1 | 05/10/2013 WEYERHAEUSER Analyst Meeting | May 10, 2013

2 | 05/10/2013 Kathy McAuley Vice President, Investor Relations

3 | 05/10/2013 FORWARD-LOOKING STATEMENT This presentation contains statements concerning the company’s future results and performance that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on various assumptions and may not be accurate because of risks and uncertainties surrounding these assumptions. Factors listed below, as well as other factors, may cause actual results to differ significantly from these forward- looking statements. There is no guarantee that any of the events anticipated by these forward-looking statements will occur. If any of the events occur, there is no guarantee what effect they will have on company operations or financial condition. The company will not update these forward-looking statements after the date of this news release. Some forward-looking statements discuss the company’s plans, strategies and intentions. They use words such as “expects,” “may,” “will,” “believes,” “should,” “approximately,” “anticipates,” “estimates,” and “plans.” In addition, these words may use the positive or negative or other variations of those terms. This release contains forward-looking statements regarding the company’s expectations during 2013 and later years, including improved selling prices, higher fee harvest volumes, higher proportion of high-value-grade sawlogs, higher growth rates of trees and high-value sawtimber from silviculture activities, and higher EBITDA from the Timberlands segment; successful implementation of the Wood Products improvement strategy, increased operating rates and cost reductions, broader and more diversified customer base, new products and markets from the Wood Products segment; cost savings and increased production from the Cellulose Fibers segment; and increased home closings, and increasing prices price of homes from single-family homebuilding operations in the Real Estate segment. Major risks, uncertainties and assumptions that affect the company’s businesses and may cause actual results to differ from these forward-looking statements, include, but are not limited to: • the effect of general economic conditions, including employment rates, housing starts, interest rate levels, availability of financing for home mortgages, and strength of the U.S. dollar; • market demand for the company’s products, which is related to the strength of the various U.S. business segments and U.S. and international economic conditions; • performance of the company’s manufacturing operations, including maintenance requirements; • the level of competition from domestic and foreign producers; • the successful execution of internal performance plans, including restructurings and cost reduction initiatives; • raw material and energy prices and transportation costs; • the effect of weather and the risk of loss from fires, floods, windstorms, hurricanes, pest infestation and other natural disasters; • federal tax policies; • the effect of forestry, land use, environmental and other governmental regulations; • legal proceedings; • performance of pension fund investments and related derivatives; • The effect of timing of retirements and changes in the market price of company stock on charges for stock-based compensation; • changes in accounting principles; and • other factors described under “Risk Factors” in the Company’s annual report on Form 10-K and quarterly reports on Form 10-Q. The company also is a large exporter and is affected by changes in economic activity in Europe and Asia, particularly Japan and China. It is affected by changes in currency exchange rates, particularly the relative value of the U.S. dollar to the euro and the Canadian dollar and the relative value of the euro to the yen. Restrictions on international trade or tariffs imposed on imports also may affect the company.

4 | 05/10/2013 DAN FULTON: Weyerhaeuser Overview DON HAID: Industry Outlook PATTY BEDIENT: Timberlands, Wood Products and Financial Overview DAN FULTON: Real Estate, Cellulose Fibers Q&A Session AGENDA

5 | 05/10/2013 Dan Fulton WELCOME & INTRODUCTION President and Chief Executive Officer

6 | 05/10/2013 WEYERHAEUSER OVERVIEW • Industry leader with unique and valuable timberlands • Capitalizing on strong recovery of U.S. housing market • Focused on growing earnings and creating value for shareholders

7 | 05/10/2013 High-Value Douglas Fir Uniquely Positioned for Export & Domestic Markets WEST COAST TIMBERLANDS

8 | 05/10/2013 High-Quality Southern Yellow Pine Sawlogs Well Positioned for Wood Products Markets SOUTHERN TIMBERLANDS

9 | 05/10/2013 Improvement Efforts Driving Profits as Housing Market Recovers WOOD PRODUCTS

10 | 05/10/2013 CELLULOSE FIBERS Innovative Manufacturer of Fluff and Value-Added Pulp Products

11 | 05/10/2013 Top 20 U.S. Homebuilder and Developer with Leading Brands in Desirable Markets REAL ESTATE

12 | 05/10/2013 HOUSING RECOVERY UNDERWAY 0.0 0.5 1.0 1.5 2.0 2.5 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 *RISI *John Burns *Global Insight TOTAL U.S. HOUSING STARTS (Seasonally Adjusted Annual Rate) Source: Census *Forecast Million Units QUARTERLY The Harvard Joint Center for Housing Studies forecasts trend (2015 and beyond) housing starts ranging between 1.6 and 1.9 million units Weyerhaeuser Well Positioned to Benefit from Housing Recovery

13 | 05/10/2013 Don Haid INDUSTRY OUTLOOK Corporate Economist & Director of Industry Analysis

14 | 05/10/2013 KEY MESSAGES • U.S. housing is recovering and contributing to economic growth • Strong and improving market fundamentals in wood products • Timberlands benefiting from strength in export markets and rising domestic log use • Cellulose fibers improving with global economies

15 | 05/10/2013 HOUSING MARKET OVERVIEW • Housing has begun its return to long-term trend levels • Fundamentals coming back into balance – Inventories falling – Prices rising – Improving employment prospects – Household formations returning to trend levels – Echo boom creating demographic push – Single-family starts are rising; multifamily share is higher than during boom

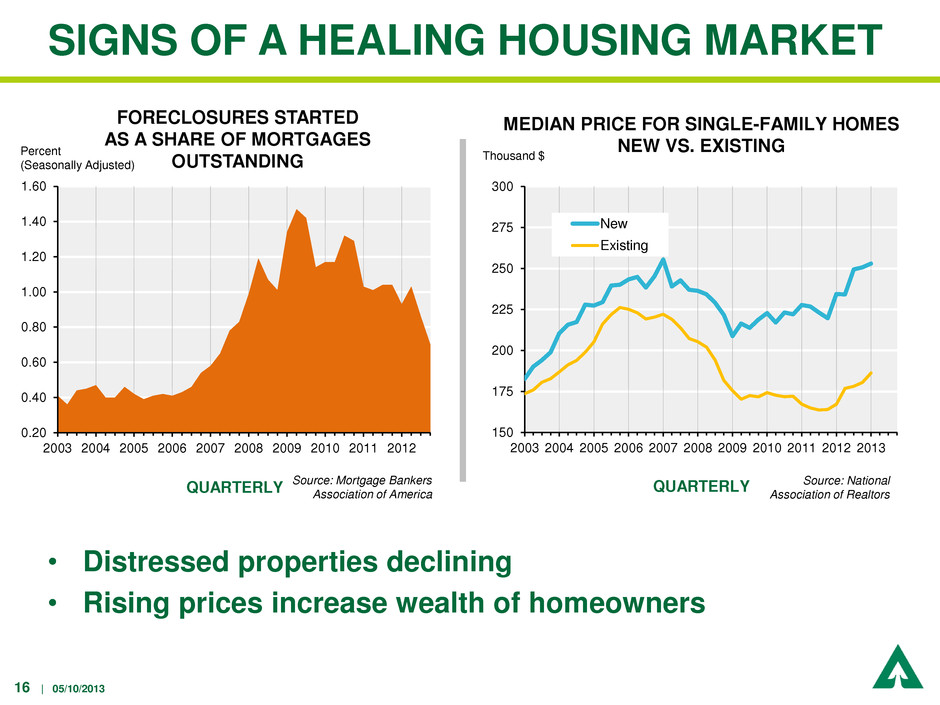

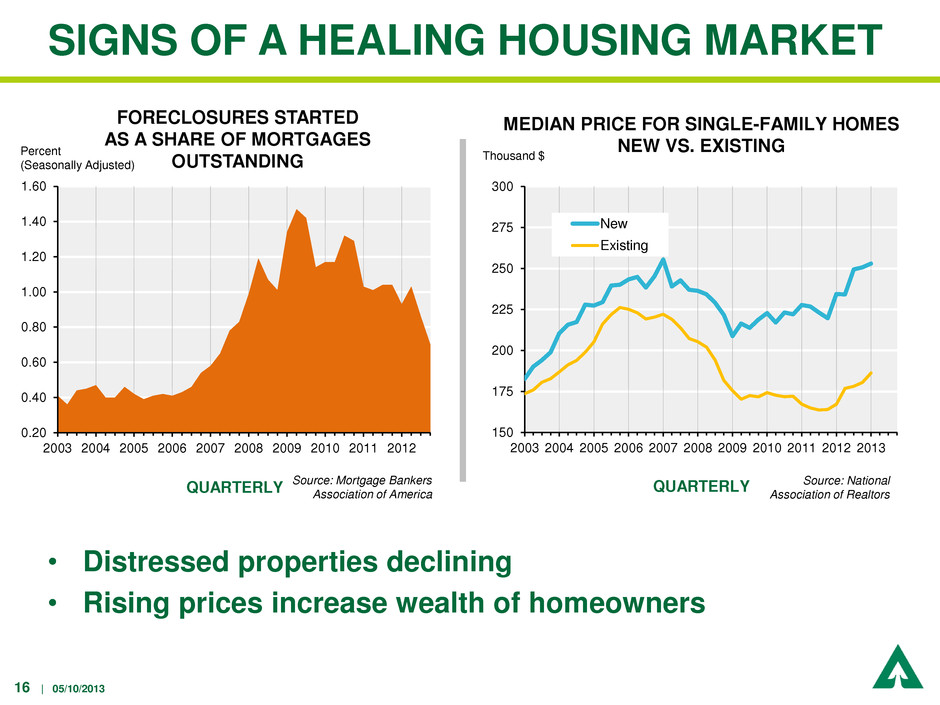

16 | 05/10/2013 SIGNS OF A HEALING HOUSING MARKET • Distressed properties declining • Rising prices increase wealth of homeowners 0.20 0.40 0.60 0.80 1.00 1.20 1.40 1.60 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 QUARTERLY Percent (Seasonally Adjusted) Source: Mortgage Bankers Association of America 150 175 200 225 250 275 300 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 New Existing MEDIAN PRICE FOR SINGLE-FAMILY HOMES NEW VS. EXISTING Thousand $ QUARTERLY Source: National Association of Realtors FORECLOSURES STARTED AS A SHARE OF MORTGAGES OUTSTANDING

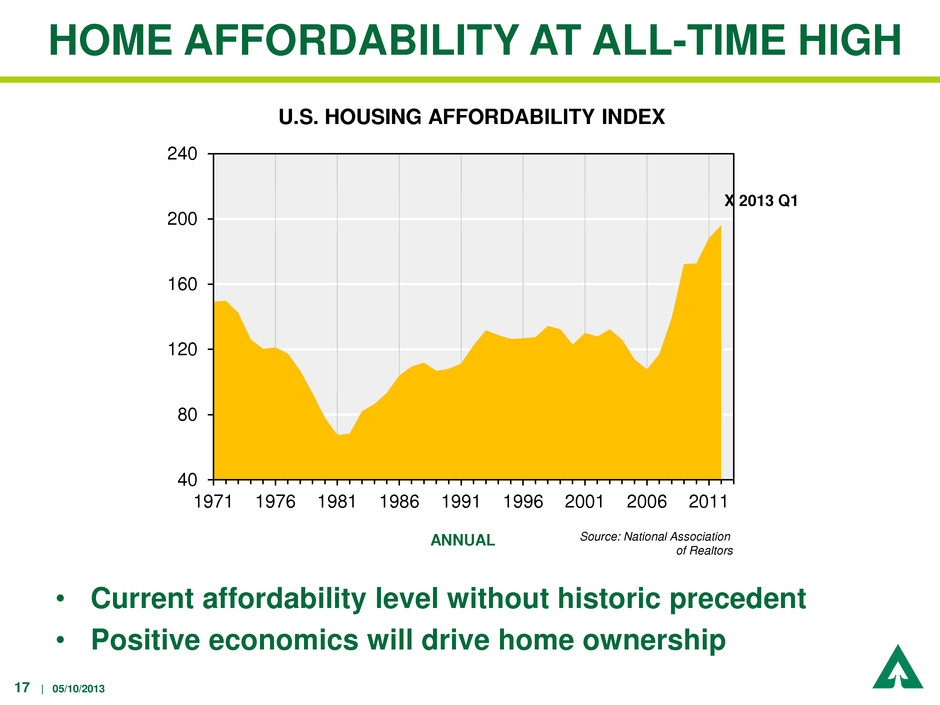

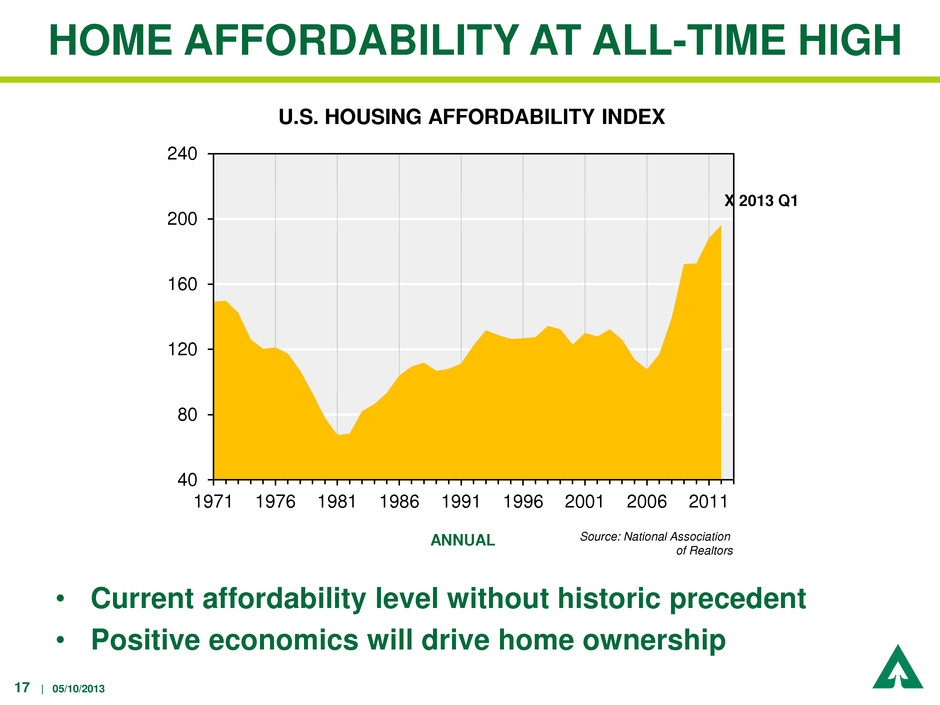

17 | 05/10/2013 40 80 120 160 200 240 1971 1976 1981 1986 1991 1996 2001 2006 2011 U.S. HOUSING AFFORDABILITY INDEX ANNUAL Source: National Association of Realtors X 2013 Q1 HOME AFFORDABILITY AT ALL-TIME HIGH • Current affordability level without historic precedent • Positive economics will drive home ownership

18 | 05/10/2013 • Construction-related employment becoming a bright spot • Rising demand for furniture and related expenditures as number of homes sold increases -200 -150 -100 -50 0 50 100 2005 2006 2007 2008 2009 2010 2011 2012 2013 Source: BLS GROWTH IN U.S. EMPLOYMENT FOR TOTAL CONSTRUCTION MONTHLY Change over Prior Month 40 50 60 70 80 90 100 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 PERSONAL CONSUMPTION EXPENDITURES FOR FURNITURE (Seasonally Adjusted Annual Rate) QUARTERLY Source: BEA HOUSING CONTRIBUTING TO ECONOMIC GROWTH Billions $

