UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

INET TECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Inet Technologies, Inc.

1500 North Greenville Avenue

Richardson, Texas 75081

April 11, 2003

Dear Stockholder:

You are cordially invited to attend the Inet Technologies, Inc. 2003 Annual Meeting of Stockholders, which will be held at Plano Centre, 2000 East Spring Creek Parkway, Plano, Texas on Monday, May 12, 2003 at 10:00 a.m. (Central Time).

Details of the business to be conducted at the meeting, which includes the election of two Class III members of our Board of Directors, ratification of our 1998 Stock Option/Stock Issuance Plan and ratification of the selection of Ernst & Young LLP as our independent auditors for 2003, are given in the attached Notice of Annual Meeting of Stockholders and Proxy Statement.

After careful consideration, our Board of Directors has approved the proposals set forth in the Proxy Statement and recommends that you vote for such proposals.

In order for us to have an efficient meeting, please complete, sign, date and promptly return the enclosed proxy in the accompanying reply envelope. If you are able to attend the meeting and wish to change your proxy vote, you may do so simply by revoking your proxy and voting in person at the meeting.

We look forward to seeing you at the meeting.

Sincerely,

Elie S. Akilian

President and Chief Executive Officer

Samuel S. Simonian

Chairman of the Board

YOUR VOTE IS IMPORTANT

In order to assure your representation at the meeting, you are requested to complete, sign, date and promptly return the enclosed proxy in the enclosed reply envelope. No postage need be affixed if mailed in the United States.

Inet Technologies, Inc.

1500 North Greenville Avenue

Richardson, Texas 75081

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 12, 2003

To the Stockholders of Inet Technologies, Inc.:

The 2003 Annual Meeting of Stockholders of Inet Technologies, Inc. will be held at Plano Centre, 2000 East Spring Creek Parkway, Plano, Texas on Monday, May 12, 2003 at 10:00 a.m. (Central Time) for the following purposes:

| | 1. | | To elect two Class III directors to serve until the 2006 Annual Meeting of Stockholders, or until their successors have been elected and qualified. |

| | 2. | | To ratify our 1998 Stock Option/Stock Issuance Plan. |

| | 3. | | To ratify the selection of Ernst & Young LLP as our independent auditors for 2003. |

| | 4. | | To act upon such other business as may properly come before the meeting or any adjournment thereof. |

Only stockholders of record at the close of business on March 31, 2003 are entitled to notice of and to vote at the meeting. A list of stockholders entitled to vote at the meeting will be available for inspection at the place of the meeting, for the duration of the meeting, and at our offices for a period of at least ten days prior to the meeting. Whether or not you plan to attend the meeting in person, please sign, date and return the enclosed proxy card in the reply envelope provided. The prompt return of your proxy card will assist us in preparing for the meeting. You may revoke your proxy in the manner described in the accompanying Proxy Statement at any time before it has been voted at the meeting. It may be possible for you to vote in person at the meeting even if you have returned a proxy. Please review the Proxy Statement for more information.

By order of our Board of Directors,

Mark H. Kleinman

Secretary

Richardson, Texas

April 11, 2003

Inet Technologies, Inc.

1500 North Greenville Avenue

Richardson, Texas 75081

PROXY STATEMENT

These proxy materials and the enclosed proxy card are being mailed in connection with the solicitation of proxies by the Board of Directors of Inet Technologies, Inc., a Delaware corporation, for our 2003 Annual Meeting of Stockholders to be held on Monday, May 12, 2003 at 10:00 a.m. (Central Time) and at any adjournment thereof. These proxy materials were first mailed to stockholders of record beginning on or about April 11, 2003.

PURPOSE OF MEETING

The specific proposals to be considered and acted upon at the meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders. The proposals are described in more detail in this Proxy Statement.

VOTING RIGHTS AND SOLICITATION

Our 2002 Annual Report has been mailed concurrently with the mailing of the Notice of Annual Meeting of Stockholders and this Proxy Statement to all stockholders entitled to notice of, and to vote at, the meeting. The 2002 Annual Report is not incorporated into this Proxy Statement and is not considered proxy solicitation material.

We have fixed March 31, 2003 as the record date for determining those stockholders who are entitled to notice of, and to vote at, the meeting. At the close of business on the record date, we had approximately 38,361,704 outstanding shares of our common stock.

The accompanying proxy card is designed to permit each holder of common stock as of the close of business on the record date to vote on the proposals to be considered at the meeting. A stockholder is permitted to vote in favor of, or to withhold authority to vote for, any or all nominees for election to our Board; to vote in favor of or against or to abstain from voting with respect to the proposal to ratify our 1998 Stock Option/Stock Issuance Plan; and to vote in favor of or against or to abstain from voting with respect to the proposal to ratify the selection of Ernst & Young LLP as our independent auditors for 2003. If a choice as to the matters coming before the meeting has been specified by a stockholder on the proxy, the shares will be voted accordingly. If no choice is specified on the returned proxy, the shares will be voted in favor of the proposals described in the Notice of Annual Meeting and in this Proxy Statement.

Any stockholder executing a proxy pursuant to this solicitation may revoke it at any time prior to its exercise by delivering written notice of such revocation to the Secretary of the meeting before the meeting or by properly executing and delivering a proxy bearing a later date. Proxies also may be revoked by any stockholder present at the meeting who elects to vote his, her or its shares in person. Attendance at the meeting does not by itself constitute the revocation of a proxy. In addition, if your shares are held of record in the name of your broker, bank or other nominee, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the meeting.

The presence, in person or by proxy, of the holders of a majority of the shares of our outstanding common stock entitled to vote is necessary to constitute a quorum at the meeting. Each of our stockholders is entitled to one vote for each share of our common stock held by that stockholder as of the record date. Cumulative voting is

1

not permitted in the election of directors. The inspector of election appointed for the meeting will tabulate the votes, separately calculating affirmative and negative votes, abstentions and broker non-votes (i.e., the submission of a proxy by a broker or nominee specifically indicating the lack of discretionary authority to vote on the matter). Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business.

As of March 31, 2003, our directors and executive officers beneficially owned an aggregate of 24,687,311 shares of our common stock, not including shares of common stock issuable upon exercise of outstanding stock options, constituting approximately 64.4% of the shares of our common stock outstanding. It is expected that our directors and executive officers will vote or direct the vote of all shares of our common stock held or owned by them, or over which they have voting control, in favor of the proposals described in this Proxy Statement. Nonetheless, the approval of the proposals is not assured. See “Principal Stockholders.”

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors is divided into three classes, which are as nearly equal in size as is practicable, designated Class I, Class II and Class III, with the term of office of one class expiring each year at our Annual Meeting of Stockholders. The term of office of the Class I directors, James R. Adams and Grant A. Dove, expires at our 2004 Annual Meeting of Stockholders; the term of office of the Class II director, George H. Heilmeier, expires at our 2005 Annual Meeting of Stockholders; and the term of office of the Class III directors, Elie S. Akilian and Samuel S. Simonian, expires at our 2003 Annual Meeting of Stockholders, or in each case upon the election and qualification of their successors or their earlier death, resignation or removal. Directors elected to replace those of a class whose terms expire at a given annual meeting shall hold office until the third succeeding annual meeting or until their respective successors have been elected and qualified or their earlier death, resignation or removal.

Nominees for Director

Elie S. Akilian and Samuel S. Simonian, each of whom presently serves as a Class III director, have each been nominated for election at the meeting to serve as a Class III director for a term expiring at our 2006 Annual Meeting of Stockholders or until his respective successor has been duly elected and qualified or his earlier death, resignation or removal. Each of the nominees has indicated his willingness to serve as a member of the Board if elected; however, if any nominee should become unavailable for election to the Board for any reason not presently known or contemplated, the proxy holders will have discretionary authority in that instance to vote for a substitute nominee who is designated by our present Board of Directors. It is not expected that any nominee will be unable or will decline to serve as a director.

