QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.5

ITEM 6. SELECTED FINANCIAL DATA

The selected financial data below should be read in conjunction with Part II, Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations, of this Annual Report on Form 10-K and Part II, Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

| | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, | |

|---|

| | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

|---|

| | (dollars in millions, except operating data and per share data)

| |

|---|

Income Statement: | | | | | | | | | | | | | | | | |

Revenues(1) | | $ | 1,037.9 | | $ | 1,117.0 | | $ | 935.8 | | $ | 868.3 | | $ | 921.8 | |

Operating expenses(2) | | | 704.8 | | | 767.7 | | | 696.9 | | | 675.1 | | | 791.2 | |

| | | | | | | | | | | | |

| | | | Operating income | | | 333.1 | | | 349.3 | | | 238.9 | | | 193.2 | | | 130.6 | |

| | Interest expense(3) | | | (75.5 | ) | | (58.8 | ) | | (32.3 | ) | | (28.6 | ) | | (38.4 | ) |

| | Other, net(4) | | | (50.8 | ) | | 32.4 | | | 37.0 | | | 37.9 | | | 18.9 | |

| | Loss on early extinguishment of debt(5) | | | — | | | — | | | — | | | — | | | (55.5 | ) |

| | Gain on disposition of DST common shares(5) | | | — | | | — | | | — | | | — | | | 228.0 | |

| | Income tax provision | | | (68.8 | ) | | (116.4 | ) | | (90.1 | ) | | (72.8 | ) | | (99.4 | ) |

| | Equity in earnings of unconsolidated affiliates | | | 9.0 | | | 7.2 | | | 7.1 | | | 7.1 | | | 6.1 | |

| | | Income from continuing operations | | | 147.0 | | | 213.7 | | | 160.6 | | | 136.8 | | | 190.3 | |

| | Discontinued operations(6) | | | (1.5 | ) | | (75.7 | ) | | (5.3 | ) | | (29.0 | ) | | (10.8 | ) |

| | | | | | | | | | | | |

| | Net income | | | 145.5 | | | 138.0 | | | 155.3 | | | 107.8 | | | 179.5 | |

| | Noncontrolling interest | | | (8.6 | ) | | (21.7 | ) | | (21.7 | ) | | (20.0 | ) | | (10.0 | ) |

| | | | | | | | | | | | |

| | Net income attributable to JCG | | $ | 136.9 | | $ | 116.3 | | $ | 133.6 | | $ | 87.8 | | $ | 169.5 | |

| | | | | | | | | | | | |

Basic earnings per share attributable to JCG common shareholders(7) | | | | | | | | | | | | | | | | |

| | Income from continuing operations | | $ | 0.87 | | $ | 1.09 | | $ | 0.69 | | $ | 0.53 | | $ | 0.78 | |

| | Discontinued operations | | | (0.01 | ) | | (0.43 | ) | | (0.03 | ) | | (0.13 | ) | | (0.05 | ) |

| | | | | | | | | | | | |

| | Net income per share | | $ | 0.86 | | $ | 0.66 | | $ | 0.66 | | $ | 0.40 | | $ | 0.73 | |

| | | | | | | | | | | | |

Diluted earnings per share attributable to JCG common shareholders(7) | | | | | | | | | | | | | | | | |

| | Income from continuing operations | | $ | 0.86 | | $ | 1.07 | | $ | 0.68 | | $ | 0.53 | | $ | 0.78 | |

| | Discontinued operations | | | (0.01 | ) | | (0.42 | ) | | (0.03 | ) | | (0.13 | ) | | (0.05 | ) |

| | | | | | | | | | | | |

| | Net income per share | | $ | 0.85 | | $ | 0.65 | | $ | 0.66 | | $ | 0.40 | | $ | 0.73 | |

| | | | | | | | | | | | |

Dividends Declared per Share | | $ | 0.04 | | $ | 0.04 | | $ | 0.04 | | $ | 0.04 | | $ | 0.04 | |

Balance Sheet: | | | | | | | | | | | | | | | | |

| | Total assets | | $ | 3,336.7 | | $ | 3,564.1 | | $ | 3,537.9 | | $ | 3,628.5 | | $ | 3,767.6 | |

| | Long-term debt obligations | | $ | 1,106.0 | | $ | 1,127.7 | | $ | 537.2 | | $ | 262.2 | | $ | 377.5 | |

| | Other long-term liabilities | | $ | 450.5 | | $ | 470.0 | | $ | 490.9 | | $ | 501.5 | | $ | 495.9 | |

Operating Data (in billions): | | | | | | | | | | | | | | | | |

| | Year-end assets under management | | $ | 123.5 | | $ | 206.7 | | $ | 167.7 | | $ | 148.5 | | $ | 139.0 | |

| | Average assets under management | | $ | 174.2 | | $ | 190.4 | | $ | 156.7 | | $ | 135.2 | | $ | 137.8 | |

| | Long-term net flows(8) | | $ | (0.6 | ) | $ | 9.8 | | $ | 2.3 | | $ | 2.0 | | $ | (20.6 | ) |

- (1)

- Revenues generally vary with average assets under management. However, revenues also include performance fees, which vary with relative investment performance and the amount of assets subject to such fees. Beginning in 2007, certain mutual funds became subject to performance fees. JCG earned $11.2 million of performance fees from mutual funds during each of the years ended December 31, 2008 and 2007.

1

- (2)

- Operating expenses include impairments, restructuring and regulatory investigation charges and recoveries. Impairment charges are related to terminated investment management relationships with assigned intangible values, and facility closures. Restructuring and impairment charges totaled $11.0 million, $5.5 million and $26.6 million in 2006, 2005 and 2004, respectively. Regulatory investigation charges represent legal fees and settlement costs, net of insurance recoveries for such expenses. Regulatory investigation charges, net of recoveries, totaled $(14.1) million, $(9.3) million and $65.0 million in 2006, 2005 and 2004, respectively.

- (3)

- Interest expense for 2007 increased from 2006 as a result of issuing $748.4 million of additional debt in 2007.

- (4)

- During 2007, JCG classified certain investment securities as trading. Net gains/(losses) on trading securities of $(41.1) million and $17.6 million were recognized in earnings for 2008 and 2007, respectively. In addition, JCG recognized impairment charges of $21.0 million and $18.2 million in 2008 and 2007, respectively, associated with structured investment vehicle ("SIV") securities acquired from money market funds advised by Janus.

- (5)

- In 2004, JCG incurred a debt extinguishment charge of $55.5 million primarily related to the premium paid to exchange certain notes with high interest rates for new notes with lower interest rates. Also during 2004, JCG sold its investment in DST Systems, Inc. common shares for a gain of $228.0 million in a taxable transaction.

- (6)

- During the third quarter 2007, JCG initiated a plan to dispose of Rapid Solutions Group ("RSG"), previously reported as the Printing and Fulfillment segment. Prior periods have been reclassified to separately present the results of continuing and discontinued operations. The results of discontinued operations for 2007 include impairment charges totaling $67.1 million (net of a $6.2 million tax benefit) to write-down the carrying value of RSG to estimated fair value less costs to sell.

- (7)

- Each component of earnings per share presented has been individually rounded.

- (8)

- Money market flows have been excluded due to the short-term nature of such investments.

2

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RECENT DEVELOPMENTS AND STRATEGIC PRIORITIES

Global markets declined significantly during 2008 with the majority of the deterioration occurring in the fourth quarter. The deterioration in global market conditions caused a significant decline in JCG's assets under management, revenues, operating margin and net income.

In response, JCG reduced its workforce by approximately 9% during the fourth quarter 2008 to decrease future compensation costs by approximately $20.0 million annually. In addition, planned reductions in future discretionary administrative, marketing and advertising costs are expected to result in further savings of $20.0 million to $25.0 million annually. Further expense reductions may be necessary if market conditions continue to deteriorate.

Despite actions taken to reduce 2009 fixed and discretionary expenses, JCG remains committed to achieving its long-term strategic objectives, which include the following:

- •

- Maintain strong long-term investment performance.

- •

- Continue expanding global product offerings.

- •

- Complete transition to advisor distribution platform.

- •

- Broaden alternative product capabilities through Janus and INTECH.

- •

- Build-out value franchise by capitalizing on Perkins' established investment process and brand.

