UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant | [X] |

| Filed by a Party other than the Registrant | [ ] |

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

[X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

--------------------------------------------------------------------------------

streetTRACKS® Series Trust

--------------------------------------------------------------------------------

Payment of Filing Fee (Check the appropriate box:)

[X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| (1) | Title of each class of securities to which transactions applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rules 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount previously paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

streetTRACKS® Series Trust

State Street Financial Center

One Lincoln Street

Boston, Massachusetts 02111

April 14, 2005

Dear Shareholders of the FORTUNE 500® Index Fund:

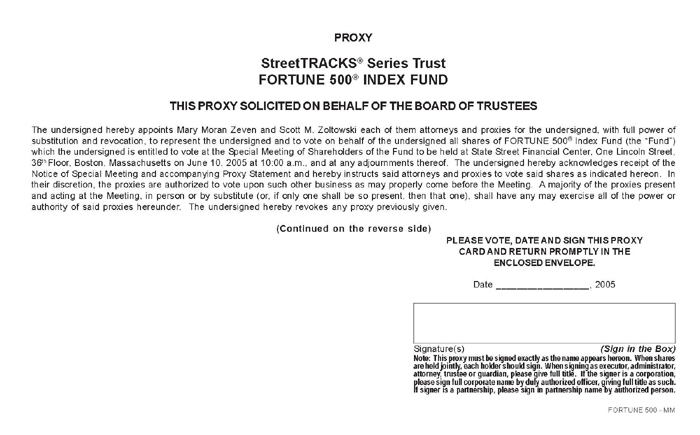

A special meeting of shareholders of the FORTUNE 500® Index Fund (the “Fund”), a series of streetTRACKS® Series Trust (the “Trust”), will be held at 10:00 a.m. Eastern Time on June 10, 2005, at State Street Financial Center, One Lincoln Street, 36th Floor, Boston, Massachusetts. A Notice and Proxy Statement regarding the meeting, a proxy card for your vote, and a postage prepaid envelope in which to return your proxy are enclosed.

Fortune, Inc. (“Fortune”), the sponsor of the Fortune 500® Index - the Fund’s underlying index, has informed the Trust that Fortune will no longer publish the Fortune 500 Index. At a meeting of the Board of Trustees of the Trust (the “Board”) held on March 28, 2005, the Board approved a new index, the Dow Jones Wilshire 5000 Composite Index (the “DJW Index”), to replace the Fortune 500 Index, and also approved a name change for the Fund. The Fund’s index is the basis for the Fund’s investment objective and may only be changed by shareholder vote. For this reason, shareholders are being asked to approve a change to the Fund’s investment objective, which includes the DJW Index.

Respectfully,

/s/ Mary Moran Zeven

MARY MORAN ZEVEN

Secretary

SHAREHOLDERS ARE STRONGLY URGED TO SIGN AND MAIL THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE TO ENSURE A QUORUM AT THE MEETING. |

streetTRACKS® SERIES TRUST

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS OF

THE FORTUNE 500® INDEX FUND

June 10, 2005

To the Shareholders of the FORTUNE 500® Fund:

NOTICE IS HEREBY GIVEN that a special meeting of shareholders of the FORTUNE 500® Index Fund (the “Fund”), a series of streetTRACKS® Series Trust (the “Trust”), will be held at State Street Financial Center, One Lincoln Street, 36th Floor, Boston, Massachusetts, 02111, on June 10, 2005, at 10:00 a.m. Eastern Time, for the following purposes:

