westmoreland.com | NASDAQ:WLB October 16, 2014 Investor Conference Call Westmoreland Enters MLP Space Agrees to Acquire the General Partner of Oxford Resource Partners

1 This document contains “forward-looking statements.” Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and similar references to future periods. Examples of forward-looking statements include, but are not limited to, statements we make about the fulfillment of all conditions to allow the transaction to close, that our cost- protected contract pricing insulates our business from the broader coal price environment, that the transaction will result in higher MLP valuation multiples, be accretive, create value for WLB shareholders, will restart distributions at the LP or create distribution growth, and that WLB will refinance its debt in the near term. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. We therefore caution you against relying on any of these forward-looking statements. They are statements neither of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements include political, economic, business, competitive, market, weather and regulatory conditions and the following: The ability of our ROVA power assets to generate free cash flow due to the fully-hedged power position through March 2019; Our substantial level of indebtedness; The effect of Environmental Protection Agency inquiries and regulations on the operations of the power plants we provide coal to; Future legislation and changes in regulations, governmental policies and taxes, including those aimed at reducing emissions of elements such as mercury, sulfur dioxides, nitrogen oxides, particulate matter or greenhouse gases; The effect of prolonged maintenance or unplanned outages at our operations or those of our major power generating customers; Our potential inability to expand or continue current coal operations due to limitations in obtaining bonding capacity for new mining permits, and/or increases in our mining costs as a result of increased bonding expenses; The potential inability of our subsidiaries to pay dividends to us due to reductions in planned coal deliveries or other business factors; Changes in our post-retirement medical benefit and pension obligations and the impact of the recently enacted healthcare legislation; The impact of the recently enacted healthcare legislation and its effect on our employee health benefit costs; Our expansion into international operations, which exposes us to risks relating to exchange rates and exchange controls, general economic and political conditions, costs associated with compliance with governmental regulations in multiple jurisdictions, tax-related risks and export or import requirements for, or restrictions related to, our products; Our efforts to effectively integrate the Canadian operations with our existing business and our ability to manage our expanded operations following the acquisition; Our ability to realize growth opportunities and cost synergies as a result of the addition of the Canadian operations; and Other factors that are described in “Risk Factors” in our 2013 Form 10-K and any subsequent quarterly filing on Form 10-Q. Forward Looking Statements

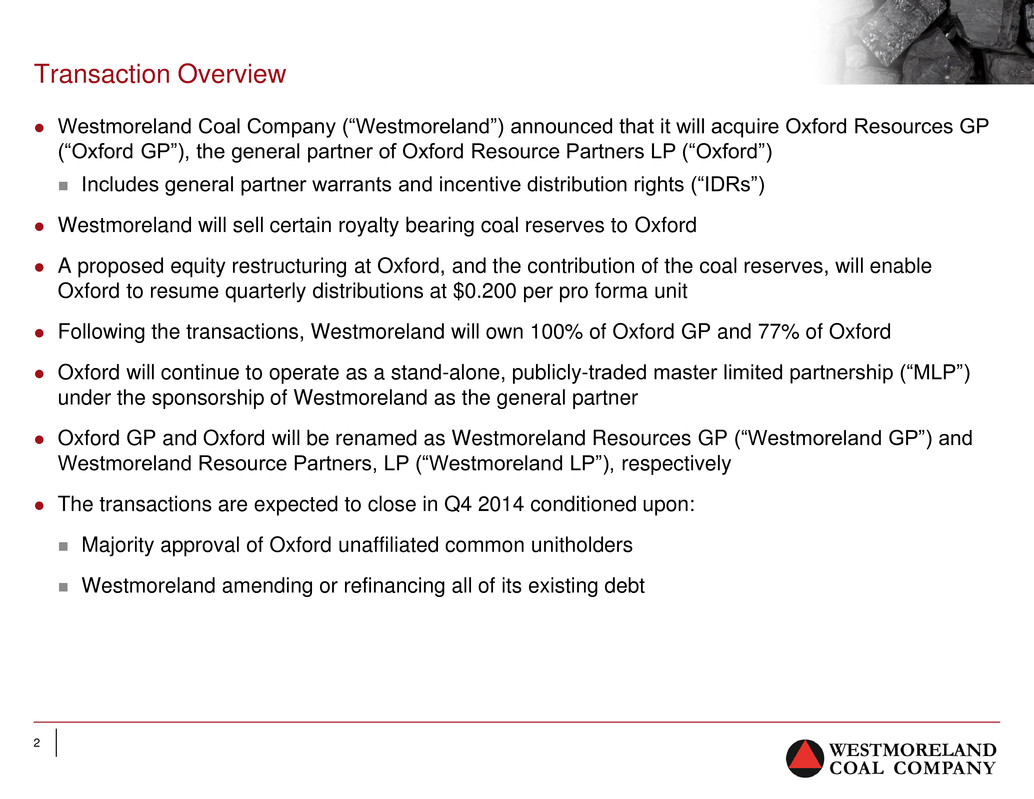

2 Westmoreland Coal Company (“Westmoreland”) announced that it will acquire Oxford Resources GP (“Oxford GP”), the general partner of Oxford Resource Partners LP (“Oxford”) Includes general partner warrants and incentive distribution rights (“IDRs”) Westmoreland will sell certain royalty bearing coal reserves to Oxford A proposed equity restructuring at Oxford, and the contribution of the coal reserves, will enable Oxford to resume quarterly distributions at $0.200 per pro forma unit Following the transactions, Westmoreland will own 100% of Oxford GP and 77% of Oxford Oxford will continue to operate as a stand-alone, publicly-traded master limited partnership (“MLP”) under the sponsorship of Westmoreland as the general partner Oxford GP and Oxford will be renamed as Westmoreland Resources GP (“Westmoreland GP”) and Westmoreland Resource Partners, LP (“Westmoreland LP”), respectively The transactions are expected to close in Q4 2014 conditioned upon: Majority approval of Oxford unaffiliated common unitholders Westmoreland amending or refinancing all of its existing debt Transaction Overview