Vote Required

The affirmative vote of at least a plurality of the shares of our common stock present in person or represented by proxy at the meeting and entitled to vote on the election of directors is necessary for the election of a director. As a result, the two nominees receiving the greatest number of votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors shall be elected to our Board of Directors, even if any such nominee receives the vote of less than a majority of the outstanding shares. Instructions withholding voting authority will have no effect on the determination of plurality, except to the extent that they affect the total votes received by any particular nominee.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINEES LISTED IN THIS PROXY STATEMENT, AND PROXIES EXECUTED AND RETURNED WILL BE SO VOTED UNLESS CONTRARY INSTRUCTIONS ARE INDICATED THEREON.

2

The nominees for election at the meeting as Class III directors are:

Name

| | Age

| | Position

|

Elie S. Akilian | | 46 | | President, Chief Executive Officer and Director |

Samuel S. Simonian | | 47 | | Chairman of the Board |

Mr. Akilian co-founded Inet in 1989, has served as a director since that time and has served as President and Chief Executive Officer since April 1999. He previously served as Executive Vice President responsible for sales and marketing from March 1989 to April 1999. Mr. Akilian received his B.S. in Electrical Engineering from The University of Texas at Arlington.

Mr. Simonian co-founded Inet in 1989 and has served as Chairman of the Board since that time. He previously served as President from 1989 to April 1999 and as Chief Executive Officer from March 1994 to April 1999. Mr. Simonian also currently serves as President of Epygi Technologies, Ltd. Mr. Simonian holds a B.S. in Electrical Engineering from The University of Texas at Arlington. Mr. Simonian is the nephew of the spouse of William H. Mina, our Senior Vice President, Administration and Legal Affairs.

Other Directors

Our current Class I directors, who are not standing for reelection at the meeting and whose terms will expire at our 2004 Annual Meeting of Stockholders, are as follows:

Name

| | Age

| | Position

|

James R. Adams | | 63 | | Director |

Grant A. Dove | | 74 | | Director |

Mr. Adams has served as a director of Inet since June 1999. Mr. Adams has served as a director of Texas Instruments Incorporated (semiconductors, digital signal processors and analog integrated circuits) since 1989 and served as its Chairman of the Board from 1996 to 1998. He previously served as Group President of SBC Communications, Inc. from 1992 to 1995 and as President of Southwestern Bell Telephone Company from 1988 to 1992. He also serves as a director of Storage Technology Corp. (digital data storage products). Mr. Adams holds an M.B.A. from The University of Texas at Austin and a B.S. in Math and Physics from Texas A&M University. Mr. Adams serves as Chairman of our Compensation Committee and as a member of our Audit Committee.

Mr. Dove has served as a director of Inet since June 1999. Mr. Dove has served as Managing Partner of Technology Strategies & Alliances since 1991. Prior to joining Technology Strategies & Alliances, Mr. Dove served as Chairman and Chief Executive Officer of the Microelectronics and Computer Technology Corporation. He currently serves as Director Emeritus of Cooper Cameron Corporation (petroleum and industrial equipment and services) and as a director of InterVoice, Inc. (converged voice and data software and related systems), Tipping Point Technologies, Inc. (computer network-based intrusion protection systems) and Intrusion Inc. (computer network security products). Mr. Dove holds a B.S. in Electrical Engineering from Virginia Polytechnic Institute and State University. Mr. Dove serves as Chairman of our Audit Committee and as a member of our Compensation Committee.

Our current Class II director, who is not standing for reelection at the meeting and whose term will expire at our 2005 Annual Meeting of Stockholders, is as follows:

Name

| | Age

| | Position

|

George H. Heilmeier | | 66 | | Director |

Dr. Heilmeier has served as a director of Inet since July 2001. Since November 1997, Dr. Heilmeier has served as Chairman Emeritus of Telcordia Technologies, Inc. (formerly known as Bell Communications

3

Research, or Bellcore, which provides operations support systems, network software and consulting and engineering services to the telecommunications industry). He served as Chairman and Chief Executive Officer of Bellcore from January 1997 to November 1997 and as President and Chief Executive Officer of Bellcore from 1991 through 1996. Dr. Heilmeier also serves as a director of TeleTech Holdings, Inc. (customer management software solutions) and as a trustee of the Fidelity Mutual Funds. He received his B.S. in Electrical Engineering from The University of Pennsylvania and a PhD in Electrical Engineering and Physics from Princeton University. Dr. Heilmeier serves as a member of our Audit and Compensation Committees.

Mark A. Weinzierl served as a Class II director until his resignation on January 21, 2003.

Director Compensation and Indemnification Arrangements

In 2002, each of Messrs. Adams and Dove and Dr. Heilmeier received $5,000 per quarter for services as a member of our Board of Directors and standing committees thereof. Additionally, each of Mr. Adams and Dr. Heilmeier received $20,000 for his service as a member of the ad hoc Special Approval Committee of our Board, which reviewed the January 2003 repurchase by us of shares held by Mark A. Weinzierl, a former director.

Effective January 1, 2003, each director who is not one of our executive officers (currently Messrs. Adams and Dove and Dr. Heilmeier) will receive $7,500 per quarter for services as a member of our Board of Directors, plus $2,000 for attendance at each meeting of the full Board of Directors. Each of such directors will also receive $1,000 per day in respect of any services that he is requested by the Board of Directors or our Chairman to perform in his capacity as a director of Inet, other than preparation for or attendance at any meeting of our Board of Directors, Audit Committee or Compensation Committee.

In addition, all directors are reimbursed for out-of-pocket expenses incurred in attending meetings of our Board and the committees on which they serve.

Each individual who joins the Board will receive an automatic grant of a non-qualified option to purchase 20,000 shares of our common stock under our 1998 Stock Option/Stock Issuance Plan at the time of his or her commencement of Board service, provided such individual has not otherwise previously been employed by us. In addition, at each Annual Meeting of Stockholders, each individual who is to continue to serve as a non-executive officer Board member will receive an automatic grant of a non-qualified option to purchase 10,000 shares of our common stock. Each option will have an exercise price per share equal to 100% of the fair market value per share of our common stock on the option grant date and a maximum term of ten years measured from the option grant date. Each option will be immediately exercisable for all the option shares, but any purchased shares will be subject to repurchase by us, at the exercise price paid per share, should the optionee’s service as a non-executive officer Board member cease prior to vesting in the shares. Each 20,000-share grant will vest, and our repurchase rights will lapse, in three equal annual installments over the director’s period of Board service, with the first installment to vest one year from the option grant date. Each additional 10,000-share grant will vest upon the director’s completion of one year of Board service measured from the option grant date. In 2002, each of Messrs. Adams and Dove and Dr. Heilmeier received an option to purchase 10,000 shares at an exercise price of $9.80 per share under our automatic grant program.

We maintain directors’ and officers’ liability insurance, and our Bylaws provide for mandatory indemnification of directors to the fullest extent permitted by Delaware law. We have entered into indemnification agreements with all of our directors. In addition, our Certificate of Incorporation limits the liability of our directors to us and our stockholders for breaches of the directors’ fiduciary duties to the fullest extent permitted by Delaware law.

Board Meetings and Committees

Our Board of Directors met five times during 2002 and acted two times by unanimous written consent. During 2002, each member of the Board participated in at least 75% of all Board and applicable committee

4

meetings held during the period (or such shorter period that he served as a director or committee member), except that Mr. Dove participated in 67% of all Board and applicable committee meetings held during 2002.

We have standing Compensation, Audit and Secondary Option Committees to devote attention to specific subjects and to assist the Board in the discharge of its responsibilities. The functions of those committees, their current members and the number of meetings held during 2002 are set forth below.

