0001064642ssga:SPDRETFsIndexBloombergGlobalAggregateBondIndex12083BroadBasedIndexMember2024-01-31

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08839

SPDR® SERIES TRUST

(Exact name of registrant as specified in charter)

One Iron Street, Boston, Massachusetts 02210

(Address of principal executive offices) (zip code)

Andrew J. DeLorme, Esq.

Chief Legal Officer

c/o SSGA Funds Management, Inc.

One Iron Street

Boston, Massachusetts 02210

(Name and address of agent for service)

Copy to:

W. John McGuire, Esq.

Morgan, Lewis & Bockius LLP

1111 Pennsylvania Avenue, NW

Washington, DC 20004

Registrant’s telephone number, including area code: (617) 664-3920

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Report to Shareholders.

| (a) | The Report to Shareholders is attached herewith. |

SPDR Bloomberg Emerging Markets Local Bond ETF

Principal Listing Exchange: NYSEArca Exchange

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about the SPDR Bloomberg Emerging Markets Local Bond ETF (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

What were the Fund costs for the last year? (based on a hypothetical $10,000 Investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR Bloomberg Emerging Markets Local Bond ETF | $30 | 0.30% |

|---|

How did the Fund perform last year and what affected its performance?

Global concerns around heightened inflation, changes in central bank policies, geopolitical risks in the Middle East and a stronger US Dollar were primary drivers of Fund performance during the reporting period.

The year 2024 saw a number of global central banks begin easing after keeping rates high to combat sticky inflation in 2023. However, the path to easing was anything but smooth, as growth and other economic data generally remained strong, and as such the speed and magnitude of policy easing was pared back for many central banks, particularly in the US. This led to substantial volatility within international bond markets as investors contended with uncertainty of the future path of interest rates.

Risk appetite was further impacted by uncertainty surrounding the incoming US President’s policies regarding taxes, energy, trade, and regulatory policies and how they would impact broader global markets. In addition, a surge in the US dollar in the fourth quarter caused a negative drag on local currency returns. The Fund uses forwards to manage currency exposure, particularly when there are flows around month end, and for currency exposure purposes during market holidays and in the event of challenging liquidity in bond markets.

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| EBND | Bloomberg Global Aggregate Bond Index | Bloomberg EM Local Currency Government Diversified Index |

|---|

| 12/31/14 | $10,000 | $10,000 | $10,000 |

|---|

| 01/31/15 | $10,057 | $9,984 | $10,052 |

|---|

| 02/28/15 | $9,910 | $9,903 | $9,912 |

|---|

| 03/31/15 | $9,653 | $9,808 | $9,661 |

|---|

| 04/30/15 | $9,944 | $9,912 | $9,967 |

|---|

| 05/31/15 | $9,703 | $9,735 | $9,732 |

|---|

| 06/30/15 | $9,601 | $9,692 | $9,639 |

|---|

| 07/31/15 | $9,334 | $9,714 | $9,380 |

|---|

| 08/31/15 | $8,938 | $9,725 | $8,989 |

|---|

| 09/30/15 | $8,730 | $9,775 | $8,797 |

|---|

| 10/31/15 | $9,070 | $9,796 | $9,137 |

|---|

| 11/30/15 | $8,924 | $9,633 | $8,998 |

|---|

| 12/31/15 | $8,802 | $9,685 | $8,886 |

|---|

| 01/31/16 | $8,781 | $9,769 | $8,872 |

|---|

| 02/29/16 | $8,874 | $9,986 | $8,966 |

|---|

| 03/31/16 | $9,605 | $10,256 | $9,727 |

|---|

| 04/30/16 | $9,814 | $10,392 | $9,934 |

|---|

| 05/31/16 | $9,345 | $10,253 | $9,465 |

|---|

| 06/30/16 | $9,835 | $10,552 | $9,964 |

|---|

| 07/31/16 | $9,928 | $10,632 | $10,073 |

|---|

| 08/31/16 | $9,943 | $10,580 | $10,101 |

|---|

| 09/30/16 | $10,071 | $10,638 | $10,233 |

|---|

| 10/31/16 | $9,943 | $10,343 | $10,113 |

|---|

| 11/30/16 | $9,313 | $9,932 | $9,467 |

|---|

| 12/31/16 | $9,426 | $9,887 | $9,590 |

|---|

| 01/31/17 | $9,677 | $9,998 | $9,849 |

|---|

| 02/28/17 | $9,851 | $10,045 | $10,028 |

|---|

| 03/31/17 | $10,006 | $10,061 | $10,197 |

|---|

| 04/30/17 | $10,061 | $10,174 | $10,263 |

|---|

| 05/31/17 | $10,245 | $10,332 | $10,456 |

|---|

| 06/30/17 | $10,276 | $10,323 | $10,491 |

|---|

| 07/31/17 | $10,517 | $10,496 | $10,740 |

|---|

| 08/31/17 | $10,634 | $10,600 | $10,856 |

|---|

| 09/30/17 | $10,604 | $10,505 | $10,834 |

|---|

| 10/31/17 | $10,385 | $10,465 | $10,618 |

|---|

| 11/30/17 | $10,572 | $10,581 | $10,826 |

|---|

| 12/31/17 | $10,709 | $10,618 | $10,975 |

|---|

| 01/31/18 | $11,057 | $10,744 | $11,338 |

|---|

| 02/28/18 | $10,897 | $10,649 | $11,181 |

|---|

| 03/31/18 | $10,997 | $10,762 | $11,293 |

|---|

| 04/30/18 | $10,719 | $10,590 | $11,016 |

|---|

| 05/31/18 | $10,257 | $10,510 | $10,541 |

|---|

| 06/30/18 | $9,965 | $10,463 | $10,253 |

|---|

| 07/31/18 | $10,110 | $10,445 | $10,408 |

|---|

| 08/31/18 | $9,623 | $10,456 | $9,919 |

|---|

| 09/30/18 | $9,792 | $10,366 | $10,097 |

|---|

| 10/31/18 | $9,720 | $10,250 | $10,024 |

|---|

| 11/30/18 | $9,898 | $10,282 | $10,222 |

|---|

| 12/31/18 | $10,004 | $10,490 | $10,350 |

|---|

| 01/31/19 | $10,452 | $10,650 | $10,821 |

|---|

| 02/28/19 | $10,377 | $10,589 | $10,750 |

|---|

| 03/31/19 | $10,255 | $10,721 | $10,631 |

|---|

| 04/30/19 | $10,203 | $10,690 | $10,582 |

|---|

| 05/31/19 | $10,197 | $10,834 | $10,578 |

|---|

| 06/30/19 | $10,733 | $11,075 | $11,126 |

|---|

| 07/31/19 | $10,858 | $11,044 | $11,267 |

|---|

| 08/31/19 | $10,575 | $11,268 | $10,984 |

|---|

| 09/30/19 | $10,640 | $11,154 | $11,056 |

|---|

| 10/31/19 | $10,876 | $11,228 | $11,302 |

|---|

| 11/30/19 | $10,707 | $11,143 | $11,138 |

|---|

| 12/31/19 | $11,048 | $11,208 | $11,496 |

|---|

| 01/31/20 | $10,946 | $11,351 | $11,395 |

|---|

| 02/29/20 | $10,702 | $11,427 | $11,154 |

|---|

| 03/31/20 | $9,819 | $11,171 | $10,245 |

|---|

| 04/30/20 | $10,180 | $11,390 | $10,610 |

|---|

| 05/31/20 | $10,512 | $11,440 | $10,959 |

|---|

| 06/30/20 | $10,602 | $11,542 | $11,062 |

|---|

| 07/31/20 | $10,881 | $11,910 | $11,365 |

|---|

| 08/31/20 | $10,849 | $11,892 | $11,335 |

|---|

| 09/30/20 | $10,698 | $11,849 | $11,181 |

|---|

| 10/31/20 | $10,753 | $11,861 | $11,242 |

|---|

| 11/30/20 | $11,219 | $12,076 | $11,734 |

|---|

| 12/31/20 | $11,555 | $12,238 | $12,086 |

|---|

| 01/31/21 | $11,411 | $12,131 | $11,949 |

|---|

| 02/28/21 | $11,128 | $11,922 | $11,661 |

|---|

| 03/31/21 | $10,783 | $11,693 | $11,305 |

|---|

| 04/30/21 | $11,010 | $11,840 | $11,539 |

|---|

| 05/31/21 | $11,179 | $11,951 | $11,741 |

|---|

| 06/30/21 | $11,062 | $11,846 | $11,605 |

|---|

| 07/31/21 | $11,019 | $12,004 | $11,580 |

|---|

| 08/31/21 | $11,075 | $11,954 | $11,625 |

|---|

| 09/30/21 | $10,687 | $11,741 | $11,228 |

|---|

| 10/31/21 | $10,568 | $11,713 | $11,102 |

|---|

| 11/30/21 | $10,349 | $11,679 | $10,878 |

|---|

| 12/31/21 | $10,429 | $11,662 | $10,960 |

|---|

| 01/31/22 | $10,378 | $11,423 | $10,914 |

|---|

| 02/28/22 | $10,115 | $11,288 | $10,648 |

|---|

| 03/31/22 | $9,794 | $10,944 | $10,183 |

|---|

| 04/30/22 | $9,243 | $10,344 | $9,617 |

|---|

| 05/31/22 | $9,335 | $10,373 | $9,704 |

|---|

| 06/30/22 | $8,874 | $10,040 | $9,234 |

|---|

| 07/31/22 | $8,952 | $10,253 | $9,312 |

|---|

| 08/31/22 | $8,919 | $9,849 | $9,275 |

|---|

| 09/30/22 | $8,408 | $9,343 | $8,752 |

|---|

| 10/31/22 | $8,366 | $9,278 | $8,708 |

|---|

| 11/30/22 | $8,982 | $9,715 | $9,331 |

|---|

| 12/31/22 | $9,189 | $9,767 | $9,565 |

|---|

| 01/31/23 | $9,635 | $10,088 | $10,029 |

|---|

| 02/28/23 | $9,256 | $9,753 | $9,633 |

|---|

| 03/31/23 | $9,611 | $10,061 | $10,001 |

|---|

| 04/30/23 | $9,599 | $10,106 | $10,004 |

|---|

| 05/31/23 | $9,540 | $9,908 | $9,937 |

|---|

| 06/30/23 | $9,661 | $9,907 | $10,085 |

|---|

| 07/31/23 | $9,872 | $9,976 | $10,302 |

|---|

| 08/31/23 | $9,604 | $9,839 | $10,032 |

|---|

| 09/30/23 | $9,266 | $9,552 | $9,685 |

|---|

| 10/31/23 | $9,149 | $9,438 | $9,550 |

|---|

| 11/30/23 | $9,713 | $9,914 | $10,144 |

|---|

| 12/31/23 | $10,089 | $10,326 | $10,536 |

|---|

| 01/31/24 | $9,887 | $10,183 | $10,335 |

|---|

| 02/29/24 | $9,836 | $10,055 | $10,287 |

|---|

| 03/31/24 | $9,798 | $10,111 | $10,258 |

|---|

| 04/30/24 | $9,576 | $9,855 | $10,026 |

|---|

| 05/31/24 | $9,716 | $9,985 | $10,175 |

|---|

| 06/30/24 | $9,670 | $9,999 | $10,137 |

|---|

| 07/31/24 | $9,892 | $10,275 | $10,367 |

|---|

| 08/31/24 | $10,216 | $10,518 | $10,704 |

|---|

| 09/30/24 | $10,507 | $10,697 | $11,020 |

|---|

| 10/31/24 | $10,020 | $10,339 | $10,514 |

|---|

| 11/30/24 | $10,029 | $10,374 | $10,527 |

|---|

| 12/31/24 | $9,833 | $10,151 | $10,323 |

|---|

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | 10 Years |

|---|

| EBND | (2.53%) | (2.30%) | (0.17%) |

|---|

| Bloomberg Global Aggregate Bond Index | (1.69%) | (1.96%) | 0.15% |

|---|

| Bloomberg EM Local Currency Government Diversified Index | (2.01%) | (2.13%) | 0.32% |

|---|

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling 1-866-787-2257 or visiting our website at www.ssga.com.

