UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

Resource Bankshares Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

April 18, 2003

Dear Fellow Shareholders:

You are cordially invited to attend the 2003 Annual Meeting of Shareholders of Resource Bankshares Corporation (the “Company”) to be held on Thursday, May 22, 2003, at 3:00 p.m., at the Sheraton Oceanfront Hotel, 36th Street and Atlantic Avenue, Virginia Beach, Virginia 23451. The accompanying Notice and Proxy Statement describe the items of business to be considered at the Annual Meeting. Please read these documents carefully.

Specifically, you will be asked to consider and approve four items of business: (i) the election of three incumbent directors, each of whom will serve a three (3) year term and until his successors are elected and qualified, (ii) the approval of an amendment to the Company’s Articles of Incorporation increasing the number of authorized shares of common stock the Company may issue from 6,666,666 to 15 million, (iii) the approval of an amendment to the Company’s Articles of Incorporation clarifying that the Company’s obligation to indemnify its directors and officers is subject to limitations imposed by federal banking law and regulations, and (iv) the ratification of the appointment of Goodman & Company, L.L.P. as independent auditors for the 2003 fiscal year. The Board of Directors encourages you to read carefully the enclosed Proxy Statement and toVOTE FOR all the matters to be considered at the Annual Meeting.

We hope you can attend the Annual Meeting.Whether or not you plan to attend, please complete, sign, and date the enclosed Proxy card and return it promptly in the enclosed envelope. Your vote is important regardless of the number of shares you own. We look forward to seeing you at the Annual Meeting, and we appreciate your continued loyalty and support.

Sincerely,

RESOURCE BANKSHARES CORPORATION

/s/ LAWRENCE N. SMITH

Lawrence N. Smith

Chief Executive Officer

RESOURCE BANKSHARES CORPORATION

NOTICE OF 2003 ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 22, 2003

To Our Shareholders:

The 2003 Annual Meeting of Shareholders of Resource Bankshares Corporation (the “Company”) will be held at the Sheraton Oceanfront Hotel, 36th Street and Atlantic Avenue, Virginia Beach, Virginia 23451, on Thursday, May 22, 2003, at 3:00 p.m., for the following purposes:

1. To elect a total of three (3) incumbent directors, each of whom will serve a term of three (3) years and until their successors are elected and qualified.

2. To adopt an amendment to the Company’s Articles of Incorporation increasing the number of authorized shares of common stock the Company may issue from 6,666,666 to 15 million.

3. To adopt an amendment to the Company’s Articles of Incorporation clarifying that the Company’s obligation to indemnify its directors and officers is subject to limitations imposed by federal banking law and regulations.

4. To ratify the appointment of Goodman & Company, L.L.P. as independent auditors for the 2003 fiscal year.

5. To transact such other business as may properly come before the meeting.

Shareholders of record at the close of business on April 1, 2003 will be entitled to notice of and to vote at the Annual Meeting and any adjournments thereof.The Board of Directors of the Company unanimously recommends that shareholders vote FOR approval of each of the items indicated in 1., 2., 3. and 4. above.

PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. IF YOU ATTEND THE MEETING, YOU MAY VOTE EITHER IN PERSON OR THROUGH YOUR PROXY.

By Order of the Board of Directors |

|

/S/ DEBRA C. DYCKMAN

|

Debra C. Dyckman Secretary of the Board |

April 18, 2003

PROXY STATEMENT

This Proxy Statement and the enclosed proxy card (“Proxy”) are furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Resource Bankshares Corporation (the “Company”) to be voted at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held at the Sheraton Oceanfront Hotel, 36th Street and Atlantic Avenue, Virginia Beach, Virginia 23451 at 3:00 p.m., Eastern Time, on Thursday, May 22, 2003, and at any adjournment thereof, for the purposes set forth in the accompanying Notice of Meeting.

Only shareholders of record at the close of business on April 1, 2003 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. This Proxy is being mailed on or about April 18, 2003.

REVOCABILITY OF PROXY

Execution of the enclosed Proxy will not affect a shareholder’s right to attend the Annual Meeting and vote in person. If your Proxy is properly signed, received by the Company and not revoked by you, the shares to which it pertains will be voted at the Annual Meeting in accordance with your instructions. If a shareholder does not return a signed Proxy, his or her shares cannot be voted by proxy.

SOLICITATION OF PROXIES

The cost of soliciting Proxies will be borne by the Company. In addition to solicitation by mail, the Company will request banks, brokers and other custodians, nominees and fiduciaries to send proxy materials to the beneficial owners and to secure their voting instructions if necessary. The Company, upon request, will reimburse them for their expenses in so doing. Officers and regular employees of the Company may solicit Proxies personally, by telephone or by telegram from some shareholders if Proxies are not received promptly, for which no additional compensation will be paid.

VOTING SHARES AND VOTE REQUIRED

On the Record Date, the Company had 3,979,167 shares of Common Stock outstanding. Each share of Common Stock is entitled to one vote on each matter presented at the Annual Meeting. Directors are elected by a plurality of votes cast by shareholders at the Annual Meeting. Under the terms of the Company’s Articles of Incorporation, the affirmative vote of a majority of the outstanding shares of Common Stock is required to approve the proposed amendments to the Company’s Articles of Incorporation. A majority of votes cast is required to ratify the appointment of auditors. Abstentions, broker non-votes, and withheld votes will be counted for purposes of determining whether a quorum exists for the transaction of business at the Annual Meeting, but such votes (i) will have the effect of a voteagainst the proposed amendments to the Company’s Articles of Incorporation and (ii) will not be considered “votes cast” based on the Company’s understanding of state law requirements and the Company’s Articles of Incorporation and Bylaws.

All shareholder meeting proxies, ballots and tabulations that identify individual shareholders are kept secret and no such document shall be available for examination, nor shall the identity or the vote of any shareholder be disclosed except as may be necessary to meet legal

requirements and the laws of Virginia. Votes will be counted and certified by the Proxy Committee of the Board of Directors, whose members are Alfred Abiouness, Thomas Hunt, and Lawrence Smith. The members of the Proxy Committee will also act as the inspectors of elections at the Annual Meeting as required under Virginia law.

