- WY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Weyerhaeuser (WY) 8-KRegulation FD Disclosure

Filed: 3 Jun 09, 12:00am

May 29, 2009

2009 Investor Meeting

Weyerhaeuser Company

Forward Looking Statement

This presentation contains statements concerning the company’s future results and performance that are forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These statements are based on various assumptions and may not be accurate because of risks and uncertainties surrounding these assumptions.

Factors listed below, as well as other factors, may cause actual results to differ significantly from these forward-looking statements. There is no guarantee that any of the events

anticipated by these forward-looking statements will occur. If any of the events occur, there is no guarantee what effect they will have on company operations or financial condition. The

company will not update these forward-looking statements after the date of this presentation.

Some forward-looking statements discuss the company’s plans, strategies and intentions. They use words such as “expects,” “may,” “will,” “believes,” “should,” “approximately,”

“anticipates,” “estimates,” and “plans.” In addition, these words may use the positive or negative or other variations of those terms.

We make forward-looking statements regarding the company’s expectations during the second quarter of 2009, including the company’s markets, the effect of facility closures and cost

control measures in the wood products segment, fee timber harvests and log prices, demand and pricing for our wood products, decreases in raw material costs for our wood products

segment, increased expenses for annual planned maintenance in the Cellulose Fiber segment, the effect of potential alternative fuel mixture tax credits, demand and prices for pulp,

home sale closings and prices, earnings and performance of our business segments, capital expenditures and the timing of debt repayments. Major risks, uncertainties and assumptions

that affect the company’s businesses and may cause actual results to differ from these forward-looking statements, include, but are not limited to:

the effect of general economic conditions, including the level of interest rates, availability of financing for home mortgages, strength of the U.S. dollar, employment rates and housing

starts;

market demand for the company’s products, which is related to the strength of the various U.S. business segments and economic conditions;

the successful execution of internal performance plans, including restructurings and cost reduction initiatives;

the restructuring of the company’s business support functions;

performance of the company’s manufacturing operations, including maintenance requirements;

raw material prices;

energy prices;

transportation costs;

performance of pension fund investments and related derivatives;

contributions to pension plans

the effect of timing of retirements and changes in the market price of company stock on charges for stock-based compensation;

the level of competition from domestic and foreign producers;

the effect of forestry, land use, environmental and other governmental regulations;

legal proceedings;

projected tax rates and IRS audit outcomes;

changes in accounting principles;

the effect of weather;

loss from fires, floods, windstorms, hurricanes, pest infestation and other natural disasters; and

other factors described under “Risk Factors” in the company’s annual report on Form 10-K or periodic reports.

The company is a large exporter and is affected by changes in economic activity in Europe and Asia, particularly Japan and China. It also is affected by changes in currency exchange

rates, particularly the relative value of the U.S. dollar to the euro and the Canadian dollar. Restrictions on international trade or tariffs imposed on imports also may affect the company.

