UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

MFS® VARIABLE INSURANCE TRUST

MFS® VARIABLE INSURANCE TRUST II

MFS® VARIABLE INSURANCE TRUST III

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrants)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | 5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | 3) | | Filing Party: |

| | 4) | | Date Filed: |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETINGS

TO BE HELD ON MARCH 23, 2017.

THIS PROXY STATEMENT IS AVAILABLE AT www.proxyonline.com/docs/MFS2017.pdf

| | |

MFS® VARIABLE INSURANCE TRUST |

MFS® Global Equity Series | | MFS® Research Series |

MFS® Growth Series | | MFS® Total Return Bond Series |

MFS® Investors Trust Series | | MFS® Total Return Series |

MFS® Mid Cap Growth Series | | MFS® Utilities Series |

MFS® New Discovery Series | | MFS® Value Series |

|

MFS® VARIABLE INSURANCE TRUST II |

MFS® Blended Research Core Equity Portfolio | | MFS® High Yield Portfolio |

MFS® Core Equity Portfolio | | MFS® International Growth Portfolio |

MFS® Corporate Bond Portfolio | | MFS® International Value Portfolio |

MFS® Emerging Markets Equity Portfolio | | MFS® Massachusetts Investors Growth Stock Portfolio |

MFS® Global Governments Portfolio | | MFS® Research International Portfolio |

MFS® Global Growth Portfolio | | MFS® Strategic Income Portfolio |

MFS® Global Research Portfolio | | MFS® Technology Portfolio |

MFS® Global Tactical Allocation Portfolio | | MFS® U.S. Government Money Market Portfolio |

MFS® Government Securities Portfolio | | |

|

MFS® VARIABLE INSURANCE TRUST III |

MFS® Blended Research Small Cap Equity Portfolio | | MFS® Limited Maturity Portfolio |

MFS® Conservative Allocation Portfolio | | MFS® Mid Cap Value Portfolio |

MFS® Global Real Estate Portfolio | | MFS® Moderate Allocation Portfolio |

MFS® Growth Allocation Portfolio | | MFS® New Discovery Value Portfolio |

MFS® Inflation-Adjusted Bond Portfolio | | |

111 Huntington Avenue, Boston, Massachusetts 02199

Notice of a Special Meeting of Shareholders

To be held on March 23, 2017

A Special Meeting of Shareholders of each of the above referenced funds (each, a “Fund” and collectively, the “Funds”) “) will be held at 111 Huntington Avenue, Boston, Massachusetts 02199, at 10:30 a.m. on Thursday, March 23, 2017, for the following purposes:

| | |

| ITEM 1. | | To elect Steven E. Buller, John A. Caroselli, Maureen R. Goldfarb, David H. Gunning, Michael Hegarty, John P. Kavanaugh, Robert J. Manning, Clarence Otis, Jr., Maryanne L. Roepke, Robin A. Stelmach, and Laurie J. Thomsen as Trustees of each of the trusts of which the Funds are series; and |

| |

| ITEM 2. | | To transact such other business as may properly come before the Meeting and any adjournments thereof. |

Each Fund will hold its meeting simultaneously with each other Fund. With respect to Item 1, all of the shareholders of Funds that are series of the same Trust will vote together as a single class.

THE TRUSTEES THAT OVERSEE YOUR FUND RECOMMEND

THAT YOU VOTE IN FAVOR OF ITEM 1.

Only a Fund’s shareholders of record on January 6, 2017 will be entitled to vote at that Fund’s Meeting of Shareholders.

By order of the Board of Trustees

CHRISTOPHER R. BOHANE

Assistant Secretary and Assistant Clerk

January 30, 2017

YOUR VOTE IS IMPORTANT. IF YOU DO NOT EXPECT TO ATTEND THE MEETING, THEN WE WOULD APPRECIATE YOUR PROMPTLY VOTING, SIGNING AND RETURNING THE ENCLOSED PROXY OR RECORDING YOUR VOTING INSTRUCTIONS BY TELEPHONE OR VIA THE INTERNET, WHICH WILL HELP AVOID THE ADDITIONAL EXPENSE OF A SECOND SOLICITATION FOR YOUR FUND. THE ENCLOSED ADDRESSED ENVELOPE REQUIRES NO POSTAGE AND IS PROVIDED FOR YOUR CONVENIENCE.

| | |

MFS® VARIABLE INSURANCE TRUST |

MFS® Global Equity Series | | MFS® Research Series |

MFS® Growth Series | | MFS® Total Return Bond Series |

MFS® Investors Trust Series | | MFS® Total Return Series |

MFS® Mid Cap Growth Series | | MFS® Utilities Series |

MFS® New Discovery Series | | MFS® Value Series |

|

MFS® VARIABLE INSURANCE TRUST II |

MFS® Blended Research Core Equity Portfolio | | MFS® High Yield Portfolio |

MFS® Core Equity Portfolio | | MFS® International Growth Portfolio |

MFS® Corporate Bond Portfolio | | MFS® International Value Portfolio |

MFS® Emerging Markets Equity Portfolio | | MFS® Massachusetts Investors Growth Stock Portfolio |

MFS® Global Governments Portfolio | | MFS® Research International Portfolio |

MFS® Global Growth Portfolio | | MFS® Strategic Income Portfolio |

MFS® Global Research Portfolio | | MFS® Technology Portfolio |

MFS® Global Tactical Allocation Portfolio | | MFS® U.S. Government Money Market Portfolio |

MFS® Government Securities Portfolio | | |

|

MFS® VARIABLE INSURANCE TRUST III |

MFS® Blended Research Small Cap Equity Portfolio | | MFS® Limited Maturity Portfolio |

MFS® Conservative Allocation Portfolio | | MFS® Mid Cap Value Portfolio |

MFS® Global Real Estate Portfolio | | MFS® Moderate Allocation Portfolio |

MFS® Growth Allocation Portfolio | | MFS® New Discovery Value Portfolio |

MFS® Inflation-Adjusted Bond Portfolio | | |

PROXY STATEMENT

JANUARY 30, 2017

This Proxy Statement is furnished in connection with the solicitation of proxies by and on behalf of the Board of Trustees (the “Board”) of MFS Variable Insurance Trust, MFS Variable Insurance Trust II and MFS Variable Insurance Trust III (each, a “Trust” and collectively, the “Trusts”) to be used at the Meeting of Shareholders (the “Meeting”) of each fund that is a series of one of the Trusts (each, a “Fund” and collectively, the “Funds”) to be held at 10:30 a.m. on March 23, 2017 at 111 Huntington Avenue, Boston, Massachusetts 02199, for the purposes set forth in the accompanying Notice of a Special Meeting of Shareholders (the “Notice”). Information regarding the Board of Trustees can be found in the section of this Proxy Statement entitled “Election of Trustees.”

Shareholders of record at the close of business on January 6, 2017 will be entitled to one vote for each dollar of net asset value held on that date. Each fractional dollar amount will be entitled to a proportionate fractional vote. On that date, all shares of each Series were owned by separate accounts established by certain insurance companies to fund benefits under variable contracts issued by those insurance companies. Each such insurance company will solicit voting instructions with respect to shares held by the separate accounts from owners of and participants and payees under variable contracts (“contract owners”) having a voting interest in the separate accounts. All shares of each Series held by a separate account will be voted. Shares for which no timely voting instructions are received will be voted in the same proportion as shares for which instructions are received.

On January 6, 2017, the following number of shares were outstanding for each Fund:

| | | | | | | | |

| | | Initial Class

Shares Outstanding | | | Service Class

Shares Outstanding | |

MFS Variable Insurance Trust | | | | | | | | |

MFS Global Equity Series | | | 2,401,875.871 | | | | 373,873.901 | |

MFS Growth Series | | | 30,371,612.807 | | | | 6,296,733.951 | |

MFS Investors Trust Series | | | 10,460,132.901 | | | | 9,065,427.114 | |

MFS Mid Cap Growth Series | | | 36,829,715.255 | | | | 11,569,948.981 | |

MFS New Discovery Series | | | 18,028,683.027 | | | | 25,313,645.212 | |

MFS Research Series | | | 14,818,994.337 | | | | 8,563,299.782 | |

MFS Total Return Bond Series | | | 75,247,033.218 | | | | 113,359,717.453 | |

MFS Total Return Series | | | 58,478,463.837 | | | | 56,014,067.131 | |

MFS Utilities Series | | | 20,656,011.577 | | | | 38,014,979.944 | |

MFS Value Series | | | 51,026,175.245 | | | | 69,728,004.253 | |

| | |

MFS Variable Insurance Trust II | | | | | | | | |

MFS Blended Research Core Equity Portfolio | | | 6,557,952.052 | | | | 3,661,939.363 | |

MFS Core Equity Portfolio | | | 7,172,195.911 | | | | 1,999,548.579 | |

MFS Corporate Bond Portfolio | | | 5,867,582.338 | | | | 16,721,064.434 | |

MFS Emerging Markets Equity Portfolio | | | 1,771,538.798 | | | | 1,959,320.652 | |