Key Fund Statistics as of 12/31/2024

- Total Net Assets$1,853,661,684

- Number of Portfolio Holdings544

- Portfolio Turnover Rate25%

- Total Advisory Fees Paid$5,837,205

What did the Fund invest in as of 12/31/2024? (as a percentage of total net assets)

| Holdings | % |

| Brazil Letras do Tesouro Nacional, 0.00%, due 07/01/26 | 1.0% |

| Peru Government Bonds, 6.90%, due 08/12/37 | 0.8% |

| Peru Government Bonds, 6.95%, due 08/12/31 | 0.6% |

| Republic of South Africa Government Bonds, 8.00%, due 01/31/30 | 0.6% |

| Republic of Poland Government Bonds, 1.75%, due 04/25/32 | 0.6% |

| Turkiye Government Bonds, 31.08%, due 11/08/28 | 0.6% |

| Colombia TES, 9.25%, due 05/28/42 | 0.6% |

| Korea Treasury Bonds, 1.88%, due 03/10/51 | 0.5% |

| Mexico Bonos, 7.75%, due 11/13/42 | 0.5% |

| Republic of South Africa Government Bonds, 8.75%, due 01/31/44 | 0.5% |

| Country | % |

| South Korea | 12.4% |

| China | 11.7% |

| Indonesia | 7.1% |

| Malaysia | 6.7% |

| Thailand | 6.3% |

| Philippines | 4.5% |

| Brazil | 4.5% |

| Czech Republic | 4.4% |

| Mexico | 4.4% |

| Israel | 4.4% |

Availability of Additional Information

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information please visit: www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs.

SPDR Bloomberg International Corporate Bond ETF

Principal Listing Exchange: NYSEArca Exchange

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about the SPDR Bloomberg International Corporate Bond ETF (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

What were the Fund costs for the last year? (based on a hypothetical $10,000 Investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR Bloomberg International Corporate Bond ETF | $49 | 0.50% |

|---|

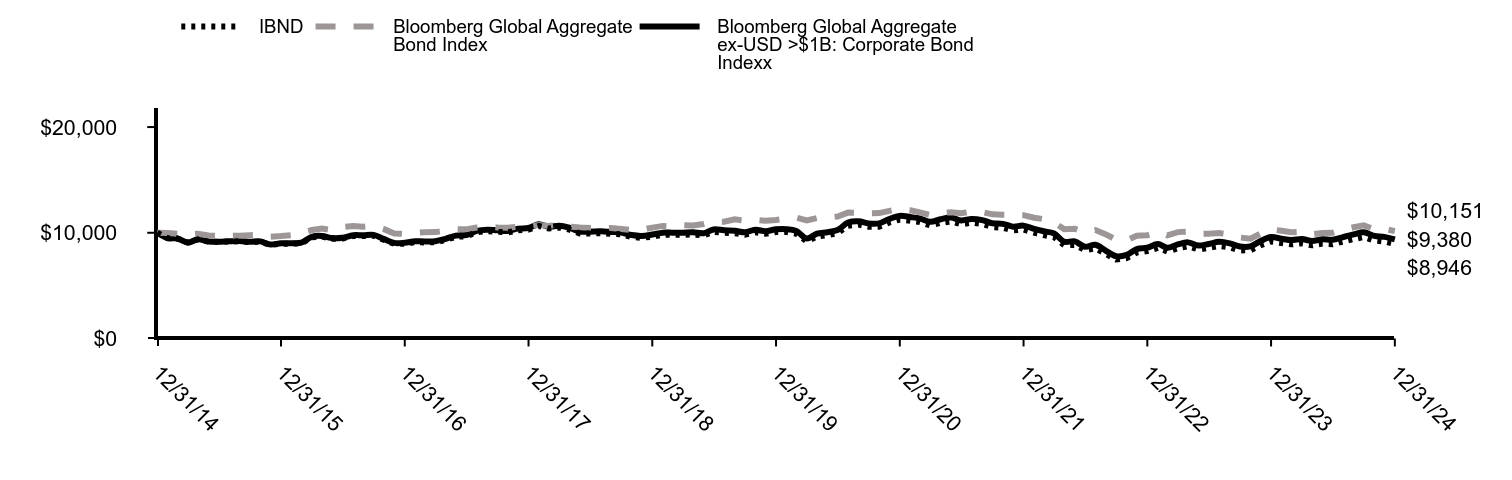

How did the Fund perform last year and what affected its performance?

Global concerns around heightened inflation and changes in central bank policies were primary drivers of Fund performance during the reporting period. The Fund performed in line with expectations.

The year 2024 saw a number of global central banks begin easing after keeping rates high to combat sticky inflation in 2023. The European Central Bank and the U.S. Federal Reserve both cut rates by 100 basis points in 2024, while the Bank of England kept cuts to 50 basis points. However the path to easing was anything but smooth, as growth and other economic data generally remained strong, and as such the speed and magnitude of policy easing was pared back for many central banks, particularly in the U.S.. This led to substantial volatility within the international bond market as investors contended with uncertainty of the future path of interest rates. All major government bond yields ended the year higher which negatively impacted spread sectors such as global corporates. Uncertainty around the incoming U.S. President’s policies regarding tariffs and their potential impacts on the international backdrop have forced investors to exercise caution in this sector.

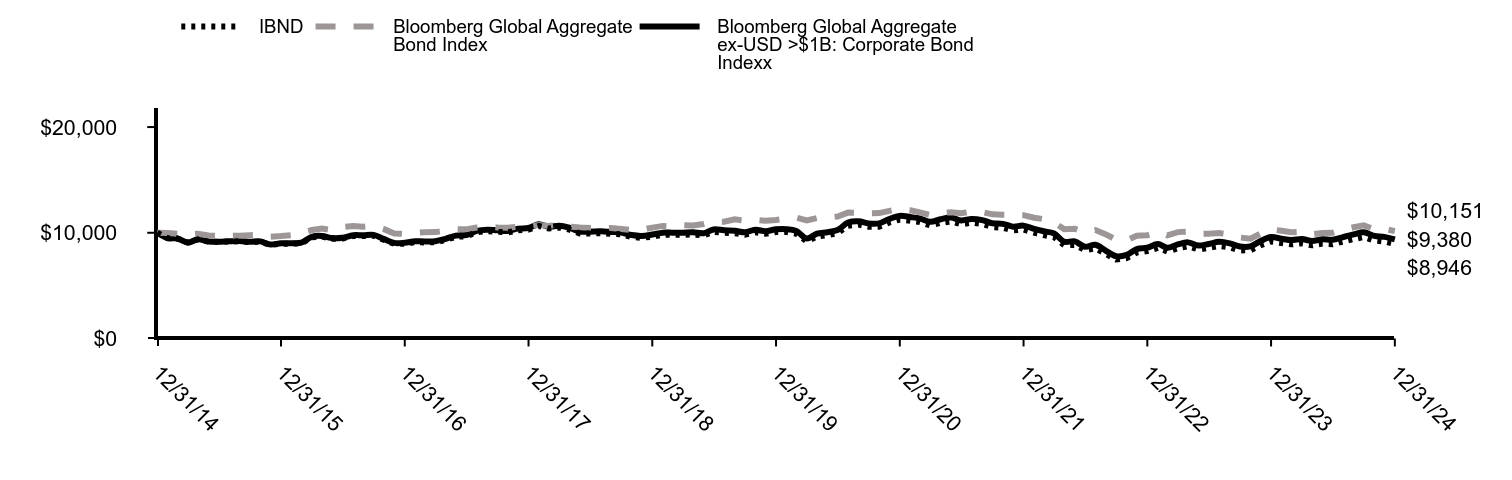

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| IBND | Bloomberg Global Aggregate Bond Index | Bloomberg Global Aggregate ex-USD >$1B: Corporate Bond Indexx |

