As filed with the Securities and Exchange Commission on May 4 , 2010

Registration No. _______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1 /A

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

LEXON TECHNOLOGIES INC.

(Exact name of registrant as specified in its charter)

| Delaware | 0-24721 | 87-0502701 |

| (State or other jurisdiction of | (Commission File Number) | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

14830 Desman Road

La Mirada, CA 90638

(Address of Principal Executive Offices)

(714) 522-0260

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Approximate date of commencement of proposed sale to public:As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [ X ]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | (Do not check if smaller reporting company) | Smaller reporting company [x] |

| Proposed maximum | Proposed maximum | |||||||||||

| Title of each class of | Amount to be | offering price per share | aggregate offering | Amount of registration | ||||||||

| securities to be registered | registered(1)(3) | (2) | price(2) | fee | ||||||||

| Common Stock, $0.001 par value | 44,362,999 | $ | 0.03 | $ | 1,330,889.97 | $ | 94.89 | |||||

| Total | $ | 94.89 |

CALCULATION OF REGISTRATION FEE

(1) In accordance with Rule 416(a), the Registrant is also registering hereunder an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions.

(2) Estimated pursuant to Rule 457(c) of the Securities Act of 1933 solely for the purpose of computing the amount of the registration fee based on the average of the high and low prices reported on the OTC Bulletin Board on March 15, 2010.

(3) Represents 44,362,999 shares of the Registrant’s Common Stock being offered by the selling stockholders named in the Registration Statement.

(4) The registration fee was paid at the time of the initial filing of this registration statement on March 15, 2010.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS

Subject to completion, dated May 4 , 2010

LEXON TECHNOLOGIES INC.

44,362,999 Shares of Common Stock

This prospectus relates to 44,362,999 shares of Common Stock of Lexon Technologies, Inc. that may be sold from time to time by the selling stockholders named in this prospectus.

We will not receive any proceeds from the sale of Common Stock covered by this prospectus.

Our Common Stock is quoted on the OTC Bulletin Board maintained by the National Association of Securities Dealers, Inc. under the symbol “LEXO.OB.” The closing bid price for our Common Stock on April 30, 2010 was $0.04 per share, as reported on the OTC Bulletin Board.

Any participating broker-dealers and any selling stockholders who are affiliates of broker-dealers are “underwriters” within the meaning of the Securities Act of 1933, as amended, or the Securities Act, and any commissions or discounts given to any such broker-dealer or affiliate of a broker-dealer may be regarded as underwriting commissions or discounts under the Securities Act. The selling stockholders have informed us that they do not have any agreement or understanding, directly or indirectly, with any person to distribute their Common Stock.

Investing in our Common Stock involves a high degree of risk. See “Risk Factors” to read about factors you should consider before buying shares of our Common Stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is May 4, 2010.

SUMMARY

The items in the following summary are described in more detail later in this prospectus. This summary provides an overview selected information and does not contain all the information you should consider. Therefore, you should also read the more detailed information set out in this prospectus, including the financial statements, the notes thereto and matters set forth under “Risk Factors.

Overview

We are one of the first movers in recycling toner cartridges for laser printers, fax and multifunction copiers. We also specialize difficult to find toner as well as color and special niche cartridges. We have a 35,000 square foot factory, 67 employees and the capacity to manufacture 50,000 cartridges per month and recycle 350 different models of toner cartridges. Our main clients include multinational companies such as Micro Center, Royal Imaging, Staples, Inc., and Royal Typewriter. We also operates an online website for the sale of its toner products and is also a supplier numerous independent online websites.

Risk Factors

Our ability to successfully operate our business and achieve our goals and strategies is subject to numerous risks as discussed more fully in the section titled “Risk Factors,” including for example:

| • | reliance on subcontractors and third party suppliers; |

| • | changes in market conditions and consumer demands that affect our industry; |

| • | inability to effectively manage rapid growth; and |

| • | the possibility of losing key members of our senior management. |

Any of the above risks could materially and adversely affect our business, financial position and results of operations. An investment in our Common Stock involves risks. You should read and consider the information set forth in “Risk Factors” and all other information set forth in this prospectus before investing in our Common Stock.

Corporate Information

Paragon was founded in the state of California in 1993 and incorporated as an S Corp in 2004. Lexon was incorporated under the laws of the State of Delaware on April 20, 1989 under the name of California Cola Distributing Company, Inc. The name was later changed to Rexford, Inc. on October 1, 1992. Effective July 21, 1999, the name of the Company was changed from Rexford, Inc. to Lexon Technologies, Inc. We have opted to keep the name of Lexon Technologies Inc, and use a dba name of Paragon Toner going forward. For the purposes of this document, Paragon will signify the name of the main operation of the Company.

Paragon is in the business of manufacturing, marketing and selling recycled monochrome and color toner cartridges for laser printers and other related devices.

Lexon / Paragon’s executive offices are located at 14830 Desman Road, La Mirada, CA 90638 and our telephone number at such address is (714) 522-0260. We maintain a website at www.paragontoner.com that contains information about our Company, but that information is not part of this prospectus.

The Offering

Common Stock offered by selling stockholders44,362,999 common shares. This number represents 8.61% of our current outstanding Common Stock (1). The total value of the shares of Common Stock based on the market price of our Common Stock at the time of sale is $1,330,889.96. (2)

| Common Stock outstanding before the offering | 515,289,722 shares. |

| Common Stock outstanding after the offering | 515,289,722 shares. |

| Proceeds to us | We will not receive any proceeds from the sale of Common Stock covered by this prospectus. |

| (1) | Based on 515,289,722 shares of Common Stock outstanding as of May 2, 2010. | |

| (2) | At the time of the sale, our Common Stock had been quoted on the OTC Bulletin Board as “LEXO.OB.” |

Summary Consolidated Financial Information

The following table provides summary consolidated financial statement data as of and for each of the fiscal years ended December 31, 2009 and 2008. The financial statement data as of and for each of the fiscal years ended December 31, 2009 and 2008 have been derived from our audited consolidated financial statements. The results of operations for past accounting periods are not necessarily indicative of the results to be expected for any future accounting period. The data set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our consolidated financial statements and the related notes included in this prospectus, and the unaudited financial statements and related notes included in this prospectus.

