Investor Presentation Second Quarter 2014 Westmoreland Coal Company westmoreland.com | NASDAQ:WLB

Westmoreland Coal Company 1 Disclaimer Forward Looking Statements This document contains “forward-looking statements.” Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and similar references to future periods. Examples of forward-looking statements include, but are not limited to, statements we make about our anticipated 2014 year end EBITDA and coal sales, the ability to optimize the Canadian assets by taking advantage of synergies and economies of scale, the possibility of a corporate re-rating, the availability of additional acquisition opportunities and that the acquisition is expected to be accretive in 2014. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward- looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. We therefore caution you against relying on any of these forward-looking statements. They are statements neither of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements include political, economic, business, competitive, market, weather and regulatory conditions and the following: Changes in our post-retirement medical benefit and pension obligations and the impact of the recently enacted healthcare legislation; The impact of the recently enacted healthcare legislation and its effect on our employee health benefit costs; Our potential inability to expand or continue current coal operations due to limitations in obtaining bonding capacity for new mining permits, and/or increases in our mining costs as a result of increased bonding expenses; Our substantial level of indebtedness and potential inability to maintain compliance with debt covenant requirements; The potential inability of our subsidiaries to pay dividends to us due to restrictions in our debt arrangements, reductions in planned coal deliveries or other business factors; The effect of Environmental Protection Agency inquiries and regulations on the operations of the power plants we provide coal to; The effect of prolonged maintenance or unplanned outages at our operations or those of our major power generating customers; Future legislation and changes in regulations, governmental policies and taxes, including those aimed at reducing emissions of elements such as mercury, sulfur dioxides, nitrogen oxides, particulate matter or greenhouse gases; Our expansion into international operations as a result of the acquisition of the Canadian assets, which exposes us to risks relating to exchange rates and exchange controls, general economic and political conditions, costs associated with compliance with governmental regulations in multiple jurisdictions, tax-related risks and export or import requirements for, or restrictions related to, our products; Our efforts to effectively integrate the Canadian operations with our existing business and our ability to manage our expanded operations following the acquisition; Our ability to realize growth opportunities and cost synergies as a result of the addition of the Canadian operations; and Other factors that are described in “Risk Factors” in our 2013 Form 10-K and any subsequent quarterly filing on Form 10-Q.

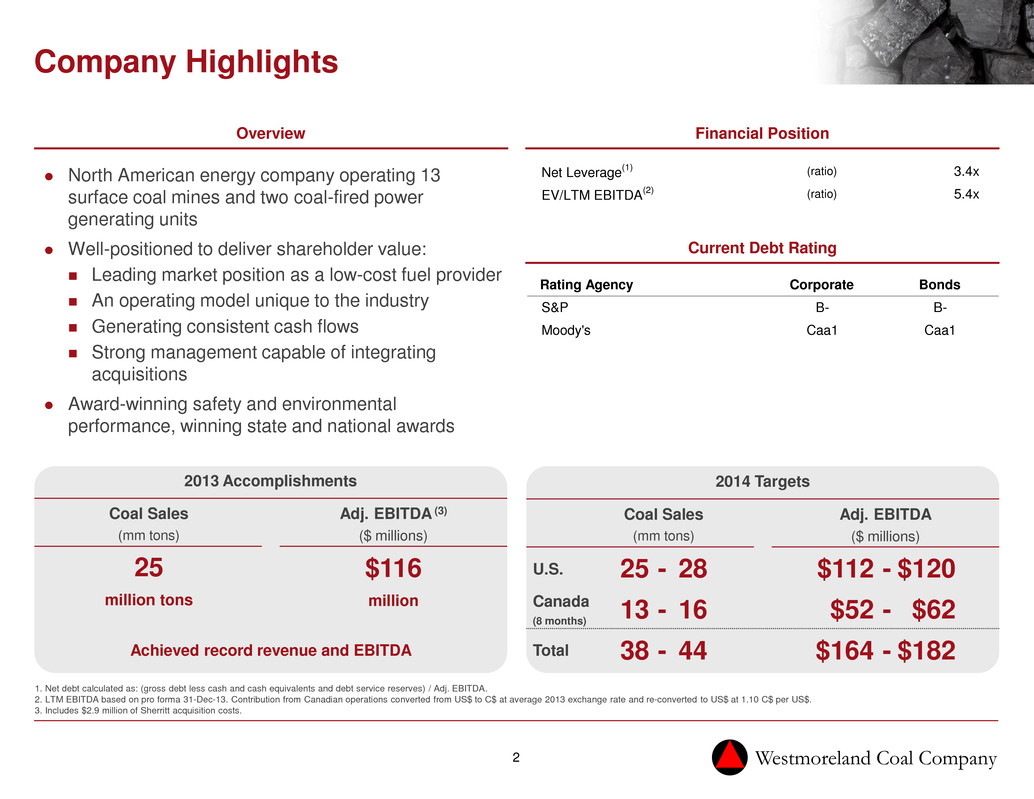

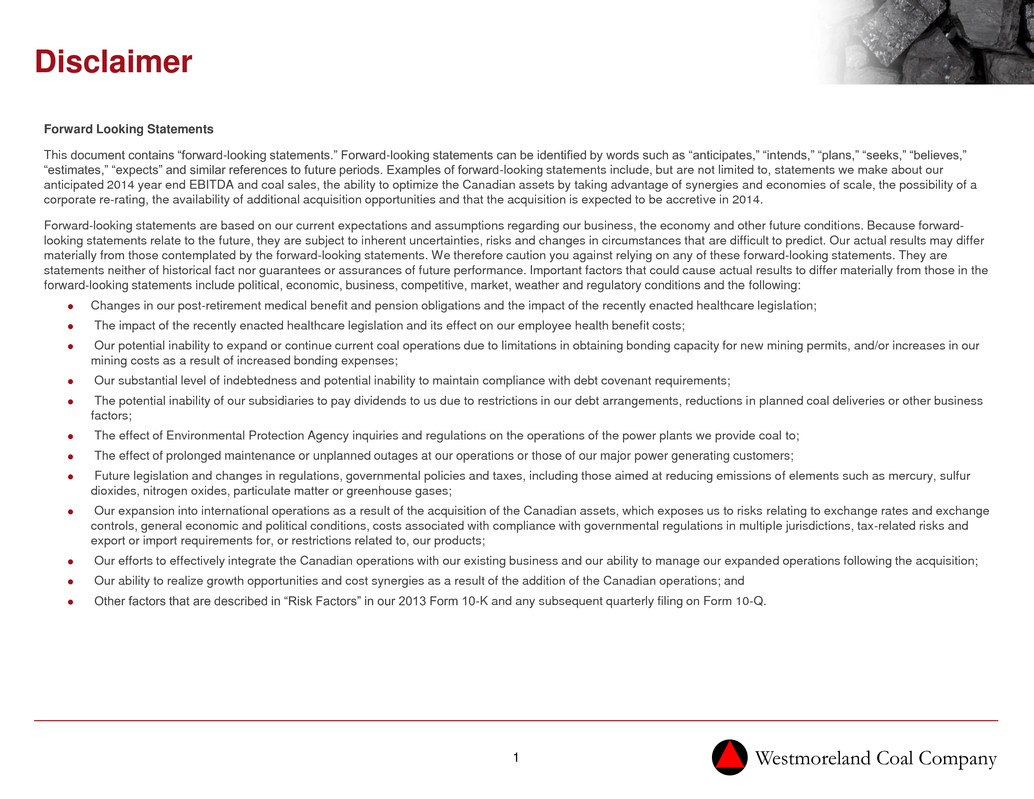

Westmoreland Coal Company 2 Net Leverage (1) (ratio) 3.4x EV/LTM EBITDA (2) (ratio) 5.4x Rating Agency Corporate Bonds S&P B- B- Moody's Caa1 Caa1 North American energy company operating 13 surface coal mines and two coal-fired power generating units Well-positioned to deliver shareholder value: Leading market position as a low-cost fuel provider An operating model unique to the industry Generating consistent cash flows Strong management capable of integrating acquisitions Award-winning safety and environmental performance, winning state and national awards Company Highlights 2014 Targets Coal Sales (mm tons) Adj. EBITDA ($ millions) 2013 Accomplishments Coal Sales (mm tons) 25 million tons Adj. EBITDA (3) ($ millions) $116 million 1. Net debt calculated as: (gross debt less cash and cash equivalents and debt service reserves) / Adj. EBITDA. 2. LTM EBITDA based on pro forma 31-Dec-13. Contribution from Canadian operations converted from US$ to C$ at average 2013 exchange rate and re-converted to US$ at 1.10 C$ per US$. 3. Includes $2.9 million of Sherritt acquisition costs. Financial Position Overview U.S. Canada (8 months) Total $112 $120 $52 $62 $164 $182 - - - 25 28 13 16 38 44 - - - Current Debt Rating Achieved record revenue and EBITDA

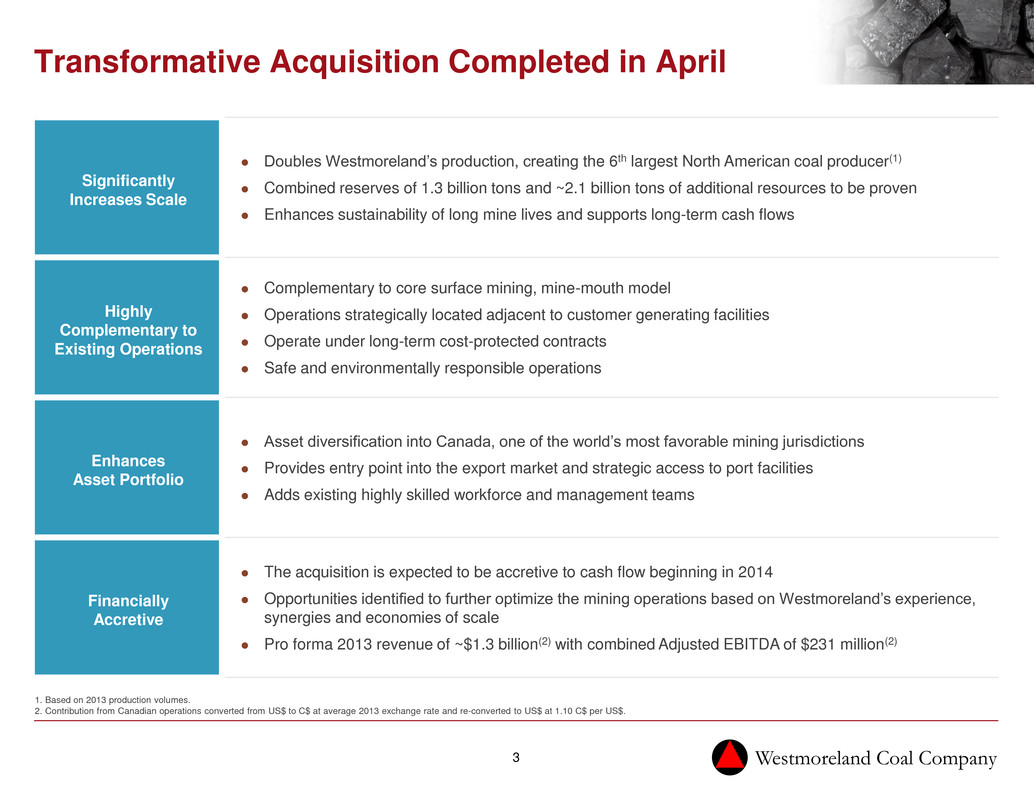

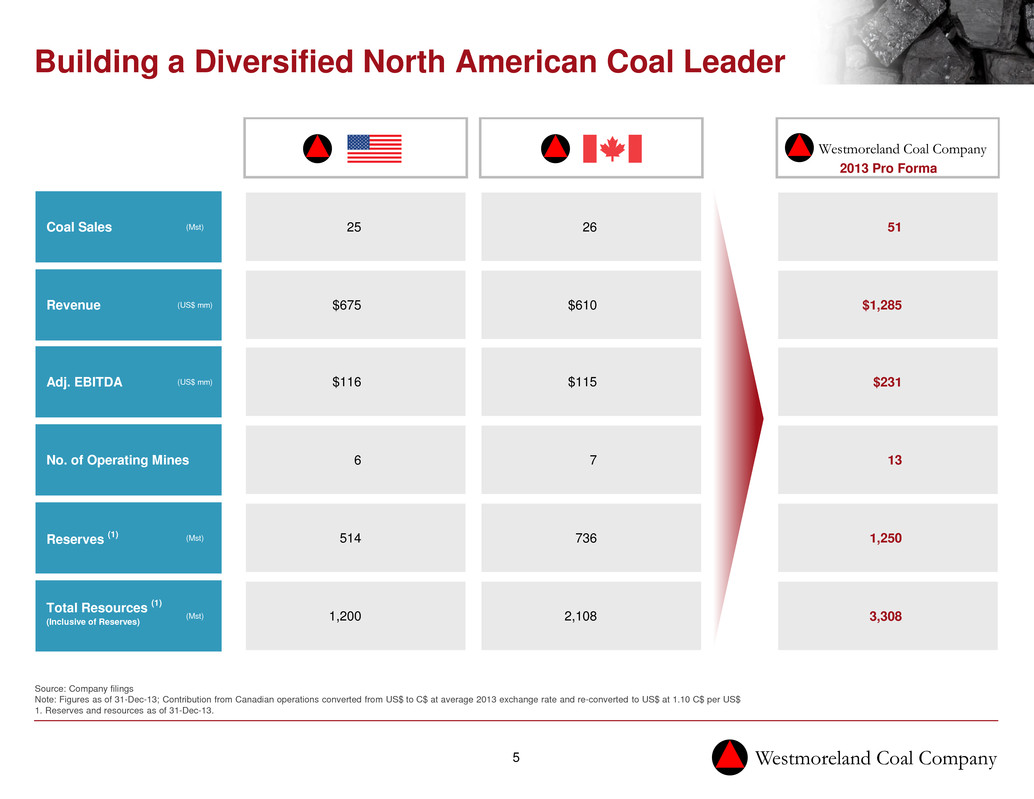

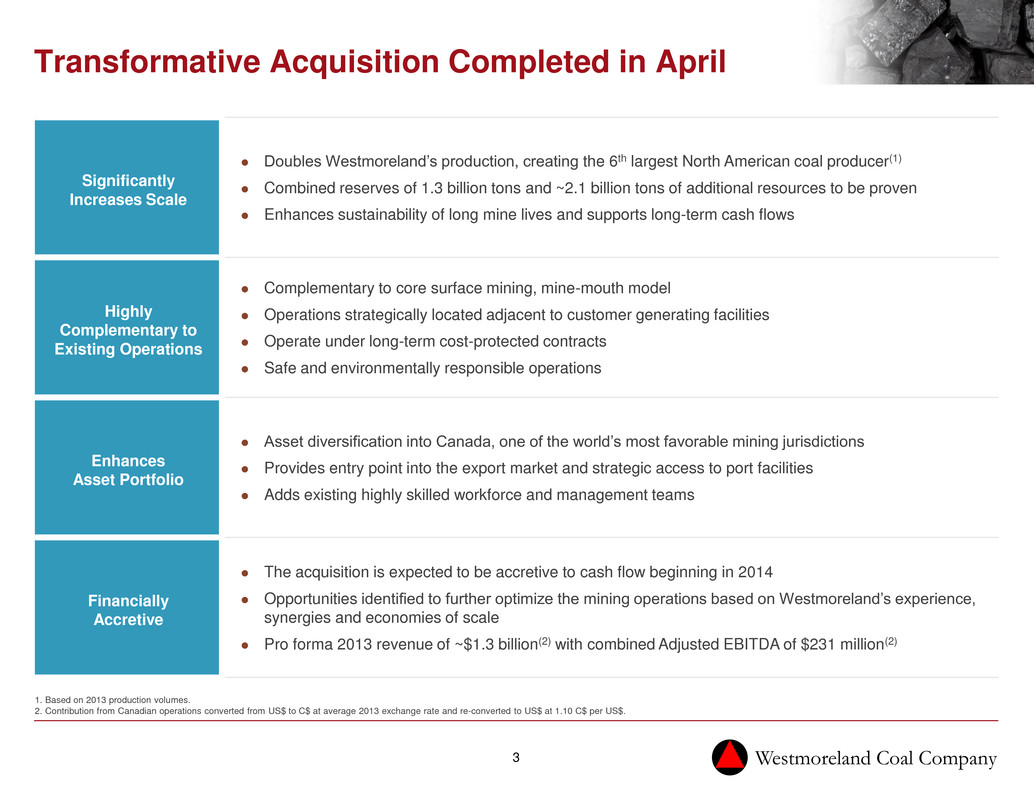

Westmoreland Coal Company 3 Transformative Acquisition Completed in April Significantly Increases Scale Doubles Westmoreland’s production, creating the 6th largest North American coal producer(1) Combined reserves of 1.3 billion tons and ~2.1 billion tons of additional resources to be proven Enhances sustainability of long mine lives and supports long-term cash flows Highly Complementary to Existing Operations Complementary to core surface mining, mine-mouth model Operations strategically located adjacent to customer generating facilities Operate under long-term cost-protected contracts Safe and environmentally responsible operations Enhances Asset Portfolio Asset diversification into Canada, one of the world’s most favorable mining jurisdictions Provides entry point into the export market and strategic access to port facilities Adds existing highly skilled workforce and management teams Financially Accretive The acquisition is expected to be accretive to cash flow beginning in 2014 Opportunities identified to further optimize the mining operations based on Westmoreland’s experience, synergies and economies of scale Pro forma 2013 revenue of ~$1.3 billion(2) with combined Adjusted EBITDA of $231 million(2) 1. Based on 2013 production volumes. 2. Contribution from Canadian operations converted from US$ to C$ at average 2013 exchange rate and re-converted to US$ at 1.10 C$ per US$.