|---|

| 12/31/14 | $10,000 | $10,000 | $10,000 |

|---|

| 01/31/15 | $9,487 | $9,984 | $9,495 |

|---|

| 02/28/15 | $9,456 | $9,903 | $9,463 |

|---|

| 03/31/15 | $9,064 | $9,808 | $9,071 |

|---|

| 04/30/15 | $9,372 | $9,912 | $9,384 |

|---|

| 05/31/15 | $9,157 | $9,735 | $9,170 |

|---|

| 06/30/15 | $9,134 | $9,692 | $9,150 |

|---|

| 07/31/15 | $9,170 | $9,714 | $9,192 |

|---|

| 08/31/15 | $9,190 | $9,725 | $9,213 |

|---|

| 09/30/15 | $9,115 | $9,775 | $9,144 |

|---|

| 10/31/15 | $9,149 | $9,796 | $9,185 |

|---|

| 11/30/15 | $8,847 | $9,633 | $8,883 |

|---|

| 12/31/15 | $8,971 | $9,685 | $9,011 |

|---|

| 01/31/16 | $8,969 | $9,769 | $9,017 |

|---|

| 02/29/16 | $9,008 | $9,986 | $9,064 |

|---|

| 03/31/16 | $9,562 | $10,256 | $9,621 |

|---|

| 04/30/16 | $9,637 | $10,392 | $9,700 |

|---|

| 05/31/16 | $9,427 | $10,253 | $9,495 |

|---|

| 06/30/16 | $9,457 | $10,552 | $9,528 |

|---|

| 07/31/16 | $9,691 | $10,632 | $9,763 |

|---|

| 08/31/16 | $9,699 | $10,580 | $9,763 |

|---|

| 09/30/16 | $9,725 | $10,638 | $9,797 |

|---|

| 10/31/16 | $9,311 | $10,343 | $9,396 |

|---|

| 11/30/16 | $8,958 | $9,932 | $9,040 |

|---|

| 12/31/16 | $8,970 | $9,887 | $9,058 |

|---|

| 01/31/17 | $9,106 | $9,998 | $9,204 |

|---|

| 02/28/17 | $9,084 | $10,045 | $9,182 |

|---|

| 03/31/17 | $9,102 | $10,061 | $9,205 |

|---|

| 04/30/17 | $9,314 | $10,174 | $9,423 |

|---|

| 05/31/17 | $9,617 | $10,332 | $9,732 |

|---|

| 06/30/17 | $9,671 | $10,323 | $9,790 |

|---|

| 07/31/17 | $10,047 | $10,496 | $10,174 |

|---|

| 08/31/17 | $10,156 | $10,600 | $10,290 |

|---|

| 09/30/17 | $10,091 | $10,505 | $10,228 |

|---|

| 10/31/17 | $10,032 | $10,465 | $10,175 |

|---|

| 11/30/17 | $10,241 | $10,581 | $10,390 |

|---|

| 12/31/17 | $10,295 | $10,618 | $10,453 |

|---|

| 01/31/18 | $10,647 | $10,744 | $10,814 |

|---|

| 02/28/18 | $10,401 | $10,649 | $10,565 |

|---|

| 03/31/18 | $10,494 | $10,762 | $10,666 |

|---|

| 04/30/18 | $10,306 | $10,590 | $10,478 |

|---|

| 05/31/18 | $9,941 | $10,510 | $10,111 |

|---|

| 06/30/18 | $9,933 | $10,463 | $10,104 |

|---|

| 07/31/18 | $9,958 | $10,445 | $10,133 |

|---|

| 08/31/18 | $9,906 | $10,456 | $10,083 |

|---|

| 09/30/18 | $9,852 | $10,366 | $10,032 |

|---|

| 10/31/18 | $9,603 | $10,250 | $9,783 |

|---|

| 11/30/18 | $9,515 | $10,282 | $9,702 |

|---|

| 12/31/18 | $9,637 | $10,490 | $9,833 |

|---|

| 01/31/19 | $9,810 | $10,650 | $10,011 |

|---|

| 02/28/19 | $9,804 | $10,589 | $10,009 |

|---|

| 03/31/19 | $9,807 | $10,721 | $10,013 |

|---|

| 04/30/19 | $9,835 | $10,690 | $10,048 |

|---|

| 05/31/19 | $9,743 | $10,834 | $9,957 |

|---|

| 06/30/19 | $10,091 | $11,075 | $10,317 |

|---|

| 07/31/19 | $9,997 | $11,044 | $10,230 |

|---|

| 08/31/19 | $9,958 | $11,268 | $10,193 |

|---|

| 09/30/19 | $9,806 | $11,154 | $10,043 |

|---|

| 10/31/19 | $10,043 | $11,228 | $10,286 |

|---|

| 11/30/19 | $9,900 | $11,143 | $10,146 |

|---|

| 12/31/19 | $10,076 | $11,208 | $10,327 |

|---|

| 01/31/20 | $10,085 | $11,351 | $10,342 |

|---|

| 02/29/20 | $9,912 | $11,427 | $10,171 |

|---|

| 03/31/20 | $9,197 | $11,171 | $9,455 |

|---|

| 04/30/20 | $9,645 | $11,390 | $9,914 |

|---|

| 05/31/20 | $9,778 | $11,440 | $10,052 |

|---|

| 06/30/20 | $9,972 | $11,542 | $10,253 |

|---|

| 07/31/20 | $10,667 | $11,910 | $10,971 |

|---|

| 08/31/20 | $10,773 | $11,892 | $11,088 |

|---|

| 09/30/20 | $10,571 | $11,849 | $10,886 |

|---|

| 10/31/20 | $10,576 | $11,861 | $10,894 |

|---|

| 11/30/20 | $10,975 | $12,076 | $11,305 |

|---|

| 12/31/20 | $11,253 | $12,238 | $11,598 |

|---|

| 01/31/21 | $11,137 | $12,131 | $11,486 |

|---|

| 02/28/21 | $11,015 | $11,922 | $11,357 |

|---|

| 03/31/21 | $10,692 | $11,693 | $11,031 |

|---|

| 04/30/21 | $10,930 | $11,840 | $11,279 |

|---|

| 05/31/21 | $11,056 | $11,951 | $11,453 |

|---|

| 06/30/21 | $10,811 | $11,846 | $11,167 |

|---|

| 07/31/21 | $10,945 | $12,004 | $11,309 |

|---|

| 08/31/21 | $10,833 | $11,954 | $11,198 |

|---|

| 09/30/21 | $10,540 | $11,741 | $10,899 |

|---|

| 10/31/21 | $10,484 | $11,713 | $10,843 |

|---|

| 11/30/21 | $10,221 | $11,679 | $10,579 |

|---|

| 12/31/21 | $10,307 | $11,662 | $10,673 |

|---|

| 01/31/22 | $10,005 | $11,423 | $10,364 |

|---|

| 02/28/22 | $9,789 | $11,288 | $10,142 |

|---|

| 03/31/22 | $9,584 | $10,944 | $9,932 |

|---|

| 04/30/22 | $8,823 | $10,344 | $9,148 |

|---|

| 05/31/22 | $8,852 | $10,373 | $9,187 |

|---|

| 06/30/22 | $8,358 | $10,040 | $8,673 |

|---|

| 07/31/22 | $8,532 | $10,253 | $8,865 |

|---|

| 08/31/22 | $7,983 | $9,849 | $8,295 |

|---|

| 09/30/22 | $7,469 | $9,343 | $7,777 |

|---|

| 10/31/22 | $7,607 | $9,278 | $7,912 |

|---|

| 11/30/22 | $8,123 | $9,715 | $8,451 |

|---|

| 12/31/22 | $8,260 | $9,767 | $8,582 |

|---|

| 01/31/23 | $8,575 | $10,088 | $8,930 |

|---|

| 02/28/23 | $8,229 | $9,753 | $8,574 |

|---|

| 03/31/23 | $8,536 | $10,061 | $8,904 |

|---|

| 04/30/23 | $8,716 | $10,106 | $9,091 |

|---|

| 05/31/23 | $8,423 | $9,908 | $8,787 |

|---|

| 06/30/23 | $8,563 | $9,907 | $8,937 |

|---|

| 07/31/23 | $8,753 | $9,976 | $9,139 |

|---|

| 08/31/23 | $8,619 | $9,839 | $9,002 |

|---|

| 09/30/23 | $8,327 | $9,552 | $8,699 |

|---|

| 10/31/23 | $8,341 | $9,438 | $8,714 |

|---|

| 11/30/23 | $8,820 | $9,914 | $9,216 |

|---|

| 12/31/23 | $9,179 | $10,326 | $9,591 |

|---|

| 01/31/24 | $9,027 | $10,183 | $9,437 |

|---|

| 02/29/24 | $8,904 | $10,055 | $9,310 |

|---|

| 03/31/24 | $8,996 | $10,111 | $9,409 |

|---|

| 04/30/24 | $8,813 | $9,855 | $9,221 |

|---|

| 05/31/24 | $8,971 | $9,985 | $9,391 |

|---|

| 06/30/24 | $8,922 | $9,999 | $9,333 |

|---|

| 07/31/24 | $9,164 | $10,275 | $9,595 |

|---|

| 08/31/24 | $9,400 | $10,518 | $9,843 |

|---|

| 09/30/24 | $9,594 | $10,697 | $10,049 |

|---|

| 10/31/24 | $9,260 | $10,339 | $9,712 |

|---|

| 11/30/24 | $9,174 | $10,374 | $9,613 |

|---|

| 12/31/24 | $8,946 | $10,151 | $9,380 |

|---|

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | 10 Years |

|---|

| IBND | (2.54%) | (2.35%) | (1.11%) |

|---|

| Bloomberg Global Aggregate Bond Index | (1.69%) | (1.96%) | 0.15% |

|---|

| Bloomberg Global Aggregate ex-USD >$1B: Corporate Bond Indexx | (2.20%) | (1.91%) | (0.64%) |

|---|

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling 1-866-787-2257 or visiting our website at www.ssga.com.

Key Fund Statistics as of 12/31/2024

- Total Net Assets$200,058,010

- Number of Portfolio Holdings838

- Portfolio Turnover Rate13%

- Total Advisory Fees Paid$885,600

What did the Fund invest in as of 12/31/2024? (as a percentage of total net assets)

| Holdings | % |

| JPMorgan Chase & Co., 1.09%, due 03/11/27 | 0.4% |

| UBS Group AG, 7.75%, due 03/01/29 | 0.4% |

| ING Groep NV, 4.50%, due 05/23/29 | 0.3% |

| Berkshire Hathaway, Inc., 1.03%, due 12/08/27 | 0.3% |

| Seven & i Holdings Co. Ltd., 0.19%, due 12/19/25 | 0.3% |

| NTT Finance Corp., 0.38%, due 09/20/30 | 0.3% |

| NTT Finance Corp., 0.84%, due 06/20/33 | 0.3% |

| Anheuser-Busch InBev SA, 1.15%, due 01/22/27 | 0.3% |

| Banque Federative du Credit Mutuel SA, 0.01%, due 05/11/26 | 0.3% |

| Societe Generale SA, 0.25%, due 07/08/27 | 0.3% |

| Country | % |

| United States | 25.9% |

| France | 20.6% |

| Germany | 10.9% |

| United Kingdom | 8.9% |

| Spain | 5.9% |

| Italy | 5.6% |

| Netherlands | 5.2% |

| Switzerland | 3.8% |

| Belgium | 2.0% |

| Japan | 1.9% |

Availability of Additional Information

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information please visit: www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs.

SPDR Bloomberg International Treasury Bond ETF

Principal Listing Exchange: NYSEArca Exchange

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about the SPDR Bloomberg International Treasury Bond ETF (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

What were the Fund costs for the last year? (based on a hypothetical $10,000 Investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR Bloomberg International Treasury Bond ETF | $34 | 0.35% |

|---|

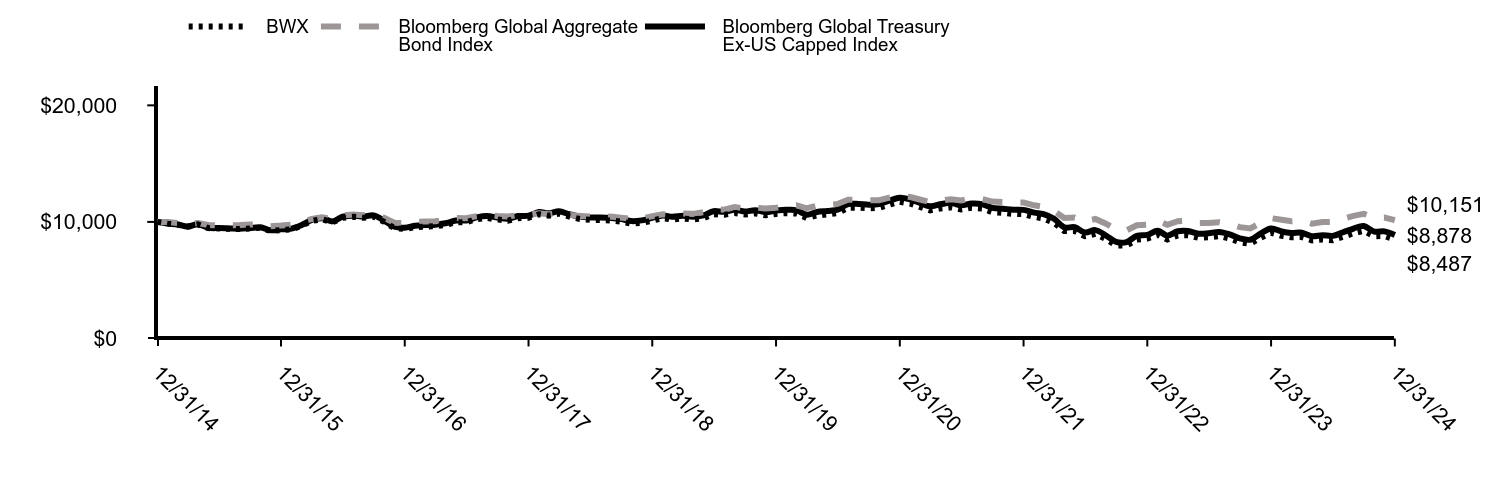

How did the Fund perform last year and what affected its performance?

Global concerns around heightened inflation and changes in central bank policies were primary drivers of Fund performance during the reporting period. The Fund performed in line with expectations.

The year 2024 saw a number of global central banks begin easing after keeping rates high to combat sticky inflation in 2023. The European Central Bank and the U.S. Federal Reserve both cut rates by 100 basis points in 2024, while the Bank of England kept cuts to 50 basis points. However the path to easing was anything but smooth, as growth and other economic data generally remained strong, and as such the speed and magnitude of policy easing was pared back for many central banks, particularly in the U.S.. This led to substantial volatility within the international government bond sector as investors contended with uncertainty of the future path of interest rates. All major government bond yields ended the year higher than where they started, resulting in negative performance for global Treasuries. Uncertainty around the incoming U.S. President’s policies regarding tariffs and their potential impacts on the international backdrop have forced investors to exercise caution in this sector.

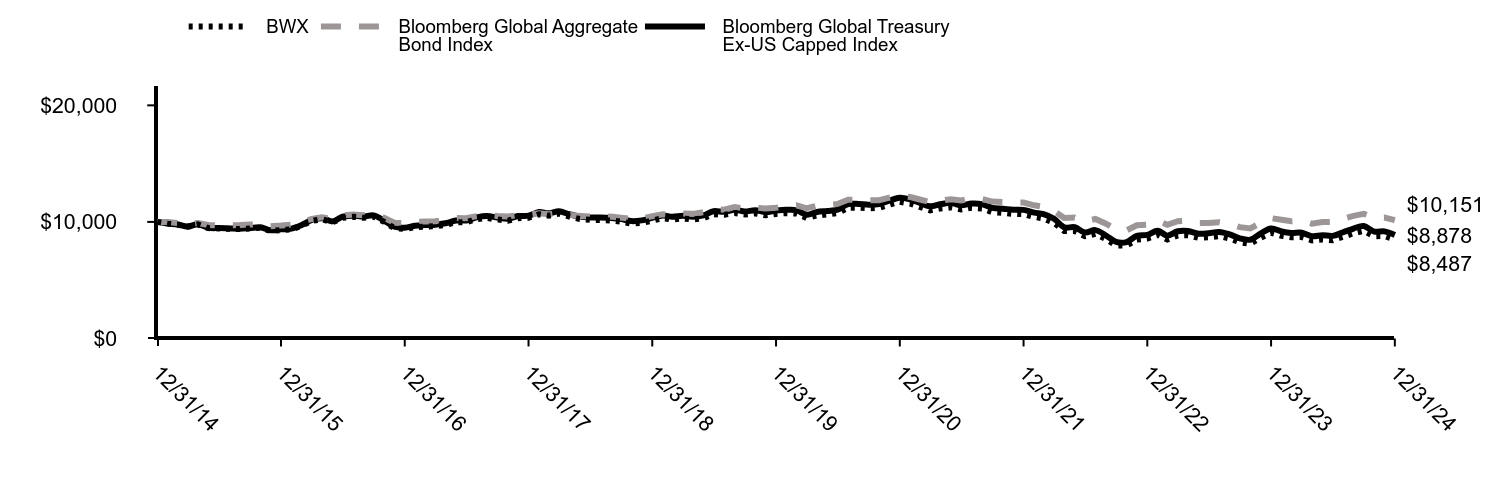

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| BWX | Bloomberg Global Aggregate Bond Index | Bloomberg Global Treasury Ex-US Capped Index |

