UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission

Only (as permitted by Rule 14a-6(e)(2) |

x Definitive Proxy Statement | |

¨ Definitive Additional Materials | |

¨ Soliciting Material Pursuant to Rule 14a-12 | |

MAGMA DESIGN AUTOMATION, INC.

(Name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

MAGMA DESIGN AUTOMATION, INC.

1650 TECHNOLOGY DRIVE

SAN JOSE, CALIFORNIA 95110

(408) 565-7500

August 11, 2010

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Magma Design Automation, Inc., which will be held at 10:00 a.m. on Thursday, September 23, 2010, at our offices at 1650 Technology Drive, San Jose, California 95110.

The formal notice of the Annual Meeting of Stockholders and the proxy statement are included with this invitation.

After reading this proxy statement, please mark, date, sign and return the enclosed proxy in the enclosed prepaid envelope, or follow the instructions included with your proxy card to submit your proxy via the toll-free telephone number or via the Internet, to ensure that your shares will be represented. YOUR SHARES CANNOT BE VOTED UNLESS YOU SIGN, DATE AND RETURN THE ENCLOSED PROXY, SUBMIT YOUR PROXY BY TELEPHONE OR VIA THE INTERNET OR ATTEND THE ANNUAL MEETING OF STOCKHOLDERS IN PERSON. Your vote is important, so please return your proxy promptly. A copy of our Annual Report on Form 10-K for the fiscal year ended May 2, 2010 is also enclosed.

The Board of Directors and management look forward to seeing you at the meeting.

|

Sincerely yours, |

/s/ Rajeev Madhavan |

| Rajeev Madhavan |

Chairman of the Board and Chief Executive Officer |

MAGMA DESIGN AUTOMATION, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held September 23, 2010

To the Stockholders of Magma Design Automation, Inc.:

The Annual Meeting of Stockholders (“Annual Meeting”) of Magma Design Automation, Inc., a Delaware corporation, will be held on Thursday, September 23, 2010 at our offices at 1650 Technology Drive, San Jose, California 95110, at 10:00 a.m. Pacific Time, for the following purposes:

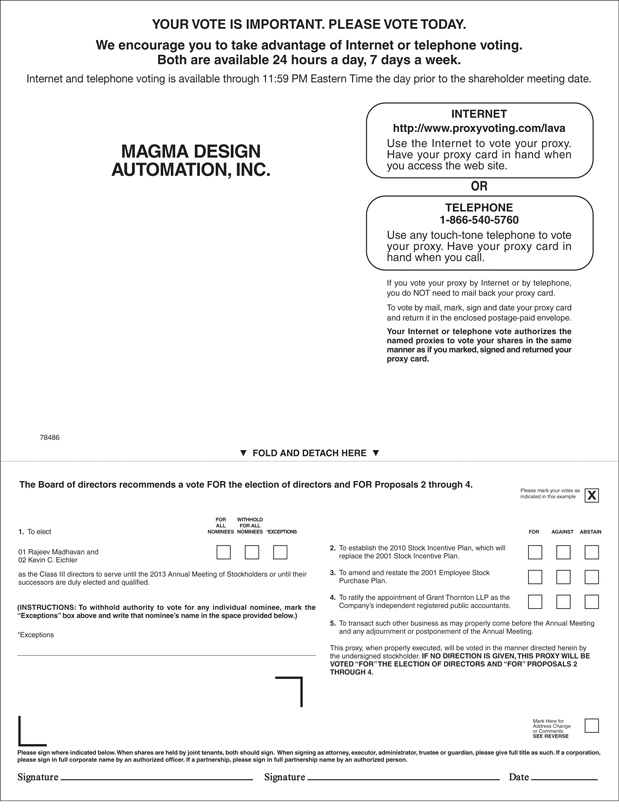

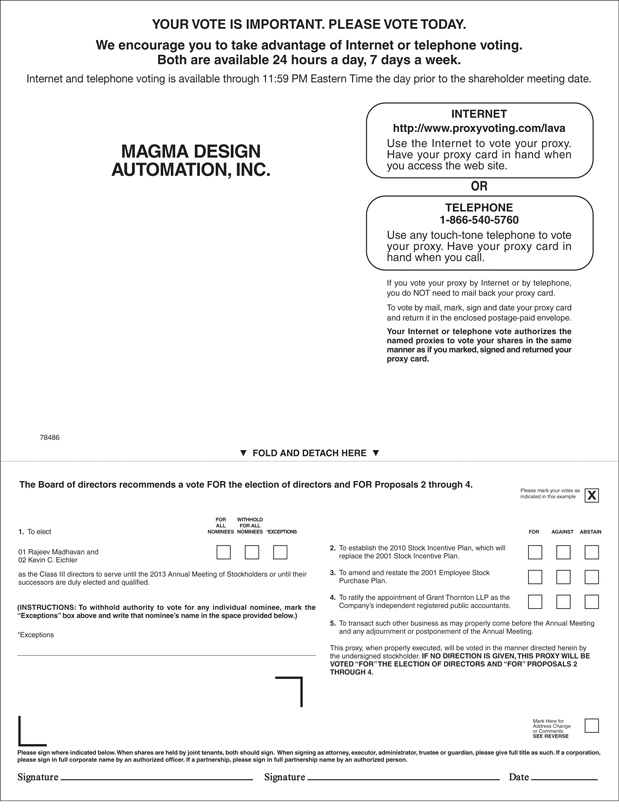

| | 1. | To elect the two Class III director nominees named in the attached proxy statement to serve until the 2013 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

| | 2. | To approve a proposal to establish the 2010 Stock Incentive Plan, which will replace the 2001 Stock Incentive Plan; |

| | 3. | To approve a proposal to amend and restate the 2001 Employee Stock Purchase Plan; |

| | 4. | To ratify the appointment of Grant Thornton LLP as Magma’s independent registered public accountants for the fiscal year ending May 1, 2011; and |

| | 5. | To transact such other business as may properly be brought before the Annual Meeting and any adjournment or postponement thereof. |

Stockholders of record as of the close of business on August 9, 2010 are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. A complete list of stockholders entitled to vote at the Annual Meeting will be available at the office of Magma’s Secretary, 1650 Technology Drive, San Jose, California 95110, for ten days prior to the Annual Meeting.

It is important that your shares are represented at the meeting. Even if you plan to attend the meeting, we hope that you will promptly mark, sign, date and return the enclosed proxy or follow the instructions included with your proxy card to submit your proxy via the toll-free telephone number or via the Internet. This will not limit your right to attend or vote at the meeting.

|

By Order of the Board of Directors |

/s/ Clayton H. Parker |

| Clayton H. Parker |

| Vice President, General Counsel and Secretary |

August 11, 2010

TABLE OF CONTENTS

TABLE OF CONTENTS

(Continued)

MAGMA DESIGN AUTOMATION, INC.

1650 TECHNOLOGY DRIVE

SAN JOSE, CALIFORNIA 95110

PROXY STATEMENT

PROCEDURAL MATTERS

General

This proxy statement is furnished in connection with the solicitation by the Board of Directors of Magma Design Automation, Inc., a Delaware corporation (“Magma” or the “Company”), of proxies in the accompanying form to be used at Magma’s Annual Meeting of Stockholders to be held at Magma’s principal executive offices on Thursday, September 23, 2010, at 10:00 a.m. Pacific Time, and any adjournment or postponement thereof (the “Annual Meeting”). Magma’s principal executive offices are located at 1650 Technology Drive, San Jose, California 95110 and its telephone number is (408) 565-7500.

Magma’s Annual Report on Form 10-K (the “Annual Report”) for the fiscal year ended May 2, 2010 (“fiscal 2010”) containing financial statements for fiscal 2010, is being mailed together with these proxy solicitation materials to all stockholders entitled to notice of and to vote at the Annual Meeting. This proxy statement, the accompanying form of proxy and the Annual Report were first mailed to stockholders entitled to vote at the Annual Meeting on or about August 16, 2010. The Annual Report is not incorporated into this proxy statement and is not considered proxy soliciting material.