The following table summarizes our key results of operations for each of the fiscal years ended December 31, 2009 and 2008.

| Year Ended December 31, | ||||||

| 2009 | 2008 | |||||

| Total net revenue | $ | 5,446,742 | $ | 6,707,301 | ||

| Gross profit | 1,547,414 | 1,716,977 | ||||

| Operating income | 101,378 | 128,322 | ||||

| Net income | 472,090 | 60,034 | ||||

RISK FACTORS

An investment in our Common Stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this prospectus, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our Common Stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

We may not maintain profitability.

Although we do not have a history of operating losses, we may incur additional substantial operating expenses for the foreseeable future in attempts to expand our business operations and/or marketing efforts, thereby potentially causing us to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. In such a situation, we may need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or maintain profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of our Common Stock and investors may lose all or a substantial amount of their investment.

We will need significant additional capital, which we may be unable to obtain.

We believe that our current cash and cash flow from operations will be sufficient to meet our present cash needs. We may, however, require additional cash resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If these resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financing covenants that would restrict our operations. Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including: Investors’ perception of, and demand for, securities of companies involved in the office supply industry; conditions of the U.S. and other capital markets in which we may seek to raise funds; and our future results of operations, financial conditions and cash flows.

Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could have a material adverse effect on our business, financial condition and results of operations. If we are unable to raise substantial capital, investors may lose all or a substantial amount of their investment.

If our strategy is unsuccessful, we will not be profitable and our shareholders could lose their investment.

We believe there are few case precedents for companies pursuing our type of business strategy, and there is no guarantee that our strategy will be successful or profitable. If our strategy is unsuccessful, we will fail to meet our objectives and not realize the revenues or profits from the business we pursue, which would cause the value of the Company to decrease, thereby potentially causing in all likelihood, our shareholders to lose their investment.

We may not be able to effectively control and manage our proposed growth business plan, which would negatively impact our operations.

If our business and markets grow and develop, of which there are no assurances, it will be necessary for us to finance and manage expansion in an orderly fashion. We may face challenges in managing expanding service offerings and in integrating any acquired businesses with our own. Such eventualities will increase demands on our existing management, workforce and facilities. Failure to satisfy increased demands could interrupt or adversely affect our operations and cause logistical and administrative inefficiencies.

We may be unable to successfully execute any of our identified business opportunities or other business opportunities that we determine to pursue.

We currently have a limited corporate infrastructure. In order to pursue business opportunities, we will need to continue to build our infrastructure and operational capabilities to make it more efficient and capable of handling increased volume and sophisticated manufacturing processes. Our ability to do any of these successfully could be affected by any one or more of the following factors:

| our ability to raise substantial additional capital to fund the implementation of our business plan; | ||

| our ability to execute our business strategy; | ||

| the ability of our products to achieve market acceptance; | ||

| our ability to manage the expansion of our operations and any acquisitions we may make, which could result in increased costs, high employee turnover or damage to customer relationships; | ||

| our ability to attract and retain qualified personnel; | ||

| our ability to manage our third party relationships effectively; | ||

| our ability to accurately predict and respond to the rapid technological changes in our industry and the evolving demands of the markets we serve; | ||

| challenges related to the manufacturing process of the Company, including breakdown or failure of equipment or processes; and | ||

| major incidents and/or catastrophic events such as fires, explosions, earthquakes or storms. |

Our failure to adequately address any one or more of the above factors could have a significant impact on our ability to implement our business plan and our ability to pursue other opportunities that arise, which could result in investors losing their entire investments.

Our business depends on the continued reliance of toner ink cartridges for printing, and if the market develops alternate, non-toner ink cartridge methods of printing which assumes dominance in the marketplace, our ability to attract and retain customers may be impaired and our business and operating results may be harmed.

We believe that toner ink cartridges will remain the industry standard for the short and immediate future. Industry reliance on toner ink cartridges is critical for our businesses. Therefore, new technological developments and changes in the imaging and printing industry will require us to make substantial investments with no assurance that these investments will be successful. If we fail or if we incur significant expenses (or significantly greater expenses than allocable) in this effort, our business, prospects, operating results and financial condition will be harmed.

Our operations may be negatively affected by currency exchange rate fluctuations.

Our assets, earnings and cash flows may be influenced by a wide variety of currencies due to the geographic diversity of the countries in which plan on operating in. Fluctuations in the exchange rates of those currencies, if we are able to commence operation in different countries, may have a significant impact on our financial results. Given the dominant role of the US currency in our affairs, the US dollar is the currency in which we present financial performance. It is also the natural currency for borrowing and holding surplus cash. We do not generally believe that active currency hedging provides long-term benefits to our shareholders. We may consider currency protection measures appropriate in specific commercial circumstances, subject to strict limits established by our Board. Therefore, in any particular year, currency fluctuations may have a significant and material adverse impact on our financial results.

Economic, political and other risks associated with international sales and operations could adversely affect our proposed business.

Since we intend to sell some of our products worldwide and currently purchase used ink cartridges from abroad, our proposed business is subject to risks associated with doing business internationally. In addition, our employees, contract manufacturers, suppliers and job functions may be located outside the U.S. Accordingly, our future results could be harmed by a variety of factors, including, but not limited to:

- interruption to transportation flows for delivery of parts to us and finished goods to our customers;

- changes in foreign currency exchange rates;

- changes in a specific country's or region's political, economic or other conditions;

- trade protection measures and import or export licensing requirements;

- negative consequences from changes in tax laws;

- difficulty in staffing and managing widespread operations;

- differing labor regulations;

- differing protection of intellectual property;

- unexpected changes in regulatory requirements; and

- geopolitical turmoil, including terrorism and war.

Our manufacturing processes and quality control capabilities are valuable for our survival, and the ability of others to replicate these capabilities could reduce the value of our products.

Our manufacturing processes and quality control capabilities are important assets for us. As a result of being one of the “first-to-market” we have gained a significant amount of know-how and expertise related to the design of these recycled toner. However, the manufacturing process is not proprietary and has not been registered for intellectual property protection. The barriers to entry are limited and increased competition would reduce our revenues and profit margins.

We may become liable for damages for violations of environmental laws and regulations.

We may be subject to various environmental laws and regulations enacted in the jurisdictions in which we operate which govern the manufacture, importation, handling and disposal of certain toner related materials used in our operations. There can be no assurance that our procedures will prevent environmental damage occurring from spills of materials handled by the Company or that such damage has not already occurred. On occasion, substantial liabilities to third parties may be incurred. We may have the benefit of insurance maintained by the Company or the operator; however, the Company may become liable for damages against which it cannot adequately insure or against which it may elect not to insure because of high costs or other reasons. We may be required to increase operating expenses or capital expenditures in order to comply with any new restrictions or regulations.