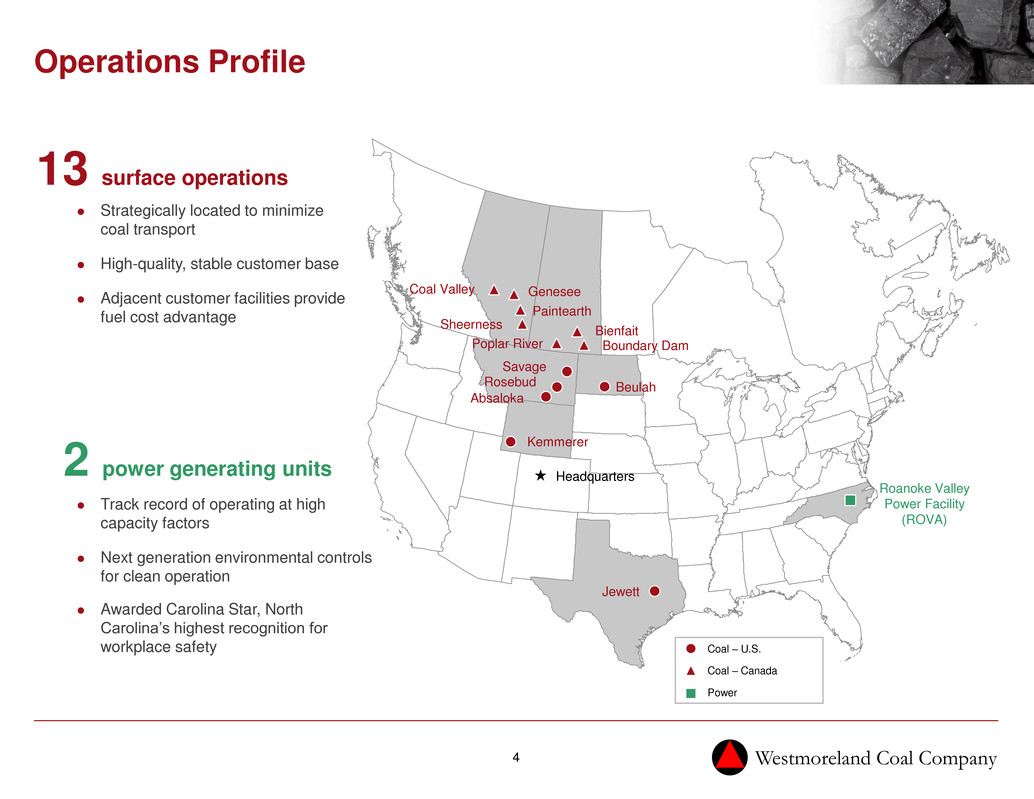

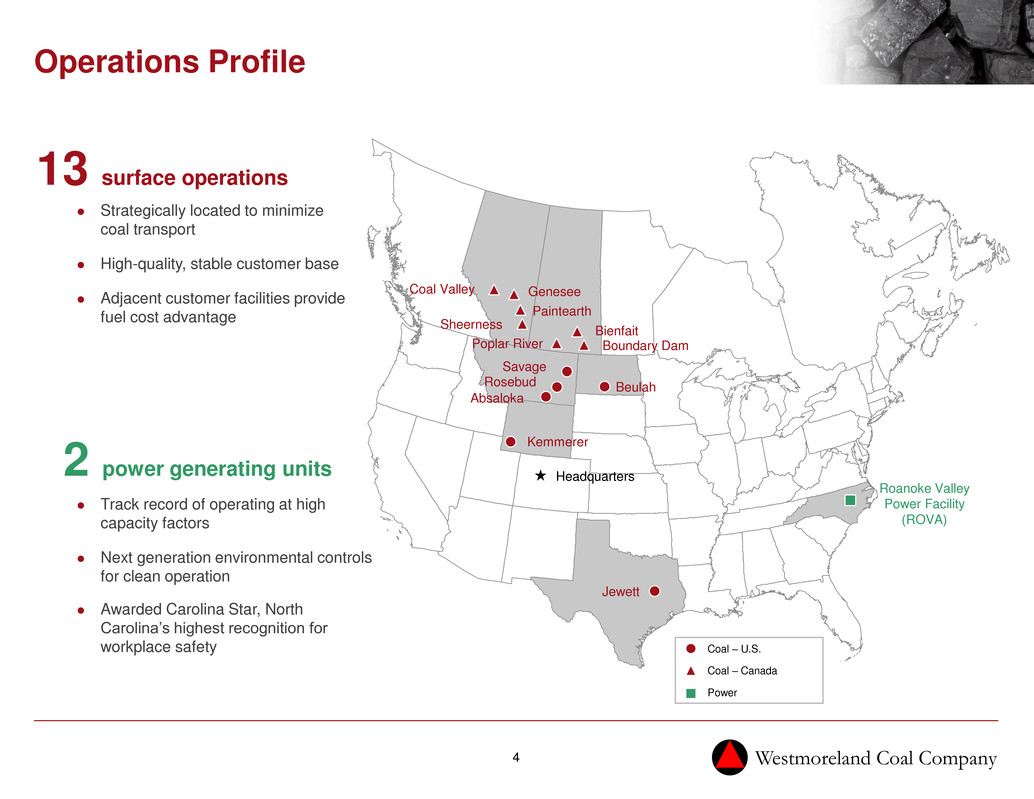

Westmoreland Coal Company 4 Operations Profile Jewett Kemmerer Beulah Savage Rosebud Absaloka Boundary Dam Bienfait Poplar River Genesee Paintearth Sheerness Coal Valley Roanoke Valley Power Facility (ROVA) Headquarters Coal – U.S. Coal – Canada Power Strategically located to minimize coal transport High-quality, stable customer base Adjacent customer facilities provide fuel cost advantage Track record of operating at high capacity factors Next generation environmental controls for clean operation Awarded Carolina Star, North Carolina’s highest recognition for workplace safety 2 power generating units 13 surface operations

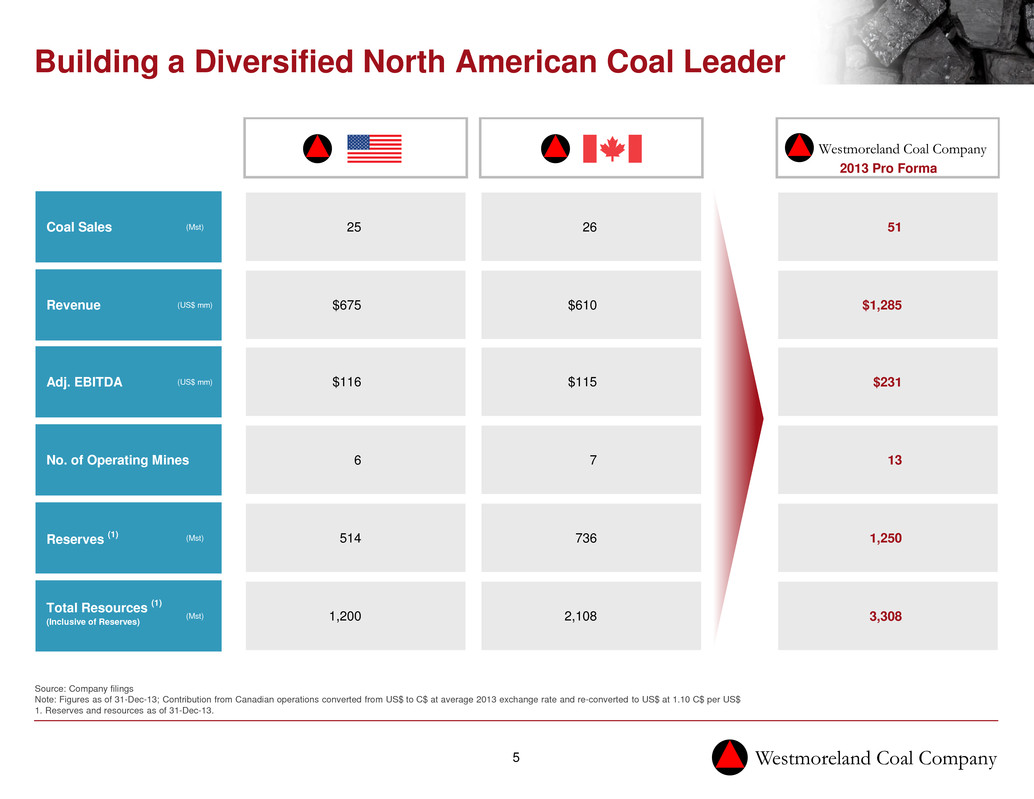

Westmoreland Coal Company 5 2013 Pro Forma Coal Sales (Mst) 25 26 51 Revenue (US$ mm) $675 $610 $1,285 Adj. EBITDA (US$ mm) $116 $115 $231 No. of Operating Mines 6 7 13 Reserves (1) (Mst) 514 736 1,250 Total Resources (1) (Inclusive of Reserves) (Mst) 1,200 2,108 3,308 Building a Diversified North American Coal Leader Source: Company filings Note: Figures as of 31-Dec-13; Contribution from Canadian operations converted from US$ to C$ at average 2013 exchange rate and re-converted to US$ at 1.10 C$ per US$ 1. Reserves and resources as of 31-Dec-13. Westmoreland Coal Company

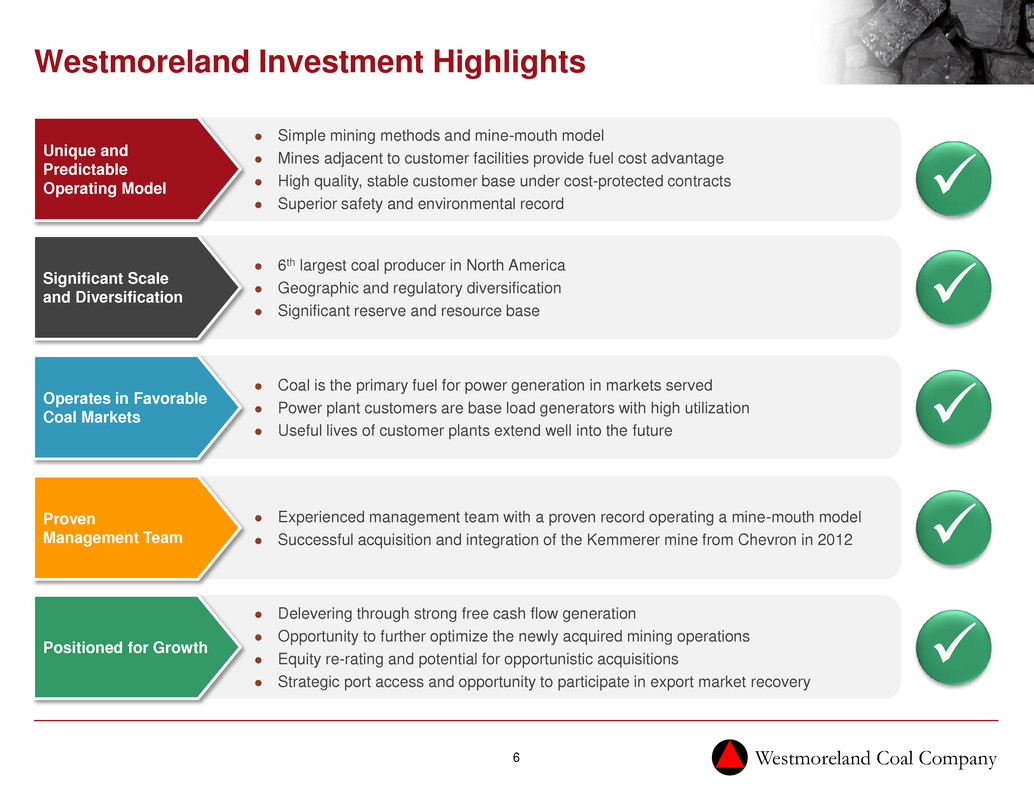

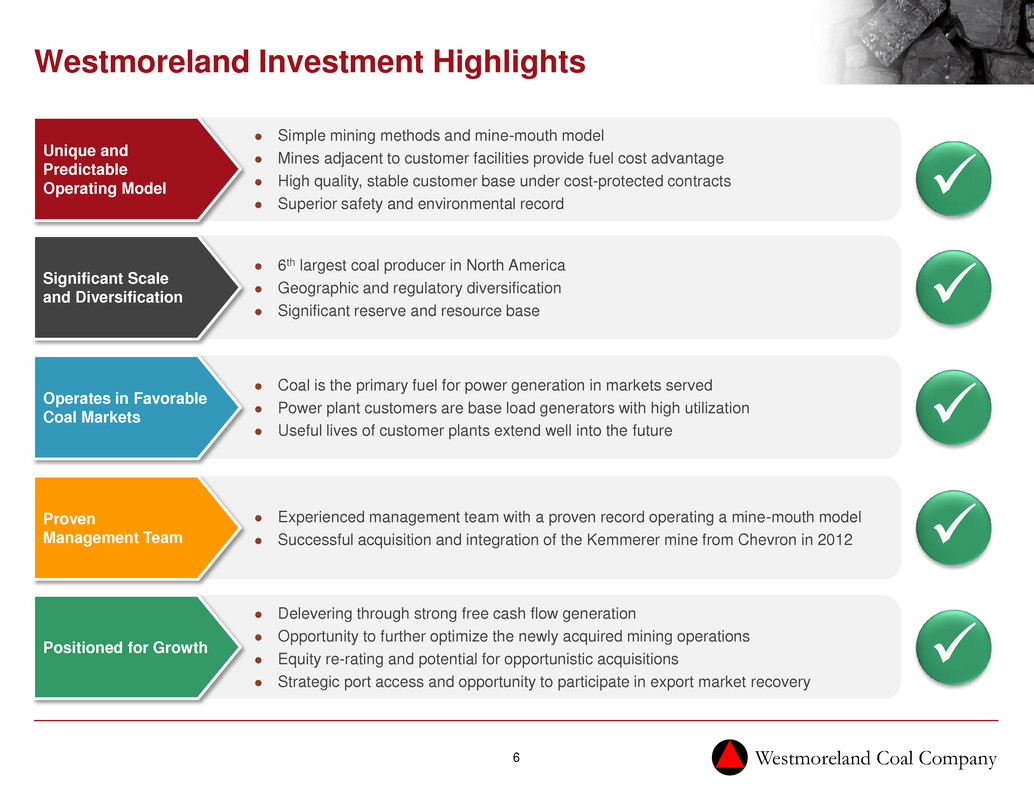

Westmoreland Coal Company 6 Westmoreland Investment Highlights Coal is the primary fuel for power generation in markets served Power plant customers are base load generators with high utilization Useful lives of customer plants extend well into the future Operates in Favorable Coal Markets Simple mining methods and mine-mouth model Mines adjacent to customer facilities provide fuel cost advantage High quality, stable customer base under cost-protected contracts Superior safety and environmental record Unique and Predictable Operating Model 6th largest coal producer in North America Geographic and regulatory diversification Significant reserve and resource base Significant Scale and Diversification Experienced management team with a proven record operating a mine-mouth model Successful acquisition and integration of the Kemmerer mine from Chevron in 2012 Proven Management Team Delevering through strong free cash flow generation Opportunity to further optimize the newly acquired mining operations Equity re-rating and potential for opportunistic acquisitions Strategic port access and opportunity to participate in export market recovery Positioned for Growth

