WEYERHAEUSER Investor Meetings March 2019

FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES This presentation contains statements and depictions that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, without limitation, with respect to future goals and prospects, business strategies, cash flow, adjusted EBITDA targets, production, supply, dividend levels and sustainability, share repurchases, operating performance, operational excellence initiatives and targets, asset and portfolio review, levels of demand and demand drivers for our products, including U.S. housing starts and housing demand, pricing outlook for our products, export markets, lumber markets, including future Canadian share of U.S. lumber markets, lumber production and lumber mill capacity, capital structure, financial ratios, credit ratings, capital expenditure plans and priorities, debt levels and maturities. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements may be identified by our use of certain words in such statements, including without limitation words such as “anticipate,” “believe,” “committed,” “continue,” “continued,” “could,” “forecast,” “estimate,” “outlook,” “goal,” “will,” “plan,” “expect,” “sustainable,” “target,” “would” and similar words and terms and phrases using such terms and words. Depictions or illustrations that constitute forward-looking statements may be identified by graphs, charts or other illustrations indicating expected or predicted occurrences of events, conditions, performance or achievements at a future date or during future time periods. We may refer to assumptions, goals or targets, or we may reference expected performance through, or events to occur by or at, a future date, and such references may also constitute forward-looking statements. Forward-looking statements are based on management’s current expectations and assumptions concerning future events, and are inherently subject to uncertainties and factors relating to our operations and business environment that are difficult to predict and often beyond the company’s control. These and other factors could cause one or more of our expectations to be unmet, one or more of our assumptions to be materially inaccurate or actual results to differ materially from those expressed or implied in our forward-looking statements. Such factors include, without limitation: our ability to successfully execute our performance plans, including cost reductions and other operational excellence initiatives; the effect of general economic conditions, including employment rates, housing starts, interest rate levels, availability of financing for home mortgages and the relative strength of the U.S. dollar; market demand for our products, including demand for our timberland properties with higher and better uses, which in turn is related to the strength of various U.S. business segments and U.S. and international economic conditions; restrictions on international trade and tariffs imposed on imports or exports; the availability and cost of shipping and transportation; performance of our manufacturing operations, including maintenance and capital requirements; potential disruptions in our manufacturing operations; the level of competition from domestic and foreign producers; raw material availability and prices; energy prices; the effect of weather; changes in global or regional climate conditions and governmental response to such changes; the risk of loss from fires, floods, windstorms, hurricanes, pest infestation and other natural disasters; federal tax policies; the effect of forestry, land use, environmental and other governmental regulations; legal proceedings; performance of pension fund investments and related derivatives; the accuracy of our estimates of costs and expenses related to contingent liabilities; the effect of timing of retirements and changes in market price of our common stock on charges for share-based compensation; changes in accounting principles; and other factors described in filings we make from time to time with the Securities and Exchange Commission, including without limitation the risk factors described in our annual report on Form 10-K for the year ended December 31, 2018. There is no guarantee that any of the anticipated events or results articulated in this presentation will occur or, if they occur, what effect they will have on the company’s results of operations or financial condition. The forward-looking statements contained herein apply only as of the date of this presentation and we do not undertake any obligation to update these forward-looking statements. Nothing on our website is intended to be included or incorporated by reference into, or made a part of, this presentation. Also included in this presentation are certain non-GAAP financial measures, which management believes complement the financial information presented in accordance with U.S. generally accepted accounting principles. Management believes such non-GAAP measures may be useful to investors. Our non- GAAP financial measures may not be comparable to similarly named or captioned non-GAAP financial measures of other companies due to potential inconsistencies in how such measures are calculated. A reconciliation of each presented non-GAAP measure to its most directly comparable GAAP measure is provided in the appendices to this presentation. 2