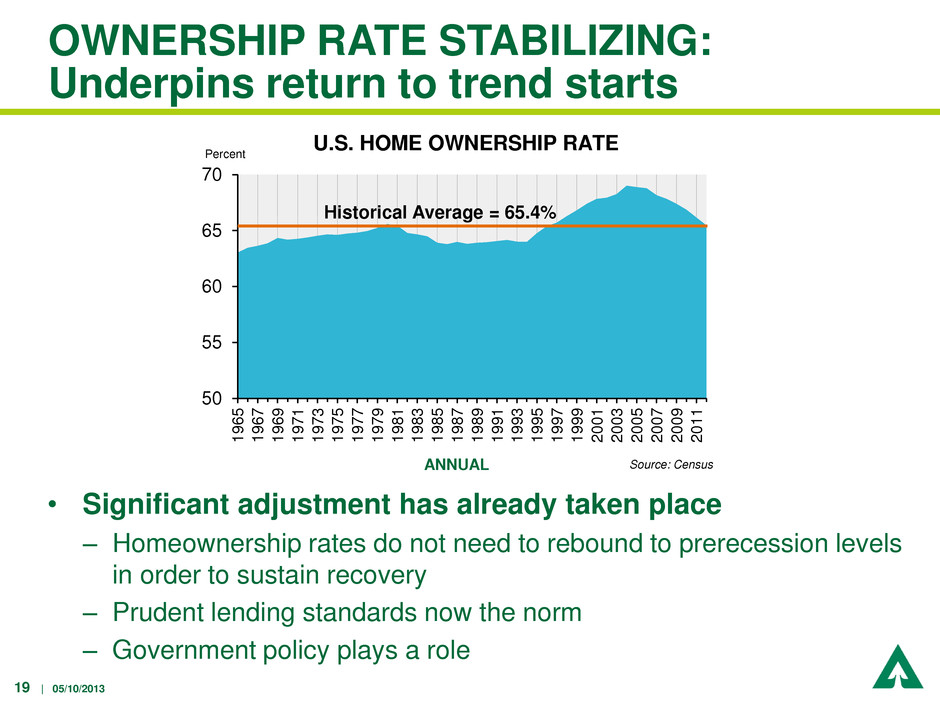

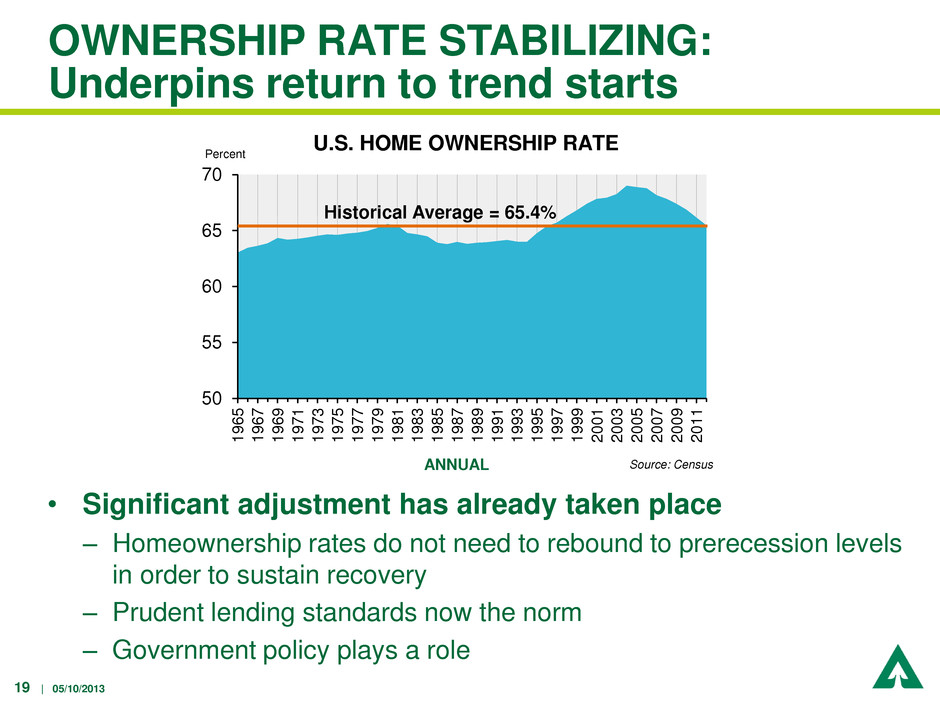

19 | 05/10/2013 OWNERSHIP RATE STABILIZING: Underpins return to trend starts • Significant adjustment has already taken place – Homeownership rates do not need to rebound to prerecession levels in order to sustain recovery – Prudent lending standards now the norm – Government policy plays a role 50 55 60 65 70 1 9 6 5 1 9 6 7 1 9 6 9 1 9 7 1 1 9 7 3 1 9 7 5 1 9 7 7 1 9 7 9 1 9 8 1 1 9 8 3 1 9 8 5 1 9 8 7 1 9 8 9 1 9 9 1 1 9 9 3 1 9 9 5 1 9 9 7 1 9 9 9 2 0 0 1 2 0 0 3 2 0 0 5 2 0 0 7 2 0 0 9 2 0 1 1 U.S. HOME OWNERSHIP RATE Percent ANNUAL Source: Census Historical Average = 65.4%

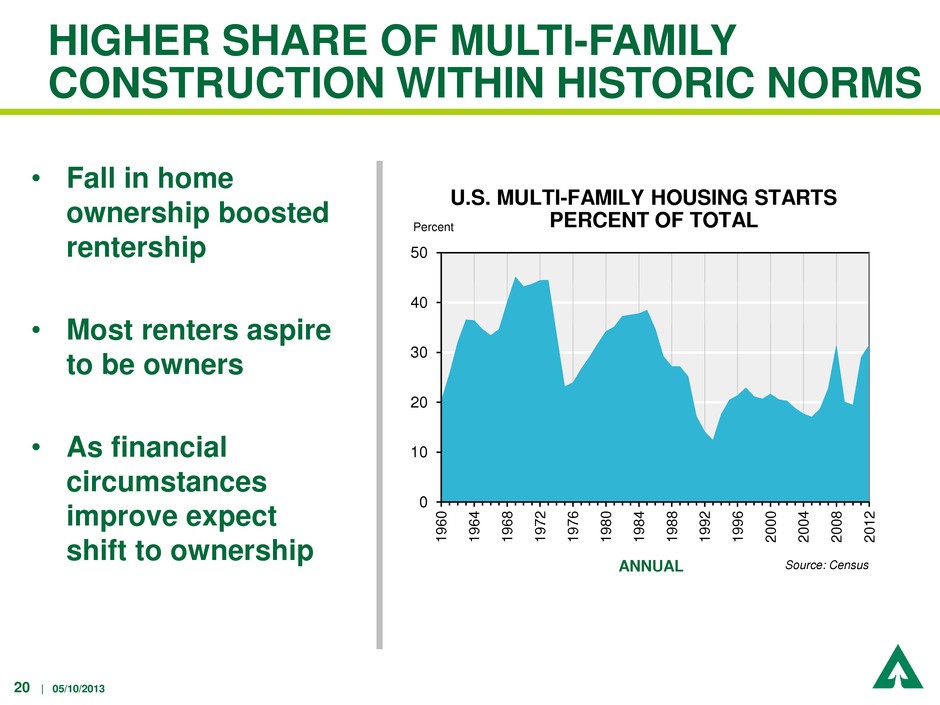

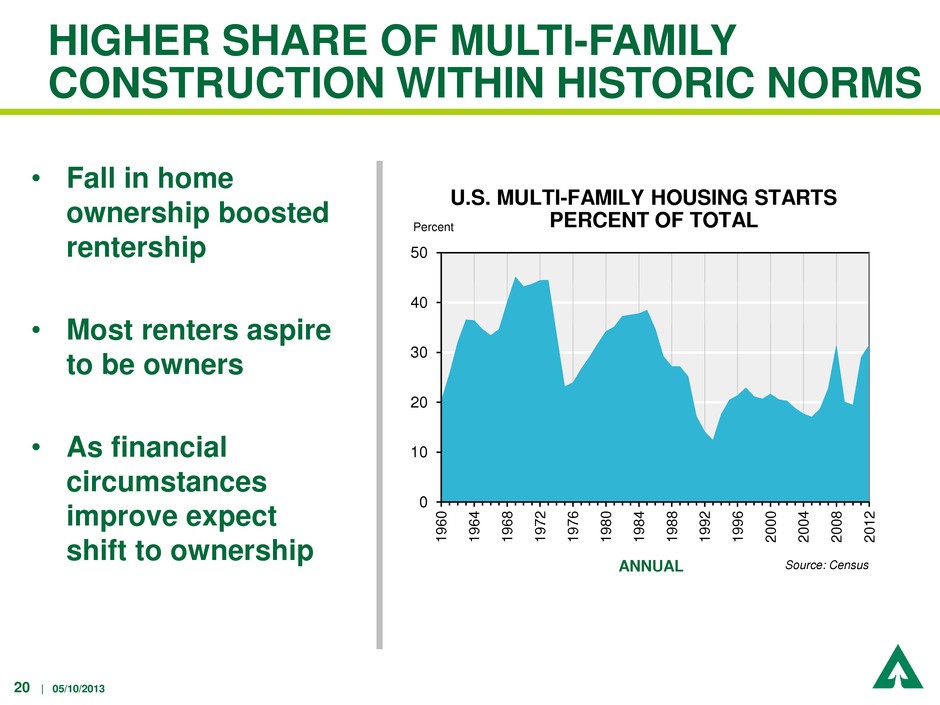

20 | 05/10/2013 HIGHER SHARE OF MULTI-FAMILY CONSTRUCTION WITHIN HISTORIC NORMS • Fall in home ownership boosted rentership • Most renters aspire to be owners • As financial circumstances improve expect shift to ownership 0 10 20 30 40 50 1 9 6 0 1 9 6 4 1 9 6 8 1 9 7 2 1 9 7 6 1 9 8 0 1 9 8 4 1 9 8 8 1 9 9 2 1 9 9 6 2 0 0 0 2 0 0 4 2 0 0 8 2 0 1 2 Source: Census PERCENT OF TOTAL Percent ANNUAL U.S. MULTI-FAMILY HOUSING STARTS

21 | 05/10/2013 OUTLOOK FOR WOOD PRODUCTS • Industry recovering from largest cycle in postwar history • Wood products demand closely linked to housing • Industry supply outlook has changed since housing bubble burst • As housing recovers, additional production will be needed to meet rising demand

22 | 05/10/2013 0 10 20 30 40 50 60 70 80 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 DEMAND ON NORTH AMERICAN LUMBER MILLS Billion Board Feet (BBF) Forecast Source: FEA ANNUAL 0 10 20 30 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 NORTH AMERICAN OSB DEMAND Billion Square Feet (BSF) ANNUAL Forecast Source: FEA WOOD PRODUCTS RECOVERING FROM LARGEST CYCLE IN POSTWAR PERIOD • Significant growth still to come as housing returns to trend levels

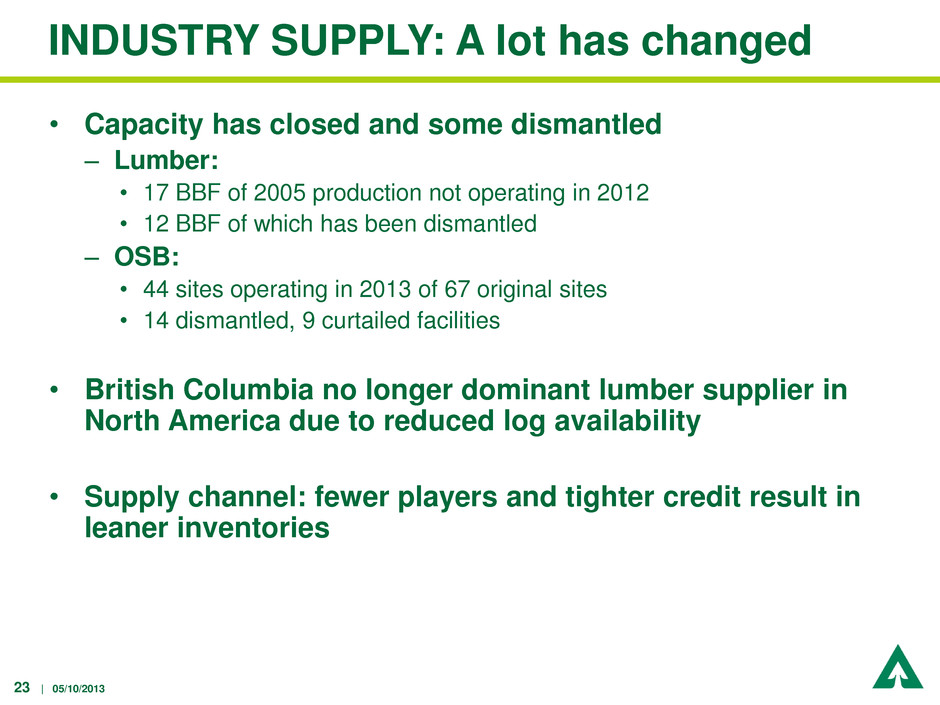

23 | 05/10/2013 INDUSTRY SUPPLY: A lot has changed • Capacity has closed and some dismantled – Lumber: • 17 BBF of 2005 production not operating in 2012 • 12 BBF of which has been dismantled – OSB: • 44 sites operating in 2013 of 67 original sites • 14 dismantled, 9 curtailed facilities • British Columbia no longer dominant lumber supplier in North America due to reduced log availability • Supply channel: fewer players and tighter credit result in leaner inventories

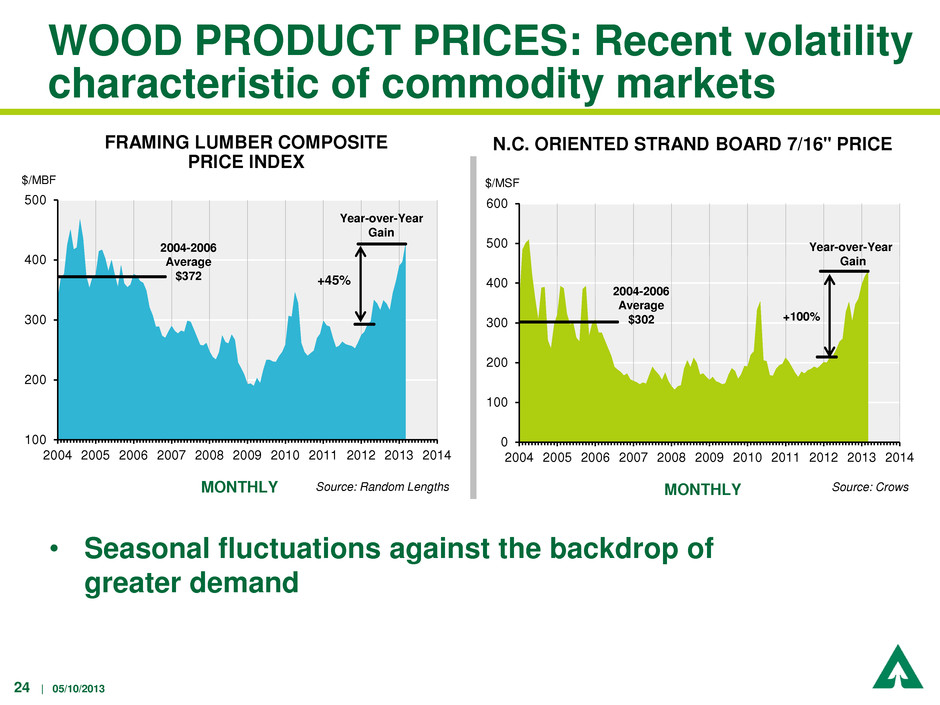

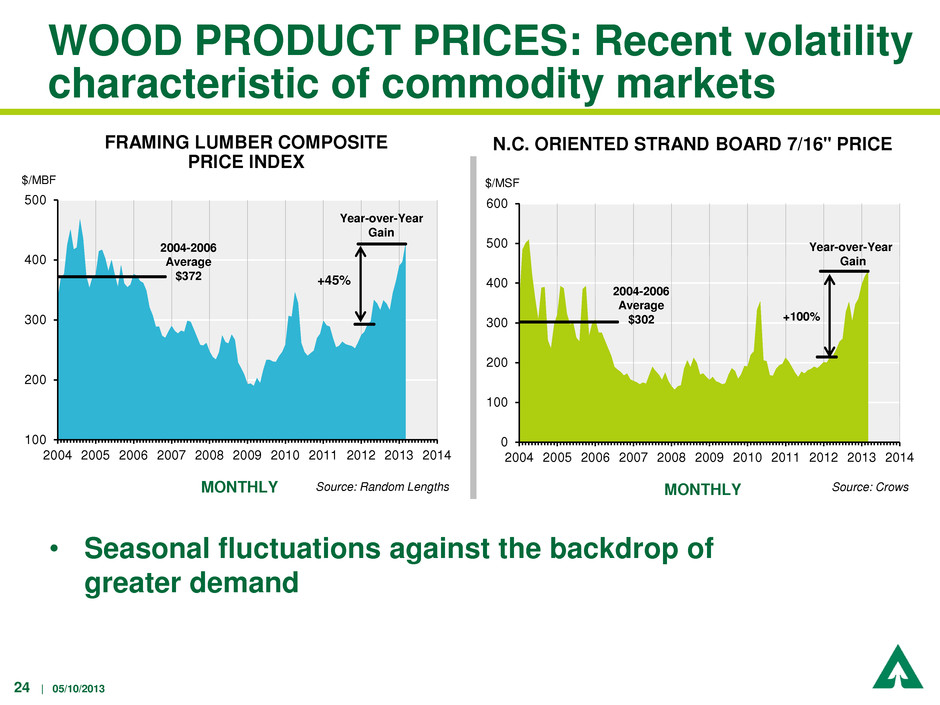

24 | 05/10/2013 100 200 300 400 500 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 FRAMING LUMBER COMPOSITE PRICE INDEX $/MBF MONTHLY Source: Random Lengths 2004-2006 Average $372 +45% Year-over-Year Gain WOOD PRODUCT PRICES: Recent volatility characteristic of commodity markets • Seasonal fluctuations against the backdrop of greater demand 0 100 200 300 400 500 600 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 N.C. ORIENTED STRAND BOARD 7/16" PRICE $/MSF MONTHLY Source: Crows 2004-2006 Average $302 +100% Year-over-Year Gain