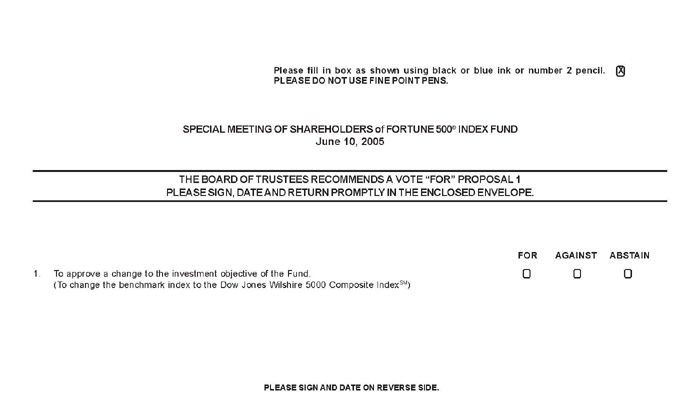

| 1. | To approve or disapprove a change to the investment objective of the Fund. |

| 2. | To transact such other business as may properly come before the meeting or any adjournments thereof. |

The Board of Trustees has fixed the close of business on April 7, 2005 as the record date (the “Record Date”) for the determination of shareholders entitled to notice of and to vote at the meeting or any adjournments thereof.

You are cordially invited to attend the meeting. Shareholders who do not expect to attend the meeting in person are requested to complete, date and sign the enclosed form of proxy and return it promptly in the envelope provided for that purpose. You may nevertheless vote in person at the meeting if you choose to attend the meeting.The enclosed proxy is being solicited by the Board of Trustees of the Trust.

By order of the Board of Trustees,

/s/Mary Moran Zeven

MARY MORAN ZEVEN

Secretary

April 14, 2005

streetTRACKS® SERIES TRUST

FORTUNE 500® Index Fund

State Street Financial Center

One Lincoln Street

Boston, Massachusetts 02111

_______________

PROXY STATEMENT

_______________

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees of the FORTUNE 500® Index Fund (the “Fund”), a series of streetTRACKS® Series Trust (the “Trust”), for use at the special meeting of shareholders, to be held at State Street Financial Center, One Lincoln Street, 36th Floor, Boston, Massachusetts, 02111, on June 10, 2005, at 10:00 a.m. Eastern Time, and at any adjournments thereof.

This Proxy Statement and the form of proxy are being mailed to shareholders on or about April 14, 2005. Any shareholder giving a proxy has the power to revoke it by mail (addressed to Secretary, streetTRACKS Series Trust, P.O. Box 5049, Boston, MA 02206-5049), or in person at the meeting, by executing a superseding proxy or by submitting a notice of revocation to the Trust. All properly executed proxies received in time for the meeting will be voted as specified in the proxy or, if no specification is made, for the proposal referred to in this Proxy Statement. For purposes of determining the presence of a quorum for transacting business at the Meeting, executed proxies marked as abstentions and broker “non-votes” (that is, proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owners or other persons entitled to vote shares on a particular matter with respect to which the brokers or nominees do not have discretionary power) will be treated as shares that are present for quorum purposes but which have not been voted. Accordingly, abstentions and broker non-votes will have the same effect as a “No” vote on Proposal 1 for which a “vote of a majority of the outstanding voting securities” of the Fund which is defined under the Investment Company Act of 1940, as amended (the “1940 Act”) as the lesser of the vote of (i) 67% or more of the shares of the Fund entitled to vote thereon, present at the special shareholder meeting, if the holders of more than 50% of such outstanding shares of such Fund are present in person or represented by proxy; or (ii) more than 50% of the outstanding shares of such Fund entitled to vote thereon, is required.

The Board of Trustees (the “Board”) has fixed the close of business on April 7, 2005 as the record date (the “Record Date”) for the determination of shareholders entitled to notice of and to vote at the meeting and at any adjournments thereof. Shareholders on the Record Date will be entitled to one vote for each share held, with no shares having cumulative voting rights. As of the Record Date, the Fund had outstanding 6,157 shares of beneficial interest.

Management of the Trust knows of no item of business other than that mentioned in Proposal 1 of the Notice of Meeting that will be presented for consideration at the meeting. If any other matter is properly presented, it is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment.