The Compensation Committee has the responsibility for establishing the compensation payable to our Chief Executive Officer and is responsible for establishing compensation payable to our other executive officers based on recommendations made by the Chief Executive Officer. The Compensation Committee also is responsible for the overall administration of our employee benefit plans, including our employee stock plans. The current members of the Compensation Committee are Messrs. Adams (Chairman) and Dove and Dr. Heilmeier. In 2002, the Compensation Committee met six times and acted by written consent one time.

The Audit Committee assists in the selection of our independent auditors and is responsible for designating those services to be performed by, and maintaining effective communication with, the auditors. The current members of the Audit Committee are Messrs. Dove (Chairman) and Adams and Dr. Heilmeier, each of whom is independent (as defined in Rule 4200(a)(15) of the National Association of Securities Dealers’ listing standards). In 2002, the Audit Committee met seven times.

The Secondary Option Committee has the authority, as delegated by our Compensation Committee, to approve limited grants of options from our 1998 Stock Option/Stock Issuance Plan to employees who are not Section 16 officers. Mr. Akilian is the sole member of the Secondary Option Committee. In 2002, the Secondary Option Committee acted 12 times by written consent.

We do not have a standing Nominating Committee or any other committee performing similar functions, and these matters are considered at meetings of the full Board of Directors.

PRINCIPAL STOCKHOLDERS

The following table sets forth specified information regarding the beneficial ownership of our common stock as of March 31, 2003 by (1) each person or entity who is known by us to beneficially own more than five percent of our common stock, (2) each of our directors, (3) each of our executive officers named in the Summary Compensation Table below and (4) all executive officers and directors as a group.

Name

| | Amount and Nature of Beneficial Ownership (1)

| | | Percent of Class

| |

FMR Corp. (2) | | 2,858,597 | (3) | | 7.5 | % |

Elie S. Akilian (4) | | 12,594,483 | (5) | | 32.8 | |

Samuel S. Simonian (6) | | 11,846,883 | (7) | | 30.9 | |

James R. Adams | | 55,480 | (8) | | * | |

Grant A. Dove | | 52,400 | (9) | | * | |

George H. Heilmeier | | 31,000 | (10) | | * | |

William H. Mina | | 127,450 | (11) | | * | |

Luis J. Pajares | | 207,157 | (12) | | * | |

Jeffrey A. Kupp | | 141,421 | (13) | | * | |

Pierce E. Brockman (14) | | 265,635 | (15) | | * | |

All executive officers and directors as a group (10 persons) | | 25,358,561 | (16) | | 66.1 | |

| * | | Indicates less than 1%. |

| (1) | | Beneficial ownership is calculated in accordance with the rules of the Securities and Exchange Commission, or SEC. Percentage of beneficial ownership is based on 38,361,704 shares of our common |

5

stock outstanding as of March 31, 2003. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of our common stock subject to options held by that person that are currently exercisable or will become exercisable within 60 days following March 31, 2003 are deemed outstanding. However, these shares are not deemed outstanding for the purpose of computing the percentage ownership of any other person or entity. Unless otherwise indicated in the footnotes to this table, the persons and entity named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable.

| (2) | | The address for the stockholder is 82 Devonshire Street, Boston, Massachusetts 02109. |

| (3) | | According to a Schedule 13G filed on February 13, 2003 by FMR Corp. (“FMR”), FMR and certain controlling persons of FMR have reported sole power to dispose or direct the disposition of 2,858,597 shares through FMR’s wholly-owned subsidiary, Fidelity Management & Research Company (“Fidelity”), the beneficial owner of the shares, as a result of Fidelity acting as investment advisor to various investment companies registered under the Investment Company Act of 1940. |

| (4) | | The address for the stockholder is 1500 North Greenville Avenue, Richardson, Texas 75081. |

| (5) | | Includes 185,200 shares held by the stockholder’s minor children. |

| (6) | | The address for the stockholder is 5070 Addison Circle, Addison, Texas 75001. |

| (7) | | Includes 267,900 shares held by the stockholder’s minor children. |

| (8) | | Includes 30,000 shares subject to options, 21,200 shares held by entities controlled by the stockholder and 100 shares held by the stockholder’s son, of which 100 shares the stockholder disclaims beneficial ownership. |

| (9) | | Includes 50,000 shares subject to options. |

| (10) | | Includes 30,000 shares subject to options. |

| (11) | | Includes 81,250 shares subject to options. |

| (12) | | Includes 203,750 shares subject to options. |

| (13) | | Includes 112,500 shares subject to options. |

| (14) | | Mr. Brockman resigned from his employment by Inet effective as of April 4, 2003. |

| (15) | | Includes 143,750 shares subject to options. |

| (16) | | Includes 671,250 shares subject to options. |

EXECUTIVE COMPENSATION

Executive Officers

Our current executive officers are as follows:

Name

| | Age

| | Position

|

Samuel S. Simonian | | 47 | | Chairman of the Board |

Elie S. Akilian | | 46 | | President, Chief Executive Officer and Director |

William H. Mina | | 58 | | Senior Vice President, Administration and Legal Affairs |

Luis J. Pajares | | 42 | | Senior Vice President, Sales and Marketing |

Jeffrey A. Kupp | | 40 | | Vice President and Chief Financial Officer |

Mark H. Kleinman | | 41 | | Vice President, General Counsel and Secretary |

Biographical information for Messrs. Simonian and Akilian is set forth under Proposal 1—Election of Directors.

6

Mr. Mina has served as Senior Vice President, Administration and Legal Affairs since February 2000. Prior to that time, he served as Senior Vice President of Finance and Administration from April 1999 to February 2000. He previously served as our Senior Vice President and Chief Financial Officer from February 1997 to April 1999. From 1996 until 2002 he also served as a member of our Board of Directors. Mr. Mina holds a B.A. in Business Administration from Dallas Baptist University and an M.B.A. from Southern Methodist University. Mr. Mina is married to Mr. Simonian’s aunt.

Mr. Pajares has served as Senior Vice President, Sales and Marketing since September 1999. From 1994 to September 1999, Mr. Pajares was employed by DSC/Alcatel (telecommunications equipment), where he served in various positions, including Vice President—International Business and Vice President—Wireless Networks. Mr. Pajares holds a B.A. from The University of Florida and an M.B.A. from The University of Dallas.

Mr. Kupp has served as Vice President and Chief Financial Officer since February 2000. From November 1997 to January 2000, Mr. Kupp was employed by IEX Corporation (a Tekelec Company providing telecommunications software products), as Vice President of Finance and Chief Financial Officer. Mr. Kupp holds a B.A. in Accounting and Computer Science from Asbury College and an M.B.A. from The Johnson Graduate School of Management at Cornell University. Mr. Kupp is a Certified Public Accountant.

Mr. Kleinman has served as Vice President, General Counsel and Secretary since January 2001. He served as our Vice President, Legal from June 2000 to January 2001. From May 1996 to April 2000, he served as Assistant General Counsel of Sterling Software, Inc. (computer software and services). Mr. Kleinman holds a B.A. in Government from The University of Texas at Austin and a J.D. from The University of Texas School of Law.

Employment, Change-in-Control and Indemnification Arrangements

The executive officers serve at the discretion of our Board of Directors. We presently do not have an employment agreement in effect with any of our officers named in the Summary Compensation Table below.

We have entered into indemnification agreements with all of our executive officers. We maintain directors’ and officers’ liability insurance, and our Bylaws provide for mandatory indemnification of officers to the fullest extent permitted by Delaware law.