25 | 05/10/2013 WOOD IS A SMALL PART OF THE OVERALL COST OF BUILDING A HOME Framing & Sheathing 15% Windows, Doors, Cabinets, Countertops & Trim 14% Excavation, Foundation and Other 26% Plumbing, Electrical & HVAC 15% Exterior and Landscape 14% Interior: Drywall, Floor Finish, Paint & Appliances 16% SINGLE-FAMILY HOME CONSTRUCTION COST (excludes finished lot cost, SG&A, financing, commissions) TOTAL SALE PRICE: $311k CONSTRUCTION COST: $180k AVERAGE LOT SIZE: 21k sq ft AVERAGE FINISHED AREA: 2k sq ft Source: NAHB Survey 2011

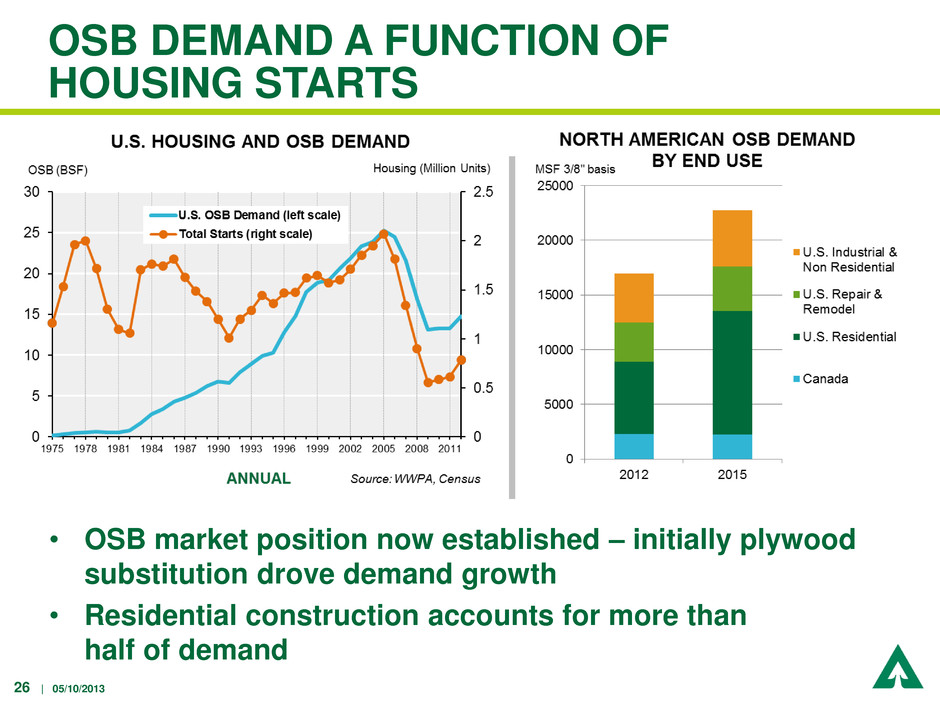

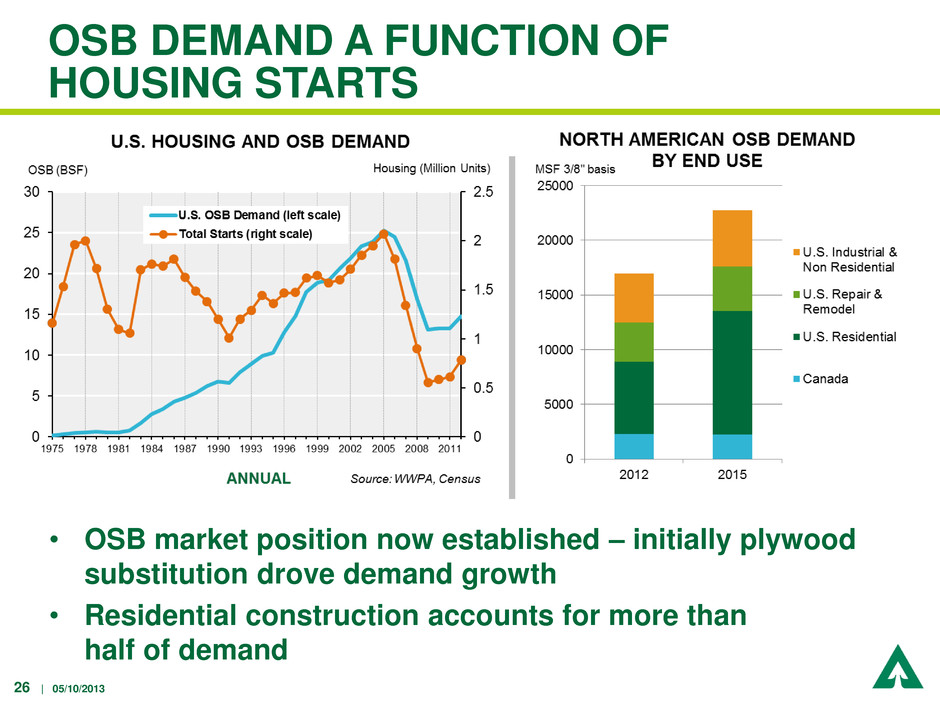

26 | 05/10/2013 OSB DEMAND A FUNCTION OF HOUSING STARTS • OSB market position now established – initially plywood substitution drove demand growth • Residential construction accounts for more than half of demand

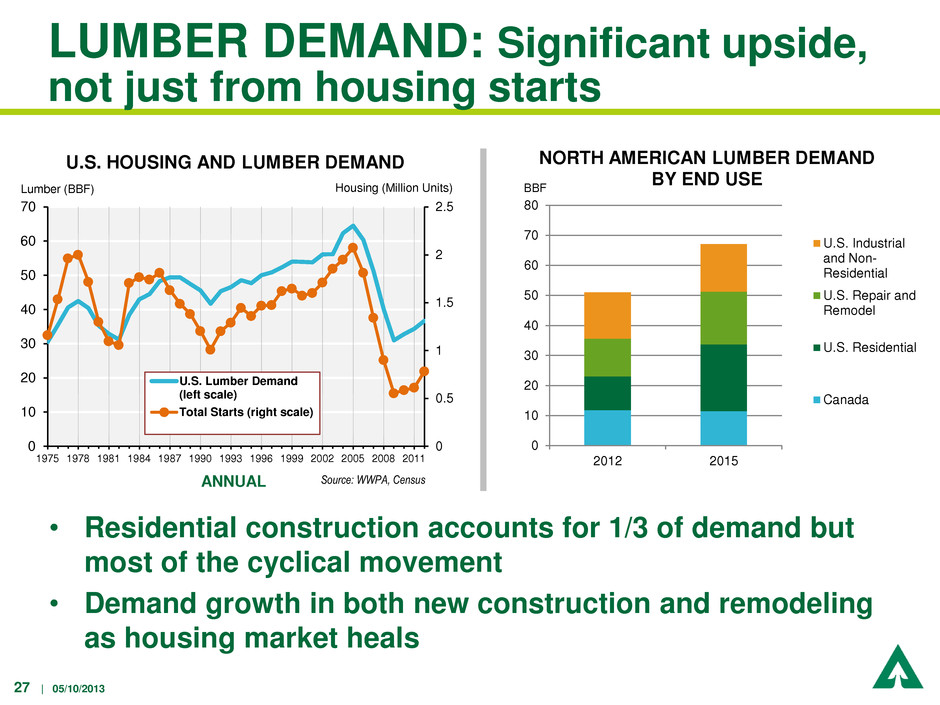

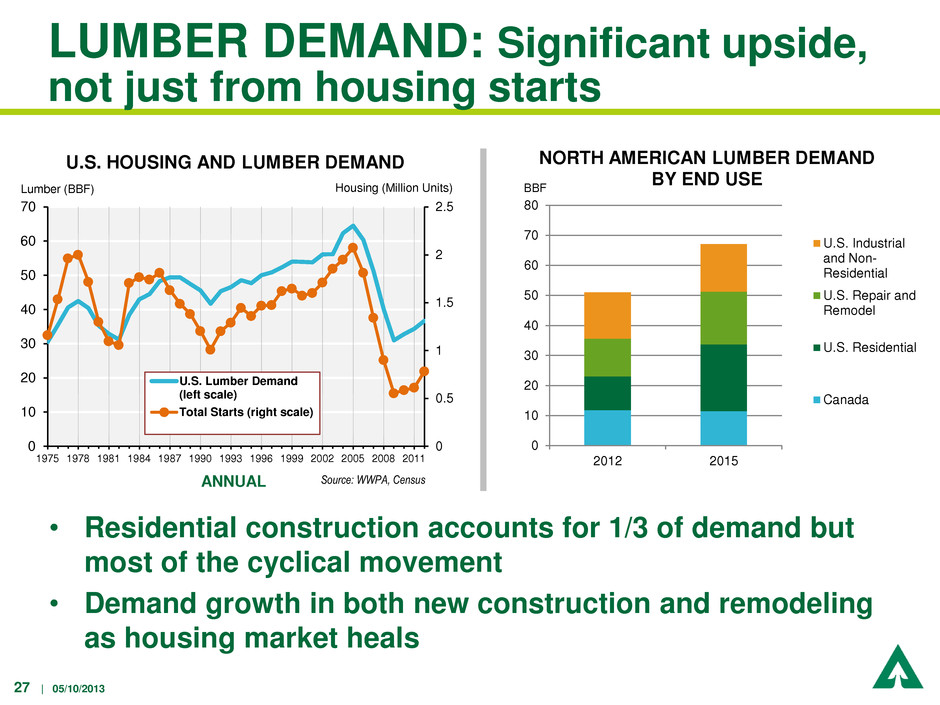

27 | 05/10/2013 LUMBER DEMAND: Significant upside, not just from housing starts • Residential construction accounts for 1/3 of demand but most of the cyclical movement • Demand growth in both new construction and remodeling as housing market heals 0 0.5 1 1.5 2 2.5 0 10 20 30 40 50 60 70 1975 1978 1981 1984 1987 1990 1993 1996 1999 2002 2005 2008 2011 U.S. Lumber Demand (left scale) Total Starts (right scale) U.S. HOUSING AND LUMBER DEMAND Lumber (BBF) ANNUAL Source: WWPA, Census Housing (Million Units) 0 10 20 30 40 50 60 70 80 2012 2015 BBF NORTH AMERICAN LUMBER DEMAND BY END USE U.S. Industrial and Non- Residential U.S. Repair and Remodel U.S. Residential Canada

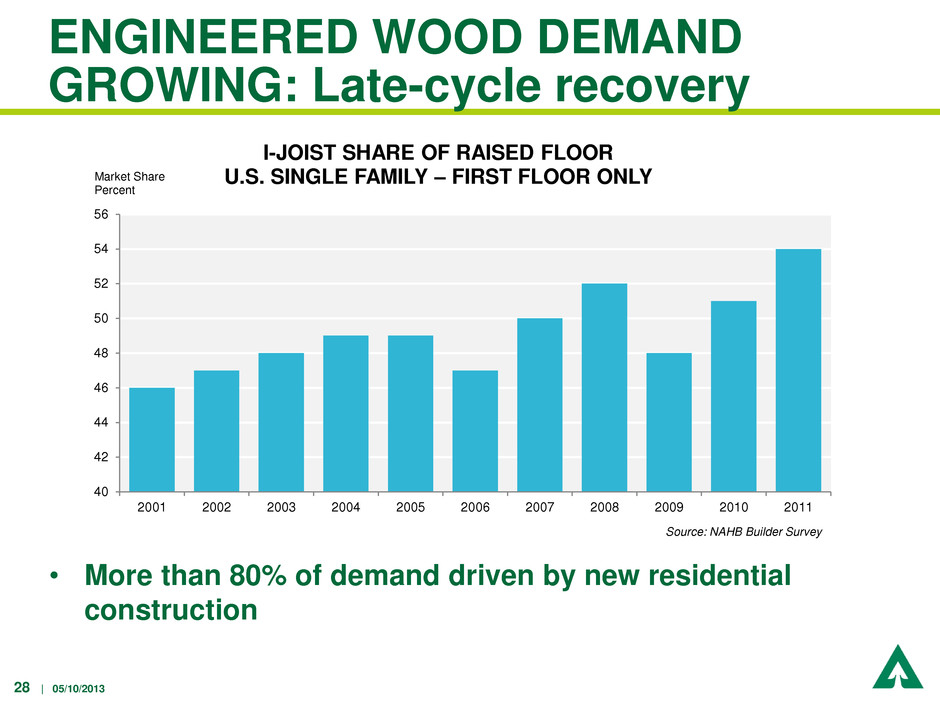

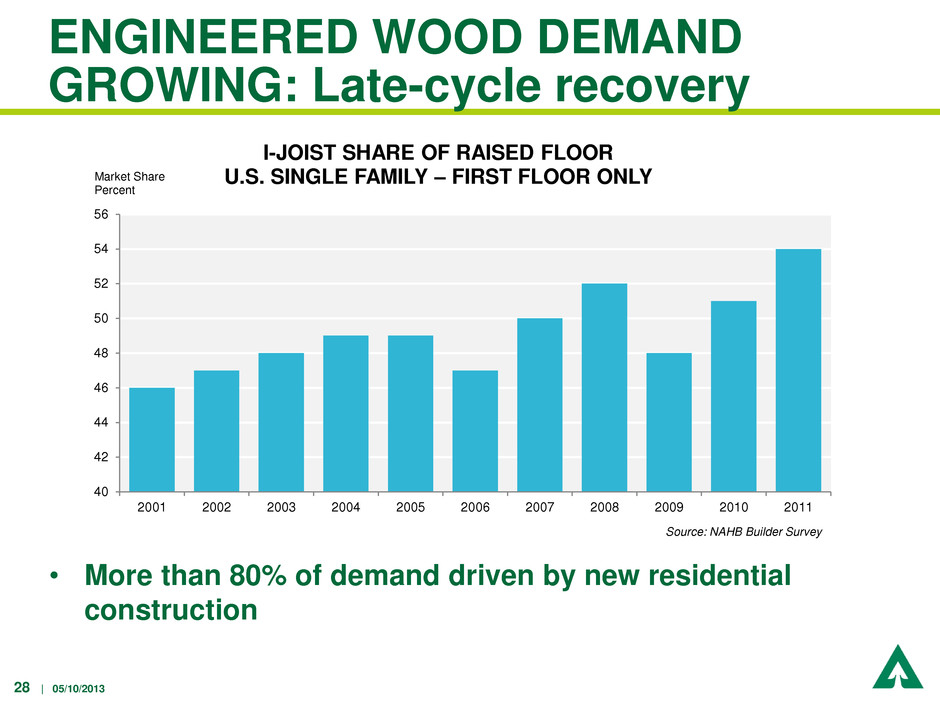

28 | 05/10/2013 ENGINEERED WOOD DEMAND GROWING: Late-cycle recovery • More than 80% of demand driven by new residential construction 40 42 44 46 48 50 52 54 56 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Market Share Percent I-JOIST SHARE OF RAISED FLOOR U.S. SINGLE FAMILY – FIRST FLOOR ONLY Source: NAHB Builder Survey

29 | 05/10/2013 LUMBER PRICES MOVED UPWARD AS HOUSING RECOVERY LIFTED DEMAND • Production growth has not kept pace with demand, driving prices • Will require additional log supplies 100 150 200 250 300 350 400 450 500 550 2000 2002 2004 2006 2008 2010 2012 2014 Southern Pine West Spruce-Pine-Fir Douglas Fir Green 2X4 LUMBER PRICES $/MBF QUARTERLY Source: Random Lengths

30 | 05/10/2013 LOWER CANADIAN LUMBER SUPPLY SUPPORTS U.S. TIMBER VALUES • Canadian lumber production declines due to mountain pine beetle • Offshore exports grow with Asian economies • Decline in available supplies to U.S. 0% 5% 10% 15% 20% 25% 30% 35% 40% 0 5 10 15 20 25 30 35 40 2005 2010 2015 2020 B B F CANADIAN LUMBER PRODUCTION AND SHARE OF U.S. MARKET Available for U.S. Off Shore Export Domestic Consumption Source: International Wood Markets, RISI, Weyerhaeuser

