SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

The Securities Exchange Act of 1934

March 18, 2014

Commission File Number 000- 29884

R.V.B. HOLDINGS LTD.

(Translation of registrant's name into English)

Moshe Aviv Tower, 53rd floor, 7 Jabotinsky St., Ramat-Gan, 52520, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): _____.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): _____.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Act of 1934.

Yes o No x

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

Attached hereto are the audited consolidated financial statements of R.V.B. Holdings Ltd. as of and for the year ended December 31, 2013.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | R.V.B. HOLDINGS LTD. | |

| | (Registrant) | |

| | By: | /s/ Ofer Naveh | |

| | | Name: Ofer Naveh | |

| | | Title: Chief Financial Officer | |

| | | | |

Date: March 18, 2014

R.V.B. HOLDINGS LTD.

CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEAR ENDED DECEMBER 31, 2013

R.V.B. HOLDINGS LTD.

CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEAR ENDED DECEMBER 31, 2013

TABLE OF CONTENTS

| | Page |

| | |

| 2 |

| | |

| CONSOLIDATED FINANCIAL STATEMENTS | |

| | |

| 3 |

| | |

| 4 |

| | |

| 5-7 |

| | |

| 8-9 |

| | |

| 10-37 |

To the Board of directors and Shareholders of

R.V.B. HOLDINGS LTD.

We have audited the accompanying consolidated statements of financial position of R.V.B. Holdings Ltd. and its subsidiary (hereafter - "the Group") as of December 31, 2013 and 2012 and the related consolidated statements of comprehensive income, changes in equity and cash flows for each of the three years in the period ended December 31, 2013. These consolidated financial statements are the responsibility of the Group's management and Board of Directors. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Group is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Group's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such consolidated financial statements present fairly, in all material respects, the financial position of the Group as of December 31, 2013 and 2012 and the results of its operations, changes in equity and cash flows for each of the three years in the period ended December 31, 2013, in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standard Board (IASB).

As discussed in Note 1d to the financial statements, the Company has incurred recurring losses and negative cash flows from operations, and the board of directors of the Company decided to cease EER's operations and to act in order to dismantle the demonstration facility in Y'bllin owned by EER and also to implement a significant cost reduction plan in the Group. Therefore, the board of directors and management of the company concluded that the Company is not a going concern.

The Financial statements are prepared in accordance with IFRS as issued by the IASB with appropriate adjustments to reflect the fact that the Company is not a going concern.

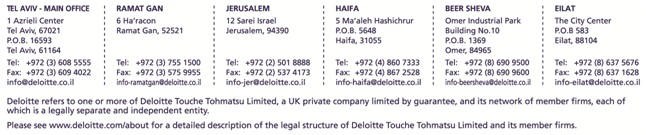

/s/ Brightman Almagor Zohar & Co. Brightman Almagor Zohar & Co. |

Certified Public Accountants (Isr.) A member firm of Deloitte Touche Tohmatsu Limited |

Tel Aviv, March 13, 2014.

R.V.B. HOLDINGS LTD.

| | | | | | | |

| | | | | | | | | | |

| | | | | | | |

| Assets | | | | | | | | | |

| | | | | | | | | | |

| Current assets | | | | | | | | | |

| Cash and cash equivalents | | 5 | | | | 102 | | | | 2,613 | |

| Accounts receivable | | 6 | | | | 85 | | | | 412 | |

| | | | | | | 187 | | | | 3,025 | |

| | | | | | | | | | | | |

| Fixed assets classified as held for sale | | 8, 13a(8) | | | | 1,642 | | | | - | |

| Total current assets | | | | | | 1,829 | | | | 3,025 | |

| | | | | | | | | | | | |

| Non-current assets | | | | | | | | | | | |

| Restricted bank deposit | | 13a(1) | | | | 298 | | | | 266 | |

| Fixed assets, net | | 8 | | | | - | | | | 11,092 | |

| Intangible assets, net | | 9 | | | | - | | | | 3,110 | |

| Total non-current assets | | | | | | 298 | | | | 14,468 | |

| | | | | | | | | | | | |

| Total assets | | | | | | 2,127 | | | | 17,493 | |

| | | | | | | | | | | | |

| Liabilities and equity | | | | | | | | | | | |

| | | | | | | | | | | | |

| Current liabilities | | | | | | | | | | | |

| Related party | | 13a(3),(10) | | | | 513 | | | | 9 | |

| Liability in respect of dismantling and vacating fixed assets | | 2h | | | | 175 | | | | - | |

| Accounts payable and accruals | | 10 | | | | 145 | | | | 360 | |

| Total current liabilities | | | | | | 833 | | | | 369 | |

| | | | | | | | | | | | |

| Non-current liabilities | | | | | | | | | | | |

| Accounts payable and accruals | | 13a(1) | | | | 436 | | | | - | |

| Liability to the Office of the Chief Scientist | | 13b | | | | - | | | | 418 | |

| Liability in respect of dismantling and vacating fixed assets | | 2h | | | | - | | | | 165 | |

| Total non-current liabilities | | | | | | 436 | | | | 583 | |

| | | | | | | | | | | | |

| Equity attributable to owners of the Company | | 14 | | | | 329 | | | | 13,113 | |

| Non-controlling interests | | | | | | 529 | | | | 3,428 | |

| Total equity | | | | | | 858 | | | | 16,541 | |

| | | | | | | | | | | | |

| Total liabilities and equity | | | | | | 2,127 | | | | 17,493 | |

| | | | | |

| | Yair Fudim Chairman of the Board | | Ofer Naveh CFO | |

Approval date of the financial statements: March 13, 2014.

The accompanying notes are an integral part of the consolidated financial statements.

| | | | | | For the year ended December 31 | |

| | | | | | 2013 | | | 2012 | | | 2011 | |

| | | | | | | |

| | | | | | | | | | | | | | | | |

| Revenues | | 13a(9) | | | | - | | | | 62 | | | | 63 | |

| | | | | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | | | | |

| Operating expenses and facility maintenance | | 16 | | | | 2,068 | | | | 2,952 | | | | 2,526 | |

| Marketing expenses | | 17 | | | | 251 | | | | 549 | | | | 1,200 | |

| Administrative and general expenses | | 18 | | | | 956 | | | | 1,430 | | | | 1,759 | |

| Other expenses | | 19 | | | | 12,415 | | | | - | | | | - | |

| Total expenses | | | | | | 15,690 | | | | 4,931 | | | | 5,485 | |

| | | | | | | | | | | | | | | | |

| Loss from ordinary activities | | | | | | (15,690 | ) | | | (4,869 | ) | | | (5,422 | ) |

| | | | | | | | | | | | | | | | |

| Financing income | | 20 | | | | 42 | | | | 428 | | | | 54 | |

| Financing expenses | | 20 | | | | (47 | ) | | | (60 | ) | | | (878 | ) |

| | | | | | | | | | | | | | | | |

| Total financing expenses, net | | | | | | (5 | ) | | | 368 | | | | (824 | ) |

| | | | | | | | | | | | | | | | |

| Loss for the year | | | | | | (15,695 | ) | | | (4,501 | ) | | | (6,246 | ) |

| | | | | | | | | | | | | | | | |

| Total comprehensive loss for the period | | | | | | (15,695 | ) | | | (4,501 | ) | | | (6,246 | ) |

| | | | | | | | | | | | | | | | |

| Loss and total comprehensive loss attributable to: | | | | | | | | | | | | | | | |

Owners of the Company | | | | | | (12,583 | ) | | | (3,615 | ) | | | (5,950 | ) |

Non-controlling interests | | | | | | (3,112 | ) | | | (886 | ) | | | (296 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | (15,695 | ) | | | (4,501 | ) | | | (6,246 | ) |

| Loss per share (in $) | | | | | | | | | | | | | | | |

| Basic and diluted loss per share | | 15 | | | | (0.054 | ) | | | (0.016 | ) | | | (0.029 | ) |

The accompanying notes are an integral part of the consolidated financial statements.

