UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-08839

SPDR®SERIES TRUST

SPDR BLOOMBERG BARCLAYS EMERGING MARKETS LOCAL BOND ETF

SPDR BLOOMBERG BARCLAYS INTERNATIONAL CORPORATE BOND ETF

SPDR BLOOMBERG BARCLAYS INTERNATIONAL TREASURY BOND ETF

SPDR BLOOMBERG BARCLAYS SHORT TERM INTERNATIONAL TREASURY BOND ETF

SPDR FTSE INTERNATIONAL GOVERNMENT INFLATION-PROTECTED BOND ETF

(Exact name of registrant as specified in charter)

One Iron Street, Boston, Massachusetts 02210

(Address of principal executive offices) (zip code)

|

Sean O’Malley, Esq. Senior Vice President and Deputy General Counsel c/o SSGA Funds Management, Inc. One Iron Street Boston, Massachusetts 02210 |

| (Name and address of agent for service) |

|

| Copy to: |

|

W. John McGuire, Esq. Morgan, Lewis & Bockius LLP 1111 Pennsylvania Avenue, NW Washington, DC 20004 |

Registrant’s telephone number, including area code: (617)664-1465

Date of fiscal year end: December 31

Date of reporting period: June 30, 2019 to December 31, 2019

Item 1. Reports to Shareholders.

Annual Report

December 31, 2019

SPDR® Series Trust - Fixed Income Funds

| SPDR Bloomberg Barclays Emerging Markets Local Bond ETF |

| SPDR Bloomberg Barclays International Corporate Bond ETF |

| SPDR Bloomberg Barclays International Treasury Bond ETF |

| SPDR Bloomberg Barclays Short Term International Treasury Bond ETF |

| SPDR FTSE International Government Inflation-Protected Bond ETF |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of a Fund’s annual and semi- annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund (or from your financial intermediary, such as a broker-dealer or bank). Instead, the reports will be made available on a Fund’s website (www.spdrs.com), and you will be notified by mail each time a report is posted, and provided with a website link to access the report. If you already elected to receive reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account.

The information contained in this report is intended for the general information of shareholders of the Trust. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Trust prospectus which contains important information concerning the Trust. You may obtain a current prospectus and SAI from the Distributor by calling 1-866-787-2257 or visiting www.spdrs.com. Please read the prospectus carefully before you invest.

TABLE OF CONTENTS

The information contained in this report is intended for the general information of shareholders of the Trust. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Trust prospectus which contains important information concerning the Trust. You may obtain a current prospectus and SAI from the Distributor by calling 1-866-787-2257 or visiting www.spdrs.com. Please read the prospectus carefully before you invest.

Notes to Performance Summaries (Unaudited)

The performance chart of a Fund’s total return at net asset value (“NAV”), the total return based on market price and its benchmark index is provided for comparative purposes only and represents the periods noted. A Fund’s per share NAV is the value of one share of a Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of a Fund and the market return is based on the market price per share of a Fund. The market price used to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of a Fund are listed for trading, as of the time that a Fund’s NAV is calculated. NAV and market returns assume that dividends and capital gain distributions have been reinvested in a Fund at NAV. Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included market returns would be lower.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, a Fund’s performance is negatively impacted by these deductions. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

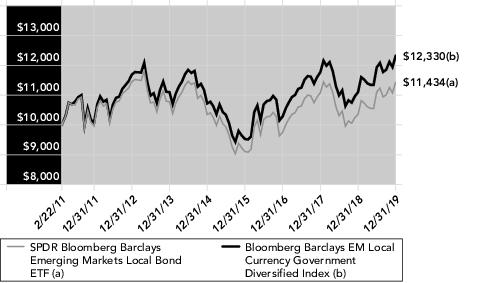

The Bloomberg Barclays EM Local Currency Government Diversified Index is designed to measure the performance of the fixed-rate local currency sovereign debt of emerging market countries. The Index includes government bonds issued by countries outside the United States, in local currencies, that have a remaining maturity of one year or more and are rated B3/B-/B- or higher.

The Bloomberg Barclays Global Aggregate ex-USD >$1B: Corporate Bond Index is designed to be a broad based measure of the global investment-grade, fixed rate, fixed income corporate markets outside the United States. The Index is part of the Barclays Global ex-USD Aggregate Bond Index (the “Aggregate Index”). The major components of the Aggregate Index are the Pan-European Aggregate and the Asian Pacific Aggregate Indices.

The Bloomberg Barclays Global Treasury ex-US Capped Index is designed to track the fixed-rate local currency sovereign debt of investment grade countries outside the United States. The Index includes government bonds issued by investment grade countries outside the United States, in local currencies, that have a remaining maturity of one year or more and are rated investment grade (Baa3/BBB-/BBB-or higher using the middle rating of Moody’s Investors Service, Inc., Standard & Poor’s, Inc. and Fitch Inc., respectively).

The Bloomberg Barclays 1-3 Year Global Treasury ex-US Capped index is designed to measure the performance of fixed-rate local currency sovereign debt of investment grade countries outside the United States that have remaining maturities of one to three years.

The FTSE International Inflation-Linked Securities Select Index is designed to measure the total return performance of inflation-linked bonds outside the United States with fixed-rate coupon payments that are linked to an inflation index. Inflation-protected public obligations of the inflation-linked government bond markets of developed and emerging market countries, commonly known in the United States as TIPS, are securities issued by such governments that are designed to provide inflation protection to investors. The FTSE International Inflation-Linked Securities Select Index prior to May 31, 2018 was known as the Citi International Inflation-Linked Securities Select Index.

See accompanying notes to financial statements.

1

SPDR BLOOMBERG BARCLAYS EMERGING MARKETS LOCAL BOND ETF

Management’s Discussion Of Fund Performance (Unaudited)

The SPDR Bloomberg Barclays Emerging Markets Local Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the fixed-rate local currency sovereign debt of emerging market countries. The Fund’s benchmark is the Bloomberg Barclays EM Local Currency Government Diversified Index (the “Index”).

The Board of Trustees approved a change in fiscal year end for the Fund from June 30 to December 31.For the 6-month period from July 1, 2019 through December 31, 2019 (the “Reporting Period”), the total return for the Fund was 2.94%, and the Index was 3.32%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, expenses and tax withholdings contributed to the difference between the Fund’s performance and that of the Index.

An uptick in emerging markets growth, improving economic data and the avoidance of a recession in the global markets with the support of accommodative central banks were positive drivers of the Fund’s performance. Towards the end of the Reporting Period, receding tail-risks improved investor sentiment and risk appetite, positively influencing the performance of the Fund. Almost all country returns were in the positive territory for the Index. Russia and Argentina were the best and worst performing countries in the Index, contributing and detracting to/from the Fund’s performance, respectively.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

2

SPDR BLOOMBERG BARCLAYS EMERGING MARKETS LOCAL BOND ETF

Management’s Discussion Of Fund Performance (Unaudited) (continued)

The SPDR Bloomberg Barclays Emerging Markets Local Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the fixed-rate local currency sovereign debt of emerging market countries. The Fund’s benchmark is the Bloomberg Barclays EM Local Currency Government Diversified Index (the “Index”).

For the 12-month period ended June 30, 2019 (the “Reporting Period”), the total return for the Fund was 7.70%, and the Index was 8.51%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, expenses and tax withholdings contributed to the difference between the Fund’s performance and that of the Index.

Brazil and Indonesia were primary drivers of the positive Fund performance during the Reporting Period, while Turkey and Argentina were key detractors. The dovish tone from developed market central banks, especially the Fed and ECB, were supportive of emerging market assets. Brazil was the best performer in the Fund as there was progress on much-needed social security reform, while Indonesian assets rallied on the back of strong activity data and dovish comments from the central bank. However, Turkey was the worst performer in the Fund as several vulnerabilities combined simultaneously to drive yields significantly higher and the currency lower. The economy fell into recession after a decade, with seasonally adjustedGDP shrinking 2.6% and leading to a sell-off in Turkish assets across the board. Argentina was also one of the worst performers as investor sentiment soured on the back of weak economic data, leading to outflows from the country.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

3

SPDR Bloomberg Barclays Emerging Markets Local Bond ETF

Performance Summary (Unaudited)

Performance as of December 31, 2019

| | | | | | | | | |

| | | Cumulative Total Return | | Average Annual Total Return | |

| | | Net

Asset

Value | Market

Value | Bloomberg Barclays EM Local Currency Government Diversified Index | | Net