|---|

| 12/31/14 | $10,000 | $10,000 | $10,000 |

|---|

| 01/31/15 | $9,851 | $9,984 | $9,859 |

|---|

| 02/28/15 | $9,774 | $9,903 | $9,782 |

|---|

| 03/31/15 | $9,588 | $9,808 | $9,602 |

|---|

| 04/30/15 | $9,780 | $9,912 | $9,801 |

|---|

| 05/31/15 | $9,470 | $9,735 | $9,497 |

|---|

| 06/30/15 | $9,438 | $9,692 | $9,467 |

|---|

| 07/31/15 | $9,410 | $9,714 | $9,442 |

|---|

| 08/31/15 | $9,389 | $9,725 | $9,422 |

|---|

| 09/30/15 | $9,433 | $9,775 | $9,472 |

|---|

| 10/31/15 | $9,490 | $9,796 | $9,536 |

|---|

| 11/30/15 | $9,229 | $9,633 | $9,279 |

|---|

| 12/31/15 | $9,301 | $9,685 | $9,359 |

|---|

| 01/31/16 | $9,359 | $9,769 | $9,425 |

|---|

| 02/29/16 | $9,651 | $9,986 | $9,718 |

|---|

| 03/31/16 | $10,091 | $10,256 | $10,166 |

|---|

| 04/30/16 | $10,228 | $10,392 | $10,312 |

|---|

| 05/31/16 | $9,960 | $10,253 | $10,046 |

|---|

| 06/30/16 | $10,351 | $10,552 | $10,445 |

|---|

| 07/31/16 | $10,435 | $10,632 | $10,539 |

|---|

| 08/31/16 | $10,354 | $10,580 | $10,456 |

|---|

| 09/30/16 | $10,450 | $10,638 | $10,558 |

|---|

| 10/31/16 | $10,002 | $10,343 | $10,114 |

|---|

| 11/30/16 | $9,475 | $9,932 | $9,583 |

|---|

| 12/31/16 | $9,397 | $9,887 | $9,507 |

|---|

| 01/31/17 | $9,555 | $9,998 | $9,673 |

|---|

| 02/28/17 | $9,603 | $10,045 | $9,725 |

|---|

| 03/31/17 | $9,633 | $10,061 | $9,761 |

|---|

| 04/30/17 | $9,751 | $10,174 | $9,885 |

|---|

| 05/31/17 | $9,974 | $10,332 | $10,116 |

|---|

| 06/30/17 | $9,977 | $10,323 | $10,123 |

|---|

| 07/31/17 | $10,234 | $10,496 | $10,387 |

|---|

| 08/31/17 | $10,341 | $10,600 | $10,505 |

|---|

| 09/30/17 | $10,202 | $10,505 | $10,369 |

|---|

| 10/31/17 | $10,107 | $10,465 | $10,277 |

|---|

| 11/30/17 | $10,322 | $10,581 | $10,500 |

|---|

| 12/31/17 | $10,350 | $10,618 | $10,536 |

|---|

| 01/31/18 | $10,652 | $10,744 | $10,846 |

|---|

| 02/28/18 | $10,539 | $10,649 | $10,735 |

|---|

| 03/31/18 | $10,708 | $10,762 | $10,911 |

|---|

| 04/30/18 | $10,457 | $10,590 | $10,660 |

|---|

| 05/31/18 | $10,257 | $10,510 | $10,463 |

|---|

| 06/30/18 | $10,178 | $10,463 | $10,386 |

|---|

| 07/31/18 | $10,159 | $10,445 | $10,370 |

|---|

| 08/31/18 | $10,112 | $10,456 | $10,326 |

|---|

| 09/30/18 | $10,024 | $10,366 | $10,239 |

|---|

| 10/31/18 | $9,857 | $10,250 | $10,071 |

|---|

| 11/30/18 | $9,914 | $10,282 | $10,132 |

|---|

| 12/31/18 | $10,116 | $10,490 | $10,343 |

|---|

| 01/31/19 | $10,318 | $10,650 | $10,554 |

|---|

| 02/28/19 | $10,208 | $10,589 | $10,444 |

|---|

| 03/31/19 | $10,290 | $10,721 | $10,528 |

|---|

| 04/30/19 | $10,215 | $10,690 | $10,453 |

|---|

| 05/31/19 | $10,321 | $10,834 | $10,567 |

|---|

| 06/30/19 | $10,665 | $11,075 | $10,920 |

|---|

| 07/31/19 | $10,607 | $11,044 | $10,867 |

|---|

| 08/31/19 | $10,769 | $11,268 | $11,035 |

|---|

| 09/30/19 | $10,632 | $11,154 | $10,900 |

|---|

| 10/31/19 | $10,726 | $11,228 | $10,999 |

|---|

| 11/30/19 | $10,569 | $11,143 | $10,844 |

|---|

| 12/31/19 | $10,686 | $11,208 | $10,968 |

|---|

| 01/31/20 | $10,752 | $11,351 | $11,041 |

|---|

| 02/29/20 | $10,720 | $11,427 | $11,013 |

|---|

| 03/31/20 | $10,333 | $11,171 | $10,622 |

|---|

| 04/30/20 | $10,549 | $11,390 | $10,846 |

|---|

| 05/31/20 | $10,641 | $11,440 | $10,938 |

|---|

| 06/30/20 | $10,755 | $11,542 | $11,057 |

|---|

| 07/31/20 | $11,213 | $11,910 | $11,529 |

|---|

| 08/31/20 | $11,222 | $11,892 | $11,544 |

|---|

| 09/30/20 | $11,159 | $11,849 | $11,481 |

|---|

| 10/31/20 | $11,205 | $11,861 | $11,534 |

|---|

| 11/30/20 | $11,480 | $12,076 | $11,818 |

|---|

| 12/31/20 | $11,726 | $12,238 | $12,078 |

|---|

| 01/31/21 | $11,570 | $12,131 | $11,922 |

|---|

| 02/28/21 | $11,282 | $11,922 | $11,630 |

|---|

| 03/31/21 | $10,994 | $11,693 | $11,337 |

|---|

| 04/30/21 | $11,158 | $11,840 | $11,510 |

|---|

| 05/31/21 | $11,246 | $11,951 | $11,642 |

|---|

| 06/30/21 | $11,062 | $11,846 | $11,419 |

|---|

| 07/31/21 | $11,210 | $12,004 | $11,579 |

|---|

| 08/31/21 | $11,150 | $11,954 | $11,519 |

|---|

| 09/30/21 | $10,834 | $11,741 | $11,200 |

|---|

| 10/31/21 | $10,775 | $11,713 | $11,135 |

|---|

| 11/30/21 | $10,690 | $11,679 | $11,050 |

|---|

| 12/31/21 | $10,669 | $11,662 | $11,032 |

|---|

| 01/31/22 | $10,435 | $11,423 | $10,796 |

|---|

| 02/28/22 | $10,304 | $11,288 | $10,665 |

|---|

| 03/31/22 | $9,921 | $10,944 | $10,268 |

|---|

| 04/30/22 | $9,211 | $10,344 | $9,536 |

|---|

| 05/31/22 | $9,217 | $10,373 | $9,546 |

|---|

| 06/30/22 | $8,773 | $10,040 | $9,089 |

|---|

| 07/31/22 | $8,968 | $10,253 | $9,294 |

|---|

| 08/31/22 | $8,523 | $9,849 | $8,835 |

|---|

| 09/30/22 | $7,982 | $9,343 | $8,282 |

|---|

| 10/31/22 | $7,972 | $9,278 | $8,270 |

|---|

| 11/30/22 | $8,485 | $9,715 | $8,804 |

|---|

| 12/31/22 | $8,572 | $9,767 | $8,887 |

|---|

| 01/31/23 | $8,893 | $10,088 | $9,234 |

|---|

| 02/28/23 | $8,492 | $9,753 | $8,822 |

|---|

| 03/31/23 | $8,848 | $10,061 | $9,199 |

|---|

| 04/30/23 | $8,854 | $10,106 | $9,214 |

|---|

| 05/31/23 | $8,635 | $9,908 | $8,983 |

|---|

| 06/30/23 | $8,677 | $9,907 | $9,029 |

|---|

| 07/31/23 | $8,776 | $9,976 | $9,134 |

|---|

| 08/31/23 | $8,575 | $9,839 | $8,928 |

|---|

| 09/30/23 | $8,246 | $9,552 | $8,590 |

|---|

| 10/31/23 | $8,134 | $9,438 | $8,473 |

|---|

| 11/30/23 | $8,633 | $9,914 | $8,995 |

|---|

| 12/31/23 | $9,062 | $10,326 | $9,442 |

|---|

| 01/31/24 | $8,807 | $10,183 | $9,181 |

|---|

| 02/29/24 | $8,685 | $10,055 | $9,056 |

|---|

| 03/31/24 | $8,698 | $10,111 | $9,070 |

|---|

| 04/30/24 | $8,415 | $9,855 | $8,780 |

|---|

| 05/31/24 | $8,489 | $9,985 | $8,861 |

|---|

| 06/30/24 | $8,428 | $9,999 | $8,800 |

|---|

| 07/31/24 | $8,725 | $10,275 | $9,112 |

|---|

| 08/31/24 | $9,031 | $10,518 | $9,433 |

|---|

| 09/30/24 | $9,231 | $10,697 | $9,648 |

|---|

| 10/31/24 | $8,772 | $10,339 | $9,171 |

|---|

| 11/30/24 | $8,786 | $10,374 | $9,185 |

|---|

| 12/31/24 | $8,487 | $10,151 | $8,878 |

|---|

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | 10 Years |

|---|

| BWX | (6.35%) | (4.50%) | (1.63%) |

|---|

| Bloomberg Global Aggregate Bond Index | (1.69%) | (1.96%) | 0.15% |

|---|

| Bloomberg Global Treasury Ex-US Capped Index | (5.97%) | (4.14%) | (1.18%) |

|---|

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling 1-866-787-2257 or visiting our website at www.ssga.com.

Key Fund Statistics as of 12/31/2024

- Total Net Assets$994,842,319

- Number of Portfolio Holdings1,245

- Portfolio Turnover Rate17%

- Total Advisory Fees Paid$3,265,524

What did the Fund invest in as of 12/31/2024? (as a percentage of total net assets)

| Holdings | % |

| Japan Government Ten Year Bonds, 1.10%, due 06/20/34 | 0.4% |

| Japan Government Ten Year Bonds, 0.80%, due 03/20/34 | 0.4% |

| Japan Government Ten Year Bonds, 0.90%, due 09/20/34 | 0.4% |

| China Government Bonds, 4.08%, due 10/22/48 | 0.4% |

| Kingdom of Belgium Government Bonds, 5.00%, due 03/28/35 | 0.3% |

| Canada Government Bonds, 3.50%, due 09/01/29 | 0.3% |

| U.K. Gilts, 4.50%, due 09/07/34 | 0.3% |

| Indonesia Treasury Bonds, 7.00%, due 05/15/27 | 0.3% |

| U.K. Gilts, 4.13%, due 01/29/27 | 0.3% |

| Japan Government Forty Year Bonds, 2.20%, due 03/20/64 | 0.3% |

| Country | % |

| Japan | 23.1% |

| France | 5.0% |

| United Kingdom | 4.9% |

| Canada | 4.6% |

| South Korea | 4.6% |

| China | 4.6% |

| Italy | 4.5% |

| Spain | 4.5% |

| Germany | 4.5% |

| Australia | 4.0% |

Availability of Additional Information

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information please visit: www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs.

