As filed with the Securities and Exchange Commission on January 21, 2003

Registration No. 333-101688

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Pre-Effective Amendment No. 2

to

FORM S-1

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

Resource Bankshares Corporation

(Exact name of registrant as specified in its charter)

Virginia | | 6712 | | 54-1904386 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (IRS Employer Identification No.) |

3720 Virginia Beach Blvd.

Virginia Beach, Virginia 23452

(757) 463-2265

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Lawrence N. Smith, Chief Executive Officer

Resource Bankshares Corporation

3720 Virginia Beach Blvd.

Virginia Beach, Virginia 23452

(757) 463-2265

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

Copies to:

T. Richard Litton, Jr., Esq. Jeffrey A. D. Cohen, Esq. Kaufman & Canoles, P.C. 150 West Main Street Suite 2100 Norfolk, Virginia 23510 (757) 624-3000 | | Scott H. Richter, Esq. Christopher J. Lange, Esq. LeClair Ryan, A Professional Corporation 707 East Main Street 11th Floor Richmond, Virginia 23219 (804) 783-2003 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box.¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box.¨

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY , 2003

700,000 Shares

RESOURCE BANKSHARES CORPORATION

Common Stock

We are selling 700,000 shares of our common stock.

Our common stock is quoted on the Nasdaq National Market under the symbol “RBKV.” The last reported sale price of our common stock on January 17, 2003 was $20.62 per share.

Investing in our common stock involves risks. See “Risk Factors” on page 7 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The shares of common stock we are offering are not deposit accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

| | | Per Share

| | Total

|

Public offering price | | $ | | | $ | |

| Underwriting discount | | $ | | | $ | |

| Proceeds, before expenses, to Resource Bankshares | | $ | | | $ | |

This is a firm commitment underwriting. The underwriters may also purchase up to 105,000 additional shares from us at the public offering price, less the underwriting discount, to cover over-allotments.

The underwriters expect to deliver the shares to purchasers on , 2003.

Joint Lead Managers

BB&T Capital Markets | | | | |

| A Division of Scott & Stringfellow, Inc. | | | | |

| | | TRIDENT SECURITIES | | |

A Division of McDonald Investments Inc. |

This prospectus is dated , 2003.

This summary highlights information about our company and the offering. This summary does not contain all the information that you should consider before investing in our common stock. You should read the entire prospectus carefully.

Resource Bankshares Corporation

Resource Bankshares Corporation is a bank holding company headquartered in Virginia Beach, Virginia. Our wholly owned subsidiary, Resource Bank, began operating as a Virginia commercial bank in September 1988. We provide our financial services primarily to customers located in the three largest metropolitan areas in Virginia—Greater Hampton Roads, northern Virginia and Greater Richmond. In recent years, these areas have seen significant population growth and each has developed an energetic business climate, which has in turn promoted further growth. We continue to capitalize on these growth markets by obtaining, building and enhancing relationships with customers that require sophisticated financial services, but that also value personal relationship banking.

As of September 30, 2002, we had assets of $647.4 million, deposits of $464.7 million and stockholders’ equity of $30.7 million. We reported net income of $4.3 million, or $1.40 per share, for the first nine months of 2002. Our assets increased by 22.5% and our net income increased by 33.8%, compared to the same nine-month period in 2001. Loans outstanding as of September 30, 2002 amounted to $421.2 million, an increase of 28.7% from September 30, 2001.

Banking Operations

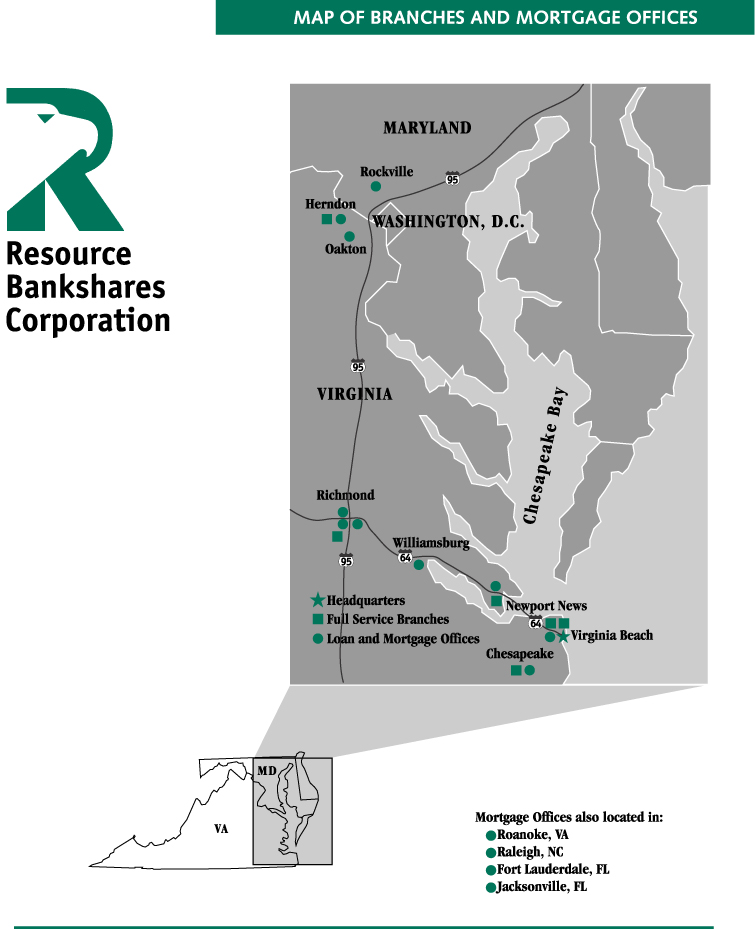

Resource Bank has six full service banking offices—two in Virginia Beach, Virginia, and one each in Chesapeake, Newport News, Richmond and Herndon, Virginia. Resource Bank markets its products to individuals, small to medium sized businesses and professionals by emphasizing personalized service, local decision making and rapid responsiveness. The bank’s financial products include checking and savings accounts, certificates of deposit and charge cards, as well as services typically associated with larger banks, such as sweep account capacity, automatic reconciliation and corporate credit cards. Additionally, we offer online banking services, providing customers with the ability to conduct banking business 24 hours per day through our Internet site, www.ResourceBankOnline.com. The bank’s commercial lending group generates most of our loans and consists of 22 senior lenders with an average of 24 years of banking experience. During the nine months ended September 30, 2002, our bank related operations generated 74.4% of our total income before income taxes.

Resource Mortgage, the bank’s mortgage division, originates mortgage loans and sells them to investors in the national secondary market. Resource Mortgage originates both conforming and non-conforming single-family loans on a national basis. During 2001, we originated and sold mortgage loans totaling over $797.7 million. In the first nine months of 2002, we originated and sold mortgage loans totaling over $635.3 million. During the nine months ended September 30, 2002, the bank’s mortgage division generated 25.6% of our total income before income taxes.

Management Team

Our senior management team consists of six officers that average over 30 years of experience in the banking industry. These officers received much of their industry training in major regional financial institutions. This experience includes managing loan portfolios much larger than Resource Bank’s current loan portfolio and also includes direct involvement in developing asset and liability management policies, customer information systems, cost allocation of technology systems, operational systems and managing major retail systems for large regional banks.

The chart below evidences the experience of our senior management team.

