SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ Confidential,for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Under Rule 14a-12

AMERIGROUP CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

April 10, 2003

Dear Stockholder:

You are cordially invited to attend AMERIGROUP Corporation’s second annual meeting of stockholders, which will be held on May 13, 2003 at 10:00 a.m., local time, at the Sheraton Oceanfront Hotel, located at 36th and Boardwalk, Virginia Beach, Virginia 23451 in the Cape Hatteras Room. After the formal business session, there will be a report on the state of the Company and a brief question and answer session.

The attached notice and proxy statement describe the items of business to be transacted at the annual meeting. Your vote is important, regardless of the number of shares you own. I urge you to vote now, even if you plan to attend the annual meeting. Please follow the instructions on the enclosed proxy card.

Remember, you can always vote in person at the annual meeting even if you have voted by proxy if you are a stockholder of record or have a legal proxy from a stockholder of record. Thank you for your interest in our Company.

Sincerely,

AMERIGROUP Corporation

Jeffrey L. McWaters

Chairman and Chief Executive Officer

4425 Corporation Lane

Virginia Beach, VA 23462

PROXY STATEMENT AND

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, MAY 13, 2003

The annual meeting of stockholders of AMERIGROUP Corporation will be held in the Cape Hatteras Room at the Sheraton Oceanfront Hotel, located at 36th and Boardwalk, Virginia Beach, Virginia 23451 on Tuesday, May 13, 2003 at 10 a.m., local time. Doors to the meeting will open at 9:30 a.m. The annual meeting will be held for the following purposes:

| | 1. | | To elect two directors to the Board of Directors for three-year terms ending in 2006; |

| | 2. | | To approve the 2003 Equity Incentive Plan; |

| | 3. | | To approve the 2003 Cash Incentive Plan; |

| | 4. | | To ratify the appointment by the Board of Directors of KPMG LLP as our independent auditors for the year ending December 31, 2003; and |

| | 5. | | To transact such other business that may properly be brought before the meeting or any adjournment or postponement thereof. |

Notice of the annual meeting has been sent to all holders of record of AMERIGROUP’s common stock at the close of business on March 21, 2003. All holders of record as of March 21, 2003 will be entitled to attend and vote at the meeting.

A copy of our 2002 Annual Report is being mailed together with this proxy material. Any stockholder who desires additional copies may obtain one without charge by sending a request to the Company, c/o Investor Relations, AMERIGROUP Corporation, 4425 Corporation Lane, Virginia Beach, VA 23462.

By Order of the Board of Directors,

STANLEY F. BALDWIN

Senior Vice President,

General Counsel and Secretary

Virginia Beach, Virginia

April 10, 2003

AMERIGROUP CORPORATION

ANNUAL MEETING OF STOCKHOLDERS

MAY 13, 2003

PROXY STATEMENT

GENERAL INFORMATION

This proxy statement has been sent to you to solicit your vote at the annual meeting of stockholders of AMERIGROUP Corporation to be held in the Cape Hatteras Room of the Sheraton Oceanfront Hotel, located at 36th and Boardwalk, Virginia Beach, Virginia 23451 on Tuesday, May 13, 2003 at 10 a.m., local time, or any adjournment or postponement thereof, for the purposes set forth in the accompanying notice. Our Board of Directors is soliciting the accompanying form of proxy and urges you to sign the proxy, fill in the date, and return it immediately. The prompt cooperation of stockholders is necessary in order to ensure a quorum and to avoid expense and delay. References in this proxy statement to “the Company,” “we,” “us” and “our” refer to AMERIGROUP Corporation.

Notice of the annual meeting has been sent to all stockholders of record of our common stock who held such shares of stock at the close of business on March 21, 2003. You may vote your shares if you were a stockholder of record of our common stock on that date. Each share is entitled to one vote at the meeting. At the close of business on March 21, 2003, there were 20,636,936 outstanding shares of our common stock, par value $0.01 per share. The presence, in person or by properly executed proxy, of the holders of a majority of the shares outstanding is necessary to constitute a quorum at the annual meeting. Directors are elected by a plurality of the votes cast, and the two nominees who receive the greatest number of votes cast for election of directors at the annual meeting will be elected. The approval by shareholders of the 2003 Equity Incentive Plan and the 2003 Cash Incentive Plan and the ratification by shareholders of the appointment of the Company’s auditors, each require the affirmative vote of the holders of a majority of all shares present and entitled to vote.

Abstentions and broker non-votes will be counted for purposes of determining the presence of a quorum. In the election of directors, broker non-votes will be disregarded and have no effect on the outcome of the vote. With respect to the approval of the 2003 Equity Incentive Plan and the 2003 Cash Incentive Plan and the ratification of the appointment of auditors, abstentions from voting will have the same effect as voting against such matter and broker non-votes will be disregarded and have no effect on the outcome of the vote.

This proxy statement and the accompanying proxy materials are being mailed to stockholders on or about April 10, 2003.

All holders of record of our common stock as of the close of business on March 21, 2003 will be entitled to attend and vote at the meeting. You may vote your shares either by proxy or in person, as follows:

| | n By | | Proxy: You can vote by completing, signing and dating the enclosed proxy card and returning it by mail in the postage paid envelope provided. The instructions for voting are contained on the enclosed proxy card. The individuals named on the card are your proxies. They will vote your shares as you indicate. If you sign your card without indicating how you wish to vote, all of your shares will be voted: |

| | n FOR | | all of the nominees for Director; |

| | n FOR | | approval of the 2003 Equity Incentive Plan; |

| | n FOR | | approval of the 2003 Cash Incentive Plan; |

| | n FOR | | ratification of the appointment of KPMG LLP as our independent auditors to serve for the 2003 |

| | n At | | the discretion of your proxies, on any other matters that may be properly brought before the annual meeting. |

| | n In | | Person: You may attend the annual meeting and vote in person. |

1

You may revoke your proxy before it is voted at the meeting by either filing a written notice of revocation dated after the proxy date with American Stock Transfer & Trust Company in its capacity as our transfer agent or by sending to American Stock Transfer & Trust Company a later-dated proxy for the same shares of common stock. You may also revoke your proxy by attending the annual meeting and voting in person at the annual meeting. The mailing address for American Stock Transfer & Trust Company is 5559 Maiden Lane, New York, NY 10038.

If your shares are registered differently and are in more than one account, you will receive more than one proxy card. To ensure that all your shares are voted, please sign and return all proxy cards. We encourage you to have all accounts registered in the same name and address whenever possible. You can accomplish this by contacting our transfer agent, American Stock Transfer & Trust Company, at 212-936-5100 or 800-937-5449.

All expenses of soliciting proxies, including clerical work, printing and postage, will be paid by the Company. Such solicitation will be made by mail and may also be made by directors, officers and employees of the Company personally or by telephone, facsimile or other electronic means, without additional compensation. The Company will also reimburse brokers and other persons holding shares in their names or in the names of nominees for their reasonable expenses for sending material to principals and obtaining their proxies. The Company has retained Morrow & Co., Inc. to aid in the solicitation of proxies. It is estimated that the fee for Morrow & Co., Inc. will be approximately $5,000 plus reasonable out-of-pocket costs and expenses. Such fees will be paid by the Company.

2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our common stock as of February 28, 2003(1), by (i) each named executive officer listed in the Summary Compensation Table, (ii) each of our directors, (iii) all directors and executive officers as a group and (iv) stockholders holding 5% or more of our outstanding common stock based on information previously provided to the Company by the beneficial owner.