Unless specified otherwise, Proxies will be voted (i)FOR the election of the three director-nominees to serve as Class C directors of the Company until the 2006 Annual Meeting and until their successors are duly elected and qualified, (ii)FOR the proposed amendment to the Company’s Articles of Incorporation increasing the number of authorized shares of common stock the Company may issue from 6,666,666 to 15 million, (iii)FOR the proposed amendment to the Company’s Articles of Incorporation clarifying that the Company’s obligation to indemnify its directors and officers is subject to limitations imposed by federal banking law and regulations, and (iv)FOR the ratification of the appointment of Goodman & Company, L.L.P. as independent auditors for 2003. In the discretion of the Proxy holders, the Proxies will also be voted for or against such other matters as may properly come before the Annual Meeting. Management is not aware of any other matters to be presented for action at the Annual Meeting.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL

OWNERS

The following table sets forth information as of April 1, 2003 relating to the beneficial ownership of the Company’s Common Stock by (i) each of the Company’s directors, director-nominees and named executive officers who own Common Stock and (ii) all of the Company’s directors, director-nominees and executive officers as a group. The named executive officers consist of those individuals for whom compensation information is provided in the “Summary Executive Compensation Table” appearing elsewhere in this Proxy Statement. Except as otherwise set forth below, the Company is not aware of any person or group of affiliated persons who owns more than 5% of the Common Stock of the Company.All of the Company’s directors, director-nominees and named executive officers receive mail at the Company’s principal executive offices at 3720 Virginia Beach Blvd., Virginia Beach, Virginia 23452.

Name

| | Number of Shares Beneficially Owned

| | | Percent of Outstanding Shares

|

Alfred E. Abiouness | | 101,349 | (1) | | 2.53 |

T. A. Grell, Jr. | | 12,574 | | | * |

Thomas W. Hunt | | 154,691 | (2) | | 3.87 |

Louis R. Jones | | 316,386 | (3) | | 7.91 |

A. Russell Kirk | | 120,446 | (4) | | 3.02 |

Lawrence N. Smith | | 148,707 | (5) | | 3.71 |

Elizabeth A. Twohy | | 54,106 | (6) | | 1.35 |

Debra C. Dyckman | | 48,092 | (7) | | 1.20 |

Harvard R. Birdsong, II | | 21,561 | (8) | | * |

James M. Miller | | 39,369 | (9) | | * |

|

Directors and Executive Officers as a Group (11 Persons) | | 1,042,251 | | | 25.03 |

2

| (1) | | Includes options to purchase 30,166 shares that are currently exercisable. |

| (2) | | Includes options to purchase 15,000 shares that are currently exercisable; also includes 70,528 shares owned by Mr. Hunt’s wife and 38,610 shares owned by Mr. Hunt’s children, for which Mr. Hunt shares voting and investment power. Does not include shares held jointly by Mr. Hunt’s spouse and Alan M. Voorhees as trustees for the benefit of Mr. Voorhees’ great grandchildren, for which Mr. Hunt does not share voting or investment power. |

| (3) | | Includes options to purchase 20,166 shares that are currently exercisable. |

| (4) | | Includes options to purchase 13,500 shares that are currently exercisable. |

| (5) | | Includes options to purchase 31,600 shares that are currently exercisable. Also includes 52,202 shares owned by the Smith Family Partnership for which Mr. Smith shares voting and investment power and 10,500 shares owned by the Smith Family Trust for which Mr. Smith has sole voting and investment power. |

| (6) | | Includes options to purchase 20,166 shares that are currently exercisable. Also includes 6,764 shares owned by Ms. Twohy’s minor children. |

| (7) | | Includes options to purchase 14,400 shares that are currently exercisable. |

| (8) | | Includes options to purchase 12,000 shares that are currently exercisable. |

| (9) | | Includes options to purchase 15,000 shares that are currently exercisable and also includes 9,488 shares in a family trust for which Mr. Miller has voting and investment power. |

PROPOSAL 1. ELECTION OF DIRECTORS

The Company’s Bylaws provide that the number of directors shall be between 5 and 15. There are currently 7 directors serving on the Board. At the Company’s 2000 Annual Meeting of Shareholders, shareholders approved an amendment to the Company’s Articles of Incorporation to create a classified Board of Directors. As a result, the Company’s Board of Directors is divided into three (3) classes, Class A, Class B and Class C. The initial terms of the Class C directors will expire at the Annual Meeting.

The Board of Directors recommends that the three nominees to serve as Class C directors, T. A. Grell, Jr., Thomas W. Hunt and Lawrence N. Smith, be re-elected to serve as the Class C directors until the 2006 Annual Meeting. Proxies received by the Company will be voted for the election of the three nominees unless marked to the contrary. A shareholder who desires to withhold voting of the Proxy for one or more of the nominees may so indicate on the Proxy. All three nominees are currently members of the Board and all have consented to be named and have indicated their intent to serve, if elected. If any nominee becomes unable to serve, an event which is not anticipated, the Proxy will be voted for a substitute nominee to be designated by the Board or the number of directors will be reduced.

The Company does not have a separate nominating committee. The functions customarily attributable to such a committee are performed by the Board as a whole. For information regarding the Company’s bylaw provisions that govern shareholder nominations of director candidates, see “Submission of Proposals and Other Matters Related to 2004 Annual Meeting” elsewhere in this Proxy Statement.

Names of Directors, Director-Nominees and Committee Memberships

The following table and accompanying footnotes set forth the names, ages and date of each director’s and director-nominee’s first election to the Board and also provide information on Board committees:

3

Name

| | Age

| | Director Since(1)

|

Alfred E. Abiouness(A)(B)(C)(D) | | 71 | | 1988 |

T. A. Grell, Jr. (A) | | 54 | | 2000 |

Thomas W. Hunt(A)(B)(C)(D) | | 47 | | 1997 |

Louis R. Jones(A)(B)(D) | | 67 | | 1993 |

A. Russell Kirk(A)(D) | | 55 | | 1992 |

Lawrence N. Smith(A)(C) | | 65 | | 1992 |

Elizabeth A. Twohy(A)(B)(D) | | 50 | | 1993 |

| (1) | | At the 1998 Annual Meeting of Resource Bank (the “Bank”), the shareholders of the Bank approved a Plan of Reorganization pursuant to which each share of Bank Common Stock was exchanged for two shares of the Company’s Common Stock and the Bank became a wholly owned banking subsidiary of the Company (“Plan of Reorganization”). The effective date of the Plan of Reorganization was July 1, 1998. Prior to the effective date of the Plan of Reorganization, all of the directors and director-nominees except Mr. Grell served on the Board of Directors of the Bank. Since the effective date of the Plan of Reorganization, the directors and director-nominees except Mr. Grell have served on the Company’s Board of Directors and have continued to serve on the Bank’s Board of Directors. All share figures in this Proxy Statement give effect to the 2:1 share exchange effectuated pursuant to the Plan of Reorganization. |

| (A) | | Member of the Credit Risk Committee of the Bank. The Credit Risk Committee reviews all loan activity and policies of the Bank, acts upon large loan requests presented to the Bank, and monitors outstanding loans and collection efforts. Also member of the Market Risk and Liquidity Risk Committees of the Bank. Each of these three committees held 12 meetings in 2002. |

| (B) | | Member of the Audit Committee. The Audit Committee is empowered by the Board of Directors to, among other things, recommend the firm to be employed by the Company as its independent auditor and to consult with such auditor regarding audits and the adequacy of internal accounting controls. The Audit Committee held four meetings in 2002. See “- Audit Committee Report” below. |

| (C) | | Member of the Proxy Committee, which collects and accounts for all proxies and exercises proxy authority at all shareholder meetings. The Proxy Committee held one meeting in 2002. |

| (D) | | Member of the Compensation Committee, which recommends to the Board the salaries for officers and the compensation to be paid directors, and determines the persons to whom stock options are granted, the number of shares subject to option, and the appropriate vesting schedule. The Compensation Committee held one meeting in 2002. |

Audit Committee Report

The Audit Committee of the Board of Directors is composed of four non-employee directors. All of these directors are “independent directors” as that term is defined under the NASDAQ Stock Market’s listing standards. To be an independent director under this definition, a director may not be an officer or employee of the Company or have certain other types of relationships with the Company. The Audit Committee held four meetings during 2002. The responsibilities of the Audit Committee are set forth in its Charter, which will be reviewed and amended periodically as appropriate.