7

Summary Compensation Table

The following table provides summary information concerning the compensation earned during each of our last three fiscal years by our current Chief Executive Officer and each of the other four most highly compensated executive officers for services rendered during 2002 in all capacities to us and our subsidiaries. These individuals are referred to as the Named Officers. No individual resigned during the last fiscal year who would otherwise have been required to be included in the table.

| | | Year

| | Annual Compensation (1)

| | Long-Term Compensation

| | All Other Compensation

| |

Name and Principal Position(s)

| | | Salary

| | Bonus

| | Restricted Stock Awards ($) (2)

| | Securities Underlying Options (#)

| |

Elie S. Akilian President, Chief Executive Officer and Director | | 2002 2001 2000 | | $ | 240,625 250,000 204,000 | | $ | 65,813 — 375,000 | | | | — — — | | $ | 192 192 192 | (4) (4) (4) |

|

William H. Mina Senior Vice President, Administration and Legal Affairs | | 2002 2001 2000 | | | 192,500 200,000 200,000 | | | 25,537 — 100,000 | | 73,200 | | 30,000 35,000 — | | | 3,995 192 13,423 | (5) (5) (5) |

|

Luis J. Pajares Senior Vice President, Sales and Marketing | | 2002 2001 2000 | | | 175,500 183,231 171,231 | | | 108,197 103,743 178,207 | | | | — 65,000 — | | | 3,659 192 13,267 | (6) (6) (6) |

|

Jeffrey A. Kupp (3) Vice President and Chief Financial Officer | | 2002 2001 2000 | | | 177,394 190,000 154,450 | | | 27,289 — 150,000 | | 146,400 | | 75,000 125,000 75,000 | | | 3,696 192 12,078 | (7) (7) (7) |

|

Pierce E. Brockman (3) Senior Vice President and Chief Technology Officer | | 2002 2001 2000 | | | 163,125 165,000 150,000 | | | 29,453 — 150,000 | | 146,400 | | 60,000 125,000 75,000 | | | 3,414 192 11,866 | (8) (8) (8) |

| (1) | | Excludes perquisites and other benefits, the aggregate of which did not exceed the lesser of $50,000 or 10% of the Named Officer’s total salary and bonus. |

| (2) | | These shares were granted on November 14, 2002 in consideration of services previously rendered to Inet at a price of $5.06 per share, which was the fair market value of the shares based upon the last sale price of our common stock as quoted on the NASDAQ Stock Market on such date. The shares are subject to vesting in three equal annual installments upon the individual’s completion of each year of service to Inet after the issuance date. Unvested shares are subject to repurchase by Inet at the original issuance price in the event that the individual ceases for any reason to remain in service to Inet. In addition, prior to such cessation of service, unvested shares will vest on an accelerated basis upon the occurrence of certain specified events constituting a change in control of Inet, unless the repurchase right is assumed by the acquiring, surviving or resulting entity. The value expressed in the table is determined by multiplying the number of shares granted by the fair market value of our common stock at December 31, 2002 ($6.10 per share based upon the last sale price of our common stock as quoted on the NASDAQ Stock Market on such date). |

| (3) | | Mr. Kupp joined Inet in February 2000. Mr. Brockman resigned from his employment by Inet effective April 4, 2003. |

| (4) | | Represents life insurance premiums paid on behalf of the officer. |

| (5) | | Consists of life insurance premiums paid on behalf of the officer as well as contributions by us to the officer’s participation in our 401(k) plan of $3,803 for 2002 and $13,231 for 2000. |

| (6) | | Consists of life insurance premiums paid on behalf of the officer as well as contributions by us to the officer’s participation in our 401(k) plan of $3,467 for 2002 and $13,076 for 2000. |

| (7) | | Consists of life insurance premiums paid on behalf of the officer as well as contributions by us to the officer’s participation in our 401(k) plan of $3,504 for 2002 and $11,918 for 2000. |

| (8) | | Consists of life insurance premiums paid on behalf of the officer as well as contributions by us to the officer’s participation in our 401(k) plan of $3,222 for 2002 and $11,674 for 2000. |

8

Option Grants in 2002

The following table provides information related to options to purchase our common stock granted to the Named Officers during 2002. No stock appreciation rights were granted during 2001.

| | | Number of Securities Underlying Options Granted

| | Individual Grants (1)

| | | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (3)

|

Name

| | | Percentage of Total Options Granted to Employees in 2002

| | | Exercise Price Per Share (2)

| | Expiration Date

| | 5%

| | 10%

|

William H. Mina | | 30,000 | | 7.7 | % | | $ | 5.06 | | November 14, 2012 | | $ | 95,466 | | $ | 241,930 |

Jeffrey A. Kupp | | 75,000 | | 19.3 | | | | 5.06 | | November 14, 2012 | | | 238,665 | | | 604,825 |

Pierce E. Brockman | | 60,000 | | 15.4 | | | | 5.06 | | November 14, 2012 | | | 190,932 | | | 483,860 |

| (1) | | Each option has a ten-year term and becomes exercisable in four equal annual installments upon the optionee’s completion of each year of service measured from the grant date. In addition, unvested options will vest on an accelerated basis upon the occurrence of certain specified events constituting a change in control of Inet, unless the option is assumed by the acquiring, surviving or resulting entity. At any time, the Compensation Committee may further provide that any such options will automatically vest in full (a) upon an acquisition of Inet, whether or not those options are assumed or replaced, (b) upon a hostile change in control of Inet or (c) in the event the optionee’s service is terminated for any reason within a designated period (not to exceed 18 months) following an acquisition in which those options are assumed or replaced or a hostile change in control. |

| (2) | | The exercise price may be paid in cash or in shares of our common stock valued at fair market value on the exercise date. Alternatively, the option may be exercised through a cashless exercise procedure pursuant to which the optionee provides irrevocable instructions to a brokerage firm to sell the purchased shares and to remit to us, out of the sale proceeds, an amount equal to the exercise price plus all applicable withholding taxes. Subject to compliance with Section 402 of the Sarbanes-Oxley Act of 2002 and other applicable laws and regulations, the Compensation Committee also may assist an optionee in the exercise of an option by authorizing a loan from us in a principal amount not to exceed the aggregate exercise price plus any tax liability incurred in connection with the exercise. |

| (3) | | The potential realizable value columns of the table above illustrate the value that might be realized upon exercise of the options immediately prior to the expiration of their terms, assuming the specified compounded rates of appreciation of the price of our common stock over the terms of the options. These amounts do not take into account provisions providing for termination of the options following termination of employment or vesting over a four year period. The use of the assumed 5% and 10% annual returns is pursuant to SEC regulations and is not intended to forecast possible future appreciation of the price of our common stock. |

Aggregated Option Exercises in 2002 and December 31, 2002 Option Values

The following table provides information concerning option holdings at December 31, 2002 by each of the Named Officers. No options were exercised by the Named Officers during 2002. No stock appreciation rights were exercised during 2002 and none were outstanding at December 31, 2002.

| | | Number of Securities

Underlying Unexercised Options at December 31, 2002 (1)

| | Value of Unexercised In-the-Money Options at December 31, 2002 (1)(2)

|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

William H. Mina | | 81,250 | | 48,750 | | $ | 123,500 | | $ | 31,200 |

Luis J. Pajares | | 191,250 | | 73,750 | | | — | | | — |

Jeffrey A. Kupp | | 68,750 | | 206,250 | | | — | | | 78,000 |

Pierce E. Brockman | | 118,750 | | 191,250 | | | 95,000 | | | 62,400 |

| (1) | | “Exercisable” refers to those options that were both exercisable and vested, while “Unexercisable” refers to those options that were unvested. |

9

| (2) | | Value is determined by subtracting the exercise price from the fair market value of our common stock at December 31, 2002 ($6.10 per share based upon the last sale price of our common stock as quoted on the NASDAQ Stock Market on such date) and multiplying by the number of shares underlying the options. |

Compensation Committee Interlocks and Insider Participation

Messrs. Adams and Dove have served as the members of our Compensation Committee since its formation in July 1999 and Dr. Heilmeier has served as a member since October 2002. None of these persons is an officer or employee, or former officer or employee, of Inet or any of our subsidiaries. No current executive officer has ever served as a member of the board of directors or compensation committee of any other entity that has or has had one or more of its executive officers serving as a member of our Board of Directors or Compensation Committee.