MFS Global Governments Portfolio | | | 16,432,785.309 | | | | 162,174.784 | |

MFS Global Growth Portfolio | | | 2,187,649.434 | | | | 112,409.627 | |

MFS Global Research Portfolio | | | 3,541,341.708 | | | | 288,721.466 | |

MFS Global Tactical Allocation Portfolio | | | 3,851,007.569 | | | | 49,506,133.072 | |

MFS Government Securities Portfolio | | | 31,002,589.289 | | | | 19,021,375.406 | |

MFS High Yield Portfolio | | | 69,457,215.975 | | | | 12,071,443.534 | |

MFS International Growth Portfolio | | | 10,433,994.333 | | | | 2,103,190.151 | |

MFS International Value Portfolio | | | 10,456,854.438 | | | | 57,575,602.921 | |

MFS Massachusetts Investors Growth Stock Portfolio | | | 32,467,579.671 | | | | 21,596,957.735 | |

MFS Research International Portfolio | | | 23,503,576.862 | | | | 6,200,585.062 | |

MFS Strategic Income Portfolio | | | 4,549,145.511 | | | | 906,264.599 | |

MFS Technology Portfolio | | | 1,158,101.086 | | | | 10,049,796.572 | |

MFS U.S. Government Money Market Portfolio | | | 179,246,875.170 | | | | 182,196,540.900 | |

| | |

MFS Variable Insurance Trust III | | | | | | | | |

MFS Blended Research Small Cap Equity Portfolio | | | 2,167,499.420 | | | | 5,750,975.563 | |

MFS Conservative Allocation Portfolio | | | 201,211.483 | | | | 55,784,139.395 | |

MFS Global Real Estate Portfolio | | | 8,181,402.741 | | | | 4,723,999.644 | |

MFS Growth Allocation Portfolio | | | 286,213.807 | | | | 38,165,678.156 | |

MFS Inflation-Adjusted Bond Portfolio | | | 16,900,601.482 | | | | 17,096,507.920 | |

MFS Limited Maturity Portfolio | | | 46,486,201.532 | | | | 15,117,032.456 | |

MFS Mid Cap Value Portfolio | | | 32,657,769.317 | | | | 7,246,377.134 | |

MFS Moderate Allocation Portfolio | | | 445,265.162 | | | | 140,397,734.132 | |

MFS New Discovery Value Portfolio | | | 4,300,039.916 | | | | 781,459.426 | |

With respect to Item 1, each Trust will vote separately. This means that for each Trust, the votes of shareholders of all Funds that are series of that Trust will be voted together as a single class.

The mailing address of each Trust and of each Fund is 111 Huntington Avenue, Boston, Massachusetts 02199. The Trustees of the Trusts and employees of Massachusetts Financial Services Company (“MFS”), the Funds’ investment adviser and administrator, may solicit proxies in person or by telephone. The Notice of a Special Meeting of the Shareholders, this Proxy Statement and the proxy card are being made

2

available to shareholders of record as of January 6, 2017, the record date, beginning on or about January 30, 2017. Upon request and without charge, the Trusts will furnish each person to whom this Proxy Statement is delivered with a copy of the Funds’ latest annual and semi-annual reports (if any) to shareholders. You may obtain copies of one or more reports without charge by contacting the insurance or annuity company through which you purchased your variable contract (if you are a contract owner) or by telephoning toll-free (800) 225-2606, or by writing to the Trust at the address appearing above or on the Funds’ website atwww.MFS.com or by contacting MFS Service Center, Inc., each Fund’s transfer and shareholder servicing agent, at 111 Huntington Avenue, Boston, Massachusetts 02199. Directions to the meeting in order to vote in person are available by telephoning (800) 225-2606. The expenses of the preparation of proxy statements and related materials, including printing and delivery costs, and vote solicitation are borne by the Funds.

The Trusts have engaged D.F King & Co. Inc., an AST One Company (“D.F. King”), the proxy tabulation agent, to provide shareholder meeting services including the distribution of this Proxy Statement and related materials to shareholders as well as vote solicitation and tracking. A proxy may be revoked prior to its exercise by a signed writing filed with D.F. King, c/o Proxy Tabulator, PO Box 9043, Smithtown, New York, 11787-9831, or by attending the Meeting and voting in person. It is anticipated that the cost of these services will be approximately $1,765,095 and may increase substantially in the event that any vote is contested or increased solicitation efforts are required.

ITEM 1 — ELECTION OF TRUSTEES

The Board, which oversees each Trust, provides broad supervision over the affairs of each Trust and Fund. Those Trustees who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of your Trust or of MFS are referred to as “Independent Trustees” throughout this Proxy Statement. MFS is responsible for the investment management of each Trust’s assets and for providing a variety of other administrative services to each Trust. The officers of each Trust are responsible for its operations.

During the 2016 calendar year the Board was comprised of twelve trustees, ten of whom are Independent Trustees. As of the date hereof, the Board consists of nine trustees, seven of whom are Independent Trustees. An Independent Trustee serves as Chair of the Board. In addition, each of the seven standing Committees of the Board, to which the Board has delegated certain authority and oversight responsibilities, is comprised exclusively of Independent Trustees. For a description of the oversight functions of each of the Committees, see “Committees” below. In connection with each of the Board’s regular meetings, the Independent Trustees meet separately from MFS with their counsel and with the Trusts’ Independent Senior Officer, who is independent of MFS and advises the Independent Trustees regarding contract review, compliance and business matters. The Board reviews its leadership structure periodically and believes that its structure is appropriate to enable the Board to exercise its oversight of the Trusts.

The Funds have retained MFS as the Funds’ investment adviser and administrator. MFS provides each Fund with investment advisory services, and is responsible for day-to-day administration of the Funds and management of the risks that arise from the Funds’ investments and operations. Certain employees of MFS serve as the Trusts’ officers, including the Trusts’ principal executive officer and principal financial and accounting officer. The Board provides oversight of the services provided by MFS and its affiliates, including the risk management activities of MFS and its affiliates. In addition, each Committee of the Board provides oversight of risk management activities with respect to the particular activities within the

3

Committee’s purview. In the course of providing oversight, the Board and the Committees receive a wide range of reports on the Trusts’ activities, including each Trusts’ investment portfolio, the compliance of the Trusts with applicable laws, and the Funds’ financial accounting and reporting. The Board and the relevant Committees meet periodically with MFS’ Chief Risk Officer and MFS’ Chief Investment Risk Officer to receive reports on MFS’ and its affiliates’ risk management activities, including their efforts to (i) identify key risks that could adversely affect the MFS Funds or MFS; (ii) implement processes and controls to mitigate such key risks; and (iii) monitor business and market conditions in order to facilitate the processes in (i) and (ii) above. In addition, the Board and the relevant Committees oversee the risk management activities related to the key risks associated with services provided by various non-affiliated service providers through the receipt of reports prepared by MFS, and, in certain circumstances, through the receipt of reports directly from service providers, such as in the case of each MFS Fund’s auditor, custodian, and pricing service providers. The Independent Trustees also meet regularly with the MFS Funds’ Chief Compliance Officer (who is also MFS’ Chief Compliance Officer) to receive reports regarding the compliance of the MFS Funds with the federal securities laws and the MFS Funds’ compliance policies and procedures. In addition, the Board meets periodically with the portfolio managers of the Funds to receive reports regarding the management of the Funds, including their investment risks.

The Board has fixed the number of Trustees of each Trust at eleven. The Nomination and Compensation Committee of each Board makes recommendations concerning the nominees for Trustees and consists solely of Independent Trustees. Each Nomination and Compensation Committee has recommended that the Board nominate for election by shareholders the nominees described in the following pages, and each Board has nominated such individuals. The Board recommends that you vote in favor of the election of the nominees.

The Funds do not hold annual shareholder meetings for the purpose of electing Trustees, and Trustees are not elected for fixed terms. This means that each Trustee will be elected to hold office until his or her successor is chosen and qualified or until his or her earlier death, resignation, retirement or removal. It is intended that proxies not limited to the contrary will be voted in favor of electing Steven E. Buller, John A. Caroselli, Maureen R. Goldfarb, David H. Gunning, Michael Hegarty, John P. Kavanaugh, Robert J. Manning, Clarence Otis, Jr., Maryanne L. Roepke, Robin A. Stelmach, and Laurie J. Thomsen as Trustees of each Trust.

Each nominee has agreed to serve as a Trustee of each Trust if elected. If, before the Meeting, any nominee refuses or is unable to serve, or if any of the nominees is unavailable at the time of the Meeting, and such refusal or inability to serve or unavailability is not anticipated, the Trustees may vote for other nominees at their discretion, or the Trustees may fix the number of Trustees at fewer than eleven for a Trust. Under the terms of the Boards’ retirement policy, an independent Trustee shall retire at the end of the calendar year in which he or she reaches the earlier of 75 years of age or 15 years of service on the Board (or, in the case of an Independent Trustee who joined the Board prior to 2015, 20 years of service on the Board). Mr. Gunning will reach the Trusts’ mandatory retirement age in 2017 and is expected to retire effective December 31, 2017. The Board may appoint a Trustee to replace him or choose to decrease the size of the Board at that time. For each Trust, the eleven nominees for election as Trustees who receive the greatest number of shareholder votes will be elected as Trustees of the Trust.