Our ability to compete and grow is dependent on access to adequate supplies of labor, equipment, parts and components.

Our ability to compete and grow will be dependent on our having access, at a reasonable cost and in a timely manner, to skilled labor, equipment, parts and components. Failure of suppliers to deliver such skilled labor, equipment, parts and components at a reasonable cost and in a timely manner would be detrimental to our ability to compete and grow. No assurances can be given we will be successful in maintaining our required supply of skilled labor, equipment and components. It is possible that the final costs of the major equipment contemplated by our capital expenditure program may be greater than the funds available to the Company, in which circumstances we may curtail, or extend the timeframes for completing, our capital expenditure plans. This could have a material adverse effect on our financial results.

The prices we will receive for our end products are uncertain.

The prices we receive for our end products will be dependent on demand for them and all estimates for the pricing of our end products are currently uncertain.

We rely on key personnel and, if we are unable to retain or motivate key personnel or hire qualified personnel, we may not be able to grow effectively.

Our success depends in large part upon the abilities and continued service of our executive officers and other key employees. There can be no assurance that we will be able to retain the services of such officers and employees. Our failure to retain the services of our key personnel could have a material adverse effect on the Company. In order to support our projected growth, we will be required to effectively recruit, hire, train and retain additional qualified management personnel. Our inability to attract and retain the necessary personnel could have a material adverse effect on the Company.

RISKS RELATED TO THIS OFFERING AND THE MARKET FOR OUR STOCK GENERALLY

There is no trading market for the Common Stock.

The Common Stock is eligible for quotation on the Over-the-Counter Bulletin Board. However, to date there has been limited trading market for the Common Stock, and we cannot give an assurance that a trading market will develop. The lack of an active, or any, trading market will impair a stockholder’s ability to sell his shares at the time he wishes to sell them or at a price that he considers reasonable. An inactive market will also impair our ability to raise capital by selling shares of capital stock and will impair our ability to acquire other companies or assets by using Common Stock as consideration.

Stockholders may have difficulty trading and obtaining quotations for our Common Stock.

Our Common Stock does not trade, and the bid and asked prices for our Common Stock on the Over-the-Counter Bulletin Board may fluctuate widely in the future. As a result, investors may find it difficult to dispose of, or to obtain accurate quotations of the price of, our securities. This severely limits the liquidity of our Common Stock, and would likely reduce the market price of our Common Stock and hamper our ability to raise additional capital.

The market price of our Common Stock is likely to be highly volatile and subject to wide fluctuations.

Dramatic fluctuations in the price of our Common Stock may make it difficult to sell our Common Stock. The market price of our Common Stock is likely to be highly volatile and could be subject to wide fluctuations in response to a number of factors that are beyond our control, including: dilution caused by our issuance of additional shares of Common Stock and other forms of equity securities, in connection with future capital financings to fund our operations and growth, to attract and retain valuable personnel and in connection with future strategic partnerships with other companies;

- variations in our quarterly operating results;

- announcements that our revenue or income are below or that costs or losses are greater than expectations;

- the general economic slowdown;

- sales of large blocks of our Common Stock;

- announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; and

- fluctuations in stock market prices and volumes;

These and other factors are largely beyond our control, and the impact of these risks, singly or in the aggregate, may result in material adverse changes to the market price of our Common Stock and/or our results of operations and financial condition.

The ownership of our Common Stock is highly concentrated in our officers and directors.

Based on the 515,289,722 of Common Stock outstanding as of March 15, 2010, our executive officers and directors beneficially own approximately 63% of our outstanding Common Stock. As a result, they have the ability to exercise control over our business by, among other items, their voting power with respect to the election of directors and all other matters requiring action by stockholders. Such concentration of share ownership may have the effect of discouraging, delaying or preventing, among other items, a change in control of the Company. Our officers and directors acquired their securities in the Company at no or nominal cost.

The Common Stock will be subject to the “penny stock” rules of the SEC, which may make it more difficult for stockholders to sell the Common Stock.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

- that a broker or dealer approve a person's account for transactions in penny stocks; and

- the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

- obtain financial information and investment experience objectives of the person; and

- make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

- sets forth the basis on which the broker or dealer made the suitability determination; and

- that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

The regulations applicable to penny stocks may severely affect the market liquidity for the Common Stock and could limit an investor’s ability to sell the Common Stock in the secondary market.

As an issuer of “penny stock,” the protection provided by the federal securities laws relating to forward looking statements does not apply to the Company.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks.

As a result, the Company will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by the Company contained a material misstatement of fact or was misleading in any material respect because of the Company’s failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

The Company has not paid dividends in the past and does not expect to pay dividends for the foreseeable future. Any return on investment may be limited to the value of the Common Stock.

No cash dividends have been paid on the Common Stock. We expect that any income received from operations will be devoted to our future operations and growth. The Company does not expect to pay cash dividends in the near future. Payment of dividends would depend upon our profitability at the time, cash available for those dividends, and other factors as the Company’s board of directors may consider relevant. If the Company does not pay dividends, the Common Stock may be less valuable because a return on an investor’s investment will only occur if the Company’s stock price appreciates.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” above.

In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

| • | our expectations regarding the market for our products and services; |

| • | our expectations regarding the continued growth of the toner and office supplies market; |

| • | our beliefs regarding the competitiveness of our products; |

| • | our expectations regarding the expansion of our manufacturing operations; |

| • | our expectations with respect to increased revenue growth and our ability to achieve profitability resulting from increases in our production volumes; |

| • | our future business development, results of operations and financial condition; and |

| • | competition from other toner re-manufacturers. |

Also, forward-looking statements represent our estimates and assumptions only as of the date of this prospectus. You should read this prospectus and the documents that we reference in this prospectus, or that we filed as exhibits to the registration statement of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of shares of our Common Stock by the selling stockholders. The selling stockholders will receive all of the net proceeds from the sales of Common Stock offered by them under this prospectus.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Our Common Stock has been quoted on the OTC Bulletin Board under the symbol “LEXO.OB.” The last reported sales price of our Common Stock on the OTC Bulletin Board on April 30, 2010 was $0.04 per share. As of April 30, 2010 there were approximately 500 holders of record of our Common Stock.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our Common Stock and do not anticipate declaring or paying any cash dividends in the foreseeable future. We currently expect to retain future earnings, if any, for the development of our business. Dividends may be paid on our Common Stock only if and when declared by our board of directors.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Cautionary Statement Regarding Forward-Looking Statements