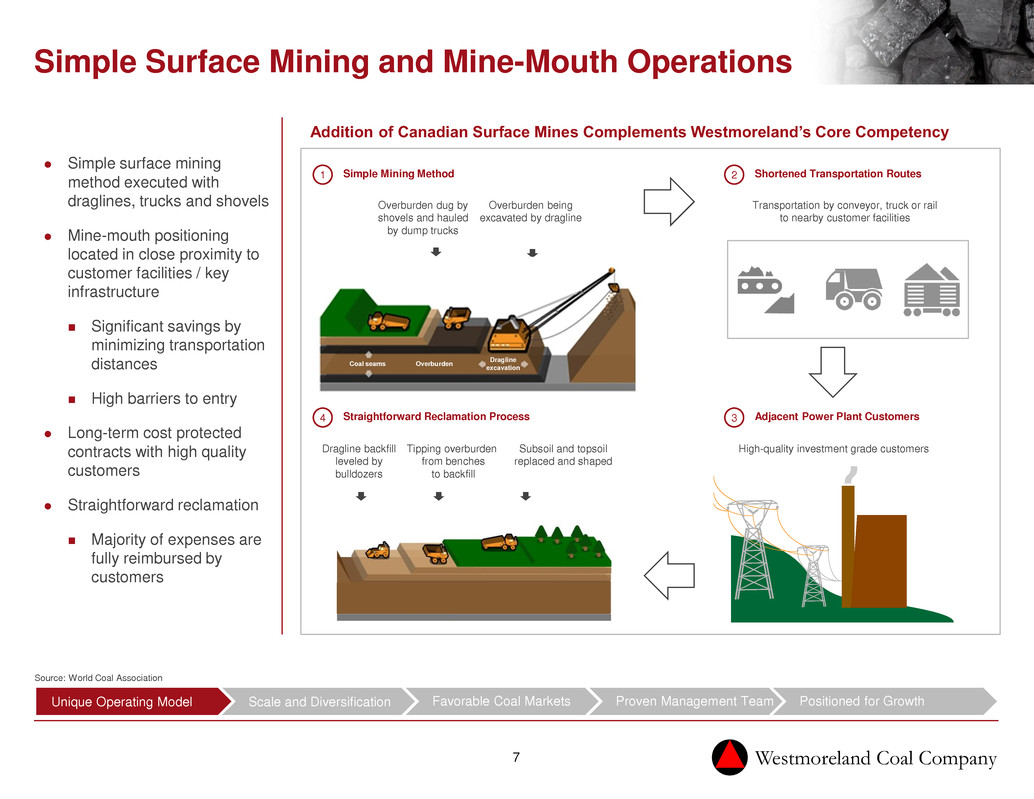

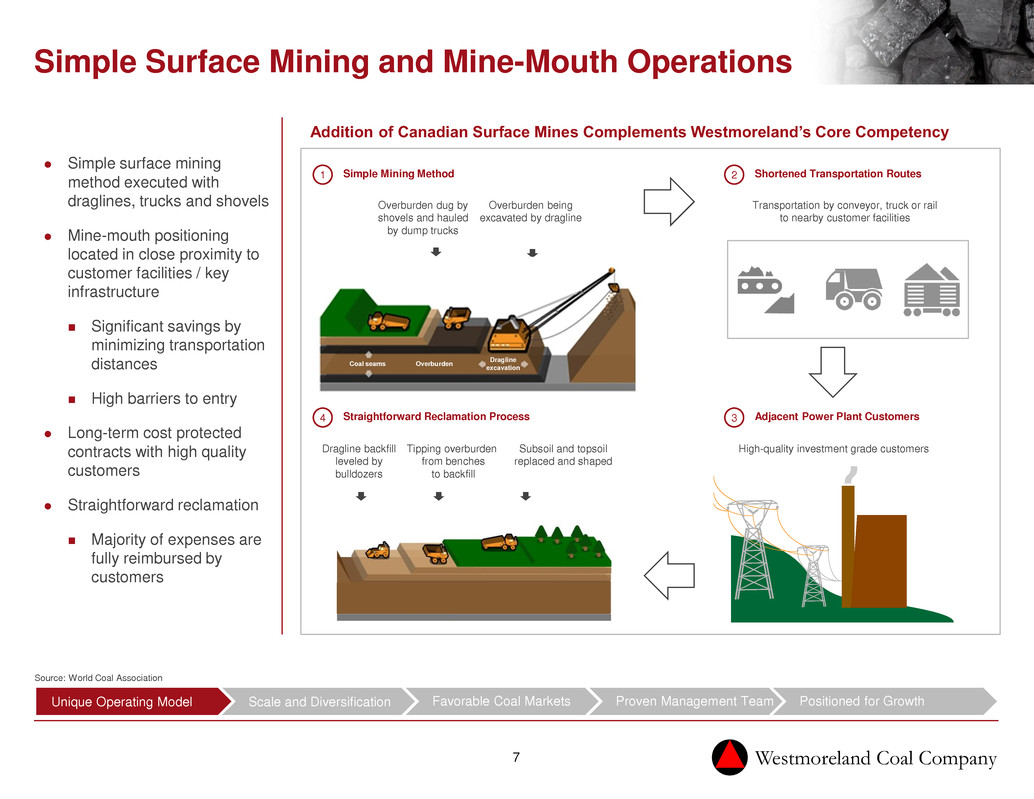

Westmoreland Coal Company 7 Simple Surface Mining and Mine-Mouth Operations Simple surface mining method executed with draglines, trucks and shovels Mine-mouth positioning located in close proximity to customer facilities / key infrastructure Significant savings by minimizing transportation distances High barriers to entry Long-term cost protected contracts with high quality customers Straightforward reclamation Majority of expenses are fully reimbursed by customers Source: World Coal Association Addition of Canadian Surface Mines Complements Westmoreland’s Core Competency Overburden dug by shovels and hauled by dump trucks Overburden being excavated by dragline Transportation by conveyor, truck or rail to nearby customer facilities Dragline backfill leveled by bulldozers Tipping overburden from benches to backfill Subsoil and topsoil replaced and shaped High-quality investment grade customers Coal seams Overburden Dragline excavation 1 Simple Mining Method 3 Adjacent Power Plant Customers 4 Straightforward Reclamation Process 2 Shortened Transportation Routes Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth

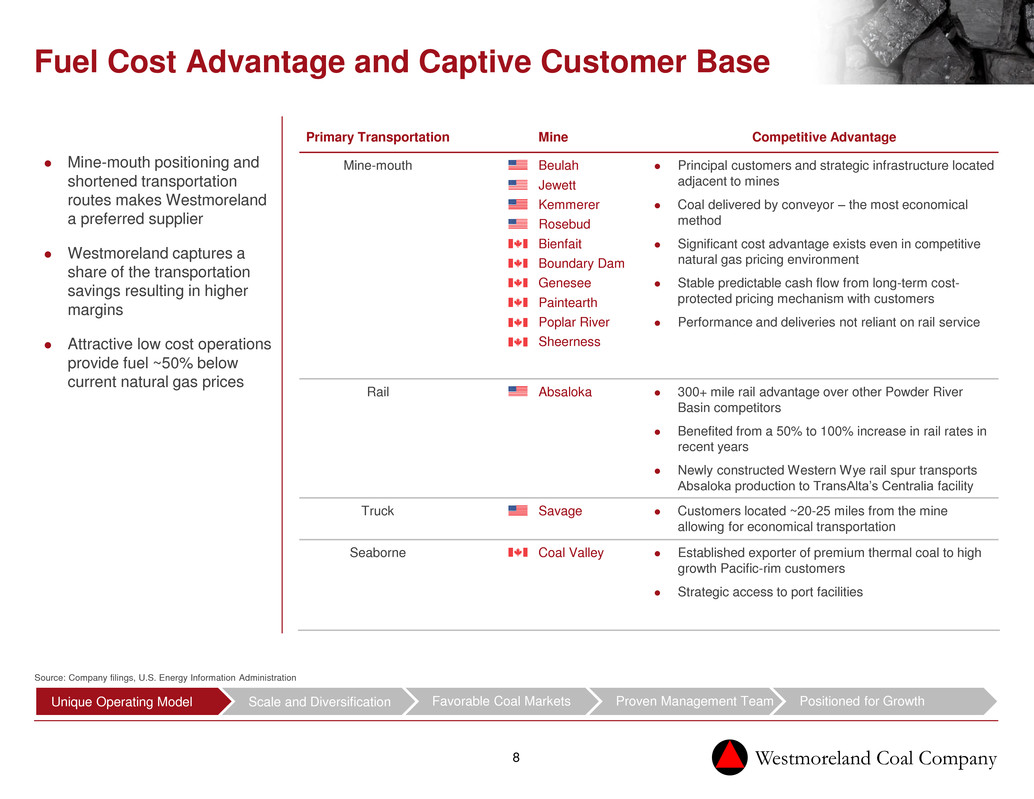

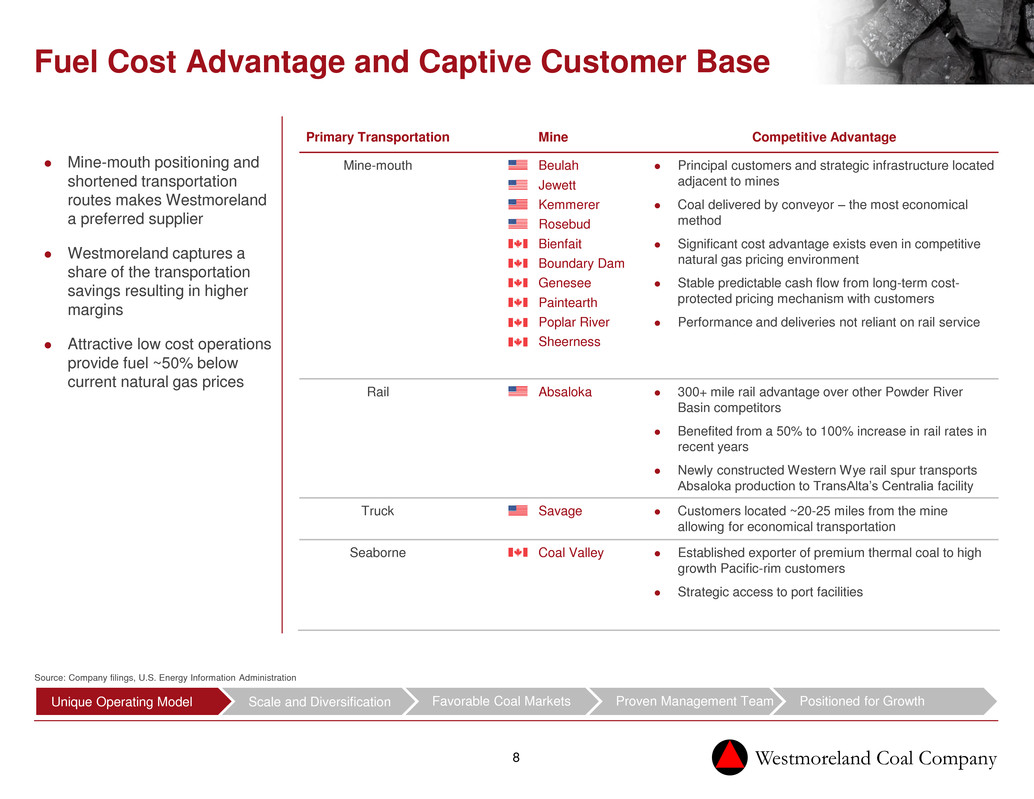

Westmoreland Coal Company 8 Fuel Cost Advantage and Captive Customer Base Primary Transportation Mine Competitive Advantage Mine-mouth Beulah Jewett Kemmerer Rosebud Bienfait Boundary Dam Genesee Paintearth Poplar River Sheerness Principal customers and strategic infrastructure located adjacent to mines Coal delivered by conveyor – the most economical method Significant cost advantage exists even in competitive natural gas pricing environment Stable predictable cash flow from long-term cost- protected pricing mechanism with customers Performance and deliveries not reliant on rail service Rail Absaloka 300+ mile rail advantage over other Powder River Basin competitors Benefited from a 50% to 100% increase in rail rates in recent years Newly constructed Western Wye rail spur transports Absaloka production to TransAlta’s Centralia facility Truck Savage Customers located ~20-25 miles from the mine allowing for economical transportation Seaborne Coal Valley Established exporter of premium thermal coal to high growth Pacific-rim customers Strategic access to port facilities Mine-mouth positioning and shortened transportation routes makes Westmoreland a preferred supplier Westmoreland captures a share of the transportation savings resulting in higher margins Attractive low cost operations provide fuel ~50% below current natural gas prices Source: Company filings, U.S. Energy Information Administration Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth

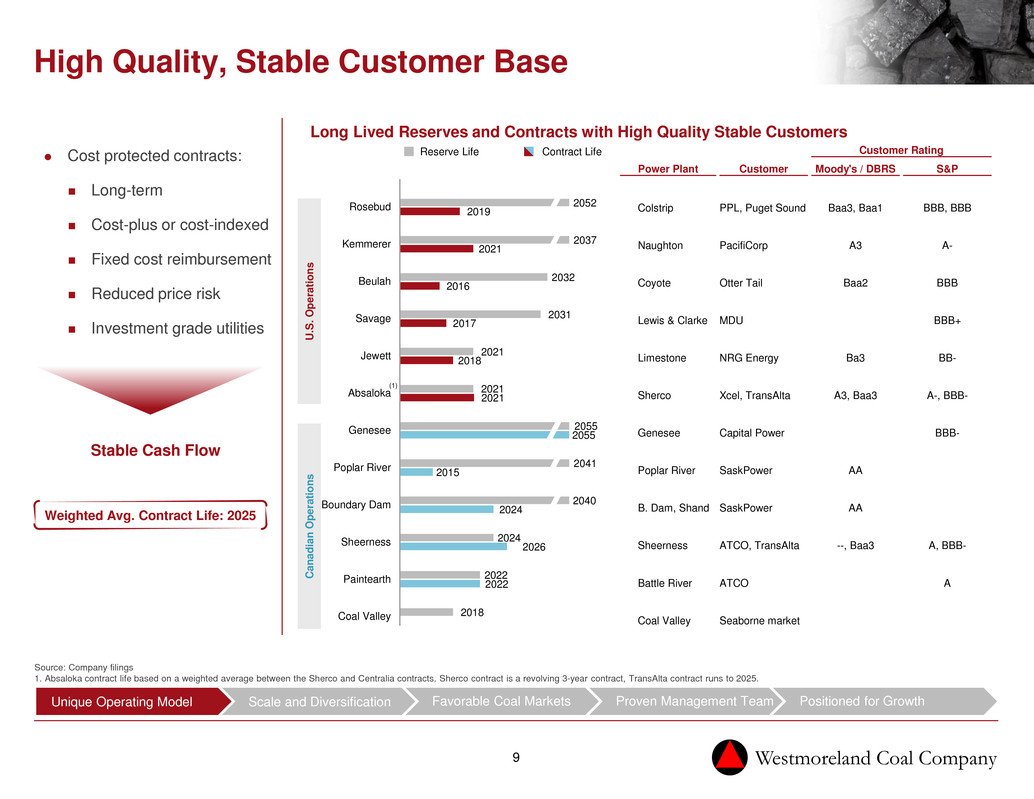

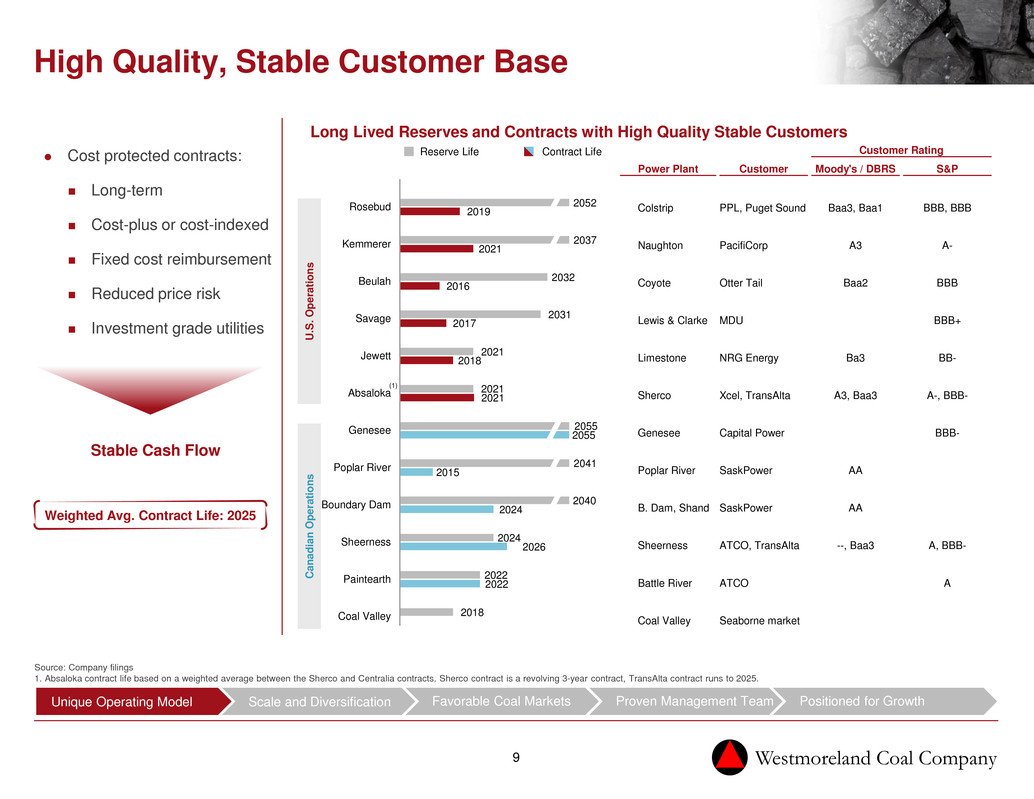

Westmoreland Coal Company 9 High Quality, Stable Customer Base Source: Company filings 1. Absaloka contract life based on a weighted average between the Sherco and Centralia contracts. Sherco contract is a revolving 3-year contract, TransAlta contract runs to 2025. Cost protected contracts: Long-term Cost-plus or cost-indexed Fixed cost reimbursement Reduced price risk Investment grade utilities Stable Cash Flow Long Lived Reserves and Contracts with High Quality Stable Customers Reserve Life Contract Life Weighted Avg. Contract Life: 2025 Customer Rating Power Plant Customer Moody's / DBRS S&P Colstrip PPL, Puget Sound Baa3, Baa1 BBB, BBB Naughton PacifiCorp A3 A- Coyote Otter Tail Baa2 BBB Lewis & Clarke MDU BBB+ Limestone NRG Energy Ba3 BB- Sherco Xcel, TransAlta A3, Baa3 A-, BBB- Genesee Capital Power BBB- Poplar River SaskPower AA B. Dam, Shand SaskPower AA Sheerness ATCO, TransAlta --, Baa3 A, BBB- Battle River ATCO A Coal Valley Seaborne market 2052 2037 2032 2031 2021 2021 2055 2041 2040 2024 2022 2018 2019 2021 2016 2017 2018 2021 2055 2015 2024 2026 2022 Rosebud Kemmerer Beulah Savage Jewett Absaloka Genesee Poplar River Boundary Dam Sheerness Paintearth Coal Valley C anad ia n Op er at ion s U .S . Op er at ion s (1) Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth

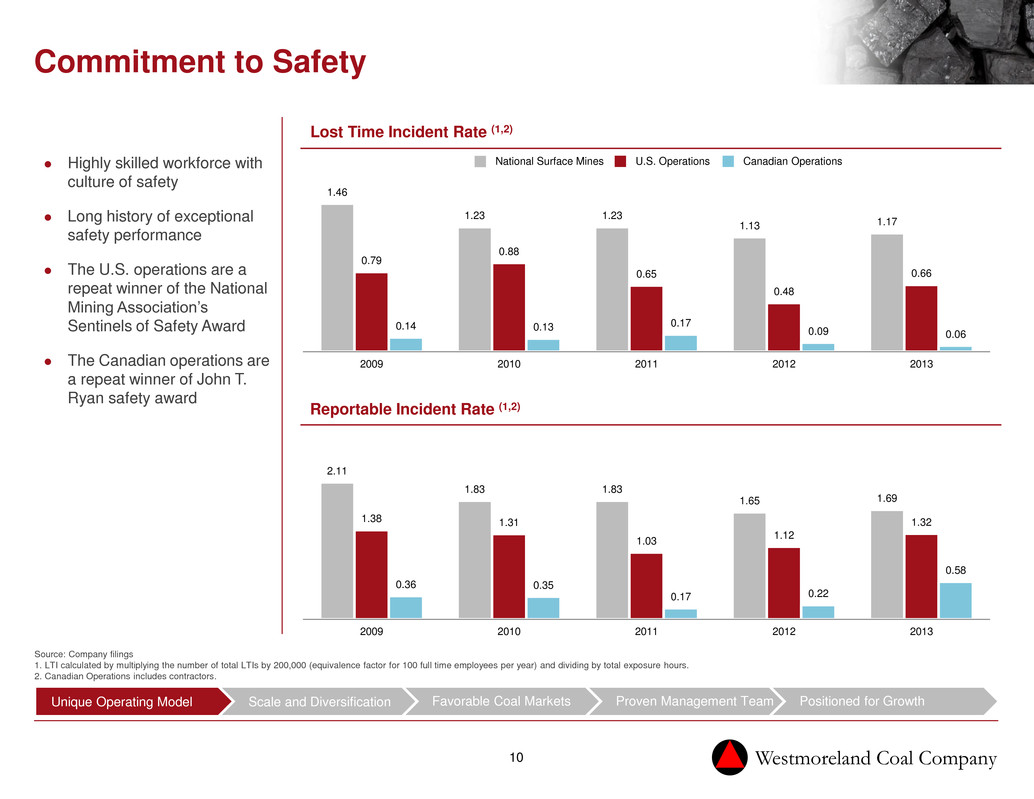

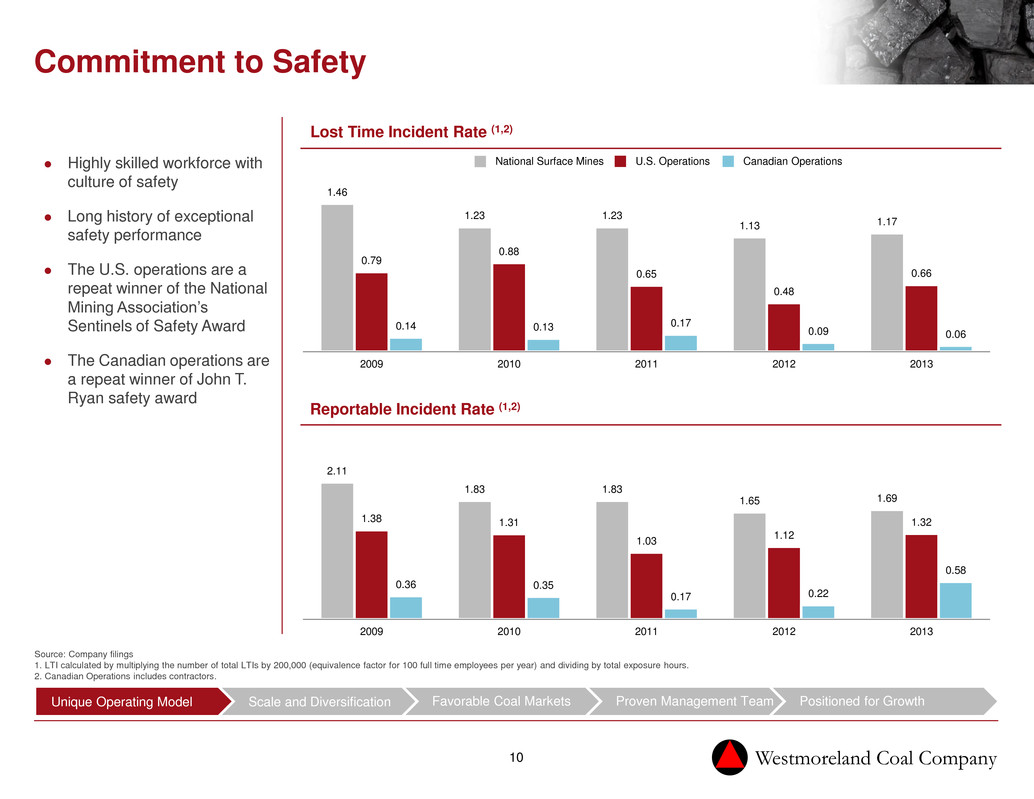

Westmoreland Coal Company 10 Commitment to Safety Highly skilled workforce with culture of safety Long history of exceptional safety performance The U.S. operations are a repeat winner of the National Mining Association’s Sentinels of Safety Award The Canadian operations are a repeat winner of John T. Ryan safety award Source: Company filings 1. LTI calculated by multiplying the number of total LTIs by 200,000 (equivalence factor for 100 full time employees per year) and dividing by total exposure hours. 2. Canadian Operations includes contractors. Reportable Incident Rate (1,2) Lost Time Incident Rate (1,2) National Surface Mines U.S. Operations Canadian Operations 1.46 1.23 1.23 1.13 1.17 0.79 0.88 0.65 0.48 0.66 0.14 0.13 0.17 0.09 0.06 2009 2010 2011 2012 2013 2.11 1.83 1.83 1.65 1.69 1.38 1.31 1.03 1.12 1.32 0.36 0.35 0.17 0.22 0.58 2009 2010 2011 2012 2013 Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth

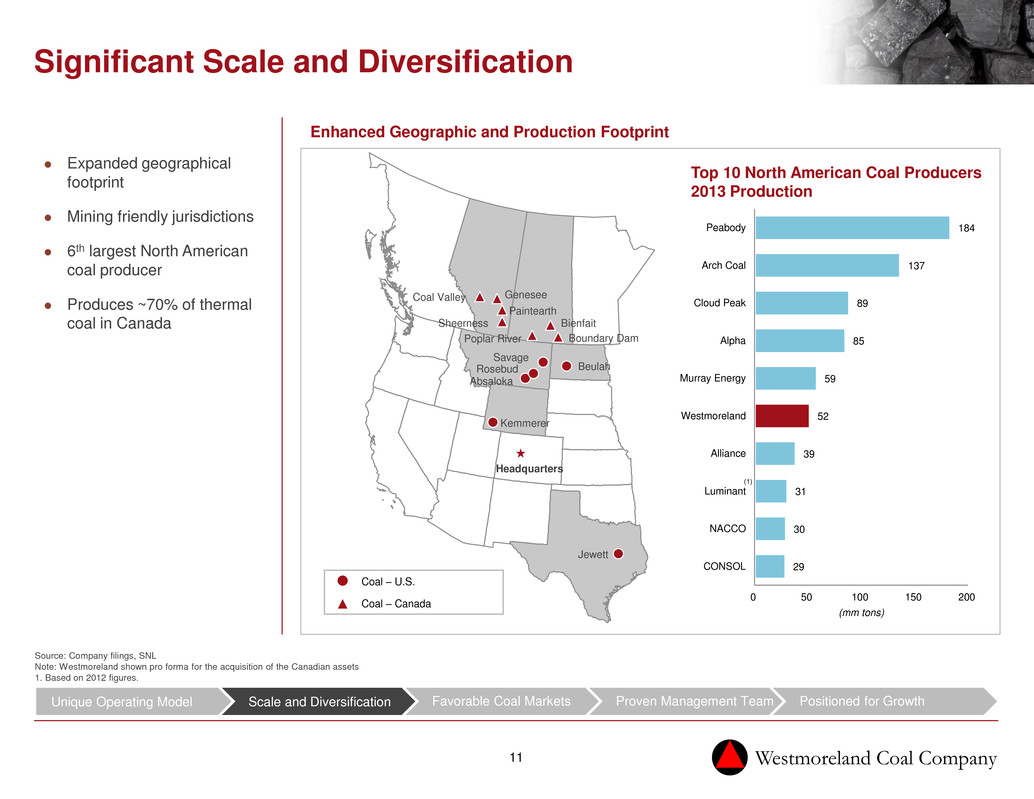

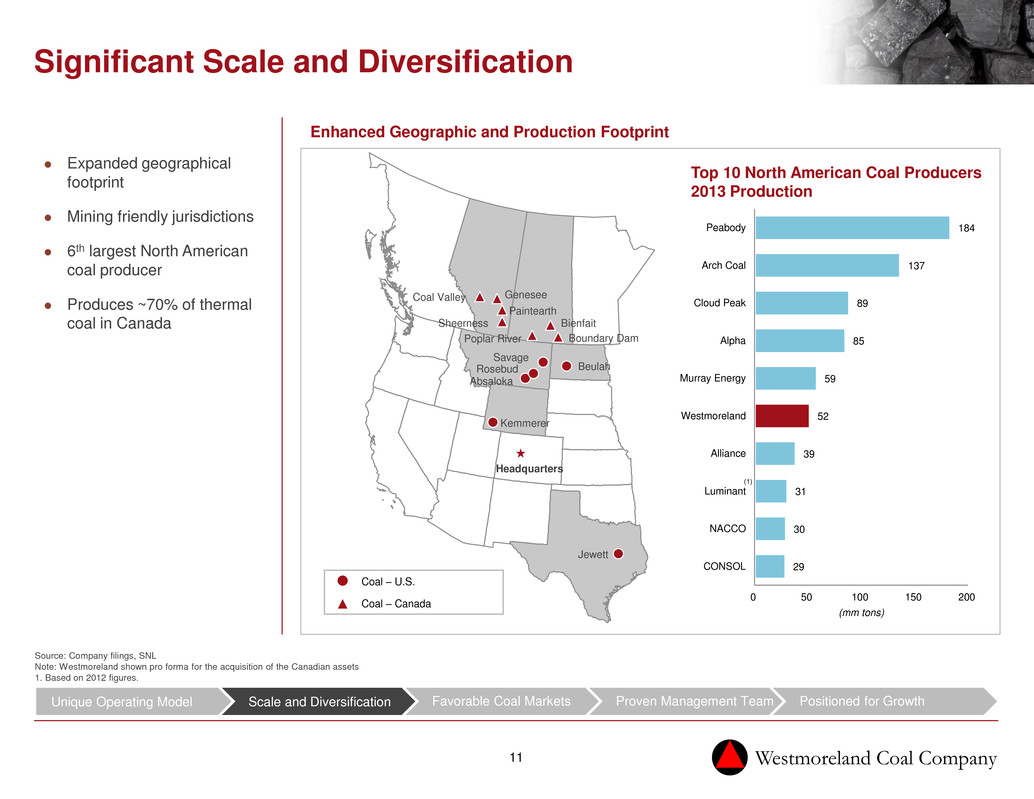

Westmoreland Coal Company 11 184 137 89 85 59 52 39 31 30 29 0 50 100 150 200 Peabody Arch Coal Cloud Peak Alpha Murray Energy Westmoreland Alliance Luminant NACCO CONSOL (mm tons) Significant Scale and Diversification Top 10 North American Coal Producers 2013 Production (1) Expanded geographical footprint Mining friendly jurisdictions 6th largest North American coal producer Produces ~70% of thermal coal in Canada Coal – U.S. Coal – Canada Enhanced Geographic and Production Footprint Source: Company filings, SNL Note: Westmoreland shown pro forma for the acquisition of the Canadian assets 1. Based on 2012 figures. Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth Headquarters Jewett Kemmerer Beulah Savage Absaloka Rosebud Paintearth Genesee Sheerness Bienfait Poplar River Coal Valley Boundary Dam

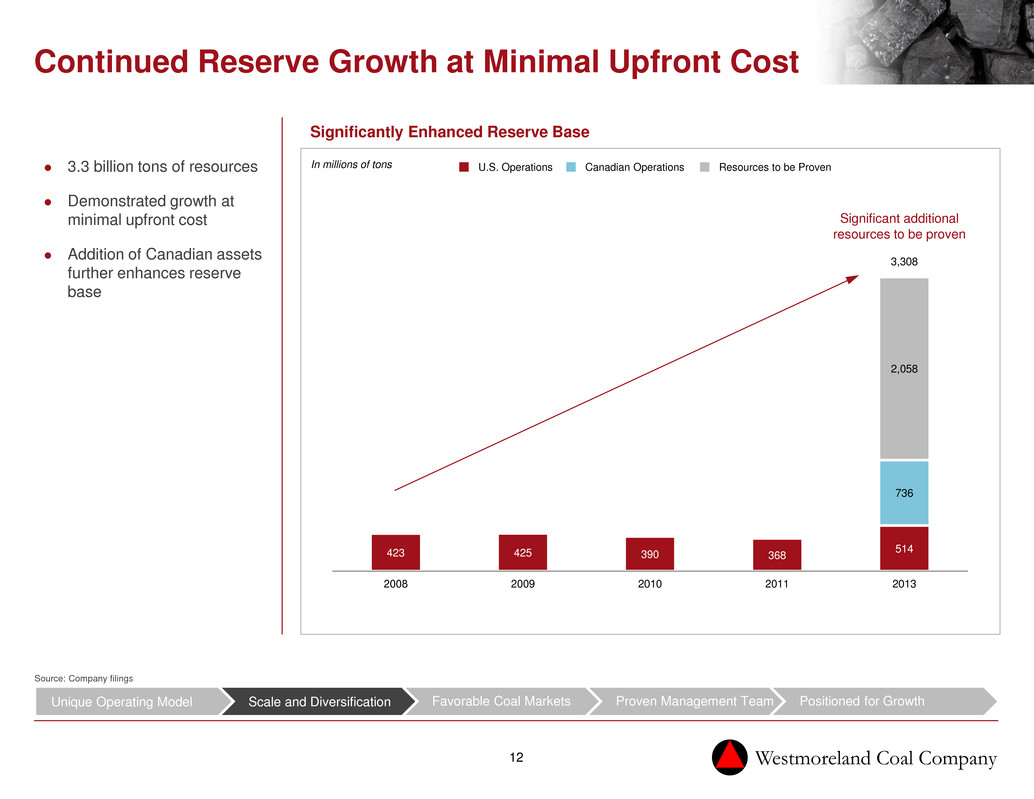

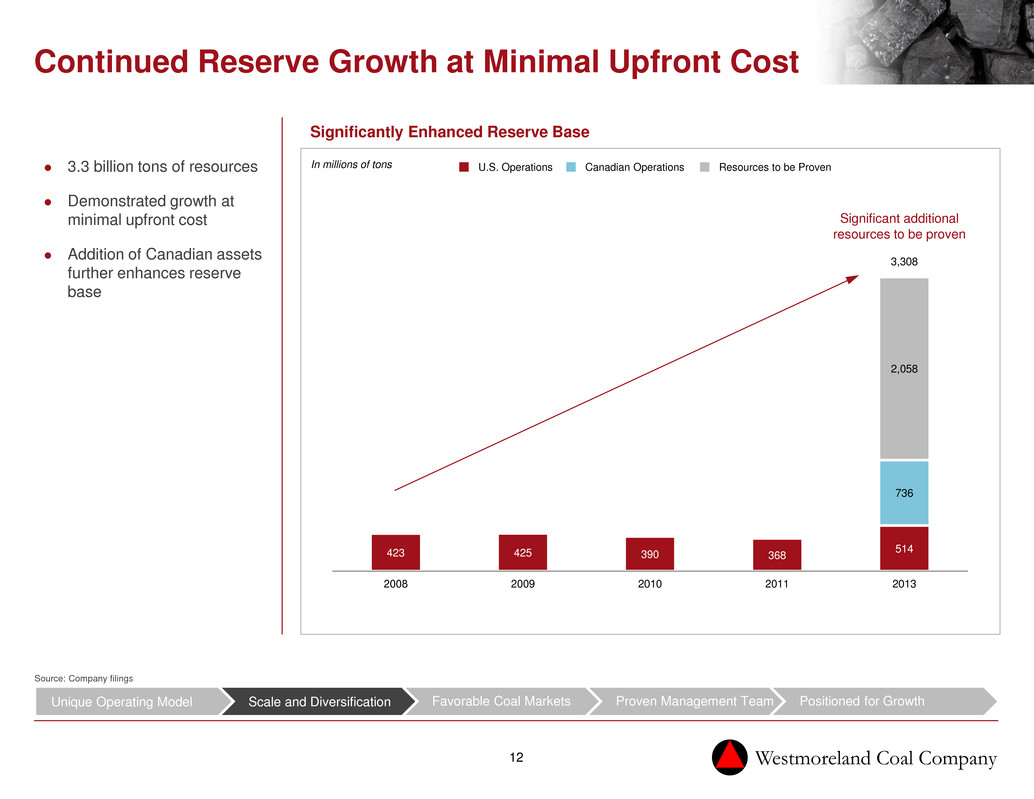

Westmoreland Coal Company 12 423 425 390 368 514 736 2,058 3,308 2008 2009 2010 2011 2013 Continued Reserve Growth at Minimal Upfront Cost 3.3 billion tons of resources Demonstrated growth at minimal upfront cost Addition of Canadian assets further enhances reserve base U.S. Operations Canadian Operations Resources to be Proven In millions of tons Significant additional resources to be proven Source: Company filings Significantly Enhanced Reserve Base Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth

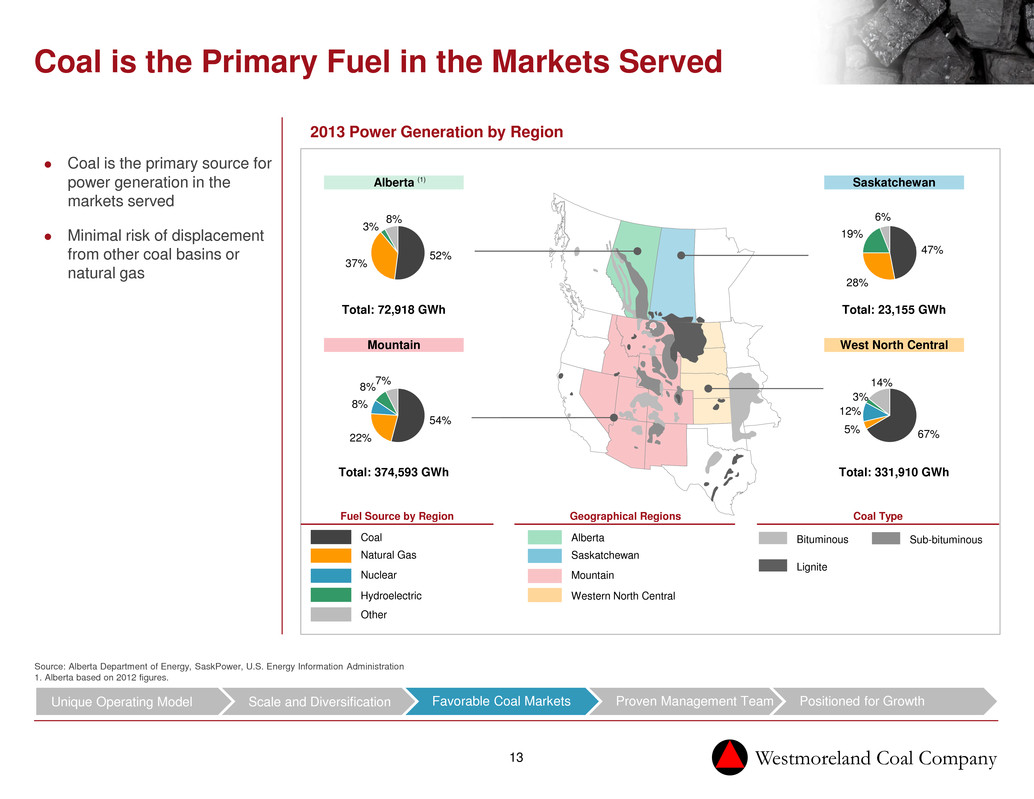

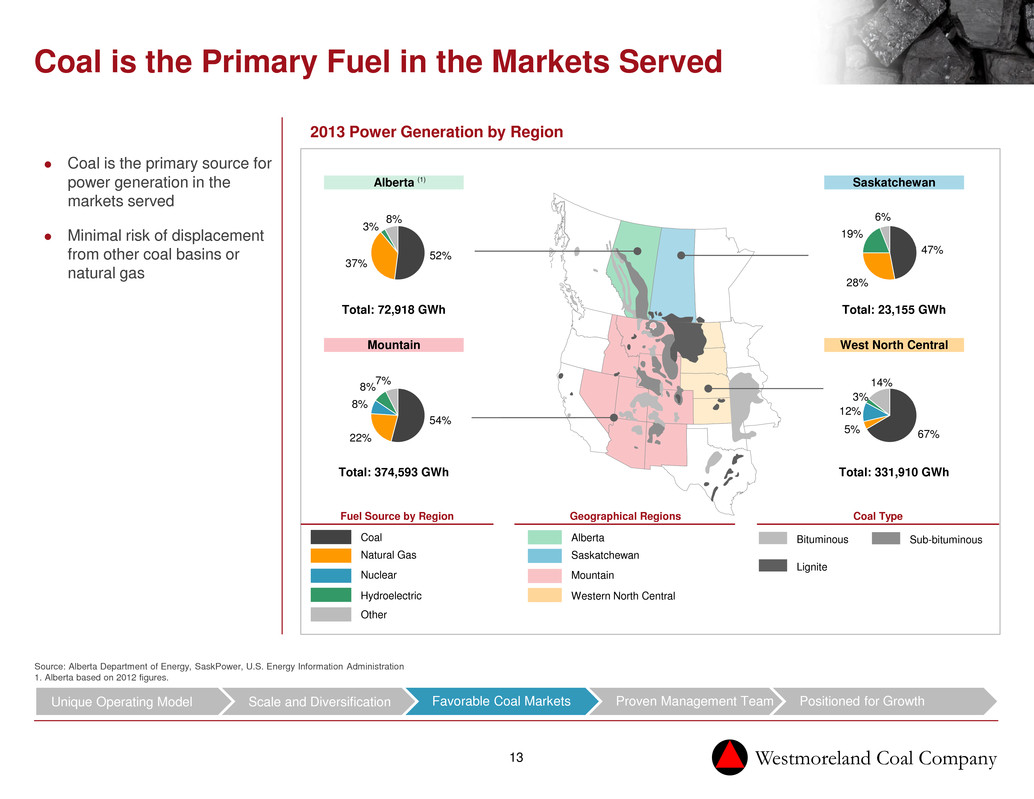

Westmoreland Coal Company 13 Coal is the primary source for power generation in the markets served Minimal risk of displacement from other coal basins or natural gas Coal is the Primary Fuel in the Markets Served 2013 Power Generation by Region Alberta Saskatchewan Mountain Western North Central Coal Natural Gas Nuclear Hydroelectric Other Fuel Source by Region Coal Type Source: Alberta Department of Energy, SaskPower, U.S. Energy Information Administration 1. Alberta based on 2012 figures. Bituminous Sub-bituminous Lignite Alberta Saskatchewan Total: 72,918 GWh Total: 22,129 GWh 52% 37% 3% 8% Mountain West North Central Total: 374,593 GWh Total: 331,910 GWh 54% 22% 8% 8% 7% Saskatchewan Total: 23,155 GWh 47% 28% 19% 6% West North Central East North Central Total: 331,910 GWh 67% 5% 12% 3% 14% Geographical Regions Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth (1)

