Exhibit 99.1

Investor Presentation

October 2017

1

Statement on Forward?Looking Information

This presentation contains forward?looking statements within the meaning of the securities laws. Forward?looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words or variations of words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “targets,” “would,” “will,” “should,” “goal,” “could” or “may” or other similar expressions. Forward?looking statements provide management’s current expectations or predictions of future conditions, events or results. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward?looking statements. They may include estimates of revenues, income, earnings per share, cost savings, capital expenditures, dividends, share repurchases, liquidity, capital structure, market share, industry volume, or other financial items, descriptions of management’s plans or objectives for future operations, or descriptions of assumptions underlying any of the above. All forward?looking statements speak only as of the date they are made and reflect the company’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance or events. Furthermore, the company disclaims any obligation to publicly update or revise any forward?looking statement, except as required by law. By their nature, forward?looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward?looking statements. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive and regulatory factors, many of which are beyond the company’s control, that are described in our Annual Report on Form 10?K for the fiscal year ended Dec. 31, 2016, as amended on July 10, 2017 and Aug. 14, 2017, and in Exhibit 99.2 to the Company’s Current Report on Form 8?K filed with the SEC on April 11, 2017, as well as additional factors we may describe from time to time in other filings with the SEC. You may get such filings for free at our website at www.peabodyenergy.com. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

Adjusted EBITDA is a non?GAAP measure defined as income (loss) from continuing operations before deducting net interest expense, income taxes, asset retirement obligation expenses, depreciation, depletion and amortization and reorganization items, net. Adjusted EBITDA is also adjusted for the discrete items that management excluded in analyzing each of the segment’s operating performance as displayed in the reconciliation. Adjusted EBITDA is used by management as one of the primary metrics to measure the Company’s operating performance. Management also believes non?GAAP performance measures are used by investors to measure the Company’s operating performance and lenders to measure the Company’s ability to incur and service debt. Adjusted EBITDA is not intended to serve as an alternative to U.S. GAAP measures of performance and may not be comparable to similarly?titled measures presented by other companies.

2

Peabody: World’s Largest Private?Sector Coal Company

We’re the only Global Pure-Play Coal Investment, and we have significant scale… high-quality assets and people… and diversity in geography and products

Our Financial Approach Return Cash to

Invest Shareholders Reduce Wisely Generate Debt Cash

1 2 3 4

3

Peabody: Who We Are; Where We Operate

23 operations

In U.S. and Australia

~7,000

Employees Globally

5.6 billion

Tons of Reserves

$4.7 billion

2016 Revenues

25+ countries

Served by Peabody Operations

Note: Information as of the year ended Dec. 31, 2016, with the exception of headcount which is provided as of

Sept. 30, 2017. Proven and probable reserves reflect estimated amounts as of Dec. 31, 2016. 4

4

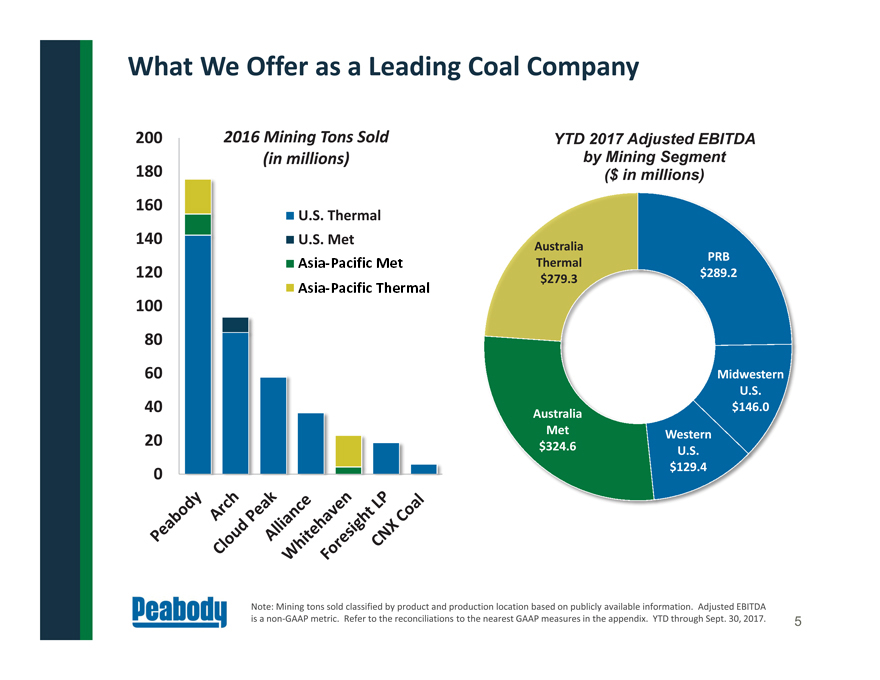

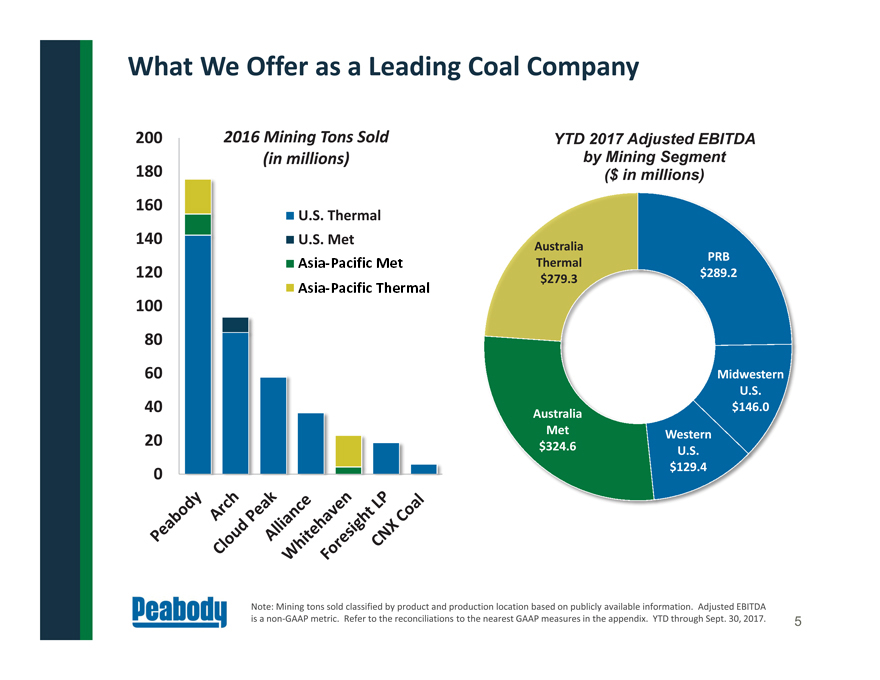

What We Offer as a Leading Coal Company

Note: Mining tons sold classified by product and production location based on publicly available information. Adjusted EBITDA

is a non?GAAP metric. Refer to the reconciliations to the nearest GAAP measures in the appendix. YTD through Sept. 30, 2017.

PRB

$289.2

Midwestern

U.S.

$146.0

Western

U.S.

$129.4

Australia

Met

$324.6

Australia

Thermal

$279.3

YTD 2017 Adjusted EBITDA

by Mining Segment

($ in millions)

0

20

40

60

80

100

120

140

160

180

200 2016 Mining Tons Sold

(in millions)

U.S. Thermal

U.S. Met

Asia-Pacific Met

Asia-Pacific Thermal

5

$238

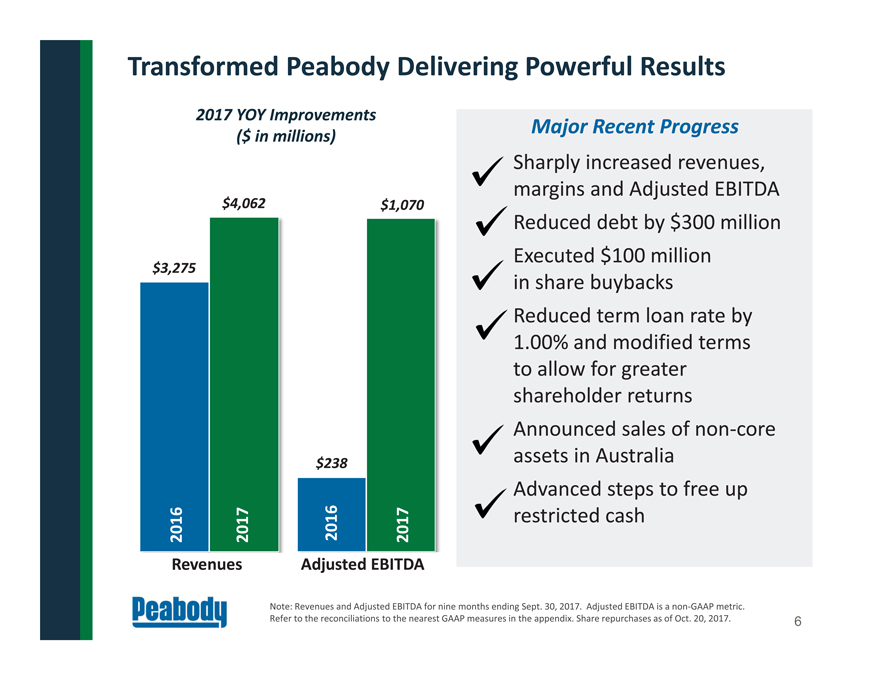

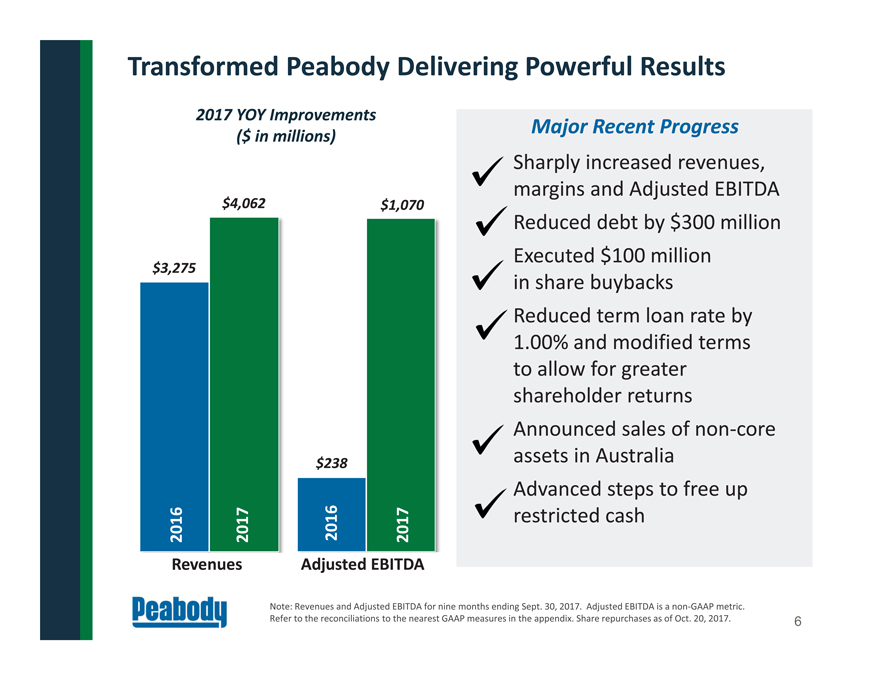

Transformed Peabody Delivering Powerful Results

Note: Revenues and Adjusted EBITDA for nine months ending Sept. 30, 2017. Adjusted EBITDA is a non?GAAP metric.

Refer to the reconciliations to the nearest GAAP measures in the appendix. Share repurchases as of Oct. 20, 2017.

Sharply increased revenues,

margins and Adjusted EBITDA

Reduced debt by $300 million

Executed $100 million

in share buybacks

Reduced term loan rate by

1.00% and modified terms

to allow for greater

shareholder returns

Announced sales of non?core

assets in Australia

Advanced steps to free up

restricted cash

Major Recent Progress

$3,275

$4,062

2016

2017

2017 YOY Improvements

($ in millions)

Revenues Adjusted EBITDA

$1,070

2017

2016

6

Mining Operations

Operations at Peabody’s North Antelope Rochelle Mine in Wyoming

7

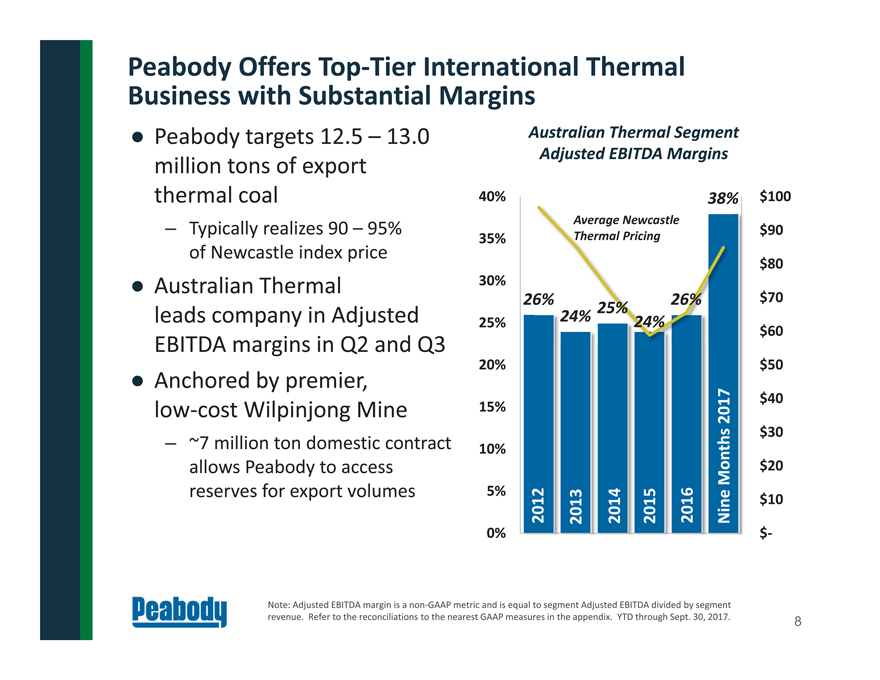

26% 24% 25% 24% 26% 38%

$- $10 $20 $30 $40

$50 $60 $70 $80 $90 $100 0% 5% 10% 15% 20% 25% 30% 35% 40%

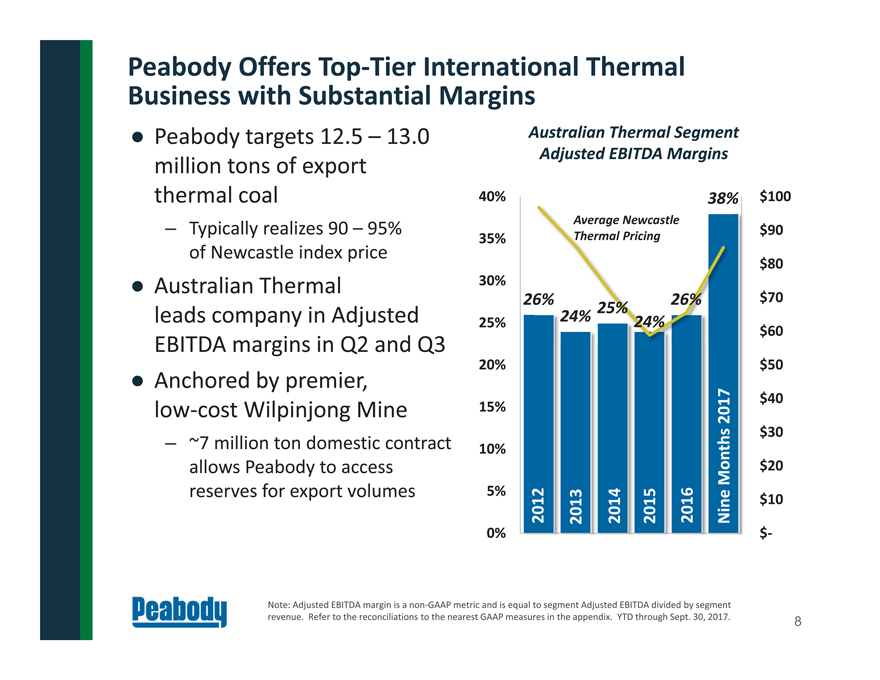

Peabody Offers Top?Tier International Thermal

Business with Substantial Margins

| • | | Peabody targets 12.5 – 13.0 million tons of export thermal coal |

– Typically realizes 90 – 95% of Newcastle index price

| • | | Australian Thermal leads company in Adjusted EBITDA margins in Q2 and Q3 |

| • | | Anchored by premier, low-cost Wilpinjong Mine |

– ~7 million ton domestic contract

allows Peabody to access

reserves for export volumes

Australian Thermal Segment

Adjusted EBITDA Margins

2014

Nine Months 2017 Note: Adjusted EBITDA margin is a non?GAAP metric and is equal to segment Adjusted EBITDA divided by segment revenue. Refer to the reconciliations to the nearest GAAP measures in the appendix. YTD through Sept. 30, 2017.