Who Can Vote

Only stockholders of record at the close of business on August 9, 2010 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. As of the close of business on the Record Date, Magma had 52,523,391 shares of common stock, $0.0001 par value per share, outstanding.

Stockholders of record—If your shares are registered directly in your name with the Company’s transfer agent, Mellon Investor Services LLC, you are considered, with respect to those shares, the stockholder of record, and these proxy materials have been sent directly to you by the Company.

Beneficial owners—Many of the Company’s stockholders hold their shares through a broker, bank, trustee or other nominee, rather than directly in their own name. If your shares are held in a brokerage account or by a bank, trustee or other nominee, you are considered the “beneficial owner” of shares held in “street name.” These proxy materials have been forwarded to you by your broker, bank, trustee or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank, trustee or other nominee on how to vote your shares. For directions on how to vote shares beneficially held in street name, please refer to the voting instruction card provided by your broker, bank, trustee or other nominee. Because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a legal proxy from the broker, bank, trustee or other nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting.

How You Can Vote

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a stockholder of record, you may vote your shares at the Annual Meeting either in person or by proxy; please refer to the voting instructions below

1

or on your proxy card. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, bank, trustee or other nominee; please refer to the voting instructions provided to you by your broker, bank, trustee or other nominee.

Internet—Stockholders of record with Internet access may submit proxies via the Internet athttp://www.proxyvoting.com/lava. Votes submitted via the Internet must be received by 11:59 p.m., Eastern Time, on September 22, 2010. Most of the Company’s stockholders who hold shares beneficially in street name may vote by accessing the website specified in the voting instructions provided by their brokers, banks, trustees or other nominees. A large number of banks and brokerage firms are participating in Broadridge Financial Solutions, Inc.’s (formerly ADP Investor Communication Services) online program for electronic voting. This program provides eligible beneficial owners the opportunity to vote over the Internet athttp://www.proxyvote.com or by telephone. Please refer to the voting instructions provided by your broker, bank, trustee or other nominee to determine if this option is available to you.

Telephone—Stockholders of record may submit proxies by calling toll free (866) 540-5760 until 11:59 p.m., Eastern Time, on September 22, 2010. If you are a beneficial owner, please follow the voting instructions provided to you by your broker, bank, trustee or other nominee with respect to telephone voting.

Mail—Stockholders of record may submit proxies by mail by completing, signing and dating their proxy cards where indicated and by returning them in the self-addressed, prepaid envelope provided. Proxy cards submitted by mail must be received by the tabulator prior to the closing of the polls at the Annual Meeting in order for the votes to be recorded. If you are a beneficial owner and received a voting instruction card, you may submit your voting instructions by completing, signing and dating the voting instruction card where indicated and returning it in the self-addressed, prepaid envelope provided. Voting instruction cards must be received by your broker, bank, trustee or other nominee by the deadline indicated on the voting instruction card in order for your shares to be voted at the Annual Meeting.

Returning your proxy or granting it by telephone or via the Internet will not affect your right to vote in person should you decide to attend the Annual Meeting. However, shares held beneficially in street name may be voted in person at the Annual Meeting only if you obtain a legal proxy from the broker, bank, trustee or other nominee that holds your shares giving you the right to vote the shares at the Annual Meeting.

The shares represented by the proxies received in response to this solicitation and not properly revoked prior to the Annual Meeting will be voted at the Annual Meeting in accordance with the instructions therein. On the matters coming before the Annual Meeting for which a choice has been specified by you on a properly completed and returned proxy card, or in a proxy granted by telephone or through the Internet, the shares will be voted accordingly. If you return your proxy card or grant your proxy by telephone or through the Internet, but do not indicate your voting preference, the individuals named as proxies will vote your sharesFOR the election of the two nominees for director listed in this proxy statement,FORthe approval the proposal to establish the 2010 Stock Incentive Plan,FOR the approval of the proposal to amend and restate the 2001 Employee Stock Purchase Plan, andFOR the ratification of the appointment of Grant Thornton LLP as Magma’s independent registered public accountants, and your shares will be voted in the proxy holders’ discretion as to other matters that may properly come before the Annual Meeting. If you hold your shares in street name and do not submit any voting instructions to your broker, your shares may constitute “broker non-votes” and may not be counted in connection with certain matters (as described below).

Revocation of Proxies

Stockholders of record can revoke their proxies at any time before they are exercised in any of three ways:

| | • | | by voting in person at the Annual Meeting; |

| | • | | by submitting written notice of revocation to Magma’s Secretary at or before the taking of the vote at the Annual Meeting; or |

| | • | | by submitting another proxy of a later date that is properly executed at or before the taking of the vote at the Annual Meeting. |

2

Attendance at the Annual Meeting in and of itself, without voting in person at the meeting, will not cause your previously granted proxy to be revoked.

For shares you hold in street name, you may change your vote by submitting new voting instructions to your broker, bank, trustee or other nominee or, if you have obtained a legal proxy from your broker, bank, trustee or other nominee giving you the right to vote your shares at the Annual Meeting, by attending the meeting and voting in person.

Required Vote and Voting of Proxies

On all matters, each holder of common stock is entitled to one vote for each share held as of the Record Date. Directors are elected by a plurality vote, which means that the two nominees for Class III director seats who receive the most affirmative votes of shares present in person or represented by proxy and entitled to vote in the election of directors will be elected to serve as Class III directors. The proposal to establish the 2010 Stock Incentive Plan, the proposal to amend and restate the 2001 Employee Stock Purchase Plan, and the ratification of the appointment of Grant Thornton LLP as Magma’s independent registered public accountants will be decided by the affirmative vote of the majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on those proposals.

Quorum; Abstentions; Broker Non-Votes

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the Inspector of Elections. The Inspector will also determine whether a quorum is present. In general, under Delaware law and Magma’s bylaws, a quorum for the transaction of business at the Annual Meeting is established if a majority of shares entitled to vote is present in person or represented by proxy at the Annual Meeting.

Abstentions with respect to any proposal, with the exception of proposals on the election of directors, are treated as shares present or represented and entitled to vote on that proposal and thus have the same effect as votesAGAINSTa matter. Shares held by you through a broker are permitted to be voted by the broker on routine “discretionary” items, such as the ratification of Magma’s independent registered public accounting firm, if the broker has transmitted the proxy materials to you and has not received voting instructions from you on how to vote your shares before the deadline set by the broker. If a broker that is the record holder of shares indicates on a proxy that it does not have discretionary authority to vote on a particular proposal as to such shares, including non-routine items such as the election of directors, the approval of the 2010 Stock Incentive Plan or the amendment and restatement of the 2001 Employee Stock Purchase Plan, or if shares are not voted in other circumstances in which proxy authority is defective or has been withheld with respect to a particular proposal, these non-voted shares, or “broker non-votes,” will be counted for quorum purposes but will not be counted in determining the number of shares necessary for approval of those matters.

Expenses of Solicitation

Magma’s Board of Directors is soliciting proxies for the Annual Meeting. Magma will bear all expenses of this solicitation, including the cost of printing and mailing the proxy materials. In addition to the solicitation of proxies by mail, solicitation may be made by directors, officers and other employees of Magma by personal interview, telephone or facsimile. No additional compensation will be paid to such persons for such solicitation. Magma will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation materials to beneficial owners of Magma’s common stock. Magma may generate other expenses in connection with the solicitation of proxies for the Annual Meeting, and may retain a proxy solicitor to assist in the solicitation of proxies.

3

Delivery of Proxy Materials to Stockholders

Each record holder of Magma’s common stock will be receiving a separate copy of the proxy statement and Annual Report. If you are a beneficial owner and share an address with another beneficial owner, you may not receive a separate copy of the proxy statement and Annual Report because some brokers, banks, trustees or other nominees may be participating in the practice of “householding,” which reduces duplicate mailings and saves printing and postage costs. Please contact your broker, bank, trustee or other nominee directly if you have questions, require additional copies of this proxy statement or the Annual Report, or wish to receive multiple copies of proxy materials in the future if you reside at the same address as another stockholder and only one copy was delivered to you.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on September 23, 2010.

