UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-8879

MFS VARIABLE INSURANCE TRUST III

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2021

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Semiannual Report

June 30, 2021

MFS® Blended Research®

Small Cap Equity Portfolio

MFS® Variable Insurance Trust III

MFS® Blended Research® Small Cap Equity Portfolio

The report is prepared for the general information of contract owners. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK OR CREDIT UNION GUARANTEE •

NOT A DEPOSIT • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY OR NCUA/NCUSIF

MFS Blended Research Small Cap Equity Portfolio

Dear Contract Owners:

After experiencing dramatic swings in the early days of the coronavirus pandemic, global equity markets have performed strongly over the past year. Though the speedy development of vaccines brightened the economic and market outlook, uncertainty remains as new variants of the virus appear, and questions persist over how fast vaccines can be made widely available in the developing world.

Global central banks have taken aggressive steps to cushion the economic and market fallout related to the virus, and governments are deploying unprecedented levels of fiscal support. Having passed a $1.9 trillion stimulus package in March, the U.S. Congress could approve additional stimulus later this year, some of it focused on infrastructure. Along with extraordinary government expenditures, pent-up consumer demand fueled a surge in economic activity as coronavirus restrictions were eased, pushing up inflation, at least temporarily. Markets initially reacted by pushing up yields on global government bonds, though some of the rate rise has since been corrected.

A spirited debate is underway among investors over whether the current price pressures will persist or prove to be temporary, caused by pandemic-induced bottlenecks. The policy measures put in place to counteract the pandemic's effects have helped build a supportive environment and are encouraging economic recovery; however, if markets disconnect from fundamentals, they can sow the seeds of instability. As such, recent dramatic increases in speculative trading in cryptocurrencies, special purpose acquisition companies (SPACs), and the like bear watching.

In the aftermath of the crisis, we could see societal changes as households, businesses, and governments adjust to a new reality, and any such alterations could affect the investment landscape. For investors, events such as the COVID-19 outbreak demonstrate the importance of having a deep understanding of company fundamentals, and we have built our global research platform to do just that.

At MFS®, we put our clients’ assets to work responsibly by carefully navigating the increasing complexity of global markets and economies. Guided by our long-term philosophy and adhering to our commitment to sustainable investing, we tune out the noise and aim to uncover what we believe are the best, most durable investment opportunities in the market. Our unique global investment platform combines collective expertise, long-term discipline, and thoughtful risk management to create sustainable value for investors.

Respectfully,

Michael W. Roberge

Chief Executive Officer

MFS Investment Management

August 13, 2021

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

MFS Blended Research Small Cap Equity Portfolio

Top ten holdings

| Box, Inc., “A” | 1.6% |

| Prestige Consumer Healthcare, Inc. | 1.5% |

| Evercore Partners, Inc. | 1.5% |

| CNO Financial Group, Inc. | 1.4% |

| Texas Roadhouse, Inc. | 1.4% |

| National Storage Affiliates Trust, REIT | 1.4% |

| Element Solutions, Inc. | 1.4% |

| UMB Financial Corp. | 1.3% |

| Brunswick Corp. | 1.3% |

| Magnolia Oil & Gas Corp., “A” | 1.3% |

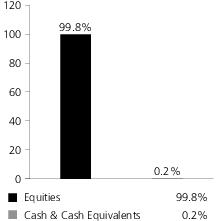

GICS equity sectors (g)

| Health Care | 20.8% |

| Information Technology | 14.7% |

| Financials | 14.0% |

| Consumer Discretionary | 13.6% |

| Industrials | 13.0% |

| Real Estate | 7.6% |

| Materials | 5.0% |

| Energy | 4.3% |

| Consumer Staples | 2.7% |

| Communication Services | 2.6% |

| Utilities | 1.5% |

| (g) | The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and S&P Global Market Intelligence Inc. (“S&P Global Market Intelligence”). GICS is a service mark of MSCI and S&P Global Market Intelligence and has been licensed for use by MFS. MFS has applied its own internal sector/industry classification methodology for equity securities and non-equity securities that are unclassified by GICS. |

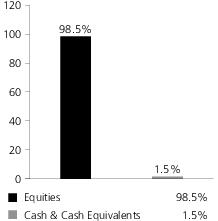

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of June 30, 2021.

The portfolio is actively managed and current holdings may be different.

MFS Blended Research Small Cap Equity Portfolio

Expense Table

Fund Expenses Borne by the Contract Holders during the Period,

January 1, 2021 through June 30, 2021

As a contract holder of the fund, you incur ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period January 1, 2021 through June 30, 2021.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight the fund's ongoing costs only and do not take into account the fees and expenses imposed under the variable contracts through which your investment in the fund is made. Therefore, the second line for each share class in the table is useful in comparing ongoing costs associated with an investment in vehicles (such as the fund) which fund benefits under variable annuity and variable life insurance contracts and to qualified pension and retirement plans only, and will not help you determine the relative total costs of investing in the fund through variable annuity and variable life insurance contracts. If the fees and expenses imposed under the variable contracts were included, your costs would have been higher.

Share

Class | | Annualized

Expense

Ratio | Beginning

Account Value

1/01/21 | Ending

Account Value

6/30/21 | Expenses

Paid During

Period (p)

1/01/21-6/30/21 |

| Initial Class | Actual | 0.52% | $1,000.00 | $1,231.90 | $2.88 |

| Hypothetical (h) | 0.52% | $1,000.00 | $1,022.22 | $2.61 |

| Service Class | Actual | 0.77% | $1,000.00 | $1,229.52 | $4.26 |

| Hypothetical (h) | 0.77% | $1,000.00 | $1,020.98 | $3.86 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class's annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

MFS Blended Research Small Cap Equity Portfolio

Portfolio of Investments − 6/30/21 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – 99.8% |