R.V.B. HOLDINGS LTD.

| | | For the year ended December 31, 2013 | |

| | | | | | | | | Capital reserve in respect of share-based payments | | | | | | Attributable to owners of the Company | | | Non-controlling interests | | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Balance as of January 1, 2013 | | | 56,885 | | | | 6,874 | | | | 64 | | | | (50,710 | ) | | | 13,113 | | | | 3,428 | | | | 16,541 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Changes during the period (unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share-based payment | | | - | | | | - | | | | 12 | | | | - | | | | 12 | | | | - | | | | 12 | |

| Change in non-controlling interests in respect of change in holding in a subsidiary | | | - | | | | (213 | ) | | | - | | | | - | | | | (213 | ) | | | 213 | | | | - | |

| | | | - | | | | (213 | ) | | | 12 | | | | - | | | | (201 | ) | | | 213 | | | | 12 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss for the period | | | - | | | | - | | | | - | | | | (12,583 | ) | | | (12,583 | ) | | | (3,112 | ) | | | (15,695 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total comprehensive loss for the period | | | - | | | | - | | | | - | | | | (12,583 | ) | | | (12,583 | ) | | | (3,112 | ) | | | (15,695 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2013 (unaudited) | | | 56,885 | | | | 6,661 | | | | 76 | | | | (63,293 | ) | | | 329 | | | | 529 | | | | 858 | |

The accompanying notes are an integral part of the consolidated financial statements.

R.V.B. HOLDINGS LTD.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

| | | For the year ended December 31, 2012 | |

| | | | | | | | | Capital reserve in respect of share-based payments | | | | | | Attributable to owners of the Company | | | Non-controlling interests | | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Balance as of January 1, 2012 | | | 42,364 | | | | 21,807 | | | | - | | | | (47,095 | ) | | | 17,076 | | | | 3,902 | | | | 20,978 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Changes during 2012 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share-based payment | | | - | | | | - | | | | 64 | | | | - | | | | 64 | | | | - | | | | 64 | |

| Issue of ordinary shares | | | 14,521 | | | | (14,521 | ) | | | - | | | | - | | | | - | | | | - | | | | - | |

| Change in non-controlling interests in respect of change in holding in a subsidiary | | | - | | | | (412 | ) | | | - | | | | - | | | | (412 | ) | | | 412 | | | | - | |

| | | | 14,521 | | | | (14,933 | ) | | | 64 | | | | - | | | | (348 | ) | | | 412 | | | | 64 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss for the year | | | - | | | | - | | | | - | | | | (3,615 | ) | | | (3,615 | ) | | | (886 | ) | | | (4,501 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total comprehensive loss for the year | | | - | | | | - | | | | - | | | | (3,615 | ) | | | (3,615 | ) | | | (886 | ) | | | (4,501 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2012 | | | 56,885 | | | | 6,874 | | | | 64 | | | | (50,710 | ) | | | 13,113 | | | | 3,428 | | | | 16,541 | |

The accompanying notes are an integral part of the consolidated financial statements.

R.V.B. HOLDINGS LTD.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

| | | For the year ended December 31, 2011 | |

| | | | | | | | | Receipts on account of options | | | Capital reserve from transactions with shareholders | | | Capital reserve in respect of share-based payments and equity component of convertible loans | | | | | | Attributable to owners of the Company | | | Non-controlling interests | | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of January 1, 2011 | | | 4,906 | | | | 34,078 | | | | 173 | | | | 161 | | | | 6,063 | | | | (41,145 | ) | | | 4,236 | | | | - | | | | 4,236 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Changes during 2011 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share-based payment | | | - | | | | - | | | | - | | | | - | | | | 1,220 | | | | - | | | | 1,220 | | | | - | | | | 1,220 | |

| Termination of employee options | | | - | | | | 2,852 | | | | - | | | | - | | | | (2,852 | ) | | | - | | | | - | | | | - | | | | - | |

| Equity component of convertible loans | | | - | | | | 1,013 | | | | - | | | | - | | | | - | | | | - | | | | 1,013 | | | | - | | | | 1,013 | |

| Conversion of shareholder's debts | | | 1,445 | | | | 15,128 | | | | - | | | | (161 | ) | | | (3,393 | ) | | | - | | | | 13,019 | | | | - | | | | 13,019 | |

| Issuance of ordinary shares – EER Transaction | | | 25,692 | | | | (20,862 | ) | | | (173 | ) | | | - | | | | (1,038 | ) | | | - | | | | 3,619 | | | | 4,117 | | | | 7,736 | |

Change in non-controlling interests in respect of change in holding in a subsidiary | | | - | | | | (81 | ) | | | - | | | | - | | | | - | | | | - | | | | (81 | ) | | | 81 | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 27,137 | | | | (1,950 | ) | | | (173 | ) | | | (161 | ) | | | (6,063 | ) | | | - | | | | 18,790 | | | | 4,198 | | | | 22,988 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss for the year | | | - | | | | - | | | | - | | | | - | | | | - | | | | (5,950 | ) | | | (5,950 | ) | | | (296 | ) | | | (6,246 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total comprehensive loss for the year | | | - | | | | - | | | | - | | | | - | | | | - | | | | (5,950 | ) | | | (5,950 | ) | | | (296 | ) | | | (6,246 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of December 31, 2011 | | | 32,043 | | | | 32,128 | | | | - | | | | - | | | | - | | | | (47,095 | ) | | | 17,076 | | | | 3,902 | | | | 20,978 | |

The accompanying notes are an integral part of the consolidated financial statements.

R.V.B. HOLDINGS LTD.

| | | For the year ended on December 31 | |

| | | 2013 | | | 2012 | | | 2011 | |

| | | | |

| | | | | | | | | | | | | |

| Cash flows from operating activity | | | | | | | | | | | | |

| Loss for the year | | | (15,695 | ) | | | (4,501 | ) | | | (6,246 | ) |

| Adjustments required to present cash flows from operating activity (Appendix A) | | | 13,389 | | | | 1,233 | | | | 3,703 | |

| | | | | | | | | | | | | |

| Net cash used in operating activity (*) | | | (2,306 | ) | | | (3,268 | ) | | | (2,543 | ) |

| | | | | | | | | | | | | |

| Cash flows from investment activity | | | | | | | | | | | | |

| Increase in restricted bank deposit | | | (11 | ) | | | (300 | ) | | | - | |

| Investment in fixed assets | | | (647 | ) | | | (60 | ) | | | (2 | ) |

| | | | | | | | | | | | | |

| Net cash used in investment activity | | | (658 | ) | | | (360 | ) | | | (2 | ) |

| | | | | | | | | | | | | |

| Cash flows from financing activity | | | | | | | | | | | | |

| EER Transaction (Note 7c) | | | - | | | | - | | | | 7,977 | |

| Repayment of bank loans | | | - | | | | (510 | ) | | | (204 | ) |

| Proceeds from shareholders loans | | | 453 | | | | - | | | | 1,466 | |

| | | | | | | | | | | | | |

| Net cash provided by financing activity | | | 453 | | | | (510 | ) | | | 9,239 | |

| | | | | | | | | | | | | |

| Increase (decrease) in cash and cash equivalents | | | (2,511 | ) | | | (4,138 | ) | | | 6,694 | |

| | | | | | | | | | | | | |

| Balance of cash and cash equivalents at the start of the year | | | 2,613 | | | | 6,751 | | | | 57 | |

| | | | | | | | | | | | | |

| Balance of cash and cash equivalents at end of the year | | | 102 | | | | 2,613 | | | | 6,751 | |

| | | | | | | | | | | | | |

| (*) Including cash interest payments in the amount of | | | - | | | | 19 | | | | 22 | |

| | | | | | | | | | | | | |

| (*) Including cash interest receipts in the amount of | | | 20 | | | | 36 | | | | 51 | |

The accompanying notes are an integral part of the consolidated financial statements.

R.V.B. HOLDINGS LTD.

CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)

Appendix A – Adjustments required to present the cash flows from operating activity

| | | For the year ended on December 31 | |

| | | 2013 | | | 2012 | | | 2011 | |

| | | | |

| | | | | | | | | | | | | |

| Income and expenses not involving cash flows: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Depreciation and amortization | | | 13,094 | | | | 1,884 | | | | 1,874 | |

| Interest accrued on loans and others, net | | | (13 | ) | | | 8 | | | | 706 | |

| Financing income regarding a short term loan | | | - | | | | (204 | ) | | | - | |

| Transformation of loan into grant | | | - | | | | - | | | | 701 | |

| Loss (profit) arising on financial liabilities at fair value through profit or loss | | | - | | | | (158 | ) | | | (52 | ) |

| Bonus in respect of options to shareholders in connection with the provision of a guarantee | | | - | | | | - | | | | 432 | |

| Share-based payments | | | 12 | | | | 64 | | | | 422 | |

| | | | | | | | | | | | | |

| | | | 13,093 | | | | 1,618 | | | | 4,083 | |

| | | | | | | | | | | | | |

| Changes in asset and liability items: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Decrease (increase) in accounts receivable | | | 379 | | | | (124 | ) | | | (14 | ) |

| Decrease in accounts payable and accruals | | | (83 | ) | | | (261 | ) | | | (366 | ) |

| | | | | | | | | | | | | |

| | | | 296 | | | | (385 | ) | | | (380 | ) |

| | | | | | | | | | | | | |

| | | | 13,389 | | | | 1,233 | | | | 3,703 | |

The accompanying notes are an integral part of the consolidated financial statements.

| | a. | R.V.B. Holdings Ltd. (formerly B.V.R Systems (1998) Ltd.) (the "Company") is an Israeli company incorporated in Israel (the Company changed its name on January 12, 2010). |

The Company’s ordinary shares are traded in the United States on the Over the Counter Bulletin Board (OTCBB) under the symbol RVBHF.

| | b. | On August 31, 2011, the Company completed the transaction, following which E.E.R. Environmental Energy Resources (Israel) Ltd.'s ("EER") became its subsidiary (the "EER Transaction"). As of January 12, 2012 the Company completed the multi-closing of the EER transaction in which it acquired all of EER's shares held by Greenstone Industries Ltd. ("Greenstone") and by S.R. Accord Ltd. ("Accord"), and the majority of EER shares held by certain other EER shareholders, and, as of the date of these financial statements, holds approximately 80% of EER's share capital and 99.1% of EER's voting rights. |

For additional information regarding the EER Transaction, see Note 7b.

| | c. | Description of EER and its operations: |

EER was incorporated in Israel on May 21, 2000, as a private company limited by shares. EER owns know-how and rights in the field of solid waste treatment through the use of Plasma-Gasification-Melting (PGM) technology, an innovative approach to waste treatment, which can be implemented, among others, for the treatment of municipal waste, medical waste and low and intermediate level radioactive waste (the “PGM Technology” or the “Technology”).

In early 2007, EER completed the construction of a facility in Yblin, Israel (containing systems similar to those found in a commercial facility) to make use of the Technology for the treatment of municipal waste (the "Yblin Facility"). The Yblin Facility, according to its permit, can operate only few times a year. At the start of 2008, the Company began depreciating the facility after a successful first year of trial running.

Over the years 2007-2009, several demonstrations were held using the Yblin Facility.

As part of the working plan of EER, the Board of Directors of the Company (the “Board”) approved an investment of up to US$ 1 million in EER's Yblin Facility. The purpose of the investment was implementing improvements in Yblin Facility which mainly include the replacement of the current processing chamber and preparation of the facility for continuous operation. These improvements have been completed as of June 2013.

During June 2013, EER also conducted an additional trial operation of the Y'bllin Facility that included, among others, a test of the capabilities of the new reactor which operates on EER's technology for treatment of solid waste through Plasma-Gasification-Melting.

Considering EER's financial difficulties and needs as mentioned in note 1d below, on July 29, 2013 the board has decided, after considerable deliberation, to cease the operation of the demonstration facility in Y'bllin and to implement a significant cutback in the personnel of the Company and EER, and following the aforementioned decision, on October 31, 2013, the Board decided to act to dismantle the facility and to sale the systems and equipment. See also notes 7d and 13 a(8) below.

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – GENERAL (continued):

| | d. | The Going Concern Assumption |

The Company has incurred recurring losses and negative cash flows from operations. As at December 31, 2013, the Company had cash and cash equivalents in a total amount of $102 thousands.

On July 29, 2013 the board of directors of the company has decided to cease the operation of the demonstration facility in Y'bllin owned by EER and to implement a significant cost reduction plan in the Company and in EER. Following the aforementioned decision, on October 31, 2013, the Board decided to act to dismantle the facility and to sale the systems and equipment

Therefore, the board of directors and management of the company concluded that the Company is not a going concern.

The Financial statements are prepared in accordance with IFRS as issued by the IASB with appropriate adjustments to reflect the fact that the Company is not a going concern.

Regarding a line credit received from Greenstone see note 13a(10) below.

| The Company | - | R.V.B. Holdings Ltd. |

| The Group | - | The Company and its Subsidiaries (as defined below) |

| Subsidiaries | - | Companies in which the Company holds 50% or more of its voting rights or have the right to appoint half or more of the members of the Board of Directors, and the financial statements of which are consolidated with those of the Company. |

| Related parties | - | As defined in IAS 24. |

| CPI | - | The Consumer Price Index, as published by the Central Bureau of Statistics. |

| Dollar | - | A United States dollar |

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

| | a. | Statement of compliance |

These consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) and its interpretations published by the International Accounting Standards Board (“IASB”).

| | b. | Presentation of the statement of financial position |

The Company’s assets and liabilities in the statement of financial position are classified according to current and non-current items.

| | c. | Basis for the preparation of the financial statements: |

The consolidated financial statements have been prepared on the historical cost basis except for certain properties and financial instruments that are measured at revalued amounts or fair values, as explained in the accounting policies below. Historical cost is generally based on the fair value of the consideration given in exchange for assets.

The principal accounting policies are set out below.

| | d. | Analysis of the expenses recognized in profit and loss |

The Company’s expenses in the statement of comprehensive income are presented based on the function of expenses within the entity.

| | (1) | Functional currency and operating currency: |

The currency of the main economic environment in which the Group operates is the US dollar (hereinafter – "the functional currency").

| | (2) | Translation of transactions that are not in the functional currency |

In the preparation of the financial statements, transactions carried out in currencies other than the Company's functional currency (hereinafter – "foreign currency") are recorded at the exchange rates in effect on the dates of the transaction. At each reporting period, monetary items stated in foreign currency are translated according to the exchange rates in effect at that date; non-monetary items that are measured in terms of historical cost are translated according to the exchange rates in effect at the time of the transaction in connection with the non-monetary item.

| | (3) | The method of recording exchange rate differences |

Exchange rate differences (primarily in respect of monetary balances that are not in the functional currency) are recognized in the income statement in the period in which they occurred.

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES (continued):

| | f. | Cash and cash equivalents |

Cash and cash equivalents include all highly liquid investments, which include short-term bank deposits (up to three months from date of deposit) that are not restricted as to withdrawal or use and the period to maturity of which did not exceed three months at time of investment.

| | g. | Consolidated financial statements |

The consolidated financial statements incorporate the financial statements of the Company and entity controlled by the Company (its subsidiary).

Control is achieved when the Company:

| | · | has power over the investee; |

| | · | is exposed, or has rights, to variable returns from its involvement with the investee; and |

| | · | has the ability to use its power to affect its returns. |

Income and expenses of subsidiaries acquired or disposed of during the year are included in the consolidated statement of comprehensive income from the effective date of acquisition and up to the effective date of disposal, as appropriate.

When necessary, adjustments are made to the financial statements of subsidiaries to bring their accounting policies into line with those used by the other members of the Group.