2016 2012 2013 2015 Average Newcastle Thermal Pricing

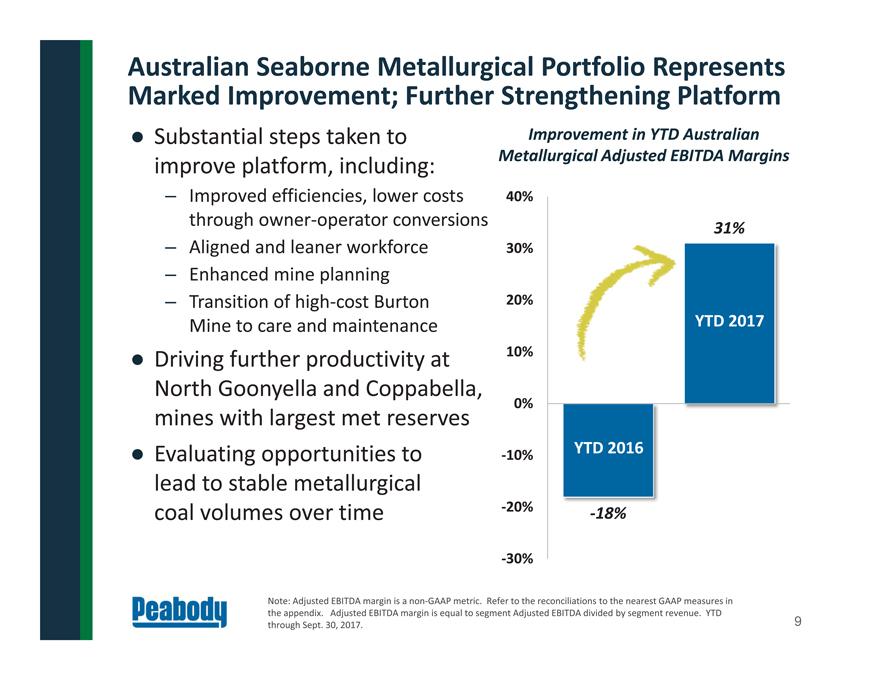

-18%

31%

30%

20%

10%

0%

10%

20%

30%

40%

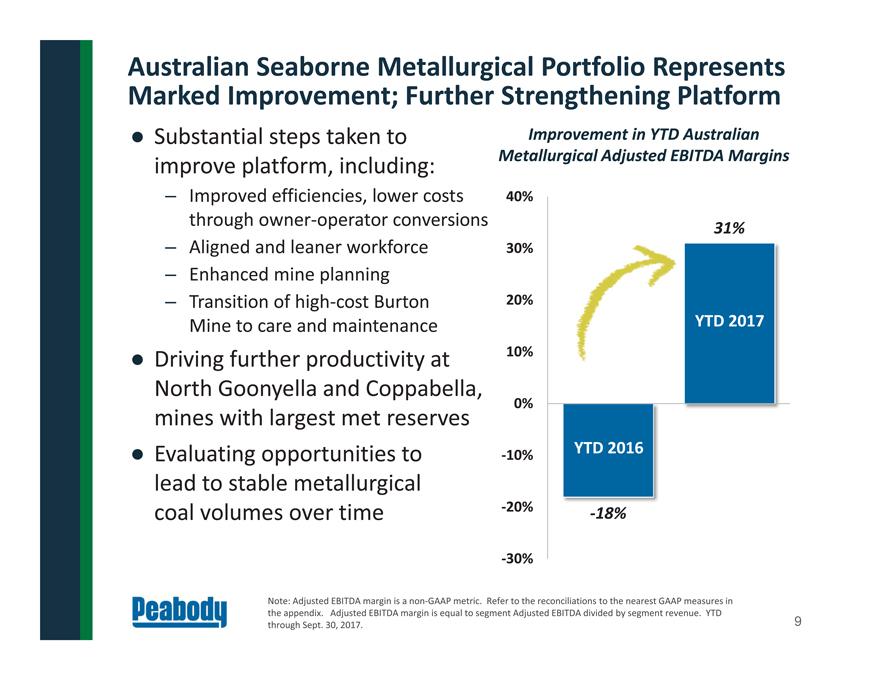

Australian Seaborne Metallurgical Portfolio Represents

Marked Improvement; Further Strengthening Platform

Substantial steps taken to

improve platform, including:

– Improved efficiencies, lower costs

through owner?operator conversions

– Aligned and leaner workforce

– Enhanced mine planning

– Transition of high?cost Burton

Mine to care and maintenance

Driving further productivity at

North Goonyella and Coppabella,

mines with largest met reserves

Evaluating opportunities to

lead to stable metallurgical

coal volumes over time

Improvement in YTD Australian

Metallurgical Adjusted EBITDA Margins

YTD 2016

YTD 2017

Note: Adjusted EBITDA margin is a non?GAAP metric. Refer to the reconciliations to the nearest GAAP measures in

the appendix. Adjusted EBITDA margin is equal to segment Adjusted EBITDA divided by segment revenue. YTD

through Sept. 30, 2017.

9

U.S. Mining Segment Represents Significant Scale,

Stable Operating Performance

Note: Contract information as of the quarter ended Sept. 30, 2017. 2018 priced volumes based on approximately

150 million tons.

Peabody position in PRB

anchored by world’s largest

coal mine – North Antelope

Rochelle Mine

– PRB mining complex serves

scores of customers in nearly

half of states in U.S.

Illinois Basin and Western

operations benefit from

transportation advantages

to local customer base

Multi?year contracts typical;

Essentially all of 2017

U.S. sales volume is priced

– ~75% – 80% of 2018

volumes are priced

Peabody’s North Antelope Rochelle Mine

10

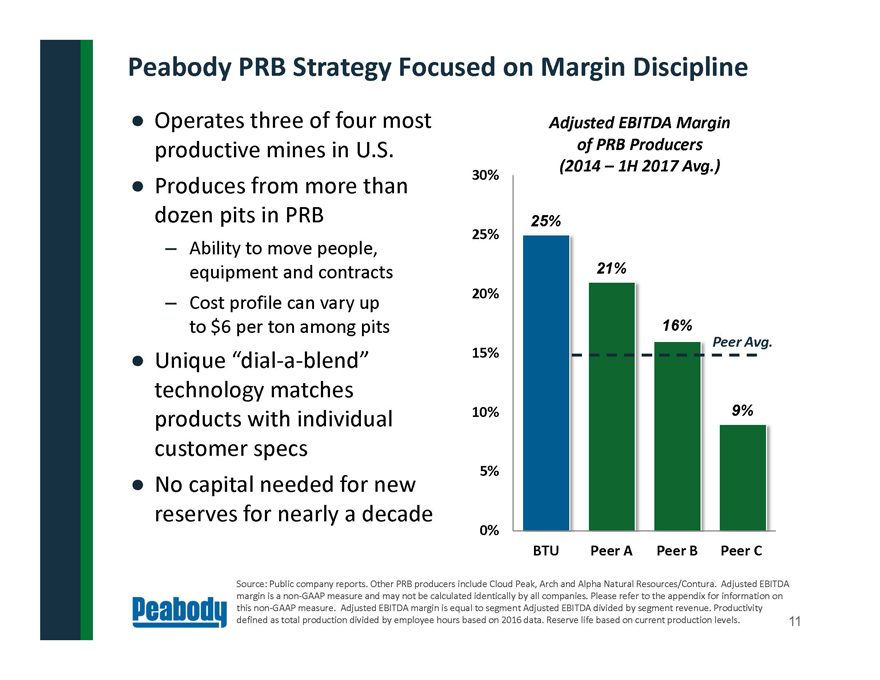

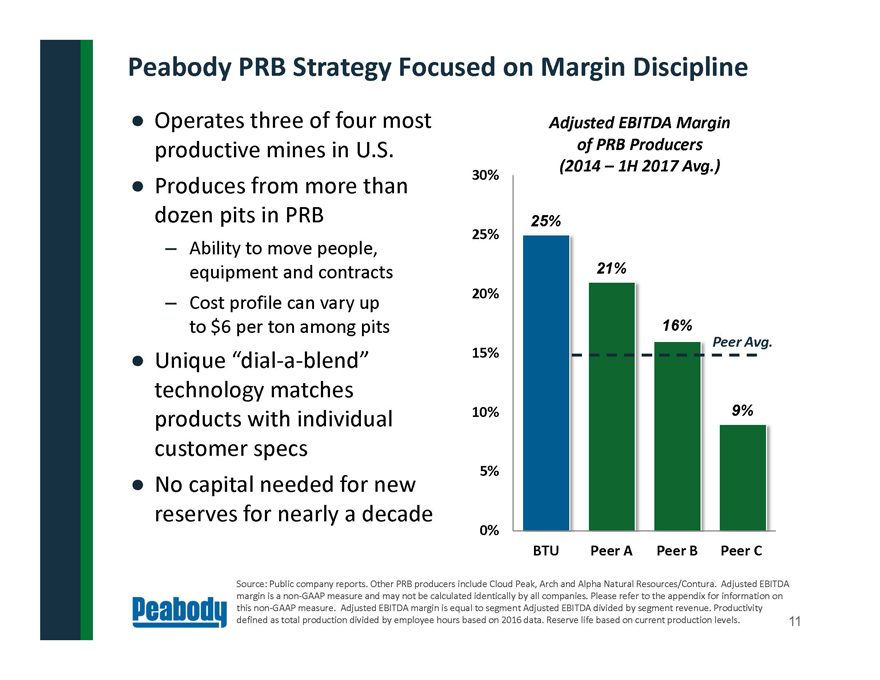

Peabody PRB Strategy Focused on Margin Discipline

25%

21%

16%

9%

0%

5%

10%

15%

20%

25%

30%

BTU Peer A Peer B Peer C

Adjusted EBITDA Margin

of PRB Producers

(2014 – 1H 2017 Avg.)

Operates three of four most

productive mines in U.S.

Produces from more than

dozen pits in PRB

– Ability to move people,

equipment and contracts

– Cost profile can vary up

to $6 per ton among pits

Unique “dial-a-blend”

technology matches

products with individual

customer specs

No capital needed for new

reserves for nearly a decade

Peer Avg.

Source: Public company reports. Other PRB producers include Cloud Peak, Arch and Alpha Natural Resources/Contura. Adjusted EBITDA

margin is a non-GAAP measure and may not be calculated identically by all companies. Please refer to the appendix for information on

this non-GAAP measure. Adjusted EBITDA margin is equal to segment Adjusted EBITDA divided by segment revenue. Productivity

defined as total production divided by employee hours based on 2016 data. Reserve life based on current production levels. 11

Peabody “DNA”

Interwoven from

PRB, Midwest

and Australian

Heritage

PRB:

Large Scale,

Innovative Process

Technologies

Australia:

Continuous

Improvement,

Global Mining

The Peabody Way

Midwest:

Capital

Discipline,

Cost Control

Trading and

Shared Services:

Support, Platform

Optimization

12

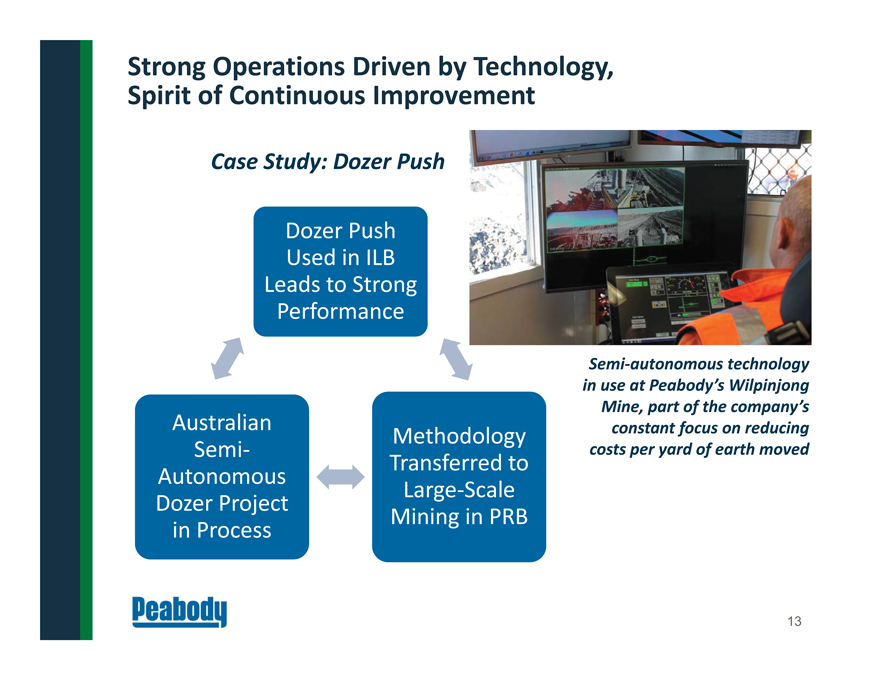

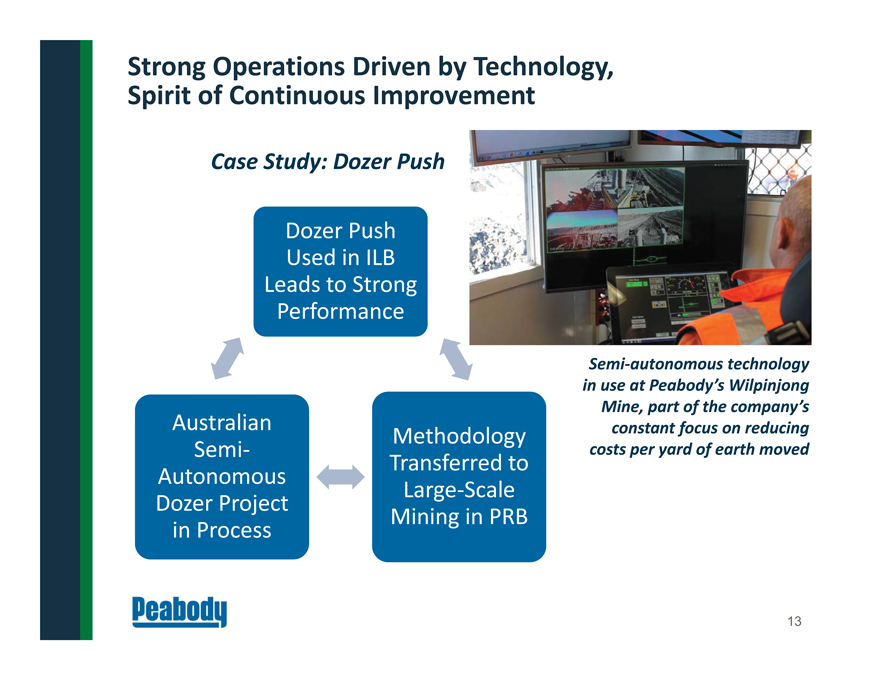

Strong Operations Driven by Technology,

Spirit of Continuous Improvement

Dozer Push

Used in ILB

Leads to Strong

Performance

Methodology

Transferred to

Large?Scale

Mining in PRB

Australian

Semi?