4

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility of the financial statements and the reporting process, including the system of internal controls. In this context, the Committee has met and held discussions with management and the independent auditors. Management represented to the Committee that the Company’s financial statements were prepared in accordance with generally accepted accounting principles, and the Committee has reviewed and discussed the financial statements with management and the independent auditors. The Committee discussed with the independent auditors matters required to be discussed by Statement of Auditing Standards No. 61 (Communication with Audit Committees). In addition, the Committee has discussed with the independent auditors the auditors’ independence from the Company and its management, including the matters in the written disclosures required by the Independence Standards Board Standards No. 1 (Independence Discussions with Audit Committees). The Committee discussed with the Company’s internal and independent auditors the overall scope and specific plans for their respective audits.

The Audit Committee meets with the internal and independent auditors, with and without management present, to discuss the results of their examinations, the evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting. The meetings also are designed to facilitate any private communications with the Committee desired by the internal auditors or independent accountants. In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements of the Company be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2002, for filing with the Securities and Exchange Commission. The Committee and the Board also have recommended, subject to shareholder approval, the selection of the Company’s independent auditors, Goodman & Company, L.L.P.

Background and Experience

The following information relates to the business background of the Company’s directors and director-nominees. There are no family relationships among any of the directors or director-nominees nor is there any arrangement or understanding between any directors or director-nominees and any other person pursuant to which the director or director-nominee was selected.

Nominees for Class C Directors Whose Terms Will Expire in 2006

Mr. Grellhas been President and Chief Operating Officer of the Bank since December 1998. He served as Executive Vice President of the Company from December 1998 until November 2001 and was named President of the Company in November 2001. Mr. Grell has also served as a director of the Company since October 2000. From 1984 until joining the Company, he was a senior officer at Central Fidelity Bank, which was acquired by Wachovia Bank. Mr. Grell has over 30 years experience in the banking industry and is active in civic affairs.

5

Mr. Hunt is the Vice President of Summit Enterprises, Inc. of McLean, Virginia, an investment management company focused primarily on venture capital opportunities, and he has been employed by Summitt Enterprises since 1984. He is the former Chairman of the Board of Directors of Eastern American Bank, FSB, which the Bank acquired in 1997. Mr. Hunt is a director of Bryce Office Systems, Inc., Intelisys Electronic Commerce and Digital Access Control, Inc. Mr. Hunt currently serves as the Chairman of the Board of the Company and the Bank.

Mr. Smith joined the Bank in December 1992 and served as its President and Chief Executive Officer until the implementation of the Plan of Reorganization, after which he also was appointed President and Chief Executive Officer of the Company. Mr. Smith served as the President of the Bank until December 1998 and as President of the Company until November 2001. He continues to serve as the Chief Executive Officer of the Company and the Bank. Mr. Smith has over 20 years of experience with United Virginia Bank/Seaboard National and United Virginia Bank – Eastern Region, predecessor of Crestar Bank – Eastern Region (“Crestar”). From 1973 until May 1983, Mr. Smith was President of Crestar and also served on major committees of the holding company, United Virginia Bankshares, Inc., predecessor of Crestar Bankshares, Inc. He retired from Crestar in May 1983. Mr. Smith formed Essex Financial Group, Inc., a financial holding company, in May 1983. Mr. Smith serves on the board of directors of Empire Machinery and Supply Corporation, a Norfolk based supplier of industrial products, and General Foam Plastics Corp., a Norfolk based manufacturer of plastic products, and previously served on the board of Heilig-Myers Corporation, a national furniture retailer that filed for bankruptcy protection in August 2000.

Class A Directors Whose Terms Will Expire in 2004

Mr. Jones has been President of Hollomon-Brown Funeral Home, Inc. since 1954. Mr. Jones is also Chairman of the Board of Snelling Funeral Homes, Inc. and is President of Allstate Leasing Corporation, Memorial Services Planning Corporation, Advance Charge Plan, Inc., Tidewater Cemetery Corporation and Lu-El Realty, Inc. Mr. Jones has also been active in civic affairs and serves on the City Council of Virginia Beach.

Mr. Kirkhas been the Vice Chairman of Armada-Hoffler Holding Company, a real estate, land development, construction and properties management firm since 2002 and served as its President from 1983 until assuming his current position. Previously, Mr. Kirk served as the Co-Chief Executive Officer of Goodman Segar Hogan Hoffler, also a real estate development, construction and properties management firm from 1983 to 1993. Mr. Kirk was appointed to the Virginia Port Authority by the Governor of Virginia in 1986, serving as its Chairman from 1994 to 1996.

Class B Directors Whose Terms Will Expire in 2005

Mr. Abiouness has been President of Abiouness, Cross & Bradshaw, Inc., a Norfolk structural engineering and architectural consulting firm, since 1974. Mr. Abiouness is a past Commissioner of the Norfolk Redevelopment and Housing Authority.

Ms. Twohyis President of Capital Concrete, Inc. of Norfolk, Virginia, a ready-mixed concrete manufacturer, where she has been employed since 1975. She is two times past

6

president of the Virginia Ready-Mixed Concrete Association and she is currently on the board of the National Ready Mix Concrete Association. Ms. Twohy is also serving her second term as a trustee of the Board of Visitors of the University of Virginia and is a board member of the Virginia Sports Hall of Fame in Portsmouth, Virginia.

Board Meetings

The business of the Company is managed under the direction of the Board. All of the members of the Company’s Board also serve on the Bank’s Board of Directors. The Company’s Board meets at least quarterly and held four meetings in 2002. The Bank’s Board generally meets monthly and held 12 meetings in 2002. During 2002, each member of the Company’s and Bank’s Board participated in at least 75% of all meetings of the Boards and at least 75% of all applicable committee meetings.