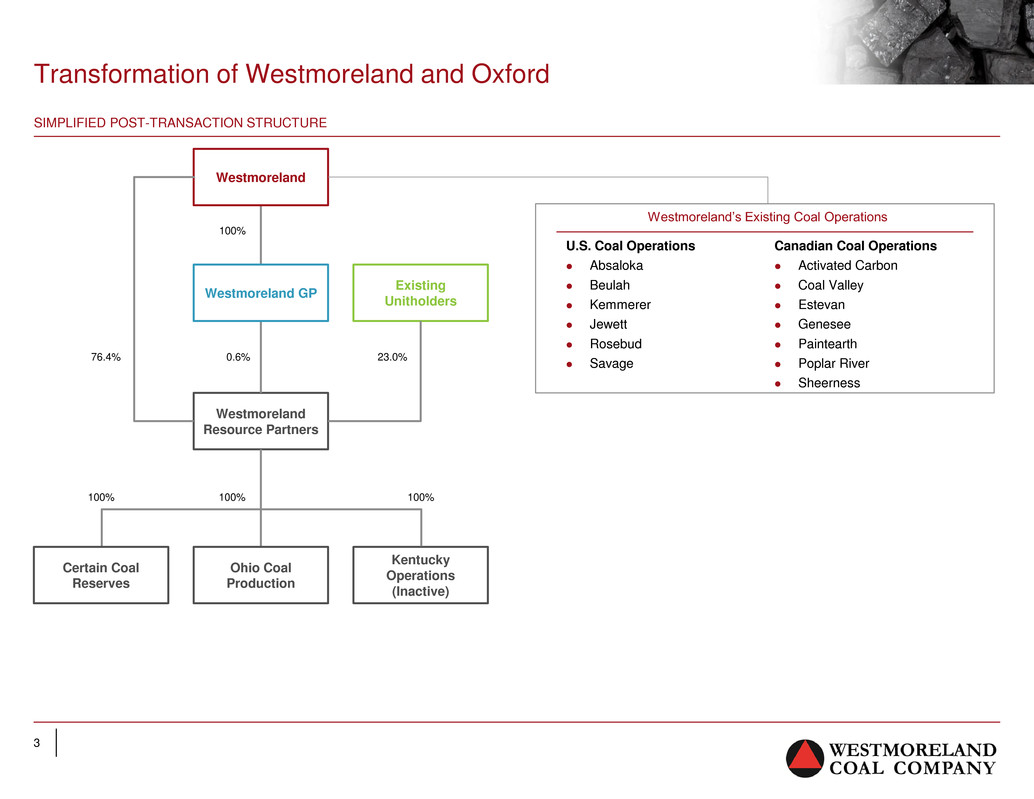

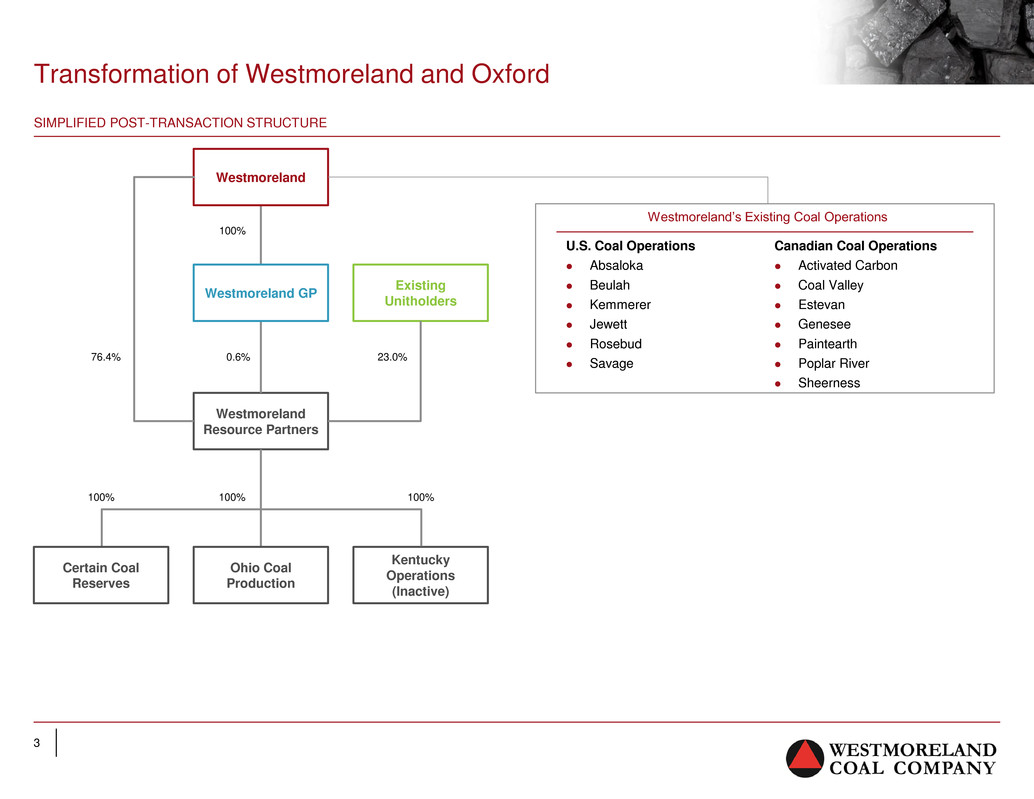

3 Transformation of Westmoreland and Oxford SIMPLIFIED POST-TRANSACTION STRUCTURE Westmoreland Resource Partners Kentucky Operations (Inactive) Existing Unitholders 23.0% 100% 100% 100% 76.4% Certain Coal Reserves 100% Westmoreland GP Westmoreland Ohio Coal Production 0.6% Westmoreland’s Existing Coal Operations Canadian Coal Operations Activated Carbon Coal Valley Estevan Genesee Paintearth Poplar River Sheerness U.S. Coal Operations Absaloka Beulah Kemmerer Jewett Rosebud Savage