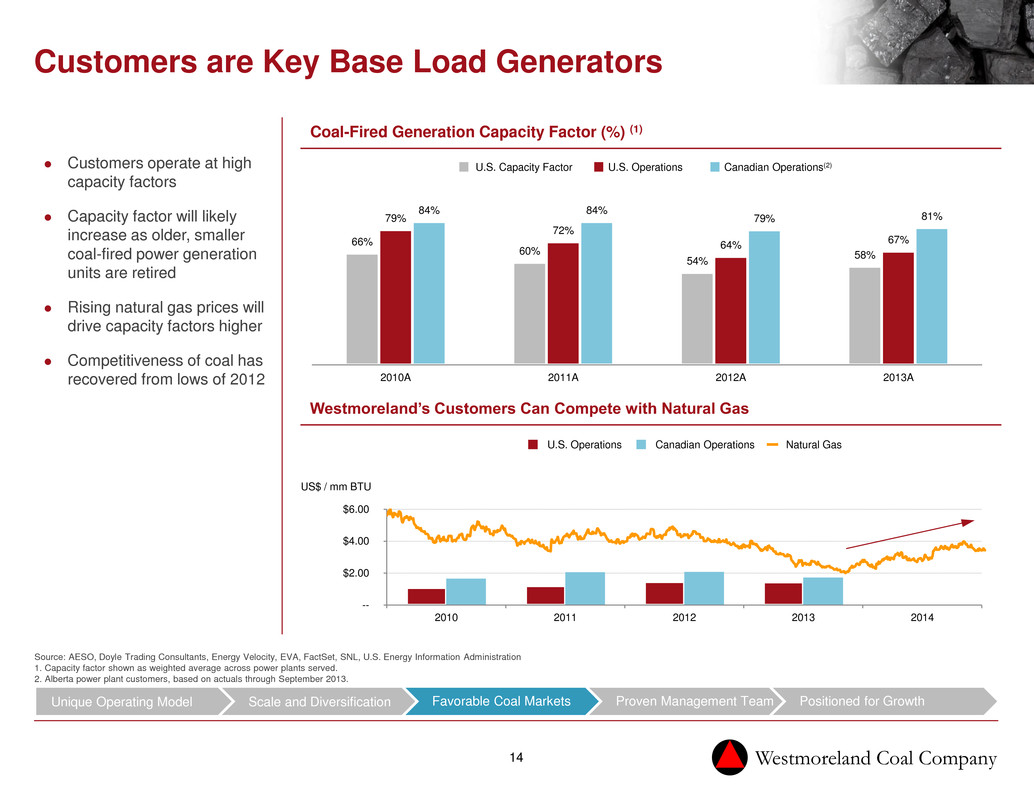

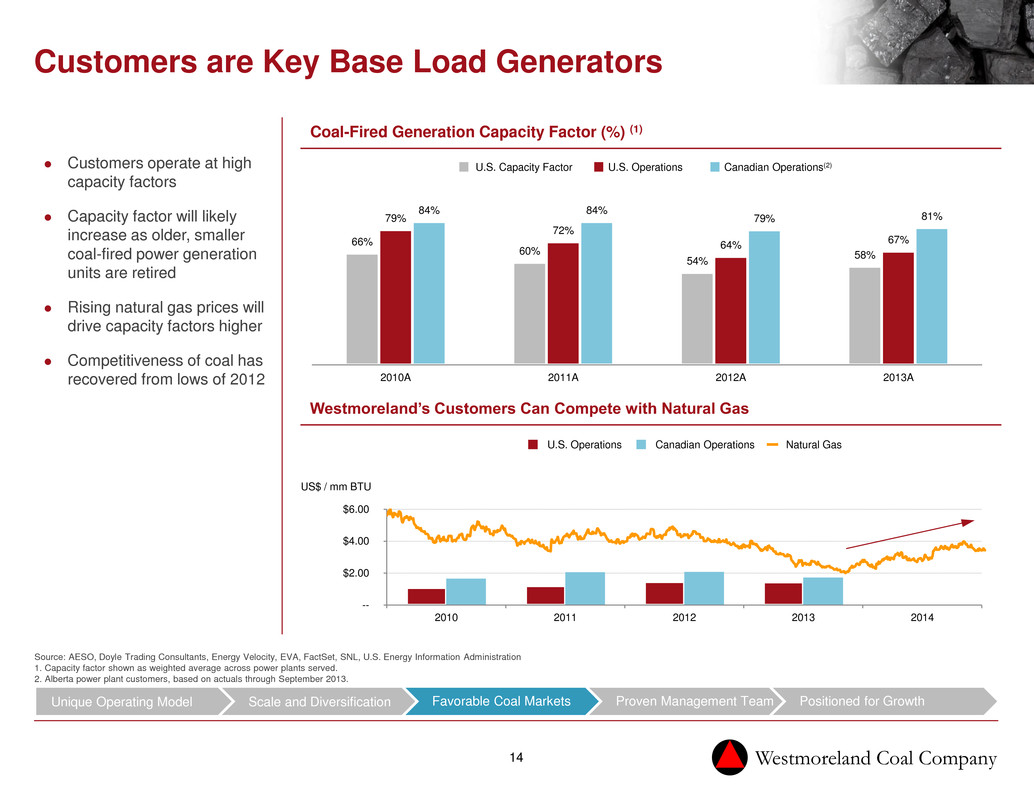

Westmoreland Coal Company 14 66% 60% 54% 58% 79% 72% 64% 67% 84% 84% 79% 81% 2010A 2011A 2012A 2013A -- $2.00 $4.00 $6.00 2010 2011 2012 2013 2014 US$ / mm BTU Source: AESO, Doyle Trading Consultants, Energy Velocity, EVA, FactSet, SNL, U.S. Energy Information Administration 1. Capacity factor shown as weighted average across power plants served. 2. Alberta power plant customers, based on actuals through September 2013. Customers are Key Base Load Generators Coal-Fired Generation Capacity Factor (%) (1) Customers operate at high capacity factors Capacity factor will likely increase as older, smaller coal-fired power generation units are retired Rising natural gas prices will drive capacity factors higher Competitiveness of coal has recovered from lows of 2012 U.S. Operations Canadian Operations Natural Gas Westmoreland’s Customers Can Compete with Natural Gas U.S. Operations Canadian Operations(2) U.S. Capacity Factor Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth

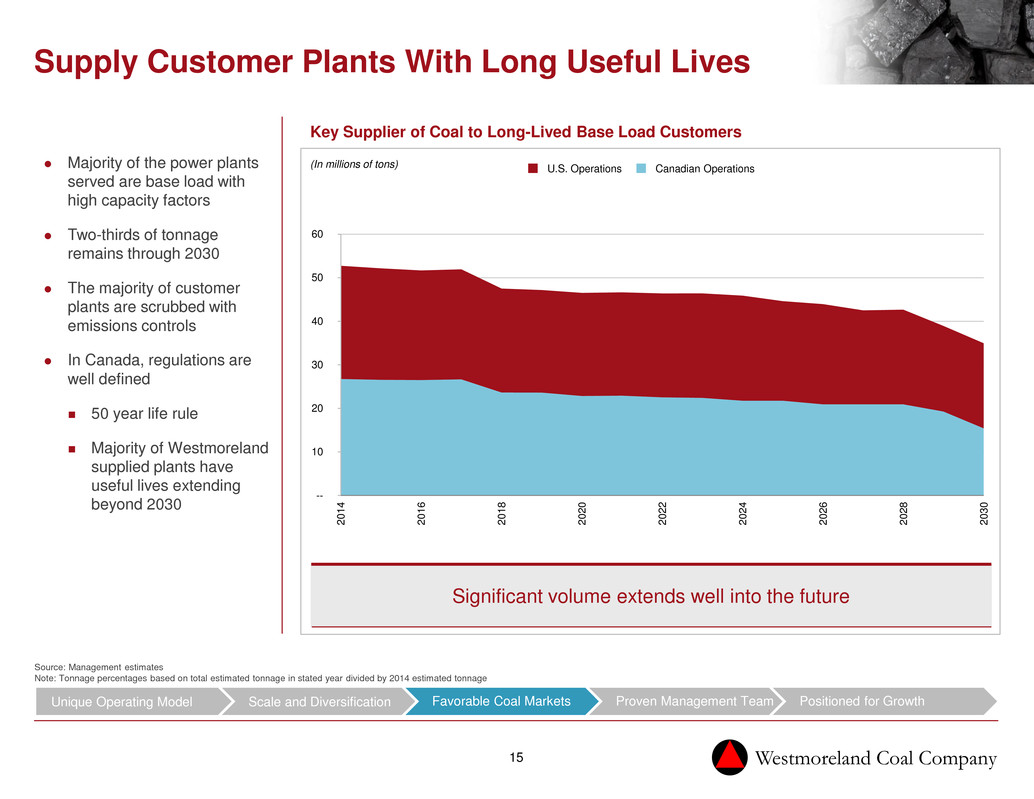

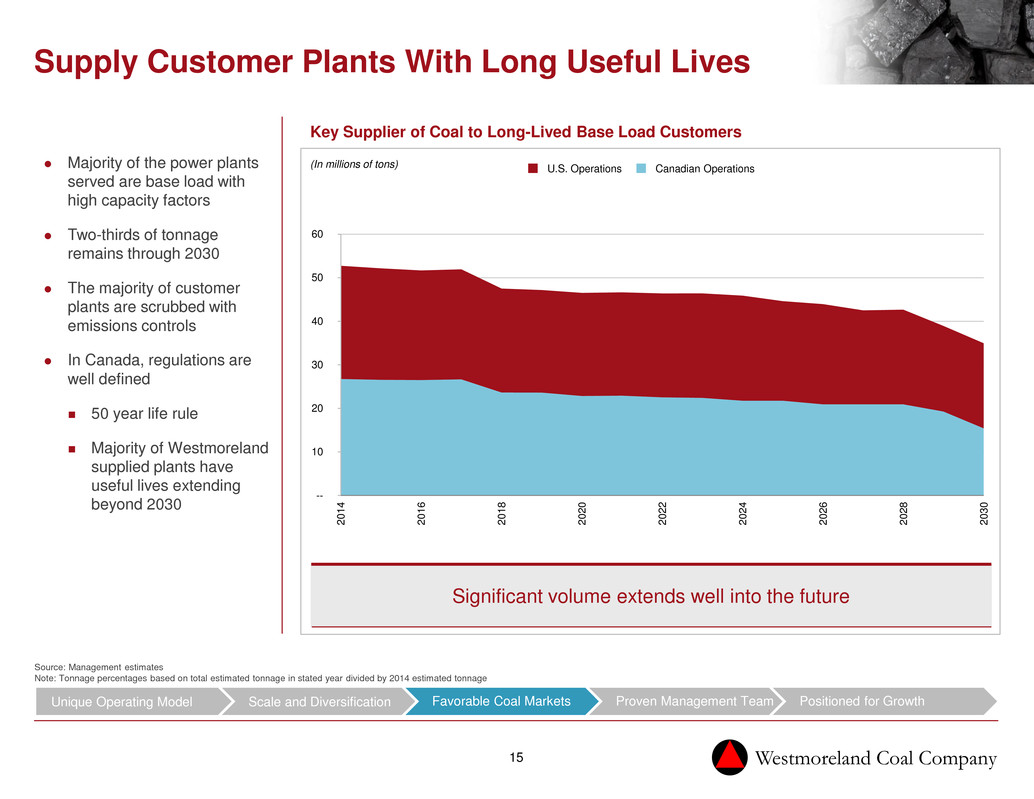

Westmoreland Coal Company 15 Supply Customer Plants With Long Useful Lives Majority of the power plants served are base load with high capacity factors Two-thirds of tonnage remains through 2030 The majority of customer plants are scrubbed with emissions controls In Canada, regulations are well defined 50 year life rule Majority of Westmoreland supplied plants have useful lives extending beyond 2030 Key Supplier of Coal to Long-Lived Base Load Customers Source: Management estimates Note: Tonnage percentages based on total estimated tonnage in stated year divided by 2014 estimated tonnage Significant volume extends well into the future (In millions of tons) -- 10 20 30 40 50 60 20 14 20 16 20 18 20 20 20 22 20 24 20 26 20 28 20 30 Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth U.S. Operations Canadian Operations

Westmoreland Coal Company 16 Experienced Management Team Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth Keith Alessi Chief Executive Officer and Interim President – Canada Operations Accomplished manager with over 30 years of senior executive experience Joined Westmoreland as Chief Executive Officer and President in May 2007 Prior Chief Executive Officer of numerous private and public companies with a deep background in integrating large acquisitions Extensive experience as a director of public and private companies Robert King President – U.S. Operations Prior Executive Vice President, Business Advancement and Support Services of CONSOL Energy and CNX Gas; also served as Senior Vice President with responsibility for strategy, mergers and acquisitions, supply chain management, permitting, environmental services, R&D Held numerous positions with Interwest Mining Company, a subsidiary of PacifiCorp, including Vice President of Operations and Engineering and VP General Manager at Centralia Mining Company Kevin Paprzycki Chief Financial Officer & Treasurer Joined Westmoreland as Controller and Principal Accounting Officer in June 2006 and was named Chief Financial Officer in April 2008 Previously Chief Financial Officer of Evans and Sutherland Computer Corporation and held senior level positions at Applied Films Corporation, Baker Hughes and Ernst and Young Jennifer Grafton General Counsel Joined Westmoreland as Associate General Counsel in December 2008 and was named General Counsel and Secretary in February 2011 Focuses her practice on SEC compliance, corporate governance, Board management, risk management and employment/labor relations

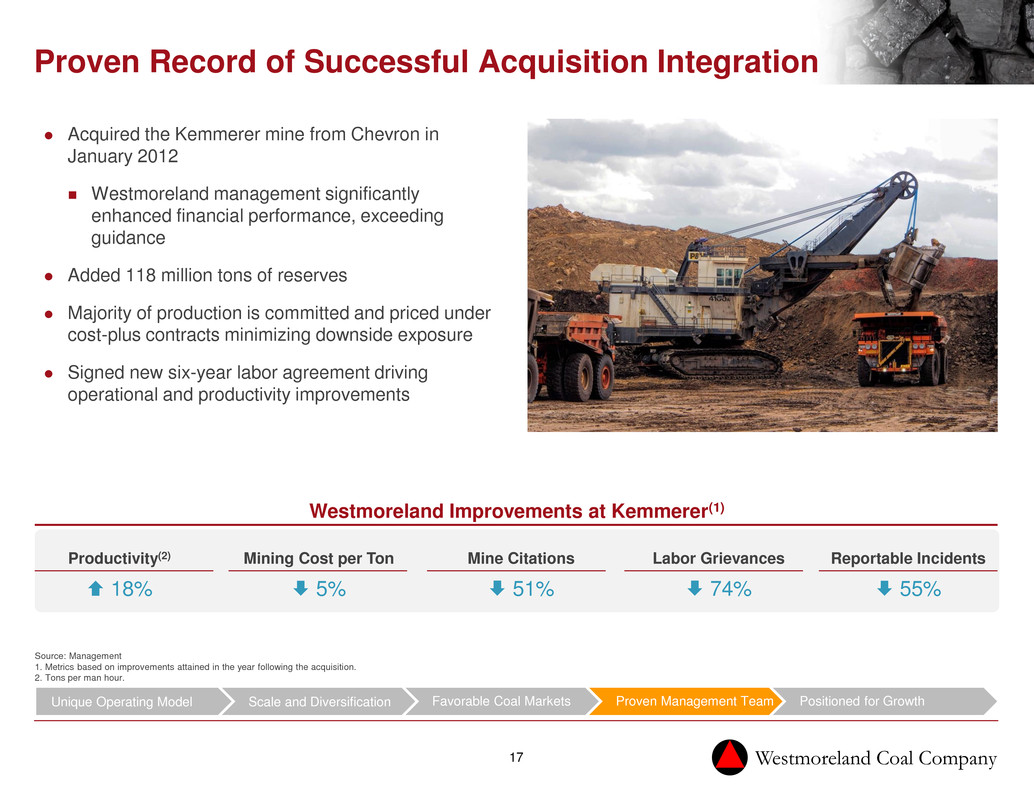

Westmoreland Coal Company 17 Proven Record of Successful Acquisition Integration Acquired the Kemmerer mine from Chevron in January 2012 Westmoreland management significantly enhanced financial performance, exceeding guidance Added 118 million tons of reserves Majority of production is committed and priced under cost-plus contracts minimizing downside exposure Signed new six-year labor agreement driving operational and productivity improvements Source: Management 1. Metrics based on improvements attained in the year following the acquisition. 2. Tons per man hour. Productivity(2) 18% Reportable Incidents 55% Labor Grievances 74% Mine Citations 51% Mining Cost per Ton 5% Westmoreland Improvements at Kemmerer(1) Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth

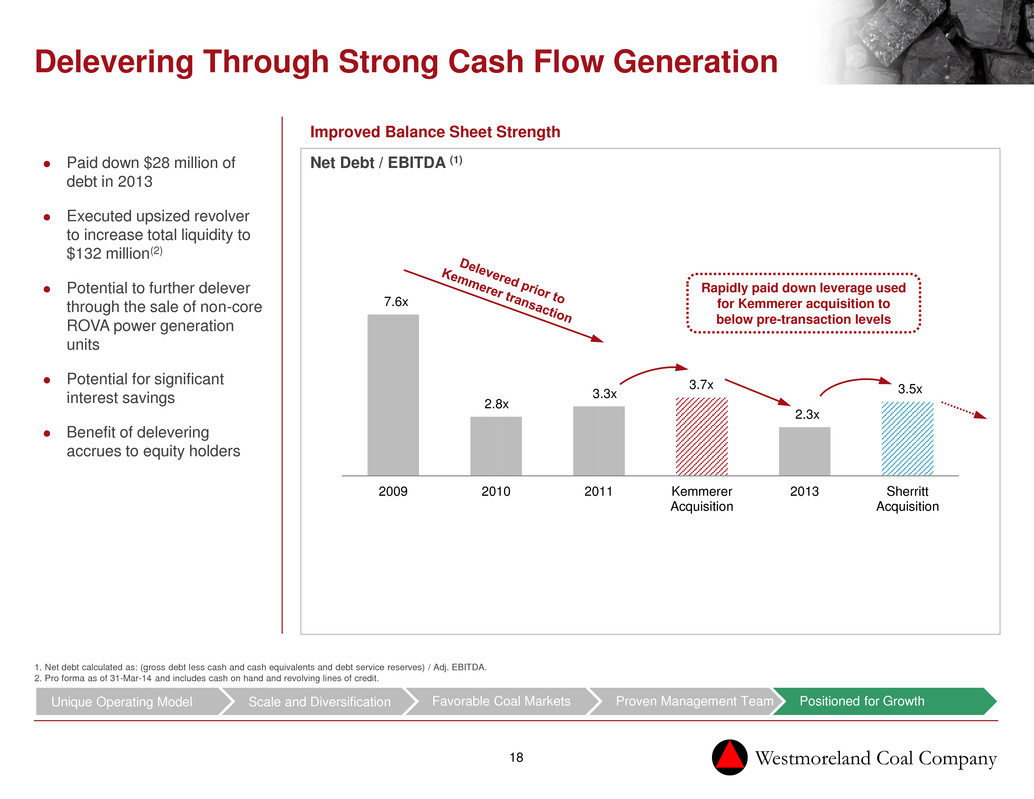

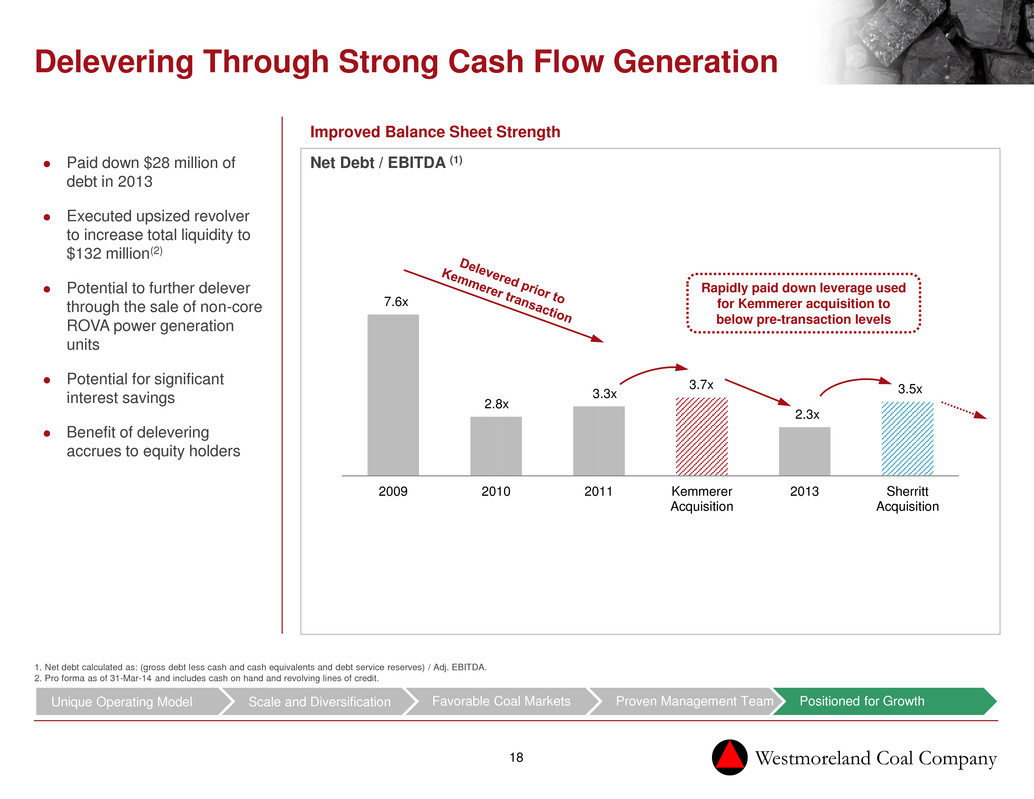

Westmoreland Coal Company 18 7.6x 2.8x 3.3x 3.7x 2.3x 3.5x 2009 2010 2011 Kemmerer Acquisition 2013 Sherritt Acquisition Delevering Through Strong Cash Flow Generation Paid down $28 million of debt in 2013 Executed upsized revolver to increase total liquidity to $132 million(2) Potential to further delever through the sale of non-core ROVA power generation units Potential for significant interest savings Benefit of delevering accrues to equity holders Improved Balance Sheet Strength 1. Net debt calculated as: (gross debt less cash and cash equivalents and debt service reserves) / Adj. EBITDA. 2. Pro forma as of 31-Mar-14 and includes cash on hand and revolving lines of credit. Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth Net Debt / EBITDA (1) Rapidly paid down leverage used for Kemmerer acquisition to below pre-transaction levels

Westmoreland Coal Company 19 Optimization of Canadian Operations Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth Integrate operations teams and best practices Implement Westmoreland’s operating and capital spending philosophy Execute upon identified opportunities for additional cost and capital savings Key areas of focus for operational cost improvements include : Dragline procedures and utilization Capital and operational planning Administrative savings due to centralization and technology

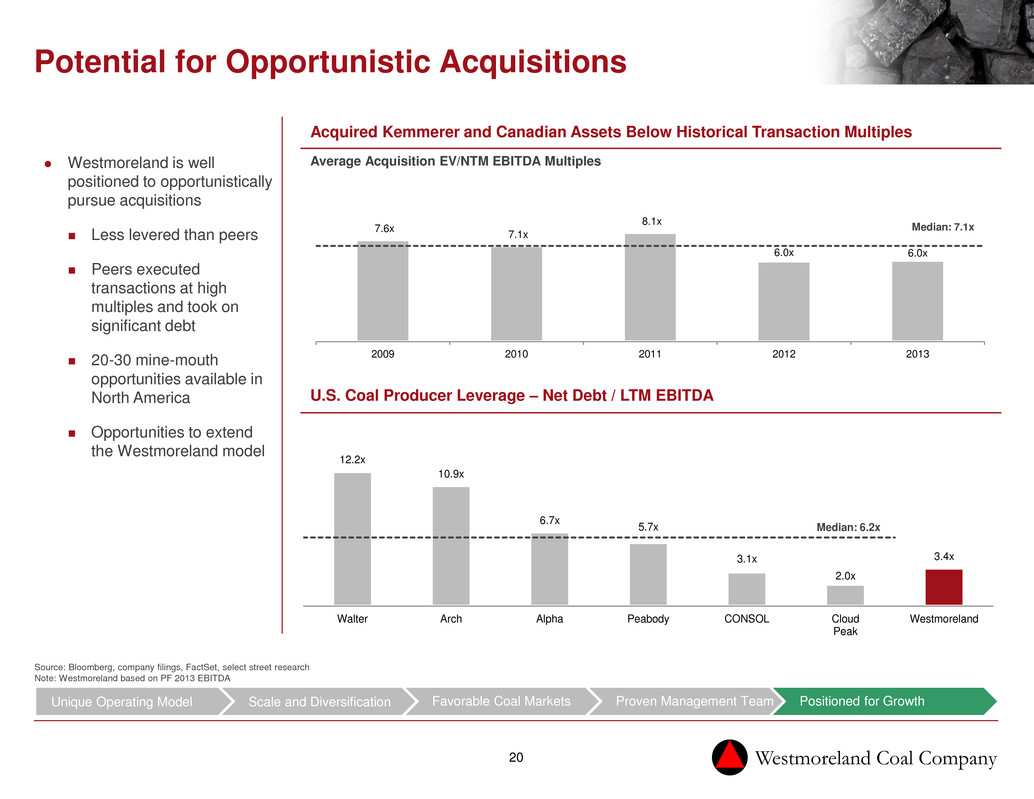

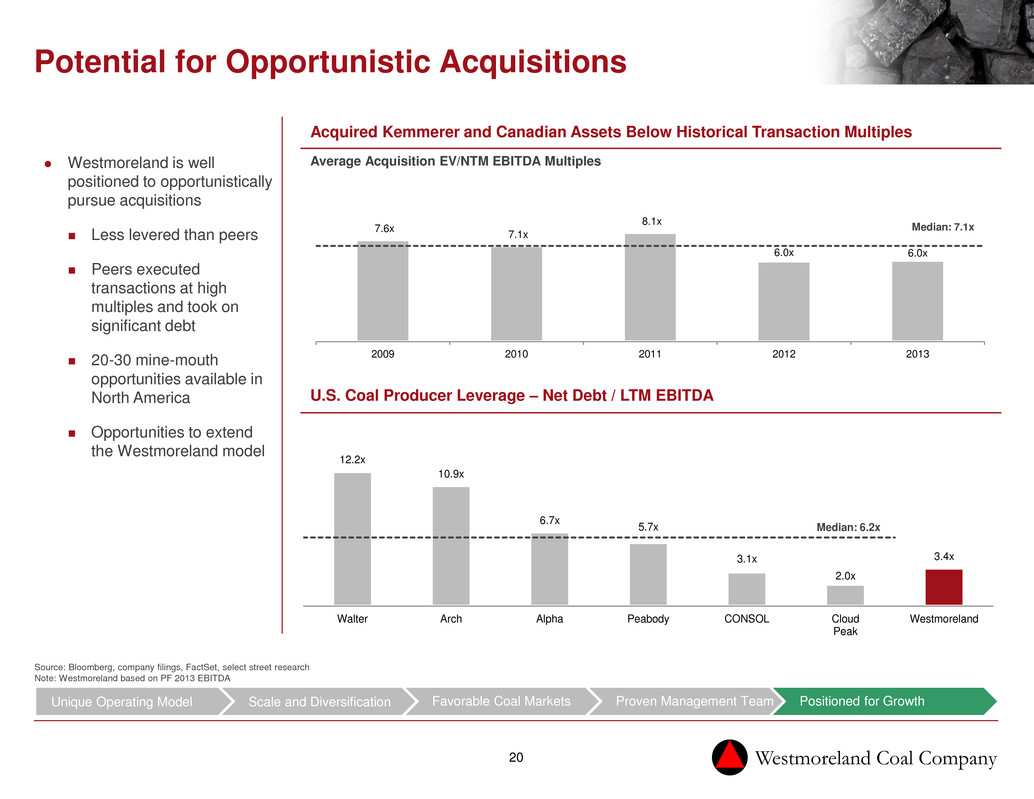

Westmoreland Coal Company 20 12.2x 10.9x 6.7x 5.7x 3.1x 2.0x 3.4x Walter Arch Alpha Peabody CONSOL Cloud Peak Westmoreland Median: 6.2x Potential for Opportunistic Acquisitions Westmoreland is well positioned to opportunistically pursue acquisitions Less levered than peers Peers executed transactions at high multiples and took on significant debt 20-30 mine-mouth opportunities available in North America Opportunities to extend the Westmoreland model Acquired Kemmerer and Canadian Assets Below Historical Transaction Multiples Source: Bloomberg, company filings, FactSet, select street research Note: Westmoreland based on PF 2013 EBITDA Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth U.S. Coal Producer Leverage – Net Debt / LTM EBITDA 7.6x 7.1x 8.1x 6.0x 6.0x 2009 2010 2011 2012 2013 Median: 7.1x Average Acquisition EV/NTM EBITDA Multiples

