purchase Agreement), and the Dividend distribution (as defined under " Item 8. Financial Information – Dividend Policy"), have been completed as of January 1, 2010 (*):

| | | | |

| | | | | | | |

| | | | |

| (In thousands, except share data) | | | | | | |

| | | | | | | |

| Equity: | | | | | | |

| Share capital: Ordinary shares, par value NIS 1.00 per share: 400,000,000 shares authorized; 118,900,535 actual shares issued and outstanding; and 138,955,428 shares issued and outstanding, on a Pro forma basis (*) | | US$ 26,406 | | | US$ 59,052 | |

| Treasury shares (1,040,000 Ordinary shares par value NIS 1.00) | | | (167 | ) | | | (167 | ) |

| Share premium and other capital reserves | | | 16,833 | | | | (8,399 | ) |

| Accumulated deficit | | | (9,489 | ) | | | (33,661 | ) |

| | | | | | | | | |

| Equity attributable to owners of the Company | | | 33,583 | | | | 19,825 | |

| | | | | | | | | |

| Non-controlling interests | | | - | | | | 3,305 | |

| | | | | | | | | |

| Total equity | | | 33,583 | | | | 23,130 | |

(*) See - "Item 18. Financial Statements" below in this shell company report.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Investing in our securities involves significant risk. You should carefully consider the risks described below as well as the other information contained in this annual report before making an investment decision. Any of the following risks could materially adversely affect our business, financial condition, results of operations and cash flows. In such case, you may lose all or part of your original investment. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially adversely affect our business, financial condition or results of operations.

Risks Related to our Business

You may have difficulty enforcing a judgment issued by a court in the United States against us in Israel.

We are organized under the laws of Israel and our headquarters are in Israel. All of our officers and directors reside outside of the United States. Therefore, you may not be able to enforce any judgment obtained in the United States against us or any of such persons. You may not be able to enforce civil actions under United States securities laws if you file a lawsuit in Israel. In addition, if a foreign judgment is enforced by an Israeli court, it will be payable in Israeli currency.

Currency fluctuations may affect the value of our assets and decrease our earnings.

The devaluation of the US dollar against the NIS may decrease the value of our assets and could impact our business. We anticipate that a significant portion of our expenses will continue to be denominated in NIS.

If we are considered to be a passive foreign investment company, either presently or in the future, U.S. Holders will be subject to adverse U.S. tax consequences.

We will be a passive foreign investment company, or a PFIC, if 75% or more of our gross income in a taxable year, including our pro rata share of the gross income of any company, U.S. or foreign, in which we are considered to own, directly or indirectly, 25% or more of the shares by value, is passive income. Alternatively, we will be considered a PFIC if at least 50% of our assets in a taxable year, averaged over the year and ordinarily determined based on fair market value, including our pro rata share of the assets of any company in which we are considered to own, directly or indirectly, 25% or more of the shares by value, are held for the production of, or produce, passive income. If we were to be a PFIC, and a U.S. Holder does not make an election to treat us as a “qualified electing fund,” or QEF, or a “mark to market” election, “excess distributions” to a U.S. Holder, and any gain recognized by a U.S. Holder on a disposition of our ordinary shares, would be taxed in an unfavorable way. Among other consequences, our dividends would be taxed at the regular rates applicable to ordinary income, rather than the 15% maximum rate applicable to certain dividends received by an individual from a qualified foreign corporation. The tests for determining PFIC status are applied annually and it is difficult to make accurate predictions of future income and assets, which are relevant to the determination of PFIC status. In addition, under the applicable statutory and regulatory provisions, it is unclear whether we would be permitted to use a gross loss from sales (sales less cost of goods sold) to offset our passive income in the calculation of gross income. In light of the uncertainties described above, we have not obtained an opinion of counsel with respect to our PFIC status and no assurance can be given that we will not be a PFIC in any year. If we determine that we have become a PFIC, we will then notify our U.S. Holders and provide them with the information necessary to comply with the QEF rules. If the IRS determines that we are a PFIC for a year with respect to which we have determined that we were not a PFIC, however, it might be too late for a U.S. Holder to make a timely QEF election, unless the U.S. Holder qualifies under the applicable Treasury regulations to make a retroactive (late) election. U.S. Holders who hold ordinary shares during a period when we are a PFIC will be subject to the foregoing rules, even if we cease to be a PFIC in subsequent years, subject to exceptions for U.S. Holders who made a timely QEF or mark-to-market election.

Your rights and responsibilities as a shareholder will be governed by Israeli law and differ in some respects from the rights and responsibilities of shareholders under U.S. law.

We are incorporated under Israeli law. The rights and responsibilities of the holders of our Ordinary Shares are governed by our articles of association and by Israeli law. These rights and responsibilities differ in some respects from the rights and responsibilities of shareholders in typical U.S. corporations. In particular, a shareholder of an Israeli company has a duty to act in good faith toward the company and other shareholders and to refrain from abusing his power in the company, including, among other things, in voting at the general meeting of shareholders on certain matters. See “Item 10. Additional Information – B. Memorandum and Articles of Association”

Risks Relating to the EER Transaction

On August 22, 2011, our shareholders approved the EER Transaction (following an approval by our audit committee and board of directors), together with a form of additional share purchase agreement, to be entered into between RVB and certain EER shareholders who elect to join the EER Transaction and sell their holdings in EER to RVB, in exchange for RVB shares (the "Additional SPA"). On August 31, 2011, we completed the EER Transaction and purchased a total of 7,996,210 EER shares from Greenstone, our controlling shareholder, and Accord. The closing of the Additional SPA is expected during September or October 2011, at which time we expect to issue a total of up to 96,100,358 RVB shares, in exchange for the EER shares of those additional EER shareholders who elected to become parties to the Additional SPA.