Today’s presenters

Dan Fulton President and Chief Executive Officer

Patty Bedient Executive Vice President – Chief Financial Officer

Tom Gideon Executive Vice President – Forest Products

Larry Burrows President and Chief Executive Officer – WRECO

Kathy McAuley Vice President – Investor Relations

Lynn Michaelis Vice President – Chief Economist

Dan Fulton

President and Chief Executive Officer

Opening Remarks

Lynn Michaelis

VP – Chief Economist

Economic Overview

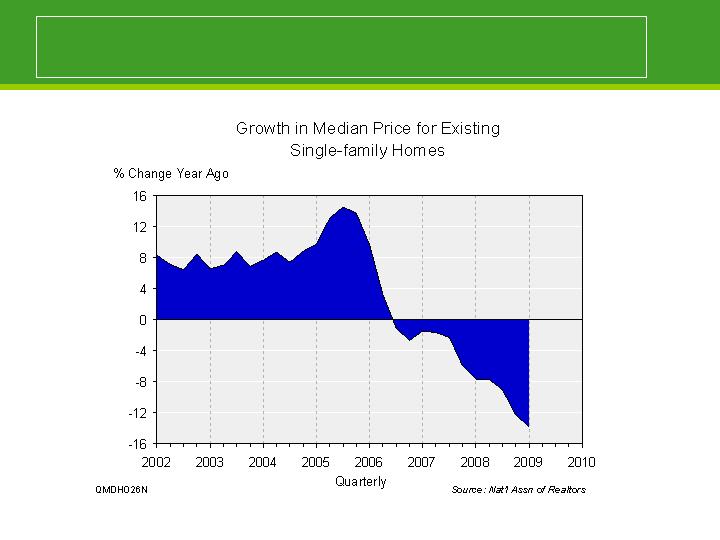

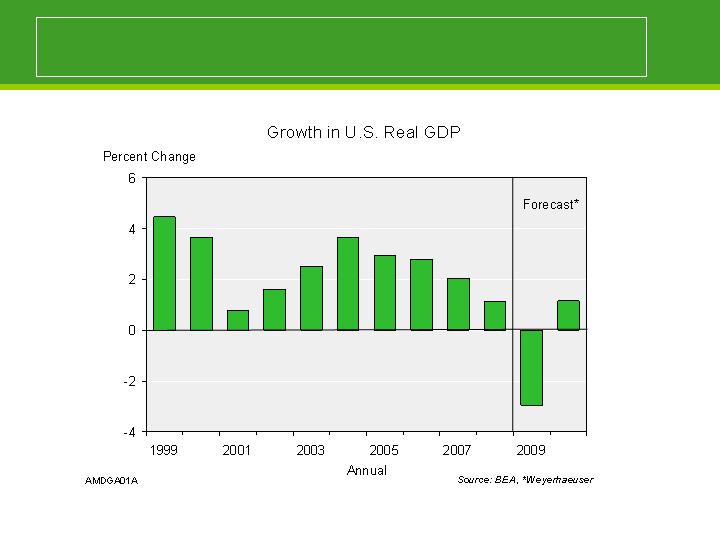

Economic setting for 2009

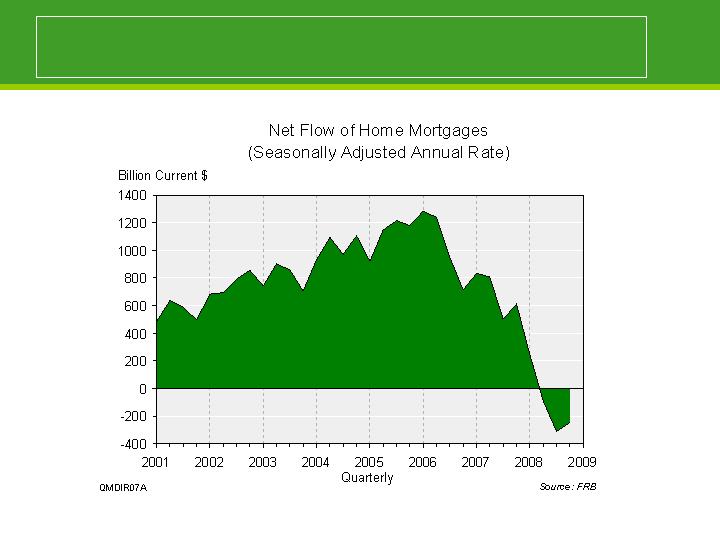

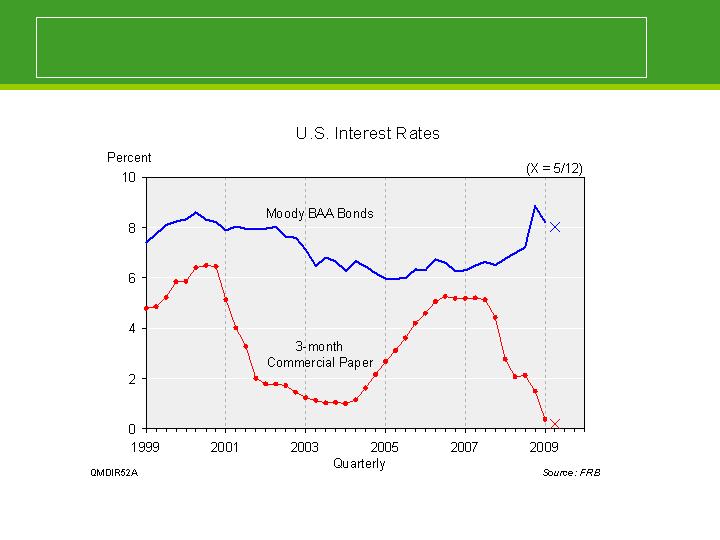

U.S. in recession since early 2008, accelerated with financial crisis

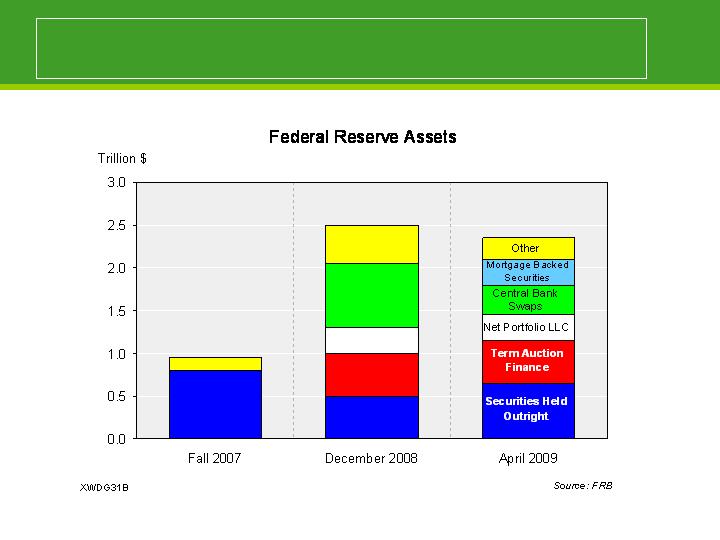

Aggressive fiscal and monetary policy are crucial to arrest the downward spiral

Decline in home prices triggered financial crisis

Dramatic shift in available credit and tougher standards

Fed taking actions to stabilize financial system

Aggressive action to stabilize financial system

Economic setting for 2009

U.S. in recession since early 2008, accelerated with financial crisis

Aggressive fiscal and monetary policy are crucial to arrest the downward spiral

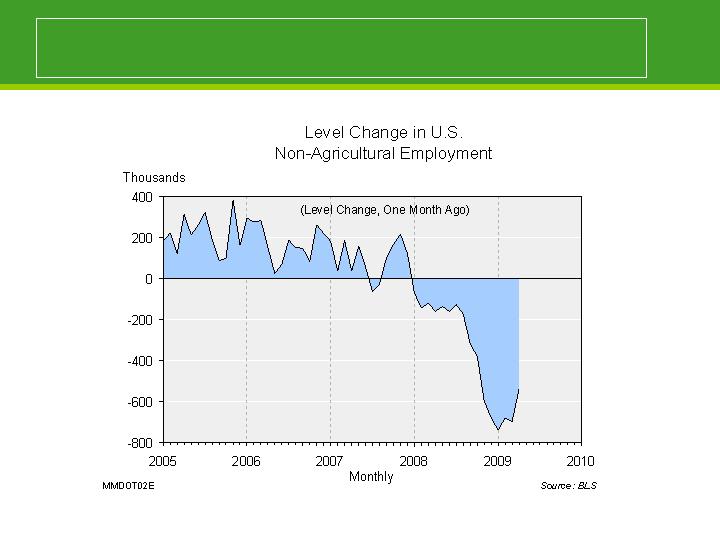

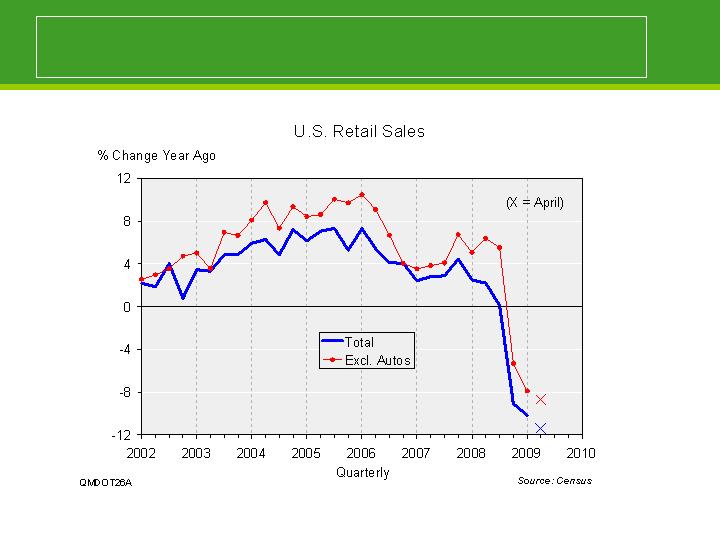

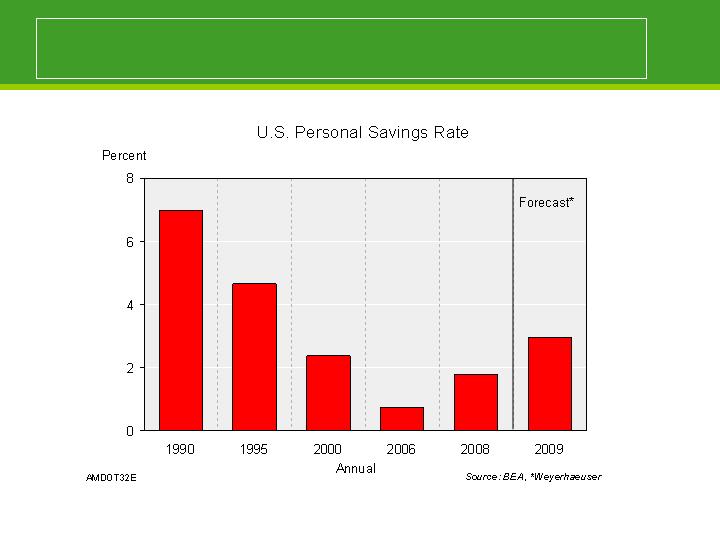

Dramatic drop in consumer spending has hit U.S. and global economies

Consumer spending uncertain given employment and wealth issues

Massive job losses

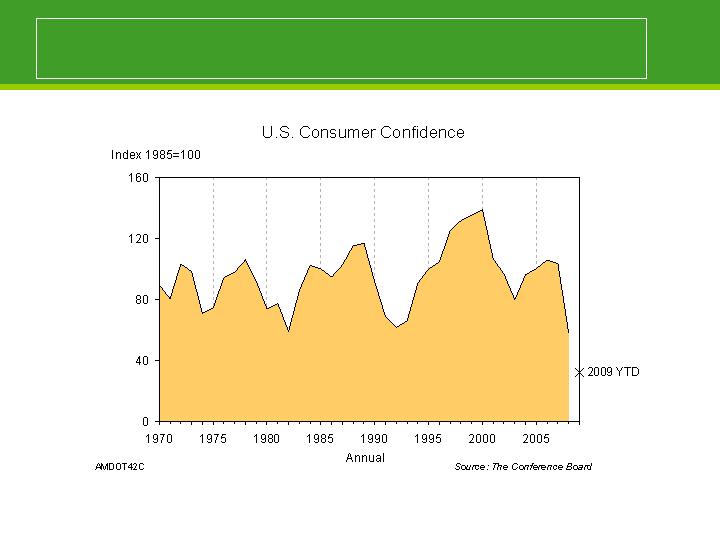

Consumer confidence near record low

Serious drop in consumer spending

Leads consumer to defer some purchases

Economic setting for 2009

U.S. in recession since early 2008, accelerated with financial crisis

Aggressive fiscal and monetary policy are crucial to arrest the downward spiral

Dramatic drop in consumer spending has hit U.S. and global economies

Traditional sources of rebound are absent:

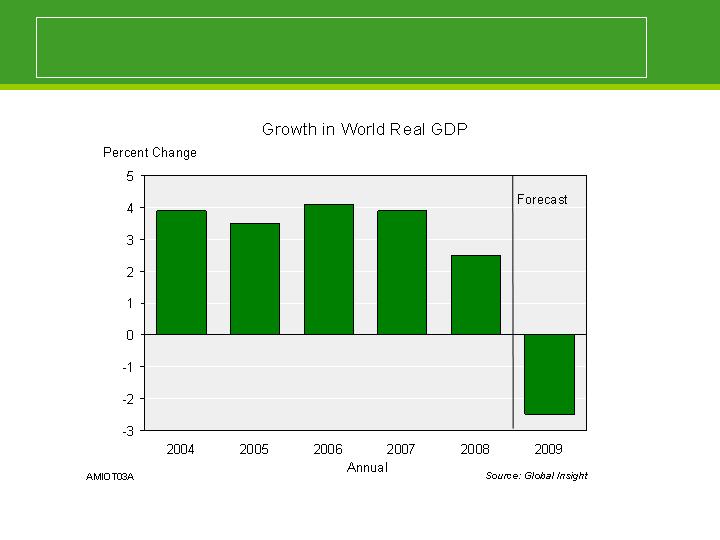

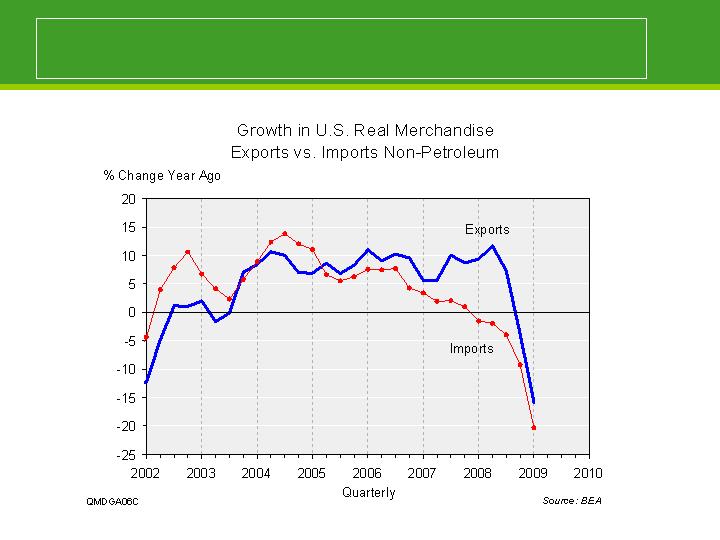

Simultaneous collapse in global growth — complicates the situation for the

U.S.