| Aerospace & Defense – 0.7% | |

| CACI International, Inc., “A” (a) | | 2,666 | $ 680,150 |

| Apparel Manufacturers – 1.5% | |

| FIGS, Inc. (a) | | 4,505 | $ 225,700 |

| Skechers USA, Inc., “A” (a) | | 26,767 | 1,333,800 |

| | | | | $1,559,500 |

| Automotive – 0.5% | |

| REV Group, Inc. | | 20,927 | $ 328,345 |

| Stoneridge, Inc. (a) | | 1,424 | 42,008 |

| XPEL, Inc. (a) | | 1,439 | 120,689 |

| | | | | $491,042 |

| Biotechnology – 7.5% | |

| Adaptive Biotechnologies Corp. (a) | | 9,936 | $ 405,985 |

| Agios Pharmaceuticals, Inc. (a) | | 1,385 | 76,327 |

| Alkermes PLC (a) | | 15,434 | 378,442 |

| AnaptysBio, Inc. (a) | | 21,350 | 553,605 |

| Avid Bioservices, Inc. (a) | | 5,934 | 152,207 |

| Clovis Oncology, Inc. (a) | | 28,406 | 164,755 |

| Coherus BioSciences, Inc. (a) | | 24,365 | 336,968 |

| CymaBay Therapeutics, Inc. (a) | | 52,598 | 229,327 |

| CytomX Therapeutics, Inc. (a) | | 64,787 | 410,102 |

| Eiger BioPharmaceuticals, Inc. (a) | | 6,947 | 59,188 |

| Exelixis, Inc. (a) | | 4,154 | 75,686 |

| ImmunoGen, Inc. (a) | | 19,407 | 127,892 |

| Lexicon Pharmaceuticals, Inc. (a) | | 33,448 | 153,526 |

| Macrogenics, Inc. (a) | | 17,632 | 473,596 |

| Meridian Bioscience, Inc. (a) | | 27,574 | 611,591 |

| Novavax, Inc. (a) | | 2,047 | 434,599 |

| Organogenesis Holdings, Inc. (a) | | 29,548 | 491,088 |

| Prothena Corp. PLC (a) | | 9,479 | 487,315 |

| Radius Health, Inc. (a) | | 10,895 | 198,725 |

| Sorrento Therapeutics, Inc. (a) | | 5,909 | 57,258 |

| Translate Bio, Inc. (a) | | 15,475 | 426,182 |

| Travere Therapeutics, Inc. (a) | | 21,826 | 318,441 |

| Vanda Pharmaceuticals, Inc. (a) | | 33,931 | 729,856 |

| Varex Imaging Corp. (a) | | 14,005 | 375,614 |

| | | | | $7,728,275 |

| Brokerage & Asset Managers – 1.5% | |

| Evercore Partners, Inc. | | 10,634 | $ 1,496,948 |

| Business Services – 2.7% | |

| Forrester Research, Inc. (a) | | 17,889 | $ 819,316 |

| MoneyGram International, Inc. (a) | | 48,043 | 484,273 |

| RE/MAX Holdings, Inc., “A” | | 23,377 | 779,155 |

| Rush Enterprises, Inc., “A” | | 9,123 | 394,479 |

| TaskUs, Inc., “A” (a) | | 10,170 | 348,221 |

| | | | | $2,825,444 |

| Chemicals – 1.8% | |

| Element Solutions, Inc. | | 59,430 | $ 1,389,473 |

| Rayonier Advanced Materials, Inc. (a) | | 72,506 | 485,065 |

| | | | | $1,874,538 |

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Computer Software – 4.6% | |

| ACI Worldwide, Inc. (a) | | 12,671 | $ 470,601 |

| Altair Engineering, Inc., “A” (a) | | 2,132 | 147,044 |

| Cornerstone OnDemand, Inc. (a) | | 12,253 | 632,010 |

| Digital Turbine, Inc. (a) | | 10,145 | 771,324 |

| Pagerduty, Inc. (a) | | 20,461 | 871,229 |

| Paylocity Holding Corp. (a) | | 4,697 | 896,188 |

| Ribbon Communications, Inc. (a) | | 10,237 | 77,904 |

| Sprout Social, Inc. (a) | | 4,575 | 409,097 |

| Tenable Holdings, Inc. (a) | | 10,150 | 419,702 |

| | | | | $4,695,099 |

| Computer Software - Systems – 3.2% | |

| Box, Inc., “A” (a) | | 65,318 | $ 1,668,875 |

| Extreme Networks, Inc. (a) | | 8,781 | 97,996 |

| Five9, Inc. (a) | | 6,260 | 1,148,021 |

| Rimini Street, Inc. (a) | | 6,460 | 39,794 |

| Verint Systems, Inc. (a) | | 7,635 | 344,109 |

| | | | | $3,298,795 |

| Construction – 2.6% | |

| Builders FirstSource, Inc. (a) | | 23,746 | $ 1,013,004 |

| Century Communities, Inc. | | 3,718 | 247,396 |

| Eagle Materials, Inc. | | 7,109 | 1,010,260 |

| GMS, Inc. (a) | | 8,408 | 404,761 |

| | | | | $2,675,421 |

| Consumer Products – 2.9% | |

| Energizer Holdings, Inc. | | 20,685 | $ 889,041 |

| Nu Skin Enterprises, Inc., “A” | | 5,923 | 335,538 |

| Prestige Consumer Healthcare, Inc. (a) | | 30,438 | 1,585,820 |

| Tupperware Brands Corp. (a) | | 7,629 | 181,189 |

| | | | | $2,991,588 |

| Consumer Services – 1.3% | |

| Grand Canyon Education, Inc. (a) | | 11,143 | $ 1,002,536 |

| Medifast, Inc. | | 1,131 | 320,050 |

| | | | | $1,322,586 |

| Electrical Equipment – 1.8% | |

| Advanced Drainage Systems, Inc. | | 6,690 | $ 779,853 |

| TriMas Corp. (a) | | 36,124 | 1,095,641 |

| | | | | $1,875,494 |

| Electronics – 5.5% | |

| Advanced Energy Industries, Inc. | | 11,811 | $ 1,331,218 |

| Alpha and Omega Semiconductor Ltd. (a) | | 7,800 | 237,042 |

| Amkor Technology, Inc. | | 40,701 | 963,393 |

| Jabil Circuit, Inc. | | 10,336 | 600,728 |

| Plexus Corp. (a) | | 11,270 | 1,030,191 |

| Sanmina Corp. (a) | | 11,592 | 451,624 |

| Silicon Laboratories, Inc. (a) | | 6,633 | 1,016,507 |

| | | | | $5,630,703 |

MFS Blended Research Small Cap Equity Portfolio

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Energy - Independent – 1.7% | |

| Antero Resources Corp. (a) | | 13,534 | $ 203,416 |

| CONSOL Energy, Inc. (a) | | 13,035 | 240,757 |

| Magnolia Oil & Gas Corp., “A” (a) | | 85,607 | 1,338,037 |

| | | | | $1,782,210 |

| Engineering - Construction – 2.5% | |

| APi Group, Inc. (a) | | 52,523 | $ 1,097,205 |

| Comfort Systems USA, Inc. | | 7,266 | 572,488 |

| Quanta Services, Inc. | | 10,049 | 910,138 |

| | | | | $2,579,831 |

| Food & Beverages – 1.2% | |

| Hostess Brands, Inc. (a) | | 74,824 | $ 1,211,401 |

| Forest & Paper Products – 0.4% | |

| Verso Corp., “A” | | 23,817 | $ 421,561 |

| Gaming & Lodging – 2.1% | |

| Everi Holdings, Inc. (a) | | 27,232 | $ 679,166 |

| Penn National Gaming, Inc. (a) | | 6,610 | 505,599 |

| Wyndham Hotels & Resorts, Inc. | | 13,906 | 1,005,265 |

| | | | | $2,190,030 |

| Insurance – 2.5% | |

| CNO Financial Group, Inc. | | 62,453 | $ 1,475,140 |

| Reinsurance Group of America, Inc. | | 9,309 | 1,061,226 |

| | | | | $2,536,366 |

| Internet – 2.1% | |

| Brightcove, Inc. (a) | | 7,486 | $ 107,424 |

| Cars.com, Inc. (a) | | 58,384 | 836,643 |

| QuinStreet, Inc. (a) | | 26,333 | 489,267 |

| TechTarget (a) | | 7,258 | 562,422 |

| TrueCar, Inc. (a) | | 24,132 | 136,346 |

| | | | | $2,132,102 |

| Leisure & Toys – 3.9% | |

| Brunswick Corp. | | 13,620 | $ 1,356,825 |

| Funko, Inc., “A” (a) | | 59,719 | 1,270,820 |

| Malibu Boats, Inc., “A” (a) | | 17,116 | 1,255,116 |

| MasterCraft Boat Holdings, Inc. (a) | | 2,941 | 77,319 |

| Nautilus, Inc. (a) | | 5,505 | 92,759 |

| | | | | $4,052,839 |

| Machinery & Tools – 2.1% | |

| ACCO Brands Corp. | | 7,874 | $ 67,953 |

| AGCO Corp. | | 777 | 101,305 |

| ITT, Inc. | | 5,595 | 512,446 |

| Regal Beloit Corp. | | 9,669 | 1,290,908 |

| Titan Machinery, Inc. (a) | | 7,310 | 226,171 |

| | | | | $2,198,783 |

| Medical & Health Technology & Services – 4.0% | |

| Community Health Systems, Inc. (a) | | 19,730 | $ 304,631 |

| Covetrus, Inc. (a) | | 5,307 | 143,289 |

| LifeStance Health Group, Inc. (a) | | 13,948 | 388,591 |

| Owens & Minor, Inc. | | 17,356 | 734,680 |

| Signify Health, Inc., “A” (a) | | 10,609 | 322,832 |

| Syneos Health, Inc. (a) | | 11,723 | 1,049,091 |

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Medical & Health Technology & Services – continued | |