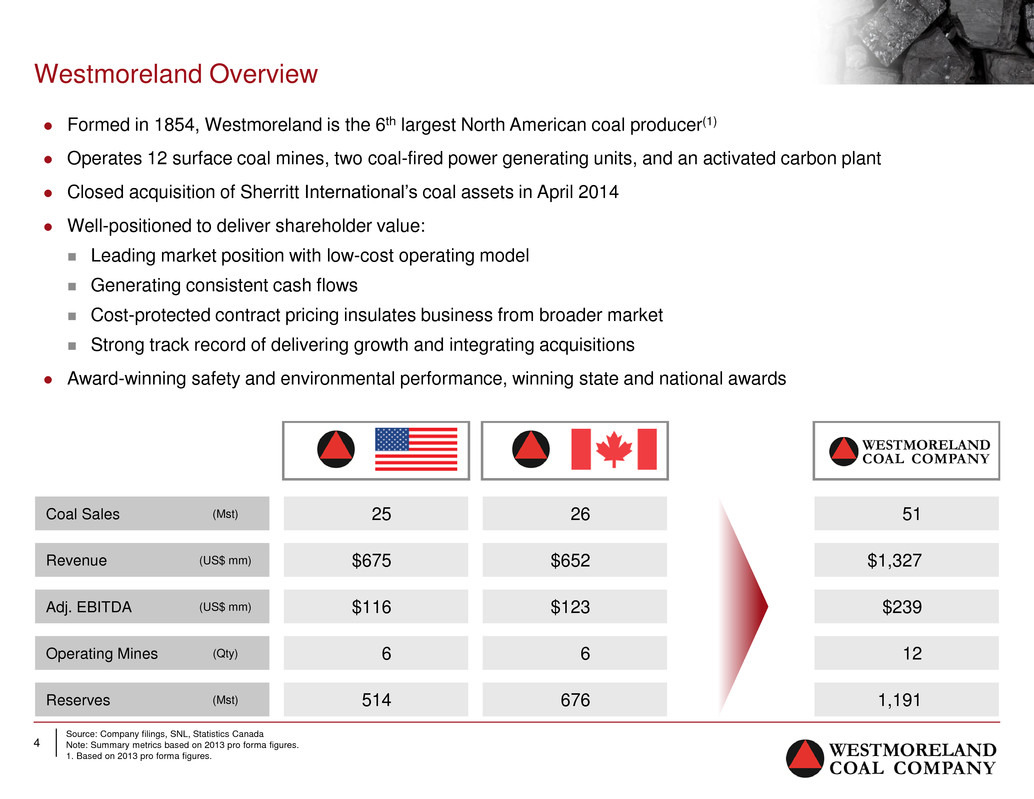

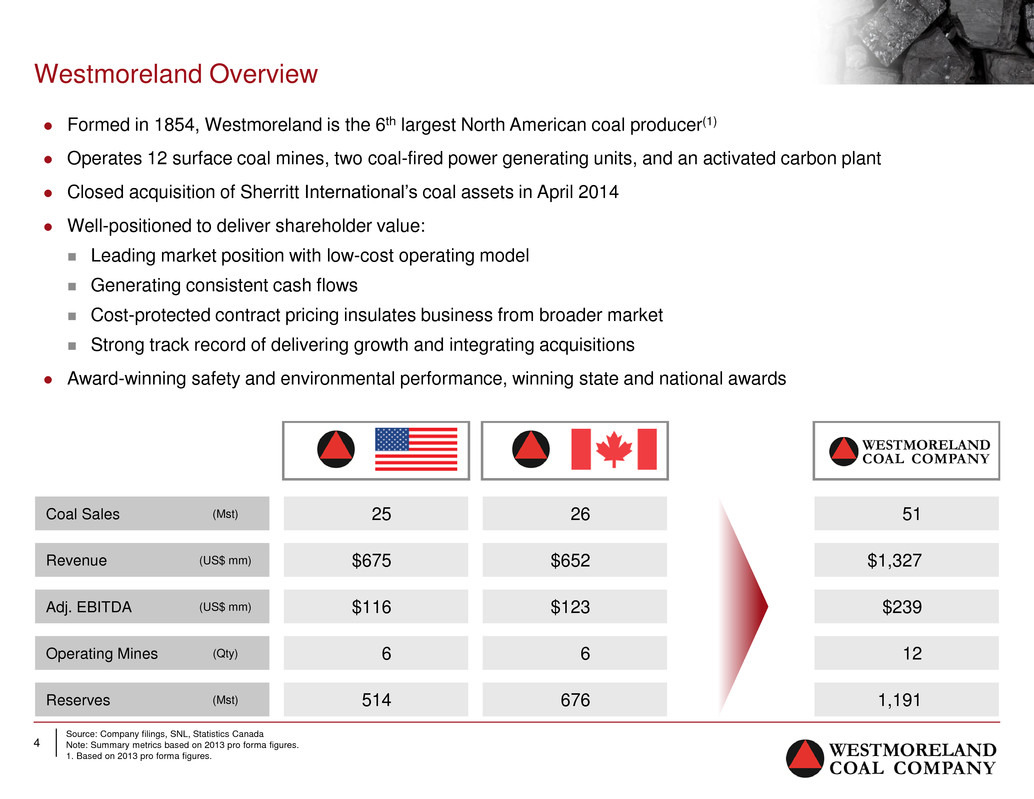

4 Source: Company filings, SNL, Statistics Canada Note: Summary metrics based on 2013 pro forma figures. 1. Based on 2013 pro forma figures. Westmoreland Overview Formed in 1854, Westmoreland is the 6th largest North American coal producer(1) Operates 12 surface coal mines, two coal-fired power generating units, and an activated carbon plant Closed acquisition of Sherritt International’s coal assets in April 2014 Well-positioned to deliver shareholder value: Leading market position with low-cost operating model Generating consistent cash flows Cost-protected contract pricing insulates business from broader market Strong track record of delivering growth and integrating acquisitions Award-winning safety and environmental performance, winning state and national awards Coal Sales (Mst) 25 26 51 Re enue (US$ mm) $675 $652 $1,327 Adj. EBITDA (US$ mm) $116 $123 $239 Operating Mines (Qty) 6 6 12 Reserves (Mst) 514 676 1,191