- •

- Leverage INTECH's products to meet market demand for large cap value, global/international and alternative strategies.

- •

- Continue to build trust in the Janus brand.

- •

- Increase institutional acceptance of Janus strategies.

2008 SUMMARY

- •

- JCG finished 2008 with assets under management of $123.5 billion, a decrease of 40% from the end of 2007.

- •

- Long-term net outflows for 2008 totaled $0.6 billion compared to inflows of $9.8 billion for 2007.

- •

- Relative long-term investment performance remained strong across all subsidiaries despite short-term underperformance for Janus, with approximately 55%, 79% and 83% of JCG's mutual funds in the top half of their Lipper categories on a one-, three- and five-year total return basis, respectively, as of December 31, 2008. (See Exhibit 99.1 for complete Lipper rankings.)

- •

- Operating margin was 32.1% for 2008 compared with 31.3% in 2007.

- •

- Diluted earnings per share, from continuing operations attributable to JCG common shareholders declined 20% to $0.86.

- •

- JCG completed the acquisition of an additional 50% interest in Perkins during the fourth quarter 2008.

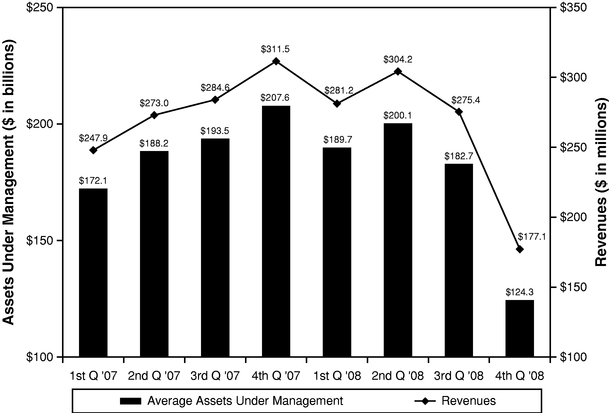

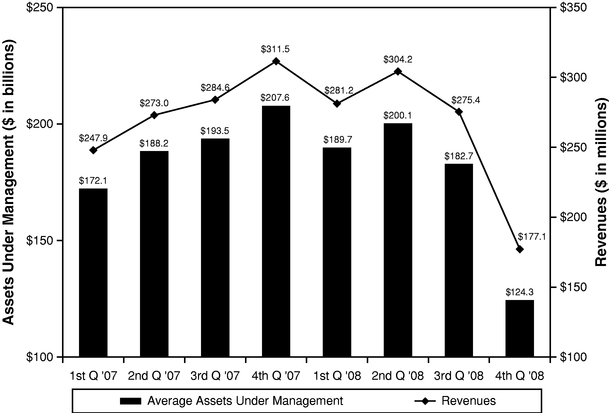

JCG's operating results for 2008 reflect strong results for the first three quarters followed by substantial declines in the fourth quarter from the deterioration of global market conditions. Total Company average assets under management of $190.8 billion for the nine months ended September 30, 2008, decreased 34.9% to $124.3 billion in the fourth quarter 2008. Operating margin for the nine months ended September 30, 2008, totaled 33.4% compared with 25.5% for the fourth quarter 2008. In the

3

event that market conditions experienced during the fourth quarter 2008 continue, JCG expects 2009 results of operations to be more consistent with or below the fourth quarter 2008, on an annualized basis, as opposed to full-year 2008.

INVESTMENT MANAGEMENT OPERATIONS (CONTINUING OPERATIONS)

Assets Under Management and Flows

The following table presents the components of JCG's assets under management (in billions):

| | | | | | | | | | | | | |

| | Year Ended December 31, | |

|---|

| | 2008 | | 2007 | | 2006 | |

|---|

Beginning of period assets | | $ | 206.7 | | $ | 167.7 | | $ | 148.5 | |

| | Long-term sales | | | | | | | | | | |

| | | Janus | | | 29.9 | | | 30.9 | | | 16.0 | |

| | | INTECH | | | 12.3 | | | 15.5 | | | 18.5 | |

| | | Perkins | | | 6.3 | | | 2.9 | | | 3.0 | |

| | Long-term redemptions | | | | | | | | | | |

| | | Janus | | | (31.1 | ) | | (22.7 | ) | | (24.6 | ) |

| | | INTECH | | | (14.0 | ) | | (13.2 | ) | | (6.5 | ) |

| | | Perkins | | | (4.0 | ) | | (3.6 | ) | | (4.1 | ) |

| | | | | | | | |

| | Long-term net flows* | | | | | | | | | | |

| | | Janus | | | (1.2 | ) | | 8.2 | | | (8.6 | ) |

| | | INTECH | | | (1.7 | ) | | 2.3 | | | 12.0 | |

| | | Perkins | | | 2.3 | | | (0.7 | ) | | (1.1 | ) |

| | | | | | | | |

| | | | Total long-term net flows | | | (0.6 | ) | | 9.8 | | | 2.3 | |

| | Net money market flows | | | (5.0 | ) | | 5.2 | | | — | |

| | Market/fund performance | | | (77.6 | ) | | 24.0 | | | 16.9 | |

| | | | | | | | |

End of period assets | | $ | 123.5 | | $ | 206.7 | | $ | 167.7 | |

| | | | | | | | |

Long-term net flows by distribution channel | | | | | | | | | | |

| | Retail intermediary | | $ | 0.8 | | $ | 6.9 | | $ | (7.9 | ) |

| | Institutional | | | (3.1 | ) | | 1.7 | | | 9.3 | |

| | International | | | 1.7 | | | 1.2 | | | 0.9 | |

| | | | | | | | |

Total | | $ | (0.6 | ) | $ | 9.8 | | $ | 2.3 | |

| | | | | | | | |

Average assets under management | | | | | | | | | | |

| | Janus | | $ | 95.6 | | $ | 100.1 | | $ | 86.1 | |

| | INTECH | | | 57.4 | | | 68.1 | | | 53.1 | |

| | Perkins | | | 10.2 | | | 11.6 | | | 7.5 | |

| | Money market | | | 11.0 | | | 10.6 | | | 10.0 | |

| | | | | | | | |

Total | | $ | 174.2 | | $ | 190.4 | | $ | 156.7 | |

| | | | | | | | |

- *

- Excludes money market flows. Sales and redemptions are presented net on a separate line due to the short-term nature of the investments.

Total Company assets under management totaled $123.5 billion in 2008, a decrease of $83.2 billion from 2007 and $44.2 billion from 2006. The decreases were driven primarily by deteriorating markets in the last half of 2008.

Janus' net long-term outflows were $1.2 billion in 2008 compared to long-term net inflows of $8.2 billion in 2007. The decline from 2007 is largely the result of increased redemptions in the retail

4

intermediary channel as a result of short-term underperformance and adverse market conditions. Industrywide, retail investors redeemed out of long-term investments at the highest rate since 1992.

INTECH's net long-term outflows were $1.7 billion in 2008 compared to long-term net inflows of $2.3 billion in 2007, primarily as a result of the relative short-term underperformance of certain key investment strategies primarily during 2007 and clients reallocating assets from INTECH to other investment strategies in response to adverse market conditions. INTECH's sales are primarily to institutional investors, which historically have allocated investments away from equity investments in deteriorating markets and reinvested as markets stabilize and begin improving.

Perkins' long-term net flows increased $3.0 billion over 2007 as a result of improved sales and strong investment performance. Perkins' 2008 positive net flows were primarily derived through the retail intermediary channel.

Both Janus and INTECH achieved positive net long-term flows internationally in 2008, which marked the 10th consecutive year of positive net flows in the international channel.

Net money market flows declined $10.2 billion from 2007. Money market flows are short-term in nature and vary widely from period to period. In January 2009, Janus announced plans to exit its institutional money market business by managing assets for capital preservation and liquidity and requiring investors to redeem no later than April 30, 2009. The institutional money market funds include the Janus Institutional Cash Management Fund, Janus Institutional Government Money Market Fund and Janus Institutional Money Market Fund. Total assets in the Janus institutional money market discipline totaled $5.8 billion at December 31, 2008. Janus will continue to offer retail money market funds which totaled $2.1 billion as of December 31, 2008. The institutional money market business contributed approximately $0.02 per diluted share to JCG's full-year 2008 diluted earnings per share.