The Trust will furnish, without charge, a copy of its annual report for its fiscal year ended June 30, 2004 and/or its semi-annual report for the period ended December 31, 2004 to any shareholder requesting such reports. Requests for the reports should be made by writing to Distributor, State Street Global Markets, LLC, State Street Financial Center, One Lincoln Street, Boston, Massachusetts 02111, or by calling: 1-866-S-TRACKS.

1

PROPOSAL 1 -

APPROVAL OR DISAPPROVAL OF A CHANGE TO THEINVESTMENT OBJECTIVE OF THE FUND

APPROVAL OR DISAPPROVAL OF A CHANGE TO THEINVESTMENT OBJECTIVE OF THE FUND

Shareholders of the Fund are being asked to approve a change to the investment objective of the Fund due to a change in the Fund’s underlying index.

Fortune, Inc. (“Fortune”), the sponsor of the Fortune 500® Index - the Fund’s underlying index, has informed the Trust that Fortune will no longer publish the Fortune 500 Index. At a meeting of the Board of Trustees of the Trust (the “Board”) held on March 28, 2005, the Board approved a new index, the Dow Jones Wilshire 5000 Composite Indexsm (the “DJW Index”), to replace the Fortune 500 Index, and also approved a name change for the Fund to reflect the new index, the streetTRACKS® Total Market ETF. The Fund’s index is the basis for the Fund’s investment objective and may only be changed by shareholder vote. For this reason, shareholders are being asked to approve a change to the Fund’s investment objective, which includes the DJW Index.

The Board recommends that shareholders vote in favor of the change in investment objective of the Fund. The reasons for the Board’s decision and a detailed description of the DJW Index are set forth below. Further information regarding the DJW Index, including historical performance data, and DJW Index disclaimers may be found at Appendix A.

The Fund’s Current Benchmark Index and Investment Objective

The Fund’s current benchmark index is theFortune 500® Index. Pursuant to a license agreement, Fortune compiled and provided the Fortune 500 Index to the Fund. The current investment objective of the Fund is:

The Fund’s investment objective is to replicate as closely as possible, before expenses, the total return performance of the Fortune 500® Index. There is no assurance that the Fund will achieve its investment objective.

In January 2005, Fortune notified the Trust that it would no longer compile the Fortune 500® Index. Therefore, unless a new benchmark index for the Fund is approved, the Fund would be forced to liquidate its assets.

The Proposed Investment Objective

The Fund may only change its investment objective by shareholder approval. If Proposal 1 is approved by shareholders, the investment objective of the Fund will be changed to:

The Fund’s investment objective is to replicate as closely as possible, before expenses, the total return performance of the Dow Jones Wilshire 5000 Composite Indexsm. There is no assurance that the Fund will achieve its investment objective.

Description of the Dow Jones Wilshire 5000 Composite Index

If Proposal 1 is approved by shareholders, the Fund’s benchmark index will be changed to the DJW Index, which isthe most comprehensive measure of the U.S. stock market. The DJW Index is designed to represent the performance of all listed U.S.-headquartered equity securities with readily available price data.The DJW Index consists of all the U.S. common stocks regularly traded on the NYSE, AMEX and the NASDAQ National Market. As of December 31, 2004, the DJW Index was comprised of 4,989 stocks.

The DJW Index is a float-adjusted market capitalization weighted index that reflects shares of securities actually available to investors in the marketplace. The DJW Index, originally named the Wilshire 5000 Total Market Index, was first calculated by the founder of Wilshire Associates (“Wilshire”) in 1974. In April of 2004 the DJW Index was co-branded by Dow Jones & Company, Inc. (“Dow Jones”) and Wilshire and at that time Dow Jones took over the calculation of the Index. As of December 31, 2004, the market capitalization of the DJW Index was $14.9 trillion.