5 Strategic Rationale Establishes instant MLP platform to drop down U.S. and Canadian assets Creates path toward higher MLP valuation multiples Tax assets provide protection for future drop downs Becomes a “sponsored” MLP Access to a portfolio of high quality assets to sustain future drop-downs Provides greater certainty of future distribution growth Creates a Premier Coal-Focused MLP Strategic partnership between coal parent and MLP Value accretive to both partners

6 Continued growth that fits Westmoreland’s model: Low cost surface mining Transportation advantaged operations Long-term operating contracts High quality customers Strong employee relations and safety culture Asset diversification into the eastern U.S. Embedded 100%-ownership of Westmoreland GP and IDRs Participate in significant Oxford free cash flow generation through Westmoreland’s ownership in LP units Gives access to high value currency for third-party acquisitions Benefits for Westmoreland Shareholders

7 Allows restart of quarterly distribution Provides greater certainty of distribution growth Eliminates overhang of subordinated units Westmoreland’s operations characterized by long-term stable cash flows Diversifies geographical asset base Improvement in cash flow generation from cost synergies Strengthens capital structure Benefits for Oxford Unitholders

8 Proposed Oxford and Westmoreland Refinancings Oxford Refinancing New $175 million credit facility Proceeds used to repay existing credit facilities and fees Four year maturity Additional $120 million delayed draw to fund acquisitions over the next year $150 million accordion takes effect when delayed draw expires to fund additional acquisitions Proposed Westmoreland Amendment or Refinancing Westmoreland must seek consent from our lenders or amend or refinance our existing debt arrangements because those arrangements would otherwise prohibit consummation of the contemplated transactions Proposed Oxford and Westmoreland capital structures provide enhanced flexibility