| Tenet Healthcare Corp. (a) | | 17,051 | $ 1,142,247 |

| | | | | $4,085,361 |

| Medical Equipment – 4.8% | |

| Accuray, Inc. (a) | | 46,746 | $ 211,292 |

| Alphatec Holdings, Inc. (a) | | 20,493 | 313,953 |

| AngioDynamics, Inc. (a) | | 18,039 | 489,398 |

| Avanos Medical, Inc. (a) | | 11,312 | 411,417 |

| Envista Holdings Corp. (a) | | 2,656 | 114,766 |

| Integer Holdings Corp. (a) | | 8,397 | 790,997 |

| LivaNova PLC (a) | | 1,337 | 112,455 |

| Maravai Lifesciences Holdings, Inc., “A” (a) | | 23,835 | 994,635 |

| Merit Medical Systems, Inc. (a) | | 5,507 | 356,083 |

| OraSure Technologies, Inc. (a) | | 18,166 | 184,203 |

| Orthofix Medical, Inc. (a) | | 4,539 | 182,059 |

| Quidel Corp. (a) | | 4,605 | 589,993 |

| Zynex, Inc. (a)(l) | | 14,459 | 224,548 |

| | | | | $4,975,799 |

| Metals & Mining – 1.6% | |

| Alcoa Corp. (a) | | 17,542 | $ 646,247 |

| Ryerson Holding Corp. (a) | | 24,208 | 353,437 |

| Schnitzer Steel Industries, Inc., “A” | | 1,917 | 94,029 |

| TimkenSteel Corp. (a) | | 24,869 | 351,896 |

| United States Steel Corp. | | 7,018 | 168,432 |

| | | | | $1,614,041 |

| Natural Gas - Distribution – 0.3% | |

| MDU Resources Group, Inc. | | 9,484 | $ 297,229 |

| Natural Gas - Pipeline – 0.6% | |

| Antero Midstream Corp. | | 21,621 | $ 224,642 |

| Equitrans Midstream Corp. | | 48,602 | 413,603 |

| | | | | $638,245 |

| Network & Telecom – 0.5% | |

| Cambium Networks Corp. (a) | | 11,006 | $ 532,140 |

| Oil Services – 2.7% | |

| Cactus, Inc., “A” | | 31,084 | $ 1,141,405 |

| ChampionX Corp. (a) | | 28,723 | 736,745 |

| Liberty Oilfield Services, Inc. (a) | | 9,250 | 130,980 |

| MRC Global, Inc. (a) | | 81,938 | 770,217 |

| | | | | $2,779,347 |

| Other Banks & Diversified Financials – 10.1% | |

| Bank OZK | | 28,786 | $ 1,213,618 |

| Cathay General Bancorp, Inc. | | 32,341 | 1,272,942 |

| First Hawaiian, Inc. | | 24,806 | 703,002 |

| Hanmi Financial Corp. | | 56,081 | 1,068,904 |

| Herc Holdings, Inc. (a) | | 699 | 78,337 |

| Prosperity Bancshares, Inc. | | 11,762 | 844,511 |

| Signature Bank | | 3,292 | 808,680 |

| SLM Corp. | | 61,452 | 1,286,805 |

| UMB Financial Corp. | | 14,630 | 1,361,468 |

| Umpqua Holdings Corp. | | 43,441 | 801,486 |

| Wintrust Financial Corp. | | 12,505 | 945,753 |

| | | | | $10,385,506 |

MFS Blended Research Small Cap Equity Portfolio

Portfolio of Investments (unaudited) – continued

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Pharmaceuticals – 2.9% | |

| Amneal Pharmaceuticals, Inc. (a) | | 17,911 | $ 91,704 |

| Collegium Pharmaceutical, Inc. (a) | | 15,505 | 366,538 |

| Emergent BioSolutions, Inc. (a) | | 6,229 | 392,365 |

| G1 Therapeutics, Inc. (a) | | 8,745 | 191,865 |

| Gritstone bio, Inc. (a) | | 17,097 | 156,096 |

| IDEAYA Biosciences, Inc. (a) | | 15,049 | 315,878 |

| KalVista Pharmaceuticals, Inc. (a) | | 9,549 | 228,794 |

| OPKO Health, Inc. (a) | | 9,755 | 39,508 |

| Phibro Animal Health Corp., “A” | | 13,525 | 390,602 |

| TCR Therapeutics, Inc. (a) | | 1,275 | 20,923 |

| United Therapeutics Corp. (a) | | 4,419 | 792,813 |

| | | | | $2,987,086 |

| Pollution Control – 0.5% | |

| U.S. Ecology, Inc. (a) | | 13,230 | $ 496,390 |

| Printing & Publishing – 0.2% | |

| Gannett Co., Inc. (a) | | 35,045 | $ 192,397 |

| Railroad & Shipping – 0.4% | |

| Genco Shipping & Trading Ltd. | | 20,395 | $ 385,058 |

| Real Estate – 6.9% | |

| CorePoint Lodging, Inc., REIT (a) | | 21,436 | $ 229,365 |

| Corporate Office Properties Trust, REIT | | 8,963 | 250,874 |

| Empire State Realty Trust, REIT, “A” | | 88,215 | 1,058,580 |

| Industrial Logistics Properties Trust, REIT | | 11,191 | 292,533 |

| Innovative Industrial Properties, Inc., REIT | | 1,374 | 262,462 |

| Life Storage, Inc., REIT | | 463 | 49,703 |

| National Storage Affiliates Trust, REIT | | 28,177 | 1,424,629 |

| Plymouth Industrial, Inc., REIT | | 2,589 | 51,832 |

| Spirit Realty Capital, Inc., REIT | | 19,304 | 923,503 |

| STAG Industrial, Inc., REIT | | 31,185 | 1,167,255 |

| STORE Capital Corp., REIT | | 30,835 | 1,064,116 |

| Uniti Group, Inc., REIT | | 28,368 | 300,417 |

| | | | | $7,075,269 |

| Restaurants – 1.4% | |

| Texas Roadhouse, Inc. | | 15,300 | $ 1,471,860 |

| Specialty Chemicals – 1.5% | |

| Kraton Corp. (a) | | 5,683 | $ 183,504 |

| Univar Solutions, Inc. (a) | | 53,970 | 1,315,789 |

| | | | | $1,499,293 |

| Issuer | | | Shares/Par | Value ($) |

| Common Stocks – continued |

| Specialty Stores – 3.0% | |

| Camping World Holdings, Inc. “A” | | 13,857 | $ 567,998 |

| Overstock.com, Inc. (a) | | 8,681 | 800,388 |

| Petco Health & Wellness Co., Inc. (a) | | 20,387 | 456,873 |

| Signet Jewelers Ltd. | | 1,275 | 103,007 |

| Urban Outfitters, Inc. (a) | | 27,516 | 1,134,210 |

| | | | | $3,062,476 |

| Telecommunications - Wireless – 0.3% | |

| Telephone and Data Systems, Inc. | | 11,539 | $ 261,474 |

| Telephone Services – 0.2% | |

| Consolidated Communications Holdings, Inc. (a) | | 23,330 | $ 205,071 |

| Trucking – 0.1% | |

| Daseke, Inc. (a) | | 11,669 | $ 75,615 |

| Utilities - Electric Power – 1.2% | |

| Portland General Electric Co. | | 26,390 | $ 1,216,051 |

| Total Common Stocks (Identified Cost, $74,109,122) | | $102,486,414 |

| Investment Companies (h) – 0.3% |

| Money Market Funds – 0.3% | |

| MFS Institutional Money Market Portfolio, 0.02% (v) (Identified Cost, $327,878) | | | 327,878 | $ 327,878 |