Name

| | Position

| | Years Experience in Banking Industry

|

| Lawrence N. Smith | | Chief Executive Officer | | 38 |

| T. A. Grell, Jr. | | President | | 31 |

| Harvard R. Birdsong, II | | EVP-Chief Credit Officer | | 31 |

| Debra C. Dyckman | | EVP-Retail Banking | | 34 |

| James M. Miller | | EVP-Operations/Finance | | 22 |

| Eleanor J. Whitehurst | | Chief Financial Officer | | 31 |

Our Strategy

Implementing our strategic plan has allowed us to experience steady growth while improving profitability. Our strategic plan has five primary components:

| | • | | Hire experienced lending officers. Resource Bank has hired a group of talented and experienced senior lending officers from major regional banks. These officers have been able to attract customers with which they have built relationships over the years, typically allowing the officers to enhance our loan production immediately. Resource Bank currently has 22 senior lending officers with an average age of 48 and an average of 24 years of experience in the financial services industry. These senior lending officers, together with our executive management team, have broad experience during a variety of economic cycles in asset and liability management, loan production and credit administration—key strengths in building and growing our company. |

| | • | | Grow and expand our loan portfolio in Virginia’s largest metropolitan markets. We have grown our loan portfolio by expanding in our current metropolitan markets and by penetrating new geographic markets. When seeking to enter new markets, our strategy is to identify a market with growth potential, hire a small group of lenders with experience in the market, and then allow those lenders to operate a loan production office and generate a profitable portfolio of loans. Once a loan production office is sufficiently profitable, the bank has the ability, on a cost effective basis, to convert the office into a full service branch that offers deposit and related products. Since 2000, the bank has implemented this strategy in Chesapeake, Newport News and Richmond, Virginia. In addition to growing our asset base in this manner, we intend to pursue “de novo” branch openings and selective branch and financial institution acquisitions when attractive opportunities arise. |

| | • | | Fund asset growth with the lowest cost sources possible. Our liability funding strategy is to generate the lowest cost deposits possible through various sources, while also diversifying our sources of funds and liquidity risks. Our bank funds its asset growth with a combination of local deposits, Internet deposits, national market deposits, federal fund borrowings and Federal Home Loan Bank, or FHLB borrowings. The bank’s asset and liability committee surveys our three major markets on a weekly basis, sets interest rates on deposits and makes funding decisions based on current market rates and maturities needed to fund new asset growth. This committee provides specific guidance on the mix of |

2

liabilities necessary to match fund our forecasted net growth in loans for the next thirty days. Our target liability mix is 40% in local and Internet deposits, 40% in national deposits and 20% in borrowings. The bank has a liability funding desk that reviews all segments of these markets on a daily basis. The bank also enters into interest rate swaps to fund loans that reprice on movements of the prime rate. By using interest rate swaps, the bank is able to maintain stable interest rate margins in both rising and falling interest rate environments.

| | • | | Maximize efficiencies in asset and liability management. Relying on the extensive industry experience of our senior management, we use sophisticated financial models to forecast future net interest income and financial margins. These models include detailed asset and liability maturities by month, current rollover yields/costs and volume forecasts, and also consider the current interest rate and economic environment, including any recent interest rate changes by the Board of Governors of the Federal Reserve System. The bank’s asset liability management committee also reviews the interest rate and volume analysis of each major asset and liability category and its impact on profitability, and maintains an interest rate analysis report that match funds each asset and liability group by maturity. Our financial models, which are reviewed by our board of directors each month, allow us to be proactive in our budget forecasts and maximize profitability in changing economic conditions. |

| | • | | Generate significant non-interest income. In addition to increasing our overall profitability, our mortgage operations are an integral part of the bank’s ability to meet customer needs—from the purchase of a building lot to a construction loan to build a home, to the ultimate placement of the permanent residential mortgage loan in the national market. We have expanded our mortgage operations and increased our non-interest income by hiring experienced mortgage loan officers and by making strategic acquisitions. We are also pursuing other strategic initiatives to generate non-interest income from ancillary sources, including insurance and asset management products, that we believe can be cross-sold effectively to our existing and expanding customer base. |

We believe that the net proceeds raised in this offering will allow us to further implement our strategy by providing the equity capital necessary to support future loan production and asset growth, branch expansion in new and existing markets, and potential acquisitions to expand our retail branch network.

3

The Offering

| Common stock offered by Resource Bankshares | 700,000 shares. |

| Common stock outstanding after the offering | 3,761,961 shares. |

| Use of proceeds | We will use the net proceeds to increase Resource Bank’s equity capital and for general corporate purposes, including the future growth and expansion of Resource Bank. See “Use of Proceeds” on page 13. |

| Dividends | We have declared quarterly cash dividends for each of the last 20 fiscal quarters. These dividends have increased from $0.06 to $0.14 per share. See “Market For Common Stock” on page 14. |

| Nasdaq National Market symbol | RBKV |

| Risk factors | You should read the “Risk Factors” section beginning on page 7 before deciding to purchase any of our shares. |

The number of shares of our common stock outstanding after this offering is based on the number of shares outstanding on September 30, 2002, and excludes 531,147 shares of common stock issuable upon exercise of stock options outstanding under our stock option plans on September 30, 2002, of which 233,497 were exercisable.

Except as otherwise indicated, all information in this prospectus assumes no exercise of the underwriters’ over-allotment option.

We were founded as a Virginia corporation in 1998 for the sole purpose of becoming a holding company for Resource Bank. Resource Bank, our wholly owned subsidiary, began operating as a Virginia commercial bank in September 1988. Our principal executive offices are located at 3720 Virginia Beach Blvd., Virginia Beach, Virginia 23452. Our telephone number is (757) 463-2265.

Except as otherwise indicated or required by the context, references in this prospectus to we, our, us, or Resource Bankshares refer to Resource Bankshares Corporation and its subsidiaries collectively. Financial information in this prospectus for periods before the date Resource Bankshares became a holding company for Resource Bank reflects the results of operations of Resource Bank.

4

Summary Consolidated Financial Information

The following table sets forth summary consolidated financial information for Resource Bankshares Corporation. The financial information for the five years ended December 31, 2001 are derived from our consolidated financial statements. The financial information for the nine-month periods ended September 30, 2002 and 2001 are derived from our unaudited consolidated financial statements. Operating results for the nine months ended September 30, 2002 are not necessarily indicative of the results that may be expected for the year ending December 31, 2002. You should read the following summary consolidated financial information with our financial statements and accompanying notes that are included elsewhere in the prospectus and the information contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 16.

| | | Nine Months Ended September 30,

| | | Years Ended December 31,

| |

| | | 2002

| | | 2001

| | | 2001

| | | 2000

| | | 1999

| | | 1998

| | | 1997

| |

| | | (unaudited) | | | | |

| | | (Dollars in thousands, except per share data) | |

Income Statement Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest income | | $ | 11,529 | | | $ | 7,730 | | | $ | 11,033 | | | $ | 9,437 | | | $ | 8,946 | | | $ | 8,410 | | | $ | 4,954 | |

| Provision for loan losses | | | 975 | | | | 45 | | | | 195 | | | | 1,100 | | | | 4,667 | | | | 150 | | | | 155 | |

| Non-interest income | | | 17,043 | | | | 13,897 | | | | 20,144 | | | | 11,890 | | | | 6,811 | | | | 7,943 | | | | 4,520 | |

| Non-interest expense | | | 21,439 | | | | 16,997 | | | | 24,521 | | | | 14,109 | | | | 12,168 | | | | 11,565 | | | | 6,533 | |

| Income taxes (benefit) | | | 1,817 | | | | 1,341 | | | | 1,918 | | | | 1,886 | | | | (387 | ) | | | 1,591 | | | | 965 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net income (loss) | | $ | 4,341 | | | $ | 3,244 | | | $ | 4,543 | | | $ | 4,233 | | | $ | (691 | )(1) | | $ | 3,047 | | | $ | 1,821 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Per Share Data(2): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income (loss)(3): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 1.40 | | | $ | 1.15 | | | $ | 1.57 | | | $ | 1.63 | | | $ | (0.27 | )(1) | | $ | 1.24 | | | $ | 0.92 | |

| Diluted | | | 1.32 | | | | 1.08 | | | | 1.49 | | | | 1.56 | | | | (0.27 | ) | | | 1.13 | | | | 0.83 | |

| Book value at period end | | | 10.04 | | | | 9.12 | | | | 9.27 | | | | 7.50 | | | | 6.25 | | | | 7.18 | | | | 6.36 | |

| Tangible book value at period end | | | 9.78 | | | | 8.90 | | | | 9.03 | | | | 7.47 | | | | 6.25 | | | | 7.18 | | | | 6.36 | |

| Cash dividends declared | | | 0.42 | | | | 0.36 | | | | 0.48 | | | | 0.42 | | | | 0.40 | | | | 0.24 | | | | 0.12 | |

| Dividend payout ratio | | | 31.82 | % | | | 33.33 | % | | | 32.21 | % | | | 26.92 | % | | | (148.15 | %) | | | 21.24 | % | | | 14.46 | % |

|

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 647,361 | | | $ | 528,247 | | | $ | 564,850 | | | $ | 404,494 | | | $ | 306,690 | | | $ | 233,460 | | | $ | 209,330 | |

