- NFLX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Netflix (NFLX) DEF 14ADefinitive proxy

Filed: 18 Apr 24, 5:06pm

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under Rule 14a-12 | |

☒ | No fee required. | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

Fellow Stockholders,

In 2023, Netflix showed that balancing consistency with adaptability is important to maintain our long-term growth. The Netflix leadership team and the Company navigated challenges while demonstrating tireless dedication to executing our long-term strategy. This past year, we stayed focused on reaccelerating growth by continuing to release films, series and games that are loved by our members; addressed account sharing in all jurisdictions; and improved our advertising offering for both consumers and advertisers. We also broadened our entertainment offerings with live events and deepened our connection with fans through consumer products and live experiences.

We continued to create and deliver world-class entertainment across a variety of genres and languages, demonstrating that great stories come from anywhere and are enjoyed by audiences everywhere. Over the last year we expanded the Bridgerton universe with Queen Charlotte: A Bridgerton Story, released action-packed films, such as The Mother starring Jennifer Lopez and Extraction 2 with Chris Hemsworth, and brought back the French TV drama Lupin for its third season, all breaking the top 10 for most popular TV series and films in English and Non-English.

At the end of 2023, we had over 260 million paid memberships, achieved approximately $33.7 billion in revenue, representing approximately 7% year-over-year growth, and over $6.9 billion of operating income, as well as increased our net cash provided by operating activities to approximately $7.3 billion.

In January of 2023, as part of the Board’s ongoing succession planning and evolution of the management team, Greg Peters was appointed to serve as the co-Chief Executive Officer

alongside Ted Sarandos, and to serve on the Board, after Reed Hastings stepped down from his role as co-Chief Executive Officer and President. In our first year under new management, we believe this leadership model that combines Ted and Greg’s complementary skill sets has proven to be effective.

This past year, the Board, alongside management, continued to actively engage with shareholders to seek their input and provide perspective on our policies and practices. In response, we adopted significant changes to our executive compensation program for our executive officers, Ted, Greg, Reed, Spencer Neumann and David Hyman, which took effect in 2024. As a continued evolution of our corporate governance structure and practices, the Board adopted corporate governance guidelines that includes a framework for director commitments. More details of these and other changes are provided in this Proxy Statement. The Board appreciates the shareholder feedback, which will continue to inform the Board’s regular review of our corporate governance practices.

On behalf of the Board, we thank you for your investment.

Warm regards,

Jay C. Hoag

Lead Independent Director

Notice

Notice of Annual Meeting of Stockholders to be Held on June 6, 2024

To the Stockholders of Netflix, Inc.:

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of Netflix, Inc., a Delaware corporation (the “Company,” “Netflix,” “we,” “us,” or “our”), will be held on June 6, 2024 at 3:00 p.m. Pacific Time (6:00 p.m. Eastern Time) (“Annual Meeting”). You can attend the Annual Meeting via the internet and vote your shares electronically by visiting www.virtualshareholdermeeting.com/NFLX2024 (there is no physical location for the Annual Meeting). You will need to have your 16-Digit Control Number included on your Notice or your proxy card (if you received a printed copy of the proxy materials) to join the Annual Meeting.

THE ANNUAL MEETING WILL BE HELD FOR THE FOLLOWING PURPOSES:

1. To elect nine directors to hold office until the 2025 annual meeting of stockholders;

2. To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024;

3. Advisory approval of the Company’s Named Executive Officer compensation;

4. To consider five stockholder proposals, if properly presented at the Annual Meeting; and

5. To transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting. |

These business items are described more fully in the Proxy Statement accompanying this Notice. Only stockholders who owned our common stock at the close of business on April 8, 2024 can vote at this meeting or any adjournments that may take place.

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING VIA THE INTERNET.

For ten days prior to the Annual Meeting, a complete list of the stockholders entitled to vote at the meeting will be available for examination by any stockholder for any purpose germane to the meeting. Please email board@netflix.com to make arrangements to examine the stockholder list.

By order of the Board of Directors

David Hyman

Chief Legal Officer and Secretary

April 18, 2024

Los Gatos, California

YOUR VOTE IS IMPORTANT. PLEASE VOTE OVER THE INTERNET, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING VIA THE INTERNET. IF YOU RECEIVED A PAPER PROXY CARD AND VOTING INSTRUCTIONS BY MAIL, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ENCLOSED ENVELOPE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING VIA THE INTERNET.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 6, 2024: THIS PROXY STATEMENT, THE NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND THE ANNUAL REPORT ARE AVAILABLE AT WWW.PROXYVOTE.COM.

Contents

| 1 | ||||

Proposal 1: | ||||

| 3 |

| ||

| 5 | ||||

| 15 | ||||

| 17 | ||||

| 20 | ||||

| 21 | ||||

| 24 | ||||

| 25 | ||||

Certain Relationships and Related Transactions

|

| 27

|

| |

Proposal 2: | ||||

| 28 | ||||

| 31 | ||||

| 32 | ||||

Proposal 3: | ||||

| 34 |

| ||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 40 | ||||

| 44 | ||||

2023 Executive Compensation under the Prior Compensation Program | 45 | |||

| 51 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 58 | ||||

| 61 | ||||

| 74 | ||||

| 74 | ||||

|

| 76

|

| |

Proposal 4 | ||||

|

| 77

|

| |

Proposal 5 | ||||

|

| 80

|

| |

Proposal 6 | ||||

|

| 84

|

| |

Proposal 7 | ||||

|

| 87

|

| |

Proposal 8 | ||||

|

| 90

|

| |

| 94 | ||||

| 95 |

| ||

| 97 | ||||

| 101 | ||||

| 102 | ||||

|

Netflix 2023 Year in Review

Business Highlights

In 2023, Netflix showed that balancing consistency with adaptability is important to maintain our long-term growth. Throughout the year, we stayed focused on reaccelerating growth by improving the offering of our lower priced ad-supported subscription plan, improving the attractiveness of our service to advertisers and members, and continuing to address account sharing in all jurisdictions, all while releasing films, series and games that are loved by our members. At the end of 2023, we had over 260 million paid memberships, and financial highlights for 2023 included achieving approximately $33.7 billion in annual revenue, representing approximately 7% year-over-year growth, over $6.9 billion in operating income, and approximately $7.3 billion in net cash provided by operating activities.

Executive Leadership

The Board of Directors (the “Board”) oversees executive succession planning on an ongoing basis. As part of the chief executive officer succession plan, we adopted a co-Chief Executive Officer structure in 2020, when Ted Sarandos was named co-CEO along with Reed Hastings. This change mostly formalized the prior working relationship between Ted and Reed. In January 2023, Reed stepped down as co-CEO and President of the Company. He continues to serve as the Executive Chairman. Greg Peters was promoted to serve as co-CEO alongside Ted. Greg was also appointed to the Board. The three of them have worked together for over 15 years and have had a long history of collaboration on corporate strategy, planning and all aspects of company management. We believe the co-CEO structure has been effective and continues to provide broad expertise and deep leadership at the highest level of the Company. In particular, Ted and Greg have complementary skill sets across both entertainment and technology sectors, which allows us to have deep expertise in these sectors at the most senior level. We believe this is a competitive differentiator in light of our strategic combination of these areas as well as the rapidly evolving competitive landscape. The co-CEO structure also provides an efficient and effective leadership model to support our future growth. The Board regularly evaluates executive succession planning, including the effectiveness of the co-CEO structure.

Board Composition

In January 2023, Greg Peters was appointed to the Board in connection with his appointment as co-CEO. In September 2023, Ambassador Susan Rice re-joined the Board. More information on each Board member can be found in the section titled, “Proposal 1: Our Board of Directors—Election of Directors—Who We Are.”

Shareholder Engagement

The Board appreciates shareholder feedback, and we engage with our shareholders throughout the year to better understand their perspectives. In response to the low say-on-pay vote at the 2023 annual meeting, we undertook three rounds of shareholder engagement to better understand our shareholders’ concerns regarding our executive compensation program.