For information regarding the EER Transaction and the Additional SPA, see "Item 7.B. Related Party Transactions – EER Transaction" in this shell company report.

The EER Transaction may not result in the benefits that RVB currently anticipates.

Achieving the expected benefits of the EER Transaction depends, among other things, on the ability to develop, market and build waste to energy facilities based on EER's PGM technology. The EER Transaction process also may result in the need to invest unanticipated additional cash resources, which may divert funds that RVB expects to use for pursuing new opportunities and other purposes and therefore, the benefits of the EER Transaction will not be realized and, as a result, RVB’s operating results may be adversely affected and its share price may decline.

The market price of our shares may decline following the completion of the EER Transaction

The market price of RVB shares may decline following the completion of the EER Transaction, and might not meet the forecasts and valuation conducted by the Company and its consultants prior to the EER Transaction.

RVB, a publically held company, is subject to certain limitations in its efforts to synergize the operations of RVB and EER.

Some transactions between RVB and EER, including any termination of such transactions, will require the approval of EER's Board of Directors, and, under certain circumstances, may require the approval of the shareholders of EER and are subject to the receipt of applicable permits and approvals. In addition, any dividend or distribution from EER requires the approval of the directors of EER. As such, RVB may be limited in its ability to fully realize the synergies and other benefits of the EER Transaction.

Our aggregate indemnification under the EER Share Purchase Agreement is capped at US$5,000,000, and our indemnification right is valid until December 31, 2012.

According to the EER Share Purchase Agreement, each Shareholder (as defined therein), shall hold harmless and indemnify us from and against certain damages relating to, among others, inaccuracies in or breaches of any representation or warranty of such Shareholder, breaches of any covenant or obligation of such Shareholder, and proceedings relating to any such inaccuracy or breach. However, the total liability of the Shareholders is limited in the aggregate to US$5,000,000 and the total liability of each Shareholder is limited to its pro rata portion of such amount (i.e. the percentage of the ordinary shares held by each Shareholder out of the total aggregate holdings of the indemnifying shareholders in EER). In addition, any demand by RVB for indemnification related to damages, can be made no later than December 31, 2012. Consequently, if we incur damages or liabilities that are higher than US$5,000,000, or if we incur damages or liabilities, or discover such damages or liabilities, after December 31, 2012, or if any Shareholder defaults on his obligation to indemnify us under the EER Share Purchase Agreement, we would be required to bear the costs ourselves. We cannot be certain that we will have sufficient funds available to bear these costs. Further, the payment of these costs may have a material adverse effect on our business, financial condition, results of operations and cash flows.

Risks Relating to EER

EER has a history of losses and it may incur future losses and may not achieve profitability.

EER is currently focusing on research and development, as well as on the introduction of its technology and penetration into relevant markets. EER has limited operating history and consequently it has incurred net losses in each of the last three fiscal years. EER has incurred net losses of NIS 28.4 million (US$7.6 million) in 2010, NIS 28.6 million (US$7.3 million) in 2009 and NIS 32.4 million (US$9.0 million) in 2008. As of December 31, 2010, EER accumulated deficit was NIS 164.4 million (US$41.1 million).

As of the date of this shell company report, EER has no source of income from the sale of products, licensing or research and development activities. In addition, EER has not yet established and operated a commercial plant which implements its technology. Therefore, EER expects that, at least for the coming years, it will continue to operate with operational losses. EER's losses could continue as EER expands its commercialization efforts, increases its marketing expenses and continues to invest in research and development. Due to the above, the extent of EER's future operating losses and the timing of becoming profitable are uncertain. In addition, EER has limited experience in commercializing its technology and is faces a number of challenges with respect to its commercialization efforts, including, among others:

| | · | EER relies on external finance for its business activity, and it may not have adequate financial or other resources; |

| | · | EER may not be able to introduce its technology to the relevant markets; |

| | · | EER may fail to obtain or maintain regulatory approvals for its facilities and products or may face adverse regulatory or legal actions relating to its facilities and services even if the necessary regulatory approvals are obtained; |

| | · | EER may face technical and engineering difficulties relating to the development, scale-up and implementation of its technology; |

| | · | EER's research and development activity is conducted in collaboration with third parties, and its success depends on their efforts. In the event that such third parties discontinue their collaboration with EER, that could adversely affect EER's research and development and engineering capabilities; |

| | · | EER may not be able to maintain and operate its demonstration facility in Israel, due to, among others, its inability to renew its business license or the lease agreement relating to the ground on which the demonstration facility is located; |

| | · | EER depends on a small number of employees who possess both executive and technical expertise, the departure of which may affect its business; and |

| | · | EER may face third party claims of intellectual property infringement. |

The occurrence of any one or more of these events may limit EER's ability to successfully commercialize its technology, which in turn could prevent EER from generating significant revenues and could harm its business, financial condition and results of operations.

EER relies on external funding for the commercialization of its technology and services.

As part of its business model, EER may enter into joint projects with third parties for the establishment of waste treatment facilities that would implement EER's technology. The estimated cost of establishing such plants ranges between tens of millions to hundreds of millions US dollars. Therefore, EER's partners, and in some cases EER itself, might need to raise significant funds on a project by project basis. External financing may not be available on a timely basis, at an attractive cost of capital, or at all. In addition, EER and/or its partners may face difficulties in raising funds for their joint projects, since EER's Plasma Gasification-Melting (PGM) technology, has not yet proven itself commercially in the field of municipal solid waste and medical waste and, therefore, senior lenders or equity providers may be reluctant to extend funds for such projects. Moreover, some of EER's target markets have previously been adversely affected by global economic slowdowns and recessions which have led to reduced consumer and governmental spending. Current and future economic slowdowns and recessions may have an adverse effect on EER's and its partners' ability to raise capital or debt at an attractive cost of capital. Consequently, EER and/or its potential partners may face difficulty to raise sufficient funds to take on new projects or establish new plants and thus EER may not be able to introduce its technology to the relevant markets. In addition, any such external financing may be dilutive to us or may require us to grant a lender a security interest in our or EER's assets.