Autonomous

Dozer Project

in Process

Case Study: Dozer Push

Semi?autonomous technology

in use at Peabody’s Wilpinjong

Mine, part of the company’s

constant focus on reducing

costs per yard of earth moved

13

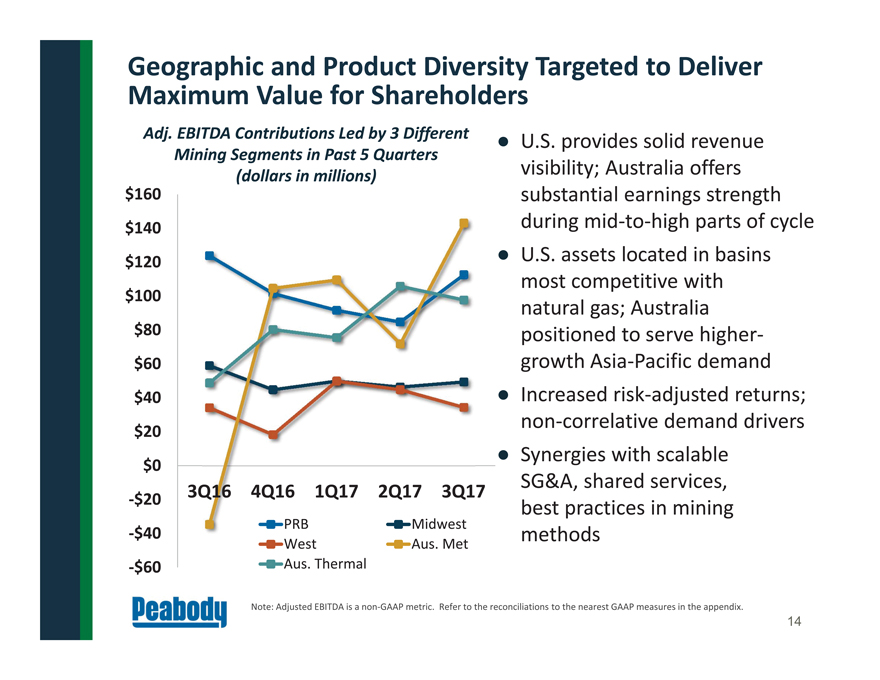

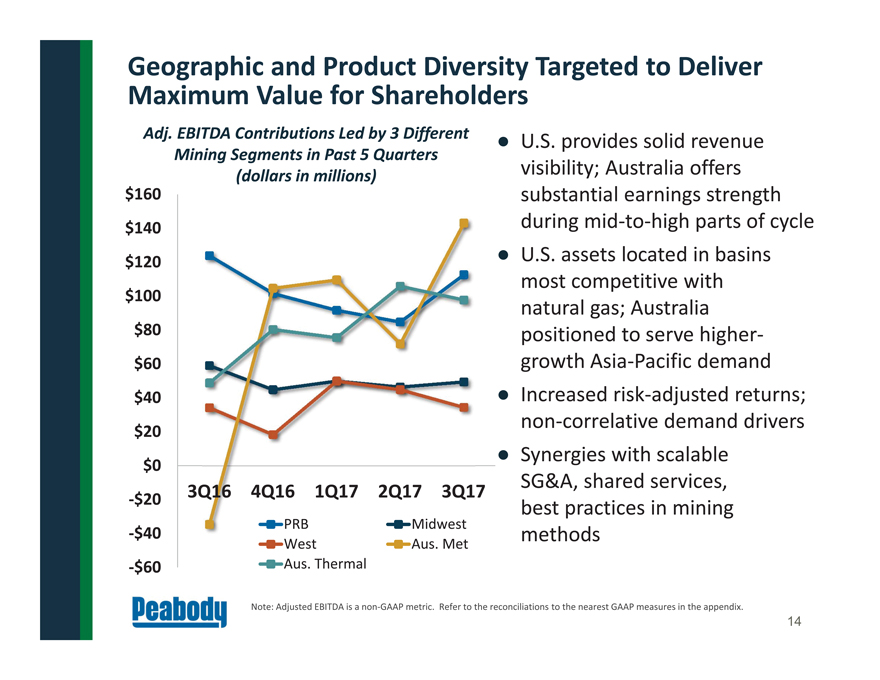

Geographic and Product Diversity Targeted to Deliver

Maximum Value for Shareholders

Note: Adjusted EBITDA is a non?GAAP metric. Refer to the reconciliations to the nearest GAAP measures in the appendix.

| • | | U.S. provides solid revenue |

visibility; Australia offers

substantial earnings strength

during mid-to-high parts of cycle

| • | | U.S. assets located in basins |

most competitive with

natural gas; Australia

positioned to serve highergrowth

Asia-Pacific demand

| • | | Increased risk-adjusted returns; |

non-correlative demand drivers

| • | | Synergies with scalable |

SG&A, shared services,

best practices in mining

methods

Adj. EBITDA Contributions Led by 3 Different

Mining Segments in Past 5 Quarters

(dollars in millions)

$60

$40

$20

$0

$20

$40

$60

$80

$100

$120

$140

$160

3Q16 4Q16 1Q17 2Q17 3Q17

PRB Midwest

West Aus. Met

Aus. Thermal

14

Industry Fundamentals

Coal railed from Peabody’s El Segundo Mine in New Mexico

15

Seaborne Thermal Coal

| • | | Chinese thermal imports up 15 |

million tonnes through 9 months

| • | | India demand down ~16 million |

tonnes through September

– Stockpiles reach lowest

levels in 2 years in August;

supportive of additional imports

up 23%, or 15 million

tonnes, through September

| • | | Australian spot pricing remains |

robust at ~$90 per tonne

| • | | Full year 2017 demand expected |

to rise 10 to 15 million

tonnes from 2016 levels

Strong Near-Term Seaborne Thermal

and Metallurgical Coal Demand at Play in 2017

Source: Industry data and Peabody Global Analytics. Data compared to the same nine-month period in 2016.

Seaborne Metallurgical Coal

| • | | Global steel production |

up 5% through nine months

| • | | Record Chinese steel production |

supports 9 million tonne increase

in imports through September

| • | | Q3 index-based settlement |

for hard coking coal

at ~$170 per tonne

| • | | 2017 seaborne demand expected |

to increase ~10 million tonnes

compared with prior year

16

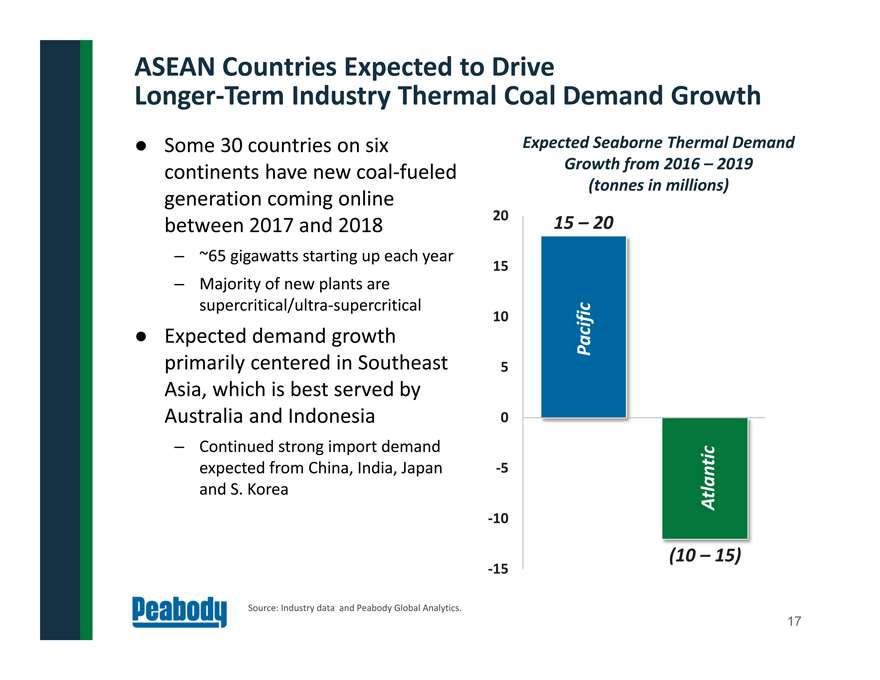

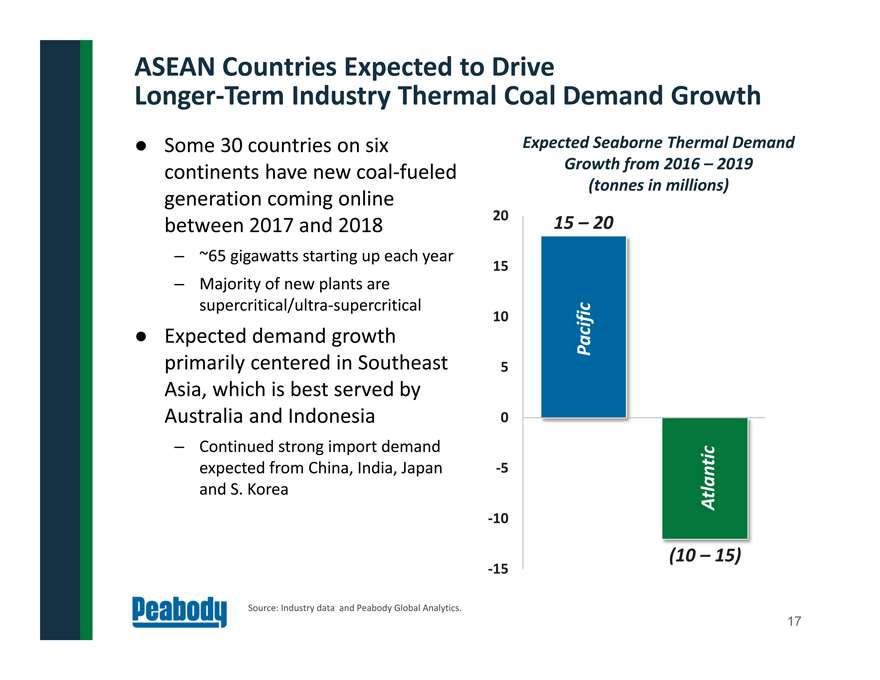

ASEAN Countries Expected to Drive

Longer-Term Industry Thermal Coal Demand Growth

Source: Industry data and Peabody Global Analytics.

| • | | Some 30 countries on six |

continents have new coal?fueled

generation coming online

between 2017 and 2018

– ~65 gigawatts starting up each year

– Majority of new plants are

supercritical/ultra-supercritical

primarily centered in Southeast

Asia, which is best served by

Australia and Indonesia

– Continued strong import demand

expected from China, India, Japan

and S. Korea

15

10

5

0

10

15

20

Atlantic

Pacific

Expected Seaborne Thermal Demand

Growth from 2016 – 2019

(tonnes in millions)

15 – 20

(10 – 15)

17

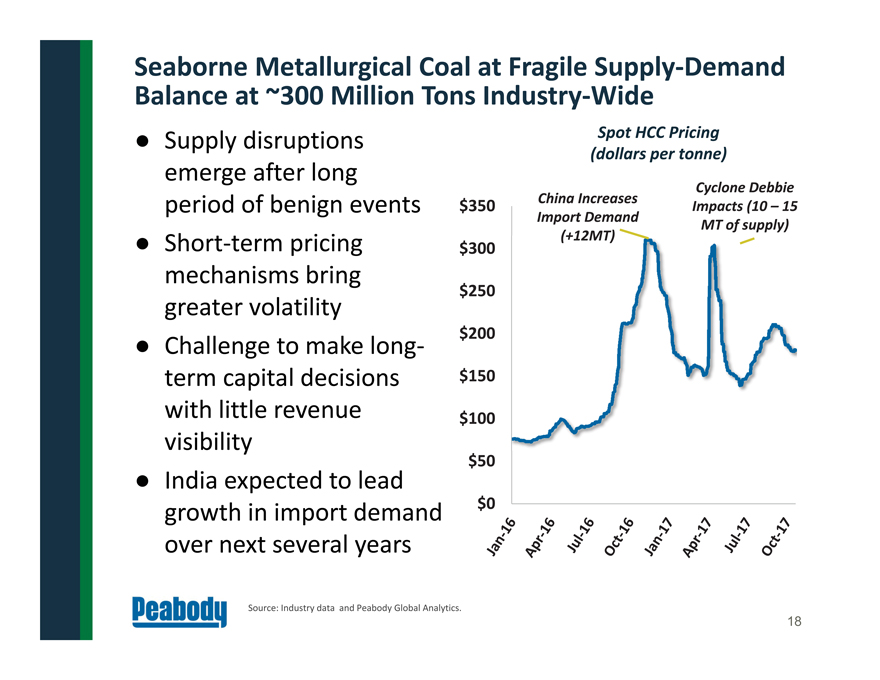

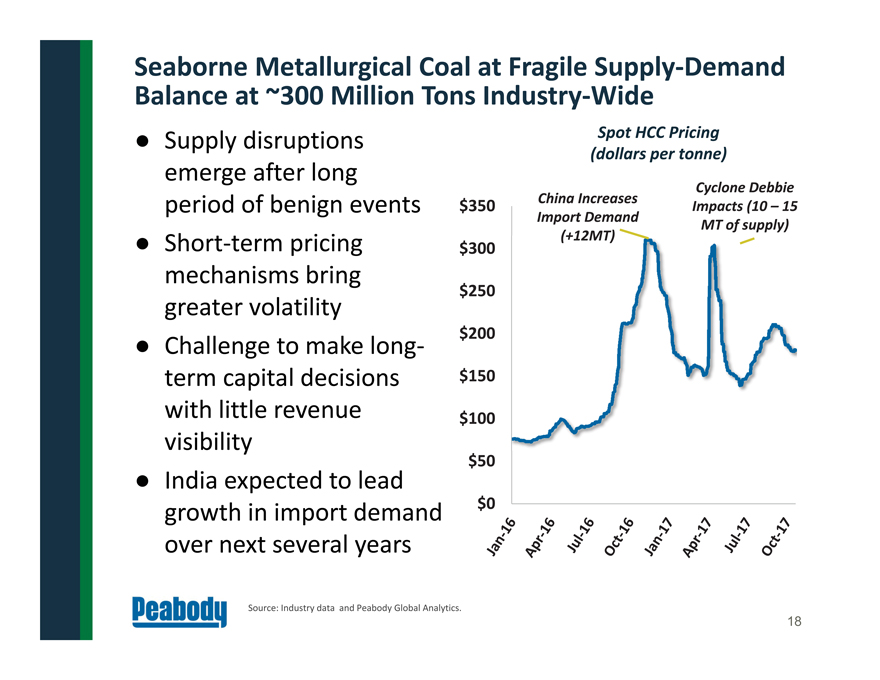

Seaborne Metallurgical Coal at Fragile Supply?Demand

Balance at ~300 Million Tons Industry?Wide

Source: Industry data and Peabody Global Analytics.

emerge after long

period of benign events

mechanisms bring

greater volatility

| • | | Challenge to make longterm |

capital decisions

with little revenue

visibility

growth in import demand

over next several years

$0

$50

$100

$150

$200

$250

$300

$350

Spot HCC Pricing

(dollars per tonne)

China Increases

Import Demand

(+12MT)

Cyclone Debbie

Impacts (10 – 15

MT of supply)

18

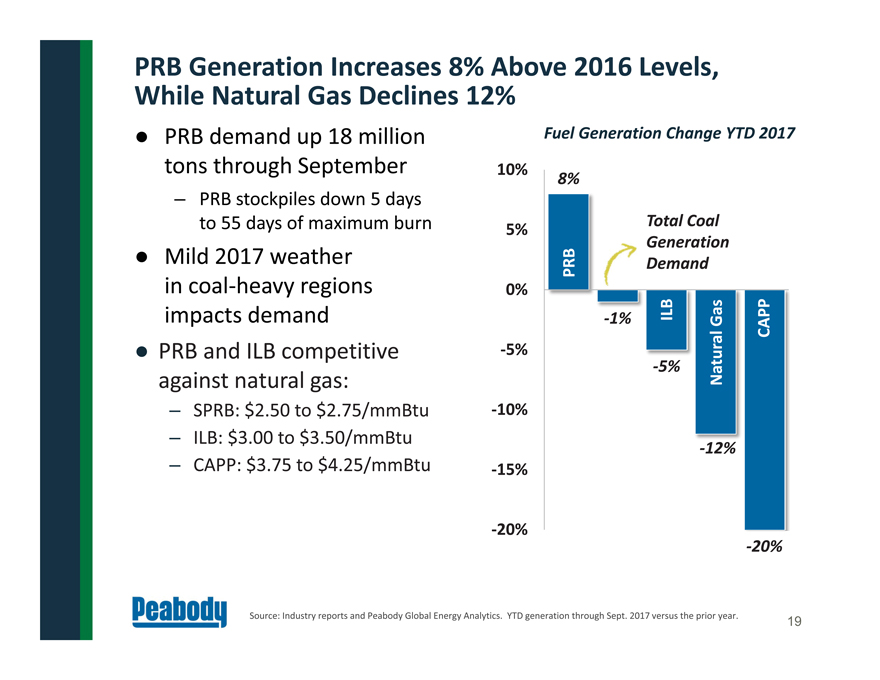

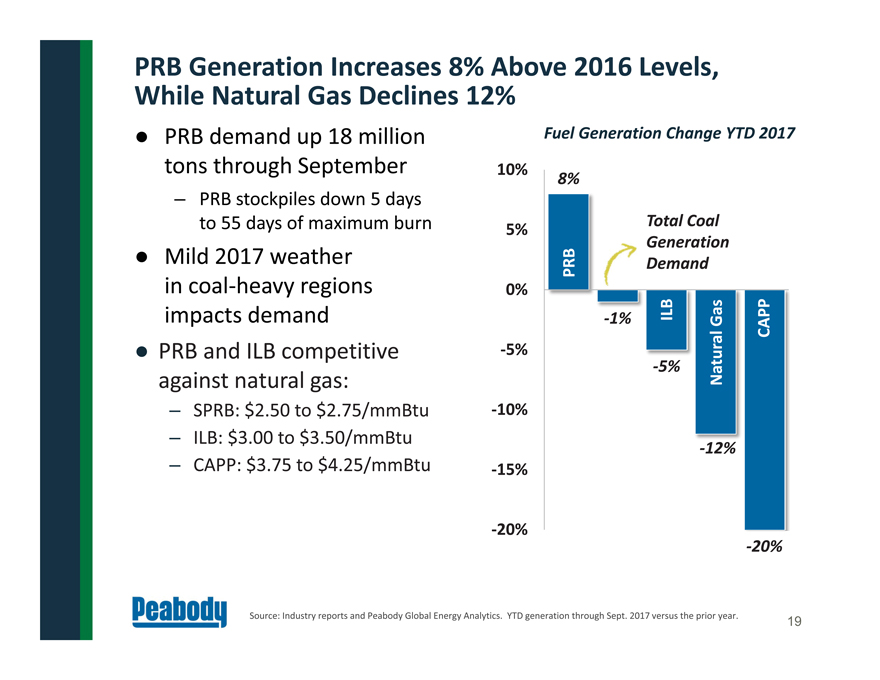

8%

1%

5%

12%

20%

20%

15%

10%

5%

0%

5%

10%

| • | | PRB demand up 18 million |

tons through September

– PRB stockpiles down 5 days

to 55 days of maximum burn

in coal-heavy regions

impacts demand

| • | | PRB and ILB competitive |

against natural gas:

– SPRB: $2.50 to $2.75/mmBtu

– ILB: $3.00 to $3.50/mmBtu

– CAPP: $3.75 to $4.25/mmBtu

PRB Generation Increases 8% Above 2016 Levels,

While Natural Gas Declines 12%

Fuel Generation Change YTD 2017

Source: Industry reports and Peabody Global Energy Analytics. YTD generation through Sept. 2017 versus the prior year.