EXECUTIVE COMPENSATION

Summary Executive Compensation Table

The following table presents an overview of executive compensation paid by the Company and its subsidiaries during 2002, 2001, and 2000 to Lawrence N. Smith, Chief Executive Officer, and to the four other most highly compensated executive officers of the Company (collectively, the “Named Executive Officers”). Compensation information includes compensation paid by the Bank to the Named Executive Officers in their capacity as executive officers of the Bank.

| | | Annual Compensation

| | Long Term Compensation

| | |

Name and principal position

| | Year

| | Salary($)

| | Bonus($)

| | Securities Underlying Options(#)

| | All Other Compensation($)(1)

|

Lawrence N. Smith, CEO of Resource Bankshares and Resource Bank | | 2002 2001 2000 | | $ | 342,000 325,000 275,625 | | $ | 290,000 276,250 220,000 | | — — 20,000 | | $ | 6,000 5,100 5,100 |

T. A. Grell, Jr., President of Resource Bankshares and Resource Bank | | 2002 2001 2000 | | | 232,000 220,500 210,000 | | | 162,000 154,000 186,000 | | — 20,000 5,000 | | | 6,000 5,100 5,100 |

Harvard R. Birdsong, II, Executive Vice President of Resource Bankshares and Resource Bank | | 2002 2001 2000 | | | 147,000 121,500 115,763 | | | 95,000 84,000 60,000 | | — 6,500 2,500 | | | 6,000 5,100 2,131 |

Debra C. Dyckman, Executive Vice President of Resource Bankshares and Resource Bank | | 2002 2001 2000 | | | 131,500 111,500 106,050 | | | 77,500 75,000 60,000 | | — 3,000 2,500 | | | 6,000 5,100 2,108 |

James M. Miller, Executive Vice President of Resource Bankshares and Resource Bank | | 2002 2001 2000 | | | 157,500 141,000 121,800 | | | 122,500 90,000 100,000 | | — 4,500 2,500 | | | 5,500 5,100 5,100 |

| (1) | | Consists of Company contributions to 401(k) Plan. |

7

Fiscal Year-End Options Table

The table below sets forth information regarding the exercise of stock options by the Named Executive Officers during 2002 and the exercisable and unexercisable stock options held as of December 31, 2002 by these executive officers. There were no stock options granted to the Named Executive Officers in 2002.

| | | | | | | | Number of Securities Underlying Unexercised Options at Fiscal Year-End (#)

| | Value of Unexercised In-the-Money Options at Fiscal Year-End (1)

| |

Name

| | Shares Acquired Upon Exercise (#)

| | Value Realized ($)

| | | Exercisable

| | Unexercisable

| | Exercisable

| | | Unexercisable

| |

Lawrence N. Smith | | 10,000 | | $ | 154,000 | (2) | | 48,267 | | 10,000 | | $ | 622,369 | (3) | | $ | 90,700 | (4) |

T. A. Grell, Jr. | | — | | | — | | | — | | 40,000 | | | — | | | | 75,813 | (5) |

Harvard R. Birdsong, II | | 3,000 | | | 12,480 | (6) | | 12,000 | | 9,000 | | | 57,720 | (7) | | | 31,060 | (8) |

Debra C. Dyckman | | 6,666 | | | 102,656 | (9) | | 14,400 | | 5,500 | | | 206,064 | (10) | | | 26,545 | (11) |

James M. Miller | | — | | | — | | | 15,000 | | 7,000 | | | 72,150 | (12) | | | 45,070 | (13) |

| (1) | | The closing price of the Company’s common stock on the Nasdaq National Market on December 31, 2002 was $20.56 per share. Under Securities and Exchange Commission rules, an option was “in-the-money” on December 31, 2002 if the exercise price per share was less than $20.56. |

| (2) | | The exercise price of these options was $3.00 per share and the closing price on March 21, 2002 was $18.40. |

| (3) | | 16,667 of the options are exercisable at $3.00 per share and 21,600 of the options are exercisable at $6.25 per share. 10,000 of the options are exercisable at $18.50 per share. |

| (4) | | The exercise price of these 10,000 options is $9.12 per share. |

| (5) | | The exercise price of 5,000 of these options is $9.12 per share, the exercise price of 14,571 of these options is $17.87 per share, and the exercise price of 20,000 of these options is $16.90 per share. The exercise price of 429 of these options is $21.75 per share, and these options therefore were not in-the-money on December 31, 2002. |

| (6) | | The exercise price of these options was $15.75 per share and the closing price on December 18, 2002 was $19.91. |

| (7) | | These options are exercisable at $15.75 per share. |

| (8) | | The exercise price of 2,500 of these options is $9.12 per share and the exercise price of 6,500 of these options is $16.90 per share. |

| (9) | | The exercise price of these options was $3.00 per share and the closing price on March 21, 2002 was $18.40. |

| (10) | | These options are exercisable at $6.25 per share. |

| (11) | | The exercise price of 2,500 of these options is $9.12 per share and the exercise price of 3,000 of these options is $16.90 per share. |

| (12) | | These options are exercisable at $15.75 per share. |

| (13) | | The exercise price of 2,500 of these options is $9.12 per share and the exercise price of 4,500 of these options is $16.90 per share. |

Retirement Savings Plan

Employees that are eligible may participate in the Bank’s Retirement Savings Plan. The plan is a combined 401(k) profit sharing, stock bonus and employee stock ownership plan, which means that contributions may be made by the Bank to the plan in either cash or Company Common Stock and are derived from current or accumulated profits. The plan’s assets may be invested in shares of Company Common Stock purchased from third parties on the open market. The plan’s 401(k) provisions permit employees to contribute to the plan through voluntary payroll savings on a pretax basis. These contributions are matched by the Bank in an amount equal to 50% of payroll savings contributions made by employees, up to 6% of an employee’s total compensation.

Retirement Benefits and Key Man Insurance Policies

During 1996, the Board of Directors of the Bank approved a plan for the payment of retirement benefits to certain key employees and entered into limited binding agreements with these key employees. Under the terms of the plan, the Bank may fund the liabilities associated

8

with this plan with life insurance contracts. In connection with funding the projected retirement benefits, the Bank paid premiums on applicable life insurance contracts in the amount of approximately $275,000 during 2002, and may continue to pay, in its sole discretion, the same annual amount of insurance premiums over the next year. The Bank owns the insurance polices and, under the plan, the Bank will recoup all the premiums advanced upon the death of the individual officer.

Stock Option Plans

At the Company’s 2001 Annual Meeting, shareholders approved and adopted the Company’s 2001 Stock Incentive Plan (“Incentive Plan”), which authorizes the issuance of stock options and other stock based awards to directors and key employees. To date, all awards under the Incentive Plan have been in the form of stock options. At the Company’s 2002 Annual Meeting, shareholders adopted an amendment to the Incentive Plan to increase the shares of common stock available for awards under the Incentive Plan from 100,000 to 200,000.

In addition to the Incentive Plan, there are three stock option plans under which the Company’s and the Bank’s directors and officers previously have been granted stock options. The 1996 Long-Term Incentive Plan, the 1994 Long-Term Director Plan and the 1993 Long-Term Incentive Plan all authorized the issuance of stock options to directors and key employees. The Company does not anticipate issuing any further stock options pursuant to these plans but the plans will remain in effect for as long as awards previously granted under the plans remain outstanding.

