EXHIBIT 99.2

R.V.B. HOLDINGS LTD.

1 Ha’Ofeh Street, Kadima-Tzoran, P.O. Box 5051, Israel

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

August 17, 2016

The enclosed proxy is being solicited by the board of directors (the “Board of Directors”, or the “Board”) of R.V.B. Holdings Ltd. (the “Company”, “we”, “our”, “us”, or “RVB”) for use at our annual general meeting of shareholders (the “Meeting”) to be held at the offices of Pearl Cohen Zedek Latzer Baratz, 1 Azrieli Center, Round Tower, 18th floor, Tel Aviv, Israel, on September 26, 2016, at 10:00 a.m. (Israel time), or at any adjournment thereof. The record date for determining which of our shareholder is entitled to notice of, and to vote at, the Meeting is as of the close of business on August 24, 2016 (the “Record Date”). As of the Record Date, we had 10,000,000 of our ordinary shares, no par value (the “Shares”) outstanding and entitled to vote.

At the Meeting, the shareholders of the Company are being asked to consider and resolve for:

| 1. | Approval and adoption of Amended and Restated Articles of Association of the Company, in the form attached hereto as Appendix A (the “Amended Articles”); |

| 2. | Approval of changing the name of the Company to “EViation Ltd.” or such similar name as may be approved by the Israeli Registrar of Companies; |

| 3. | Approval as required under §267 and §275 of the Israeli Companies Law, 1999-5759 (the “Israeli Companies Law”), of the proposed compensation package for Mr. Omer Bar-Yohay. A summary of the proposed compensation terms is included under Proposal no. 3; |

| 4. | Approval as required under §267 and §275 of the Israeli Companies Law, of option grants to certain non-executive directors of the Company as set forth on Appendix B attached hereto, under the new Employee Share Option Plan adopted by the Board (the “ESOP”), such grants to be made following the approval of the ESOP by the Israeli Income Tax Authority; |

| 5. | Approval as required under §267 and §275 of the Israeli Companies Law and ratification of the Company’s purchase of insurance policies of directors’ and officers’ liability, as described in proposal no. 5 hereunder; |

| 6. | Approval as required under §267 and §275 of the Israeli Companies Law of amended indemnification agreements between the Company and its officers and directors, in the form attached hereto as Appendix C; |

| 7. | Approval of the appointment of the CPA firm Somekh Chaikin (KPMG Israel) as the independent auditors of the Company for the 2016 fiscal year and the period ending at the close of the next annual general meeting, and authorization of the Company’s management to negotiate and conclude the remuneration of such auditors and the other terms of their retention; |

If you do not state whether you are a controlling shareholder or have personal interest with respect to Proposals no. 3, 4, 5 and 6, your shares will not be voted for Proposals no. 3, 4, 5 and 6.

At the Meeting, management shall also present and discuss the following major developments in the Company’s business:

| 1. | Presentation and discussion of the acquisition (at cost) and assumption by the Company’s subsidiary, EViation Tech Ltd. (the “Subsidiary”), for the purpose of developing and commercializing electric propulsion aviation (the “Business”), of all rights and obligations acquired and/or entered into on behalf of the Subsidiary prior to its formation, all in the framework of entrepreneurial activity in the Business by certain controlling shareholders of the Company (the “Prior Entrepreneurial Activity”). |

| 2. | Presentation and discussion of the Company’s entrance on July 17, 2016 into a Loan and Credit Agreement, as ratified by the audit committee of the Company (the “Audit Committee”) and the Board on August 15, 2016, with the controlling shareholders of the Company, Aviv Tzidon and Magic Stones Ltd. (“Controlling Shareholders”) pursuant to which they loaned a total of $500,000 to the Company for a period of seven years at an annual interest rate equal to the lower of (i) 3.2% per annum, and (ii) the minimum rate required by law to avoid the imputing of tax. As security for such loan, the Company granted to the Buyers a specific lien and security interest on all of the shares of the Subsidiary held by the Company. The loan may be repaid by the Company at any time in minimum increments of $50,000. The proceeds of the loan are to be used for funding the on-going operations of the Company |

| 3. | Presentation and discussion of the Subsidiary’s entrance on July 17, 2016 into a Loan and Credit Agreement, as ratified by the Audit Committee and the Board on August 15, 2016, with the Controlling Shareholders pursuant to which they granted a credit line to the Subsidiary of up to a total of $4,500,000 for a period of seven years at an annual interest rate equal to the lower of (i) 3.2% per annum, and (ii) the minimum rate required by law to avoid the imputing of tax. Draws on such credit line may be made in increments of not less than $50,000, and outstanding amounts on the credit line may be repaid in increments of not less than $50,000. Accrued interest is payable annually. As security for amounts owing under the credit line, the Subsidiary granted to the Controlling Shareholders a floating lien and charge on all of the assets of the Subsidiary, and a specific charge on all of the intellectual property rights owned by the Subsidiary at any time. An event of default on any one of the loan made to the Company and the credit line granted to the Subsidiary triggers an event of default under the other of such loan and credit line. |

| 4. | Presentation and discussion of the Service Agreement between the Company and the Subsidiary and Phinergy Ltd., a company in which Aviv Tzidon is an interested party, for procurement by the Company and the Subsidiary of financial management services, a sublease for office space to be used by the Subsidiary, administrative services and human resources services. All of such services are provided by Phinergy on at ‘at cost’ basis determined by a formula set out in the Services Agreement. The monthly rent for the premises to be used by the Subsidiary is currently NIS 8,040. |

Under the Israeli Companies Law-1999,5759, and regulations promulgated hereunder, the Loan and Credit Agreement requires the approval of the Company's Audit Committee and Board of directors. Proxy

We expect to solicit proxies by mail and to mail this proxy statement and the accompanying proxy card to shareholders on or about August 26, 2016. We will bear cost of the preparation and mailing of these proxy materials and the solicitation of proxies.

Upon the receipt of a properly executed proxy in the form enclosed, the persons named as proxies therein will vote the ordinary shares of the Company (“Shares”) covered thereby in accordance with the instructions of the shareholder executing the proxy.

With respect to the proposals set forth in the accompanying Notice of Meeting, a shareholder may vote either in favor of or against each of the proposals, or may abstain from voting on any of the proposals. Shareholders should specify their choices on the accompanying proxy card. If you sign and return the enclosed proxy card, your shares will be voted as abstained of all of the proposed resolutions, whether or not you specifically indicate an “ABSTAIN” vote, unless you specifically vote in favor or vote against a specific resolution.

We are not aware of any other matters to be presented at the Meeting.

Any shareholder returning the accompanying proxy may revoke such proxy at any time prior to its exercise by any of the following: (i) sending written notice to the Company of such revocation; (ii) executing and delivering to the Company a later-dated proxy, which is received by the Company at the address stated above at least 24 hours prior to the Meeting; (iii) voting in person at the Meeting; or (iv) requesting the return of the proxy at the Meeting.

Legal Quorum

Each Share is entitled to one vote on each matter to be voted upon at the Meeting. Subject to the Company's articles of association, two or more shareholders present in person or by proxy (“Present Shareholders”) and holding or representing together at least 25% of the voting rights of our issued share capital will constitute a quorum for the Meeting. If within half an hour from the time appointed for the Meeting a quorum is not present, the Meeting shall stand adjourned one day thereafter at the same time and place or to such other day, time and place as the Board may indicate in a notice to the Shareholders. At such adjourned Meeting any number of Shareholders shall constitute a quorum for the business for which the original Meeting was called.