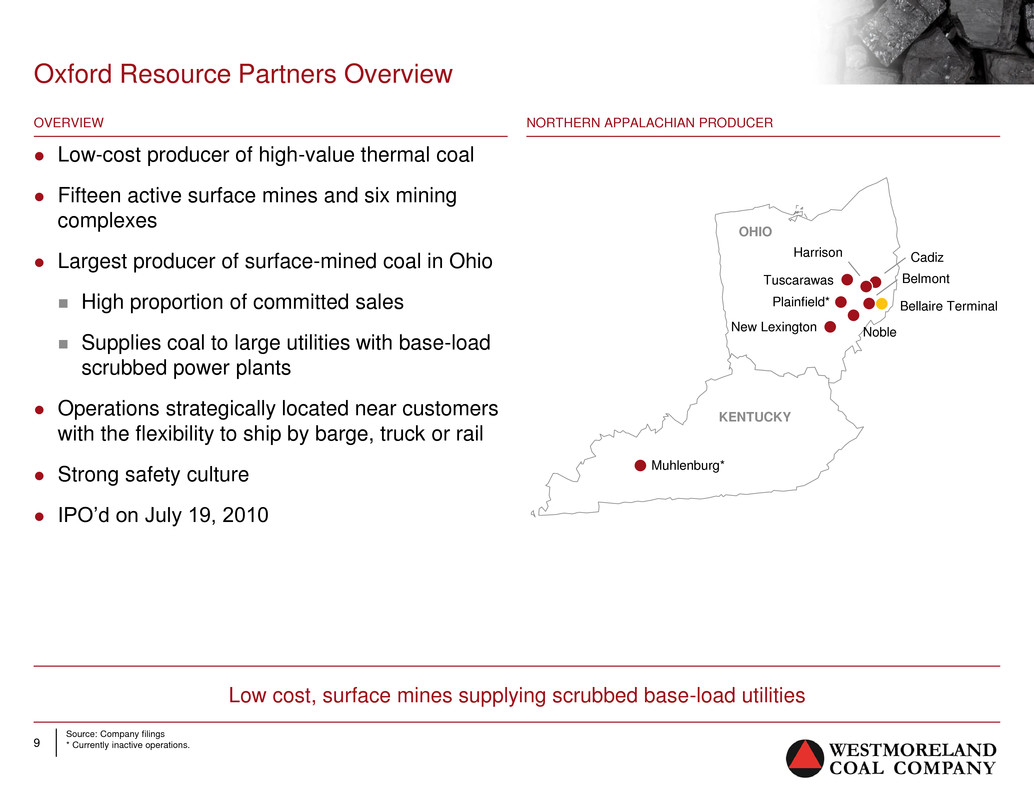

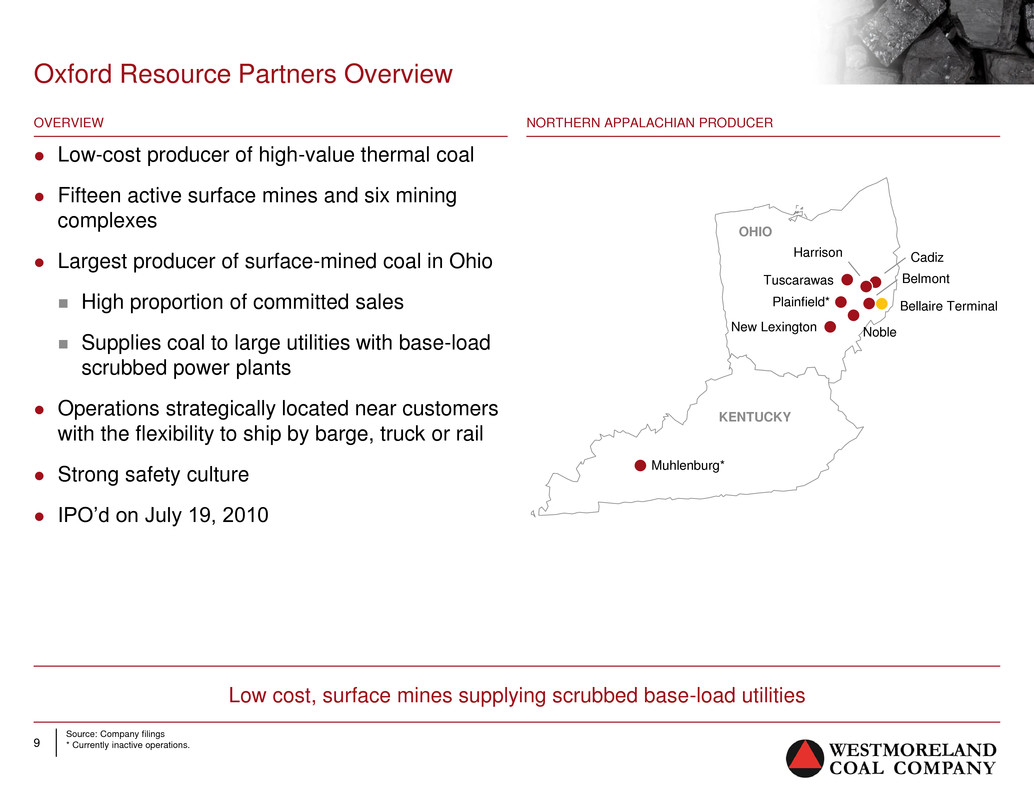

9 Source: Company filings * Currently inactive operations. Oxford Resource Partners Overview Low-cost producer of high-value thermal coal Fifteen active surface mines and six mining complexes Largest producer of surface-mined coal in Ohio High proportion of committed sales Supplies coal to large utilities with base-load scrubbed power plants Operations strategically located near customers with the flexibility to ship by barge, truck or rail Strong safety culture IPO’d on July 19, 2010 OVERVIEW Low cost, surface mines supplying scrubbed base-load utilities NORTHERN APPALACHIAN PRODUCER Harrison Cadiz Belmont Noble New Lexington Bellaire Terminal Tuscarawas Plainfield* Muhlenburg* OHIO KENTUCKY