SPDR FTSE International Government Inflation-Protected Bond ETF

Principal Listing Exchange: NYSEArca Exchange

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about the SPDR FTSE International Government Inflation-Protected Bond ETF (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

What were the Fund costs for the last year? (based on a hypothetical $10,000 Investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR FTSE International Government Inflation-Protected Bond ETF | $48 | 0.50% |

|---|

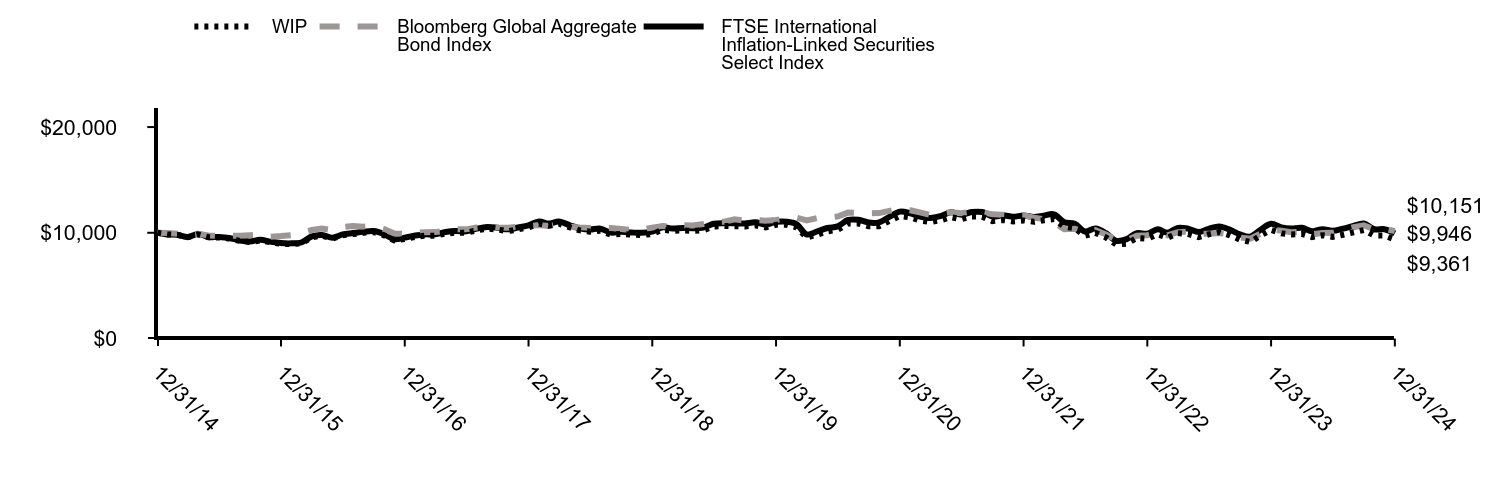

How did the Fund perform last year and what affected its performance?

Global concerns around heightened inflation and changes in central bank policies were primary drivers of Fund performance during the reporting period. The Fund performed in line with expectations.

The year 2024 saw a number of global central banks begin easing after keeping rates high to combat sticky inflation in 2023. The European Central Bank and the U.S. Federal Reserve both cut rates by 100 basis points in 2024, while the Bank of England kept cuts to 50 basis points. However the path to easing was anything but smooth, as growth and other economic data generally remained strong, and as such the speed and magnitude of policy easing was pared back for many central banks, particularly in the U.S.. This led to substantial volatility within the international government bond sector as investors contended with uncertainty of the future path of interest rates. All major government bond yields ended the year higher than where they started, resulting in negative performance for global Treasuries. Uncertainty around the incoming U.S. President’s policies regarding tariffs and their potential impacts on the international backdrop have forced investors to exercise caution in this sector.

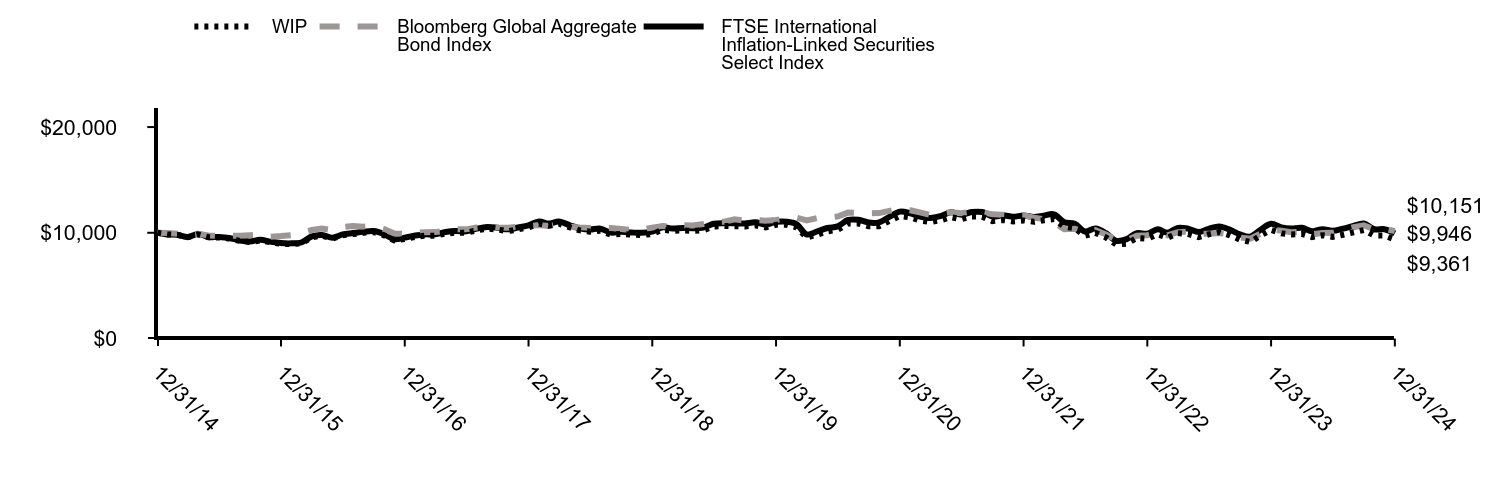

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| WIP | Bloomberg Global Aggregate Bond Index | FTSE International Inflation-Linked Securities Select Index |