| Collateral for Securities Loaned – 0.1% |

| State Street Navigator Securities Lending Government Money Market Portfolio, 0.02% (j) (Identified Cost, $101,472) | | | 101,472 | $ 101,472 |

| Other Assets, Less Liabilities – (0.2)% | | (245,291) |

| Net Assets – 100.0% | $102,670,473 |

| (a) | Non-income producing security. | | | |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund's investments in affiliated issuers and in unaffiliated issuers were $327,878 and $102,587,886, respectively. | | | |

| (j) | The rate quoted is the annualized seven-day yield of the fund at period end. | | | |

| (l) | A portion of this security is on loan. See Note 2 for additional information. | | | |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. | | | |

| The following abbreviations are used in this report and are defined: |

| REIT | Real Estate Investment Trust |

See Notes to Financial Statements

MFS Blended Research Small Cap Equity Portfolio

| Financial Statements | Statement of Assets and Liabilities (unaudited) |

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| At 6/30/21Assets | |

| Investments in unaffiliated issuers, at value, including $98,491 of securities on loan (identified cost, $74,210,594) | $102,587,886 |

| Investments in affiliated issuers, at value (identified cost, $327,878) | 327,878 |

| Receivables for | |

| Investments sold | 466,119 |

| Fund shares sold | 25,521 |

| Interest and dividends | 68,608 |

| Other assets | 661 |

| Total assets | $103,476,673 |

| Liabilities | |

| Payables for | |

| Fund shares reacquired | $650,218 |

| Collateral for securities loaned, at value | 101,472 |

| Payable to affiliates | |

| Investment adviser | 2,191 |

| Administrative services fee | 134 |

| Shareholder servicing costs | 59 |

| Distribution and/or service fees | 881 |

| Accrued expenses and other liabilities | 51,245 |

| Total liabilities | $806,200 |

| Net assets | $102,670,473 |

| Net assets consist of | |

| Paid-in capital | $62,043,695 |

| Total distributable earnings (loss) | 40,626,778 |

| Net assets | $102,670,473 |

| Shares of beneficial interest outstanding | 7,835,275 |

| | Net assets | Shares

outstanding | Net asset value

per share |

| Initial Class | $38,926,373 | 2,896,908 | $13.44 |

| Service Class | 63,744,100 | 4,938,367 | 12.91 |

See Notes to Financial Statements

MFS Blended Research Small Cap Equity Portfolio

| Financial Statements | Statement of Operations (unaudited) |

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Six months ended 6/30/21 | |

| Net investment income (loss) | |

| Income | |

| Dividends | $458,666 |

| Other | 10,371 |

| Income on securities loaned | 2,714 |

| Dividends from affiliated issuers | 194 |

| Total investment income | $471,945 |

| Expenses | |

| Management fee | $201,109 |

| Distribution and/or service fees | 78,557 |

| Shareholder servicing costs | 5,972 |

| Administrative services fee | 11,919 |

| Independent Trustees' compensation | 1,802 |

| Custodian fee | 1,547 |

| Shareholder communications | 7,522 |

| Audit and tax fees | 28,015 |

| Legal fees | 317 |

| Miscellaneous | 11,432 |

| Total expenses | $348,192 |

| Reduction of expenses by investment adviser | (5,991) |

| Net expenses | $342,201 |

| Net investment income (loss) | $129,744 |

| Realized and unrealized gain (loss) | |

| Realized gain (loss) (identified cost basis) | |

| Unaffiliated issuers | $15,349,867 |

| Change in unrealized appreciation or depreciation | |

| Unaffiliated issuers | $5,517,287 |

| Net realized and unrealized gain (loss) | $20,867,154 |

| Change in net assets from operations | $20,996,898 |

See Notes to Financial Statements

MFS Blended Research Small Cap Equity Portfolio

| Financial Statements | Statements of Changes in Net Assets |

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | Six months ended | Year ended |

| | 6/30/21

(unaudited) | 12/31/20 |

| Change in net assets | | |

| From operations | | |

| Net investment income (loss) | $129,744 | $770,676 |

| Net realized gain (loss) | 15,349,867 | (3,204,516) |

| Net unrealized gain (loss) | 5,517,287 | 7,925,642 |

| Change in net assets from operations | $20,996,898 | $5,491,802 |

| Total distributions to shareholders | $— | $(7,515,113) |

| Change in net assets from fund share transactions | $(11,547,646) | $(1,294,777) |

| Total change in net assets | $9,449,252 | $(3,318,088) |

| Net assets | | |

| At beginning of period | 93,221,221 | 96,539,309 |

| At end of period | $102,670,473 | $93,221,221 |

See Notes to Financial Statements

MFS Blended Research Small Cap Equity Portfolio

| Financial Statements | Financial Highlights |

The financial highlights table is intended to help you understand the fund's financial performance for the semiannual period and the past 5 fiscal years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| Initial Class | Six months

ended | Year ended |

| | 6/30/21

(unaudited) | 12/31/20 | 12/31/19 | 12/31/18 | 12/31/17 | 12/31/16 |

| Net asset value, beginning of period | $10.91 | $11.66 | $11.25 | $13.47 | $13.23 | $12.29 |

| Income (loss) from investment operations | | | | | | |

| Net investment income (loss) (d) | $0.03 | $0.10 | $0.10 | $0.09 | $0.11 | $0.11(c) |

| Net realized and unrealized gain (loss) | 2.50 | 0.01(g) | 2.56 | (0.40) | 1.70 | 2.35 |

| Total from investment operations | $2.53 | $0.11 | $2.66 | $(0.31) | $1.81 | $2.46 |

| Less distributions declared to shareholders | | | | | | |

| From net investment income | $— | $(0.09) | $(0.10) | $(0.13) | $(0.12) | $(0.16) |

| From net realized gain | — | (0.77) | (2.15) | (1.78) | (1.45) | (1.36) |

| Total distributions declared to shareholders | $— | $(0.86) | $(2.25) | $(1.91) | $(1.57) | $(1.52) |

| Net asset value, end of period (x) | $13.44 | $10.91 | $11.66 | $11.25 | $13.47 | $13.23 |

| Total return (%) (k)(r)(s)(x) | 23.19(n) | 2.23 | 26.78 | (5.11) | 14.97 | 20.90(c) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | |

| Expenses before expense reductions (f) | 0.54(a) | 0.55 | 0.54 | 0.54 | 0.53 | 0.42(c) |

| Expenses after expense reductions (f) | 0.52(a) | 0.54 | 0.53 | 0.53 | 0.52 | 0.41(c) |

| Net investment income (loss) | 0.42(a)(l) | 1.05 | 0.81 | 0.69 | 0.82 | 0.92(c) |

| Portfolio turnover | 43(n) | 84 | 59 | 72 | 81 | 72 |

| Net assets at end of period (000 omitted) | $38,926 | $33,850 | $35,441 | $29,936 | $36,195 | $28,715 |