All intra-group transactions, balances, income and expenses are eliminated in full on consolidation.

| | (2) | Non-controlling interest |

Total comprehensive income of subsidiaries is attributed to the owners of the Company and to the non-controlling interests even if this results in the non-controlling interests having a deficit balance.

Changes in the Group's ownership interests in subsidiaries that do not result in the Group losing control over the subsidiaries are accounted for as equity transactions. The carrying amounts of the Group's interests and the non-controlling interests are adjusted to reflect the changes in their relative interests in the subsidiaries. Any difference between the amount by which the non-controlling interests are adjusted and the fair value of the consideration paid or received is recognised directly in equity and attributed to the owners of the Company.

| | (3) | Regarding the accounting treatment of the EER transaction see note 1d above. |

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES (continued):

A fixed asset is a tangible item, which is held for use in manufacture or the supply of goods or services, or rent for others, which is forecasted to be used for more than one period. The Company presents its fixed asset items according to the cost model.

Under the cost model, fixed asset items are presented in the balance sheet at cost (net of received investment grants), net of accumulated depreciation and less accumulated impairment losses.

Any component of a fixed-asset item having a cost that is significant in relation to the total cost of the asset shall be depreciated separately. The depreciation is carried out systematically over the estimated useful life of the asset by the straight line method from the time at which the asset is ready for its intended use.

The annual rates of depreciation are as follows:

| | | | | | |

| | | | | % | |

| Buildings | | 12.5 | | 8 | |

| Construction and miscellaneous | | 12.5 | | 8 | |

| Plasma, compressors and bellows | | 12.5 | | 8 | |

| Machinery and equipment | | 12.5 | | 8 | |

| Pipelines | | 12.5 | | 8 | |

| Crane and reactor | | 12.5 | | 8 | |

| Faucets and electricity | | 10 | | 10 | |

| Steam boilers | | 5 | | 20 | |

| Furniture and office equipment | | 3-17, mainly 3 | | 6-33 (mainly 33%) | |

The useful life of an asset is reviewed by the Company's management at the end of each financial year. Changes are treated as changes in estimates and accounted for prospectively.

Liability in respect of costs for dismantling and removing an item and restoring the site on which the asset is located:

The cost of a fixed-asset item includes, among others, costs to dismantle and remove the item and to restore the site on which the asset is located, for which the Company incurred an obligation, when the item was purchased or as a result of the use of this item during a certain period, that is not for the purpose of manufacturing inventory during that period.

| | · | Changes in said liability regarding the end of the period of depreciation of the item will be deducted from or added to the asset during the period in which they occurred. |

| | · | Changes in said liability deriving from the passage of time are recognized in the statement of income as a financing cost as incurred. |

See also note 13a(8).

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES (continued):

| | i. | Non-current assets held for sale: |

Non-current assets and disposal groups are classified as held for sale if their carrying amount will be recovered principally through a sale transaction rather than through continuing use. This condition is regarded as met only when the asset (or disposal group) is available for immediate sale in its present condition subject only to terms that are usual and customary for sales of such asset (or disposal group) and its sale is highly probable. Management must be committed to the sale, which should be expected to qualify for recognition as a completed sale within one year from the date of classification.

Non-current assets (and disposal groups) classified as held for sale are measured at the lower of their previous carrying amount and fair value less costs to sell.

| | j. | Impairment of tangible and intangible assets other than goodwill: |

At the end of each reporting period, the Group reviews the carrying amounts of its tangible and intangible assets to determine whether there is any indication that those assets have suffered an impairment loss. If any such indication exists, the recoverable amount of the asset is estimated in order to determine the extent of the impairment loss (if any). When it is not possible to estimate the recoverable amount of an individual asset, the Group estimates the recoverable amount of the cash-generating unit to which the asset belongs.

Intangible assets with indefinite useful lives and intangible assets not yet available for use are tested for impairment at least annually, and whenever there is an indication that the asset may be impaired.

Recoverable amount is the higher of fair value less costs to sell and value in use. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset for which the estimates of future cash flows have not been adjusted.

If the recoverable amount of an asset (or cash-generating unit) is estimated to be less than its carrying amount, the carrying amount of the asset (or cash-generating unit) is reduced to its recoverable amount. An impairment loss is recognized immediately in profit or loss, unless the relevant asset is carried at a revalued amount, in which case the impairment loss is treated as a revaluation decrease.

When an impairment loss subsequently reverses, the carrying amount of the asset (or a cash-generating unit) is increased to the revised estimate of its recoverable amount, but so that the increased carrying amount does not exceed the carrying amount that would have been determined had no impairment loss been recognized for the asset (or cash-generating unit) in prior years. A reversal of an impairment loss is recognized immediately in profit or loss, unless the relevant asset is carried at a revalued amount, in which case the reversal of the impairment loss is treated as a revaluation increase.

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES (continued):

Financial assets are recognized in the balance sheet when the Company becomes a party to the contractual terms of the instrument.

Investments in financial instruments are initially measured at fair value plus transaction costs, except for those financial assets classified at fair value through profit or loss, where the transaction costs are carried to the income statement.

The Company's financial assets are loans and receivables. The classification is dependent on the nature and purpose of holding the financial asset and is determined at the initial date of recognition of the financial asset.

As for the publication of IFRS 9 "Financial Instruments", see note 3b.

Deposits, loans and other receivables with fixed or determinable payments that are not quoted in an active market, are classified as loans and receivables. The value of these financial assets is not materially different than their fair value.

| | l. | Financial liabilities and equity instruments issued by the Company: |

| | (1) | Classification as a financial liability or an equity instrument |

Non-derivative financial instruments are classified as either financial liabilities or as equity instruments in accordance with the substance of the contractual arrangement.

An equity instrument is any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities. Equity instruments issued by the Company are recorded at the amount of the proceeds received, net of direct issuing costs.

Financial liabilities of the Company are measured in accordance with their classification as other financial liabilities, at amortized cost (not at fair value through profit and loss).

| | (2) | Other financial liabilities |

Other financial liabilities (credit, loans, and accounts payable) are initially measured at fair value, net of transaction costs. The value of these financial liabilities is not materially different than their fair value.

| | m. | Leasing of real estate by the Company |

Payments made under operating leases were recognized in the statement of income on a straight-line basis over the term of the lease. Regarding onerous contracts see note 2o below.

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES (continued):

| | n. | Government grants and grants from the office of the Chief Scientist |

Grants received from the Chief Scientist (prior to the Amendment to IAS 20), which EER is required to repay with the addition of interest payments, provided the conditions associated with the grant are met, and which do not constitute forgivable loans, are recognized on the date of initial recognition, the amount to be repaid is presented as a liability at its nominal value without reflecting the benefit that arises from the capitalization of the grant at a capitalization rate that reflects the level of risk of the research and development project.

A provision is recognized if, as a result of a past event, the group has a present legal or constructive obligation, and it is probable that an outflow of economic benefits, which can be estimated reliably, will be used to settle the obligation.

The amount recognized as a provision, reflects management's best estimate of the amount required in order to settle the obligation on the balance sheet date, whilst taking into account the risks and uncertainties connected with the obligation. When the provision is measured using the forecasted cash flows in order to settle the liability, the book value of the provision is the current value of the forecasted cash flows.

When the entire amount or a portion thereof, which is required to settle the commitment at the balance sheet date is expected to be recovered by a third party, the Group recognizes the asset, in respect of said recovery, up to the amount of the recognized provision, only when it is virtually certain that the indemnification will be received and that it can be reliably measured.

Onerous contracts

Present obligations arising under onerous contracts are recognised and measured as provisions. An onerous contract is considered to exist where the Group has a contract under which the unavoidable costs of meeting the obligations under the contract exceed the economic benefits expected to be received from the contract.