Revenues

Revenues are generally based upon a percentage of the market value of assets under management and are calculated as a percentage of the daily average asset balance in accordance with contractual agreements with the Company's investment products. Certain investment products are also subject to performance fees that vary based on their relative performance as compared to a benchmark index and the level of assets subject to such fees. Assets under management primarily consist of domestic and international equity and debt securities. Accordingly, fluctuations in the financial markets, relative investment performance, sales and redemptions of investment products, and changes in the composition of assets under management are all factors that have a direct effect on JCG's operating results.

5

The following graph depicts the direct relationship between average assets under management and investment management revenues:

2008 Compared to 2007

Investment management fees decreased $71.2 million, or 7.9%, as a result of a decrease in average assets under management driven primarily by declining markets.

Performance fee revenue is derived from certain mutual funds and separate accounts. The increase in performance fee revenue of $8.1 million, or 41.5%, was principally due to one separate account reaching its one-year anniversary during the second quarter 2008 on which the first contractual performance fee was recognized for the previous 12 months. Going forward, performance fees on this account will be recognized quarterly.

Shareowner servicing fees and other revenue decreased $16.0 million, or 8.0%, over the comparable prior period primarily from a decrease in transfer agent fees. Transfer agent fees are calculated based on long-term average assets under management in Janus' largest fund series (Janus Investment Fund) ("JIF"), which declined at a comparable rate.

Employee compensation and benefits decreased $42.8 million, or 11.9%, principally due to lower incentive compensation partially offset by $8.0 million in severance incurred primarily as a result of the 9% workforce reduction in October 2008. Investment team compensation decreased $33.7 million as a result of lower revenue and a decline in short-term relative investment performance. The investment team compensation plan is linked to individual investment performance, but also ties the aggregate level of compensation to revenue. Sales commissions decreased $9.9 million due to lower sales and the company-wide bonus accrual decreased $16.7 million as a result of the impact of adverse market conditions on the Company's operating results.

6

Long-term incentive compensation decreased $36.4 million, or 45.6%, primarily as a result of the performance-based acceleration and contractual acceleration of awards in 2007, and a $2.9 million net benefit from revising JCG's forfeiture estimate in the fourth quarter 2008 due to higher than projected employee departures. Long-term incentive compensation in 2007 also included a $17.0 million charge for the contractual acceleration of awards related to certain portfolio managers who resigned.

Long-term incentive grants made during 2008 totaled $84.3 million and will be recognized ratably over a three-year period. In addition to these awards, retention awards were granted to certain Janus investment team members and INTECH employees to facilitate succession planning and incentivize key personnel to remain with the Company. The Janus retention grant totaled $21.0 million and will be recognized ratably over a four-year period. The INTECH retention grant totaled $10.0 million and will be recognized ratably over a 10-year period. Future long-term incentive amortization will also be impacted by the 2009 annual grant totaling $70.0 million, which will be recognized ratably over a four-year period.

Distribution expenses decreased $6.8 million, or 4.8%, as a result of a similar decrease in assets under management subject to third-party concessions. Distribution fees are calculated based on a contractual percentage of the market value of assets under management distributed through third-party intermediaries.

Interest expense increased $16.7 million, or 28.4%, from the issuance of additional debt in June 2007. All of JCG's outstanding debt includes an interest rate adjustment covenant that provides that the interest rate payable will increase by 25 basis points for each level that the Company's debt rating is decreased by Moody's Investors Service, Inc. ("Moody's") from its existing rating of Baa3 or by S&P from its existing rating of BBB-, up to a maximum increase of 200 basis points. On February 23, 2009, S&P lowered JCG's credit rating to BB+, which will result in a 25 basis point increase in the interest rates payable on all of JCG's outstanding debt, or approximately $2.8 million of additional annual interest expense.

Net investment losses totaled $60.4 million in 2008 and include a $21.0 million impairment charge on SIV securities and $41.1 million of mark-to-market losses on consolidated investment products, net of $1.7 million of realized gains. Net investment gains of $4.7 million in 2007 include $17.6 million of income previously recorded as unrealized gains in equity partially offset by an $18.2 million impairment charge on SIV securities. JCG implemented a hedge strategy in December 2008 covering the majority of invested seed capital to mitigate a portion of the earnings volatility created by the mark-to-market accounting of seed capital investments.

The decrease in noncontrolling interest is largely the result of a decline in INTECH earnings associated with lower average assets under management in the relevant investment products and approximately $4.0 million of losses associated with the noncontrolling interest in consolidated investment products.

JCG's tax rate will decrease by approximately 1.25% from the current rate effective January 1, 2009 as a result of a legislative change in Colorado state taxes enacted during the second quarter 2008. The income tax provision for 2008 includes a $12.9 million tax benefit as a result of applying the lower tax rate to deferred tax assets and liabilities expected to be realized or settled on or after January 1, 2009.

2007 Compared to 2006

Investment management fees increased $147.7 million, or 19.7%, from a similar increase in average assets under management driven primarily by market appreciation and investment performance combined with positive long-term net inflows.

The increase in performance fee revenue was primarily due to fees of $11.2 million earned on mutual funds, partially offset by a decrease of $6.5 million of fees on INTECH private accounts as a result of recent relative underperformance.

7

Shareowner servicing fees and other revenue improved $28.9 million, or 16.9%, over the comparable prior period primarily as a result of an increase in transfer agent fees. Average JIF assets, excluding money market assets, increased 15.6% over the prior year.

Employee compensation and benefits increased $45.5 million, or 14.4%, principally due to higher base salaries, investment team compensation and sales commissions. Base salaries increased $11.5 million from annual merit increases and an 8.3% growth in the average number of employees. Investment team compensation increased $21.0 million due to higher management fee revenue and relative investment performance. Sales commissions increased $6.6 million due to improved sales, primarily in the retail intermediary channel.

Long-term incentive compensation decreased $2.8 million due to the final vesting of a previous grant in the first quarter 2007, partially offset by an increase related to the 2007 annual grant awarded in February, a $17.0 million charge for the contractual acceleration of awards related to certain portfolio managers who resigned in 2007 and accelerated vesting of previous awards based on 2007 financial performance.

Distribution expenses increased $31.5 million, or 28.6%, from a similar increase in assets under management subject to third-party concessions.

Interest expense increased $26.5 million as a result of the issuance of additional debt during 2007.

Investment gains decreased $7.0 million primarily from the recognition of an $18.2 million impairment charge on SIV securities acquired from money market funds advised by Janus and a decrease in realized gains related to the sale of seed capital investments. The impairment charge and decrease in realized gains were partially offset by $17.6 million of income previously recorded as unrealized gains in equity. In the fourth quarter 2007, JCG evaluated its seed capital investments and determined that mutual funds and separate accounts in which it owns a majority interest should be consolidated, with changes in market value reported in current period earnings.

DISCONTINUED OPERATIONS

During the second quarter 2008, JCG disposed of its Printing and Fulfillment operations for $14.5 million.

LIQUIDITY AND CAPITAL RESOURCES

Cash Flows

A summary of cash flow data from continuing operations for the years ended December 31 is as follows(in millions):

| | | | | | | | | | | |

| | 2008 | | 2007 | | 2006 | |

|---|

Cash flows provided by (used for): | | | | | | | | | | |

| | Operating activities | | $ | 238.2 | | $ | 290.8 | | $ | 298.6 | |

| | Investing activities | | | (148.8 | ) | | (103.3 | ) | | 48.0 | |

| | Financing activities | | | (287.5 | ) | | (213.9 | ) | | (340.5 | ) |

| | | | | | | | |

Net increase (decrease) in cash and cash equivalents | | | (198.1 | ) | | (26.4 | ) | | 6.1 | |

Balance at beginning of year | | | 480.7 | | | 507.1 | | | 501.0 | |

| | | | | | | | |

Balance at end of year | |

$ |

282.6 | |

$ |

480.7 | |

$ |

507.1 | |

| | | | | | | | |

8

2008 Cash Flows

JCG's cash flow from operations historically has been positive and sufficient to fund ordinary operations and capital requirements. Fluctuations in operating cash flows are attributable to changes in net income and working capital items, which can vary from period to period based on the amount and timing of cash receipts and payments. The decline in cash flow from operations in 2008 was driven by lower revenues in the second half of 2008 as a result of the deterioration in global market conditions.