Compensation of Directors

Directors who are employees of the Company or the Bank do not receive any extra compensation for attendance at Board or Committee meetings of the Company or the Bank. The members of the Company’s Board of Directors and Bank’s Board of Directors are currently the same and directors do not receive separate compensation for serving on the Company’s Board of Directors. During 2002, non-employee directors of the Bank received compensation for their service on the Bank’s Board of Directors in the amount of $1,900 for each meeting attended. In addition, an annual retainer of $15,000 was paid to the Chairman of the Bank’s Board and an annual retainer of $12,000 was paid to the Bank’s other non-employee directors. Non-employee directors also received $500 for each Audit Committee meeting attended and $1,000 for each Compensation Committee meeting attended.

Executive Officer Employment Agreements

The Company believes that employment agreements are an important component of attracting and retaining quality management and key personnel. The Company also believes that employment agreements provide important protection by imposing certain non-competition, confidentiality, and non-solicitation of employee covenants upon executive officers and other key employees. To provide flexibility with respect to employment needs, however, most of the Company’s employment agreements are terminable by the Company with or without cause, subject generally to severance payment obligations upon termination without cause.

The Company entered into an employment agreement with Lawrence N. Smith in June 2002, under which Mr. Smith serves as Chief Executive Officer of the Company and the Bank.

9

The initial term of Mr. Smith’s agreement is five years. Under the terms of his agreement, Mr. Smith’s current annual base salary is $360,000. On an ongoing basis, the Bank’s board of directors will determine Mr. Smith’s annual salary in a manner commensurate with his position and performance, provided, however, Mr. Smith’s salary under the agreement is required to be at least $342,000. Mr. Smith is also eligible to participate in benefit, disability and retirement plans and in bonus programs as determined by the boards of directors of the Company or the Bank from time to time.

If the Bank terminates Mr. Smith’s employment “without cause” (as defined in the agreement), it is required to pay his regular base salary for the lesser of the remainder of the initial five year term or a three year period following termination. However, no further payments would be payable if Mr. Smith violates the non-competition covenants set forth in his agreement. Upon a “change of control” (as defined in the agreement) of the Bank in which Mr. Smith is not given reasonably equivalent duties, responsibilities and compensation, Mr. Smith’s employment with the Bank may be terminated or he may resign and, in either case, Mr. Smith will be entitled to receive a one time payment of 2.99 times the average of his total W-2 income, which would include his regular base salary and bonus, for the three year period prior to the change of control.

In addition to the agreement with Mr. Smith, the Bank entered into an employment agreement with T. A. Grell, Jr. in June 2002, under which Mr. Grell serves as President of the Company and the Bank. Mr. Grell’s agreement has substantially the same terms as Mr. Smith’s agreement, except that Mr. Grell’s current annual base salary is $244,000.

The Bank has also entered into written employment agreements with its other executive officers, including Debra C. Dyckman, Harvard R. Birdsong, II and James M. Miller. These employment agreements are substantially similar to the agreements described in the preceding paragraphs, except that the initial annual base salaries differ from employee to employee and severance payments upon termination of employment without cause generally would be made for the lesser of the remainder of the initial term of the agreements or 18 months following termination of employment. The current annual salary under Ms. Dyckman’s employment agreement is $138,500, the current annual salary under Mr. Birdsong’s employment agreement is $155,000 and the current annual salary under Mr. Miller’s employment agreement is $165,500.

In addition to employment agreements with executive officers, the Bank has also entered into employment agreements with key employees in the Bank’s mortgage division and with many senior lending officers. Employment agreements for mortgage division executives typically have terms of five years, provide for certain severance payments upon termination without cause and provide for change of control payments of 2.99 times base salary. The Bank currently has written employment agreements with five mortgage division executives. Of the Bank’s 22 senior lending officers, the Bank currently has written employment agreements with 16.

Compensation Committee Interlocks and Insider Participation

No member of the Company’s Compensation Committee was an officer or employee of the Company during 2002. During 2002, no executive officer of the Company served as a member of the Compensation Committee of another entity, nor did any executive officer of the Company serve as a director of another entity, one of whose executive officers served on the Company’s Compensation Committee.

10

Two members of the Compensation Committee, Alfred Abiouness and Russell Kirk, have outstanding loans with the Bank. Each of these loans was made in the ordinary course of business on substantially the same terms, including interest rates, collateral and repayment terms, as those prevailing at the time for comparable transactions with unrelated parties and did not involve more than the normal risk of collectibility or present other unfavorable features.

Compensation Committee Report Concerning Compensation of Certain Executive Officers

This report describes the Company’s executive officer compensation strategy, the components of the compensation program and the manner in which the 2002 compensation determinations were made for the Company’s Chief Executive Officer, Lawrence N. Smith, and the Company’s and Bank’s other executive officers (collectively “Executive Officers”).

In addition to the information set forth above under “Executive Compensation,” the Compensation Committee is required to provide shareholders a report explaining the rationale and considerations that led to the fundamental executive compensation decisions affecting the Company’s Executive Officers. In fulfillment of this requirement, the Compensation Committee, at the direction of the Company’s Board of Directors, has prepared the following report for inclusion in this Proxy Statement. None of the members of the Compensation Committee are executive officers or employees of the Company.

Compensation Philosophy

The compensation of the Company’s Executive Officers is designed to attract, retain, motivate and reward qualified, dedicated executives, and to directly link compensation with (i) the Executive Officer’s previous and anticipated performance, (ii) the contributions and responsibilities of the Executive Officer to the Company and (iii) the Company’s profitability. None of these three factors is given more relative consideration than any other. The principal components of an Executive Officer’s compensation package in 2002 were (i) a base salary at a stated annual rate, together with certain other benefits as may be provided from time to time and (ii) discretionary cash bonuses. See “ – Bonus Program” below. In addition, stock option awards have been made in the past, and will continue to be made in the future, to the Company’s Executive Officers pursuant to the Company’s various stock option and stock incentive plans. In 2002, the Compensation Committee granted options to purchase an aggregate of 2,500 shares of Common Stock to key employees.

Employment Agreements

The Company and the Bank have entered into Employment Agreements with certain Executive Officers. The Compensation Committee believes that written employment agreements are necessary to attract and retain a quality management team and are consistent with the Company’s compensation philosophy. To strengthen the Company’s and Bank’s ability to retain quality management, numerous written employment agreements were entered into between the Bank and certain Executive Officers effective in June 2002. The principal terms of these employment agreements are described under “ – Executive Officer Employment Agreements” above.

11

Bonus Program

The Bank has historically awarded annual cash bonuses to Executive Officers based upon individual performance and financial performance of the Company and the Bank. Bonus awards to certain Executive Officers in 2002 are reflected in the “Summary Executive Compensation Table” above. Bonuses for the five Executive Officers listed in the Summary Executive Compensation Table are based on individual performance and financial performance of the Company. Specifically, under the Company’s current bonus program, the Company must earn a 13% return on equity for these Executive Officers to meet the minimum financial goals required for bonus eligibility. The Compensation Committee expects that such bonuses will continue to be awarded in the future.