If you are a registered stockholder, this proxy statement and Magma’s Annual Report are available athttp://investor.magma-da.com/annuals.cfm. Beneficial holders can access this proxy statement and Magma’s Annual Report via the Internet athttp://www.proxyvote.com.

IMPORTANT

Please mark, sign and date the enclosed proxy card and return it in the enclosed postage-prepaid return envelope, or follow the instructions included with your proxy card to submit your proxy via the toll- free telephone number or via the Internet so that, whether you intend to be present at the Annual Meeting or not, your shares can be voted. This will not limit your rights to attend or vote at the Annual Meeting.

4

MAGMA’S BOARD OF DIRECTORS

Director Independence

The Board believes that a substantial majority of the members of its Board of Directors should be independent directors. The Board also believes that it is useful and appropriate to have members of management, including the Chief Executive Officer, as directors. The Board has determined that each of our current directors other than Messrs. Madhavan and Jewell qualifies as an “independent director” as defined by Nasdaq listing requirements. Timothy Ng, who served on the Board during fiscal 2010 until his resignation in February 2010, and Chester Silvestri, who served on the Board during fiscal 2010 until his resignation in July 2010, also qualified as “independent directors” as defined by Nasdaq listing requirements during the respective term of their service on the Board. The Nasdaq independence definition includes a series of objective tests, such as a requirement that the director is not an employee of the Company and has not engaged in various types of business dealings with the Company. In addition, the Board has made the determination, as to each independent director, that no relationship exists which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the directors reviewed and discussed information provided by the directors and the Company with regard to each director’s business and personal activities as they may relate to Magma and Magma’s management.

The members of the Audit Committee each also meet special independence standards established by the Securities and Exchange Commission (the “SEC”) for audit committees. In addition, the Board has determined that each of Mr. Eichler and Mr. Sugishita is an “audit committee financial expert” as defined by SEC rules. This designation does not impose any duties, obligations or liabilities on Mr. Eichler or Mr. Sugishita that are greater than those generally imposed on other members of the Audit Committee and the Board, and their designation as an audit committee financial expert does not affect the duties, obligations or liability of any other member of the Audit Committee or the Board. Additionally, each member of the Compensation and Nominating Committee meets the definition of “non-employee director” under Rule 16b-3 promulgated under the Securities Exchange Act of 1934 as well as the definition of “outside director” under the regulations promulgated under Section 162(m) of the Internal Revenue Code.

Stockholder Communications

Stockholders wishing to communicate with the Board or any individual director should send the communication by mail to Clayton H. Parker, Secretary, Magma Design Automation, Inc., 1650 Technology Drive, San Jose, California 95110. The Secretary will review all stockholder communications and has the authority to disregard any communication that is inappropriate or irrelevant to the Company and its operations, or to take other appropriate action with respect to such communication. If a stockholder communication is deemed appropriate, the Secretary will submit it to the Chairman of the Board or the individual director.

Code of Ethics

Magma has adopted a Code of Conduct and Ethics that applies to its principal executive officer, principal financial officer, controller and all of its other employees and directors. The Code of Conduct and Ethics is available on Magma’s website at http://investor.magma-da.com/governance.cfm. If applicable, Magma intends to satisfy its disclosure obligations regarding an amendment to, or waiver of, a provision of this Code of Conduct and Ethics by posting such information on Magma’s website at http://investor.magma-da.com/governance.cfm or by filing a Form 8-K with the SEC.

Board and Committee Meetings

The Board and its committees hold scheduled meetings throughout the year and also hold special meetings and act by written consent from time to time as appropriate. The Board held seven meetings during fiscal 2010. All directors except Mr. Silvestri attended at least 75% of the aggregate number of meetings of the Board and the

5

committees on which such directors served. The Board has a policy of encouraging but not requiring members to attend the annual meetings of stockholders. One Board member attended the 2009 annual meeting of stockholders in person.

Board Committees and Charters

The Board has two standing committees: the Audit Committee and the Compensation and Nominating Committee. The Board appoints the members and chairpersons of these committees. Each member of these committees is an independent director in accordance with Nasdaq standards. Each committee has a written charter approved by the Board, which is available on Magma’s website athttp://investor.magma-da.com/governance.cfm.

Audit Committee:

| | |

Members: | | Kevin C. Eichler (Chair), Thomas M. Rohrs, and David Sugishita (appointed in July 2010). Chester J. Silvestri served on the Audit Committee during fiscal 2010 until his resignation from the Board in July 2010. |

| |

Number of Meetings in Fiscal 2010: | | Six |

| |

Functions: | | Assists the Board in its general oversight of Magma’s financial reporting, internal controls, disclosure controls procedures, compliance with legal and regulatory requirements, and internal audit functions and is directly responsible for the appointment, oversight and compensation of the independent registered public accountants. Pre-approves all audit services and permitted non-audit services. Pre-approves related-party transactions. The responsibilities and activities of the Audit Committee are described in greater detail in “Report of the Audit Committee.” |

| |

| Compensation and Nominating Committee: | | |

| |

Members: | | Thomas M. Rohrs (Chair) and Govind Kizhepat (appointed February 2010). Mr. Silvestri served as Chair of the committee during fiscal 2010 until his resignation from the Board in July 2010 and Mr. Ng also served as a member of the committee during fiscal 2010 until his resignation from the Board in February 2010. |

| |

Number of Meetings in Fiscal 2010: | | Two |

| |

Functions: | | The Committee’s compensation-related functions are described below under “Processes and Procedures for Determination of Executive and Director Compensation.” In its role as Magma’s nominating committee, the Committee identifies, evaluates and recommends director candidates to the Board. For more information, see “Nominations to the Board.” |

6

Nominations to the Board

The Compensation and Nominating Committee identifies, evaluates and recommends to the Board candidates for appointment or election as members of the Board, makes recommendations regarding the structure and composition of the Board, and oversees the evaluation of the Board and committees of the Board. The Compensation and Nominating Committee charter includes a written policy with regard to the nomination process. The Compensation and Nominating Committee evaluates potential director candidates based on a variety of criteria, including the candidate’s relevant experience, other board memberships held, the diversity and collective experience of the Board and its committees, as well as independence and possible conflicts of interest. There are no specific minimum qualifications that an individual must meet in order to be nominated; each is considered on a case-by-case basis. The Company does not have a formal policy for the consideration of diversity in identifying nominees for director. However, in assessing directors based on the criteria set forth above, the Compensation and Nominating Committee strives to create diversity in perspective, background and experience in the Board as a whole when identifying and selecting nominees for the Board. On an annual basis, as part of the Board’s self-evaluation, the Compensation and Nominating Committee assesses whether the mix of Board members is appropriate for the Company.

Candidates may come to the attention of the Compensation and Nominating Committee from current Board members, stockholders, professional search firms, officers or other persons. The Compensation and Nominating Committee will review all candidates in the same manner regardless of the source of the recommendation. The Compensation and Nominating Committee will consider properly submitted stockholder recommendations of candidates. Any stockholder recommendation must include the candidate’s name and qualifications for Board membership, the candidate’s age, business address, residence address, principal occupation or employment, the number of shares of Magma common stock beneficially owned by the candidate and information that would be required to solicit a proxy under federal securities law (including, with respect to nominees for the slate of directors to be voted on at the Annual Meeting, such person’s written consent to being named in the proxy statement as a nominee and, with respect to all nominees, such person’s written consent to serving as a director if elected). In addition, the recommendation must include the stockholder’s name, address and the number of shares of Magma common stock beneficially owned and the period they have been held. The recommendation should be sent to Clayton H. Parker, Secretary of Magma Design Automation, Inc., 1650 Technology Drive, San Jose, California 95110. To be timely for next year’s annual meeting, the recommendation must be delivered to the Secretary no sooner than 120 days and no later than 90 days prior to the first anniversary of this Annual Meeting.

