Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

Related financial report

Loudeye similar filings

- 11 Apr 05 Entry into a Material Definitive Agreement

- 21 Mar 05 Unregistered Sales of Equity Securities

- 7 Mar 05 Entry into a Material Definitive Agreement

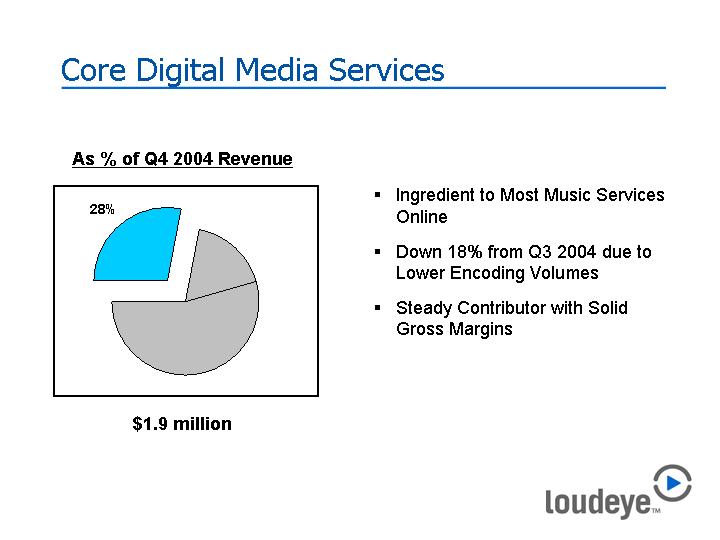

- 1 Mar 05 Loudeye Announces Record Fourth Quarter and Full-Year 2004 Revenues and Provides Guidance for Significant 2005 Revenue Growth

- 28 Feb 05 Entry into a Material Definitive Agreement

- 4 Feb 05 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard

- 1 Feb 05 Loudeye Appoints Seasoned Technology Veteran Michael Brochu President and Chief Executive Officer

Filing view

External links