See Notes to Financial Statements

MFS Blended Research Small Cap Equity Portfolio

Financial Highlights - continued

| Service Class | Six months

ended | Year ended |

| | 6/30/21

(unaudited) | 12/31/20 | 12/31/19 | 12/31/18 | 12/31/17 | 12/31/16 |

| Net asset value, beginning of period | $10.50 | $11.24 | $10.92 | $13.12 | $12.92 | $12.03 |

| Income (loss) from investment operations | | | | | | |

| Net investment income (loss) (d) | $0.01 | $0.07 | $0.07 | $0.06 | $0.07 | $0.08(c) |

| Net realized and unrealized gain (loss) | 2.40 | 0.02(g) | 2.46 | (0.39) | 1.67 | 2.29 |

| Total from investment operations | $2.41 | $0.09 | $2.53 | $(0.33) | $1.74 | $2.37 |

| Less distributions declared to shareholders | | | | | | |

| From net investment income | $— | $(0.06) | $(0.06) | $(0.09) | $(0.09) | $(0.12) |

| From net realized gain | — | (0.77) | (2.15) | (1.78) | (1.45) | (1.36) |

| Total distributions declared to shareholders | $— | $(0.83) | $(2.21) | $(1.87) | $(1.54) | $(1.48) |

| Net asset value, end of period (x) | $12.91 | $10.50 | $11.24 | $10.92 | $13.12 | $12.92 |

| Total return (%) (k)(r)(s)(x) | 22.95(n) | 2.14 | 26.36 | (5.35) | 14.70 | 20.58(c) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | |

| Expenses before expense reductions (f) | 0.79(a) | 0.80 | 0.79 | 0.79 | 0.78 | 0.67(c) |

| Expenses after expense reductions (f) | 0.77(a) | 0.79 | 0.78 | 0.78 | 0.77 | 0.66(c) |

| Net investment income (loss) | 0.16(a)(l) | 0.80 | 0.56 | 0.43 | 0.55 | 0.66(c) |

| Portfolio turnover | 43(n) | 84 | 59 | 72 | 81 | 72 |

| Net assets at end of period (000 omitted) | $63,744 | $59,371 | $61,099 | $55,648 | $71,366 | $74,453 |

| (a) | Annualized. |

| (c) | Amount reflects a one-time reimbursement of expenses by the custodian (or former custodian) without which net investment income and performance would be lower and expenses would be higher. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (g) | The per share amount varies from the net realized and unrealized gain/loss for the period because of the timing of sales of fund shares and the per share amount of realized and unrealized gains and losses at such time. |

| (k) | The total return does not reflect expenses that apply to separate accounts. Inclusion of these charges would reduce the total return figures for all periods shown. |

| (l) | Recognition of net investment income by the fund may be affected by the timing of the declaration of dividends by companies in which the fund invests and the actual annual net investment income ratio may differ. |

| (n) | Not annualized. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (x) | The net asset values and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements (unaudited)

(1) Business and Organization

MFS Blended Research Small Cap Equity Portfolio (the fund) is a diversified series of MFS Variable Insurance Trust III (the trust). The trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The shareholders of each series of the trust are separate accounts of insurance companies, which offer variable annuity and/or life insurance products, and qualified retirement and pension plans.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies.

(2) Significant Accounting Policies

General — The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued. The fund will generally focus on securities of small size companies which may be more volatile than those of larger companies.

Certain of the fund's investments, derivatives, debt and other contracts may be based on reference interest rates such as the London Interbank Offered Rate (“LIBOR”). In 2017, the regulatory authority that oversees financial services firms in the United Kingdom announced plans to transition away from LIBOR by the end of 2021. In March 2021, the administrator of LIBOR announced the extension of the publication of the more commonly used U.S. dollar LIBOR settings to the end of June 2023. Although the full impacts of the transition away from LIBOR are not fully known, the transition may result in, among other things, an increase in volatility or illiquidity of the markets for instruments that currently rely on LIBOR to determine interest rates and this could have an adverse impact on the fund's performance. With respect to the fund's accounting for investments, derivatives, debt and other contracts that undergo reference rate-related modifications as a result of the transition, management will rely upon the relief provided by FASB Codification Topic 848 – Reference Rate Reform (Topic 848). The guidance in Topic 848 permits the fund to disregard the GAAP accounting requirements around certain contract modifications resulting from the LIBOR transition such that for contracts considered in scope, the fund can account for those modified contracts as a continuation of the existing contracts.

Balance Sheet Offsetting — The fund's accounting policy with respect to balance sheet offsetting is that, absent an event of default by the counterparty or a termination of the agreement, the International Swaps and Derivatives Association (ISDA) Master Agreement, or similar agreement, does not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the fund and the applicable counterparty. The fund's right to setoff may be restricted or prohibited by the bankruptcy or insolvency laws of the particular jurisdiction to which a specific master netting agreement counterparty is subject. Balance sheet offsetting disclosures, to the extent applicable to the fund, have been included in the fund’s Significant Accounting Policies note under the captions for each of the fund’s in-scope financial instruments and transactions.

Investment Valuations — Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price on their primary market or exchange as provided by a third-party pricing service. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation on their primary market or exchange as provided by a third-party pricing service. Short-term instruments with a maturity at issuance of 60 days or less may be valued at amortized cost, which approximates market value. Open-end investment companies are generally valued at net asset value per share.

Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. In determining values, third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements (unaudited) - continued

has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halt of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material effect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

Various inputs are used in determining the value of the fund's assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment's level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund's assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser's own assumptions in determining the fair value of investments. The following is a summary of the levels used as of June 30, 2021 in valuing the fund's assets or liabilities:

| Financial Instruments | Level 1 | Level 2 | Level 3 | Total |

| Equity Securities | $102,486,414 | $— | $— | $102,486,414 |

| Mutual Funds | 429,350 | — | — | 429,350 |

| Total | $102,915,764 | $— | $— | $102,915,764 |

For further information regarding security characteristics, see the Portfolio of Investments.

Security Loans — Under its Securities Lending Agency Agreement with the fund, State Street Bank and Trust Company, as lending agent, loans the securities of the fund to certain qualified institutions (the “Borrowers”) approved by the fund. Security loans can be terminated at the discretion of either the lending agent or the fund and the related securities must be returned within the earlier of the standard trade settlement period for such securities or within three business days. The loans are collateralized by cash and/or U.S. Treasury and federal agency obligations in an amount typically at least equal to the market value of the securities loaned. On loans collateralized by cash, the cash collateral is invested in a money market fund. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. The lending agent provides the fund with indemnification against Borrower default. In the event of Borrower default, the lending agent will, for the benefit of the fund, either purchase securities identical to those loaned or, when such purchase is commercially impracticable, pay the fund the market value of the loaned securities. In return, the lending agent assumes the fund's rights to the related collateral. If the collateral value is less than the cost to purchase identical securities, the lending agent is responsible for the shortfall, but only to the extent that such shortfall is not due to a decline in collateral value resulting from collateral reinvestment for which the fund bears the risk of loss. At period end, the fund had investment securities on loan, all of which were classified as equity securities in the fund's Portfolio of Investments, with a fair value of $98,491. The fair value of the fund's investment securities on loan and a related liability of $101,472 for cash collateral received on securities loaned are both presented gross in the Statement of Assets and Liabilities. The collateral on securities loaned exceeded the value of securities on loan at period end. The liability for cash collateral for securities loaned is carried at fair value, which is categorized as level 2 within the fair value hierarchy. A portion of the income generated upon investment of the collateral is remitted to the Borrowers, and the remainder is allocated between the fund and the lending agent. On loans collateralized by U.S. Treasury and/or federal agency obligations, a fee is received from the Borrower, and is allocated between the fund and the lending agent. Income from securities lending is separately reported in the Statement of Operations. The dividend and interest income earned on the securities loaned is accounted for in the same manner as other dividend and interest income.