EER may require additional funding for its ongoing operations and for the commercialization of its technology and services

EER's current day to day operations require substantial amounts of financial resources. As of the date of this shell company report, EER has no source of income, and it has not yet established and operated a commercial plant which implements its technology. There is no assurance that EER will be able to raise external financing on a timely basis, at an attractive cost of capital, or at all. If adequate external financing on acceptable terms is not available, EER may not be able to continue its operations, develop its technology or market its technology and services.

EER's ability to commercialize its technology depends on collaboration with third parties

EER's business strategy includes entering into cooperative arrangements with third parties for establishing plants and marketing EER's technology and services worldwide. There is no certainty that EER will be able to negotiate such arrangements on acceptable terms, if at all, or that such arrangements will be successful in yielding commercially viable products. If EER is unable to establish such arrangements, it would require additional working capital to undertake such activities on its own and would require extensive marketing expertise that EER does not currently posses. In addition, EER could encounter significant delays in introducing its technology into certain markets or find that penetrating such markets would not be feasible without, or would be adversely affected by the absence of, such arrangements. To the extent that EER enters into such joint venture arrangements, its revenues will depend upon the robustness, stability and efforts of third parties. There is no certainty that any such arrangements will be successful.

EER operates in a competitive market, and its technology has not yet proven itself commercially in the field of solid waste and medical waste

EER's Plasma Gasification-Melting (PGM) technology has been developed to convert solid waste into synthesis gas and products suitable for construction materials or other uses. The core of the technology was developed at the Kurchatov Institute in Russia. This technology has been used for more than two decades for the treatment of low and intermediate level radioactive waste in Russia. The PGM technology is applicable for treatment of, among others, municipal solid waste (MSW), municipal effluent sludge, industrial waste and medical waste. The waste treatment market is a conservative market and new technologies are not easily accepted. Therefore, traditional applied technologies in the treatment of solid waste still enjoy greater market recognition compared to PGM technology and other advanced technologies, and some companies that offer solutions based on these traditional technologies have substantial experience in establishing and operating waste treatment facilities and greater financial capabilities compared to EER. In addition there is no certainty that potential customers will prefer the technology of EER over the technologies of EER's competitors, either those using traditional technologies or those using other kinds of advanced technologies for waste treatment. Additionally, the development of a more effective or cheaper technology by a competitor will have an adverse effect on EER.

Moreover, Plasma based, gasification based and Plasma gasification based technologies are implemented by different companies for the treatment of municipal solid waste (MSW), municipal effluent sludge, industrial waste and medical waste for more than a decade. Some of the prominent competitors in the field of PGM include Thermoselect, Ebara, S4 Energy Solution, Alter NRG and Plasco Energy Group. Most of these companies enjoy greater financial capabilities compared to EER, and some of them are located in Europe or in the U.S., and thus they are geographically closer to the EER's target markets.

EER faces uncertainty relating to the costs of potential projects and the pricing of its services

EER currently faces uncertainty relating to the pricing and construction costs of solid waste treatment facilities, and its marketing costs. Failure to assess its future costs correctly could result in substantial losses to EER. When calculating the profitability of potential projects, EER makes several assumptions relating to its expected income from waste treatment fees (Tipping Fees) and energy sales, as well is its expected capital and operational costs. These assumptions are based on the existing prices in the relevant markets, and, among others, the existence of certain governmental subsidies and incentive plans for "green" technologies. Price reductions or changes in such governmental subsidies and incentive plans in these markets may affect the profitability of potential project and may result in losses to EER.

EER may encounter engineering difficulties relating to the scale up its technology

As of the date of this shell company report, EER has not yet established and operated a commercial plant that implements its technology. The testing and demonstrations of EER's technology are done mostly in EER's demonstration facility in Israel and are limited in their duration due to the restrictions contained in EER’s operating license. While demonstrations conducted in recent years have proven that EER's technology is feasible for commercial use, EER may face unforeseeable challenges and engineering difficulties and may not be able to successfully scale up its technology for commercial use.

EER's research and development activity is conducted in collaboration with third parties, and its success depends on their efforts

As of the date of this shell company report, some of the research and development activity relating to EER's technology is conducted at the Royal Institute of Technology of Sweden, in collaboration with EER. Some research and development activity is also conducted in collaboration with additional third parties. The successful development of EER's technology depends on the resources, stability and efforts of such third parties. In the event that such third parties discontinue their collaboration with EER, that could adversely affect EER's research and development capabilities.

Changes in the legislation, standards and regulations relating to EER’s field of operations may adversely affect its operations and profitability

EER's business activity is regulated by environmental laws and regulations in the markets in which it operates. More specifically, EER's business activity is bound by the provisions of the Israeli Clean Air Law, the Israeli Hazardous Substances Law (and the Hazardous Waste License obtained in connection therewith) and additional environmental laws and regulations. In addition, EER's international business activity is expected to be subject to international and regional conventions and directives, as well as local laws, regulations and standards, relating to environmental, hazard control, medical and radioactive waste treatment, and other aspects that may be related to the establishment and operation of waste treatment facilities. EER spends substantial amounts of cash in order to comply with these regulations. Any changes in legislation, standards and regulations or any policy changes undertaken by various authorities pertaining to environmental protection under the jurisdictions EER operates in could have a significant effect on the activity of EER.