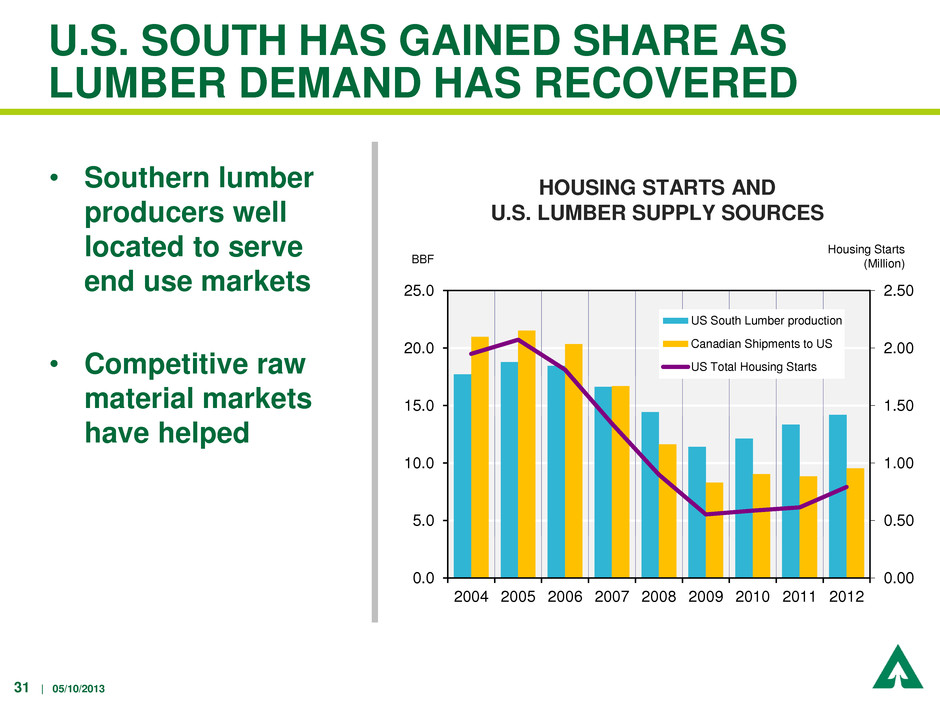

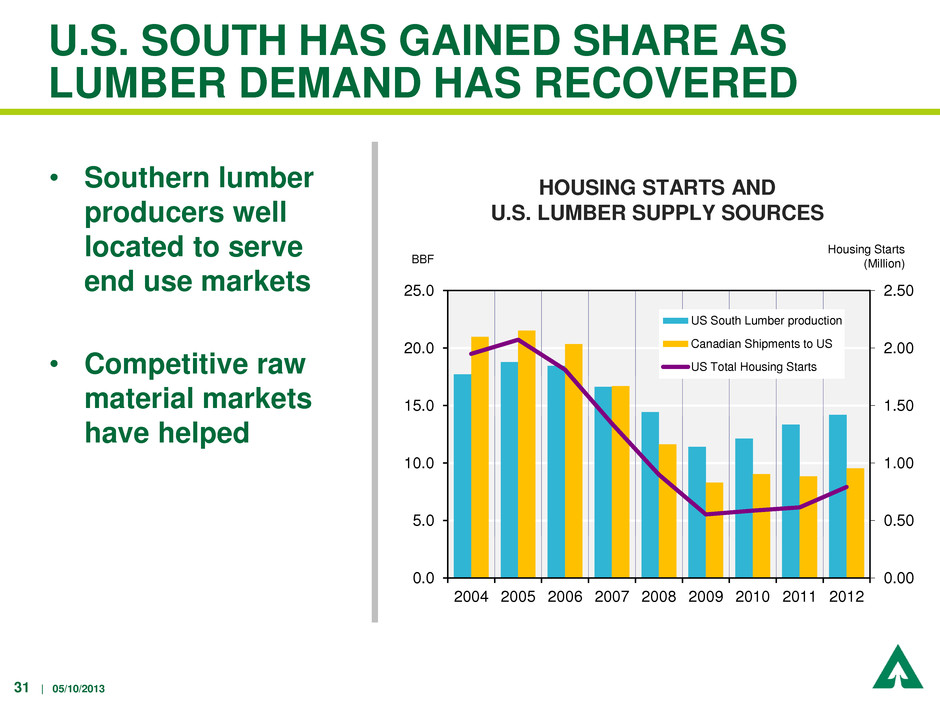

31 | 05/10/2013 U.S. SOUTH HAS GAINED SHARE AS LUMBER DEMAND HAS RECOVERED • Southern lumber producers well located to serve end use markets • Competitive raw material markets have helped 0.00 0.50 1.00 1.50 2.00 2.50 0.0 5.0 10.0 15.0 20.0 25.0 2004 2005 2006 2007 2008 2009 2010 2011 2012 US South Lumber production Canadian Shipments to US US Total Housing Starts BBF Housing Starts (Million) HOUSING STARTS AND U.S. LUMBER SUPPLY SOURCES

32 | 05/10/2013 SOUTHERN LOG PRICES IMPROVE WITH RISING DEMAND • Sawlog prices lag lumber • Deferred volumes consumed as demand rises and Canadian import share declines 150 200 250 300 350 400 450 500 1990 1993 1996 1999 2002 2005 2008 2011 2014 SYP 2x4 Sawtimber SOUTHERN PINE WEST 2X4 LUMBER PRICE VS. AVERAGE DELIVERED $/MBF Scribner QUARTERLY Source: Random Lengths, Timber Mart-South 0 5 10 15 20 25 2001 2003 2005 2007 2009 2011 2013 2015 PROJECTED HARVEST BBF, Int'l 1/4 ANNUAL Source: FEA Forecast

33 | 05/10/2013 10 20 30 40 50 60 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 $/Green Ton Delivered QUARTERLY Source: Timber Mart-South Pulpwood Chip-N-Saw Sawtimber SAWLOGS COMMAND HIGHEST PRICE SOUTHERN LOG AND FIBER PRICES

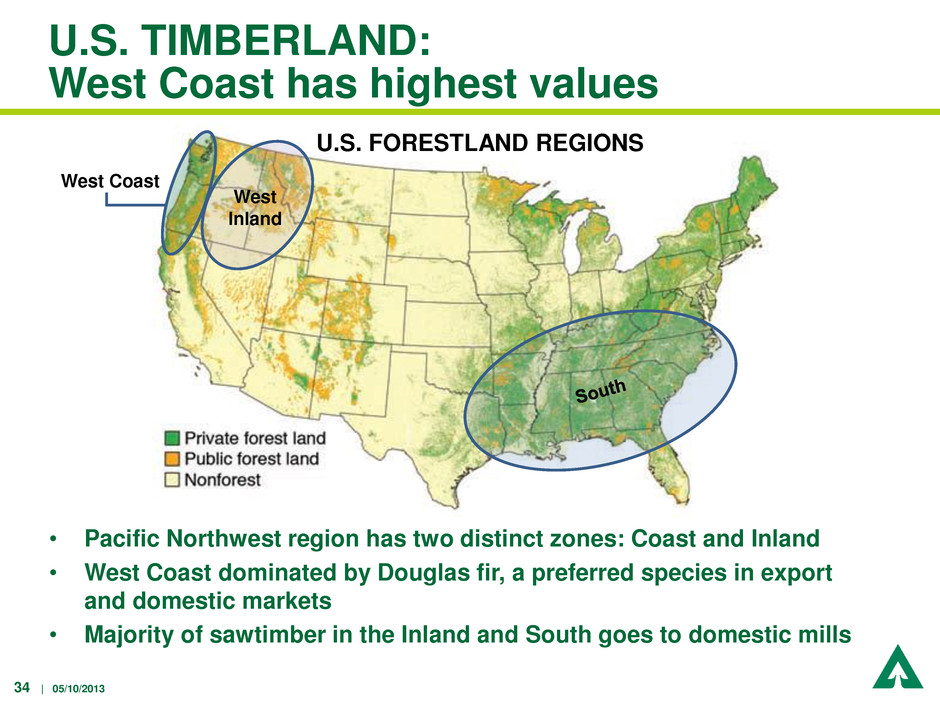

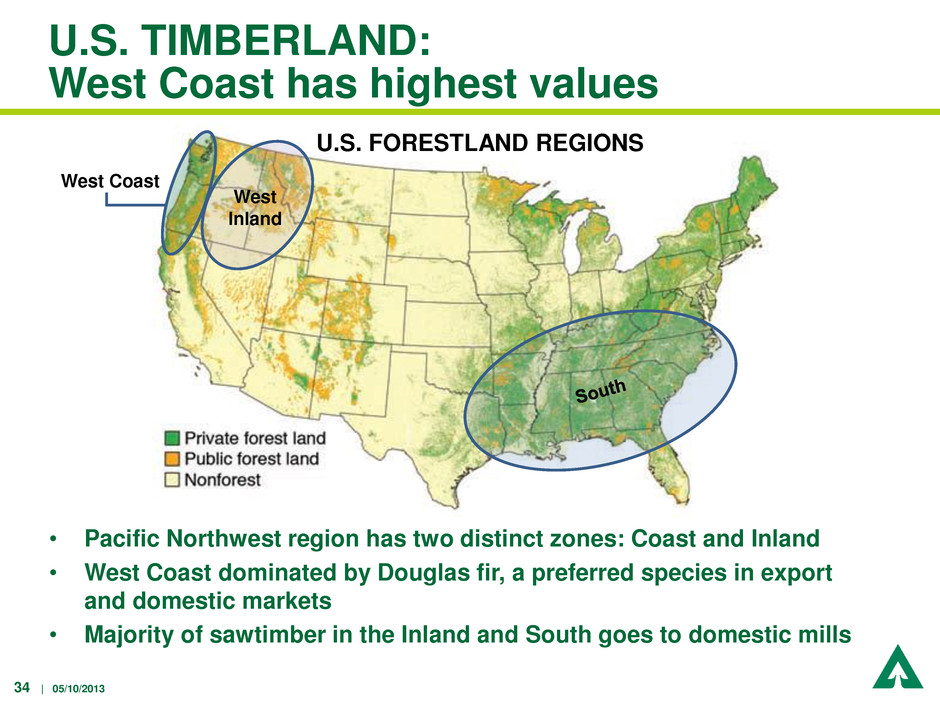

34 | 05/10/2013 U.S. TIMBERLAND: West Coast has highest values • Pacific Northwest region has two distinct zones: Coast and Inland • West Coast dominated by Douglas fir, a preferred species in export and domestic markets • Majority of sawtimber in the Inland and South goes to domestic mills U.S. FORESTLAND REGIONS West Inland West Coast

35 | 05/10/2013 200 300 400 500 600 700 800 2008 2009 2010 2011 2012 2013 Japan Export (FAS) China Export (FAS) Domestic (Delivered) Source: Log Lines WESTERN DOUGLAS FIR LOG PRICES $/MBF QUARTERLY WEST COAST REBOUND STARTED WITH EXPORT MARKET • West Coast timberlands supply both export and domestic customers • Offshore customers pay a premium over domestic to ensure supply • California market awakening after prolonged pause

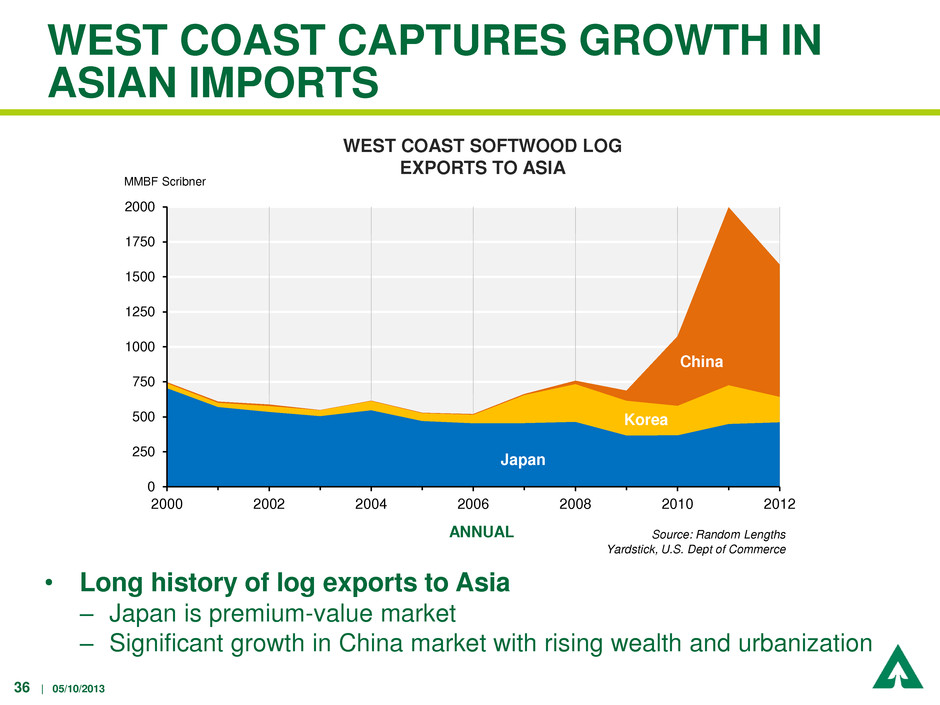

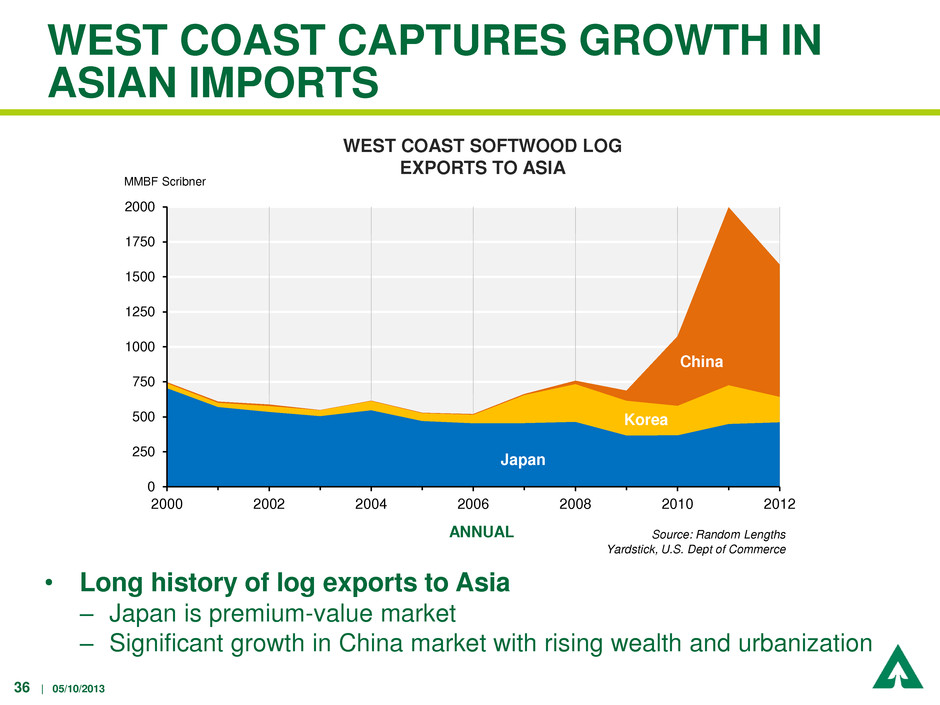

36 | 05/10/2013 WEST COAST CAPTURES GROWTH IN ASIAN IMPORTS 0 250 500 750 1000 1250 1500 1750 2000 2000 2002 2004 2006 2008 2010 2012 WEST COAST SOFTWOOD LOG EXPORTS TO ASIA MMBF Scribner ANNUAL Source: Random Lengths Yardstick, U.S. Dept of Commerce Japan Korea China • Long history of log exports to Asia – Japan is premium-value market – Significant growth in China market with rising wealth and urbanization

