UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08837

THE SELECT SECTOR SPDR® TRUST

(Exact name of registrant as specified in charter)

One Iron Street, Boston, Massachusetts 02210

(Address of principal executive offices) (zip code)

Sean O’Malley, Esq.

Senior Vice President and General Counsel

c/o SSGA Funds Management, Inc.

One Iron Street

Boston, Massachusetts 02210

(Name and address of agent for service)

Copy to:

W. John McGuire, Esq.

Morgan, Lewis, & Bockius, LLP

1111 Pennsylvania Avenue, NW

Washington, D.C. 20004

Registrant’s telephone number, including area code: (617) 664-1465

Date of fiscal year end: September 30

Date of reporting period: March 31, 2023

Item 1. Report to Shareholders.

(a) The Reports to Shareholders are attached herewith.

The Select Sector SPDR Trust

Semi-Annual Report

March 31, 2023

Select Sector SPDR Funds

The Select Sector SPDR Trust consists of eleven separate investment portfolios (each a “Select Sector SPDR Fund” or a “Fund” and collectively the “Select Sector SPDR Funds” or the “Funds”).

Select Sector SPDR Funds are “index funds” that unbundle the benchmark S&P 500®† and give you ownership in particular sectors or groups of industries that are represented by a specified Select Sector Index. Through a single share, investors can buy or sell any of eleven major industry sectors that make up the S&P 500®, in the same way as they would buy or sell a share of stock. Select Sector SPDR Fund shares are different from the shares of conventional mutual funds. Select Sector SPDR Funds trade on NYSE Arca, Inc.

Eleven Select Sector SPDR Funds

Shares are available for exchange trading in the following Funds of The Select Sector SPDR Trust:

| The Communication Services Select Sector SPDR Fund | XLC |

| The Consumer Discretionary Select Sector SPDR Fund | XLY |

| The Consumer Staples Select Sector SPDR Fund | XLP |

| The Energy Select Sector SPDR Fund | XLE |

| The Financial Select Sector SPDR Fund | XLF |

| The Health Care Select Sector SPDR Fund | XLV |

| The Industrial Select Sector SPDR Fund | XLI |

| The Materials Select Sector SPDR Fund | XLB |

| The Real Estate Select Sector SPDR Fund | XLRE |

| The Technology Select Sector SPDR Fund | XLK |

| The Utilities Select Sector SPDR Fund | XLU |

Each of these Funds is designed to, before expenses, correspond generally to the price and yield performance of a Select Sector Index. Each Fund’s portfolio is comprised principally of shares of constituent companies in the S&P 500®. Each stock in the S&P 500® is allocated to one Select Sector Index. The combined companies of the eleven Select Sector Indexes represent all of the companies in the S& P 500®. Each Select Sector SPDR Fund can be expected to move up or down in value with its underlying Select Sector Index. Investors cannot invest directly in an index. Funds focused on a single sector generally experience greater price fluctuations than the overall stock market.

Objective

Select Sector SPDR Funds are designed to provide investors with an affordable way to invest in a portfolio of equity securities in a sector or group of industries in a single trade. Select Sector SPDR Funds allow you to tailor asset allocations to fit your particular investment needs or goals. One Fund may complement another; individual Select Sector SPDR Funds can be used to increase exposure to certain industries that may be outperforming the market or to hedge other holdings in your portfolio. Although an individual Select Sector SPDR Fund may bear a higher level of risk than a broad-market fund, because of less diversification, sector investments may also offer opportunities for returns greater than an investment in the entire constituents of the S&P 500®.

The information contained in this report is intended for the general information of shareholders of the Trust. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Trust prospectus which contains important information concerning the Trust. You may obtain a current prospectus from the Distributor, ALPS Portfolio Solutions Distributor, Inc., by calling 1-866-SECTOR-ETF (1-866-732-8673). Please read the prospectus carefully before you invest.

† S&P 500: the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged, index of common stock prices.

TABLE OF CONTENTS (Unaudited)

[This Page Intentionally Left Blank]

The Communication Services Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of March 31, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Meta Platforms, Inc. Class A | 2,217,292,543 | 22.1% | |

| | Alphabet, Inc. Class A | 1,259,917,961 | 12.6 | |

| | Alphabet, Inc. Class C | 1,101,197,656 | 11.0 | |

| | Netflix, Inc. | 476,655,992 | 4.8 | |

| | Activision Blizzard, Inc. | 443,389,494 | 4.4 | |

| | TOTAL | 5,498,453,646 | 54.9% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of March 31, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

1

The Consumer Discretionary Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of March 31, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Amazon.com, Inc. | 3,247,602,967 | 22.7% | |

| | Tesla, Inc. | 2,414,517,194 | 16.8 | |

| | Home Depot, Inc. | 1,301,594,887 | 9.1 | |

| | NIKE, Inc. Class B | 661,089,325 | 4.6 | |

| | McDonald's Corp. | 631,563,216 | 4.4 | |

| | TOTAL | 8,256,367,589 | 57.6% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

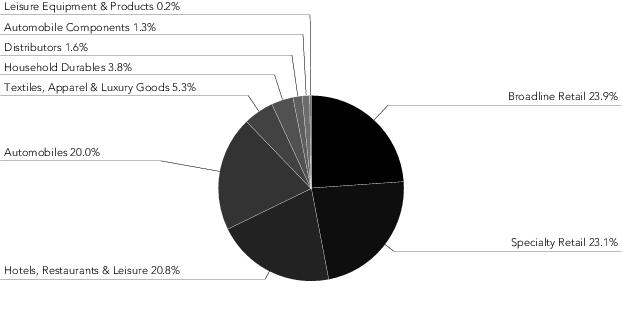

Industry Breakdown as of March 31, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

2

The Consumer Staples Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of March 31, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Procter & Gamble Co. | 2,388,937,698 | 14.1% | |

| | PepsiCo, Inc. | 1,709,901,809 | 10.1 | |

| | Coca-Cola Co. | 1,644,188,022 | 9.7 | |

| | Costco Wholesale Corp. | 1,501,499,900 | 8.8 | |

| | Walmart, Inc. | 779,156,912 | 4.6 | |

| | TOTAL | 8,023,684,341 | 47.3% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

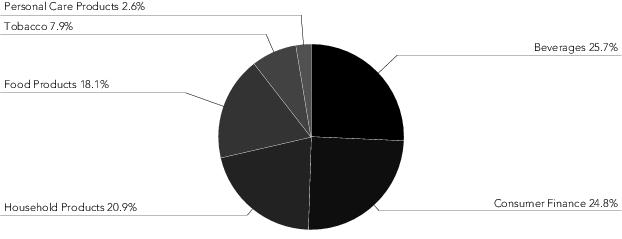

Industry Breakdown as of March 31, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

3

The Energy Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of March 31, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Exxon Mobil Corp. | 8,768,980,871 | 23.0% | |

| | Chevron Corp. | 7,454,013,385 | 19.6 | |

| | Marathon Petroleum Corp. | 1,760,164,122 | 4.6 | |

| | EOG Resources, Inc. | 1,729,170,509 | 4.6 | |

| | Schlumberger NV | 1,623,434,593 | 4.3 | |

| | TOTAL | 21,335,763,480 | 56.1% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of March 31, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

4

The Financial Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of March 31, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Berkshire Hathaway, Inc. Class B | 3,698,546,484 | 12.5% | |

| | JPMorgan Chase & Co. | 2,541,119,537 | 8.6 | |

| | Visa, Inc. Class A | 2,435,682,257 | 8.3 | |

| | Mastercard, Inc. Class A | 2,038,474,623 | 6.9 | |

| | Bank of America Corp. | 1,327,083,758 | 4.5 | |

| | TOTAL | 12,040,906,659 | 40.8% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

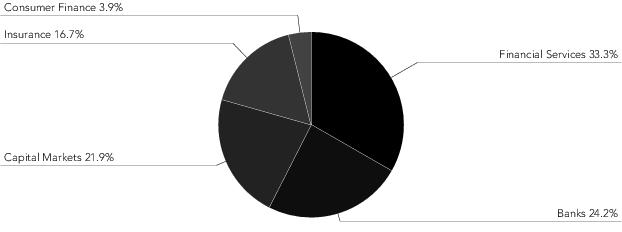

Industry Breakdown as of March 31, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

5

The Health Care Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of March 31, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | UnitedHealth Group, Inc. | 3,478,793,119 | 9.0% | |

| | Johnson & Johnson | 3,192,694,805 | 8.3 | |

| | AbbVie, Inc. | 2,220,477,189 | 5.8 | |

| | Eli Lilly & Co. | 2,133,791,061 | 5.6 | |

| | Merck & Co., Inc. | 2,125,135,675 | 5.5 | |

| | TOTAL | 13,150,891,849 | 34.2% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of March 31, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

6

The Industrial Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of March 31, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Raytheon Technologies Corp. | 668,438,282 | 4.8% | |

| | United Parcel Service, Inc. Class B | 659,659,115 | 4.8 | |

| | Honeywell International, Inc. | 594,980,832 | 4.3 | |

| | Union Pacific Corp. | 573,776,562 | 4.1 | |

| | Boeing Co. | 556,618,220 | 4.0 | |

| | TOTAL | 3,053,473,011 | 22.0% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of March 31, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

7

The Materials Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of March 31, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Linde PLC | 1,035,501,219 | 19.3% | |

| | Air Products & Chemicals, Inc. | 377,280,205 | 7.0 | |

| | Freeport-McMoRan, Inc. | 345,867,950 | 6.4 | |

| | Sherwin-Williams Co. | 313,522,233 | 5.8 | |

| | Corteva, Inc. | 254,284,631 | 4.7 | |

| | TOTAL | 2,326,456,238 | 43.2% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of March 31, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

8

The Real Estate Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of March 31, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Prologis, Inc. REIT | 606,357,620 | 13.0% | |

| | American Tower Corp. REIT | 500,906,611 | 10.8 | |

| | Equinix, Inc. REIT | 351,323,856 | 7.5 | |

| | Crown Castle, Inc. REIT | 305,122,409 | 6.6 | |

| | Public Storage REIT | 251,463,871 | 5.4 | |

| | TOTAL | 2,015,174,367 | 43.3% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of March 31, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

9

The Technology Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of March 31, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | Apple, Inc. | 10,005,035,085 | 23.0% | |

| | Microsoft Corp. | 9,997,298,088 | 22.9 | |

| | NVIDIA Corp. | 1,954,689,156 | 4.5 | |

| | Broadcom, Inc. | 1,568,286,872 | 3.6 | |

| | Cisco Systems, Inc. | 1,256,255,915 | 2.9 | |

| | TOTAL | 24,781,565,116 | 56.9% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of March 31, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

10

The Utilities Select Sector SPDR Fund

Portfolio Statistics (Unaudited)

Top Five Holdings as of March 31, 2023

| | | | |

| | Description | Market Value | % of Net Assets | |

| | NextEra Energy, Inc. | 2,400,993,748 | 15.5% | |

| | Southern Co. | 1,187,405,940 | 7.7 | |

| | Duke Energy Corp. | 1,164,387,980 | 7.5 | |

| | Sempra Energy | 744,799,331 | 4.8 | |

| | American Electric Power Co., Inc. | 732,926,452 | 4.8 | |

| | TOTAL | 6,230,513,451 | 40.3% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Industry Breakdown as of March 31, 2023*

* The Fund’s industry breakdown is expressed as a percentage of total common stock and may change over time.