Intellectual property is extremely important to EER's business, and its inability to protect its intellectual property would harm EER's competitive position

As of June 28, 2011, EER has had nine active families of patent applications and patents. In addition to patents, EER relies on confidentiality agreements and similar mechanisms to protect its know-how and intellectual property, the core of which was historically developed at the Kurchatov Institute in Russia. These measures are limited in terms of their effectiveness in protecting EER’s intellectual property and could therefore prove inadequate in limiting unauthorized use of EER’s know-how. Additionally, such measures do not guarantee that other parties may not claim rights in certain know-how that is being used by EER in its research and development activities. There is also no assurance that pending patent applications will be approved, that any patents will be broad enough to protect EER's technology, will provide it with competitive advantages or will not be challenged or invalidated by third parties, or that the patents of others will not have an adverse effect on EER's ability to do business.

EER's business may suffer if EER becomes involved in disputes or protracted negotiations regarding its intellectual property rights or the intellectual property rights of third parties

EER is subject to the risk of adverse claims and litigation alleging infringement by EER of the intellectual property rights of others. There are increasing numbers of patents and patent applications in EER's industry. Third parties may assert infringement claims in the future, alleging infringement by EER's current or future technology or applications. EER may institute or otherwise be involved in litigation to protect its registered patents and/or trade secrets or know-how, challenge the validity of proprietary rights of others or defend against alleged infringement by EER of proprietary rights of others. This type of litigation is costly and diverts management’s attention from its day-to-day responsibilities of running EER's business. In addition, an adverse determination in such litigation could:

| | · | limit the value of EER's trade secrets or know how; |

| | · | subject EER to significant liabilities to third parties; |

| | · | require EER to seek licenses from third parties; or |

| | · | prevent EER from commercializing and marketing its technology and service, any of which could have a material adverse effect on EER's business, financial condition and results of operations. |

EER has received grants from the Office of the Chief Scientist in Israel, and it is therefore obligated to pay certain royalties to the Israeli government from sales of its products, and it is bound by the provisions of the Israeli Research and Development Law

EER has received grants from the government of Israel through the Office of the Chief Scientist of the Ministry of Industry, Trade and Labor, or the Office of the Chief Scientist, for the financing of a portion of its research and development expenditures in Israel, pursuant to the Encouragement of Industrial Research and Development Law 5744-1984, or the R&D Law. Under the R&D Law, royalties on the revenues derived from sales of products (and related services) developed (in all or in part) according to, or as a result of, the Office of the Chief Scientist funded plans are payable to the Israeli government, at annual rates which are determined under the Encouragement of Industrial Research and Development Regulations (Rate of Royalties and Rules for the Payment thereof), 1996, or the R&D Regulations, up to the aggregate amount of the grants received by the Office of the Chief Scientist, plus annual interest (as defined in the R&D Regulations). Any intellectual property developed using the Office of the Chief Scientist funds must be fully and originally owned by the Israeli company which received such funds. The R&D Law restricts the ability to transfer abroad know-how funded by the Office of the Chief Scientist. Transfer of such know-how to a foreign entity requires prior approval from the Office of the Chief Scientist, and is subject to payment of a redemption fee to the Office of the Chief Scientist calculated according to formulas provided under the R&D Law. As of the date of this shell company report, EER has received a total of NIS 1.7 million (approximately US$0.4 million), out which an amount of NIS 1.5 million (approximately US$0.35 million) has not yet been repaid by EER.

If EER transfers outside of Israel know-how and technology, which were developed according to, or as a result of, the Office of the Chief Scientist funded plans, without obtaining the approval of the Office of the Chief Scientist, it may also be subject to criminal charges. In recent years, the government of Israel has accelerated the rate of repayment of the Office of Chief Scientist grants and may further accelerate them in the future. These restrictions on transferring technologies and/or manufacturing outside of Israel continue to apply even after EER have repaid any grants, in whole or in part.

EER's dependence on a single Demo Facility magnifies the risk of an interruption in its business operations

As of the date of this shell company report, EER does not own any other facility other than an operational demonstration facility, located near the village of I’billin, in Northern Israel (the "Demo Facility"). The current business license relating to the operation of the Demo Facility, which is subject to certain conditions set forth by the Israeli Ministry of Environmental Protection, is valid until December 31, 2011. The business license must be renewed on an annual basis. In the event that EER is unable to renew its business license, or if EER will not be able to meet the conditions of the new license, it could have a significant effect on its activity.

In addition, in September 2007, EER has entered into a lease agreement with respect to the ground on which the Demo Facility is located (the "Lease Agreement"). The original term of the Lease Agreement was three years, and EER had an option to extend the term of the rent for additional two years. EER has exercised the option in 2010, and consequently the term of the Lease Agreement was extended until July 2012. Pursuant to the terms of the Lease Agreement, the Demo Facility is the property of EER, and EER is responsible for disassembling the Demo Facility and removing it from the property at the end of the lease period. As of the date of this shell company report, there is no certainty that the term of the Lease Agreement will be extended beyond July 2012. The disassembly and the transfer of the Demo Facility to another location may require substantial investments, and may not be economically feasible for EER. Therefore, if the Lease Agreement is not extended beyond 2012, that could have a significant effect on EER's business activity. In addition, any event affecting the Demo Facility, including natural disaster, labor stoppages or armed conflict, or EER's lack of financial resources to operate the plant, may disrupt or indefinitely discontinue EER's research and development, operational and marketing capabilities and could significantly impair its business.