Net cash used for investing activities in 2008 primarily represents $67.7 million for the purchase of an additional 3% interest in INTECH and $90.0 million for an additional 50% interest in Perkins.

Cash used for financing activities in 2008 primarily represents stock buybacks of $291.7 million.

2007 Cash Flows

Operating cash flows in 2007 decreased $7.8 million to $290.8 million due to changes in net income and working capital items.

Net cash used for investing activities in 2007 includes $81.0 million for the purchase of an additional 4% interest in INTECH and $108.5 million (including $3.5 million of purchased accrued interest) for the purchase of SIV securities from money market funds advised by Janus, partially offset by $55.2 million of proceeds from the net sale of investments in advised funds.

Cash used for financing activities in 2007 includes $748.4 million of proceeds from the issuance of long-term debt, offset by the repayment of $158.1 million of long-term debt and common stock buybacks of $845.6 million.

2006 Cash Flows

Operating cash flows in 2006 increased $31.1 million to $298.6 million due to changes in net income and working capital items.

Net cash generated from investing activities in 2006 includes proceeds from the maturity and sale of marketable securities, partially offset by $90.0 million for the purchase of an additional 5% interest in INTECH and capital expenditures.

Cash used for financing activities in 2006 consists primarily of common stock repurchases of $516.4 million and the repayment of $113.1 million of long-term debt, partially offset by the issuance of $275.0 million of debt.

Money Market Funds Advised by Janus

Janus advises the Money Funds that attempt to provide current income and limit exposure to losses by investing in high-quality securities with short-term durations that present minimal credit risk. Adverse events or circumstances related to individual securities or the market in which the securities trade may cause other-than-temporary declines in value. JCG continuously evaluates the securities held by the Money Funds to determine if any holdings are distressed or may become distressed in the near future. In such circumstances, JCG would consider whether taking any action, including, but not limited to, a potential election by JCG to provide further support to the Money Funds that could result in additional impairments and financial losses, would be appropriate. Under certain situations, JCG may elect to support one or more of the Money Funds to enable them to maintain a net asset value equal to one dollar through a variety of means, including but not limited to, purchasing securities held by the Money Funds, reimbursing for any losses incurred or providing a letter of credit. However, JCG is not contractually or legally obligated to provide support to the Money Funds. JCG's recently announced plan to exit the institutional money market business is expected to substantially reduce the likelihood of

9

the Money Funds holding a distressed security. Institutional money market portfolios typically hold higher yielding assets, and therefore have a higher risk, as compared to retail money market portfolios.

JCG's decision to provide support to the Money Funds is based on the facts and circumstances at the time a holding in the Money Funds becomes or is expected to become distressed. A holding is considered distressed when there is significant doubt regarding the issuer's ability to pay required amounts when due, often resulting in a decline in the securities' credit ratings. If a security falls below the minimum rating required by investment restrictions, the Money Funds must dispose of the investment unless the Money Funds' Board of Trustees determines that such disposition is not in the best interests of the Money Funds. In determining whether to take any action in response to a distressed condition or a downgrade affecting securities held by the Money Funds, JCG considers many factors, which may include the potential financial and reputational impact to the Money Funds and JCG, the regulatory and operational restrictions, the size of a holding, a security's expected time to maturity and likelihood of payment at maturity, general market conditions, discussions with the Money Funds' Board of Trustees and JCG's Board of Directors, and JCG's liquidity and financial condition. No single factor is determinative and there is no predetermined threshold with respect to each factor that would lead JCG to consider providing support to the Money Funds.

Given recent market events impacting liquidity for mutual funds, including money market funds, JCG has enhanced its emphasis on managing the Money Funds for capital preservation and liquidity while remaining in line with their investment objectives. The Money Funds elected to participate in the U.S. Department of Treasury's Temporary Guarantee Program for money market mutual funds (the "Program"). The Program guarantees for shareholders of a Money Fund as of September 19, 2008 the lesser of (i) the amount the shareholder held as of the close of business on September 19, 2008; or (ii) the number of shares held as of the date that the Program is utilized. A Money Fund must be in liquidation to utilize the guarantee provided by the Program. The Program was originally effective until December 18, 2008, but was extended to April 30, 2009.

Financial Support Provided to the Funds

On December 21, 2007, Moody's Investors Service, Inc. downgraded securities issued by certain SIVs including those issued by Stanfield Victoria Funding LLC ("Stanfield securities") to a rating below what is generally permitted to be held by the Money Funds. The Money Funds held $105.0 million of Stanfield securities plus $3.5 million of accrued interest at the time of the downgrade. In connection with this downgrade, JCG determined that it was in the best interests of the applicable Money Funds and their shareholders for JCG to purchase the Stanfield securities from the Money Funds at amortized cost plus accrued interest. Subsequent to purchase, JCG has recognized impairment charges totaling $39.2 million (including $3.5 million of purchased accrued interest), reflecting the difference between the low end of the range of estimated fair value and the purchase price of the Stanfield securities. In addition, JCG received a cash distribution totaling $17.1 million which reduced the carrying value of the Stanfield securities. Included in JCG's estimate of fair value is the assumption that no interest income payable on the securities will be received. JCG's total additional risk of loss with respect to the Stanfield securities at December 31, 2008 is limited to the $52.2 million carrying value of its investment. Additional impairment charges on the Stanfield securities may be recognized if the underlying assets experience further other-than-temporary deterioration in value.

In January 2008, the Stanfield securities were placed with an enforcement manager to be restructured or sold at the election of each senior note holder. JCG elected to participate in the restructuring of the Stanfield securities. In addition, the collateral agent, Deutsche Bank, filed an interpleader complaint due to conflicting positions of note holders that effectively prevented the enforcement manager from making any cash payments and other distributions, or from restructuring the Stanfield securities.

10

An amendment to the security agreement for the Stanfield securities was approved in December 2008 following the resolution of the interpleader complaint allowing available cash in the Stanfield vehicle to be distributed to security holders. A new legal structure is expected to be announced in 2009 at which time JCG may elect to receive its proportionate share of underlying assets or participate in the new legal structure.

Short-Term Liquidity and Capital Requirements

The Company has cash and marketable securities of $407.9 million at December 31, 2008. JCG believes that existing cash and cash from operations should be sufficient to satisfy its short-term capital requirements. However, significant further deterioration in global market conditions and JCG's operating results may adversely impact liquidity. Expected short-term uses of cash include ordinary operations, capital expenditures, income tax payments, and interest and principal payments on outstanding debt.

Common Stock Repurchase Program

JCG's Board of Directors authorized five separate $500 million share repurchase programs beginning in July 2004 with the most recent authorization in July 2008. During 2008 and 2007, the Company repurchased 10.8 million shares for $281.0 million and 31.5 million shares for $828.6 million, respectively, under these authorizations. As of December 31, 2008, $521.2 million is available under the current authorizations. Given the current market conditions, JCG suspended stock buybacks in the fourth quarter 2008 to preserve liquidity and financial flexibility.

Long-Term Liquidity and Capital Requirements

Expected long-term commitments at December 31, 2008, include the following(in millions):

| | | | | | | | | | | | | |

| | Current | | 2 to 3 Years | | 4 to 5 Years | | After 5 Years | |

|---|

Debt | | $ | 22.0 | | $ | 275.0 | | $ | 300.0 | | $ | 532.4 | |

Interest payments | | | 74.5 | | | 142.3 | | | 81.6 | | | 107.5 | |

Operating leases | | | 18.1 | | | 34.0 | | | 29.4 | | | 59.8 | |

| | | | | | | | | | |

Total | | $ | 114.6 | | $ | 451.3 | | $ | 411.0 | | $ | 699.7 | |

| | | | | | | | | | |

The information presented above does not include operating related liabilities or capital expenditures that will be committed to in the normal course of business. JCG expects to fund its long-term commitments over the next three years from existing cash and cash generated from normal operations. For commitments beyond three years, JCG anticipates using cash generated from normal operations, refinancing debt or accessing capital and credit markets as necessary.

Operating lease obligations are presented net of estimated sublease income of $4.7 million.