| Total loans (net of unearned income) | | | 421,246 | | | | 327,261 | | | | 344,936 | | | | 288,513 | | | | 255,671 | | | | 188,522 | | | | 150,590 | |

| Total deposits | | | 464,725 | | | | 496,302 | | | | 411,504 | | | | 330,645 | | | | 260,469 | | | | 206,219 | | | | 169,508 | |

| Stockholders’ equity | | | 30,736 | | | | 28,710 | | | | 28,779 | | | | 19,672 | | | | 15,870 | | | | 17,789 | | | | 15,602 | |

|

Performance Ratios(4): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Return (loss) on average assets | | | 0.97 | % | | | 0.95 | % | | | 0.95 | % | | | 1.21 | % | | | (0.25 | )% | | | 1.27 | % | | | 1.40 | % |

| Return (loss) on average stockholders’ equity | | | 19.93 | | | | 18.91 | | | | 18.73 | | | | 24.13 | | | | (3.90 | ) | | | 18.19 | | | | 18.59 | |

| Net interest margin(5) | | | 2.79 | | | | 2.47 | | | | 2.52 | | | | 2.92 | | | | 3.42 | | | | 3.62 | | | | 3.90 | |

|

Asset Quality Ratios: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Allowance to period-end loans | | | 1.08 | % | | | 1.13 | % | | | 1.07 | % | | | 1.22 | % | | | 1.04 | % | | | 1.33 | % | | | 1.71 | % |

| Allowance to nonperforming loans | | | 545.13 | | | | 109.32 | | | | 227.93 | | | | 263.75 | | | | 361.51 | | | | 264.55 | | | | 58.50 | |

| Nonperforming assets to total assets | | | 0.14 | | | | 0.65 | | | | 0.29 | | | | 0.33 | | | | 0.25 | | | | 0.68 | | | | 2.43 | |

| Net charge-offs (recoveries) to average loans(4) | | | 0.04 | | | | (0.04 | ) | | | 0.01 | | | | 0.10 | | | | 2.06 | | | | 0.13 | | | | 0.02 | |

|

Capital Ratios: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tier 1 risk-based capital | | | 8.88 | % | | | 10.06 | % | | | 9.49 | % | | | 8.74 | % | | | 8.20 | % | | | 9.23 | % | | | 9.69 | % |

| Total risk-based capital | | | 10.62 | | | | 11.07 | | | | 10.44 | | | | 10.75 | | | | 9.24 | | | | 10.48 | | | | 10.93 | |

| Leverage capital ratio | | | 6.38 | | | | 7.46 | | | | 6.88 | | | | 6.69 | | | | 7.19 | | | | 7.52 | | | | 9.67 | |

| Total equity to total assets | | | 4.75 | | | | 5.43 | | | | 5.09 | | | | 4.86 | | | | 5.17 | | | | 7.62 | | | | 7.45 | |

| (1) | | Our loss in 1999 was attributable to a $4.7 million provision for loan losses in the third quarter that occurred as a result of credit problems with a significant borrower in our now discontinued asset based lending portfolio. |

| (2) | | All per share figures have been adjusted to reflect a two-for-one stock split on July 1, 1998. |

| (3) | | Net income per share is computed using the basic and diluted weighted average outstanding shares. |

| (4) | | Ratios for the nine months ended September 30, 2002 and 2001 have been annualized. |

| (5) | | Net interest margin is calculated as tax-equivalent net interest income divided by average earning assets and represents our net yield on earning assets. |

5

Recent Developments

For the year ended December 31, 2002, our net income was $6.3 million, a 39.3% increase over the $4.5 million reported in 2001. Diluted earnings per share for this period increased 29.5% to $1.93 in 2002, from $1.49 for the same period in 2001. The primary factor contributing to the increase in our net income was our net interest income, which grew 48.4% from $11.0 million for the year ended 2001 to $16.3 million for the year ended 2002. Net interest income growth occurred as the result of increases in average earning assets, from $454.8 million at year end 2001 to $584.4 million at year end 2002, up 28.5%, and also from a 0.35% improvement in our net interest margin which increased from 2.52% in 2001 to 2.87% in 2002. Our returns on average equity and assets improved to 21.5% and 1.0% from 18.7% and 0.9% for the years ended December 31, 2002 and 2001, respectively.

As of December 31, 2002, our net loans totaled $427.7 million, up 25.3% compared to $341.2 million at the end of 2001. Our ratio of nonperforming assets to total assets declined to 0.11% at December 31, 2002, versus 0.29% at December 31, 2001. Mortgage banking net income increased from $2.4 million in 2001 to $2.7 million in 2002, up 12.5%, as mortgage loans originated grew 17.8%, from $797.7 million in 2001 to $940.0 million in 2002.

The following table sets forth selected consolidated financial data for the years ended December 31, 2002 and 2001. The financial data for the year ended December 31, 2002 is unaudited.

| | | Year Ended December 31,

| |

| | | 2002

| | | 2001

| |

| | | (Unaudited) | | | (Audited) | |

| | | (Dollars in thousands, except per share data) | |

Income Statement Data: | | | | | | | | |

| Net interest income | | $ | 16,373 | | | $ | 11,033 | |

| Provision for loan losses | | | 1,550 | | | | 195 | |

| Non-interest income | | | 24,176 | | | | 20,144 | |

| Non-interest expense | | | 30,312 | | | | 24,521 | |

| Income taxes | | | 2,358 | | | | 1,918 | |

| Net income | | | 6,329 | | | | 4,543 | |

|

Per Share Data: | | | | | | | | |

| Net income (1): | | | | | | | | |

| Basic | | $ | 2.05 | | | $ | 1.57 | |

| Diluted | | | 1.93 | | | | 1.49 | |

| Book value at period end | | | 10.63 | | | | 9.27 | |

| Tangible book value at period end | | | 10.36 | | | | 9.03 | |

| Cash dividends declared | | | 0.56 | | | | 0.48 | |

| Dividend payout ratio | | | 29.02 | % | | | 32.21 | % |

|

Balance Sheet Data: | | | | | | | | |

| Total assets | | $ | 715,167 | | | $ | 564,850 | |

| Net loans | | | 427,735 | | | | 341,239 | |

| Deposits | | | 516,449 | | | | 411,504 | |

| Stockholders’ equity | | | 32,167 | | | | 28,779 | |

|

Performance Ratios: | | | | | | | | |

| Return on average assets | | | 1.00 | % | | | 0.92 | % |

| Return on average stockholders’ equity | | | 21.55 | | | | 18.73 | |

| Net interest margin (2) | | | 2.87 | | | | 2.52 | |

|

Asset Quality Ratios: | | | | | | | | |

| Allowance to period-end loans | | | 1.16 | % | | | 1.07 | % |

| Allowance to nonperforming loans | | | 619.93 | | | | 227.93 | |

| Nonperforming assets to total assets | | | 0.11 | | | | 0.29 | |

| Net charge-offs to average loans | | | 0.06 | | | | 0.01 | |

|

Capital Ratios: | | | | | | | | |

| Tier 1 risk-based capital | | | 8.36 | % | | | 9.49 | % |

| Total risk-based capital | | | 10.64 | | | | 10.44 | |

| Leverage capital ratio | | | 6.63 | | | | 6.88 | |

| Total equity to total assets | | | 4.50 | | | | 5.09 | |

| (1) | | Net income per share is computed using the basic and diluted weighted average outstanding shares. |

| (2) | | Net interest margin is calculated as tax-equivalent net interest income divided by average earning assets and represents our net yield on earning assets. |

6

An investment in our common stock involves risk. You should carefully read and consider the risks described below together with all of the other information included in this prospectus, before you decide to purchase our common stock.

As we continue to grow our loan portfolio, we may experience additional loan defaults which may adversely affect our financial condition and results of operations.

Our loans outstanding have grown from $288.5 million at December 31, 2000 to $421.2 million at September 30, 2002, an increase of 45.9%. As we continue to increase the number and size of our outstanding loans, we may experience a corresponding increase in loan defaults. The risk of loan defaults is unavoidable in the banking industry, and we try to limit exposure to this risk by monitoring carefully the amount of loans in specific industries and by exercising prudent lending practices. However, we cannot eliminate the risk, and substantial credit losses could result in reduced earnings or losses.