Indemnifications — Under the fund's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund's maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements (unaudited) - continued

Investment Transactions and Income — Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. Dividends received in cash are recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded when the fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Dividend payments received in additional securities are recorded on the ex-dividend date in an amount equal to the value of the security on such date.

The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

Tax Matters and Distributions — The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns, when filed, will remain subject to examination by the Internal Revenue Service for a three year period. Management has analyzed the fund’s tax positions taken on federal and state tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability. Foreign taxes, if any, have been accrued by the fund in the accompanying financial statements in accordance with the applicable foreign tax law. Foreign income taxes may be withheld by certain countries in which the fund invests. Additionally, capital gains realized by the fund on securities issued in or by certain foreign countries may be subject to capital gains tax imposed by those countries.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future.

Book/tax differences primarily relate to wash sale loss deferrals.

The tax character of distributions declared to shareholders for the last fiscal year is as follows:

| | Year ended

12/31/20 |

| Ordinary income (including any short-term capital gains) | $1,857,641 |

| Long-term capital gains | 5,657,472 |

| Total distributions | $7,515,113 |

The federal tax cost and the tax basis components of distributable earnings were as follows:

| As of 6/30/21 | |

| Cost of investments | $75,268,184 |

| Gross appreciation | 29,048,989 |

| Gross depreciation | (1,401,409) |

| Net unrealized appreciation (depreciation) | $27,647,580 |

| As of 12/31/20 | |

| Undistributed ordinary income | 769,347 |

| Capital loss carryforwards | (3,322,161) |

| Net unrealized appreciation (depreciation) | 22,182,694 |

The aggregate cost above includes prior fiscal year end tax adjustments, if applicable.

As of December 31, 2020, the fund had capital loss carryforwards available to offset future realized gains. These net capital losses may be carried forward indefinitely and their character is retained as short-term and/or long-term losses. Such losses are characterized as follows:

| Short-Term | $(2,619,187) |

| Long-Term | (702,974) |

| Total | $(3,322,161) |

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements (unaudited) - continued

Multiple Classes of Shares of Beneficial Interest — The fund offers multiple classes of shares, which differ in their respective distribution and/or service fees. The fund's income, realized and unrealized gain (loss), and common expenses are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to differences in separate class expenses. The fund’s distributions declared to shareholders as reported in the Statements of Changes in Net Assets are presented by class as follows:

| | Six months

ended

6/30/21 | | Year

ended

12/31/20 |

| Initial Class | $— | | $2,607,703 |

| Service Class | — | | 4,907,410 |

| Total | $— | | $7,515,113 |

(3) Transactions with Affiliates

Investment Adviser — The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund. The management fee is computed daily and paid monthly at an annual rate of 0.40% of the fund’s average daily net assets. MFS has agreed in writing to reduce its management fee by a specified amount if certain MFS mutual fund assets exceed thresholds agreed to by MFS and the fund's Board of Trustees. For the six months ended June 30, 2021, this management fee reduction amounted to $5,991, which is included in the reduction of total expenses in the Statement of Operations. The management fee incurred for the six months ended June 30, 2021 was equivalent to an annual effective rate of 0.39% of the fund's average daily net assets.

The investment adviser has agreed in writing to pay a portion of the fund’s total annual operating expenses, excluding interest, taxes, extraordinary expenses, brokerage and transaction costs, and investment-related expenses, such that total annual operating expenses do not exceed 0.60% of average daily net assets for the Initial Class shares and 0.85% of average daily net assets for the Service Class shares. This written agreement will continue until modified by the fund’s Board of Trustees, but such agreement will continue at least until April 30, 2023. For the six months ended June 30, 2021, the fund’s actual operating expenses did not exceed the limit and therefore, the investment adviser did not pay any portion of the fund’s expenses related to this agreement.

Distributor — MFS Fund Distributors, Inc. (MFD), a wholly-owned subsidiary of MFS, is the distributor of shares of the fund. The Trustees have adopted a distribution plan for the Service Class shares pursuant to Rule 12b-1 under the Investment Company Act of 1940.

The fund's distribution plan provides that the fund will pay MFD distribution and/or service fees equal to 0.25% per annum of its average daily net assets attributable to Service Class shares as partial consideration for services performed and expenses incurred by MFD and financial intermediaries (including participating insurance companies that invest in the fund to fund variable annuity and variable life insurance contracts, sponsors of qualified retirement and pension plans that invest in the fund, and affiliates of these participating insurance companies and plan sponsors) in connection with the sale and distribution of the Service Class shares. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

Shareholder Servicing Agent — MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, receives a fee from the fund for its services as shareholder servicing agent. For the six months ended June 30, 2021, the fee was $5,599, which equated to 0.0111% annually of the fund's average daily net assets. MFSC also receives reimbursement from the fund for out-of-pocket expenses paid by MFSC on behalf of the fund. For the six months ended June 30, 2021, these costs amounted to $373.

Administrator — MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund reimburses MFS the costs incurred to provide these services. The fund is charged an annual fixed amount of $17,500 plus a fee based on average daily net assets. The administrative services fee incurred for the six months ended June 30, 2021 was equivalent to an annual effective rate of 0.0237% of the fund's average daily net assets.

Trustees’ and Officers’ Compensation — The fund pays compensation to independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The fund does not pay compensation directly to Trustees or officers of the fund who are also officers of the investment adviser, all of whom receive remuneration from MFS for their services to the fund. Certain officers and Trustees of the fund are officers or directors of MFS, MFD, and MFSC.

Other — The fund invests in the MFS Institutional Money Market Portfolio which is managed by MFS and seeks current income consistent with preservation of capital and liquidity. This money market fund does not pay a management fee to MFS but does incur investment and operating costs.

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements (unaudited) - continued

The adviser has voluntarily undertaken to reimburse the fund from its own resources on a quarterly basis for the cost of investment research embedded in the cost of the fund’s securities trades. This agreement may be rescinded at any time. For the six months ended June 30, 2021, this reimbursement amounted to $10,349, which is included in “Other” income in the Statement of Operations.

The fund is permitted to engage in purchase and sale transactions with funds and accounts for which MFS serves as investment adviser or sub-adviser (“cross-trades”) pursuant to a policy adopted by the Board of Trustees. This policy has been designed to ensure that cross-trades conducted by the fund comply with Rule 17a-7 under the Investment Company Act of 1940. During the six months ended June 30, 2021, the fund engaged in purchase transactions pursuant to this policy, which amounted to $331,854.

(4) Portfolio Securities

For the six months ended June 30, 2021, purchases and sales of investments, other than short-term obligations, aggregated $42,965,303 and $54,043,348, respectively.