Name

| | Number of Shares

| | Percent

| |

Jeffrey L. McWaters(2)(3) | | 583,958 | | 2.8 | % |

Carlos A. Ferrer(4) | | 118,194 | | * | |

William J. McBride(2)(5) | | 73,875 | | * | |

Uwe E. Reinhardt, Ph.D.(6) | | 40,000 | | * | |

Richard D. Shirk(2)(7) | | 22,000 | | * | |

Wasatch Advisors, Inc.(8) | | 2,883,113 | | 14.0 | % |

Wellington Management Company, LLP(9) | | 1,704,450 | | 8.3 | % |

RS Investments(10) | | 1,411,000 | | 6.8 | % |

Theodore M. Wille, Jr.(2)(11) | | 111,100 | | * | |

Lorenzo Childress, Jr., M.D.(2)(12) | | 117,500 | | * | |

Scott M. Tabakin (2)(13) | | 45,452 | | * | |

Scott S. Pickens (2)(14) | | 55,658 | | * | |

All executive officers and directors as a group (17 persons) | | 1,542,285 | | 7.1 | % |

* Represents beneficial ownership of less than one percent.

| (1) | | This table does not include any shares owned by C. Sage Givens or Charles W. Newhall, III, each of whom were a member of the Board of Directors of AMERIGROUP until they resigned on March 28, 2003. |

| (2) | | The address for this person is c/o AMERIGROUP Corporation, 4425 Corporation Lane, Suite 300, Virginia Beach, VA 23462. |

| (3) | | Includes options to purchase 427,458 shares of common stock. |

| (4) | | Represents securities owned by FFC Partners I, L.P. and Mr. Ferrer. Mr. Ferrer is a general partner of Ferrer Freeman & Company, LLC, and shares investment and voting power in respect to the securities beneficially owned by these funds. Mr. Ferrer’s address is c/o Ferrer Freeman & Company, LLC, 10 Glenville Street, Greenwich, CT 06831. |

| (5) | | Includes options only. |

| (6) | | Includes options only. Dr. Reinhardt’s address is 351 Wallace Hall, Princeton University, Princeton, NJ 08544. |

| (7) | | Includes options to purchase 20,000 shares of common stock. |

| (8) | | Represents securities owned by Wasatch Advisors, Inc. (“Wasatch”) on December 31, 2002, as derived from information that Wasatch has reported in a Schedule 13G under the Securities Exchange Act of 1934, as amended (“the Exchange Act”), filed with the Securities and Exchange Commission, (“SEC”) on February 12, 2003. Such Schedule 13G indicates that Wasatch, an investment advisor registered under Section 203 of the Investment Advisors Act of 1940, owns approximately 14.0 percent of the outstanding shares of AMERIGROUP. Wasatch manages five mutual funds and also acts as an investment advisor to unaffiliated clients (“Accounts”) that have large portfolios of stocks, such as pension and retirement funds. AMERIGROUP’s common stock is held in three different Wasatch mutual funds as well as by a number of Accounts. Approximately 60 percent of the shares are held by three different funds: the Wasatch Small Cap Growth Fund, the Wasatch Core Growth Fund and the Wasatch Micro Cap Fund. Taken together these funds own approximately 7.8 percent of AMERIGROUP’s common stock. No individual fund holds 5 percent or more of AMERIGROUP’s common stock. Each of these funds has a separate manager who has the authority to vote the shares as he or she sees fit. The remaining shares of AMERIGROUP common stock are held in the Accounts for which Wasatch provides advisory services. The principal business address for Wasatch is 150 Social Hall Avenue, Salt Lake City, UT 84111. |

3

| (9) | | As of December 31, 2002, based on the Schedule 13G filed by Wellington Management Company, LLP (“WMC”). WMC is a registered investment advisor under the Investment Advisers Act of 1940, as amended. As of December 31, 2002, WMC, in its capacity as investment advisor, may be deemed to have beneficial ownership of 1,704,450 shares of common stock that are owned by numerous investment advisory clients, none of which is known to have such interest with respect to more than five percent of the class. WMC has shared voting authority over 1,453,630 shares and no voting authority over 250,820 shares, based on information provided to the Company by Wellington Management Company, LLP. |

| (10) | | Represents securities owned by RS Investment Management Co. LLC (“RS”) as of December 31, 2002, as derived from information RS has reported in a Schedule 13G under the Exchange Act, filed with the SEC on February 14, 2003. RS, an investment advisor in accordance with section 240.13d-1(b)(1)(ii)(E), owns approximately 6.8 percent of the outstanding shares of AMERIGROUP. RS manages multiple mutual funds and also acts as an investment advisor to unaffiliated clients that have large portfolios of stocks, such as pension and retirement funds. AMERIGROUP’s common stock is held in several different RS mutual funds as well as by a number of Accounts. No individual fund holds 5 percent or more of AMERIGROUP’s common stock. Each of these funds has a separate manager who has the authority to vote the shares as he or she sees fit. The remaining shares of AMERIGROUP common stock are held in the Accounts for which RS provides advisory services. The principal business address for RS is 388 Market Street, San Francisco, CA 94111. |

| (11) | | Includes options to purchase 15,200 shares of common stock. |

| (12) | | Includes options to purchase 87,504 shares of common stock. |

| (13) | | Includes options to purchase 38,875 shares of common stock. |

| (14) | | Includes options to purchase 41,417 shares of common stock. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our executive officers and Directors and persons who own more than ten percent of our common stock to file reports of ownership and changes in ownership with the SEC and the New York Stock Exchange. Executive officers, Directors and greater than ten percent stockholders are required by SEC regulation to furnish to us copies of all Section 16(a) forms they file. Based solely on a review of the copies of Section 16(a) forms furnished to us and written representations from certain reporting persons that no other filings were required for those persons, we believe that all the Section 16(a) filing requirements applicable to our executive officers, Directors and greater than ten percent stockholders were complied with for year 2002, except that Mr. William McBride, a member of the Board of Directors of the Company, did not timely report on Form 4 an acquisition of 6,887 shares received pursuant to a pro-rata distribution from a limited partnership of which Mr. McBride is a non-managing member, Mr. Herman Wright, Chief Marketing Officer, did not timely report on Form 4 an exercise of 30,625 shares, Ms. Kathleen Toth, Chief Accounting Officer, did not timely report on Form 4 an acquisition of 226 shares, Ms. Sherri Lee, Treasurer, did not timely report on Form 4 an acquisition of 80 shares and Mr. Scott Tabakin, Chief Financial Officer, did not timely report on Form 4 an acquisition of 153 shares.

4

PROPOSAL #1: ELECTION OF DIRECTORS

The Company’s Board of Directors currently has five members, only one of whom, Mr. McWaters, is an employee of the Company. On March 28, 2003, each of C. Sage Givens and Charles W. Newhall, III resigned from the Board of Directors of the Company. The vacancies on the Board were not filled, and, in accordance with the Company’s Amended and Restated Certificate of Incorporation, the size of the Board was reduced from seven to five members.

The Company’s Amended and Restated Certificate of Incorporation provides for a Board of Directors divided into three classes, as nearly equal in number as the then total number of Directors constituting the entire Board permits, with the term of office of one class expiring each year at the annual meeting. Each class of Directors is elected for a term of three years, except in the case of elections to fill vacancies or newly appointed Directorships.

Two Directors will be elected at the annual meeting to serve until the annual meeting of stockholders in 2006 and until the election and qualification of their successors, or their earlier death, resignation or removal. Unless otherwise indicated on any proxy, the Board of Directors intends to vote the shares represented by proxies received by the Board for each of the nominees whose biographical information appears in the section immediately following. Each of the nominees are now serving as a director of the Company. Both nominees have consented to serve if elected. However, if at the time of the meeting any nominee is unable or unwilling to serve, the proxies will be voted for such other person as the Board of Directors may designate. Mr. Ferrer has informed the Company that other professional commitments may result in his being unable to serve a full three-year term. The Board of Directors nevertheless recommends that the stockholders vote for re-election of Mr. Ferrer. If Mr. Ferrer resigns as director before his term expires, the Board of Directors would seek to fill the vacancy with an appropriately qualified replacement.

VOTE REQUIRED

Directors will be elected by a plurality of the votes cast. The Board of Directors unanimously recommends that you vote FOR the election to the Board of Directors of each of the two nominees identified below.