|---|

| 12/31/14 | $10,000 | $10,000 | $10,000 |

|---|

| 01/31/15 | $9,846 | $9,984 | $9,844 |

|---|

| 02/28/15 | $9,802 | $9,903 | $9,812 |

|---|

| 03/31/15 | $9,580 | $9,808 | $9,603 |

|---|

| 04/30/15 | $9,849 | $9,912 | $9,874 |

|---|

| 05/31/15 | $9,577 | $9,735 | $9,604 |

|---|

| 06/30/15 | $9,551 | $9,692 | $9,592 |

|---|

| 07/31/15 | $9,467 | $9,714 | $9,506 |

|---|

| 08/31/15 | $9,236 | $9,725 | $9,281 |

|---|

| 09/30/15 | $9,123 | $9,775 | $9,178 |

|---|

| 10/31/15 | $9,273 | $9,796 | $9,330 |

|---|

| 11/30/15 | $9,092 | $9,633 | $9,154 |

|---|

| 12/31/15 | $8,957 | $9,685 | $9,021 |

|---|

| 01/31/16 | $8,927 | $9,769 | $8,997 |

|---|

| 02/29/16 | $8,992 | $9,986 | $9,080 |

|---|

| 03/31/16 | $9,585 | $10,256 | $9,658 |

|---|

| 04/30/16 | $9,716 | $10,392 | $9,796 |

|---|

| 05/31/16 | $9,446 | $10,253 | $9,530 |

|---|

| 06/30/16 | $9,753 | $10,552 | $9,844 |

|---|

| 07/31/16 | $9,875 | $10,632 | $9,972 |

|---|

| 08/31/16 | $9,996 | $10,580 | $10,094 |

|---|

| 09/30/16 | $10,062 | $10,638 | $10,163 |

|---|

| 10/31/16 | $9,761 | $10,343 | $9,874 |

|---|

| 11/30/16 | $9,281 | $9,932 | $9,399 |

|---|

| 12/31/16 | $9,419 | $9,887 | $9,541 |

|---|

| 01/31/17 | $9,619 | $9,998 | $9,747 |

|---|

| 02/28/17 | $9,714 | $10,045 | $9,844 |

|---|

| 03/31/17 | $9,725 | $10,061 | $9,858 |

|---|

| 04/30/17 | $9,926 | $10,174 | $10,066 |

|---|

| 05/31/17 | $10,014 | $10,332 | $10,160 |

|---|

| 06/30/17 | $9,987 | $10,323 | $10,138 |

|---|

| 07/31/17 | $10,233 | $10,496 | $10,388 |

|---|

| 08/31/17 | $10,388 | $10,600 | $10,553 |

|---|

| 09/30/17 | $10,308 | $10,505 | $10,478 |

|---|

| 10/31/17 | $10,149 | $10,465 | $10,321 |

|---|

| 11/30/17 | $10,317 | $10,581 | $10,496 |

|---|

| 12/31/17 | $10,512 | $10,618 | $10,704 |

|---|

| 01/31/18 | $10,870 | $10,744 | $11,068 |

|---|

| 02/28/18 | $10,673 | $10,649 | $10,867 |

|---|

| 03/31/18 | $10,853 | $10,762 | $11,056 |

|---|

| 04/30/18 | $10,537 | $10,590 | $10,735 |

|---|

| 05/31/18 | $10,224 | $10,510 | $10,419 |

|---|

| 06/30/18 | $10,108 | $10,463 | $10,307 |

|---|

| 07/31/18 | $10,181 | $10,445 | $10,385 |

|---|

| 08/31/18 | $9,811 | $10,456 | $10,015 |

|---|

| 09/30/18 | $9,889 | $10,366 | $10,094 |

|---|

| 10/31/18 | $9,821 | $10,250 | $10,026 |

|---|

| 11/30/18 | $9,783 | $10,282 | $9,994 |

|---|

| 12/31/18 | $9,892 | $10,490 | $10,109 |

|---|

| 01/31/19 | $10,283 | $10,650 | $10,509 |

|---|

| 02/28/19 | $10,174 | $10,589 | $10,407 |

|---|

| 03/31/19 | $10,224 | $10,721 | $10,459 |

|---|

| 04/30/19 | $10,187 | $10,690 | $10,432 |

|---|

| 05/31/19 | $10,244 | $10,834 | $10,496 |

|---|

| 06/30/19 | $10,591 | $11,075 | $10,857 |

|---|

| 07/31/19 | $10,639 | $11,044 | $10,911 |

|---|

| 08/31/19 | $10,616 | $11,268 | $10,892 |

|---|

| 09/30/19 | $10,600 | $11,154 | $10,878 |

|---|

| 10/31/19 | $10,698 | $11,228 | $10,984 |

|---|

| 11/30/19 | $10,505 | $11,143 | $10,772 |

|---|

| 12/31/19 | $10,758 | $11,208 | $11,036 |

|---|

| 01/31/20 | $10,747 | $11,351 | $11,054 |

|---|

| 02/29/20 | $10,524 | $11,427 | $10,829 |

|---|

| 03/31/20 | $9,549 | $11,171 | $9,835 |

|---|

| 04/30/20 | $9,821 | $11,390 | $10,121 |

|---|

| 05/31/20 | $10,137 | $11,440 | $10,453 |

|---|

| 06/30/20 | $10,277 | $11,542 | $10,600 |

|---|

| 07/31/20 | $10,870 | $11,910 | $11,216 |

|---|

| 08/31/20 | $10,867 | $11,892 | $11,225 |

|---|

| 09/30/20 | $10,607 | $11,849 | $10,964 |

|---|

| 10/31/20 | $10,622 | $11,861 | $10,989 |

|---|

| 11/30/20 | $11,115 | $12,076 | $11,503 |

|---|

| 12/31/20 | $11,593 | $12,238 | $11,998 |

|---|

| 01/31/21 | $11,449 | $12,131 | $11,845 |

|---|

| 02/28/21 | $11,159 | $11,922 | $11,542 |

|---|

| 03/31/21 | $11,011 | $11,693 | $11,395 |

|---|

| 04/30/21 | $11,180 | $11,840 | $11,579 |

|---|

| 05/31/21 | $11,477 | $11,951 | $11,935 |

|---|

| 06/30/21 | $11,281 | $11,846 | $11,696 |

|---|

| 07/31/21 | $11,531 | $12,004 | $11,959 |

|---|

| 08/31/21 | $11,525 | $11,954 | $11,960 |

|---|

| 09/30/21 | $11,105 | $11,741 | $11,535 |

|---|

| 10/31/21 | $11,206 | $11,713 | $11,651 |

|---|

| 11/30/21 | $11,076 | $11,679 | $11,521 |

|---|

| 12/31/21 | $11,167 | $11,662 | $11,626 |

|---|

| 01/31/22 | $11,037 | $11,423 | $11,491 |

|---|

| 02/28/22 | $11,174 | $11,288 | $11,614 |

|---|

| 03/31/22 | $11,297 | $10,944 | $11,747 |

|---|

| 04/30/22 | $10,569 | $10,344 | $11,000 |

|---|

| 05/31/22 | $10,430 | $10,373 | $10,855 |

|---|

| 06/30/22 | $9,716 | $10,040 | $10,121 |

|---|

| 07/31/22 | $9,985 | $10,253 | $10,398 |

|---|

| 08/31/22 | $9,560 | $9,849 | $9,964 |

|---|

| 09/30/22 | $8,887 | $9,343 | $9,239 |

|---|

| 10/31/22 | $8,972 | $9,278 | $9,393 |

|---|

| 11/30/22 | $9,514 | $9,715 | $9,969 |

|---|

| 12/31/22 | $9,446 | $9,767 | $9,907 |

|---|

| 01/31/23 | $9,850 | $10,088 | $10,332 |

|---|

| 02/28/23 | $9,525 | $9,753 | $10,002 |

|---|

| 03/31/23 | $9,966 | $10,061 | $10,465 |

|---|

| 04/30/23 | $9,892 | $10,106 | $10,395 |

|---|

| 05/31/23 | $9,588 | $9,908 | $10,077 |

|---|

| 06/30/23 | $9,852 | $9,907 | $10,370 |

|---|

| 07/31/23 | $10,073 | $9,976 | $10,602 |

|---|

| 08/31/23 | $9,764 | $9,839 | $10,292 |

|---|

| 09/30/23 | $9,354 | $9,552 | $9,859 |

|---|

| 10/31/23 | $9,130 | $9,438 | $9,640 |

|---|

| 11/30/23 | $9,743 | $9,914 | $10,284 |

|---|

| 12/31/23 | $10,271 | $10,326 | $10,849 |

|---|

| 01/31/24 | $9,942 | $10,183 | $10,504 |

|---|

| 02/29/24 | $9,843 | $10,055 | $10,405 |

|---|

| 03/31/24 | $9,893 | $10,111 | $10,469 |

|---|

| 04/30/24 | $9,590 | $9,855 | $10,146 |

|---|

| 05/31/24 | $9,766 | $9,985 | $10,335 |

|---|

| 06/30/24 | $9,614 | $9,999 | $10,184 |

|---|

| 07/31/24 | $9,809 | $10,275 | $10,399 |

|---|

| 08/31/24 | $10,042 | $10,518 | $10,653 |

|---|

| 09/30/24 | $10,254 | $10,697 | $10,882 |

|---|

| 10/31/24 | $9,735 | $10,339 | $10,334 |

|---|

| 11/30/24 | $9,729 | $10,374 | $10,332 |

|---|

| 12/31/24 | $9,361 | $10,151 | $9,946 |

|---|

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | 10 Years |

|---|

| WIP | (8.86%) | (2.74%) | (0.66%) |

|---|

| Bloomberg Global Aggregate Bond Index | (1.69%) | (1.96%) | 0.15% |

|---|

| FTSE International Inflation-Linked Securities Select Index | (8.33%) | (2.06%) | (0.05%) |

|---|

(1) Effective February 15, 2016, the Fund changed its benchmark index from the DB Global Government ex-US Inflation-Linked Securities Select Index. The Fund's performance in the tables is based on the Fund's prior investment strategy to track a different benchmark index for periods prior to February 15, 2016.

(2) The FTSE International Inflation-Linked Securities Select Index returns represent the Fund’s prior benchmark index from December 31, 2014 through February 14, 2016 and the FTSE International Inflation-Linked Securities Select Index from February 15, 2016 through December 31, 2024.

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling 1-866-787-2257 or visiting our website at www.ssga.com.

Key Fund Statistics as of 12/31/2024

- Total Net Assets$297,024,904

- Number of Portfolio Holdings167

- Portfolio Turnover Rate12%

- Total Advisory Fees Paid$1,893,518

What did the Fund invest in as of 12/31/2024? (as a percentage of total net assets)

| Holdings | % |

| Deutsche Bundesrepublik Bonds Inflation-Linked, 0.50%, due 04/15/30 | 1.6% |

| Spain Government Bonds Inflation-Linked, 0.70%, due 11/30/33 | 1.5% |

| U.K. Inflation-Linked Gilts, 1.25%, due 11/22/32 | 1.4% |

| Spain Government Bonds Inflation-Linked, 1.00%, due 11/30/30 | 1.4% |

| Spain Government Bonds Inflation-Linked, 0.65%, due 11/30/27 | 1.3% |

| U.K. Inflation-Linked Gilts, 0.75%, due 03/22/34 | 1.3% |

| Deutsche Bundesrepublik Bonds Inflation-Linked, 0.10%, due 04/15/26 | 1.3% |

| New Zealand Government Bonds Inflation-Linked, 2.50%, due 09/20/35 | 1.2% |

| Australia Government Bonds, 2.50%, due 09/20/30 | 1.2% |

| Colombia TES, 4.75%, due 04/04/35 | 1.1% |

| Country | % |

| United Kingdom | 19.4% |

| France | 8.3% |

| Brazil | 6.9% |

| Italy | 5.8% |

| Colombia | 4.7% |

| Chile | 4.7% |

| Australia | 4.7% |

| Canada | 4.6% |

| Spain | 4.6% |

| Japan | 4.6% |

Availability of Additional Information

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information please visit: www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs.

SPDR Bloomberg Short Term International Treasury Bond ETF

Principal Listing Exchange: NYSEArca Exchange

Annual Shareholder Report

December 31, 2024

This annual shareholder report contains important information about the SPDR Bloomberg Short Term International Treasury Bond ETF (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund, including the Prospectus, Statement of Additional Information, financial statements and other information at www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs. You can also request this information about the Fund by contacting us at 1-866-787-2257.

What were the Fund costs for the last year? (based on a hypothetical $10,000 Investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| SPDR Bloomberg Short Term International Treasury Bond ETF | $34 | 0.35% |

|---|

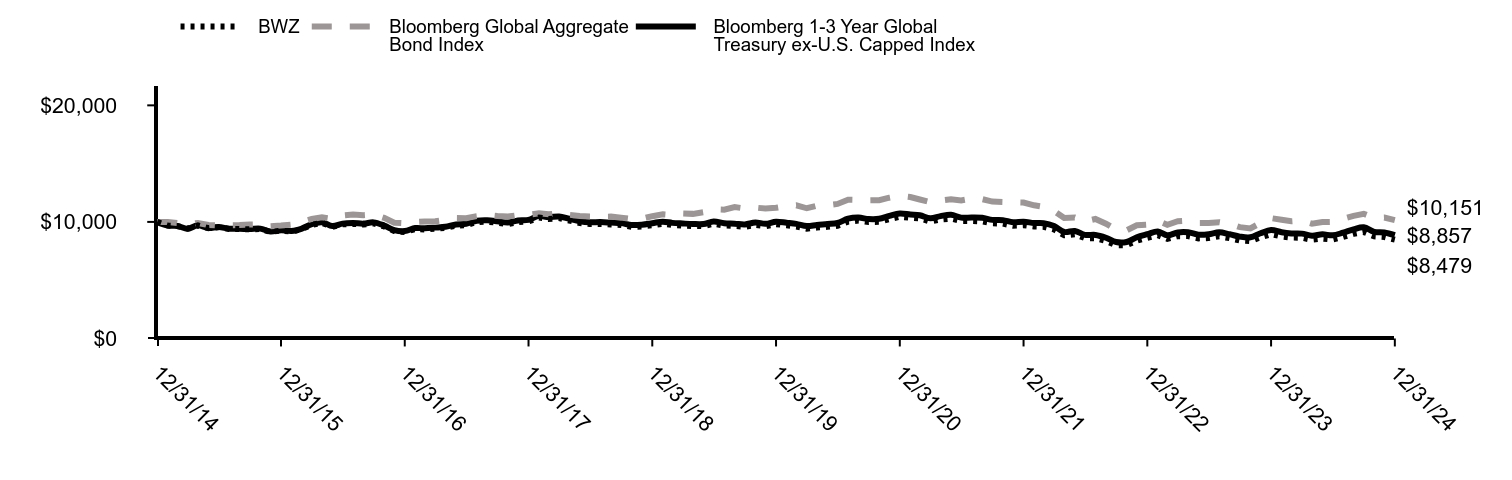

How did the Fund perform last year and what affected its performance?

Global concerns around heightened inflation and changes in central bank policies were primary drivers of Fund performance during the reporting period. The Fund performed in line with expectations.

The year 2024 saw a number of global central banks begin easing after keeping rates high to combat sticky inflation in 2023. The European Central Bank and the U.S. Federal Reserve both cut rates by 100 basis points in 2024, while the Bank of England kept cuts to 50 basis points. However the path to easing was anything but smooth, as growth and other economic data generally remained strong, and as such the speed and magnitude of policy easing was pared back for many central banks, particularly in the U.S.. This led to substantial volatility within the international government bond sector as investors contended with uncertainty of the future path of interest rates.

All major government bond yields ended the year higher than where they started, resulting in negative performance for global Treasuries. Uncertainty around the incoming U.S. President’s policies regarding tariffs and their potential impacts on the international backdrop have forced investors to exercise caution in this sector.

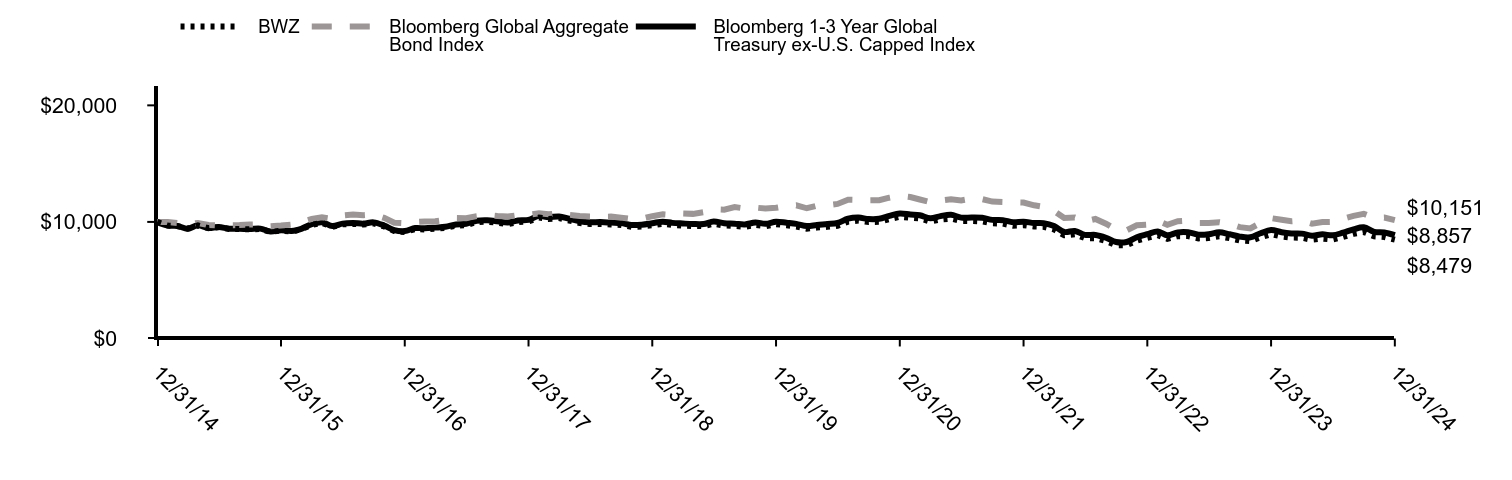

The Fund's benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains.

Comparison of Change in Value of a $10,000 Investment

(Based on Net Asset Value)

| BWZ | Bloomberg Global Aggregate Bond Index | Bloomberg 1-3 Year Global Treasury ex-U.S. Capped Index |

