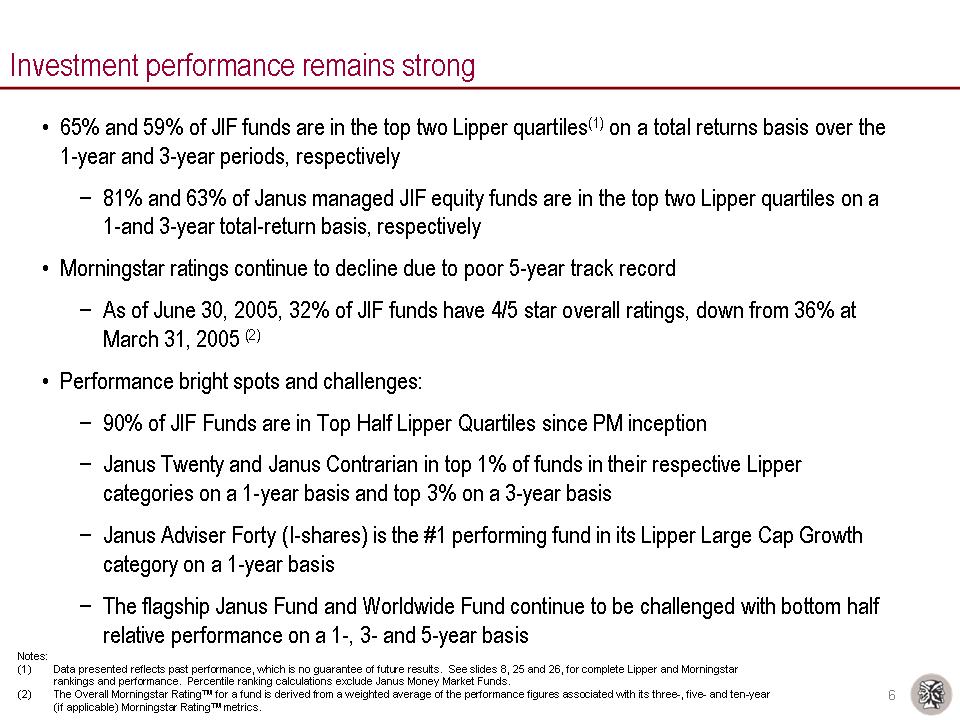

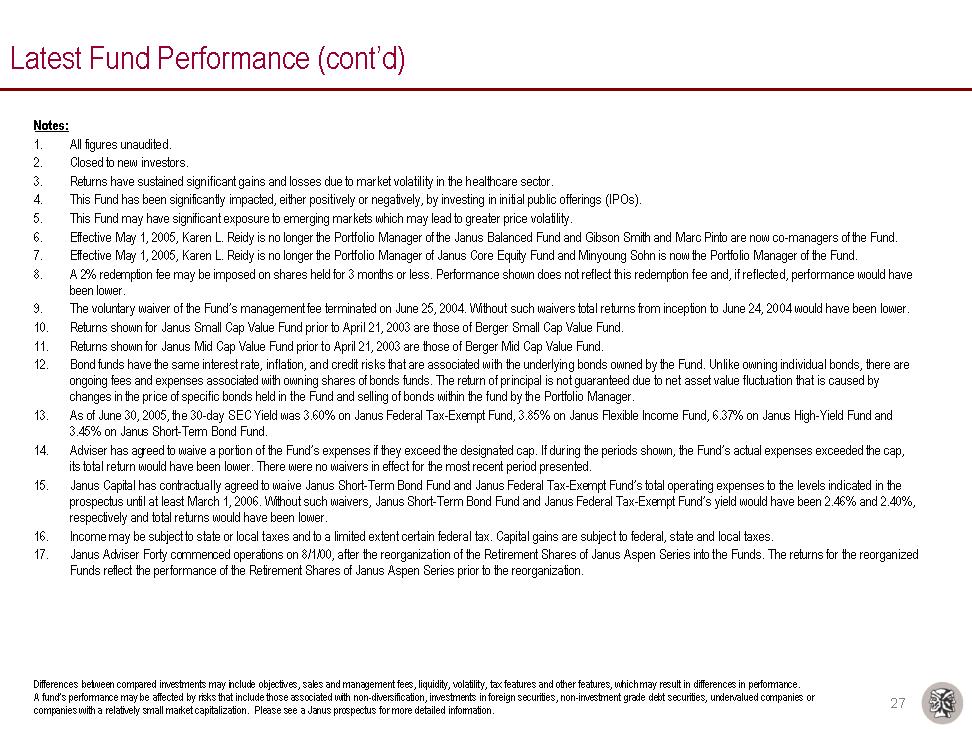

| Latest Fund Performance (cont'd) Notes: All figures unaudited. Closed to new investors. Returns have sustained significant gains and losses due to market volatility in the healthcare sector. This Fund has been significantly impacted, either positively or negatively, by investing in initial public offerings (IPOs). This Fund may have significant exposure to emerging markets which may lead to greater price volatility. Effective May 1, 2005, Karen L. Reidy is no longer the Portfolio Manager of the Janus Balanced Fund and Gibson Smith and Marc Pinto are now co-managers of the Fund. Effective May 1, 2005, Karen L. Reidy is no longer the Portfolio Manager of Janus Core Equity Fund and Minyoung Sohn is now the Portfolio Manager of the Fund. A 2% redemption fee may be imposed on shares held for 3 months or less. Performance shown does not reflect this redemption fee and, if reflected, performance would have been lower. The voluntary waiver of the Fund's management fee terminated on June 25, 2004. Without such waivers total returns from inception to June 24, 2004 would have been lower. Returns shown for Janus Small Cap Value Fund prior to April 21, 2003 are those of Berger Small Cap Value Fund. Returns shown for Janus Mid Cap Value Fund prior to April 21, 2003 are those of Berger Mid Cap Value Fund. Bond funds have the same interest rate, inflation, and credit risks that are associated with the underlying bonds owned by the Fund. Unlike owning individual bonds, there are ongoing fees and expenses associated with owning shares of bonds funds. The return of principal is not guaranteed due to net asset value fluctuation that is caused by changes in the price of specific bonds held in the Fund and selling of bonds within the fund