NOMINEES FOR DIRECTOR

(Terms to expire in 2006)

|

Carlos A. Ferrer | |

Mr. Ferrer, age 49, has been one of our Directors since 1996. Mr. Ferrer is a General Partner of Ferrer Freeman & Company, LLC, a private equity firm founded in 1995 that manages funds dedicated to investing in the health care industry. |

|

William J. McBride | |

Mr. McBride, age 58, has been one of our Directors since 1995. Mr. McBride has been retired since 1995. Prior to that, Mr. McBride was President, Chief Operating Officer and a director of Value Health, Inc. and President and Chief Executive Officer of CIGNA Healthplans, Inc. Mr. McBride also serves on the board of directors of VistaCare, Inc. and a number of privately held companies. |

5

DIRECTORS CONTINUING IN OFFICE

Jeffrey L. McWaters | | Mr. McWaters, age 46, has been our Chairman of the Board of Directors and Chief Executive Officer since he founded our Company in December 1994. From 1991 to 1994, Mr. McWaters served as President and Chief Executive Officer of Options Mental Health, a national managed behavioral health care company and prior to that, in various senior-operating positions with EQUICOR–Equitable HCA Corporation and CIGNA HealthCare. Mr. McWaters is a member of the Board of Visitors of the College of William and Mary and a director of the American Association of Health Plans. His term as Director expires in 2004. |

|

Uwe E. Reinhardt, Ph.D. | | Dr. Reinhardt, age 65, joined the Board of Directors in 2002. He is the James Madison professor of Political Economy and Professor of Economics and Public Affairs of Princeton University, a Trustee of Duke University and of its Duke University Health System, a Trustee of the H&Q Healthcare Investors and H&Q Life Sciences Investors, and a member of the Editorial Board of theJournal of the American Medical Association, Health Affairsand several other journals. Dr. Reinhardt serves on the Board of Boston Scientific Corporation and Triad Hospitals, Inc. He is a Commissioner on the Henry J. Kaiser Family Foundation’s Commission on Medicaid and the Uninsured. Until 2002, he had served for five years on the Center for Health Care Strategies, a non-profit think tank focused on improving managed-care techniques for the Medicaid and SCHIP populations. |

|

Richard D. Shirk | | Mr. Shirk, age 57, joined the Board of Directors in 2002. Mr. Shirk has been retired since April 2002. Prior to that, Mr. Shirk served as Chairman, Chief Executive Officer and President of the holding company, Cerulean Companies, and was president and chief executive officer of Blue Cross Blue Shield of Georgia. He has also held senior executive positions with Cigna Healthcare, Equicor and The Equitable. In addition, Mr. Shirk serves on the Board of Directors of the SSgA funds, the Healthcare Georgia Foundation and privately held companies. His term as Director expires in 2005. |

6

INFORMATION ABOUT THE BOARD OF DIRECTORS AND ITS COMMITTEES

The Board of Directors met six times in 2002. There were four Regular and two Special Board Meetings. No incumbent director attended less than 75% of the aggregate of all meetings of the Board of Directors and any committees of the Board on which he or she served, if any, during his or her tenure as director.

The Board of Directors has two standing committees: the Audit Committee and the Compensation Committee. The Audit Committee approves the scope of audits and other services to be performed by the Company’s independent and internal auditors; considers whether the performance of any professional service by the auditors other than services provided in connection with the audit function could impair the independence of the outside auditors; reviews the results of internal and external audits, the accounting principles applied in financial reporting, and financial and operational controls; and reviews interim audited financial statements each quarter before the Company files its Form 10-K and Form 10-Q with the SEC. The Compensation Committee considers management proposals relating to compensation, reviews and makes recommendations to the Board of Directors with respect to compensation and benefit issues, and administers the terms of performance-based compensation within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

The Audit Committee

The Audit Committee of the Board of Directors is composed of three independent Directors, who qualify as “independent” under Sections 303.01(B)(2)(a) and (3) of the New York Stock Exchange listing standards and operates under a charter adopted by the Board of Directors (attached as Exhibit A hereto). These Directors are Carlos A. Ferrer, Uwe E. Reinhardt, Ph.D. and William J. McBride, with Mr. McBride serving as the Chairperson. Charles W. Newhall, III served as a member of the Audit Committee until November 5, 2002, at which time he resigned as a member of the committee and Dr. Reinhardt was elected by the Board of Directors to serve in his place. The Board of Directors has determined that at least one independent member of the Audit Committee, William J. McBride, has accounting or related financial management expertise. The independent and internal auditors have unrestricted access to the Audit Committee and vice versa. The Audit Committee met six times in 2002. No membership changes are contemplated for 2003.

The Audit Committee Report

The Audit Committee has reviewed and discussed with management the Company’s audited financial statements as of, and for, the year ended December 31, 2002.

At its meeting on March 10, 2003, the Audit Committee discussed with the Company’s independent auditors, KPMG LLP, the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended by the Auditing Standards Board of the American Institute of Certified Public Accountants.

The Audit Committee received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standard No. 1, Independence Discussions with Audit Committees, as amended by the Independence Standards Board, and has discussed with the auditors the auditor’s independence. The Audit Committee considered whether the provision of non-financial audit services was compatible with KPMG’s independence in performing audit services.

Based upon the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2002 which was filed with the Securities and Exchange Commission on March 14, 2003.

Members of the Audit Committee:

William J. McBride (Chairperson)

Carlos A. Ferrer

Uwe E. Reinhardt, Ph.D.

7

COMPENSATION OF DIRECTORS

Directors who are officers or employees of the Company receive no compensation for service as a member of the Board of Directors. Directors who are not officers or employees of the Company receive a quarterly retainer of $2,500 and $2,500 for each Regular Board meeting that they attend in person. Directors are not compensated for participating in Special Board meetings or participating in Regular Board Meetings by conference call, unless an exception is granted by the Chairman of the Board of Directors. The Chairman of the Audit Committee receives an additional retainer of $1,000 per quarter. Directors are not separately compensated for participation or attendance at Committee meetings.

In February 2002, the Company granted to Dr. Uwe E. Reinhardt an option to purchase 40,000 shares of common stock under our 2000 Equity Incentive Plan at an exercise price of $21.25 per share, subject to his agreement to serve on our Board of Directors, which occurred in March 2002. Options covering 20,000 of the shares were vested as of the date of grant, and the remaining 20,000 vested on February 7, 2003. In August of 2002, the Company granted to Richard D. Shirk an option to purchase 40,000 shares of common stock under the 2000 Equity Incentive Plan at an exercise price of $24.92 per share upon Mr. Shirk’s election to the Board of Directors. Options covering 20,000 of the shares were vested on the date of grant, with the remaining 20,000 vesting on the first anniversary of the grant, assuming continued service as a director.

EXECUTIVE OFFICER COMPENSATION

The table below sets forth a summary of the compensation the Company paid for the last three fiscal years to the Chief Executive Officer and to the four additional most highly compensated persons serving as executive officers (collectively with the Chief Executive Officer, the “Named Executive Officers”) at the end of the last fiscal year.