Asset

Value | Market

Value | Bloomberg Barclays EM Local Currency Government Diversified Index | |

| | SIX MONTHS | 2.94% | 3.08% | 3.32% | | N/A | N/A | N/A | |

| | ONE YEAR | 10.44% | 10.32% | 11.07% | | 10.44% | 10.32% | 11.07% | |

| | FIVE YEARS | 10.48% | 10.00% | 14.96% | | 2.01% | 1.92% | 2.83% | |

| | SINCE INCEPTION(1) | 14.34% | 14.67% | 23.30% | | 1.52% | 1.56% | 2.39% | |

| | | | | | | | | |

| (1) | For the period February 23, 2011 to December 31, 2019. Since shares of the Fund did not trade in the secondary market until one day after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (2/23/11, 2/24/11, respectively),the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The One Year Total Return based on Net Asset Value, Market Value and the Bloomberg Barclays EM Local Currency Government Diversified Index for the year ended June 30, 2019 was 1.59%, 1.99% and 2.10%, respectively.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for SPDR Bloomberg Barclays Emerging Markets Local Bond ETF as stated in the Fees and Expenses table of the most recent prospectus is 0.30%. Please see the financial highlights for the total expense ratio for the fiscal period ended December 31, 2019.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

4

SPDR Bloomberg Barclays Emerging Markets Local Bond ETF

Portfolio Statistics (Unaudited)

Top Five Holdings as of December 31, 2019

| | | |

| | Description | % of Net Assets | |

| | Brazil Notas do Tesouro Nacional Serie F

10.00% 1/1/2023 | 1.4% | |

| | Brazil Notas do Tesouro Nacional Serie F

10.00% 1/1/2025 | 1.2 | |

| | Brazil Letras do Tesouro Nacional

Zero Coupon, 1/1/2022 | 1.0 | |

| | Colombian TES

6.00% 4/28/2028 | 1.0 | |

| | Brazil Notas do Tesouro Nacional Serie F

10.00% 1/1/2027 | 0.8 | |

| | TOTAL | 5.4% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Asset Allocation as of December 31, 2019

| | | |

| | | % of Net Assets | |

| | Foreign Government Obligations | 97.3% | |

| | Short-Term Investment | 0.5 | |

| | Other Assets in Excess of Liabilities | 2.2 | |

| | TOTAL | 100.0% | |

Top Ten Countries as of December 31, 2019

| | | |

| | Description | % of Total Investments | |

| | South Korea | 12.7% | |

| | Brazil | 8.5 | |

| | Thailand | 7.0 | |

| | Indonesia | 6.9 | |

| | Mexico | 6.7 | |

| | China | 6.2 | |

| | Israel | 4.8 | |

| | Malaysia | 4.7 | |

| | South Africa | 4.7 | |

| | Russia | 4.7 | |

| | TOTAL | 66.9% | |

(The Fund's asset allocation and sector breakdown are expressed as a percentage of net assets and total investments, respectively, and may change over time.)

See accompanying notes to financial statements.

5

SPDR BLOOMBERG BARCLAYS INTERNATIONAL CORPORATE BOND ETF

Management’s Discussion Of Fund Performance (Unaudited)

The SPDR Bloomberg Barclays International Corporate Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the investment grade corporate sector of the global bond market outside of the United States. The Fund’s benchmark is the Bloomberg Barclays Global Aggregate ex-USD >$1B: Corporate Bond Index (the “Index”).

The Board of Trustees approved a change in fiscal year end for the Fund from June 30 to December 31. For the 6-month period from July 1, 2019 through December 31, 2019 (the “Reporting Period”), the total return for the Fund was–0.15%, and the Index was 0.10%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees and expenses contributed to the difference between the Fund’s performance and that of the Index.

The slowdown in global growth, decelerating core and headline inflation, and geopolitical uncertainty were significant contributors to the volatility and underlying risk-off sentiment that defined the markets during the Reporting Period. Central banks took an accommodative stance during the Reporting Period, implementing easy monetary policies that saw interest rates decline around the world, positively impacting the Fund’s performance and alleviating concerns about an impending recession. A significant rally in rates and corporate credit spread tightening were the primary drivers of the Fund’s performance over the Reporting Period. Supply and demand dynamics were supportive of investment grade corporate flows, which contributed positively to performance. Within the corporate sector, communications, utilities and energy made significant positive contributions to the Fund’s performance.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

6

SPDR BLOOMBERG BARCLAYS INTERNATIONAL CORPORATE BOND ETF

Management’s Discussion Of Fund Performance (Unaudited) (continued)

The SPDR Bloomberg Barclays International Corporate Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the investment grade corporate sector of the global bond market outside of the United States. The Fund’s benchmark is the Bloomberg Barclays Global Aggregate ex-USD >$1B: Corporate Bond Index (the “Index”).

For the 12-month period ended June 30, 2019 (the “Reporting Period”), the total return for the Fund was 1.59%, and the Index was 2.10%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees and expenses contributed to the difference between the Fund’s performance and that of the Index.

Significant rally in euro area and UK rates, and a modest tightening in corporate credit spreads were the primary drivers of fund performance over the Reporting Period. The fund’s total returns were mostly driven by the rates component, with a much smaller credit spread return component. Rates rallied across euro area as the European Central Bank (ECB) was dovish over the Reporting Period due to concerns over euro area growth, soft inflation and rising trade tension with the US. In addition, the ongoing Brexit concerns led to a risk-off sentiment leading to a rally in UK rates as well. Weak economic data aided the rates rally too, particularly in the euro area, as its Manufacturing PMI (PMI: Purchasing Manager’s Index - a leading indicator of overall economic activity) shrank for the fifth consecutive month to 47.6. Increasing demand for higher-yielding assets on the back of expectations of more central bank stimulus counterbalanced the strong euro area corporate credit supply leading to corporate credit spreads across euro area and UK remaining flat/modestly tighter.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

7

SPDR Bloomberg Barclays International Corporate Bond ETF

Performance Summary (Unaudited)

Performance as of December 31, 2019

| | | | | | | | | |

| | | Cumulative Total Return | | Average Annual Total Return | |

| | | Net

Asset

Value | Market

Value | Bloomberg Barclays Global Aggregate ex-USD >$1B: Corporate Bond Index | | Net

Asset

Value | Market

Value | Bloomberg Barclays Global Aggregate ex-USD >$1B: Corporate Bond Index | |

| | SIX MONTHS | –0.15% | –0.18% | 0.10% | | N/A | N/A | N/A | |

| | ONE YEAR | 4.55% | 4.09% | 5.03% | | 4.55% | 4.09% | 5.03% | |

| | FIVE YEARS | 0.76% | 0.37% | 3.27% | | 0.15% | 0.07% | 0.65% | |

| | SINCE INCEPTION(1) | 25.57% | 25.79% | 31.33% | | 2.39% | 2.41% | 2.87% | |

| | | | | | | | | |

| (1) | For the period May 19, 2010 to December 31, 2019. Since shares of the Fund did not trade in the secondary market until one day after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund (5/19/10, 5/20/10, respectively), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The One Year Total Return based on Net Asset Value, Market Value and the Bloomberg Barclays Global Aggregate ex-USD >$1B: Corporate Bond Index for the year ended June 30, 2019 was 1.59%, 1.99% and 2.10%, respectively.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for SPDR Bloomberg Barclays International Corporate Bond ETF as stated in the Fees and Expenses table of the most recent prospectus is 0.50%. Please see the financial highlights for the total expense ratio for the fiscal period ended December 31, 2019.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

8

SPDR Bloomberg Barclays International Corporate Bond ETF

Portfolio Statistics (Unaudited)

Top Five Holdings as of December 31, 2019

| | | |

| | Description | % of Net Assets | |

| | Anheuser-Busch InBev NV

2.75% 3/17/2036 | 0.6% | |

| | Deutsche Bank AG

1.13% 3/17/2025 | 0.5 | |

| | Volkswagen International Finance NV

1.88% 3/30/2027 | 0.5 | |

| | Panasonic Corp.

0.47% 9/18/2026 | 0.5 | |

| | Sanofi

0.50% 1/13/2027 | 0.5 | |

| | TOTAL | 2.6% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Asset Allocation as of December 31, 2019

| | | |

| | | % of Net Assets | |

| | Corporate Bonds & Notes | 98.5% | |

| | Short-Term Investment | 0.0 * | |

| | Other Assets in Excess of Liabilities | 1.5 | |

| | TOTAL | 100.0% | |

| * | Amount shown represents less than 0.05% of net assets. |

Sector Breakdown as of December 31, 2019

| | | |

| | | % of Total Investments | |

| | Financial | 47.1% | |

| | Consumer, Non-cyclical | 14.2 | |

| | Communications | 11.9 | |

| | Consumer, Cyclical | 8.4 | |

| | Utilities | 4.9 | |

| | Energy | 4.6 | |

| | Technology | 4.2 | |

| | Industrial | 3.3 | |

| | Basic Materials | 1.1 | |

| | Diversified | 0.3 | |

| | Short-Term Investment | 0.0* | |

| | TOTAL | 100.0% | |

| * | Amount shown represents less than 0.05% of net assets. | | |

(The Fund's sector breakdown is expressed as a percentage of net assets and may change over time.)