2024 Proxy Statement |

1

|

Engagement since the 2023 annual meeting

54%

We invited 29 shareholders, representing over 54% of shares outstanding as of December 31, 2023 to engage and provide feedback | 23

We met with 23 shareholders, including 9 of the top 10 shareholders, collectively representing approximately 48% of our shares outstanding

| 70%

Compensation Committee members participated in 70% of the engagements, meeting with shareholders representing approximately 37% of shares outstanding |

Engagement team included Compensation Committee members, and Netflix Legal and Investor Relations teams

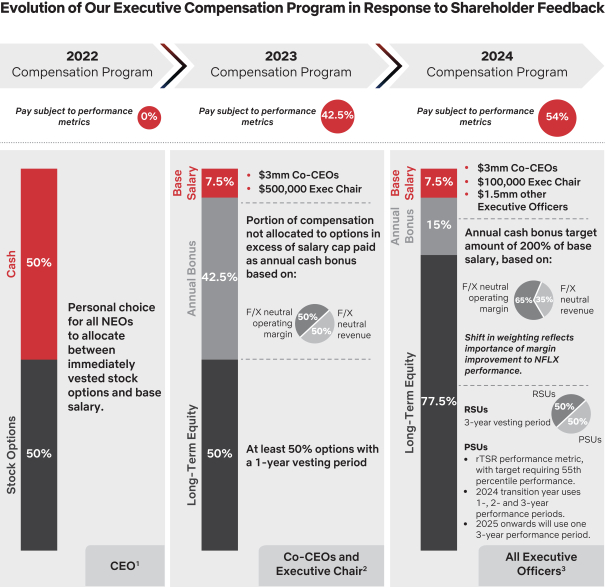

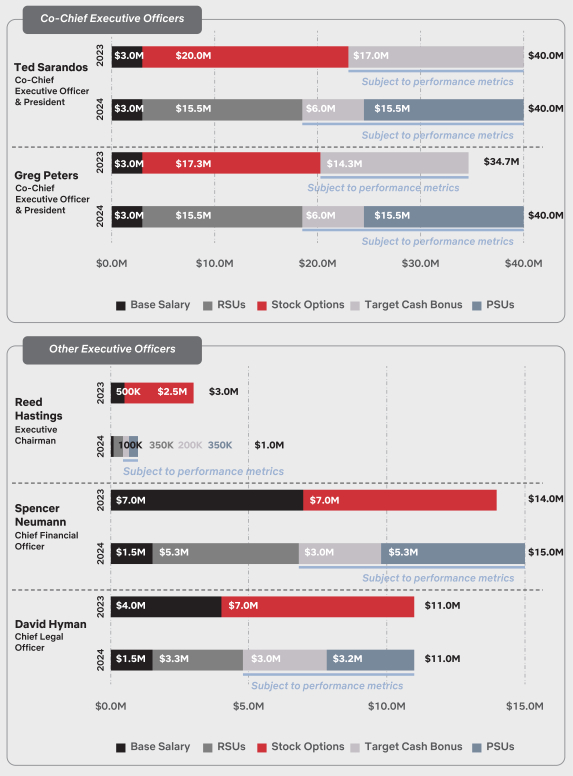

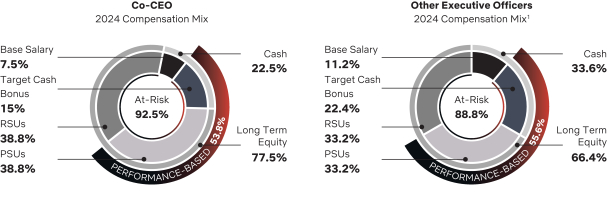

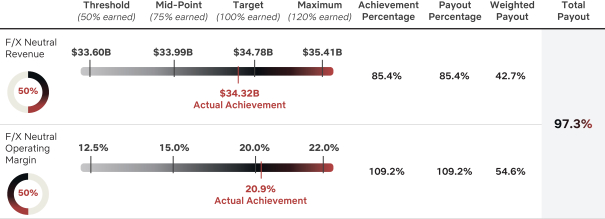

In response to these discussions and feedback, the Compensation Committee evolved our executive compensation program to: (1) eliminate the ability to allocate compensation between cash salary and stock options for our executive officers as defined under Rule 3b-7 (“Executive Officers”); (2) limit guaranteed cash compensation by setting base salary at $3 million for the co-CEOs, $100,000 for our Executive Chairman, and $1.5 million for the other Executive Officers; (3) expand participation in the annual performance-based cash bonus program to all Executive Officers; (4) grant performance-based restricted stock unit awards (“PSUs”) and time-based restricted stock unit awards (“RSUs”) to Executive Officers instead of stock options; (5) evolve our change-in-control severance arrangements to include “double-trigger” provisions; and (6) adopt stock ownership guidelines for Executive Officers. A detailed discussion of our engagement with shareholders regarding our executive compensation program and key changes for the 2023 and 2024 compensation years are included in the Compensation Discussion and Analysis section.

Inclusion and Diversity

We believe a critical component of our success is our company culture. This culture, which is detailed in a “Culture Memo” located on our website, includes Inclusion as one of our values. We want our members and members-to-be all over the world to see themselves, their cultures and lived experiences reflected on screen, so we work to build diversity and inclusion into all aspects of our operations globally. This means supporting talent in front of and behind the camera through our Fund for Creative Equity and Grow Creative work, and investing in the future of tech through our Emerging Talent program.

It’s equally important that our employee base is as diverse as the communities we serve. We look to help increase representation by training our recruiters and managers how to hire with diversity and inclusion in mind, expanding outreach to underrepresented communities and helping senior leaders diversify their networks. We are equipping our leaders with the skills to lead inclusively so they create the type of work environment where people of all backgrounds have an equal opportunity to contribute at their highest levels without exclusion and bias. We also support numerous employee resource groups, representing employees and allies from a broad array of historically underrepresented and/or marginalized communities.

We publish annually an update on our inclusion initiatives and progress, which provides a snapshot of representation within the Company, our progress to date and areas we are focused on for improvement in our ESG report. We also publish our U.S. Employer Equal Opportunity data (“EEO-1 data”) reaching back to our 2014 filing. In 2023, we shared the latest round of research done in partnership with the USC Annenberg Inclusion Initiative, which examined several inclusion metrics in our U.S.-commissioned films and series from 2020 to 2021 and demonstrated notable gains year-over-year for women and people from underrepresented racial/ethnic groups.

Environment

In 2023, we made further progress towards meeting our climate targets by helping to modernize the production of films and series. We continued to (a) optimize, electrify and decarbonize energy use in productions, (b) bring remaining unabated emissions to zero by investing in the power of nature to capture carbon, and (c) embrace cleaner technologies like electric vehicles and clean mobile power across our films and series, helping reduce our carbon emissions and transition away from fossil fuels. We also maintained the Netflix Sustainability Stories collection with over 200 films and TV series from every genre.

Transparency

We are committed to continued shareholder engagement and transparency and provide comprehensive information about our ESG initiatives and activities on our Investor Relations website. We publish annually an ESG report that covers our ESG performance for the prior year. We align our reporting to the Task Force on Climate-Related Financial Disclosures (“TCFD”) and the Sustainability Accounting Standards Board (“SASB”) reporting framework for the “Internet & Media Services” and “Media & Entertainment” industries. The ESG Reports, Political Activity Disclosures, EEO-1 data and other ESG information are available at ir.netflix.net/esg.

| 2 |

|

Directors Standing for Election

Nine directors, Richard Barton, Mathias Döpfner, Reed Hastings, Jay Hoag, Greg Peters, Ambassador Susan Rice, Ted Sarandos, Brad Smith, and Anne Sweeney (currently designated as the Class I and Class III directors), are to be elected at the Annual Meeting. Unless otherwise instructed, the proxy holders will vote the proxies received by them for Messrs. Barton, Döpfner, Hastings, Hoag, Peters, Sarandos and Smith, Ambassador Rice and Ms. Sweeney, each of whom is currently a director of the Company. If any of Messrs. Barton, Döpfner, Hastings, Hoag, Peters, Sarandos and Smith, Ambassador Rice or Ms. Sweeney is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for a substitute nominee designated by the Board to fill the vacancy. Each of Messrs. Barton, Döpfner, Hastings, Hoag, Peters, Sarandos and Smith, Ambassador Rice and Ms. Sweeney has agreed to serve as a director of the Company if elected.

Stockholders approved the management proposal to declassify the Board at the 2022 annual meeting of stockholders. As such, the term of the office of directors elected at this Annual Meeting will continue until the annual meeting of stockholders held in 2025 or until such director’s successor has been duly elected or appointed and qualified, or until their earlier resignation or removal, with the entire Board standing for annual election beginning in 2025.