We maintain an allowance for loan losses that we believe is appropriate to provide for any potential losses in our loan portfolio. The amount of this allowance is determined by management through a periodic review and consideration of several factors, including:

| | • | | an ongoing review of the quality, size and diversity of our loan portfolio; |

| | • | | evaluation of nonperforming loans; |

| | • | | historical loan loss experience; and |

| | • | | the amount and quality of collateral, including guarantees, securing the loans. |

Our allowance for loan losses was $4.5 million at September 30, 2002. Although we believe this loan loss allowance is adequate to absorb probable losses in our loan portfolio, we cannot predict such losses or that our allowance will be adequate. Our ability to predict the probable losses in our loan portfolio is made even more difficult by the fact that nearly half of our outstanding loans were originated after December 2000 and are, consequently, unseasoned. Excess loan losses could have a material adverse effect on our financial condition and results of operations.

We have been sued in a class action lawsuit under the Telephone Consumer Protection Act, and it is possible that we will suffer material losses as a result of this lawsuit.

Resource Mortgage, a division of Resource Bank, historically has used facsimiles to disseminate product and interest rate information to mortgage brokers on a national basis. The facsimile form of business communication is consistent with traditional industry practice. In March 2002, Resource Bankshares and Resource Bank were sued in Indiana state court in a class action lawsuit under the Telephone Consumer Protection Act, or TCPA. The lawsuit alleges that Resource Bank violated the TCPA by sending unsolicited fax advertisements without obtaining prior express invitation or permission to send the faxes. Resource Bankshares has been dismissed from the litigation but the lawsuit is still pending against Resource Bank.

Under the TCPA, recipients of unsolicited fax advertisements are entitled to damages of $500 per fax for inadvertent violations of the TCPA and up to $1,500 per fax for knowing or willful violations. While we are continuing to investigate the number of faxes transmitted during the period for which the plaintiff in the lawsuit seeks class certification, we expect the number of faxes to be significant.

We are contesting the lawsuit vigorously and asserting a number of defenses. We also have insurance coverage for any litigation costs and damages associated with the lawsuit, including attorneys’ fees and expenses, subject to a policy limit of $3 million. However, it is possible that the plaintiff ultimately may prevail in the litigation and it is also possible that any adverse judgment against Resource Bank may significantly exceed our $3 million insurance coverage. Any such adverse judgment could materially and adversely affect our financial condition. In addition, our insurance coverage does not apply to violations of law that are found to be willful on our part or to civil fines or penalties. See “Business-Legal Proceedings,” on page .

7

We may be unable to successfully manage our sustained growth using the net proceeds from this offering.

We have grown substantially from $404.5 million of total assets at December 31, 2000 to $647.4 million in total assets at September 30, 2002, an increase of 60.0%, and maintained an average growth rate in assets of 42.5% over the last four years. Although we do not expect to continue to grow as fast as we have since the beginning of 1998, it is our intention to expand our asset base. In particular, we intend to use the funds raised in this offering to support anticipated increases in our deposits and loans. Additional capital also would increase our legal lending limit under federal law, which in turn would allow us to compete more actively in our market area for larger loans. Our future profitability will depend in part on our ability to manage growth successfully. Our ability to manage growth successfully will depend on our ability to maintain cost controls and asset quality while attracting additional loans and deposits, as well as on factors beyond our control, such as economic conditions and interest rate trends. If we grow too quickly and are not able to control costs and maintain asset quality, growth could materially adversely affect our financial performance.

Falling interest rates could have a negative impact on our profitability.

Our profitability depends in substantial part on our net interest margin, which is the difference between the rates we receive on loans and investments and the rates we pay for deposits and other sources of funds. Our net interest margin depends on many factors that are partly or completely outside of our control, including competition, federal economic, monetary and fiscal policies, and economic conditions generally. Recently, net interest margins for some financial institutions have changed in response to these and other factors. Falling interest rates could negatively affect our profitability. We try to minimize our exposure to interest rate risk, but we are unable to completely eliminate this risk.

As of September 30, 2002, assets re-pricing exceeded liabilities re-pricing for the following calendar quarter by $107.5 million, or 17.4% of total interest bearing assets. For the next three calendar quarters, we anticipate that liabilities re-pricing will exceed assets re-pricing by $75.4 million, or 12.2% of interest earning assets. Accordingly, if short-term interest rates were reduced 1% by the Board of Governors of the Federal Reserve System, or Federal Reserve, our financial models, which include a number of assumptions, indicate that our net interest income would be reduced by approximately $269,000 in the following calendar quarter, and would be reduced in the aggregate by approximately $320,000 during the next three calendar quarters. Should short-term rates increase, we would experience a positive impact to our net interest income in a similar manner.

Periods of rising interest rates will adversely affect our income from our mortgage division.

One of the components of our strategic plan is to generate significant non-interest income from our mortgage division. In periods of rising interest rates, consumer demand for new mortgages and re-financings decreases, which in turn adversely impacts our mortgage division. For example, decreases in market interest rates during 2001 caused an increase of 144.5% in our residential mortgage volume and 154.5% in our mortgage banking income. However, increases in market interest rates during 1999 and the first half of 2000 resulted in only a modest increase of 14.1% in our 2000 residential mortgage volume and a resultant increase of 21.2% in our mortgage banking income. Of our $653.3 million in mortgage loan volume for the first nine months of 2002, approximately 40% was related to the refinancing of homes. In the event that market interest rates increase in the future, we will likely experience reductions in our mortgage banking income. Because interest rates depend on factors outside of our control, we cannot eliminate the interest rate risk associated with our mortgage operations.

We may be adversely affected by changes in government monetary policy.

As a bank holding company, our business is affected by the monetary policies established by the Federal Reserve, which regulates the national money supply in order to mitigate recessionary and inflationary pressures. In setting its policy, the Federal Reserve may utilize techniques such as the following:

| | • | | engaging in open market transactions in United States government securities; |

| | • | | setting the discount rate on member bank borrowings; and |

| | • | | determining reserve requirements. |

8

These techniques may have an adverse effect on our deposit levels, net interest margin, loan demand or our business and operations.

Our future success will depend on our ability to compete effectively in the highly competitive financial services industry.

We face substantial competition in all phases of our operations from a variety of different competitors. In particular, there is very strong competition for financial services in the three large metropolitan areas of Virginia in which we conduct a substantial portion of our business. Our future growth and success will depend on our ability to compete effectively in this highly competitive financial services environment. Many of our competitors offer products and services which we do not, and many have substantially greater resources, name recognition and market presence that benefit them in attracting business. In addition, larger competitors may be able to price loans and deposits more aggressively than we do. Some of the financial services organizations with which we compete are not subject to the same degree of regulation as is imposed on bank holding companies and federally insured state-chartered banks, national banks and federal savings institutions. As a result, these nonbank competitors have certain advantages over us in accessing funding and in providing various services.

We depend on the services of a number of key personnel, and a loss of any of those personnel could disrupt our operations and result in reduced revenues.

We are a relationship-driven organization. Our growth and development to date have depended in large part on the efforts of our senior officers: Lawrence N. Smith, Chief Executive Officer; T.A. Grell, Jr., President; Harvard R. Birdsong, II, EVP-Chief Credit Officer; Debra C. Dyckman, EVP-Retail Banking; James M. Miller, EVP Operations/Finance; and Eleanor J. Whitehurst, Chief Financial Officer. These senior officers have primary contact with our customers and are extremely important in maintaining personalized relationships with our customer base, a key aspect of our business strategy, and in increasing our market presence. The unexpected loss of services of one or more of these key employees could have a material adverse effect on our operations and possibly result in reduced revenues.

Our senior officers have many years of experience in the banking industry and are extremely valuable to us and would be difficult to replace. The loss of the services of these officers could have a material adverse effect upon our future prospects. Although we have entered into employment contracts with each of our senior officers, and have purchased key man life insurance policies to mitigate the risk of an unforeseen departure or death of our senior officers, we cannot offer any assurance that they and other key employees will remain employed by us.

We cannot assure you that economic conditions in the markets in which we operate will remain favorable.