PRB

ILB

CAPP

Total Coal

Generation

Demand

Natural Gas

19

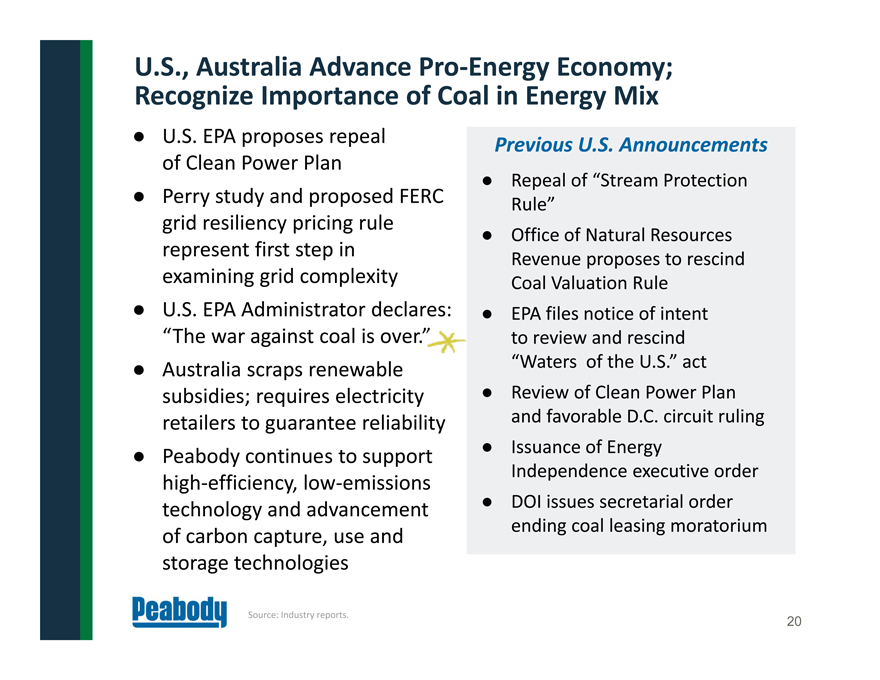

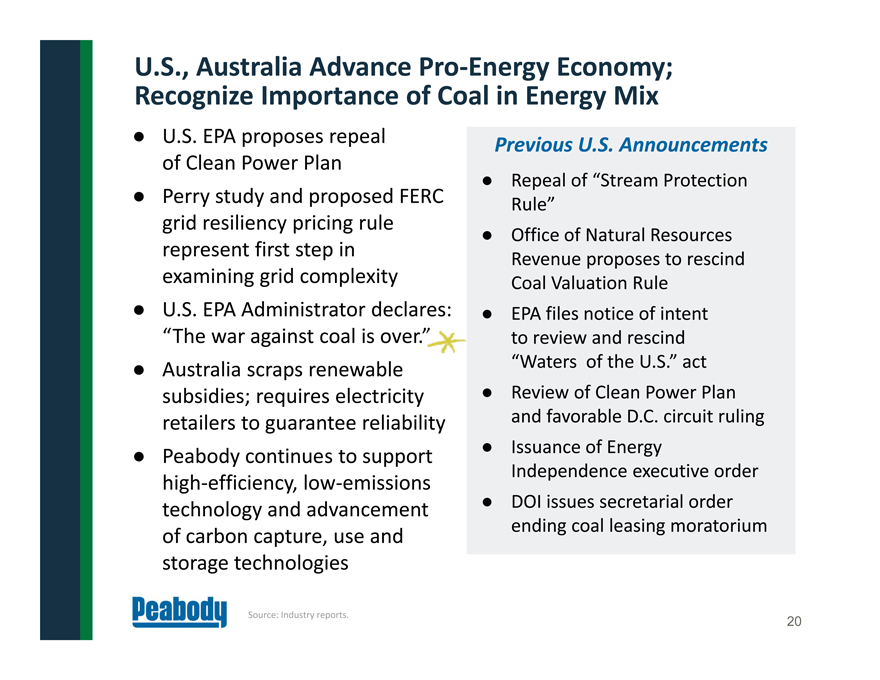

U.S., Australia Advance Pro-Energy Economy; Recognize Importance of Coal in Energy Mix

| • | | U.S. EPA proposes repeal of Clean Power Plan |

| • | | Perry study and proposed FERC grid resiliency pricing rule represent first step in examining grid complexity |

| • | | U.S. EPA Administrator declares: “The war against coal is over.” |

| • | | Australia scraps renewable subsidies; requires electricity retailers to guarantee reliability |

| • | | Peabody continues to support high-efficiency, low-emissions technology and advancement of carbon capture, use and storage technologies Previous U.S. Announcements |

| • | | Repeal of “Stream Protection Rule” Office of Natural Resources Revenue proposes to rescind Coal Valuation Rule |

| • | | EPA files notice of intent to review and rescind “Waters of the U.S.” act |

| • | | Review of Clean Power Plan and favorable D.C. circuit ruling |

| • | | Issuance of Energy Independence executive order |

| • | | DOI issues secretarial order ending coal leasing moratorium |

Source: Industry reports. 20

Financial Approach

21

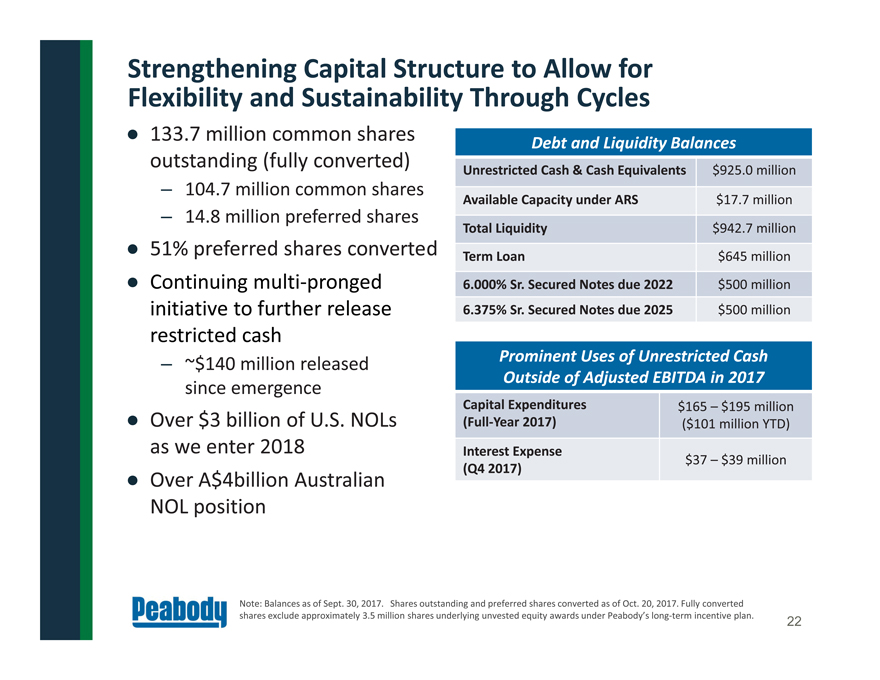

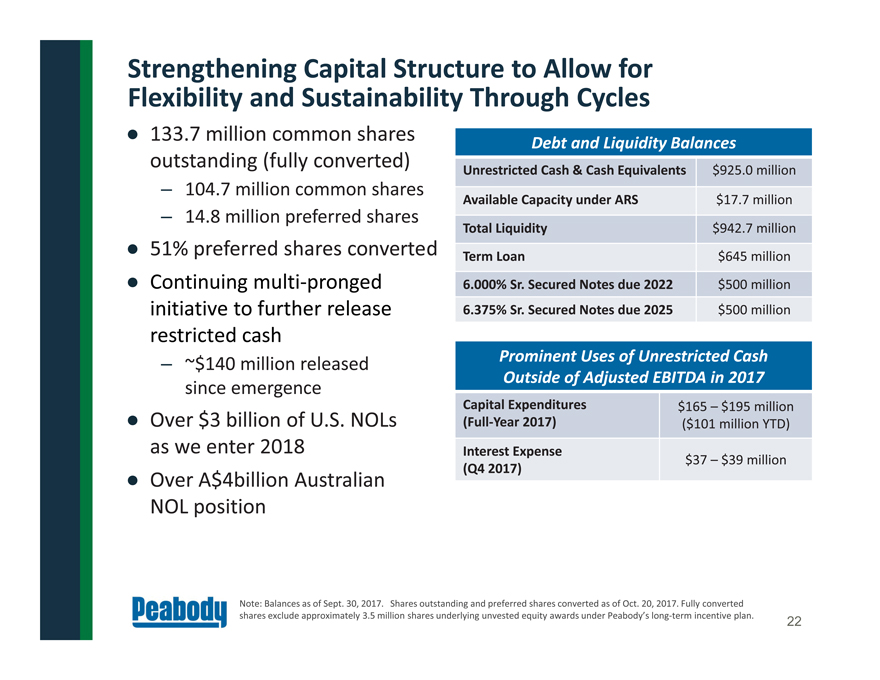

Strengthening Capital Structure to Allow for

Flexibility and Sustainability Through Cycles

| • | | 133.7 million common shares |

outstanding (fully converted)

– 104.7 million common shares

– 14.8 million preferred shares

| • | | 51% preferred shares converted |

| • | | Continuing multi-pronged |

initiative to further release

restricted cash

– ~$140 million released

since emergence

| • | | Over $3 billion of U.S. NOLs |

as we enter 2018

| • | | Over A$4billion Australian |

NOL position

Note: Balances as of Sept. 30, 2017. Shares outstanding and preferred shares converted as of Oct. 20, 2017. Fully converted

shares exclude approximately 3.5 million shares underlying unvested equity awards under Peabody’s long-term incentive plan.

Share Repurchases

Debt Repayment

Debt and Liquidity Balances

Unrestricted Cash & Cash Equivalents $925.0 million

Available Capacity under ARS $17.7 million

Total Liquidity $942.7 million

Term Loan $645 million

6.000% Sr. Secured Notes due 2022 $500 million

6.375% Sr. Secured Notes due 2025 $500 million

Prominent Uses of Unrestricted Cash

Outside of Adjusted EBITDA in 2017

Capital Expenditures

(Full-Year 2017)

$165 – $195 million

($101 million YTD)

Interest Expense

(Q4 2017) $37 – $39 million

22

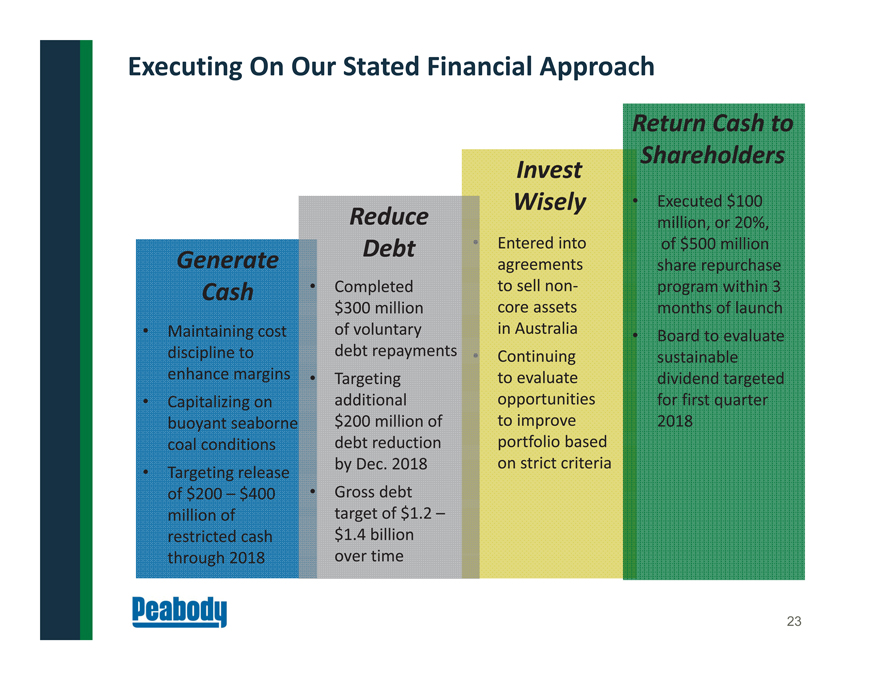

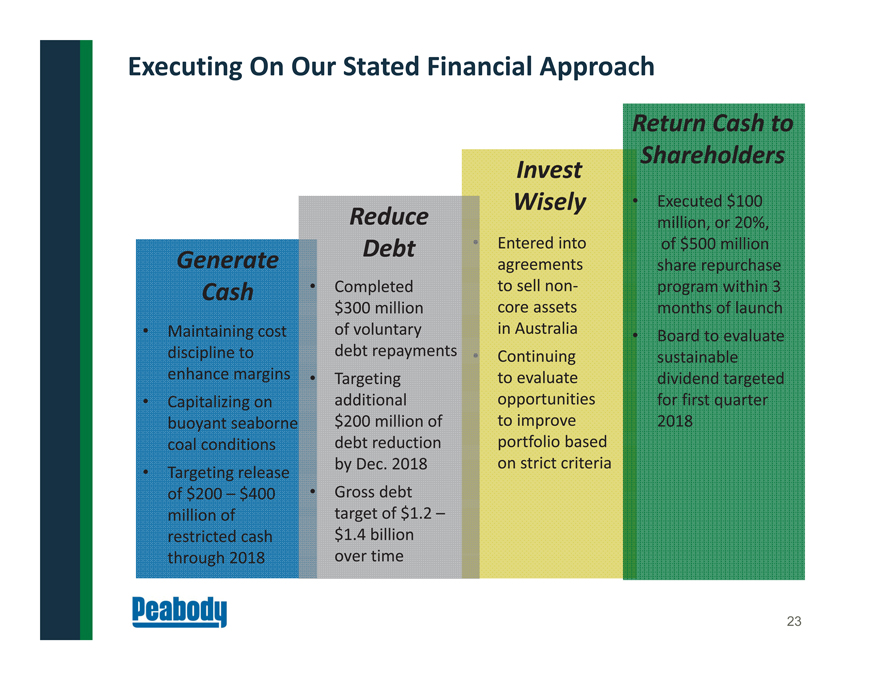

| • | | Entered into agreements to sell noncore assets in Australia |

| • | | Continuing to evaluate opportunities to improve portfolio based on strict criteria Executing On Our Stated Financial Approach Generate Cash Invest Wisely Return Cash to Shareholders Reduce Debt |

| • | | Maintaining cost discipline to enhance margins |

| • | | Capitalizing on buoyant seaborne coal conditions |

| • | | Targeting release of $200 – $400 million of restricted cash through 2018 |