Nominee | Age | Principal Occupation | ||

Richard Barton | 56 | Chief Executive Officer and co-founder of Zillow Group | ||

Mathias Döpfner | 61 | Chairman and CEO of Axel Springer SE | ||

Reed Hastings | 63 | Executive Chairman of Netflix | ||

Jay Hoag | 65 | General Partner, TCV | ||

Greg Peters | 53 | co-Chief Executive Officer and President of Netflix | ||

Ambassador Susan Rice | 59 | Former US Permanent Representative to the United Nations | ||

Ted Sarandos | 59 | co-Chief Executive Officer and President of Netflix | ||

Brad Smith | 65 | Vice Chairman of Microsoft | ||

Anne Sweeney | 66 | Former Co-Chair, Disney Media Networks and President, Disney/ABC Television Group | ||

Each nominee has extensive business experience, education and personal skills that qualifies them to serve as an effective Board member. The specific experience, qualifications and skills of Messrs. Barton, Döpfner, Hastings, Hoag, Peters, Sarandos and Smith, Ambassador Rice and Ms. Sweeney are set forth below. The Nominating and Governance Committee evaluates potential candidates for service on the Board.

Required Vote

We have implemented majority voting in uncontested elections of directors. Our bylaws provide that in an uncontested election, each director will be elected by a vote of the majority votes cast, which includes votes to withhold authority but excludes abstentions. Abstentions and broker non-votes are not counted as votes cast and therefore will have no effect on determining whether the required majority vote has been attained.

Netflix Recommendation

|

|

| 4 |

|

Who We Are

Board Overview

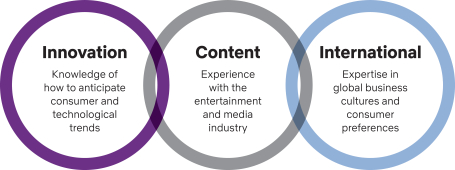

Our Board is composed of 13 highly experienced, talented, and qualified directors with experience as board members and executives at some of the world’s most successful companies. We believe that the Board is well situated to navigate the changing competitive terrain that Netflix operates within. The Board has led Netflix through its evolution from a US DVD-by-mail company to a global streaming company to one of the leading entertainment companies in the world, while effectively managing risk and overseeing management performance. We believe that a diverse mix of skills, experience, perspectives and backgrounds contribute to an effective Board. The composition of our Board has evolved over the past several years, and when looking to fill Board positions, we will continue to evaluate potential candidates who we believe complement and augment our current Board. As further discussed under “How We are Selected, Elected, and Evaluated—Consideration of Director Nominees—Director Qualifications,” the Nominating and Governance Committee considers a number of factors, including characteristics such as gender, race and national origin when evaluating potential Board candidates.

| STRATEGY ALIGNMENT Our Board has the experience and expertise that aligns with these important facets of our long-term strategy |

| ||

Board Diversity Matrix (as of April 18, 2024)

The following chart summarizes certain self-identified personal characteristics of our directors, in accordance with Nasdaq Listing Rule 5605(f). The Board Diversity Matrix for 2023 is available on our website at ir.netflix.net/governancedocs.

Total Number of Directors | 13 | |||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | ||||

Part I: Gender Identity | ||||||||

Directors | 4 | 9 | 0 | 0 | ||||

Part II: Demographic Background | ||||||||

African American or Black | 1 | 1 | 0 | 0 | ||||

Alaskan Native or Native American | 0 | 0 | 0 | 0 | ||||

Asian | 0 | 0 | 0 | 0 | ||||

Hispanic or Latinx | 0 | 0 | 0 | 0 | ||||

White | 3 | 8 | 0 | 0 | ||||

Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||

LGBTQ+ | 0 | |||||||

Did Not Disclose Demographic Background | 1 | |||||||

2024 Proxy Statement |

5

|

Our Directors

Directors standing for election:

Richard Barton | INDEPENDENT DIRECTOR |

Other Public • Qurate Retail, Inc. (formerly Liberty Interactive Corporation) • Zillow Group, Inc. | ||

DIRECTOR SINCE: 2002 CLASS: I | AGE: 56 COMMITTEES: AUDIT | |||

Why this director is valuable to Netflix Having founded successful internet-based companies (including Zillow, Expedia and GlassDoor), Mr. Barton provides strategic and technical insight to the Board, and as the Chief Executive of Zillow Group, brings extensive leadership and operational experience, as well as financial acumen to the Board. In addition, Mr. Barton brings experience with respect to marketing products to consumers through the internet.

Also... Mr. Barton was a venture partner at Benchmark, a venture capital firm that has been an early-stage investor in companies like Twitter, Instagram, Uber and Zillow, from 2005 to 2018. He has served on many public company boards, including Altimeter Growth Corp. from 2020 to 2021 and Altimeter Growth Corp. 2 from 2021 to 2022. Mr. Barton holds a B.S. in general engineering: industrial economics from Stanford University.

Career Snapshot: • Co-founder and Chief Executive of Zillow Group (2005-2011 and 2019-present) • Co-founder and Chairman of GlassDoor (2007-2018) • Founder and Chief Executive Officer of Expedia (1996-2003) | ||||

Mathias Döpfner | INDEPENDENT DIRECTOR |

Other Public • Warner Music Group Corp. | ||

DIRECTOR SINCE: 2018 CLASS: III | AGE: 61 COMMITTEES: COMPENSATION | |||

Why this director is valuable to Netflix As a media executive located in Germany, Mr. Döpfner brings international perspective, media experience and business acumen to the Board.

Also... Mr. Döpfner has extensive experience in media and digital transformation and a strong track record of increasing revenues related to digital activities. He previously served on the boards of Vodafone Group plc from 2015 to 2018 and Time Warner Inc. from 2006 to 2018. Additionally, his relationships and honorary offices at entities including the American Jewish Committee and the steering committee of the Bilderberg conference among many others provide him with relevant insight and perspective in international media. He studied Musicology, German and Theatrical Arts in Frankfurt and Boston.

Career Snapshot: • Chairman and CEO, Axel Springer SE (POLITICO, Business Insider, BILD, WELT) (since 2002) • His former roles at Axel Springer SE include editor-in-chief of Die Welt (1998-2000) and as a member of the Management Board (starting in 2000) • Visiting Professor in media at University of Cambridge, St. John’s College (2010) | ||||

| 6 |

|

| Proposal 1: Our Board of Directors | ||

Reed Hastings | EXECUTIVE CHAIRMAN OF THE BOARD |

Other Public • None | ||

DIRECTOR AND CHAIRPERSON SINCE: 1997 CLASS: III | AGE: 63 COMMITTEES: NONE | |||

Why this director is valuable to Netflix Mr. Hastings is the co-founder and Executive Chairman, and previously served as the co-Chief Executive Officer and President of Netflix for over 25 years. He deeply understands the technology and business of Netflix and brings strategic and operational insight to the Board. He is also a software engineer, holds an MSCS in Artificial Intelligence from Stanford University, and has unique management and industry insights.

Also... Mr. Hastings is an active educational philanthropist: he served on the California State Board of education from 2000 to 2004, and after receiving his B.A. from Bowdoin College in 1983 served in the Peace Corps as a high school math teacher. Mr. Hastings previously served on the board of Facebook, Inc. from 2011 to 2019 and Microsoft Corporation from 2007 to 2012. He currently serves on the boards of Bloomberg LP and numerous non-profit organizations.

Career Snapshot: • Co-Founder, Chief Executive Officer, President (1999-January 2023) and Chairman of Netflix (since 1997) • Founder, Pure Software (1991) through IPO (1995) and ultimate sale to Rational Software | ||||

Jay C. Hoag | LEAD INDEPENDENT DIRECTOR |

Other Public • Peloton Interactive, Inc. • TripAdvisor, Inc. • Zillow Group, Inc. | ||

DIRECTOR SINCE: 1999 CLASS: III |

AGE: 65 COMMITTEES: NOMINATING AND GOVERNANCE (CHAIR) | |||

Why this director is valuable to Netflix As a venture capital investor, Mr. Hoag brings strategic insights and financial experience to the Board. He has evaluated, invested in and served as a board member for numerous companies, both public and private, and is familiar with a full range of corporate and board functions. His many years of experience in helping companies shape and implement strategy provide the Board with unique perspectives on matters such as risk management, corporate governance, talent selection and management.

Also... Mr. Hoag has been a technology investor and venture capitalist for more than 40 years, involved in numerous technology investments including Actuate Software (acquired by OpenText), Airbnb, Ariba (acquired by SAP), Altiris (acquired by Symantec), BlueCoat Systems (formerly CacheFlow), C|NET, eHarmony, Electronic Arts, Encompass (acquired by Yahoo!), EXE Technologies (acquired by SSA Global), Expedia, Facebook, Fandango (acquired by Comcast), Groupon, LinkedIn, ONYX Software, Peloton, Prodege (parent company of Swagbucks & acquired by a private equity firm), RealNetworks, Sportradar, Spotify, SpringStreet (acquired by Homestore.com), Strava, TechTarget, TripAdvisor, Vacationspot.com (acquired by Expedia), Viant (acquired by iXL), and Zillow. Mr. Hoag is chair of TCV’s Investment Committee, a member of TCV’s Executive Committee, and is on the Investment Advisory Committee at the University of Michigan, the Board of Trustees of Northwestern University, and the Board of Trust at Vanderbilt University. Previously, Mr. Hoag served on the board of directors of a number of other public and private companies, including TechTarget, Inc. from 2004 to 2016, Electronic Arts from 2011 to 2021, Prodege from 2014 to 2021, and TCV Acquisition Corp. from 2021 to 2023. Mr. Hoag holds an M.B.A. from the University of Michigan and a B.A. from Northwestern University.