Share-based payments to employees and others that provide similar services, which are settled in equity instruments of the Group, are measured at fair value on the grant date. On the grant date, the Company measures the fair value of the granted equity instruments by using the Black and Scholes model. If the equity instruments granted to them have not vested until these employees have completed a defined period of service, have met performance conditions or defined market conditions are met, the company recognizes the share-based payment transactions in its financial statements over the vesting period against an increase in its shareholders' equity, under "Capital reserve in respect of share-based payment". At each balance sheet date, the Company estimates the number of equity instruments that are expected to vest. Any change in the estimate relative to previous periods is recognized in the income statement over the remaining vesting period.

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES (continued):

In view of losses for tax purposes accrued by the Company and given the fact that as of the reporting date there was no certainty as to the realization of these losses in the foreseeable future, the Company does not recognize deferred taxes in respect of carry-forward losses and in respect of temporary differences in the value of certain revenues and expenses, between the financing reporting and the reporting for tax purposes.

| | (1) | Post-employment benefits |

The Company has defined contribution plans in accordance with Section 14 of the Israeli Severance Pay Law. In respect of these plans, the actuarial and economic risks are not imposed on the Company. In said plans, during the employment period, an entity makes fixed payments to a separate entity without having a legal or constructive obligation to make additional payments if the fund has not accumulated sufficient amounts. Deposits with the defined contribution plan are included as an expense at the date of the deposit, parallel to receiving services from the employee. The Company makes deposits with pension funds and insurance companies in respect of its liabilities to pay severance pay to some of its employees on a current basis.

| | (2) | Short-term employee benefits |

Short-term employee benefits include wages, vacation days, sick leave, recreation and deposits with the National Insurance Institute, which are paid within one year of the period in which the employee provides the related service. These benefits are recognized as an expense upon the provision of services.

| | s. | Earnings (loss) per share |

The Company presents basic and diluted earnings (loss) per share ("EPS") data for its ordinary shares. Basic EPS is calculated by dividing the profit or loss attributable to ordinary shareholders of the Company by the weighted average number of ordinary shares outstanding during the period. Diluted EPS is determined by adjusting the profit or loss attributable to ordinary shareholders and the weighted average number of ordinary shares outstanding for the effects of all dilutive potential ordinary shares, which comprise share options granted to employees and others (See Note 17).

Revenue is measured at the fair value of the consideration received or receivable.

Rendering of services

Revenue from a contract to provide services is recognized by reference to the stage of completion of the contract.

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES (continued):

| | u. | Exchange rates and linkage basis: |

| | (1) | Balances in or linked to foreign currency are presented according to the representative exchange rate published by the Bank of Israel at the balance sheet date. |

| | (2) | Balances linked to the CPI are presented according to the CPI for the last month of the reporting period. |

| | (3) | Data in respect of changes in the CPI and the dollar's exchange rate are as presented as follows: |

| | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Date of the financial statements | | | | | | | | | |

| As of December 31, 2013 | | | 3.471 | | | | 114.2 | | | | 114.1 | |

| As of December 31, 2012 | | | 3.733 | | | | 112.1 | | | | 111.9 | |

| | | | | | | | | | | | | |

| Rate of change | | | |

| For the year ended December 31, 2013 | | | (7.02 | ) | | | 1.8 | | | | 1.9 | |

| For the year ended December 31, 2012 | | | (2.30 | ) | | | 1.6 | | | | 1.4 | |

| For the year ended December 31, 2011 | | | 7.66 | | | | 2.2 | | | | 2.5 | |

| | v. | Accounting treatment of the EER Transaction: |

Although in the EER Transaction, mentioned in note 7b below, the Company was the legal purchaser of the rights in EER, the Company had no business activity ("Shell Company") as of the date of the EER transaction and thus does not meet the definition of a Business under IFRS 3, and since the majority of the shareholders of the Company after the completion of transaction (including the completion of the Additional SPA) are former shareholders of EER, this transaction does not meet the definition of a 'Business Combination' under IFRS 3. For accounting purposes the transaction is treated as a capital transaction of EER.

See also notes 7b & 7c.

NOTE 3 –NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRS):

There are no IFRSs or IFRIC interpretations that are effective for the first time for the financial year beginning on or after 1 January 2013 that had or would be expected to have a material impact on the group.

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 4 – CRITICAL ACCOUNTING JUDGMENTS AND KEY SOURCES OF ESTIMATION UNCERTAINTY:

In the Company's accounting policy, which is described in note 2 above, the Company is required in certain cases to use accounting judgment regarding estimates and assumptions in connection with the book value of assets and liabilities that are not necessarily found in other sources. The related estimates and assumptions are based on past experience and other factors which are considered relevant. Actual results may differ from these estimates.

Revisions to accounting estimates are recognized in the period in which the estimate is revised if the revision affects only that period or in the period of the revision and future periods if the revision affects both current and future periods.

Regarding Impairment of tangible and intangible assets see notes 8 and 9 below.

NOTE 5 – CASH AND CASH EQUIVALENTS

Composed as follows:

| | | | |

| | | | |

| | | | | | | |

| | | | |

| | | | | | | |

| In Dollars | | | 6 | | | | 2,382 | |

| In New Israel Shekels (NIS) | | | 96 | | | | 231 | |

| | | | 102 | | | | 2,613 | |

NOTE 6 – ACCOUNTS RECEIVABLE

Composed as follows:

| | | | |

| | | | | | | |

| | | | |

| | | | | | | |

| Institutions | | | 50 | | | | 79 | |

| Employees | | | - | | | | 2 | |

| Prepaid expenses | | | 23 | | | | 141 | |

| Restricted bank deposit | | | 12 | | | | 53 | |

| Advances to suppliers | | | - | | | | 137 | |

| | | | | | | | | |

| | | | 85 | | | | 412 | |

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 7 – SUBSIDIARY

As of December 31, 2013 the Company's only subsidiary is EER.

As mentioned in note 7b(1) below, as of January 12, 2012, RVB completed the multi-closing of EER Transaction in which it acquired all of EER shares held by Greenstone and Accord, and the majority of EER shares held by certain other EER shareholders, and holds 80% of EER's share capital and 99% of EER's voting rights.

Regarding the accounting treatment of the EER transaction see note 2v above and 7c below..

Below is a description of the EER Transaction, including a summary of the terms and conditions of the EER Share Purchase Agreement, the Option Agreement, the Voting Agreement and the Services Agreement, and the actions that took place at the closing of the EER transaction on August 31, 2011, (the "Closing Date") in connection therewith:

| | (1) | At the Closing Date, pursuant to the EER Share Purchase Agreement, the Company acquired all of EER's shares held by Greenstone (6,274,760 ordinary shares of EER), for a total cash consideration of US$ 15,686,900. In addition, the Company acquired all of EER’s share capital held by Accord (1,721,450 ordinary shares of EER), in exchange for 20,054,893 ordinary shares of the Company (each EER share was exchanged for 11.65 ordinary shares of the Company).On October 11, 2011 an initial closing of an Additional SPA was completed with certain EER shareholders. At this closing, the Company issued a total of 38,066,489 ordinary shares of the Company in exchange for a total of 3,267,510 EER shares from these certain EER shareholders. |

On January 12, 2012, an additional closing of the Additional SPA with other EER shareholders who elected to become parties to the Additional SPA was completed. At this additional closing the Company issued a total of 55,703,870 ordinary shares of the Company, in exchange for 4,781,448 EER shares of these certain EER shareholders.

| | (2) | In addition, pursuant to the EER Share Purchase Agreement, the Company was provided with the opportunity, before the lapse of 24 months following the Closing Date, to make an investment from time to time in EER’s share capital in an aggregate amount of up to US$ 8,000,000 by purchasing EER ordinary shares at a price per share of US$ 2.5. Since the closing date and until August 31, 2013 (the end of the above mentioned 24 month period) the Company has made an investment in a total amount of approximately $7 million. |

| | (3) | Pursuant to the Option Agreement, the Company granted Mazal an option to sell to the Company or to whom the Company may direct, no later than December 31, 2016, Mazal’s holdings in EER, in exchange for shares of the Company at the same exchange ratio applied for the purchase of EER's shares pursuant to the Share Purchase Agreement (the "Put Option"), and Mazal granted the Company the option to buy all of Mazal's holdings in EER, upon the occurrence of certain reorganizational events on or prior to December 31, 2016 (the "Call Option"). |