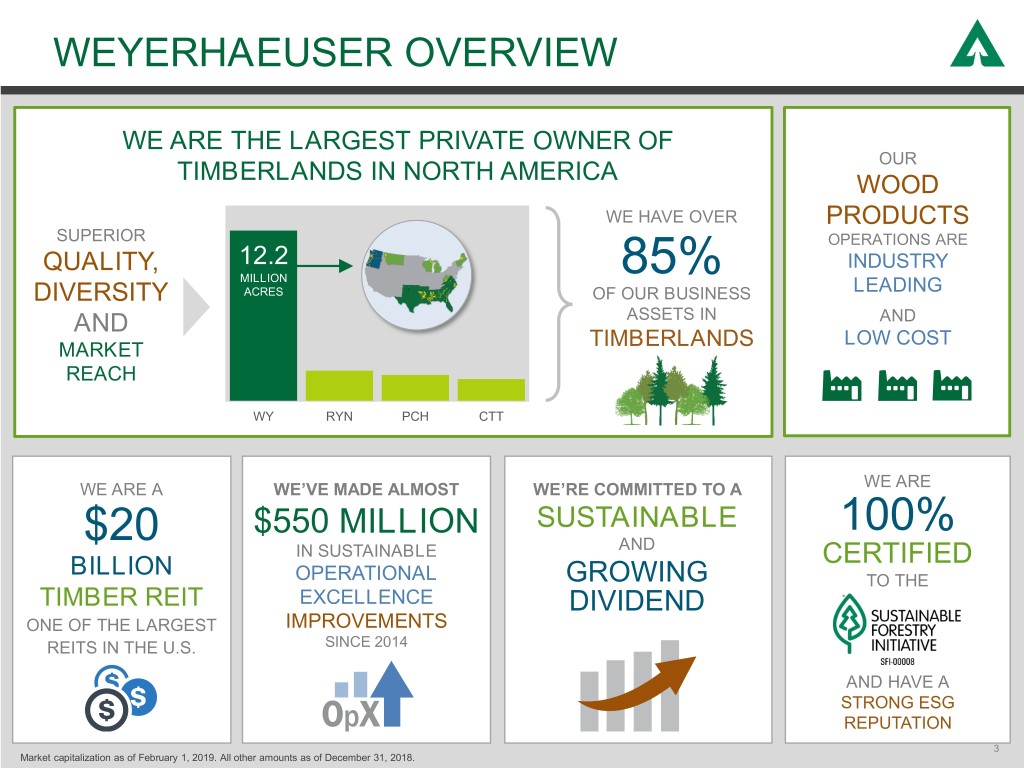

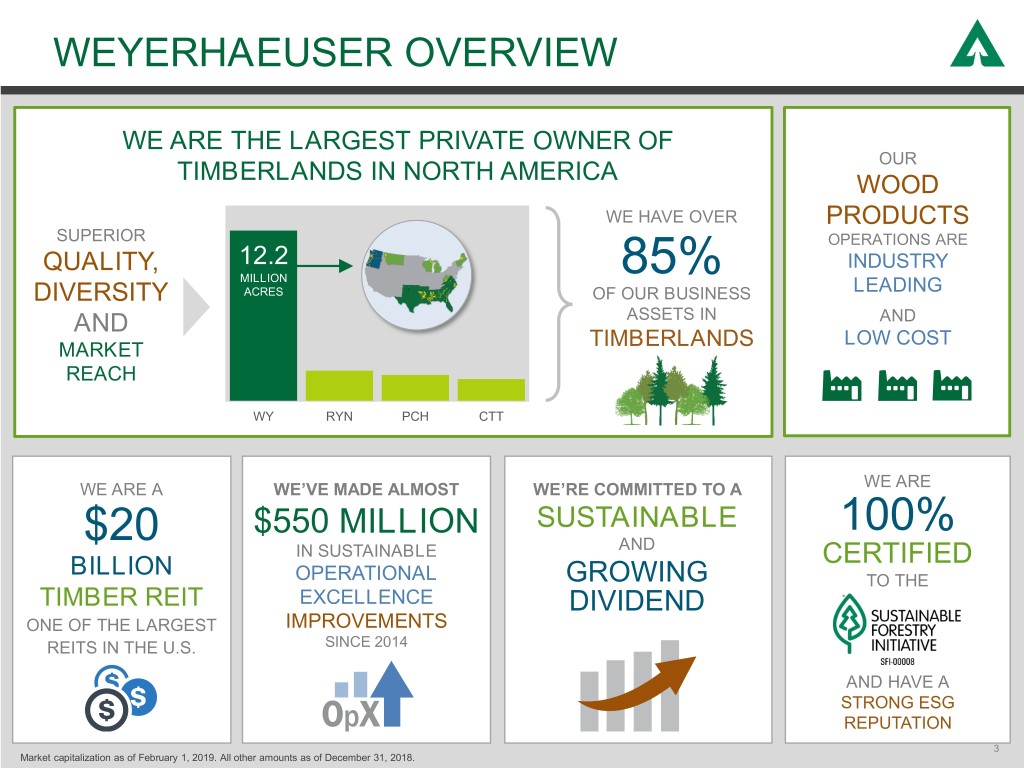

WEYERHAEUSER OVERVIEW WE ARE THE LARGEST PRIVATE OWNER OF OUR TIMBERLANDS IN NORTH AMERICA WOOD WE HAVE OVER PRODUCTS SUPERIOR OPERATIONS ARE 12.212.2 QUALITY, MILLION 85% INDUSTRY MILLIONACRES LEADING DIVERSITY ACRES OF OUR BUSINESS AND ASSETS IN AND TIMBERLANDS LOW COST MARKET REACH WY RYN PCH CTT WE ARE A WE’VE MADE ALMOST WE’RE COMMITTED TO A WE ARE $20 $550 MILLION SUSTAINABLE 100% IN SUSTAINABLE AND BILLION CERTIFIED OPERATIONAL GROWING TO THE TIMBER REIT EXCELLENCE DIVIDEND ONE OF THE LARGEST IMPROVEMENTS REITS IN THE U.S. SINCE 2014 AND HAVE A STRONG ESG REPUTATION 3 Market capitalization as of February 1, 2019. All other amounts as of December 31, 2018.

2018 ACCOMPLISHMENTS CAPITAL ALLOCATION PERFORMANCE ✓ RETURNED NEARLY ✓ GENERATED OVER $1.4 BILLION $2 BILLION to shareholders of EBITDA** for the second year in a row ✓ INCREASED QUARTERLY ✓ INCREASED DIVIDEND by 6% Real Estate & ENR EBITDA ** by ✓ REPURCHASED OVER 10% $365 MILLION of common shares ✓ CAPTURED $44 MILLION ✓ REDUCED PENSION of OpX LIABILITIES by over $2 BILLION* * Includes annuity purchase transaction communicated in August 2018 and completed in January 2019. ** Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold, unallocated pension service costs and special items. Adjusted EBITDA excludes 4 results from joint ventures. See appendix for reconciliation to GAAP amounts.

DRIVING FINANCIAL PERFORMANCE MARKET LEADING POSITIONS STRONG EARNINGS POWER » across our businesses » from scale timber and land portfolio, and lower volatility wood products operations DEMONSTRATED TRACK RECORD PROVEN COMMITMENT » of improved execution » to disciplined capital allocation ADJUSTED CASH FROM ADJUSTED EBITDA* OPERATIONS** WE HAVE RETURNED $2.08 B $2.03 B $1.51 B $5.2 $1.58 B $1.39 B $1.23 B BILLION TO SHAREHOLDERS IN THE LAST 3 YEARS $BILLIONS $BILLIONS $0 2016 2017 2018 2016 2017 2018 * See appendix for reconciliation to GAAP amounts. ** Adjusted cash from operations, as we define it, is net cash from operations adjusted for significant non-recurring items. See appendix for reconciliation to GAAP amounts. 5

2019 FOCUS AREAS OPERATIONAL Focus on cost, reliability EXCELLENCE » and customers PEOPLE Accelerate development DEVELOPMENT » and build bench strength CAPITAL Maintain disciplined approach ALLOCATION » to drive value for shareholders Reinforce progress and ✓ CULTURE » emphasize focused innovation 6