4

Unless otherwise noted, the following table presents certain information as of January 1, 2017 regarding the nominees, including the current Trustees of each Trust, standing for election, including their principal occupations, which, unless specific dates are shown, are of more than five years duration, although the titles may not have been the same throughout.

| | | | | | | | |

| Name, Age | | Position(s) Held with Fund | | Trustee/Officer Since(1) | | Principal Occupations During the Past Five Years | | Other Directorships(2) |

| INTERESTED TRUSTEES | | | | |

Robert J. Manning(3) (age 53) | | Trustee | | February 2004 | | Massachusetts Financial Services Company, Chairman, Executive Chairman (since January 2017) and Director; Chairman (until January 2017); Chief Executive Officer (until 2015); Co-Chief Executive Officer(2015-2016) | | N/A |

Robin A. Stelmach(3) (age 55) | | Trustee | | January 2014 | | Massachusetts Financial Services Company, Vice Chair (since January 2017); Chief Operating Officer and Executive Vice President (until January 2017) | | N/A |

| INDEPENDENT TRUSTEES | | | | |

David H. Gunning (age 74) | | Trustee and Chair of Trustees | | January 2004 | | Private investor | | Lincoln Electric Holdings, Inc., Director; Development Alternatives, Inc.,Director/Non-Executive Chairman |

5

| | | | | | | | |

| Name, Age | | Position(s) Held with Fund | | Trustee/Officer Since(1) | | Principal Occupations During the Past Five Years | | Other Directorships(2) |

Steven E. Buller (age 65) | | Trustee | | February 2014 | | Chairman, Financial Accounting Standards Advisory Council (until 2015); Standing Advisory Group, Public Company Accounting Oversight Board, Member (until 2014); BlackRock, Inc. (investment management), Managing Director (until 2014), BlackRock Finco UK (investment management), Director (until 2014) | | N/A |

John A. Caroselli (age 63)(4) | | Nominee | | N/A | | JC Global Advisors, LLC, President; and First Capital Corporation, Executive Vice President (until 2015) | | N/A |

Maureen R. Goldfarb (age 61) | | Trustee | | January 2009 | | Private investor | | N/A |

Michael Hegarty (age 72) | | Trustee | | December 2004 | | Private investor | | Rouse Properties Inc., Director; Capmark Financial Group Inc., Director (until 2015) |

John P. Kavanaugh (age 62) | | Trustee and Vice Chair of Trustees | | January 2009 | | Private investor | | N/A |

Clarence Otis, Jr.(4) (age 61) | | Nominee | | N/A | | Darden Restaurants, Inc., Chief Executive Officer (until 2014) | | VF Corporation, Director; Verizon Communications, Inc., Director; and Federal Reserve Bank of Atlanta, Director (until 2015). |

6

| | | | | | | | |

| Name, Age | | Position(s) Held with Fund | | Trustee/Officer Since(1) | | Principal Occupations During the Past Five Years | | Other Directorships(2) |

Maryanne L. Roepke (age 60) | | Trustee | | May 2014 | | American Century Investments (investment management), Senior Vice President and Chief Compliance Officer (until 2014) | | N/A |

| Laurie J. Thomsen (age 59) | | Trustee | | March 2005 | | Private investor | | The Travelers Companies, Director; Dycom Industries, Inc., Director |

| (1) | | Date first appointed to serve as Trustee of an MFS Fund. Each Trustee has served continuously since appointment unless indicated otherwise. For the period from December 15, 2004 until February 22, 2005, Mr. Manning served as Advisory Trustee. |

| (2) | | Directorships or trusteeships of companies required to report to the Securities and Exchange Commission (i.e., “public companies”). |

| (3) | | “Interested person” of the Trust within the meaning of the Investment Company Act of 1940 (referred to as the 1940 Act), which is the principal federal law governing investment companies like the fund, as a result of a position with MFS. The address of MFS is 111 Huntington Avenue, Boston, Massachusetts 02199. |

| (4) | | Messrs. Caroselli and Otis do not currently serve as Trustee and have been nominated by the Board to stand for election at the Meeting. |

Unless otherwise noted, each current Trustee listed above served as a board member of 138 funds within the MFS Family of Funds (the “MFS Funds”) as of date hereof. The address of each Trustee is c/o MFS, 111 Huntington Avenue, Boston, Massachusetts 02199.

The following provides an overview of the considerations that led the Board to conclude that each individual serving as a Trustee of the Trust or each proposed nominee should serve as a Trustee. The current Trustees joined the Board at different points in time since 2004. Generally, no one factor was decisive in the original selection of an individual to join the Board. Among the factors the Board considered when concluding that an individual should serve on the Board were the following: (i) the individual’s business and professional experience and accomplishments; (ii) the individual’s ability to work effectively with the other members of the Board; (iii) the individual’s prior experience, if any, serving on the boards of public companies (including, where relevant, other investment companies) and other complex enterprises and organizations; and (iv) how the individual’s skills, experience and attributes would contribute to an appropriate mix of relevant skills and experience on the Board.

In respect of each current Trustee and each nominee, the individual’s substantial professional accomplishments and prior experience, including, in some cases, in fields related to the operations of the Trusts, were a significant factor in the determination that the individual should serve as a Trustee of the

7

Trusts. Following is a summary of each current Trustee’s and each nominee’s professional experience and additional considerations that contributed to the Board’s conclusion that an individual should serve on the Board:

Steven E. Buller, CPA

Mr. Buller has substantial accounting, investment management, and executive experience at firms within the investment management industry. Mr. Buller was the Chief Financial Officer of BlackRock, Inc. (“BlackRock”), where he oversaw BlackRock’s tax department, internal audit and control functions, and the global corporate and investment company accounting policy. Prior to joining BlackRock, Mr. Buller was an auditor at Ernst & Young LLP for over 30 years, where he served as Global Director of Asset Management and as the audit partner for various investment company complexes. Mr. Buller was chairman of the Financial Accounting Standards Advisory Council until December 31, 2015 and was a member of the Standing Advisory Group of the Public Company Accounting Oversight Board until December 31, 2014. He has also served on the boards of BlackRock Finco UK, a privately-held company, and Person-to-Person, a community service organization.

John A. Caroselli

Mr. Caroselli has substantial senior executive experience in the financial services industry. Mr. Caroselli is the president of JC Global Advisors, LLC, where he provides consulting services with specialization in strategy development and execution, merger integration, market growth plan design and organizational development. He served as Executive Vice President and Chief Development Officer of First Capital Corporation, Executive Vice President and Chief Strategy Officer of KeySpan Corporation, and Executive Vice President of Corporate Development of AXA Financial. Mr. Caroselli also held senior officer positions with Chase Manhattan Corporation, Chemical Bank, and Manufacturers Hanover Trust. Mr. Caroselli currently serves on the boards of several non-profit organizations.

Maureen R. Goldfarb

Ms. Goldfarb has substantial executive and board experience at firms within the investment management industry. She was the Chief Executive Officer and Chairman of the Board of Trustees of the John Hancock Funds and an Executive Vice President of John Hancock Financial Services, Inc. Prior to joining John Hancock, Ms. Goldfarb was a Senior Vice President with Massachusetts Mutual Life Insurance Company. She also held various marketing, distribution, and portfolio management positions with other investment management firms. Ms. Goldfarb is a former member of the Board of Governors of the Investment Company Institute.

David H. Gunning

Mr. Gunning has substantial executive and board experience at publicly-traded and privately-held companies, including past service as the Vice Chairman and a director of Cleveland-Cliffs Inc. (now Cliffs Natural Resources Inc.), a director of Lincoln Electronic Holdings, Inc., and a director of Southwest Gas Corp. He is the former Chairman and Chief Executive Officer of Capitol American Financial Corp. Mr. Gunning is also a former partner and head of the corporate department of Jones Day, a large international law firm.

8

Michael Hegarty

Mr. Hegarty has substantial senior executive and board experience at firms within the financial services industry, as well as board experience at publicly-traded and privately held companies. He served as the Vice Chairman and Chief Operating Officer of AXA Financial and as the President and Chief Operating Officer of The Equitable Life Assurance Society. Mr. Hegarty also served as Vice Chairman of Chase Manhattan Corporation and Chemical Bank. He is a former director of AllianceBernstein, which serves as the general partner of a publicly-traded investment adviser, and a former trustee of investment companies in the EQ Advisers Trust family of funds.

John P. Kavanaugh

Mr. Kavanaugh has substantial executive, investment management, and board experience at firms within the investment management and mutual fund industry. He was the Chief Investment Officer of The Hanover Insurance Group, Inc., and the President and Chairman of Opus Investment Management, Inc., an investment adviser. Mr. Kavanaugh held research and portfolio management positions with Allmerica Financial and PruCapital, Inc. He is a Chartered Financial Analyst and currently serves on the board of the Independent Directors Council, a unit of the Investment Company Institute which serves the mutual fund independent director community.