Board Leadership Structure

Magma’s current Chairman of the Board is also the Company’s Chief Executive Officer (“CEO”). The Board has not designated a lead independent director. The Board believes it is important to select its Chairman and the Company’s CEO in the manner it considers in the best interests of the Company at any given point in time. The members of the Board possess considerable business experience and in-depth knowledge of the issues the Company faces, and are therefore in the best position to evaluate the needs of the Company and how best to organize the Company’s leadership structure to meet those needs. Accordingly, the Chairman and CEO positions may be filled by one individual or by two different individuals. The Board believes that the most effective leadership structure for the Company at this time is for Mr. Madhavan to serve as both Chairman and CEO. As the Company’s founder, Mr. Madhavan possesses an in-depth knowledge of the Company, the industry in which it conducts its business and the challenges it faces. The Board believes that these experiences and insights put the CEO in the best position to provide broad leadership for the Board as it considers the Company’s strategic and business plans.

7

Board Role in Risk Oversight

Board’s Role in Risk Oversight

One of the principal functions of the Board of Directors is to provide oversight concerning the Company’s assessment and management of risk related to Magma’s business. The Board is involved in risk oversight through direct decision-making authority with respect to fundamental financial and business strategies and major corporate activities as well as through its oversight of management and the committees of the Board. Management is responsible for identifying the material risks facing the Company, implementing appropriate risk management strategies and ensuring that information with respect to material risks is shared with the Board and/or the appropriate Board committee. In connection with this responsibility, members of management therefore provide regular reports to the Board regarding business operations and strategic planning, financial planning and budgeting, material litigation and regulations, including any material risk to the Company relating to such matters.

The Board has delegated oversight for specific areas of risk exposure to committees of the Board. The Audit Committee is responsible for primary risk oversight related to the Company’s financial reporting, accounting and internal controls and oversees risk related to the Company’s compliance with legal and regulatory requirements. The Compensation and Nominating Committee is responsible for overseeing the Company’s assessment of risk related to Magma’s compensation plans and policies and policies and procedures related to management succession, including both emergency CEO succession and CEO succession in the ordinary course of business.

At each regular meeting of the Board, the chairperson of the committees reports to the full Board regarding matters reported and discussed at the committee meetings, including any matters concerning risk exposure and risk oversight considered by the committee. Members of management regularly attend meetings of the committees and the Board when they are not in executive session and present to the Board and committees at these meetings on matters involving the assessment and management of material risks facing the Company. In addition, members of the Board are free to communicate directly with members of management regarding any matter.

Compensation Risk Assessment

Consistent with new SEC disclosure requirements, the Compensation and Nominating Committee considers, in establishing and reviewing our executive compensation program, whether the program encourages unnecessary or excessive risk taking and has concluded that it does not. The executive compensation program reflects a balanced approach using both quantitative and qualitative assessments of performance without putting an undue emphasis on a single performance measure. Base salaries are fixed in amount and thus do not encourage risk taking. While the Company’s annual bonus plan focuses on achievement of annual goals, executives’ annual bonuses are based on multiple Company and individual performance criteria as described above and the Compensation and Nominating Committee retains discretion to reduce bonus amounts otherwise payable based on any factors it deems appropriate. The Compensation and Nominating Committee believes that the annual bonus plan appropriately balances risk and the desire to focus executives on specific annual goals important to the Company’s success.

A substantial portion of compensation provided to the Company’s executive officers is in the form of equity awards that further align executives’ interests with those of stockholders. The Compensation and Nominating Committee believes that these awards do not encourage unnecessary or excessive risk taking because the ultimate value of the awards is tied to the Company’s stock price, and because grants are subject to long-term vesting schedules to help ensure that executives always have significant value tied to long-term stock price performance. The Company’s current practice is to grant executives restricted stock units. The Compensation and Nominating Committee believes this mixture provides an appropriate balance between the goals of increasing the price of the Company’s common stock (as stock options only have value if the stock price increases after the option is granted) and avoiding risks that could threaten the Company’s growth and stability (as restricted stock units are exposed to decreases in the Company’s stock price).

8

In addition, the Company’s management, in consultation with the Compensation and Nominating Committee, conducted an assessment of the risks posed by the Company’s compensation policies and practices for employees generally. In particular, management and the Compensation and Nominating Committee noted in reviewing these policies and practices that the design of the Company’s annual cash incentive program includes multiple Company and individual performance criteria and does not encourage the taking of short-term risks at the expense of long-term results. In addition, the Company’s long-term equity incentive awards are generally subject to multiyear vesting schedules that help to link the interests of the Company’s employees with those of its stockholders. Based on its assessment, the Company concluded that its compensation policies and practices for employees do not create risks that are reasonably likely to have a material adverse effect on the Company.

Processes and Procedures for Determination of Executive and Director Compensation

The Compensation and Nominating Committee is responsible for, among other things, establishing and governing Magma’s compensation and benefit practices. The Compensation and Nominating Committee evaluates and approves the compensation arrangements, plans, policies and programs that apply to Magma’s executive officers and directors and administers Magma’s equity-based compensation plans. Pursuant to the Compensation and Nominating Committee’s charter, its principal compensation related responsibilities, duties and areas of authority include, among other things:

| | • | | To determine and approve the form and amount of compensation to be paid or awarded to Magma’s non-employee directors and all employees of the Company, including its executive officers; |

| | • | | To review and approve the corporate goals and objectives relevant to the compensation of Magma’s Chief Executive Officer and President and other executive officers, to evaluate the performance of the Chief Executive Officer and President and other executive officers and to determine the terms of the compensatory agreements and arrangements for such persons; |

| | • | | To annually review and make recommendations to the Board of Directors with respect to adoption and approval of, or amendments to, all cash-based and equity-based incentive compensation plans and arrangements, and the amounts and shares reserved thereunder; |

| | • | | To approve grants of stock, stock options or stock purchase rights to individuals eligible for such grants in such amounts or such terms as it may deem appropriate, to interpret Magma’s equity-based compensation plans and agreements and to determine acceptable forms of consideration for stock acquired pursuant to the equity-based incentive compensation plans; |

| | • | | To employ advisors, commission any necessary studies or surveys concerning comparative levels of executive compensation and to obtain recommendations from outside consultants concerning compatible pay programs, as appropriate; and |

| | • | | To perform any other activities required by applicable law or Nasdaq rules or regulations, or as the Board deems necessary or appropriate. |

The Compensation and Nominating Committee’s charter permits it to delegate certain of its functions to subcommittees of the Compensation and Nominating Committee or to Magma’s Chief Executive Officer and President. The Compensation and Nominating Committee’s authority to determine and approve the form and amount of compensation to be paid or awarded to Magma’s employees who are not executive officers may be delegated to a subcommittee or to the Chief Executive Officer and President. The Compensation and Nominating Committee has delegated this authority to the Chief Executive Officer and President, and also takes into account the Chief Executive Officer and President’s recommendations regarding corporate goals and objectives, performance evaluations and compensatory arrangements for Magma’s executive officers other than the Chief Executive Officer and President. The Compensation and Nominating Committee may also delegate its authority to approve option grants to Magma’s employees who are not executive officers to the Chief Executive Officer and President, but any such grants must have an exercise price at least equal to the fair market value of Magma’s common stock on the grant date. The Compensation and Nominating Committee has previously delegated to the

9

Chief Executive Officer and President the authority to approve regular monthly grants to newly hired employees and consultants and selective retention or meritorious grants as proposed by management.

As indicated above, pursuant to its charter, the Compensation and Nominating Committee is authorized to employ advisors, commission compensation studies or surveys and to obtain recommendations from outside consultants. For fiscal 2010, members of Magma’s management decided not to retain a consulting firm to assist the Compensation and Nominating committee with a review of Executive compensation for fiscal 2010.