This report may contain “forward-looking” statements. Examples of forward-looking statements include, but are not limited to: (a) projections of revenues, capital expenditures, growth, prospects, dividends, capital structure and other financial matters; (b) statements of plans and objectives of our management or Board of Directors; (c) statements of future economic performance; (d) statements of assumptions underlying other statements and statements about us and our business relating to the future; and (e) any statements using the words “anticipate,” “expect,” “may,” “project,” “intend” or similar expressions. All forward-looking statements included in this Report are based on information available to the Company on the date hereof, and the Company assumes no obligation to update any such forward-looking statement. It is important to note that the Company's actual results could differ materially from those in such forward-looking statements. Additionally, the following discussion and analysis should be read in conjunction with the Financial Statements and notes thereto appearing elsewhere in this Report.

Results of Operations for the Year Ended December 31, 2009 compared to December 31, 2008

The following table summarizes our results of operations for the periods indicated.

| Year Ended December 31, | ||||||

| 2009 | 2008 | |||||

| Total net revenue | $ | 5,446,742 | $ | 6,707,301 | ||

| Total cost of goods sold | 3,899,328 | 4,990,324 | ||||

| Gross profit | 1,547,414 | 1,716,977 | ||||

| Gross profit margin(1) | 28.4% | 25.6% | ||||

| Selling, general and administrative expenses | 1,446,036 | 1,588,655 | ||||

| Operating income | 101,378 | 128,322 | ||||

| Operating profit margin(2) | 1.9% | 2.0% | ||||

| Other income (expenses): | ||||||

| Interest expense | (47,903 | ) | (66,039 | ) | ||

| Gain on forgiveness of debt from discontinued operations | 418,970 | 0 | ||||

| Other income, net | 3,528 | 0 | ||||

| Total net other expense | 374,595 | (66,039 | ) | |||

| Income before income tax expenses | 475,973 | 62,283 | ||||

| Provision for income taxes(3) | 3,883 | 2,249 | ||||

| Net income | 472,090 | 60,034 | ||||

Notes:

| (1) | Gross profit margin for each period is calculated by dividing gross profit by total revenues for each period. |

| (2) | Operating profit margin for each period is calculated by dividing operating income by total revenues for each period. |

| (3) | The Company elected to be subject to the S corporation provisions of the Internal Revenue Code for federal and state income tax purposes effective January 27, 2004. Accordingly, as an S corporation, the Company’s taxable income or losses and applicable tax credits are passed through to its shareholder and reported on shareholder’s individual income tax return. However, the State of California requires S corporations to pay a state franchise tax (currently 1.5% on its taxable income). |

Revenues. Total revenues during the year ended December 31, 2009 were $5,446,742 compared to $6,707,301 for the year ended December 31, 2008.

Operating Expenses. Total operating expenses during the year ended December 31, 2009 were $1,446,036 in selling, general and administrative expenses compared to $1,588,655 for the year ended December 31, 2008.

Other Income (Expense). Other income for the year ended December 31, 2009 was $374,595 which consisted of interest expense of $47,903 and gain on forgiveness of debt of 418,970 compared to other income of ($66,039) for the year ended in 2008 which consisted of interest expense of $66,039.

Liquidity and Capital Resources

At December 31, 2009, we had current assets of $1,386,702 and current liabilities of $1,476,763, for negative working capital of $90,061. Current assets consisted solely of cash and cash equivalents, accounts receivables, inventory and other current assets. We also had net property and equipment of $112,392, intangibles, net of amortization of $276,365, security deposits of $20,748 and goodwill of $3,214,289 for total assets of $5,200,496.

Current liabilities at December 31, 2009, consisted of accounts payable of $552,634, accounts payable-related parties of $91,960, line of credit of $450,000, current accrued expenses of $110,747, notes payable of $249,534, capital lease obligations of $21,888, for total current liabilities of $1,476,763. We also had contingent liabilities of $274,610.

For the year ended December 31, 2009, net cash flows used in operating activities totaled $180,096, compared to net cash flows provided by operating activities of $488,988 in the prior year.

For the year ended December 31, 2009, there was $53,089 cash provided by investing activities compared to the net cash used in investing activities of $210,859.

Net cash provided by financing activities for the year ended December 31, 2009 was $108,405, compared net cash used of $209,970 for the prior year which consisted of cash paid on notes payable of $89,268, payment on capital lease obligations of $32,152 and distribution to shareholder of $193,285, offset by proceeds from line of credit of $104,735.

Going forward, with a viable cash flow positive operation in place, we expect to fund our business with cash flow from our current business. To date, we have retained earnings of $130,510 and a working capital deficit of approximately $90,000 at December 31, 2009.

QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

Credit Risk

The Company is exposed to credit risk from its cash in bank and fixed deposits and bills and accounts receivable. The credit risk on cash in bank and fixed deposits is limited because the counterparties are recognized financial institutions. Bills and accounts receivable are subjected to credit evaluations. An allowance has been made for estimated irrecoverable amounts which has been determined by reference to past default experience and the current economic environment.

Inflation

Inflationary factors, such as increases in the cost of raw materials and overhead costs, could impair our operating results. Although we do not believe that inflation has had a material impact on our financial position or results of operations to date, a high rate of inflation in the future may have an adverse effect on our ability to maintain current levels of gross margin and selling, general and administrative expenses as a percentage of sales revenue if the selling prices of our products do not increase with these increased costs.

OUR BUSINESS

Overview

Paragon is one of the first movers in recycling toner cartridges for laser printers, fax and multifunction copiers. Paragon also specializes in difficult to find toner as well as color and special niche cartridges. Paragon has a 35,000 square foot factory, 67 employees and the capacity to manufacture 50,000 cartridges per month and recycle 350 different models of toner cartridges. Our main clients include multinational companies such as Micro Center, Royal Imaging, Staples, Inc.,and Royal Typewriter. Paragon also operates an online website for the sale of its toner products and is also a supplier numerous independent online websites.