Robert J. Manning

Mr. Manning is Executive Chairman of MFS (the Funds’ investment adviser) and in this capacity heads its Board of Directors. He has substantial executive and investment management experience, having worked for MFS for 30 years.

Clarence Otis, Jr.

Mr. Otis has substantial executive, financial, and board experience at publicly-traded and privately-held companies. Mr. Otis was the Chairman and Chief Executive Officer of Darden Restaurants, Inc., the world’s largest full-service restaurant company, and he previously served in other senior positions at Darden Restaurants, including Chief Financial Officer and Executive Vice President. Mr. Otis is a director of VF Corporation and Verizon Communications, Inc. He is a former director of the Federal Reserve Bank of Atlanta. Mr. Otis currently serves on the boards of several non-profit organizations.

Maryanne L. Roepke

Ms. Roepke has substantial executive and compliance experience within the investment management industry. She was a Senior Vice President and the Chief Compliance Officer of American Century Investments, Inc. (“American Century”), where she worked for over 30 years. She currently is a trustee of Rockhurst University. She is a former member of the Investment Company Institute’s Chief Compliance Officer Committee and Risk Management Advisory Committee.

Robin A. Stelmach

Ms. Stelmach is Vice Chair of MFS (the Funds’ investment adviser). Previously she was Executive Vice President and Chief Operating Officer of MFS and oversaw the company’s Global Investment Technology and Global Investment & Client Support departments, as well as the MFS Service Center.

9

Laurie J. Thomsen

Ms. Thomsen has substantial venture capital financing experience, as well as board experience at publicly-traded and privately-held companies. Ms. Thomsen was a co-founding General Partner of Prism Venture Partners, a venture capital firm investing in healthcare and technology companies, and served as an Executive Partner of New Profit, Inc., a venture philanthropy firm. Prior to that, she was a General Partner at Harbourvest Partners, a venture capital firm. Ms. Thomsen is a director of The Travelers Companies, Inc. and Dycom Industries, Inc.

Information about each Fund, including information about its investment adviser, principal underwriter and administrator, Independent Registered Public Accounting Firm, executive officers, and the interests of certain persons appears under “Fund Information” below.

Required Vote

For each Trust, approval of this matter as to any nominee will require the affirmative vote of shares representing a plurality of the Trust’s voting power entitled to be cast at the Meeting that are present in person or by proxy. Shareholders of all Funds of each Trust will vote together as a single class on this Item 1.

The Board, including the Independent Trustees, unanimously recommends that the shareholders of the Funds vote to elect each of the nominees as Trustees of each Trust.

10

Committees

Each Trust’s Board meets regularly throughout the year to discuss matters and to take certain actions relating to the Trust. Each Trust’s Board has several standing committees, which are described below.

| | | | | | |

| Name of Committee | | No. of

Meetings In

Last

Fiscal Year(1) | | Functions | | Current Members(2),(4) |

| AUDIT COMMITTEE | | 6 | | Oversees the accounting and auditing procedures of the Fund and, among other duties, considers the selection of the independent accountants for the Fund and the scope of the audit, and considers the effect on the independence of those accountants of any non-audit services such accountants provide to the Fund and any audit or non-audit services such accountants provide to other MFS Funds, MFS and/or certain affiliates. The Committee is also responsible for establishing procedures for the receipt, retention, and treatment of complaints received by the Fund regarding accounting, internal accounting controls, or auditing matters and the confidential, anonymous submission of concerns regarding questionable fund accounting matters by officers of the Fund and employees of the Fund’s investment adviser, administrator, principal underwriter, or any other provider of accounting-related services to the Fund. Reviews and evaluates the contractual arrangements of the Fund relating to custody and fund accounting services, and makes recommendations to the full Board of Trustees on these matters. | | Buller*(3),Kavanaugh*(3), and Roepke*(3) |

11

| | | | | | |

| Name of Committee | | No. of

Meetings In

Last

Fiscal Year(1) | | Functions | | Current Members(2),(4) |

| COMPLIANCE COMMITTEE | | 6 | | Oversees the development and implementation of the Fund’s regulatory and fiduciary compliance policies, procedures, and practices under the 1940 Act, and other applicable laws, as well as oversight of compliance policies of the Fund’s investment adviser and certain other service providers as they relate to Fund activities. The Fund’s Chief Compliance Officer assists the Committee in carrying out its responsibilities. | | Buller*, Kavanaugh* and Roepke* |

| | | |

| CONTRACTS REVIEW COMMITTEE | | 5 | | Requests, reviews, and considers the information deemed reasonably necessary to evaluate the terms of the investment advisory and principal underwriting agreements and the Plan of Distribution under Rule 12b-1 that each Fund proposes to renew or continue, and to make its recommendations to the full Board of Trustees on these matters. | | All Independent Trustees of the Board (Buller, Goldfarb, Gunning, Hegarty, Kavanaugh, Roepke, and Thomsen) |

12

| | | | | | |

| Name of Committee | | No. of

Meetings In

Last

Fiscal Year(1) | | Functions | | Current Members(2),(4) |

| NOMINATION AND COMPENSATION COMMITTEE | | 3 | | Recommends qualified candidates to the Board in the event that a position is vacated or created. The Committee will consider recommendations by shareholders when a vacancy exists. Shareholders wishing to recommend candidates for Trustee for consideration by the Committee may do so by writing to the Fund’s Secretary at the principal executive office of the Fund. Such recommendations must be accompanied by biographical and occupational data on the candidate (including whether the candidate would be an “interested person” of the Fund), a written consent by the candidate to be named as a nominee and to serve as Trustee if elected, record and ownership information for the recommending shareholder with respect to the Fund, and a description of any arrangements or understandings regarding recommendation of the candidate for consideration. The Committee is also responsible for making recommendations to the Board regarding any necessary standards or qualifications for service on the Board. The Committee also reviews and makes recommendations to the Board regarding compensation for the Independent Trustees. | | All Independent Trustees of the Board (Buller, Goldfarb, Gunning, Hegarty, Kavanaugh, Roepke, and Thomsen) |

13

| | | | | | |

| Name of Committee | | No. of

Meetings In

Last

Fiscal Year(1) | | Functions | | Current Members(2),(4) |

| PORTFOLIO TRADING AND MARKETING REVIEW COMMITTEE | | 6 | | Oversees the policies, procedures, and practices of the Fund with respect to brokerage transactions involving portfolio securities as those policies, procedures, and practices are carried out by MFS and its affiliates. The Committee also oversees the lending of portfolio securities, the Trust’s borrowing and lending policies, and the administration of the Fund’s proxy voting policies and procedures by MFS. The Committee also oversees the policies, procedures, and practices of the Applicable Fund Service Providers with respect to the selection and oversight of the Fund’s counterparties in derivatives, repurchase and reverse repurchase agreements, and similar investment-related transactions. In addition, the Committee receives reports from MFS regarding the policies, procedures, and practices of MFS and its affiliates in connection with their marketing and distribution of shares of the Fund. | | All Independent Trustees of the Board (Buller, Goldfarb, Gunning, Hegarty, Kavanaugh, Roepke, and Thomsen) |

14

| | | | | | |

| Name of Committee | | No. of

Meetings In

Last

Fiscal Year(1) | | Functions | | Current Members(2),(4) |

| PRICING COMMITTEE | | 6 | | Oversees the determination of the value of the portfolio securities and other assets held by the Fund and determines or causes to be determined the fair value of securities and assets for which market quotations are not “readily available” in accordance with the 1940 Act. The Committee delegates primary responsibility for carrying out these functions to MFS and MFS’ internal valuation committee pursuant to pricing policies and procedures approved by the Committee and adopted by the full Board. These policies include methodologies to be followed by MFS in determining the fair values of portfolio securities and other assets held by the Fund for which market quotations are not readily available, and the Committee approves and/or ratifies these fair values. The Committee meets periodically with the members of MFS’ internal valuation committee to review and assess the quality of fair valuation and other pricing determinations made pursuant to the Fund’s pricing policies and procedures, and to review and assess the policies and procedures themselves. The Committee also exercises the responsibilities of the Board under the Amortized Cost Valuation Procedures approved by the Board on behalf of each Fund which holds itself out as a “money market fund” in accordance with Rule 2a-7 under the 1940 Act. The Committee also reviews and evaluates the contractual arrangements of service providers relating to the pricing and valuation of the Fund’s portfolio securities and other assets. | | Goldfarb*, Hegarty* and Thomsen* |

15

| | | | | | |

| Name of Committee | | No. of

Meetings In

Last

Fiscal Year(1) | | Functions | | Current Members(2),(4) |

| SERVICES CONTRACTS COMMITTEE | | 6 | | Reviews and evaluates the contractual arrangements of the Fund relating to transfer agency, sub-transfer agency, and administrative services, and makes recommendations to the full Board of Trustees on these matters. | | Goldfarb*, Hegarty*, and Thomsen* |

| (1) | | Each Fund has a fiscal year end of December 31st. |

| (2) | | Information about each committee member is set forth above. Although Mr. Gunning is not a member of all Committees of the Board, he is invited to and attends many of the Committees’ meetings in his capacity as Chair of the Trustees. |

| (3) | | Audit Committee Financial Expert. |

| (4) | | Nominee Mr. Otis is expected to serve on the Audit Committee and Pricing Committee, and nominee Mr. Caroselli is expected to serve on the Compliance Committee and Services Contracts Committee. Both Messrs. Otis and Caroselli are also expected to serve on the Contracts Review Committee, Nomination and Compensation Committee, and the Portfolio Trading and Marketing Review Committee. |

The Trustees generally hold at least 8 regular meetings each calendar year. These regular meetings generally take place over a two-day period. The performance and operations of each of the Trusts is reviewed by the Trustees at each meeting and more in-depth reviews of particular Trusts are conducted by the Trustees throughout the year. The Board of Trustees of each Trust held 8 meetings during the calendar year ended December 31, 2016.Each Trustee attended at least 75% of the Board and applicable committee meetings noted for each Trust.