As certain of the Company’s officers and directors are considered controlling shareholders of the Company, approval of Proposals 3- 6 will require, pursuant to §275 of the Israeli Companies Law, the affirmative vote of at least a majority of the Shares voted on the matter, and the fulfillment of one of the following two conditions: either (a) the majority voting for the resolution must include at least a majority of the total number of Shares voted by Present Shareholders who do not have personal interest in the Proposal (“Disinterested Shareholders”) (abstention votes by Disinterested Shareholders are not taken into account in counting the above-referenced votes); or (b) the total number of Shares voted against such proposal by Disinterested Shareholders must not exceed two percent (2%) of the total voting rights in the Company.

In addition, approval of Proposals 3 - 6 will require, pursuant to §267 of the Israeli Companies Law, the affirmative vote of a simple majority of the Shares voted on the matter, and the fulfillment of one of the following two conditions: either (a) the majority voting for the resolution must include at least a majority of the total number of Shares voted by Disinterested Shareholders who are not controlling shareholders or that have a personal interest in the approval of the compensation policy of the Company (“§267 Disinterested Shareholders”) (abstention votes by §267 Disinterested Shareholders are not taken into account in counting the above-referenced votes); or (b) the total number of Shares voted against such proposal by §267 Disinterested Shareholders must not exceed two percent (2%) of the total voting rights in the Company.

Approval of Proposals 1, 2 and 7 will require the affirmative vote of at least a majority of the Shares voted on the matter.

For this purpose, “personal interest” is defined as a personal interest of a shareholder or its attorney-in-fact in the approval of an act or transaction of the Company, including (i) the personal interest of any of his or her relatives (which includes for these purposes any members of his/her immediate family or the spouse of any such members of his or her immediate family); or (ii) the personal interest of a corporate entity in which a shareholder or any of his/her aforementioned relatives serves as a director or as the chief executive officer, owns at least 5% of its issued share capital or its voting rights, or has the right to appoint a director or the chief executive officer – but excluding a personal interest arising solely from one’s ownership of equity in a company. Shareholders wishing to express their position on an agenda item for this Meeting may do so by submitting a written statement (“Position Statement”) to the Company’s offices, c/o Ilan Gerzi, Adv., at Pearl Cohen Zedek Latzer Baratz, 1 Azrieli Center, Round Tower, 18th floor, Tel Aviv, Israel. Any Position Statement received will be furnished to the Commission on Form 6-K, and will be made available to the public on the Commission’s website at http://www.sec.gov. Position Statements must be submitted to the Company no later than September 15, 2016.

AFTER CAREFUL CONSIDERATION, OUR BOARD OF DIRECTORS RECOMMENDS THAT OUR SHAREHOLDERS VOTE “FOR” THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT.

THIS PROXY STATEMENT INCORPORATES

ADDITIONAL INFORMATION

This proxy statement incorporates by reference important additional information about the Company from documents that are not included in or delivered with this proxy statement. This information is available to you without charge, excluding all exhibits to such documents unless the Company has specifically incorporated by reference an exhibit in this proxy statement. For a more detailed description of the information incorporated by reference into this proxy statement, see the section entitled “Where You Can Find More Information” on page 24 of this proxy statement.

You may obtain copies of this information by requesting it in writing or by telephone (+972 (0)8 913 7934) from the Company at the following address:

1 Ha’Ofeh Street Kadima-Tzoran, P.O. Box 5051, Israel 6092000

info@eviation.co

PLEASE REQUEST DOCUMENTS FROM THE COMPANY NOT LATER THAN SEPTEMBER 1, 2016, IN ORDER TO RECEIVE THEM BEFORE THE MEETING.

RVB shareholders should rely only on the information contained in, or incorporated by reference into, this proxy statement in deciding how to vote on the proposals. No one has been authorized to provide you with information that is different from that contained in, or incorporated by reference into, this proxy statement. This proxy statement is dated August 26, 2016. You should not assume that the information contained in, or incorporated by reference into, this proxy statement is accurate as of any date other than that date.

This proxy statement does not constitute a solicitation of a proxy in any jurisdiction to or from any person to whom it is unlawful to make any such solicitation in such jurisdiction. Information contained in this proxy statement regarding RVB has been provided by RVB, and information contained in this proxy statement regarding the Subsidiary has been obtained from the Subsidiary.

PRESENTATION - BACKGROUND

R.V.B. Holdings Ltd., formerly B.V.R. Systems (1998) Ltd. (“BVR”), is an Israeli company that was formed in January 1998 to receive all of the assets and liabilities of the defense related business of BVR Technologies Ltd. in accordance with the terms of a reorganization plan. BVR commenced operations as an independent company effective as of January 1, 1998. In November 2009, BVR sold substantially all of its assets and liabilities, including the brand name “B.V.R.”, to Elbit Systems Ltd. (“Elbit”) and following the sale changed its name in January 2010 to R.V.B. Holdings Ltd. RVB was controlled by Mr. Aviv Tzidon until March 2010, when Greenstone Industries Ltd. (“Greenstone”) purchased a controlling interest in RVB from A.O. Tzidon (1999) Ltd. and Aviv Tzidon.

On April 2, 2015, the Tel Aviv District Court (the “Court”) granted Greenstone’s petition, due to the financial and business condition of the Company, to appoint Adv. Mordechai Shalev as the temporary receiver of the Company (the “Temporary Receiver”), with a mandate to identify and liquidate the Company’s assets and to investigate its conduct. The Temporary Liquidator may be granted additional powers as may be determined by the Court.

On October 28, 2015, the Temporary Receiver filed with the Court an agreement for the sale of the Company (the “Agreement”) by way of a share issuance to Aviv and Magic Stones (collectively, the “Buyer”) in consideration for payment of NIS 600,000 by the Buyer. The Agreement was reached following a ‘request for instructions’ (RFI) procedure carried out by the Temporary Receiver to sell the Company as a “shell company”, free and clear from all assets and obligations of any kind.

On February 2, 2016, the Court approved (1) canceling the nominal value of the Company’s shares, such that the Company’s shares will not have any nominal value, (2) converting 71,923,175 non-tradeable options to purchase ordinary shares of the Company into 71,923,175 ordinary shares of the Company, (3) conducting a reverse split of the Company’s shares at a ratio of 30,465:1, such that for each 30,465 shares of the Company, the shareholders of the Company received one share, and (4) increasing the share capital of the Company to 700,000,000 ordinary shares of the Company with no nominal value. After giving effect to such actions, the total number of issued Ordinary shares of the Company as of immediately prior to the issuance to Aviv and Magic Stones below, was 10,000.

Pursuant to the Agreement, following its approval by the Court, the Company, through its Temporary Receiver, issued to the Buyer 9,990,000 Ordinary Shares representing, on the date of their issuance, 99.9% of the issued and outstanding share capital of the Company on a fully diluted basis (the “Issuance”), in consideration for which the Buyer payed the Company (through its Temporary Receiver) the amount of NIS 600,000, and the Company issued 4,995,000 Ordinary Shares to Aviv Tzidon, and to Magic Stones - Gemstone Import and Marketing Ltd, each.

Additionally, the Court ruled, at the request of the Temporary Receiver, that (a) all assets, obligations and rights of any kind of the Company would be transferred to the liquidation fund; and (b) upon the Issuance, the issued shares would be free and clear from all assets and obligations of any kind.

The Agreement received final approval by the Court in January 2016, and subsequently by the Israeli Official Receiver, and then FINRA.