(5) Shares of Beneficial Interest

The fund's Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest. Transactions in fund shares were as follows:

| | Six months ended

6/30/21 | | Year ended

12/31/20 |

| | Shares | Amount | | Shares | Amount |

| Shares sold | | | | | |

| Initial Class | 123,510 | $1,574,246 | | 825,995 | $6,434,636 |

| Service Class | 284,405 | 3,527,917 | | 1,413,665 | 11,455,698 |

| | 407,915 | $5,102,163 | | 2,239,660 | $17,890,334 |

Shares issued to shareholders

in reinvestment of distributions | | | | | |

| Initial Class | — | $— | | 281,002 | $2,607,703 |

| Service Class | — | — | | 549,542 | 4,907,410 |

| | — | $— | | 830,544 | $7,515,113 |

| Shares reacquired | | | | | |

| Initial Class | (328,165) | $(4,189,684) | | (1,046,160) | $(10,004,310) |

| Service Class | (1,002,114) | (12,460,125) | | (1,740,816) | (16,695,914) |

| | (1,330,279) | $(16,649,809) | | (2,786,976) | $(26,700,224) |

| Net change | | | | | |

| Initial Class | (204,655) | $(2,615,438) | | 60,837 | $(961,971) |

| Service Class | (717,709) | (8,932,208) | | 222,391 | (332,806) |

| | (922,364) | $(11,547,646) | | 283,228 | $(1,294,777) |

(6) Line of Credit

The fund and certain other funds managed by MFS participate in a $1.25 billion unsecured committed line of credit of which $1 billion is reserved for use by the fund and certain other MFS U.S. funds. The line of credit is provided by a syndicate of banks under a credit agreement. Borrowings may be made for temporary financing needs. Interest is charged to each fund, based on its borrowings, generally at a rate equal to the highest of one month LIBOR, the Federal Funds Effective Rate and the Overnight Bank Funding Rate, plus an agreed upon spread. A commitment fee, based on the average daily, unused portion of the committed line of credit, is allocated among the participating funds. In addition, the fund and other funds managed by MFS have established unsecured uncommitted borrowing arrangements with certain banks for temporary financing needs. Interest is charged to each fund, based on its borrowings, at rates equal to customary reference rates plus an agreed upon spread. For the six months ended June 30, 2021, the fund’s commitment fee and interest expense were $177 and $0, respectively, and are included in “Miscellaneous” expense in the Statement of Operations.

(7) Investments in Affiliated Issuers

An affiliated issuer may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. For the purposes of this report, the following were affiliated issuers:

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements (unaudited) - continued

| Affiliated Issuers | Beginning

Value | Purchases | Sales

Proceeds | Realized

Gain

(Loss) | Change in

Unrealized

Appreciation or

Depreciation | Ending

Value |

| MFS Institutional Money Market Portfolio | $529,846 | $7,718,129 | $7,920,097 | $— | $— | $327,878 |

| Affiliated Issuers | Dividend

Income | Capital Gain

Distributions |

| MFS Institutional Money Market Portfolio | $194 | $— |

(8) Impacts of COVID-19

The pandemic related to the global spread of novel coronavirus disease (COVID-19), which was first detected in December 2019, has resulted in significant disruptions to global business activity and the global economy, as well as the economies of individual countries, the financial performance of individual companies and sectors, and the securities and commodities markets in general. Multiple surges in cases globally, the availability and widespread adoption of vaccines, and the emergence of variant strains of the virus continue to create uncertainty as to the future and long-term impacts resulting from the pandemic including impacts to the prices and liquidity of the fund's investments and the fund's performance.

MFS Blended Research Small Cap Equity Portfolio

Statement Regarding Liquidity Risk Management Program

The fund has adopted and implemented a liquidity risk management program (the “Program”) as required by Rule 22e-4 under the Investment Company Act of 1940, as amended. The fund’s Board of Trustees (the “Board”) has designated MFS as the administrator of the Program. The Program is reasonably designed to assess and manage the liquidity risk of the fund. Liquidity risk is the risk that the fund could not meet requests to redeem shares issued by the fund without significant dilution of remaining investors' interests.

MFS provided a written report to the Board for consideration at its April 2021 meeting that addressed the operation of the Program and provided an assessment of the adequacy and effectiveness of the Program during the period from January 1, 2020 to December 31, 2020 (the “Covered Period”). The report concluded that during the Covered Period the Program had operated effectively and had adequately and effectively been implemented to assess and manage the fund’s liquidity risk. MFS also reported that there were no liquidity events that impacted the fund or its ability to timely meet redemptions without dilution to existing shareholders during the Covered Period.

There can be no assurance that the Program will achieve its objectives in the future. Further information on liquidity risk, and other principal risks to which an investment in the fund may be subject, can be found in the prospectus.

MFS Blended Research Small Cap Equity Portfolio

Proxy Voting Policies and Information

MFS votes proxies on behalf of the fund pursuant to proxy voting policies and procedures that are available without charge, upon request, by calling 1-800-225-2606, by visiting mfs.com/proxyvoting, or by visiting the SEC’s Web site at http://www.sec.gov.

Information regarding how the fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available by August 31 of each year without charge by visiting mfs.com/proxyvoting, or by visiting the SEC’s Web site at http://www.sec.gov.

Quarterly Portfolio Disclosure

The fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s Form N-PORT reports are available on the SEC’s Web site at http://www.sec.gov. A shareholder can obtain the portfolio holdings report for the first and third quarters of the fund's fiscal year at mfs.com/vit3 by choosing the fund's name and then scrolling to the “Resources” section and clicking on the “Prospectus and Reports” tab.

FURTHER INFORMATION

From time to time, MFS may post important information about the fund or the MFS Funds on the MFS Web site (mfs.com). This information is available at https://www.mfs.com/announcements or at mfs.com/vit3 by choosing the fund's name and then scrolling to the “Resources” section and clicking on the “Announcements” tab, if any.

Information About Fund Contracts and Legal Claims

The fund has entered into contractual arrangements with an investment adviser, administrator, distributor, shareholder servicing agent, 529 program manager (if applicable), and custodian who each provide services to the fund. Unless expressly stated otherwise, shareholders are not parties to, or intended beneficiaries of these contractual arrangements, and these contractual arrangements are not intended to create any shareholder right to enforce them against the service providers or to seek any remedy under them against the service providers, either directly or on behalf of the fund.

Under the Trust’s By-Laws and Declaration of Trust, any claims asserted against or on behalf of the MFS Funds, including claims against Trustees and Officers, must be brought in state and federal courts located within the Commonwealth of Massachusetts.

Semiannual Report

June 30, 2021

MFS® Conservative

Allocation Portfolio

MFS® Variable Insurance Trust III

MFS® Conservative Allocation Portfolio

The report is prepared for the general information of contract owners. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK OR CREDIT UNION GUARANTEE •

NOT A DEPOSIT • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY OR NCUA/NCUSIF

MFS Conservative Allocation Portfolio

Dear Contract Owners:

After experiencing dramatic swings in the early days of the coronavirus pandemic, global equity markets have performed strongly over the past year. Though the speedy development of vaccines brightened the economic and market outlook, uncertainty remains as new variants of the virus appear, and questions persist over how fast vaccines can be made widely available in the developing world.

Global central banks have taken aggressive steps to cushion the economic and market fallout related to the virus, and governments are deploying unprecedented levels of fiscal support. Having passed a $1.9 trillion stimulus package in March, the U.S. Congress could approve additional stimulus later this year, some of it focused on infrastructure. Along with extraordinary government expenditures, pent-up consumer demand fueled a surge in economic activity as coronavirus restrictions were eased, pushing up inflation, at least temporarily. Markets initially reacted by pushing up yields on global government bonds, though some of the rate rise has since been corrected.

A spirited debate is underway among investors over whether the current price pressures will persist or prove to be temporary, caused by pandemic-induced bottlenecks. The policy measures put in place to counteract the pandemic's effects have helped build a supportive environment and are encouraging economic recovery; however, if markets disconnect from fundamentals, they can sow the seeds of instability. As such, recent dramatic increases in speculative trading in cryptocurrencies, special purpose acquisition companies (SPACs), and the like bear watching.

In the aftermath of the crisis, we could see societal changes as households, businesses, and governments adjust to a new reality, and any such alterations could affect the investment landscape. For investors, events such as the COVID-19 outbreak demonstrate the importance of having a deep understanding of company fundamentals, and we have built our global research platform to do just that.