Report on Executive Compensation

During 2002, compensation decisions concerning our executive officers were made by the Compensation Committee of the Board of Directors, which is composed of the independent directors listed below. The following report describes the procedures employed by the Compensation Committee in formulating the compensation policy for our executive officers during 2002.

It is the duty of our Compensation Committee to recommend to our Board of Directors the compensation payable to our Chief Executive Officer and the compensation payable to our other executive officers (taking into account the recommendation of our Chief Executive Officer), and to establish the general compensation policies for such individuals.

The following objectives are evaluated and considered when making compensation decisions: (1) provide competitive annual cash compensation to attract, retain and motivate high-caliber executives; (2) in at-risk compensation, align the interests of executives with those of our stockholders through equity-based compensation and/or equity ownership; (3) communicate overall corporate objectives to executives so that all parties are working towards similar goals; and (4) deliver compensation through cost- and tax-effective programs.

General

Our overall philosophy is to reward executives for building long-term value for our stockholders. We compensate our executive officers with a combination of salary and incentives designed to focus their efforts on maximizing both our near-term and long-term financial results. In addition, our compensation structure also rewards individual performance that furthers our strategic goals and contributes to our success. Elements of our compensation structure include the following:

| | • | | Equity incentives/equity ownership |

Each executive officer’s compensation package is designed to provide an appropriately weighted mix of these elements that reflects our philosophy that a strong emphasis be placed on the variable portions of compensation. The actual value of total compensation is ultimately based on performance, and will be strongly linked to stockholder value.

Base Salary

Each executive officer’s base salary is considered for adjustment each year on the basis of (1) the Compensation Committee’s evaluation of the officer’s personal performance for the year taking into account the recommendation of the Chief Executive Officer, (2) the competitive marketplace for persons in comparable

10

positions, with the goal to provide base compensation roughly in the median range of the levels paid by peer companies, and (3) when appropriate, our performance and profitability. In many instances, the qualitative factors involve a subjective assessment by the Compensation Committee.

Annual Incentives

We maintain annual cash incentive bonus programs to reward executive officers and other key employees for attaining pre-established performance goals, with the objective to provide cash incentive compensation in the upper range of the levels paid by peer companies. The annual incentives vary significantly and in general are based on our profitability, revenue growth and total stockholder return; our financial performance relative to that of our peers; the achievement of our strategic objectives; each individual’s contribution towards our performance; and each officer’s achievement of his individual goals. Cash incentive compensation paid to our Senior Vice President, Sales and Marketing is based primarily on our sales order activity.

Equity Incentives/Equity Ownership

We believe equity-based incentives utilizing our stock incentive plans are effective means of aligning the interests of executives with those of stockholders. In general, the greater responsibility an executive officer has, the greater the equity portion of his total compensation package, although historically we have not made grants of equity-based incentives to our Chief Executive Officer. Our goal is to provide equity-based incentives in the upper range of the levels implemented by peer companies.

Compliance with the Internal Revenue Code

Section 162(m) of the Internal Revenue Code imposes a limit on tax deductions for annual compensation, other than performance-based compensation, in excess of $1,000,000 paid by a corporation to its chief executive officer and the other most highly compensated executive officers of a corporation. We have not and do not currently anticipate paying cash compensation in excess of $1,000,000 per year to any employee. Our Board of Directors and Compensation Committee will continue to assess the impact of Section 162(m) on our compensation practices and determine what further action, if any, is appropriate.

CEO Compensation

In setting compensation payable to our Chief Executive Officer, Mr. Akilian, the Compensation Committee has sought to be competitive with companies of similar size within the industry. Given that consideration, Mr. Akilian’s compensation is tied to our performance and to his personal performance. In 2002, Mr. Akilian earned a base salary of $250,000 through August 2002, after which his compensation was reduced to $225,000 as part of our cost-cutting initiatives. Mr. Akilian also earned a cash bonus of $65,813 for services rendered in 2002. This bonus was based on our financial performance under tight market conditions and Mr. Akilian’s significant contribution to that performance. In particular, our 2002 results reflected net income of $7.6 million for 2002, compared to net income of $193,000 for 2001, and cash generated from operations during the year was $34.9 million.

Summary

It is the opinion of the Compensation Committee that the executive compensation policies and plans provide the necessary total remuneration program to properly align our performance and the interests of our stockholders through the use of competitive and equitable executive compensation in a balanced and reasonable manner, in both the short and long term.

Submitted by the Compensation Committee of the Board of Directors:

James R. Adams (Chairman)

Grant A. Dove

George H. Heilmeier

11

Stock Performance Graph

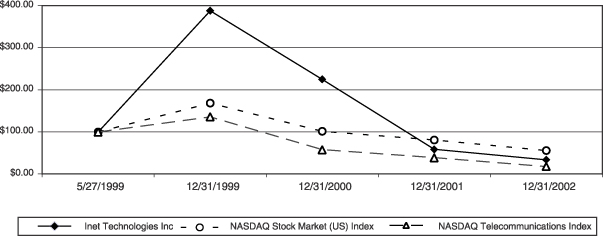

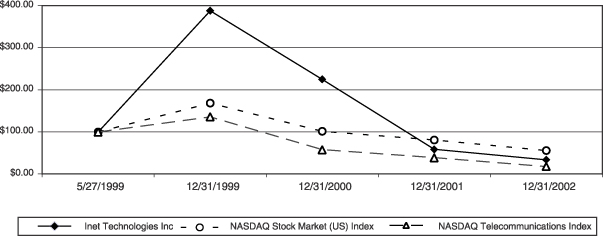

The graph below depicts our stock price as an index assuming $100 invested on May 27, 1999, the date of our initial public offering, along with the composite prices of companies listed in the NASDAQ Stock Market (U.S.) Index and the NASDAQ Telecommunications Index. The comparisons in the graph are required by regulations of the SEC and are not intended to forecast or to be indicative of the possible future performance of our common stock.

Comparison of the Cumulative Total Return* Among Inet Technologies, Inc.,

the NASDAQ Stock Market (U.S.) Index and the NASDAQ Telecommunications Index

* $100 invested 5/27/99 in stock or index—including reinvestment of dividends. Fiscal year ending December 31.

Measurement Period (Fiscal Year Covered)

| | Inet Technologies, Inc.

| | NASDAQ Stock Market (U.S.) Index

| | NASDAQ Telecommunications Index

|

5/27/1999 | | 100.00 | | 100.00 | | 100.00 |

12/31/1999 | | 388.19 | | 168.58 | | 136.07 |

12/31/2000 | | 225.00 | | 101.72 | | 57.99 |

12/31/2001 | | 58.72 | | 80.70 | | 38.82 |

12/31/2002 | | 33.89 | | 55.79 | | 17.88 |

The preceding Report on Executive Compensation, the Stock Performance Graph and the Report of the Audit Committee that follows and references in this Proxy Statement to the independence of the Audit Committee members shall not be deemed incorporated by reference into any of our previous filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 which might incorporate filings made by us under those Acts, nor will such reports, graph or other information be incorporated by reference into any future filings made by us under those Acts, except to the extent that we specifically incorporate this information by reference.

12

Certain Transactions with Management

Epygi Technologies, Ltd., an entity controlled by Mr. Simonian, our Chairman of the Board, performs development services for us pursuant to a Consulting Agreement for which it is paid a monthly fee per full-time programmer plus reimbursement of reasonable business expenses. Since the beginning of 2002 through March 31, 2003, we have made payments totaling approximately $1.1 million to Epygi for providing these services to us.

On January 21, 2003, we repurchased in a privately-negotiated transaction 8,969,984 restricted shares of our common stock from Mark A. Weinzierl, a member of our Board of Directors until that date, for an aggregate cash purchase price of approximately $35.4 million.