TABLE OF CONTENTS

| 8 |

| 12 |

| 34 |

Approval of the Amended Articles as set forth on Appendix A. | |

| 35 |

| Approval of changing the name of the Company to “EViation Ltd.”, or such similar name as may be approved by the Israeli Registrar of Companies. | |

| 36 |

| Approval as required under §267 and §275 of the Israeli Companies Law, of the proposed compensation terms for Mr. Omer Bar-Yohay. | |

| 37 |

Approval as required under §275 of the Israeli Companies Law, of option grants to certain non-executive directors of the Company as set forth on Appendix B attached hereto, under the new Employee Share Option Plan adopted by the Board (the “ESOP”), such grants to be made following the approval of the ESOP by the Israeli Income Tax Authority. | |

| 38 |

| Approval and ratification of the Company’s purchase of insurance policies of directors’ and officers’ liability, as described in proposal 5 hereto. | |

| 39 |

Approval of amended indemnification agreements between the Company and its officers and directors, as described on Appendix C attached hereto. | |

| 40 |

| Approval of the appointment of CPA firm Somekh Chaikin (KPMG Israel) as the independent auditors of the Company for the 2016 fiscal year and the period ending at the close of the next annual general meeting, and authorization of the Board of Directors to negotiate and conclude the remuneration of such auditors and the other terms of their retention. | |

| 41 |

| Presentation and discussion of the acquisition and assumption by the Subsidiary of the Prior Entrepreneurial Activity. | |

| 41 |

| Presentation and discussion of the Company's entrance into a Loan Agreement with the Controlling shareholders pursuant to which they loaned a total of $500,000 to the Company for a period of up to seven years and the Subsidiary’s entrance into the Loan and Credit Agreement with the Controlling Shareholders granting a credit line to the Subsidiary of up to a total of $4,500,000 for a period of seven years. | |

| 41 |

| 41 |

| A-1 |

| B-1 |

| C-1 |

The following section of this proxy statement answers various questions that you, as a shareholder of RVB, may have regarding the Meeting. The following questions and answers are intended to provide brief answers to commonly asked questions. RVB urges you to carefully read the remainder of this proxy statement, because this section alone does not provide all the information that might be important to you with respect to the proposals. Additional important information is also contained in the Appendices to, and the documents incorporated by reference in, this proxy statement.

GENERAL

| Q. | Why am I receiving this Proxy statement? |

| A. | This is a proxy statement for an annual general meeting of the shareholders of RVB (the “Meeting”) at which the RVB shareholders will vote on the following proposals: |

| 1. | Approval of the Amended Articles as set forth on Appendix A; |

| 2. | Approval of changing the name of the Company to “EViation Ltd.” or such similar name as may be approved by the Israeli Registrar of Companies; |

| 3. | Approval as required under §267 and §275 of the Israeli Companies Law, of the proposed compensation package for Mr. Omer Bar-Yohay; |

| 4. | Approval as required under §267 and §275 of the Israeli Companies Law, of option grants to certain non-executive directors of the Company as set forth on Appendix b attached hereto, under the ESOP, such grants to be made following the approval of the ESOP by the Israeli Income Tax Authority; |

| 5. | Approval under §267 and §275 of the Israeli Companies Law and ratification of the Company’s purchase of insurance policies of directors’ and officers’ liability, as described in proposal 5 hereto; |

| 6. | Approval under §267 and §275 of the Israeli Companies Law of amended indemnification agreements between the Company and its officers and directors, in the form attached hereto as Appendix c; and |

| 7. | Approval of the appointment of the CPA firm Somekh Chaikin (KPMG Israel) as the independent auditors of the Company for the 2016 fiscal year and the period ending at the close of the next annual general meeting, and authorization of the Board of Directors to negotiate and conclude the remuneration of such auditors and the other terms of their retention. |

In addition the Proposals above to be voted upon at the Meeting, various matters will be presented by management to the Shareholders for discussion:

| 1. | The acquisition and assumption by the Subsidiary of the Prior Entrepreneurial Activity; |

| 2. | The Parent Company's entrance into a Loan Agreement and the Subsidiary’s entrance into the Loan and Credit Agreement, each with the Controlling Shareholders. |

The enclosed voting materials allow you to vote your shares without attending the Meeting in person. Your vote is very important, and we encourage you to vote by proxy as soon as possible. We have included in this proxy statement important information about the Meeting. Also included in or incorporated by reference into this proxy statement is important information about RVB. You should read this information and the information incorporated by reference into this proxy statement carefully and in its entirety. We have attached to this proxy statement the Amended Articles in Appendix A and the various other documents included in Appendices B and C.

| Q: | What RVB shareholder approvals are needed to approve Proposals 1 through 7? |

| A: | • | As certain of the Company’s officers and directors are considered controlling shareholders of the Company, who are deemed to have a personal interest Proposals 3 - 6, the approval of these Proposals will require, pursuant to §275 of the Israeli Companies Law, the affirmative vote of at least a majority of the Shares voted on the matter, and the fulfillment of one of the following two conditions: either (a) the majority voting for the resolution must include at least a majority of the total number of Shares voted by Present Shareholders who do not have personal interest in the Proposal (“Disinterested Shareholders”) (abstention votes by Disinterested Shareholders are not taken into account in counting the above-referenced votes); or (b) the total number of Shares voted against such proposal by Disinterested Shareholders must not exceed two percent (2%) of the total voting rights in the Company. |

| | • | Approval of Proposals 3 – 6 will also require, pursuant to §267 of the Israeli Companies Law, the affirmative vote of a simple majority of the Shares voted on the matter, and the fulfillment of one of the following two conditions: either (a) the majority voting for the resolution must include at least a majority of the total number of Shares voted by Disinterested Shareholders who are not controlling shareholders or that have a personal interest in the approval of the compensation policy of the Company (“§267 Disinterested Shareholders”) (abstention votes by §267 Disinterested Shareholders are not taken into account in counting the above-referenced votes); or (b) the total number of Shares voted against such proposal by §267 Disinterested Shareholders must not exceed two percent (2%) of the total voting rights in the Company. |

| • | Approval of Proposals 1, 2, and 7 will require the affirmative vote of at least a majority of the Shares voted on the matter. |

If you do not state whether you are a controlling shareholder or have personal interest with respect to Proposals no. 3, 4, 5 and 6, your shares will not be voted for Proposals no. 3, 4, 5 and 6.

Aviv and Magic Stones, our controlling shareholders, have agreed to vote in favor of all of the aforesaid Proposals.

| Q: | What does RVB’s Board of Directors recommend? |

| A: | RVB’s Board of Directors unanimously recommends that you vote “FOR” Proposals 1 through 7. |

| Q: | When will the Meeting be held? |

| A: | The Meeting will be held on September 26, 2016, at the offices of Pearl Cohen Zedek Latzer Baratz, legal counsel of the Company, at 1 Azrieli Center, Round Tower, 18th Floor, Tel Aviv, Israel, commencing at 10:00 am, Israel time, and any adjournments or postponements thereof will be held at the same location. |

| Q: | Who is eligible to vote at the RVB General Meeting? |

| A: | Shareholders of RVB are eligible to vote their shares at the Meeting if they were holders of record of RVB Shares at the close of business on August 24, 2016, the record date for the Meeting. |

| Q: | What if I don’t vote as an RVB shareholder? |

| A: | If you fail to vote your RVB Shares by proxy or in person, or fail to indicate whether you have a personal interest in any of Proposals 3 - 6 at the Meeting, the shares represented by your proxy or owned by you will be deemed not to have been cast for the purpose of the approval of these proposals. Accordingly, such shares will not be counted in calculating the percentage of affirmative votes required for approval of the aforesaid proposals. If a shareholder instructs in a proxy that it wishes to abstain from voting its shares on any one or more of the proposals, the shares represented by such proxy will be deemed as neither a vote “for” nor a vote “against” such proposals, although they will be counted in determining whether a quorum is present. |