At MFS®, we put our clients’ assets to work responsibly by carefully navigating the increasing complexity of global markets and economies. Guided by our long-term philosophy and adhering to our commitment to sustainable investing, we tune out the noise and aim to uncover what we believe are the best, most durable investment opportunities in the market. Our unique global investment platform combines collective expertise, long-term discipline, and thoughtful risk management to create sustainable value for investors.

Respectfully,

Michael W. Roberge

Chief Executive Officer

MFS Investment Management

August 13, 2021

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

MFS Conservative Allocation Portfolio

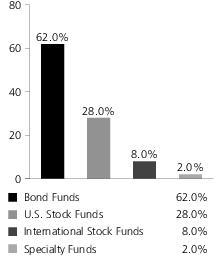

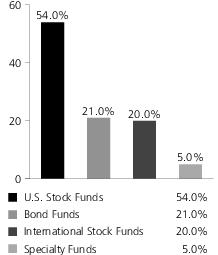

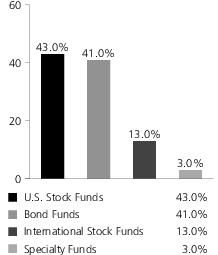

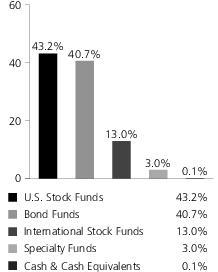

Portfolio target allocation

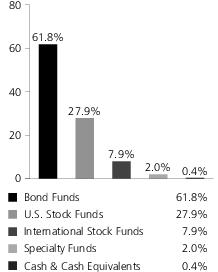

Portfolio actual allocation

Portfolio holdings

| MFS Total Return Bond Series | 17.0% |

| MFS Limited Maturity Portfolio | 12.0% |

| MFS Government Securities Portfolio | 10.0% |

| MFS Inflation-Adjusted Bond Portfolio | 9.9% |

| MFS Global Governments Portfolio | 7.9% |

| MFS Growth Series | 6.0% |

| MFS Research Series | 6.0% |

| MFS Value Series | 6.0% |

| MFS High Yield Portfolio | 5.0% |

| MFS Mid Cap Growth Series | 4.0% |

| MFS Mid Cap Value Portfolio | 3.9% |

| MFS Research International Portfolio | 3.9% |

| MFS International Intrinsic Value Portfolio | 2.0% |

| MFS International Growth Portfolio | 2.0% |

| MFS Global Real Estate Portfolio | 2.0% |

| MFS New Discovery Series | 1.0% |

| MFS New Discovery Value Portfolio | 1.0% |

| Cash & Cash Equivalents | 0.4% |

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. MFS endeavors to fully invest all MFS funds-of-funds in underlying funds on a daily basis. Any divergence from 0.0% in Cash & Cash Equivalents is typically due to the timing of fund subscriptions/redemptions and the settlement of subsequent investment in/divestment from the underlying funds. While the MFS funds-of-funds' subscriptions/redemptions are processed at the same day NAV of the underlying funds, a positive/negative cash balance will be reflected on the MFS funds-of-funds' Statements of Assets and Liabilities until the trades with the underlying funds settle, which is typically two business days. Please see the fund's Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of June 30, 2021.

The portfolio is actively managed and current holdings may be different.

MFS Conservative Allocation Portfolio

Expense Table

Fund Expenses Borne by the Contract Holders during the Period,

January 1, 2021 through June 30, 2021

As a contract holder of the fund, you incur ongoing costs, including distribution and/or service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. Because the underlying funds have varied expenses and fee levels and the fund may own different proportions of the underlying funds at different times, the amount of fees and expenses incurred indirectly by the fund will vary. If these indirect costs were included, your costs would have been higher.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period January 1, 2021 through June 30, 2021.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight the fund's ongoing costs only and do not take into account the fees and expenses imposed under the variable contracts through which your investment in the fund is made. Therefore, the second line for each share class in the table is useful in comparing ongoing costs associated with an investment in vehicles (such as the fund) which fund benefits under variable annuity and variable life insurance contracts and to qualified pension and retirement plans only, and will not help you determine the relative total costs of investing in the fund through variable annuity and variable life insurance contracts. If the fees and expenses imposed under the variable contracts were included, your costs would have been higher.

Share

Class | | Annualized

Expense

Ratio | Beginning

Account Value

1/01/21 | Ending

Account Value

6/30/21 | Expenses

Paid During

Period (p)

1/01/21-6/30/21 |

| Initial Class | Actual | 0.03% | $1,000.00 | $1,039.33 | $0.15 |

| Hypothetical (h) | 0.03% | $1,000.00 | $1024.65 | $0.15 |

| Service Class | Actual | 0.28% | $1,000.00 | $1,038.37 | $1.42 |

| Hypothetical (h) | 0.28% | $1,000.00 | $1,023.41 | $1.40 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). In addition to the fees and expenses which the fund bears directly, the fund indirectly bears a pro rata share of the fees and expenses of the underlying funds in which the fund invests. If these indirect costs were included, your costs would have been higher. |

MFS Conservative Allocation Portfolio

Portfolio of Investments − 6/30/21 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Issuer | | | Shares/Par | Value ($) |

| Investment Companies (h) – 100.0% |

| Bond Funds – 61.8% |

| MFS Global Governments Portfolio - Initial Class | | | 2,968,464 | $ 32,979,632 |

| MFS Government Securities Portfolio - Initial Class | | | 3,292,270 | 41,647,218 |

| MFS High Yield Portfolio - Initial Class | | | 3,583,991 | 20,858,825 |

| MFS Inflation-Adjusted Bond Portfolio - Initial Class | | | 3,470,699 | 41,440,149 |

| MFS Limited Maturity Portfolio - Initial Class | | | 4,761,155 | 49,992,123 |

| MFS Total Return Bond Series - Initial Class | | | 5,069,516 | 70,922,537 |

| | | | | $ 257,840,484 |

| International Stock Funds – 7.9% |

| MFS International Growth Portfolio - Initial Class | | | 477,837 | $ 8,271,364 |

| MFS International Intrinsic Value Portfolio - Initial Class | | | 225,178 | 8,277,537 |

| MFS Research International Portfolio - Initial Class | | | 845,697 | 16,499,539 |

| | | | | $33,048,440 |

| Specialty Funds – 2.0% |

| MFS Global Real Estate Portfolio - Initial Class | | | 477,527 | $ 8,251,675 |

| Issuer | | | Shares/Par | Value ($) |

| Investment Companies (h) – continued |

| U.S. Stock Funds – 27.9% |

| MFS Growth Series - Initial Class | | | 301,237 | $ 25,102,108 |

| MFS Mid Cap Growth Series - Initial Class | | | 1,254,690 | 16,699,922 |

| MFS Mid Cap Value Portfolio - Initial Class | | | 1,617,574 | 16,547,778 |

| MFS New Discovery Series - Initial Class | | | 141,690 | 4,158,606 |

| MFS New Discovery Value Portfolio - Initial Class | | | 374,424 | 4,126,153 |

| MFS Research Series - Initial Class | | | 664,609 | 25,049,097 |

| MFS Value Series - Initial Class | | | 1,066,498 | 24,977,393 |

| | | | | $ 116,661,057 |

| Money Market Funds – 0.4% | |

| MFS Institutional Money Market Portfolio, 0.02% (v) | | | 1,651,796 | $ 1,651,796 |

| Total Investment Companies (Identified Cost, $335,145,147) | $ 417,453,452 |

| Other Assets, Less Liabilities – (0.0)% | | (48,379) |

| Net Assets – 100.0% | $ 417,405,073 |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate value of the fund’s investments in affiliated issuers was $417,453,452. | | | |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. | | | |