See accompanying notes to financial statements.

9

SPDR BLOOMBERG BARCLAYS INTERNATIONAL TREASURY BOND ETF

Management's Discussion of Fund Performance (Unaudited)

The SPDR Bloomberg Barclays International Treasury Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the fixed-rate local currency sovereign debt of investment grade countries outside the United States. The Fund’s benchmark is the Bloomberg Barclays Global Treasury ex-US Capped Index (the “Index”).

The Board of Trustees approved a change in fiscal year end for the Fund from June 30 to December 31. For the 6-month period from July 1, 2019 through December 31, 2019 (the “Reporting Period”), the total return for the Fund was 0.20%, and the Index was 0.44%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, expenses and tax withholdings contributed to the difference between the Fund’s performance and that of the Index.

The slowdown in global growth, decelerating core and headline inflation, and geopolitical uncertainty were significant contributors to the volatility and underlying risk-off sentiment that defined the markets during the Reporting Period. Central banks took an accommodative stance during the Reporting Period, implementing easy monetary policies that saw interest rates decline around the world, positively impacting the Fund’s performance and alleviating concerns about an impending recession. Towards the end of the Reporting Period, the spike in risk-on sentiment, the bond market sell off and yield curve steepening were the primary drivers of the Fund’s performance. Credit spread tightening and excess returns were broadly positive, but total returns were dented by rising global government bonds.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

10

SPDR BLOOMBERG BARCLAYS INTERNATIONAL TREASURY BOND ETF

Management's Discussion of Fund Performance (Unaudited) (continued)

The SPDR Bloomberg Barclays International Treasury Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the fixed-rate local currency sovereign debt of investment grade countries outside the United States. The Fund’s benchmark is the Bloomberg Barclays Global Treasury ex-US Capped Index (the “Index”).

For the 12-month period ended June 30, 2019 (the “Reporting Period”), the total return for the Fund was 4.78%, and the Index was 5.14%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, expenses and tax withholdings contributed to the difference between the Fund’s performance and that of the Index.

The Fund lost 0.61% in the second half of 2018, as central banks were less accommodative on their monetary policies. A slowdown in global growth, decelerating core and headline inflation, and increasing trade and political uncertainties (Brexit, US-China trade dispute) were major contributors to risk-off sentiment in late 2018. A dovish turn by central banks in 2019 increased the likelihood of easy monetary policy, and interest rates around the world declined through June 2019, positively impacting Fund performance. The Fund gained 5.42% in the first half of 2019.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

11

SPDR Bloomberg Barclays International Treasury Bond ETF

Performance Summary (Unaudited)

Performance as of December 31, 2019

| | | | | | | | | |

| | | Cumulative Total Return | | Average Annual Total Return | |

| | | Net

Asset

Value | Market

Value | Bloomberg Barclays Global Treasury ex-US Capped Index | | Net

Asset

Value | Market

Value | Bloomberg Barclays Global Treasury ex-US Capped Index | |

| | SIX MONTHS | 0.20% | 0.27% | 0.44% | | N/A | N/A | N/A | |

| | ONE YEAR | 5.64% | 5.47% | 6.04% | | 5.64% | 5.47% | 6.04% | |

| | FIVE YEARS | 6.86% | 6.81% | 9.68% | | 1.34% | 1.33% | 1.86% | |

| | TEN YEARS | 14.67% | 14.95% | 20.53% | | 1.38% | 1.40% | 1.88% | |

| | | | | | | | | |

The One Year Total Return based on Net Asset Value, Market Value and the Bloomberg Barclays Global Treasury ex-US Capped Index for the year ended June 30, 2019 was 4.78%, 5.18% and 5.14%, respectively.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for SPDR Bloomberg Barclays International Treasury Bond ETF as stated in the Fees and Expenses table of the most recent prospectus is 0.35%. Please see the financial highlights for the total expense ratio for the fiscal period ended December 31, 2019.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

12

SPDR Bloomberg Barclays International Treasury Bond ETF

Portfolio Statistics (Unaudited)

Top Five Holdings as of December 31, 2019

| | | |

| | Description | % of Net Assets | |

| | China Government Bond

3.29% 10/18/2023 | 1.0% | |

| | Indonesia Treasury Bond

6.13% 5/15/2028 | 0.5 | |

| | Korea Treasury Bond

5.50% 3/10/2028 | 0.5 | |

| | Denmark Government Bond

4.50% 11/15/2039 | 0.4 | |

| | China Government Bond

4.08% 10/22/2048 | 0.4 | |

| | TOTAL | 2.8% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Asset Allocation as of December 31, 2019

| | | |

| | | % of Net Assets | |

| | Foreign Government Obligations | 98.4% | |

| | Short-Term Investments | 0.1 | |

| | Other Assets in Excess of Liabilities | 1.5 | |

| | TOTAL | 100.0% | |

Top Ten Countries as of December 31, 2019

| | | |

| | Description | % of Total Investments | |

| | Japan | 22.6% | |

| | France | 5.5 | |

| | United Kingdom | 5.4 | |

| | Italy | 5.1 | |

| | Spain | 4.6 | |

| | South Korea | 4.6 | |

| | Belgium | 4.6 | |

| | Germany | 4.6 | |

| | Australia | 4.5 | |

| | Canada | 4.4 | |

| | TOTAL | 65.9% | |

(The Fund's asset allocation and top ten countries are expressed as a percentage of net assets and total investments, respectively, and may change over time.)

See accompanying notes to financial statements.

13

SPDR BLOOMBERG BARCLAYS SHORT TERM INTERNATIONAL TREASURY BOND ETF

Management’s Discussion Of Fund Performance (Unaudited)

The SPDR Bloomberg Barclays Short Term International Treasury Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the short-term (1-3 year remaining maturity) fixed rate, investment grade debt issued by foreign governments of investment grade countries. The Fund’s benchmark is the Bloomberg Barclays 1-3 Year Global Treasury ex-US Capped Index (the “Index”).

The Board of Trustees approved a change in fiscal year end for the Fund from June 30 to December 31. For the 6-month period from July 1, 2019 through December 31, 2019 (the “Reporting Period”), the total return for the Fund was–0.36%, and the Index was–0.15%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, expenses and tax withholdings contributed to the difference between the Fund’s performance and that of the Index as the Fund.

The slowdown in global growth, decelerating core and headline inflation, and geopolitical uncertainty were significant contributors to the volatility and underlying risk-off sentiment that defined the markets during the Reporting Period. Central banks took an accommodative stance during the Reporting Period, implementing easy monetary policies that saw interest rates decline around the world, positively impacting the Fund’s performance and alleviating concerns about an impending recession. Towards the end of the Reporting Period, the spike in risk-on sentiment, the bond market sell off and yield curve steepening were the primary drivers of the Fund’s performance. Total returns were dented by rising global government bonds.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

14

SPDR BLOOMBERG BARCLAYS SHORT TERM INTERNATIONAL TREASURY BOND ETF

Management’s Discussion Of Fund Performance (Unaudited) (continued)

The SPDR Bloomberg Barclays Short Term International Treasury Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the short-term (1-3 year remaining maturity) fixed rate, investment grade debt issued by foreign governments of investment grade countries. The Fund’s benchmark is the Bloomberg Barclays 1-3 Year Global Treasury ex-US Capped Index (the “Index”).

For the 12-month period ended June 30, 2019 (the “Reporting Period”), the total return for the Fund was 0.21%, and the Index was 0.65%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, expenses and tax withholdings contributed to the difference between the Fund’s performance and that of the Index.