INTECH

Each fiscal year through 2012, each of the two INTECH founding members has the option to require JCG to purchase from him an ownership interest of up to approximately 1.5% of INTECH ("Annual Option Shares") at fair value. At December 31, 2008, the two founders have an aggregate ownership interest of approximately 8% in INTECH. In the event that either INTECH founder does not fully exercise his annual voluntary sale option in a given year, JCG has the option to require the INTECH founder to sell the remaining balance of the Annual Option Shares for that year at fair value.

11

In addition, the founders can require JCG to purchase their INTECH interests if the founder's employment is terminated. The purchase price of the departing founder's INTECH interests will be based on fair value. Each founder is entitled to retain approximately 1% of INTECH's shares then outstanding after employment until his death unless he is terminated for cause or leaves voluntarily while not in good standing. An INTECH founder will be deemed to be in good standing if he voluntarily leaves on or after January 1, 2009, after providing 12 months' prior notice and cooperation with the transition.

The long-term commitments schedule above does not include any estimate for the purchase of the outstanding INTECH interests due to the uncertainty of this obligation and the price at which it may occur. Total INTECH interests held by the two founders are valued at approximately $67.5 million as of December 31, 2008 and are included in redeemable noncontrolling interests on the balance sheet.

Redeemable interests held by other INTECH employees are valued at $3.2 million as of December 31, 2008 and are included in redeemable noncontrolling interests on the balance sheet.

Perkins

On December 31, 2008, JCG increased its ownership of Perkins to approximately 80% with the purchase of an additional 50% ownership interest for $90.0 million in cash. Upon closing the transaction, Perkins granted profit interest awards designed to retain and incentivize key employees to grow the business. These awards vest on the fifth anniversary of grant and are generally entitled to a total of 5% of Perkins' annual net income. In addition, these awards have a formula-driven terminal value based on revenue growth and relative investment performance of products managed by Perkins. JCG can call and terminate any or all of the awards on the fifth, seventh or each subsequent anniversary of grant or prior to the fifth anniversary of grant if the formula yields a terminal value of $40.0 million. Participants can require JCG to terminate the awards in exchange for the then-applicable formula price on the sixth anniversary of grant. The profit interests are also subject to termination at premiums or discounts to the formula at the option of JCG or the relevant employee, as applicable, upon certain corporate or employment-related events affecting Perkins or the relevant employee.

JCG also has the option to acquire any or all of the remaining 20% interest of Perkins at fair value on the third, fifth, seventh or each subsequent anniversary of closing. The noncontrolling owners of Perkins have the option to require JCG to purchase any or all of their remaining interests on the fourth or sixth anniversary of closing at fair value. The total Perkins noncontrolling interest is valued at $36.0 million as of December 31, 2008 and is included in redeemable noncontrolling interests on the balance sheet.

Other Sources of Liquidity

Credit Facility

JCG has a $350 million Five-Year Competitive Advance and Revolving Credit Facility Agreement (the "Credit Facility") with a syndicate of banks. The Credit Facility contains a number of financial covenants, including a specified financing leverage ratio and interest coverage ratio. At December 31, 2008, JCG was in compliance with all covenants and there were no borrowings under the Credit Facility. In the event that assets under management continue to decline, JCG may not be able to access or utilize all or a portion of its credit available under the Credit Facility. Accordingly, JCG may seek less restrictive financial covenants that, if obtained, would allow for continued access to the Credit Facility in the event that current market conditions persist or further deteriorate. JCG's credit line may decrease and its costs to borrow under the Credit Facility may increase in exchange for less restrictive financial covenants. There is no guarantee that any efforts undertaken by JCG to renegotiate the terms of the Credit Facility will be successful.

12

Shelf Registration

The Company has effective a Shelf-Registration Statement ("Shelf Registration") with the SEC, under which JCG could register an indeterminate amount of JCG's common stock, preferred stock and debt securities.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

JCG's consolidated financial statements and accompanying notes have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting periods.

JCG continually evaluates the accounting policies and estimates used to prepare the consolidated financial statements. In general, management's estimates are based on historical experience, information from third-party professionals and various other assumptions that are believed to be reasonable under current facts and circumstances. Actual results could differ from those estimates made by management. JCG's critical accounting policies and estimates include income taxes, intangible assets and goodwill, marketable securities and equity compensation.

Accounting for Intangible Assets and Goodwill

Intangible assets and goodwill comprise $2.6 billion, or 79%, of total assets at December 31, 2008. Intangible assets and goodwill require significant management estimates and judgment, including the valuation and expected life determination in connection with the initial purchase price allocation and the ongoing evaluation for impairment. JCG separately tests goodwill and indefinite-lived intangible assets for impairment annually or more frequently if events or changes in circumstances indicate that the asset may be impaired.

In connection with the purchase price allocation of acquisitions, JCG will rely on in-house financial expertise or utilize a third-party expert, if considered necessary. Valuations generally rely on management's estimates and judgments as to growth rates and operating margins over a range of possible assumptions for various products, distribution channels and business strategies.

Goodwill represents the excess of cost over the fair value of the identifiable net assets of acquired companies and is not amortized. Goodwill is tested for impairment by comparing the fair value of the "reporting unit" associated with the goodwill to the reporting unit's recorded value. If the fair value of the reporting unit is less than its recorded value, a process similar to a purchase price allocation is undertaken to determine the amount, if any, of the goodwill impairment. All assets, including previously unrecognized intangible assets, and liabilities are fair valued and any unallocated value is assigned to goodwill. Because the allocation of fair value includes intangible assets not previously recognized, the amount of the goodwill impairment charge may significantly exceed the difference between the fair value of the reporting unit and its recorded value. For purposes of testing goodwill for impairment, JCG has identified one reporting unit.

Indefinite-lived intangible assets primarily represent mutual fund advisory contracts, brand name and trademark. The assignment of indefinite lives to mutual fund advisory contracts, brand name and trademark is based on the assumption that they are expected to generate cash flows indefinitely. This assumption, with respect to mutual fund advisory contracts, is supported by the fact that historically there have not been significant switches between fund managers in the mutual fund industry. Indefinite-lived intangible assets are tested for impairment by comparing the fair value of the asset to its recorded value.

13

Definite-lived intangible assets represent client relationships, which are amortized over their estimated lives of seven to 25 years using the straight-line method. Definite-lived intangible assets are tested only when there are indications of impairment. One component of JCG's definite-lived intangible assets is subadvised contracts. Each subadvised contract has a specific allocation of value and therefore, the loss of an individual contract will cause an impairment charge. JCG recorded impairments of $0.4 million and $11.0 million in 2007 and 2006, respectively, associated with the termination of subadvised contracts. There were no impairments of subadvised contracts in 2008. At December 31, 2008, the net book value of intangible assets related to subadvised contracts was $12.7 million.

To complete the tests for potential impairment of goodwill and intangible assets, JCG uses a discounted cash flow analysis that requires assumptions regarding projected future earnings and discount rates. In projecting future earnings, JCG considers the following: equity market performance; performance compared to peers; significant changes in the underlying business and products; material and ongoing negative industry or economic trends; and/or other factors that may influence future earnings. Changes in the assumptions underlying the discounted cash flow analysis could materially affect JCG's impairment conclusion. Due to the significance of the identified intangible assets and goodwill to JCG's consolidated balance sheet, any impairment charge could have a material adverse effect on the Company's results of operations.

Subsequent to the annual impairment test for goodwill performed as of October 1, global market conditions rapidly deteriorated and JCG's market capitalization declined below net book value. In response, JCG completed another goodwill impairment test as of December 31, 2008, and concluded that goodwill was not impaired. JCG's fair value was estimated using a discounted cash flow analysis as well as analyzing current and historical control premiums within the financial services industry. Based on this analysis, JCG's estimated fair value exceeded net book value as of December 31, 2008. In the event that global market conditions and JCG's results of operations continue to deteriorate, further analysis will be undertaken which may result in a material impairment charge.

Accounting for Income Taxes

Significant management judgment is required in developing JCG's provision for income taxes, including the valuation allowances that might be required against deferred tax assets and the evaluation of various income tax contingencies.

Valuation Allowance

JCG has not recorded a valuation allowance on its deferred tax assets as of December 31, 2008, based on management's belief that future income will more likely than not be sufficient to realize the benefit of the Company's deferred tax assets over time. In the event that actual results differ from these estimates, or if JCG's historical trend of positive income changes, JCG may be required to record a valuation allowance on deferred tax assets, which could have a material adverse effect on JCG's consolidated financial condition and results of operations.