Current Business Model

The process Paragon employs when recycling toner cartridges is as follows:

| a. | Disassemble Empty (Used) Cartridges – We inspect and evaluate components to determine if the components can be recycled. | |

| b. | Clean Components – We remove old components and clean components to be recycled. | |

| c. | Inspect Components – We inspect all new and recycled components before assembly. | |

| d. | Assemble Components – We assemble all of the components to create a refurbished cartridge and refill the cartridge with toner. | |

| e. | Perform Quality Control Tests – We test all finished products using accurate testing equipment. | |

| f. | Package – We package the product for shipping to the consumer. |

We are a vendor to:

| a. | Big Box Clients (including Staples, Inc. and Micro Center by Micro Electronics, Inc.) | |

| b. | Distributors | |

| c. | Online Retailers | |

| d. | Small Businesses and Individuals through our online direct sales division. |

Paragon has benefited from the significant growth trends in the global recycled toner industry. Paragon has experienced a dramatic upward trend in its overall sales and net profits.

Post Merger Strategy

We plan to focus on the following activities after the merger:

| a. | Attract High Caliber Management- Our management has demonstrated the ability to create value and maintain a profitable operation. As a private enterprise the company has been successful in achieving solid growth in sales and profits. As a public company, we intend to both improve the efficiency of our operations to optimize our organic growth and expand our operations by rapid growth through acquisition. Therefore, we will seek seasoned management having an in-depth knowledge of our industry and the requisite expertise to create a more efficient operation, by effectively introducing new products while expanding our client base. In addition, we will attract talented individuals with experience in mergers and acquisitions who can successfully identify ideal target companies, maximize terms during negotiation and successfully integrate these targets with our company’s operations. As a public company, we can create competitive incentive packages by allotting a certain percentage of the compensation in the form of equity and/or stock options. |

| b. | Invest in Infrastructure- We will identify aspects of our operations that can be upgraded or improved to increase sales and productivity. These improvements may include factory automation and identification of more cost effective suppliers. |

| c. | Increase Marketing– We have achieved growth in revenues and profitability with minimal expenditures towards marketing our products. Our current marketing efforts are comprised primarily of word of mouth and our staff’s persistent cold-calling sales efforts. After raising additional funds, we expect to expand our client base by hiring a more seasoned marketing staff and by investing in advertising with a specific focus on internet advertising. |

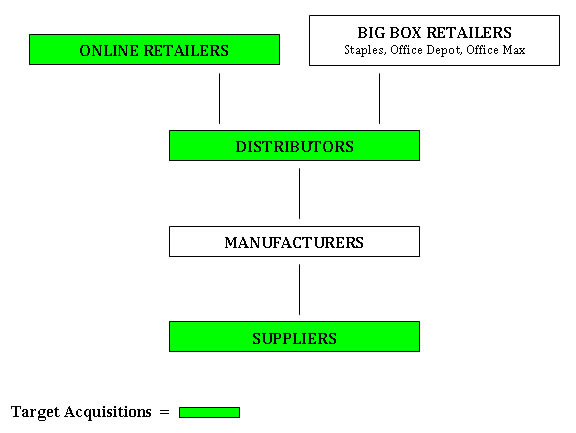

| d. | Growth by Acquisition- We will acquire other companies or assets within our industry or related industries, focusing on a vertical acquisition approach. |

ACQUISITION STRATEGY

A Vertical Approach

We will focus our merger and acquisition activities on suppliers, distributors and online retailers. This vertical approach will increase sales and profitability. Integrating with these types of firms is relatively easier since each target in the vertical chain has a distinct role. By utilizing our stock, we can acquire companies with a combination of cash and stock to minimize excess use of our cash reserves.

| (i) | Suppliers–(empty cartridge collectors and brokers) Maintaining a supply of empty cartridges is critical for our success. While we are proficient in both directly collecting and sourcing empty cartridges, an acquisition in this sector will ultimately increase our product quality control, sales and profitability. By controlling the source of our empty cartridges, we can insure the highest quality for our customers. In addition, by securing direct and preferential access to the empty cartridges, we can readily meet any order and reduce the raw material costs, thereby leading to higher net margins. | |

| (ii) | Distributors– Many of our clients are large distributors who buy products from us and resell them to retailers and end users at higher prices. We will seek acquisition of a large distributor with a large client database, so we can utilize its sales channels and offer its clients high quality product at cheaper price while maintaining a high degree of profitability. While we favor already profitable distribution companies, we also view distressed distributors as viable acquisition targets. We can restructure these distributors and realize significant value from aggressively marketing to their client base. |

| (iii) | Online Retailers– Our online division at “www.yourcartridges.com” has significantly higher margins and real time cash flow. By acquiring online retailers, we can again provide the product at a cheaper cost and be more competitive in the internet market. Moreover, the cost of integration will be marginal as we already have a staff in place for both marketing and customer service. Based on our experience, online retailers can be purchased at low cost since they are often operated and owned by small independent business owners. By having access to their client database, we can create an aggressive marketing strategy to maximize their existing customer base. In the future, we intend to have more than half our revenues generated from online sources in order to optimize our margins and cashflow. |

Quality Standards

Our laser toner cartridges not only meet OEM standards, but often exceed OEM standards. Our defect ratio is less than 1%, which is considered low in the toner industry. We also offer a 100% guarantee for all of our finished products.

Profitability

Since our establishment and most notably for the last two years we have seen an increase in both our profits and our revenues. This can be attributed to our experience in maintaining a streamline operation and our ability to reduce costs while maintaining high quality standards. The defective rate of our products is less than 1% and our repeat and long standing business with the major market players illustrate the high quality of our products.

Strong Online Presence

Our website YourCartridges.com is a leader in the online industry. The website alone has annual revenue of $650,000 without any significant marketing effort on our part. The net profit margin for the online segment of operation is close to 20% with greater cash flow. More importantly, we have obtained the expertise to expand this presence as well as identify strong Internet companies for possible acquisition.

Competition

We compete primarily with other small remanufacturers of toner cartridge products. However, due to the recent economic downturn and the failure of many individual companies to achieve profitability in this industry, many of our direct competitors have exited the market.

Insurance

We maintain medical and accident insurance for our employees to the extent required under federal laws and the laws of the State of California, and we also maintain fire and general commercial insurance with respect to our facilities. We do not have any business liability or disruption insurance coverage for our operations.

ISO 9001, 14001, Minority Status

We have minority owned business status in the state of California. We are in process of obtaining our ISO Certification for 9001and 14001.