Summary Compensation Table

| | | | | Annual Compensation

| | | Long-Term

Compensation

| | |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other Annual Compensation ($)

| | | Securities Underlying Options

(#)

| | All Other Compensation ($)(4)

|

Jeffrey L. McWaters | | 2002 | | 560,083 | | 1,350,000 | | — | | | 100,000 | | 1,000 |

Chairman and Chief Executive | | 2001 | | 437,419 | | 950,000 | | 3,952 | (1) | | 50,000 | | 4,195 |

Officer | | 2000 | | 411,061 | | 850,000 | | — | | | 100,000 | | 500 |

Scott M. Tabakin | | 2002 | | 321,923 | | 250,000 | | — | | | 52,500 | | 141 |

Senior Vice President, | | 2001 | | 177,692 | | 410,000 | | 126,960 | (2) | | 100,000 | | — |

Chief Financial Officer | | 2000 | | — | | — | | — | | | — | | — |

Lorenzo Childress, Jr., M.D. | | 2002 | | 306,901 | | 250,000 | | — | | | 20,000 | | 1,295 |

Senior Vice President, | | 2001 | | 283,041 | | 400,000 | | — | | | 17,500 | | 1,000 |

Chief Medical Officer | | 2000 | | 268,271 | | 210,000 | | — | | | 25,000 | | 500 |

Scott S. Pickens | | 2002 | | 267,600 | | 250,000 | | — | | | 21,000 | | 1,172 |

Senior Vice President, | | 2001 | | 257,354 | | 410,000 | | — | | | 12,500 | | 2,000 |

Chief Information Officer | | 2000 | | 129,808 | | 176,000 | | 94,334 | (3) | | 37,500 | | 500 |

Theodore M. Wille, Jr. | | 2002 | | 291,530 | | 235,000 | | — | | | 21,000 | | 1,272 |

Senior Vice President, | | 2001 | | 281,031 | | 410,000 | | — | | | 10,000 | | 1,000 |

Chief Operating Officer | | 2000 | | 267,886 | | 210,000 | | — | | | 30,000 | | 500 |

| (1) | | Compensation for the payment of taxes. |

| (2) | | Compensation of $69,637 for relocation and $57,323 for payment of taxes. |

| (3) | | Compensation of $58,874 for relocation and $35,460 for payment of taxes. |

| (4) | | For 2002, compensation for corporate matching funds for the Company’s 401(k) retirement plan of $1,000 for Mr. McWaters, Mr. Childress, Mr. Pickens and Mr. Wille and for life insurance premiums. |

8

The following table sets forth information concerning individual grants of stock options made during 2002 to the Named Executive Officers.

Option Grants In Last Fiscal Year

| | | Number of Securities Underlying Options Granted (1)

| | Percent of Total Options Granted to Employees in Fiscal Year

| | Exercise Price ($/Share)

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (2)

|

Name

| | | | | | | | | | 5% ($)

| | 10% ($)

|

| Jeffrey L. McWaters | | 100,000 | | 9.3% | | $ | 21.25 | | 02/07/12 | | 1,336,401 | | 3,386,703 |

| Scott M. Tabakin | | 52,500 | | 4.9% | | $ | 21.25 | | 02/07/12 | | 701,611 | | 1,778,019 |

| Theodore M. Wille, Jr. | | 21,000 | | 1.9% | | $ | 21.25 | | 02/07/12 | | 280,644 | | 711,208 |

| Lorenzo Childress, Jr., MD | | 20,000 | | 1.9% | | $ | 21.25 | | 02/07/12 | | 267,280 | | 677,341 |

| Scott S. Pickens | | 21,000 | | 1.9% | | $ | 21.25 | | 02/07/12 | | 280,644 | | 711,208 |

| (1) | | The options were granted on February 7, 2002. Options covering twenty percent (20%) of the shares were vested on the date of grant. Another five percent vested on April 1, 2002 and the remaining options vest in five percent increments each quarter thereafter. |

| (2) | | Calculated based on the fair market value at the date of grant, which is equal to the exercise price. The amounts shown in these columns are the potential realizable value of options granted at assumed rates of stock price appreciation (5% and 10%) specified by the SEC, and have not been discounted to reflect the present value of such amounts. The assumed rates of stock price appreciation are not intended to forecast the future appreciation of the common stock. |

The following table sets forth information concerning the exercise of stock options during 2002 by the Named Executive Officers.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year–End Option Values

| | | Number of Shares Acquired on Exercise | | Value Realized ($)(1) | | Number of Securities Underlying Unexercised Options at Fiscal Year-End

| | Value of In-the-Money Options at Fiscal Year-End ($) (2)

|

Name

| |

| |

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Jeffrey L. McWaters | | — | | — | | 356,207 | | 143,751 | | 8,804,166 | | 1,809,578 |

| Scott M. Tabakin | | 40,000 | | 664,024 | | 8,375 | | 104,125 | | 75,878 | | 1,380,873 |

| Theodore M. Wille, Jr. | | 48,750 | | 1,082,250 | | 52,225 | | 27,525 | | 1,185,704 | | 408,595 |

| Lorenzo Childress, Jr., M.D. | | 32,496 | | 797,106 | | 59,378 | | 33,126 | | 1,310,963 | | 538,321 |

| Scott S. Pickens | | 8,933 | | 134,442 | | 24,042 | | 38,025 | | 322,146 | | 496,850 |

| (1) | | This amount represents the aggregate market value of the common stock at the time each option was exercised less the aggregate exercise price of the option. |

| (2) | | Value was calculated using the fair market value of $30.31 per share, which was the closing price on December 31, 2002. |

9

EQUITY COMPENSATION PLAN INFORMATION

The following table is relevant to Proposal #2 relating to approval of the 2003 Equity Incentive Plan and Proposal #3 relating to approval of the 2003 Cash Incentive Plan. It provides information as of December 31, 2002 about the Company's common stock that may be issued to employees, consultants or members of the Board of Directors under all of our existing equity compensation plans, namely the 1994 Stock Plan, the 2000 Equity Incentive Plan and the Company's Employee Stock Purchase Plan:

Plan category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | Weighted- average exercise price of outstanding options, warrants and rights

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (1)

|

Equity compensation plans approved by

security holders | | 2,414,934 | | $ | 10.05 | | 1,183,433 |

Equity compensation plans not approved by

security holders | | — | | | — | | — |

| | |

| |

|

| |

|

Total | | 2,414,934 | | $ | 10.05 | | 1,183,433 |

| (1) | | Includes a total of 635,907 shares not yet issued as of December 31, 2002 under the 1994 Stock Plan and 2000 Equity Incentive Plan and 547,526 shares not yet issued under the Employee Stock Purchase Plan. |

AGREEMENTS WITH EMPLOYEES

Jeffrey L. McWaters. The Company employs Mr. McWaters as its Chief Executive Officer and he serves as Chairman of the Board of Directors pursuant to an Amended and Restated Employment Agreement dated October 2, 2000 (the “Agreement”). The Agreement has an initial term of three years, commencing on October 28, 1999, and continues from year to year thereafter, unless earlier terminated as provided in the Agreement. Pursuant to the Agreement, as long as Mr. McWaters is employed with the Company, the Board of Directors agrees to employ Mr. McWaters as Chief Executive Officer and nominate him as a Director and Chairman of the Board of Directors. The Agreement relates primarily to termination provisions and provides the following:

| | • | | Mr. McWaters may terminate his employment on 30 days’ written notice to us, and if termination is at his option (other than on account of “Changed Circumstances” as described below) he is not entitled to severance benefits. |

| | • | | The Company may terminate Mr. McWaters for cause upon 30 days’ written notice, in which event Mr. McWaters would not be entitled to severance benefits. |

| | • | | If the Company terminates Mr. McWaters without cause or if Mr. McWaters terminates his employment on account of Changed Circumstances, Mr. McWaters would be entitled to (1) 24 months of severance payments based on his then current base salary, (2) a lump sum payment equal to two times the average annual bonus paid to him in the immediately preceding three years, and (3) medical and other health insurance benefits for 24 months. “Changed Circumstances” for purposes of the Agreement means a significant reduction in Mr. McWaters’ responsibilities, including without limitation the hiring of another executive to whom Mr. McWaters is required to report. |

| | • | | If Mr. McWaters terminates his employment on account of Changed Circumstances, or if the Company terminates his employment without cause during the 16-month period beginning four months before a change of control, Mr. McWaters would be entitled to be paid an amount equal to (1) two times his then current gross annual base salary plus (2) two times the average annual bonus paid to him in the immediately preceding three years, reduced as necessary to avoid characterization as a “parachute payment” within the meaning of Section 280G of the Code. Payment would be made, at Mr. McWaters’ election, either in a lump sum or in up to 24 monthly installments. In addition, Mr. McWaters would be entitled to continued medical and other health insurance benefits for so long as any installment payments are being made. |

10

Change of control for these purposes includes: (1) the acquisition by a person or group of 20% of the voting power of our outstanding securities, (2) either a majority of the Directors nominated at an annual meeting of stockholders being nominated by other than “incumbent Directors” (i.e., the Directors on October 2, 2000 and any Directors subsequently nominated by at least 2/3 of the then incumbent Directors) or the incumbent Directors’ ceasing to constitute a majority of the Directors, (3) stockholder approval of (A) a merger or other business combination where our outstanding stock immediately prior to such transaction does not continue to represent more than 50% of the surviving entity, (B) a complete liquidation of the Company, or (C) a sale of substantially all of the Company’s assets or (4) any other event that the Board of Directors determines to affect the control of the Company.