See accompanying notes to financial statements.

11

THE COMMUNICATION SERVICES SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| Security Description | | | Shares | | Value |

| COMMON STOCKS — 99.9% | |

| DIVERSIFIED TELECOMMUNICATION SERVICES — 8.5% | |

AT&T, Inc.

| | 21,916,137 | | $ 421,885,637 |

Verizon Communications, Inc.

| | 11,011,791 | | 428,248,552 |

| | | | | | 850,134,189 |

| ENTERTAINMENT — 23.9% | |

Activision Blizzard, Inc.

| | 5,180,389 | | 443,389,494 |

Electronic Arts, Inc.

| | 2,910,928 | | 350,621,278 |

Live Nation Entertainment, Inc. (a)

| | 1,592,835 | | 111,498,450 |

Netflix, Inc. (a)

| | 1,379,692 | | 476,655,992 |

Take-Two Interactive Software, Inc. (a)

| | 1,771,652 | | 211,358,084 |

Walt Disney Co. (a)

| | 4,316,745 | | 432,235,677 |

Warner Bros Discovery, Inc. (a)

| | 24,692,594 | | 372,858,169 |

| | | | | | 2,398,617,144 |

| INTERACTIVE MEDIA & SERVICES — 46.9% | |

Alphabet, Inc. Class A (a)

| | 12,146,129 | | 1,259,917,961 |

Alphabet, Inc. Class C (a)

| | 10,588,439 | | 1,101,197,656 |

Match Group, Inc. (a)

| | 3,120,920 | | 119,812,119 |

Meta Platforms, Inc. Class A (a)

| | 10,461,888 | | 2,217,292,543 |

| | | | | | 4,698,220,279 |

| MEDIA — 16.4% | |

Charter Communications, Inc. Class A (a)

| | 1,176,897 | | 420,870,136 |

Comcast Corp. Class A

| | 11,439,023 | | 433,653,362 |

DISH Network Corp. Class A (a) (b)

| | 2,808,647 | | 26,204,677 |

Fox Corp. Class A (b)

| | 3,317,698 | | 112,967,617 |

Fox Corp. Class B

| | 1,540,117 | | 48,221,063 |

Interpublic Group of Cos., Inc.

| | 4,341,395 | | 161,673,550 |

News Corp. Class A

| | 4,272,498 | | 73,786,041 |

News Corp. Class B

| | 1,317,261 | | 22,959,859 |

Omnicom Group, Inc.

| | 2,265,013 | | 213,681,326 |

| Security Description | | | Shares | | Value |

Paramount Global Class B (b)

| | 5,643,181 | | $ 125,899,368 |

| | | | | | 1,639,916,999 |

| WIRELESS TELECOMMUNICATION SERVICES — 4.2% | |

T-Mobile U.S., Inc. (a)

| | 2,895,298 | | 419,354,963 |

TOTAL COMMON STOCKS

(Cost $11,850,466,222)

| | | | | 10,006,243,574 |

| SHORT-TERM INVESTMENTS — 0.3% | | | |

State Street Institutional Liquid Reserves Fund, Premier Class 4.97% (c) (d)

| | 5,017,155 | | 5,017,656 |

State Street Navigator Securities Lending Portfolio II (e) (f)

| | 19,851,115 | | 19,851,115 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $24,868,628)

| | 24,868,771 | |

TOTAL INVESTMENTS — 100.2%

(Cost $11,875,334,850)

| | 10,031,112,345 | |

LIABILITIES IN EXCESS OF OTHER ASSETS — (0.2)%

| | (18,110,528) | |

NET ASSETS — 100.0%

| | $ 10,013,001,817 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the shares of the security are on loan at March 31, 2023. |

| (c) | The Fund invested in certain money market funds managed by SSGA Funds Management, Inc. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (d) | The rate shown is the annualized seven-day yield at March 31, 2023. |

| (e) | The Fund invested in an affiliated entity. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (f) | Investment of cash collateral for securities loaned. |

The following table summarizes the value of the Fund's investments according to the fair value hierarchy as of March 31, 2023.

| Description | | Level 1 –

Quoted Prices | | Level 2 –

Other Significant

Observable Inputs | | Level 3 –

Significant

Unobservable Inputs | | Total |

| ASSETS: | | | | | | | | |

| INVESTMENTS: | | | | | | | | |

Common Stocks

| | $10,006,243,574 | | $— | | $— | | $10,006,243,574 |

Short-Term Investments

| | 24,868,771 | | — | | — | | 24,868,771 |

TOTAL INVESTMENTS

| | $10,031,112,345 | | $— | | $— | | $10,031,112,345 |

See accompanying notes to financial statements.

12

THE COMMUNICATION SERVICES SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS (continued)

March 31, 2023 (Unaudited)

Affiliate Table

| | Number of

Shares Held

at

9/30/22 | | Value at

9/30/22 | | Cost of

Purchases | | Proceeds

from

Shares Sold | | Realized

Gain (Loss) | | Change in

Unrealized

Appreciation/

Depreciation | | Number of

Shares Held

at

3/31/23 | | Value at

3/31/23 | | Dividend

Income |

State Street Institutional Liquid Reserves Fund, Premier Class

| 5,928,151 | | $ 5,929,337 | | $101,951,229 | | $102,861,674 | | $(404) | | $(832) | | 5,017,155 | | $ 5,017,656 | | $141,964 |

State Street Navigator Securities Lending Portfolio II

| 51,992,399 | | 51,992,399 | | 289,268,247 | | 321,409,531 | | — | | — | | 19,851,115 | | 19,851,115 | | 49,392 |

Total

| | | $57,921,736 | | $391,219,476 | | $424,271,205 | | $(404) | | $(832) | | | | $24,868,771 | | $191,356 |

See accompanying notes to financial statements.

13

THE CONSUMER DISCRETIONARY SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| Security Description | | | Shares | | Value |

| COMMON STOCKS — 99.9% | |

| AUTOMOBILE COMPONENTS — 1.3% | |

Aptiv PLC (a)

| | 1,224,754 | | $ 137,405,151 |

BorgWarner, Inc.

| | 1,058,347 | | 51,975,421 |

| | | | | | 189,380,572 |

| AUTOMOBILES — 20.0% | |

Ford Motor Co.

| | 17,698,225 | | 222,997,635 |

General Motors Co.

| | 6,304,100 | | 231,234,388 |

Tesla, Inc. (a)

| | 11,638,471 | | 2,414,517,194 |

| | | | | | 2,868,749,217 |

| BROADLINE RETAIL — 23.9% | |

Amazon.com, Inc. (a)

| | 31,441,601 | | 3,247,602,967 |

eBay, Inc.

| | 2,452,965 | | 108,838,057 |

Etsy, Inc. (a) (b)

| | 568,163 | | 63,253,587 |

| | | | | | 3,419,694,611 |

| DISTRIBUTORS — 1.6% | |

Genuine Parts Co.

| | 637,184 | | 106,607,255 |

LKQ Corp.

| | 1,147,356 | | 65,123,926 |

Pool Corp. (b)

| | 176,486 | | 60,435,866 |

| | | | | | 232,167,047 |

| HOTELS, RESTAURANTS & LEISURE — 20.8% | |

Booking Holdings, Inc. (a)

| | 175,346 | | 465,089,484 |

Caesars Entertainment, Inc. (a)

| | 969,935 | | 47,342,527 |

Carnival Corp. (a) (b)

| | 4,529,892 | | 45,978,404 |

Chipotle Mexican Grill, Inc. (a)

| | 124,891 | | 213,350,046 |

Darden Restaurants, Inc. (b)

| | 550,157 | | 85,362,360 |

Domino's Pizza, Inc.

| | 160,042 | | 52,793,055 |

Expedia Group, Inc. (a)

| | 668,206 | | 64,836,028 |

Hilton Worldwide Holdings, Inc.

| | 1,204,387 | | 169,661,997 |

Las Vegas Sands Corp. (a)

| | 1,485,508 | | 85,342,435 |

Marriott International, Inc. Class A

| | 1,216,232 | | 201,943,161 |

McDonald's Corp.

| | 2,258,729 | | 631,563,216 |

MGM Resorts International

| | 1,422,263 | | 63,176,922 |

Norwegian Cruise Line Holdings Ltd. (a) (b)

| | 1,904,785 | | 25,619,358 |

Royal Caribbean Cruises Ltd. (a) (b)

| | 992,208 | | 64,791,182 |

Starbucks Corp.

| | 5,195,084 | | 540,964,097 |

Wynn Resorts Ltd. (a)

| | 466,125 | | 52,164,049 |

Yum! Brands, Inc.

| | 1,265,684 | | 167,171,543 |

| | | | | | 2,977,149,864 |

| HOUSEHOLD DURABLES — 3.8% | |

DR Horton, Inc.

| | 1,412,492 | | 137,986,344 |

Garmin Ltd.