Career Snapshot: • Founding General Partner of TCV (Technology Crossover Ventures), a venture capital firm (since 1995) | ||||

2024 Proxy Statement |

7

|

Greg Peters | CO-CHIEF EXECUTIVE OFFICER AND PRESIDENT OF THE COMPANY AND DIRECTOR |

Other Public • DoorDash Inc. | ||

DIRECTOR SINCE: 2023 CLASS: I | AGE: 53 COMMITTEES: NONE | |||

Why this director is valuable to Netflix Mr. Peters, our co-Chief Executive Officer, has served in roles of increasing responsibility at Netflix since 2008, including Chief Operating Officer and Chief Product Officer. Mr. Peters brings to the Board a deep understanding of the Company’s business, including its technology and worldwide operations, as well as business acumen and executive leadership experience.

Also... Greg previously held positions at digital entertainment software provider, Mediabolic Inc., Red Hat Network, the provider of Linux and Open Source technology, and online vendor Wine.com. He previously served on the boards of Highland Transcend Partners I Corp. from 2020 to 2022 and 2U, Inc. from 2018 to 2023. He holds a degree in physics and astronomy from Yale University.

Career Snapshot: • co-Chief Executive Officer (since January 2023); Chief Operating Officer (2020-January 2023) and Chief Product Officer (2017-January 2023) and other various executive positions at Netflix • Senior Vice President of consumer electronics products for Macrovision Solutions Corp. (later renamed Rovi Corporation), a technology company | ||||

Ambassador Susan Rice | INDEPENDENT DIRECTOR |

Other Public • None | ||

DIRECTOR SINCE: 2023 CLASS: I |

AGE: 59 COMMITTEES: NOMINATING AND GOVERNANCE | |||

Why this director is valuable to Netflix As a U.S. diplomat and former Domestic Policy Advisor and National Security Advisor to the President, Ambassador Rice brings her unique experience and expertise in international affairs, global security, governmental and public policy matters to the Board.

Also... Ambassador Rice was a Distinguished Visiting Research Fellow at American University’s School of International Service, Non-Resident Senior Fellow at the Belfer Center for Science and International Affairs at Harvard’s Kennedy School of Government, and Contributing Opinion Writer for the New York Times. She has served on numerous boards, including the John F. Kennedy Center for the Performing Arts, Bureau of National Affairs, National Democratic Institute, and the US Fund for UNICEF. She was also a board member of Netflix from 2018 to 2021. Ambassador Rice earned her master’s degree and doctorate in international relations from Oxford University, where she was a Rhodes Scholar, and her Bachelor’s degree from Stanford University.

Career Snapshot: • U.S. Domestic Policy Advisor (2021-2023) • U.S. National Security Advisor (2013-2017) • U.S. Permanent Representative to the United Nations (2009-2013) • Assistant Secretary of State for African Affairs (1997-2001) • Special Assistant to the President, National Security Council, The White House (1995-1997) | ||||

| 8 |

|

| Proposal 1: Our Board of Directors | ||

Ted Sarandos |

CO-CHIEF EXECUTIVE OFFICER AND PRESIDENT OF THE COMPANY AND DIRECTOR |

Other Public Company • Spotify Technology S.A. | ||

DIRECTOR SINCE: 2020 CLASS: III | AGE: 59 COMMITTEES: NONE | |||

Why this director is valuable to Netflix Mr. Sarandos, as co-Chief Executive Officer and former Chief Content Officer, has significant executive management and leadership experience and is integral to developing corporate strategy. His in-depth knowledge about Netflix and experience in the entertainment industry provide a unique business perspective to the Board.

Also... Mr. Sarandos has been responsible for all content operations since 2000, and led the Company’s transition into original content production that began in 2013 with the launch of series such as House of Cards, Arrested Development and Orange is the New Black. With more than 20 years’ experience in home entertainment, he is recognized in the industry as an innovator in film acquisition and distribution and was named one of Time Magazine’s 100 Most Influential People of 2013. He is a Henry Crown Fellow at the Aspen Institute and is Chair of the Board of Trustees for the Academy Museum of Motion Pictures, is a trustee of the American Film Institute, and on the board of Exploring the Arts.

Career Snapshot: • co-Chief Executive Officer (since 2020) and Chief Content Officer of Netflix (2000-January 2023) • Executive at video distributor ETD and Video City/West Coast video, a video rental retail chain • Producer/Executive Producer for award-winning and critically acclaimed documentaries and independent films including the Emmy-nominated Outrage and Tony Bennett: The Music Never Ends. | ||||

Brad Smith | INDEPENDENT DIRECTOR |

Other Public • None | ||

DIRECTOR SINCE: 2015 CLASS: I | AGE: 65 COMMITTEES: NOMINATING AND GOVERNANCE | |||

Why this director is valuable to Netflix With a leading role at Microsoft, Mr. Smith brings broad business and international experience on a variety of issues, including government affairs and public policy to the Board. Mr. Smith also brings experience playing a key role in representing Microsoft externally and in leading Microsoft’s work on a number of critical issues, involving the intersection of technology and society, including artificial intelligence, cybersecurity, privacy, accessibility, environmental sustainability and digital safety, among others, which provides additional expertise to the Board.

Also... Mr. Smith has led a push for diversity within Microsoft’s legal division, advocating for increasing employment of diverse employees at the company and associated law firms. Mr. Smith holds a B.A. in international relations and economics from Princeton, a J.D. from Columbia University School of Law and also studied international law and economics at the Graduate Institute of International Studies in Geneva.

Career Snapshot: • Vice Chair and President of Microsoft (since 2021); he originally joined Microsoft in 1993 • Associate and then Partner, Covington & Burling (1986-1993) | ||||

2024 Proxy Statement |

9

|

Anne Sweeney | INDEPENDENT DIRECTOR |

Other Public • None | ||

DIRECTOR SINCE: 2015 CLASS: I | AGE: 66 COMMITTEES: COMPENSATION | |||

Why this director is valuable to Netflix Ms. Sweeney has held various senior positions with large entertainment companies, which provided her with broad strategic and operational experience. Her experience in the entertainment industry provides a unique business perspective to the Board as Netflix builds its global internet TV network.

Also... Ms. Sweeney’s entertainment experience spans more than three decades, including her oversight of Disney’s cable, broadcast and satellite properties globally for 18 years. During that time, she was charged with launching and running over 118 Disney Channels in 164 countries in 34 languages, and had oversight over various ABC properties including ABC Television Network, ABC Studios and the Disney ABC Cable Networks Group. Prior to Disney, she was CEO of FX Networks, Inc. from 1993 to 1996 and spent more than 12 years at Viacom’s Nickelodeon Network. She holds an Ed. M. From Harvard University and a B.A. from the College of New Rochelle.

Career Snapshot: • Various executive positions at The Walt Disney Company from 1996 to 2015, including President of the Disney Channel (1996-1998), President of Disney/ABC Cable Networks (1996-2004), and Co-chair of Disney Media Networks (2004-2015) • Chairman and CEO of FX Networks, part of the Fox Entertainment Group/21st Century Fox (1993-1996) | ||||

Directors not standing for election:

Timothy Haley | INDEPENDENT DIRECTOR |

Other Public • 2U, Inc. • ThredUp, Inc. • Zuora, Inc. | ||

DIRECTOR SINCE: 1998 CLASS: II (EXPIRES 2025) | AGE: 69 COMMITTEES: COMPENSATION (CHAIR) | |||

Why this director is valuable to Netflix As a venture capital investor, Mr. Haley brings strategic and financial experience to the Board. He has evaluated, invested in and served as a board member on numerous companies. His executive recruiting background also provides the Board with insight into talent selection and management.

Also... Mr. Haley was President of Haley Associates, an executive recruiting firm serving the high technology industry from 1986 to 1998, and serves on the boards of several private companies. Mr. Haley holds a B.A. from Santa Clara University.