Housing not playing traditional role — not rebounding quickly

Crisis was a global event – serious recession in 2009

Net exports were helping, until late 2008

Economic setting for 2009

U.S. in recession since early 2008, accelerated with financial crisis

Aggressive fiscal and monetary policy are crucial to arrest the downward spiral

Dramatic drop in consumer spending has hit U.S. and global economies

Traditional sources of rebound are absent

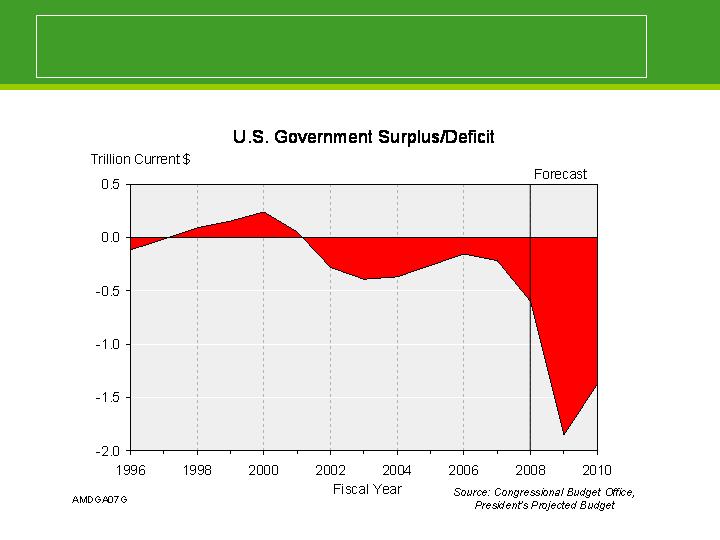

Federal government primary source for turnaround

Massive deficits to offset consumer spending decline

Signs recession will end this year

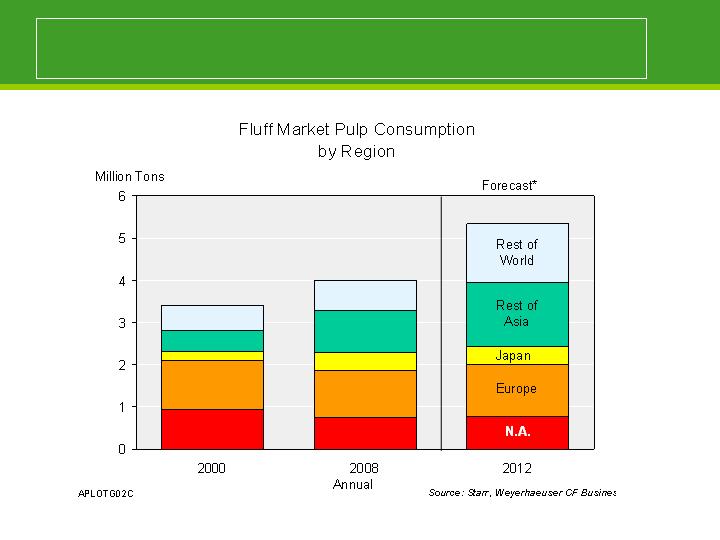

Key Messages - Cellulose Fibers

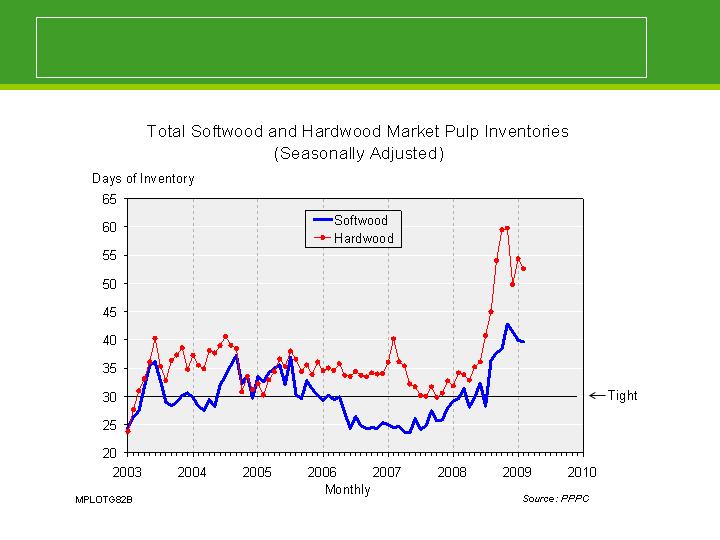

Pulp prices hit hard in late 2008

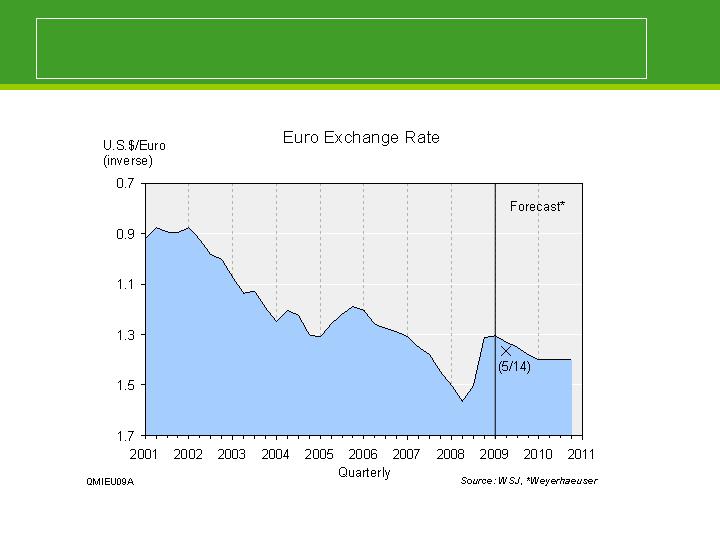

Rebound in the U.S. dollar against Euro and C$

Deterioration in pulp demand

Corresponding surge in pulp inventories

Recent weakness in dollar favorable for pulp prices

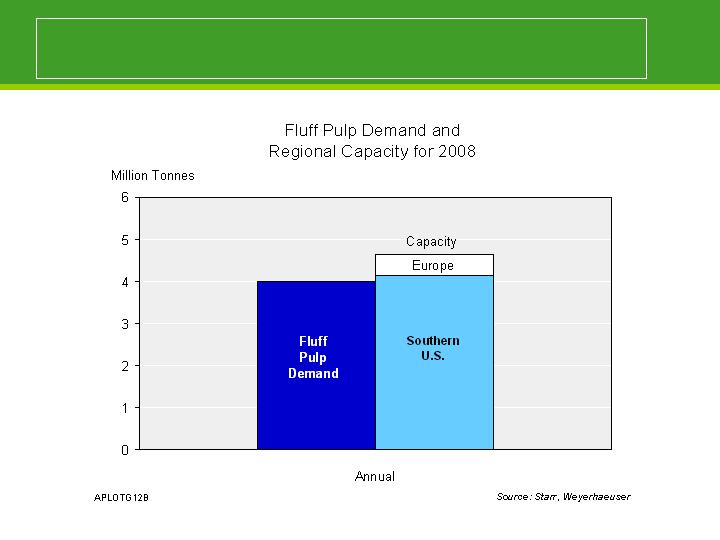

Fluff market is global and growing

U.S. South primary source of fluff

Excess inventory dampens prices

Fluff pulp prices held up better

Softwood capacity declining

Expect dollar decline to continue

Summary - Cellulose Fibers

Fluff pulp prices have held up relative to NBSK prices

Dollar decline is critical to price outlook

Tom Gideon

Executive Vice President – Forest Products

Cellulose Fibers

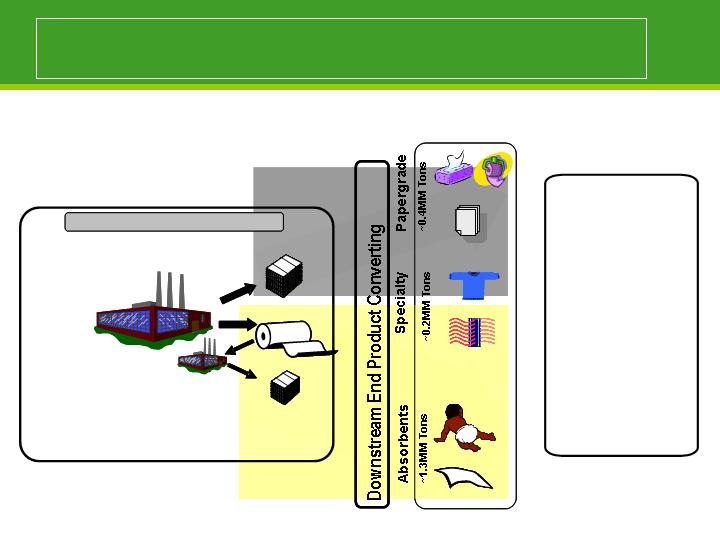

Cellulose Fibers business

End Uses

Operations

6 Manufacturing Facilities

~1.9MM Tons

5

“

Primary

”

Mills

Bales

Rolls

Bales

Grande Prairie, AB

Flint River, GA

Pt Wentworth, GA

Columbus, MS

New Bern, NC

6 Manufacturing Facilities

~1.9MM Tons

5

“

Primary

”

Mills

1

“Converting”

Plant

Columbus, MS (

“CMF”)