Nomination and Compensation Committee

The Trustees have adopted a written charter for the Nomination and Compensation Committee, a copy of which is included as Exhibit 1 to this Proxy Statement. The Trusts currently do not maintain a website on which the charter is available.

Each Trust’s Nomination and Compensation Committee consists only of Independent Trustees.

The Nomination and Compensation Committee requires that Trustee candidates have a college degree or equivalent business experience, but has not otherwise established specific, minimum qualifications that must be met by an individual to be considered by the Committee for nomination as a Trustee. The Nomination and Compensation Committee may take into account a wide variety of factors in considering Trustee candidates, including, but not limited to: (i) availability and commitment of a candidate to attend meetings and perform his or her responsibilities to the Board; (ii) relevant industry and related experience; (iii) educational background; (iv) financial expertise; (v) an assessment of the candidate’s ability, judgment and expertise; (vi) overall diversity of the composition of the Board; and (vii) such other factors as the Committee deems appropriate. While the Committee has not adopted a particular definition of diversity, when considering a nominee’s and the Board’s diversity, the Committee generally considers the manner in which each nominee’s professional experience, expertise in matters that are relevant to the oversight of

16

the Funds (e.g., investment management, distribution, accounting, trading, compliance, legal), general leadership experience, and life experience (including with respect to gender and ethnicity) are complementary and, as a whole, contribute to the ability of the Board to oversee the Funds. The Nomination and Compensation Committee may consider candidates for Trustee recommended by each Trust’s current Trustees, officers or shareholders or by MFS or any other source deemed appropriate by the Nomination and Compensation Committee. The Nomination and Compensation Committee may, but is not required to, retain a third-party search firm at the applicable Trust’s expense to identify potential candidates.

The Nomination and Compensation Committee will review and consider nominees recommended by shareholders to serve as Trustee, provided that the recommending shareholder follows the Procedures for Shareholders to Submit Nominee Candidates, which are set forth as Appendix B to the Trusts’ Nomination and Compensation Committee Charter, attached to this Proxy Statement as Exhibit 1. Among other requirements, these procedures provide that the recommending shareholder must submit any recommendation in writing to the Trust, to the attention of the Trust’s Secretary, at the address of the principal executive offices of the Trust. Any recommendation must include certain biographical information and other information regarding the candidate and the recommending shareholder, and must include a written and signed consent of the candidate to be named as a nominee and to serve as a Trustee if elected. The Nomination and Compensation Committee takes the diversity of a particular nominee and the overall diversity of the Board into account when considering and evaluating nominees for trustee. The foregoing description is only a summary.

The Nomination and Compensation Committee has full discretion to reject nominees recommended by shareholders, and there is no assurance that any such person properly recommended and considered by the Committee will be nominated for election to the Board of a Trust.

Share Ownership

Shares of each Fund are sold exclusively to insurance company separate accounts. As of November 30, 2016, the current and proposed Trustees and officers of each Trust represented in this proxy statement as a group owned less than 1% of the outstanding shares of any class of any Fund. Except as set forth in the table below, as of November 30, 2016, no current or proposed Trustee or officer of any Fund beneficially owned shares of any class of any Fund.

| | | | |

| Trustee | | Fund | | Aggregate Dollar Range of Equity

Securities in the Fund* |

| Laurie J. Thomsen | | MFS Growth Series | | $50,001 – $100,000 |

| Laurie J. Thomsen | | MFS Total Return Series | | $50,001 – $100,000 |

| Laurie J. Thomsen | | MFS Utilities Series | | $50,001 – $100,000 |

| * | | Ms. Thomsen is a contract owner of a variable contract issued by an insurance company that holds shares of the applicable Funds. |

Under the terms of the Board’s policy, each independent Trustee is required to have invested on an aggregate basis, within two years of membership on the Board, an amount equal to his or her calendar year’s base retainer and meeting attendance fees in shares of the MFS Funds. The table below shows the dollar range of equity securities beneficially owned by each current Trustee and nominee on an aggregate basis, in all MFS Funds overseen, or to be overseen, by the current Trustee and nominee as of

17

November 30, 2016. The tables below show the dollar range of equity securities beneficially owned by each current Trustee and nominee in each Fund overseen or to be overseen by the Trustee as of November 30, 2016.

The following dollar ranges apply to the table below:

| | | | |

| Name of Trustees | | Aggregate Dollar

Range of Equity Securities in All

MFS Funds Overseen or to be Overseen by

the Nominee | |

Interested Trustee Nominees | | | | |

Robert J. Manning | | | D | |

Robin A. Stelmach | | | D | |

| |

Independent Trustee Nominees | | | | |

Steven E. Buller | | | D | |

John A. Caroselli* | | | N | |

Maureen R. Goldfarb | | | D | |

David H. Gunning | | | D | |

Michael Hegarty | | | D | |

John P. Kavanaugh | | | D | |

Clarence Otis, Jr.* | | | N | |

Maryann L. Roepke | | | D | |

Laurie J. Thomsen | | | D | |

| * | | Did not serve on the Board as of November 30, 2016 and was not subject to the Board’s policy requiring each Independent Trustee to invest on an aggregate basis, within two years of membership on the Board, an amount equal to his or her calendar year’s base retainer and meeting attendance fees in shares of the MFS Funds. |

Shareholder Communications with the Board of Trustees

The Board of Trustees of each Trust has adopted procedures by which shareholders may send communications to the Board. Shareholders may mail written communications to the Board of Trustees, [Name of Trust], c/o Massachusetts Financial Services Company, 111 Huntington Avenue, Boston, Massachusetts 02199, Attention: Frank Tarantino, Independent Senior Officer (“ISO”) of the Fund. Shareholder communications must (i) be in writing and be signed by the shareholder, (ii) identify the MFS Trust to which they relate and (iii) identify the class and number of shares held by the shareholder. The ISO is responsible for reviewing all properly submitted shareholder communications. The ISO shall either (i) provide a copy of each properly submitted shareholder communication to the Board at its next regularly scheduled meeting or (ii) if the ISO determines that the communication requires more immediate attention, forward the communication to the Chair of the Trustees promptly after receipt. The ISO may, in good faith, determine

18

that a shareholder communication should not be provided to the Board because it is ministerial in nature (such as a request for Trust literature, share data or financial information). The ISO may in such cases forward the communication to the appropriate party or parties at MFS. These procedures do not apply to (i) any communication from an officer or Trustee of the Trust, (ii) any communication from an employee or agent of the Trust, unless such communication is made solely in such employee’s or agent’s capacity as a shareholder or (iii) any shareholder proposal submitted pursuant to Rule l4a-8 under the Securities Exchange Act of 1934, as amended, or any communication made in connection with such a proposal. Each Trust’s Trustees are not required to attend the Trust’s shareholder meetings or to otherwise make themselves available to shareholders for communications, other than pursuant to the aforementioned procedures.

Each Trust’s Declaration of Trust currently provides that the Trust will indemnify its Trustees and officers against liabilities and expenses incurred in connection with litigation in which they may be involved because of their offices with the Trust, unless it is finally adjudicated or, in case of a settlement, it has been determined by Trustees not involved in the matter or independent legal counsel, that they have not acted in good faith in the reasonable belief that their actions were in the best interests of the Trust or that they engaged in willful misfeasance or acted with bad faith, gross negligence or reckless disregard of the duties involved in the conduct of their offices.

19

Trustee Compensation Table

The table below shows (i) the cash compensation paid to the Trustees by each Fund for December 31, 2016, its most recently completed fiscal year and (ii) the total cash compensation received by each Trustee from the MFS fund complex for calendar year 2016. Interested Trustees receive no compensation from the Funds for their services as Trustees. The table includes information for Messrs. Robert Butler, William Gutow and Robert Uek, each of whom retired effective December 31, 2016 under the Board’s mandatory retirement policy. This table does not include information for Messrs. Caroselli and Otis because they did not serve as a Trustee of the Board during any Fund’s recently completed fiscal year or during the calendar year 2016.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

December 31, 2016 | | Name and Position | |

| | | Interested Trustees | | Independent Trustees | |

Aggregate Compensation

Paid by Fund | | Robert J.