Income Tax Contingencies

At December 31, 2008, JCG has an accrued liability of $37.0 million related to tax contingencies for issues raised by various taxing authorities. At any one time, tax returns filed in previous years are subject to audit by various taxing authorities. As a result of these audits and negotiations, additional tax assessments may be proposed or tax contingencies recorded in prior years may be reversed. On January 1, 2007, JCG reduced its tax contingencies liability by $29.3 million as a result of the implementation of Financial Accounting Standards Board Interpretation No. 48, "Accounting for Uncertainty in Income Taxes." The reduction in the liability and the related change in deferred taxes were accounted for as an increase to retained earnings.

14

Valuation of Marketable Securities

JCG records all marketable securities classified as trading or available-for-sale at fair value. Fair value is generally determined using observable market data based on recent trading activity. Where observable market data is unavailable due to a lack of trading activity, JCG uses internally developed models to estimate fair value and independent third parties to validate assumptions when appropriate. Estimating fair value requires significant management judgment, including benchmarking to similar instruments with observable market data and applying appropriate discounts that reflect differences between the securities that JCG is valuing and the selected benchmark. Depending on the type of securities owned by JCG, other valuation methodologies may be required. Any variation in the assumptions used to approximate fair value could have a material adverse effect on the Company's financial condition and results of operations.

JCG periodically evaluates the carrying value of marketable securities for potential impairment. In determining if an impairment exists, JCG considers the duration, extent and circumstances of any decline in fair value. If the decline in value is determined to be other-than-temporary, the carrying value of the security is written down to fair value with the loss recognized currently in earnings.

Equity Compensation

JCG uses the Black-Scholes option pricing model to estimate the fair value of stock options for recording compensation expense. The Black-Scholes model requires management to estimate certain variables, including the lives of options from grant date to exercise date, the volatility of the underlying shares and future dividend rates. The two most significant estimates in the Black-Scholes model are volatility and expected life. An increase in the volatility rate increases the value of stock options and a decrease causes a decline in value. JCG estimated expected volatility using an average of JCG's historical volatility and industry and market averages, as appropriate. For expected lives, an increase in the expected life of an option increases its value. JCG factored in employee termination rates combined with vesting periods to determine the average expected life used in the model.

JCG records equity compensation net of estimated forfeitures over the vesting term. Determining the forfeiture estimate requires significant judgment as to the number of actual awards that will ultimately vest over the term of the award. The estimate is reviewed quarterly and any change in actual forfeitures in comparison to estimates may cause an increase or decrease in the ultimate expense recognized in that period and future periods. During the fourth quarter 2008 and third quarter 2006, the forfeiture estimate was adjusted to reflect higher than projected employee departures resulting in $2.9 million and $5.0 million, respectively, of decreases to long-term incentive compensation expense.

Recent Accounting Pronouncements

Information regarding accounting pronouncements that have been issued but not yet adopted by the Company is incorporated by reference from Part II, Item 8, Financial Statements and Supplemental Data, Note 3 — Recent Accounting Pronouncements, of this Annual Report on Form 10-K.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The following information, together with information included in other parts of this Management's Discussion and Analysis of Financial Condition and Results of Operations, describes the key aspects of certain financial instruments that have market risk to JCG.

Investment Management Fees

Revenues are generally based upon a percentage of the market value of assets under management and are calculated as a percentage of the daily average asset balance in accordance with contractual

15

agreements with the Company's investment advisory clients. Assets under management primarily include domestic and international equity and debt securities. Accordingly, fluctuations in the financial markets have a direct effect on JCG's operating results. In addition, fluctuations in interest rates may affect the value of assets under management in the money market and other fixed income investment products. The graph in Item 7, Management Discussion and Analysis of Financial Condition and Results of Operations — Investment Management Operations, presents the historical direct relationship between revenue and average assets under management.

Performance Fees

Performance fee revenue is derived from certain private accounts and mutual funds. JCG recognized performance fees of $27.6 million, $19.5 million and $14.9 million in 2008, 2007 and 2006, respectively.

Private account performance fees are specified in client contracts and are based on investment performance as compared to an established benchmark index over a specified period of time. Performance fees are recognized at the end of the contractual period if the stated performance criteria are achieved. At December 31, 2008, $6.7 billion of assets under management were subject to private account performance fees.

Mutual fund performance fees were recorded beginning in the first quarter 2007. The investment management fee paid by each fund is the base management fee plus or minus a performance fee adjustment as determined by the relative investment performance of each fund compared to a specified benchmark index. The performance fee adjustment is up to 15 basis points, calculated using each fund's daily net average assets over the performance period. The measurement period begins as a trailing 12-month period and each subsequent month will be added to each successive measurement period until a 36-month period is achieved. At that point, the measurement period will become a rolling 36-month period. At December 31, 2008, $16.1 billion of assets under management were subject to mutual fund performance fees.

Trading Securities

At December 31, 2008, seed capital investments classified as trading totaled $62.4 million. Trading securities are carried in JCG's consolidated financial statements at fair value, with changes in value recognized as gains and losses currently in earnings. JCG recognized losses of $41.1 million in earnings on securities classified as trading for the year ended December 31, 2008.

JCG implemented an economic hedge strategy in December 2008 covering the majority of invested seed capital to mitigate a portion of the earnings volatility created by the mark-to-market accounting of seed capital investments. The strategy utilizes futures contracts and call options on various market indices to minimize market losses while allowing for limited participation in market gains. These instruments are accounted for at fair value under Statement of Financial Accounting Standard No. 133 (as amended and interpreted), "Accounting for Derivatives and Hedging Activities" ("SFAS 133"), with changes in fair value reported currently in earnings but have not been designated as hedging instruments under SFAS 133. At December 31, 2008, the total fair value of derivative instruments totaled $0.8 million and is included in marketable securities.

Available-for-Sale Securities

At December 31, 2008, seed capital investments classified as available-for-sale totaled $62.1 million, representing $9.9 million of investments in advised funds and $52.2 million of SIV securities issued by Stanfield Victoria Funding LLC. Investments in advised funds are carried in JCG's consolidated financial statements at fair value, with changes in value recognized as gains and losses in other comprehensive income. Accumulated gains and losses are reclassified to earnings when the securities are sold. SIV securities are carried in JCG's consolidated financial statements based on JCG's estimate

16

of fair value. An other-than-temporary impairment charge of $21.0 million was recognized on JCG's SIV investment during the third quarter 2008. No other impairment charges were recognized on available-for-sale securities during 2008. In the event that current market conditions persist or further deteriorate, JCG may recognize impairment charges on available-for-sale securities.

Foreign Currency Exchange Sensitivity

JCG has international subsidiaries that conduct business within other foreign countries. With respect to these operations, matters arise as to financial accounting and reporting for foreign currency transactions and for translating foreign currency financial statements into U.S. dollars. The exposure to foreign currency fluctuations is not material as the majority of the revenue earned by international subsidiaries is denominated in U.S. dollars.

Interest Rate Risk on Long-Term Debt

JCG is not exposed to interest rate risk other than from the potential change in interest rates on the Company's debt in the event of a change in credit ratings by Moody's or S&P. All of JCG's outstanding debt includes an interest rate adjustment covenant that provides that the interest rate payable will increase by 25 basis points for each level that the Company's debt rating is decreased by Moody's from its existing rating of Baa3 or by S&P from its existing rating of BBB-, up to a maximum increase of 200 basis points. If at any time after the interest has been adjusted upward, either Moody's or S&P increases its rating, then for each level of such increase in the rating, the interest payable will be decreased by 25 basis points, but in no event to a rate less than the interest rate payable on the date of their issuance. The interest rate adjustment covenant will permanently terminate if the Company's debt ratings increase to Baa2 by Moody's and BBB by S&P (or higher), with a stable or positive outlook regardless of any subsequent decrease in the ratings by either or both rating agencies. On February 23, 2009, S&P lowered JCG's credit rating to BB+, which will result in a 25 basis point increase in the interest rates payable on all of JCG's outstanding debt, or approximately $2.8 million of additional annual interest expense.