Because of EER's small size, it depends on a small number of employees who possess both executive and technical expertise, and the loss of any of these key employees would hurt EER's ability to implement its business strategy and to compete effectively in its target markets

Because of EER's small size and its reliance on employees with either executive or advanced technical skills, its success depends significantly upon the continued contributions of its officers and key personnel. All of EER's key management and technical personnel have unique expertise, which might be in high demand among its competitors, and the loss of any of these individuals could cause EER's business to suffer.

In addition, EER's business operations depend heavily on the knowledge and efforts of Mr. Moshe Stern. Mr. Stern is the original founder of EER, and is responsible for the establishment and maintenance of most of EER's business relationships and collaborations. Until the closing of the EER Transaction, Mr. Stern was the chief executive officer of EER. Following the closing of the EER Transaction, Mr. Stern resigned from his position as the chief executive officer of EER, and is no longer an employee of EER. However, Mr. Stern is currently providing business development services to RVB, pursuant to the Services Agreement, and therefore EER (which is now a subsidiary of RVB) can still benefit from his knowledge and skills. If, in the future, EER is not able to benefit from Mr. Stern's knowledge and skills, that may adversely affect its relationship with existing and potential partners, its ability to raise funds its ability to commercialize its technology and services.

EER might not be able effectively manage its growth

If the commercialization of EER's technology and services is successful, EER's business will need to grow. Continued growth would subject EER to numerous challenges, including, among others, implementing appropriate operational and financial systems and controls, and increasing and training its manpower within a short period of time to cope with the EER's administrative, marketing, engineering and operational needs. EER's expected growth may place significant demands on its management and require financial and operational resources. If EER is unable to manage its growth, its business, financial condition and results of operations could be harmed.

ITEM 4. Information on the Company

A. History and Development of the Company

Our legal and commercial name is R.V.B. Holdings Ltd. Our office is located at Platinum House, 21 Ha'a'rba'ah St., Tel Aviv, 64739, Israel, and our telephone number is +972 (3) 684-5500.

We were incorporated as an Israeli corporation under the name B.V.R. Systems (1998) Ltd., in January 1998 to receive all of the assets and liabilities of the defense-related business of BVR Technologies Ltd., or BVR-T, in accordance with the terms of a reorganization plan. The reorganization plan was consummated, and BVR commenced operations as of January 1, 1998. In January 2010, we changed our name to R.V.B. Holdings Ltd.. Our corporate governance complies with the Israeli Companies Law, 1999, as amended (the "Companies Law").

On July 19, 2009, we entered into an asset purchase agreement with Elbit Systems Ltd., whereby Elbit acquired substantially all of our assets and business for cash consideration of approximately US$34 million and assumed substantially all of our business related liabilities (the "Elbit Transaction"). The sale of our business to Elbit was completed on November 19, 2009. For more information related to the Elbit Transaction see "- Item 10C. Material Contracts" below.

On March 24, 2010, Greenstone exercised its option to purchase from Aviv Tzidon and A.O. Tzidon (1999) Ltd., a company wholly owned by Aviv Tzidon (collectively: "Tzidon"), the control of the Company. As part of the closing of the option exercise by Greenstone, A.O. Tzidon (1999) Ltd. purchased from HSN General Managers Holdings Limited Partnership (“HSN”) all of its holdings in the Company, namely 20,000,000 of our Ordinary Shares, which constitute part of the shares sold by Tzidon to Greenstone, at a price per share of US$0.215 and an aggregate consideration of US$4,300,000, pursuant to a share purchase agreement between HSN and Tzidon, dated February 6, 2011. On March 15, 2011, pursuant to an agreement entered into by and among Greenstone and Tzidon on December 12, 2010 and the option awarded to Greenstone to purchase up to 65% but not less than 50.14% of our issued share capital as of that date, Tzidon sold to Greenstone: (i) 76,680,848 of our ordinary shares, constituting 65% of our issued and outstanding share capital as of that date (not taking into account 1,040,000 of our dormant shares); and (ii) 1,800,000 options exercisable into 1,800,000 of our ordinary shares.

On August 22, 2011, our shareholders approved the EER Transaction (following an approval by our audit committee and board of directors), together with the Additional SPA. On August 31, 2011, we completed the EER Transaction and purchased a total of 7,996,210 EER shares from Greenstone, our controlling shareholder, and Accord. The closing of the Additional SPA is expected during September or October 2011, at which time we expect to issue a total of up to 96,100,358 RVB shares, in exchange for the EER shares of those additional EER shareholders who elected to become parties to the Additional SPA. For information regarding the EER Transaction and the Additional SPA, see "Item 7.B. Related Party Transactions – EER Transaction" in this shell company report.

From October 1998 until March 2001, our ordinary shares traded on the NASDAQ National Market. Between March 2001 and February 2003, our Ordinary Shares traded on the NASDAQ Small Cap Market under the symbol BVRSF. From February 2003 until March 2010 our shares traded on the Over the Counter Bulletin Board under the symbol BVRSF.OB. Since March 2010, our ordinary shares have traded under the symbol, RVBHF.OB which reflects our name change to R.V.B. Holdings Ltd.

Capital Expenditures

We had no capital expenditures during the first eight months of 2011, and during 2010. Our capital expenditures totaled US$0.2 million in the year ended December 31, 2009 and US$0.3 million in the year ended December 31, 2008.

B. Business Overview

General

On August 31, 2011, the EER Transaction was completed, following which we have become the controlling shareholder of EER. For additional information, see "Item 7.B. Related Party Transactions – EER Transaction" in this shell company report.

Below is a description of EER's business. As of the date of this shell company report, we do not have any other business activity besides EER's business.