| Q: | What do I need to do now if I am a RVB shareholder? |

| A: | After you have carefully read this proxy statement, please fill out and sign the enclosed proxy card, and then mail it in the enclosed return envelope as soon as possible, so that your shares may be voted at the Meeting. In order for your shares to be voted at the Meeting if you choose to vote by proxy, your proxy card must be received by RVB at least 72 hours before the time of the Meeting. If a proxy is not received in the manner described above, it will not be valid at the Meeting. You can also attend the Meeting and vote in person if you are the record holder of the shares. |

| Q: | Whom can I contact with questions about the proposed transactions, or on how to submit a proxy or if I need additional copies of the proxy statement or accompanying documents? |

| A: | If you are a RVB shareholder, you may contact the corporate offices of RVB at 1 Ha’Ofeh Street, P.O. Box 5051, Kadima-Tzoran 6092000 Israel, Tel. +972 (8) 913-7934, Fax +972 (8) 915-7234, E-mail IR@eviation.co. |

| Q: | Who is deemed to have a personal interest under Israeli law? |

| A: | Under applicable Israeli law, a personal interest means a personal interest of a person or such person’s attorney-in-fact in an act or transaction of a company, including: |

| o | a personal interest of that person’s relative (i.e., spouse, sibling, offspring, parent, or grandparent, as well as such a relative of such person’s spouse, or the spouse of any of the above); or |

| o | a personal interest of another entity in which that person or his or her relative (as defined above) holds 5% or more of the issued shares or voting rights, has the right to appoint a director or the chief executive officer, or serves as director or chief executive officer. |

An interest resulting solely from holding the Company’s shares will not be deemed a personal interest.

| Q: | How do I indicate on the proxy card whether or not I have a personal interest? |

| A: | In completing a proxy card to send to the Company, you must indicate on the proxy card: (i) whether you have a personal interest in the approval of each of Proposals 3 - 6; (ii) whether you have a personal interest derived from your relationship with a controlling shareholder in the approval of each of Proposals 3 - 6; and (iii) with respect to Proposals 3 - 6, whether you are a controlling shareholder of the Company. |

| Q: | What happens if I do not indicate how to vote my shares on the proxy card? |

| A: | If you sign and return the enclosed proxy card, your shares will be voted as abstained of all of the proposed resolutions, whether or not you specifically indicate an “ABSTAIN” vote, unless you specifically vote in favor or vote against a specific resolution. |

CAUTIONARY STATEMENT CONCERNING FORWARD LOOKING STATEMENTS

This proxy statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are based on the current expectations, assumptions, estimates and projections of RVB and the Subsidiary. These forward-looking statements can be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “anticipate”, “estimate”, “plan” or similar words. These statements discuss future expectations, identify strategies, contain projections of results of operations, or state other forward-looking information. Known and unknown risks, uncertainties and other factors could cause the actual results to differ materially from those contained in any forward-looking statement. There can be no assurance that RVB’s expectations expressed in these forward-looking statements will turn out to be correct. The actual results of RVB and the Subsidiary could be materially different from and/or worse than those expectations. Important risks and factors that could cause the actual results of RVB and/or the Subsidiary to be materially different from their expectations are set forth in “Risk Factors” and elsewhere in this proxy statement. RVB does not undertake any obligation to update or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this proxy statement or to reflect the occurrence of unanticipated events, except as required by law.

As a foreign private issuer, RVB is exempt from the rules under the Exchange Act related to the furnishing and content of proxy statements. The circulation of this proxy statement should not be taken as an admission that RVB is subject to those proxy rules.

SUMMARY

This summary highlights selected information from this proxy statement and may not contain all of the information that is important to you. To understand the business of the Subsidiary fully for a more complete description of the terms and conditions of the Agreements, you should read carefully this entire proxy statement, including the Appendices, and the documents we refer to in this proxy statement. Please see “Where You Can Find More Information” below in this proxy statement. Certain items in this summary include a page reference directing you to a more complete description of that item.

THE COMPANIES

The Company

R.V.B. Holdings Ltd., or RVB, is a public company incorporated under the laws of the State of Israel. Our shares are quoted on the OTC Market, Pink, under the symbol, RVBHF. We may be deemed to be a “shell company”, defined by Rule 12b-2 promulgated under the Securities Exchange Act of 1934 as (1) a company that has no or nominal operations; and (2) either: (i) no or nominal assets; (ii) assets consisting solely of cash and cash equivalents; or (iii) assets consisting of any amount of cash and cash equivalents and nominal other assets. Our controlling shareholders are Mr. Aviv Tzidon (“Aviv”) and Magic Stones - Gemstone Import and Marketing Ltd. (“Magic Stones”), each of whom holds approximately 41.21% of our outstanding share capital. For a more detailed description, see the section entitled “Information about RVB” in this proxy statement below.

The Subsidiary

See the section titled, “Information about the Subsidiary” on the following page.

INFORMATION ABOUT THE SUBSIDIARY

General

The Subsidiary was incorporated in Israel on May 15, 2016, as a wholly-owned subsidiary of the Company, a private company limited by shares. The Subsidiary seeks to develop and manufacture a light, electric passenger aircraft, which we refer to as the “EViation Aircraft”, and to provide supportive services required for an economically viable electric aircraft eco-system.

The viable electric aircraft eco-system that the Subsidiary seeks to establish is intended to enable passengers to book an “on demand” flight as a cost-effective solution compared with other available transportation methods of regional travels. The EViation Aircraft to be developed will be inexpensive to operate, significantly reducing the cost of travel for passengers.

About the EViation Aircraft

The EViation Aircraft is planned to be an emissions-free, quiet, high speed, safe and easy to fly aircraft, with lower operating and ownership costs. The Subsidiary expects this aircraft to achieve a reduction of over 50% of operational costs, compared with similarly sized non-electric aircraft. The Subsidiary also estimates that such cost reduction, combined with the inherently low maintenance costs of electrical drives, will place the EViation Aircraft in competition with personal automobiles and the various modes of public transportation to destinations over 100 miles away.

The EViation Aircraft is designed to accommodate up to six passengers for a maximum travel distance of 700 miles, using electrical power only. It will be able cruise at 200 knots (ktas) using only 90 kilowatt (kW) of power during the flight, at a cost per seat mile, or “CASM”, of approximately US $0.10, allowing the EViation Aircraft to favorably compete in the general aviation market in addition to providing a viable alternative to the regional transportation options of today.

The EViation Aircraft is designed to provide an economically accessible travel option for a wider range of passengers. In addition, due to the quiet and emission free engine of the EViation Aircraft, the Subsidiary will be able to utilize many small airfields that were not previously accessible due to environmental regulations.

In addition to the License and Service Agreement, the Subsidiary intends to enter into license agreements with a number of inventors and holders of key proprietary technologies, in order to facilitate the further development and improvement of the EViation Aircraft’s airframe design, electric system, battery technology and flight control systems.

Core Enabling Technologies for the EViation Aircraft

Airframe design

The Subsidiary has secured an exclusive license for any electric and hybrid implementations of a highly efficient and IP protected airframe concept. Mr. Aviv Tzidon (“Aviv”) has contracted on behalf of the Subsidiary with Mr. John McGinnis, the inventor and patent owner of the design (“McGinnis”), as well as with certain companies controlled by McGinnis, Synergy Aircraft LLC and MC Square Design USA, to construct four flying scaled models with the designated airframe design to be tested for the Subsidiary’s proof of concept. The Subsidiary expects the scaled models to be completed and delivered to us during the second half of 2016.