Bales

Rolls

Bales

Grande Prairie, AB

Flint River, GA

Pt Wentworth, GA

Columbus, MS

New Bern, NC

Towel/Tissue

Paper

Textiles

Filter Media

Diapers

Wipes

Towel/Tissue

Paper

Textiles

Filter Media

Diapers

Wipes

Towel/Tissue

Towel/Tissue

Paper

Paper

Textiles

Filter Media

Textiles

Filter Media

Diapers

Wipes

Diapers

Wipes

35% - Europe

35% - North

America

30% - Asia, South

America

End Product

Flows

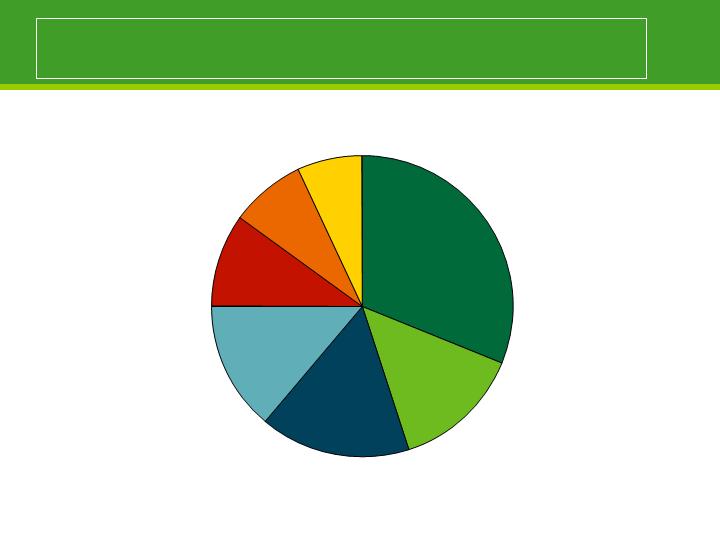

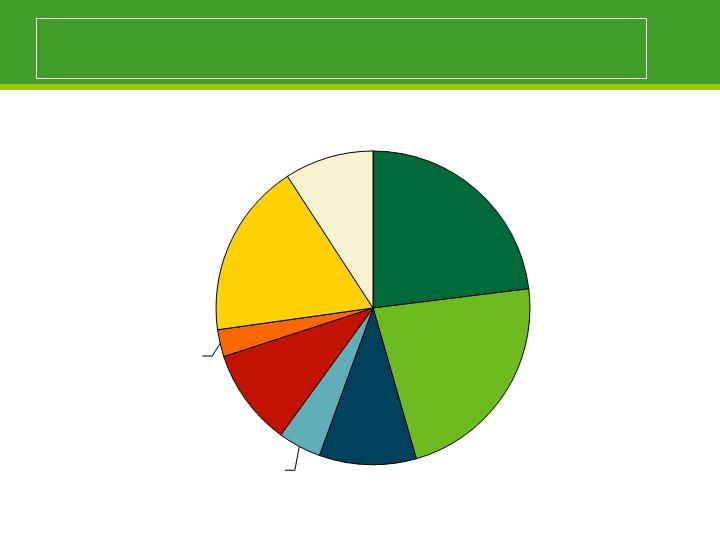

Cash cost of goods sold in 2008

Fiber

31%

Chemicals

14%

Freight 16%

Maintenance

14%

Labor Cost

10%

Energy

8%

Packaging,

Supplies & Other

7%

Addressing the short-term, positioning for the long-term

Continuing our leadership position with key customers

Aggressively reducing costs

Slowed back each mill to achieve lowest cost position

Reduced chemical and other costs

Cut all discretionary spending

Extended salary freeze to hourly workers

Lynn Michaelis

VP – Chief Economist

Economic Overview - Housing

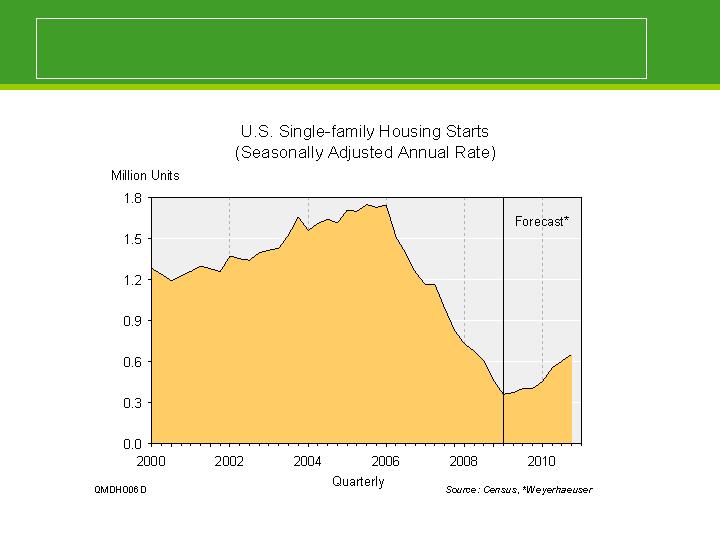

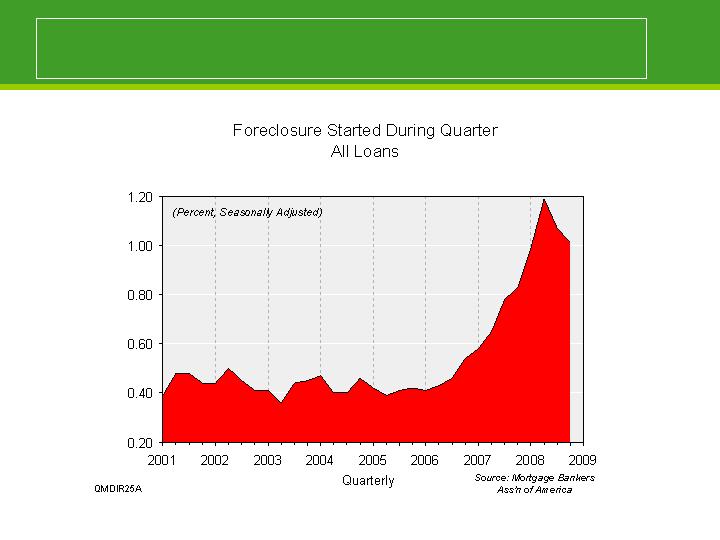

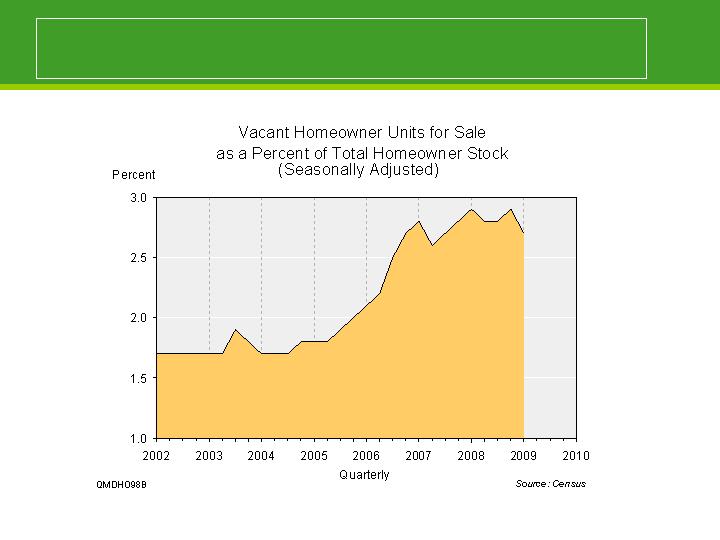

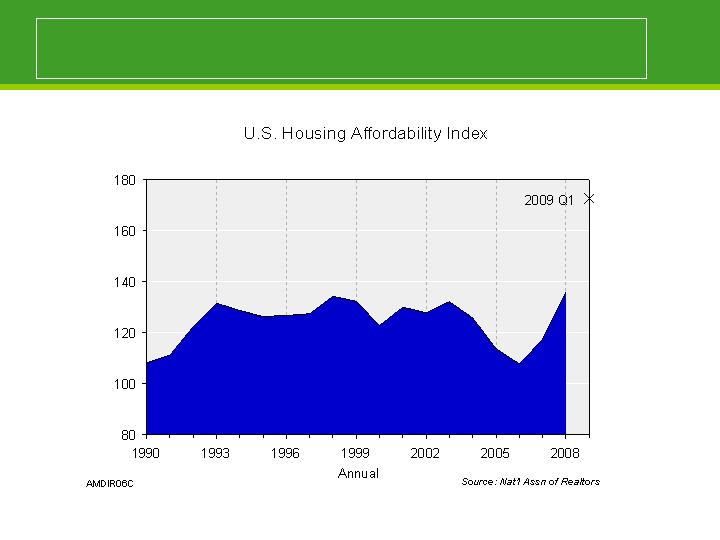

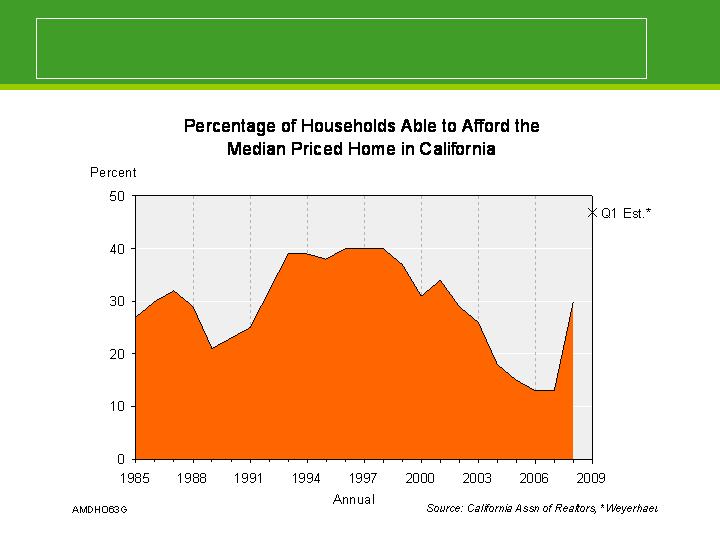

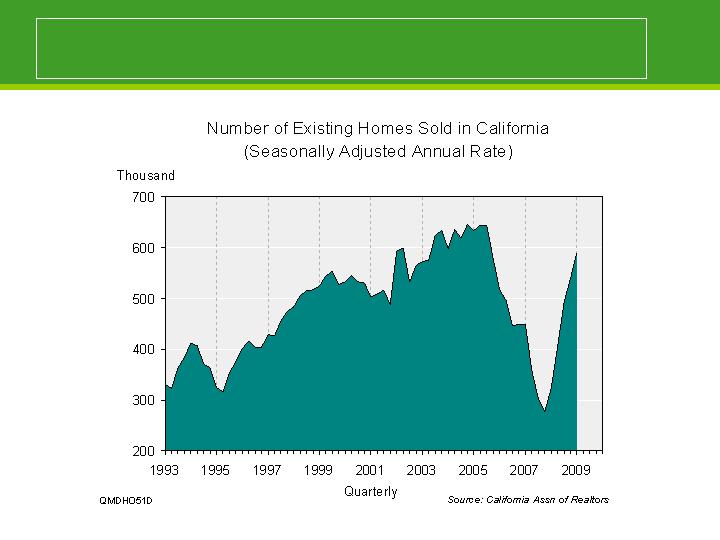

Key messages – housing industry

At bottom, expect slow rebound in 2009

High inventory, foreclosures and tougher lending standards

Increase in existing home sales is a bright spot

The bubble markets were hit hard

But low prices and improved affordability are resulting in a surge

of existing home sales

Rate of rebound depends on national policy actions and

regional employment

At bottom in 2009, but gains momentum in 2010

Foreclosure rate remains high

High vacant stock of units for sale

Affordability is now at record levels

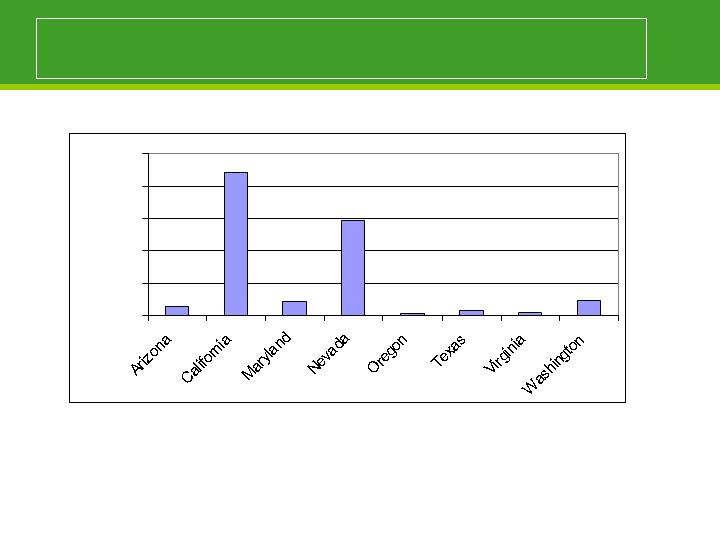

All WRECO regions are below 2002 levels

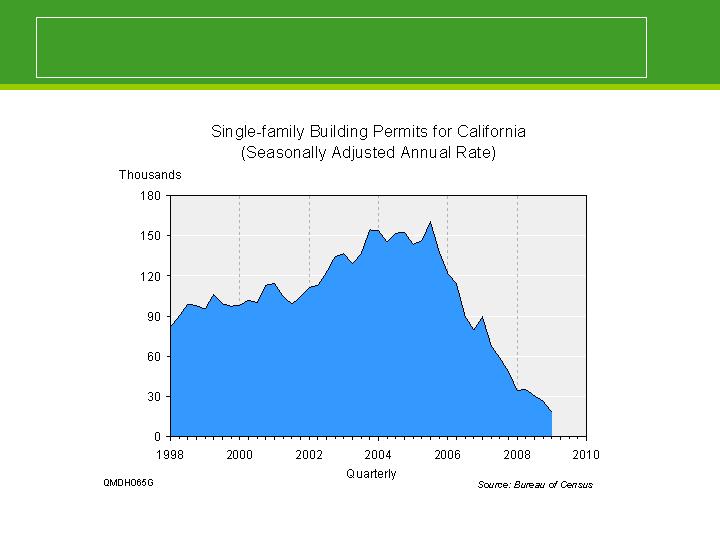

Single

-

family Building Permits

(Thousands)

2002

2005

2008

Las Vegas

25

30

6

Phoenix

40

51

11

Washington DC

30

25

9

Seattle

10

18

6

Houston

29

51

28

Source: Census

California housing seriously challenged

Housing prices down 65% from peak

Housing affordability at record levels

At current prices, houses are selling

Summary - housing

Another challenging year in 2009, but most of house price decline is behind us

Varies by region

Variety of factors helping stabilize housing and construction market in 2009

Recent home sales are encouraging

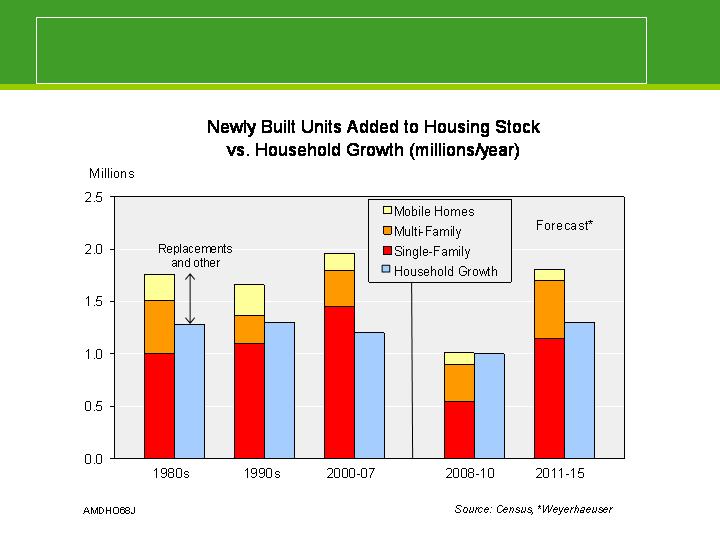

Single-family housing starts double by end of 2010, with upside potential

Larry Burrows

President and CEO — Weyerhaeuser Real Estate Company

Weyerhaeuser Real Estate Company

(WRECO)