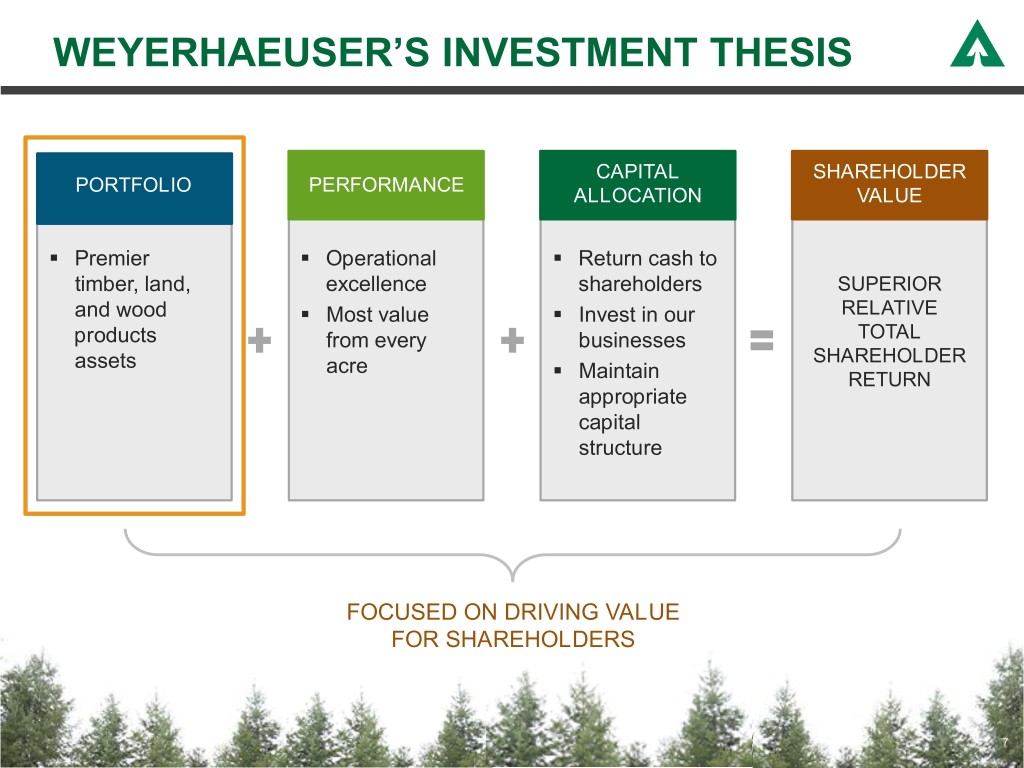

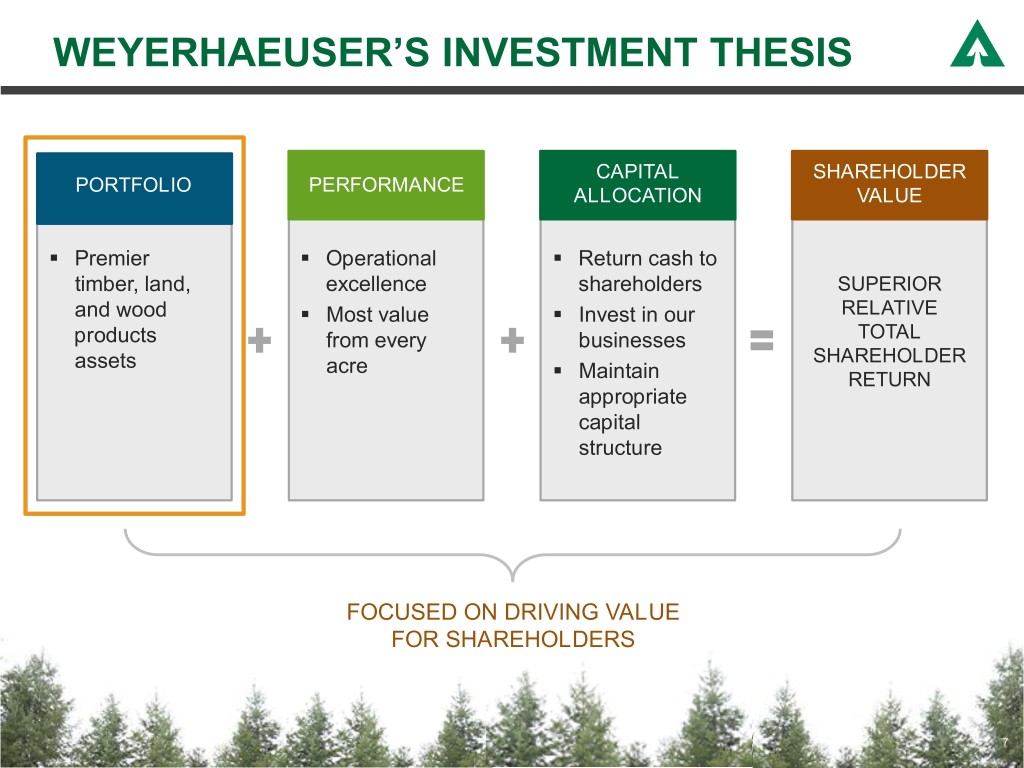

WEYERHAEUSER’S INVESTMENT THESIS CAPITAL SHAREHOLDER PORTFOLIO PERFORMANCE ALLOCATION VALUE ▪ Premier ▪ Operational ▪ Return cash to timber, land, excellence shareholders SUPERIOR and wood ▪ Most value ▪ Invest in our RELATIVE products from every businesses TOTAL assets acre ▪ SHAREHOLDER Maintain RETURN appropriate capital structure FOCUSED ON DRIVING VALUE FOR SHAREHOLDERS 7 7

THREE BUSINESS SEGMENTS REAL ESTATE, WOOD TIMBERLANDS ENERGY & NATURAL PRODUCTS RESOURCES Largest private timberland Maximizing value from Leading wood products owner in the U.S. every acre manufacturer ▪ Unmatched scale and ▪ Premium recreation and ▪ Low-cost and diversity conservation lands well-positioned ▪ Superior quality and ▪ Valuable surface and ▪ Lumber, OSB, productivity subsurface resources Engineered Wood, ▪ Sustainably certified Distribution 8

TIMBERLANDS: Largest private U.S. owner with unmatched quality, diversity and scale ▪ 50 hardwood and softwood species ▪ NORTH Diverse lumber and fiber markets ▪ Premium value hardwood sawlogs 2.4 MILLION ACRES WEST 2.9 MILLION ACRES ▪ High value Douglas fir ▪ Diverse domestic and export customers ▪ Unique access to premium Japanese export market SOUTH ▪ Superior quality Southern Yellow Pine ▪ 6.9 MILLION Access to all Southern markets ACRES ▪ Emerging export business Total acres as of December 31, 2018. 9

REAL ESTATE & ENR: Maximizing the value of every acre REAL ESTATE ENERGY & NATURAL RESOURCES IDENTIFIED AVO ACRES LEASES & AGREEMENTS North 22% 1.6 South West North MILLION 58% AVO West ACRES 20% South ENR EBITDA MIX Determine timber net present value for 1 60% Aggregates & each acre industrial minerals 2 Identify opportunities to capture premium 35% Oil & natural gas value (Asset Value Optimization — AVO) 5% Wind, solar & other Deliver a premium to timber net 3 present value AVO acres as of December 31, 2018. EBITDA percentages are approximate based on 2018 full year results. 10