Electric drive

A highly efficient set of motors and controllers has been purchased and integrated as the electric drive system and delivered to McGinnis for integration into a full scale demonstrator. Aviv has contracted on behalf of the Subsidiary with McGinnis for the completion of a full scale experimental aircraft, which we refer to as the electric synergy prime aircraft, for the testing of our developed electric drive and energy management system. The Subsidiary’s technology for the electric drive and energy management system is based on modified and enhanced versions of existing products that were acquired on behalf of the Subsidiary during 2015 and that will be incorporated in the electric full scale demonstrator.

In exchange for the development and production of the full scaled electric synergy prime aircraft by McGinnis, the Subsidiary has granted McGinnis (and/or his companies that a parties to the License and Services Agreement) the right to use the full scale electric synergy prime aircraft for demonstration or exhibitions for a period of three years from its completion. The full scale electric synergy prime aircraft is expected to be completed by the end of 2016.

Battery technology

The EViation Aircraft will utilize an aluminum-air battery to be developed and supplied by Phinergy Ltd., a company controlled by Aviv, and a Lithium Polymer buffer battery for high power at takeoff, as well as for regenerated power storage. The aluminum-air battery system produces electricity from the reaction of oxygen in the air with aluminum, and will be integrated into our airframes as part of a combined battery solution. The integration and optimization of the batteries and energy storage system into our airframes design is expected to be performed by the Subsidiary during the second half of 2016.

Autonomous flight and sensing systems

In addition to the development and manufacturing of the EViation Aircraft, the Subsidiary is also developing services and technologies that will demonstrate our vision of the EViation Aircraft eco-system. These developments include low cost auto-piloting solutions, high volume, machine airspace management and real-time remote assistance and piloting service. These technologies are sub-systems that could be integrated into existing and future general aviation aircraft as products or services, regardless of the maturity of the EViation Aircraft.

Remote Ground Station Assistance and Control

Under the Laminar MOU, Aviv has contracted on behalf of the Subsidiary with Mr. Austin Meyer and Laminar Research LLC, for the development of the software to be integrated into the Subsidiary’s ground stations and air traffic control demonstrators. Software that includes uniquely modified versions of a commercially available flight simulator and a controller, developed for and owned by the Subsidiary, will be integrated into the Eviation aircraft’s hardware. The system created shall be used for safety support, to safely manage and control high numbers of aircraft in a given airspace.

Collision Avoidance and Remote Communication

The Subsidiary is also developing an obstacle detection and collision warning system, in addition to other optical sensors to assist with full surrounding awareness by the aircraft. This system will also include a machine to machine (M2M) data connection that will allow the plane to communicate with other planes for safety and automated formation flights.

Auto Landing System

The Subsidiary has bought all rights under a U.S. patent for a high precision electro-optical positioning system. Under the rights obtained, the Subsidiary has completed the conceptual design of a low-cost auto-landing system, currently being developed under contract with Zickel Engineering Ltd. The system is expected to be completed during the second half of 2016, and integrated as part of our advanced auto-pilot system. As such, this feature will be integrated into the electric synergy prime aircraft and scaled models provided by McGinnis. The integrated system is intended to be included in the EViation Aircraft for an autonomous takeoff and landing system.

The autonomous flight and sensing systems are also intended to be developed as the first stage for auto-pilot aircraft.

Market Overview

General Aviation

General aviation, comprising all aircraft other than military aircraft and scheduled commercial airliners, presents an uncommon form of long distance transport method, reserved mainly for ultra-wealthy individuals.

According to the 2014 General Aviation Statistical Databook and 2015 Industry Outlook, the general aviation market includes approximately 400,000 aircraft worldwide, ranging from two-seat training aircraft and utility helicopters to intercontinental business jets flying today, most of which are based in the United States and Europe. In the U.S., the general aviation fleet flies almost 23 million flight hours to more than 5,000 U.S. public airports, while scheduled commercial airlines serve less than 500 airports. The European general aviation fleet can access over 4,200 airports.

The global aviation industry has been growing and developing over the past few years. In 2014, the General Aviation industry showed total revenue of roughly $24.5 billion and delivery of 2,454 new aircraft, a slight increase compared to the previous year. The increase is mostly attributable to a 6.5% increase in the number of business jets delivered that year. In comparison, the commercial aviation industry is estimated at $260 billion in new aircraft deliveries each year. Moreover, commercial aviation has been growing at roughly 5% per year since 1980, compared with a 0.5% annual growth rate for general aviation since 2010.

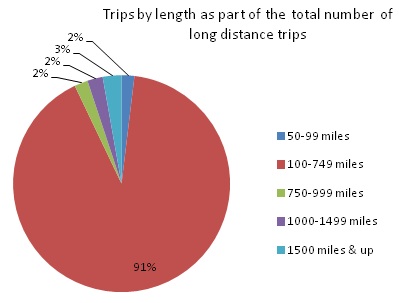

Regional Transportation

According to national household travel surveys made in 2001 and 2009, or NHTS, as summarized in Long Distance Transportation Patterns: Mode Choice, out of the 2.6 billion trips of over 50 miles in distance taken annually by Americans, 2.36 billion trips are of 100-750 miles, making the regional distance account for 91% of the total trips taken, and an estimated total of over $1 trillion spent on this type of travel.

Figure 1: 91% of trips over 50 miles are “regional”

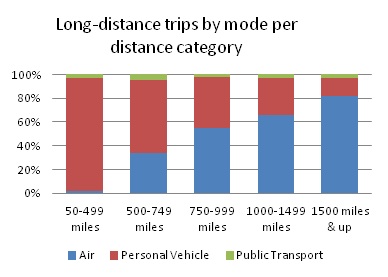

As expected, in long distance trips, and as seen in Figure 2 below, personal vehicles and aviation exchange places as the trip length grows.

Figure 2: Short distance by car, long distance by plane

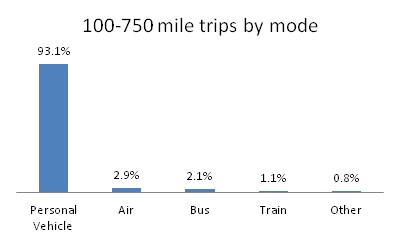

The Subsidiary aims to target trips at a destination distance of 100-749 miles, rendering 50-100 miles more suitable for a car and trips over 750 miles for main-stream commercial aviation. According to the data provided by the NHTS, we estimate a regional-distance trip that accounts for 91% of all trips over 50 miles, and that is served almost exclusively by cars (93.1%).

Figure 3: personal vehicle market dominance

Competition

The EViation Aircraft will compete with light aircraft in the general aviation market and with trains, buses and private automobiles in the regional travel market. Light aircraft are highly expensive for travel. The CASM (cost per seat mile) for light aircraft is estimated at US $0.20 to US $0.50, not including pilot’s expenses1. According to an AAA, “Your Driving Costs” 2015 report, the driving CASM for a mid-size sedan at full seating capacity in 2015 was US $0.12 - US $0.20. The average CASM in the commercial aviation industry is US $0.13, but additional costs for the customer significantly vary based on competition on routes, so that regional prices in the U.S. commercial aviation industry range between US $0.21 and US $0.90 cents per mile traveled.2 Buses and regional trains are less expensive (CASM of US $0.8 - US $0.11), but are also very slow in commute. High speed trains are more expensive (CASM of US $0.25 - US $0.35), and like commercial aviation require a significant investment in infrastructure.

The EViation Aircraft adds a unique and inexpensive alternative to the current existing regional transportation options for travel distances of 100-750, while using the existing infrastructure of general aviation, at an estimated CASM of US $0.10 or less.