The Fund lost 1.00% in the second half of 2018, as central banks were less accommodative on their monetary policies. A slowdown in global growth, decelerating core and headline inflation, and increasing trade and political uncertainties (Brexit, US-China trade dispute) were major contributors to risk-off sentiment in late 2018. A dovish turn by central banks in 2019 increased the likelihood of easy monetary policy, and interest rates around the world declined through June 2019, positively impacting Fund performance. The Fund gained 1.24% in the first half of 2019.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

15

SPDR Bloomberg Barclays Short Term International Treasury Bond ETF

Performance Summary (Unaudited)

Performance as of December 31, 2019

| | | | | | | | | |

| | | Cumulative Total Return | | Average Annual Total Return | |

| | | Net

Asset

Value | Market

Value | Bloomberg Barclays 1-3 Year Global Treasury ex-US Capped Index | | Net

Asset

Value | Market

Value | Bloomberg Barclays 1-3 Year Global Treasury ex-US Capped Index | |

| | SIX MONTHS | –0.36% | –0.32% | –0.15% | | N/A | N/A | N/A | |

| | ONE YEAR | 0.89% | 1.03% | 1.31% | | 0.89% | 1.03% | 1.31% | |

| | FIVE YEARS | –1.96% | –1.82% | 0.17% | | –0.40% | –0.37% | 0.03% | |

| | TEN YEARS | –9.50% | –9.98% | –5.66% | | –0.99% | –1.05% | –0.58% | |

| | | | | | | | | |

The One Year Total Return based on Net Asset Value, Market Value and the Bloomberg Barclays 1-3 Year Global Treasury ex-US Capped Index for the year ended June 30, 2019 was 0.21%, 0.42% and 0.65%, respectively.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for SPDR Bloomberg Barclays Short Term International Treasury Bond ETF as stated in the Fees and Expenses table of the most recent prospectus is 0.35%. Please see the financial highlights for the total expense ratio for the fiscal period ended December 31, 2019.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

16

SPDR Bloomberg Barclays Short Term International Treasury Bond ETF

Portfolio Statistics (Unaudited)

Top Five Holdings as of December 31, 2019

| | | |

| | Description | % of Net Assets | |

| | Korea Treasury Bond

2.00% 3/10/2021 | 3.8% | |

| | Government of Japan 5 Year Bond

0.10% 6/20/2021 | 2.5 | |

| | Government of Japan 5 Year Bond

0.10% 3/20/2022 | 2.4 | |

| | China Government Bond

3.17% 10/11/2021 | 2.1 | |

| | Government of Japan 5 Year Bond

0.10% 9/20/2021 | 2.0 | |

| | TOTAL | 12.8% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Asset Allocation as of December 31, 2019

| | | |

| | | % of Net Assets | |

| | Foreign Government Obligations | 95.1% | |

| | Short-Term Investment | 0.0 * | |

| | Other Assets in Excess of Liabilities | 4.9 | |

| | TOTAL | 100.0% | |

| * | Amount shown represents less than 0.05% of net assets. |

Top Ten Countries as of December 31, 2019

| | | |

| | Description | % of Total Investments | |

| | Japan | 20.7% | |

| | Italy | 8.4 | |

| | France | 7.0 | |

| | Germany | 5.5 | |

| | South Korea | 4.8 | |

| | Canada | 4.8 | |

| | United Kingdom | 4.8 | |

| | Spain | 4.8 | |

| | Australia | 4.0 | |

| | Belgium | 3.6 | |

| | TOTAL | 68.4% | |

(The Fund's asset allocation and top ten countries are expressed as a percentage of net assets and total investments, respectively, and may change over time.)

See accompanying notes to financial statements.

17

SPDR FTSE INTERNATIONAL GOVERNMENT INFLATION-PROTECTED BOND ETF

Management’s Discussion Of Fund Performance (Unaudited)

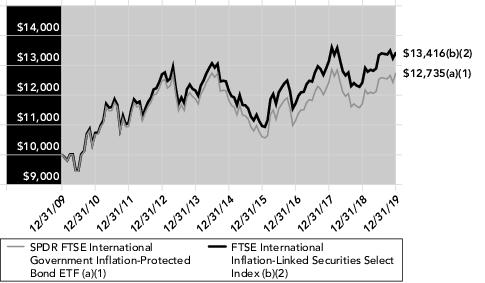

The SPDR FTSE International Government Inflation-Protected Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the inflation protected sector of the global bond market outside the United States. The Fund’s benchmark is the FTSE International Inflation-Linked Securities Select Index (the “Index”).

The Board of Trustees approved a change in fiscal year end for the Fund from June 30 to December 31. For the 6-month period from July 1, 2019 through December 31, 2019 (the “Reporting Period”), the total return for the Fund was 1.58%, and the Index was 1.65%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, expenses and tax withholdings contributed to the difference between the Fund’s performance and that of the Index.

The slowdown in global growth, decelerating core and headline inflation, and geopolitical uncertainty were significant contributors to the volatility and underlying risk-off sentiment that defined the markets during the Reporting Period. Central banks took an accommodative stance during the Reporting Period, implementing easy monetary policies that saw interest rates decline around the world, positively impacting the Fund’s performance and alleviating concerns about an impending recession. Towards the end of the Reporting Period, the spike in risk-on sentiment, the bond market sell off and yield curve steepening were the primary drivers of the Fund’s performance. Credit spread tightening and excess returns were broadly positive, but total returns were dented by rising global government bonds.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

18

SPDR FTSE INTERNATIONAL GOVERNMENT INFLATION-PROTECTED BOND ETF

Management’s Discussion Of Fund Performance (Unaudited) (continued)

The SPDR FTSE International Government Inflation-Protected Bond ETF (the “Fund”) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of an index that tracks the inflation protected sector of the global bond market outside the United States. The Fund’s benchmark is the FTSE International Inflation-Linked Securities Select Index (the “Index”). For the 12-month period ended June 30, 2019 (the “Reporting Period”), the total return for the Fund was 4.78%, and the Index was 5.34%. The Fund and Index returns reflect the reinvestment of dividends and other income. The Fund’s performance reflects the expenses of managing the Fund, including brokerage and advisory expenses. The Index is unmanaged and Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns. Fees, expenses and tax withholdings contributed to the difference between the Fund’s performance and that of the Index.

The Fund lost 2.13% in the second half of 2018, as central banks were less accommodative on their monetary policies. A slowdown in global growth, decelerating core and headline inflation, and increasing trade and political uncertainties (Brexit, US-China trade dispute) were major contributors to risk-off sentiment in late 2018. A dovish turn by central banks in 2019 increased the likelihood of easy monetary policy, and interest rates around the world declined through June 2019, positively impacting Fund performance. The Fund gained 7.07% in the first half of 2019.

The views expressed above reflect those of the Fund’s portfolio manager only through the Reporting Period, and do not necessarily represent the views of the Adviser as a whole. Any such views are subject to change at any time based upon market or other conditions and the Adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund.

See accompanying notes to financial statements.

19

SPDR FTSE International Government Inflation-Protected Bond ETF

Performance Summary (Unaudited)

Performance as of December 31, 2019

| | | | | | | | | |

| | | Cumulative Total Return | | Average Annual Total Return | |

| | | Net

Asset

Value | Market

Value | FTSE International Inflation-Linked Securities Select Index | | Net

Asset

Value | Market

Value | FTSE International Inflation-Linked Securities Select Index | |

| | SIX MONTHS | 1.58% | 0.87% | 1.65% | | N/A | N/A | N/A | |

| | ONE YEAR | 8.75% | 8.59% | 9.18% | | 8.75% | 8.59% | 9.18% | |

| | FIVE YEARS(1) (2) | 7.58% | 7.69% | 10.36% | | 1.47% | 1.49% | 1.99% | |

| | TEN YEARS(1) (2) | 27.35% | 26.58% | 34.16% | | 2.45% | 2.38% | 2.98% | |

| | | | | | | | | |

| (1) | Effective February 15, 2016, the Fund changed its benchmark index from the DB Global Government ex-US Inflation-Linked Securities Select Index. The Fund's performance in the tables is based on the Fund's prior investment strategy to track a different benchmark index for periods prior to February 15, 2016. |

| (2) | The FTSE International Inflation-Linked Securities Select Index (formerly, Citi International Inflation-Linked Securities Select Index) inception date is January 15, 2016. Index returns in the line graph below represent the Fund’s prior benchmark index from December 31, 2009 through February 14, 2016 and the FTSE International Inflation-Linked Securities Select Index (formerly, Citi International Inflation-Linked Securities Select Index from February 15, 2016 through December 31, 2019. |

The One Year Total Return based on Net Asset Value, Market Value and the FTSE International Inflation-Linked Securities Select Index for the year ended June 30, 2019 was 4.78%, 6.01% and 5.34%, respectively.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

Line graph is based on cumulative total return.

The total expense ratio for SPDR FTSE International Government Inflation-Protected Bond ETF as stated in the Fees and Expenses table of the most recent prospectus is 0.50%. Please see the financial highlights for the total expense ratio for the fiscal period ended December 31, 2019.

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. Visit www.spdrs.com for most recent month-end performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. See "Notes to Performance Summaries" on page 1 for more information.

See accompanying notes to financial statements.