17

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Index to Financial Statements

| | | |

| | Page |

|---|

Financial Statements: | | |

| | Reports of Independent Registered Public Accounting Firm — Deloitte & Touche LLP | | 19 |

| | Management Report on Internal Control Over Financial Reporting | | 21 |

| | Consolidated Balance Sheets as of December 31, 2008 and 2007 | | 22 |

| | Consolidated Statements of Income for the Three Years Ended December 31, 2008 | | 23 |

| | Consolidated Statements of Cash Flows for the Three Years Ended December 31, 2008 | | 24 |

| | Consolidated Statements of Changes in Stockholders' Equity for the Three Years Ended December 31, 2008 | | 25 |

| | Notes to Consolidated Financial Statements | | 26 |

Financial Statement Schedules: | | |

| | All schedules are omitted because they are not applicable or are insignificant, or the required information is shown in the consolidated financial statements or notes thereto. | | |

18

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Janus Capital Group Inc.

We have audited the accompanying consolidated balance sheets of Janus Capital Group Inc. and subsidiaries (the "Company") as of December 31, 2008 and 2007, and the related consolidated statements of income, stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2008. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2008 and 2007, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2008, in conformity with accounting principles generally accepted in the United States of America.

As discussed in Notes 2 and 21 to the consolidated financial statements, effective January 1, 2009 the Company adopted Statement of Financial Accounting Standards ("SFAS") No. 160,Noncontrolling Interests in Consolidated Financial Statements—an amendment of ARB No. 51 and the amended provisions of Emerging Issues Task Force Topic D-98Classification and Measurement of Redeemable Securities and retrospectively adjusted all periods presented in the consolidated financial statements for the changes required by these statements.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Company's internal control over financial reporting as of December 31, 2008, based on the criteria established inInternal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated February 26, 2009 expressed an unqualified opinion on the Company's internal control over financial reporting.

/s/ Deloitte & Touche LLP

Denver, Colorado

February 26, 2009 (July 14, 2009 as to Notes 2 and 21)

19

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Janus Capital Group Inc.

We have audited the internal control over financial reporting of Janus Capital Group Inc. and subsidiaries (the "Company") as of December 31, 2008, based on criteria established inInternal Control — Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. The Company's management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management Report on Internal Control Over Financial Reporting. Our responsibility is to express an opinion on the Company's internal control over financial reporting based on our audit. We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company's internal control over financial reporting is a process designed by, or under the supervision of, the company's principal executive and principal financial officers, or persons performing similar functions, and effected by the company's board of directors, management, and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company's assets that could have a material effect on the financial statements.

Because of the inherent limitations of internal control over financial reporting, including the possibility of collusion or improper management override of controls, material misstatements due to error or fraud may not be prevented or detected on a timely basis. Also, projections of any evaluation of the effectiveness of the internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2008, based on the criteria established inInternal Control — Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the accompanying consolidated financial statements as of and for the year ended December 31, 2008 of the Company and our report dated February 26, 2009 (July 14, 2009 as to Notes 2 and 21) expressed an unqualified opinion on those financial statements.

/s/ Deloitte & Touche LLP

Denver, CO

February 26, 2009

20

MANAGEMENT REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Janus Capital Group Inc. ("JCG") management is responsible for establishing and maintaining adequate internal control over JCG's financial reporting, as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act. JCG' internal control system was designed to provide reasonable assurance to JCG's management and board of directors regarding the preparation and fair presentation of published financial statements. There are inherent limitations in the effectiveness of any internal control, including the possibility of human error and the circumvention or overriding of controls. Accordingly, even effective internal controls can provide only reasonable assurances with respect to financial statement preparation. Further, because of changes in conditions, the effectiveness of internal controls may vary over time.

JCG has assessed the effectiveness of JCG's internal controls over financial reporting as of December 31, 2008. In making this assessment, JCG used the criteria set forth in the Committee of Sponsoring Organizations of the Treadway Commission (COSO) inInternal Control — Integrated Framework.

Based on the assessment using those criteria, JCG believes that, as of December 31, 2008, internal control over financial reporting is effective.

JCG's independent registered public accounting firm audited the financial statements included in the Annual Report on Form 10-K and have issued an audit report on management's assessment of JCG's internal control over financial reporting. This report appears on page 32 of this Annual Report on Form 10-K.

February 26, 2009

21

JANUS CAPITAL GROUP INC.

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Dollars in Millions, Except Share Data)

| | | | | | | | | | |

| | December 31,

2008 | | December 31,

2007 | |

|---|

ASSETS | | | | | | | |

Current assets: | | | | | | | |

| | Cash and cash equivalents | | $ | 282.6 | | $ | 480.7 | |

| | Marketable securities | | | 125.3 | | | 210.7 | |

| | Accounts receivable | | | 101.1 | | | 164.5 | |

| | Income taxes receivable | | | 16.4 | | | 5.9 | |

| | Other current assets | | | 58.5 | | | 62.3 | |

| | Assets related to discontinued operations | | | — | | | 29.8 | |

| | | | | | |

| | | | Total current assets | | | 583.9 | | | 953.9 | |

Other assets: | | | | | | | |

| | Other assets | | | 60.2 | | | 112.2 | |

| | Property and equipment, net | | | 51.1 | | | 46.5 | |

| | Intangibles, net | | | 1,321.2 | | | 1,310.4 | |

| | Goodwill | | | 1,320.3 | | | 1,141.1 | |

| | | | | | |

Total assets | | $ | 3,336.7 | | $ | 3,564.1 | |

| | | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | |

Current liabilities: | | | | | | | |

| | Accounts payable | | $ | 0.5 | | $ | 2.2 | |

| | Accrued compensation and benefits | | | 90.0 | | | 134.5 | |

| | Current portion of long-term debt | | | 22.0 | | | — | |

| | Other accrued liabilities | | | 44.1 | | | 79.2 | |

| | Liabilities related to discontinued operations | | | — | | | 10.8 | |

| | | | | | |

| | | | Total current liabilities | | | 156.6 | | | 226.7 | |

Other liabilities: | | | | | | | |

| | Long-term debt | | | 1,106.0 | | | 1,127.7 | |

| | Deferred income taxes | | | 388.1 | | | 404.3 | |

| | Other liabilities | | | 62.4 | | | 65.7 | |

| | | | | | |

| | | | Total liabilities | | | 1,713.1 | | | 1,824.4 | |

| | | | | | |

Commitments and contingencies | | | | | | | |

Redeemable noncontrolling interests | | | 106.8 | | | 245.8 | |

| | | | | | |

STOCKHOLDERS' EQUITY | | | | | | | |

Preferred stock ($1.00 par, 10,000,000 share authorized, none issued) | | | — | | | — | |

Common stock ($0.01 par, 1,000,000,000 shares authorized; 244,591,618 shares issued, 157,890,142 and 166,287,937 shares outstanding, respectively) | | | 1.6 | | | 1.7 | |

Retained earnings | | | 1,510.6 | | | 1,480.3 | |

Accumulated other comprehensive income (loss) | | | (5.3 | ) | | 4.8 | |

| | | | | | |

| | | | Total JCG stockholders' equity | | | 1,506.9 | | | 1,486.8 | |

Noncontrolling interests | | | 9.9 | | | 7.1 | |

| | | | | | |

| | | | Total stockholders' equity | | | 1,516.8 | | | 1,493.9 | |

| | | | | | |

Total liabilities and stockholders' equity | | $ | 3,336.7 | | $ | 3,564.1 | |

| | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

22

JANUS CAPITAL GROUP INC.