| • | | Completed $300 million of voluntary debt repayments |

| • | | Targeting additional $200 million of debt reduction by Dec. 2018 |

| • | | Gross debt target of $1.2 – $1.4 billion over time |

| • | | Executed $100 million, or 20%, |

of $500 million share repurchase program within 3 months of launch

| • | | Board to evaluate sustainable dividend targeted for first quarter 2018 |

23

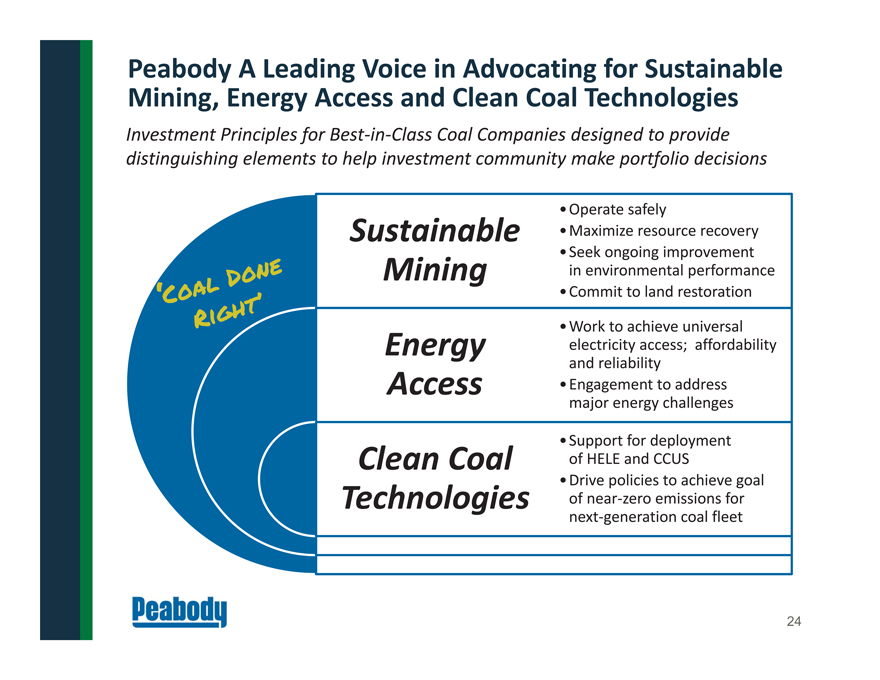

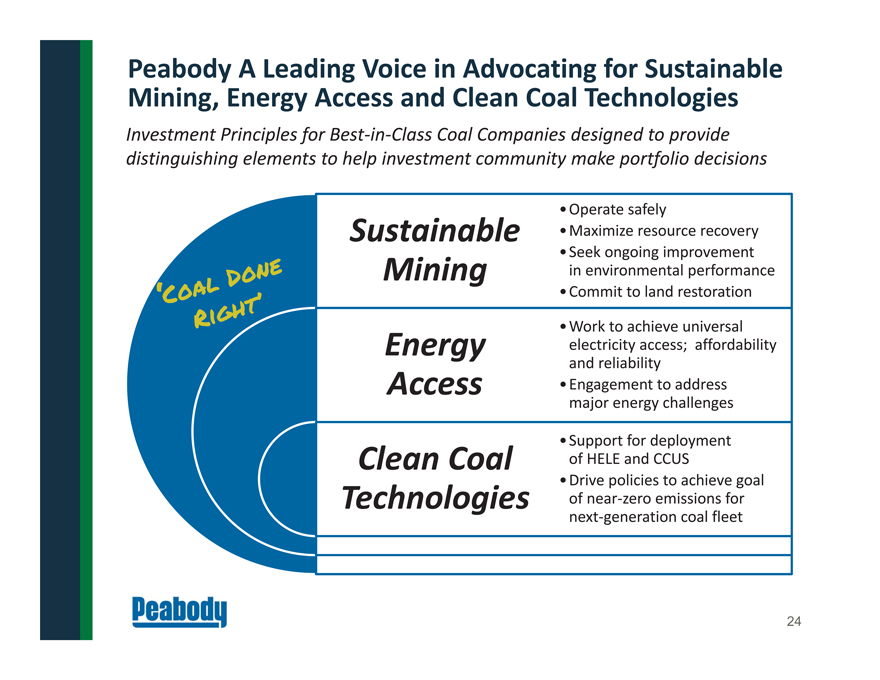

Peabody A Leading Voice in Advocating for Sustainable

Mining, Energy Access and Clean Coal Technologies

Sustainable

Mining

Energy

Access

Clean Coal

Technologies

| • | | Maximize resource recovery |

| • | | Seek ongoing improvement |

in environmental performance

| • | | Commit to land restoration |

| • | | Work to achieve universal |

electricity access; affordability

and reliability

major energy challenges

of HELE and CCUS

| • | | Drive policies to achieve goal |

of near?zero emissions for

next?generation coal fleet

Investment Principles for Best?in?Class Coal Companies designed to provide

distinguishing elements to help investment community make portfolio decisions

24

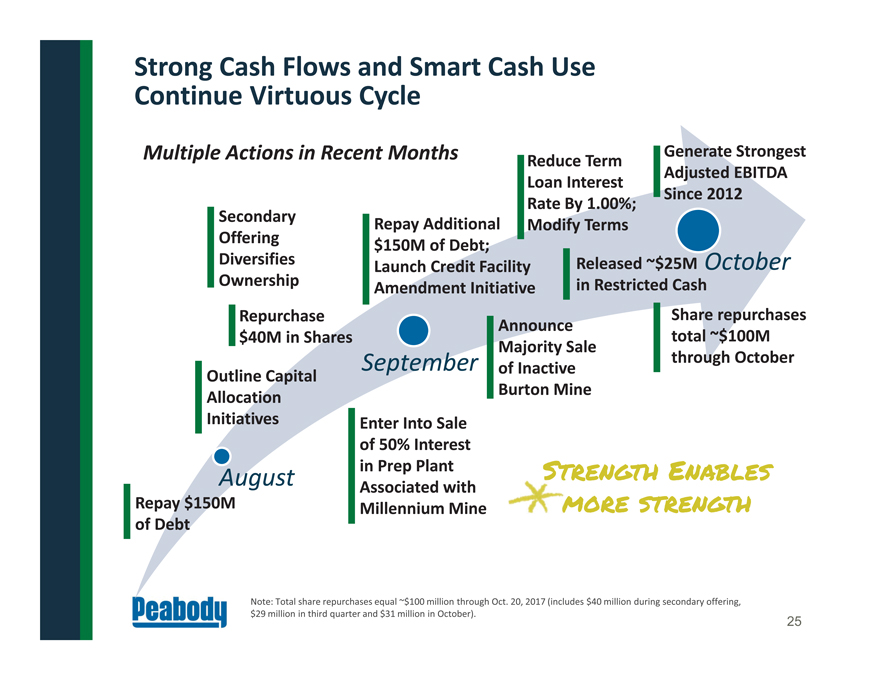

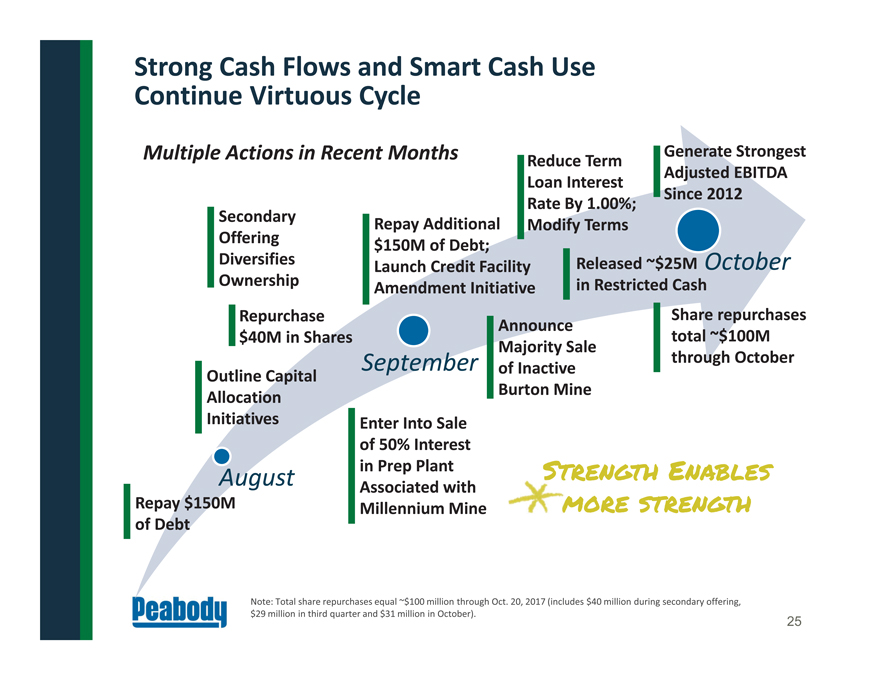

Strong Cash Flows and Smart Cash Use

Continue Virtuous Cycle

August

September

October

Outline Capital

Allocation

Initiatives

Repurchase

$40M in Shares

Repay $150M

of Debt

Repay Additional

$150M of Debt;

Launch Credit Facility

Amendment Initiative

Reduce Term

Loan Interest

Rate By 1.00%;

Modify Terms

Announce

Majority Sale

of Inactive

Burton Mine

Share repurchases

total ~$100M

through October

Enter Into Sale

of 50% Interest

in Prep Plant

Associated with

Millennium Mine

Released ~$25M

in Restricted Cash

Generate Strongest

Adjusted EBITDA

Since 2012

Note: Total share repurchases equal ~$100 million through Oct. 20, 2017 (includes $40 million during secondary offering,

$29 million in third quarter and $31 million in October).

Strength Enables

more strength

Secondary

Offering

Diversifies

Ownership

Multiple Actions in Recent Months

25

APPENDIX

26

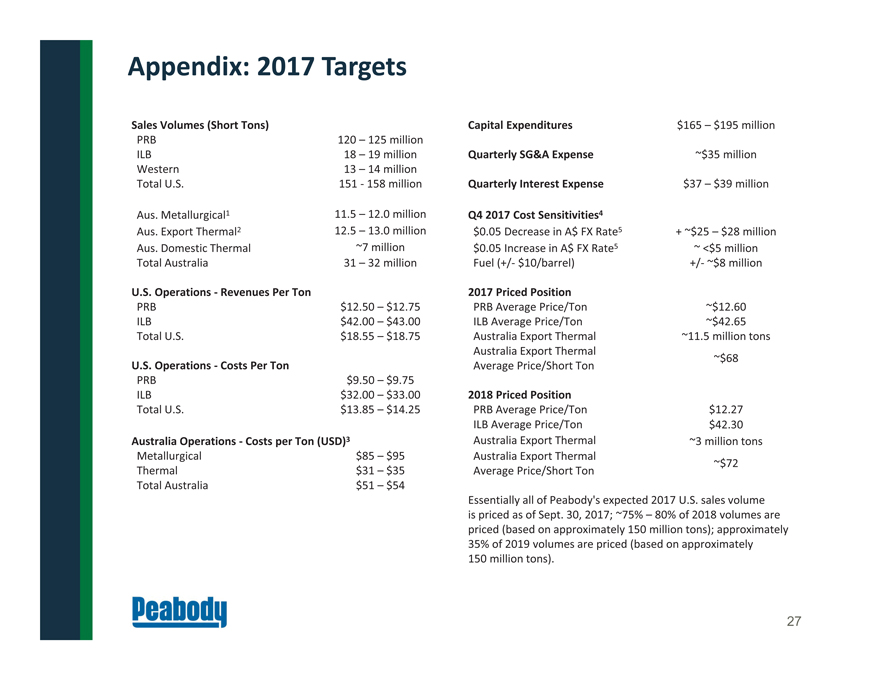

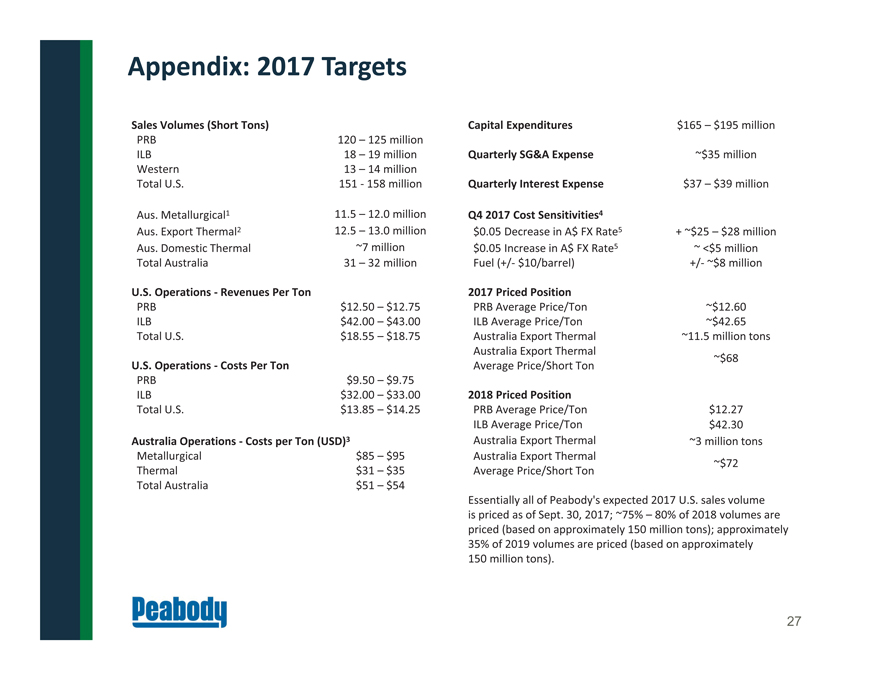

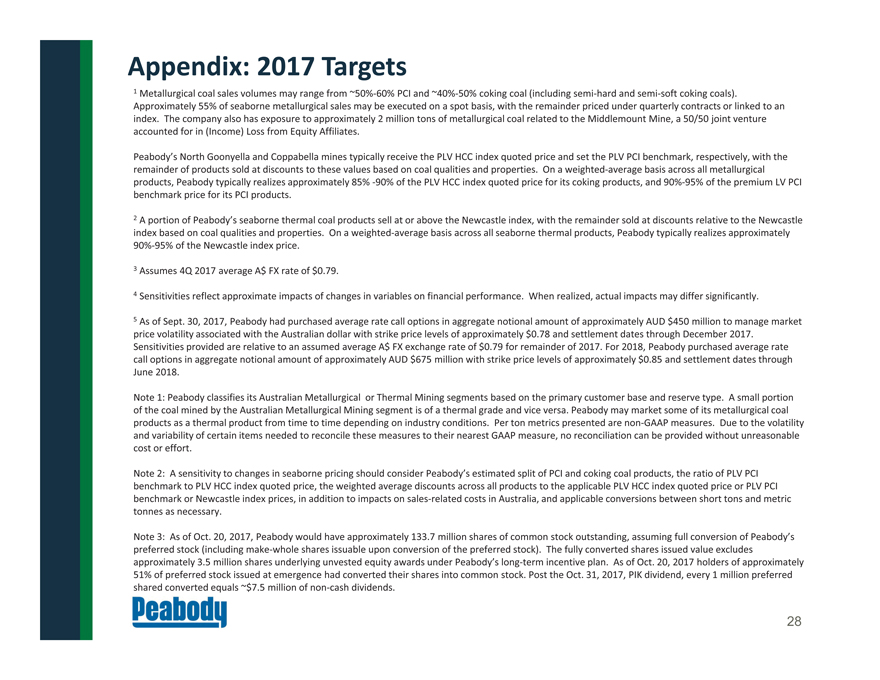

Appendix: 2017 Targets

Sales Volumes (Short Tons) Capital Expenditures $165 – $195 million

PRB 120 – 125 million

ILB 18 – 19 million Quarterly SG&A Expense ~$35 million

Western 13 – 14 million

Total U.S. 151 - 158 million Quarterly Interest Expense $37 – $39 million

Aus. Metallurgical1 11.5 – 12.0 million Q4 2017 Cost Sensitivities4

Aus. Export Thermal2 12.5 – 13.0 million $0.05 Decrease in A$ FX Rate5 + ~$25 – $28 million

Aus. Domestic Thermal ~7 million $0.05 Increase in A$ FX Rate5 ~ <$5 million

Total Australia 31 – 32 million Fuel (+/- $10/barrel) +/- ~$8 million

U.S. Operations - Revenues Per Ton 2017 Priced Position

PRB $12.50 – $12.75 PRB Average Price/Ton ~$12.60

ILB $42.00 – $43.00 ILB Average Price/Ton ~$42.65

Total U.S. $18.55 – $18.75 Australia Export Thermal ~11.5 million tons

Australia Export Thermal

U.S. Operations ? Costs Per Ton Average Price/Short Ton ~$68

PRB $9.50 – $9.75

ILB $32.00 – $33.00 2018 Priced Position

Total U.S. $13.85 – $14.25 PRB Average Price/Ton $12.27

ILB Average Price/Ton $42.30

Australia Operations - Costs per Ton (USD)3 Australia Export Thermal ~3 million tons

Metallurgical $85 – $95 Australia Export Thermal

Thermal $31 – $35 Average Price/Short Ton ~$72

Total Australia $51 – $54

Essentially all of Peabody’s expected 2017 U.S. sales volume

is priced as of Sept. 30, 2017; ~75% – 80% of 2018 volumes are

priced (based on approximately 150 million tons); approximately

35% of 2019 volumes are priced (based on approximately

150 million tons).