Our Business Strategy

Our business plan includes four distinct stages as described herein:

| 1. | Proof of Concept – The Subsidiary is currently in the proof of concept stage, and intends to test all the components of the Eviation Aircraft core enabling technologies (airframe design, electric drive, battery technology and autonomous flight and sensing systems). Testing will take place on the scaled models and electric synergy prime aircraft that are under construction. This stage will include the design validation process and completion of construction of the electric synergy prime aircraft as an experimental aircraft in the U.S. Our goal is to successfully complete the construction and first test flights of the electric synergy prime aircraft model. The Subsidiary expects to complete the proof of concept stage by the end of 2016. The expected cost of this stage is approximately US $2.4 million. |

| 2. | Aircraft and Services Development – Following the proof of concept stage, the Subsidiary intends to develop potential products to defined services and solutions and protect any intellectual property created during the proof of concept stage. The Subsidiary also intends to partner with leading aerospace industrial suppliers to commercialize and market these services and solutions. This stage will focus mainly on the development and commercialization of autonomous flight and sensing systems, including the remote pilot assistance and auto landing system. In addition, the Subsidiary intends to continue the flight testing of the electric synergy prime aircraft to both validate and improve the EViation Aircraft’s design. We expect to complete this stage by the end of 2017 at an estimated cost of approximately US $2 million. |

| 3. | Production - In this third stage the Subsidiary plans to complete the industrial production design process for the EViation Aircraft, based on the results of the flight tests for the purpose of commercialization and type certification of the EViation Aircraft. The Subsidiary further intends to partner with established airframe manufacturers to support the process of commercialization of the design. The Subsidiary also plans, based on the assessment of the certification process, to complete the development of the transportation service platform and initiate its marketing. The Subsidiary may independently manufacture a limited series of experimental EViation Aircraft, to be sold in the U.S. market. This stage is planned to be completed by the end of 2018. The Subsidiary cannot estimate the cost at of this stage at this time. |

| 1 | Aircraft owners and pilots association, https://www.aopa.org |

| 2 | MIT Airline data project – http://web.mit.edu/airlinedata/www/Res_Glossary.html |

| 4. | Production and Operations - In the fourth and final stage, the Subsidiary plans to complete the certification process of the EViation Aircraft and partner with manufacturers and marketers for the commercialization of the aircraft, along with additional developed systems and services. The Subsidiary estimates the earliest expected sale of a complete certified EViation Aircraft will be in the year 2022. |

Employees

As of the date of this proxy statement, the Subsidiary outsources to related and third parties all of its design and development activities.

Liquidity and Capital Resources

In order to advance the business of the Company, on July 14, 2016, the Controlling Shareholders and the Company entered into a Loan and Credit Agreement pursuant to which they loaned a total of $500,000 to the Company for a period of seven years at an annual interest rate equal to the lower of (i) 3.2% per annum, and (ii) the minimum rate required by law to avoid the imputing of tax. As security for such loan, the Company granted to the Buyers a specific lien and security interest on all of the shares of the Subsidiary held by the Company. The loan may be repaid by the Company at any time in minimum increments of $50,000. The proceeds of the loan are to be used for funding the on-going operations of the Company.

Additionally, on July 14, 2016, the Controlling Shareholders and the Subsidiary entered into a Loan and Credit Agreement with the Subsidiary pursuant to which they granted a credit line to the Subsidiary of up to a total of $4,500,000 for a period of seven years at an annual interest rate equal to the lower of (i) 3.2% per annum, and (ii) the minimum rate required by law to avoid the imputing of tax. Draws on such credit line may be made in increments of not less than $50,000, and outstanding amounts on the credit line may be repaid in increments of not less than $50,000. Accrued interest is payable annually. As security for amounts owing under the credit line, the Subsidiary granted to the Controlling Shareholders a floating lien and charge on all of the assets of the Subsidiary, and a specific charge on all of the intellectual property rights owned by the Subsidiary at any time. An event of default on any one of the loan made to the Company and the credit line granted to the Subsidiary triggers an event of default under the other of such loan and credit line.

Material agreements

License and Service Agreement for the manufacturing of the scaled models and electric synergy prime aircraft

On September 1, 2015, Mr. Aviv Tzidon (“Aviv”), entered on behalf of the Subsidiary into a license and service agreement with Mr. John McGinnis, on behalf of himself and on behalf of his companies, Synergy Aircraft LLC and MC Squared Design USA (collectively, “McGinnis”), for a patent and know-how in the field of aircraft, including a Double Boxtail Aircraft design. Pursuant to the terms of the agreement, the Subsidiary acquired a worldwide exclusive license to a patent and know-how necessary for the completion and utilization of a flying electric double box tail aircraft for use solely in the field of electric powered aircraft (including hybrid electric) above 55lbs, including the rights to develop, make, commercialize, and import products and processes. Three years after the termination of the agreement, the license will automatically become non-exclusive. Pursuant to the terms of the agreement, the Subsidiary agreed to pay US $300,000 for the development and production of four flying, unmanned, scaled demonstrators, the first of which was provided to us in March 2016. The Subsidiary will be the owner of the physical scaled demonstrators and their accompanying manuals, copies of design files and drawings. Aviv also agreed on behalf of the Subsidiary to pay US $500,000 for the development and production of a full scale electric synergy prime aircraft, in consideration for which the Subsidiary was granted the right to use the full-scale electric synergy prime aircraft for demonstrations, exhibitions and events for a period of three years from the completion of the full scale electric Synergy prime aircraft. Of the US $500,000 to be paid to McGinnis, US $200,000 was paid (by Aviv on behalf of the Subsidiary) in September 1, 2015; US $200,000 was paid between January and April 2016 to enable completion of the sub-scale demos; and US $100,000 is payable upon completion of the full scale electric Synergy prime aircraft, which is to take place by the end of 2016. By March 2016, one model had been delivered, as well as all of the needed files and drawings. The remaining 3 models are expected to be delivered by October 2016. According to the terms of the agreement, we will not be the owners of the physical embodiment of the full scale electric Synergy prime aircraft or its intellectual property. Pursuant to the terms of the agreement, McGinnis will provide additional services and certain deliverables to us, and we agreed to pay in accordance with a statement of work. The payment terms of each statement of work will be determined on or before August 30th of each calendar year beginning on August 30, 2016. The statement of work for additional services is as follows:

2016-2017 (US $500,000)

| 1. | Project engineering for the electric transatlantic aircraft |

| 2. | Synergy – prime modifications for the transatlantic project |

| 3. | Initial planning for an Eviation air frame (500kW model-12 seater) |

| 4. | Demos of Synergy prime as agreed |

2017-2018 (US $500,000)

| 1. | Development of the EViation Aircraft- delivery of modeling files and documentation |

| 2. | Demos of Synergy prime as agreed |

2018-2019 (US $500,000)

| 1. | Pre-production preparations for the EViation Aircraft |

| 2. | Demos of Synergy prime as agreed |

2019-2020 (US $500,000)

To be determined.

Pursuant to the terms of the agreement, McGinnis is and shall remain the sole and exclusive owner of the patent and the know-how he has developed that relates thereto. Any intellectual property developed in the course of or as a result of the services under the agreement shall belong to McGinnis and will automatically and for no additional consideration licensed to us under the license granted in this agreement. We will have the right to coordinate, review, comment and approve any filing, prosecution, maintenance and enforcement of patent applications and patents on the new developed intellectual property.

Administrative Services Agreement for the provision of various services and the lease of office space

On November 30, 2015, Aviv and Mr. Michael Ilan (beneficial owner of Magic Stones) entered on behalf of the Subsidiary into an Administrative Services Agreement with Phinergy Ltd., a company also controlled by Aviv and Mr. Ilan – the “ASA”. Pursuant to the ASA, Phinergy provides the Subsidiary with (i) administrative and general services, including secretarial and management services; (ii) human resource services; (iii) accounting and bookkeeping services; and (iv) office space and office services, including telephone, fax and data communications and cleaning services (the services described in (i) through (iv), collectively – the “Services”). In consideration for these Services, the Subsidiary pays a monthly fee calculated on the basis of the actual cost to Phinergy of providing the Services, derived as a percentage of the global costs paid by Phinergy for receiving such services for itself and the Subsidiary together. Fees are paid on a quarterly basis in arrears.