The Agreement further:

| | • | | provides for a base annual salary of not less than $425,000, subject to adjustment from time to time by the Board of Directors, plus a discretionary bonus, |

| | • | | contains a non–compete clause that provides that, for 24 months following termination, Mr. McWaters may not (1) engage in any business activity related to Medicaid managed health care in the markets in which we operate, or (2) solicit, interfere with, influence or endeavor to entice any employee, customer or any independent contractor of the Company, or any organization that is considered a prospect of the Company’s by virtue of having established contact with the Company for the purpose of doing business, and |

| | • | | provides for indemnification of Mr. McWaters in his capacity as a Director or officer of the Company. |

Lorenzo Childress, Jr., M.D. The Company employs Dr. Childress as Chief Medical Officer pursuant to a letter agreement dated March 17, 1995. The letter agreement established Dr. Childress’ initial salary, option bonus opportunity, initial grant of options and reimbursement of relocation expenses. In addition, the Company agreed to provide to Dr. Childress three months base salary as severance payment in the event of the termination of his employment without cause.

Theodore M. Wille. Mr. Wille has announced his intention to retire from the Company. In order to induce Mr. Wille to remain with the Company through a transition period, the Company has entered into an Employment Agreement with Mr. Wille dated November 25, 2002 (the “Retirement Agreement”). The Retirement Agreement provides for the continued employment of Mr. Wille through January 1, 2004, unless earlier terminated pursuant to the terms of the Retirement Agreement.

The Retirement Agreement generally provides the following with respect to regular compensation and benefits:

| | • | | An annual base salary of $294,580 (subject to increase in the discretion of the Board of Directors based on Mr. Wille’s performance in 2002); and |

| | • | | Benefits generally available to other executive employees of the Company. |

In the event that Mr. Wille remains an active full-time employee of the Company through December 31, 2003, retires effective January 1, 2004, and duly executes a release of claims against the Company in the form attached to the Retirement Agreement, he will be entitled to receive on January 2, 2004 (or if later, upon the effectiveness of the release):

| | • | | A lump-sum payment in the amount of his base salary for 2003 (which shall be determined by annualizing his base salary (of at least $24,584.33) for December 2003; |

| | • | | A regular annual incentive bonus for 2003 of at least $125,000; |

11

| | • | | A special incentive bonus of at least $125,000 subject to his attainment of certain special performance objectives; and |

| | • | | A waiver by the Company of the noncompete restrictions otherwise imposed upon Mr. Wille under his Noncompetition, Nondisclosure and Developments Agreement with the Company (which agreement otherwise will remain in effect in accordance with its terms). |

Mr. Wille may voluntarily terminate his employment with us upon 90 days notice. We may terminate Mr. Wille’s employment without cause upon 30 days notice. We may terminate Mr. Wille’s employment with cause (as defined in the Retirement Agreement) upon 10 days notice.

If Mr. Wille voluntarily terminates his employment prior to December 31, 2003, or if we terminate his employment with cause, Mr. Wille will be entitled to no further compensation or benefits under the Retirement Agreement (other than any unpaid salary and vacation pay through the date of termination). If we terminate Mr. Wille’s employment without cause, Mr. Wille will be entitled to (i) unpaid salary and vacation pay through the date of termination, (ii) upon effective execution of a release in a form attached to the Retirement Agreement, the amount of base salary he would have earned from the date of termination through December 31, 2003, had he remained employed, and (iii) the additional benefits described above to which he would have been entitled (payable at the same time and in the same manner) had he remained employed through December 31, 2003. Mr. Wille’s estate will be entitled to specified portions of such payments if Mr. Wille dies on or after July 31, 2003 and before December 31, 2003, upon effective execution by his estate of a release in a form attached to the Retirement Agreement.

REPORT OF THE COMPENSATION COMMITTEE

Overview

The Compensation Committee of the Board of Directors is currently composed of two independent Directors. These Directors are William J. McBride and Richard D. Shirk, with Mr. Shirk serving as the Chairperson.

Prior to their resignations on March 28, 2003, C. Sage Givens and Charles W. Newhall, III were both members of the Board of Directors and members of the Compensation Committee, with Ms. Givens serving as the Chairperson of the Compensation Committee. The vacancies on the Compensation Committee have not been filled.

The Compensation Committee is responsible for considering management proposals relating to compensation and reviewing and approving the compensation of the executive officers of the Company, including the Named Executive Officers. The Compensation Committee will also be responsible for administering any awards under our 2003 Equity Incentive Plan and 2003 Cash Incentive Plan (which are described more fully as part of Proposals #2 and #3 beginning on pages 17 and 22, respectively) that are intended to qualify for the performance-based compensation exception under Section 162(m) of the Code. This Committee met six times in 2002. The key components of the Company’s executive compensation program are base salary, annual incentive compensation and equity compensation in the form of stock option grants. Each member of the Compensation Committee is an independent non-employee Director who has never been an employee of the Company. The Compensation Committee utilizes independent compensation consultants for the purpose of understanding market pay levels and trends.

Compensation Philosophy

The Company’s executive compensation program is designed to allow the Company to be competitive in the marketplace with respect to attracting, retaining and motivating executive officers. The marketplace for executive talent is viewed to be companies generally engaged in the health care and insurance industries (including some, but not all, of the companies that are included in the peer group indices in the “Performance Graph” on page16) as well as firms in general industry of similar size and scope. The current program emphasizes pay-for-performance elements, such as annual cash incentives and stock option grants. While compensation surveys and

12

other externally available pay information are used to understand the relevant labor markets and as guidelines for reasonableness, corporate, health plan and individual performance are the most important determinants in developing individual pay amounts.

Base Salary Compensation

Base salary compensation for executive officers is determined by an assessment of all of the following:

| | n | | overall Company performance (financial and non-financial), |

| | n | | executive officer performance, experience and responsibilities, and |

| | n | | applicable market pay information. |

The Compensation Committee believes that current base salaries for all Named Executive Officers are at or below median market levels, which is consistent with the Company’s philosophy of rewarding performance through incentive compensation.

The Chairman’s Bonus Plan

The Chairman’s Bonus Plan (the “Bonus Plan”) is an annual plan designed to reward the Company’s management, including its Chief Executive Officer and its executive officers, for the attainment of corporate and individual performance goals. All participants in the Bonus Plan are eligible for cash awards and certain of the participants are eligible for awards partly in cash and partly in equity-based compensation. The award target reflects the participant’s level of responsibility along with past performance and anticipated future contributions to the Company. The cash component is paid under the terms of our 2000 Cash Incentive Plan and the equity-based component previously has been satisfied with awards under our 2000 Equity Incentive Plan. We expect that, for future years, the awards will be payable under our 2003 Equity Incentive Plan and our 2003 Cash Incentive Plan, respectively, which are discussed more fully in and being submitted for your approval pursuant to Proposals #2 and #3, below. The corporate performance goals have historically been total premium revenue, earnings per share and administrative and health benefit expense ratios.

The Company’s annual targets for each of the performance goals, which the Company refers to as Strategic Initiatives, are determined based upon the current year’s requirements under the Company’s three-year Business Plan. For 2002 and prior years, these annual Strategic Initiatives were reviewed by the Compensation Committee and approved by the Board of Directors. We expect that, for 2003 and future years, the Compensation Committee will be responsible for establishing the performance goals under the Plan.