The terms and conditions of the Option Agreement shall apply, where applicable, to 150,000 options to purchase EER shares, which EER granted to EER's former CEO, on June 2011;

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 7 – SUBSIDIARY (continued)

| | b. | The EER Transaction (continued) |

| | (4) | Pursuant to the Shareholders Agreement, Mazal undertook to vote with its EER shares in the same manner as then voted on such matter by the Company and/or as instructed by the Company in its sole discretion. The Shareholders Agreement also contains certain provisions concerning rights of first refusal, pursuant to which, if Mazal proposes transfer in any way any of the Mazal EER shares, to one or more third parties except to a permitted transferee, then the Company shall have a right of first refusal with respect to such transfer; |

| | (5) | Pursuant to the Management Agreement, Greenstone will provide the Company with management and accounting services, for a total consideration of NIS 25,000 per month plus VAT, and in addition, 10,050,190 options to purchase ordinary shares of the Company, with an exercise price of US$ 0.2145 per share (adjusted for future dividends), which shall become vested and exercisable in accordance with the Vesting Schedule (see note 15d(2) below). The parameters used in the calculation of the fair value of the options are a share price of $0.09, an exercise price of US$0.2145 per share, the expected volatility of companies operating in this field - 32%, the life of the option – 5 years and a risk-free interest of 1%; The fair value of these options is immaterial. Greenstone noticed the Company that it waives the total consideration of the management fees valid from September 1, 2012. |

| | d. | Additional information regarding EER |

| | (1) | Considering EER's financial difficulties and needs as mentioned in note 1d above, on July 29, 2013 the board has decided, after considerable deliberation, to cease the operation of the demonstration facility in Y'bllin and to implement a significant cutback in the personnel of the Company and EER. |

As a result of the cease of operation of the Facility, the Company has recognized a significant impairment loss on the value of its assets in the reported period in a total amount of approximately $12.4 million (see note 19).

Following the aforementioned decision, on October 31, 2013, the Board decided to act to dismantle the facility and to sale the systems and equipment. See also note 13a(8) below.

In addition, the Company and EER are continuing with their efforts to enter into collaborations based on the technology of EER and/or sell the technology.

| | (2) | In addition, the Company had an immediate need for funding for the period beginning as of the cease of the Facility’s operation. Therefore, the Board approved the receipt of a line of credit from Greenstone in the amount of up to NIS 2 million. For more details regarding the credit line received from Greenstone see note 13a(10) below. |

| | (3) | The Board of Directors of EER approved, on several different dates, allotments of options to shareholders, employees and officers of EER (in this note – “the options”). |

As of the date of these financial statements there are options that were allotted to employees, officers and others, which confer approximately 5% of the fully-diluted share capital of EER.

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 8 – FIXED ASSETS

| | A. | Composition and changes: |

| | | Furniture & | | | Yblin | | | | |

| | | | | | | | | | |

| | | | |

| Cost | | | | | | | | | |

| As of January 1, 2013 | | | 212 | | | | 19,027 | | | | 19,239 | |

| Changes in the accounting year - | | | | | | | | | | | | |

| Additions | | | 2 | | | | 532 | | | | 534 | |

| Impairment (**) | | | - | | | | (9,351 | ) | | | (9,351 | ) |

| As of December 31, 2013 | | | 214 | | | | 10,208 | | | | 10,422 | |

| | | | | | | | | | | | | |

| As of January 1, 2012 | | | 200 | | | | 18,979 | | | | 19,179 | |

| Changes in the accounting year - | | | | | | | | | | | | |

| Additions | | | 12 | | | | 48 | | | | 60 | |

| As of December 31, 2012 | | | 212 | | | | 19,027 | | | | 19,239 | |

| | | | | | | | | | | | | |

| Accumulated depreciation | | | | | | | | | | | | |

| As of January 1, 2013 | | | 179 | | | | 7,968 | | | | 8,147 | |

| Changes in the accounting year - | | | | | | | | | | | | |

| Additions | | | 2 | | | | 631 | | | | 633 | |

| As of December 31, 2013 | | | 181 | | | | 8,599 | | | | 8,780 | |

| | | | | | | | | | | | | |

| As of January 1, 2012 | | | 174 | | | | 6,500 | | | | 6,674 | |

| Changes in the accounting year - | | | | | | | | | | | | |

| Additions | | | 5 | | | | 1,468 | | | | 1,473 | |

| As of December 31, 2012 | | | 179 | | | | 7,968 | | | | 8,147 | |

| | | | | | | | | | | | | |

| Depreciated cost: | | | | | | | | | | | | |

| As of December 31, 2013 | | | 33 | | | | 1,609 | | | | 1,642 | |

| | | | | | | | | | | | | |

| As of December 31, 2012 | | | 33 | | | | 11,059 | | | | 11,092 | |

| | | | | | | | | | | | | |

| The cost as of December 31, 2013 and 2012 includes: | | | | | | | | | | | | |

| Capitalized expenses | | | - | | | | 2,348 | | | | 2,348 | |

| Offset of a grant from the Chief Scientist of: | | | - | | | | 271 | | | | 271 | |

| | B. | The recoverable amount of the fixed assets was determined according to the management assessment based on data and estimates provided by a third party which EER has entered into an agreement with him in respect of the dismantle of the Yblin facility and the sale of the systems and equipment (after deducting selling expenses). See also note 13 a (8) below. |

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 9 –INTANGIBLE ASSETS

| | | Know-how for | |

| | | The Implement of | |

| | | waste treatment | |

| | | | |

| | | | |

| Cost | | | |

| As of January 1, 2013 | | | 5,164 | |

| Changes in the accounting year - | | | | |

| Impairment | | | (2,904 | ) |

| As of December 31, 2013 | | | 2,260 | |

| | | | | |

| As of January 1, 2012 | | | 5,164 | |

| Changes in the accounting year - | | | | |

| Additions | | | - | |

| As of December 31, 2012 | | | 5,164 | |

| | | | | |

| Accumulated depreciation | | | | |

| As of January 1, 2013 | | | 2,054 | |

| Changes in the accounting year - | | | | |

| Additions | | | 206 | |

| As of December 31, 2013 | | | 2,260 | |

| | | | | |

| As of January 1, 2012 | | | 1,643 | |

| Changes in the accounting year - | | | | |

| Additions | | | 411 | |

| As of December 31, 2012 | | | 2,054 | |

| | | | | |

| Depreciated cost as of December 31, 2013 | | | - | |

| | | | | |

| Depreciated cost as of December 31, 2012 | | | 3,110 | |

| | b. | The depreciation of intangible assets is presented in the statement of comprehensive income under administrative and general expenses. |

| | c. | Material intangible assets: |

The balance includes acquisition and development costs of know-how to implement new technology for the treatment of solid waste, bio-medical waste and low and intermediate radioactive waste.

As of January 1, 2008 and after completing one year of trial running of the Yblin facility for the treatment of solid waste ("the facility") the Company began depreciating the know-how.

The know-how is depreciated over a period of 12.5 years, based on the remaining useful life of the main patent registered thereto as of the date of commencement of depreciation.

The Company has numerous patents in respect of the said know-how.

In light of the present financial situation of the Company as mentioned in note 1d above, the Company recognized, during the report period, an impairment of the balance of its intangible assets.