2

To be included in the DJW Index, an issue must be all of the following:

| · | An equity issue: a common stock, real estate investment trust (REIT) or limited partnership; |

| · | A U.S.-headquartered company; and |

| · | A security that has its primary market listing in the U.S. |

The DJW Index does not include bulletin board listed stocks. The aggregate value of the DJW Index is based on the following criteria:

| · | Market capitalization; |

| · | Trading volume; |

| · | Institutional holdings; and |

| · | If applicable, any conversion rules for companies with multiple share classes. |

The capitalization float adjustment of the DJW Index is based on the following rules:

| · | Shares outstanding for multiple classes of stock of one company are combined into the primary class’s shares outstanding to reflect the company's total market capitalization. |

| · | Float adjustments are based on block ownership of each class of stock, and then are combined to determine total float for a company's combined shares. |

| · | Float-adjustment factors will be implemented only if the blocked shares are greater than 5% of the company's total shares outstanding. |

Periodic adjustment and ongoing maintenance and review of the DJW Index are based on the following rules:

| · | Stock additions and deletions are made after the close of trading on the third Friday of each month. The additions include all new non-component companies that met inclusion standards as of the close of trading on the second Friday of that month, whether from initial public offerings or new exchange listing. |

| · | An issue that becomes a pink sheet or otherwise stops trading for ten consecutive days will be removed from the DJW Index at the next monthly review. It will be removed at its latest quoted value, or at $0.01 if no recent quoted value is available. Until the monthly review, the issue will remain in the DJW Index at its last exchange-traded price. |

| · | Additions and deletions are pre-announced by the second day prior to the implementation date. |

| · | An issue that fails index inclusion guidelines is removed from the DJW Index as soon as prudently possible. |

| · | Periodic shares updates are made quarterly after the close of trading on the third Friday of March, June, September and December. The changes become effective at the opening of trading on the next business day. |

| · | If the cumulative impact of corporate actions during the period between quarterly shares updates changes a company's float-adjusted shares outstanding by 10% or more, the company's shares and float factor will be updated as soon as prudently possible. Share and float changes based on corporate actions will be implemented using standard Dow Jones Indexes procedures. |

| · | Except to account for stock splits and reverse splits, shares and float factors will not be adjusted for bulletin board and pink sheet stocks until they are returned to exchange listings. Companies that are re-listed as of the close of trading on the second Friday of each month will have their shares and float adjustments made at the same time as the monthly index additions and deletions, after the close of trading on the third Friday of each month. |

3

Change in Fund Strategy

Currently, in seeking to replicate the total return of the Fortune 500 Index, the Fund purchases all of the stocks in the Fortune 500 Index. If the Fund, however, changes its benchmark index to the DJW Index, because of the practical difficulties and expense of purchasing approximately 5,000 stocks, the Fund will not purchase all of the stocks in the DJW Index. Instead, the Fund will utilize a “sampling” methodology in seeking its objective. Sampling means that the Fund’s investment adviser,SSgA Funds Management, Inc. (“SSgA FM” or the “Adviser”),will use quantitative analysis to select stocks from the DJW Index universe to obtain a representative sample of stocks that resemble the DJW Index in terms of key risk factors, performance attributes and other characteristics. These include industry weightings, market capitalization, and other financial characteristics of stocks. The quantity of holdings in the Fund will be based on a number of factors, including asset size of the Fund. The Adviser generally expects the Fund to hold less than the total number of stocks in the DJW Index, but reserves the right to hold as many stocks as it believes necessary to achieve the Fund’s investment objective.

SSgA FM will continue to use an ‘‘indexing’’ investment approach, to attempt to replicate, before expenses, the total return performance of the DJW Index. SSgA FM will seek a correlation of 0.95 or better between the Fund’s performance and the total return performance of the DJW Index; a figure of 1.00 would represent perfect correlation.