Participants under the Plan can receive an award under the Bonus Plan only if both the Company’s Strategic Initiatives and their respective individual objectives are met. The Company’s Strategic Initiatives, as well as the individual’s performance goals, are developed to encourage responsible and profitable growth and the creation of shareholder value, while taking into consideration other non-financial goals such as quality standards, operational excellence, market leadership, member and provider satisfaction and the execution of strategic plans.

Cash Awards

The Company’s policy is to provide a target cash incentive award as a percentage of base salary that, when combined with base salary compensation, will represent median to 75% percentile of the total annual compensation levels in the applicable marketplace.

In 2002, the Company exceeded its performance goals, reflecting better than planned financial performance and the accomplishment of all of the Company’s Strategic Initiatives, including major acquisitions of health care plans in Florida and the District of Columbia.

13

Stock Options

The Company has used stock options granted under its 2000 Equity Incentive Plan as the primary means to reward executive officers and other key staff for long-term sustained performance, and as a tool to retain, attract and motivate critical employees. The use of stock options, in the opinion of the Compensation Committee, provides a significant and critical link between the results achieved for the organization’s stockholders and the rewards of executive officers and other staff.

Stock options granted pursuant to the Plan typically have a 10-year term and vest over five years, commencing on the first day of the applicable bonus period. The bonus period runs concurrent with the calendar year. Because of a shortfall in the number of shares available for issuance under the 2000 Equity Incentive Plan, the award targets for all Participants were reduced by 10% for 2002. Accordingly, the Compensation Committee approved a special vesting schedule with respect to the option grants for 2002, which were granted on February 10, 2003. Those option grants were 40% vested as of the date of grant. Another 5% of the options vested on April 1, 2003, and the options will continue to vest at a rate of 5% per calendar quarter until fully vested. The Compensation Committee has historically reviewed and recommended to the Board of Directors the aggregate amount of stock option awards, as well as their applicable terms, vesting and timing. Provided that you approve our 2003 Equity Incentive Plan, we anticipate that any future grants will be made under the terms of the plan and that the amount and terms of such grants will be determined by the Compensation Committee.

Chief Executive Officer Compensation

Pursuant to a contract entered into in 2000, Mr. Jeffrey L. McWaters, the Company’s Chairman and Chief Executive Officer, is entitled to receive an annual base salary of not less than $425,000, subject to adjustment from time to time by the Board of Directors. Effective April 1, 2002, his base salary was adjusted to $600,000. Based on applicable external information provided by our outside compensation consultant, and verified by the Compensation Committee’s independent compensation consultant, this salary is at or below median levels of pay for his position in the market. Mr. McWaters also has an annual incentive target equal to 150% of his base salary. For the fiscal year 2002, based on an evaluation of Company performance against its Strategic Objectives, the Compensation Committee recommended and the full Board (excluding Mr. McWaters) approved an award for Mr. McWaters of 150% of base salary, or $900,000.

Due to a shortfall in the number of options available for grant under the 2000 Equity Incentive Plan, all associates eligible to receive option grants under the Bonus Plan for performance in 2002 received options covering less shares than their bonus target. Mr. McWaters was granted options to purchase 100,000 shares of common stock at an exercise price of $26.78 per share. This grant was less than his bonus target. In partial substitution for the reduced number of options and in recognition of Mr. McWaters’ outstanding performance in 2002, the Compensation Committee approved an additional cash award to Mr. McWaters in the amount of $450,000.

Executive Compensation Tax Deductibility

The Omnibus Budget Reconciliation Act of 1993 amended the Code to generally provide that compensation paid by a publicly-held corporation to its chief executive officer and four most highly compensated executive officers in excess of $1 million per year per executive will be deductible by the corporation only if paid pursuant to qualifying performance-based compensation plans approved by stockholders of the corporation. It is the Compensation Committee’s intended policy to maximize the effectiveness of the Company’s executive compensation programs while also taking into consideration the requirements of Section 162(m) of the Code. In that regard, the Compensation Committee intends to maintain flexibility to take actions which it deems to be in the best interest of

14

the Company and its stockholders. Accordingly, although the Compensation Committee intends to preserve the deductibility of compensation to the extent consistent with its overall compensation policy, it reserves the authority to award non-deductible compensation as it deems appropriate.

Members of the Compensation Committee(1):

Richard D. Shirk (Chairperson)

William J. McBride

| (1) | | Prior to their resignations on March 28, 2003, C. Sage Givens and Charles W. Newhall, III were Directors and members of the Compensation Committee, with Ms. Givens serving as the Chairperson of the Compensation Committee. On March 28, 2003, C. Sage Givens and Charles W. Newhall, III resigned from the Board of Directors of AMERIGROUP. The vacancies on the Compensation Committee have not been filled. |

15

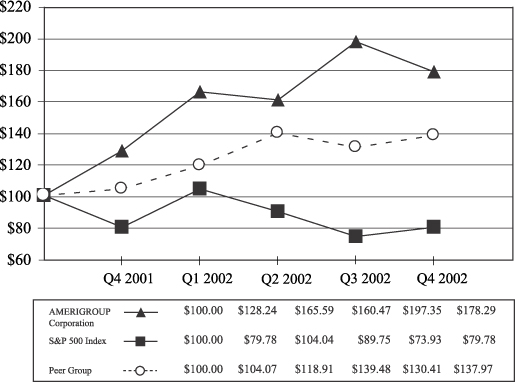

PERFORMANCE GRAPH

The following line graph compares the percentage performance change in the cumulative total stockholder return on the Company’s common stock against the cumulative total return of the Standard & Poor’s Corporation Composite 500 Index (the “S&P 500”) and a peer group index for the period from November 6, 2001 (the date of our initial public offering) to December 31, 2002. The graph assumes an initial investment of $100 in AMERIGROUP common stock and in each of the indices.

The peer group index consists of WellPoint Health Networks (WLP), Health Net Inc. (HNT), Coventry Health Care Inc. (CVH), Centene Corporation (CNTE) and United Health Care (UNH).

Comparisons of Total Stockholder Returns

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Indemnification Agreements

The Company has entered into an indemnification agreement with each of its officers and Directors. The indemnification agreement provides that the Director or officer will be indemnified to the fullest extent permitted by law for claims arising in such person’s capacity as a Director or officer. The agreement further provides that in the event of a change of control, the Company would seek legal advice from an approved special independent counsel selected by the officer or Director, who has not performed services for either party for 5 years, to determine the extent to which the officer or Director would be entitled to an indemnity under applicable law. Also, in the event of a change of control or a potential change of control the Company would, at the officer’s or Director’s request, establish a trust in an amount equal to all reasonable expenses anticipated in connection with investigating, preparing for and defending any claim. The Company believes that these agreements are necessary to attract and retain skilled management with experience relevant to our industry.

16

PROPOSAL #2: APPROVAL OF THE 2003 EQUITY INCENTIVE PLAN

The Board of Directors has adopted the 2003 Equity Incentive Plan (the “Equity Incentive Plan”), subject to approval by stockholders, and recommends it for stockholder approval at the forthcoming Annual Meeting. The Board of Directors believes it to be in the best interest of the Company to adopt the Equity Incentive Plan to promote our long-term growth and profitability by providing our key employees and our directors with incentives to improve the value of our stock. We are seeking your approval so that we may use the Equity Incentive Plan to grant incentive stock options (options that enjoy certain favorable tax treatment under Sections 421 and 422 of the Code) as well as to enhance our ability to grant awards that qualify for the performance-based exception to the federal income tax deduction limits that otherwise apply to us under Section 162(m) of the Code.

The Equity Incentive Plan is intended to encourage the key employees and directors of the Company to own common stock of the Company and to provide additional incentive to those employees and directors of the Company whose contributions are essential to the growth and success of the Company’s business, in order to strengthen the commitment of such persons to the Company, motivate such persons to faithfully and diligently perform their responsibilities and attract and retain competent and dedicated persons whose efforts will result in the long-term growth and profitability of the Company.