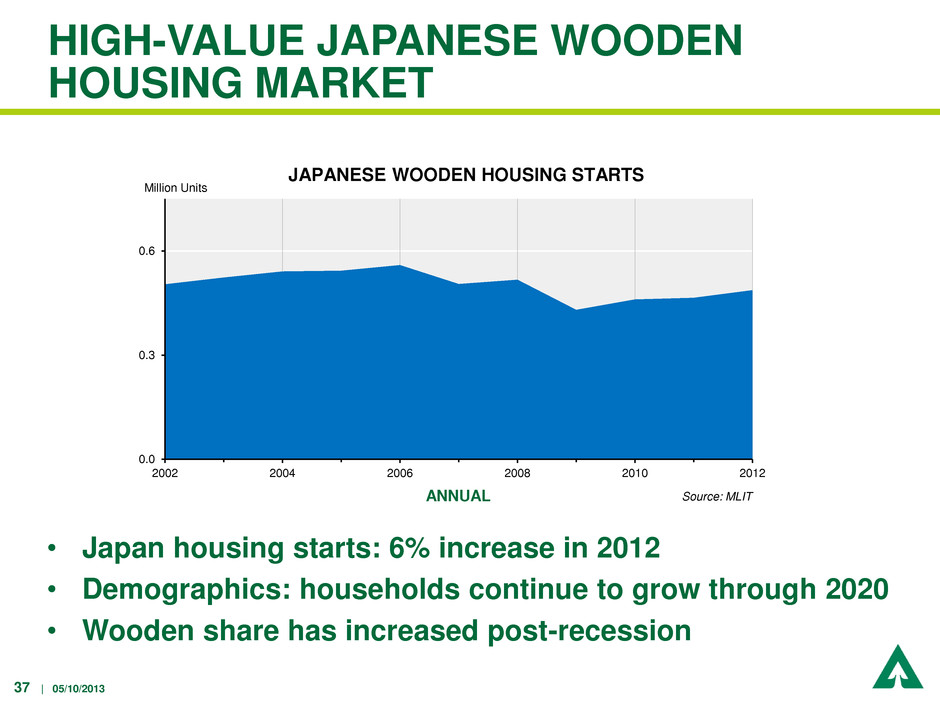

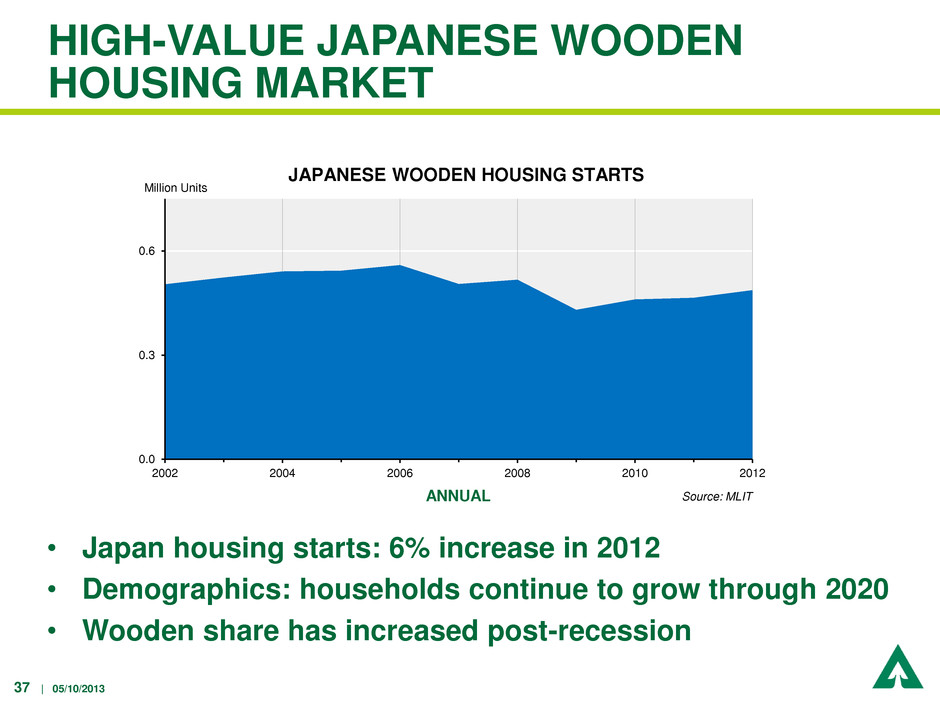

37 | 05/10/2013 0.0 0.3 0.6 2002 2004 2006 2008 2010 2012 JAPANESE WOODEN HOUSING STARTS Million Units Source: MLIT ANNUAL HIGH-VALUE JAPANESE WOODEN HOUSING MARKET • Japan housing starts: 6% increase in 2012 • Demographics: households continue to grow through 2020 • Wooden share has increased post-recession

38 | 05/10/2013 CHINA GROWTH A MAJOR DRIVER OF NORTH AMERICAN EXPORT DEMAND • China market is for industrial wood (concrete forms, etc.) not structural lumber • Supplies from many regions needed to meet rising wood deficit 0 5 10 15 20 25 30 35 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 MCM CHINA SOFTWOOD LOG IMPORTS Other Russia Source: China Customs Data

39 | 05/10/2013 • Pacific Rim logs advantaged over Russian logs in China – Sustainable – Economical • Economic wood supply in decline – Poor regeneration – Difficult transportation RUSSIAN LOGS: No competitive advantage in China Source: International Wood Markets, Weyerhaeuser 180 190 200 210 220 230 240 250 260 BC Logs mfg in China US Logs mfg in China Siberian Logs mfg in China NZ Logs mfg in China LUMBER MANUFACTURING COSTS IN CHINA FROM IMPORTED LOGS (Q1 2013) Net Wood Cost Total Sawmilling Cost Capital (Depr+Amort) EBIT Margin U.S. $ / M3 Lumber Basis

40 | 05/10/2013 ATTRACTIVE FUNDAMENTALS FOR WOOD PRODUCTS AND TIMBER • Rising demand: U.S. housing returning to trend and export markets growing • Wood products demand drives log demand • Domestic log demand bolstered by diminished Canadian lumber supply

41 | 05/10/2013 GLOBAL FACTORS AFFECT CELLULOSE FIBERS MARKETS • Export businesses benefit from growth in Asian economies and weaker U.S. dollar – Fluff market growth 3.6% per year, driven by emerging economies • Eurozone debt issues driving near-term currency volatility but southern pine pulp competitive at trend exchange rates

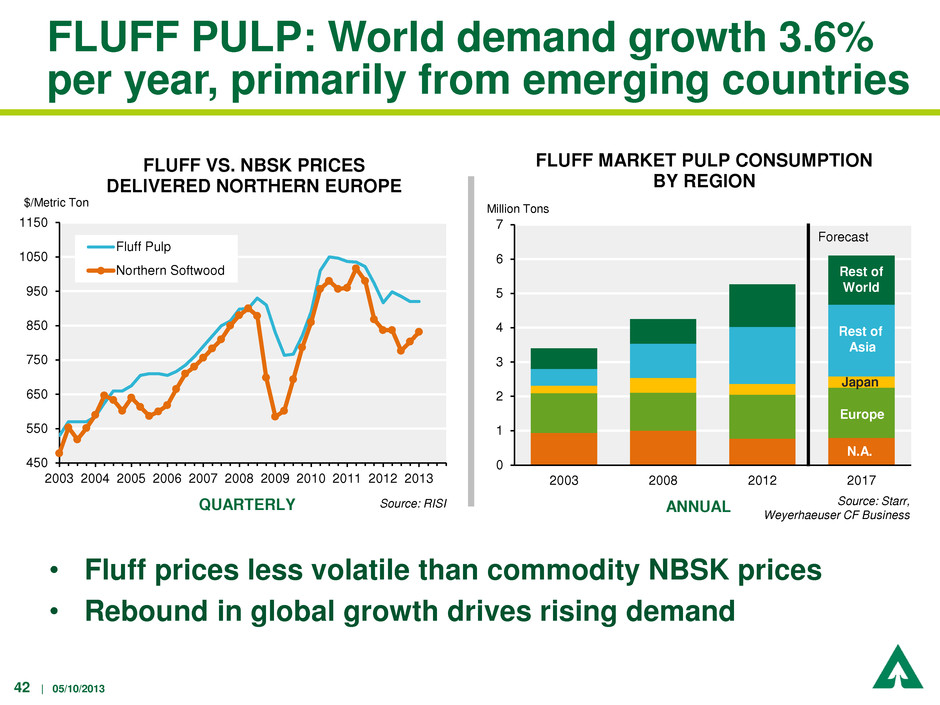

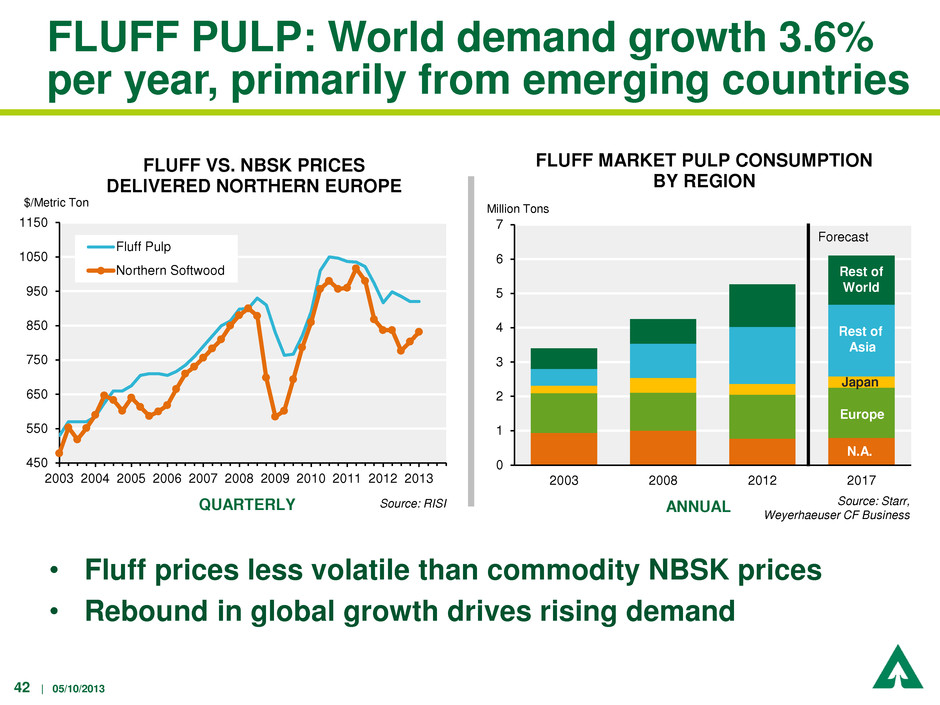

42 | 05/10/2013 450 550 650 750 850 950 1050 1150 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Fluff Pulp Northern Softwood FLUFF VS. NBSK PRICES DELIVERED NORTHERN EUROPE $/Metric Ton QUARTERLY Source: RISI FLUFF PULP: World demand growth 3.6% per year, primarily from emerging countries 0 1 2 3 4 5 6 7 2003 2008 2012 2017 FLUFF MARKET PULP CONSUMPTION BY REGION Million Tons ANNUAL Source: Starr, Weyerhaeuser CF Business Rest of World Rest of Asia Japan Europe N.A. Forecast • Fluff prices less volatile than commodity NBSK prices • Rebound in global growth drives rising demand

43 | 05/10/2013 KEY MESSAGES • U.S. housing is recovering and contributing to economic growth • Strong and improving market fundamentals in wood products • Timberlands benefiting from strength in export markets and rising domestic log use • Cellulose fibers improving with global economies

44 | 05/10/2013 Patty Bedient Executive Vice President, and Chief Financial Officer

45 | 05/10/2013 TIMBERLANDS

46 | 05/10/2013 WEYERHAEUSER TIMBERLANDS: Competitive advantages • World-class timber holdings • Increasing harvest volume and improving mix • Innovative silviculture • Scale operations • Unique position on U.S. West Coast

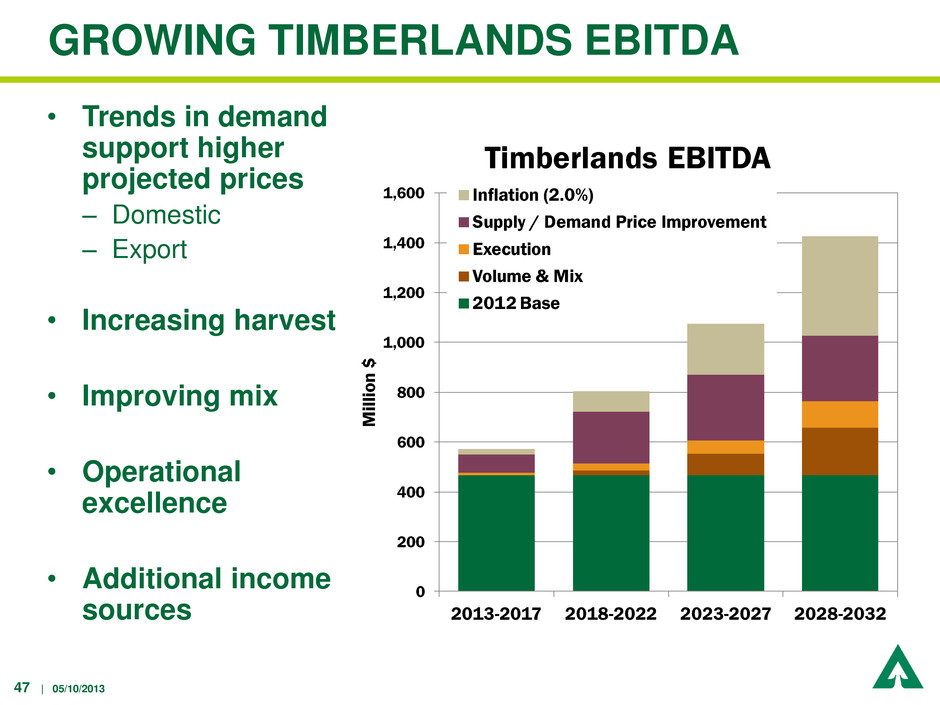

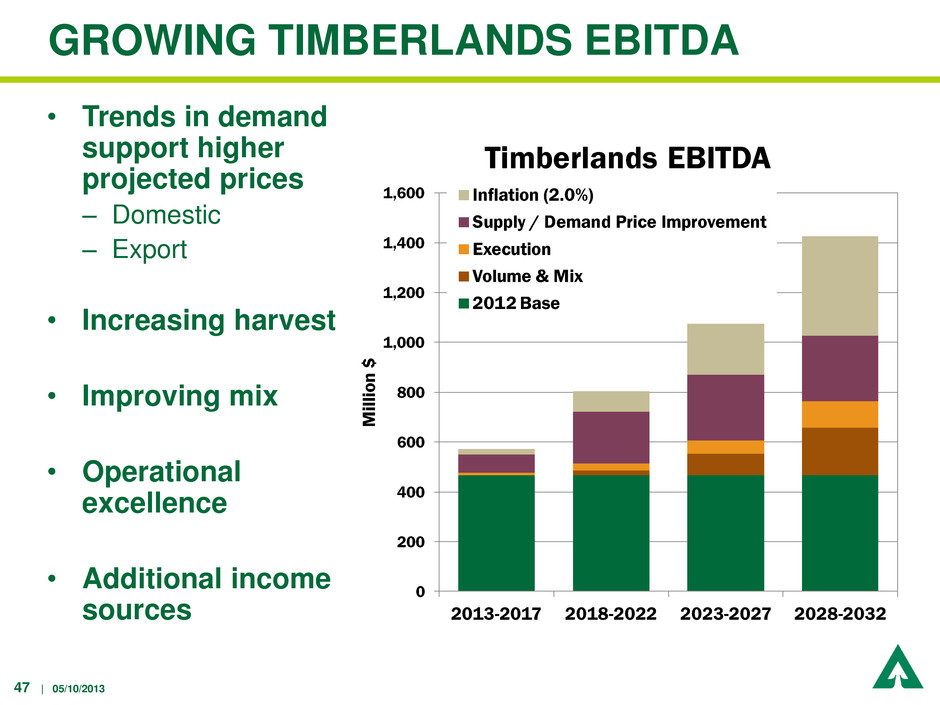

47 | 05/10/2013 GROWING TIMBERLANDS EBITDA • Trends in demand support higher projected prices – Domestic – Export • Increasing harvest • Improving mix • Operational excellence • Additional income sources 0 200 400 600 800 1,000 1,200 1,400 1,600 2013-2017 2018-2022 2023-2027 2028-2032 M ill io n $ Timberlands EBITDA Inflation (2.0%) Supply / Demand Price Improvement Execution Volume & Mix 2012 Base