The Laminar MOU

On February 5, 2016, the Subsidiary (as an entity in formation) entered into a “Memorandum of Understandings” with Laminar Research LLC (the “Laminar MOU” and “Laminar”, respectively) for the development of an air traffic control (ATC) algorithm and its implementation on subscale aircraft models. The Laminar MOU comprises several steps of development by Laminar, for a total payment by the Subsidiary of $180,000. The Subsidiary receives an irrevocable, royalty-free license for a limited number of copies of the finished software products.

Intellectual Property

In the framework of the Prior Entrepreneurial Activity, the Subsidiary acquired from Eye Point Ltd., a company owned by Mr. Dekel Tzidon, all rights under US patent No. 8,314,928 (the “Eye Point Patent”). The Eye Point Patent will expire on November 12, 2026. This patent allows us to develop our conceptual design of an auto-landing system.

We also license US Patent No. 8,657,226, owned by McGinnis, pursuant to the LSA. This patent will expire on April 26, 2029. Pursuant to our agreement with McGinnis, any patents and other types of intellectual property developed in the framework of the LSA will be owned by McGinnis and will be added to the license already granted by McGinnis for no additional consideration.

While our intellectual property rights in the aggregate are important to the operation of each of our businesses, we do not believe that our business would be materially affected by the expiration of any particular intellectual property right or termination of any particular intellectual property patent license agreement.

Regulatory Aspects

Our business is regulated by the Federal Aviation Administration (FAA) and the Department of Homeland Security. In the U.S., the EViation Aircraft will be required to comply with FAA regulations governing production and quality systems, airworthiness and installation approvals, repair procedures and continuing operational safety. When we reach the stage of mass production and deployment of the EViation Aircraft, we will also be subject to various federal, state, and local laws and regulations relating to environmental protection, including the discharge, treatment, storage, disposal and remediation of hazardous substances and wastes. We will continually assess our compliance status and management of environmental matters to ensure our operations are in substantial compliance with all applicable environmental laws and regulations. Investigation, remediation, operation and maintenance costs associated with environmental compliance and management of sites will be a normal, recurring part of our operations. It is reasonably possible that costs we incur to ensure continued environmental compliance could have a material impact on our results of operations, financial condition or cash flows, if additional work requirements or more stringent clean-up standards are imposed by regulators, new areas of soil, air and groundwater contamination are discovered and/or expansions of work scope are prompted by the results of investigations.

Research and Development

Research and development expenditures involve experimentation, design, development and related test activities for the EViation Aircraft. The total research and development expenses on behalf of the business amounted to US $0.9 million in 2015 and are expected to be US $2 million in 2016. Research and development costs also include costs of service providers.

RISK FACTORS

RISK FACTORS RELATED TO OUR COMPANY

We are a start-up company.

The Company’s sole business is ownership of the Subsidiary, a start-up company engaged in a new business that has not generated any revenue since its inception. We expect to incur significant operating losses for the foreseeable future, and there can be no assurance that we will be able to validate and market products in the future that will generate revenues or that any revenues generated will be sufficient for us to become profitable or thereafter maintain profitability.

We have no operating history upon which to evaluate our business.

We have no history of operations in our industry as we are embarking on a new business venture. Accordingly, it is more difficult to accurately assess growth rate and earnings potential. Our business is dependent upon the implementation of our business plan. We have just finalized our licensing agreements and are setting in place operations. Our limited operating history makes it difficult for prospective investors to evaluate our business. Therefore, our operations are subject to all of the risks inherent in the initial expenses, challenges, complications and delays frequently encountered in connection with the early stages of any new business, as well as those risks that are specific to aviation industry. Investors should evaluate us in light of the problems and uncertainties frequently encountered by early stage companies attempting, like ours, to develop markets for new products, services, and technologies, such as unforeseen capital requirements, failure of market acceptance, failure to establish business relationships, and competitive disadvantages as against larger and more established companies. If we are unable to successfully address these difficulties as they arise, our future growth and earnings will be negatively affected. It is possible that you could lose your entire investment.

We may be unable to obtain additional capital that we will require to implement our business plan, which could restrict our ability to grow.

We expect that loans of up to US $5 million to be provided to us under the Company’s Loan Agreement and Subsidiary’s Loan and Credit Line Agreement will suffice for our working capital through December 31, 2017, as described in our business plan. .

We will require additional capital to continue implementing our business plan beyond January 1, 2018 and to grow our business beyond the development phase. We plan to partner with an established airframe manufacturer to support and fund the process of commercialization of the design. We may not, however, succeed in securing such partnership and obtaining the additional capital required, and if we are able to secure such additional capital, it may not be pursuant to terms deemed favorable to the Company and its shareholders. We may seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financing covenants that would restrict our operations. Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

| · | investors’ perception of an aviation company, and demand for its securities; |

| · | conditions of the U.S. and other capital markets in which we may seek to raise funds; |

| · | our future results of operations and financial condition; and |

| · | economic, political and other conditions in North America. |

Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could have a material adverse effect on our business, financial condition and results of operations. In addition, our administrative requirements (such as salaries, insurance, expenses and general overhead expenses, as well as legal compliance costs and accounting expenses) may require a substantial amount of additional capital and cash flow.

We may pursue sources of additional capital through various financing transactions or arrangements, including partnership with an established airframe manufacturer, joint venturing of projects, debt financing, equity financing or other means. We may not be successful in locating suitable financing transactions in the time period required or at all, and we may not obtain the capital we require by other means. If we do not succeed in raising additional capital, our resources may not be sufficient to fund our planned operations going forward. Any additional capital raised through the sale of equity may dilute the ownership percentages of our stockholders, and could also result in a decrease in the fair market value of our equity securities because our assets would be owned by a larger pool of outstanding equity. The terms of securities we issue in future capital transactions may be more favorable to our new investors, and may include preferences, superior voting rights and the issuance of other derivative securities, and issuances of incentive awards under equity employee incentive plans, which may have a further dilutive effect.

Our ability to obtain needed financing may be impaired by such factors as the capital markets, our status as a new enterprise without a significant demonstrated operating history and/or the loss of key management. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, we may be required to cease our operations.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes, which may adversely impact our financial condition.

Our lack of diversification will increase the risk of an investment in the Company, and our financial condition and results of operation may deteriorate if we fail to diversify.

Our new business will initially be in the regional transportation (or aviation) industry. Larger companies have the ability to manage their risk by diversification. However, we will lack diversification, in terms of both the nature and geographic scope of our business. As a result, we will likely be impacted more acutely by factors affecting our industry or the regions in which we operate than we would if our business were more diversified, enhancing our risk profile. If we cannot diversify or expand our operations, our financial condition and results of operations could deteriorate.

The success of our business depends upon the continuing contributions of our Chief Executive Officer and other key personnel and our ability to attract highly qualified personnel to expand our business.