Career Snapshot: • Managing Director, Redpoint Ventures, a venture capital firm (since 1999) • Managing Director, Institutional Venture Partners, a venture capital firm (since 1998) | ||||

| 10 |

|

| Proposal 1: Our Board of Directors | ||

Leslie Kilgore | INDEPENDENT DIRECTOR |

Other Public • Pinterest, Inc. | ||

DIRECTOR SINCE: 2012 (INDEPENDENT SINCE 2015) CLASS: II (EXPIRES 2025) |

AGE: 58 COMMITTEES: AUDIT | |||

Why this director is valuable to Netflix Ms. Kilgore’s experience as a marketing executive with internet retailers and consumer product companies provides a unique business perspective and her numerous managerial positions provide strategic and operational experience to the Board.

Also... As our former Chief Marketing Officer, Ms. Kilgore deeply understands the Netflix business and is able to bring years of marketing experience to the Board. She holds an M.B.A. from the Stanford University Graduate School of Business and a B.S. from The Wharton School of Business at the University of Pennsylvania. She previously served on the boards of LinkedIn Corp., Medallia, Inc. from 2015 to 2021, and Nextdoor Holdings, Inc. from 2015 to 2023 and she currently serves on the boards of several other companies.

Career Snapshot: • Chief Marketing Officer of Netflix (2000-2012) • Director of Marketing at Amazon (1999-2000) • Brand manager at The Procter & Gamble Company (1992-1999) | ||||

Strive Masiyiwa | INDEPENDENT DIRECTOR |

Other Public • Unilever Plc | ||

DIRECTOR SINCE: 2020 CLASS: II (EXPIRES 2025) | AGE: 63 COMMITTEES: NOMINATING AND GOVERNANCE | |||

Why this director is valuable to Netflix As the Chairman and founder of Econet, a telecommunications and technology group with operations and investments in numerous countries in Africa, LatAm, Europe and Israel, Mr. Masiyiwa provides a unique international perspective to the Board. In addition, his experience in building businesses across Africa and the world provides the Company with valuable insight as it expands globally.

Also... Mr. Masiyiwa serves on several international boards including Unilever Plc and National Geographic Society, as well as the Global Advisory boards of Bank of America, Stanford University, and the Prince of Wales Trust for Africa, and is a member of the United States Holocaust Museum’s Committee on Antisemitism. A former board member of the Rockefeller Foundation for 15 years, he is Chairman Emeritus of the Alliance for a Green Revolution in Africa (AGRA) and was previously the African Union Special Envoy to the continent’s COVID response. He received a BSc in Electrical and Electronic Engineering from the University of Wales. Mr. Masiyiwa has received honorary doctorates from Morehouse College, Yale University, Nelson Mandela University and Cardiff University.

Career Snapshot: • Founder and Executive Chairman of Econet Global (1993-Present) | ||||

2024 Proxy Statement |

11

|

Ann Mather | INDEPENDENT DIRECTOR |

Other Public • Blend Labs, Inc. • Bumble Inc. | ||

DIRECTOR SINCE: 2010 CLASS: II (EXPIRES 2025) |

AGE: 64 COMMITTEES: AUDIT (CHAIR, FINANCIAL EXPERT) | |||

Why this director is valuable to Netflix Ms. Mather’s experience as an executive with several major media companies provides a unique business perspective. As a former CFO and senior finance executive at major corporations, she brings more than 20 years of financial and accounting expertise to the Board. Additionally, Ms. Mather’s numerous managerial positions and service on public company boards provides strategic, operational and corporate governance experience.

Also... Ms. Mather previously served on the board of Shutterfly, Inc., a photography and image-sharing company from 2013 to 2019, Glu Mobile Inc., a publisher of mobile games from 2005 to 2021, Airbnb, Inc., a vacation rental online marketplace company from 2018 to 2021, Arista Networks, Inc., a computer networking company from 2013 to 2022 and Alphabet Inc. from 2005 to 2023. She has also been an independent trustee to the board of trustees of Dodge & Cox Funds, a mutual fund, since May 2011. She received her M.A. from Cambridge University, and is an Honorary Fellow of Sidney Sussex College Cambridge.

Career Snapshot: • Executive Vice President and CFO of Pixar (1999-2004) • Executive Vice President and CFO of Village Roadshow Pictures (1999) • Various executive positions at The Walt Disney Company (1993-1999) | ||||

| 12 |

|

| Proposal 1: Our Board of Directors | ||

Board Skills and Experience

Our Board believes that having a diverse mix of directors with complementary skills, experience, and expertise is important to meeting its oversight responsibility. That diversity, combined with transparent and broad access to information and exposure to management beyond the executive officers, allows the Board to exercise effective management oversight and to ensure the care of our shareholders’ interests. Below are a number of skills that our Board members bring to Netflix. If an individual is not listed under a particular attribute, it does not signify a director’s lack of ability to contribute in such area.

Leadership

| ||||||

Experience leading an enterprise scale organization, resulting in a practical understanding of organizational behavior, processes, strategic planning, and risk management. Demonstrated strengths in developing talent, planning succession, and driving change and long-term growth. |

Richard Barton

Mathias Döpfner

Timothy Haley

Reed Hastings

Jay Hoag

Leslie Kilgore |

Strive Masiyiwa

Ann Mather

Greg Peters

Ambassador Susan Rice

Ted Sarandos

Brad Smith

Anne Sweeney | ||||

Strategy

| ||||||

Experience and expertise in identifying and developing opportunities for long-term value creation, including experience in driving innovation, opening markets, improving operations, identifying risks, and executing successfully. |

Richard Barton

Mathias Döpfner

Timothy Haley

Reed Hastings

Jay Hoag

Leslie Kilgore |

Strive Masiyiwa

Ann Mather

Greg Peters

Ambassador Susan Rice

Ted Sarandos

Brad Smith

Anne Sweeney | ||||

Finance & Accounting

| ||||||

Management or oversight of the finance function of an enterprise, resulting in proficiency in complex financial management, capital allocation, and financial reporting processes. |

Richard Barton

Mathias Döpfner

Timothy Haley

Reed Hastings |

Jay Hoag

Leslie Kilgore

Ann Mather

Anne Sweeney | ||||

Entertainment & Media

| ||||||

Experience and expertise with the entertainment and media industry, resulting in a deep understanding of consumer expectations and innovations in content and delivery. |

Richard Barton

Mathias Döpfner

Reed Hastings

Leslie Kilgore |

Ann Mather

Greg Peters

Ted Sarandos

Anne Sweeney | ||||

Demographic Diversity

| ||||||

Representation of gender, ethnic, race, geographic, cultural, or other perspectives that expand the Board’s understanding of the needs and viewpoints of our members, partners, employees, governments, and other stakeholders worldwide. |

Mathias Döpfner

Leslie Kilgore

Strive Masiyiwa |

Ann Mather

Ambassador Susan Rice

Anne Sweeney | ||||

2024 Proxy Statement |

13

|

Global Business & Government Relations

| ||||||

Expertise in global business cultures, consumer preferences, and government relations gained through local experience in international markets or senior positions overseeing public policy. |

Mathias Döpfner

Strive Masiyiwa

Ann Mather |

Greg Peters

Ambassador Susan Rice

Ted Sarandos

Brad Smith | ||||

Technology

| ||||||

Experience and expertise in technology-related business or technology functions, resulting in knowledge of how to anticipate technological trends, understand and manage technology related risks, generate disruptive innovation, and extend or create new business models. |

Richard Barton

Reed Hastings

Jay Hoag |

Strive Masiyiwa

Greg Peters

Brad Smith | ||||

Marketing

| ||||||

Experience and expertise developing strategies to grow market share, package and position product offerings, build brand awareness and equity, and enhance enterprise reputation. |

Richard Barton |

Leslie Kilgore

Ted Sarandos | ||||

Human Capital Management

| ||||||

Experience and expertise related to human resource issues such as attracting and retaining talent, succession planning, engagement of employees, and the development and evolution of culture, including the alignment of culture and long-term strategy. |

Timothy Haley

Reed Hastings |

Greg Peters

Ted Sarandos | ||||

DIRECTOR INDEPENDENCE

The Board has determined that each of Messrs. Barton, Döpfner, Haley, Hoag, Masiyiwa and Smith, Mses. Kilgore, Mather, and Sweeney and Ambassador Rice are independent under the applicable rules of the SEC and the listing standards of the Nasdaq Stock Market; therefore, every member of the Audit Committee, Compensation Committee and Nominating and Governance Committee is an independent director in accordance with those standards.

| 14 |

|

How We are Selected, Elected and Evaluated

Consideration of Director Nominees

Director Qualifications

In discharging its responsibilities to nominate candidates for election to the Board, the Nominating and Governance Committee has not specified any minimum qualifications for serving on the Board. However, the Nominating and Governance Committee endeavors to evaluate, propose and approve candidates with business experience, diversity, as well as personal skills and knowledge with respect to technology, finance, marketing, financial reporting and any other areas that may be expected to contribute to an effective Board. With respect to diversity, the committee may consider such factors as diversity in viewpoint, professional experience, education, international experience, skills and other individual qualifications and attributes that contribute to board heterogeneity, including characteristics such as gender, race, and national origin.