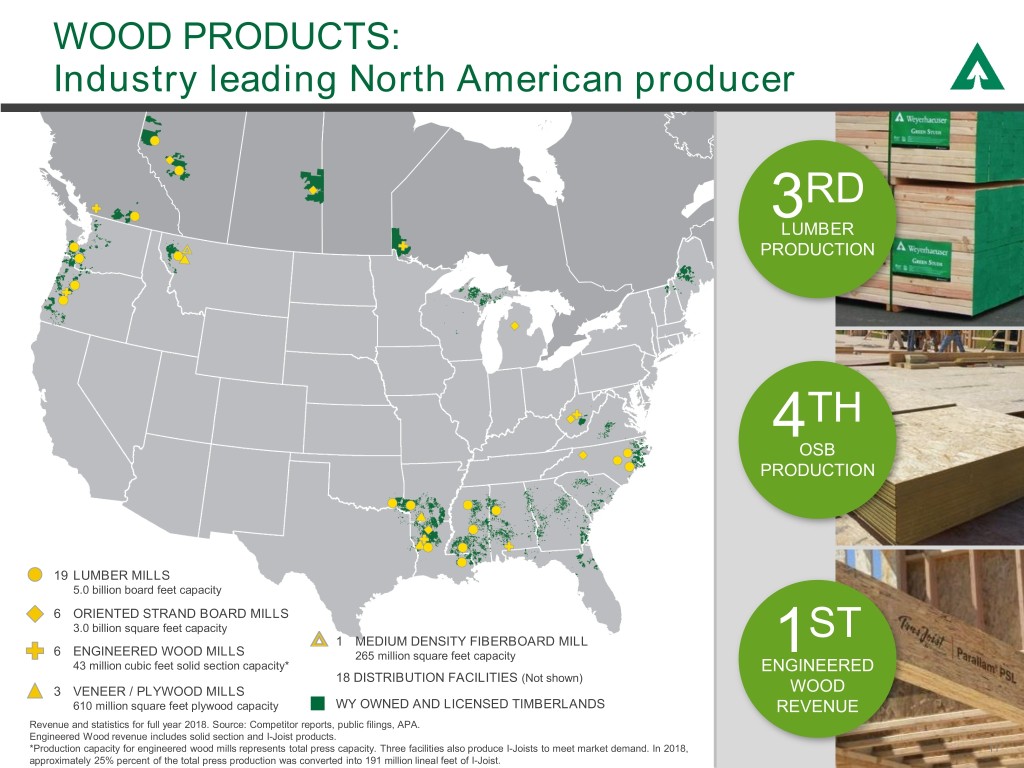

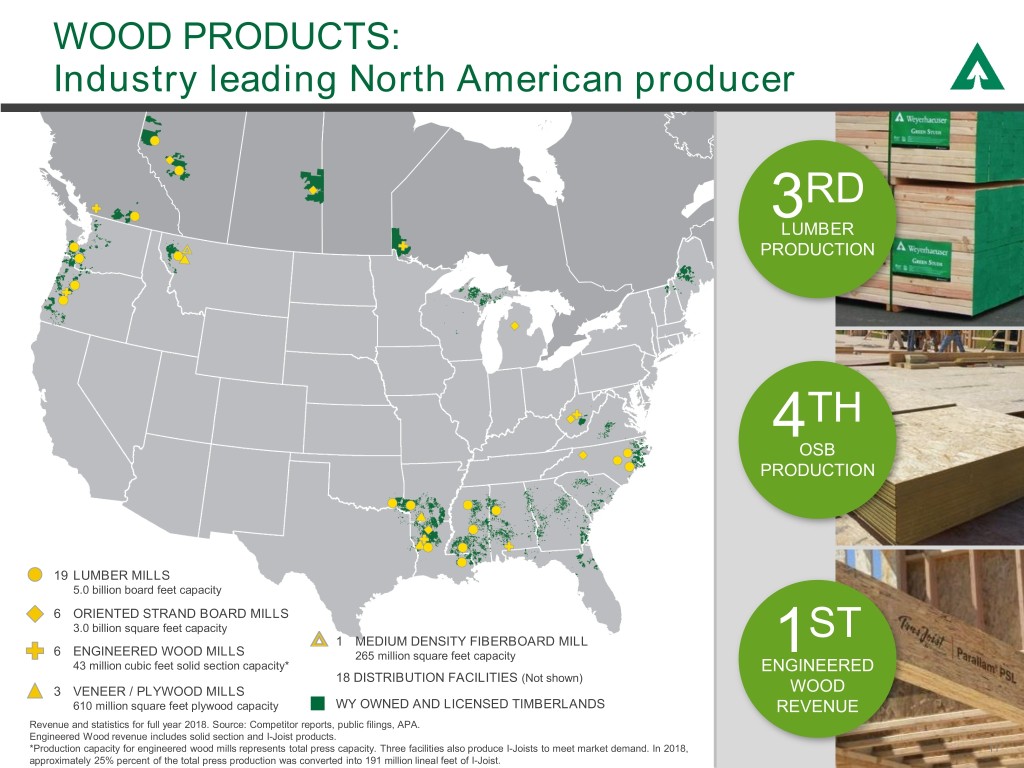

WOOD PRODUCTS: Industry leading North American producer 3RD LUMBER PRODUCTION 4TH OSB PRODUCTION 19 LUMBER MILLS 5.0 billion board feet capacity 6 ORIENTED STRAND BOARD MILLS 3.0 billion square feet capacity 1 MEDIUM DENSITY FIBERBOARD MILL ST 6 ENGINEERED WOOD MILLS 265 million square feet capacity 1 43 million cubic feet solid section capacity* ENGINEERED 18 DISTRIBUTION FACILITIES (Not shown) 3 VENEER / PLYWOOD MILLS WOOD 610 million square feet plywood capacity WY OWNED AND LICENSED TIMBERLANDS REVENUE Revenue and statistics for full year 2018. Source: Competitor reports, public filings, APA. Engineered Wood revenue includes solid section and I-Joist products. *Production capacity for engineered wood mills represents total press capacity. Three facilities also produce I-Joists to meet market demand. In 2018, 11 approximately 25% percent of the total press production was converted into 191 million lineal feet of I-Joist.

WEYERHAEUSER’S INVESTMENT THESIS CAPITAL SHAREHOLDER PORTFOLIO PERFORMANCE ALLOCATION VALUE ▪ Premier ▪ Operational ▪ Return cash to timber, land, excellence shareholders SUPERIOR and wood ▪ Most value ▪ Invest in our RELATIVE products from every acre businesses TOTAL assets ▪ SHAREHOLDER Maintain RETURN appropriate capital structure FOCUSED ON DRIVING VALUE FOR SHAREHOLDERS 12 12

2019 OPX TARGETS 275 $40-50 250 225 ACHIEVED $543 MM 200 2014-2018 TARGET 175 $80-$100 MM IN 2019 150 125 $20 $10 $214 100 $10-15 $1-5 75 50 $ MILLIONS MILLIONS $ $99 $83 $75 $72 25 0 TIMBERLANDS LUMBER OSB EWP DISTRIBUTION » KEY INITIATIVES » ▪ Harvest and transportation ▪ Reliability ▪ Controllable cost ▪ Controllable cost ▪ Product margins productivity ▪ Controllable cost ▪ Reliability ▪ Improved recovery ▪ Operating costs ▪ Marketing and ▪ Improved recovery ▪ Improved recovery ▪ Product mix ▪ Selling expenses merchandising ▪ Product mix ▪ Product mix ▪ Silviculture best practices 13