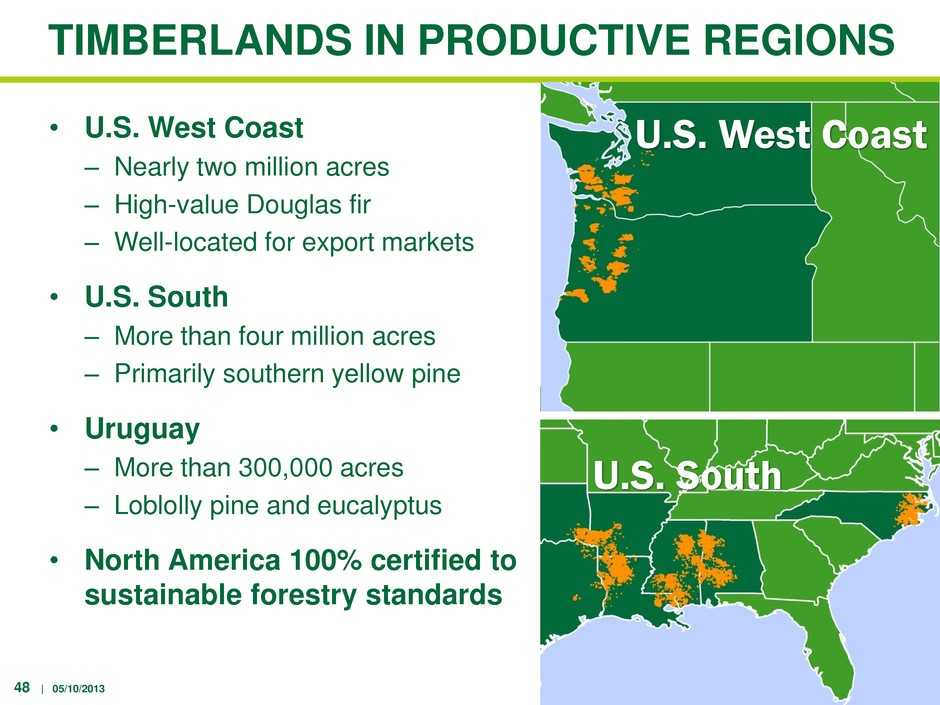

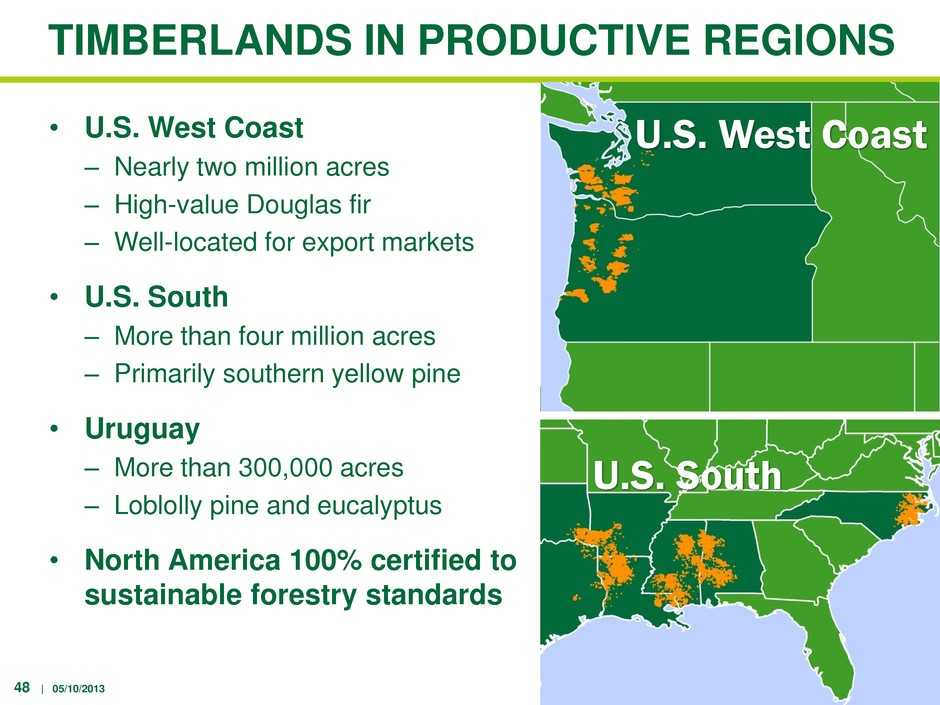

48 | 05/10/2013 TIMBERLANDS IN PRODUCTIVE REGIONS • U.S. West Coast – Nearly two million acres – High-value Douglas fir – Well-located for export markets • U.S. South – More than four million acres – Primarily southern yellow pine • Uruguay – More than 300,000 acres – Loblolly pine and eucalyptus • North America 100% certified to sustainable forestry standards U.S. West Coast U.S. South

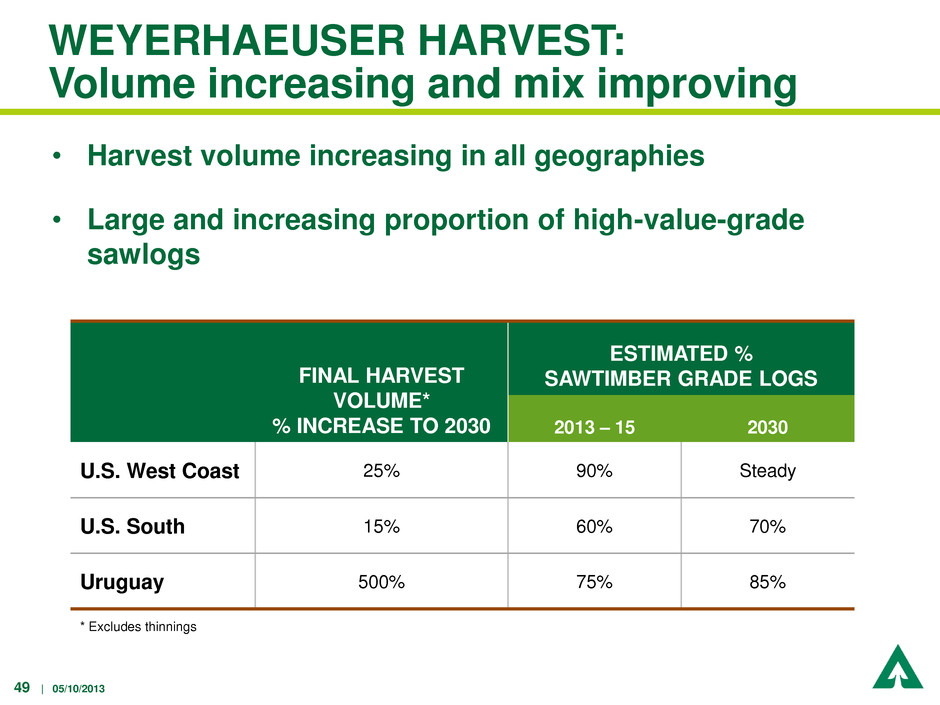

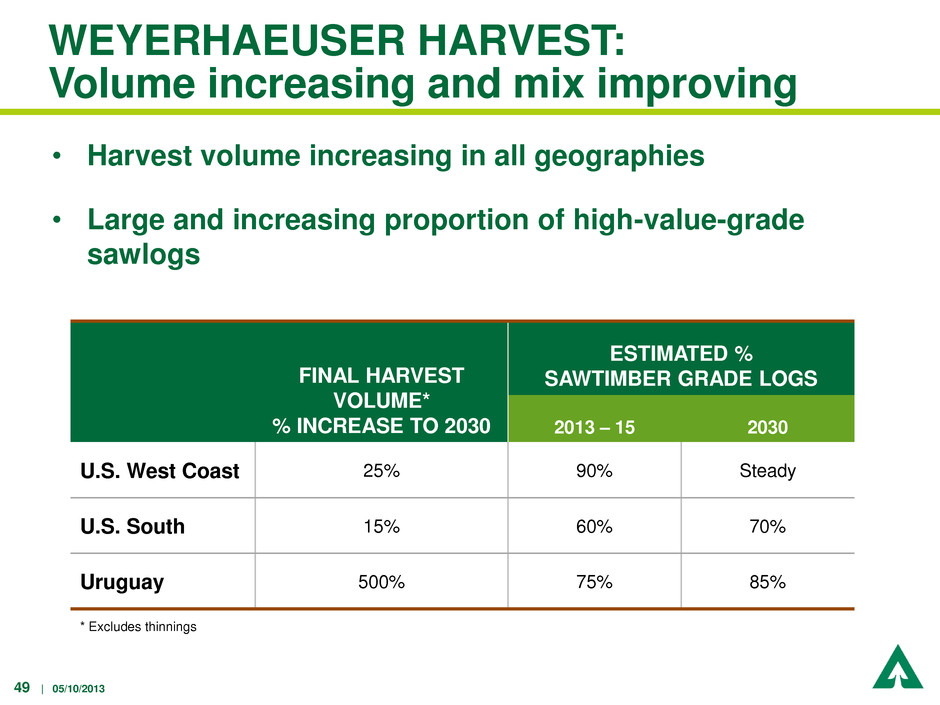

49 | 05/10/2013 WEYERHAEUSER HARVEST: Volume increasing and mix improving • Harvest volume increasing in all geographies • Large and increasing proportion of high-value-grade sawlogs FINAL HARVEST VOLUME* % INCREASE TO 2030 ESTIMATED % SAWTIMBER GRADE LOGS 2013 – 15 2030 U.S. West Coast 25% 90% Steady U.S. South 15% 60% 70% Uruguay 500% 75% 85% * Excludes thinnings

50 | 05/10/2013 INNOVATIVE SILVICULTURE AND SCALE OPERATIONS • Innovative silviculture – Superior seedlings – Faster growth rate – High-value sawtimber • Scale operations – Effective deployment of technology – Cost-effective harvesting and hauling – Strategic port access

51 | 05/10/2013 0 1 2 3 4 5 6 7 Acres (Millions) International Southeast Appalachia Lake States Northeast Intermountain West Pacific Northwest (west of Cascades) Source: 2012 10Ks PUBLIC TIMBER REIT OWNERSHIP BY GEOGRAPHY

52 | 05/10/2013 UNIQUELY POSITIONED ON WEST COAST 0 500 1000 1500 2000 Thousands of Acres LARGEST PACIFIC NORTHWEST TIMBERLAND OWNERS (WEST OF THE CASCADES) Source: WY, Atterbury Consultants (1/1/2013)

53 | 05/10/2013 U.S. WEST COAST VALUE HIGHER THAN OTHER GEOGRAPHIES Sources: National Council of Real Estate Investment Fiduciaries (NCREIF) 4Q 2012, Public Information 0 500 1000 1500 2000 2500 3000 3500 4000 4500 5000 Pacific Northwest South Northeast Lake States $ / Acre TIMBERLANDS MARKET VALUE BY U.S. GEOGRAPHY Recent Westside Transactions NCREIF (Westside & Eastside)

54 | 05/10/2013 U.S. WEST COAST FOCUSED ON HIGHER-VALUE DOUGLAS FIR • Douglas fir lumber – High strength and stiffness for its weight – Does not have to be dried – Stays straight – Easy to machine and finish – Holds nails and screws – Resistant to splitting • Uniquely valued in premium Japanese market for post and beam houses – Log size large enough to meet market requirements – Attractive color and grain

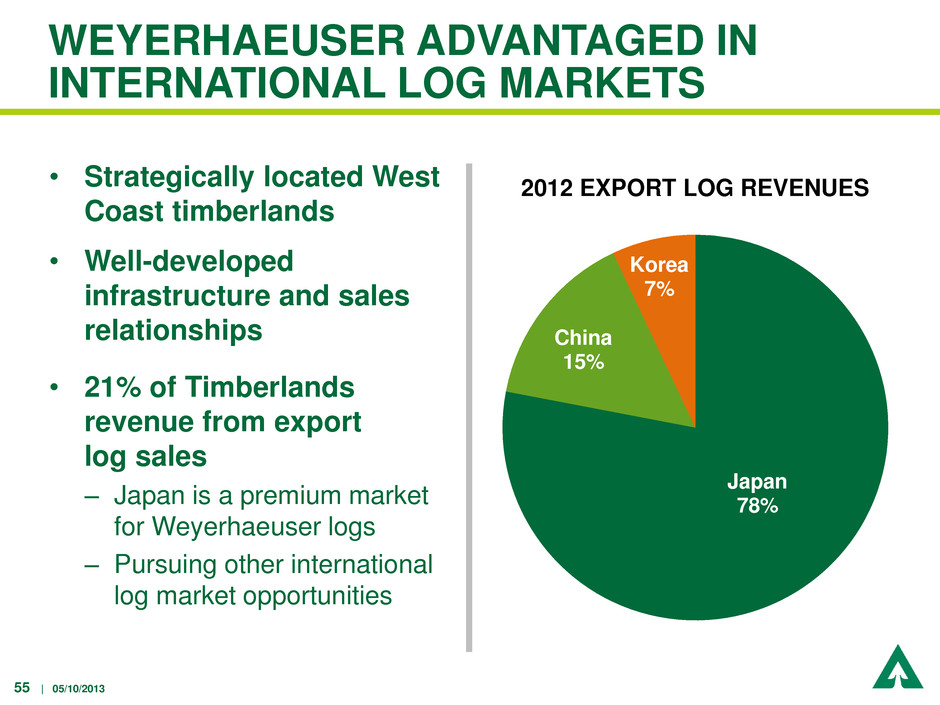

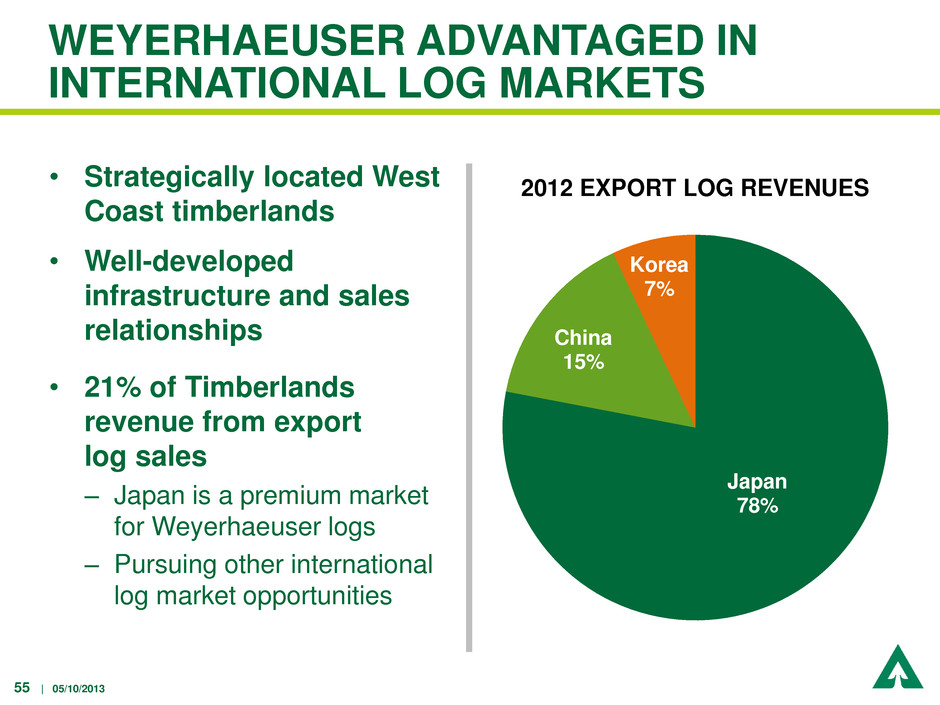

55 | 05/10/2013 WEYERHAEUSER ADVANTAGED IN INTERNATIONAL LOG MARKETS • Strategically located West Coast timberlands • Well-developed infrastructure and sales relationships • 21% of Timberlands revenue from export log sales – Japan is a premium market for Weyerhaeuser logs – Pursuing other international log market opportunities Japan 78% China 15% Korea 7% 2012 EXPORT LOG REVENUES

56 | 05/10/2013 ADDITIONAL VALUE STREAMS • Seven million acres of mineral rights – Oil and gas: ~$22MM revenue and 1,000 wells in 2012 – Minerals and aggregates: ~$9MM revenue and 38 mines in 2012 • Recreational – Hunting leases generated $19MM revenue in 2012 (on more than 90% of U.S. South ownership) • Higher and better use properties • Renewable energy / biomass • Weyerhaeuser Solutions

57 | 05/10/2013 • World-class timber holdings • Increasing harvest volume and improving mix • Innovative silviculture • Scale operations • Unique position on U.S. West Coast – Greater value and volume per acre – Higher-value Douglas fir – Export capability WEYERHAEUSER TIMBERLANDS: Competitive advantages

58 | 05/10/2013 WOOD PRODUCTS

59 | 05/10/2013 SUCCESSFULLY EXECUTING WOOD PRODUCTS IMPROVEMENT STRATEGY • Operating improvements – Reduce costs throughout the system – Sustainably improve manufacturing reliability and uptime – Increase operating rates at manufacturing sites and throughput at distribution centers – Optimize raw materials • Top-line revenue growth – Broaden and diversify customer base and enter new markets – Upgrade product mix – Innovate with new products Today, Weyerhaeuser’s Lumber and OSB Businesses Are Top-Quartile Performers

60 | 05/10/2013 Product Mix Lumber, 48% Specialty Products & Other, 8% Engineered Wood Products, 15% OSB / Plywood Panels, 29% Markets DIVERSE WOOD PRODUCTS BUSINESS WITH BROAD MARKET REACH Source: Weyerhaeuser 2012 FY data Residential 71% Treater 14% HIW 9% Export 5% Industrial 1% FY 2012 SALES OF $2.9B, Q1 2013 SALES OF $1.0B

61 | 05/10/2013 IMPROVING OPERATING EFFICIENCY • Increasing throughput • Incremental productivity enhancements • Improving grade recovery • Innovating with high-value products 2013 2011 2012 2013 Q1 CAPACITY UTILIZATION RATE Lumber 4.5 BBF 79% 85% 90% OSB 3.0 BSF 71% 83% 88% TJI 260* / 380 MMLF 47%* / 32% 56%* / 39% 68%* / 46% Solid Section 28* / 33 MMCF 48%* / 41% 55%* / 47% 66%* / 56% *excludes idled capacity

62 | 05/10/2013 ($40) ($20) $0 $20 $40 $60 $80 $100 $120 Q1 Q2 Q3 Q4 Q1 EBITDA ($ millions) Lumber OSB ELP Distribution 2012 $246MM $209MM Wood Products Segment EBITDA 2013 STRATEGY DELIVERING PROFITABLE RESULTS: Tenfold EBITDA increase from 1Q12 to 1Q13

63 | 05/10/2013 FURTHER IMPROVEMENTS TO LEVERAGE HOUSING RECOVERY • Maintain operational excellence in high-demand market • Align with customers that value scale and pay for consistency and service • Strategically deploy capital to optimize operations All Businesses Driving Operational Improvement and Cash Flow Growth

64 | 05/10/2013 REAL ESTATE

65 | 05/10/2013 TOP 20 BUILDER OF SINGLE-FAMILY HOMES • Operating in select markets with positive long-term trends • Land development integral to strategy • Profits from homebuilding and lot sales

66 | 05/10/2013 2.0 17.7 3.2 1.6 1.2 1.3 0 4 8 12 16 20 AZ CA MD and VA NV* TX WA Thousands STRONG LAND PIPELINE: Well positioned for California recovery CONTROLLED LOTS (As of March 31, 2013) * The business also controls approximately 67,000 lots, mostly under option, in a large master planned community in Nevada. Development and construction of these lots is on hold, pending improvements in the local market.