As stated above in the Report of the Compensation Committee, the Company traditionally has used stock options grants, among other purposes, as part of its performance based annual Chairman’s Bonus Plan (the “Bonus Plan”). The Company intends to use stock allocated under the Equity Incentive Plan to make stock option awards under the Bonus Plan for 2003 and in the future. In order for a participant under the Bonus Plan to receive an equity award, the Company and the participant each must have achieved their performance goals. These goals are developed to encourage responsible and profitable growth and the creation of stockholder value, while taking into consideration other non-financial goals such as quality standards, operational excellence, market leadership, member and provider satisfaction and execution of strategic plans.

Vote Required

The affirmative vote of a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote on this proposal is required for approval of the Equity Incentive Plan.

The Board of Directors unanimously recommends that you vote FOR approval of the adoption of the Equity Incentive Plan.

Equity Incentive Plan Description

The following is a brief description of the principal features of the Equity Incentive Plan. It does not purport to be complete and is qualified in its entirety by the full text of the Equity Incentive Plan, which is attached hereto as Exhibit B.

GENERAL. We have reserved for issuance under the Equity Incentive Plan a maximum of 1,650,000 shares of common stock, plus the maximum number of shares authorized for issuance under the Company’s 1994 Stock Plan (2,249,500 shares) and the maximum number of shares authorized for issuance under the Company’s 2000 Equity Incentive Plan (2,064,000 shares), minus the number of shares actually issued (whether before or after stockholder approval of the Equity Incentive Plan) under the 1994 Stock Plan and the 2000 Equity Incentive Plan, all subject to adjustment as described in the Equity Incentive Plan. As of March 21, 2003, there remained a total of 722 shares available for grant under the 1994 Stock Plan and the 2000 Equity Incentive Plan combined. The Company anticipates that if the Equity Incentive Plan is approved, all future grants will be made under the Equity Incentive Plan and no future grants will be made under the 1994 Stock Plan or the 2000 Equity Incentive Plan. If an award granted under the Equity Incentive Plan expires or is terminated, the shares of common stock underlying the award will again be available under the Equity Incentive Plan. In addition, to the extent shares of our common stock are used to exercise any award (as described below) or to satisfy tax withholding obligations under the Equity Incentive Plan, an equal number of shares will remain available for issuance under the Equity Incentive Plan.

17

No individual may be granted awards under the Equity Incentive Plan in any calendar year covering more than 500,000 shares. In addition, the number of shares with respect to which restricted stock, restricted stock units, or stock bonus awards (as described below) may be granted to any individual in any calendar year may not exceed 300,000, and the aggregate number of shares with respect to which restricted stock, stock-settled restricted stock units, or stock bonus awards may be granted under the Equity Incentive Plan shall not exceed 500,000.

In the event of any change in the Company’s capitalization or in the event of a corporate transaction such as a merger, consolidation, separation or similar event, the Equity Incentive Plan provides for appropriate adjustments in the number and class of shares of common stock available for issuance or grant and in the number and/or price of shares subject to awards.

TYPES OF AWARDS. The following awards may be granted under the Equity Incentive Plan:

| | • | | stock options, including incentive stock options and non-qualified stock options, |

| | • | | restricted stock units, |

| | • | | stock appreciation rights, |

| | • | | other stock-based awards. |

ADMINISTRATION. The Equity Incentive Plan will be administered by the Board of Directors or, in the discretion of the Board of Directors, by the Compensation Committee. The Board anticipates that the Compensation Committee will administer the Equity Incentive Plan. For convenience, the administrator of the Equity Incentive Plan will be referred to below as the Committee.

The Committee may, subject to the provisions of the Equity Incentive Plan, determine the persons to whom awards will be granted, the type of awards to be granted, the number of shares to be made subject to awards and the exercise price. The Committee may also condition the award on the attainment of certain goals, determine other terms and conditions that shall apply to awards, interpret the Equity Incentive Plan and prescribe, amend and rescind rules and regulations relating to the Equity Incentive Plan. The Committee may delegate to any of our senior management the authority to make grants of awards to our employees who are not our executive officers or directors. The terms and conditions of each award granted under the Equity Incentive Plan will be set forth in a written award agreement relating to the award.

In the event that the Committee grants an award that is intended to constitute qualified performance-based compensation within the meaning Section 162(m) of the Code, the Committee in its discretion may condition payment under the award in whole or in part on the attainment of (or a specified increase or decrease in) one or more of the following business criteria as applied to an award recipient under the Equity Incentive Plan and/or a business unit of the Company or its affiliates: (1) return on total stockholder equity; (2) earnings per share of our common stock; (3) net income (before or after taxes); (4) earnings before all or any interest, taxes, depreciation and/or amortization (“EBIT,” “EBITA,” or “EBITDA”); (5) gross revenue; (6) return on assets; (7) market share; (8) cost reduction goals; (9) earnings from continuing operations, levels of expense, cost or liability; and (10) membership goals, in each case, as applicable, as determined in accordance with generally accepted accounting principles. Payments under such awards will be made, in the case of employees covered under Section 162(m) of the Code, solely on account of the attainment of such performance goals established in writing by the Committee not later than the date on which 25% of the period of service to which the award relates has elapsed.

The Committee may, in its absolute discretion, without amendment to the Equity Incentive Plan, (i) accelerate the date on which any option or stock appreciation right becomes exercisable, waive or amend the operation of provisions respecting exercise after termination of employment or otherwise adjust any of the terms of such option or stock appreciation right, and (ii) accelerate the lapse of restrictions, or waive any other

18

condition imposed, with respect to any restricted stock, restricted stock units, stock bonus or other awards or otherwise adjust any of the terms applicable to any such award, provided that the Committee may not adversely affect any outstanding award without the consent of the holder thereof.

ELIGIBILITY. Awards may be granted under the Equity Incentive Plan to our employees and directors, as selected by the Committee in its sole discretion.

Grants under the Equity Incentive Plan will be made in the discretion of the Committee and, accordingly, are not yet determinable. In addition, benefits under the Equity Incentive Plan will depend on a number of factors, including the fair market value of our common stock on future dates and the exercise decisions made by the participants. Consequently, it is not possible to determine the benefits that might be received by participants under the Equity Incentive Plan. As of March 21, 2003, the closing price per share of our common stock on the New York Stock Exchange was $27.27

TERMS AND CONDITIONS OF OPTIONS. Stock options granted under the Equity Incentive Plan may be either “incentive stock options,” as that term is defined in Section 422 of the Code, or non-qualified stock options (i.e., any option that is not such an incentive stock option). The exercise price of a stock option granted under the Equity Incentive Plan will be determined by the Committee at the time the option is granted, but the exercise price may not be less than the fair market value of the common stock (determined generally as the closing price per share of our common stock on the trading day most recently preceding the date of grant). Stock options are exercisable at the times and upon the conditions that the Committee may determine, as reflected in the applicable option agreement. The Committee will also determine the maximum duration of the period in which the option may be exercised, which may not exceed ten years from the date of grant.

The option exercise price must be paid in full at the time of exercise, and is payable (in the discretion of the Committee) by any one of the following methods or a combination thereof:

| | • | | in cash or cash equivalents, |

| | • | | the surrender of previously acquired shares of common stock that have been held by the participant for at least six months prior to the date of surrender, |

| | • | | authorization for us to withhold a number of shares otherwise payable pursuant to the exercise of an option, or |

| | • | | to the extent permitted by applicable law, through a “broker cashless exercise” procedure acceptable to the Committee. |

OUTSIDE DIRECTOR OPTIONS. Non-employee directors, or outside directors, will be eligible for grants of non-qualified options under the Equity Incentive Plan. Each outside director will be granted, upon his or her first election or appointment to the Board of Directors, an option to purchase such number of shares of common stock as is determined by the Committee in its discretion. In addition, immediately following each annual meeting of stockholders, each outside director (other than an outside director who is first elected at that annual meeting) will be granted an option to purchase such number of shares of common stock as is determined by the Committee in its discretion. The option will become exercisable as is determined by the Committee in its discretion. Each option granted to an outside director will expire on the tenth anniversary of the date of grant of such option. The other terms of the options granted to outside directors will be subject to the terms and conditions applicable to non-qualified options granted to employees.