PERFORMANCE: #1 or #2 in all business lines ADJUSTED EBITDA* ADJUSTED EBITDA MARGIN* / ACRE OWNED WESTERN TIMBERLANDS LUMBER+ ORIENTED STRAND BOARD 30% 50% $240 25% 40% $200 20% 30% $160 15% 20% 10% $120 10% 5% $80 0% 0% $40 -5% -10% 2011 2012 2013 2014 2015 2016 2017 2018 2011 2012 2013 2014 2015 2016 2017 2018 2011 2012 2013 2014 2015 2016 2017 2018 Weyerhaeuser vs Rayonier, NCREIF Weyerhaeuser vs West Fraser, Canfor, Interfor Weyerhaeuser vs LP, Norbord SOUTHERN TIMBERLANDS ENGINEERED WOOD PRODUCTS DISTRIBUTION 18% 6% $80 15% 4% $60 12% 2% 9% 0% $40 6% -2% 3% $20 -4% 0% -6% $0 -3% -8% 2011 2012 2013 2014 2015 2016 2017 2018 2011 2012 2013 2014 2015 2016 2017 2018 2011 2012 2013 2014 2015 2016 2017 2018 Weyerhaeuser vs Rayonier, NCREIF^ Weyerhaeuser vs Boise, LP Weyerhaeuser vs Boise, Blue Linx** * See appendix for reconciliation to GAAP amounts. | +2017 and 2018 results for all companies include expenses for softwood lumber countervailing and anti-dumping duties. | ^ NCREIF South average acres for 2018. | ** Blue Linx 2018 results not yet available. | Source for competitor data: public SEC filings, National Council of Real Estate Investment Fiduciaries (NCREIF). 14

REAL ESTATE & ENR: OpX progress and targets PREMIUM TO TIMBER VALUE ADJUSTED EBITDA* $264 MM 65% $241 MM 55% TARGET $260 MM IN 2019 2017 2018 2017 2018 » KEY INITIATIVES » ▪ Continually refine AVO acreage ▪ Exceed 30% premium to timber value ▪ Capture additional value from surface and subsurface assets * See appendix for reconciliation to GAAP amounts. 15

WEYERHAEUSER’S INVESTMENT THESIS CAPITAL SHAREHOLDER PORTFOLIO PERFORMANCE ALLOCATION VALUE ▪ Premier ▪ Operational ▪ Return cash to timber, land, excellence shareholders SUPERIOR and wood ▪ Most value ▪ Invest in our RELATIVE products from every businesses TOTAL assets acre ▪ SHAREHOLDER Maintain RETURN appropriate capital structure FOCUSED ON DRIVING VALUE FOR SHAREHOLDERS 1616

RETURNING CASH TO SHAREHOLDERS SUSTAINABLE AND GROWING OPPORTUNISTIC DIVIDEND SHARE REPURCHASE Quarterly dividend per share INCREASED $0.4 127% $0.34 2018 billion SINCE 2011 $0.32 $0.31 $0.29 REPURCHASED $0.22 $3.1 $0.20 BILLION 2017 $2.7 $0.17 - SINCE 2014 $0.15 billion 2014 2011 2012 2013 2013 2014 2015 2017 2018 Q1 Q4 Q2 Q3 Q3 Q3 Q4 Q3 ► Increased dividend by 6% in 2018 Q3 ► New $500 million authorization approved in February 2019 ► Seven increases since 2011 ► Deploy opportunistically 17

INVESTING IN OUR BUSINESSES: Disciplined capital expenditures for 2019 $120 million of sustaining capex TIMBERLANDS » Reforestation and silviculture Roads and infrastructure $270 million; lower than 2018 WOOD PRODUCTS » Maintenance capex Projects to reduce cost and improve productivity REAL ESTATE, Very minimal expenditures ENERGY & NATURAL RESOURCES » Primarily entitlement activities CORPORATE » $10 million for IT systems » $400 MILLION IN 2019 » 18

MAINTAIN APPROPRIATE CAPITAL STRUCTURE DEBT FINANCIAL RATIOS CREDIT RATINGS ▪ $6.2 billion long-term ▪ Achieved target ratios ▪ Solid investment grade debt outstanding* ▪ Target: Net debt to ▪ Moody’s: Baa2 stable ‒ 96% fixed rate Adjusted EBITDA ≤ 3.5x ▪ S&P: BBB stable ‒ Refinanced 2019 maturity over the cycle ‒ No maturities until 2021 ▪ ▪ Target: Net debt to Revolving line of credit enterprise value ≤ 25% ‒ $1.5 billion total capacity ‒ Used for working capital management STRONG BALANCE SHEET AND FINANCIAL FLEXIBILITY * Pro forma following announced March 2019 redemption of $500 million 7.375% notes due 2019. 19

WEYERHAEUSER’S INVESTMENT THESIS CAPITAL SHAREHOLDER PORTFOLIO PERFORMANCE ALLOCATION VALUE ▪ Premier ▪ Operational ▪ Return cash to timber, land, excellence shareholders SUPERIOR and wood ▪ Most value ▪ Invest in our RELATIVE products from every acre businesses TOTAL assets ▪ SHAREHOLDER Maintain RETURN appropriate capital structure FOCUSED ON DRIVING VALUE FOR SHAREHOLDERS 20 20

CONTINUED GROWTH IN U.S. HOUSING MARKET U.S. HOUSING STARTS KEY DRIVERS SEASONALLY ADJUSTED ANNUAL RATE 2.5 Forecast* ▪ U.S. housing starts below trend levels 2.0 ▪ Multi-family Strong household formations Single-family ▪ 1.5 Solid economic fundamentals FEA ▪ RISI Favorable demographics 1.0 ▪ MILLIONS Builders responding to demand for affordable product 0.5 Anticipate 0.0 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 1.3 MILLION STARTS in 2019 Source: Bureau of Census, *FEA, *RISI QUARTERLY U.S. REPAIR & REMODEL TOTAL SPENDING Forecast KEY DRIVERS 350 300 ▪ 250 Housing stock continues to age 200 ▪ Increased home equity 150 ▪ $BILLIONS 100 Expect continued growth in repair & 50 remodel spending 0 2002 2004 2006 2008 2010 2012 2014 2016 2018 21 Source: Harvard Joint Center for Housing Studies ANNUAL

LUMBER: Strong demand growth and rising operating rates KEY DRIVERS NORTH AMERICAN LUMBER CONSUMPTION BY END USE, 2018 ▪ Demand rising with repair & remodel and New new residential construction activity Repair & Residential Remodel 29% ▪ Demand growth expected to outpace 40% industry capacity additions ▪ Expect favorable market dynamics in 2019 PRICING OUTLOOK Non-Residential Industrial FRAMING LUMBER COMPOSITE & Other 25% 550 Source: FEA 6% Forecast* 500 FEA 450 NORTH AMERICAN LUMBER DEMAND AND CAPACITY 400 90 Forecast Demand Capacity 350 RISI QTD 75 FEA $/MBF 300 60 250 Demand 200 45 Rising Approx. 150 BBF 2 BBF 30 2005 2007 2009 2011 2013 2015 2017 2019 2021 Per Year Through Source: Random Lengths, *FEA, *RISI QUARTERLY Q1 QTD as of 2/22/19 15 2021 0 SENSITIVITY 2005 2007 2009 2011 2013 2015 2017 2019 2021 Source: FEA ANNUAL $10/MBF ≈ $45 million EBITDA 22