Principal Risks

The principal risks of investing in the Fund will not change due to the change in investment objective. The principal risks are:

Unlike many investment companies, the Fund is not actively ‘‘managed.’’ Therefore, it may not sell a stock because the stock’s issuer was in financial trouble unless that stock is removed from the DJW Index or the stock is no longer included in the Adviser’s representative sample of stocks. An investment in the Fund involves risks similar to those of investing in any fund of equity securities traded on exchanges, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. You should anticipate that the value of the Shares will decline, more or less, in correlation with any decline in value of the DJW Index. In addition, the principal risks of investing in the Fund are:

| · | Stock values could decline generally or could underperform other investments. |

| · | Micro, small and mid-sized companies may be more volatile and more likely than large-capitalization companies to have relatively limited product lines, markets or financial resources, or depend on a few key employees. |

| · | The Fund’s return may not match the return of the DJW Index for a number of reasons. For example, the Fund incurs a number of operating expenses not applicable to the DJW Index, and incurs costs in buying and selling securities, especially when rebalancing the Fund’s securities holdings to reflect changes in the composition of the DJW Index or representative sample of the DJW Index. The Fund may not be fully invested at times, either as a result of cash flows into the Fund or reserves of cash held by the Fund to meet redemptions and pay expenses. Since the Fund utilizes a sampling approach and may hold futures or other derivative positions, its return may not correlate as well with the return on the DJW Index, as would be the case if the Fund purchased all of the stocks in the DJW Index. |

The Fund is classified as non-diversified. Although the Fund will hold a relatively large number of stocks, the Fund could become less diversified if the largest companies in the DJW Index substantially increase in value relative to the other component stocks. If this situation occurred, the performance of that large company could have a substantial impact on the Fund’s share price. The Fund intends to maintain the required level of diversification so as to qualify as a ‘‘regulated investment company’’ for purposes of the Internal Revenue Code, in order to avoid liability for federal income tax to the extent that its earnings are distributed to shareholders. Compliance with diversification requirements of the Internal Revenue Code could limit the investment flexibility of the Fund.

4

The Fund’s shares will change in value, and you could lose money by investing in the Fund. The Fund may not achieve its objective. An investment in the Fund is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Board Considerations

In connection with their consideration of the change in investment objective and new benchmark index, the Trustees received information from the Adviser, which the Trustees reviewed at a Special Board meeting held on March 28, 2005. At the meeting, at which the Board was represented by its counsel, the Adviser discussed the reason for the proposed change in benchmark index and the need to find a new benchmark index or else liquidate the Fund. The Adviser then reviewed detailed information regarding the DJW Index, including, but not limited to: (i) a description of the DJW Index; (ii) the methodology for calculation; (iii) the criteria for selecting component companies; (iv) the float-adjustment process and effect; (v) the on going component adjustment process; and (vi) historical data including the correlation of performance of the Fortune 500 Index and the DJW Index. The Adviser provided information to the Board regarding any change or effect on management caused by the change in the index, including any additional resources required to manage the Fund. The Adviser stated that the Fund would not bear any increase in management fee and that there should not be a material increase in other operating expenses due to the change in the index. Lastly, the Adviser provided information regarding any anticipated transaction costs or tax implications due to the change in the Fund’s portfolio that will be required due to the change in the index.

Based on its consideration of the forgoing factors and such other factors, it considered relevant, the Board determined that the DJW Index is an appropriate broad market index to replace the Fortune 500 Index and that the change in investment objective is in the best interests of the Fund and its shareholders. Accordingly, the Board of Trustees voted to approve Proposal 1.

Shareholder Approval

To become effective, the proposed change in investment objective must be approved by the “vote of a majority of the outstanding voting securities” of the Fund which is defined under the 1940 Act as the lesser of the vote of (i) 67% or more of the shares of the Fund entitled to vote thereon present at the special shareholder meeting, if the holders of more than 50% of such outstanding shares of such Fund are present in person or represented by proxy; or (ii) more than 50% of the outstanding shares of such Fund entitled to vote thereon. The Board determined to submit the Proposal for consideration by the shareholders of the Fund. If the shareholders do not approve the proposed change in investment objective, the Board in connection with the Adviser will consider other alternatives, such as the liquidation of the Fund.THE BOARD OF TRUSTEES RECOMMENDS A VOTE “FOR” APPROVAL OF THE PROPOSED CHANGE IN INVESTMENT OBJECTIVE.