EER's industry

With the rapid growth in the world's population, the waste generation volume is becoming an increasing concern around the world. The world's population is producing approximately 2.5 billion tons of municipal solid waste (MSW) each year. Certain factors, such as the rate of growth in the general population, improvements in the quality of life and continuous increase in the global GNP, contribute to the accelerated growth in the production of MSW. In order to cope with the constant growth in the production of waste, the global waste management industry is undergoing certain changes, among which the transfer from traditional waste disposal methods to a resource recovery processes. In light of these changes, the development of new technology is required in order to convert certain types of waste into recycled materials or energy.

Nations around the world vary in their progress towards the facilitation of these changes. Countries like Germany, Japan, Denmark and the Netherlands, which are characterized as 'mature markets' already have clear regulatory, fiscal and policy frameworks in place for such matters, and over the last few years, they placed substantial investments in the development of modern waste treatment solutions. On the other hand, some countries, like UK, Italy, Spain, Greece, Canada, Australia, some Gulf Arab States and parts of East and South East Asia, are characterized as immature markets. These countries are expected to show rapid growth in the amount of waste treatment over the next ten to fifteen years, due to the increase of new regulations which aim to direct the waste streams from traditional waste treatment methods, such as landfill, to the alternative technology sector. Other countries, as some EU Member States, some countries in the Middle East, South Africa, Latin America and the Caribbean, are characterized as embryonic markets. In these countries, there is little governmental investment in the development or the adoption of "green" advance technologies, and the relevant regulation is considered obsolete. The US, one of EER's primary target markets, can be divided into different categories, some US states are mature, some are emerging and some are embryonic.

There are currently three main waste disposal methods, employed by different companies and governments around the world:

| | · | Recycling - Recycling is the process of sorting waste and reusing the items from which utility can still be derived. This method is not always economically feasible, as it requires substantial amount resources for sorting waste. In addition, large percent of waste is not recyclable. |

| | · | Landfill - the most traditional and common method, which involves disposal of waste by burial in landfill sites. This method, though it is common, is a main factor for pollution of air, ground and underground water. Therefore, in recent years, some countries, such as Germany, Austria, Belgium, the Netherlands, and Switzerland, have banned the disposal of untreated waste in landfills. |

| | · | Waste to Energy (WTE) - this method is divided into three main methods: biological, physical and thermal. The thermal treatment is divided to three main processes: Incineration, Thermal Gasification/ Pyrolisys and Plasma Gasification. The Incineration process has a lot of disadvantages, such as the emission of toxic gases and ashes which require additional separate treatment, and therefore the Thermal process is more attractive. |

Each year, approximately 170 million tons of municipal solid waste is treated in about 900 waste treatment facilities around the world. The WTE market was estimated to be worth US$7 billion in 2010, and its estimated annual growth is 6-10%. Thus, the WTE market is expected to be worth about US$ 27 billion in 2021.

The main entrance barriers to the solid waste market include acquisition and development costs, licensing costs, depending on local regulation in each country in which the technology is implemented, facilities establishment Costs, Large competitors and willingness of finance institutions to finance the establishment of facilities based on new technologies.

The global economic crisis has caused, among others, to a decrease in the investments in the advanced technologies, including the PGM technology. According to EER's estimation, in spite of the recovery from the crisis during 2009 and 2010, it is still very difficult for EER and its customers to obtain financing for its activity and facilities from private investors and especially from institutional investors.

Competition

Many companies around the world are in the business of developing advanced technologies for the treatment of solid waste, and such companies can compete with EER in its target markets. Some of these companies use different variations of the plasma gasification technology, and some use other WTE technological solutions.

Below is a description of the main new thermal treatment technologies (NTTT), which compete with EER's PGM technology:

| | · | Gasification technology - thermal reaction under a lack of oxygen which creates fuel gas, which causes an early heat of the waste, a process which increases the energetic efficiency. |

| | · | Pyrolysis technology - a similar process to the Gasification. The waste is first processed in an early process for the creation of refuse derived fuel. |

| | · | Plasma technology - Gasification of the materials with the highest temperatures (approximately 800 degrees) under special conditions. |

| | · | Thermal Hydrolysis technology - technology based on "cold incineration ". This technology cannot be used for treatment with solid waste. |

| | · | Hybrid facilities - technologies combined facilities. The PGM technology belongs to this technology. |

These are the main advantages of the PGM technology:

| | · | Decreased operating costs due to the combination of three processes in one union continuous process. |

| | · | Decreased operating costs due to the fact that the pollution level in this technology is lower, compared to other technologies. |

| | · | The ability to handle a wide spectrum of waste without the necessity of any preliminary sorting or treatment. |

| | · | The solid residue of the process is an environmentally benign material which can be used as raw material in construction. |

In addition, Pursuant to EER's estimation, its ability to prove the implementation of the PGM technology by a demonstration facility may provide it a competitive advantage compared to the other NTTT.

EER's major competitors in the field of waste treatment include:

| | · | Thermoselct – a Swiss origin Pyrolysis/Gasification technology, which has been implemented in Japan by JFE and licensed in the US by IWT. Thermoselct has several commercial installations in Japan that are processing selective portion of municipal solid waste (“MSW”) and industrial waste. Thermoselct MSW project in Germany failed to provide desired output and is currently closed. |

| | · | JFE is a large Japanese engineering company, active in various waste treatment areas, also with own proprietary solutions. |

| | · | Ebara – a Japanese gasification technology with several installations in Japan for MSW. It is estimated that its technology currently is too expensive to be implemented in Europe. |

| | · | Westinghouse (AlterNRG) – Plasma Arc technology, implemented by AlterNRG, a Canadian listed company. There are several installations in Japan, but no success yet in other countries. |

| | · | Plasco Energy – Canadian Plasma Arc technology company, aiming for MSW conversion. It has built a large demonstration plant that is not working currently on a continuous MSW waste stream. Plasco Energy has raised significant funds to establish its first commercial facility and to support a vast worldwide business development activity related to waste treatment. |

| | · | InEntech (S4) – MIT Plasma technology. Significant funds were invested in the technology so far. Several installations are located in Asia and one in US. It has formed together with Waste Management, a joint venture, for the implementation of its technology. |

Other companies in the field include, Nippon Steel (Japan), Entech, S4 Energy Solution, GEM, Enerkem, Nexterra and OE that mostly have gasification technology for specific waste streams.