WRECO’s competitive strengths

Geographic diversity

Local value propositions

Land entitlement and development expertise

Customer satisfaction

Located in diverse and high-growth geographies

Unique brands with distinctive value propositions

High levels of customer satisfaction

Willingness to Refer

84

88

92

96

100

2007

2008

Q1 2009

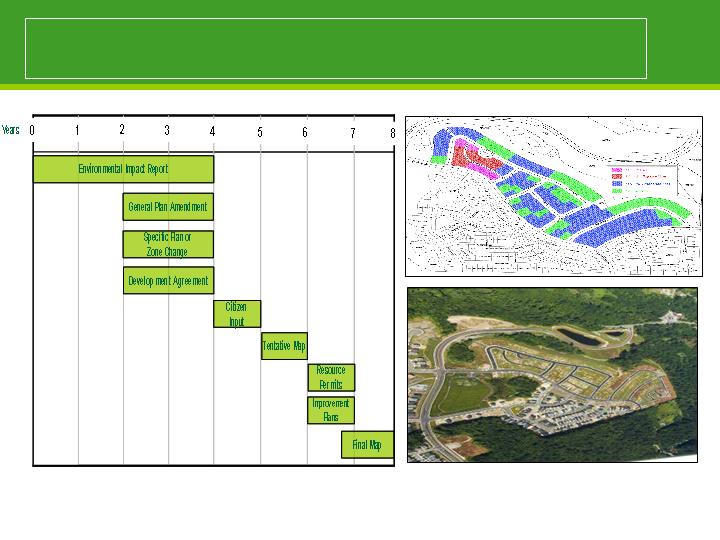

Creating value through entitling and developing land

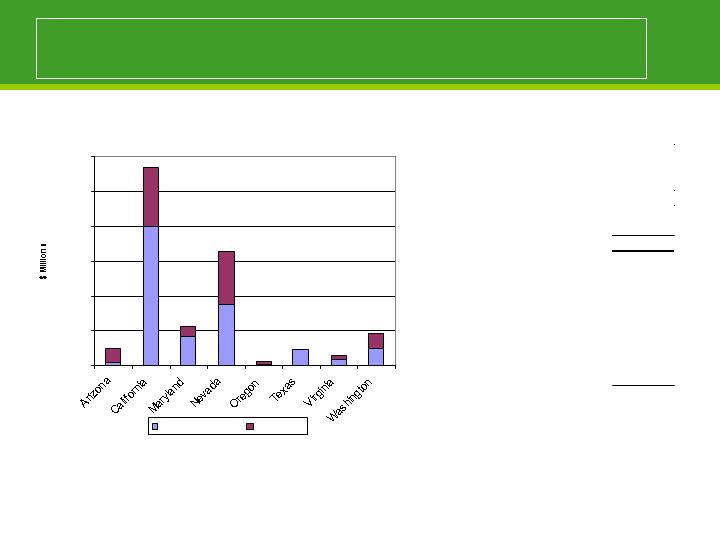

WRECO residential lot position

Total lots owned – 44,000; an additional 72,000 lots are controlled via option agreements

Number of lots owned as of 3/31/09

0

5,000

10,000

15,000

20,000

25,000

* Historic cost includes land purchase price, entitlement and development costs, taxes, and capitalized interest

WRECO residential lots – dollars invested

Consolidated Totals ($ Millions)

Historic Cost *

$2,500

Impairments to historic cost

-$900

Current book value of residential lots

$1,600

Balance Sheet Classification ($Millions)

Real estate in process of development

and for sale

$700

Land being processed for development

$1,200

Less: Completed & in process home

inventory, and commercial acreage

-$300

Current book value of residential lots

$1,600

Investment as of 3/31/09

$0

$200

$400

$600

$800

$1,000

$1,200

Current Book Value

Impairment

* Historic cost includes land purchase price , entitlement and development costs, taxes, and capitalized interest

WRECO residential lots – California by sub-markets

Totals ($ Millions)