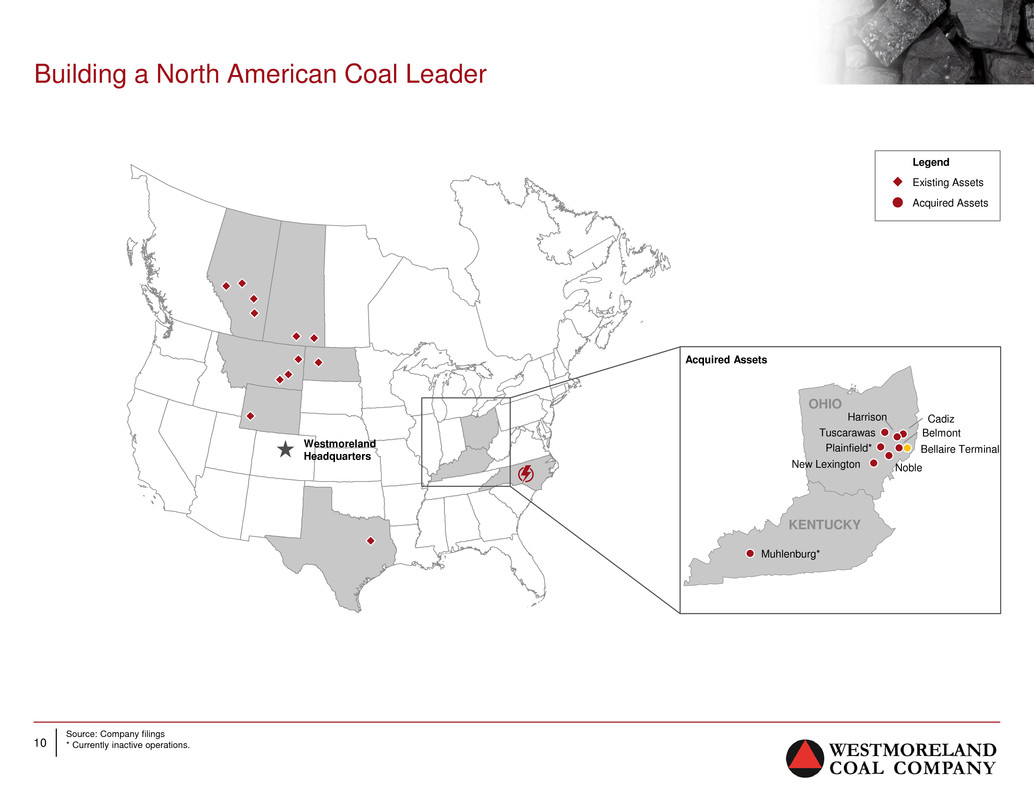

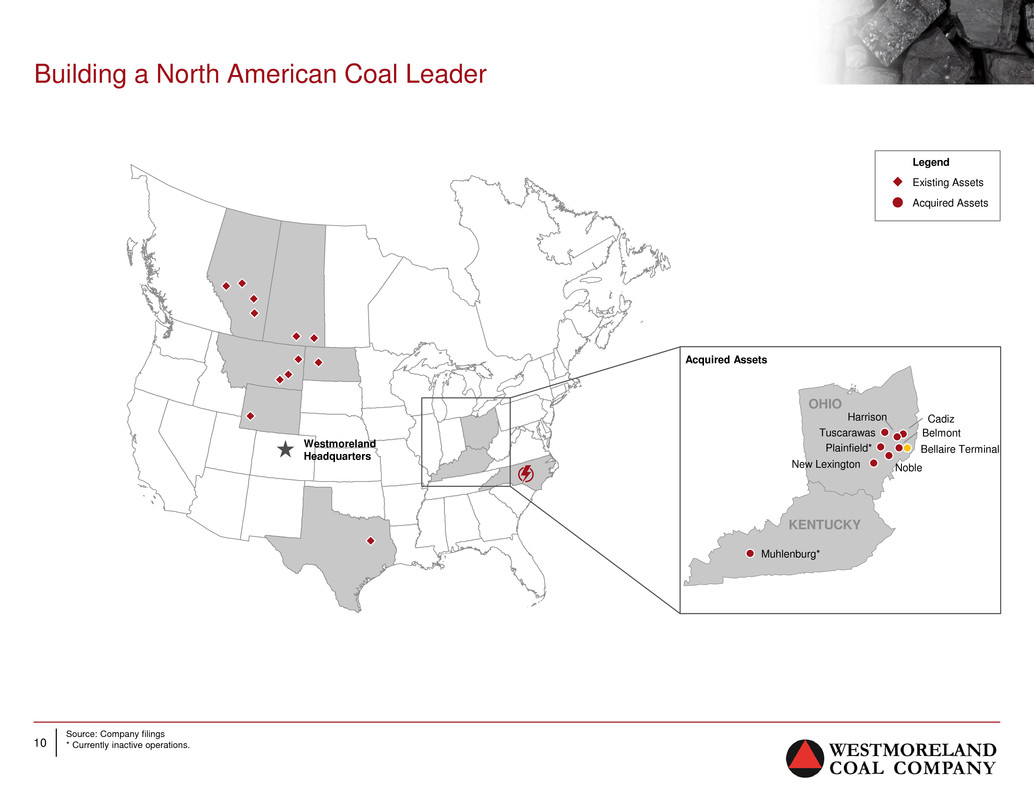

10 Source: Company filings * Currently inactive operations. Building a North American Coal Leader Westmoreland Headquarters Legend Existing Assets Acquired Assets Harrison Cadiz Belmont Noble New Lexington Bellaire Terminal Tuscarawas Plainfield* Muhlenburg* OHIO KENTUCKY Acquired Assets