PROPOSAL 2

RATIFICATION OF 1998 STOCK OPTION/STOCK ISSUANCE PLAN

Our stockholders are being asked to ratify our 1998 Stock Option/Stock Issuance Plan (the “1998 Plan”) for purposes of Treasury Regulation Sections 1.162-27(f)(1), (2) and (3). The 1998 Plan was initially adopted by our Board of Directors and approved by our stockholders on July 23, 1998, which was prior to our initial public offering of common stock in 1999. Despite the pre-initial public offering stockholder approval, our Board of Directors believes that stockholder ratification of the 1998 Plan is necessary to avoid application of the deductibility limits imposed by Internal Revenue Code (“Code”) Section 162(m) for compensation that may be earned by our executive officers with respect to stock options and stock appreciation rights awarded under the 1998 Plan subsequent to the meeting.

Treasury Regulation Sections 1.162-27(f)(1) and (2) generally provide that, in the case of a corporation that effects an initial public offering of its securities, the $1 million limitation on tax deductibility of certain compensation paid to the corporation’s chief executive officer or any of the corporation’s four highest compensated officers (other than the chief executive officer), as of the end of the corporation’s taxable year (all such persons being the “Covered Individuals”), mandated by Code Section 162(m) does not apply to any remuneration (a) paid pursuant to a plan during the period prior to the initial public offering, or (b) paid subsequent to the initial public offering and until the earliest to occur of:

| | • | | the expiration of the plan; |

| | • | | the material modification of the plan; |

| | • | | the exhaustion of all shares reserved under the plan before the initial public offering; or |

| | • | | the annual stockholders’ meeting that occurs after the close of the third calendar year following the calendar year in which the initial public offering occurred. |

Treasury Regulation Section 1.162-27(f)(3) generally provides that compensation received pursuant to the exercise of a stock option or a stock appreciation right, or substantial vesting of restricted property, granted or awarded under a plan described in the immediately preceding sentence will not be subject to the $1 million limitation on deductibility if the grant occurs before the earliest of the events listed in the immediately preceding sentence.

The 1998 Plan expires in July 2008, there has been no material modification of the 1998 Plan and the share reserve under the 1998 Plan prior to our initial public offering has not been exhausted. Accordingly, if our stockholders do not ratify the 1998 Plan at the meeting, stock option grants and stock appreciation rights awarded under the 1998 Plan after the meeting that otherwise meet the requirements for exemption under Code Section 162(m) of compensation earned upon exercise of the option or right would be subject to the deductibility limits imposed by Code Section 162(m) on compensation paid to our Covered Individuals.

13

Our Board of Directors believes that avoiding the application of the Code Section 162(m) deductibility limits will allow us to continue to utilize equity incentives to attract and retain the services of key individuals essential to our long-term growth and financial success and to continue to ensure that any compensation deemed paid by us in connection with disqualifying dispositions of incentive stock option shares or the exercise of non-statutory options or stock appreciation rights (in each case granted after the meeting and otherwise in compliance with the requirements of Code Section 162(m)) will qualify as performance-based compensation for purposes of Code Section 162(m) and will not have to be taken into account for purposes of the $1 million limitation per Covered Individual on the deductibility of compensation paid to our executive officers. We rely significantly on equity incentives (such as stock option grants) to attract and retain key employees and believe that such equity incentives are necessary for us to remain competitive in the marketplace for executive talent and other key employees.

The following is a summary of the principal features of the 1998 Plan. However, this summary does not set forth a complete description of all provisions of the 1998 Plan. Any stockholder who wishes to obtain a copy of the actual plan document may do so upon written request to us at:

Inet Technologies, Inc.

1500 N. Greenville Ave.

Richardson, Texas 75081

Tel.: (469) 330-4000

Attention: Corporate Secretary

Additionally, we previously filed on July 24, 1998 a copy of the actual plan document as Exhibit 10.3 to our Registration Statement on Form S-1 (Reg. No. 333-59753), which can be viewed at the Internet site maintained by the Securities and Exchange Commission. The address of that site ishttp://www.sec.gov.

Equity Incentive Programs

The 1998 Plan consists of three separate equity incentive programs: (a) the Discretionary Option Grant Program, (b) the Stock Issuance Program and (c) the Automatic Option Grant Program for non-employee Board members. The principal features of each program are described below. The Compensation Committee of the Board of Directors will administer the Discretionary Option Grant and Stock Issuance Programs. The Board of Directors may at any time appoint a secondary committee of one or more Board members to have separate but concurrent authority with the Compensation Committee to make option grants under the Discretionary Option Grant Program and issue stock under the Stock Issuance Program to individuals other than our executive officers and non-employee Board members. All grants under the Automatic Option Grant Program will be made in strict compliance with the express provisions of such program. Neither the Compensation Committee nor any secondary committee will exercise any administrative discretion under the Automatic Option Grant Program.

The term Plan Administrator, as used in this summary, will mean the Compensation Committee and any secondary committee, to the extent that each such entity is acting within the scope of its administrative jurisdiction under the 1998 Plan.

Share Reserve

An aggregate of 8,605,468 shares of our common stock have been authorized for issuance over the term of the 1998 Plan, including pursuant to the exercise of options that were outstanding under a predecessor plan at the time that the 1998 Plan was adopted. In addition, on the first trading day of each calendar year during the term of the 1998 Plan, the number of shares of common stock available for issuance under the 1998 Plan will automatically increase by an amount equal to one percent of the total number of shares of our common stock outstanding on the last trading day of the immediately preceding calendar year;provided, that in no event will any such annual increase exceed 500,000 shares of common stock.

14

As of March 31, 2003, 3,798,573 shares of common stock authorized under the 1998 Plan were subject to outstanding options, 1,790,050 shares of common stock authorized under the 1998 Plan had been issued, and 3,016,845 shares of common stock remained available for future awards.

No participant in the 1998 Plan may receive option grants, separately exercisable stock appreciation rights or direct stock issuances for more than 1,000,000 shares of common stock in the aggregate per calendar year.

The shares of common stock issuable under the 1998 Plan may be drawn from shares of our authorized but unissued shares of common stock or from shares of common stock reacquired by us, including shares repurchased on the open market.

In the event any change is made to the outstanding shares of common stock by reason of any recapitalization, stock dividend, stock split, combination of shares, exchange of shares or other change in corporate structure effected without our receipt of consideration, appropriate adjustments will be made to: (a) the maximum number and/or class of securities issuable under the 1998 Plan, (b) the maximum number and/or class of securities by which the share reserve may increase annually under the automatic share increase reserve provisions, (c) the number and/or class of securities for which any one person may be granted options or direct stock issuances per calendar year, (d) the number and/or class of securities for which automatic option grants are to be subsequently granted to eligible directors and (e) the number and/or class of securities and the exercise price per share in effect under each outstanding option (including any options incorporated from the predecessor 1995 Employee Stock Option Plan, which was incorporated into the 1998 Plan).

Eligibility

Officers and employees, non-employee Board members and independent consultants in the service of us or our parent and subsidiaries (whether now existing or subsequently established) are eligible to participate in the Discretionary Option Grant and Stock Issuance Programs. Participation in the Automatic Option Grant Program is limited to non-employee members of our Board of Directors.

As of March 31, 2003, seven executive officers, three non-employee Board members and approximately 465 other employees and consultants were eligible to participate in the Discretionary Option Grant and Stock Issuance Programs and the three non-employee Board members were also eligible to participate in the Automatic Option Grant Program.

Valuation

The fair market value per share of common stock on any relevant date under the 1998 Plan is deemed to be equal to the closing sales price per share on that date as quoted on the NASDAQ Stock Market. On March 31, 2003, the fair market value per share determined on such basis was $5.90.