|---|

| 12/31/14 | $10,000 | $10,000 | $10,000 |

|---|

| 01/31/15 | $9,685 | $9,984 | $9,684 |

|---|

| 02/28/15 | $9,648 | $9,903 | $9,651 |

|---|

| 03/31/15 | $9,415 | $9,808 | $9,423 |

|---|

| 04/30/15 | $9,694 | $9,912 | $9,706 |

|---|

| 05/31/15 | $9,462 | $9,735 | $9,475 |

|---|

| 06/30/15 | $9,545 | $9,692 | $9,560 |

|---|

| 07/31/15 | $9,396 | $9,714 | $9,415 |

|---|

| 08/31/15 | $9,385 | $9,725 | $9,408 |

|---|

| 09/30/15 | $9,365 | $9,775 | $9,391 |

|---|

| 10/31/15 | $9,393 | $9,796 | $9,423 |

|---|

| 11/30/15 | $9,141 | $9,633 | $9,173 |

|---|

| 12/31/15 | $9,255 | $9,685 | $9,290 |

|---|

| 01/31/16 | $9,174 | $9,769 | $9,213 |

|---|

| 02/29/16 | $9,365 | $9,986 | $9,407 |

|---|

| 03/31/16 | $9,755 | $10,256 | $9,806 |

|---|

| 04/30/16 | $9,920 | $10,392 | $9,975 |

|---|

| 05/31/16 | $9,579 | $10,253 | $9,640 |

|---|

| 06/30/16 | $9,789 | $10,552 | $9,855 |

|---|

| 07/31/16 | $9,831 | $10,632 | $9,901 |

|---|

| 08/31/16 | $9,778 | $10,580 | $9,853 |

|---|

| 09/30/16 | $9,879 | $10,638 | $9,960 |

|---|

| 10/31/16 | $9,608 | $10,343 | $9,690 |

|---|

| 11/30/16 | $9,214 | $9,932 | $9,295 |

|---|

| 12/31/16 | $9,127 | $9,887 | $9,212 |

|---|

| 01/31/17 | $9,381 | $9,998 | $9,471 |

|---|

| 02/28/17 | $9,358 | $10,045 | $9,451 |

|---|

| 03/31/17 | $9,412 | $10,061 | $9,510 |

|---|

| 04/30/17 | $9,482 | $10,174 | $9,583 |

|---|

| 05/31/17 | $9,678 | $10,332 | $9,785 |

|---|

| 06/30/17 | $9,728 | $10,323 | $9,838 |

|---|

| 07/31/17 | $9,984 | $10,496 | $10,100 |

|---|

| 08/31/17 | $10,021 | $10,600 | $10,143 |

|---|

| 09/30/17 | $9,935 | $10,505 | $10,060 |

|---|

| 10/31/17 | $9,813 | $10,465 | $9,940 |

|---|

| 11/30/17 | $9,994 | $10,581 | $10,128 |

|---|

| 12/31/17 | $10,035 | $10,618 | $10,174 |

|---|

| 01/31/18 | $10,377 | $10,744 | $10,522 |

|---|

| 02/28/18 | $10,253 | $10,649 | $10,400 |

|---|

| 03/31/18 | $10,319 | $10,762 | $10,469 |

|---|

| 04/30/18 | $10,116 | $10,590 | $10,267 |

|---|

| 05/31/18 | $9,906 | $10,510 | $10,059 |

|---|

| 06/30/18 | $9,815 | $10,463 | $9,968 |

|---|

| 07/31/18 | $9,830 | $10,445 | $9,985 |

|---|

| 08/31/18 | $9,784 | $10,456 | $9,943 |

|---|

| 09/30/18 | $9,744 | $10,366 | $9,904 |

|---|

| 10/31/18 | $9,576 | $10,250 | $9,734 |

|---|

| 11/30/18 | $9,600 | $10,282 | $9,763 |

|---|

| 12/31/18 | $9,718 | $10,490 | $9,888 |

|---|

| 01/31/19 | $9,846 | $10,650 | $10,023 |

|---|

| 02/28/19 | $9,740 | $10,589 | $9,918 |

|---|

| 03/31/19 | $9,687 | $10,721 | $9,864 |

|---|

| 04/30/19 | $9,643 | $10,690 | $9,822 |

|---|

| 05/31/19 | $9,638 | $10,834 | $9,822 |

|---|

| 06/30/19 | $9,839 | $11,075 | $10,033 |

|---|

| 07/31/19 | $9,695 | $11,044 | $9,890 |

|---|

| 08/31/19 | $9,652 | $11,268 | $9,849 |

|---|

| 09/30/19 | $9,585 | $11,154 | $9,784 |

|---|

| 10/31/19 | $9,743 | $11,228 | $9,949 |

|---|

| 11/30/19 | $9,630 | $11,143 | $9,836 |

|---|

| 12/31/19 | $9,804 | $11,208 | $10,017 |

|---|

| 01/31/20 | $9,709 | $11,351 | $9,924 |

|---|

| 02/29/20 | $9,609 | $11,427 | $9,829 |

|---|

| 03/31/20 | $9,423 | $11,171 | $9,643 |

|---|

| 04/30/20 | $9,511 | $11,390 | $9,739 |

|---|

| 05/31/20 | $9,583 | $11,440 | $9,817 |

|---|

| 06/30/20 | $9,672 | $11,542 | $9,909 |

|---|

| 07/31/20 | $10,027 | $11,910 | $10,277 |

|---|

| 08/31/20 | $10,118 | $11,892 | $10,374 |

|---|

| 09/30/20 | $9,989 | $11,849 | $10,244 |

|---|

| 10/31/20 | $10,007 | $11,861 | $10,267 |

|---|

| 11/30/20 | $10,246 | $12,076 | $10,515 |

|---|

| 12/31/20 | $10,441 | $12,238 | $10,720 |

|---|

| 01/31/21 | $10,355 | $12,131 | $10,635 |

|---|

| 02/28/21 | $10,295 | $11,922 | $10,577 |

|---|

| 03/31/21 | $10,030 | $11,693 | $10,305 |

|---|

| 04/30/21 | $10,209 | $11,840 | $10,494 |

|---|

| 05/31/21 | $10,284 | $11,951 | $10,610 |

|---|

| 06/30/21 | $10,078 | $11,846 | $10,366 |

|---|

| 07/31/21 | $10,082 | $12,004 | $10,374 |

|---|

| 08/31/21 | $10,053 | $11,954 | $10,349 |

|---|

| 09/30/21 | $9,880 | $11,741 | $10,174 |

|---|

| 10/31/21 | $9,854 | $11,713 | $10,149 |

|---|

| 11/30/21 | $9,671 | $11,679 | $9,967 |

|---|

| 12/31/21 | $9,719 | $11,662 | $10,018 |

|---|

| 01/31/22 | $9,605 | $11,423 | $9,905 |

|---|

| 02/28/22 | $9,582 | $11,288 | $9,889 |

|---|

| 03/31/22 | $9,354 | $10,944 | $9,647 |

|---|

| 04/30/22 | $8,854 | $10,344 | $9,134 |

|---|

| 05/31/22 | $8,940 | $10,373 | $9,224 |

|---|

| 06/30/22 | $8,612 | $10,040 | $8,887 |

|---|

| 07/31/22 | $8,604 | $10,253 | $8,885 |

|---|

| 08/31/22 | $8,368 | $9,849 | $8,643 |

|---|

| 09/30/22 | $7,999 | $9,343 | $8,271 |

|---|

| 10/31/22 | $7,999 | $9,278 | $8,275 |

|---|

| 11/30/22 | $8,389 | $9,715 | $8,682 |

|---|

| 12/31/22 | $8,642 | $9,767 | $8,946 |

|---|

| 01/31/23 | $8,861 | $10,088 | $9,177 |

|---|

| 02/28/23 | $8,545 | $9,753 | $8,852 |

|---|

| 03/31/23 | $8,776 | $10,061 | $9,097 |

|---|

| 04/30/23 | $8,783 | $10,106 | $9,109 |

|---|

| 05/31/23 | $8,583 | $9,908 | $8,904 |

|---|

| 06/30/23 | $8,615 | $9,907 | $8,943 |

|---|

| 07/31/23 | $8,769 | $9,976 | $9,107 |

|---|

| 08/31/23 | $8,602 | $9,839 | $8,937 |

|---|

| 09/30/23 | $8,410 | $9,552 | $8,740 |

|---|

| 10/31/23 | $8,354 | $9,438 | $8,684 |

|---|

| 11/30/23 | $8,682 | $9,914 | $9,029 |

|---|

| 12/31/23 | $8,944 | $10,326 | $9,305 |

|---|

| 01/31/24 | $8,753 | $10,183 | $9,110 |

|---|

| 02/29/24 | $8,656 | $10,055 | $9,010 |

|---|

| 03/31/24 | $8,637 | $10,111 | $8,994 |

|---|

| 04/30/24 | $8,467 | $9,855 | $8,820 |

|---|

| 05/31/24 | $8,573 | $9,985 | $8,933 |

|---|

| 06/30/24 | $8,489 | $9,999 | $8,848 |

|---|

| 07/31/24 | $8,705 | $10,275 | $9,076 |

|---|

| 08/31/24 | $8,971 | $10,518 | $9,361 |

|---|

| 09/30/24 | $9,137 | $10,697 | $9,536 |

|---|

| 10/31/24 | $8,761 | $10,339 | $9,147 |

|---|

| 11/30/24 | $8,703 | $10,374 | $9,089 |

|---|

| 12/31/24 | $8,479 | $10,151 | $8,857 |

|---|

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | 10 Years |

|---|

| BWZ | (5.20%) | (2.86%) | (1.64%) |

|---|

| Bloomberg Global Aggregate Bond Index | (1.69%) | (1.96%) | 0.15% |

|---|

| Bloomberg 1-3 Year Global Treasury ex-U.S. Capped Index | (4.81%) | (2.43%) | (1.21%) |

|---|

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption or sale of Fund shares. Updated performance information is available by calling 1-866-787-2257 or visiting our website at www.ssga.com.

Key Fund Statistics as of 12/31/2024

- Total Net Assets$134,318,276

- Number of Portfolio Holdings225

- Portfolio Turnover Rate47%

- Total Advisory Fees Paid$551,063

What did the Fund invest in as of 12/31/2024? (as a percentage of total net assets)

| Holdings | % |

| Australia Government Bonds, 4.25%, due 04/21/26 | 1.4% |

| Australia Government Bonds, 4.75%, due 04/21/27 | 1.3% |

| Kingdom of Belgium Government Bonds, 4.50%, due 03/28/26 | 1.3% |

| Mexico Bonos, 7.50%, due 06/03/27 | 1.2% |

| Japan Government Ten Year Bonds, 0.10%, due 03/20/26 | 1.2% |

| Japan Government Ten Year Bonds, 0.10%, due 12/20/26 | 1.2% |

| Japan Government Ten Year Bonds, 0.10%, due 03/20/27 | 1.2% |

| Japan Government Ten Year Bonds, 0.10%, due 06/20/27 | 1.2% |

| Japan Government Five Year Bonds, 0.01%, due 06/20/27 | 1.2% |

| Japan Government Five Year Bonds, 0.01%, due 09/20/26 | 1.1% |

| Country | % |

| Japan | 23.1% |

| Italy | 5.0% |

| France | 4.9% |

| Canada | 4.6% |

| South Korea | 4.6% |

| United Kingdom | 4.6% |

| Australia | 4.5% |

| China | 4.5% |

| Spain | 4.5% |

| Germany | 4.3% |

Availability of Additional Information

For additional information about the Fund, including its Prospectus, Statement of Additional Information, financial statements, holdings and proxy information please visit: www.ssga.com/us/en/institutional/fund-finder?tab=documents&type=etfs.

Item 2. Code of Ethics.

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party (the “Code of Ethics”). During the period covered by this report, no substantive amendments were made to the Code of Ethics. During the period covered by this report, the registrant did not grant any waivers, including any implicit waivers, from any provision of the Code of Ethics.

The Code of Ethics is attached hereto as Exhibit 19(a)(1).

Item 3. Audit Committee Financial Expert.

| (a)(1) | The Board of Trustees of the registrant has determined that the registrant has five Board members serving on the Audit Committee that possess the attributes identified in Instructions 2(b) of Item 3 to Form N-CSR to qualify as an “audit committee financial expert.” |

| (2) | Dwight Churchill, Clare Richer, Kristi Rowsell, James Ross, Sandra Sponem and Carl Verboncoeur are the registrant’s audit committee financial experts. The Board also determined that each of the foregoing persons are not “interested person(s)” of the registrant as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”). |

Item 4. Principal Accountant Fees and Services.

For the fiscal years ending December 31, 2024 and December 31, 2023, the aggregate audit fees billed for professional services rendered by the principal accountant, Ernst & Young LLP (“EY”), were $126,175 and $123,675, respectively. Audit fees include the performance of the annual audits, security counts performed during the course of the period for each series of the registrant and routine regulatory filings (one for each SEC registrant).

For the fiscal years ending December 31, 2024 and December 31, 2024, EY did not bill the registrant any fees for assurances and related services that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item.

For the fiscal years ending December 31, 2024 and December 31, 2023, the aggregate tax fees billed for professional services rendered by EY for the review of year-end distribution requirements were $13,890 and $13,890, respectively.

For the fiscal years ended December 31, 2024 and December 31, 2023, there were no fees billed for professional services rendered by EY for products and services provided by EY to the Trust, other than the services reported in paragraphs (a) through (c).