Historic Cost*

$1,100

Impairments to historic cost

-$300

Current book value of residential lots

$800

Mennifee

Preserve / Candlewood

Tournament Hills

LA Ventura

Spring Canyon

No Cal

Las Positas

Nevada

Investment as of 3/31/09

$0

$100

$200

$300

$400

Inland Empire

LA/Ventura

Northern California

San Diego

Current Book Value

Impairment

Managing through the cycle

Adjusted staffing

40% reduction since Q1 2008

Additional 20% reduction by year end

Reduced unsold completed inventory by 30% from Q1 2008

Selectively selling non-strategic residential lots

Curtailing spending on land acquisitions and development

Repositioning product to meet market conditions

2007 – Fairbrook Plan #2

2009 – Montclaire Plan #2

Priced at $420,000-$560,000

Priced at $320,000-$410,000

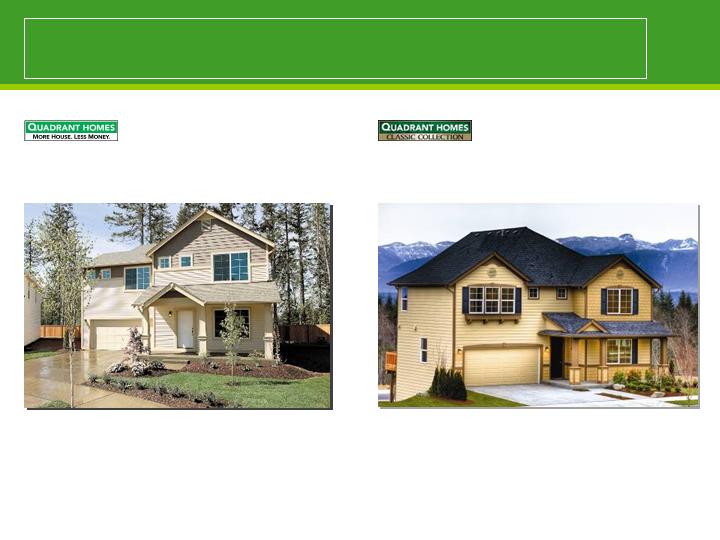

Offering a second product line to expand buyer pool

Cascade 2440

Classic Collection 3450

Priced at $360,000 to 480,000

Priced at $490,000-580,000

Repositioning product to meet emerging trends

Designed for the “ages” with enhanced green features

Improving signs in April

Average Sales per Week

20

40

60

80

100

120

140

2007

2008

2009

Cancellation Rate

5

10

15

20

25

30

2007

2008

2009

Addressing the short-term, positioning for the long-term

Long-term single-family housing fundamentals are favorable

WRECO is well-positioned in desirable markets

Market downturn is creating opportunities

Major business imperatives

Generate cash

Reduce and rebalance land position

Re-underwrite all option deals: either renegotiate or walk

Sell non-strategic assets

Lynn Michaelis

VP – Chief Economist

Economic Overview – Wood

Products

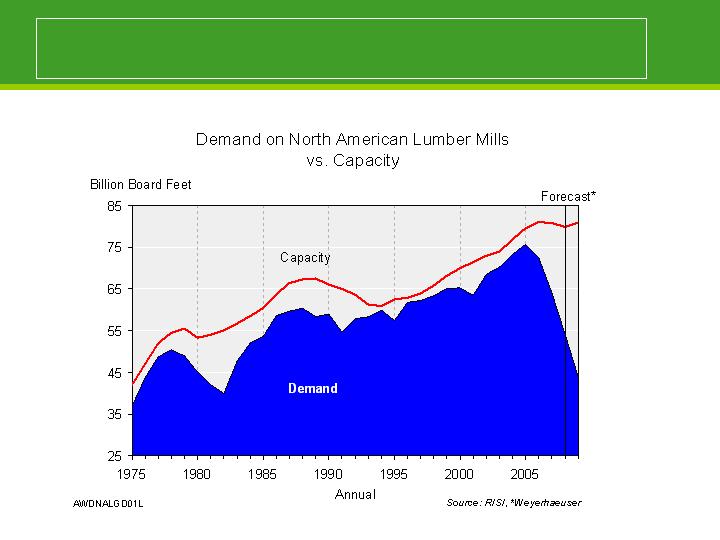

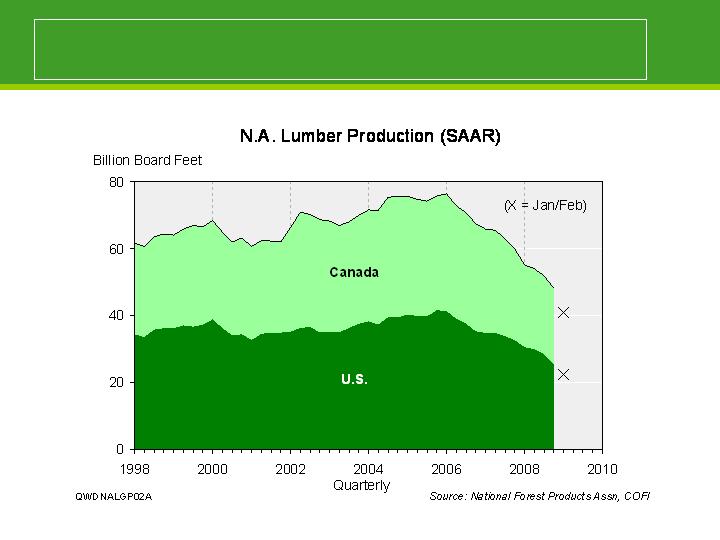

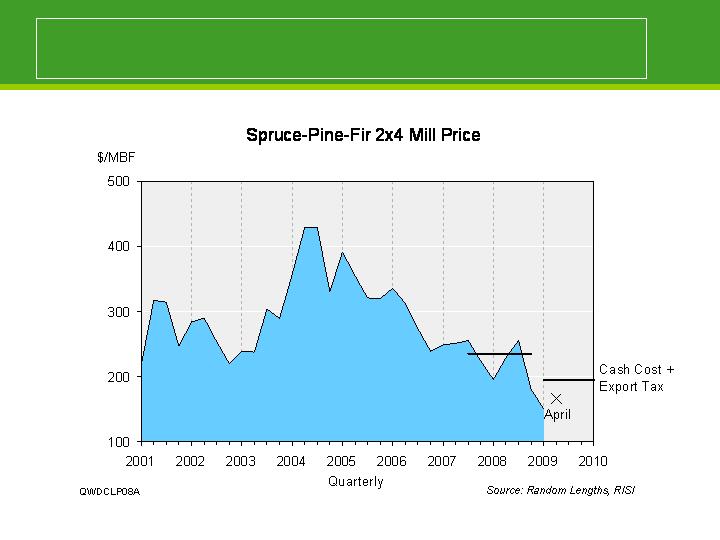

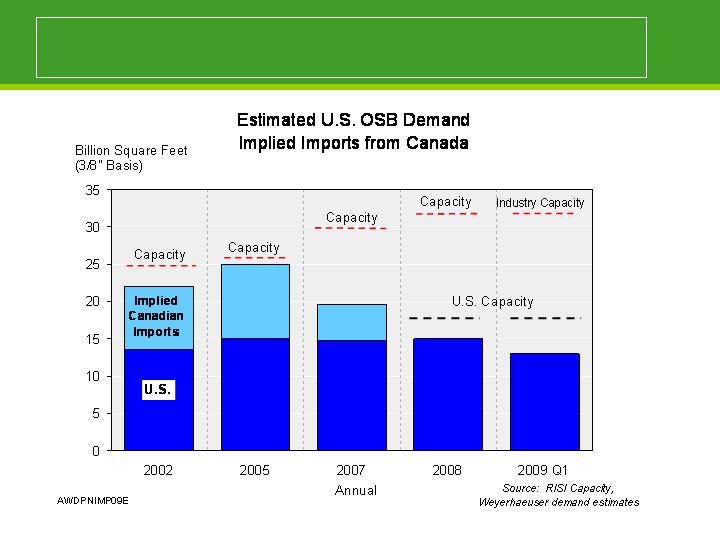

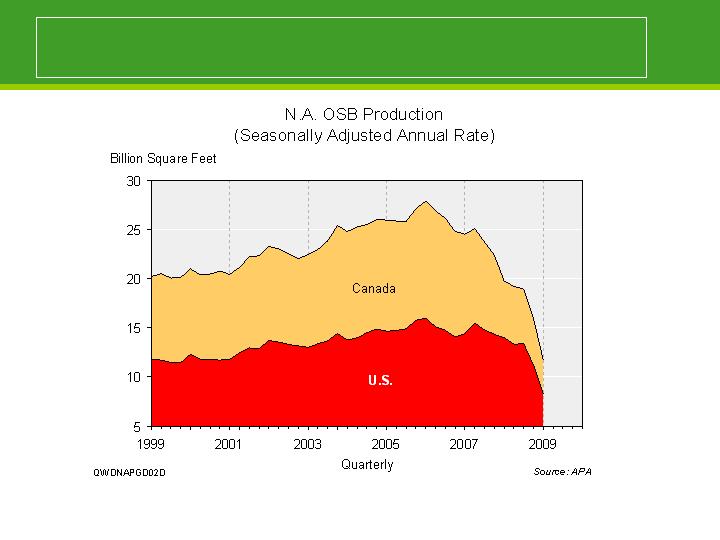

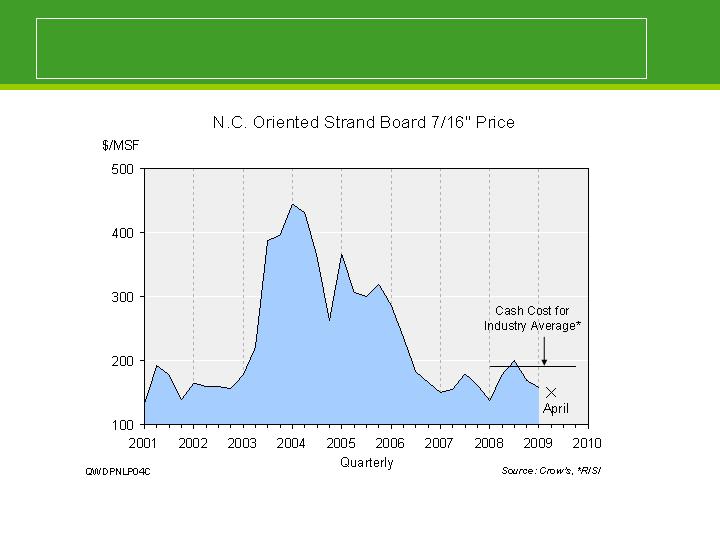

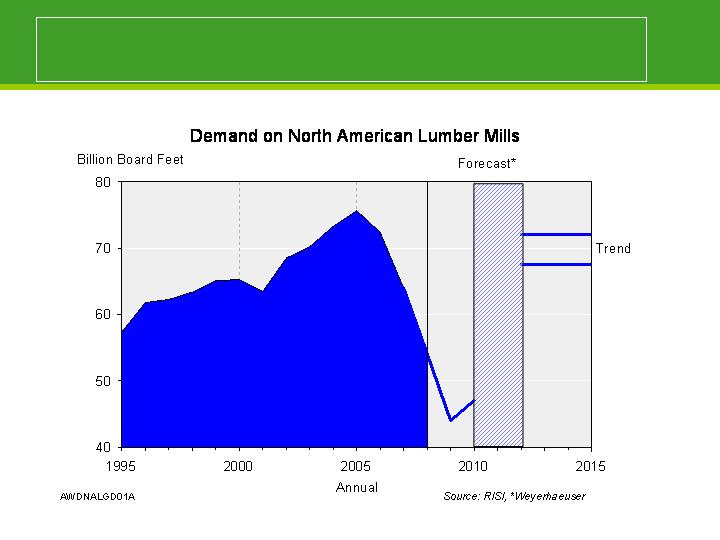

Key messages – Wood Products markets

Unprecedented demand drop has driven prices to levels below cash

operating costs

Prices should rebound to cover cash operating costs for an average mill

For lumber, need to see prices cover Canadian mill costs

Canadian dollar is a major issue for both the lumber and OSB price outlook

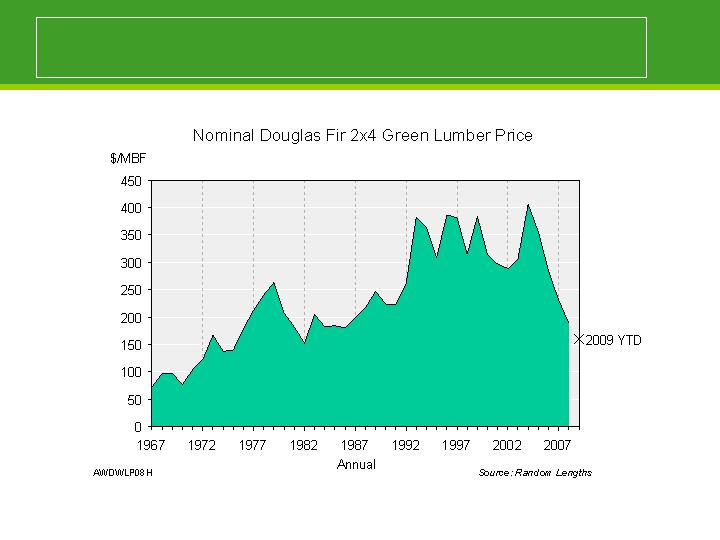

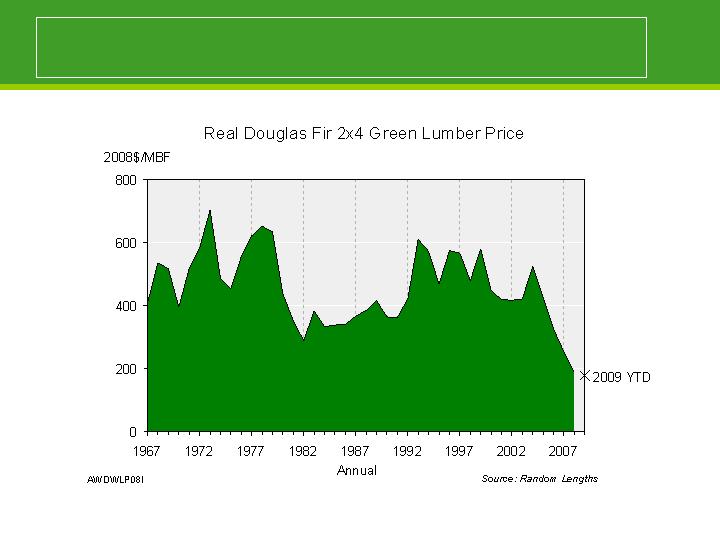

Severity compared to earlier cycles

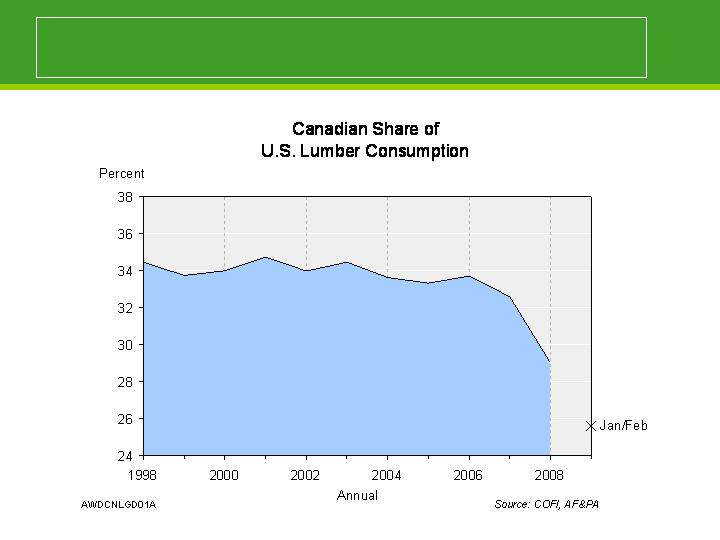

All regions curtailed output, but bigger hit for Canada

Prices fell below cash cost to force closures

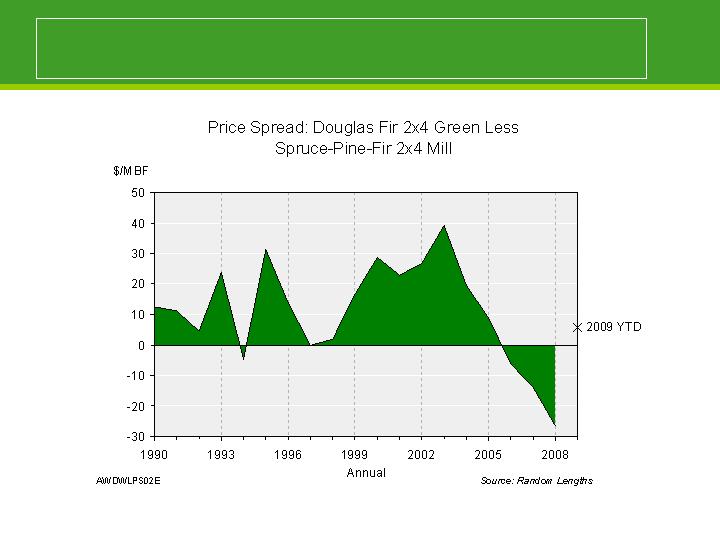

Another anomaly: Douglas Fir below Spruce

In nominal dollars, prices back to 1982 levels

But adjusted for inflation — 1935?