We provide our financial services primarily to customers located in Virginia’s three largest metropolitan areas—Greater Hampton Roads, northern Virginia, and Greater Richmond. Our financial success is dependent to a certain extent upon the general economic conditions in these geographic markets. An economic downturn in these market areas could cause any of the following consequences, each of which could adversely affect our business:

| | • | | demand for our products and services could decline; |

| | • | | loan delinquencies may increase; and |

| | • | | problem assets and foreclosures may increase. |

Additionally, the adverse consequences to us in the event of an economic downturn in our three primary markets could be compounded by the fact that 75% of our commercial and real estate loans are secured by real estate located in these markets. A significant decline in real estate values in these markets would mean that the collateral for many of our loans would provide less security. As a result, we would be more likely to suffer losses

9

on defaulted loans because our ability to fully recover on defaulted loans by selling the real estate collateral securing the loans would be diminished. In addition, many of our loans are dependent on the successful completion of real estate projects and the demand for the sale of homes, both of which could be adversely affected by a decline in the real estate markets.

Future economic conditions in our markets will depend on factors outside of our control such as political and market conditions, broad trends in industry and finance, legislative and regulatory changes, changes in governments, military and fiscal policies and inflation. Recently, the United States economy experienced a significant downturn and is currently growing at a moderate pace. Additionally, it is possible that the United States may go to war with Iraq in the near future. Adverse changes in economic conditions in Resource Bank’s geographic markets would likely impair its ability to collect loans and could otherwise have a negative effect on our financial condition.

Our executive officers and directors will be able to influence the outcome of any shareholder vote.

After the offering, five of our senior officers: Messrs. Smith, Grell, Birdsong and Miller and Ms. Dyckman will, assuming they exercised all of their currently exercisable stock options, own approximately 6% of our outstanding common stock. Additionally, all of our directors and executive officers as a group will, assuming they exercised all of their currently exercisable stock options, own approximately 20% of our outstanding common stock. Accordingly, our executive officers and directors will be able to influence the outcome of all matters that are submitted to our shareholders for approval, including the election of members to our board of directors or other significant corporate transactions.

We may not pay dividends to shareholders in the future.

Although we have paid cash dividends to our shareholders for the past 20 fiscal quarters, we cannot assure you that we will pay cash dividends in the future. Historically, our dividend payout ratio has ranged from approximately 14.5% to 33.3%, and our board of directors currently targets a dividend payout ratio in a range of 25% to 35% of our after-tax earnings. We will not pay any dividends to our shareholders if, after making such dividends, we would be undercapitalized under federal or state banking regulations. Additionally, we may elect to retain our earnings to support the development and growth of our business. Our board of directors will determine our future dividend policy based on an analysis of factors that the board deems relevant. Our ability to pay dividends to our shareholders is also limited by certain restrictions imposed by state and federal laws. Pursuant to federal banking law, we may not, without prior regulatory approval, pay a dividend if the total of all of the dividends declared by us in any calendar year exceeds the total of our net profits for that year combined with our retained net profits of the preceding two calendar years, less any required transfers to surplus or to a fund for the retirement of any preferred stock. Additionally, Resource Bank’s ability to pay us dividends is generally limited to the amount of its retained earnings, which could affect our ability to pay dividends to our shareholders. As of September 30, 2002, Resource Bank could pay us up to $10.3 million in dividends without having to obtain prior regulatory approval.

Resource Bank’s ability to pay us dividends is subject to regulatory limitations which may affect our ability to service our debt and pay dividends to our shareholders.

We are a separate entity from Resource Bank and do not have significant operations of our own. We currently depend on our cash and liquidity as well as dividends from Resource Bank to pay our operating expenses. In addition, at September 30, 2002, we had an aggregate outstanding amount of $16.2 million in trust preferred securities. As of September 30, 2002, our annual interest payments due on our trust preferred securities, based on applicable interest rates as of that date, were approximately $1.2 million. In addition, the availability of dividends from Resource Bank is limited to the amount of its retained earnings. As of September 30, 2002, Resource Bank could pay us up to $10.3 million in dividends without having to gain any prior regulatory approval. In the event that Resource Bank is unable to pay dividends sufficient to satisfy our obligations, we may not be able to service our

10

debt, pay our obligations as they become due, or pay dividends on our common stock. Under such circumstances, an inability to receive dividends from Resource Bank could adversely affect our financial condition, results of operations and prospects and could also negatively affect the price of our common stock.

Our common stock trades publicly, but has a limited trading volume compared to other stocks.

Our common stock is traded publicly on the Nasdaq National Market under the symbol “RBKV.” However, daily trading volumes for our stock are relatively small compared to many other stocks quoted on the Nasdaq National Market. Although we have several market makers in our stock, this alone does not assure significant trading volume or liquidity. During the nine months ended September 30, 2002, the average daily trading volume of our stock was 3,277 shares. We cannot assure you that this offering will increase the trading volume for our stock.

Provisions in Virginia law and in our articles of incorporation and employment agreements may prevent or delay a change in control and thereby potentially adversely impact the price of our common stock.

Pursuant to our articles of incorporation, our board of directors has the authority to issue shares of preferred stock and to determine the price, rights, preferences and restrictions, including the voting rights, of those shares without any further vote or action by stockholders. The rights of the holders of our common stock will be subject to, and may be adversely affected by, the rights of the holders of any preferred stock that may be issued in the future.

Additionally, Virginia corporate law and our charter documents contain several other provisions that may make it more difficult for a third party to acquire control of us without the approval of our board of directors, and may make it more difficult or expensive for a third party to acquire a majority of our outstanding common stock. For example, our articles of incorporation divide our board of directors into three classes serving staggered three-year terms, and therefore it would take several years for our shareholders to replace a majority of the members of our board if they so desired.

Additionally, our employment agreements include provisions which require payments to be made to our executive and senior loan officers in the event of a change in control of us or our subsidiaries. Provisions in Virginia law and in our articles of incorporation and employment agreements may, in some circumstances, have the effect of delaying, deferring or preventing a change in control of us and may discourage bids for our common stock at a premium over the current market price. To the extent that these provisions are negatively perceived by investors, there may be an adverse impact on our stock price.

11

FORWARD-LOOKING STATEMENTS

Some of the matters discussed under the captions “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and elsewhere in this prospectus include forward-looking statements. These forward-looking statements include statements regarding profitability, liquidity, allowance for loan losses, interest rate sensitivity, market risk, and financial and other goals. Forward-looking statements often use words such as “believes,” “expects,” “plans,” “may,” “will,” “should,” “projects,” “contemplates,” “anticipates,” “forecasts,” “intends” or other words of similar meaning. You can also identify them by the fact that they do not relate strictly to historical or current facts. The forward-looking statements we use in this prospectus are subject to significant risks, assumptions and uncertainties, including, among other things, the following important factors that could effect the actual outcome of future events:

| | • | | fluctuations in market rates of interest and loan and deposit pricing, which could negatively affect our net interest margin, asset valuations and expense projections; |

| | • | | adverse changes in the economies of our market areas, which might effect our business prospects and could cause credit-related losses and expenses; |

| | • | | continuing the well-established and valued relationships we have built with our customers; |

| | • | | adverse developments in our loan origination volume; |

| | • | | competitive factors in the banking industry, such as the trend towards consolidation in the markets in which we operate; |

| | • | | an unfavorable resolution to the class action lawsuit to which Resource Bank currently is a party; and |

| | • | | changes in banking legislation or the regulatory requirements of federal and state agencies applicable to bank holding companies and banks like ours. |

Because of these and other uncertainties, our actual future results may be materially different from the results indicated by these forward-looking statements. In addition, our past results of operations do not necessarily indicate our future results.

We caution you that the above list of important factors is not exclusive, and other factors are discussed in more detail under “Risk Factors” in this prospectus. These forward-looking statements are made as of the date of this prospectus and we may not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the date the forward-looking statement was made.

12

Based on an assumed public offering price of $20.62 (the closing price of our common stock on the Nasdaq National Market on January 17, 2003), our net proceeds from the sale of 700,000 shares of our common stock will be approximately $13.3 million, after deducting the underwriting discount and our estimated offering expenses. We anticipate that approximately $6.0 million of these proceeds will be contributed to Resource Bank’s capital to support its future loan production and asset growth. We anticipate that the approximately $7.3 million in remaining proceeds will be retained by us for working capital and other general corporate purposes, including branch expansion in new and existing markets and potential acquisitions to expand our retail branch network. We currently have no commitments or agreements with respect to branch expansion or acquisitions. Our officers and directors will have broad authority in deciding how to utilize the net proceeds of the offering. Pending application of the net proceeds as described above, we intend to invest the net proceeds of this offering in short-term investment grade securities.