20

SPDR FTSE International Government Inflation-Protected Bond ETF

Portfolio Statistics (Unaudited)

Top Five Holdings as of December 31, 2019

| | | |

| | Description | % of Net Assets | |

| | Brazil Notas do Tesouro Nacional Serie B

6.00% 8/15/2050 | 1.6% | |

| | Deutsche Bundesrepublik Inflation Linked Bond

0.10% 4/15/2023 | 1.3 | |

| | Bonos de la Tesoreria de la Republica

3.00% 1/1/2044 | 1.3 | |

| | Brazil Notas do Tesouro Nacional Serie B

6.00% 8/15/2022 | 1.3 | |

| | Spain Government Inflation Linked Bond

1.80% 11/30/2024 | 1.2 | |

| | TOTAL | 6.7% | |

(The five largest holdings are subject to change, and there are no guarantees the Fund will continue to remain invested in any particular company.)

Asset Allocation as of December 31, 2019

| | | |

| | | % of Net Assets | |

| | Foreign Government Obligations | 99.4% | |

| | Short-Term Investment | 0.0 * | |

| | Other Assets in Excess of Liabilities | 0.6 | |

| | TOTAL | 100.0% | |

| * | Amount shown represents less than 0.05% of net assets. |

Top Ten Countries as of December 31, 2019

| | | |

| | Description | % of Total Investments | |

| | United Kingdom | 21.9% | |

| | Brazil | 8.7 | |

| | France | 8.3 | |

| | Italy | 5.9 | |

| | Chile | 5.0 | |

| | South Africa | 4.8 | |

| | Mexico | 4.6 | |

| | Spain | 4.6 | |

| | Canada | 4.6 | |

| | Japan | 4.5 | |

| | TOTAL | 72.9% | |

(The Fund's asset allocation and top ten countries are expressed as a percentage of net assets and total investments, respectively, and may change over time.)

See accompanying notes to financial statements.

21

SPDR BLOOMBERG BARCLAYS EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS

December 31, 2019

| Security Description | | | Principal

Amount | | Value |

| FOREIGN GOVERNMENT OBLIGATIONS — 97.3% | | | |

| BRAZIL — 8.4% | | | | | |

| Brazil Letras do Tesouro Nacional: | | | | | |

Series LTN, Zero Coupon, 4/1/2021

| | BRL | 10,600,000 | | $2,488,374 |

Series LTN, Zero Coupon, 7/1/2021

| | BRL | 35,450,000 | | 8,204,873 |

Series LTN, Zero Coupon, 10/1/2021

| | BRL | 18,200,000 | | 4,141,719 |

Series LTN, Zero Coupon, 1/1/2022

| | BRL | 44,835,000 | | 10,056,059 |

Series LTN, Zero Coupon, 7/1/2022

| | BRL | 39,000,000 | | 8,466,496 |

Series LTN, Zero Coupon, 7/1/2023

| | BRL | 32,100,000 | | 6,503,768 |

| Brazil Notas do Tesouro Nacional Serie F: | | | | | |

Series NTNF, 10.00%, 1/1/2021

| | BRL | 19,810,000 | | 5,176,354 |

Series NTNF, 10.00%, 1/1/2023

| | BRL | 49,910,000 | | 13,794,699 |

Series NTNF, 10.00%, 1/1/2025

| | BRL | 42,850,000 | | 12,244,788 |

Series NTNF, 10.00%, 1/1/2027

| | BRL | 29,075,000 | | 8,522,814 |

Series NTNF, 10.00%, 1/1/2029

| | BRL | 15,890,000 | | 4,774,846 |

| Brazilian Government International Bond: | | | | | |

8.50%, 1/5/2024

| | BRL | 350,000 | | 93,097 |

10.25%, 1/10/2028

| | BRL | 1,000,000 | | 292,353 |

12.50%, 1/5/2022

| | BRL | 350,000 | | 97,224 |

| | | | | | 84,857,464 |

| CHILE — 2.8% | | | | | |

| Bonos de la Tesoreria de la Republica en pesos: | | | | | |

4.00%, 3/1/2023 (a)

| | CLP | 2,000,000,000 | | 2,802,202 |

4.50%, 3/1/2021

| | CLP | 1,670,000,000 | | 2,288,157 |

4.50%, 3/1/2026

| | CLP | 3,265,000,000 | | 4,784,711 |

4.70%, 9/1/2030 (a)

| | CLP | 2,820,000,000 | | 4,266,894 |

5.00%, 3/1/2035

| | CLP | 3,580,000,000 | | 5,576,721 |

5.10%, 7/15/2050

| | CLP | 950,000,000 | | 1,526,186 |

Series 10YR, 6.00%, 1/1/2022

| | CLP | 65,000,000 | | 93,142 |

Series 30YR, 6.00%, 1/1/2043

| | CLP | 3,050,000,000 | | 5,523,853 |

| Bonos del Banco Central de Chile en Pesos: | | | | | |

Series 10YR, 6.00%, 2/1/2021

| | CLP | 305,000,000 | | 423,296 |

Series 10YR, 6.00%, 3/1/2022

| | CLP | 310,000,000 | | 446,827 |

| Security Description | | | Principal

Amount | | Value |

Chile Government International Bond 5.50%, 8/5/2020

| | CLP | 610,000,000 | | $827,090 |

| | | | | | 28,559,079 |

| CHINA — 6.1% | | | | | |

| China Development Bank: | | | | | |

Series 1903, 3.30%, 2/1/2024

| | CNY | 21,000,000 | | 3,020,949 |

Series 1908, 3.42%, 7/2/2024

| | CNY | 17,000,000 | | 2,454,783 |

Series 1915, 3.45%, 9/20/2029

| | CNY | 10,000,000 | | 1,418,412 |

Series 1904, 3.68%, 2/26/2026

| | CNY | 18,000,000 | | 2,609,899 |

Series 1516, 3.94%, 7/10/2022

| | CNY | 3,000,000 | | 441,484 |

Series 1213, 4.21%, 3/22/2022

| | CNY | 10,000,000 | | 1,475,056 |

Series 1708, 4.30%, 8/21/2024

| | CNY | 10,000,000 | | 1,495,520 |

Series 1805, 4.88%, 2/9/2028

| | CNY | 3,000,000 | | 466,459 |

Series 1421, 5.10%, 8/7/2021

| | CNY | 10,000,000 | | 1,487,184 |

| China Government Bond: | | | | | |

Series 1902, 2.44%, 2/21/2021

| | CNY | 10,000,000 | | 1,433,760 |

Series 1903, 2.69%, 3/7/2022

| | CNY | 25,000,000 | | 3,587,231 |

Series 1909, 2.74%, 7/11/2021

| | CNY | 17,000,000 | | 2,446,136 |

Series 1913, 2.94%, 10/17/2024

| | CNY | 10,000,000 | | 1,439,941 |

Series 1822, 3.00%, 10/18/2020

| | CNY | 4,100,000 | | 591,454 |

Series 1904, 3.19%, 4/11/2024

| | CNY | 27,000,000 | | 3,932,186 |

Series 1828, 3.22%, 12/6/2025

| | CNY | 7,790,000 | | 1,131,477 |

Series 1814, 3.24%, 7/5/2021

| | CNY | 30,000,000 | | 4,350,926 |

Series 1907, 3.25%, 6/6/2026

| | CNY | 24,800,000 | | 3,598,790 |

Series 1827, 3.25%, 11/22/2028

| | CNY | 25,000,000 | | 3,622,131 |

Series 1823, 3.29%, 10/18/2023

| | CNY | 20,000,000 | | 2,923,037 |

Series 1906, 3.29%, 5/23/2029

| | CNY | 12,600,000 | | 1,828,544 |

Series 1710, 3.52%, 5/4/2027

| | CNY | 5,000,000 | | 736,621 |

Series 1608, 3.52%, 4/25/2046

| | CNY | 6,000,000 | | 826,607 |

Series 1521, 3.74%, 9/22/2035

| | CNY | 16,000,000 | | 2,377,922 |

3.74%, 10/20/2045

| | CNY | 3,000,000 | | 437,697 |

See accompanying notes to financial statements.