Canadian lumber delivered costs eventually drive U.S. lumber and log

markets

U.S. lumber production not sufficient to meet U.S. demand

Cost structure in Canada is primarily operating costs, not stumpage

Canadian exchange rate can significantly shift relative cost structure

between U.S. and Canadian mills

Canada accounts for over 25% of U.S. needs

Different cost structure in Canadian lumber industry

In Canada, labor and energy costs account for 75-85% of total lumber

costs

Much higher delivered log prices due to harvest and haul costs

Stumpage is formula driven

In U.S., labor and energy costs account for only 40-50% of labor cost

Stumpage prices reflect logistic advantage and species premiums

For average mill to breakeven, need $25/mbf price lift

Production Costs and Margins for an

Average B.C. Interior Mill

2007

Q

3

2008

April

2009

Cash Costs in C$**

253

2

27

201

Cash Costs in U.S.$**

236

2

18

165

SPF 2x4 Price*

245

256

167

Less Export Tax

33

22

Mill Net

222

145

Implied Margin for Avg. Mill

4

(20)

*

Random Lengths

**Based on RISI Survey

–

Average B.C. Mill

Expect C$ to hold or strengthen in 2009

Drop in housing revealed structural change

Reason Canadian output has collapsed

Shift has kept prices below cash operating costs

Summary - Wood Products

Another challenging year given housing starts and excess capacity

Prices need to reflect cash operating costs for average mills eventually

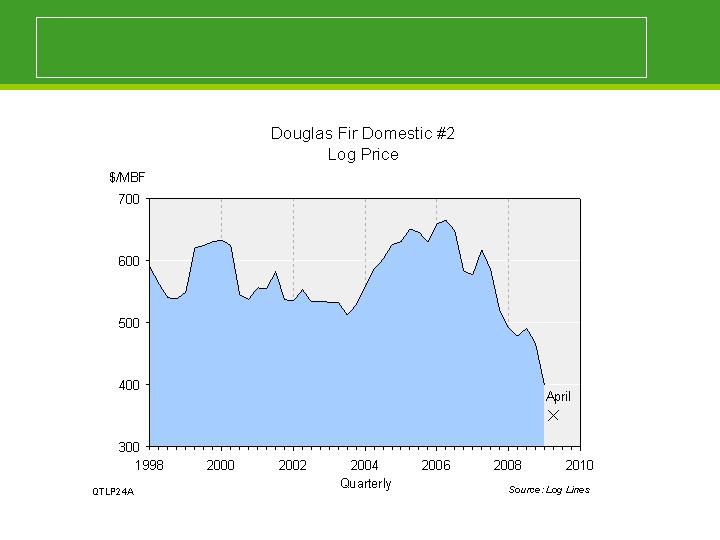

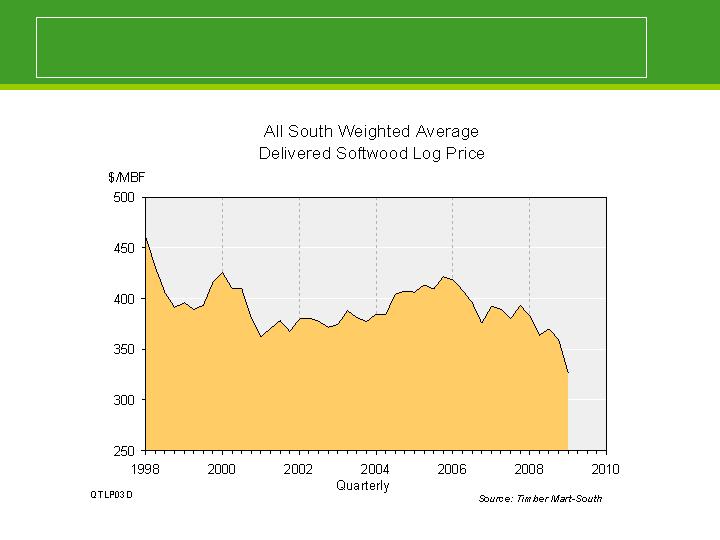

Log prices moved sharply lower in late 2008—will help U.S. sawmill cost

position in 2009

Very challenging for OSB and engineered lumber in 2009-10 given low

operating rates

Tom Gideon

Executive Vice President – Forest Products

Wood Products

Actions

Impact

Lumber

Announced closure of 4 mills

Announced shift reductions at 5 mills

Total capacity reduction of 1.2 bbf

OSB

All mills now operating at 5/2

Total capacity reduced by 2.7bsf

550 msf since Jan

Veneer

5 mills closed

Capacity Reduction

25% reduction in TJI’s

28% reduction in Microllam &

35% reduction in Veneer

Timberstrand

Permanently idled East Kentucky

Capacity reduced 39%

SGA

Headcount reduced by 200+

SG&A reduced by 13% to 15%

compared to last year

Aggressive actions this year

Cash cost of production in 2008

Raw

Materials*

Salaries /

Labor

Energy

Resins &

Additives

Other

Lumber

64%

19%

4%

0%

13%

OSB

31%

17%

8%

24%

21%

EWP - TJI

79%

10%

1%

4%

6%

* Raw materials are

Logs for lumber and OSB

LVL and OSB for TJI

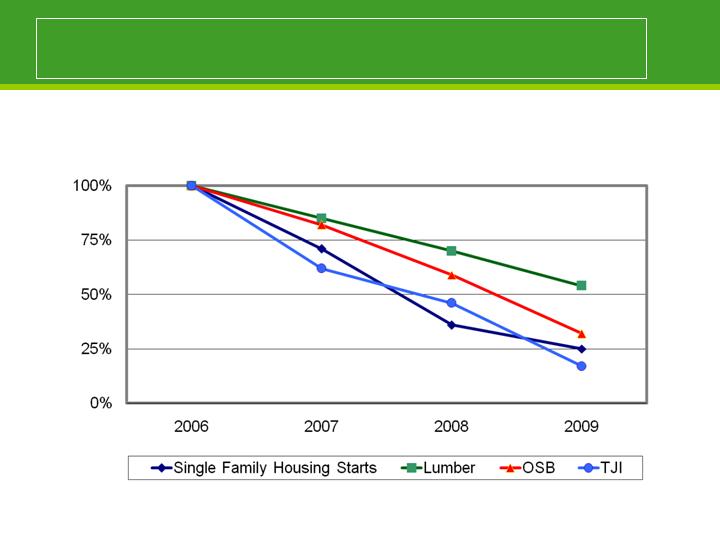

Production response to lower housing starts

Volume as a percentage of 2006 levels

Addressing the short-term, positioning for the long-term

Significant short-term challenges

Adjusting the controllable variables

Relentlessly reducing costs

Ensuring the best balance between demand and supply

Maintaining pricing discipline across all product lines

Lynn Michaelis

VP – Chief Economist

Economic Overview –

Timberlands

Key messages - Timberlands

Log prices in the West fell over 25% during the last two months

Log prices in the South are also adjusting, but not as severely

Timberland prices remain stable reflecting favorable long-term outlook

Log prices lag lumber prices

Western production now below early 1990’s

Southern log prices have held up better

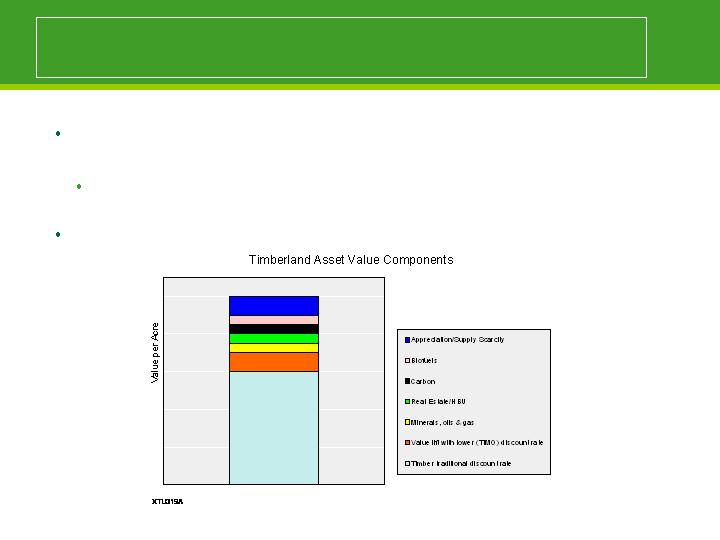

Timberland prices reflect long-term outlook

Financial owners taking longer term view

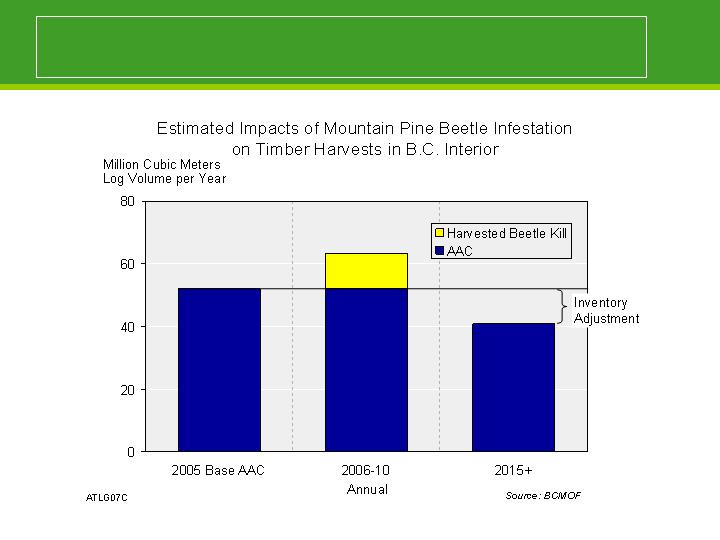

Long-term trend appreciation based on:

Historic returns and expected rebound in housing starts

Decline in Canadian harvest due to Mountain pine beetle

Additional revenue from non-traditional sources

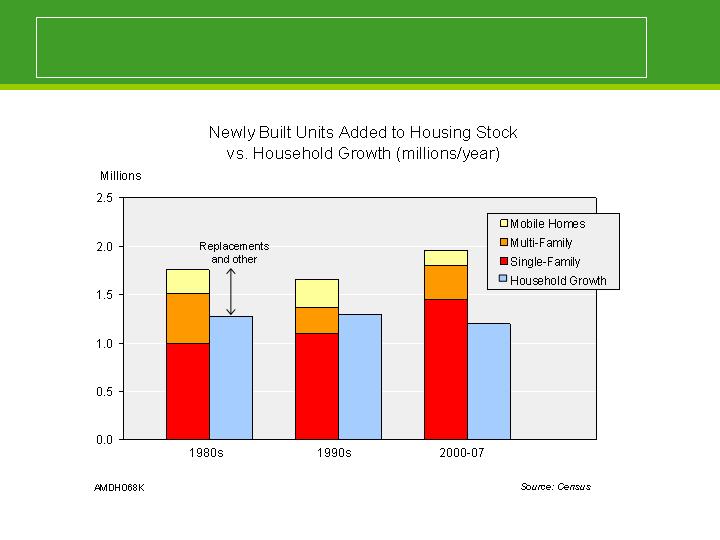

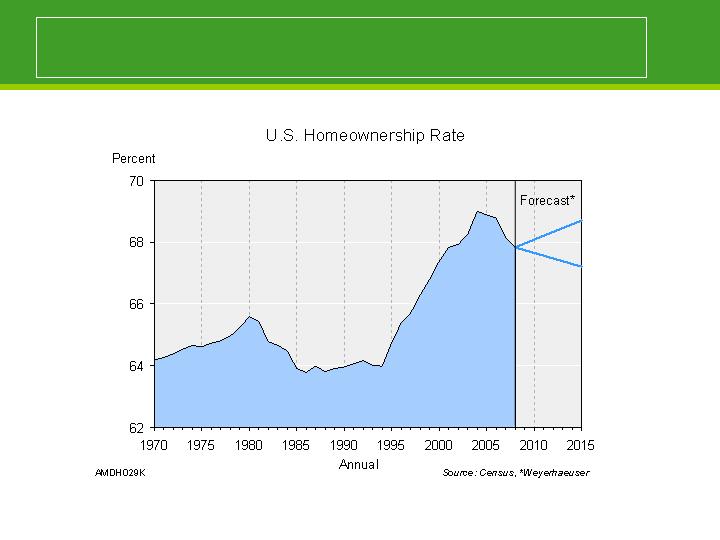

Housing demand driven by formation of households

Share of single family determined by ownership trend

Expect favorable single-family housing starts even if

ownership trends lower

Given trend demand range for housing — lumber approaches 2005 peak

Reason lumber capacity expected to decline by 2015

Trend value for U.S. timber driven by Canadian costs

U.S. needs Canadian supply to meet lumber demand

Marginal supply has price setting role

U.S. producers bid improving lumber prices back to log prices

U.S. needs Canadian lumber through the cycle

Trend price logic: step one

Production Costs for Average B.C. Interior Mills

2008

201

1

-

1

5

*

In Canadian $

/MBF

Net Wood Cost

121

18

9

Manufacturing

9

9

110

Margin

27

34

__

__

___

___

__

___

Total

Long

-

Term

Cost

190

3

35

Duties

29

34

____

__

___

_

_

___

SPF 2x4

in C$

/MBF

219

3

69

Exchange Rate (C$/US$)