The following table shows (a) our capitalization at September 30, 2002, and (b) our capitalization at September 30, 2002, as adjusted to reflect the receipt of $13.3 million in net proceeds from the sale of 700,000 shares of our common stock in this offering at an assumed public offering price of $20.62 per share (the closing price of our common stock on the Nasdaq National Market on January 17, 2003), after giving effect to the underwriting discount and our estimated offering expenses.

| | | At September 30, 2002

| |

| | | Actual

| | | As Adjusted

| |

| | | (in thousands) | |

| Stockholders’ equity: | | | | | | | | |

| Preferred stock, par value $10.00; 500,000 shares authorized; none issued and outstanding | | $ | — | | | $ | — | |

| Common stock, par value $1.50; 6,666,666 shares authorized; 3,061,961 shares issued and outstanding, 3,761,961 shares issued and outstanding, as adjusted | | | 4,593 | | | | 5,643 | |

| | | | | | | | | |

| Additional paid-in capital | | | 14,977 | | | | 27,227 | |

| | | | | | | | | |

| Retained earnings | | | 11,199 | | | | 11,199 | |

| Accumulated other comprehensive income (loss) | | | (33 | ) | | | (33 | ) |

| | |

|

|

| |

|

|

|

| Total stockholders’ equity | | $ | 30,736 | | | $ | 44,036 | |

| | |

|

|

| |

|

|

|

The table excludes 531,147 shares of common stock issuable upon the exercise of stock options outstanding under our stock option plans on September 30, 2002, of which 233,497 were exercisable.

13

Our common stock trades on the Nasdaq National Market under the symbol “RBKV.” The following table shows the high and low closing sales prices of our common stock and the dividends declared per share for the periods indicated.

| | | High

| | Low

| | Cash Dividend Declared

|

2003 | | | | | | | | | |

| First Quarter (through January 17, 2003) | | $ | 21.01 | | $ | 20.43 | | $ | 0.17 |

|

2002 | | | | | | | | | |

| Fourth Quarter | | | 22.21 | | | 19.00 | | | 0.14 |

| Third Quarter | | | 20.99 | | | 17.65 | | | 0.14 |

| Second Quarter | | | 20.29 | | | 18.15 | | | 0.14 |

| First Quarter | | | 19.65 | | | 18.00 | | | 0.14 |

|

2001 | | | | | | | | | |

| Fourth Quarter | | | 17.00 | | | 14.50 | | | 0.12 |

| Third Quarter | | | 17.99 | | | 14.50 | | | 0.12 |

| Second Quarter | | | 16.00 | | | 14.00 | �� | | 0.12 |

| First Quarter | | | 16.50 | | | 10.13 | | | 0.12 |

|

2000 | | | | | | | | | |

| Fourth Quarter | | | 11.00 | | | 9.63 | | | 0.12 |

| Third Quarter | | | 10.00 | | | 7.88 | | | 0.10 |

| Second Quarter | | | 10.63 | | | 8.63 | | | 0.10 |

| First Quarter | | | 12.63 | | | 8.63 | | | 0.10 |

As of September 30, 2002, there were 3,061,961 shares of our common stock outstanding held by approximately 800 shareholders of record.

We have declared and paid cash dividends for the past 20 fiscal quarters. Our dividend payout ratio during this period has ranged from approximately 14.5% to 33.3%. Currently, our board of directors targets a dividend payout ratio in a range of 25% to 35% of our after-tax earnings. We will not pay any dividends to our shareholders if, after making such dividends, we would be undercapitalized under federal or state banking regulations. Additionally, declarations of dividends are at the discretion of our board of directors, and we cannot assure you that dividends will be declared at any time in the future.

Federal banking law does not permit us, without prior regulatory approval, to pay a dividend if the total of all of the dividends declared by us in any calendar year exceeds the total of our net profits for that year combined with our retained net profits of the preceding two calendar years, less any required transfers to surplus or to a fund for the retirement of any preferred stock. Additionally, we depend on dividends we receive from Resource Bank to provide funding for future dividends, if any, on our common stock. As a banking corporation organized under Virginia law, Resource Bank’s ability to pay us dividends is generally limited to the amount of its retained earnings. As of September 30, 2002, Resource Bank could pay us up to $10.3 million in dividends without having to obtain prior regulatory approval.

The Federal Reserve recommends that banking organizations pay dividends only if the net income available to shareholders in the past year fully funds those dividends and the expected rate of earnings retention is consistent with capital needs, asset quality and overall financial condition. Our dividend policy complies with this recommendation.

14

SELECTED CONSOLIDATED FINANCIAL DATA

The following table sets forth selected consolidated financial data for Resource Bankshares Corporation. The financial data for the five years ended December 31, 2001 are derived from our consolidated financial statements. The financial data for the nine-month periods ended September 30, 2002 and 2001 are derived from our unaudited consolidated financial statements. Operating results for the nine months ended September 30, 2002 are not necessarily indicative of the results that may be expected for the year ending December 31, 2002. You should read the consolidated selected financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our consolidated financial statements, and accompanying notes and other financial data included elsewhere in this prospectus.

| | | Nine Months Ended September 30,

| | | Years Ended December 31,

| |

| | | 2002

| | | 2001

| | | 2001

| | | 2000

| | | 1999

| | | 1998

| | | 1997

| |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| | | (Dollars in thousands, except per share data) | |

Income Statement Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net interest income | | $ | 11,529 | | | $ | 7,730 | | | $ | 11,033 | | | $ | 9,437 | | | $ | 8,946 | | | $ | 8,410 | | | $ | 4,954 | |

| Provision for loan losses | | | 975 | | | | 45 | | | | 195 | | | | 1,100 | | | | 4,667 | | | | 150 | | | | 155 | |

| Non-interest income | | | 17,043 | | | | 13,897 | | | | 20,144 | | | | 11,890 | | | | 6,811 | | | | 7,943 | | | | 4,520 | |

| Non-interest expense | | | 21,439 | | | | 16,997 | | | | 24,521 | | | | 14,109 | | | | 12,168 | | | | 11,565 | | | | 6,533 | |

| Income taxes (benefit) | | | 1,817 | | | | 1,341 | | | | 1,918 | | | | 1,886 | | | | (387 | ) | | | 1,591 | | | | 965 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net income (loss) | | $ | 4,341 | | | $ | 3,244 | | | $ | 4,543 | | | $ | 4,233 | | | $ | (691 | )(1) | | $ | 3,047 | | | $ | 1,821 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Per Share Data(2): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income (loss)(3): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 1.40 | | | $ | 1.15 | | | $ | 1.57 | | | $ | 1.63 | | | $ | (0.27 | )(1) | | $ | 1.24 | | | $ | 0.92 | |

| Diluted | | | 1.32 | | | | 1.08 | | | | 1.49 | | | | 1.56 | | | | (0.27 | ) | | | 1.13 | | | | 0.83 | |

| Book value at period end | | | 10.04 | | | | 9.12 | | | | 9.27 | | | | 7.50 | | | | 6.25 | | | | 7.18 | | | | 6.36 | |

| Tangible book value at period end | | | 9.78 | | | | 8.90 | | | | 9.03 | | | | 7.47 | | | | 6.25 | | | | 7.18 | | | | 6.36 | |

| Cash dividends declared | | | 0.42 | | | | 0.36 | | | | 0.48 | | | | 0.42 | | | | 0.40 | | | | 0.24 | | | | 0.12 | |

| Dividend payout ratio | | | 31.82 | % | | | 33.33 | % | | | 32.21 | % | | | 26.92 | % | | | (148.15 | %) | | | 21.24 | % | | | 14.46 | % |

|

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 647,361 | | | $ | 528,247 | | | $ | 564,850 | | | $ | 404,494 | | | $ | 306,690 | | | $ | 233,460 | | | $ | 209,330 | |

| Total loans (net of unearned income) | | | 421,246 | | | | 327,261 | | | | 344,936 | | | | 288,513 | | | | 255,671 | | | | 188,522 | | | | 150,590 | |

| Total deposits | | | 464,725 | | | | 496,302 | | | | 411,504 | | | | 330,645 | | | | 260,469 | | | | 206,219 | | | | 169,508 | |