22

SPDR BLOOMBERG BARCLAYS EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS (continued)

December 31, 2019

| Security Description | | | Principal

Amount | | Value |

Series 1910, 3.86%, 7/22/2049

| | CNY | 23,500,000 | | $3,463,987 |

Series 1817, 3.97%, 7/23/2048

| | CNY | 10,000,000 | | 1,485,312 |

Series 1715, 4.05%, 7/24/2047

| | CNY | 5,000,000 | | 755,731 |

Series 1824, 4.08%, 10/22/2048

| | CNY | 22,300,000 | | 3,400,565 |

Series 1508, 4.09%, 4/27/2035

| | CNY | 1,000,000 | | 155,033 |

Series 1806, 4.22%, 3/19/2048

| | CNY | 6,000,000 | | 935,226 |

Series 1722, 4.28%, 10/23/2047

| | CNY | 3,250,000 | | 512,751 |

Series 1116, 4.50%, 6/23/2041

| | CNY | 4,000,000 | | 657,596 |

| | | | | | 61,500,407 |

| COLOMBIA — 4.0% | | | | | |

| Colombia Government International Bond: | | | | | |

4.38%, 3/21/2023

| | COP | 1,610,000,000 | | 479,742 |

7.75%, 4/14/2021

| | COP | 400,000,000 | | 125,653 |

9.85%, 6/28/2027

| | COP | 115,000,000 | | 43,953 |

| Colombian TES: | | | | | |

Series B, 6.00%, 4/28/2028

| | COP | 32,215,000,000 | | 9,770,735 |

Series B, 6.25%, 11/26/2025

| | COP | 20,695,000,000 | | 6,489,453 |

Series B, 7.00%, 5/4/2022

| | COP | 25,554,000,000 | | 8,127,907 |

Series B, 7.00%, 6/30/2032

| | COP | 10,614,000,000 | | 3,375,924 |

Series B, 7.25%, 10/18/2034

| | COP | 7,825,000,000 | | 2,528,188 |

Series B, 7.50%, 8/26/2026

| | COP | 25,162,000,000 | | 8,370,955 |

Series B, 7.75%, 9/18/2030

| | COP | 3,400,000,000 | | 1,145,451 |

Series B, 11.00%, 7/24/2020

| | COP | 235,000,000 | | 74,329 |

| | | | | | 40,532,290 |

| CZECH REPUBLIC — 3.6% | | | | | |

| Czech Republic Government Bond: | | | | | |

Series 100, 0.25%, 2/10/2027

| | CZK | 57,900,000 | | 2,306,369 |

Series 97, 0.45%, 10/25/2023

| | CZK | 105,340,000 | | 4,435,158 |

Series 104, 0.75%, 2/23/2021

| | CZK | 18,100,000 | | 788,362 |

Series 94, 0.95%, 5/15/2030

| | CZK | 103,770,000 | | 4,271,242 |

Series 95, 1.00%, 6/26/2026

| | CZK | 81,470,000 | | 3,457,960 |

| Security Description | | | Principal

Amount | | Value |

Series 15Y, 2.00%, 10/13/2033

| | CZK | 73,850,000 | | $3,327,727 |

Series 89, 2.40%, 9/17/2025

| | CZK | 78,520,000 | | 3,621,057 |

Series 78, 2.50%, 8/25/2028

| | CZK | 68,240,000 | | 3,230,471 |

Series 105, 2.75%, 7/23/2029

| | CZK | 53,450,000 | | 2,585,170 |

Series 61, 3.85%, 9/29/2021

| | CZK | 61,070,000 | | 2,791,869 |

Series 49, 4.20%, 12/4/2036

| | CZK | 33,130,000 | | 1,970,777 |

Series 52, 4.70%, 9/12/2022

| | CZK | 22,800,000 | | 1,088,412 |

Series 53, 4.85%, 11/26/2057

| | CZK | 12,300,000 | | 874,849 |

Series 58, 5.70%, 5/25/2024

| | CZK | 44,000,000 | | 2,292,647 |

| | | | | | 37,042,070 |

| HUNGARY — 3.2% | | | | | |

| Hungary Government Bond: | | | | | |

Series 21/C, 0.50%, 4/21/2021

| | HUF | 382,900,000 | | 1,306,736 |

Series 20/C, 1.00%, 9/23/2020

| | HUF | 196,250,000 | | 670,596 |

Series 22/C, 1.50%, 8/24/2022

| | HUF | 40,000,000 | | 139,867 |

Series 22/B, 1.75%, 10/26/2022

| | HUF | 908,500,000 | | 3,200,777 |

Series 21/B, 2.50%, 10/27/2021

| | HUF | 978,500,000 | | 3,469,364 |

Series 24/C, 2.50%, 10/24/2024

| | HUF | 760,000,000 | | 2,765,934 |

Series 26/D, 2.75%, 12/22/2026

| | HUF | 520,000,000 | | 1,918,645 |

Series 24/B, 3.00%, 6/26/2024

| | HUF | 748,980,000 | | 2,788,028 |

Series 27/A, 3.00%, 10/27/2027

| | HUF | 1,073,880,000 | | 4,006,690 |

Series 30/A, 3.00%, 8/21/2030

| | HUF | 340,000,000 | | 1,259,844 |

Series 31/A, 3.25%, 10/22/2031

| | HUF | 135,000,000 | | 505,024 |

Series 20/B, 3.50%, 6/24/2020

| | HUF | 39,380,000 | | 135,777 |

Series 25/B, 5.50%, 6/24/2025

| | HUF | 1,374,220,000 | | 5,751,199 |

Series 23/A, 6.00%, 11/24/2023

| | HUF | 17,340,000 | | 71,286 |

Series 28/A, 6.75%, 10/22/2028

| | HUF | 467,000,000 | | 2,220,880 |

Series 22/A, 7.00%, 6/24/2022

| | HUF | 595,590,000 | | 2,367,448 |

See accompanying notes to financial statements.

23

SPDR BLOOMBERG BARCLAYS EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS (continued)