CONSOLIDATED STATEMENTS OF INCOME

(Dollars in Millions, Except Per Share Data)

| | | | | | | | | | | | |

| | For the year ended December 31, | |

|---|

| | 2008 | | 2007 | | 2006 | |

|---|

Revenues: | | | | | | | | | | |

| | Investment management fees | | $ | 826.7 | | $ | 897.9 | | $ | 750.2 | |

| | Performance fees | | | 27.6 | | | 19.5 | | | 14.9 | |

| | Shareowner servicing fees and other | | | 183.6 | | | 199.6 | | | 170.7 | |

| | | | | | | | |

| | | Total | | | 1,037.9 | | | 1,117.0 | | | 935.8 | |

| | | | | | | | |

Operating Expenses: | | | | | | | | | | |

| | Employee compensation and benefits | | | 317.9 | | | 360.7 | | | 315.2 | |

| | Long-term incentive compensation | | | 43.5 | | | 79.9 | | | 82.7 | |

| | Marketing and advertising | | | 33.1 | | | 25.9 | | | 28.3 | |

| | Distribution | | | 134.9 | | | 141.7 | | | 110.2 | |

| | Depreciation and amortization | | | 40.2 | | | 33.8 | | | 32.0 | |

| | General, administrative and occupancy | | | 135.2 | | | 125.3 | | | 117.5 | |

| | Restructuring and impairments | | | — | | | 0.4 | | | 11.0 | |

| | | | | | | | |

| | | Total | | | 704.8 | | | 767.7 | | | 696.9 | |

| | | | | | | | |

Operating Income | | | 333.1 | | | 349.3 | | | 238.9 | |

Interest expense | | | (75.5 | ) | | (58.8 | ) | | (32.3 | ) |

Investment gains (losses), net | | | (60.4 | ) | | 4.7 | | | 11.7 | |

Other income, net | | | 9.6 | | | 27.7 | | | 25.3 | |

| | | | | | | | |

Income before taxes, equity earnings and noncontrolling interest | | | 206.8 | | | 322.9 | | | 243.6 | |

Income tax provision | | | (68.8 | ) | | (116.4 | ) | | (90.1 | ) |

Equity in earnings of unconsolidated affiliate | | | 9.0 | | | 7.2 | | | 7.1 | |

| | | | | | | | |

Income from continuing operations | | | 147.0 | | | 213.7 | | | 160.6 | |

Loss from discontinued operations | | | (1.5 | ) | | (75.7 | ) | | (5.3 | ) |

| | | | | | | | |

Net income | | | 145.5 | | | 138.0 | | | 155.3 | |

Noncontrolling interest | | | (8.6 | ) | | (21.7 | ) | | (21.7 | ) |

| | | | | | | | |

Net income attributable to JCG | | $ | 136.9 | | $ | 116.3 | | $ | 133.6 | |

| | | | | | | | |

Basic earnings per share attributable to JCG common shareholders | | | | | | | | | | |

| | Income from continuing operations | | $ | 0.87 | | $ | 1.09 | | $ | 0.69 | |

| | Loss from discontinued operations | | | (0.01 | ) | | (0.43 | ) | | (0.03 | ) |

| | | | | | | | |

| | | Net income | | $ | 0.86 | | $ | 0.66 | | $ | 0.66 | |

| | | | | | | | |

Diluted earnings per share attributable to JCG common shareholders | | | | | | | | | | |

| | Income from continuing operations | | $ | 0.86 | | $ | 1.07 | | $ | 0.68 | |

| | Loss from discontinued operations | | | (0.01 | ) | | (0.42 | ) | | (0.03 | ) |

| | | | | | | | |

| | | Net income | | $ | 0.85 | | $ | 0.65 | | $ | 0.66 | |

| | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

23

JANUS CAPITAL GROUP INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in Millions)

| | | | | | | | | | | | | |

| | For the year ended December 31, | |

|---|

| | 2008 | | 2007 | | 2006 | |

|---|

CASH FLOWS PROVIDED BY (USED FOR): | | | | | | | | | | |

Continuing Operations | | | | | | | | | | |

Operating Activities: | | | | | | | | | | |

| | Net income | | $ | 147.0 | | $ | 213.7 | | $ | 160.6 | |

| | Adjustments to net income: | | | | | | | | | | |

| | | Depreciation and amortization | | | 40.2 | | | 33.8 | | | 32.2 | |

| | | Deferred income taxes | | | (29.0 | ) | | 16.2 | | | (20.5 | ) |

| | | Amortization of stock-based compensation | | | 31.1 | | | 49.6 | | | 71.9 | |

| | | Investment (gains) losses, net | | | 60.4 | | | (6.1 | ) | | (10.4 | ) |

| | Payment of deferred commissions, net | | | (0.7 | ) | | (27.7 | ) | | 2.1 | |

| | Other, net | | | 5.6 | | | (4.8 | ) | | 6.5 | |

| | Changes in working capital items: | | | | | | | | | | |

| | | Accounts receivable | | | 66.3 | | | (30.1 | ) | | 3.7 | |

| | | Other current assets | | | (4.7 | ) | | 12.6 | | | 0.2 | |

| | | Accounts payable and accrued compensation payable | | | (49.0 | ) | | 31.0 | | | 14.4 | |

| | | Other accrued liabilities | | | (29.0 | ) | | 2.6 | | | 37.9 | |

| | | | | | | | |

| | | | Net operating | | | 238.2 | | | 290.8 | | | 298.6 | |

| | | | | | | | |

Investing Activities: | | | | | | | | | | |

| | Purchase of property and equipment | | | (20.1 | ) | | (16.7 | ) | | (14.8 | ) |

| | Acquisitions | | | (161.4 | ) | | (81.0 | ) | | (90.0 | ) |

| | Distribution of cash from discontinued operations | | | 13.5 | | | 44.2 | | | — | |

| | Purchase of marketable securities | | | (72.3 | ) | | (177.5 | ) | | (65.3 | ) |

| | Proceeds from sales and maturities of marketable securities | | | 91.5 | | | 127.7 | | | 218.1 | |

| | | | | | | | |

| | | | Net investing | | | (148.8 | ) | | (103.3 | ) | | 48.0 | |

| | | | | | | | |

Financing Activities: | | | | | | | | | | |

| | Proceeds from issuance of long-term debt | | | — | | | 748.4 | | | 275.0 | |

| | Debt issuance costs | | | — | | | (6.9 | ) | | (2.2 | ) |

| | Repayment of long-term debt | | | — | | | (158.1 | ) | | (113.1 | ) |

| | Proceeds from stock plans | | | 21.6 | | | 73.2 | | | 41.9 | |

| | Excess tax benefit from equity-based compensation | | | 4.4 | | | 10.6 | | | 4.4 | |

| | Repurchase of common stock | | | (291.7 | ) | | (845.6 | ) | | (516.4 | ) |

| | Distributions to noncontrolling interest | | | (15.3 | ) | | (28.2 | ) | | (21.8 | ) |

| | Dividends paid to shareholders | | | (6.5 | ) | | (7.2 | ) | | (8.3 | ) |

| | Other, net | | | — | | | (0.1 | ) | | — | |

| | | | | | | | |

| | | | Net financing | | | (287.5 | ) | | (213.9 | ) | | (340.5 | ) |

| | | | | | | | |

Cash and Cash Equivalents: | | | | | | | | | | |

| | Net increase (decrease) | | | (198.1 | ) | | (26.4 | ) | | 6.1 | |

| | At beginning of period | | | 480.7 | | | 507.1 | | | 501.0 | |

| | | | | | | | |

| | At end of period | | $ | 282.6 | | $ | 480.7 | | $ | 507.1 | |

| | | | | | | | |

Discontinued Operations | | | | | | | | | | |

| | Operating activities | | $ | (6.7 | ) | $ | (2.1 | ) | $ | 3.3 | |

| | Investing activities | | | 2.8 | | | (46.2 | ) | | (2.2 | ) |

| | | | | | | | |

Cash and Cash Equivalents: | | | | | | | | | | |

| | Net increase (decrease) | | | (3.9 | ) | | (48.3 | ) | | 1.1 | |

| | At beginning of period | | | 4.3 | | | 52.6 | | | 51.5 | |

| | | | | | | | |

| | At end of period | | $ | 0.4 | | $ | 4.3 | | $ | 52.6 | |

| | | | | | | | |

Supplemental Cash Flow Information: | | | | | | | | | | |

| | Cash paid for interest | | $ | 71.8 | | $ | 55.5 | | $ | 32.5 | |

| | Cash paid for income taxes | | $ | 99.9 | | $ | 85.7 | | $ | 81.7 | |

The accompanying notes are an integral part of these consolidated financial statements.

24

JANUS CAPITAL GROUP INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(Amounts in Millions, Except Per Share Data)

| | | | | | | | | | | | | | | | | | | | | |

| | Shares | | Common

Stock | | Retained

Earnings | | Accumulated

Other

Comprehensive

Income (Loss) | | Nonredeemable

Noncontrolling