| | 693,135 | | 69,951,184 |

Lennar Corp. Class A

| | 1,146,020 | | 120,458,162 |

Mohawk Industries, Inc. (a)

| | 238,375 | | 23,889,943 |

Newell Brands, Inc. (b)

| | 1,701,278 | | 21,163,898 |

NVR, Inc. (a)

| | 13,675 | | 76,199,698 |

PulteGroup, Inc.

| | 1,019,765 | | 59,431,904 |

Whirlpool Corp.

| | 246,373 | | 32,526,164 |

| | | | | | 541,607,297 |

| Security Description | | | Shares | | Value |

| LEISURE EQUIPMENT & PRODUCTS — 0.2% | |

Hasbro, Inc.

| | 586,834 | | $ 31,507,118 |

| SPECIALTY RETAIL — 23.0% | |

Advance Auto Parts, Inc.

| | 267,842 | | 32,572,267 |

AutoZone, Inc. (a)

| | 84,842 | | 208,554,362 |

Bath & Body Works, Inc.

| | 1,032,511 | | 37,769,252 |

Best Buy Co., Inc.

| | 890,156 | | 69,672,510 |

CarMax, Inc. (a) (b)

| | 714,343 | | 45,917,968 |

Home Depot, Inc.

| | 4,410,392 | | 1,301,594,887 |

Lowe's Cos., Inc.

| | 2,733,393 | | 546,596,598 |

O'Reilly Automotive, Inc. (a)

| | 281,824 | | 239,262,940 |

Ross Stores, Inc.

| | 1,556,679 | | 165,210,342 |

TJX Cos., Inc.

| | 5,223,139 | | 409,285,172 |

Tractor Supply Co.

| | 499,337 | | 117,364,169 |

Ulta Beauty, Inc. (a)

| | 229,969 | | 125,487,184 |

| | | | | | 3,299,287,651 |

| TEXTILES, APPAREL & LUXURY GOODS — 5.3% | |

NIKE, Inc. Class B

| | 5,390,487 | | 661,089,325 |

Ralph Lauren Corp. (b)

| | 185,819 | | 21,679,503 |

Tapestry, Inc.

| | 1,067,136 | | 46,004,233 |

VF Corp.

| | 1,493,322 | | 34,212,007 |

| | | | | | 762,985,068 |

TOTAL COMMON STOCKS

(Cost $16,926,965,505)

| | | | | 14,322,528,445 |

| SHORT-TERM INVESTMENTS — 0.4% | | | |

State Street Institutional Liquid Reserves Fund, Premier Class 4.97% (c) (d)

| | 14,880,916 | | 14,882,404 |

State Street Navigator Securities Lending Portfolio II (e) (f)

| | 38,484,345 | | 38,484,345 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $53,367,741)

| | 53,366,749 | |

TOTAL INVESTMENTS — 100.3%

(Cost $16,980,333,246)

| | 14,375,895,194 | |

LIABILITIES IN EXCESS OF OTHER ASSETS — (0.3)%

| | (41,198,636) | |

NET ASSETS — 100.0%

| | $ 14,334,696,558 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the shares of the security are on loan at March 31, 2023. |

| (c) | The Fund invested in certain money market funds managed by SSGA Funds Management, Inc. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (d) | The rate shown is the annualized seven-day yield at March 31, 2023. |

| (e) | The Fund invested in an affiliated entity. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (f) | Investment of cash collateral for securities loaned. |

See accompanying notes to financial statements.

14

THE CONSUMER DISCRETIONARY SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS (continued)

March 31, 2023 (Unaudited)

The following table summarizes the value of the Fund's investments according to the fair value hierarchy as of March 31, 2023.

| Description | | Level 1 –

Quoted Prices | | Level 2 –

Other Significant

Observable Inputs | | Level 3 –

Significant

Unobservable Inputs | | Total |

| ASSETS: | | | | | | | | |

| INVESTMENTS: | | | | | | | | |

Common Stocks

| | $14,322,528,445 | | $— | | $— | | $14,322,528,445 |

Short-Term Investments

| | 53,366,749 | | — | | — | | 53,366,749 |

TOTAL INVESTMENTS

| | $14,375,895,194 | | $— | | $— | | $14,375,895,194 |

Affiliate Table

| | Number of

Shares Held

at

9/30/22 | | Value at

9/30/22 | | Cost of

Purchases | | Proceeds

from

Shares Sold | | Realized

Gain (Loss) | | Change in

Unrealized

Appreciation/

Depreciation | | Number of

Shares Held

at

3/31/23 | | Value at

3/31/23 | | Dividend

Income |

State Street Institutional Liquid Reserves Fund, Premier Class

| 17,296,217 | | $ 17,299,677 | | $103,976,660 | | $ 106,393,218 | | $2,648 | | $(3,363) | | 14,880,916 | | $14,882,404 | | $354,625 |

State Street Navigator Securities Lending Portfolio II

| 115,679,767 | | 115,679,767 | | 890,244,292 | | 967,439,714 | | — | | — | | 38,484,345 | | 38,484,345 | | 164,180 |

Total

| | | $132,979,444 | | $994,220,952 | | $1,073,832,932 | | $2,648 | | $(3,363) | | | | $53,366,749 | | $518,805 |

See accompanying notes to financial statements.

15

THE CONSUMER STAPLES SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| Security Description | | | Shares | | Value |

| COMMON STOCKS — 99.5% | |

| BEVERAGES — 25.6% | |

Brown-Forman Corp. Class B

| | 1,406,274 | | $ 90,381,230 |

Coca-Cola Co.

| | 26,506,336 | | 1,644,188,022 |

Constellation Brands, Inc. Class A

| | 1,249,163 | | 282,173,430 |

Keurig Dr Pepper, Inc.

| | 6,538,208 | | 230,667,978 |

Molson Coors Beverage Co. Class B (a)

| | 1,445,703 | | 74,713,931 |

Monster Beverage Corp. (b)

| | 5,861,048 | | 316,555,203 |

PepsiCo, Inc.

| | 9,379,604 | | 1,709,901,809 |

| | | | | | 4,348,581,603 |

| CONSUMER FINANCE — 24.7% | |

Costco Wholesale Corp.

| | 3,021,917 | | 1,501,499,900 |

Dollar General Corp.

| | 1,720,151 | | 362,022,979 |

Dollar Tree, Inc. (b)

| | 1,599,798 | | 229,651,003 |

Kroger Co.

| | 5,012,020 | | 247,443,427 |

Sysco Corp.

| | 3,905,686 | | 301,636,130 |

Target Corp.

| | 3,488,396 | | 577,783,030 |

Walgreens Boots Alliance, Inc. (a)

| | 5,508,130 | | 190,471,135 |

Walmart, Inc.

| | 5,284,211 | | 779,156,912 |

| | | | | | 4,189,664,516 |

| FOOD PRODUCTS — 18.0% | |

Archer-Daniels-Midland Co.

| | 4,209,324 | | 335,314,750 |

Bunge Ltd.

| | 1,152,047 | | 110,043,529 |

Campbell Soup Co.

| | 1,542,908 | | 84,829,082 |

Conagra Brands, Inc.

| | 3,667,231 | | 137,741,196 |

General Mills, Inc.

| | 4,536,570 | | 387,695,272 |

Hershey Co.

| | 1,130,771 | | 287,679,450 |

Hormel Foods Corp. (a)

| | 2,227,084 | | 88,816,110 |

J.M. Smucker Co.

| | 820,071 | | 129,054,573 |

Kellogg Co.

| | 1,968,350 | | 131,800,716 |

Kraft Heinz Co.

| | 6,126,246 | | 236,901,933 |

Lamb Weston Holdings, Inc.

| | 1,106,405 | | 115,641,451 |

McCormick & Co., Inc.

| | 1,929,084 | | 160,519,080 |

Mondelez International, Inc. Class A

| | 10,489,622 | | 731,336,446 |

Tyson Foods, Inc. Class A

| | 2,196,538 | | 130,298,634 |

| | | | | | 3,067,672,222 |

| HOUSEHOLD PRODUCTS — 20.8% | |

Church & Dwight Co., Inc.

| | 1,876,429 | | 165,895,088 |

| Security Description | | | Shares | | Value |

Clorox Co.

| | 950,480 | | $ 150,403,955 |

Colgate-Palmolive Co.

| | 6,426,373 | | 482,941,931 |

Kimberly-Clark Corp.

| | 2,596,899 | | 348,555,784 |

Procter & Gamble Co.

| | 16,066,566 | | 2,388,937,698 |

| | | | | | 3,536,734,456 |

| PERSONAL CARE PRODUCTS — 2.6% | |

Estee Lauder Cos., Inc. Class A

| | 1,782,494 | | 439,313,471 |

| TOBACCO — 7.8% | |

Altria Group, Inc.

| | 13,738,266 | | 613,001,429 |

Philip Morris International, Inc.

| | 7,359,235 | | 715,685,604 |

| | | | | | 1,328,687,033 |

TOTAL COMMON STOCKS

(Cost $17,710,665,241)

| | | | | 16,910,653,301 |

| SHORT-TERM INVESTMENTS — 0.2% | | | |

State Street Institutional Liquid Reserves Fund, Premier Class 4.97% (c) (d)

| | 33,330,731 | | 33,334,064 |

State Street Navigator Securities Lending Portfolio II (e) (f)

| | 2,794,700 | | 2,794,700 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $36,129,705)

| | 36,128,764 | |

TOTAL INVESTMENTS — 99.7%

(Cost $17,746,794,946)

| | 16,946,782,065 | |

OTHER ASSETS IN EXCESS OF LIABILITIES — 0.3%

| | 42,893,025 | |

NET ASSETS — 100.0%

| | $ 16,989,675,090 | |

| (a) | All or a portion of the shares of the security are on loan at March 31, 2023. |

| (b) | Non-income producing security. |

| (c) | The Fund invested in certain money market funds managed by SSGA Funds Management, Inc. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (d) | The rate shown is the annualized seven-day yield at March 31, 2023. |

| (e) | The Fund invested in an affiliated entity. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (f) | Investment of cash collateral for securities loaned. |

The following table summarizes the value of the Fund's investments according to the fair value hierarchy as of March 31, 2023.

| Description | | Level 1 –

Quoted Prices | | Level 2 –

Other Significant

Observable Inputs | | Level 3 –

Significant

Unobservable Inputs | | Total |

| ASSETS: | | | | | | | | |

| INVESTMENTS: | | | | | | | | |

Common Stocks

| | $16,910,653,301 | | $— | | $— | | $16,910,653,301 |

Short-Term Investments

| | 36,128,764 | | — | | — | | 36,128,764 |

TOTAL INVESTMENTS

| | $16,946,782,065 | | $— | | $— | | $16,946,782,065 |

See accompanying notes to financial statements.