Manning | | Robin A.

Stelmach | | Steven E.

Buller | | | Robert E.

Butler* | | | Maureen R.

Goldfarb | | | David H.

Gunning | | | William R.

Gutow* | | | Michael

Hegarty | | | John P.

Kavanaugh | | | Maryanne L.

Roepke | | | Laurie J.

Thomsen | | | Robert

W. Uek* | |

Variable Insurance Trust | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

MFS Global Equity Series | | Not

Applicable | | Not

Applicable | | | 304 | | | | 307 | | | | 306 | | | | 318 | | | | 304 | | | | 306 | | | | 304 | | | | 305 | | | | 306 | | | | 307 | |

MFS Growth Series | | Not

Applicable | | Not

Applicable | | | 2,744 | | | | 2,813 | | | | 2,781 | | | | 3,125 | | | | 2,719 | | | | 2,781 | | | | 2,745 | | | | 2,751 | | | | 2,788 | | | | 2,820 | |

MFS Investors Trust Series | | Not

Applicable | | Not

Applicable | | | 1,055 | | | | 1,077 | | | | 1,067 | | | | 1,181 | | | | 1,046 | | | | 1,067 | | | | 1,055 | | | | 1,057 | | | | 1,069 | | | | 1,080 | |

MFS Mid Cap Growth Series | | Not

Applicable | | Not

Applicable | | | 1,041 | | | | 1,060 | | | | 1,051 | | | | 1,144 | | | | 1,034 | | | | 1,051 | | | | 1,041 | | | | 1,043 | | | | 1,053 | | | | 1,062 | |

MFS New Discovery Series | | Not

Applicable | | Not

Applicable | | | 1,753 | | | | 1,784 | | | | 1,770 | | | | 1,927 | | | | 1,741 | | | | 1,770 | | | | 1,753 | | | | 1,756 | | | | 1,773 | | | | 1,788 | |

MFS Research Series | | Not

Applicable | | Not

Applicable | | | 1,746 | | | | 1,776 | | | | 1,762 | | | | 1,910 | | | | 1,736 | | | | 1,762 | | | | 1,747 | | | | 1,749 | | | | 1,765 | | | | 1,779 | |

MFS Total Return Bond Series | | Not

Applicable | | Not

Applicable | | | 4,625 | | | | 4,746 | | | | 4,690 | | | | 5,295 | | | | 4,581 | | | | 4,690 | | | | 4,625 | | | | 4,636 | | | | 4,702 | | | | 4,759 | |

MFS Total Return Series | | Not

Applicable | | Not

Applicable | | | 4,637 | | | | 4,763 | | | | 4,705 | | | | 5,330 | | | | 4,592 | | | | 4,705 | | | | 4,638 | | | | 4,649 | | | | 4,717 | | | | 4,776 | |

MFS Utilities Series | | Not

Applicable | | Not

Applicable | | | 3,640 | | | | 3,716 | | | | 3,682 | | | | 4,063 | | | | 3,612 | | | | 3,682 | | | | 3,639 | | | | 3,647 | | | | 3,688 | | | | 3,725 | |

MFS Value Series | | Not

Applicable | | Not

Applicable | | | 4,573 | | | | 4,678 | | | | 4,630 | | | | 5,155 | | | | 4,535 | | | | 4,630 | | | | 4,573 | | | | 4,583 | | | | 4,640 | | | | 4,690 | |

20

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

December 31, 2016 | | Name and Position | |

| | | Interested Trustees | | Independent Trustees | |

Aggregate Compensation

Paid by Fund | | Robert J.

Manning | | Robin A.

Stelmach | | Steven E.

Buller | | | Robert E.

Butler* | | | Maureen R.

Goldfarb | | | David H.

Gunning | | | William R.

Gutow* | | | Michael

Hegarty | | | John P.

Kavanaugh | | | Maryanne L.

Roepke | | | Laurie J.

Thomsen | | | Robert

W. Uek* | |

Variable Insurance Trust II | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

MFS Blended Research Core Equity Portfolio | | Not

Applicable | | Not

Applicable | | | 1,053 | | | | 1,075 | | | | 1,065 | | | | 1,175 | | | | 1,044 | | | | 1,065 | | | | 1,053 | | | | 1,055 | | | | 1,067 | | | | 1,077 | |

MFS Core Equity Portfolio | | Not

Applicable | | Not

Applicable | | | 1,012 | | | | 1,021 | | | | 1,017 | | | | 1,064 | | | | 1,008 | | | | 1,017 | | | | 1,012 | | | | 1,013 | | | | 1,018 | | | | 1,022 | |

MFS Corporate Bond Portfolio | | Not

Applicable | | Not

Applicable | | | 1,022 | | | | 1,035 | | | | 1,029 | | | | 1,092 | | | | 1,017 | | | | 1,029 | | | | 1,022 | | | | 1,023 | | | | 1,030 | | | | 1,036 | |

MFS Emerging Markets Equity Portfolio | | Not

Applicable | | Not

Applicable | | | 304 | | | | 306 | | | | 305 | | | | 317 | | | | 303 | | | | 305 | | | | 304 | | | | 304 | | | | 305 | | | | 307 | |

MFS Global Governments Portfolio | | Not

Applicable | | Not

Applicable | | | 518 | | | | 527 | | | | 523 | | | | 566 | | | | 515 | | | | 523 | | | | 518 | | | | 519 | | | | 524 | | | | 528 | |

MFS Global Growth Portfolio | | Not

Applicable | | Not

Applicable | | | 304 | | | | 307 | | | | 305 | | | | 317 | | | | 303 | | | | 305 | | | | 304 | | | | 304 | | | | 306 | | | | 307 | |

MFS Global Research Portfolio | | Not

Applicable | | Not

Applicable | | | 506 | | | | 511 | | | | 509 | | | | 533 | | | | 505 | | | | 509 | | | | 506 | | | | 507 | | | | 509 | | | | 512 | |

MFS Global Tactical Allocation Portfolio | | Not

Applicable | | Not

Applicable | | | 1,779 | | | | 1,818 | | | | 1,800 | | | | 1,998 | | | | 1,764 | | | | 1,800 | | | | 1,779 | | | | 1,782 | | | | 1,804 | | | | 1,823 | |

MFS Government Securities Portfolio | | Not

Applicable | | Not

Applicable | | | 1,754 | | | | 1,786 | | | | 1,771 | | | | 1,930 | | | | 1,742 | | | | 1,771 | | | | 1,754 | | | | 1,757 | | | | 1,774 | | | | 1,789 | |

MFS High Yield Portfolio | | Not

Applicable | | Not

Applicable | | | 1,056 | | | | 1,079 | | | | 1,069 | | | | 1,185 | | | | 1,048 | | | | 1,069 | | | | 1,056 | | | | 1,058 | | | | 1,071 | | | | 1,082 | |

MFS International Growth Portfolio | | Not

Applicable | | Not

Applicable | | | 515 | | | | 523 | | | | 519 | | | | 557 | | | | 512 | | | | 519 | | | | 515 | | | | 516 | | | | 520 | | | | 523 | |

MFS International Value Portfolio | | Not

Applicable | | Not

Applicable | | | 2,740 | | | | 2,808 | | | | 2,777 | | | | 3,117 | | | | 2,716 | | | | 2,777 | | | | 2,740 | | | | 2,746 | | | | 2,783 | | | | 2,816 | |

MFS Massachusetts Investors Growth Stock Portfolio | | Not

Applicable | | Not

Applicable | | | 1,782 | | | | 1,823 | | | | 1,805 | | | | 2,009 | | | | 1,767 | | | | 1,805 | | | | 1,783 | | | | 1,786 | | | | 1,808 | | | | 1,828 | |

MFS Research International Portfolio | | Not

Applicable | | Not

Applicable | | | 1,043 | | | | 1,062 | | | | 1,054 | | | | 1,150 | | | | 1,036 | | | | 1,054 | | | | 1,043 | | | | 1,045 | | | | 1,055 | | | | 1,065 | |

21

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

December 31, 2016 | | Name and Position | |

| | | Interested Trustees | | Independent Trustees | |

Aggregate Compensation

Paid by Fund | | Robert J.

Manning | | Robin A.

Stelmach | | Steven E.

Buller | | | Robert E.

Butler* | | | Maureen R.

Goldfarb | | | David H.

Gunning | | | William R.

Gutow* | | | Michael

Hegarty | | | John P.

Kavanaugh | | | Maryanne L.

Roepke | | | Laurie J.