LUMBER: Canadian supply decreasing KEY DRIVERS CANADIAN LUMBER EXPORTS TO U.S. 25 40% Canadian Lumber Exports to U.S. ▪ Canadian Share of U.S. Consumption 35% Canadian share of US lumber market 20 decreased to 28% in 2018 30% 25% - 20% duties on Canadian lumber 15 20% - Log supply declining due to BC fires, 10 pine beetle and AAC reductions 15% ▪ BBF IN EXPORTS 10% Expect continued decline in Canadian 5 share 5% SHARE OF CONSUMPTION IN PERCENT IN CONSUMPTION OF SHARE ▪ 0 0% U.S. Southern lumber production rising 2004 2006 2008 2010 2012 2014 2016 2018 NOV as Canadian production declines Source: Random Lengths, FEA ANNUAL LTM NORTH AMERICAN LUMBER PRODUCTION SENSITIVITY SHARE, BY REGION 35% 2% Canadian share of US market Forecast = 1 BBF lumber consumption 30% US South 25% 20% British Columbia 15% SHARE OF PRODUCTION IN PERCENT IN OF PRODUCTION SHARE 10% 2005 2007 2009 2011 2013 2015 2017 2019 2021 Source: FEA ANNUAL 23

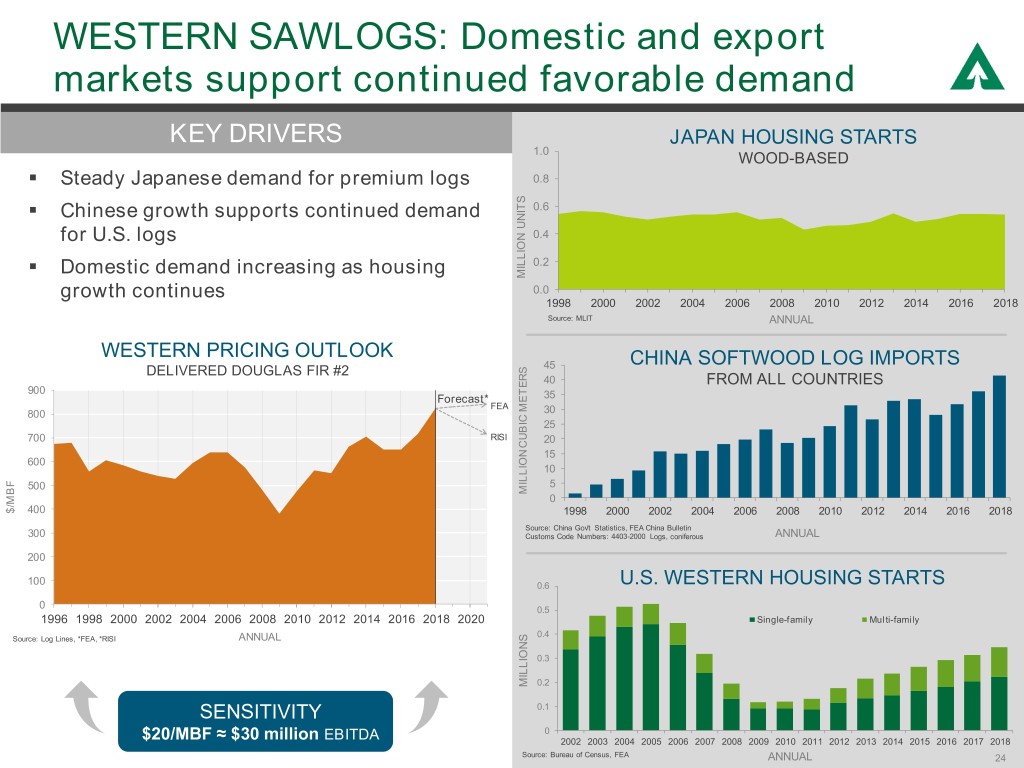

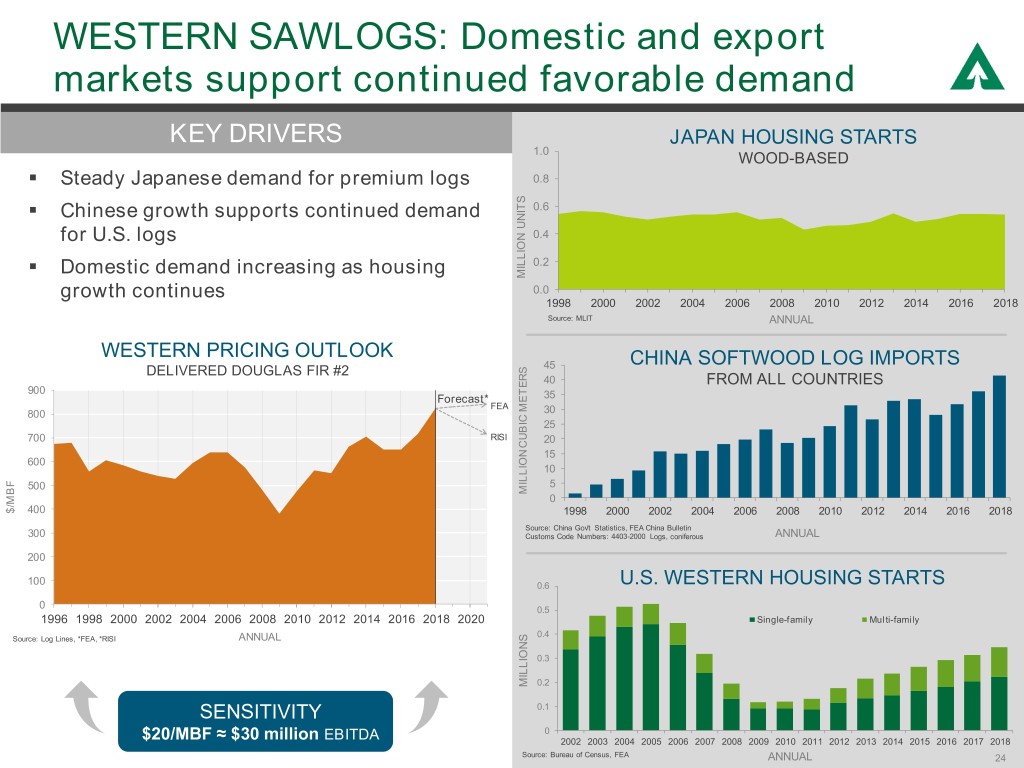

WESTERN SAWLOGS: Domestic and export markets support continued favorable demand KEY DRIVERS JAPAN HOUSING STARTS 1.0 WOOD-BASED ▪ Steady Japanese demand for premium logs 0.8 ▪ Chinese growth supports continued demand 0.6 for U.S. logs 0.4 ▪ Domestic demand increasing as housing 0.2 MILLION MILLION UNITS growth continues 0.0 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 Source: MLIT ANNUAL WESTERN PRICING OUTLOOK CHINA SOFTWOOD LOG IMPORTS DELIVERED DOUGLAS FIR #2 45 40 FROM ALL COUNTRIES 900 Forecast* 35 FEA 800 30 25 700 RISI 20 15 600 10 500 5 MILLION CUBIC METERS CUBIC MILLION 0 $/MBF 400 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 Source: China Gov't Statistics, FEA China Bulletin 300 Customs Code Numbers: 4403-2000 Logs, coniferous ANNUAL 200 100 0.6 U.S. WESTERN HOUSING STARTS 0 0.5 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 Single-family Multi-family 0.4 Source: Log Lines, *FEA, *RISI ANNUAL 0.3 MILLIONS 0.2 SENSITIVITY 0.1 0 $20/MBF ≈ $30 million EBITDA 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Source: Bureau of Census, FEA ANNUAL 24