16

THE CONSUMER STAPLES SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS (continued)

March 31, 2023 (Unaudited)

Affiliate Table

| | Number of

Shares Held

at

9/30/22 | | Value at

9/30/22 | | Cost of

Purchases | | Proceeds

from

Shares Sold | | Realized

Gain (Loss) | | Change in

Unrealized

Appreciation/

Depreciation | | Number of

Shares Held

at

3/31/23 | | Value at

3/31/23 | | Dividend

Income |

State Street Institutional Liquid Reserves Fund, Premier Class

| 16,130,664 | | $16,133,890 | | $ 331,627,450 | | $ 314,425,000 | | $(828) | | $(1,448) | | 33,330,731 | | $33,334,064 | | $551,723 |

State Street Navigator Securities Lending Portfolio II

| 24,693,312 | | 24,693,312 | | 1,012,493,859 | | 1,034,392,471 | | — | | — | | 2,794,700 | | 2,794,700 | | 60,178 |

Total

| | | $40,827,202 | | $1,344,121,309 | | $1,348,817,471 | | $(828) | | $(1,448) | | | | $36,128,764 | | $611,901 |

See accompanying notes to financial statements.

17

THE ENERGY SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| Security Description | | | Shares | | Value |

| COMMON STOCKS — 99.6% | |

| ENERGY EQUIPMENT & SERVICES — 8.6% | |

Baker Hughes Co. (a)

| | 28,927,417 | | $ 834,845,254 |

Halliburton Co.

| | 25,996,748 | | 822,537,107 |

Schlumberger NV

| | 33,063,841 | | 1,623,434,593 |

| | | | | | 3,280,816,954 |

| OIL, GAS & CONSUMABLE FUELS — 91.0% | |

APA Corp.

| | 9,244,999 | | 333,374,664 |

Chevron Corp.

| | 45,685,299 | | 7,454,013,385 |

ConocoPhillips

| | 16,179,794 | | 1,605,197,363 |

Coterra Energy, Inc. (a)

| | 22,672,234 | | 556,376,622 |

Devon Energy Corp. (a)

| | 18,797,069 | | 951,319,662 |

Diamondback Energy, Inc.

| | 5,284,537 | | 714,310,866 |

EOG Resources, Inc. (a)

| | 15,084,799 | | 1,729,170,509 |

EQT Corp. (a)

| | 10,554,354 | | 336,789,436 |

Exxon Mobil Corp.

| | 79,965,173 | | 8,768,980,871 |

Hess Corp. (a)

| | 7,978,820 | | 1,055,917,039 |

Kinder Morgan, Inc. (a)

| | 56,884,130 | | 996,041,116 |

Marathon Oil Corp.

| | 18,261,312 | | 437,541,036 |

Marathon Petroleum Corp. (a)

| | 13,054,692 | | 1,760,164,122 |

Occidental Petroleum Corp. (a)

| | 20,908,576 | | 1,305,322,400 |

ONEOK, Inc.

| | 12,852,135 | | 816,624,658 |

Phillips 66 (a)

| | 13,399,772 | | 1,358,468,885 |

Pioneer Natural Resources Co. (a)

| | 6,832,106 | | 1,395,389,330 |

Targa Resources Corp.

| | 6,509,402 | | 474,860,876 |

Valero Energy Corp. (a)

| | 11,085,631 | | 1,547,554,088 |

Williams Cos., Inc. (a)

| | 35,023,435 | | 1,045,799,769 |

| | | | | | 34,643,216,697 |

TOTAL COMMON STOCKS

(Cost $36,420,759,916)

| | | | | 37,924,033,651 |

| Security Description | | | Shares | | Value |

| SHORT-TERM INVESTMENTS — 0.3% | | | |

State Street Institutional Liquid Reserves Fund, Premier Class 4.97% (b) (c)

| | 92,476,067 | | $ 92,485,315 |

State Street Navigator Securities Lending Portfolio II (d) (e)

| | 22,111,247 | | 22,111,247 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $114,605,113)

| | 114,596,562 | |

TOTAL INVESTMENTS — 99.9%

(Cost $36,535,365,029)

| | 38,038,630,213 | |

OTHER ASSETS IN EXCESS OF LIABILITIES — 0.1%

| | 26,670,570 | |

NET ASSETS — 100.0%

| | $ 38,065,300,783 | |

| (a) | All or a portion of the shares of the security are on loan at March 31, 2023. |

| (b) | The Fund invested in certain money market funds managed by SSGA Funds Management, Inc. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (c) | The rate shown is the annualized seven-day yield at March 31, 2023. |

| (d) | The Fund invested in an affiliated entity. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (e) | Investment of cash collateral for securities loaned. |

At March 31, 2023, open futures contracts were as follows:

| Description | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | Value | | Unrealized

Appreciation

(Depreciation) |

| E-mini S&P 500 Energy Select Sector Index (long) | | 1,670 | | 06/16/2023 | | $143,495,440 | | $145,785,576 | | $2,290,136 |

During the period ended March 31, 2023, average notional value related to futures contracts was $179,857,223.

See accompanying notes to financial statements.

18

THE ENERGY SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS (continued)

March 31, 2023 (Unaudited)

The following table summarizes the value of the Fund's investments according to the fair value hierarchy as of March 31, 2023.

| Description | | Level 1 –

Quoted Prices | | Level 2 –

Other Significant

Observable Inputs | | Level 3 –

Significant

Unobservable Inputs | | Total |

| ASSETS: | | | | | | | | |

| INVESTMENTS: | | | | | | | | |

Common Stocks

| | $37,924,033,651 | | $— | | $— | | $37,924,033,651 |

Short-Term Investments

| | 114,596,562 | | — | | — | | 114,596,562 |

TOTAL INVESTMENTS

| | $38,038,630,213 | | $— | | $— | | $38,038,630,213 |

| OTHER FINANCIAL INSTRUMENTS: | | | | | | | | |

Futures Contracts(a)

| | $ 2,290,136 | | $— | | $— | | $ 2,290,136 |

TOTAL INVESTMENTS AND OTHER FINANCIAL INSTRUMENTS

| | $38,040,920,349 | | $— | | $— | | $38,040,920,349 |

| (a) | Futures Contracts are valued at unrealized appreciation (depreciation). |

Affiliate Table

| | Number of

Shares Held

at

9/30/22 | | Value at

9/30/22 | | Cost of

Purchases | | Proceeds

from

Shares Sold | | Realized

Gain (Loss) | | Change in

Unrealized

Appreciation/

Depreciation | | Number of

Shares Held

at

3/31/23 | | Value at

3/31/23 | | Dividend

Income |

State Street Institutional Liquid Reserves Fund, Premier Class

| 97,350,272 | | $ 97,369,742 | | $1,161,265,887 | | $1,166,154,559 | | $15,751 | | $(11,506) | | 92,476,067 | | $ 92,485,315 | | $2,266,955 |

State Street Navigator Securities Lending Portfolio II

| 32,065,518 | | 32,065,518 | | 2,131,923,106 | | 2,141,877,377 | | — | | — | | 22,111,247 | | 22,111,247 | | 185,151 |

Total

| | | $129,435,260 | | $3,293,188,993 | | $3,308,031,936 | | $15,751 | | $(11,506) | | | | $114,596,562 | | $2,452,106 |

See accompanying notes to financial statements.

19

THE FINANCIAL SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| Security Description | | | Shares | | Value |

| COMMON STOCKS — 99.7% | |

| BANKS — 24.1% | |

Bank of America Corp.

| | 46,401,530 | | $ 1,327,083,758 |

Citigroup, Inc.

| | 12,876,759 | | 603,791,229 |

Citizens Financial Group, Inc.

| | 3,274,106 | | 99,434,599 |

Comerica, Inc.

| | 876,512 | | 38,058,151 |

Fifth Third Bancorp (a)

| | 4,543,278 | | 121,032,926 |

First Republic Bank (a)

| | 1,243,361 | | 17,394,620 |

Huntington Bancshares, Inc. (a)

| | 9,593,999 | | 107,452,789 |

JPMorgan Chase & Co.

| | 19,500,572 | | 2,541,119,537 |

KeyCorp (a)

| | 6,205,042 | | 77,687,126 |

M&T Bank Corp.

| | 1,125,529 | | 134,579,503 |

PNC Financial Services Group, Inc.

| | 2,666,036 | | 338,853,176 |

Regions Financial Corp.

| | 6,209,394 | | 115,246,353 |

Truist Financial Corp.

| | 8,821,148 | | 300,801,147 |

U.S. Bancorp

| | 9,262,506 | | 333,913,341 |

Wells Fargo & Co.

| | 25,333,068 | | 946,950,082 |

Zions Bancorp NA (a)

| | 1,001,230 | | 29,966,814 |

| | | | | | 7,133,365,151 |

| CAPITAL MARKETS — 21.9% | |

Ameriprise Financial, Inc.

| | 700,131 | | 214,590,152 |

Bank of New York Mellon Corp.

| | 4,889,942 | | 222,198,964 |

BlackRock, Inc.

| | 995,739 | | 666,268,880 |

Cboe Global Markets, Inc.

| | 705,392 | | 94,691,822 |

Charles Schwab Corp.

| | 10,140,664 | | 531,167,980 |

CME Group, Inc.

| | 2,391,659 | | 458,050,532 |

FactSet Research Systems, Inc.

| | 254,268 | | 105,544,104 |

Franklin Resources, Inc. (a)

| | 1,908,612 | | 51,418,007 |

Goldman Sachs Group, Inc.

| | 2,251,260 | | 736,409,659 |

Intercontinental Exchange, Inc.

| | 3,715,280 | | 387,466,551 |

Invesco Ltd.