2001 Stock Incentive Plan

The Board and the Compensation Committee strive to compensate key employees of the Company and the Bank in a manner that aligns closely the interests of such key employees with the interests of the Company’s shareholders. In furtherance of this goal, in 2001 the Board adopted the 2001 Stock Incentive Plan (“Incentive Plan”), which was approved by shareholders. At the Company’s 2002 Annual Meeting, shareholders approved an amendment to the Incentive Plan that increased the shares of Common Stock available for awards under the Incentive Plan to 200,000. The purpose of the Incentive Plan is to support the business goals of the Company and to attract, retain and motivate management officials of high caliber by providing incentives that will, through the award of options to acquire the Company’s Common Stock, associate more closely the interests of Executive Officers and key employees of the Company and the Bank with the interests of the Company’s shareholders. In 2002, the Compensation Committee did not grant any stock options to Executive Officers.

Limitation on Deductibility of Certain Compensation for Federal Income Tax Purposes

Section 162(m) of the Internal Revenue Code (“162(m)”) precludes the Company from taking a deduction for compensation in excess of $1 million for the Chief Executive Officer or certain of its other highest paid officers. Certain performance based compensation, however, is specifically exempt from the deduction limit. The Compensation Committee does not believe that 162(m) will impact the Company in 2003 because it is not anticipated that compensation in excess of $1 million will be paid to any employee of the Company.

• Alfred E. Abiouness

• Thomas W. Hunt

• Louis R. Jones

• A. Russell Kirk

• Elizabeth A. Twohy

THE PRECEDING “COMPENSATION COMMITTEE REPORT CONCERNING COMPENSATION OF CERTAIN EXECUTIVE OFFICERS”, THE AUDIT COMMITTEE REPORT APPEARING ELSEWHERE IN THIS PROXY STATEMENT AND THE STOCK PERFORMANCE GRAPH BELOW SHALL NOT BE DEEMED TO BE SOLICITING MATERIAL OR TO BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT OF 1933, AS AMENDED,

12

OR THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, OR INCORPORATED BY REFERENCE IN ANY DOCUMENTS SO FILED.

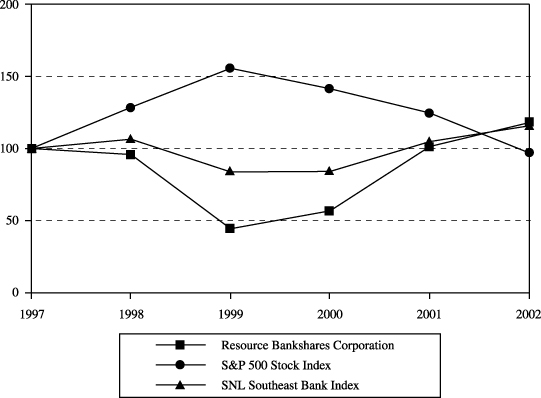

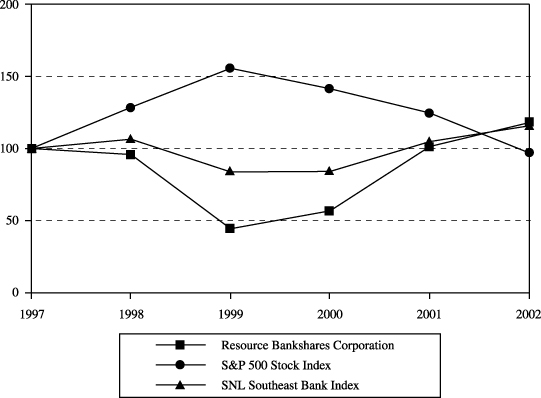

Company Stock Price Performance

The following graph shows a comparison of cumulative total shareholder returns for (i) the Company, (ii) the S & P 500 Stock Index, and (iii) the SNL Southeast Bank Index for the period beginning December 31, 1997 and ending December 31, 2002. The trading history of the Company’s Common Stock set forth below for periods prior to the implementation of the Plan of Reorganization reflects performance of the Bank’s Common Stock on NASDAQ. Effective July 23, 1998, the Company’s Common Stock began trading on the American Stock Exchange (“AMEX”) instead of the NASDAQ National Market System. The Company’s Common Stock again began trading on NASDAQ’s National Market System on December 15, 2000. The total shareholder return assumes $100 invested at the beginning of the period in the Company’s Common Stock, the S & P 500 Stock Index, and the SNL Southeast Bank Index, including reinvestment of dividends.

Comparison of Cumulative Total Return Among The Company,

S & P 500 Stock Index,

and SNL Southeast Bank Index

| | | December 31, 1997

| | Return December 1998

| | Return December 1999

| | Return December 2000

| | Return December 2001

| | Return December 2002

|

Resource Bankshares Corporation | | 100 | | 95.83 | | 44.40 | | 56.84 | | 101.37 | | 117.99 |

S & P 500 Stock Index | | 100 | | 128.55 | | 155.60 | | 141.42 | | 124.63 | | 96.95 |

SNL Southeast Bank Index | | 100 | | 106.46 | | 83.77 | | 84.12 | | 104.79 | | 115.76 |

13

Certain Relationships and Related Transactions

The directors and executive officers of the Company and the Bank, and their family members and certain business organizations and individuals associated with each of them, have been customers of the Bank, have had normal banking transactions, including loans, with the Bank, and are expected to continue to do so in the future. As of December 31, 2002, the Bank had aggregate direct and indirect loans to the directors and executive officers of the Company and the Bank totaling approximately $3.5 million, which represented approximately 11% of the Company’s shareholders’ equity as of that date. Each of these transactions was made in the ordinary course of business on substantially the same terms, including interest rates, collateral and repayment terms, as those prevailing at the time for comparable transactions with unrelated parties and did not involve more than the normal risk of collectibility or present other unfavorable features.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires directors, officers and persons who beneficially own more than 10% of a registered class of equity securities of the Company to file initial reports of ownership (Forms 3) and reports of changes in beneficial ownership (Forms 4 and 5) with the Securities and Exchange Commission (“SEC”) and Nasdaq. Such persons are also required under the rules and regulations promulgated by the SEC to furnish the Company with copies of all Section 16(a) forms they file. Based solely on a review of the copies of such forms furnished to the Company, the Company believes that all reporting requirements under Section 16(a) for 2002 were met in a timely manner by its directors, officers and greater than 10% beneficial owners, except that Elizabeth Twohy filed a Form 4 in February 2003 with respect to 2,500 shares of Company Common Stock purchased in 1998 by Capital Concrete. Ms. Twohy is the President of, and a significant equity holder in, Capital Concrete.

PROPOSAL 2.