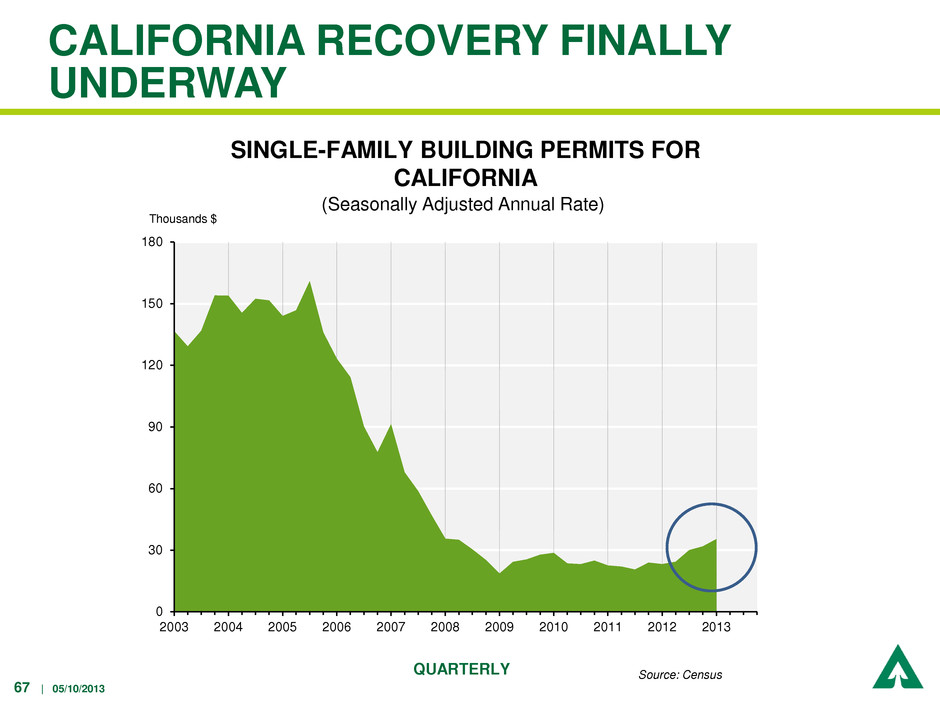

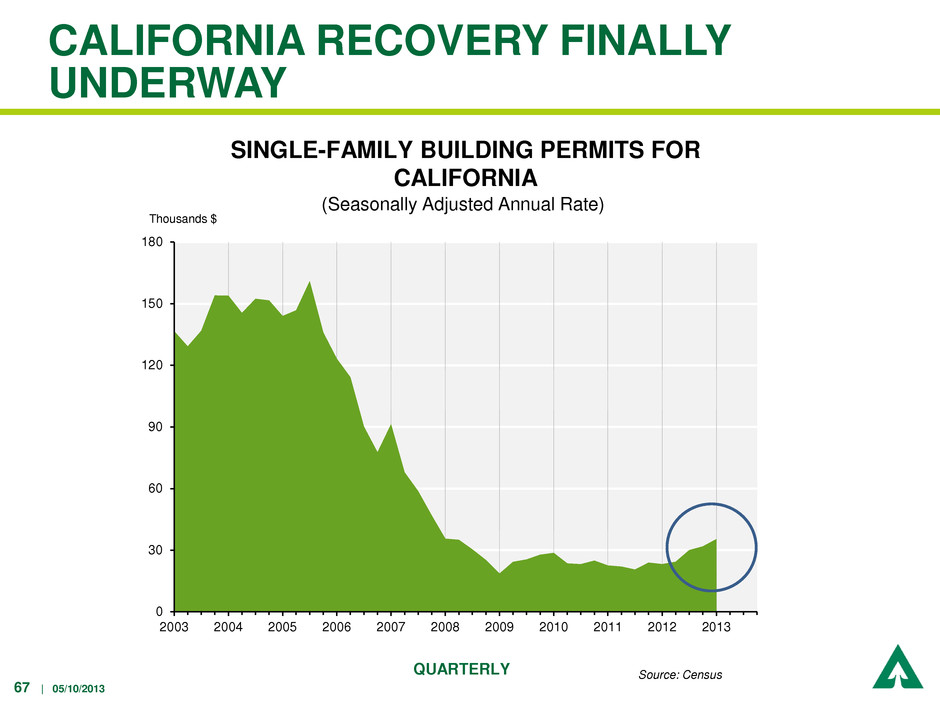

67 | 05/10/2013 0 30 60 90 120 150 180 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Source: Census SINGLE-FAMILY BUILDING PERMITS FOR CALIFORNIA (Seasonally Adjusted Annual Rate) QUARTERLY CALIFORNIA RECOVERY FINALLY UNDERWAY Thousands $

68 | 05/10/2013 CAPITALIZING ON IMPROVING MARKETS • Well positioned to grow earnings – Opening new communities – Increasing prices – Expect 2,800 closings in 2013 (20% year-over-year improvement) – Recovering California market will drive sales and backlog • Controlling costs • Accelerating land development Strategically Positioned for Housing Rebound

69 | 05/10/2013 CELLULOSE FIBERS

70 | 05/10/2013 BUILDING ON OUR STRENGTHS • Focused on fluff and value-added grades • Growing with global customers • Innovating for higher margins • Driving operational excellence • Strategically located manufacturing sites

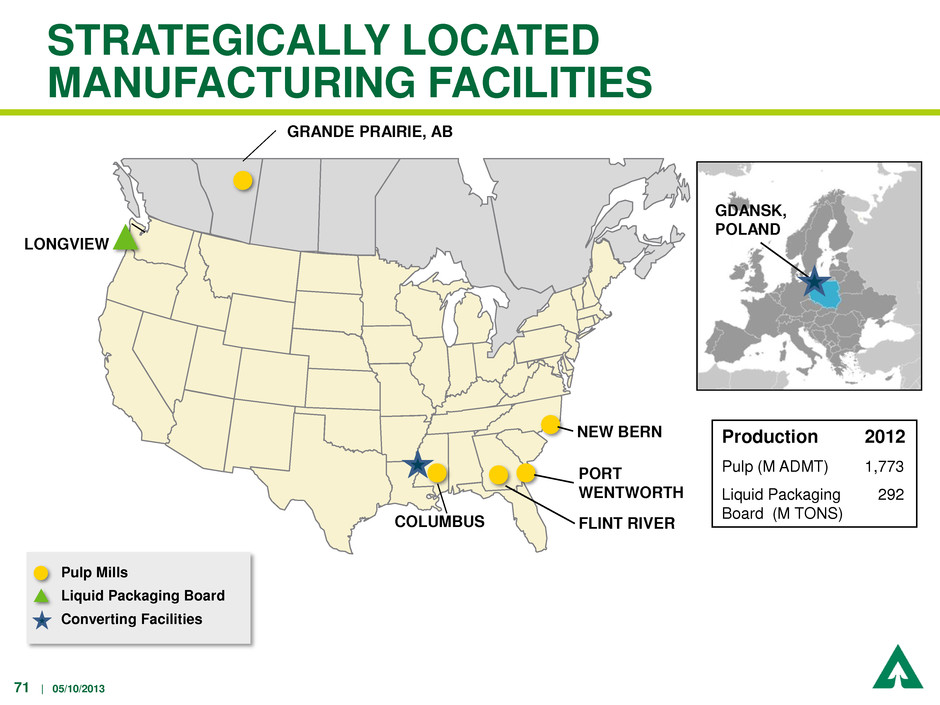

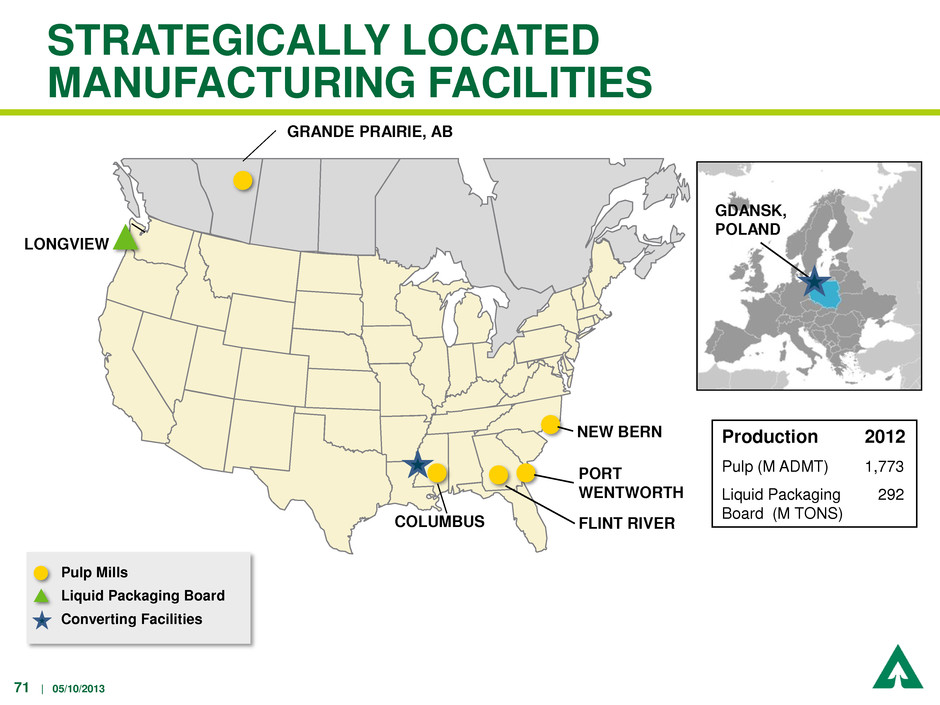

71 | 05/10/2013 STRATEGICALLY LOCATED MANUFACTURING FACILITIES GRANDE PRAIRIE, AB NEW BERN FLINT RIVER COLUMBUS LONGVIEW PORT WENTWORTH GDANSK, POLAND Pulp Mills Liquid Packaging Board Converting Facilities Production 2012 Pulp (M ADMT) 1,773 Liquid Packaging Board (M TONS) 292

72 | 05/10/2013 HOW OUR PRODUCTS ARE USED • Fluff: 40% of sales – Diapers and personal care products • Specialty (Crosslink, Pearl®): 22% of sales – Textiles, nonwovens, and industrial applications • Pulp for Premium Towel & Tissue: 20% of sales • Liquid Packaging Board: 18% of sales – Dairy, juice and premium beverage containers

73 | 05/10/2013 0 5 10 15 20 25 30 G lo b al Ma rk e t Siz e (MM to n s ) Papergrade Towel & Tissue Fluff Dissolving Wood Pulp Pearl® (launched in 2011) Crosslink FOCUSED ON VALUE-ADDED GRADES WY = 23% global share WY = 10% global share Increasing V alue Per T o n $$$

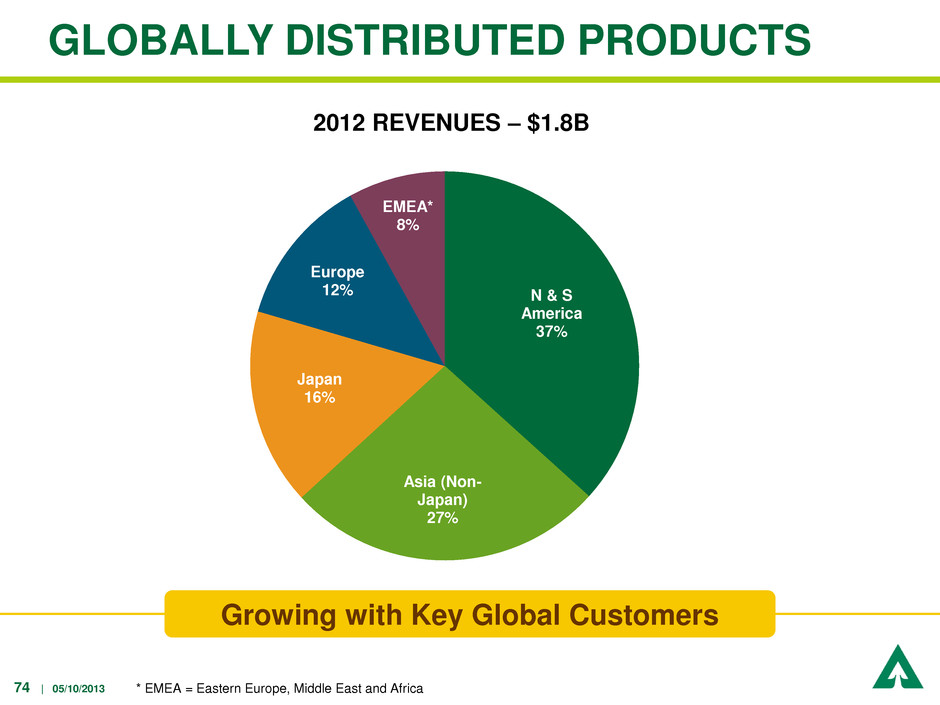

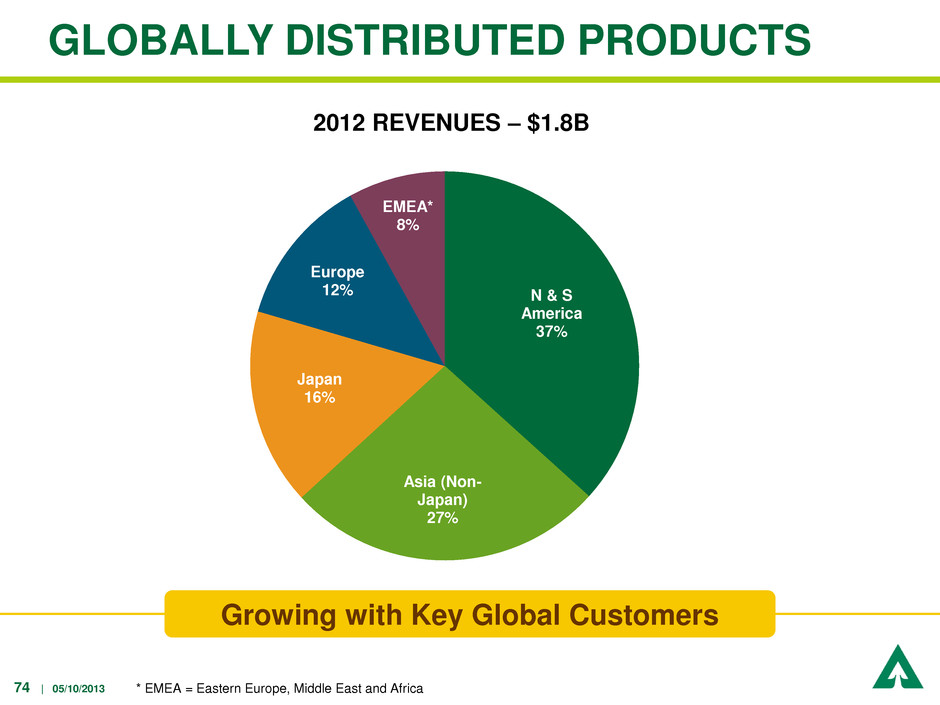

74 | 05/10/2013 GLOBALLY DISTRIBUTED PRODUCTS N & S America 37% Asia (Non- Japan) 27% Japan 16% Europe 12% EMEA* 8% 2012 REVENUES – $1.8B * EMEA = Eastern Europe, Middle East and Africa Growing with Key Global Customers