Compensation and Nominating Committee Interlocks and Insider Participation

The Compensation and Nominating Committee is currently composed of Messrs. Rohrs and Kizhepat. Mr. Rohrs served as a member of the committee during all of fiscal 2010 and Mr. Kizhepat served as a member of the committee since his appointment to the Board in February 2010. Mr. Silvestri served as Chair of the committee during fiscal 2010 until his resignation from the Board in July 2010 and Mr. Ng also served as a member of the committee during fiscal 2010 until his resignation from the Board in February 2010. No one who served on the Compensation and Nominating Committee at any time during fiscal 2010 is or has been an executive officer of the Company or had any relationships requiring disclosure by the Company under the SEC’s rules requiring disclosure of certain relationships and related party transactions. None of the Company’s executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity, the executive officers of which served as a director of the Company or a member of the Company’s Compensation and Nominating Committee during fiscal 2010. No member of the Compensation and Nominating Committee is or was formerly an officer or an employee of the Company.

DIRECTOR COMPENSATION—FISCAL 2010

The following table presents information regarding the compensation paid for fiscal 2010 to individuals who were members of the Board of Directors at any time during fiscal 2010 and who were not also our employees (referred to herein as “Non-Employee Directors”). The compensation paid to Messrs. Madhavan and Jewell, who are also employed by us, is presented below in the “Summary Compensation Table” and the related explanatory tables. Directors who are also officers or employees of the Company receive no additional compensation for their services as directors.

| | | | | | | | | |

Name | | Fees Earned or

Paid in Cash

($) | | Stock

Awards

($)(1)(2) | | | Option

Awards

($)(1)(2) | | Total ($) |

| (a) | | (b) | | (c) | | | (d) | | (h) |

Kevin C. Eichler | | 105,500 | | 18,199 | (3) | | 0 | | 123,699 |

Govind Kizhepat | | 6,875 | | 59,748 | (4) | | | | 66,623 |

Susumu Kohyama | | 39,500 | | 18,199 | (3) | | 0 | | 57,699 |

Timothy Ng | | 123,573 | | 18,199 | (5) | | 0 | | 141,772 |

Thomas M. Rohrs | | 60,500 | | 18,199 | (3) | | 0 | | 78,699 |

Chester J. Silvestri | | 64,500 | | 18,199 | (3)(6) | | 0 | | 82,699 |

| (1) | The amounts reported in column (c) of the table above reflect the fair value on the grant date of the stock awards granted to our Non-Employee Directors during fiscal 2010 as determined under the principles used to calculate the value of equity awards for purposes of the Company’s financial statements. For a discussion of the assumptions and methodologies used to calculate the amounts referred to above, please see the discussion of stock awards contained in Note 14—“Stock-Based Compensation” to Magma’s Consolidated Financial Statements as set forth in our Annual Report on Form 10-K for fiscal 2010 filed with the SEC, filed with the SEC and incorporated herein by reference. |

10

| (2) | The following table presents the number of outstanding and unvested option awards and unvested stock awards held by each of our Non-Employee Directors as of May 2, 2010: |

| | | | |

Name | | Aggregate

Number of Shares

Underlying Options

(#) | | Aggregate

Number of Shares

Underlying RSUs

(#) |

Kevin C. Eichler | | 263,333 | | 10,000 |

Govind Kizhepat | | 0 | | 25,000 |

Susumu Kohyama | | 133,333 | | 10,000 |

Timothy Ng (5) | | 213,333 | | 0 |

Thomas M. Rohrs | | 253,366 | | 10,000 |

Chester J. Silvestri (6) | | 223,366 | | 0 |

| (3) | Represents an award of 10,000 restricted stock units granted on September 18, 2009. |

| (4) | Represents awards of 20,000 and 5,000 restricted stock units granted on February 14, 2010. |

| (5) | Mr. Ng resigned from the Board of Directors on February 13, 2010 and continues to provide services to the Company as a consultant. |

| (6) | Mr. Silvestri resigned from the Board of Directors on July 20, 2010. His 10,000 restricted stock unit award was accelerated to his resignation date and resulted in an incremental expense of $34,500. |

Director Compensation

Compensation for our Non-Employee Directors during fiscal 2010 consisted of an annual retainer, an additional retainer for acting as a Chairman of one of our Board of Directors’ committees, an additional retainer for non-chair members of certain committees, fees for attending meetings and an annual equity award. The Board of Directors reviews our director compensation program on an annual basis.

Annual Retainer and Fees

The following table sets forth the schedule of annual retainer fees, committee fees and meeting fees for each Non-Employee Director in effect during fiscal 2010:

| | |

Type of Fee | | Amount ($) |

Annual Board Retainer | | 30,000 |

Additional Annual Fee to the Chairman of Audit Committee | | 20,000 |

Additional Annual Fee to the Chairman of Compensation and Nominating Committee | | 15,000 |

Additional Annual Fee to non-Chair Members of Audit Committee | | 10,000 |

Additional Annual Fee to non-Chair Members of Compensation and Nominating Committee | | 7,500 |

Fee for Each Board or Committee Meeting Attended In Person | | 2,500 |

Fee for Each Board or Committee Meeting Attended Telephonically | | 1,000 |

All Non-Employee Directors are also reimbursed for out-of-pocket expenses they incur serving as directors.

In addition, Messrs. Eichler and Ng were paid an additional fee of $45,000 and $83,448, respectively, for sitting on a special committee of the Board of Directors.

Equity Awards

Non-Employee Directors are eligible to receive automatic grants of equity awards under Magma’s 2001 Stock Incentive Plan (the “2001 Plan”). Each Non-Employee Director who first joins the Board of Directors will receive an initial award of 20,000 restricted stock units upon appointment or election. The initial award will become vested as to 25% of the award on the first anniversary of the award date, with the remaining portion of

11

the award vesting in twelve quarterly installments following such date, subject to the Non-Employee Director’s continued service as a member of the Board of Directors on each applicable vesting date.

In addition, on the first business day following each regular annual meeting of the Company’s stockholders after the Non-Employee Director’s initial appointment or election to the Board of Directors, the director will receive an additional annual award of 10,000 restricted stock units. Effective May 25, 2010, the Board of Directors approved an increase in this annual restricted stock unit award from 10,000 to 20,000 restricted stock units. Any Non-Employee Directors who are initially appointed to the Board of Directors other than in connection with the regular annual meeting of the Company’s stockholders will be entitled to a pro-rata portion of this annual restricted stock unit grant. The annual awards and the pro-rata interim awards vest in full on the day immediately prior to the annual meeting of stockholders in the year immediately following the year of grant, provided that the Non-Employee Director continues as a member of the Board of Directors on that date.

Pursuant to the terms of the 2001 Plan, all restricted stock unit awards granted to our Non-Employee Directors will accelerate and become fully vested upon the occurrence of a “change in control” of Magma (as such term is defined in the 2001 Plan) to the extent unvested on such date.

The Compensation Committee administers the 2001 Plan with respect to the Non-Employee Director grants and has the ability to interpret and make all required determinations under the plan, subject to plan limits.

12

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board of Directors, as now authorized, consists of seven members divided into three classes of approximately equal size. The Class III members of the Board of Directors are scheduled for election at the Annual Meeting, to serve until the 2013 annual meeting of stockholders, or until their successors have been elected by the stockholders or appointed by the Board of Directors pursuant to the Company’s bylaws. The nominees recommended for nomination by the Compensation and Nominating Committee and nominated by the Board of Directors to serve as the two Class III members of the Board of Directors are Rajeev Madhavan and Kevin C. Eichler, each of whom is currently a Class III director and has consented to serve if elected. If any nominee is unable to serve as a director at the time of the Annual Meeting, proxies may be voted for any nominee designated by the Board of Directors to fill the vacancy.

The Class I directors are Roy E. Jewell and Thomas M. Rohrs. The Class II directors are Govind Kizhepat, Susumu Kohyama and David Sugishita. Except as described below, each of Magma’s directors has been engaged in his principal occupation during the past five years. There are no family relationships among any of Magma’s directors or executive officers.

In recommending director nominees for selection by the Board, the Compensation and Nominating Committee considers a number of factors, which are described in more detail above under “Magma’s Board of Directors—Nominations to the Board.” In considering these factors, the Compensation and Nominating Committee and the Board consider the fit of each individual’s qualifications and skills with those of the Company’s other directors in order to build a board of directors that, as a whole, is effective, collegial and responsive to the Company and its stockholders.