27

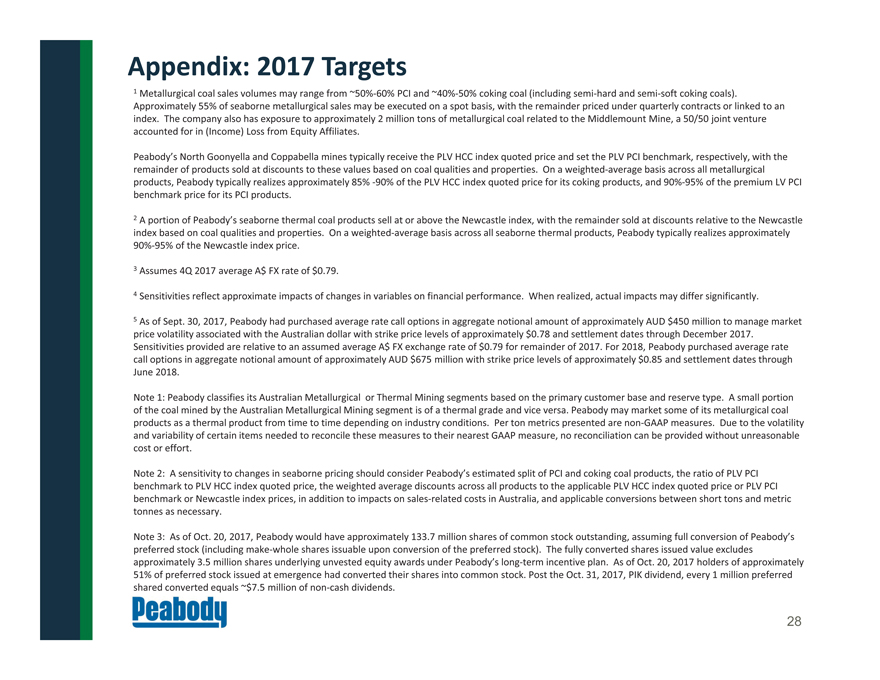

Appendix: 2017 Targets

1 Metallurgical coal sales volumes may range from ~50%?60% PCI and ~40%?50% coking coal (including semi?hard and semi?soft coking coals). Approximately 55% of seaborne metallurgical sales may be executed on a spot basis, with the remainder priced under quarterly contracts or linked to an index. The company also has exposure to approximately 2 million tons of metallurgical coal related to the Middlemount Mine, a 50/50 joint venture accounted for in (Income) Loss from Equity Affiliates.

Peabody’s North Goonyella and Coppabella mines typically receive the PLV HCC index quoted price and set the PLV PCI benchmark, respectively, with the remainder of products sold at discounts to these values based on coal qualities and properties. On a weighted-average basis across all metallurgical

products, Peabody typically realizes approximately 85% -90% of the PLV HCC index quoted price for its coking products, and 90%-95% of the premium LV PCI benchmark price for its PCI products.

2 A portion of Peabody’s seaborne thermal coal products sell at or above the Newcastle index, with the remainder sold at discounts relative to the Newcastle index based on coal qualities and properties. On a weighted-average basis across all seaborne thermal products, Peabody typically realizes approximately

90%-95% of the Newcastle index price.

3 Assumes 4Q 2017 average A$ FX rate of $0.79.

4 Sensitivities reflect approximate impacts of changes in variables on financial performance. When realized, actual impacts may differ significantly.

5 As of Sept. 30, 2017, Peabody had purchased average rate call options in aggregate notional amount of approximately AUD $450 million to manage market

price volatility associated with the Australian dollar with strike price levels of approximately $0.78 and settlement dates through December 2017.

Sensitivities provided are relative to an assumed average A$ FX exchange rate of $0.79 for remainder of 2017. For 2018, Peabody purchased average rate call options in aggregate notional amount of approximately AUD $675 million with strike price levels of approximately $0.85 and settlement dates through

June 2018.

Note 1: Peabody classifies its Australian Metallurgical or Thermal Mining segments based on the primary customer base and reserve type. A small portion of the coal mined by the Australian Metallurgical Mining segment is of a thermal grade and vice versa. Peabody may market some of its metallurgical coal products as a thermal product from time to time depending on industry conditions. Per ton metrics presented are non-GAAP measures. Due to the volatility and variability of certain items needed to reconcile these measures to their nearest GAAP measure, no reconciliation can be provided without unreasonable cost or effort.

Note 2: A sensitivity to changes in seaborne pricing should consider Peabody’s estimated split of PCI and coking coal products, the ratio of PLV PCI

benchmark to PLV HCC index quoted price, the weighted average discounts across all products to the applicable PLV HCC index quoted price or PLV PCI benchmark or Newcastle index prices, in addition to impacts on sales-related costs in Australia, and applicable conversions between short tons and metric tonnes as necessary.

Note 3: As of Oct. 20, 2017, Peabody would have approximately 133.7 million shares of common stock outstanding, assuming full conversion of Peabody’s preferred stock (including make?whole shares issuable upon conversion of the preferred stock). The fully converted shares issued value excludes approximately 3.5 million shares underlying unvested equity awards under Peabody’s long-term incentive plan. As of Oct. 20, 2017 holders of approximately 51% of preferred stock issued at emergence had converted their shares into common stock. Post the Oct. 31, 2017, PIK dividend, every 1 million preferred shared converted equals ~$7.5 million of non-cash dividends.

28

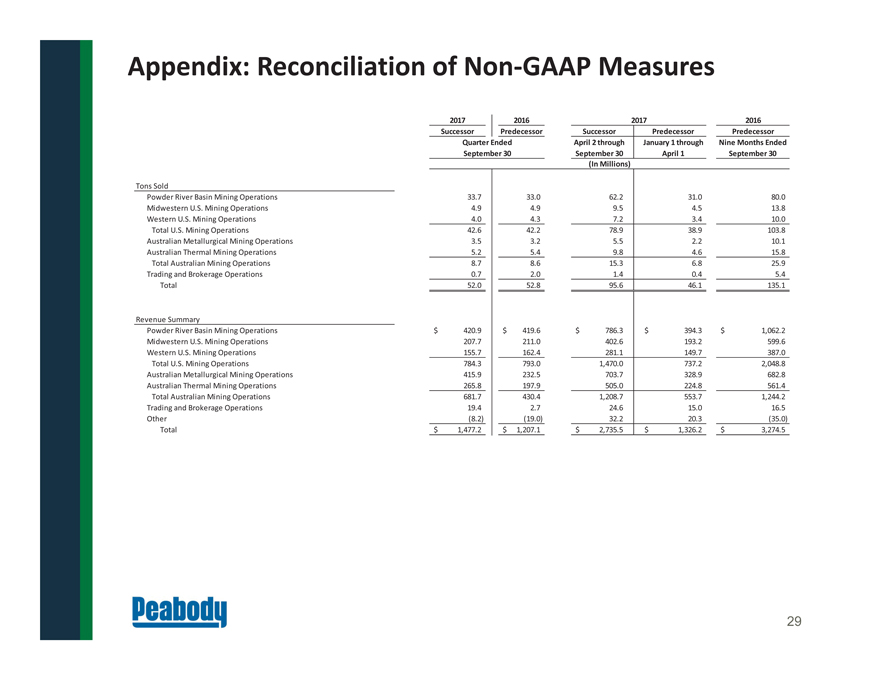

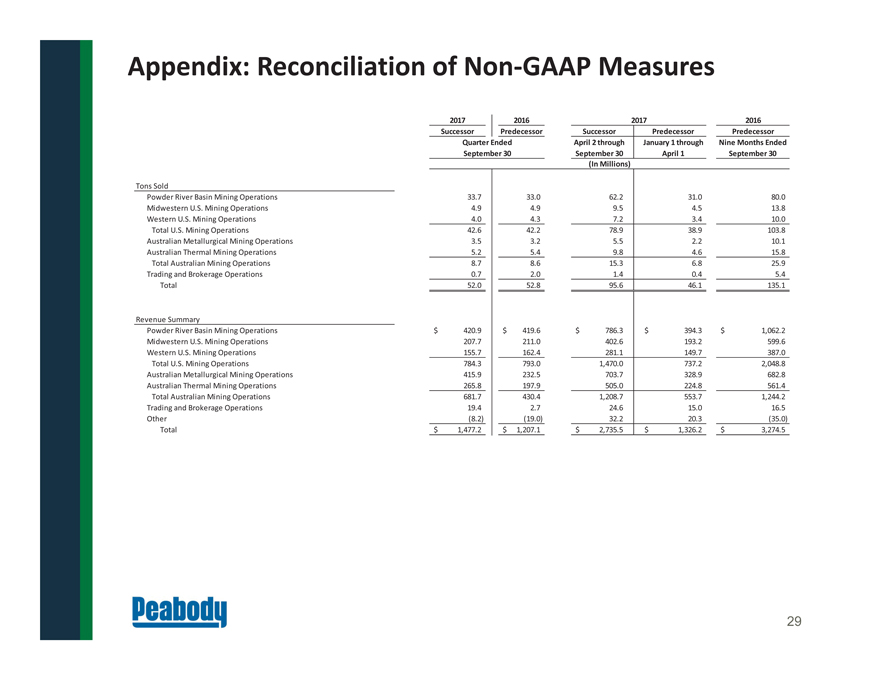

Appendix: Reconciliation of Non?GAAP Measures

2017 2016 2016

Successor Predecessor Successor Predecessor Predecessor

April 2 through January 1 through Nine Months Ended

September 30 April 1 September 30

Powder River Basin Mining Operations 33.7 33.0 62.2 31.0 80.0

Midwestern U.S. Mining Operations 4.9 4.9 9.5 4.5 13.8

Western U.S. Mining Operations 4.0 4.3 7.2 3.4 10.0

Total U.S. Mining Operations 42.6 42.2 78.9 38.9 103.8

Australian Metallurgical Mining Operations 3.5 3.2 5.5 2.2 10.1

Australian Thermal Mining Operations 5.2 5.4 9.8 4.6 15.8

Total Australian Mining Operations 8.7 8.6 15.3 6.8 25.9

Trading and Brokerage Operations 0.7 2.0 1.4 0.4 5.4

Total 52.0 52.8 95.6 46.1 135.1

Powder River Basin Mining Operations $ 420.9 $ 419.6 $ 786.3 $ 394.3 $ 1,062.2

Midwestern U.S. Mining Operations 207.7 211.0 402.6 193.2 599.6

Western U.S. Mining Operations 155.7 162.4 281.1 149.7 387.0

Total U.S. Mining Operations 784.3 793.0 1,470.0 737.2 2,048.8

Australian Metallurgical Mining Operations 415.9 232.5 703.7 328.9 682.8

Australian Thermal Mining Operations 265.8 197.9 505.0 224.8 561.4

Total Australian Mining Operations 681.7 430.4 1,208.7 553.7 1,244.2

Trading and Brokerage Operations 19.4 2.7 24.6 15.0 16.5

Other (8.2) (19.0) 32.2 20.3 (35.0)

Total $ 1,477.2 $ 1,207.1 $ 2,735.5 $ 1,326.2 $ 3,274.5

Tons Sold

2017

(In Millions)

Quarter Ended

September 30

Revenue Summary

29

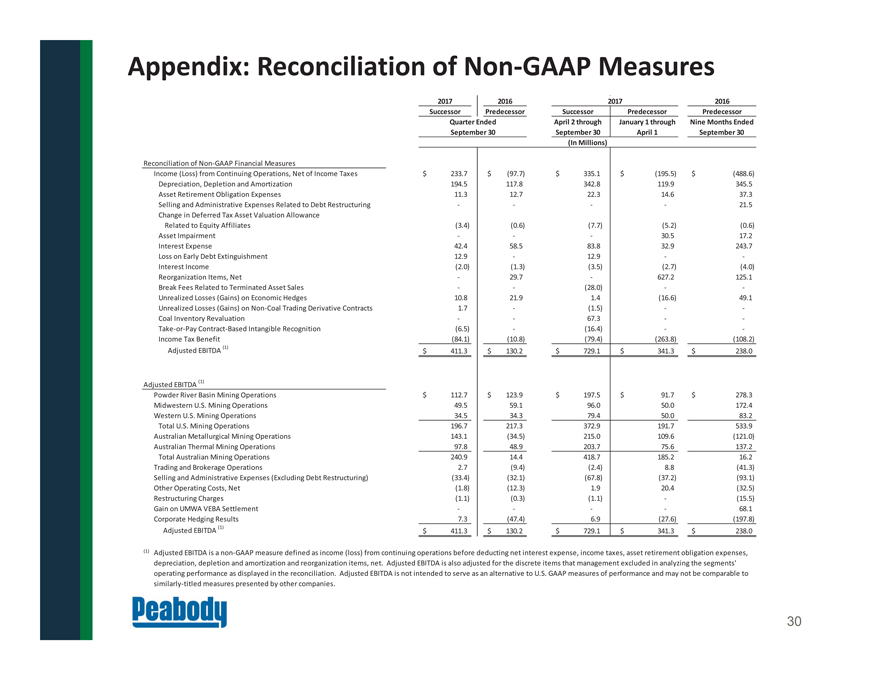

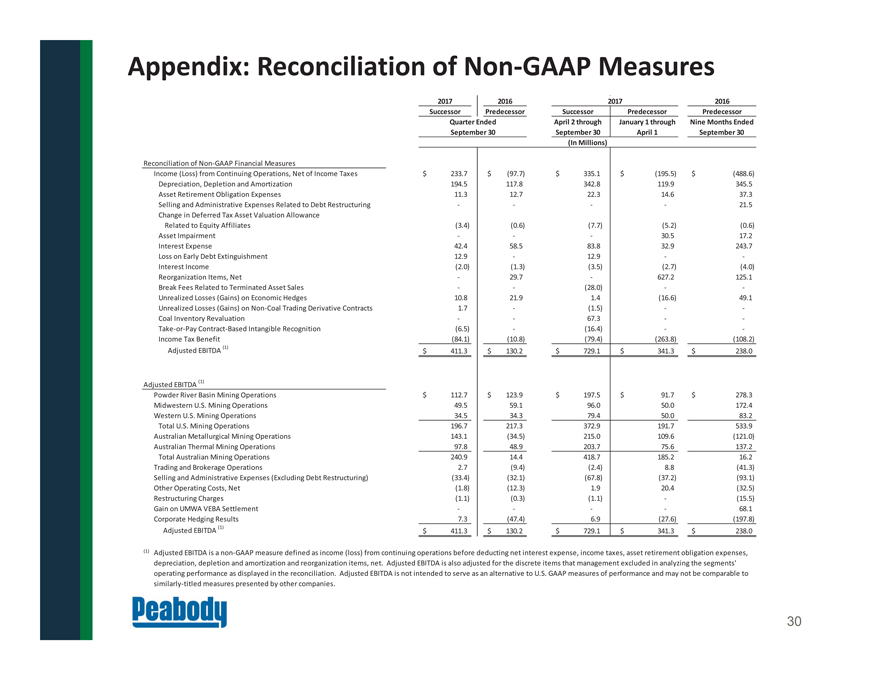

Appendix: Reconciliation of Non-GAAP Measures

2017 2016 2016

Successor Predecessor Successor Predecessor Predecessor

April 2 through January 1 through Nine Months Ended

September 30 April 1 September 30

Income (Loss) from Continuing Operations, Net of Income Taxes $ 233.7 $ (97.7) $ 335.1 $ (195.5) $ (488.6)

Depreciation, Depletion and Amortization 1 94.5 117.8 342.8 119.9 345.5

Asset Retirement Obligation Expenses 11.3 12.7 22.3 14.6 37.3

Selling and Administrative Expenses Related to Debt Restructuring - - - - 21.5

Change in Deferred Tax Asset Valuation Allowance

Related to Equity Affiliates ( 3.4) (0.6) (7.7) (5.2) (0.6)

Asset Impairment - - - 30.5 17.2

Interest Expense 42.4 58.5 83.8 32.9 243.7

Loss on Early Debt Extinguishment 12.9 - 12.9 - -

Interest Income (2.0) (1.3) (3.5) (2.7) (4.0)

Reorganization Items, Net - 29.7 - 627.2 125.1

Break Fees Related to Terminated Asset Sales ? ? (28.0) ? ?