| | 3,043,427 | | 49,912,203 |

MarketAxess Holdings, Inc.

| | 250,102 | | 97,862,412 |

Moody's Corp.

| | 1,047,466 | | 320,545,545 |

Morgan Stanley

| | 8,685,865 | | 762,618,947 |

MSCI, Inc.

| | 531,574 | | 297,516,652 |

Nasdaq, Inc.

| | 2,253,595 | | 123,204,039 |

Northern Trust Corp. (a)

| | 1,385,573 | | 122,110,548 |

Raymond James Financial, Inc. (a)

| | 1,288,661 | | 120,193,411 |

S&P Global, Inc.

| | 2,188,661 | | 754,584,653 |

State Street Corp. (b)

| | 2,320,288 | | 175,622,599 |

T Rowe Price Group, Inc. (a)

| | 1,491,241 | | 168,361,109 |

| | | | | | 6,460,338,769 |

| CONSUMER FINANCE — 3.9% | |

American Express Co.

| | 3,957,989 | | 652,870,285 |

Capital One Financial Corp.

| | 2,535,036 | | 243,769,062 |

Discover Financial Services

| | 1,775,036 | | 175,444,558 |

Synchrony Financial

| | 2,905,636 | | 84,495,895 |

| | | | | | 1,156,579,800 |

| FINANCIAL SERVICES — 33.1% | |

Berkshire Hathaway, Inc. Class B (c)

| | 11,978,322 | | 3,698,546,484 |

Fidelity National Information Services, Inc.

| | 3,945,014 | | 214,332,611 |

| Security Description | | | Shares | | Value |

Fiserv, Inc. (c)

| | 4,221,909 | | $ 477,202,374 |

FleetCor Technologies, Inc. (c)

| | 490,251 | | 103,369,423 |

Global Payments, Inc.

| | 1,749,108 | | 184,076,126 |

Jack Henry & Associates, Inc.

| | 485,411 | | 73,161,146 |

Mastercard, Inc. Class A

| | 5,609,297 | | 2,038,474,623 |

PayPal Holdings, Inc. (c)

| | 7,521,695 | | 571,197,518 |

Visa, Inc. Class A (a)

| | 10,803,168 | | 2,435,682,257 |

| | | | | | 9,796,042,562 |

| INSURANCE — 16.7% | |

Aflac, Inc.

| | 3,722,250 | | 240,159,570 |

Allstate Corp.

| | 1,748,609 | | 193,763,363 |

American International Group, Inc.

| | 4,939,637 | | 248,760,119 |

Aon PLC Class A

| | 1,365,634 | | 430,570,744 |

Arch Capital Group Ltd. (c)

| | 2,459,007 | | 166,892,805 |

Arthur J Gallagher & Co.

| | 1,410,000 | | 269,747,100 |

Assurant, Inc.

| | 353,573 | | 42,453,510 |

Brown & Brown, Inc.

| | 1,562,755 | | 89,733,392 |

Chubb Ltd.

| | 2,759,208 | | 535,783,010 |

Cincinnati Financial Corp.

| | 1,044,967 | | 117,119,902 |

Everest Re Group Ltd.

| | 260,428 | | 93,238,433 |

Globe Life, Inc.

| | 601,308 | | 66,155,906 |

Hartford Financial Services Group, Inc.

| | 2,094,954 | | 145,997,344 |

Lincoln National Corp. (a)

| | 1,030,407 | | 23,153,245 |

Loews Corp.

| | 1,296,710 | | 75,235,114 |

Marsh & McLennan Cos., Inc.

| | 3,291,177 | | 548,145,530 |

MetLife, Inc.

| | 4,381,704 | | 253,875,930 |

Principal Financial Group, Inc. (a)

| | 1,512,688 | | 112,422,972 |

Progressive Corp.

| | 3,888,587 | | 556,301,256 |

Prudential Financial, Inc.

| | 2,446,660 | | 202,436,649 |

Travelers Cos., Inc.

| | 1,536,403 | | 263,354,838 |

W R Berkley Corp. (a)

| | 1,354,197 | | 84,312,305 |

Willis Towers Watson PLC

| | 709,669 | | 164,912,882 |

| | | | | | 4,924,525,919 |

TOTAL COMMON STOCKS

(Cost $34,110,154,568)

| | | | | 29,470,852,201 |

| SHORT-TERM INVESTMENTS — 1.8% | | | |

State Street Institutional Liquid Reserves Fund, Premier Class 4.97% (d) (e)

| | 52,800,007 | | 52,805,287 |

State Street Navigator Securities Lending Portfolio II (b) (f)

| | 469,204,050 | | 469,204,050 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $522,009,927)

| | 522,009,337 | |

TOTAL INVESTMENTS — 101.5%

(Cost $34,632,164,495)

| | 29,992,861,538 | |

LIABILITIES IN EXCESS OF OTHER ASSETS — (1.5)%

| | (449,057,426) | |

NET ASSETS — 100.0%

| | $ 29,543,804,112 | |

| (a) | All or a portion of the shares of the security are on loan at March 31, 2023. |

See accompanying notes to financial statements.

20

THE FINANCIAL SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS (continued)

March 31, 2023 (Unaudited)

| (b) | The Fund invested in an affiliated entity. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (c) | Non-income producing security. |

| (d) | The Fund invested in certain money market funds managed by SSGA Funds Management, Inc. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (e) | The rate shown is the annualized seven-day yield at March 31, 2023. |

| (f) | Investment of cash collateral for securities loaned. |

The following table summarizes the value of the Fund's investments according to the fair value hierarchy as of March 31, 2023.

| Description | | Level 1 –

Quoted Prices | | Level 2 –

Other Significant

Observable Inputs | | Level 3 –

Significant

Unobservable Inputs | | Total |

| ASSETS: | | | | | | | | |

| INVESTMENTS: | | | | | | | | |

Common Stocks

| | $29,470,852,201 | | $— | | $— | | $29,470,852,201 |

Short-Term Investments

| | 522,009,337 | | — | | — | | 522,009,337 |

TOTAL INVESTMENTS

| | $29,992,861,538 | | $— | | $— | | $29,992,861,538 |

Affiliate Table

| | Number of

Shares Held

at

9/30/22 | | Value at

9/30/22 | | Cost of

Purchases | | Proceeds

from

Shares Sold | | Realized

Gain (Loss) | | Change in

Unrealized

Appreciation/

Depreciation | | Number of

Shares Held

at

3/31/23 | | Value at

3/31/23 | | Dividend

Income |

State Street Corp.

| 2,979,555 | | $181,186,739 | | $ 133,057,589 | | $ 179,045,641 | | $(23,079,075) | | $63,502,987 | | 2,320,288 | | $175,622,599 | | $3,394,417 |

State Street Institutional Liquid Reserves Fund, Premier Class

| 62,474,114 | | 62,486,609 | | 530,972,057 | | 540,638,693 | | (7,705) | | (6,981) | | 52,800,007 | | 52,805,287 | | 997,718 |

State Street Navigator Securities Lending Portfolio II

| 122,805,648 | | 122,805,648 | | 1,777,234,722 | | 1,430,836,320 | | — | | — | | 469,204,050 | | 469,204,050 | | 256,817 |

Total

| | | $366,478,996 | | $2,441,264,368 | | $2,150,520,654 | | $(23,086,780) | | $63,496,006 | | | | $697,631,936 | | $4,648,952 |

See accompanying notes to financial statements.

21

THE HEALTH CARE SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| Security Description | | | Shares | | Value |

| COMMON STOCKS — 99.8% | |

| BIOTECHNOLOGY — 16.1% | |

AbbVie, Inc. (a)

| | 13,932,843 | | $ 2,220,477,189 |

Amgen, Inc.

| | 4,206,928 | | 1,017,024,844 |

Biogen, Inc. (a) (b)

| | 1,134,554 | | 315,440,049 |

Gilead Sciences, Inc.

| | 9,824,384 | | 815,129,140 |

Incyte Corp. (a) (b)

| | 1,459,044 | | 105,445,110 |

Moderna, Inc. (a) (b)

| | 2,602,951 | | 399,761,214 |

Regeneron Pharmaceuticals, Inc. (b)

| | 845,107 | | 694,399,069 |

Vertex Pharmaceuticals, Inc. (b)

| | 2,026,101 | | 638,363,642 |

| | | | | | 6,206,040,257 |

| HEALTH CARE EQUIPMENT & SUPPLIES — 20.1% | |

Abbott Laboratories

| | 13,736,606 | | 1,390,968,724 |

Align Technology, Inc. (b)

| | 572,423 | | 191,269,421 |

Baxter International, Inc.

| | 3,976,058 | | 161,268,913 |

Becton Dickinson & Co.

| | 2,236,718 | | 553,677,174 |

Boston Scientific Corp. (b)

| | 11,284,371 | | 564,557,081 |

Cooper Cos., Inc.

| | 388,765 | | 145,149,300 |

DENTSPLY SIRONA, Inc. (a)

| | 1,696,293 | | 66,630,389 |

Dexcom, Inc. (a) (b)

| | 3,044,308 | | 353,687,704 |

Edwards Lifesciences Corp. (b)

| | 4,870,943 | | 402,973,114 |

GE HealthCare Technologies, Inc. (a) (b)

| | 2,860,651 | | 234,659,202 |

Hologic, Inc. (b)

| | 1,942,519 | | 156,761,283 |

IDEXX Laboratories, Inc. (b)

| | 652,452 | | 326,278,196 |

Insulet Corp. (a) (b)

| | 545,190 | | 173,893,802 |

Intuitive Surgical, Inc. (b)

| | 2,760,578 | | 705,244,862 |

Medtronic PLC

| | 10,479,728 | | 844,875,671 |

ResMed, Inc. (a)

| | 1,157,401 | | 253,459,245 |

STERIS PLC

| | 782,162 | | 149,611,947 |

Stryker Corp. (a)

| | 2,656,279 | | 758,287,966 |

Teleflex, Inc. (a)

| | 370,326 | | 93,807,279 |

Zimmer Biomet Holdings, Inc.