The following table sets forth certain information as of July 22, 2010 regarding the Class III nominees to the Board of Directors. The following paragraphs also describe the primary individual experience, qualifications, attributes and skills of each of the Class III nominees that led to the Board’s conclusion that each nominee should serve as a member of the Board, as well as provide a brief biographical description of each of the Class III nominees.

| | | | | | | | |

Name | | Age | | Current

Term

Expires | | Director

Since | | Principal Occupation |

Rajeev Madhavan | | 44 | | 2010 | | 1997 | | Magma Chairman and Chief Executive Officer |

Kevin C. Eichler | | 50 | | 2010 | | 2003 | | Senior Vice President & Chief Financial Officer, Ultra Clean Holdings, Inc. |

Rajeev Madhavan has served as our Chief Executive Officer and Chairman of the Board since our inception in 1997. Mr. Madhavan served as our President and Chief Executive Officer from inception until 2001. Prior to co-founding Magma, from 1994 until 1997, Mr. Madhavan founded and served as the President and Chief Executive Officer of Ambit Design Systems, Inc., an electronic design automation software company, later acquired by Cadence Design Systems, Inc., an electronic design automation software company. Mr. Madhavan, in addition to founding Magma, previously co-founded Ambit Design Systems, Inc. and co-founded and served as director of engineering of LogicVision, Inc. Mr. Madhavan has extensive industry and brings valuable technical, operational, and corporate governance expertise. Mr. Madhavan’s tenure and leadership experience with the Company since the Company’s inception also brings to the Board a unique perspective with respect to the Company’s business strategy and operations.

Kevin C. Eichlerhas been Senior Vice President and Chief Financial Officer of Ultra Clean Holdings, Inc. (Nasdaq: UCTT), a leading developer and supplier of critical subsystems for the semiconductor capital equipment, medical device, research, flat panel and energy industries since July 2009. From January 2008 to

13

March 2009, Mr. Eichler served as Senior Vice President and Chief Financial Officer of Credence Systems Corporation (Nasdaq: CMOS), a global provider of automated test equipment to the high growth, consumer semiconductor industry. From February 2006 to December 2007, Mr. Eichler served as Executive Vice President, Operations and Chief Financial Officer of Markettools, Inc., the defining provider of on-demand market research. From 1998 to February 2006, Mr. Eichler served as Vice President and Chief Financial Officer of MIPS Technologies (Nasdaq: MIPS), a leading provider of industry-standard processor architectures and cores for digital consumer and business applications. Mr. Eichler serves on the board of directors of Crossing Automation Inc., a leading supplier of efficient, cost-effective front-end and back-end automation solutions and engineering services to high-volume semiconductor equipment manufacturers, and until July 2010 he also served on the board of directors of Support.com, Inc. (formerly Supportsoft, Inc.) (Nasdaq: SPRT), which provides services and software that help consumers and small businesses with their technology needs. As the current Chief Financial Officer of Ultra Clean Holdings, Inc. and a former Chief Financial Officer of Credence Systems Corporation and President, Operations and Chief Financial Officer of Markettools, Inc, and Vice President and Chief Financial Officer of MIPS Technologies, Mr. Eichler has significant operating experience, as well as financial, accounting and corporate governance expertise.

Required Vote

The nominees for the two Class III director seats who receive the most affirmative votes of shares present in person or represented by proxy and entitled to vote on this proposal at the Annual Meeting will be elected to serve as directors. Unless marked to the contrary, proxies received will be voted “FOR” each of the nominees set forth above.

The Board of Directors recommends a vote “FOR” election as director of each of the nominees set forth above.

The following table sets forth certain information as of July 22, 2010, regarding the Class I directors, who have been elected to serve until the 2011 annual meeting of stockholders, and the Class II directors, who have been elected to serve until the 2012 annual meeting of stockholders. The following paragraphs also describe the primary individual experience, qualifications, attributes and skills of each of the Class I and Class II directors that led to the Board’s conclusion that each director should serve as a member of the Board, as well as provide a brief biographical description of each of the Class I and Class II directors.

| | | | | | | | | | |

Name | | Age | | Director

Class | | Current

Term

Expires | | Director

Since | | Principal Occupation |

Roy E. Jewell | | 55 | | I | | 2011 | | 2001 | | President and Chief Operating Officer, Magma Design Automation, Inc. |

| | | | | |

Thomas M. Rohrs | | 59 | | I | | 2011 | | 2003 | | Chief Executive Officer, Skyline Solar |

| | | | | |

Govind Kizhepat | | 47 | | II | | 2012 | | 2010 | | Vice President, Business Development, QLogic Corp. |

| | | | | |

Susumu Kohyama | | 67 | | II | | 2012 | | 2005 | | Chairman of the Board, Covalent Materials Corporation |

| | | | | |

Dave Sugishita | | 62 | | II | | 2012 | | 2010 | | Chairman of the Board, Atmel Corporation |

Roy E. Jewell has served as our President since 2001. Mr. Jewell has also served as our Chief Operating Officer since 2001. From 1999 to 2000, Mr. Jewell served as the Chief Executive Officer at a company he co-founded, Clarisay, Inc., a supplier of surface acoustic wave filters. From 1998 to 1999, Mr. Jewell was a member of the CEO Staff at Avant! Corporation, a provider of software products for integrated circuit designs. From 1992 to 1998, Mr. Jewell was the President and Chief Executive Officer of Technology Modeling Associates, Inc., or TMA, subsequently acquired by Avant! Corporation. Prior to that time, Mr. Jewell served in

14

various marketing positions at TMA. As President and Chief Operating Officer of Magma, as well as his previous senior management roles in the semiconductor and electronic design automation industries, Mr. Jewell has extensive industry experience as well as operational and corporate governance experience. Mr. Jewell’s tenure as our President and Chief Operating Officer also brings to the Board an intimate knowledge of the Company’s day-to-day operations, which gives him a detailed understanding of the Company’s business strategy and operations that is invaluable to the Board.

Thomas M. Rohrswas appointed Chief Executive Officer of Skyline Solar, a manufacturer of high gain solar arrays, in July 2010. From February 2010 to July 2010, Mr. Rohrs served as Advisor at Bloom Energy. Previously, from September 2009 to January 2010, Mr. Rohrs was Advisor to the CEO at Abound Solar. From July 2009 to September 2009, Mr. Rohrs acted as interim CEO of Electroglas, Inc., a supplier of wafer probing technologies to the semiconductor industry. From February 2009 to July 2009, Mr. Rohrs served as Executive Chairman of Electroglas, which filed for bankruptcy protection in July 2009. From April 2006 to February 2009, Mr. Rohrs served as Chairman and Chief Executive Officer of Electroglas. Mr. Rohrs has served as a director of Electroglas since 2004. From 2003 to 2006, Mr. Rohrs served as an independent advisor or consultant to businesses. From 1997 until 2003, Mr. Rohrs was an executive at Applied Materials, Inc., a manufacturer of products and services to the semiconductor industry, in a number of positions including Senior Vice President, Global Operations and Member of the Executive Committee. Mr. Rohrs currently serves as a member of the board of directors of Advanced Energy Industries, Inc. and was a member of the board of directors of Ultra Clean Technology from 2004 to 2008. Mr. Rohrs, in addition to his current role as Chief Executive Officer of Skyline Solar, has served in senior management positions in the semiconductor and semiconductor equipment industries. He has significant management and operating experience, as well as substantial corporate governance expertise.