The Recycled Toner Cartridge Market

The recycled toner business is a multi-billion dollar industry with continuing growth. According to Lyra Research, the recycled toner market size in 2008 was $6 Billion and is expected to grow to $8.2 Billion by the year 2012. As recycled toner is considerably less expensive than retail toner while maintaining equal quality, the market is expanding annually. Moreover, the market penetration of our products is still at its early stage. Walmart, Best Buy, Costco, Target, and most other major retailers do not yet carry recycled toner. In addition, the United Nations and U.S. federal, state and local governments have still not adopted a policy for the use of recycled toner.

Finally, recycled toner serves the protection of the environment as plastic cartridges are now being reused numerous times. More recently, the Obama administration is actively promoting clean technology and recycling of all products in the U.S. For example, under the new Stimulus Plan, tax breaks are being offered to recycling manufacturers. Staples Canada recently held an empty cartridge drive to collect one million empty cartridges for Earth Day April 22, 2009. Moreover, companies throughout the U.S. and internationally are emphasizing the use of the “green” products. Inevitably, companies and individuals will use products such as ours as it not only cheaper but helpful in preserving our economy.

For the consumer there is an effort to market “green” products, Walmart will introduce a “Sustainability Index” to mark each product based on their environmental impact.

Cartridges require tremendous energy to produce and recycling cartridges will save energy for the environment and reduce pollution. Secondly, an empty cartridge takes 400 – 1000 years to biodegrade. According to the UDC, there are 400 million empty cartridges being disposed of every year in the U.S. While saving costs and helping to protect the environment, the use of refurbished toner will continue to grow in the U.S.

Our Employees

As of March 15, 2010, we employed 67 full-time employees. The following table sets forth the number of our full-time employees by function as of March 15, 2010:

| As of | |||

| March 15, | |||

| Functions | 2010 | ||

| Executives Management & Sales | 6 | ||

| Technical & Engineering Staff | 3 | ||

| Production Staff | 50 | ||

| Administrative Staff | 8 | ||

| Total | 67 |

We believe that we maintain a satisfactory working relationship with our employees and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations.

Litigation

To the best knowledge of management, there are two pending legal proceedings against us.

On July 14, 2008, Advanced Digital Technology Co. Ltd., a Korean corporation (“ADT”), filed a claim against Lexon and certain named individuals who are former and current officers of the Company. The claim alleges breach of an agreement to settle an earlier dispute, involving ADT's investment of $150,000 in Lexon on or about January 16, 2007 and ADT's subsequent unilateral decision to rescind and demand a refund of this investment. The total amount of damages claimed under the pending lawsuit is the investment amount of $150,000 plus filing costs, interest and attorney fees for an aggregate amount of $178,522.05. On or about May 2, 2009, Lexon became aware of a default judgment entered in the amount above. Such judgment was entered on December 22, 2009. On or about May 8, 2009, Lexonhasretained the law firm of Smith, Chapman & Campbell for the purpose of setting aside the default judgment as the Company was never in receipt of the notice of default entry. On or about July 21, 2009, the court set aside the default as the court agreed that service was never properly served. To date, Lexon has not received the complaint for this case.

On September 5, 2008, Vivien and David Bollenberg, a current shareholder (the “Bollenbergs”), filed a claim against Lexon and other third parties, including ByungHwee Hwang (also referred to as "Ben Hwang") and other financial agents and institutions involved in the alleged fraudulent transaction. The lawsuit is currently pending in the Orange County Superior Court in Santa Ana, California. The filed complaint alleges that Ben Hwang together with his representatives, including his accountant, escrow agent and real estate agent/broker, made certain representations to and solicited the Bollenbergs to make an investment in several companies and ventures including Lexon with the intent to misappropriate the solicited funds for personal use. The Bollenbergs allege that they invested a total of $1,500,000 among and between the various companies and ventures recommended by Ben Hwang, of which investment amount approximately $550,000 was invested in Lexon ($150,000 for 600,000 shares at $0.25 per share and $400,000 initially invested in Lexon Korea and later converted into 1,150,000 shares in Lexon for a total of 1,750,000 shares in Lexon). The final disposition of this case has not yet been resolved. To date, Lexon has not been served the complaint for this action.

On or about August 5, 2009, Development Specialists, Inc. as Assignee for the Benefit of Creditors of Rhinotek Computer Products, Inc. (“Rhinotek”) filed a claim against Paragon for recovery of a preferential transfer in the amount of $143,289.39. As per the preferential transfer claim, the Assignee alleges that Paragons was inequitably paid the aforementioned amount during the 90 days prior to the insolvency of Rhinotek. We have retained Assay &Mauss to serve as legal counsel to assert the defense that such payments were in the course of ordinary business. On or about December 15, 2010, we have settled this case without prejudice in the amount of $12,000. Moreover, Paragon has also lodged a proof of claim against Rhinotekin the amount $247,793.24 which is the outstanding amount owed to us at the time of their insolvency.

MANAGEMENT

Directors and Executive Officers

The following table sets forth certain information relating to our directors and executive officers as of October 9, 2009. The business address of all of our directors and executive officers is our registered office at 14830 Desman Road, La Mirada, CA 90638.

| Name | Age | Position | ||

| James Park | 42 | President, Chief Executive Officer and Chairman of the Board of Directors | ||

| Young Won | 48 | Chief Operating Officer and Director | ||

| Bong S. Park | 75 | Chief Financial Officer and Director |

James Parkis the founder of Paragon and has worked at the company since 1993. Mr. Park was instrumental to Paragon’s growth from a small independent business. Mr. Park is a graduate of the University of California of Los Angeles.

Young Wonhas worked at Paragon for the last 14 years. Mr. Won is in charge of the production, operation, research and development of the company. He is has been integral in the success of Paragon. Previously, he worked for the Los Angeles Metropolitan Water District as a metallurgical engineer. Mr. Won received a B.S. in mechanical engineering from Korea University. He also graduated from the University of Southern California with an M.S. in materials science.

Bong S. Park was the Chief Financial Officer of the Company since 1997. He was previously the CEO of Tokyo Printing Ink, Corp. USA from 1985-1997. His experience as a seasoned executive and his extensive knowledge in the ink and toner industry has been instrumental for the growth of the Company. Mr. Park received a B.A. degree in business administration from Korea University.

Committees and Meetings

The board of directors is currently composed of 3 people. All board action requires the approval of a majority of the directors in attendance at a meeting at which a quorum is present.