AMENDMENT TO ARTICLES OF INCORPORATION

INCREASE IN AUTHORIZED COMMON SHARES

The Company’s Board of Directors has unanimously approved and recommended that the shareholders of the Company approve an amendment to the Company’s Articles of Incorporation (“Articles”) to increase the number of authorized shares of Common Stock the Company may issue from 6,666,666 to 15 million. A copy of this proposed amendment to the Articles is attached to this Proxy Statement as part ofExhibit A.

Purpose and Effect of Amendment.

As of the Record Date, 3,979,167 shares of Common Stock were outstanding and an additional 519,647 shares were subject to outstanding stock options. As a result, currently there are only 2,167,852 authorized shares of Common Stock available for future issuance under the Articles.

The Board believes that by increasing the number of shares of Common Stock the Company is authorized to issue, the Company will have the flexibility to raise equity through the

14

sale of additional shares if the need should arise. In addition, the Company will have the flexibility to issue additional shares in connection with possible dividend reinvestment plans, stock-based compensation plans, future acquisitions or other corporate purposes. The Company will also be able to pay stock dividends or declare a stock split if and when the Board determines that it is advisable to do so.

If the proposed amendment to the Articles is approved, the Board will be able to issue authorized but unissued shares of Common Stock from time to time without further approval of the Company’s shareholders, unless shareholder approval is required by law or by the rules of Nasdaq.

At present, the Board does not have any plans, agreements, contracts, arrangements or understandings with respect to the issuance of any additional shares of Common Stock, specifically including future issuances to raise equity or issuances in connection with any new dividend reinvestment plans, additional stock-based compensation plans, future acquisitions, stock dividends or stock splits. The Company may issue additional authorized Common Stock if the issuance is permitted or required under any existing dividend reinvestment, stock based benefit or similar plans.

The authorization of additional shares of Common Stock will have no immediate effect on the rights of existing shareholders. However, because shareholders do not have preemptive or other subscription rights with respect to the Company’s Common Stock, the future issuance of Common Stock, other than on a pro rata basis to all shareholders, would reduce each shareholder’s proportionate equity interest in the Company.

The additional shares of Common Stock provided for in the proposed amendment to the Articles could have an anti-takeover effect. For example, if additional shares are issued in the future, it could make it more difficult or expensive for someone seeking control of the Company by diluting that party’s voting power. The Board is not presenting this proposal as an anti-takeover provision, however, and the Board is not aware of any effort or planned effort to obtain control of the Company.

Vote Required to Approve Amendment.

As allowed under Virginia law, the Company’s Articles provide that any amendment to the Articles must be approved by a majority of the votes entitled to be cast on the amendment. As a result, the affirmative vote of a majority of the outstanding shares of Common Stock is required to approve the proposed amendment to the Articles.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR APPROVAL OF THE PROPOSED AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION DESCRIBED ABOVE IN PROPOSAL 2.

15

PROPOSAL 3.

AMENDMENT TO ARTICLES OF INCORPORATION

CLARIFICATION OF INDEMNIFICATION OBLIGATIONS

In addition to the proposed amendment to the Articles described in Proposal 2 above, the Board has unanimously approved and recommended that the shareholders of the Company approve an amendment to the Company’s Articles to clarify that the Company’s obligation to indemnify its directors and officers is subject to limitations imposed by federal banking law and regulations. A copy of this proposed amendment to the Articles is attached to this Proxy Statement as part ofExhibit A.

Purpose and Effect of Amendment.

The Company’s Articles currently provide that the Company will indemnify any director or officer who is or was a party to any proceeding by reason of the fact that he or she is or was such a director or officer or is or was serving at the request of the Company as a director, officer, employee or agent of another entity or enterprise.

In July 2002, the Board of Governors of the Federal Reserve (“Federal Reserve”) issued written guidance regarding indemnification obligations of bank holding companies and state member banks. In this written guidance, the Federal Reserve noted that bank holding companies and Federal Reserve member banks are prohibited under federal banking law from paying or reimbursing directors, officers or other designated affiliated persons for any liability or legal expense in any administrative proceeding brought by a federal banking agency that results in a final order or settlement in which such person is assessed a civil money penalty, is removed or prohibited from banking or is required to cease an action or take any affirmative action, including making restitution, with respect to the bank or bank holding company.

The Federal Reserve, through its written guidance, has encouraged bank holding companies and Federal Reserve member banks to review and revise, as appropriate, broadly worded indemnification provisions that may be inconsistent with federal banking law limitations on indemnification payments. While the Board believes that the Company’s current Articles contain qualifying language that would preclude the Company from making indemnification payments in violation of any applicable law, including federal banking law, the Board believes it is in the Company’s best interests to clarify the indemnification provisions in the Articles in the context of the Federal Reserve’s specific recommendations and guidance.

Vote Required to Approve Amendment.

As allowed under Virginia law, the Company’s Articles provide that any amendment to the Articles must be approved by a majority of the votes entitled to be cast on the amendment. As a result, the affirmative vote of a majority of the outstanding shares of Common Stock is required to approve the proposed amendment to the Articles.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR APPROVAL OF THE PROPOSED AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION DESCRIBED ABOVE IN PROPOSAL 3.

16

PROPOSAL 4. RATIFICATION OF APPOINTMENT OF AUDITORS

The Company’s Audit Committee has selected and approved Goodman & Company, L.L.P. (“Goodman & Company”) as the firm of independent certified public accountants to audit the financial statements of the Company for the fiscal year ending December 31, 2003, and the Audit Committee desires that such appointment be ratified by the Company’s shareholders. Goodman & Company audited the Company’s financial statements for the fiscal years ended December 31, 1998 through December 31, 2002, and audited the Bank’s financial statements from 1992 through 1997. A representative of Goodman & Company will be present at the Annual Meeting, will have the opportunity to make a statement if he or she desires, and will be available to respond to appropriate questions.

Audit Fees. Goodman & Company billed the Company an aggregate of $50,410 for the audit of the Company’s consolidated financial statements for 2002 and reviews of the financial statements included in the Company’s Forms 10-Q for 2002.

All Other Fees. Goodman & Company billed the Company an aggregate of $68,571 during 2002 for services not related to the financial statements referenced above. These fees consisted of fees for assisting the Company with the preparation of tax returns, an audit of the Company’s 401(k) plan and miscellaneous consulting services. The Audit Committee has considered and determined that the non-audit related services provided by Goodman & Company are compatible with maintaining the independence of Goodman & Company as the Company’s principal accountants.

OTHER MATTERS

The Board of Directors does not know of any matters that will be presented for action at the Annual Meeting other than those described above or matters incident to the conduct of the Annual Meeting. If, however, any other matters not presently known to management should come before the Annual Meeting, it is intended that the shares represented by the Proxy will be voted on such matters in accordance with the discretion of the holders of such Proxy.