Govind Kizhepat was appointed to Magma’s board in February, 2010. Mr. Kizhepat currently serves as Vice President of Business Development at QLogic Corporation, a leading supplier of high-performance network infrastructure solutions. In 2002 Kizhepat founded NetXen, a provider of intelligent network controller chips and adapters for the enterprise server market, and served as CEO until it was acquired by QLogic in April 2009. He was previously an entrepreneur in residence at Benchmark Capital and executive vice president of Globespan, heading the Media Gateway Division. In 1996, Kizhepat founded iCompression and served as CEO and chairman until it was acquired by Globespan. Mr. Kizhepat’s prior experience includes serving in various technical leadership and management positions at S3 and Sun Microsystems, where he played key roles in the development of SuperSPARC and UltraSPARC processors. Mr. Kizhepat holds a Bachelor of Science degree in electrical engineering from the University of Delhi in India, and a Master of Science degree in electrical engineering from Wayne State University in Michigan. In addition to his current senior management role in a semiconductor supplier, Mr. Kizhepat has founded and led multiple semiconductor companies. He has valuable experience in the semiconductor industries, and brings substantial technical, management and operational expertise.

Susumu Kohyama has been Chairman of the Board of Covalent Materials Corporation (formerly Toshiba Ceramics Co., Ltd. until 2007), a leading materials company serving the semiconductor and LCD industries, since April 2010. From 2004 to April, 2010, Dr. Kohyama served as President and Chief Executive Officer of Covalent. Dr. Kohyama has over 25 years of experience in the semiconductor industry. From 2003 to 2004, he served as Chief Technology Officer of the Electronic Devices Group of Toshiba Corporation. From 2001 to 2003, Dr. Kohyama served as Executive Vice President of Toshiba Semiconductor Company. As the President and CEO of semiconductor supplier Toshiba Ceramics Co., Ltd., and previous senior management positions in the semiconductor industry such as Chief Technology Officer of the Electronic Devices Group of Toshiba Corporation. Dr. Kohyama has extensive industry experience and provides valuable expertise to the Board.

David Sugishitawas appointed to the board in July 2010. Mr. Sugishita has also served as Chairman of the Board at Atmel Corporation since August 2006 and as a director since 2004. In addition, Mr. Sugishita is Chairman of both the Audit Committee and the Corporate Governance and Nominating Committee of Atmel. Mr. Sugishita also serves as a director and Chairman of the Audit committee for both Ditech Networks, Inc. since 2003 and Immersion Corporation since June 2010. Previously, Mr. Sugishita served as a director and Chairman

15

of the Audit Committee of Micro Component Technology, Inc. from 1994 to March 2009. Since 2000, Mr. Sugishita has taken various short-term assignments including Executive Vice President of Special Projects at Peregrine from 2003 to 2004; Executive Vice President/Chief Financial officer at SONICblue, Inc. in 2002 and Senior Vice President and Chief Financial officer of Rightworks, Inc. from 2000 to 2001. Prior to 2000, Mr. Sugishita held various senior financial management positions at Synopsys (Senior Vice President/Finance & Operations/Chief Financial Officer) from 1997 to 2000; Actel (Senior Vice President/Chief Financial Officer) from 1995 to 1997; Micro Component Technology (Senior Vice President/Chief Financial Officer) from 1994 to 1995, Applied Materials (Vice President/Corporate Controller/Chief Accounting Officer) from 1991 to 1994; and National Semiconductor (Vice President/Finance) from 1978 to 1991. Mr. Sugishita holds a B.S. degree in business administration from San Jose State University and an M.B.A. from Santa Clara University. As the current Chairman of the Board of Atmel Corporation, and Atmel’s Chairman of the Audit and Corporate Governance and Nominating Committees, as well as Chairman of the Audit Committees for Ditech Networks Inc. and Immersion Corporation, as well as having served in numerous senior financial management positions in the EDA, semiconductor, and semiconductor equipment industries, Mr. Sugishita has extensive industry experience, as well as financial, accounting and corporate governance experience.

16

PROPOSAL NO. 2

APPROVAL OF THE MAGMA DESIGN AUTOMATION, INC.

2010 STOCK INCENTIVE PLAN

General

At the Annual Meeting, stockholders will be asked to approve the Magma Design Automation, Inc. 2010 Stock Incentive Plan (the “2010 Plan”), which was adopted, subject to stockholder approval, by the Board of Directors on August 6, 2010.

The Company believes that incentives and stock-based awards focus employees on the objective of creating stockholder value and promoting the success of the Company, and that incentive compensation plans like the proposed 2010 Plan are an important attraction, retention and motivation tool for participants in the plan.

The Company currently maintains the Magma Design Automation, Inc. Amended and Restated 2001 Stock Incentive Plan (the “2001 Plan”). As of July 16, 2010, a total of 4,611,805 shares of the Company’s common stock were then available for new award grants under the 2001 Plan. In addition, a total of 11,490,851 shares of the Company’s common stock were then subject to outstanding awards granted under all of the Company’s equity incentive plans (including the 2001 Plan). Of the shares subject to outstanding awards, 9,247,866 shares were subject to outstanding options and 2,242,985 shares were subject to outstanding restricted stock unit awards under the plans. The outstanding options had a weighted-average exercise price of $6.47 and a weighted-average remaining term of 2.84 years. The Company’s outstanding stock option awards generally may not be transferred to third parties for value and do not include dividend equivalent rights. (As noted below, the 2004 Plan has been terminated and the shares that were available for new award grants under the 2004 Plan as of July 16, 2010 were not used for award grant purposes and are not available for future grants.)

The Board of Directors approved the 2010 Plan based, in part, on a belief that the number of shares currently available under the 2001 Plan does not give the Company sufficient authority and flexibility to adequately provide for future incentives. If stockholders approve the 2010 Plan, no new awards will be granted under the 2001 Plan after the Annual Meeting. In that case, the number of shares of the Company’s common stock that remain available for award grants under the 2001 Plan immediately prior to the Annual Meeting will become available for award grants under the 2010 Plan. An additional 5,388,195 shares of the Company’s common stock will also be made available for award grants under the 2010 Plan, so that if stockholders approve the 2010 Plan, a maximum of 10,000,000 shares will initially be available for award grants under that plan. In addition, if stockholders approve the 2010 Plan, any shares of common stock subject to outstanding awards under the 2001 Plan that expire, are cancelled, or otherwise terminate after the Annual Meeting will also be available for award grant purposes under the 2010 Plan.

In order to address potential stockholder concerns regarding the number of options, stock appreciation rights or other stock awards we intend to grant in a given year, the Board of Directors commits to our stockholders that over the next three fiscal years (commencing on May 3, 2010) it will not grant a number of shares subject to options, stock appreciation rights or other stock awards to employees or nonemployee directors at an average rate greater than 8.85% of the number of shares of our common stock that we believe will be outstanding over such three year period. For purposes of calculating the number of shares granted in a year, any full-value awards will count as equivalent to 2.00 shares.

If stockholders do not approve the 2010 Plan, the Company will continue to have the authority to grant awards under the 2001 Plan. If stockholders approve the 2010 Plan, the termination of our grant authority under the 2001 Plan will not affect awards then outstanding under that plan.

17

Summary Description of the 2010 Stock Incentive Plan

The principal terms of the 2010 Plan are summarized below. The following summary is qualified in its entirety by the full text of the 2010 Plan, which appears asExhibitA to this Proxy Statement.

Purpose. The purpose of the 2010 Plan is to promote the long-term success of the Company and the creation of stockholder value by encouraging employees, directors and other eligible persons to focus on critical long-term objectives, encouraging the attraction and retention of employees, directors and other eligible persons with exceptional qualifications and linking the interests of these individuals directly to stockholder interests through awards granted under the plan.

Administration. Our Board of Directors or one or more committees appointed by our Board of Directors will administer the 2010 Plan. Our Board of Directors has delegated general administrative authority for the 2010 Plan to the Compensation Committee. A committee may delegate some or all of its authority with respect to the 2010 Plan to another committee of directors, and certain limited authority to grant awards to employees may be delegated to one or more officers of the Company. (The appropriate acting body, be it the Board of Directors, a committee within its delegated authority, or an officer within his or her delegated authority, is referred to in this proposal as the “Administrator”).