Identifying and Evaluating Nominees for Directors

The Nominating and Governance Committee utilizes a variety of methods for identifying and evaluating nominees for director. Candidates may come to the attention of the Nominating and Governance Committee through management, current Board members, stockholders or other persons. These candidates are evaluated at meetings of the Nominating and Governance Committee as necessary and discussed by the members of the Nominating and Governance Committee from time to time. Candidates may be considered at any point during the year.

The Nominating and Governance Committee considers properly submitted stockholder nominations for candidates for the Board. Following verification of the stockholder status of persons proposing candidates, recommendations are aggregated and considered by the Nominating and Governance Committee. If any materials are provided by a stockholder in connection with the nomination of a director candidate, such materials are forwarded to the Nominating and Governance Committee. The Nominating and Governance Committee also reviews materials provided by professional search firms or other parties in connection with a nominee who is not proposed by a stockholder.

Stockholder Nominees

The Nominating and Governance Committee considers properly submitted stockholder nominations for candidates for membership on the Board as described under “Identifying and Evaluating Nominees for Directors.” Any stockholder nominations proposed for consideration by the Nominating and Governance Committee should include the nominee’s name and qualifications for Board membership. In addition, they should be submitted within the time frame as specified under “Stockholder Proposals” and mailed to: Netflix, Inc., 121 Albright Way, Los Gatos, California 95032, Attention: Secretary, with a copy via email to stockholderproposals@netflix.com.

Our bylaws provide a proxy access right for stockholders, pursuant to which a stockholder, or a group of up to 20 stockholders, owning at least three percent of outstanding shares of our common stock continuously for at least three years, may nominate and include in our annual meeting proxy materials director nominees constituting up to the greater of (a) two directors or (b) twenty percent of the Board, subject to certain limitations and provided that the stockholders and nominees satisfy the requirements

2024 Proxy Statement |

15

|

specified in our bylaws. Appropriately nominated proxy access nominees or nominees who comply with both our advance notice bylaw provisions and the SEC’s Rule 14a-19 will be included in the Company’s proxy statement and ballot.

Our Board Evaluation Process

Our Board periodically conducts a self-evaluation to help assure and enhance its performance. This process is overseen by the Nominating and Governance Committee, and typically involves interviews of each director by our Chief Legal Officer. Feedback is sought primarily in the following areas: (a) the Board’s effectiveness, structure, culture and composition, (b) the quality of and access to information shared with the Board about our business and (c) performance of the directors and quality of Board discussions.

| 16 |

|

How We Govern and are Governed

Our Approach to Corporate Governance

Corporate Governance Philosophy

Netflix operates in a highly competitive industry and has been in a state of constant innovation since inception. We have redefined how people watch video entertainment—first through DVD-by-mail, then streaming video, and now as one of the world’s leading entertainment services with over 260 million memberships in over 190 countries in 2023. We compete with a broad set of activities for consumers’ leisure time including linear TV, video games, and social media to name just a few, and we expect our industry to remain highly competitive as this dynamic market continues to evolve and entertainment companies all around the world develop their own streaming offering.

Our corporate governance structure is built against this backdrop. Governance, in this context, means finding the right balance of rights and responsibilities among shareholders, the Board, and management, and ensuring that there are appropriate checks and balances in place. With the rapid evolution of technology and the changing media landscape, we are continually adjusting our service to meet the dynamic needs and desires of our consumers. Our governance structure is built to help us to do that.

At our 2022 annual meeting, the Netflix Board proposed and shareholders approved significant changes to our corporate governance structure. We implemented a phased-in declassification of our Board, with directors elected at each successive year’s annual meeting serving one-year terms and the entire Board standing for annual elections beginning in 2025 and beyond.

Corporate Governance Practices and Shareholder Rights

We seek to implement corporate governance practices and shareholder rights to align with the long-term interests of shareholders and have adopted the following:

| • | One share, one vote: We have a single class of shares with each share entitled to one vote. |

| • | Majority voting standard: We have a majority voting standard in uncontested director elections. |

| • | Annual director elections (fully declassified in 2025): We have phased-in the declassification of our Board with directors elected at this year’s annual meeting serving one-year terms and the entire Board standing for annual elections beginning in 2025 and beyond. |

| • | Elimination of supermajority voting: We eliminated supermajority voting provisions in our Charter and Bylaws. |

| • | Proxy Access: A group of up to 20 shareholders, owning at least 3% of shares continuously for at least three years may nominate up to two directors or 20% of the Board (whichever is greater) for inclusion in our proxy statement. |

| • | Shareholder right to call a special meeting: Shareholders holding a not less than 20% net-long position in the Company continuously for at least one year may call a special meeting. |

| • | Director resignation policy: Any incumbent director who fails to receive a majority of votes cast in an uncontested election must tender their resignation to the Board. The Nominating and Governance Committee must then make a recommendation to the Board regarding whether to accept or reject the resignation or take other action. The Board will act on the Nominating and Governance Committee’s recommendation and publicly disclose its decision and the rationale within 90 days from the date the election results are certified. |

| • | Policy on directors’ service on other public company boards: As part of our newly adopted corporate governance guidelines, we have included a policy that the Netflix co-CEOs may not serve on more than two boards of other public companies in addition to the Company’s Board, and that directors other than the co-CEOs, may not serve on more than four boards of other public companies in addition to the Company’s Board. |

2024 Proxy Statement |

17

|

Shareholder Engagement and 2023 Shareholder Proposals

We are dedicated to engaging with our shareholders to solicit their views on a wide variety of issues, including corporate governance, environmental and social matters, executive compensation and other matters. We proactively engage with our shareholders throughout the year.

Over the past several years, in response to shareholder feedback, and as part of our ongoing evaluation of best practices, the Board has incorporated enhancements to our disclosures and corporate governance practices as set forth below.

| Responsive Actions to Feedback | ||

2023-2024 | ||

Executive Compensation Program Changes

Adoption of Corporate Governance Guidelines, which includes a policy on directors’ service on other public company boards

Adoption of Human Rights Statement | • Significantly evolved our executive compensation program in response to shareholder feedback

• We adopted corporate governance guidelines, which in conjunction with our charter and bylaws, provide the framework pursuant to which the Board oversees the Company’s business in accordance with its fiduciary responsibilities. The corporate governance guidelines address various issues such as board composition, director qualifications, board terms, board responsibilities and procedures, among other items. In particular, the corporate governance guidelines include a policy for directors’ service on other public company boards. Namely, our co-CEOs may not serve on more than two boards of other public companies in addition to the Netflix board, and directors other than the co-CEOs may not serve on more than four boards of other public companies in addition to the Netflix board.

• As further detailed below, we adopted a Human Rights Statement that sets forth a commitment to respecting internationally recognized human rights as defined by the International Bill of Human Rights. | |

2022 | ||

Declassification of the Board (fully declassified in 2025)

Elimination of Supermajority Voting Provisions

Shareholder Right to Call Special Meetings

Majority Vote Standard for Uncontested Director Elections

Executive Compensation Program Changes

Political Activity Disclosures | • Announced intention to make governance changes, including removal of supermajority provisions, providing shareholders the ability to call special meetings, phased-in declassification of the Board and changing the voting standard for our directors in uncontested elections

• Adopted amendments to our Charter and Bylaws to implement the phased-in declassification of the Board (fully declassified in 2025), removal of supermajority voting provisions, addition of shareholders’ right to call a special meeting, and adoption of a majority vote standard for uncontested director elections

• Evolved our executive compensation program in response to shareholder feedback

• Began publishing on our Investor Relations website disclosure regarding our political activities, including our political contributions, which to date have been limited | |

| 18 |

|

| Proposal 1: Our Board of Directors | ||

2021 | ||

Diversity and Inclusion Reporting | • Published our first Inclusion Report and publish annually an update on our inclusion initiatives and progress

• Published our EEO-1 reports, which are published annually | |

2020 | ||

Sustainability Reporting

Enhanced Proxy Disclosures | • Published our first annual Environmental Social Governance (“ESG”) Report, which continues to be published annually

• Significantly enhanced readability and presentation of our proxy statement, including proxy disclosures of director qualifications and skills | |

2019 | ||

Proxy Access | • Implemented proxy access bylaws with provisions and structure broadly consistent with market best practice | |

2023 Shareholder Proposals

At our 2023 annual meeting, shareholders presented four proposals for a vote. These proposals did not receive majority support from our shareholders. One of the proposals requested that we adopt a policy on freedom of association and received approximately 35% approval. While the proposal did not pass, we recognized the importance of the rights to freedom of association and collective bargaining and that these are just one component of the larger issue of human rights. We adopted a Human Rights Statement which expressly reflects our support for the rights to freedom of association and collective bargaining, the elimination of forced or compulsory labour, the abolition of child labour, an end to workplace discrimination and the creation of a safe and healthy working environment, as informed by the ILO Declaration on Fundamental Principles and Rights at Work and in accordance with applicable local law. The Human Rights Statement is available on our Investor Relations website at ir.netflix.net/governancedocs.