RESTRICTED STOCK. The Equity Incentive Plan provides for awards of common stock that are subject to restrictions on transferability and others restrictions that may be determined by the Committee in its discretion. Such restrictions will lapse on terms established by the Committee. Except as may be otherwise provided under the award agreement relating to the restricted stock, a participant granted restricted stock will have all the rights of a stockholder (for instance, the right to receive dividends on the shares of restricted stock and the right to vote the shares).

19

RESTRICTED STOCK UNITS. The Equity Incentive Plan provides for awards of restricted stock units which, upon vesting, entitle the participant to receive an amount in cash or common stock (as determined by the Committee and set forth in the applicable award agreement) equal to the fair market value of the number of shares made subject to the award. Vesting of all or a portion of a restricted stock unit award may be subject to terms and conditions established by the Committee.

STOCK APPRECIATION RIGHTS (“SARs”). The Equity Incentive Plan provides that the Committee, in its discretion, may award stock appreciation rights, either in tandem with stock options or freestanding and unrelated to options. The grant price of a freestanding SAR will be the fair market value of a share of common stock (as described above). The grant price of tandem SARs will equal the exercise price of the related option. Tandem SARs may be exercised for all or part of the shares subject to the related option upon surrender of the right to exercise the equivalent portion of the related option. Freestanding SARs may be exercised upon whatever terms and conditions the Committee imposes. SARs will be payable in cash, shares of common stock or a combination of both, as determined in the Committee's discretion and set forth in the applicable award agreement.

STOCK BONUSES; OTHER AWARDS. The Equity Incentive Plan provides that the Committee, in its discretion, may award shares of common stock to employees that are not subject to restrictions on transferability or otherwise. In addition, the Committee may grant other awards valued in whole or in part, by reference to, or otherwise based on, our common stock.

CHANGE IN CONTROL. The Committee in its discretion may provide that, in the event of a change in control (as defined in the Equity Incentive Plan), whether alone or in combination with other events, the vesting and exercisability restrictions on any outstanding award that is not yet fully vested and exercisable will lapse in part or in full. Unless otherwise provided in an award agreement, all outstanding shares of restricted stock and restricted stock units shall immediately vest, and each option and stock appreciation right shall become fully and immediately exercisable, if (i) there is a change in control and (ii) the participant’s employment with or service as a director of the Company or affiliate is terminated for any reason other than for cause (as defined in the Equity Incentive Plan) within two years following the change in control, or the participant terminates employment or service with the Company and its affiliates within two years following the change in control and after there is a material adverse change in the nature or status of the participant’s duties or responsibilities from those in effect immediately prior to the change in control.

TERMINATION OF EMPLOYMENT. Unless otherwise determined by the Committee, the termination of a participant’s employment or service will immediately cancel any unvested portion of awards granted under the Equity Incentive Plan. At the time of grant, the Committee in its discretion may provide that, if a participant’s employment or service terminates other than because of cause, death or disability, all options that are exercisable at the time of termination may be exercised by the participant for no longer than 90 days after the date of termination (or such other period as it determines). If a participant’s employment or service terminates for cause, all options held by the participant will immediately terminate. The Committee may provide that, if a participant’s employment or service terminates as a result of death, all options that are exercisable at the time of death may be exercised by the participant’s heirs or distributees for a period of one year (or such other period as it determines). The Committee may provide that, if a participant’s employment or service terminates because of disability, all options that are exercisable at the time of termination may be exercised for a period of one year (or such other period as it determines). However, in no case may an option be exercised after it expires.

AMENDMENT AND TERMINATION OF THE EQUITY INCENTIVE PLAN. The Board of Directors may modify or terminate the Equity Incentive Plan or any portion of the Equity Incentive Plan at any time, except that an amendment that requires stockholder approval in order for the Equity Incentive Plan to continue to comply with any law, regulation or stock exchange requirement will not be effective unless approved by the requisite vote of our stockholders. In addition, the Equity Incentive Plan or any outstanding option may not be

20

amended to decrease the exercise price of any outstanding option unless first approved by the requisite vote of stockholders. No awards may be granted under the Equity Incentive Plan after the day prior to the tenth anniversary of its adoption date, but awards granted prior to that time can continue after such time in accordance with their terms.

CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF OPTIONS. The following is a discussion of certain federal income tax effects currently applicable to stock options granted under the Plan. The discussion is a summary only, and the applicable law is subject to change. Reference is made to the Code for a complete statement of all relevant federal tax provisions.

Nonqualified Stock Options (“NSOs”)

An optionee generally will not recognize taxable income upon the grant of an NSO. Rather, at the time of exercise of such NSO, the optionee will recognize ordinary income for income tax purposes in an amount equal to the excess of the fair market value of the shares purchased over the exercise price. The Company will generally be entitled to a tax deduction at such time and in the same amount that the optionee recognizes ordinary income.

If shares acquired upon exercise of an NSO are later sold or exchanged, then the difference between the amount received upon such sale, exchange or disposition and the fair market value of such stock on the date of such exercise will generally be taxable as long-term or short-term capital gain or loss (if the stock is a capital asset of the optionee) depending upon the length of time such shares were held by the optionee.

Incentive Stock Options (“ISOs”)

An optionee will not recognize any ordinary income (and the Company will not be permitted any deduction) upon the grant or timely exercise of an ISO. However, the amount by which the fair market value of the Common Stock on the exercise date of an ISO exceeds the purchase price generally will constitute an item which increases the optionee’s “alternative minimum taxable income.”

Exercise of an ISO will be timely if made during its term and if the optionee remains an employee of the Company or a subsidiary at all times during the period beginning on the date of grant of the ISO and ending on the date three months before the date of exercise (or one year before the date of exercise in the case of a disabled optionee, and without limit in the case of death). The tax consequences of an untimely exercise of an ISO will be determined in accordance with the rules applicable to NSOs, discussed above.

If stock acquired pursuant to the timely exercise of an ISO is later disposed of, and if the stock is a capital asset of the optionee, the optionee generally will recognize short-term or long-term capital gain or loss (depending upon the length of time such shares were held by the optionee) equal to the difference between the amount realized upon such sale and the exercise price. The Company, under these circumstances, will not be entitled to any income tax deduction in connection with either the exercise of the ISO or the sale of such stock by the optionee.

If, however, stock acquired pursuant to the exercise of an ISO is disposed of by the optionee prior to the expiration of two years from the date of grant of the ISO or within one year from the date such stock is transferred to him or her upon exercise (a “disqualifying disposition”), any gain realized by the optionee generally will be taxable at the time of such disqualifying disposition as follows: (i) at ordinary income rates to the extent of the difference between the exercise price and the lesser of the fair market value of the stock on the date the ISO is exercised or the amount realized on such disqualifying disposition and (ii) if the stock is a capital asset of the optionee, as short-term or long-term capital gain (depending upon the length of time such shares were held by the optionee) to the extent of any excess of the amount realized on such disqualifying disposition over the sum of the exercise price and any ordinary income recognized by the optionee. In such case, the Company may claim an income tax deduction at the time of such disqualifying disposition for the amount taxable to the optionee as ordinary income.

21

PROPOSAL #3: APPROVAL OF THE 2003 CASH INCENTIVE PLAN

The Board of Directors has adopted the 2003 Cash Incentive Plan the (“Cash Incentive Plan”),subject toapproval by stockholders, and recommends it for stockholder approval at the forthcoming Annual Meeting. The Board of Directors believes it to be in the best interest of the Company to adopt the Cash Incentive Plan to promote our long-term growth and profitability by providing management personnel with incentives to improve stockholder value.