Unrealized Losses (Gains) on Economic Hedges 10.8 21.9 1.4 (16.6) 49.1

Unrealized Losses (Gains) on Non-Coal Trading Derivative Contracts 1.7 - (1.5) - -

Coal Inventory Revaluation - - 67.3 - -

Take-or-Pay Contract?Based Intangible Recognition ( 6.5) - (16.4) - -

Income Tax Benefit (84.1) (10.8) (79.4) (263.8) (108.2)

Adjusted EBITDA (1) $ 411.3 $ 130.2 $ 729.1 $ 341.3 $ 238.0

Powder River Basin Mining Operations $ 112.7 $ 123.9 $ 197.5 $ 91.7 $ 278.3

Midwestern U.S. Mining Operations 49.5 59.1 96.0 50.0 172.4

Western U.S. Mining Operations 34.5 34.3 79.4 50.0 83.2

Total U.S. Mining Operations 196.7 217.3 372.9 191.7 533.9

Australian Metallurgical Mining Operations 143.1 (34.5) 215.0 109.6 (121.0)

Australian Thermal Mining Operations 97.8 48.9 203.7 75.6 137.2

Total Australian Mining Operations 240.9 14.4 418.7 185.2 16.2

Trading and Brokerage Operations 2.7 (9.4) (2.4) 8.8 (41.3)

Selling and Administrative Expenses (Excluding Debt Restructuring) (33.4) (32.1) (67.8) (37.2) (93.1)

Other Operating Costs, Net (1.8) (12.3) 1.9 20.4 (32.5)

Restructuring Charges (1.1) (0.3) (1.1) - (15.5)

Gain on UMWA VEBA Settlement - - - - 68.1

Corporate Hedging Results 7.3 (47.4) 6.9 (27.6) (197.8)

Adjusted EBITDA (1) $ 411.3 $ 130.2 $ 729.1 $ 341.3 $ 238.0

(1) Adjusted EBITDA is a non-GAAP measure defined as income (loss) from continuing operations before deducting net interest expense, income taxes, asset retirement obligation expenses,

depreciation, depletion and amortization and reorganization items, net. Adjusted EBITDA is also adjusted for the discrete items that management excluded in analyzing the segments’

operating performance as displayed in the reconciliation. Adjusted EBITDA is not intended to serve as an alternative to U.S. GAAP measures of performance and may not be comparable to

similarly-titled measures presented by other companies.

Adjusted EBITDA (1)

Reconciliation of Non-GAAP Financial Measures

2017

Quarter Ended

September 30

(In Millions)

30

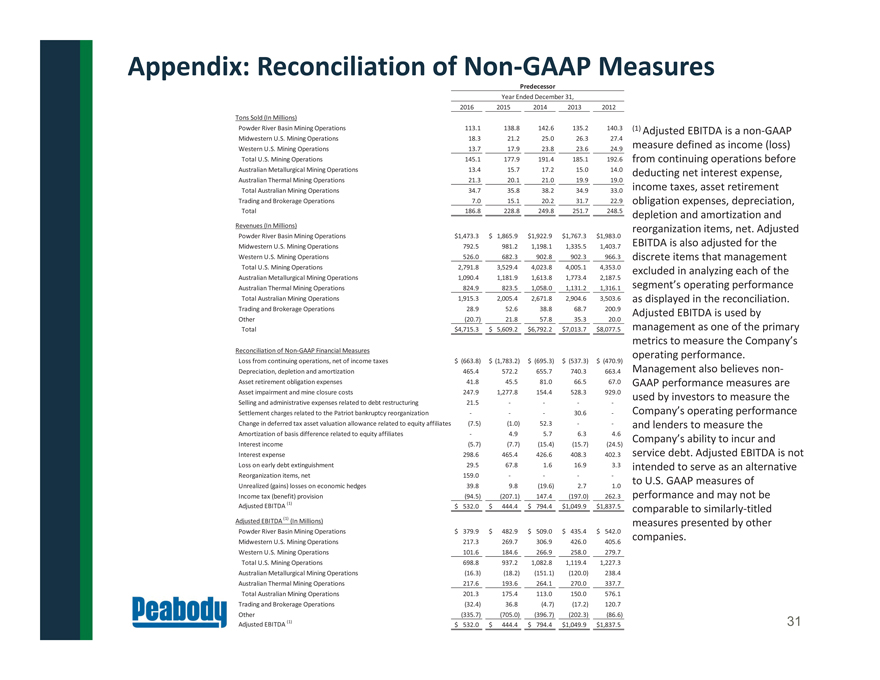

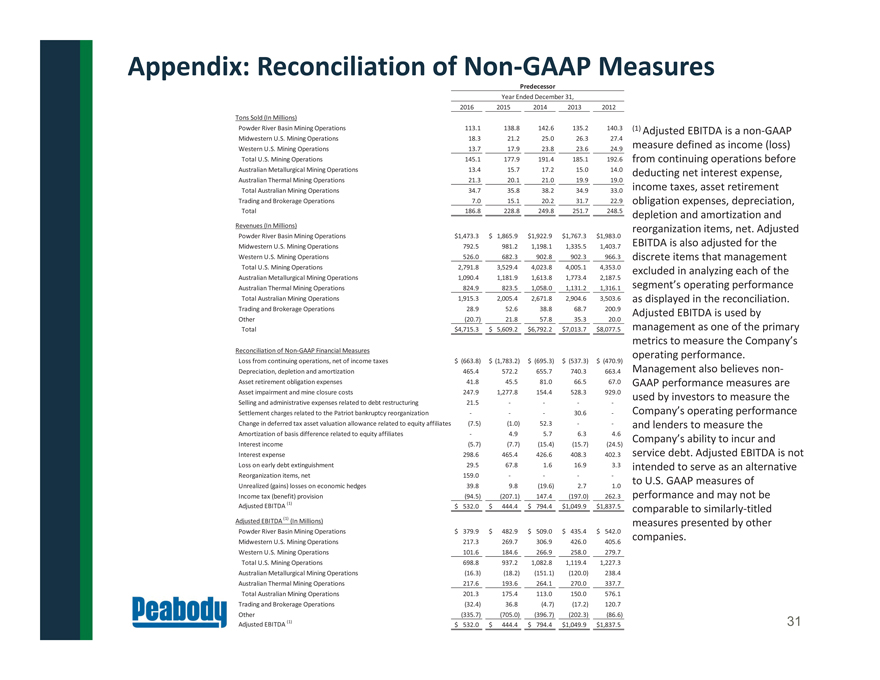

| (1) | Adjusted EBITDA is a non?GAAP measure defined as income (loss) from continuing operations before |

deducting net interest expense, income taxes, asset retirement obligation expenses, depreciation, depletion and amortization and

reorganization items, net. Adjusted EBITDA is also adjusted for the discrete items that management excluded in analyzing each of the segment’s operating performance as displayed in the reconciliation. Adjusted EBITDA is used by management as one of the primary

metrics to measure the Company’s operating performance. Management also believes non? GAAP performance measures are used by investors to measure the Company’s operating performance and lenders to measure the Company’s ability to incur and service debt. Adjusted EBITDA is not intended to serve as an alternative to U.S. GAAP measures of performance and may not be comparable to similarly-titled measures presented by other companies. Appendix: Reconciliation of Non?GAAP Measures 2016 2015 2014 2013 2012 Tons Sold (In Millions) Powder River Basin Mining Operations 113.1 138.8 142.6 135.2 140.3 Midwestern U.S. Mining Operations 18.3 21.2 25.0 26.3 27.4 Western U.S. Mining Operations 13.7 17.9 23.8 23.6 24.9 Total U.S. Mining Operations 145.1 177.9 191.4 185.1 192.6 Australian Metallurgical Mining Operations 13.4 15.7 17.2 15.0 14.0 Australian Thermal Mining Operations 21.3 20.1 21.0 19.9 19.0 Total Australian Mining Operations 34.7 35.8 38.2 34.9 33.0 Trading and Brokerage Operations 7.0 15.1 20.2 31.7 22.9 Total 186.8 228.8 249.8 251.7 248.5 Revenues (In Millions) Powder River Basin Mining Operations $ 1,473.3 $ 1,865.9 $ 1,922.9 $ 1,767.3 $ 1,983.0 Midwestern U.S. Mining Operations 792.5 981.2 1,198.1 1,335.5 1,403.7 Western U.S. Mining Operations 526.0 682.3 902.8 902.3 966.3 Total U.S. Mining Operations 2,791.8 3,529.4 4,023.8 4,005.1 4,353.0 Australian Metallurgical Mining Operations 1,090.4 1,181.9 1,613.8 1,773.4 2,187.5 Australian Thermal Mining Operations 824.9 823.5 1,058.0 1,131.2 1,316.1 Total Australian Mining Operations 1,915.3 2,005.4 2,671.8 2,904.6 3,503.6 Trading and Brokerage Operations 28.9 52.6 38.8 68.7 200.9 Other (20.7) 21.8 57.8 35.3 20.0 Total $4 ,715.3 $ 5,609.2 $ 6,792.2 $ 7,013.7 $ 8,077.5 Reconciliation of Non?GAAP Financial Measures Loss from continuing operations, net of income taxes $ (663.8) $ (1,783.2) $ (695.3) $ (537.3) $ (470.9) Depreciation, depletion and amortization 465.4 572.2 655.7 740.3 663.4 Asset retirement obligation expenses 41.8 45.5 81.0 66.5 67.0 Asset impairment and mine closure costs 247.9 1,277.8 154.4 528.3 929.0 Selling and administrative expenses related to debt restructuring 21.5--- Settlement charges related to the Patriot bankruptcy reorganization --- 30.6 - Change in deferred tax asset valuation allowance related to equity affiliates (7.5) (1.0) 52.3 -- Amortization of basis difference related to equity affiliates ? 4.9 5.7 6.3 4.6 Interest income (5.7) (7.7) (15.4) (15.7) (24.5) Interest expense 298.6 465.4 426.6 408.3 402.3 Loss on early debt extinguishment 29.5 67.8 1.6 16.9 3.3 Reorganization items, net 159.0 ---- Unrealized (gains) losses on economichedges 39.8 9.8 (19.6) 2.7 1.0 Income tax (benefit) provision (94.5) (207.1) 147.4 (197.0) 262.3 Adjusted EBITDA (1) $ 532.0 $ 444.4 $ 794.4 $ 1,049.9 $ 1,837.5 Adjusted EBITDA (1) (In Millions) Powder River Basin Mining Operations $ 379.9 $ 482.9 $ 509.0 $ 435.4 $ 542.0 Midwestern U.S. Mining Operations 217.3 269.7 306.9 426.0 405.6 Western U.S. Mining Operations 101.6 184.6 266.9 258.0 279.7 Total U.S. Mining Operations 698.8 937.2 1,082.8 1,119.4 1,227.3 Australian Metallurgical Mining Operations (16.3) (18.2) (151.1) (120.0) 238.4 Australian Thermal Mining Operations 217.6 193.6 264.1 270.0 337.7 Total Australian Mining Operations 201.3 175.4 113.0 150.0 576.1 Trading and Brokerage Operations (32.4) 36.8 (4.7) (17.2) 120.7 Other (335.7) (705.0) (396.7) (202.3) (86.6) Adjusted EBITDA (1) $ 532.0 $ 444.4 $ 794.4 $ 1,049.9 $ 1,837.5 Predecessor

Year Ended December 31, 31

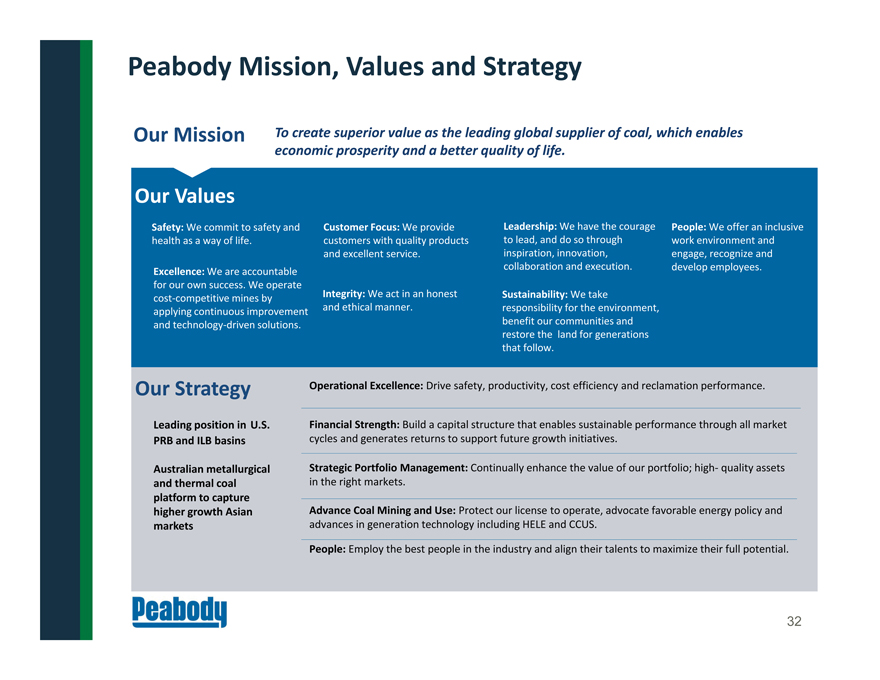

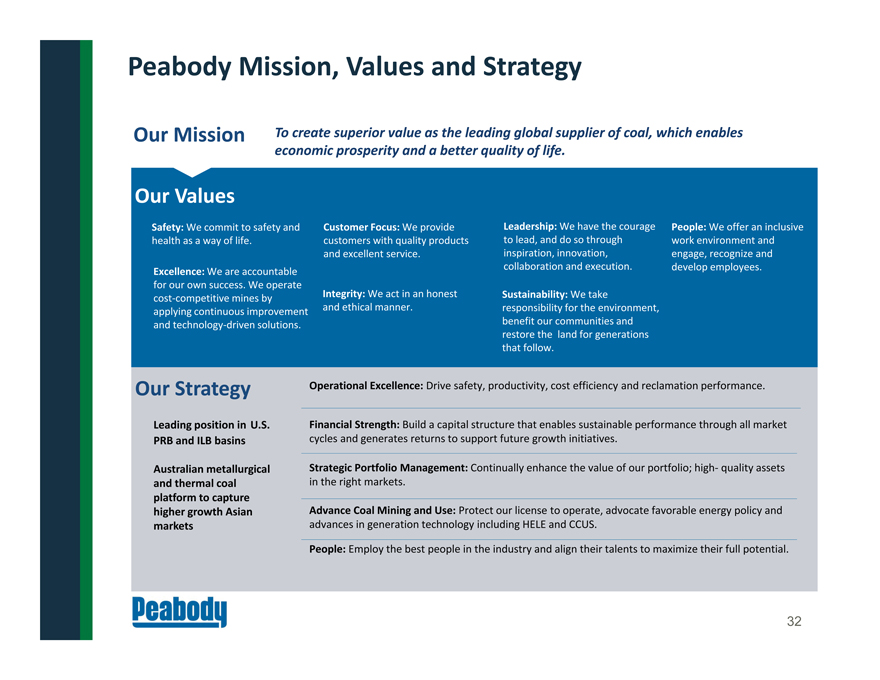

Peabody Mission, Values and Strategy

Our Mission To create superior value as the leading global supplier of coal, which enables

economic prosperity and a better quality of life.

Safety: We commit to safety and

health as a way of life.

People: We offer an inclusive

work environment and

engage, recognize and

develop employees.

Customer Focus: We provide

customers with quality products

and excellent service.

Excellence: We are accountable

for our own success. We operate

cost?competitive mines by

applying continuous improvement

and technology?driven solutions.

Leadership: We have the courage

to lead, and do so through

inspiration, innovation,

collaboration and execution.

Sustainability: We take

responsibility for the environment,

benefit our communities and

restore the land for generations

that follow.

Integrity: We act in an honest

and ethical manner.

Our Values

Leading position in U.S.

PRB and ILB basins

Australian metallurgical

and thermal coal

platform to capture

higher growth Asian

markets

Operational Excellence: Drive safety, productivity, cost efficiency and reclamation performance.

Financial Strength: Build a capital structure that enables sustainable performance through all market

cycles and generates returns to support future growth initiatives.

Strategic Portfolio Management: Continually enhance the value of our portfolio; high? quality assets

in the right markets.

Advance Coal Mining and Use: Protect our license to operate, advocate favorable energy policy and

advances in generation technology including HELE and CCUS.

People: Employ the best people in the industry and align their talents to maximize their full potential.