The Administrator has broad authority under the 2010 Plan with respect to award grants including, without limitation, the authority:

| | • | | to interpret the 2010 Plan and to apply its provisions, and to adopt, amend or rescind rules, procedures and forms relating to the plan; |

| | • | | to select participants and determine the type(s) of award(s) that they are to receive; |

| | • | | to determine the number of shares that are to be subject to awards and the terms and conditions of awards, including the price (if any) to be paid for the shares or the award; |

| | • | | to cancel, modify, or waive the Company’s rights with respect to, or modify, discontinue, suspend, or terminate any or all outstanding awards, subject to any required consents; |

| | • | | to accelerate or extend the vesting or exercisability or extend the term of any or all outstanding awards; |

| | • | | subject to the other provisions of the 2010 Plan, to make certain adjustments to an outstanding award and to authorize the conversion, succession or substitution of an award; and |

| | • | | to allow the purchase price of an award or shares of the Company’s common stock to be paid in the form of cash, check, or electronic funds transfer, by the delivery of already-owned shares of the Company’s common stock or by a reduction of the number of shares deliverable pursuant to the award, by services rendered by the recipient of the award, by notice and third party payment or cashless exercise on such terms as the Administrator may authorize, or any other form permitted by law. |

No Repricing. In no case (except due to an adjustment to reflect a stock split or similar event or any repricing that may be approved by stockholders) will any adjustment be made to a stock option or stock appreciation right award under the 2010 Plan (by amendment, cancellation and regrant, exchange or other means) that would constitute a repricing of the per share exercise or base price of the award.

Eligibility. Persons eligible to receive awards under the 2010 Plan include officers or employees of the Company or any of its subsidiaries, directors of the Company, and certain consultants and advisors to the Company or any of its subsidiaries. Currently, approximately 668 officers and employees of the Company and its subsidiaries (including all of the Company’s named executive officers), and each of the Company’s five non-employee directors, are considered eligible under the 2010 Plan.

Authorized Shares; Limits on Awards. The maximum number of shares of the Company’s common stock that may be issued or transferred pursuant to awards under the 2010 Plan equals the sum of: (1) 5,388,195 shares,

18

plus (2) the number of shares available for additional award grant purposes under the 2001 Plan as of the date of the Annual Meeting and determined immediately prior to the termination of the authority to grant new awards under that plan as of the date of the Annual Meeting, plus (3) the number of any shares subject to stock options or stock appreciation rights granted under the 2001 Plan and outstanding as of the date of the Annual Meeting which expire, or for any reason are cancelled or terminated, after the date of the Annual Meeting without being exercised, plus (4) the number of any shares subject to restricted stock and restricted stock unit awards granted under the 2001 Plan that are outstanding and unvested as of the date of the Annual Meeting which are forfeited, terminated, cancelled, or otherwise reacquired after the date of the Annual Meeting without having become vested. As of July 16, 2010, approximately 4,611,805 shares were available for additional award grant purposes under the 2001 Plan and approximately 11,052,130 shares were subject to awards then outstanding under the 2001 Plan. As noted above, no additional awards will be granted under the 2001 Plan if stockholders approve the 2010 Plan.

Shares issued in respect of any “full-value award” granted under the 2010 Plan will be counted against the share limit described in the preceding paragraph as 1.92 shares for every one share actually issued in connection with the award. For example, if the Company granted 100 shares of its common stock under the 2010 Plan, 192 shares would be charged against the share limit with respect to that award. For this purpose, a “full-value award” generally means any award granted under the plan other than a stock option or stock appreciation right.

The following other limits are also contained in the 2010 Plan:

| | • | | The maximum number of shares that may be delivered pursuant to options qualified as incentive stock options granted under the plan is 5,388,195 shares. |

| | • | | The maximum number of shares subject to those options and stock appreciation rights that are granted during any calendar year to any individual under the plan is 1,000,000 shares. |

| | • | | “Performance-Based Awards” under Section 11(a) of the 2010 Plan granted to a participant in any one calendar year will not provide for payment of more than (1) in the case of awards payable only in cash and not related to shares, $4,000,000, and (2) in the case of awards related to shares (and in addition to options and stock appreciation rights which are subject to the limit referred to above), 1,000,000 shares. |

Except as described in the next sentence, shares that are subject to or underlie awards which expire or for any reason are cancelled or terminated, are forfeited, fail to vest, or for any other reason are not paid or delivered under the 2010 Plan will again be available for subsequent awards under the 2010 Plan. Shares that are exchanged by a participant or withheld by the Company to pay the exercise price of an award granted under the 2010 Plan, as well as any shares exchanged or withheld to satisfy the tax withholding obligations related to any award, will not be available for subsequent awards under the 2010 Plan. To the extent that an award is settled in cash or a form other than shares, the shares that would have been delivered had there been no such cash or other settlement will not be counted against the shares available for issuance under the 2010 Plan. In the event that shares are delivered in respect of a dividend equivalent right, only the actual number of shares delivered with respect to the award shall be counted against the share limits of the 2010 Plan. (For purposes of clarity, if 1,000 dividend equivalent rights are granted and outstanding when the Company pays a dividend, and 50 shares are delivered in payment of those rights with respect to that dividend, 50 shares shall be counted against the share limits of the plan.) To the extent that shares are delivered pursuant to the exercise of a stock appreciation right or stock option, the number of underlying shares as to which the exercise related shall be counted against the applicable share limits, as opposed to only counting the shares actually issued. (For purposes of clarity, if a stock appreciation right relates to 100,000 shares and is exercised at a time when the payment due to the participant is 15,000 shares, 100,000 shares shall be charged against the applicable share limits with respect to such exercise.) In addition, the 2010 Plan generally provides that shares issued in connection with awards that are granted by or become obligations of the Company through the assumption of awards (or in substitution for awards) in connection with an acquisition of another company will not count against the shares available for issuance under the 2010 Plan. The Company may not increase the applicable share limits of the 2010 Plan by repurchasing shares of common stock on the market (by using cash received through the exercise of stock options or otherwise).

19

Types of Awards. The 2010 Plan authorizes stock options, stock appreciation rights, restricted stock, stock bonuses and other forms of awards granted or denominated in the Company’s common stock or units of the Company’s common stock, as well as cash bonus awards. The 2010 Plan retains flexibility to offer competitive incentives and to tailor benefits to specific needs and circumstances. Any award may, by its terms, provide that it may be paid or settled in cash.

A stock option is the right to purchase shares of the Company’s common stock at a future date at a specified price per share (the “exercise price”). The per share exercise price of an option generally may not be less than the fair market value of a share of the Company’s common stock on the date of grant. The maximum term of an option is five years from the date of grant. An option may either be an incentive stock option or a nonqualified stock option. Incentive stock option benefits are taxed differently from nonqualified stock options, as described under “Federal Income Tax Consequences of Awards Under the 2010 Plan” below. Incentive stock options are also subject to more restrictive terms and are limited in amount by the U.S. Internal Revenue Code and the 2010 Plan. Incentive stock options may only be granted to employees of the Company or a subsidiary.

A stock appreciation right is the right to receive payment of an amount equal to the excess of the fair market value of share of the Company’s common stock on the date of exercise of the stock appreciation right over the base price of the stock appreciation right. The base price will be established by the Administrator at the time of grant of the stock appreciation right and generally may not be less than the fair market value of a share of the Company’s common stock on the date of grant. Stock appreciation rights may be granted in connection with other awards or independently. The maximum term of a stock appreciation right is five years from the date of grant.

The per share exercise price of an option or the per share base price of a stock appreciation right may not be less than the fair market value of a share of the Company’s common stock on the date of grant

The other types of awards that may be granted under the 2010 Plan include, without limitation, stock bonuses, restricted stock, performance stock, stock units, dividend equivalents, or similar rights to purchase or acquire shares, and cash awards.

Performance-Based Awards. The Administrator may grant awards that are intended to be performance-based awards within the meaning of Section 162(m) of the U.S. Internal Revenue Code (“Performance-Based Awards”). Performance-Based Awards are in addition to any of the other types of awards that may be granted under the 2010 Plan (including options and stock appreciation rights which may also qualify as performance-based awards for Section 162(m) purposes). Performance-Based Awards may be in the form of restricted stock, performance stock, stock units, other rights, or cash bonus opportunities.