For the fiscal years ended December 31, 2024 and December 31, 2023, the aggregate fees for professional services rendered by EY for products and services provided by EY to the Adviser and any entity controlling, controlled by, or under common control with the Adviser that provides ongoing services to the Trust that (i) relate directly to the operations and financial reporting of the Trust and (ii) were pre-approved by the Audit Committee were approximately $9,556,710 and $9,540,002, respectively.

| (e)(1) | Audit Committee Pre-Approval Policies and Procedures. |

The registrant’s Audit Committee Charter states the following with respect to pre-approval procedures:

Before the independent auditors are engaged by the Trust to render audit, audit-related or permissible non-audit services, either:

| | (a) | The Audit Committee shall pre-approve all audit, audit-related and permissible non-audit services provided to the Trust. The Audit Committee may delegate to one or more of its members the authority to grant pre-approvals. Any decision of any member to whom authority is delegated under this section shall be presented to the full Audit Committee at its next regularly scheduled meeting; |

or

| | (b) | The engagement to render the audit, audit-related or permissible non-audit service is entered into pursuant to pre-approval policies and procedures established by the Audit Committee. Any such policies and procedures must (1) be detailed as to the particular service and (2) not involve any delegation of the Audit Committee’s responsibilities to the investment adviser. The Audit Committee must be informed of each service entered into pursuant to the policies and procedures. A copy of any such policies and procedures shall be attached as an exhibit to the Audit Committee Charter. |

| | (c) | Pre-Approval for a service provided to the Trust other than audit or audit-related services is not required if: (1) the aggregate amount of all such permissible non-audit services provided to the Trust constitutes not more than five percent (5%) of the total amount of revenues paid by the Trust to the independent auditors during the fiscal year in which the permissible non-audit services are provided; (2) such services were not recognized by the Trust at the time of the engagement to be permissible non-audit services; and (3) such services are promptly brought to the attention of the Audit Committee and are approved by the Audit Committee or by one or more members of the Audit Committee to whom authority to grant such approvals has been delegated by the Audit Committee prior to the completion of the audit. |

| | (d) | The Audit Committee shall pre-approve any permissible non-audit services proposed to be provided by the independent auditors to (a) the investment adviser and (b) any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Trust, if the independent auditors’ engagement with the investment adviser or any such control persons relates directly to the operations and financial reporting of the Trust. It shall be the responsibility of the independent auditors to notify the Audit Committee of any permissible non-audit services that need to be pre-approved. |

Notwithstanding the above, Pre-Approval for any permissible non-audit services under this Sub-section is not required if: (1) the aggregate amount of all such permissible non-audit services constitutes not more than five percent (5%) of the total amount of revenues paid to the independent auditors by the Trust and any other entity that has its services approved under this Section (i.e., the investment adviser or any control person) during the fiscal year in which the permissible non-audit services are provided; (2) such services were not recognized by the Trust at the time of the engagement to be permissible non-audit services; and (3) such services are promptly brought to the attention of the Audit Committee and are approved by the Audit Committee or by one or more members of the Audit Committee to whom authority to grant such approvals has been delegated by the Audit Committee prior to the completion of the audit.

| (e)(2) | Percentage of Services. |

One hundred percent of the services described in each of paragraphs (b) through (d) of this Item were approved by the registrant’s Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

| (g) | The aggregate non-audit fees billed for by EY for services rendered to the registrant, and rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser were as follows: |

| | | | | | | | |

| | | FY 2024

(in millions) | | | FY 2023

(in millions) | |

Non audit services billed to: | | | | | | | | |

Registrant: | | | See Item 4(c) | | | | See Item 4(c) | |

Investment Adviser: | | | — | | | | — | |

Other entities in the Investment Company Complex (1)(2): | | | | | | | | |

Audit Related Fees | | $ | 18.5 | | | $ | 17.9 | |

Tax Fees | | $ | 3.2 | | | $ | 5.6 | |

All Other Fees | | $ | 15.0 | | | $ | 15.5 | |

| (1) | Information is for the calendar years 2024 and 2023, respectively. |

| (2) | Services under the caption Audit-Related Fees consisted principally of reports on the processing of transactions by servicing organizations, audits of employee benefit plan, non-statutory audits and due diligence procedures. Services under the caption Tax Fees consisted principally of expatriate, compliance and corporate tax advisory services. Services under the caption All Other Fees primarily related to statutory and financial statement audits and the requirement to opine on the design and operating effectiveness of internal control over financial reporting. |

| (h) | The registrant’s principal accountant notified the registrant’s Audit Committee of all non-audit services that were rendered by EY to the Adviser and any entity controlling, controlled by, or under common control with the Adviser that provides services to the registrant, which services were not required to be pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, allowing the registrant’s Audit Committee to consider whether such services were compatible with maintaining EY’s independence. |

Item 5. Audit Committees of Listed Registrants.

The registrant has an audit committee which was established by the Board of Trustees of the Trust in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “1934 Act”). The members of the registrant’s Audit Committee are Dwight Churchill, Carolyn Clancy, Clare Richer, Kristi Rowsell, James Ross, Sandra Sponem and Carl Verboncoeur.

Item 6. Investments.

| (a) | A Schedule of Investments for each applicable series of the registrant is included as a part of the report to shareholders filed under Item 7(a) of this Form N-CSR. |

| (b) | Not applicable to the registrant. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies

| (a) | The registrant’s Financial Statements are attached herewith. |

| (b) | The registrant’s Financial Highlights are included as part of the Financial Statements filed under Item 7(a) of this Form. |

Annual Financial Statements and Other Information

December 31, 2024

SPDR® Series Trust - Fixed Income Funds

| SPDR Bloomberg Emerging Markets Local Bond ETF |

| SPDR Bloomberg International Corporate Bond ETF |

| SPDR Bloomberg International Treasury Bond ETF |

| SPDR Bloomberg Short Term International Treasury Bond ETF |

| SPDR FTSE International Government Inflation-Protected Bond ETF |

The information contained in this report is intended for the general information of shareholders of the Trust. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Trust prospectus which contains important information concerning the Trust. You may obtain a current prospectus and SAI from the Distributor by calling 1-866-787-2257 or visiting www.ssga.com. Please read the prospectus carefully before you invest.

TABLE OF CONTENTS

Changes in and Disagreements with Accountants for Open-End Management Investment Companies (N-CSR Item 8) - Not Applicable

Proxy Disclosures for Open-End Management Investment Companies (N-CSR Item 9) - Not applicable

Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies (N-CSR Item 10) - Please see Statement of Operations in the Financial Statements under Item 7 above

Statement Regarding Basis for Approval of Investment Advisory Contract (Unaudited) (N-CSR Item 11) - Not Applicable

SPDR BLOOMBERG EMERGING MARKETS LOCAL BOND ETF

SCHEDULE OF INVESTMENTS

December 31, 2024

| Security Description | | | Principal

Amount | | Value |

| FOREIGN GOVERNMENT OBLIGATIONS — 97.9% | | | |

| BRAZIL — 4.5% | | | |

Brazil Government International Bonds 10.25%, 1/10/2028

| | BRL | 1,000,000 | | $155,111 |

| Brazil Letras do Tesouro Nacional: | | | | | |

Zero Coupon, 7/1/2025

| | BRL | 14,500,000 | | 2,199,864 |

Zero Coupon, 10/1/2025

| | BRL | 5,000,000 | | 728,568 |

Zero Coupon, 1/1/2026

| | BRL | 66,000,000 | | 9,248,087 |

Zero Coupon, 4/1/2026

| | BRL | 26,000,000 | | 3,511,870 |

Zero Coupon, 7/1/2026

| | BRL | 142,000,000 | | 18,456,311 |

Zero Coupon, 10/1/2026

| | BRL | 42,000,000 | | 5,246,660 |

Zero Coupon, 7/1/2027

| | BRL | 60,000,000 | | 6,731,633 |

Zero Coupon, 1/1/2028

| | BRL | 26,800,000 | | 2,791,189 |

Zero Coupon, 7/1/2028

| | BRL | 12,000,000 | | 1,163,956 |

Zero Coupon, 1/1/2030

| | BRL | 73,010,000 | | 5,740,808 |

| Brazil Notas do Tesouro Nacional: | | | | | |

10.00%, 1/1/2027

| | BRL | 39,875,000 | | 5,856,911 |

10.00%, 1/1/2029

| | BRL | 68,590,000 | | 9,330,414 |

10.00%, 1/1/2031

| | BRL | 44,000,000 | | 5,674,339 |

10.00%, 1/1/2033

| | BRL | 34,300,000 | | 4,265,748 |

10.00%, 1/1/2035

| | BRL | 11,000,000 | | 1,335,010 |

| | | | | | 82,436,479 |

| CHILE — 3.5% | | | |

| Bonos de la Tesoreria de la Republica en pesos: | | | | | |

Zero Coupon, 5/6/2027

| | CLP | 2,300,000,000 | | 2,057,749 |

2.30%, 10/1/2028

| | CLP | 335,000,000 | | 298,003 |

2.80%, 10/1/2033

| | CLP | 1,000,000,000 | | 794,484 |

4.50%, 3/1/2026

| | CLP | 3,115,000,000 | | 3,112,110 |

4.70%, 9/1/2030

| | CLP | 9,660,000,000 | | 9,173,030 |

5.00%, 10/1/2028

| | CLP | 4,780,000,000 | | 4,682,816 |

5.00%, 3/1/2035

| | CLP | 6,000,000,000 | | 5,607,823 |

5.10%, 7/15/2050

| | CLP | 4,970,000,000 | | 4,712,961 |

5.30%, 11/1/2037

| | CLP | 6,840,000,000 | | 6,457,912 |

5.80%, 10/1/2029

| | CLP | 7,020,000,000 | | 7,046,858 |

5.80%, 10/1/2034

| | CLP | 3,250,000,000 | | 3,235,224 |

6.00%, 4/1/2033

| | CLP | 8,250,000,000 | | 8,351,536 |

6.00%, 1/1/2043

| | CLP | 6,295,000,000 | | 6,525,178 |

7.00%, 5/1/2034

| | CLP | 3,000,000,000 | | 3,261,743 |

| | | | | | 65,317,427 |

| Security Description | | | Principal

Amount | | Value |

| CHINA — 11.7% | | | |

| China Development Bank: | | | | | |

3.80%, 1/25/2036

| | CNY | 6,500,000 | | $1,064,444 |

4.88%, 2/9/2028

| | CNY | 3,000,000 | | 453,892 |

| China Government Bonds: | | | | | |

1.35%, 9/25/2026

| | CNY | 5,000,000 | | 687,862 |

1.62%, 8/15/2027

| | CNY | 5,000,000 | | 692,374 |

1.67%, 6/15/2026

| | CNY | 12,000,000 | | 1,657,681 |

1.85%, 5/15/2027

| | CNY | 10,000,000 | | 1,392,283 |

1.87%, 9/15/2031

| | CNY | 10,000,000 | | 1,393,910 |

1.91%, 7/15/2029

| | CNY | 20,000,000 | | 2,798,156 |

1.99%, 3/15/2026

| | CNY | 15,000,000 | | 2,078,916 |

2.04%, 2/25/2027

| | CNY | 13,000,000 | | 1,814,957 |

2.05%, 4/15/2029

| | CNY | 13,000,000 | | 1,828,323 |

2.11%, 8/25/2034

| | CNY | 6,000,000 | | 851,922 |

2.12%, 6/25/2031

| | CNY | 10,000,000 | | 1,412,939 |

2.18%, 8/15/2026

| | CNY | 34,000,000 | | 4,735,904 |

2.27%, 5/25/2034

| | CNY | 30,000,000 | | 4,315,965 |

2.28%, 3/25/2031

| | CNY | 10,000,000 | | 1,425,560 |

2.30%, 5/15/2026

| | CNY | 28,000,000 | | 3,892,451 |

2.35%, 2/25/2034

| | CNY | 20,000,000 | | 2,884,105 |

2.37%, 1/20/2027

| | CNY | 18,500,000 | | 2,597,984 |

2.37%, 1/15/2029

| | CNY | 17,000,000 | | 2,416,075 |

2.39%, 11/15/2026

| | CNY | 20,000,000 | | 2,803,565 |

2.40%, 7/15/2028

| | CNY | 21,000,000 | | 2,982,554 |

2.44%, 10/15/2027

| | CNY | 15,000,000 | | 2,121,836 |

2.46%, 2/15/2026

| | CNY | 3,000,000 | | 417,556 |

2.48%, 4/15/2027

| | CNY | 20,000,000 | | 2,823,237 |

2.48%, 9/25/2028

| | CNY | 10,000,000 | | 1,425,040 |

2.50%, 7/25/2027

| | CNY | 19,000,000 | | 2,683,149 |

2.52%, 8/25/2033

| | CNY | 18,000,000 | | 2,622,559 |

2.54%, 12/25/2030

| | CNY | 20,000,000 | | 2,888,560 |

2.55%, 10/15/2028

| | CNY | 15,000,000 | | 2,143,546 |

2.60%, 9/15/2030

| | CNY | 5,000,000 | | 723,292 |

2.60%, 9/1/2032

| | CNY | 20,000,000 | | 2,919,222 |

2.62%, 4/15/2028

| | CNY | 21,000,000 | | 2,999,266 |

2.62%, 9/25/2029

| | CNY | 20,000,000 | | 2,885,649 |

2.62%, 6/25/2030