Thomsen | | | Robert

W. Uek* | |

MFS Strategic Income Portfolio | | Not

Applicable | | Not

Applicable | | | 305 | | | | 308 | | | | 306 | | | | 320 | | | | 304 | | | | 306 | | | | 305 | | | | 305 | | | | 307 | | | | 308 | |

MFS Technology Portfolio | | Not

Applicable | | Not

Applicable | | | 511 | | | | 517 | | | | 514 | | | | 545 | | | | 509 | | | | 514 | | | | 511 | | | | 511 | | | | 515 | | | | 518 | |

MFS U.S. Government Money Market Portfolio | | Not

Applicable | | Not

Applicable | | | 1,041 | | | | 1,060 | | | | 1,051 | | | | 1,144 | | | | 1,034 | | | | 1,051 | | | | 1,041 | | | | 1,043 | | | | 1,053 | | | | 1,062 | |

Variable Insurance Trust III | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

MFS Blended Research Small Cap Equity Portfolio | | Not

Applicable | | Not

Applicable | | | 507 | | | | 512 | | | | 509 | | | | 534 | | | | 505 | | | | 509 | | | | 507 | | | | 507 | | | | 510 | | | | 512 | |

MFS Conservative Allocation Portfolio | | Not

Applicable | | Not

Applicable | | | 1,754 | | | | 1,786 | | | | 1,771 | | | | 1,930 | | | | 1,742 | | | | 1,771 | | | | 1,754 | | | | 1,757 | | | | 1,774 | | | | 1,789 | |

MFS Global Real Estate Portfolio | | Not

Applicable | | Not

Applicable | | | 1,012 | | | | 1,021 | | | | 1,017 | | | | 1,064 | | | | 1,008 | | | | 1,017 | | | | 1,012 | | | | 1,013 | | | | 1,018 | | | | 1,022 | |

MFS Growth Allocation Portfolio | | Not

Applicable | | Not

Applicable | | | 1,050 | | | | 1,071 | | | | 1,061 | | | | 1,168 | | | | 1,042 | | | | 1,061 | | | | 1,050 | | | | 1,052 | | | | 1,064 | | | | 1,074 | |

MFS Inflation-Adjusted Bond Portfolio | | Not

Applicable | | Not

Applicable | | | 1,036 | | | | 1,053 | | | | 1,045 | | | | 1,130 | | | | 1,030 | | | | 1,045 | | | | 1,036 | | | | 1,038 | | | | 1,047 | | | | 1,055 | |

MFS Limited Maturity Portfolio | | Not

Applicable | | Not

Applicable | | | 1,753 | | | | 1,785 | | | | 1,770 | | | | 1,928 | | | | 1,742 | | | | 1,770 | | | | 1,754 | | | | 1,756 | | | | 1,774 | | | | 1,788 | |

MFS Mid Cap Value Portfolio | | Not

Applicable | | Not

Applicable | | | 1,031 | | | | 1,047 | | | | 1,039 | | | | 1,117 | | | | 1,025 | | | | 1,039 | | | | 1,031 | | | | 1,033 | | | | 1,041 | | | | 1,048 | |

MFS Moderate Allocation Portfolio | | Not

Applicable | | Not

Applicable | | | 3,669 | | | | 3,755 | | | | 3,716 | | | | 4,142 | | | | 3,638 | | | | 3,716 | | | | 3,670 | | | | 3,678 | | | | 3,724 | | | | 3,764 | |

MFS New Discovery Value Portfolio | | Not

Applicable | | Not

Applicable | | | 305 | | | | 307 | | | | 306 | | | | 319 | | | | 304 | | | | 306 | | | | 305 | | | | 305 | | | | 306 | | | | 308 | |

Retirement Benefits Accrued as Part of Fund Expense | | Not

Applicable | | Not

Applicable | |

| Not

Applicable |

| |

| Not

Applicable |

| |

| Not

Applicable |

| |

| Not

Applicable |

| |

| Not

Applicable |

| |

| Not

Applicable |

| |

| Not

Applicable |

| |

| Not

Applicable |

| |

| Not

Applicable |

| |

| Not

Applicable |

|

Total Trustee Compensation Paid by Fund Complex1 | | Not

Applicable | | Not

Applicable | | | $356,238 | | | | $367,238 | | | | $362,238 | | | | $417,238 | | | | $352,238 | | | | $362,238 | | | | $356,238 | | | | $357,238 | | | | $363,238 | | | | $368,488 | |

| * | | Messrs. Butler, Gutow and Uek retired as Trustees of the Fund on December 31, 2016. |

| 1 | | For the calendar year ended December 31, 2016 for 134 funds that paid Trustee compensation. |

22

FUND INFORMATION

This section provides certain information about each Fund, including information about its investment adviser, principal underwriter and administrator, Independent Registered Public Accounting Firm, executive officers and the identity of persons holding more than 5% of the outstanding shares of any class of any Fund.

Investment Adviser, Principal Underwriter and Administrator

Each Fund engages as its investment adviser and administrator MFS, a Delaware corporation with offices at 111 Huntington Avenue, Boston, Massachusetts 02199. Each Fund engages as its principal underwriter MFS Fund Distributors, Inc. (“MFD”), a Delaware corporation with offices at 111 Huntington Avenue, Boston, Massachusetts 02199. MFS and its predecessor organizations have a history of money management dating from 1924. MFS is a subsidiary of Sun Life of Canada (U.S.) Financial Services Holdings, Inc., which in turn is an indirect majority-owned subsidiary of Sun Life Financial Inc. (a diversified financial services company).

Independent Registered Public Accounting Firm

The Independent Registered Public Accounting Firm for each Fund is Deloitte & Touche LLP (“Deloitte”), and the fiscal year end for each Fund is December 31.

The Independent Registered Public Accounting Firm does not have a direct or material indirect interest in any Fund.

The Funds do not expect representatives of Deloitte to be present at the Meetings, but they will have the opportunity to make a statement if they wish, and they will be available should any matter arise requiring their presence.

To the extent required by applicable regulations, pre-approval by the Audit Committee of the Board is needed for all audit and permissible non-audit services rendered by the Independent Registered Public Accounting Firm to each Trust and all permissible non-audit services rendered by the Independent Registered Public Accounting Firm to MFS and any entity controlling, controlled by or under common control with MFS that provides ongoing services to a Trust (including MFS Service Center, Inc.) (each, a “Service Affiliate”) if the services relate directly to the operations and financial reporting of such Trust. Pre-approval is currently on an engagement-by-engagement basis. In the event pre-approval of such services is necessary between regular meetings of the Audit Committee and it is not practical to wait to seek pre-approval at the next regular meeting of the Audit Committee, pre-approval of such services may be referred to the Chair of the Audit Committee; provided that the Chair may not pre-approve any individual engagement for such services exceeding $50,000 or multiple engagements for such services in the aggregate exceeding $100,000 between such regular meetings of the Audit Committee. Any engagement pre-approved by the Chair between regular meetings of the Audit Committee shall be presented for ratification by the entire Audit Committee at its next regularly scheduled meeting.

23

Schedule A attached hereto includes tables that set forth for each Fund, for each Fund’s 2015 and 2014 fiscal years, the fees billed by the Independent Registered Public Accounting Firm for (a) all audit and non-audit services provided directly to the Fund and (b) those non-audit services provided to the Fund’s Service Affiliates that relate directly to the Fund’s operations and financial reporting under the following captions:

| | (i) | | Audit Fees – fees related to the audit and review of the financial statements included in annual reports and registration statements, and other services that are normally provided in connection with statutory and regulatory filings or engagements. |

| | (ii) | | Audit-Related Fees – fees related to assurance and related services that are reasonably related to the performance of the audit or review of financial statements, but not reported under “Audit Fees”, including accounting consultations, agreed-upon procedure reports (inclusive of annual review of basic maintenance testing associated with the Preferred Shares), attestation reports, comfort letters and internal control reviews. |

| | (iii) | | Tax Fees – fees associated with tax compliance, tax advice and tax planning, including services relating to the filing or amendment of federal, state or local income tax returns, regulated investment company qualification reviews and tax distribution and analysis reviews. |

| | (iv) | | All Other Fees – fees for products and services provided to a Trust by the Independent Registered Public Accounting Firm other than those reported under “Audit Fees”, “Audit- Related Fees” and “Tax Fees.” |

Schedule A attached hereto also sets forth the aggregate fees billed by the Independent Registered Public Accounting Firm for each Fund’s 2015 and 2014 fiscal years, for non-audit services rendered to each Fund and to each Fund’s Service Affiliates. During the periods indicated in the tables attached hereto as Schedule A, no services described above under “Audit- Related Fees,” “Tax Fees” or “All Other Fees” were approved pursuant to thede minimis exception set forth in paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

The Audit Committee has considered whether the provision by a Fund’s Independent Registered Public Accounting Firm of non-audit services to the Fund’s Service Affiliates that were not pre-approved by the Audit Committee (because such services did not relate directly to the operations and financial reporting of the Fund) was compatible with maintaining the independence of the Independent Registered Public Accounting Firm as the Fund’s principal auditor.