We currently do not have standing audit, nominating or compensation committees. Our entire board of directors handles the functions that would otherwise be handled by each of the committees. We intend, however, to establish an audit committee, a nominating committee and a compensation committee of the board of directors as soon as practicable. We envision that the audit committee will be primarily responsible for reviewing the services performed by our independent auditors, evaluating our accounting policies and our system of internal controls. The nominating committee would be primarily responsible for nominating directors and setting policies and procedures for the nomination of directors. The nominating committee would also be responsible for overseeing the creation and implementation of our corporate governance policies and procedures. The compensation committee will be primarily responsible for reviewing and approving our salary and benefit policies (including equity plans), including compensation of executive officers.

Upon the establishment of an audit committee, the board will determine whether any of the directors qualify as an audit committee financial expert.

Code of Business Conduct and Ethics

We currently do not have a code of ethics that applies to our officers, employees and directors, including our Chief Executive Officer and senior executives.

EXECUTIVE COMPENSATION

Summary Compensation Table— Fiscal Year Ended December 31, 2009

The following table sets forth information concerning all cash and non-cash compensation awarded to, earned by or paid to the named persons for services rendered in all capacities during the noted periods. No other executive officers received total annual salary and bonus compensation in excess of $100,000 during the fiscal year ended December 31, 2008.

| Name and | Stock | Option | All Other | |||||||||||||||

| Principal | Salary | Awards | Awards | Compensation | Total | |||||||||||||

| Position (1) | ($) | Bonus ($) | ($) | ($) | ($) | ($) | ||||||||||||

| James Park | 98,000 | 0 | 0 | 0 | 0 | 98,000 | ||||||||||||

| Young Won | 84,000 | 0 | 0 | 0 | 0 | 84,000 | ||||||||||||

| Bong S. Park | 84,000 | 0 | 0 | 0 | 0 | 84,000 |

Employment Agreements

As the incoming CEO of the Company, Mr. Park has entered into a new employment contract with the Company. Under the terms of the contract, he will receive a salary of $168,000 for a one-year term. No bonus or stock options are included in the contract. Any change in compensation will be determined by the Board of Directors after conclusion of the initial one-year term.

Director Compensation

No director of the Paragon has received any compensation for services as director for the period since inception of the Company in 2004.

Compensation Committee Interlocks and Insider Participation

During the last fiscal year we did not have a standing Compensation Committee. The Board was responsible for the functions that would otherwise be handled by the compensation committee.

Indemnification of Directors and Executive Officers and Limitation of Liability

The General Corporation Law of Delaware, Section 102(b)(7) provides that directors, officers, employees or agents of Delaware corporations are entitled, under certain circumstances, to be indemnified against expenses (including attorneys’ fees) and other liabilities actually and reasonably incurred by them in connection with any suit brought against them in their capacity as a director, officer, employee or agent, if they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation, and with respect to any criminal action or proceeding, if they had no reasonable cause to believe their conduct was unlawful. This statute provides that directors, officers, employees and agents may also be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by them in connection with a derivative suit brought against them in their capacity as a director, if they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification may be made without court approval if such person was adjudged liable to the corporation

TRANSACTIONS WITH RELATED PERSONS, PROMOTERS AND CERTAIN

CONTROL PERSONS; CORPORATE GOVERNANCE

Transactions with Related Persons

Our directors are not independent as that term is defined under the Nasdaq Marketplace Rules.

Joon Ho Chang , a former director of the Company, received 8,000,000 shares of Common Stock as a fee for professional services rendered in the merger transaction.

PRINCIPAL AND SELLING STOCKHOLDERS

The following table sets forth certain information with respect to the beneficial ownership of our Common Stock as of March 15, 2010 for (a) each of our directors, (b) each of our executive officers, (c) each stockholder known to be the beneficial owner of more than five percent of any class of our voting securities, (d) all directors and executive officers as a group and (e) each selling stockholder participating in this offering. Beneficial ownership is determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934 and does not necessarily bear on the economic incidents of ownership or the rights to transfer the shares described below. Unless otherwise indicated by a footnote, (a) each stockholder has sole voting power and dispositive power with respect to the indicated shares (b) the address of each stockholder who is a director or executive officer is 14830 Desman Road La Mirada, CA, 90638, and (c) none of the selling stockholders are broker-dealers or affiliates of broker-dealers. None of the selling stockholders has had any position, office or other material relationship with the Company in the past three years.