December 31, 2019

| Security Description | | | Principal

Amount | | Value |

Series 20/A, 7.50%, 11/12/2020

| | HUF | 12,450,000 | | $44,946 |

| | | | | | 32,623,041 |

| INDONESIA — 6.8% | | | | | |

| Indonesia Treasury Bond: | | | | | |

Series FR63, 5.63%, 5/15/2023

| | IDR | 26,555,000,000 | | 1,878,640 |

Series FR64, 6.13%, 5/15/2028

| | IDR | 41,000,000,000 | | 2,782,071 |

Series FR62, 6.38%, 4/15/2042

| | IDR | 1,700,000,000 | | 103,621 |

Series FR81, 6.50%, 6/15/2025

| | IDR | 50,700,000,000 | | 3,668,149 |

Series FR65, 6.63%, 5/15/2033

| | IDR | 74,870,000,000 | | 4,973,658 |

Series FR61, 7.00%, 5/15/2022

| | IDR | 78,033,000,000 | | 5,722,139 |

Series FR59, 7.00%, 5/15/2027

| | IDR | 64,710,000,000 | | 4,642,982 |

Series FR82, 7.00%, 9/15/2030

| | IDR | 25,000,000,000 | | 1,781,041 |

Series FR76, 7.38%, 5/15/2048

| | IDR | 7,700,000,000 | | 536,629 |

Series FR74, 7.50%, 8/15/2032

| | IDR | 26,300,000,000 | | 1,885,466 |

Series FR80, 7.50%, 6/15/2035

| | IDR | 17,000,000,000 | | 1,225,048 |

Series FR75, 7.50%, 5/15/2038

| | IDR | 41,910,000,000 | | 2,981,208 |

Series FR77, 8.13%, 5/15/2024

| | IDR | 93,000,000,000 | | 7,141,221 |

Series FR53, 8.25%, 7/15/2021

| | IDR | 32,975,000,000 | | 2,462,759 |

Series FR78, 8.25%, 5/15/2029

| | IDR | 97,500,000,000 | | 7,571,043 |

Series FR58, 8.25%, 6/15/2032

| | IDR | 3,710,000,000 | | 282,425 |

Series FR72, 8.25%, 5/15/2036

| | IDR | 33,090,000,000 | | 2,490,838 |

Series FR70, 8.38%, 3/15/2024

| | IDR | 41,100,000,000 | | 3,171,779 |

Series FR68, 8.38%, 3/15/2034

| | IDR | 44,400,000,000 | | 3,422,150 |

Series FR79, 8.38%, 4/15/2039

| | IDR | 39,150,000,000 | | 3,017,504 |

Series FR73, 8.75%, 5/15/2031

| | IDR | 9,050,000,000 | | 719,583 |

Series FR67, 8.75%, 2/15/2044

| | IDR | 7,050,000,000 | | 558,801 |

Series FR71, 9.00%, 3/15/2029

| | IDR | 6,000,000,000 | | 482,014 |

Series FR57, 9.50%, 5/15/2041

| | IDR | 1,000,000,000 | | 84,067 |

Series FR45, 9.75%, 5/15/2037

| | IDR | 1,250,000,000 | | 106,156 |

Series FR34, 12.80%, 6/15/2021

| | IDR | 350,000,000 | | 27,655 |

| Security Description | | | Principal

Amount | | Value |

| Perusahaan Penerbit SBSN Indonesia: | | | | | |

Series PBS, 6.50%, 5/15/2021

| | IDR | 20,000,000,000 | | $1,453,215 |

Series PBS, 8.25%, 9/15/2020

| | IDR | 7,150,000,000 | | 525,913 |

Series PBS, 8.75%, 8/15/2023

| | IDR | 3,800,000,000 | | 291,996 |

Series PBS, 8.88%, 11/15/2031

| | IDR | 34,200,000,000 | | 2,706,747 |

| | | | | | 68,696,518 |

| ISRAEL — 4.6% | | | | | |

| Israel Government Bond: | | | | | |

Series 0121, 0.50%, 1/31/2021

| | ILS | 3,300,000 | | 958,386 |

Series 0722, 0.75%, 7/31/2022

| | ILS | 1,200,000 | | 351,419 |

Series 0421, 1.00%, 4/30/2021

| | ILS | 10,550,000 | | 3,086,685 |

Series 1122, 1.25%, 11/30/2022

| | ILS | 7,760,000 | | 2,308,049 |

Series 1123, 1.50%, 11/30/2023

| | ILS | 10,035,000 | | 3,031,110 |

Series 0825, 1.75%, 8/31/2025

| | ILS | 13,580,000 | | 4,190,593 |

Series 0327, 2.00%, 3/31/2027

| | ILS | 11,550,000 | | 3,643,489 |

Series 0928, 2.25%, 9/28/2028

| | ILS | 11,395,000 | | 3,683,104 |

Series 0324, 3.75%, 3/31/2024

| | ILS | 10,600,000 | | 3,501,449 |

Series 0347, 3.75%, 3/31/2047

| | ILS | 9,575,000 | | 3,876,278 |

Series 0323, 4.25%, 3/31/2023

| | ILS | 6,650,000 | | 2,168,110 |

Series 0122, 5.50%, 1/31/2022

| | ILS | 17,595,000 | | 5,654,549 |

Series 0142, 5.50%, 1/31/2042

| | ILS | 11,810,000 | | 5,859,253 |

Series 1026, 6.25%, 10/30/2026

| | ILS | 12,425,000 | | 4,933,608 |

| | | | | | 47,246,082 |

| MALAYSIA — 4.6% | | | | | |

| Malaysia Government Bond: | | | | | |

Series 0517, 3.44%, 2/15/2021

| | MYR | 1,800,000 | | 442,450 |

Series 0313, 3.48%, 3/15/2023

| | MYR | 1,860,000 | | 459,810 |

Series 0307, 3.50%, 5/31/2027

| | MYR | 600,000 | | 148,067 |

Series 0315, 3.66%, 10/15/2020

| | MYR | 200,000 | | 49,182 |

Series 0218, 3.76%, 4/20/2023

| | MYR | 15,000,000 | | 3,742,935 |

See accompanying notes to financial statements.

24

SPDR BLOOMBERG BARCLAYS EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS (continued)

December 31, 2019

| Security Description | | | Principal

Amount | | Value |

Series 0215, 3.80%, 9/30/2022

| | MYR | 4,795,000 | | $1,194,156 |

Series 0116, 3.80%, 8/17/2023

| | MYR | 4,131,000 | | 1,033,173 |

Series 0419, 3.83%, 7/5/2034

| | MYR | 2,000,000 | | 499,782 |

Series 0413, 3.84%, 4/15/2033

| | MYR | 9,860,000 | | 2,457,673 |

Series 0117, 3.88%, 3/10/2022

| | MYR | 3,600,000 | | 896,370 |

Series 0118, 3.88%, 3/14/2025

| | MYR | 2,800,000 | | 705,402 |

Series 0212, 3.89%, 3/15/2027

| | MYR | 600,000 | | 151,709 |

Series 0219, 3.89%, 8/15/2029

| | MYR | 5,295,000 | | 1,353,684 |

Series 0316, 3.90%, 11/30/2026

| | MYR | 2,085,000 | | 527,034 |

Series 0119, 3.91%, 7/15/2026

| | MYR | 1,500,000 | | 379,450 |

Series 0115, 3.96%, 9/15/2025

| | MYR | 6,672,000 | | 1,689,117 |

Series 0314, 4.05%, 9/30/2021

| | MYR | 2,420,000 | | 601,857 |

Series 0217, 4.06%, 9/30/2024

| | MYR | 5,645,000 | | 1,431,169 |

Series 0412, 4.13%, 4/15/2032

| | MYR | 800,000 | | 205,567 |

Series 0111, 4.16%, 7/15/2021

| | MYR | 4,900,000 | | 1,218,624 |

Series 0114, 4.18%, 7/15/2024

| | MYR | 3,797,000 | | 967,174 |

Series 0411, 4.23%, 6/30/2031

| | MYR | 3,610,000 | | 936,353 |

Series 0415, 4.25%, 5/31/2035

| | MYR | 1,650,000 | | 428,061 |

Series 0318, 4.64%, 11/7/2033

| | MYR | 4,180,000 | | 1,127,329 |

Series 0216, 4.74%, 3/15/2046

| | MYR | 4,425,000 | | 1,189,486 |

Series 0317, 4.76%, 4/7/2037

| | MYR | 3,135,000 | | 859,440 |

Series 3/05, 4.84%, 7/15/2025

| | MYR | 170,000 | | 44,854 |

Series 0518, 4.92%, 7/6/2048

| | MYR | 3,000,000 | | 832,079 |

Series 0713, 4.94%, 9/30/2043

| | MYR | 300,000 | | 83,498 |

| Malaysia Government Investment Issue: | | | | | |

Series 0613, 3.72%, 3/23/2021

| | MYR | 1,500,000 | | 369,633 |

Series 0418, 3.73%, 3/31/2022

| | MYR | 1,630,000 | | 404,207 |

Series 0319, 3.73%, 3/31/2026

| | MYR | 3,300,000 | | 823,214 |

| Security Description | | | Principal

Amount | | Value |

Series 0216, 3.74%, 8/26/2021

| | MYR | 1,500,000 | | $370,634 |

Series 0317, 3.95%, 4/14/2022

| | MYR | 1,400,000 | | 348,511 |

Series 0217, 4.05%, 8/15/2024

| | MYR | 3,400,000 | | 860,016 |

Series 0316, 4.07%, 9/30/2026

| | MYR | 4,425,000 | | 1,125,894 |

Series 0318, 4.09%, 11/30/2023

| | MYR | 2,350,000 | | 593,635 |

Series 0118, 4.13%, 8/15/2025

| | MYR | 7,150,000 | | 1,818,851 |

Series 0119, 4.13%, 7/9/2029

| | MYR | 13,000,000 | | 3,344,209 |

Series 0115, 4.19%, 7/15/2022

| | MYR | 4,020,000 | | 1,008,026 |

Series 0117, 4.26%, 7/26/2027

| | MYR | 5,920,000 | | 1,527,200 |

Series 0218, 4.37%, 10/31/2028

| | MYR | 7,700,000 | | 2,011,496 |

Series 0116, 4.39%, 7/7/2023

| | MYR | 2,390,000 | | 608,181 |

Series 0813, 4.44%, 5/22/2024

| | MYR | 2,300,000 | | 590,348 |

Series 0219, 4.47%, 9/15/2039

| | MYR | 6,000,000 | | 1,588,791 |

Series 0513, 4.58%, 8/30/2033

| | MYR | 7,400,000 | | 1,977,187 |

Series 0517, 4.76%, 8/4/2037

| | MYR | 5,300,000 | | 1,442,936 |

Series 0615, 4.79%, 10/31/2035

| | MYR | 810,000 | | 220,168 |

Series 0417, 4.90%, 5/8/2047

| | MYR | 1,500,000 | | 411,742 |

| | | | | | 47,100,364 |

| MEXICO — 6.5% | | | | | |

| Mexican Bonos: | | | | | |

Series M, 5.75%, 3/5/2026

| | MXN | 73,640,000 | | 3,694,479 |

Series M, 6.50%, 6/10/2021

| | MXN | 80,269,000 | | 4,234,143 |

Series M, 6.50%, 6/9/2022

| | MXN | 101,748,000 | | 5,356,695 |

Series M, 7.25%, 12/9/2021

| | MXN | 110,200,000 | | 5,883,772 |

Series M 20, 7.50%, 6/3/2027

| | MXN | 125,590,000 | | 6,906,851 |

Series M, 7.75%, 5/29/2031

| | MXN | 84,028,000 | | 4,746,710 |

Series M, 7.75%, 11/23/2034

| | MXN | 12,710,000 | | 720,648 |

Series M, 7.75%, 11/13/2042

| | MXN | 89,980,000 | | 5,053,108 |

Series M, 8.00%, 12/7/2023

| | MXN | 77,230,000 | | 4,259,796 |

Series M, 8.00%, 9/5/2024

| | MXN | 67,200,000 | | 3,733,543 |

See accompanying notes to financial statements.