Discretionary Option Grant Program

The Plan Administrator has complete discretion under the Discretionary Option Grant Program to determine which eligible individuals are to receive option grants, the time or times when those grants are to be made, the number of shares subject to each such grant, the status of any granted option as either an incentive stock option or a non-statutory option under the federal tax laws, the vesting schedule (if any) to be in effect for the option grant and the maximum term for which any granted option is to remain outstanding.

Each granted option will have an exercise price per share determined by the Plan Administrator and may be less than, equal to or greater than the fair market value of the shares on the grant date. No granted option will have a term in excess of ten years, and the option will generally become exercisable in one or more installments

15

over a specified period of service measured from the grant date. However, one or more options may be structured so that they will be immediately exercisable for any or all of the option shares. The shares acquired under immediately exercisable options will be subject to repurchase by us, at the exercise price paid per share, if the optionee ceases service with us prior to vesting in those shares.

Upon cessation of service, the optionee will have a limited period of time in which to exercise any outstanding option to the extent exercisable for vested shares. The Plan Administrator will have complete discretion to extend the period following the optionee’s cessation of service during which his or her outstanding options may be exercised and/or to accelerate the exercisability or vesting of such options in whole or in part. Such discretion may be exercised at any time while the options remain outstanding, whether before or after the optionee’s actual cessation of service.

The Plan Administrator is authorized to issue tandem stock appreciation rights under the Discretionary Option Grant Program, which provide the holders with the right to surrender their options for an appreciation distribution from us equal in amount to the excess of (a) the fair market value of the vested shares of common stock subject to the surrendered option over (b) the aggregate exercise price payable for such shares. Such appreciation distribution may, at the discretion of the Plan Administrator, be made in cash or in shares of common stock.

The Plan Administrator also has the authority to effect the cancellation of outstanding options under the Discretionary Option Grant Program (and outstanding options incorporated from the predecessor 1995 Employee Stock Option Plan, which was incorporated into the 1998 Plan) that have exercise prices in excess of the then-current market price of our common stock and to issue replacement options with an exercise price per share based on the market price of our common stock at the time of the new grant.

Stock Issuance Program

Shares of our common stock will be issued under the Stock Issuance Program at a price per share equal to the fair market value of the shares on the issuance date unless otherwise determined by the Plan Administrator. Shares will be issued for such valid consideration as the Plan Administrator deems appropriate, including cash and promissory notes. The shares may also be issued as a bonus for past services without any cash outlay required of the recipient. The shares issued may be fully vested upon issuance or may vest upon the completion of a designated service period or the attainment of pre-established performance goals. The Plan Administrator will, however, have the discretionary authority at any time to accelerate the vesting of any and all unvested shares outstanding under the stock issuance program.

Automatic Option Grant Program

Under the Automatic Option Grant Program, eligible non-employee Board members receive a series of option grants over their period of Board service. Each non-employee Board member will, at the time of his or her initial election or appointment to the Board, receive a non-statutory stock option grant for 20,000 shares of common stock. In addition, on the date of each annual stockholders meeting, each individual who is to continue to serve as a non-employee Board member, whether or not that individual is standing for re-election to the Board, will be automatically granted an option to purchase 10,000 shares of common stock. There will be no limit on the number of such 10,000-share option grants any one eligible non-employee Board member may receive over his or her period of continued Board service.

Each automatic grant will have an exercise price per share equal to the fair market value per share of common stock on the grant date and will have a maximum term of ten years, subject to earlier termination following the optionee’s cessation of Board service.

Each option will be immediately exercisable for the option shares, and the shares acquired under the option will be subject to repurchase by us at the option exercise price paid per share, upon the optionee’s cessation of

16

Board service prior to vesting in those shares. The shares subject to each initial 20,000-share automatic grant will vest in three equal annual installments upon the optionee’s completion of each year of Board service over the three years measured from the option grant date. The shares subject to each annual 10,000-share grant will vest upon the completion of one year of Board service measured from the option grant date.

Each outstanding automatic option grant will automatically accelerate and become immediately exercisable for any or all of the option shares as fully-vested shares upon certain changes in control or ownership of Inet or upon the optionee’s death or disability while a Board member. Following the optionee’s cessation of Board service for any reason, each option will remain exercisable for a 12-month period and may be exercised during that time for any or all shares in which the optionee is vested at the time of such cessation of Board service.

General Provisions

Accelerated Vesting

In the event that we are acquired by merger or asset sale, each outstanding, unvested option under the Discretionary Option Grant Program that is not to be assumed or replaced by the successor corporation or otherwise continued in effect will automatically vest in full, and all unvested shares outstanding under the Discretionary Option Grant Program will immediately vest, except to the extent our repurchase rights with respect to those shares are to be assigned to the successor corporation or otherwise continued in effect. The Plan Administrator will have the authority under the Discretionary Option Grant Program to provide that options granted under such program will automatically vest in full (a) upon an acquisition of Inet, whether or not those options are assumed or replaced, (b) upon a hostile change in control of Inet effected through a tender offer for more than 50% of our outstanding voting stock or by proxy contest for the election of Board members, or (c) in the event the individual’s service is terminated, whether involuntarily or through a resignation for good reason, within a designated period (not to exceed 18 months) following an acquisition in which those options are assumed or replaced or a hostile change in control. The vesting of outstanding shares under the Stock Issuance Program may be accelerated upon similar terms and conditions.

The options granted under the Automatic Option Grant Program will automatically accelerate and become exercisable in full upon any acquisition or change in control transaction. The acceleration of vesting in the event of a change in the ownership or control of Inet may be seen as an anti-takeover provision and may have the effect of discouraging a merger proposal, a takeover attempt or other efforts to gain control of us.

Limited Stock Appreciation Rights

Each option granted under the Automatic Option Grant Program includes a limited stock appreciation right so that upon the successful completion of a hostile tender offer for more than 50% of our outstanding voting securities, the option may be surrendered to us in return for a cash distribution from us. The amount of the distribution per surrendered option share will be equal to the excess of (a) the fair market value per share at the time the option is surrendered or, if greater, the tender offer price paid per share in the hostile take-over, over (b) the exercise price payable per share under such option. In addition, the Plan Administrator may grant such rights to our executive officers as part of their option grants under the Discretionary Option Grant Program.

Financial Assistance

Subject to compliance with Section 402 of the Sarbanes-Oxley Act of 2002 and other applicable laws and regulations, the Plan Administrator may institute a loan program to assist one or more participants in financing the exercise of outstanding options under the Discretionary Option Grant Program through full-recourse interest-bearing promissory notes. However, the maximum amount of financing provided any participant may not exceed the cash consideration payable for the issued shares plus all applicable withholding taxes incurred in connection with the acquisition of those shares.

17

Special Tax Election

The Plan Administrator may provide one or more holders of non-statutory options under the 1998 Plan with the right to have us withhold a portion of the shares otherwise issuable to such individuals in satisfaction of the withholding taxes to which such individuals become subject in connection with the exercise of those options or the vesting of those shares. Alternatively, the Plan Administrator may allow such individuals to deliver previously acquired shares of common stock in payment of such withholding tax liability.

Amendment and Termination

The Board of Directors may amend or modify the 1998 Plan at any time, subject to any required stockholder approval pursuant to applicable laws and regulations. Unless sooner terminated by the Board, the 1998 Plan will terminate on the earliest of (a) July 23, 2008, (b) the date on which all shares available for issuance under the 1998 Plan have been issued as fully-vested shares or (c) the termination of all outstanding options in connection with certain changes in control or ownership of Inet.