| Stockholders’ equity | | | 30,736 | | | | 28,710 | | | | 28,779 | | | | 19,672 | | | | 15,870 | | | | 17,789 | | | | 15,602 | |

|

Performance Ratios(4): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Return (loss) on average assets | | | 0.97 | % | | | 0.95 | % | | | 0.95 | % | | | 1.21 | % | | | (0.25 | )% | | | 1.27 | % | | | 1.40 | % |

| Return (loss) on average stockholders’ equity | | | 19.93 | | | | 18.91 | | | | 18.73 | | | | 24.13 | | | | (3.90 | ) | | | 18.19 | | | | 18.59 | |

| Net interest margin(5) | | | 2.79 | | | | 2.47 | | | | 2.52 | | | | 2.92 | | | | 3.42 | | | | 3.62 | | | | 3.90 | |

|

Asset Quality Ratios: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Allowance to period-end loans | | | 1.08 | % | | | 1.13 | % | | | 1.07 | % | | | 1.22 | % | | | 1.04 | % | | | 1.33 | % | | | 1.71 | % |

| Allowance to nonperforming loans | | | 545.13 | | | | 109.32 | | | | 227.93 | | | | 263.75 | | | | 361.51 | | | | 264.55 | | | | 58.50 | |

| Nonperforming assets to total assets | | | 0.14 | | | | 0.65 | | | | 0.29 | | | | 0.33 | | | | 0.25 | | | | 0.68 | | | | 2.43 | |

| Net charge-offs (recoveries) to average loans(4) | | | 0.04 | | | | (0.04 | ) | | | 0.01 | | | | 0.10 | | | | 2.06 | | | | 0.13 | | | | 0.02 | |

|

Capital Ratios: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tier 1 risk-based capital | | | 8.88 | % | | | 10.06 | % | | | 9.49 | % | | | 8.74 | % | | | 8.20 | % | | | 9.23 | % | | | 9.69 | % |

| Total risk-based capital | | | 10.62 | | | | 11.07 | | | | 10.44 | | | | 10.75 | | | | 9.24 | | | | 10.48 | | | | 10.93 | |

| Leverage capital ratio | | | 6.38 | | | | 7.46 | | | | 6.88 | | | | 6.69 | | | | 7.19 | | | | 7.52 | | | | 9.67 | |

| Total equity to total assets | | | 4.75 | | | | 5.43 | | | | 5.09 | | | | 4.86 | | | | 5.17 | | | | 7.62 | | | | 7.45 | |

| (1) | | Our loss in 1999 was attributable to a $4.7 million provision for loan losses in the third quarter that occurred as a result of credit problems with a significant borrower in our now discontinued asset based lending portfolio. |

| (2) | | All per share figures have been adjusted to reflect a two-for-one stock split on July 1, 1998. |

| (3) | | Net income per share is computed using the basic and diluted weighted average outstanding shares. |

| (4) | | Ratios for the nine months ended September 30, 2002 and 2001 have been annualized. |

| (5) | | Net interest margin is calculated as tax-equivalent net interest income divided by average earning assets and represents our net yield on earning assets. |

15

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion is intended to assist readers in understanding and evaluating our financial condition and results of operations. In conjunction with reviewing the following discussion, you should also read and review our consolidated financial statements and accompanying notes that are included elsewhere in this prospectus.

Overview

For the nine months ended September 30, 2002, our net income increased by 33.8% compared to the same period in 2001 from $3.2 million to $4.3 million. Earnings per share for the first nine months of 2002 were $1.40 per share compared to $1.15 for the comparable period of 2001. This increase primarily resulted from loan growth and increases in mortgage banking fee income, as continued low interest rates generated greater demand for new residential mortgage loans and refinancings. Our return on average assets was 0.97% for the first nine months of 2002, compared to 0.95% for the first nine months of 2001. Our return on average equity was 19.9% and 18.9% for the nine months ended September 30, 2002 and 2001, respectively.

In 2001, we had net income of $4.5 million compared to net income $4.2 million in 2000 and a net loss of $690,800 in 1999. Our earnings per share were $1.57 in 2001 compared to $1.63 in 2000 and a $0.27 per share loss in 1999. Our loss in 1999 was directly attributable to a $4.7 million provision for loan losses taken in the third quarter of that year, which occurred primarily as a result of credit problems with an affiliated group of borrowers in our asset based lending portfolio. Since the loan loss in 1999, we have terminated our asset based lending program.

During the first nine months of 2002, total loans increased 22.1% from $344.9 million at December 31, 2001 to $421.2 million at September 30, 2002. Total deposits at September 30, 2002 were $464.7 million, a 12.9% increase from $411.5 million at December 31, 2001. During 2001, our total loans grew 19.6% from $288.5 million at year end 2000 to $344.9 million at year end 2001, and our total deposits grew 24.5% from $330.6 million at year end 2000 to $411.5 million at year end 2001. The growth in our loans and deposits reflects Resource Bank’s sustained growth and continued penetration in its markets.

Our allowance for loan losses was $4.5 million at September 30, 2002 compared to $3.7 million at September 30, 2001. The allowance for loan losses as a percentage of period end loans was 1.1% at September 30, 2002 and September 30, 2001. The provisions for loan losses were $975,000 and $45,000 for the nine months ended September 30, 2002 and 2001, respectively. Total nonperforming assets, which includes non-accrual loans, loans 90 days or more past due and still accruing and other foreclosed real estate owned were $901,000 at September 30, 2002, down from $1.7 million at December 31, 2001.

Nine Months Ended September 30, 2002 and September 30, 2001

Results of Operations

Summary. For the nine months ended September 30, 2002, our net income increased by 33.8% compared to the same period in 2001 from $3.2 million to $4.3 million. Earnings per share for the nine months ended September 30, 2002 were $1.40 per share compared to $1.15 for the comparable period of 2001. The increase in our net income occurred primarily as a result of growth in interest bearing assets and increases in mortgage banking income. Our return on average assets was 0.97% for the first nine months of 2002, compared to 0.95% for the same period of 2001. Our return on average equity was 19.9% and 18.9% for the nine months ended September 30, 2002 and 2001, respectively.

Net Interest Income. As the largest component of income, net interest income represents the amount that interest and fees earned on loans and investments exceed the interest costs of funds used to support these earning

16

assets. Net interest income is determined by the relative levels, rates and mix of earning assets and interest-bearing liabilities. Our net interest income for the nine months ended September 30, 2002 compared to the first nine months of 2001 increased by 49.1% from $7.7 million to $11.5 million. On a tax equivalent basis, net interest income was $11.8 million in the nine months ended September 30, 2002 compared to $8.1 million during the comparable period of 2001. The increase in our net interest income was attributable to a 29.6% increase in average interest earning assets and an increase in our net interest margin from 2.47% for the nine months ended September 30, 2001 to 2.79% for the nine months ended September 30, 2002.

Non-interest Income. Our non-interest income for the nine months ended September 30, 2002 compared to the first nine months of 2001 increased by 22.3% from $13.9 million to $17.0 million. The increase in our non-interest income was primarily attributable to increased activity in our mortgage banking division, which accounted for 86.0% and 87.0% of total non-interest income for the periods ended September 30, 2002 and 2001, respectively. For the nine months ended September 30, 2002 compared to the same period for 2001, mortgage banking income increased by 20.7% from $12.1 million to $14.6 million. We derive our mortgage banking income primarily from discount fees, or points, collected on loans originated, premiums received on the sale of mortgage loans and their related servicing rights to investors, and other fees. The increased income and profitability in our mortgage division occurred in large part because of a declining interest rate environment. During periods of declining or continued low interest rates, demand for new residential mortgages, particularly re-financings, tends to increase significantly. In addition, other non-interest income generated primarily from title insurance sales commissions, service charges and fee income, and gains on the sale of assets, increased for the nine months ended September 30, 2002 compared to the first nine months of 2001 by 33.3% from $1.8 million to $2.4 million.