| | 1,653,313 | | 213,608,040 |

| | | | | | 7,740,669,313 |

| HEALTH CARE PROVIDERS & SERVICES — 21.4% | |

AmerisourceBergen Corp. (a)

| | 1,274,752 | | 204,100,543 |

Cardinal Health, Inc. (a)

| | 2,029,820 | | 153,251,410 |

Centene Corp. (b)

| | 4,339,085 | | 274,273,563 |

Cigna Group

| | 2,353,051 | | 601,275,122 |

CVS Health Corp.

| | 10,116,794 | | 751,778,962 |

DaVita, Inc. (a) (b)

| | 433,802 | | 35,185,680 |

Elevance Health, Inc. (a)

| | 1,881,607 | | 865,181,715 |

HCA Healthcare, Inc.

| | 1,670,464 | | 440,467,947 |

Henry Schein, Inc. (a) (b)

| | 1,069,888 | | 87,238,668 |

Humana, Inc.

| | 984,616 | | 477,991,683 |

Laboratory Corp. of America Holdings (a)

| | 697,953 | | 160,124,377 |

McKesson Corp.

| | 1,078,826 | | 384,115,997 |

Molina Healthcare, Inc. (a) (b)

| | 460,079 | | 123,066,532 |

Quest Diagnostics, Inc. (a)

| | 874,592 | | 123,737,276 |

UnitedHealth Group, Inc.

| | 7,361,123 | | 3,478,793,119 |

Universal Health Services, Inc. Class B (a)

| | 506,422 | | 64,366,236 |

| | | | | | 8,224,948,830 |

| Security Description | | | Shares | | Value |

| LIFE SCIENCES TOOLS & SERVICES — 12.9% | |

Agilent Technologies, Inc.

| | 2,330,849 | | $ 322,449,651 |

Bio-Rad Laboratories, Inc. Class A (b)

| | 169,925 | | 81,397,474 |

Bio-Techne Corp.

| | 1,240,314 | | 92,018,896 |

Charles River Laboratories International, Inc. (a) (b)

| | 401,559 | | 81,042,637 |

Danaher Corp. (a)

| | 5,164,133 | | 1,301,568,081 |

Illumina, Inc. (a) (b)

| | 1,239,253 | | 288,188,285 |

IQVIA Holdings, Inc. (b)

| | 1,462,989 | | 290,973,882 |

Mettler-Toledo International, Inc. (b)

| | 174,149 | | 266,484,541 |

PerkinElmer, Inc. (a)

| | 995,111 | | 132,608,492 |

Thermo Fisher Scientific, Inc.

| | 3,089,848 | | 1,780,895,692 |

Waters Corp. (b)

| | 468,041 | | 144,919,535 |

West Pharmaceutical Services, Inc. (a)

| | 583,252 | | 202,079,320 |

| | | | | | 4,984,626,486 |

| PHARMACEUTICALS — 29.3% | |

Bristol-Myers Squibb Co.

| | 16,750,731 | | 1,160,993,166 |

Catalent, Inc. (a) (b)

| | 1,420,413 | | 93,335,338 |

Eli Lilly & Co.

| | 6,213,357 | | 2,133,791,061 |

Johnson & Johnson

| | 20,598,031 | | 3,192,694,805 |

Merck & Co., Inc.

| | 19,974,957 | | 2,125,135,675 |

Organon & Co. (a)

| | 2,003,945 | | 47,132,787 |

Pfizer, Inc.

| | 44,224,044 | | 1,804,340,995 |

Viatris, Inc.

| | 9,554,039 | | 91,909,855 |

Zoetis, Inc. (a)

| | 3,671,933 | | 611,156,529 |

| | | | | | 11,260,490,211 |

TOTAL COMMON STOCKS

(Cost $41,041,278,415)

| | | | | 38,416,775,097 |

| SHORT-TERM INVESTMENTS — 0.3% | | | |

State Street Institutional Liquid Reserves Fund, Premier Class 4.97% (c) (d)

| | 30,290,768 | | 30,293,797 |

State Street Navigator Securities Lending Portfolio II (e) (f)

| | 81,367,759 | | 81,367,759 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $111,663,758)

| | 111,661,556 | |

TOTAL INVESTMENTS — 100.1%

(Cost $41,152,942,173)

| | 38,528,436,653 | |

LIABILITIES IN EXCESS OF OTHER ASSETS — (0.1)%

| | (53,451,099) | |

NET ASSETS — 100.0%

| | $ 38,474,985,554 | |

| (a) | All or a portion of the shares of the security are on loan at March 31, 2023. |

| (b) | Non-income producing security. |

| (c) | The Fund invested in certain money market funds managed by SSGA Funds Management, Inc. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (d) | The rate shown is the annualized seven-day yield at March 31, 2023. |

See accompanying notes to financial statements.

22

THE HEALTH CARE SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS (continued)

March 31, 2023 (Unaudited)

| (e) | The Fund invested in an affiliated entity. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (f) | Investment of cash collateral for securities loaned. |

The following table summarizes the value of the Fund's investments according to the fair value hierarchy as of March 31, 2023.

| Description | | Level 1 –

Quoted Prices | | Level 2 –

Other Significant

Observable Inputs | | Level 3 –

Significant

Unobservable Inputs | | Total |

| ASSETS: | | | | | | | | |

| INVESTMENTS: | | | | | | | | |

Common Stocks

| | $38,416,775,097 | | $— | | $— | | $38,416,775,097 |

Short-Term Investments

| | 111,661,556 | | — | | — | | 111,661,556 |

TOTAL INVESTMENTS

| | $38,528,436,653 | | $— | | $— | | $38,528,436,653 |

Affiliate Table

| | Number of

Shares Held

at

9/30/22 | | Value at

9/30/22 | | Cost of

Purchases | | Proceeds

from

Shares Sold | | Realized

Gain (Loss) | | Change in

Unrealized

Appreciation/

Depreciation | | Number of

Shares Held

at

3/31/23 | | Value at

3/31/23 | | Dividend

Income |

State Street Institutional Liquid Reserves Fund, Premier Class

| 40,926,004 | | $ 40,934,189 | | $ 525,676,761 | | $ 536,317,894 | | $8,120 | | $(7,379) | | 30,290,768 | | $ 30,293,797 | | $1,233,499 |

State Street Navigator Securities Lending Portfolio II

| 158,598,098 | | 158,598,098 | | 1,307,942,950 | | 1,385,173,289 | | — | | — | | 81,367,759 | | 81,367,759 | | 105,310 |

Total

| | | $199,532,287 | | $1,833,619,711 | | $1,921,491,183 | | $8,120 | | $(7,379) | | | | $111,661,556 | | $1,338,809 |

See accompanying notes to financial statements.

23

THE INDUSTRIAL SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| Security Description | | | Shares | | Value |

| COMMON STOCKS — 99.8% | |

| AEROSPACE & DEFENSE — 20.2% | |

Boeing Co. (a)

| | 2,620,243 | | $ 556,618,220 |

General Dynamics Corp.

| | 1,048,698 | | 239,323,371 |

Howmet Aerospace, Inc.

| | 1,714,841 | | 72,657,813 |

Huntington Ingalls Industries, Inc.

| | 185,601 | | 38,423,119 |

L3Harris Technologies, Inc.

| | 886,739 | | 174,013,661 |

Lockheed Martin Corp.

| | 1,058,740 | | 500,498,160 |

Northrop Grumman Corp.

| | 670,453 | | 309,561,559 |

Raytheon Technologies Corp.

| | 6,825,674 | | 668,438,282 |

Textron, Inc. (b)

| | 972,328 | | 68,675,527 |

TransDigm Group, Inc.

| | 241,752 | | 178,183,312 |

| | | | | | 2,806,393,024 |

| AIR FREIGHT & LOGISTICS — 7.5% | |

C.H. Robinson Worldwide, Inc. (b)

| | 548,235 | | 54,478,112 |

Expeditors International of Washington, Inc. (b)

| | 741,201 | | 81,621,054 |

FedEx Corp.

| | 1,082,085 | | 247,245,602 |

United Parcel Service, Inc. Class B

| | 3,400,480 | | 659,659,115 |

| | | | | | 1,043,003,883 |

| BUILDING PRODUCTS — 5.1% | |

A O Smith Corp.

| | 590,844 | | 40,856,863 |

Allegion PLC

| | 409,110 | | 43,664,310 |

Carrier Global Corp.

| | 3,885,012 | | 177,739,299 |

Johnson Controls International PLC

| | 3,200,663 | | 192,743,926 |

Masco Corp.

| | 1,048,899 | | 52,151,258 |

Trane Technologies PLC

| | 1,066,877 | | 196,284,030 |

| | | | | | 703,439,686 |

| COMMERCIAL SERVICES & SUPPLIES — 5.7% | |

Cintas Corp.

| | 402,350 | | 186,159,298 |

Copart, Inc. (a)

| | 1,996,453 | | 150,153,230 |

Republic Services, Inc.

| | 956,579 | | 129,348,612 |

Rollins, Inc.

| | 1,078,060 | | 40,459,592 |

Waste Management, Inc.

| | 1,730,856 | | 282,423,774 |

| | | | | | 788,544,506 |

| CONSTRUCTION & ENGINEERING — 0.8% | |

Quanta Services, Inc. (b)

| | 665,512 | | 110,900,920 |

| ELECTRICAL EQUIPMENT — 6.4% | |

AMETEK, Inc.

| | 1,069,583 | | 155,442,497 |

Eaton Corp. PLC

| | 1,853,216 | | 317,530,029 |

Emerson Electric Co.

| | 2,662,884 | | 232,043,712 |

Generac Holdings, Inc. (a) (b)

| | 295,096 | | 31,873,319 |

Rockwell Automation, Inc. (b)

| | 534,570 | | 156,869,567 |

| | | | | | 893,759,124 |

| GROUND TRANSPORTATION — 9.4% | |

CSX Corp.

| | 9,797,108 | | 293,325,414 |

J.B. Hunt Transport Services, Inc.

| | 386,501 | | 67,815,465 |

Norfolk Southern Corp.

| | 1,061,496 | | 225,037,152 |

Old Dominion Freight Line, Inc.

| | 421,892 | | 143,797,669 |

Union Pacific Corp.

| | 2,850,922 | | 573,776,562 |

| | | | | | 1,303,752,262 |

| Security Description | | | Shares | | Value |

| INDUSTRIAL CONGLOMERATES — 9.7% | |

3M Co.