SUBMISSION OF PROPOSALS AND OTHER MATTERS RELATED TO 2004 ANNUAL MEETING

The next Annual Meeting will be held on or about May 27, 2004. Any shareholder who wishes to submit a proposal for consideration at that meeting, and who wishes to have such proposal included in the Company’s proxy statement, must comply with SEC Rule 14a-8 and must submit the proposal in writing no later than December 20, 2003. The deadline for shareholders to notify the Company of non-Rule 14a-8 matters that may be raised for consideration at the next Annual Meeting is March 4, 2004. All such proposals and notifications should be sent to Lawrence N. Smith, Chief Executive Officer, at 3720 Virginia Beach Boulevard, Virginia Beach, Virginia 23452.

Under the terms of the Company’s bylaws, March 4, 2004 is also the deadline for shareholders to notify the Company of an intention to nominate candidates for directors at the next Annual Meeting. Such nominations must comply with the notice provisions included in the Company’s bylaws. These notice provisions require that nominations by shareholders of director candidates set forth the following information: (1) as to each individual nominated (i) the name,

17

date of birth, business address and residence address of such individual, (ii) the business experience during the past five years of such nominee, (iii) whether the nominee is or has ever been at any time a director, officer or owner of 5% or more of any class of capital stock or other equity interest of any corporation or other entity, (iv) any directorships held by such nominee in any company with a class of securities registered under the Securities Exchange Act of 1934, (v) whether in the last five years such nominee has been convicted in a criminal proceeding or been subject to certain other legal proceedings, including bankruptcies, and (vi) such other information regarding the nominee as would be required to be included in a proxy statement filed pursuant to the Exchange Act had the nominee been nominated by the Board of Directors; and (2) as to the person submitting the nomination notice and any person acting in concert with such person, (i) the name and business address of such person, (ii) the name and address of such person as they appear on the Company’s books, (iii) the class and number of shares of the Company that are beneficially owned by such person, (iv) a representation that the shareholder (A) is a holder of record of Common Stock of the Company entitled to vote at the meeting at which directors will be elected and (B) intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice and (v) a description of all arrangements or understandings between the shareholder and each nominee and any other person or persons pursuant to which the nomination or nominations are to be made by the shareholder. Generally, nominations are required to be delivered to the Company not later than 45 days before the date on which the Company first mailed its proxy materials for the prior year’s annual meeting of shareholders.

GENERAL

The Company’s 2002 Annual Report to Shareholders accompanies this Proxy Statement. The 2002 Annual Report to Shareholders does not form any part of the material for the solicitation of proxies. Upon written request, the Company will provide shareholders with a copy of its Annual Report on Form 10-K for the year ended December 31, 2002 (the “Form 10-K”), as filed with the SEC, without charge. Please direct written requests for a copy of the Form 10-K to: Lu Ann Klevecz, Vice President-Corporate Communications, Resource Bank, 3720 Virginia Beach Boulevard, Virginia Beach, Virginia 23452.

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY PROMPTLY

By Order of the Board of Directors

April 18, 2003

18

EXHIBIT A

Copy of Proposed Amendments to Articles of Incorporation

ARTICLE III

CAPITAL STOCK

(Article III(a) would be amended to read as follows)

(a) The Corporation shall have the authority to issue 15,000,000 shares of Common Stock, par value $1.50 per share, and 500,000 shares of Preferred Stock, par value $10.00 per share.

ARTICLE V

LIMIT ON LIABILITY AND INDEMNIFICATION

(Language to be added to Article V(b) appears in bold, underline and italics)

(a) To the full extent that the VSCA, as it exists on the date hereof or may hereafter be amended, permits the limitation or elimination of the liability of directors or officers, a director or officer of the Corporation shall not be liable to the Corporation or its shareholders for monetary damages.

(b) To the full extent permitted and in the manner prescribed by the VSCA and any other applicable law, the Corporation shall indemnify a director or officer of the Corporation who is or was a party to any proceeding by reason of the fact that he is or was such a director or officer or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust, employee benefit plan or other enterprise;provided, however, that in no event shall the Corporation have any indemnification obligations under this Article 5(b) to the extent an indemnification payment would violate applicable federal banking law and regulations.

(c) Reference herein to directors, officers, employees or agents shall include former directors, officers, employees and agents and their respective heirs, executors and administrators.

RESOURCE BANKSHARES CORPORATION

Proxy Solicited on Behalf of the

Board of Directors for

Annual Meeting of Shareholders

to be Held May 22, 2003

The undersigned, having received the Annual Report to Shareholders and the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement dated April 18, 2003, hereby appoints Lawrence N. Smith and T. A. Grell, Jr. (each with power to act alone) as proxies, with full power of substitution, and hereby authorizes them to represent and vote, as directed below, all the shares of the Common Stock of Resource Bankshares Corporation held of record by the undersigned on April 1, 2003, at the Annual Meeting of Shareholders to be held on May 22, 2003 and any adjournment thereof.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSALS 1, 2, 3, AND 4

To elect the following Class C directors to hold office for a term of three years.

T. A. Grell, Jr. Thomas W. Hunt Lawrence N. Smith

¨ | | FOR all nominees listed | | ¨ | | | WITHHOLD AUTHORITY |

| | | (except as indicated below to the contrary) | | | | | to vote for all nominees listed |

(INSTRUCTIONS: To withhold authority to vote for any individual nominee write the nominee’s name on the line provided below.)

| | | | | FOR | | AGAINST | | ABSTAIN |

2. | | Amendment to Company’s Articles of Incorporation to increase the number of authorized shares of common stock the Company may issue to 15 million. | | ¨ | | ¨ | | ¨ |

|

3. | | Amendment to Company’s Articles of Incorporation to clarify that the Company’s obligation to indemnify its directors and officers is subject to limitations imposed by federal banking law and regulation. | | FOR ¨ | | AGAINST ¨ | | ABSTAIN ¨ |

4.. | | TO RATIFY the appointment by the Audit Committee of the Board of Directors of Goodman & Company, L.L.P. as the Company’s independent auditors for the year ending December 31, 2003. | | FOR ¨ | | AGAINST ¨ | | ABSTAIN ¨ |

|

5.

| | IN THEIR DISCRETION, on such other matters as may properly come before the meeting, or, if any nominee listed in Proposal 1 above is unable to serve for any reason, to vote or refrain from voting for a substitute nominee or nominees. This proxy is revocable at any time prior to its exercise. This proxy, when properly executed, will be voted as directed.Where no direction is given, this proxy will be voted for Proposals 1, 2, 3, and 4. |

Please sign your name(s) exactly as they appear hereon. If signer is a corporation, please sign the full corporate name by duly authorized officer. If an attorney, guardian, administrator, executor, or trustee, please give full title as such. If a limited liability company or partnership, sign in limited liability company or partnership name by authorized person. Date: , 2003 |

|

|

|

|

PLEASE COMPLETE, DATE, SIGN AND RETURN THIS PROXY PROMPTLY IN THE ACCOMPANYING ENVELOPE. |