75 | 05/10/2013 OPERATIONAL EXCELLENCE • Continuing to improve operational efficiency • Capital spending focused on efficiency improvements and cost reduction • On schedule to extend period between mill maintenance outages from 12 to 18 months – Three of six mills have begun an 18-month outage schedule – Cost savings potential: $24MM per year – Production increase estimate: 21,000 tons per year

76 | 05/10/2013 FINANCIAL UPDATE

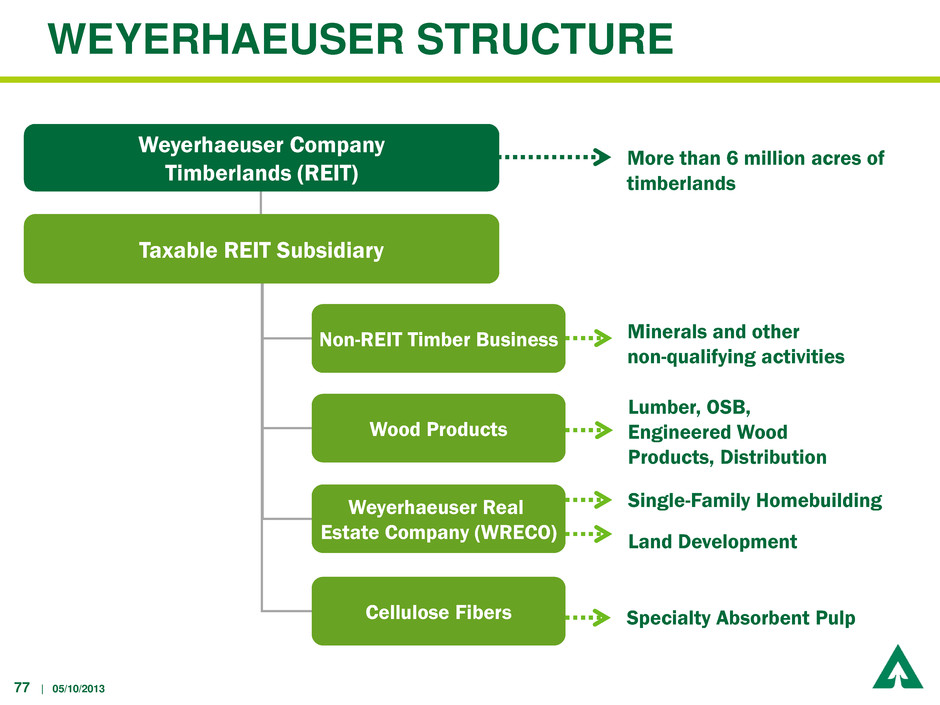

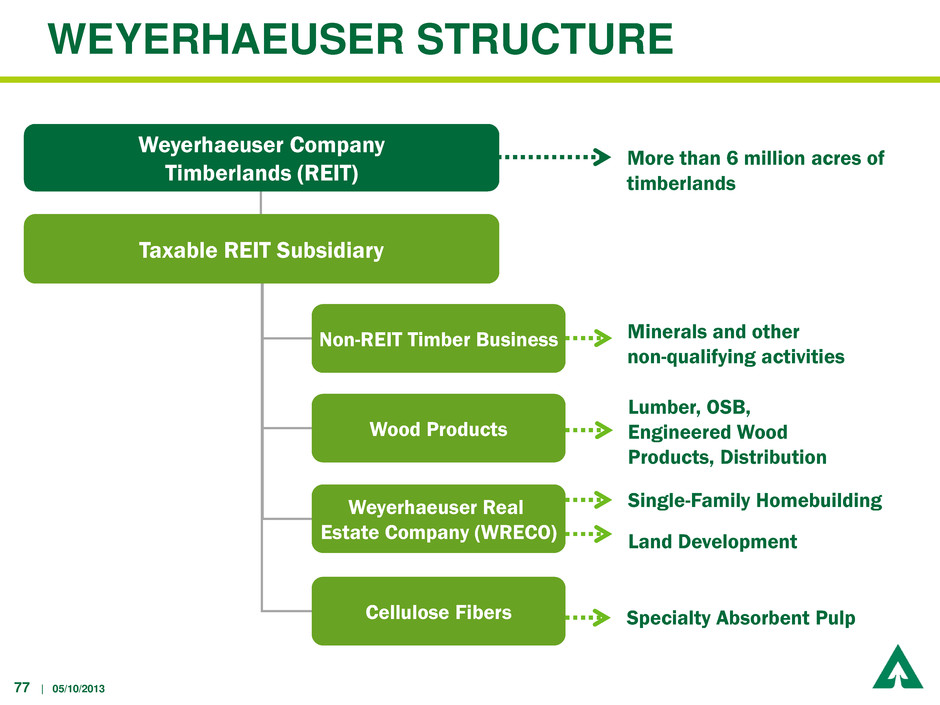

77 | 05/10/2013 Minerals and other non-qualifying activities Weyerhaeuser Company Timberlands (REIT) Taxable REIT Subsidiary Non-REIT Timber Business Wood Products Cellulose Fibers Weyerhaeuser Real Estate Company (WRECO) More than 6 million acres of timberlands Specialty Absorbent Pulp Single-Family Homebuilding Land Development Lumber, OSB, Engineered Wood Products, Distribution WEYERHAEUSER STRUCTURE

78 | 05/10/2013 BENEFITS OF REIT STRUCTURE • Significant cash flow benefits from lower overall tax burden – No taxes on qualified timberland earnings – Eventual elimination of tax on the sale of timberlands (built-in gains) • REIT rules are manageable • Aligned with timberlands-focused strategy – Enhances ability to grow timberland earnings – Able to maintain current non-timber businesses without additional adjustments

79 | 05/10/2013 COMMITTED TO A SUSTAINABLE, GROWING DIVIDEND • Targeting a dividend payout of 75% of Funds Available for Distribution (FAD) over cycle – FAD defined as cash flow before debt repayment and dividends • Increased quarterly dividend by 33% over the last six months – October 2012: 13% increase to 17 cents per share – April 2013: 18% increase to 20 cents per share

80 | 05/10/2013 STRONG CAPITAL STRUCTURE • Significant liquidity – Cash balance as of March 31, 2013: $639MM – $1B credit facility, expires June 2015 – no borrowings outstanding – Net debt to enterprise value* as of March 31, 2013: 17% Total Debt ($ Millions) 2013 2014 2015 2016 2017 Beginning of year $4,291 $3,882 $3,867 $3,867 $3,867 Scheduled debt maturities (409) (15) 0 0 (281) End of year $3,882 $3,867 $3,867 $3,867 $3,586 *Long-term debt, net of cash and equivalents, divided by enterprise value. Enterprise value is defined as long-term debt, net of cash and equivalents, plus market capitalization.

81 | 05/10/2013 TARGETED INVESTMENT IN BUSINESSES: Shifting capital expenditure allocation $0 $50 $100 $150 $200 $250 $300 $350 2010 2011 2012 2013 Est. C a p ital Ex p e n d it u res ($ mi ll io n s ) Timberlands Operations Wood Products Cellulose Fibers Other 47% 50% 63% 65% Est. Percent of Depreciation

82 | 05/10/2013 Dan Fulton CONCLUSION President and Chief Executive Officer

83 | 05/10/2013 THIRD PARTY AWARDS AND RECOGNITION Most Admired Companies FORTUNE Magazine, 1988-2012 World’s Most Ethical Companies Ethisphere Institute, 2009, 2010, 2012 Top 100 S&P 500 Clean Capitalism Ranking Corporate Knights, 2012 100 Best Corporate Citizens Corporate Responsibility Magazine, 2008-2012 Top 10 Best Corporate Citizens, 2012 Joint Sector Leader Forest Footprint Disclosure Project, 2011 oekom Prime Status oekom Research, 2011-2012 Dow Jones Sustainability Index 2005/06 - 2012/13 (North America); 2011/12 - 2012/13 (World) The Sustainability Yearbook RobecoSAM, 2011-2013 Bronze Class Distinction, 2012 FTSE4Good Index Series FTSE Group, 2005-2008 and 2011-2012 Maplecroft Climate Innovation Indices Cycles 1 (Leader), 2, and 3 ECPI Global Equity Indices Global Ethical Equity Global Eco Real Estate and Building STOXX ESG Leaders Indices 2012/2013

84 | 05/10/2013 REASONS TO OWN WEYERHAEUSER • Industry leader with unique and valuable timberlands • Capitalizing on strong recovery of U.S. housing market • Focused on growing earnings and creating value for shareholders

85 | 05/10/2013 Q&A SESSION

86 | 05/10/2013 BIOGRAPHIES

87 | 05/10/2013 DAN FULTON Dan Fulton was elected chief executive officer and a member of the board of directors in April 2008. He has been president of Weyerhaeuser Company since January 2008. From May 2001 until March 2008 he was president and chief executive officer of Weyerhaeuser Real Estate Company, a wholly owned subsidiary of Weyerhaeuser Company. Mr. Fulton is on the board of NAREIT (the National Association of Real Estate Investment Trusts) and of NAFO (National Alliance of Forest Owners). He is chair of the Washington State Roundtable, a member of the Business Roundtable, and the chair of the Business Roundtable’s Housing Subcommittee. Dan is also a member of the Advisory Board for the Foster School of Business at the University of Washington, and past chair of the Policy Advisory Board of the Joint Center of Housing Studies at Harvard University. Fulton graduated with a bachelor of arts degree in economics from Miami University (Ohio) in 1970. He received a master of business administration degree in finance from the University of Washington in 1976, and he completed the Stanford University Executive Program in 2001.

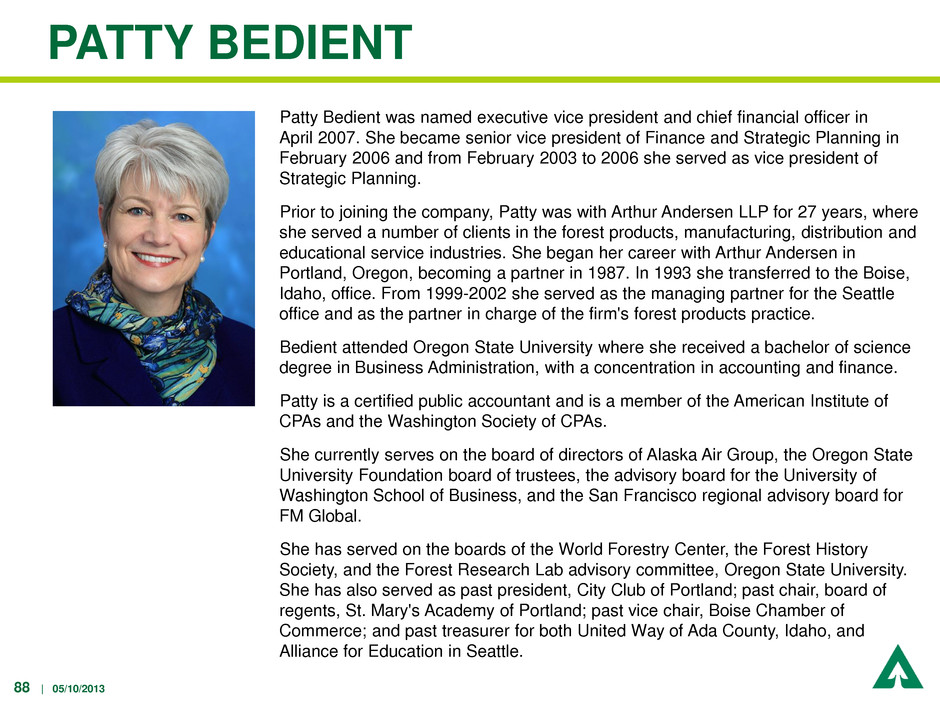

88 | 05/10/2013 PATTY BEDIENT Patty Bedient was named executive vice president and chief financial officer in April 2007. She became senior vice president of Finance and Strategic Planning in February 2006 and from February 2003 to 2006 she served as vice president of Strategic Planning. Prior to joining the company, Patty was with Arthur Andersen LLP for 27 years, where she served a number of clients in the forest products, manufacturing, distribution and educational service industries. She began her career with Arthur Andersen in Portland, Oregon, becoming a partner in 1987. In 1993 she transferred to the Boise, Idaho, office. From 1999-2002 she served as the managing partner for the Seattle office and as the partner in charge of the firm's forest products practice. Bedient attended Oregon State University where she received a bachelor of science degree in Business Administration, with a concentration in accounting and finance. Patty is a certified public accountant and is a member of the American Institute of CPAs and the Washington Society of CPAs. She currently serves on the board of directors of Alaska Air Group, the Oregon State University Foundation board of trustees, the advisory board for the University of Washington School of Business, and the San Francisco regional advisory board for FM Global. She has served on the boards of the World Forestry Center, the Forest History Society, and the Forest Research Lab advisory committee, Oregon State University. She has also served as past president, City Club of Portland; past chair, board of regents, St. Mary's Academy of Portland; past vice chair, Boise Chamber of Commerce; and past treasurer for both United Way of Ada County, Idaho, and Alliance for Education in Seattle.

89 | 05/10/2013 DON HAID Don Haid is the corporate economist and director of Industry Analysis for Weyerhaeuser Company. Educated in both Canada and the US, his credentials include undergraduate and master’s degrees in forestry and forest economics from the University of Alberta and PhD in resource economics from the University of California at Berkeley. Prior to joining Weyerhaeuser, Don worked as an economist for the Economic Studies unit of the Canadian Forest Service followed by a stint as a consultant with HA Simons ltd. (now AMEC). As leader of Weyerhaeuser’s Markets and Economic Research Group (M&ER), Don’s work focuses on industry analysis, supported with outside data, covering housing, wood products, timber and cellulose fibers sectors with the objective of adding value to Weyerhaeuser business performance. Don works with senior leadership in a variety of roles to support the decision making process. Key responsibilities include; price forecasting and industry outlooks for corporate strategic planning, operational planning and the capital allocation process. Identifying emerging strategic issues, business implications and response, is also integral to the M&ER mission.

90 | 05/10/2012 EBITDA RECONCILIATION: TIMBERLANDS $ millions 2012 Timberlands EBITDA1 $460 Depreciation, Depletion and Amortization (142) Special Items 0 Operating Income (GAAP) $318 Interest Income and Other 3 Loss Attributable to Non-Controlling Interest 1 Net Contribution to Earnings (GAAP) $322 1. Adjusted EBITDA excluding special items is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, pension and postretirement costs not allocated to business segments (primarily interest cost, expected return on plan assets, amortization of actuarial loss and amortization of prior service cost / credit), special items and interest included in cost of products sold. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results.

91 | 05/10/2012 $ Millions 2012 Q1 2012 Q2 2012 Q3 2012 Q4 L u m b er O S B E W P D is t O th er T O T A L L u m b er O S B E W P D is t O th er T O T A L L u m b er O S B E W P D is t O th er T O T A L L u m b er O S B E W P D is t O th er T O T A L Adjusted EBITDA Excluding Special Items1 $14 $12 $9 ($9) ($6) $20 $48 $19 $4 ($5) ($3) $63 $41 $51 $7 ($3) ($4) $92 $27 $61 ($3) ($12) ($2) $71 Depletion, Depreciation & Amortization (12) (7) (14) (1) -- (34) (11) (8) (12) (1) (1) (33) (11) (8) (12) (2) -- (33) (11) (8) (13) (1) -- (33) Special Items -- -- -- -- -- -- -- -- -- -- 6 6 -- -- -- -- -- -- -- -- -- -- -- -- Operating Income (GAAP) $2 $5 ($5) ($10) ($6) ($14) $37 $11 ($8) ($6) $2 $36 $30 $43 ($5) ($5) ($4) $59 $16 $53 ($16) ($13) ($2) $38 Interest Income and Other -- -- -- -- 1 1 -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- Net Contribution to Earnings (GAAP) $2 $5 ($5) ($10) ($5) ($13) $37 $11 ($8) ($6) $2 $36 $30 $43 ($5) ($5) ($4) $59 $16 $53 ($16) ($13) ($2) $38 $ Millions 2013 Q1 L u m b er O S B E W P D is t O th er T O T A L Adjusted EBITDA Excluding Special Items1 $101 $102 $11 ($3) ($2) $209 Depletion, Depreciation & Amortization (10) (8) (12) (1) -- (31) Special Items -- -- -- -- -- -- Operating Income (GAAP) $91 $94 ($1) ($4) ($2) $178 Interest Income and Other -- -- -- -- -- -- Net Contribution to Earnings (GAAP) $91 $94 ($1) ($4) ($2) $178 EBITDA RECONCILIATION: WOOD PRODUCTS 1. Adjusted EBITDA excluding special items is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, pension and postretirement costs not allocated to business segments (primarily interest cost, expected return on plan assets, amortization of actuarial loss and amortization of prior service cost / credit), special items and interest included in cost of products sold. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results.