Material Agreements

The Kurchatov Institute Agreement

On June 6, 2000, EER Ltd., has entered into an agreement with the Kurchatov Institute, which was amended on February 12, 2002 (the “Kurchatov Agreement”) (the agreement and the rights and obligations of EER Ltd. thereunder were later assigned to EER). Under the terms of the Kurchatov Agreement, Kurchatov Institute assigned and transferred to EER Ltd. all then present and future intellectual property rights and know-how related to the Demo Facility (which was designed, manufactured and constructed for EER by Kurchatov Institute's subsidiary under a separate agreement) and to the Additional Projects (as defined below) (collectively, the "IP Rights"). According to the Kurchatov Agreement, EER Ltd. shall cover all the expenses related to the assigning, registration and recordation of the IP Rights. According to the Kurchatov Agreement, The Kurchatov Institute shall fully cooperate with EER Ltd. for the purposes of utilizing the PGM technology with regard to Municipal Solid Waste ("MSW"), Medical Waste (“MW”), Low Radio Active Waste (“LRAW”) and PGM Compatible Industrial Waste (“IW”), including, but not only, for the designing and construction of plants and installations by EER Ltd., its licensee(s) and/or other purposes (the "Additional Projects"). Upon EER’s request, the Kurchatov Institute shall assign to EER any know-how or intellectual property rights relating to such technologies to be used outside the territories comprising the former Soviet Union, provided the financial and other legal and reasonable interests of the Kurchatov Institute have been satisfied. The Kurchatov Institute and its affiliates shall exclusively work with EER Ltd. on any of the aforementioned applications of the PGM Technology, and shall not assist, directly or indirectly, any individual or entity to engage in any activity in the fields of SMW, MW, LRAW and IW. In addition, the Kurchatov Institute undertook to provide EER Ltd. its know-how and experienced highly qualified specialists in order to obtain the required scientific and technical qualifications in the works related to the Projects, as will be mutually agreed by the parties. In consideration for Kurchatov Institute’s undertakings under the Kurchatov Agreement, EER shall pay Kurchatov Institute a royalty in the amount of 1% of the purchase price actually received by EER from the sale of the Additional Projects.

The PyroGenesis Agreement

On December 5, 2005, EER entered into an agreement for the purchase of equipment with PyroGenesis Inc. (“PyroGenesis” and the “PyroGenesis Agreement”), under which EER purchased from PyroGenesis a Non-Transferred Arc Plasma Torch System (the “Equipment”) which was installed in the Demo Facility, for an aggregate amount of US$810,000 (the “Purchase Price”). The Purchase price did not include spare and wear parts, and certain other components. Pursuant to the PyroGenesis Agreement, PyroGenesis was provided with a right of first refusal for the supply of any and all future torch systems required by EER.

The Radon Center Agreement

On December 28, 2005, EER entered into an agreement on partnership, R&D collaboration and joint activity with the Radon Center (the “Radon Agreement”), under which the parties agreed to enter into a scientific cooperation, including research and experiment actions, relating to the Technology. According to the Radon Agreement, EER may use, from time to time, Radon Center’s test facility for Low Radio Active Waste treatment, in order to perform experiments and demonstrations. The original term of the Radon Agreement was 5 years, and it has not been renewed. However, even though the Radon agreement expired, EER and the Radon Center continue their collaboration.

The Lease Agreement

In September 2007, EER entered into the Lease Agreement with Naser Recycling Ltd. (the "Naser"), with respect to the ground on which the Demo Facility is located. The original term of the Lease Agreement was three years, and EER had an option to extend the term of the rent for additional two years. EER has exercised the option in 2010, and consequently the term of the Lease Agreement was extended until July 2012. The rent for the entire extension period (NIS 600,000 in the aggregate, not including VAT (approximately US$175 thousands)) was paid in advance. This amount is based on a monthly fee of NIS 25,000, which is approximately US$7 thousands. Pursuant to the terms of the Lease Agreement, the Demo Facility is the property of EER, and EER is responsible for disassembling the Demo Facility and removing it from the property at the end of rental period. As of the date of this shell company report, there is no certainty that the term Lease Agreement will be extended beyond July 2012.

The Primus Agreement

In December 2009, EER entered into an exclusive representation agreement with Primus Security & Consulting, LLC ("Primus" and the “Primus Agreement”), pursuant to which Primus shall provide strategic consulting and intermediary services related to identifying and accessing parties in the U.S. and in other countries, that might be interested in long-term relationships with EER, for the utilization of EER's Technology. According to the Primus Agreement, Primus has the exclusive right to market and sell projects using EER's Technology, which shall expire in December 2011, following which the parties will negotiate and decide whether or not to extend it for additional period. Primus is entitled to a monthly fee of US$10,000, and is also entitled to additional payments following certain events, including (but not limited to) the closing and the successful establishment of joint ventures introduced by Primus, successful raise of capital for projects by Primus and certain events related to EER's subsidiary in Texas. In addition, Primus is entitled to receive up to 15% of the shares awarding distribution rights (without voting rights) of any U.S. subsidiary formed by EER to accommodate projects introduced by Primus. The Primus Agreement expires in December 2011.