1.02

1.25

__

__

__

____

_

_

__

SPF 2x4

(US$

/MBF

)

215

2

95

*Extrapolation not a forecast

Source: RISI

Trend price logic: step two

Trend Price for West Coast

Lumber and Logs

201

1

-

1

5

*

SPF 2X4

(MBF)

$

295

-

$310

Plus

historic

spread

25

Implied DF 2X4

(MBF)

$

320

-

$335

Less mfg

95

Plus residuals

45

Less margin

24

Equals Wood Cost

$246

-

$261

Implied log price

(MBF Scribner)

$59

0

-

$625

*RISI mfg costs, Random Lengths

More to timberland valuation story

Finite resource capable of providing multiple values such as land

appreciation, timber production and appreciation, and non-timber income

Potential government actions could boost those values

Timberland are part of the asset mix of many diversified portfolios

Summary - Timberlands

Log prices fell into line with lumber prices

Timberland prices have been relatively stable

Tom Gideon

Executive Vice President – Forest Products

Timberlands

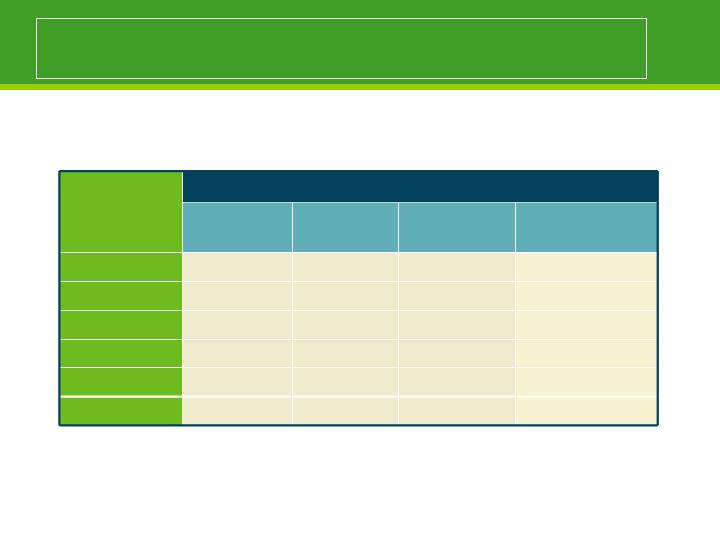

Global footprint

Thousands of Acres

Fee

Ownership

Long-term

Lease

Total Fee and

Lease

License

Arrangements

U.S. West

2,220

2,220

U.S. South

3,433

696

4,129

Canada

15,178

Uruguay

321

26

347

China

52

Total

5,974

722

6,696

15,230

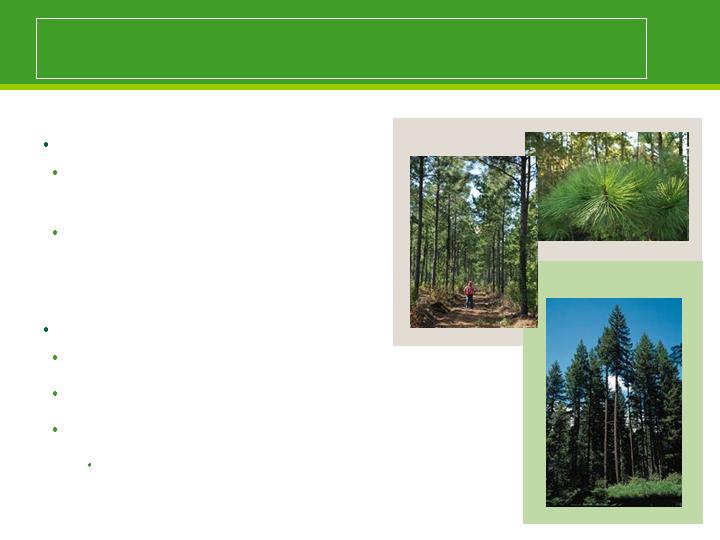

Tree species

Loblolly pine in the South

Fast early growth, resulting in younger

harvest ages (compared to Douglas fir)

Responsive to management to influence

growth and reduce risk of insect loss

Douglas fir in the West

Manageable to increase yields

Taller / older at normal harvest ages compared to pine

Products generally command higher market values

Current market conditions are unprecedented

Loblolly Pine

Douglas Fir

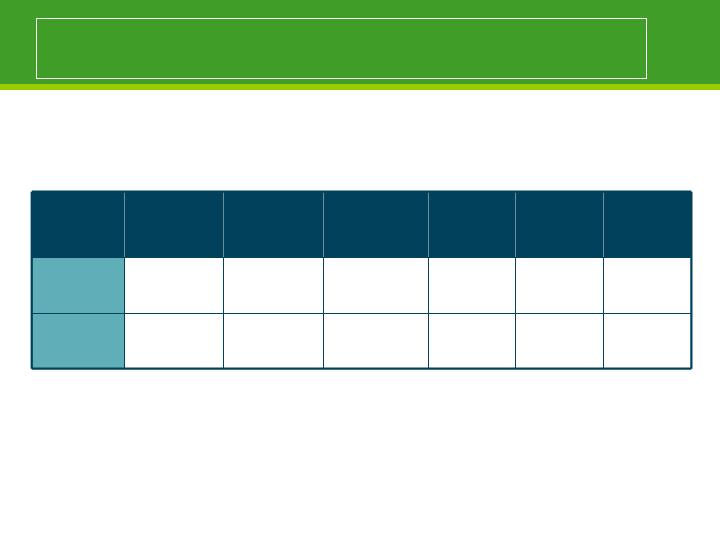

Cash costs of production for 2008

Logging

23%

Hauling &

Roads

23%

Export OSP

10%

Forestry

10%

Canadian

Operations

18%

Other

9%

Marketing/Handling

4%

International

Operations

3%

Cash costs of production in 2008

Logging

Hauling &

Roads

Marketing

& Handling

Forestry

Export

OSP

Other

U.S. West

30%

28%

8%

5%

19%

10%

U.S.

South

32%

33%

3%

20%

0%

12%

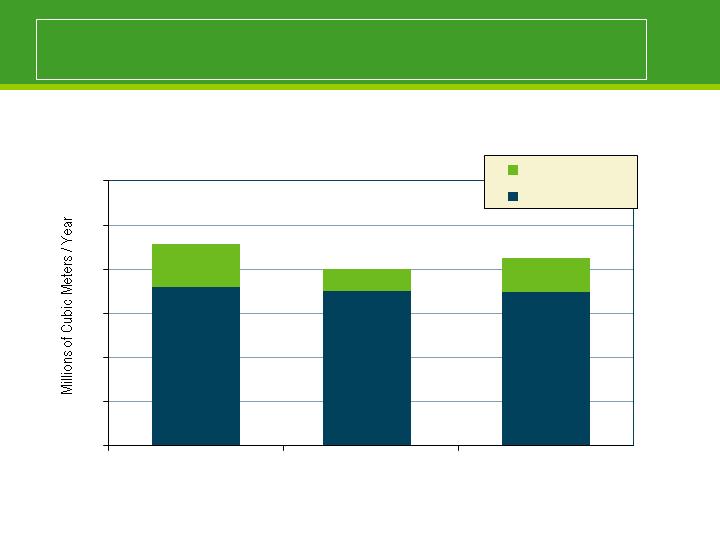

Sustainable harvest availability

Actual

Estimated Availability

U.S. Timberlands Harvest

0

5

10

15

20

25

30

2004-2008

2009-2013

2014-2018

Commercial Thin

Final Harvest

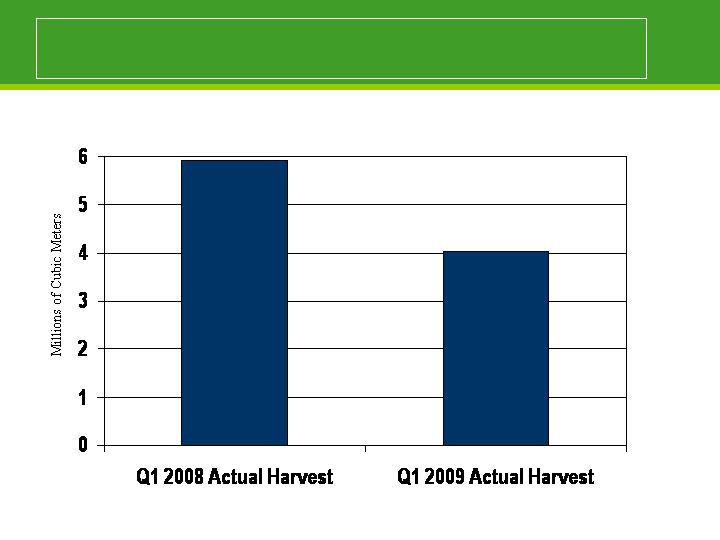

Deferring harvest in 2009

Minerals

Weyerhaeuser routinely reserves mineral rights when selling timberlands

acreage – in the U.S. as of year end 2008 our managed assets included

6.4 million surface acres

6.8 million net minerals acres

A leader in developing mineral, oil and gas revenue

Royalty payments on oil and gas production

Bonus income from oil and gas leasing and exploration activity

Royalty payments on hard minerals (rock, sand and gravel)

Geothermal lease and option revenues

Addressing the short-term, positioning for the long-term

Flexing harvest volumes to meet market needs

Capturing export market value

Continuing cost reductions

Consolidating export facilities and operating areas

Optimizing silviculture investments on a site by site basis

Continuing to develop all potential value streams

Minerals

Biomass / energy

Conservation easements

Carbon credits

Patty Bedient

Executive Vice President – Chief Financial Officer

Financial Overview

Liquidity and debt maturities

Over $1.7 billion cash and short-term investments

at March 31, 2009

Near-term debt maturities (including WRECO)

2009 $458 million

2010 43 million

2011 30 million

$2.2 billion in unused committed bank facilities

BBB- (stable) / Ba1 (stable)

Reducing cash expenditures

Variable cost reductions

$375 million SG&A target reached

Froze salaries

Eliminated 401-K match

More actions to come

Capital expenditures less than $200 million

Quarterly dividend $0.25/share

REIT update

Actions taken to increase flexibility to consider REIT conversion

Calendar year adopted

Legal reorganization

Wholly owned subsidiary of Weyerhaeuser Company holds

manufacturing and real estate assets

Conversion unlikely in 2009

Limitations on NOL carryback

Low level of timber income reduces 2009 benefit

Earnings and profit distribution

Other considerations

REIT technical tests

TRS market value less than 25% of gross REIT assets

Dividends from TRS limited to 25% of REIT qualifying income

Other income limited to 5%

Monitoring potential tax policy changes

Dan Fulton

President and Chief Executive Officer

Closing Remarks

Questions