| | 2,565,321 | | $ 269,640,891 |

General Electric Co.

| | 5,075,515 | | 485,219,234 |

Honeywell International, Inc.

| | 3,113,127 | | 594,980,832 |

| | | | | | 1,349,840,957 |

| MACHINERY — 20.7% | |

Caterpillar, Inc.

| | 2,424,755 | | 554,880,934 |

Cummins, Inc.

| | 658,093 | | 157,205,256 |

Deere & Co.

| | 1,259,994 | | 520,226,323 |

Dover Corp.

| | 650,639 | | 98,858,090 |

Fortive Corp.

| | 1,643,561 | | 112,041,553 |

IDEX Corp.

| | 351,227 | | 81,143,974 |

Illinois Tool Works, Inc.

| | 1,293,636 | | 314,935,684 |

Ingersoll Rand, Inc.

| | 1,885,830 | | 109,717,589 |

Nordson Corp.

| | 250,271 | | 55,625,232 |

Otis Worldwide Corp.

| | 1,932,155 | | 163,073,882 |

PACCAR, Inc.

| | 2,431,042 | | 177,952,274 |

Parker-Hannifin Corp.

| | 597,762 | | 200,913,786 |

Pentair PLC

| | 766,154 | | 42,345,332 |

Snap-on, Inc.

| | 247,291 | | 61,053,675 |

Stanley Black & Decker, Inc. (b)

| | 689,061 | | 55,524,535 |

Westinghouse Air Brake Technologies Corp.

| | 846,980 | | 85,595,799 |

Xylem, Inc.

| | 839,495 | | 87,895,127 |

| | | | | | 2,878,989,045 |

| PASSENGER AIRLINES — 2.4% | |

Alaska Air Group, Inc. (a) (b)

| | 593,920 | | 24,920,883 |

American Airlines Group, Inc. (a) (b)

| | 3,030,146 | | 44,694,654 |

Delta Air Lines, Inc. (a)

| | 2,986,411 | | 104,285,472 |

Southwest Airlines Co.

| | 2,767,741 | | 90,062,292 |

United Airlines Holdings, Inc. (a)

| | 1,522,631 | | 67,376,422 |

| | | | | | 331,339,723 |

| PROFESSIONAL SERVICES — 8.9% | |

Automatic Data Processing, Inc.

| | 1,930,760 | | 429,845,099 |

Broadridge Financial Solutions, Inc.

| | 548,131 | | 80,339,561 |

CoStar Group, Inc. (a)

| | 1,894,084 | | 130,407,683 |

Equifax, Inc. (b)

| | 570,537 | | 115,727,725 |

Jacobs Solutions, Inc.

| | 590,146 | | 69,348,056 |

Leidos Holdings, Inc.

| | 636,568 | | 58,602,450 |

Paychex, Inc.

| | 1,495,234 | | 171,338,864 |

Robert Half International, Inc.

| | 501,515 | | 40,407,064 |

Verisk Analytics, Inc. (b)

| | 728,318 | | 139,735,092 |

| | | | | | 1,235,751,594 |

| TRADING COMPANIES & DISTRIBUTORS — 3.0% | |

Fastenal Co.

| | 2,658,632 | | 143,406,610 |

United Rentals, Inc.

| | 323,067 | | 127,856,996 |

W.W. Grainger, Inc.

| | 209,424 | | 144,253,345 |

| | | | | | 415,516,951 |

TOTAL COMMON STOCKS

(Cost $15,705,363,443)

| | | | | 13,861,231,675 |

See accompanying notes to financial statements.

24

THE INDUSTRIAL SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS (continued)

March 31, 2023 (Unaudited)

| Security Description | | | Shares | | Value |

| SHORT-TERM INVESTMENTS — 0.7% | | | |

State Street Institutional Liquid Reserves Fund, Premier Class 4.97% (c) (d)

| | 12,426,947 | | $ 12,428,190 |

State Street Navigator Securities Lending Portfolio II (e) (f)

| | 85,576,330 | | 85,576,330 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $98,005,629)

| | 98,004,520 | |

TOTAL INVESTMENTS — 100.5%

(Cost $15,803,369,072)

| | 13,959,236,195 | |

LIABILITIES IN EXCESS OF OTHER ASSETS — (0.5)%

| | (72,708,359) | |

NET ASSETS — 100.0%

| | $ 13,886,527,836 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the shares of the security are on loan at March 31, 2023. |

| (c) | The Fund invested in certain money market funds managed by SSGA Funds Management, Inc. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (d) | The rate shown is the annualized seven-day yield at March 31, 2023. |

| (e) | The Fund invested in an affiliated entity. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (f) | Investment of cash collateral for securities loaned. |

At March 31, 2023, open futures contracts were as follows:

| Description | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | Value | | Unrealized

Appreciation

(Depreciation) |

| E-mini S&P 500 Industrial Select Sector Index (long) | | 250 | | 06/16/2023 | | $25,116,250 | | $25,699,175 | | $582,925 |

During the period ended March 31, 2023, average notional value related to futures contracts was $24,192,663.

The following table summarizes the value of the Fund's investments according to the fair value hierarchy as of March 31, 2023.

| Description | | Level 1 –

Quoted Prices | | Level 2 –

Other Significant

Observable Inputs | | Level 3 –

Significant

Unobservable Inputs | | Total |

| ASSETS: | | | | | | | | |

| INVESTMENTS: | | | | | | | | |

Common Stocks

| | $13,861,231,675 | | $— | | $— | | $13,861,231,675 |

Short-Term Investments

| | 98,004,520 | | — | | — | | 98,004,520 |

TOTAL INVESTMENTS

| | $13,959,236,195 | | $— | | $— | | $13,959,236,195 |

| OTHER FINANCIAL INSTRUMENTS: | | | | | | | | |

Futures Contracts(a)

| | $ 582,925 | | $— | | $— | | $ 582,925 |

TOTAL INVESTMENTS AND OTHER FINANCIAL INSTRUMENTS

| | $13,959,819,120 | | $— | | $— | | $13,959,819,120 |

| (a) | Futures Contracts are valued at unrealized appreciation (depreciation). |

Affiliate Table

| | Number of

Shares Held

at

9/30/22 | | Value at

9/30/22 | | Cost of

Purchases | | Proceeds

from

Shares Sold | | Realized

Gain (Loss) | | Change in

Unrealized

Appreciation/

Depreciation | | Number of

Shares Held

at

3/31/23 | | Value at

3/31/23 | | Dividend

Income |

State Street Institutional Liquid Reserves Fund, Premier Class

| 17,536,831 | | $ 17,540,339 | | $ 184,988,762 | | $ 190,101,364 | | $4,453 | | $(4,000) | | 12,426,947 | | $12,428,190 | | $381,722 |

State Street Navigator Securities Lending Portfolio II

| 107,539,397 | | 107,539,397 | | 1,058,282,301 | | 1,080,245,367 | | — | | — | | 85,576,330 | | 85,576,330 | | 153,354 |

Total

| | | $125,079,736 | | $1,243,271,063 | | $1,270,346,731 | | $4,453 | | $(4,000) | | | | $98,004,520 | | $535,076 |

See accompanying notes to financial statements.

25

THE MATERIALS SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| Security Description | | | Shares | | Value |

| COMMON STOCKS — 99.8% | |

| CHEMICALS — 68.0% | |

Air Products & Chemicals, Inc.

| | 1,313,604 | | $ 377,280,205 |

Albemarle Corp. (a)

| | 692,948 | | 153,169,226 |

Celanese Corp. (a)

| | 590,038 | | 64,249,238 |

CF Industries Holdings, Inc.

| | 1,160,442 | | 84,120,440 |

Corteva, Inc.

| | 4,216,293 | | 254,284,631 |

Dow, Inc.

| | 4,169,309 | | 228,561,519 |

DuPont de Nemours, Inc.

| | 2,709,769 | | 194,480,121 |

Eastman Chemical Co.

| | 702,693 | | 59,265,128 |

Ecolab, Inc.

| | 1,465,722 | | 242,620,963 |

FMC Corp.

| | 745,078 | | 90,996,376 |

International Flavors & Fragrances, Inc.

| | 1,508,082 | | 138,683,221 |

Linde PLC

| | 2,913,294 | | 1,035,501,219 |

LyondellBasell Industries NV Class A

| | 1,502,310 | | 141,051,886 |

Mosaic Co. (a)

| | 2,013,920 | | 92,398,649 |

PPG Industries, Inc.

| | 1,390,171 | | 185,699,042 |

Sherwin-Williams Co.

| | 1,394,858 | | 313,522,233 |

| | | | | | 3,655,884,097 |

| CONSTRUCTION MATERIALS — 4.9% | |

Martin Marietta Materials, Inc.

| | 367,263 | | 130,400,401 |

Vulcan Materials Co.

| | 786,132 | | 134,868,806 |

| | | | | | 265,269,207 |

| CONTAINERS & PACKAGING — 9.8% | |

Amcor PLC

| | 8,788,276 | | 100,010,581 |

Avery Dennison Corp.

| | 478,924 | | 85,693,871 |

Ball Corp. (a)

| | 1,856,814 | | 102,329,020 |

International Paper Co.

| | 2,103,758 | | 75,861,514 |

Packaging Corp. of America

| | 547,333 | | 75,986,240 |

Sealed Air Corp.

| | 855,640 | | 39,282,432 |

Westrock Co.

| | 1,506,245 | | 45,895,285 |

| | | | | | 525,058,943 |

| Security Description | | | Shares | | Value |

| METALS & MINING — 17.1% | |

Freeport-McMoRan, Inc.

| | 8,454,362 | | $ 345,867,950 |

Newmont Corp.

| | 4,694,910 | | 230,144,488 |

Nucor Corp.

| | 1,496,479 | | 231,161,111 |

Steel Dynamics, Inc.

| | 986,567 | | 111,541,265 |

| | | | | | 918,714,814 |

TOTAL COMMON STOCKS

(Cost $6,245,066,205)

| | | | | 5,364,927,061 |

| SHORT-TERM INVESTMENTS — 0.9% | | | |

State Street Institutional Liquid Reserves Fund, Premier Class 4.97% (b) (c)

| | 10,317,415 | | 10,318,447 |

State Street Navigator Securities Lending Portfolio II (d) (e)

| | 40,291,447 | | 40,291,447 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $50,610,652)

| | 50,609,894 | |

TOTAL INVESTMENTS — 100.7%

(Cost $6,295,676,857)

| | 5,415,536,955 | |

LIABILITIES IN EXCESS OF OTHER ASSETS — (0.7)%

| | (38,184,210) | |

NET ASSETS — 100.0%

| | $ 5,377,352,745 | |

| (a) | All or a portion of the shares of the security are on loan at March 31, 2023. |

| (b) | The Fund invested in certain money market funds managed by SSGA Funds Management, Inc. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (c) | The rate shown is the annualized seven-day yield at March 31, 2023. |

| (d) | The Fund invested in an affiliated entity. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (e) | Investment of cash collateral for securities loaned. |

At March 31, 2023, open futures contracts were as follows:

| Description | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | Value | | Unrealized

Appreciation

(Depreciation) |

| E-mini S&P 500 Materials Select Sector Index (long) | | 150 | | 06/16/2023 | | $12,385,995 | | $12,927,000 | | $541,005 |

During the period ended March 31, 2023, average notional value related to futures contracts was $13,636,507.