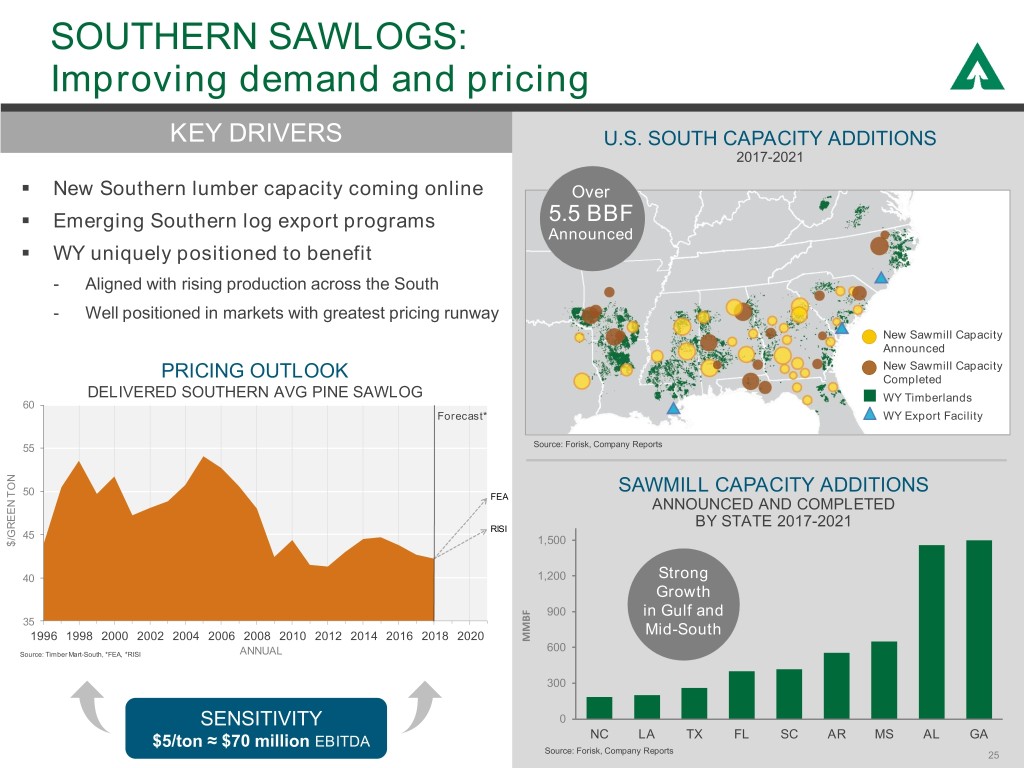

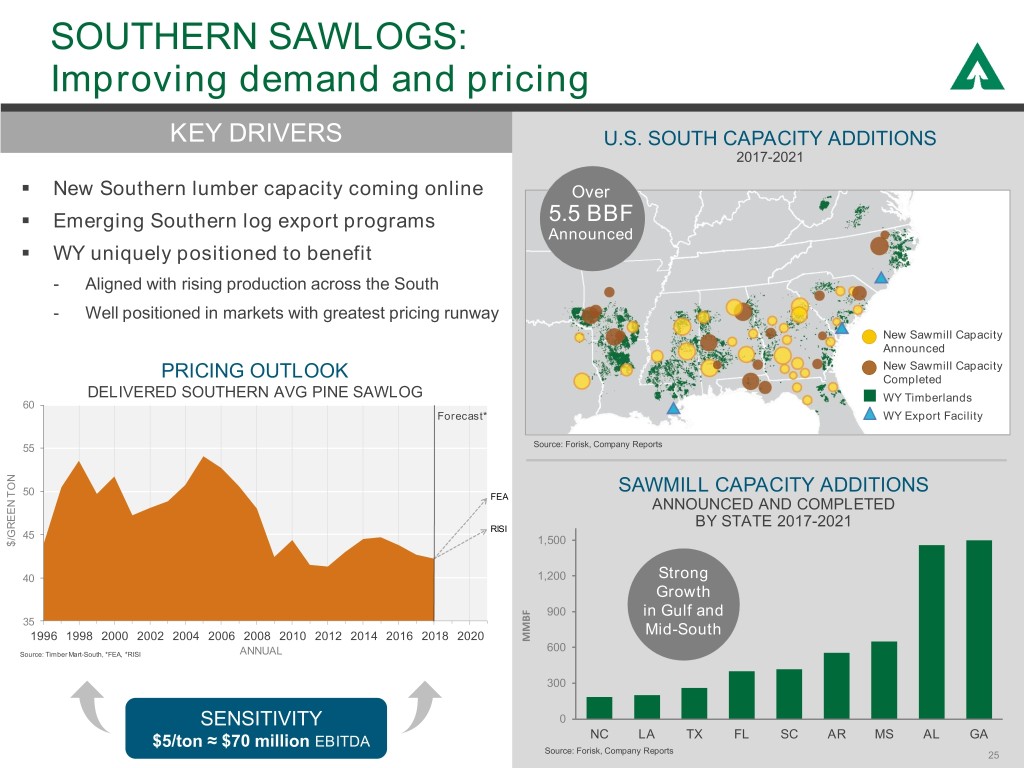

SOUTHERN SAWLOGS: Improving demand and pricing KEY DRIVERS U.S. SOUTH CAPACITY ADDITIONS 2017-2021 ▪ New Southern lumber capacity coming online Over ▪ Emerging Southern log export programs 5.5 BBF Announced ▪ WY uniquely positioned to benefit - Aligned with rising production across the South - Well positioned in markets with greatest pricing runway New Sawmill Capacity Announced New Sawmill Capacity PRICING OUTLOOK Completed DELIVERED SOUTHERN AVG PINE SAWLOG WY Timberlands 60 Forecast* WY Export Facility 55 Source: Forisk, Company Reports 50 SAWMILL CAPACITY ADDITIONS FEA ANNOUNCED AND COMPLETED RISI BY STATE 2017-2021 45 1,500 $/GREEN TON $/GREEN 40 1,200 Strong Growth 900 in Gulf and 35 Mid-South 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 MMBF 600 Source: Timber Mart-South, *FEA, *RISI ANNUAL 300 SENSITIVITY 0 $5/ton ≈ $70 million EBITDA NC LA TX FL SC AR MS AL GA Source: Forisk, Company Reports 25