Compensation-focused Engagement following 2023 Annual Meeting

Cumulatively, since the last annual meeting, we invited 29 shareholders, representing 54% of our shares outstanding as of December 31, 2023, to engage and provide feedback on our executive compensation program and other areas of shareholder interest. We conducted three rounds of engagement and met with 23 shareholders, including nine of our top 10 shareholders, collectively representing approximately 48% of our shares outstanding. Members of the Netflix Legal and Investor Relations teams participated in all shareholder meetings, and the Compensation Committee members participated in 70% of the engagements, meeting with shareholders representing approximately 37% of shares outstanding.

Our engagement discussions following the 2023 annual meeting focused primarily on our executive compensation program and potential changes. In response to these discussions and feedback, the Compensation Committee substantially evolved our compensation program for our Executive Officers to: (1) eliminate the ability to allocate compensation between cash salary and stock options for our Executive Officers; (2) limit guaranteed cash compensation by setting base salary at $3 million for the co-CEOs, $100,000 for our Executive Chairman, and $1.5 million for the other Executive Officers; (3) expand participation in the annual performance-based cash bonus program to all Executive Officers; (4) grant performance-based restricted stock unit awards and time-based restricted stock unit awards with expanded vesting terms instead of stock options for long term equity compensation; (5) evolve our change-in-control severance arrangements to include “double-trigger” provisions; and (6) adopt stock ownership guidelines for Executive Officers. A detailed discussion of our engagement with shareholders regarding our executive compensation program and key changes for the 2024 compensation year are included in the Compensation Discussion and Analysis section.

In addition to executive compensation, we also discussed the co-CEO leadership structure; succession planning; board composition; board oversight of issues such as labor matters, generative AI and cybersecurity; and other ESG topics, including climate and human capital, as well as shareholder proposals submitted for the 2024 annual meeting. Shareholders inquired about

2024 Proxy Statement |

19

|

the co-CEO model following Reed’s transition to Executive Chairman. We explained the working relationship between Ted and Greg, and that it was an effective leadership model to further support our continued growth and strategic initiatives. Shareholders asked about the Board’s role in overseeing matters such as labor, generative AI and cybersecurity. We explained Netflix’s approach to sharing information with the Board in a manner that is transparent and in depth, and that these topics have been regularly discussed by the Board.

The Role of the Board in Risk Oversight

The Board’s role in our risk oversight process includes reviewing and discussing with members of management areas of material risk to the Company, including overall enterprise, strategic, operational, financial and legal risks. The Board oversees the Company’s ESG efforts, which include human capital management, inclusion, diversity, sustainability (including climate strategy) and other matters. The Board also oversees succession planning. The Board receives regular updates from management, typically in the form of an interactive memo, where directors ask questions to management, and further discuss matters at meetings. Each of the committees oversee various ESG matters, depending on the specific issues. Committees report to the full Board regarding their respective considerations and actions.

Board

The Board as a whole oversees matters related to enterprise, strategic, operational, financial and legal risk and the Company’s ESG efforts.

| ||||

Nominating and Governance

Primary committee responsible for Board structure, governance and director independence, as well as assisting the Board in overseeing ESG matters

|

Audit Committee

Oversees matters of financial and legal risk, including cybersecurity risk |

Compensation Committee

Oversees risks related to compensation issues | ||

Company management

The executive team, led by our co-CEOs, supervises day-to-day risk management processes, including identifying, assessing, monitoring, managing and mitigating significant business risks. Company management reports to the Board on an annual basis, or more frequently if needed, on top areas of risk. | ||||

Code of Ethics

We have adopted a Code of Ethics for our directors, officers and other employees. A copy of the Code of Ethics is available on our Investor Relations website at ir.netflix.net/governancedocs. Any changes to or waivers of the Code of Ethics will be posted at that website.

| 20 |

|

How We are Organized

Board Meetings and Committees

The Board held five meetings during 2023. Each Board member attended at least 75% of the aggregate of the total number of Board meetings and meetings of the Board committees.

As of the date of this Proxy Statement, the Board has three standing committees: (1) the Compensation Committee; (2) the Audit Committee; and (3) the Nominating and Governance Committee.

Compensation Committee

The Compensation Committee of the Board consists of three non-employee directors: Messrs. Döpfner and Haley (Chair), and Ms. Sweeney. Each member of the Compensation Committee is independent in compliance with the rules of the SEC and the listing standards of the Nasdaq Stock Market as they pertain to Compensation Committee members. Each of the Compensation Committee members is also a non-employee director under Rule 16b-3 of the Exchange Act. The Compensation Committee reviews and approves all forms of compensation to be provided to our executive officers and directors. For a description of the role of the executive officers in recommending compensation and the role of any compensation consultants, please see the section entitled “Compensation Discussion and Analysis” below. The Compensation Committee held six meetings in 2023. Each member attended all the Compensation Committee meetings held in 2023.

The Report of the Compensation Committee is included in this Proxy Statement. In addition, the Board has adopted a written charter for the Compensation Committee, which is available on our Investor Relations website at ir.netflix.net/governancedocs.

Audit Committee

The Audit Committee of the Board consists of three non-employee directors: Mr. Barton, and Mses. Kilgore and Mather (Chair), each of whom is independent in compliance with the rules of the SEC and the listing standards of the Nasdaq Stock Market as they pertain to audit committee members. The Board has determined that Ms. Mather is an audit committee financial expert as defined by Item 407(d)(5)(ii) of Regulation S-K.

The Audit Committee engages the Company’s independent registered public accounting firm, reviews the Company’s financial controls, evaluates the scope of the annual audit, reviews audit results, consults with management and the Company’s independent registered public accounting firm prior to the presentation of financial statements to stockholders and, as appropriate, initiates inquiries into aspects of the Company’s internal accounting controls and financial affairs. The Audit Committee met seven times in 2023. Each member attended all of the Audit Committee meetings held in 2023, other than Mr. Barton who did not attend one meeting.

The Report of the Audit Committee is included in this Proxy Statement. In addition, the Board has adopted a written charter for the Audit Committee, which is available on our Investor Relations website at ir.netflix.net/governancedocs.

2024 Proxy Statement |

21

|

Nominating and Governance Committee

The Nominating and Governance Committee of the Board consists of four non-employee directors, Messrs. Hoag (Chair), Smith and Masiyiwa, and Ambassador Rice (joined December 2023). Each director serving on the Nominating and Governance Committee is independent under the listing standards of the Nasdaq Stock Market.

The Nominating and Governance Committee reviews and approves candidates for election and to fill vacancies on the Board, including re-nominations of members whose terms are due to expire, and reviews and provides guidance to the Board on corporate governance matters. The Nominating and Governance Committee met two times in 2023. Each member attended all the Nominating and Governance Committee meetings held in 2023, other than Ambassador Rice who was not a member of the Nominating and Governance Committee at the time of the meetings in 2023.

The Board has adopted a written charter for the Nominating and Governance Committee, which is available on our Investor Relations website at ir.netflix.net/governancedocs.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves on the board of directors or compensation committee of a company that has an executive officer that serves on our Board or Compensation Committee. No member of our Board is an executive officer of a company in which one of our executive officers serves as a member of the board of directors or compensation committee of that company.

In 2023, the Compensation Committee consisted of Messrs. Döpfner and Haley, and Ms. Sweeney, none of whom is currently or was formerly an officer or employee of the Company. None of Messrs. Döpfner or Haley or Ms. Sweeney had a relationship with the Company that required disclosure under Item 404 of Regulation S-K. In addition to Messrs. Döpfner, and Haley, and Ms. Sweeney, our co-CEOs and Chief Talent Officer participated in the executive compensation process for the year ended December 31, 2023 as described below in the section entitled “Compensation Discussion and Analysis.”