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 10 – ACCOUNTS PAYABLE AND ACCRUALS:

| | | | |

| | | | | | | |

| | | | |

| | | | | | | |

| Institutions, net | | | 11 | | | | - | |

| Trade payables (mainly in NIS) | | | 32 | | | | 114 | |

| Accrued expenses | | | 42 | | | | 100 | |

| Employees and institutions in respect of payroll (*) | | | 60 | | | | 146 | |

| | | | 145 | | | | 360 | |

| | | | | | | | | |

| (*) See also note 11. | |

NOTE 11 – EMPLOYEE BENEFITS

| | | | |

| | | | | | | |

| | | | |

| Short-term employee benefits: | | | | | | |

| Payroll, wages and social benefits | | | 43 | | | | 110 | |

| Short-term vacation | | | 17 | | | | 36 | |

| | | | 60 | | | | 146 | |

| | b. | Post-employment benefits: |

| | (1) | Plans in respect of severance pay |

The Severance Pay Law in Israel requires the Company and its subsidiaries to pay severance pay upon dismissal of an employee or upon termination of employment in other certain circumstances. In principle, the Severance Pay Law in Israel stipulates that the severance pay amount equals the employee's last salary multiplied by the amount of years in which the employee was employed.

The Group applies to most of its employees Section 14 to the Israeli Severance Pay Act of, 1963, pursuant to which it is exempt from any severance pay liability, subject to it making certain monthly allocations to employees' pension plans. The Group will not have a legal or constructive obligation to make additional payments if the plan does not have sufficient assets to pay the entire employee benefits relating to the employee's service during the current period and in previous periods.

In accordance with the Israeli Annual Vacation Act of, 1951, the Group's employees are entitled to several paid vacation days in respect of each year of employment. Pursuant to said law, the number of vacation days per year to which each employee is entitled is determined in accordance with the seniority of said employee.

An employee is entitled, with the consent of the Company, to use the vacation days and accumulate up to 60 vacation days.

An employee terminating his employment before using his accumulated vacation leave is entitled to payment in respect of the balance of vacation leave.

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 12 – INCOME TAX

| | a. | On August 2013 the "Arrangements Law" was published. Pursuant the Arrangements Law the corporate income tax rate will be increased to 26.5% in 2014 (an increase of 1.5%). |

| | b. | The Company and EER received final tax assessments (including assessments considered as final) through to the tax year 2009. |

| | c. | As at December 31, 2013 the Company has carried forward tax losses in the amount of approximately NIS 114 million (approximately $33 million), and EER has carried forward tax losses in the amount of approximately NIS 218 million (approximately $63 million). |

| | d. | In view of the losses for tax purposes and since the Company and EER does not anticipate any taxable income in the foreseeable future, the Company and EER have not recorded deferred tax assets in respect of carry forward losses. |

NOTE 13 – COMMITMENTS AND CONTIGENT LIABILITIES

In July 2012, EER entered into a new lease agreement with Naser Recycling Ltd. ("Naser"), with respect to the ground on which the Yblin Facility is located (the "Lease Agreement") for a period of five years (the "Lease Period") and EER has an option to extend the term of the rent for an additional five years (the "Option period"). The monthly rent for the first 18 months of the Lease Period is NIS 40 thousands (approximately $10 thousands) and NIS 45 thousands (approximately $11 thousands) for the remaining Lease Period. The monthly rent for the Option Period will be NIS 50 thousands (approximately $13 thousands). All the amounts mentioned above are linked to the CPI and do not include VAT. The payment of the rent will be paid for each year of lease in advance.

In addition to the rent fees and if the Yblin plant becomes a commercial plant, Naser will be entitled to receive certain payments from profits generated by the plant and/or from proceeds of the sale of the plant, as set forth in the Lease Agreement.

Pursuant to the terms of the Lease Agreement, the Yblin Facility is the property of EER, and EER is responsible for disassembling the Yblin Facility and removing it from the property at the end of rental period.

It was further agreed that to secure EER's commitments pursuant to the Lease Agreement, EER gave Naser a bank guarantee in the amount of $250 thousand.

At the Company's decision to cease the operation of the Yblin Facility, the Company recognized a provision in respect of an onerous contract in a total amount of approximately $589 thousands which represents its obligations under the lease agreement. As at December 31, 2013the balance of this provision is $436 thousands.

As of the date of these financial statements EER in negotiations with Naser to change the lease agreement terms according to the circumstances mentioned above.

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 13 – COMMITMENTS AND CONTIGENT LIABILITIES (continued):

| | a. | Commitments (continued): |

| | (2) | The Kurchatov Institute Agreement |

On June 6, 2000, EER entered into an agreement with the Kurchatov Institute, which was amended on February 12, 2002 (the “Kurchatov Agreement”). Under the terms of the Kurchatov Agreement, Kurchatov Institute assigned and transferred to EER all then present and future intellectual property rights and know-how related to the Yblin Facility (which was designed, manufactured and constructed for EER by Kurchatov Institute's subsidiary under a separate agreement) and to the Additional Projects (as defined below) (collectively, the "IP Rights"). According to the Kurchatov Agreement, EER shall cover all the expenses related to the assigning, registration and recordation of the IP Rights.

According to the Kurchatov Agreement, the Kurchatov Institute shall fully cooperate with EER for the purposes of utilizing the PGM technology with regard to Municipal Solid Waste ("MSW"), Medical Waste (“MW”), Low and intermediate Radio Active Waste (“LRAW”) and PGM Compatible Industrial Waste (“IW”), including, but not only, for the designing and construction of plants and installations by EER, its licensee(s) and/or other purposes (the "Additional Projects"). Upon EER’s request, the Kurchatov Institute shall assign to EER any know-how or intellectual property rights relating to such technologies to be used outside the territories comprising the former Soviet Union, provided the financial and other legal and reasonable interests of the Kurchatov Institute have been satisfied. The Kurchatov Institute and its affiliates shall exclusively work with EER on any of the aforementioned applications of the PGM Technology, and shall not assist, directly or indirectly, any individual or entity to engage in any activity in the fields of MSW, MW, LRAW and IW. In addition, the Kurchatov Institute undertook to provide EER its know-how and experienced highly qualified specialists in order to obtain the required scientific and technical qualifications in the works related to the Projects, as was mutually agreed by the parties. In consideration for Kurchatov Institute’s undertakings under the Kurchatov Agreement, EER shall pay Kurchatov Institute a royalty in the amount of 1% of the purchase price actually received by EER from the sale of the Additional Projects.

| | (3) | Management service agreements |

| | a. | According to a management service agreement between EER and Greenstone (the “Greenstone Agreement”), Greenstone undertook to provide EER with management services, office services, accounting services and office rental in accordance with EER needs. In consideration for such services, EER undertook to pay Greenstone the sum of NIS 20,000 per month (plus VAT) linked to the Consumer Price Index (in this section – “the management fees”), as of January 2002 (approximately NIS 25,000 as of the date of this report). The term of the management agreement was set at one year, at the end of which the agreement will be renewed automatically for additional one-year periods, and may be terminated by one month’s notice by either party. |

In view of the financial condition of EER, since June 2013 the management fees are not being paid and accrued. As at December 31, 2013 the debt management fee is approximately $52 thousands.

| | b. | Regarding the management service agreement between the Company and Greenstone see note 7b (5) above. |

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 13 – COMMITMENTS AND CONTIGENT LIABILITIES (continued):

| | a. | Commitments (continued): |

On March 2013, the Company’s audit committee and the Board of Directors approved to renew the directors’ and officers’ liability insurance for the Company's officers and directors (“D&O insurance policy”) with coverage in an aggregate amount of $7.5 million for a period of one year until March 23, 2015 for a total premium of $ 38,500. This D&O insurance policy is subject to the approval of the Company’s shareholder’s.

On May 31, 2012, EER entered into an agreement with a third party located in the U.S. (the "US Company"), for the initial planning and the supply of EER's technology of Plasma-Gasification-Melting Waste-To-Energy (the “Framework Agreement") in plants (the “Facilities”) located in five states in the U.S. and such other territories as may be agreed between EER and the US Company ("Territories").

Under the Framework Agreement, each of EER and the US Company has granted the other certain exclusivity rights (subject to some exceptions) with respect to the Territories.