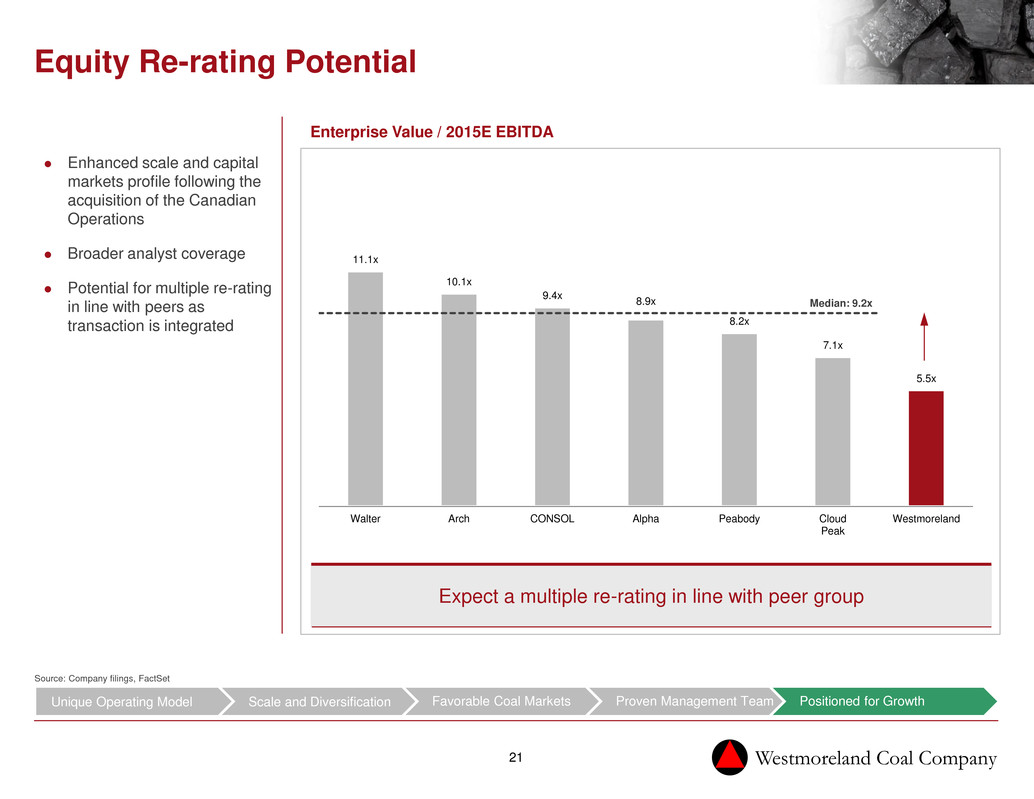

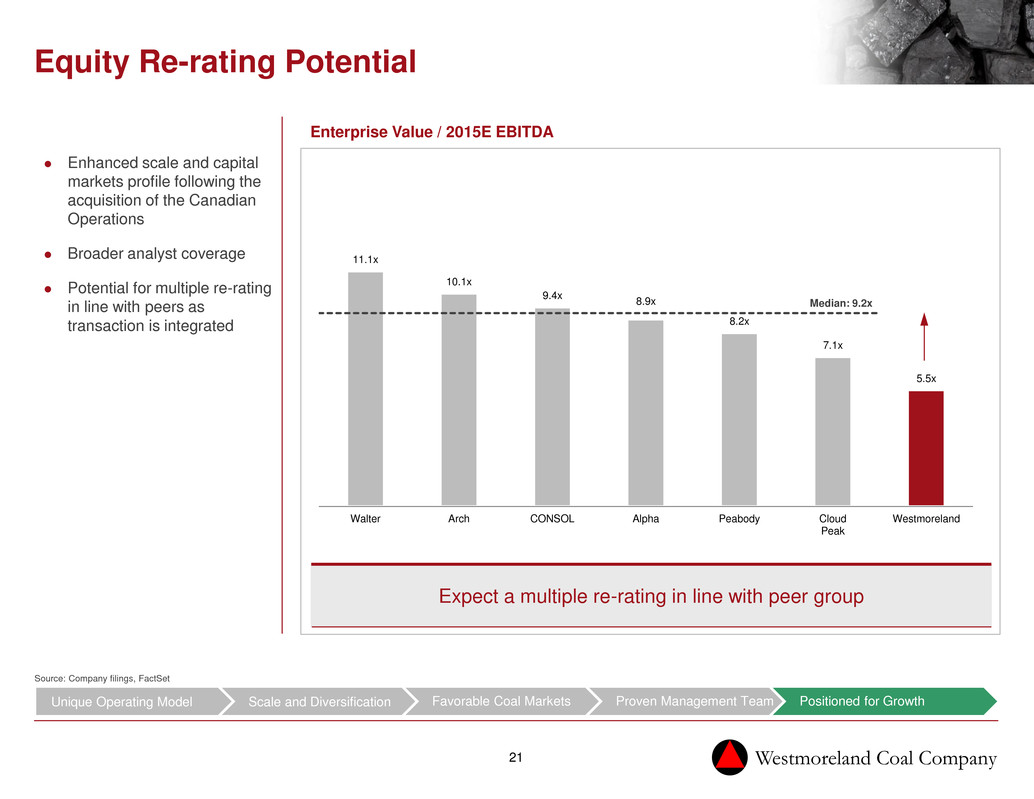

Westmoreland Coal Company 21 11.1x 10.1x 9.4x 8.9x 8.2x 7.1x 5.5x Walter Arch CONSOL Alpha Peabody Cloud Peak Westmoreland Median: 9.2x Equity Re-rating Potential Enhanced scale and capital markets profile following the acquisition of the Canadian Operations Broader analyst coverage Potential for multiple re-rating in line with peers as transaction is integrated Enterprise Value / 2015E EBITDA Expect a multiple re-rating in line with peer group Source: Company filings, FactSet Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth

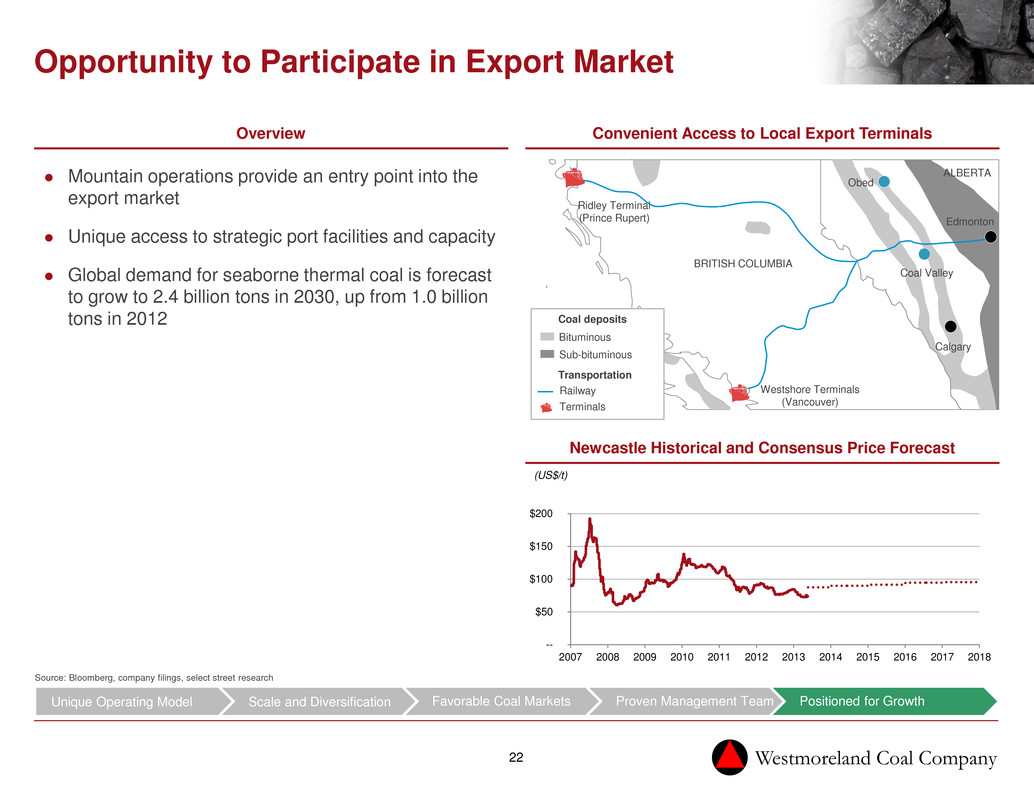

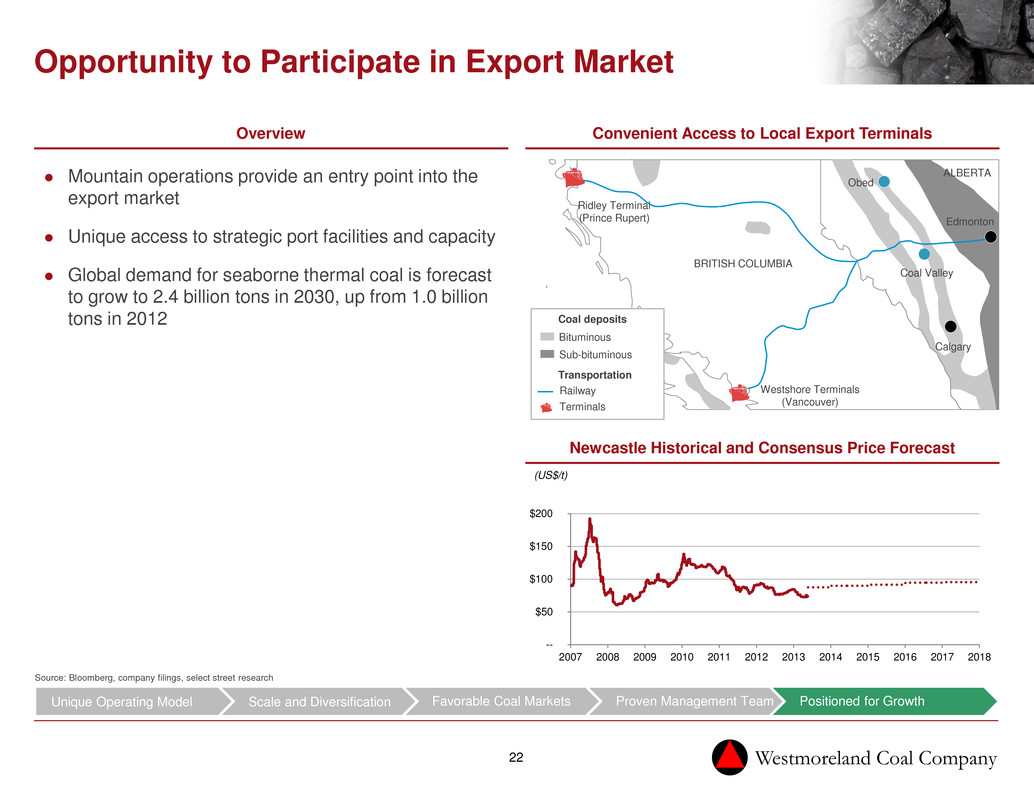

Westmoreland Coal Company 22 -- $50 $100 $150 $200 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Opportunity to Participate in Export Market Mountain operations provide an entry point into the export market Unique access to strategic port facilities and capacity Global demand for seaborne thermal coal is forecast to grow to 2.4 billion tons in 2030, up from 1.0 billion tons in 2012 Convenient Access to Local Export Terminals Overview Source: Bloomberg, company filings, select street research Newcastle Historical and Consensus Price Forecast Unique Operating Model Scale and Diversification Favorable Coal Markets Proven Management Team Positioned for Growth (US$/t) Westshore Terminals (Vancouver) Coal deposits Bituminous Sub-bituminous Transportation Railway Terminals BRITISH COLUMBIA Calgary Edmonton Coal Valley ALBERTA Obed Ridley Terminal (Prince Rupert)

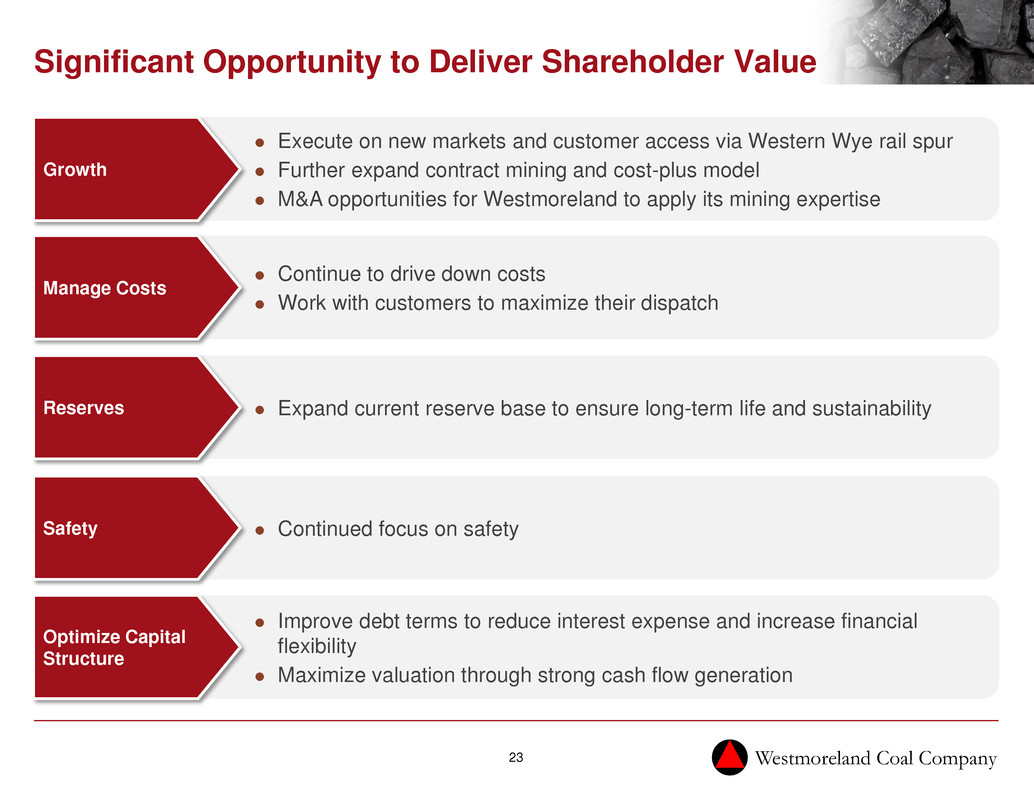

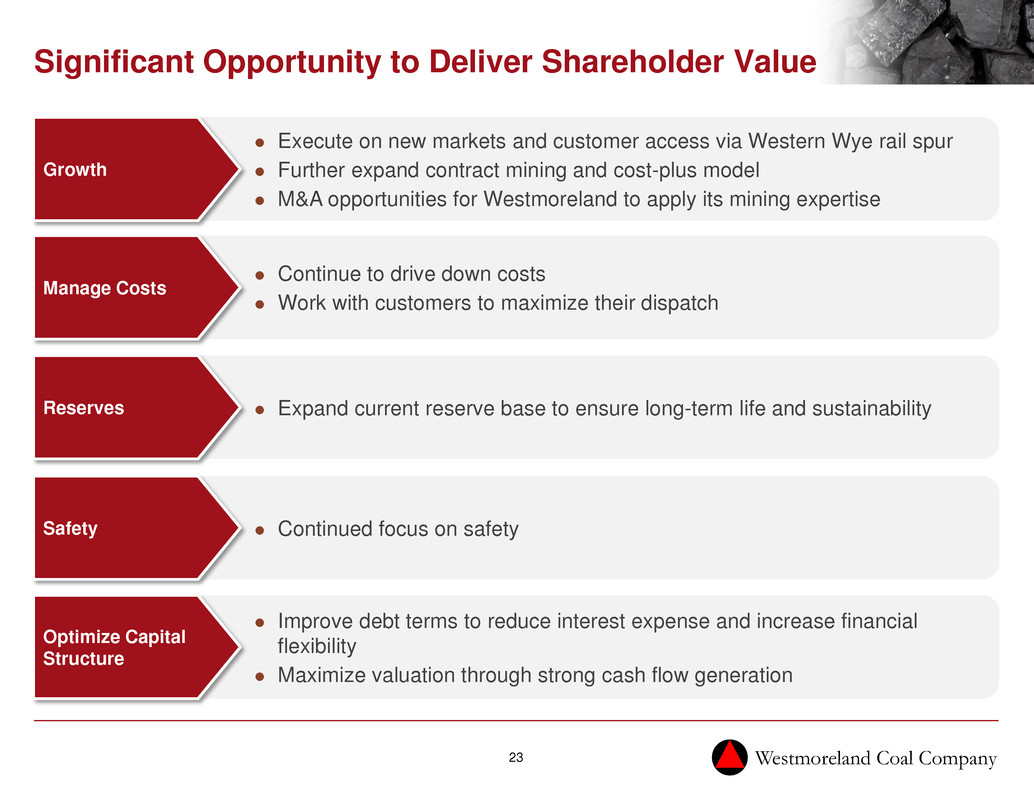

Westmoreland Coal Company 23 Execute on new markets and customer access via Western Wye rail spur Further expand contract mining and cost-plus model M&A opportunities for Westmoreland to apply its mining expertise Growth Significant Opportunity to Deliver Shareholder Value Expand current reserve base to ensure long-term life and sustainability Reserves Continue to drive down costs Work with customers to maximize their dispatch Manage Costs Continued focus on safety Safety Improve debt terms to reduce interest expense and increase financial flexibility Maximize valuation through strong cash flow generation Optimize Capital Structure

Westmoreland Coal Company 24 Investor Relations For investor relations please contact: Kevin Paprzycki Chief Financial Officer and Treasurer Westmoreland Coal Company 9540 South Maroon Circle, Suite 200 Englewood, CO 80112 (720) 354-4489 Toll Free: (855) 922-6463