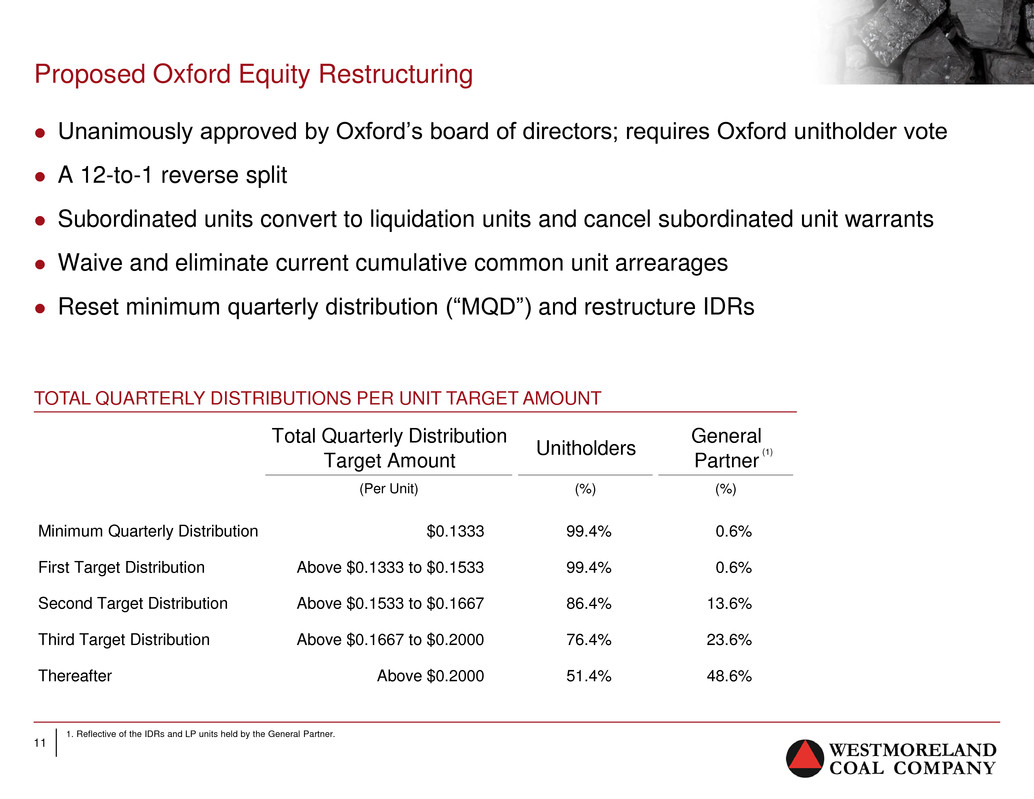

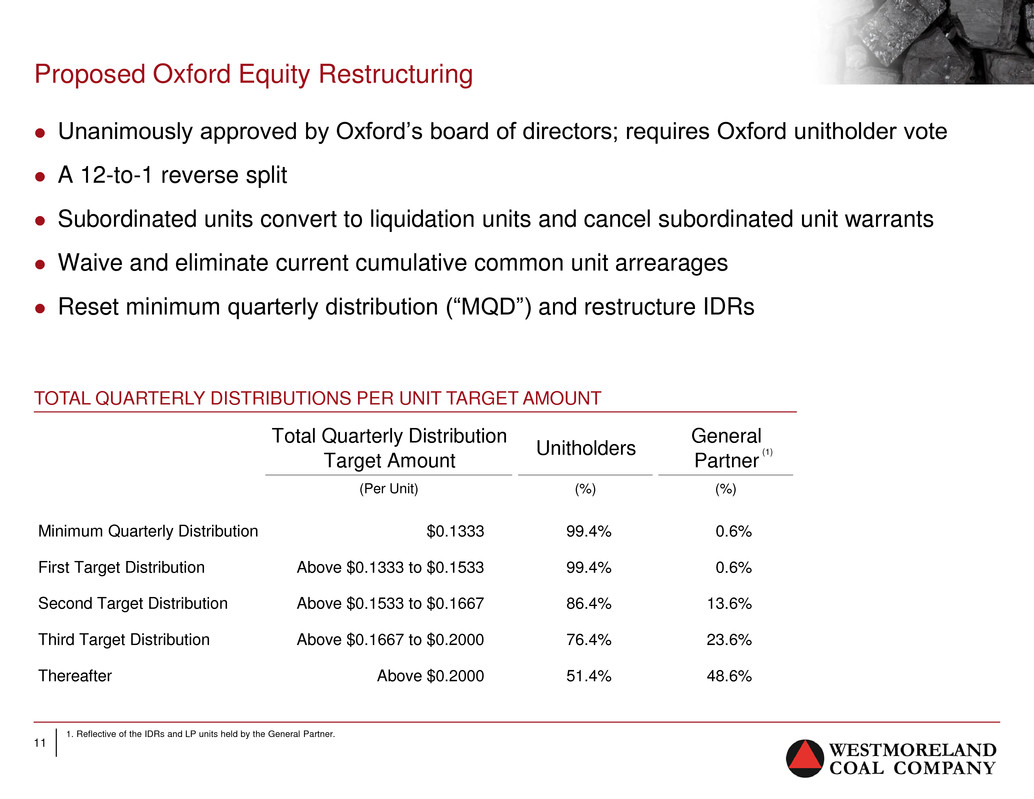

11 Total Quarterly Distribution Target Amount Unitholders General Partner (Per Unit) (%) (%) Minimum Quarterly Distribution $0.1333 99.4% 0.6% First Target Distribution Above $0.1333 to $0.1533 99.4% 0.6% Second Target Distribution Above $0.1533 to $0.1667 86.4% 13.6% Third Target Distribution Above $0.1667 to $0.2000 76.4% 23.6% Thereafter Above $0.2000 51.4% 48.6% 1. Reflective of the IDRs and LP units held by the General Partner. Unanimously approved by Oxford’s board of directors; requires Oxford unitholder vote A 12-to-1 reverse split Subordinated units convert to liquidation units and cancel subordinated unit warrants Waive and eliminate current cumulative common unit arrearages Reset minimum quarterly distribution (“MQD”) and restructure IDRs Proposed Oxford Equity Restructuring TOTAL QUARTERLY DISTRIBUTIONS PER UNIT TARGET AMOUNT (1)

12 Westmoreland’s Support of Oxford Equity Restructuring Sale of royalty bearing coal reserves are expected to generate approximately $5.8 million in average annual cash flow for Westmoreland LP over the 2015-18 period Total cash flow stream will last through the mid-2020s No capital expenditure commitment Westmoreland supplies certainty of cash flows through minimum royalty payment Westmoreland to relinquish its right to receive IDRs for up to six quarters following closing May be shortened if additional drop downs are completed Westmoreland to authorize a one-time special distribution to unaffiliated unitholders consisting of 202,184 post-reverse split common units Represents an approximately 25% “unit dividend”

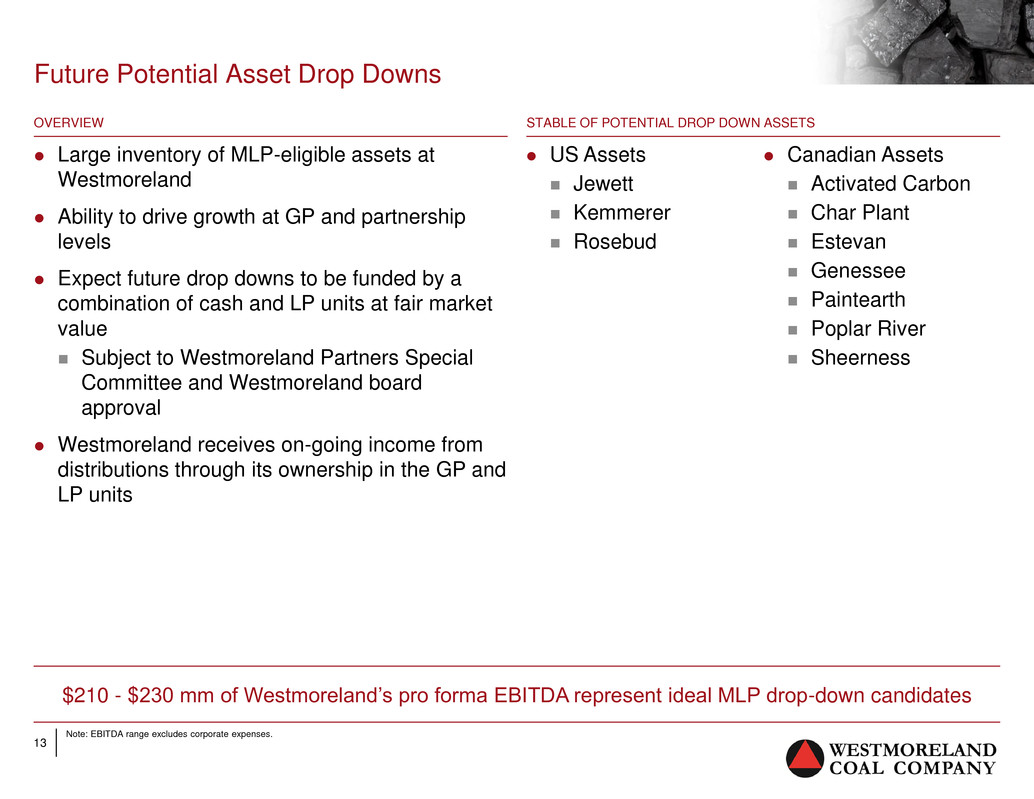

13 Note: EBITDA range excludes corporate expenses. Future Potential Asset Drop Downs Large inventory of MLP-eligible assets at Westmoreland Ability to drive growth at GP and partnership levels Expect future drop downs to be funded by a combination of cash and LP units at fair market value Subject to Westmoreland Partners Special Committee and Westmoreland board approval Westmoreland receives on-going income from distributions through its ownership in the GP and LP units STABLE OF POTENTIAL DROP DOWN ASSETS OVERVIEW US Assets Jewett Kemmerer Rosebud Canadian Assets Activated Carbon Char Plant Estevan Genessee Paintearth Poplar River Sheerness $210 - $230 mm of Westmoreland’s pro forma EBITDA represent ideal MLP drop-down candidates