We will rely heavily on the services of our CEO, Mr. Omer Bar Yohay, as well as our shareholder Mr. Aviv Tzidon and other senior management personnel that we intend to hire. Loss of the services of any of such individuals or any other key management and technical personnel could have a material adverse impact on our future operations. Our success is also dependent on our ability to retain these key employees and our ability to attract and retain, among others, skilled financial, engineering, technical and managerial personnel to continue the development and commercialization of the EViation Aircraft. As such, our future success highly depends on our ability to attract, retain and motivate personnel, including contractors, required for the development, maintenance and expansion of our activities. There can be no assurance that we will be able to retain our existing personnel or attract additional qualified employees or consultants. The loss of personnel or the inability to hire and retain additional qualified personnel in the future could have a material adverse effect on our business, financial condition and results of operation. In addition, if we fail to engage qualified personnel, we may be unable to meet our responsibilities as a public reporting company under the rules and regulations of the Securities and Exchange Commission.

The product we intend to market may not be accepted by the market.

Our success depends on the acceptance of the EViation Aircraft as a viable alternative to the current existing regional transportation options. Market acceptance will depend upon several factors, including (a) the desire and ability of consumers to use EViation Aircraft (b) the accessibility of the EViation Aircraft; and (c) the convenience of using the EViation Aircraft. A number of factors may inhibit acceptance of the EViation Aircraft, including (i) the ease of use of competing alternatives such as cars, trains and buses; (ii) our inability to change Consumers’ habits of using car, train and buses for regional travel; (iii) our inability to change consumers’ perception that using light aircraft is highly expensive and is reserved mainly for the extremely rich population of the world; or (iv) fear of individuals to use the EViation Aircraft. If the EViation Aircraft is not accepted by the market, we may have to curtail our business operations, which could have a material negative effect on operating results and result in a lower stock price.

We may not be able to compete successfully against current and future competitors.

We will compete, in our proposed businesses, with other companies, some of which have far greater marketing and financial resources and experience than we do. A number of companies may develop and offer products that provide the same or greater functionality than our product. We may not be able to maintain our competitive position against current or potential competitors, especially those in the general aviation market with significantly greater financial, marketing, service, support, technical and other resources. Competitors with greater resources may be able to undertake more extensive marketing campaigns, adopt more aggressive pricing policies and make more attractive offers to potential employees, distributors, resellers or other strategic partners. We expect additional competition from other established and emerging companies as the market for light aircraft continues to develop.

In addition, we cannot guarantee that we will be able to penetrate the regional transportation market and be able to compete at a profit. In addition to established competitors, other companies can easily enter our market and compete with us. Effective competition could result in price reductions, reduced margins or have other negative implications, any of which could adversely affect our business and chances for success. Competition is likely to increase significantly as new companies enter the market and current competitors expand their services. Many of these potential competitors are likely to enjoy substantial competitive advantages, including: larger technical staffs, greater name recognition, larger customer bases and substantially greater financial, marketing, technical and other resources. To be competitive, we must respond promptly and effectively to the challenges of technological change, evolving standards and competitors’ innovations by continuing to enhance our services and sales and marketing channels. Any pricing pressures, reduced margins or loss of market share resulting from increased competition or our failure to compete effectively, could seriously damage our business and chances for success.

Our commercial success will depend in part on the ability of the licensors of key technologies to maintain protection of their intellectual property.

Our success will depend in part on the ability of the licensors of key technologies to obtain, maintain and enforce patent and other intellectual property rights for the technology and to preserve trade secrets, and on our ability to operate without infringing upon the proprietary rights of third parties. We cannot be certain that our licensors were the first inventors of inventions covered by their patents and patent applications or that they were the first to file. Accordingly, there can be no assurance that licensed patents and patents application used by the Subsidiary are valid or will afford us protection against competitors with similar technologies. Failure to obtain or maintain patent or other intellectual property protection on the technology underlying our licensed electric double box tail aircraft may have a material adverse effect on our competitive position and business prospects. It is also possible that the technology may infringe on third party patents or other intellectual property rights owned by others. If we are found liable for infringement, we may be liable for significant money damages and may encounter significant delays in bringing products and services to market.

We may be forced to abandon development of the EViation Aircraft altogether, which will significantly impair our ability to generate revenues.

We are currently in the proof of concept stage, and intend to test all the components of the EViation Aircraft enabling core technologies (airframe design, electric drive, battery technology and autonomous flight and sensing systems). Testing will take place on the scaled models and electric synergy prime aircraft that are currently under construction by McGinnis. Upon the completion of the testing, the results of such testing may not support the claims sought by us. Further, success in the proof of concept stage does not ensure that the later stages of development would be successful, and the results of later testing may not meet our expectation or the results of the proof of concept stage. Any such failure may cause us to abandon the development of the EViation Aircraft altogether. In addition, we depend on McGinnis to deliver the scaled models and electric synergy prime aircraft to us in a timely manner. Any delays, suspension, or termination of the agreement with McGinnis will delay our testing and the implementation of our business plan, and may thus materially adversely affect our business, results of operations, ability to certify the EViation Aircraft, and, ultimately, our ability to commercialize the EViation Aircraft and generate revenues.

Our future growth is dependent upon consumers’ willingness to adopt light electric aircraft.

Our growth is highly dependent upon the adoption by consumers of light electric aircraft as a viable alternative for regional travel, and we are subject to an elevated risk of any reduced demand for, alternative fuel aircraft in general, and light electric aircraft in particular. If the market for light electric aircraft in North America, Europe and Asia does not develop as we expect, or develops more slowly than we expect, our business, prospects, financial condition and operating results will be harmed. The market for alternative fuel aircraft is relatively new, rapidly evolving, characterized by rapidly changing technologies, price competition, additional competitors, evolving government regulation and industry standards.

Other factors that may influence the adoption of alternative fuel aircraft, and specifically electric aircraft, include:

| · | perceptions about electric aircraft quality, safety (in particular with respect to lithium-ion battery packs), design, performance and cost, especially if adverse events or accidents occur that are linked to the quality or safety of electric aircraft, such as those relating to the battery in the Boeing Dreamliner; |

| · | perceptions about airplane safety in general, in particular safety issues that may be attributed to the use of advanced technology; |

| · | the limited range over which electric aircraft may fly on a single battery charge and the effects of weather on this range; |

| · | the decline of an electric aircraft’s range resulting from deterioration over time in the battery’s ability to hold a charge; |

| · | The availability of service for electric aircraft; |

| · | concerns about electric grid capacity and reliability, which could derail our present efforts to promote electric aircraft as a practical solution to aircraft which require gasoline; |

| · | consumers’ desire and ability to use electric aircraft in regional trips instead of other alternatives such as trains, buses and cars; |

| · | government regulations and economic incentives promoting fuel efficiency and alternate forms of energy as well as tax and other governmental incentives to purchase and use electric aircraft; |

Our Business is subject to extensive and costly government regulation.

Our product is subject to extensive regulation and we may never obtain the certification required for its operation. In the U.S., the EViation Aircraft must comply with Federal Aviation Administration regulations governing production and quality systems, airworthiness and installation approvals, repair procedures and continuing operational safety before it can be certified. The FAA and foreign regulatory authorities have full discretion over this approval process. We will need to perform significant testing of the EViation Aircraft and its systems before we could file an application for certification. We may encounter delays or rejections based upon the FAA regulations, which may delay the commercialization of our product. Failure to obtain FAA certification of the EViation Aircraft in a timely manner or at all will severely undermine our business by delaying or halting commercialization of our product, imposing costly procedures and diminishing competitive advantage, and we may be required to cease our operations.

Our business is also subject to various federal, state, and local laws and regulations relating to environmental footprint in emissions, noise and treatment of hazardous materials. However, the costs incurred to ensure continued environmental compliance could have a material impact on our results of operations, financial condition or cash flows if additional work requirements or more stringent clean-up standards are imposed by regulators, new areas of soil, air and groundwater contamination are discovered and/or expansions of work scope are prompted by the results of investigations.

We may be subject to legal proceedings and/or to product liability lawsuits.