See accompanying notes to financial statements.

26

THE MATERIALS SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS (continued)

March 31, 2023 (Unaudited)

The following table summarizes the value of the Fund's investments according to the fair value hierarchy as of March 31, 2023.

| Description | | Level 1 –

Quoted Prices | | Level 2 –

Other Significant

Observable Inputs | | Level 3 –

Significant

Unobservable Inputs | | Total |

| ASSETS: | | | | | | | | |

| INVESTMENTS: | | | | | | | | |

Common Stocks

| | $5,364,927,061 | | $— | | $— | | $5,364,927,061 |

Short-Term Investments

| | 50,609,894 | | — | | — | | 50,609,894 |

TOTAL INVESTMENTS

| | $5,415,536,955 | | $— | | $— | | $5,415,536,955 |

| OTHER FINANCIAL INSTRUMENTS: | | | | | | | | |

Futures Contracts(a)

| | $ 541,005 | | $— | | $— | | $ 541,005 |

TOTAL INVESTMENTS AND OTHER FINANCIAL INSTRUMENTS

| | $5,416,077,960 | | $— | | $— | | $5,416,077,960 |

| (a) | Futures Contracts are valued at unrealized appreciation (depreciation). |

Affiliate Table

| | Number of

Shares Held

at

9/30/22 | | Value at

9/30/22 | | Cost of

Purchases | | Proceeds

from

Shares Sold | | Realized

Gain (Loss) | | Change in

Unrealized

Appreciation/

Depreciation | | Number of

Shares Held

at

3/31/23 | | Value at

3/31/23 | | Dividend

Income |

State Street Institutional Liquid Reserves Fund, Premier Class

| 3,340,391 | | $3,341,060 | | $ 86,456,538 | | $ 79,478,412 | | $305 | | $(1,044) | | 10,317,415 | | $10,318,447 | | $264,280 |

State Street Navigator Securities Lending Portfolio II

| — | | — | | 486,590,281 | | 446,298,834 | | — | | — | | 40,291,447 | | 40,291,447 | | 75,344 |

Total

| | | $3,341,060 | | $573,046,819 | | $525,777,246 | | $305 | | $(1,044) | | | | $50,609,894 | | $339,624 |

See accompanying notes to financial statements.

27

THE REAL ESTATE SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS

March 31, 2023 (Unaudited)

| Security Description | | | Shares | | Value |

| COMMON STOCKS — 99.5% | |

| HEALTH CARE REITs — 7.2% | |

Healthpeak Properties, Inc. REIT

| | 2,873,226 | | $ 63,124,775 |

Ventas, Inc. REIT

| | 2,106,755 | | 91,327,829 |

Welltower, Inc. REIT

| | 2,488,192 | | 178,378,485 |

| | | | | | 332,831,089 |

| HOTEL & RESORT REITs — 1.3% | |

Host Hotels & Resorts, Inc. REIT

| | 3,757,264 | | 61,957,284 |

| INDUSTRIAL REITs — 13.0% | |

Prologis, Inc. REIT

| | 4,859,803 | | 606,357,620 |

| OFFICE REITs — 3.1% | |

Alexandria Real Estate Equities, Inc. REIT

| | 829,570 | | 104,185,696 |

Boston Properties, Inc. REIT

| | 749,615 | | 40,569,164 |

| | | | | | 144,754,860 |

| REAL ESTATE MANAGEMENT & DEVELOPMENT — 2.6% | |

CBRE Group, Inc. Class A (a)

| | 1,663,884 | | 121,147,394 |

| RESIDENTIAL REITs — 13.3% | |

AvalonBay Communities, Inc. REIT

| | 736,771 | | 123,821,734 |

Camden Property Trust REIT

| | 578,768 | | 60,678,037 |

Equity Residential REIT

| | 1,793,761 | | 107,625,660 |

Essex Property Trust, Inc. REIT

| | 339,463 | | 70,995,292 |

Invitation Homes, Inc. REIT

| | 3,059,217 | | 95,539,347 |

Mid-America Apartment Communities, Inc. REIT

| | 608,248 | | 91,869,778 |

UDR, Inc. REIT

| | 1,625,005 | | 66,722,705 |

| | | | | | 617,252,553 |

| RETAIL REITs — 11.9% | |

Federal Realty Investment Trust REIT

| | 384,692 | | 38,019,110 |

Kimco Realty Corp. REIT

| | 3,249,955 | | 63,471,621 |

Realty Income Corp. REIT

| | 3,302,252 | | 209,098,597 |

Regency Centers Corp. REIT

| | 809,273 | | 49,511,322 |

Simon Property Group, Inc. REIT

| | 1,721,568 | | 192,763,969 |

| | | | | | 552,864,619 |

| Security Description | | | Shares | | Value |

| SPECIALIZED REITs — 47.1% | |

American Tower Corp. REIT

| | 2,451,339 | | $ 500,906,611 |

Crown Castle, Inc. REIT

| | 2,279,755 | | 305,122,409 |

Digital Realty Trust, Inc. REIT

| | 1,514,066 | | 148,847,828 |

Equinix, Inc. REIT

| | 487,246 | | 351,323,856 |

Extra Space Storage, Inc. REIT

| | 705,333 | | 114,919,906 |

Iron Mountain, Inc. REIT

| | 1,527,623 | | 80,826,533 |

Public Storage REIT

| | 832,276 | | 251,463,871 |

SBA Communications Corp. REIT

| | 568,523 | | 148,424,300 |

VICI Properties, Inc. REIT

| | 5,285,110 | | 172,400,288 |

Weyerhaeuser Co. REIT

| | 3,859,243 | | 116,278,992 |

| | | | | | 2,190,514,594 |

TOTAL COMMON STOCKS

(Cost $5,815,008,126)

| | | | | 4,627,680,013 |

| SHORT-TERM INVESTMENT — 0.1% | | | |

State Street Institutional Liquid Reserves Fund, Premier Class 4.97% (b) (c)

(Cost $4,376,299)

| | 4,375,635 | | 4,376,073 |

TOTAL INVESTMENTS — 99.6%

(Cost $5,819,384,425)

| | 4,632,056,086 | |

OTHER ASSETS IN EXCESS OF LIABILITIES — 0.4%

| | 19,764,432 | |

NET ASSETS — 100.0%

| | $ 4,651,820,518 | |

| (a) | Non-income producing security. |

| (b) | The Fund invested in certain money market funds managed by SSGA Funds Management, Inc. Amounts related to these transactions during the period ended March 31, 2023 are shown in the Affiliate Table below. |

| (c) | The rate shown is the annualized seven-day yield at March 31, 2023. |

| REIT | Real Estate Investment Trust |

At March 31, 2023, open futures contracts were as follows:

| Description | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | Value | | Unrealized

Appreciation

(Depreciation) |

| E-mini S&P 500 Real Estate Select Sector Index (long) | | 485 | | 06/16/2023 | | $21,878,300 | | $22,340,313 | | $460,412 |

During the period ended March 31, 2023, average notional value related to futures contracts was $12,529,848.

See accompanying notes to financial statements.

28

THE REAL ESTATE SELECT SECTOR SPDR FUND

SCHEDULE OF INVESTMENTS (continued)

March 31, 2023 (Unaudited)

The following table summarizes the value of the Fund's investments according to the fair value hierarchy as of March 31, 2023.

| Description | | Level 1 –

Quoted Prices | | Level 2 –

Other Significant

Observable Inputs | | Level 3 –

Significant

Unobservable Inputs | | Total |

| ASSETS: | | | | | | | | |

| INVESTMENTS: | | | | | | | | |

Common Stocks

| | $4,627,680,013 | | $— | | $— | | $4,627,680,013 |

Short-Term Investment

| | 4,376,073 | | — | | — | | 4,376,073 |

TOTAL INVESTMENTS

| | $4,632,056,086 | | $— | | $— | | $4,632,056,086 |

| OTHER FINANCIAL INSTRUMENTS: | | | | | | | | |

Futures Contracts(a)

| | $ 460,412 | | $— | | $— | | $ 460,412 |

TOTAL INVESTMENTS AND OTHER FINANCIAL INSTRUMENTS

| | $4,632,516,498 | | $— | | $— | | $4,632,516,498 |

| (a) | Futures Contracts are valued at unrealized appreciation (depreciation). |

Affiliate Table

| | Number of

Shares Held

at

9/30/22 | | Value at

9/30/22 | | Cost of

Purchases | | Proceeds

from

Shares Sold | | Realized

Gain (Loss) | | Change in

Unrealized

Appreciation/

Depreciation | | Number of

Shares Held

at

3/31/23 | | Value at

3/31/23 | | Dividend

Income |

State Street Institutional Liquid Reserves Fund, Premier Class

| 14,197,398 | | $14,200,238 | | $138,369,321 | | $148,192,584 | | $(676) | | $(226) | | 4,375,635 | | $4,376,073 | | $99,249 |

State Street Navigator Securities Lending Portfolio II