| Number of | ||||||

| Shares | Percentage | |||||

| Beneficially | Beneficially | |||||

| Name | Owned | Owned | ||||

| Management and Directors | ||||||

| James Park (CEO and Director) | 198,406,99 | 38.50% | ||||

| Young Won (COO and Director) | 99,030,531 | 19.22% | ||||

| Hyung Soon Lee (Director) | 28,828,333 | 5.59% | ||||

| Total of Management and Directors | 326,265,783 | 63.31% | ||||

| Beneficial shareholders with more than 5% | ||||||

| None | ||||||

| Selling shareholders | ||||||

| Stacey Park | 1,000,000 | 0.19% | ||||

| Fabian Hui Hong Looi | 3,723,733 | 0.72% | ||||

| Paul Kim | 3,723,333 | 0.72% | ||||

| Alex Ahn | 1,498,716 | 0.29% | ||||

| Roy A. Kim | 380,443 | 0.07% | ||||

| Young Yun | 749,358 | 0.15% | ||||

| Jisoon Lee | 599,487 | 0.12% | ||||

| Kim Yoshizawa | 69,172 | 0.01% | ||||

| Patrick A. Love | 380,443 | 0.07% | ||||

| Seung K. Lee | 380,443 | 0.07% | ||||

| Kang Chul Park | 3,723,733 | 0.72% | ||||

| Leandra Burke | 749,358 | 0.15% | ||||

| Seung Ho Lee | 749,358 | 0.15% | ||||

| Miguel Pulido | 749,358 | 0.15% | ||||

| IlanDouek | 749,358 | 0.15% | ||||

| JihoonYoo | 749,358 | 0.15% | ||||

| Yoon Hee Kim | 80,700 | 0.02% | ||||

| Yang H. Park | 2,750,000 | 0.53% |

| Sunmin Won | 1,000,000 | 0.19% | ||||

| Yang K. Park | 1,000,000 | 0.19% | ||||

| Dimitri Felix & Associates LLC | 7,000,000 | 1.36% | ||||

| Stacey Park | 500,000 | 0.10% | ||||

| Peter Park | 2,500,00 | 0.49% | ||||

| Samuel Shim | 750,000 | 0.15% | ||||

| Patricia Shim | 1,250,000 | 0.24% | ||||

| Joshua Gluckman | 25,000 | 0.005% | ||||

| Seung-AeGluckman | 25,000 | 0.005% | ||||

| Carol Gluckman | 50,000 | 0.01% | ||||

| The Wurzer Trust 1987 | 25,000 | 0.005% | ||||

| Winton Low | 12,500 | 0.002% | ||||

| Peter Park | 25,000 | 0.005% | ||||

| Kimberly Yoshizawa | 100,000 | 0.02% | ||||

| Jisoon Lee | 187,500 | 0.04% | ||||

| Sarah Kim | 37,500 | 0.01% | ||||

| Paul N. Carson | 250,000 | 0.05% | ||||

| Todd W. Henreckson | 25,000 | 0.005% | ||||

| Michael T. Henreckson | 6,250 | 0.0012% | ||||

| Stephan P. Henreckson | 6,250 | 0.0012% | ||||

| Sarah L. Hennreckson | 2,500 | 0.0005% | ||||

| Jonathan Henreckson | 2,500 | 0.0005% | ||||

| Rebecca Henreckson | 1,250 | 0.0002% | ||||

| Andy Chung | 1,000,000 | 0.19% | ||||

| GonChol Ha | 2,500,000 | 0.49% | ||||

| Kyung Hwan Doh | 150,000 | 0.03% | ||||

| Juan Wozniak | 125,000 | 0.02% | ||||

| Golden Tulip Capital Management Limited | 3,000,000 | 0.58% |

DESCRIPTION OF CAPITAL STOCK

The Company’s authorized capital stock consists of 2,000,000,000 shares of Common Stock at a par value of $0.001 per share. As of March 15, 2010, there were 515,289,722 shares of the Company’s Common Stock issued and outstanding held by approximately 500 stockholders of record.

Holders of the Company’s Common Stock are entitled to one (1) vote for each share on all matters submitted to a stockholder vote. Holders of Common Stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of Common Stock voting for the election of directors can elect all of the directors. Holders of the Company’s Common Stock representing a majority of the voting power of the Company’s capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of stockholders. A vote by the holders of a majority of the Company’s outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to the Company’s articles of incorporation.

Holders of the Company’s Common Stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of a liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the Common Stock. The Company’s Common Stock has no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to the Company’s Common Stock.

Transfer Agent and Registrar

Our independent stock transfer agent is Fidelity Transfer Company, located at 8915 South 700 East, Suite 102 Sandy, Utah 84070. Their phone number is 801-562-1300.

PLAN OF DISTRIBUTION

The selling stockholders may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of Common Stock or interests in shares of Common Stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The selling stockholders may use any one or more of the following methods when disposing of shares or interests therein:

ordinary brokerage transactions and transactions in which the broker-,dealer solicits purchasers;

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

an exchange distribution in accordance with the rules of the applicable exchange; - privately negotiated transactions;

short sales effected after the date the registration statement of which this Prospectus is a part is declared effective by the SEC;

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share; and

a combination of any such methods of sale.

The selling stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of Common Stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of Common Stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer the shares of Common Stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our Common Stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the Common Stock in the course of hedging the positions they assume. The selling stockholders may also sell shares of our Common Stock short and deliver these securities to close out their short positions, or loan or pledge the Common Stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the selling stockholders from the sale of the Common Stock offered by them will be the purchase price of the Common Stock less discounts or commissions, if any. Each of the selling stockholders reserves the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of Common Stock to be made directly or through agents. We will not receive any of the proceeds from this offering.

Broker-dealers engaged by the selling stockholders may arrange for other broker-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchase of shares, from the purchaser) in amounts to be negotiated. The selling stockholders do not expect these commissions and discounts to exceed what is customary in the types of transactions involved, and in no case will the maximum compensation received by any broker-dealer exceed eight percent (8%) pursuant to FINRA Rule 2710.

The selling stockholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule.

Any underwriters, agents, or broker-dealers, and any selling stockholders who are affiliates of broker-dealers, that participate in the sale of the Common Stock or interests therein may be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. Selling stockholders who are “underwriters” within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act. We know of no existing arrangements between any of the selling stockholders and any other stockholder, broker, dealer, underwriter, or agent relating to the sale or distribution of the shares, nor can we presently estimate the amount, if any, of such compensation.

To the extent required, the shares of our Common Stock to be sold, the names of the selling stockholders, the respective purchase prices and public offering prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of some states, if applicable, the Common Stock may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the Common Stock may not be sold unless it has been registered or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

We have advised the selling stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the selling stockholders and their affiliates. In addition, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

EXPERTS

The consolidated financial statements of Lexon Technologies, Inc. and its subsidiaries included in this prospectus and in the registration statement have been audited by Choi, Kim & Park, LLP independent registered public accounting firm, to the extent and for the periods set forth in their report appearing elsewhere herein and in the registration statement, and are included in reliance on such report, given the authority of said firm as an expert in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the Securities and Exchange Commission, or SEC, a registration statement on Form S-1 under the Securities Act with respect to the Common Stock offered in this offering. This prospectus does not contain all of the information set forth in the registration statement. For further information with respect to us and the Common Stock offered in this offering, we refer you to the registration statement and to the attached exhibits. With respect to each such document filed as an exhibit to the registration statement, we refer you to the exhibit for a more complete description of the matters involved.

You may inspect our registration statement and the attached exhibits and schedules without charge at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may obtain copies of all or any part of our registration statement from the SEC upon payment of prescribed fees. You may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330.

Our SEC filings, including the registration statement and the exhibits filed with the registration statement, are also available from the SEC’s website at www.sec.gov, which contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

Item 16. Exhibits.

| To be Filed | ||||||

| Exhibit | Filed | By | ||||

| Index | Description of Document | Herewith | Amendment | |||

| 1 | CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2009 AND 2008 | Yes | No |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

LEXON TECHNOLOGIES INC.

| Date: May 4 , 2010 | By: | /s/ James Park |

| [name] James Park | ||

| [title] CEO |

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of Lexon Technologies, Inc.

We have audited the accompanying balance sheets of Lexon Technologies, Inc. the “Company”) as of December 31, 2009 and 2008 and the related statements of operations, stockholders’ equity, and cash flows for the years then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.