Non-interest Expense. Our non-interest expense for the nine months ended September 30, 2002 compared to the first nine months of 2001 increased 25.9% from $17.0 million to $21.4 million. This increase was primarily the result of the acquisition of Atlantic Mortgage and Investment, a commercial mortgage company, and First Jefferson Mortgage Corporation, a residential mortgage company, late in the first quarter of 2001. For the period ended September 30, 2002, a full nine months of expenses are reflected for these businesses, whose operations have been consolidated with our mortgage division. The largest component of non-interest expense, salaries and employee benefits, which represents 67.4% of total non-interest expense, increased 26.4% to $14.4 million for the nine months ended September 30, 2002 over the same period in 2001, and was primarily attributable to these acquisitions. Occupancy expense increased by 13.7% to $1.3 million, depreciation and equipment maintenance increased by 19.3% to $1.5 million, marketing and business development increased 38.6% to $535,000, and outside computer services increased 30.7% to $694,000 for the nine months ended September 30, 2002 as compared to the same period in 2001. Total other non-interest expense categories increased 31.6% to $2.9 million for the nine months ended September 30, 2002 over the same period in 2001.

Income Taxes. We incurred income taxes of $1.8 million in the nine months ended September 30, 2002 compared to $1.3 million for the comparable period of 2001, resulting in effective tax rates of 29.5% and 29.3% for the respective periods. Our effective federal tax rate is positively impacted primarily by our investments in tax-free municipal securities and bank-owned life insurance. For the nine months ended September 30, 2002, total income from these tax-exempt items was $833,000. In addition, a Virginia commercial bank is subject to a franchise tax based upon components of its balance sheet, which is reflected in other non-interest expense rather than income taxes.

Analysis of Financial Condition

Summary. During the nine months ended September 30, 2002, total assets grew from $564.9 million at December 31, 2001 to $647.3 million, an increase of $82.4 million or 14.6%. This increase occurred primarily because of the $76.3 million growth in our loan portfolio during the period. Total deposits and FHLB advances increased 12.9% and 14.6% from December 31, 2001 to September 30, 2002, respectively, to fund this growth in our loan portfolio.

17

Investment Securities. Our securities available for sale were $21.8 million at September 30, 2002, a decrease of 81.0% or $92.9 million from a balance of $114.6 million at December 31, 2001. Securities held to maturity increased in the nine months ended September 30, 2002, from $0 at December 31, 2001 to $110.2 million at September 30, 2002. Funds advanced in settlement of mortgage loans were $64.4 million at September 30, 2002, a slight decrease of $7.6 million or 10.5% compared to a balance of $72.0 million at year end 2001.

Loans. During the nine months ended September 30, 2002, total loans increased 22.1% from $344.9 million at December 31, 2001 to $421.2 million at September 30, 2002. Average loans represented 68.0% of average interest earning assets for the nine months ended September 30, 2002, compared to 68.8% for the first nine months of 2001.

Asset Quality. Our allowance for loan losses was $4.5 million at September 30, 2002, compared to $3.7 million at December 31, 2001 and September 30, 2001. The allowance for loan losses as a percentage of period end loans was 1.1% at September 30, 2002 and 2001. The provisions for loan losses were $975,000 and $45,000 for the nine months ended September 30, 2002 and 2001, respectively. Total nonperforming assets, which includes non-accrual loans, loans 90 days or more past due and still accruing and other foreclosed real estate owned were $901,000 at September 30, 2002, down from $1.7 million at December 31, 2001.

Deposits. Total deposits at September 30, 2002 were $464.7 million, up 12.9% from $411.5 million at December 31, 2001. Of our average interest bearing deposits during the nine months ended September 30, 2002, 80.2% were certificates of deposit, 18.6% were demand or money market accounts and 1.2% were savings accounts. The composition of our deposits at September 30, 2002 approximated our target deposit mix of 50% in local and Internet deposits and 50% in national markets.

Borrowed Funds. FHLB advances were $96.0 million at September 30, 2002, an increase of 14.6% from the balance of $83.8 million December 31, 2001.

Capital Structure. Stockholders’ equity was $30.7 million at September 30, 2002, an increase of $2.0 million or 7.0% from December 31, 2001.

Three Years Ended December 31, 2001

Results of Operations

Summary. In 2001, we had net income of $4.5 million, compared to net income of $4.2 million for 2000, and compared to a net loss of $690,800 in 1999. Our earnings per share were $1.57 in 2001, compared to $1.63 in 2000, and compared to a $0.27 per share loss in 1999. Our loss in 1999 was directly attributable to a $4.7 million provision for loan losses taken in the third quarter. Management concluded this provision was necessary as a result of credit problems with an affiliated group of borrowers in our asset based lending portfolio. Since the loss in 1999, we have terminated our asset based lending program.

In 2001, our mortgage banking division reported net income before taxes of $2.3 million, compared to $673,990 for 2000, and compared to a $418,897 net loss before taxes in 1999. The loss in our mortgage division in 1999 occurred as a result of expenses associated with reorganizing our mortgage division and decreased loan origination volume. Rising interest rates in 1999 resulted in a decrease in mortgage loan originations for the year.

Net Interest Income. For the year ended December 31, 2001, net interest income was $11.0 million, an increase of approximately $1.6 million, or 16.9%, over $9.4 million for the same period in 2000. Average interest earning assets increased $119.0 million from 2000 to 2001 while average interest bearing liabilities increased $118.7 million. The yield on average interest earning assets for the year ended December 31, 2001 was 7.3% compared with 8.6% for the comparable 2000 period. The 2001 yield on loans was 7.2% compared to 8.7% in 2000. The cost on average interest bearing liabilities decreased 1.1% during 2001 to 5.0%, compared to 6.1% during 2000.

18

Net interest income for the year ended December 31, 2000 increased 5.5%, or $492,000, over 1999. Average interest earning assets increased $74.4 million from 1999 to 2000 while average interest bearing liabilities increased $75.3 million. The yield on average interest earning assets for the year ended December 31, 2000 was 8.6% compared with 8.2% for the comparable 1999 period. The 2000 yield on loans was 8.7%, compared to 8.3% in 1999. The cost on average interest bearing liabilities increased 82 basis points during 2000 to 6.1%, compared to 5.3% during 1999.

Our net interest income is sensitive to the loan origination volume of our mortgage banking division. All loans originated by the mortgage banking division are sold, servicing released, in the secondary mortgage market. Each mortgage loan originated is sold when the borrower locks in the interest rate on the loan. When the volume of mortgage loan originations increases, typically in a declining interest rate environment, “funds advanced in settlement of mortgage loans” increase. This balance sheet item represents funds advanced to close mortgage loans, pending delivery of the loans to the loan purchaser. Until a mortgage loan is transferred to the purchaser, we receive interest on the loan at the note rate. Funds advanced in settlement of mortgage loans are financed to a large extent with short term borrowings and short term certificates of deposit. Thus, as funds advanced in settlement of mortgage loans increase, a corresponding increase in net interest income occurs. The average balance of funds advanced in settlement of mortgage loans was $45.6 million for the year ended December 31, 2001, $16.2 million for the year ended December 31, 2000, and $16.1 million in the year ended December 31, 1999.

19

The following table sets forth average balances of total interest earning assets and total interest bearing liabilities for the periods indicated, showing the average distribution of assets, liabilities, stockholders’ equity and the related income, expense and corresponding weighted-average yields and costs.

Average Balances, Interest Income and Expenses, and Average Yields and Rates

| | | Year Ended December 31,

| |

| | | 2001

| | | 2000

| | | 1999

| |

| | | Average Balance(1)

| | | Income/ Expense

| | Yield/ Rate(2)

| | | Average Balance(1)

| | | Income/ Expense

| | Yield/ Rate(2)

| | | Average Balance(1)

| | | Income/ Expense

| | Yield/ Rate(2)

| |

| | | (Dollars in thousands) | |

| Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Earning Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Securities(3) | | $ | 92,626 | | | $ | 7,079 | | 7.64 | % | | $ | 48,012 | | | $ | 3,870 | | 8.06 | % | | $ | 21,791 | | | $ | 1,468 | | 6.74 | % |

| Loans(4) | | | 306,802 | | | | 22,148 | | 7.22 | % | | | 263,110 | | | | 22,821 | | 8.67 | % | | | 217,598 | | | | 18,072 | | 8.31 | % |

| Interest bearing deposits in other banks | | | 9,791 | | | | 366 | | 3.74 | % | | | 8,487 | | | | 537 | | 6.33 | % | | | 5,974 | | | | 293 | | 4.90 | % |

| Other earning assets(5) | | | 45,596 | | | | 3,523 | | 7.73 | % | | | 16,227 | | | | 1,561 | | 9.62 | % | | | 16,118 | | | | 1,548 | | 9.60 | % |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|