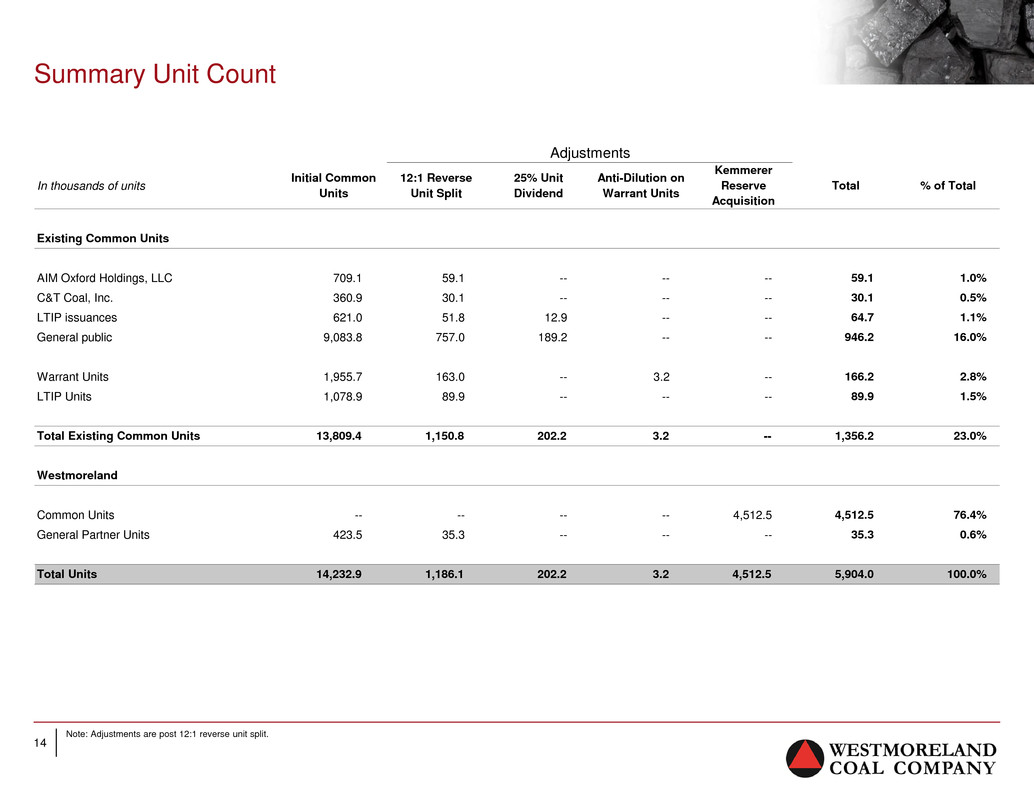

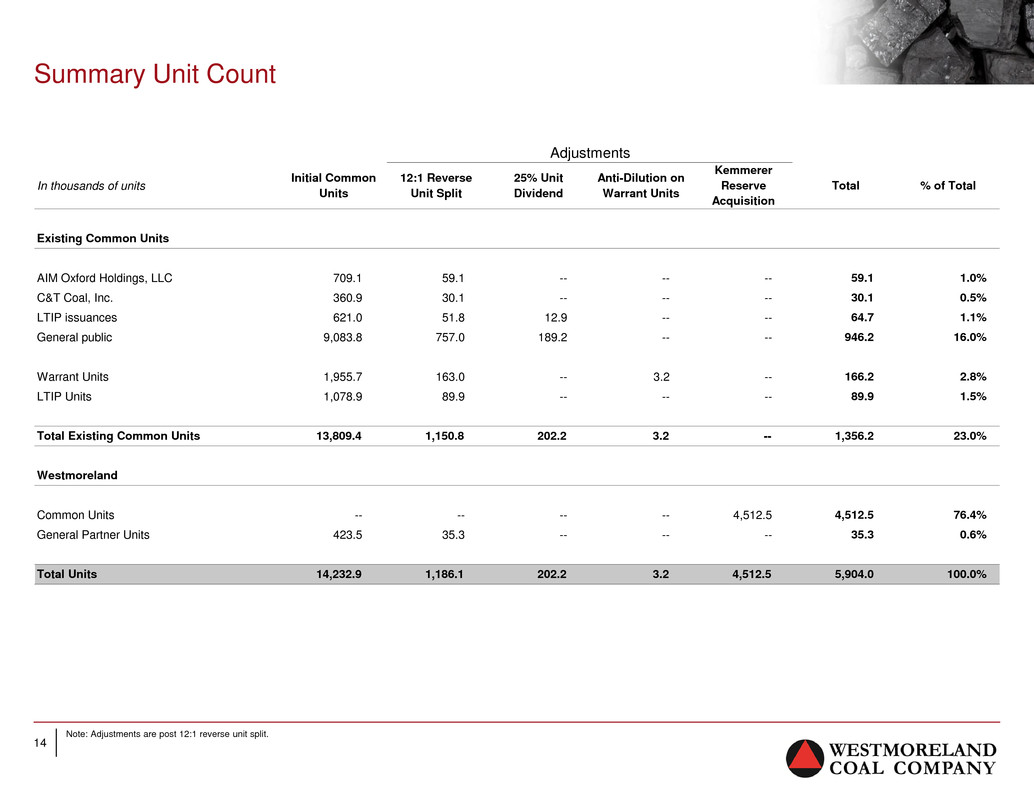

14 Note: Adjustments are post 12:1 reverse unit split. Summary Unit Count Adjustments In thousands of units Initial Common Units 12:1 Reverse Unit Split 25% Unit Dividend Anti-Dilution on Warrant Units Kemmerer Reserve Acquisition Total % of Total Existing Common Units AIM Oxford Holdings, LLC 709.1 59.1 -- -- -- 59.1 1.0% C&T Coal, Inc. 360.9 30.1 -- -- -- 30.1 0.5% LTIP issuances 621.0 51.8 12.9 -- -- 64.7 1.1% General public 9,083.8 757.0 189.2 -- -- 946.2 16.0% Warrant Units 1,955.7 163.0 -- 3.2 -- 166.2 2.8% LTIP Units 1,078.9 89.9 -- -- -- 89.9 1.5% Total Existing Common Units 13,809.4 1,150.8 202.2 3.2 -- 1,356.2 23.0% Westmoreland Common Units -- -- -- -- 4,512.5 4,512.5 76.4% General Partner Units 423.5 35.3 -- -- -- 35.3 0.6% Total Units 14,232.9 1,186.1 202.2 3.2 4,512.5 5,904.0 100.0%

15 Investor Relations For investor relations please contact: Kevin Paprzycki Chief Financial Officer and Treasurer Westmoreland Coal Company 9540 South Maroon Circle, Suite 200 Englewood, CO 80112 (720) 354-4489 Toll Free: (855) 922-6463