KTH Agreement

On June 4, 2009, EER entered into a cooperation agreement with KTH (the “KTH Agreement”). Under the terms of the KTH Agreement, which is valid for a term of 5 years, KTH undertook to provide EER with technical and scientific support in the ongoing development of the PGM process, including full access to laboratories and facilities of KTH. In the event that EER requests KTH to perform any particular project, EER shall send to KTH a specific work order, specifying the tasks to be performed and the consideration to be paid to KTH for performance of such work. The parties agreed that EER shall have and retain all rights and interests in the PGM process. Any publication of work by KTH which is related to or involving the cooperation between the parties shall require the prior written consent of EER.

The SNC Agreement

On September 15, 2010, EER entered into a memorandum of understanding (the “SNC MOU”) with SNC-Lavalin Engineers & Constructors Inc. (“SLE&C”) which, to the best of EER’s knowledge, is a private company and a subsidiary of SNC-Lavalin Group Inc., a company whose shares are listed for trade on the Toronto Stock Exchange, Canada (“SNCL-G”), and among the leading engineering and construction corporations in the world. The SNC MOU establishes methods of cooperation between EER and SLE&C in respect to projects aimed at exploiting PGM Technology. According to the SNC MOU, the parties will cooperate in identifying projects where technology can be applied to the PGM, bidding implementation, establishment and operation. In the event that the parties are not able to reach an understating regarding the cooperation on a particular project, the interested party will be allowed to do so on its own, while the other will be obligated to refrain from acting on it, unless such party: (i) can establish that it was aware of such project, prior to its identification by the other party, and had determined to pursue such project independently; or (ii) obtains the consent of the other party. Each party shall bear its own cost of pursuing such project and all related expenses until a definitive contract with a client is signed and comes into effect. The parties agreed that none of SLE&C, any client or third party will obtain any rights in the Technology, unless expressly agreed in writing by EER. The SNC MOU may be terminated upon a 30 day prior notice and terminates automatically on December 31, 2012.

The LOI with Approved Storage & Waste Hauling Inc.

On January 25, 2011, EER entered into a letter of intent with Approved Storage & Waste Hauling Inc. ("ASWH" and the "ASWH LOI"), relating to the formation of a joint venture for an initial pilot project (the "Pilot Project"). According to the ASWH LOI, the Pilot Project will process Regulated Medical Waste in an initial capacity of 15-30 short tons per day, and will be owned by a newly formed U.S. company mutually owned by EER and ASWH. The terms of the Pilot Project would be determined in a definitive agreement, the closing of which shall be 45 days from the expiration date of the LOI. EER and ASWH agreed on certain terms to be included in the definitive agreement, which relate, among other things, to pricing, investment, legal structure and ownership of the Pilot Project. According to the ASWH LOI, the definitive agreement would also include provisions relating to exclusivity on certain geographic areas. According to its terms, the ASWH LOI shall have terminated on December 31, 2011, but it was extended until December 31, 2012. EER and ASWH are currently working with the local and state regulatory bodies to prepare the permitting package for the project.

The Mid West LOI

On March 21, 2011, EER entered into a letter of intent (the “Mid-West LOI") with a third party located in the U.S. (the "US Company"), for the purposes of developing, constructing and operating PGM facilities in five states in the U.S. using EER’s Technology (the “Facilities”). Under the terms of the Mid-West LOI, the US Company will forward to EER all relevant data regarding EER’s plan to develop and operate a PGM facility in one out of the five states (the "First Project”). Per the US Company's request, EER shall provide with all necessary information regarding the Technology, subject to appropriate confidentiality undertakings by the US Company. The US Company shall grant to EER an equity position equal to 14.25% of its then fully diluted share capital (the "US Company Shares”). In exchange for such shares, EER shall produce a Preliminary Engineering Design study for the First Project (the “Study”), which cost shall not exceed US$3,000,000. If the cost exceeds such amount, EER shall not be entitled to additional shares. The US Company shares shall only be transferred to EER upon completion of the Study. The Study will comprise as least 45% of the total work and expense required for the completed front end engineering design for the First Project. Such completed front end engineering design or any further study to be performed by EER shall be funded through the finance raised by the US Company in connection with the First Project. The US Company shall be responsible for obtaining and maintaining all the relevant licenses, permits and approvals from any relevant authority in order to establish and operate the First Project, and EER will be responsible to provide any technical and financial data to meet these requirements. EER shall grant an exclusive license to the US Company to operate all facilities in the five states. The US Company is responsible for obtaining financing for the construction of the first Project. EER shall receive a royalty equal to 5% of the Syngas generated total revenues of the first Plant. All the above mentioned understandings are preliminary and subject to the execution of a definitive agreement between the parties. According to the Mid-West LOI, the US Company and EER shall sign within 6 months from the date of the Mid-West LOI, a binding agreement for the delivery of the First Project and with respect to the US Company Shares, the Study, the technology licenses and royalties and any other agreements as the parties may determine. The definitive agreements shall require the approval of the board of directors of each of the parties. In the event the definitive agreements are not executed by the parties within the 6 months stipulated above, then the Mid-West LOI shall expire and shall have no further force and effect and neither party shall have any further liability in connection therewith. During the period in which the Mid-West LOI is in force, EER and the US Company shall not approach to any other entity in connection with a project using PGM Technology within the geographical scope of the Mid-West LOI. The parties have explicitly agreed that no license to any patent or other intellectual property of either party is granted by the Mid-West LOI.

The Greenstone-EER Management Service Agreement