Stock Awards

The table below shows, as to our Chief Executive Officer, the four other most highly compensated of our executive officers and the other individuals and groups indicated, the number of shares of common stock subject, as of March 31, 2003, to option grants and restricted stock issuances made under the 1998 Plan during 2002, together with the per share weighted average exercise price payable or purchase price paid.

| | | Option Grants

| | Restricted Stock Issuances

|

Name and Position(s)

| | No. of Shares Underlying Options Granted

| | Weighted-Average Exercise Price Per Share

| | No. of Shares

| | Weighted-Average Issuance Price Per Share

|

William H. Mina Senior Vice President, Administration and Legal Affairs | | 30,000 | | $ | 5.06 | | 12,000 | | $ | 5.06 |

Pierce E. Brockman Senior Vice President and Chief Technology Officer | | 60,000 | | | 5.06 | | 24,000 | | | 5.06 |

Jeffrey A. Kupp Vice President and Chief Financial Officer | | 75,000 | | | 5.06 | | 24,000 | | | 5.06 |

All executive officers as a group (7 persons) | | 200,000 | | | 5.06 | | 72,000 | | | 5.06 |

James R. Adams, Director | | 10,000 | | | 9.80 | | — | | | — |

Grant A. Dove, Director | | 10,000 | | | 9.80 | | — | | | — |

George H. Heilmeier, Director | | 10,000 | | | 9.80 | | — | | | — |

All non-executive officer directors as a group (3 persons) | | 30,000 | | | 9.80 | | — | | | — |

All employees, excluding executive officers, as a group (approximately 465 persons) | | 158,400 | | | 5.47 | | 12,000 | | | 5.06 |

Federal Income Tax Consequences

Option Grants

Options granted under the 1998 Plan may be either incentive stock options, which satisfy the requirements of Section 422 of the Code, or non-statutory options, which are not intended to meet such requirements. The federal income tax treatment for the two types of options differs as follows:

Incentive Options. No taxable income is recognized by the optionee at the time of the option grant, and no taxable income is generally recognized at the time the option is exercised. However, the optionee would have a “tax preference” equal to the excess of the fair market value of such shares on the option exercise date over the

18

exercise price paid for the shares, which may result in liability for alternative minimum tax purposes. The optionee will, however, recognize taxable income in the year in which the purchased shares are sold or otherwise disposed. For federal tax purposes, dispositions are divided into two categories: qualifying and disqualifying. A qualifying disposition occurs if the sale or other disposition is made after the optionee has held the shares for more than two years after the option grant date and more than one year after the exercise date. If either of these two holding periods is not satisfied, then a disqualifying disposition will result.

If the optionee makes a disqualifying disposition of the purchased shares, we will be entitled to an income tax deduction, for the taxable year in which such disposition occurs, equal to the lesser of (a) the excess of the fair market value of such shares on the option exercise date over the exercise price paid for the shares, or (b) the amount realized on the disposition over the exercise price paid for the shares. If the optionee makes a qualifying disposition, we will not be entitled to any income tax deduction.

Non-Statutory Options. No taxable income is recognized by an optionee upon the grant of a non-statutory option. The optionee will generally recognize ordinary income, in the year in which the option is exercised, equal to the excess of the fair market value of the purchased shares on the exercise date over the exercise price paid for the shares, and the optionee will be required to satisfy the tax withholding requirements applicable to such income.

If the shares acquired upon exercise of the non-statutory option are unvested and subject to repurchase by us in the event of the optionee’s termination of service prior to vesting in those shares, then the optionee will not recognize any taxable income at the time of exercise but will have to report as ordinary income, as and when our repurchase right lapses, an amount equal to the excess of (a) the fair market value of the shares on the date the repurchase right lapses over (b) the exercise price paid for the shares. The optionee may, however, elect under Section 83(b) of the Code to include as ordinary income in the year of exercise of the option an amount equal to the excess of (a) the fair market value of the purchased shares on the exercise date over (b) the exercise price paid for such shares. If the Section 83(b) election is made, the optionee will not recognize any additional income as and when the repurchase right lapses.

We will be entitled to an income tax deduction equal to the amount of ordinary income recognized by the optionee with respect to the exercised non-statutory option. The deduction will generally be allowed for the taxable year in which such ordinary income is recognized by the optionee.

Stock Appreciation Rights

No taxable income is recognized upon receipt of a stock appreciation right. The holder will recognize ordinary income, in the year in which the stock appreciation right is exercised, in an amount equal to the appreciation distribution. We will be entitled to an income tax deduction equal to the appreciation distribution in the taxable year in which such ordinary income is recognized by the optionee.

Direct Stock Issuances

The tax principles applicable to direct stock issuances under the 1998 Plan will be substantially the same as those summarized above for the exercise of non-statutory option grants.

Deductibility of Executive Compensation

We believe that any compensation deemed paid by us in connection with disqualifying dispositions of incentive stock option shares or the exercise of non-statutory options subject to awards made prior to the meeting (or subsequent to stockholder ratification of this Proposal at the meeting) with exercise prices not less than the fair market value of the option shares on the grant date will qualify as performance-based compensation for purposes of Code Section 162(m) and will not have to be taken into account for purposes of the $1 million limitation per Covered Individual on the deductibility of compensation paid to our executive officers.

19

Accordingly, all compensation deemed paid with respect to those options will be deductible by us without limitation under Code Section 162(m). However, if this Proposal is not ratified by stockholders at the meeting, then any compensation deemed paid by us in connection with disqualifying dispositions of incentive stock option shares or the exercise of non-statutory options subject to awards made under the 1998 Plan to our executive officers after the meeting would be subject to the deductibility limits imposed by Code Section 162(m).

We believe that any compensation deemed paid by us in connection with direct stock issuances made prior to the meeting will qualify for treatment as performance-based compensation for purposes of Code Section 162(m) and will not have to be taken into account for purposes of the $1 million limitation per Covered Individual on the deductibility of compensation paid to our executive officers. Accordingly, all compensation deemed paid with respect to those issuances will be deductible by Inet without limitation under Code Section 162(m). However, regardless of stockholder ratification of this Proposal at the meeting, any compensation deemed paid by us in connection with direct stock issuances after the meeting will have to be taken into account for purposes of such $1 million limitation unless and to the extent that such direct stock issuances otherwise qualify as performance-based compensation for purposes of Code Section 162(m).

Accounting Treatment

We have elected to follow Accounting Principles Board Opinion No. 25,Accounting for Stock Issued to Employees(“APB 25”), in accounting for our employee stock options. Under APB 25, if the exercise price of an employee’s stock options equals or exceeds the market price of the underlying stock on the date of grant, no compensation expense is recognized. Option grants with exercise prices less than the fair market value of the shares on the grant date will result in a direct compensation expense in an amount equal to the excess of such fair market value over the exercise price. The expense must be amortized against our earnings over the period that the option shares vest. Although Statement of Financial Accounting Standards No. 123,Accounting for Stock-Based Compensation(“SFAS 123”), allows us to continue to follow the present APB 25 guidelines, we are required to disclose, as if we had adopted SFAS 123, pro forma net income (loss) and net income (loss) per share as if the fair value of options at the time of grant was treated as compensation expense. In addition, the number of outstanding options may be a factor in determining our earnings per share on a diluted basis.

On March 31, 2000, the Financial Accounting Standards Board issued Interpretation No. 44, which is an interpretation of APB 25 governing the accounting principles applicable to equity incentive plans. Under the Interpretation, option grants made to consultants (but not non-employee Board members) after December 15, 1998 will result in a direct charge to our reported earnings based upon the fair value of the option measured initially as of the grant date and then subsequently on the vesting date of each installment of the underlying option shares. Such charge will accordingly include the appreciation in the value of the option shares over the period between the grant date of the option (or, if later, the July 1, 2000 effective date of the Interpretation) and the vesting date of each installment of the option shares. In addition, any options which are repriced after December 15, 1998 will also trigger a direct charge to our earnings measured by the appreciation in the value of the underlying shares over the period between the grant date of the option (or, if later, the July 1, 2000 effective date of the Interpretation) and the date the option is exercised for those shares.