25

SPDR BLOOMBERG BARCLAYS EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS (continued)

December 31, 2019

| Security Description | | | Principal

Amount | | Value |

Series M, 8.00%, 11/7/2047

| | MXN | 51,000,000 | | $2,957,508 |

Series M 20, 8.50%, 5/31/2029

| | MXN | 86,415,000 | | 5,093,332 |

Series M 30, 8.50%, 11/18/2038

| | MXN | 62,240,000 | | 3,758,098 |

Series M 20, 10.00%, 12/5/2024

| | MXN | 134,860,000 | | 8,105,526 |

Series M 30, 10.00%, 11/20/2036

| | MXN | 24,137,000 | | 1,650,504 |

| | | | | | 66,154,713 |

| PERU — 3.2% | | | | | |

| Peru Government Bond: | | | | | |

5.40%, 8/12/2034 (a)

| | PEN | 5,950,000 | | 1,885,937 |

5.94%, 2/12/2029 (a)

| | PEN | 1,625,000 | | 553,640 |

6.15%, 8/12/2032 (a)

| | PEN | 12,657,000 | | 4,329,555 |

6.90%, 8/12/2037

| | PEN | 11,075,000 | | 4,029,973 |

6.95%, 8/12/2031

| | PEN | 6,370,000 | | 2,317,191 |

8.20%, 8/12/2026

| | PEN | 1,300,000 | | 499,562 |

| Peruvian Government International Bond: | | | | | |

Series REGS, 5.40%, 8/12/2034

| | PEN | 1,604,000 | | 508,411 |

Series REGS, 5.70%, 8/12/2024

| | PEN | 3,794,000 | | 1,279,603 |

Series REGS, 6.35%, 8/12/2028

| | PEN | 14,910,000 | | 5,220,838 |

Series REGS, 6.71%, 2/12/2055

| | PEN | 475,000 | | 173,768 |

Series REGS, 6.85%, 2/12/2042

| | PEN | 7,225,000 | | 2,616,069 |

Series REGS, 6.90%, 8/12/2037

| | PEN | 4,460,000 | | 1,622,905 |

Series REGS, 6.95%, 8/12/2031

| | PEN | 4,412,000 | | 1,604,937 |

Series REGS, 8.20%, 8/12/2026

| | PEN | 15,935,000 | | 6,123,481 |

| | | | | | 32,765,870 |

| PHILIPPINES — 4.2% | | | | | |

| Philippine Government Bond: | | | | | |

Series 5-73, 3.38%, 8/20/2020

| | PHP | 20,650,000 | | 406,962 |

Series 7-57, 3.50%, 3/20/2021

| | PHP | 77,450,000 | | 1,524,713 |

Series 7-58, 3.50%, 4/21/2023

| | PHP | 3,500,000 | | 68,364 |

Series R105, 3.50%, 9/20/2026

| | PHP | 22,000,000 | | 412,267 |

Series 2020, 3.63%, 3/21/2033

| | PHP | 18,150,000 | | 314,300 |

Series 5-74, 4.00%, 1/26/2022

| | PHP | 173,800,000 | | 3,443,467 |

Series 1059, 4.13%, 8/20/2024

| | PHP | 13,700,000 | | 271,551 |

| Security Description | | | Principal

Amount | | Value |

Series 3-23, 4.25%, 1/25/2021

| | PHP | 71,050,000 | | $1,408,977 |

Series 7-59, 4.50%, 4/20/2024

| | PHP | 68,200,000 | | 1,375,595 |

Series R511, 4.63%, 12/4/2022

| | PHP | 189,850,000 | | 3,830,379 |

Series 2511, 4.63%, 9/9/2040

| | PHP | 68,100,000 | | 1,213,349 |

Series 1061, 4.75%, 5/4/2027

| | PHP | 173,450,000 | | 3,504,389 |

Series 2021, 5.25%, 5/18/2037

| | PHP | 48,800,000 | | 984,300 |

Series 5-75, 5.50%, 3/8/2023

| | PHP | 32,000,000 | | 662,158 |

Series 7-61, 5.75%, 4/12/2025

| | PHP | 114,500,000 | | 2,444,997 |

Series 1052, 5.88%, 12/16/2020

| | PHP | 7,950,000 | | 160,158 |

Series R251, 6.13%, 10/24/2037

| | PHP | 72,000,000 | | 1,591,092 |

Series 7-62, 6.25%, 2/14/2026

| | PHP | 85,000,000 | | 1,863,126 |

Series 1063, 6.25%, 3/22/2028

| | PHP | 130,700,000 | | 2,897,736 |

Series 1054, 6.38%, 1/19/2022

| | PHP | 4,700,000 | | 97,536 |

Series 2023, 6.75%, 1/24/2039

| | PHP | 140,000,000 | | 3,293,537 |

Series 1064, 6.88%, 1/10/2029

| | PHP | 63,000,000 | | 1,470,329 |

Series 2017, 8.00%, 7/19/2031

| | PHP | 327,737,338 | | 8,433,935 |

Series 25-8, 8.13%, 12/16/2035

| | PHP | 13,300,000 | | 353,329 |

| Philippine Government International Bond: | | | | | |

3.90%, 11/26/2022

| | PHP | 31,000,000 | | 611,320 |

6.25%, 1/14/2036

| | PHP | 20,000,000 | | 477,225 |

| | | | | | 43,115,091 |

| POLAND — 4.6% | | | | | |

| Poland Government Bond: | | | | | |

Series 0720, Zero Coupon, 7/25/2020

| | PLN | 2,500,000 | | 656,412 |

Series 0521, Zero Coupon, 5/25/2021

| | PLN | 2,500,000 | | 647,263 |

Series 0721, 1.75%, 7/25/2021

| | PLN | 14,800,000 | | 3,924,368 |

Series 0421, 2.00%, 4/25/2021

| | PLN | 8,800,000 | | 2,340,982 |

Series 0422, 2.25%, 4/25/2022

| | PLN | 18,935,000 | | 5,074,380 |

Series 0123, 2.50%, 1/25/2023

| | PLN | 6,140,000 | | 1,660,575 |

Series 0424, 2.50%, 4/25/2024

| | PLN | 26,650,000 | | 7,244,411 |

Series 0726, 2.50%, 7/25/2026

| | PLN | 10,000,000 | | 2,719,745 |

See accompanying notes to financial statements.

26

SPDR BLOOMBERG BARCLAYS EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS (continued)

December 31, 2019

| Security Description | | | Principal

Amount | | Value |

Series 0727, 2.50%, 7/25/2027

| | PLN | 20,000,000 | | $5,429,534 |

Series 0428, 2.75%, 4/25/2028

| | PLN | 18,500,000 | | 5,114,498 |

Series 1029, 2.75%, 10/25/2029

| | PLN | 9,800,000 | | 2,726,318 |

Series 0725, 3.25%, 7/25/2025

| | PLN | 10,400,000 | | 2,934,771 |

Series 1023, 4.00%, 10/25/2023

| | PLN | 9,000,000 | | 2,573,126 |

Series 1021, 5.75%, 10/25/2021

| | PLN | 11,250,000 | | 3,195,109 |

| | | | | | 46,241,492 |

| ROMANIA — 2.9% | | | | | |

| Romania Government Bond: | | | | | |

Series 3Y, 2.30%, 10/26/2020

| | RON | 3,335,000 | | 774,015 |

Series 5Y, 3.25%, 3/22/2021

| | RON | 3,905,000 | | 912,377 |

Series 7Y, 3.25%, 4/29/2024

| | RON | 3,830,000 | | 876,188 |

Series 5Y, 3.40%, 3/8/2022

| | RON | 15,710,000 | | 3,659,520 |

Series 7Y, 3.50%, 12/19/2022

| | RON | 3,705,000 | | 861,625 |

Series 15Y, 3.65%, 9/24/2031

| | RON | 4,750,000 | | 996,844 |

Series 3Y, 4.00%, 10/27/2021

| | RON | 6,985,000 | | 1,647,758 |

Series 3Y, 4.00%, 8/8/2022

| | RON | 1,250,000 | | 294,640 |

Series 5Y, 4.25%, 6/28/2023

| | RON | 20,140,000 | | 4,777,656 |

Series 4.3Y, 4.40%, 9/25/2023

| | RON | 2,500,000 | | 597,827 |

Series 5Y, 4.50%, 6/17/2024

| | RON | 14,700,000 | | 3,519,402 |

Series 10Y, 4.75%, 2/24/2025

| | RON | 7,625,000 | | 1,845,587 |

Series 7Y, 4.85%, 4/22/2026

| | RON | 6,175,000 | | 1,505,962 |

Series 10Y, 5.00%, 2/12/2029

| | RON | 10,350,000 | | 2,524,430 |

Series 15YR, 5.80%, 7/26/2027

| | RON | 9,140,000 | | 2,356,184 |

Series 10Y, 5.85%, 4/26/2023

| | RON | 1,550,000 | | 385,816 |

Series 10YR, 5.95%, 6/11/2021