Our Strategy

32

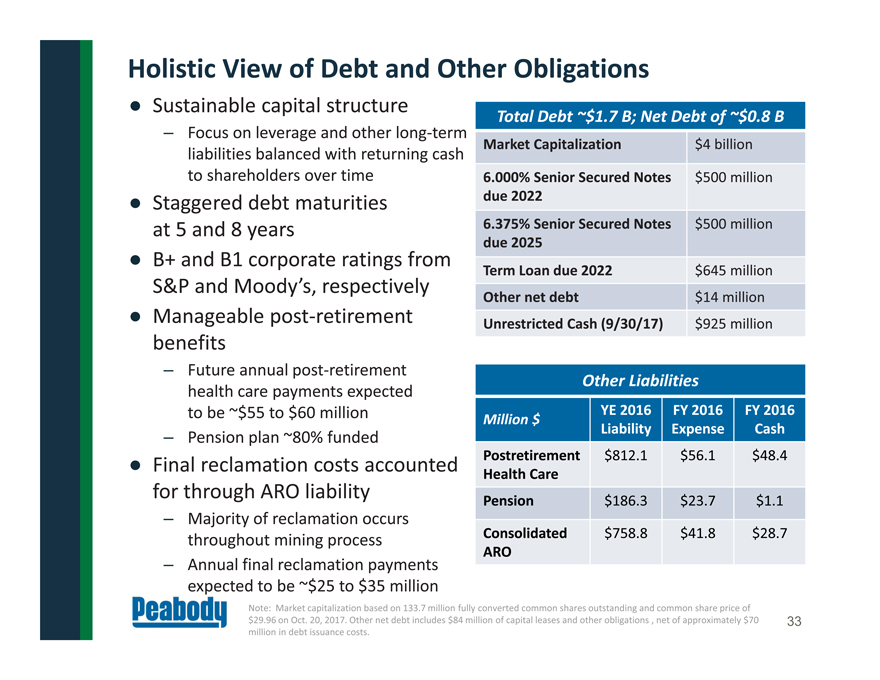

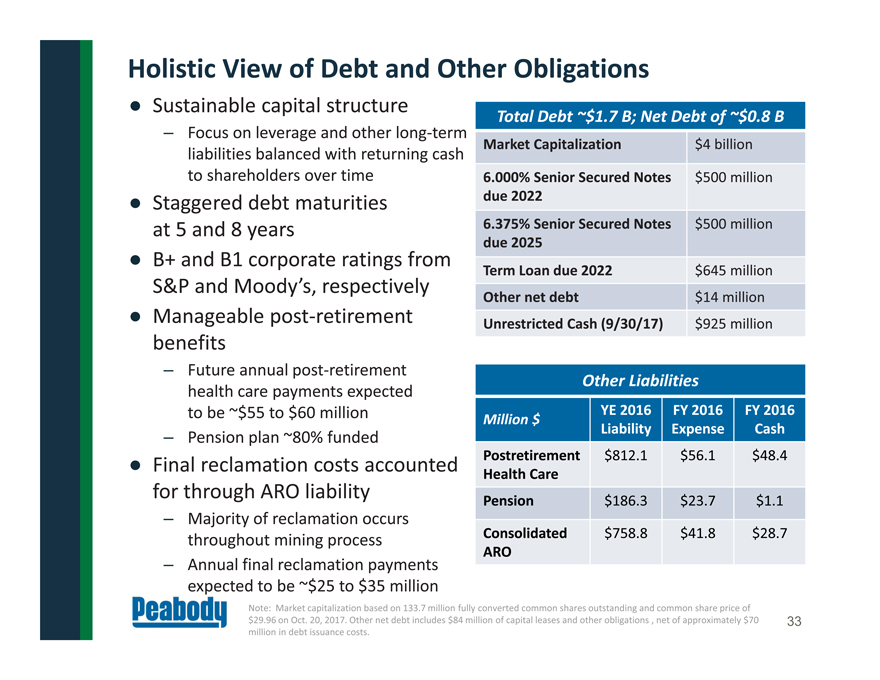

Holistic View of Debt and Other Obligations

Other Liabilities Million $ YE 2016 Liability FY 2016

Expense FY 2016 Cash

Postretirement

Health Care $812.1 $56.1 $48.4 Pension $186.3 $23.7 $1.1

Consolidated ARO

$758.8 $41.8 $28.7 Sustainable capital structure

– Focus on leverage and other long-term liabilities balanced with returning cash

to shareholders over time Staggered debt maturities

at 5 and 8 years B+ and B1 corporate ratings from

S&P and Moody’s, respectively

Manageable post?retirement benefits

– Future annual post?retirement health care payments expected

to be ~$55 to $60 million – Pension plan ~80% funded Final reclamation costs accounted for through ARO liability – Majority of reclamation occurs throughout mining process – Annual final reclamation payments

expected to be ~$25 to $35 million Note: Market capitalization based on 133.7 million fully converted common shares outstanding and common share price of

$29.96 on Oct. 20, 2017. Other net debt includes $84 million of capital leases and other obligations , net of approximately $70 million in debt issuance costs.

Total Debt ~$1.7 B; Net Debt of ~$0.8 B Market Capitalization $4 billion 6.000% Senior Secured Notes due 2022 $500 million 6.375% Senior Secured Notes

due 2025 $500 million Term Loan due 2022 $645 million Other net debt $14 million Unrestricted Cash (9/30/17) $925 million 33

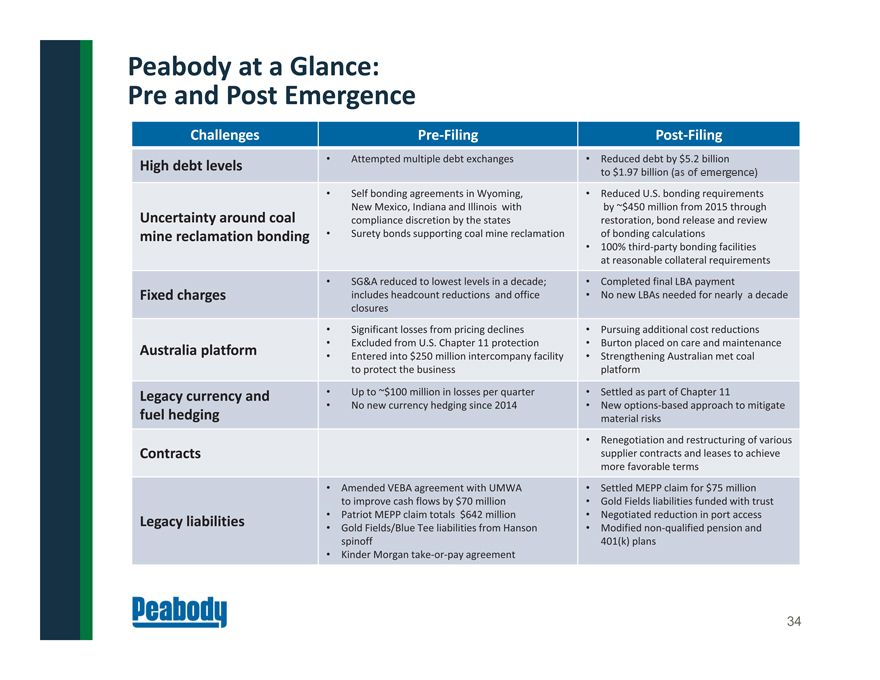

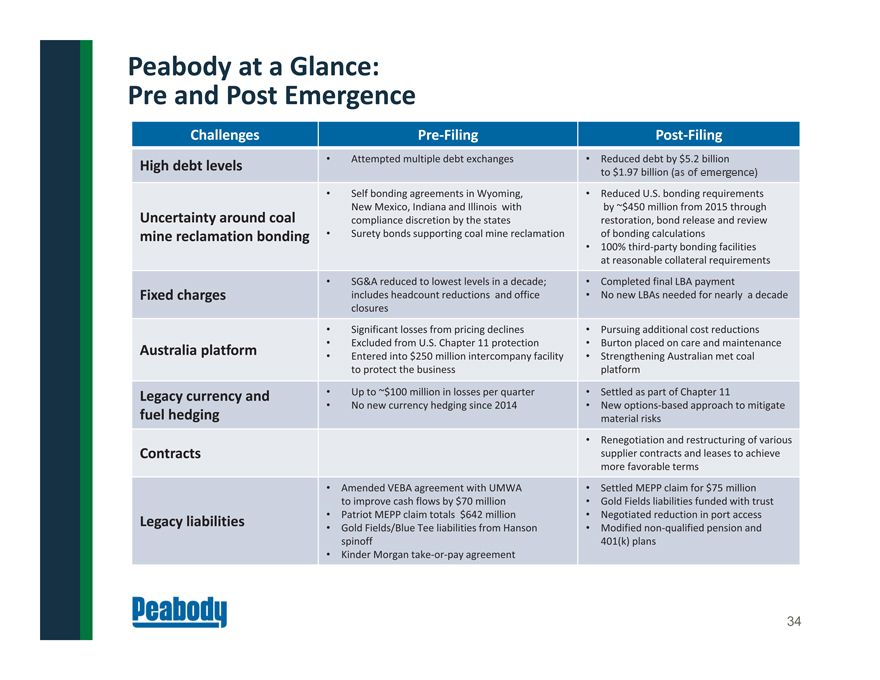

Peabody at a Glance: Pre and Post Emergence Challenges Pre-Filing Post?Filing High debt levels • Attempted multiple debt exchanges • Reduced debt by $5.2 billion to $1.97 billion as of emergence Uncertainty around coal mine reclamation bonding

| • | | Self bonding agreements in Wyoming, New Mexico, Indiana and Illinois with compliance discretion by the states Surety bonds supporting coal mine reclamation |

| • | | Reduced U.S. bonding requirements by ~$450 million from 2015 through restoration, bond release and review of bonding calculations 100% third?party bonding facilities at reasonable collateral requirements Fixed charges |

| • | | SG&A reduced to lowest levels in a decade; includes headcount reductions and office closures Completed final LBA payment No new LBAs needed for nearly a decade Australia platform Significant losses from pricing declines |

| • | | Excluded from U.S. Chapter 11 protection Entered into $250 million intercompany facility to protect the business |

| • | | Pursuing additional cost reductions Burton placed on care and maintenance Strengthening Australian met coal platform Legacy currency and fuel hedging Up to ~$100 million in losses per quarter No new currency hedging since 2014 Settled as part of Chapter 11 New options-based approach to mitigate material risks Contracts Renegotiation and restructuring of various supplier contracts and leases to achieve more favorable terms Legacy liabilities Amended VEBA agreement with UMWA to improve cash flows by $70 million Patriot MEPP claim totals $642 million Gold Fields/Blue Tee liabilities from Hanson spinoff Kinder Morgan take-or-pay agreement Settled MEPP claim for $75 million Gold Fields liabilities funded with trust Negotiated reduction in port access |

| • | | Modified non-qualified pension and 401(k) plans 34 |

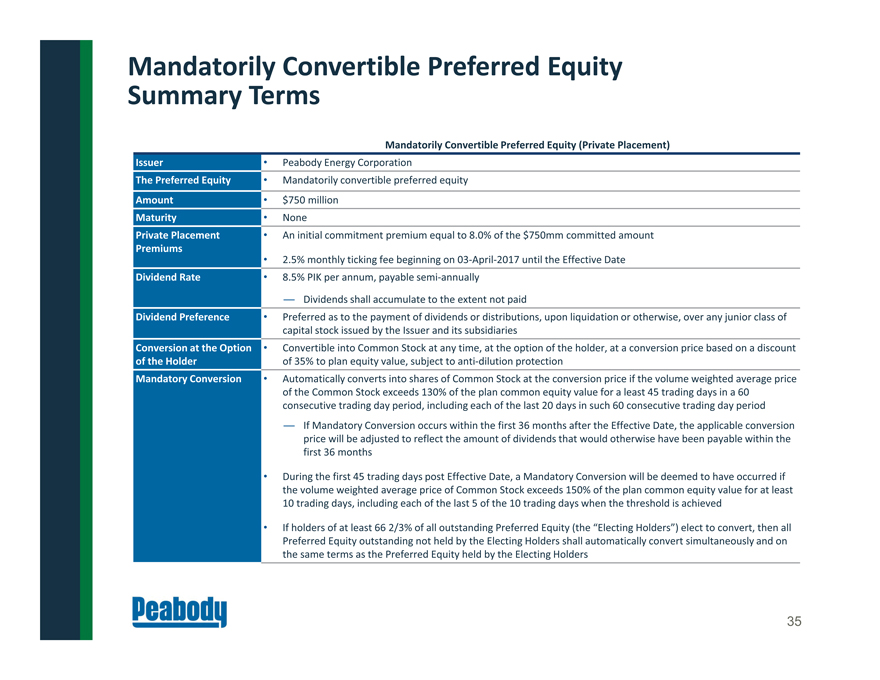

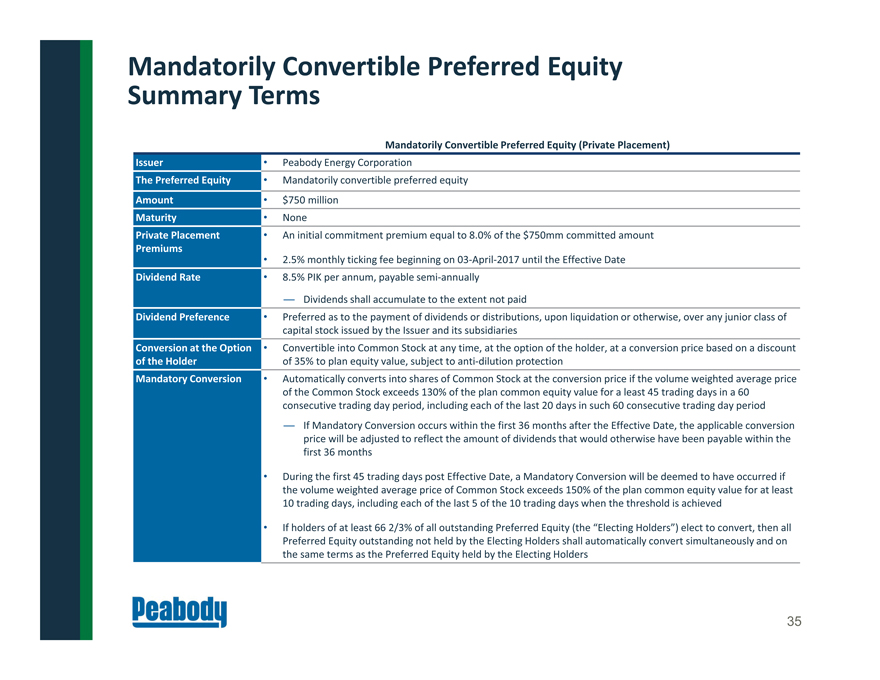

Mandatorily Convertible Preferred Equity

Summary Terms

Mandatorily Convertible Preferred Equity (Private Placement)

Issuer • Peabody Energy Corporation

The Preferred Equity

• Mandatorily convertible preferred equity

Amount

• $750 million

Maturity

• None

Private Placement

Premiums

| • | | An initial commitment premium equal to 8.0% of the $750mm committed amount |

| • | | 2.5% monthly ticking fee beginning on 03-April-2017 until the Effective Date |

Dividend Rate • 8.5% PIK per annum, payable semi?annually

— Dividends shall accumulate to the extent not paid

Dividend Preference • Preferred as to the payment of dividends or distributions, upon liquidation or otherwise, over any junior class of

capital stock issued by the Issuer and its subsidiaries

Conversion at the Option

of the Holder

| • | | Convertible into Common Stock at any time, at the option of the holder, at a conversion price based on a discount |

of 35% to plan equity value, subject to anti-dilution protection

Mandatory Conversion

• Automatically converts into shares of Common Stock at the conversion price if the volume weighted average price

of the Common Stock exceeds 130% of the plan common equity value for a least 45 trading days in a 60

consecutive trading day period, including each of the last 20 days in such 60 consecutive trading day period

— If Mandatory Conversion occurs within the first 36 months after the Effective Date, the applicable conversion

price will be adjusted to reflect the amount of dividends that would otherwise have been payable within the

first 36 months

| • | | During the first 45 trading days post Effective Date, a Mandatory Conversion will be deemed to have occurred if |

the volume weighted average price of Common Stock exceeds 150% of the plan common equity value for at least

10 trading days, including each of the last 5 of the 10 trading days when the threshold is achieved

| • | | If holders of at least 66 2/3% of all outstanding Preferred Equity (the “Electing Holders”) elect to convert, then all |

Preferred Equity outstanding not held by the Electing Holders shall automatically convert simultaneously and on

the same terms as the Preferred Equity held by the Electing Holders

35