In addition, EER has agreed to invest $400,000 in the US Company, in consideration of equity in the US Company, which shall constitute 1.9% of the US Company's fully-diluted capital. The first tranche was transferred to the US Company but was subsequently returned to EER, since the investment round did not materialize. Since then, and due, inter alia, to the time which has passed, EER notified the US Company that it will not make the equity investments in the US Company.

| | (8) | Agreement on dismantling the facility |

During November 2013 EER entered into an agreement with a third party (the "Contractor") in connection with dismantle and sale of the Yblin facility and the equipment therein. According to the agreement, the contractor will, at his own expense and responsibility, dismantle and sale the Yblin facility and the equipment therein in accordance with the terms stipulated in the agreement.

In return the company would pay the contractor the sum of NIS 1 million (of which NIS 400 thousands have been paid up front and the remaining sum will be paid with the progress and sales). In addition, the contractor will be entitled to a Commission from the total amount received in respect of such sales, all in accordance with the terms stipulated in the agreement.

See also note 8B.

| | (9) | During December 2011 EER entered into an agreement with a company from the Czech Republic regarding a feasibility study work to be performed by EER with regard to the design, engineering, construction and operation of a hazardous waste treatment facility. |

In consideration for the performance of the study work, EER was entitled to a total sum of US $125,000. A down payment of US $ 63,000 received in December 2011 and was recorded as revenue in 2011. An additional payment of US $ 62,000 was received and recorded as revenue in 2012.

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 13– COMMITMENTS AND CONTIGENT LIABILITIES (continued):

| | a. | Commitments (continued): |

Following the above mentioned regarding the Company's financial situation, the Company had an immediate need for funding for the period beginning as of the cease of the Facility’s operation. Therefore, the Board, following the approval of the Company’s Audit Committee and subject to the approval by the board of directors of Greenstone, approved the receipt of a line of credit from Greenstone in the amount of up to NIS 1 million (the “Line of Credit”) which will bear no interest and will be linked to the consumer price index (“CPI”). The Line of Credit plus any additional amounts due to the indexation to the CPI shall be repaid in one installment within six months as of the day of the approval of the Line of Credit. The board of directors of Greenstone approved the Line of Credit on August 2013.

During November 2013, the Board, following the approval of the Company’s Audit Committee and subject to the approval by the board of directors of Greenstone, approved the receipt of an additional line of credit from Greenstone in the amount of up to NIS 1 million.

As of December 31, 2013 the Company received a total amount of NIS 1.6 million (approximately $461 thousands) from Greenstone and subsequent to the balance sheet date the Company received an additional amount of approximately NIS 0.3 million.

| | b. | Contingent liabilities: |

During 2004 the Israeli office of the Chief Scientist (the "Scientist") approved EER's application to obtain financial assistance for conducting research and development in connection with EER's products. The approval was contingent on the Company's compliance with the provisions of the Israeli Law of Encouragement of Research and Development in Industry, 1984, and on fulfillment of the terms of the approval that include, inter alia, the payment of royalties in respect of revenues from products developed with the assistance of the Chief Scientist.

As of the balance sheet date, EER has received grants in the amount of NIS 1.7 million, the liability in respect thereof was recorded in full in accordance with IAS 20 (before its amendment in 2008).

In August 2010 EER paid royalties of NIS 169 thousands to the Scientist. In February 2012 and January 2013 EER paid additional royalties of NIS 17 thousands to the Scientist.

See also note 2n.

In light of the financial situation of the Company as mentioned in note 1d above, the Company recorded, during the report period, a profit in the amount of approximately $429 thousands for canceling the remaining obligations for royalties' payments to the Scientist, in light of the fact that the company doesn't anticipate revenues from products developed with the assistance of the Chief Scientist.

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 14 - SHAREHOLDERS' EQUITY

| | a. | The Company’s ordinary shares are traded in the United States on the Over the Counter Bulletin Board (OTCBB) under the symbol RVBHF. |

| | | | |

| | | | |

| | | | | | | |

| | | | |

| Balance as of January 1 | | | 232,725,787 | | | | 177,021,917 | |

| Issuance of shares (*) | | | - | | | | 55,703,870 | |

| | | | | | | | | |

| Balance as of December 31 | | | 232,725,787 | | | | 232,725,787 | |

| | | | | | | | | |

| Ordinary shares of NIS 1.00 par value each | | | | | | | | |

The authorized ordinary shares of the Company as of December 31, 2013 and 2012 was 400,000,000 shares with a value of NIS 1.00 per share.

The holders of ordinary shares are entitled to receive dividends and are entitled to one vote per share at general meetings of the Company.

In January 2011 the Company purchased 1,040,000 shares of the Company from its former employees.

The rights attached to these Company shares are suspended until their re-issuance (dormant shares).

| | d. | Share-based compensation |

| | 1. | In 2009, the Company granted a third party, an option to purchase 3,000,000 Ordinary Shares of the Company, at an exercise price per share of $0.18, exercisable for a period of five years. As of December 31, 2013, this option is still outstanding. |

| | 2. | On June 29, 2011, the Company's board of directors approved a share options plan (the "2011 Plan"). Under the 2011 Plan, the Company may grant to any of its and its affiliates' (i.e. present or future company that either controls or is controlled by the Company) employees, officers and directors options to purchase ordinary shares of the Company. The options under the 2011 Plan shall become vested and exercisable, in accordance with the following vesting schedule: (i) 33% of the options shall vest on the first anniversary of the date of grant; and (ii) 8.375% of the options shall vest on the last business day of each subsequent fiscal quarter following the first anniversary of the date of grant, such that all options shall become vested and exercisable by the third anniversary of the date of grant (the "Vesting Schedule"). |

The options, granted under 2011 plan are allocated on behalf of the participant to a Trustee - under the provisions of the 102 Capital Gains Track and will be held by the Trustee for the period stated in Section 102 of the Israeli Income Tax Ordinance, 1961, as amended and the Israeli Income Tax Regulations (Tax Relieves in Allocation of Shares to Employees), 2003.

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 14 - SHAREHOLDERS' EQUITY (continued)

| | d. | Share-based compensation (continued) |

On January 2012, following the approval of the Company's audit committee and board of directors, the Company granted to seven of its and its affiliates employees options to purchase 25,793,156 ordinary shares of the Company with an exercise price of US$ 0.2145 per share (adjusted for future dividend), (including 10,000,000 options to the Company's former CEO), according to the 2011 plan. On November 2012 the Company granted to additional three of its affiliate employees options to purchase 1,148,593 ordinary shares of the Company, according to the 2011 plan.

| | 3. | On August 22, 2011, the Company's shareholders approved (following the approval of the Company's audit committee and board of directors), among others: (i) the grant to each of the Company's directors, Gedaliah Shelef, Alicia Rotbard and Jonathan Regev, options to purchase 900,000 ordinary shares of the Company, with an exercise price of US$0.2145 per share (adjusted for future dividend). The options were granted under the 2011 Plan; and (ii) the grant to Yair Fudim, of options to purchase shares of the Company representing, on a fully diluted basis, approximately 0.3% of the Company's issued and outstanding share capital as of the date of the grant (actually 861,445 were granted), with an exercise price of US$ 0.2145 per share (adjusted for future dividend). The options shall become vested and exercisable, in accordance with the Vesting Schedule. The options described in this paragraph were granted in January 2012. |

The parameters used in the calculation of the fair value of the options described above, are a share price of $0.09 (regarding Yair Fudim) and 0.04$ (regarding the other directors), an exercise price of US$0.2145 per share, the expected volatility of companies operating in this field - 32%, the life of the option – 5 years and a risk-free interest of 1%. The fair value of these options is immaterial.

| | 4. | Regarding options granted to Greenstone pursuant to the Management Agreement see note 7b (5) above. |

| | 5. | Regarding options granted to Mazal pursuant to the Option Agreement see note 7b (3) above. |

R.V.B. HOLDINGS LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 15 – LOSS PER ORDINARY SHARE

The following table summarizes information related to the computation of basic and diluted loss per Ordinary Share for the years indicated:

| | | Year ended December 31, | |

| | | 2013 | | | 2012 | | | | |

| | | $ thousands | |