24

Executive Officers

The following table provides information as of January 1, 2017 about the current executive officers of each Trust, including their principal occupations, which, unless specific dates are shown, are of more than five years’ duration, although the titles may not have been the same throughout. Each officer will hold office until his or her successor is chosen and qualified, or until he or she retires, resigns or is removed from office.

| | | | | | |

| Name, Age | | Position(s) Held With Trust | | Officer Since(1) | | Principal Occupations During the Past Five Years(2) |

OFFICERS | | | | | | |

| Christopher R. Bohane(3) (Age 42) | | Assistant Secretary and Assistant Clerk | | July 2005 | | Massachusetts Financial Services Company, Vice President and Assistant General Counsel |

| | | |

Kino Clark(3) (Age 48) | | Assistant Treasurer | | January 2012 | | Massachusetts Financial Services Company, Vice President |

| | | |

Thomas H. Connors(3) (Age 57) | | Assistant Secretary and Assistant Clerk | | September 2012 | | Massachusetts Financial Services Company, Vice President and Senior Counsel; Deutsche Investment Management Americas Inc. (financial service provider), Director and Senior Counsel (until 2012) |

| | | |

Ethan D. Corey(3) (Age 53) | | Assistant Secretary and Assistant Clerk | | July 2005 | | Massachusetts Financial Services Company, Senior Vice President and Associate General Counsel |

| | | |

David L. DiLorenzo(3) (Age 48) | | President | | July 2005 | | Massachusetts Financial Services Company, Senior Vice President |

| | | |

Brian E. Langenfeld(3) (Age 43) | | Assistant Secretary and Assistant Clerk | | June 2006 | | Massachusetts Financial Services Company, Vice President and Senior Counsel |

| | | |

Susan A. Pereira(3) (Age 46) | | Assistant Secretary and Assistant Clerk | | July 2005 | | Massachusetts Financial Services Company, Vice President and Senior Counsel |

| | | |

Kasey L. Philips(3) (Age 46) | | Assistant Treasurer | | September 2012 | | Massachusetts Financial Services Company, Vice President; Wells Fargo Funds Management, LLC, Senior Vice President, and Treasurer (until 2012) |

| | | |

| Mark N. Polebaum(3) (Age 64) | | Secretary and Clerk | | January 2006 | | Massachusetts Financial Services Company, Executive Vice President, General Counsel and Secretary |

| | | |

Matthew A. Stowe(3) (Age 42) | | Assistant Secretary and Assistant Clerk | | October 2014 | | Massachusetts Financial Services Company, Vice President and Assistant General Counsel |

| | | |

Frank L. Tarantino (Age 72) | | Independent Senior Officer | | June 2004 | | Tarantino LLC (provider of compliance services), Principal |

25

| | | | | | |

| Name, Age | | Position(s) Held With Trust | | Officer Since(1) | | Principal Occupations During the Past Five Years(2) |

| | | |

| Richard S. Weitzel(3) (Age 46) | | Assistant Secretary and Assistant Clerk | | October 2007 | | Massachusetts Financial Services Company, Senior Vice President and Associate General Counsel |

| | | |

Martin J. Wolin (Age 49) | | Chief Compliance Officer | | July 2015 | | Massachusetts Financial Services Company, Senior Vice President and Chief Compliance Officer (since July 2015); Mercer (financial service provider), Chief Risk and Compliance Officer, North America and Latin America (until July 2015) |

| | | |

James O. Yost(3) (Age 56) | | Treasurer | | September 1990 | | Massachusetts Financial Services Company, Senior Vice President |

| (1) | | Date first appointed to serve as officer of an MFS fund. Prior to January 2012, Messrs. DiLorenzo and Yost served as Assistant Treasurers of the Funds. From January 2012 through December 2016, Messrs. DiLorenzo and Yost served as Treasurer and Deputy Treasurer of the Funds, respectively. |

| (2) | | Officers do not serve as directors or trustees of companies required to report to the Securities and Exchange Commission (i.e., “public companies”). |

| (3) | | “Interested person” of the Trust within the meaning of the 1940 Act, as a result of position with MFS. The address of MFS is 111 Huntington Avenue, Boston, Massachusetts 02199. |

Each Fund’s officers held comparable positions with the 138 funds in the MFS Family of Funds, and with certain affiliates of MFS as of date hereof. The address of each officer is c/o MFS, 111 Huntington Avenue, Boston, Massachusetts 02199

Interests of Certain Persons

Schedule B attached hereto sets forth, as of November 30, 2016, to the best knowledge of each Fund, the shareholders who beneficially owned more than 5% of the outstanding shares of each class of such Fund.

FURTHER INFORMATION ABOUT VOTING AND THE MEETING

Manner of Voting Proxies

All proxies received by management will be voted on all matters presented at the Meeting, and if not limited to the contrary, will be voted FOR the election of Steven E. Buller, John A. Caroselli, Maureen R. Goldfarb, David H. Gunning, Michael Hegarty, John P. Kavanaugh, Robert J. Manning, Clarence Otis, Jr., Maryanne L. Roepke, Robin A. Stelmach, and Laurie J. Thomsen as Trustees of the Trust (if still available for election).

All proxies received, including proxies that reflect (i) abstentions or (ii) the withholding of authority to vote, will be counted as shares that are present on a particular matter for purposes of determining the presence of a quorum for that matter. With respect to the series of MFS Variable Insurance Trust and MFS Variable Insurance Trust II, shares representing a majority of a Fund’s voting power entitled to be cast at the Meeting that are present in person or represented by proxy constitute a quorum. With respect to the series of MFS Variable Insurance Trust III, shares representing a one-third of a Fund’s voting power entitled to be cast at the Meeting that are present in person or represented by proxy constitute a quorum. With respect to the election of Trustees, neither abstentions nor withholding authority to vote have any effect on the outcome of the voting.

26

Each shareholder of a Fund is entitled to one vote for each dollar of net asset value (number of shares of the Fund owned by such shareholder, times net asset value per share) of the Fund that such shareholder owns at the close of business on January 6, 2017, on each matter on which the shareholder is entitled to vote. Each fractional dollar amount is entitled to a proportionate fractional vote.

Each Fund will reimburse the record holders of its shares for their expenses incurred in providing proxy material to and obtaining voting instructions from contract owners.

Each Fund knows of no other matters to be brought before the Meeting. If, however, because of any unexpected occurrence, any nominee is not available for election or if any other matters properly come before the Meeting, it is each Fund’s intention that proxies not limited to the contrary will be voted in accordance with the judgment of the persons named in the proxy materials.

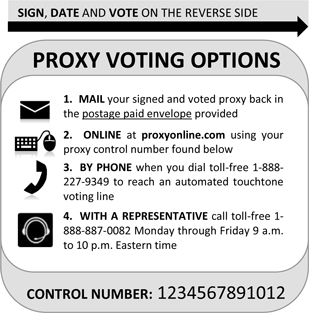

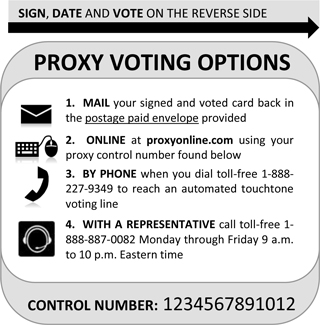

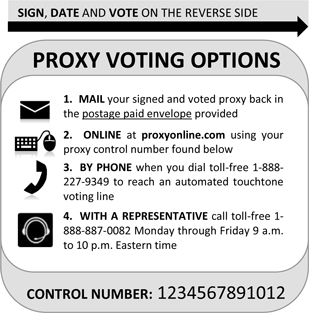

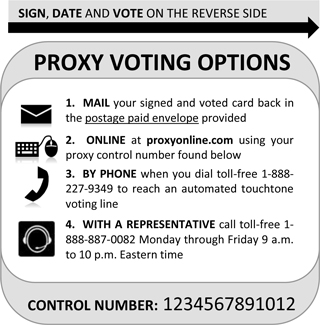

Instructions for Voting Proxies

The giving of a proxy will not affect a shareholder’s right to vote in person should the shareholder decide to attend the Meeting. To vote by mail, please mark, sign, date and return the enclosed proxy card following the instructions printed on the card. Please refer to your proxy card for instructions on voting by telephone or internet.

Submission of Proposals

Each Fund that is a series of MFS Variable Insurance Trust and MFS Variable Insurance Trust II is part of a Massachusetts business trust and each Fund that is a series of MFS Variable Insurance Trust III is a part of a Delaware trust, and as such is not required to hold annual meetings of shareholders. However, the Trustees may from time to time schedule special meetings. Shareholder proposals for inclusion in a Fund’s proxy statement for any subsequent meeting must be received by the applicable Fund a reasonable period of time prior to any such meeting.

Additional Information

Because all shareholders of Funds that are series of the same Trust will vote together as a single class with respect to the election of Trustees, the Meeting of shareholders of each Fund is called to be held at the same time as the Meeting of shareholders of each of the other Funds. It is anticipated that all Meetings will be held simultaneously.

Each Fund that owns shares of another Fund (the “underlying fund”) will vote shares in the same proportion as those underlying fund shareholders unaffiliated with the Funds.

With regard to a proposal other than the election of Trustees (if any), if any shareholder at the Meeting objects to the holding of simultaneous Meetings and moves for an adjournment of that Meeting to a time promptly after the simultaneous Meetings, the persons named as proxies will vote in favor of such adjournment with respect to such other proposals.

The expense of the preparation of this Proxy Statement and related materials, including printing and delivery costs, the solicitation of proxies, and the tabulation costs, will be borne on a proportional basis by the Funds.

27