Policy Regarding Director Attendance at the Annual Meeting

Our policy regarding directors’ attendance at the annual meetings of stockholders and their attendance record at last year’s annual meeting of stockholders can be found on our Investor Relations website at ir.netflix.net/governancedocs.

The Board’s Leadership Structure

Reed Hastings, the co-founder and former co-CEO and President of the Company, serves as the Executive Chairman of the Board. The Board believes that Mr. Hastings is best situated to serve as the Executive Chairman given his role as the founder and former CEO. He continues to be employed by Netflix and serves as a strategic adviser to the co-CEOs. He is the director most familiar with our business and industry and is therefore best able to identify the strategic priorities to be discussed by the Board. The Board also believes that the Executive Chairman helps facilitate information flow between management and the Board and fosters strategic development and execution. The co-CEOs also serve on the Board. The Board has appointed Jay Hoag as its lead independent director. As lead independent director, Mr. Hoag’s responsibilities include:

| • | coordinating the activities of the independent directors, and authorization to call meetings of the independent directors; |

| • | coordinating with the Executive Chairman, Chief Executive Officer(s) and Corporate Secretary, as appropriate, in helping set the agenda for Board meetings, including suggestions from other members of the Board; |

| • | chairing executive sessions of the independent directors; |

| • | providing feedback and perspective to the Executive Chairman and Chief Executive Officer(s) about discussions among the independent directors; |

| • | helping facilitate communication among the Executive Chairman, Chief Executive Officer(s) and the independent directors; |

| 22 |

|

| Proposal 1: Our Board of Directors | ||

| • | presiding at Board meetings where the Executive Chairman is not present; and |

| • | performing other duties assigned from time to time by the Board. |

In addition, the Board maintains effective independent oversight through a number of governance practices, including, open and direct communication with management, input on meeting agendas, periodic performance evaluations and regular executive sessions.

2024 Proxy Statement |

23

|

How to

Communicate

with Us

Communications with the Board

We provide a process for stockholders to send communications to the Board through the email address board@netflix.com. Information regarding stockholder communications with the Board can be found on the Company’s Investor Relations website at ir.netflix.net/governancedocs.

| 24 |

|

How We are Paid

Our directors, other than Ambassador Susan Rice, do not receive cash for services they provide as directors or members of Board committees but may be reimbursed for their reasonable expenses for attending Board and Board committee meetings. Each non-employee director other than Ambassador Rice receives stock options pursuant to the Director Equity Compensation Plan. The Director Equity Compensation Plan provides for a monthly grant of stock options to non-employee directors of the Company in consideration for services provided to us and subject to the terms and conditions of our equity compensation plans. Ambassador Rice received an annual cash retainer of $300,000, paid monthly in arrears.

We believe that for our Company, compensating directors with options is appropriate and creates the right incentives and long-term value alignment with stockholders. Without long-term value creation, directors are not compensated as the intrinsic value of options on dates of grant is zero. Ambassador Rice was compensated in cash given her long career as a public servant in a number of U.S. administrations in order to facilitate potential future optionality.

The actual number of options granted each month to each of our directors is determined by the following formula: $25,000 / ([fair market value on the date of grant] x 0.40). Each monthly grant is made on the first trading day of the month, is fully vested upon grant and is exercisable at a strike price equal to the fair market value on the date of grant. The table below sets forth information concerning the compensation of our non-employee directors during 2023.

Compensia, Inc. (“Compensia”) annually advises the Board on our Board compensation program for the upcoming year, based on a comparison against our peer group’s board compensation programs and other compensation-related developments. We have not made any changes to the compensation program for our Board since 2016.

The following table summarizes the compensation paid to all Board members for the year ended December 31, 2023, other than Reed Hastings, Greg Peters and Ted Sarandos whose compensation is reflected in the Summary Compensation Table:

Name | Fees Earned or Paid in Cash ($) | Option Awards ($)(1) | Total ($) | ||||||||||||

Richard N. Barton | — | 424,426 | 424,426 | (2) | |||||||||||

Mathias Döpfner | — | 424,717 | 424,717 | (3) | |||||||||||

Timothy M. Haley | — | 424,426 | 424,426 | (4) | |||||||||||

Jay C. Hoag | — | 424,426 | 424,426 | (5) | |||||||||||

Leslie Kilgore | — | 424,426 | 424,426 | (6) | |||||||||||

Strive Masiyiwa | — | 424,717 | 424,717 | (7) | |||||||||||

Ann Mather | — | 424,426 | 424,426 | (8) | |||||||||||

Susan E. Rice(9) | 95,833 | — | 95,833 | ||||||||||||

Bradford L. Smith | — | 424,426 | 424,426 | (10) | |||||||||||

Anne M. Sweeney | — | 424,426 | 424,426 | (11) | |||||||||||

| (1) | Option awards reflect the monthly grant of stock options to each non-employee director on the dates and at the aggregate grant date fair values computed in accordance with FASB ASC Topic 718 as shown below. Only options to purchase whole shares are granted with any remaining amount of the grant value carried over to the next monthly grant. The differences in option award values for each of Messrs. Döpfner and Masiyiwa reflect the different carryover amounts relating to the appointment month for each director. For a discussion of the assumptions made in the valuation reflected in the Option Awards column, refer to Note 9 to our consolidated financial statements for the fiscal year ended December 31, 2023 in our Form 10-K filed with the SEC on January 26, 2024. |

2024 Proxy Statement |

25

|

For all directors, other than Messrs. Döpfner and Masiyiwa: |

Grant Date | Fair Value ($) | |||

1/3/2023 | 36,571 | |||

2/1/2023 | 36,415 | |||

3/1/2023 | 36,669 | |||

4/3/2023 | 35,050 | |||

5/1/2023 | 35,170 | |||

6/1/2023 | 35,131 | |||

7/3/2023 | 34,721 | |||

8/1/2023 | 34,499 | |||

9/1/2023 | 34,598 | |||

10/2/2023 | 35,372 | |||

11/1/2023 | 35,053 | |||

12/1/2023 | 35,177 | |||

For Messrs. Döpfner and Masiyiwa: |

Grant Date | Fair Value ($) | |||

1/3/2023 | 36,571 | |||

2/1/2023 | 36,627 | |||

3/1/2023 | 36,485 | |||

4/3/2023 | 35,050 | |||

5/1/2023 | 35,170 | |||

6/1/2023 | 35,131 | |||

7/3/2023 | 34,721 | |||

8/1/2023 | 34,499 | |||

9/1/2023 | 34,598 | |||

10/2/2023 | 35,372 | |||

11/1/2023 | 35,053 | |||

12/1/2023 | 35,440 | |||

| (2) | Aggregate number of option awards outstanding held by Mr. Barton at December 31, 2023 was 24,705. |

| (3) | Aggregate number of option awards outstanding held by Mr. Döpfner at December 31, 2023 was 10,772. |

| (4) | Aggregate number of option awards outstanding held by Mr. Haley at December 31, 2023 was 32,048. |

| (5) | Aggregate number of option awards outstanding held by Mr. Hoag at December 31, 2023 was 9,239. |

| (6) | Aggregate number of option awards outstanding held by Ms. Kilgore at December 31, 2023 was 17,358. |

| (7) | Aggregate number of option awards outstanding held by Mr. Masiyiwa at December 31, 2023 was 6,118. |

| (8) | Aggregate number of option awards outstanding held by Ms. Mather at December 31, 2023 was 18,998. |

| (9) | Ambassador Susan Rice joined the Board on September 6, 2023. |

| (10) | Aggregate number of option awards outstanding held by Mr. Smith at December 31, 2023 was 29,525. |

| (11) | Aggregate number of option awards outstanding held by Ms. Sweeney at December 31, 2023 was 14,358. |

| 26 |

|

Certain Relationships and Related

Transactions

Agreements with Directors and Executive Officers

We have entered into indemnification agreements with each of our directors and executive officers. These agreements require us to indemnify such individuals, to the fullest extent permitted by Delaware law, for certain liabilities to which they may become subject as a result of their affiliation with us.

Procedures for Approval of Related Party Transactions

We have a written policy concerning the review and approval of related party transactions. Potential related party transactions are identified through an internal review process that includes a review of payments made in connection with transactions in which related persons may have had a direct or indirect material interest. Those transactions that are determined to be related party transactions under Item 404 of Regulation S-K are submitted for review by the Audit Committee for approval and to conduct a conflicts-of-interest analysis. The individual identified as the “related party” may not participate in any review or analysis of the related party transaction.

2024 Proxy Statement |

27

|

| Proposal 2: Our Auditors - Ratification of Appointment of Independent Registered Public Accounting Firm | ||