5

PRINCIPAL HOLDERS

Although the Fund does not have information concerning the beneficial ownership of the Fund held in the names of DTC participants, as of April 7, 2005, the names, addresses and percentage ownership of each DTC participant that owned of record 5% or more of the outstanding shares of the Fund were as follows:

FUND | NAME AND ADDRESS | PERCENTAGE OF OWNERSHIP |

FORTUNE 500 Index Fund | Charles Schwab & Company, Inc. c/o ADP Proxy Services 51 Mercedes Way Edgewood, NY 11717 | 19.26% |

State Street Global Advisors State Street Financial Center One Lincoln Street Boston, MA 02110 | 12.90% | |

American Enterprise Investment Services LLC P.O. Box 9446 Minneapolis, MN 55440 | 9.07% | |

National Financial Services 200 Liberty Street New York, NY 10281 | 8.83% |

6

MISCELLANEOUS

Fund Management and Other Service Providers

INVESTMENT ADVISER: SSgA Funds Management, Inc. serves as the Adviser to the Fund and, subject to the supervision of the Board, is responsible for the investment management of the Fund. The Adviser, State Street Bank and Trust Company (‘‘State Street’’) and other affiliates of State Street make up State Street Global Advisors (‘‘SSgA’’), the investment management arm of State Street Corporation. As of December 31, 2004, the Adviser managed approximately $98 billion in assets. As of December 31, 2004, SSgA managed approximately $1.4 trillion in assets. The Adviser’s principal business address is State Street Financial Center, One Lincoln Street, Boston, Massachusetts 02111.

For the services provided to the Fund under the Investment Advisory Agreement between the Trust and SSgA FM, the Fund pays SSgA FM monthly fees based on 0.20% of the Fund’s average daily net assets.SSgA FM pays all expenses of the Fund other than the management fee, distribution and services (12b-1) fees, brokerage, taxes, interest, fees and expenses of the Independent Trustees (including any Trustee’s counsel fees), litigation expenses and other extraordinary expenses.

DISTRIBUTOR: State Street Global Markets, LLC is the Distributor of the Fund’s Shares. The Distributor will not distribute Shares in less than Creation Units, and it does not maintain a secondary market in the Fund’s Shares. The Distributor may enter into selected dealer agreements with other broker dealers or other qualified financial institutions for the sale of Creation Units of Shares.

ADMINISTRATOR, CUSTODIAN AND TRANSFER AGENT: State Street is the Administrator for the Trust, the Custodian for the Trust’s assets and serves as Transfer Agent to the Trust.

COUNSEL: Clifford Chance U.S. LLP serves as counsel to the Trust, including the Fund.

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS: Ernst & Young LLP serves as the independent registered public accounting firm to the Trust and will audit the Fund’s financial statements annually.

Proxies will be solicited by mail and may be solicited in person or by telephone or telegraph, by officers of the Trust or personnel of the Administrator. The expenses connected with the solicitation of proxies, including proxies solicited by the Trust's officers or agents in person, by telephone or by telegraph, will be borne by the Adviser. The Adviser will reimburse banks, brokers, and other persons holding the Trust's shares registered in their names or in the names of their nominees for their expenses incurred in sending proxy material to and obtaining proxies from the beneficial owners of such shares.

Shareholder Proposals

The Trust does not hold annual shareholder meetings. Any shareholder proposal intended to be presented at any future meeting of shareholders must be received by the Trust at its principal office a reasonable time before the solicitation of proxies for such meeting in order for such proposal to be considered for inclusion in that Proxy Statement relating to such meeting. Shareholders wishing to submit proposals for inclusion in a proxy statement for a subsequent shareholder meeting should send their written proposals to the Trust (addressed to Secretary, streetTRACKS Series Trust, P.O. Box 5049, Boston, MA 02206-5049).