by the Portfolio Manager. As of June 30, 2005, the 30-day SEC Yield was 3.60% on Janus Federal Tax-Exempt Fund, 3.85% on Janus Flexible Income Fund, 6.37% on Janus High-Yield Fund and 3.45% on Janus Short-Term Bond Fund. Adviser has agreed to waive a portion of the Fund's expenses if they exceed the designated cap. If during the periods shown, the Fund's actual expenses exceeded the cap, its total return would have been lower. There were no waivers in effect for the most recent period presented. Janus Capital has contractually agreed to waive Janus Short-Term Bond Fund and Janus Federal Tax-Exempt Fund's total operating expenses to the levels indicated in the prospectus until at least March 1, 2006. Without such waivers, Janus Short-Term Bond Fund and Janus Federal Tax-Exempt Fund's yield would have been 2.46% and 2.40%, respectively and total returns would have been lower. Income may be subject to state or local taxes and to a limited extent certain federal tax. Capital gains are subject to federal, state and local taxes. Janus Adviser Forty commenced operations on 8/1/00, after the reorganization of the Retirement Shares of Janus Aspen Series into the Funds. The returns for the reorganized Funds reflect the performance of the Retirement Shares of Janus Aspen Series prior to the reorganization. Differences between compared investments may include objectives, sales and management fees, liquidity, volatility, tax features and other features, which may result in differences in performance. A fund's performance may be affected by risks that include those associated with non-diversification, investments in foreign securities, non-investment grade debt securities, undervalued companies or companies with a relatively small market capitalization. Please see a Janus prospectus for more detailed information. |