OSB: Continued strong market fundamentals KEY DRIVERS NORTH AMERICAN OSB CONSUMPTION BY END USE, 2018 ▪ Demand rising with repair & remodel and new Repair & Remodel residential construction activity 25% ▪ New Operating rates exceeded 90% in 2018 Residential 54% ▪ Industry capacity growth serving rising demand Industrial ▪ Expect continued strong operating rates and 10% favorable pricing Non- Residential & Other PRICING OUTLOOK Source: FEA 11% NORTH CENTRAL OSB 450 Forecast* NORTH AMERICAN OSB CAPACITY 400 AND DEMAND 350 35 Forecast 300 FEA Operating Capacity Non-Operating Capacity Demand RISI 30 250 QTD $/MSF 200 25 150 100 20 Demand Rising Approx. 3/8" 50 1 BSF BSF 15 Per Year 0 Through 2005 2007 2009 2011 2013 2015 2017 2019 2021 2021 Source: Random Lengths, *FEA, *RISI QUARTERLY 10 Q1 QTD as of 2/22/19 5 SENSITIVITY 0 2005 2007 2009 2011 2013 2015 2017 2019 2021 $10/MSF ≈ $30 million EBITDA 26 Source: FEA ANNUAL

WEYERHAEUSER’S INVESTMENT THESIS CAPITAL SHAREHOLDER PORTFOLIO PERFORMANCE ALLOCATION VALUE ▪ Premier ▪ Operational ▪ Return cash to timber, land, excellence shareholders SUPERIOR and wood ▪ Most value ▪ Invest in our RELATIVE products from every acre businesses TOTAL assets ▪ SHAREHOLDER Maintain RETURN appropriate capital structure FOCUSED ON DRIVING VALUE FOR SHAREHOLDERS 27 27

APPENDIX 28

29

STRONG ESG REPUTATION: More than a Century of Industry-Leading Practices WE ARE THE ONLY ETHISPHERE named We are in the We have a North American forestry us one of the top 100 Best “Winning” rating or wood products World’s Most Ethical Corporate Citizens, from 2020 Women company on the Companies® according to Corporate on Boards Dow Jones Responsibility Magazine Sustainability Indices 1900 1930 1941 1942 2000 2005 Company founded by Led the industry to Established first tree Established first forest 100% certified to First listing on Frederick Weyerhaeuser develop sustainable farm in the U.S. research facility in U.S. Sustainable Forestry Dow Jones practices Initiative (SFI) Sustainability Index 30

ADJUSTED EBITDA RECONCILIATION: Timberlands $ Millions 2011 2012 2013 2014 2015 2016 2017 2018 West $279 $258 $373 $571 $459 $443 $508 $532 South 226 298 328 410 430 426 383 351 North 29 28 32 47 41 26 23 19 Other (15) (8) 46 2 7 6 22 0 Adjusted EBITDA including Legacy Plum $519 $576 $779 $1,030 $937 $901 $936 $902 Creek operations1,3 Less: EBITDA attributable to Plum Creek2 175 203 235 291 260 36 - - Weyerhaeuser Timberlands $344 $373 $544 $739 $678 $865 $936 $902 Adjusted EBITDA3 Depletion, Depreciation & Amortization (138) (143) (168) (207) (208) (366) (356) (319) Special Items - - - - - - (48) - Operating Income (GAAP) $206 $230 $376 $532 $470 $499 $532 $583 Interest Income and Other 4 3 4 - - - - - Loss Attributable to Non-Controlling - 1 - - - - - - Interest Net Contribution to Earnings $210 $234 $380 $532 $470 $499 $532 $583 1. Results exclude Real Estate, Energy & Natural Resources, which was reported as part of legacy Weyerhaeuser’s Timberlands segment, and include Plum Creek. West includes Plum Creek Washington and Oregon operations. South includes Plum Creek Southern Resources. North includes Plum Creek Northern Resources less Washington and Oregon. Results from Longview Timber are included in Other for 2013 and in Western Timberlands for 2014 and forward. Other also includes results from international operations and certain administrative charges. 2. Results represent Plum Creek Timberlands EBITDA from October 1, 2011 through February 18, 2016. 3. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold, unallocated pension service costs and special items. Adjusted EBITDA excludes results from joint ventures. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results. 31

ADJUSTED EBITDA RECONCILIATION: Wood Products $ Millions 2011 2012 2013 2014 2015 20161 2017 2018 Lumber ($7) $130 $317 $319 $212 $289 $459 $459 OSB (4) 143 247 46 41 183 359 329 EWP 6 17 45 79 114 145 173 177 Distribution (37) (29) (33) 2 10 25 38 32 Other (1) (15) (2) - (5) (1) (12) (10) Adjusted EBITDA2 ($43) $246 $574 $446 $372 $641 $1,017 $987 Depletion, Depreciation & (151) (133) (123) (119) (106) (129) (145) (149) Amortization Special Items (52) 6 (10) - (8) - (303) - Operating Income (GAAP) ($246) $119 $441 $327 $258 $512 $569 $838 Interest Income and Other 3 1 - - - - - - Net Contribution to Earnings ($243) $120 $441 $327 $258 $512 $569 $838 1. Amounts presented reflect the results of operations acquired in our merger with Plum Creek Timber, Inc. beginning on the merger date of February 19, 2016. 2. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold, unallocated pension service costs and special items. Adjusted EBITDA excludes results from joint ventures. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results. 32

ADJUSTED EBITDA RECONCILIATION: Real Estate, Energy & Natural Resources $ Millions 2017 2018 Adjusted EBITDA1 $241 $264 Depletion, Depreciation & Amortization (15) (14) Basis of Real Estate Sold (81) (124) Operating Income (GAAP) $145 $126 Interest Income and Other 1 1 Net Contribution to Earnings $146 $127 1. Adjusted EBITDA is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted EBITDA, as we define it, is operating income adjusted for depreciation, depletion, amortization, basis of real estate sold, unallocated pension service costs and special items. Adjusted EBITDA excludes results from joint ventures. Adjusted EBITDA should not be considered in isolation from and is not intended to represent an alternative to our GAAP results. 33

ADJUSTED CASH FROM OPERATIONS RECONCILIATION $ Millions 2016 2017 2018 Adjusted Cash from Operations1 $1,229 $1,393 $1,508 Cash paid for income taxes related to the sale of our Cellulose Fibers businesses (494) — — Cash paid for product remediation — (192) (96) Cash contribution to our U.S. qualified pension plan — — (300) Net Cash from Operations (GAAP) $735 $1,201 $1,112 1. Adjusted cash from operations is a non-GAAP measure that management uses to evaluate the performance of the company. Adjusted cash from operations, as we define it, is net cash from operations adjusted for significant non-recurring items. Adjusted cash from operations should not be considered in isolation and is not intended to represent an alternative to our GAAP results. 34