7

In the event that sufficient votes in favor of the proposals set forth in the Notice of this meeting are not received by June 10, 2005, the persons named as attorneys in the enclosed proxy may propose one or more adjournments of the meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of the holders of a majority of the shares present in person or by proxy at the session of the meeting to be adjourned. The persons named as proxies in the enclosed proxy card will vote in favor of such adjournment those proxies which they are entitled to vote in favor of the proposal for which further solicitation of proxies is to be made. They will vote against any such adjournment those proxies required to be voted against such proposal. Abstentions and broker "non-votes'' will be counted as shares that are present for purposes of determining the presence of a quorum and will have the effect of a vote against the proposal set forth in this proxy statement and against adjournment of the meeting. The costs of any such additional solicitation and of any adjourned session will be borne by the Adviser.

By order of the Board of Trustees,

/s/Mary Moran Zeven

Mary Moran Zeven

Secretary

State Street Financial Center

One Lincoln Street

Boston, MA 02111

8

APPENDIX A

HISTORICAL INDEX DATA, STATISTICS AND CHARACTERISTICS

Dow Jones Wilshire 5000 Composite Index Statistics as of December 31

Year | Annual Performance1 | Market Cap ($Billions) | Holdings |

| 2004 | 12.48% | 14,945.4 | 4,989 |

| 2003 | 31.64% | 13,158.5 | 5,215 |

| 2002 | -20.86% | 10,142.3 | 5,639 |

| 2001 | -10.97% | 12,842.5 | 6,050 |

| 2000 | -10.89% | 14,441.6 | 6,653 |

| 1 | The Index performance results are hypothetical. An investor cannot invest directly in an index. The Index does not charge management fees or brokerage expenses and no such fees or expenses were deducted from the hypothetical performance shown. In addition the results actual investors might have received would have been different from those shown because of differences in the timing, amounts of their investments and fees and expenses associated with an investment in the Fund. Past performance is no guarantee of future results. |

Dow Jones Wilshire 5000 Composite IndexFundamental Characteristics

Period Ending December 31, 2004

| Total Market Value ($) | 13.6 trillion |

| Mean Market Value ($) | 2,719 million |

| Median Market Value ($) | 250 million |

| Weighted Average Market Value ($) | 77,784 million |

| Largest Company's Market Value ($) | 385 billion |

| Smallest Company's Market Value ($) | under 1 million |

By Exchange | Number of Companies | % Market Value of Companies |

| NYSE | 1675 | 79.6 |

| AMEX | 377 | 0.4 |

| NASDAQ | 2937 | 19.9 |

By Sector | Number of Companies | % Market Value of Companies |

| Capital Goods | 239 | 5.74 |

| Consumer Durables | 196 | 2.05 |

| Consumer Non-Durables | 1033 | 27.66 |

| Energy | 201 | 7.13 |

| Finance | 977 | 22.15 |

| Materials & Services | 1084 | 9.26 |

| Technology | 959 | 17.95 |

| Transportation | 101 | 1.58 |

| Utilities | 199 | 6.47 |

Capitalization Weighted Turnover | |

| Historical 5 Year Average | 6.56% |

| 2003 | 3.87% |

Source: www.wilshire.com. Some information may be based on estimated data.

A-1

INDEX DISCLAIMER

"Dow Jones," “Wilshire” "Dow Jones Wilshire 5000 Composite IndexSM," are service marks of Dow Jones & Company, Inc. and Wilshire Associates Incorporated and have been licensed for use for certain purposes by SSgA Funds Management, Inc. streetTRACKS® Total Market ETF, based on the Dow Jones Wilshire 5000 Composite IndexSM, is not sponsored, endorsed, sold or promoted by Dow Jones or Wilshire and neither Dow Jones nor Wilshire makes any representation regarding the advisability of investing in such product(s).

A-2