Use these links to rapidly review the document

PROXY STATEMENT TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| Janus Capital Group Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

March 11, 2016

Dear Shareholder:

We cordially invite you to attend the 2016 Annual Meeting of Shareholders ("Annual Meeting") of Janus Capital Group Inc., which will be held at the JW Marriott Hotel, 150 Clayton Lane, Denver, Colorado, on Friday, April 22, 2016, at 10:00 a.m. local time.

At the Annual Meeting, you will be asked to vote on proposals to (i) elect ten directors named in the accompanying Proxy Statement; (ii) ratify the appointment of our independent auditor; (iii) approve, by non-binding vote, executive compensation (say on pay vote); (iv) approve, by non-binding advisory vote, the adoption of an amendment to the amended and restated bylaws designating Delaware as the exclusive forum for certain legal actions; and (v) consider other business as may properly come before the meeting.

Pursuant to the rules of the Securities and Exchange Commission, we have elected to provide access to our proxy materials over the Internet. Accordingly, we will mail, on or before March 11, 2016, a Notice of Internet Availability of Proxy Materials ("Notice") to our shareholders of record and beneficial owners as of the close of business on February 26, 2016, the record date for the Annual Meeting. On the date of mailing of the Notice, all shareholders and beneficial owners will have the ability to access all of the proxy materials on the following websites:www.proxyvote.com and atir.janus.com in the "Documents" subsection under "SEC Filings."

The Notice will also identify (i) the date, time and location of the Annual Meeting; (ii) the matters to be acted upon at the Annual Meeting and the recommendation of our Board of Directors with regard to such matters; (iii) a toll-free telephone number, an email address, and a website where shareholders can request a paper or e-mail copy of the Proxy Statement and a form of proxy relating to the Annual Meeting; (iv) information about how to access and vote using the form of proxy; and (v) information about how to obtain directions to attend the Annual Meeting and vote in person. These proxy materials will be available free of charge.

Your vote is important. We encourage you to access and read the proxy materials and vote promptly. If you attend the Annual Meeting, you may vote in person even if you previously voted by proxy. Thank you for your interest and support.

Sincerely,

Glenn S. Schafer

Chairman of the Board

Table of Contents

PROXY STATEMENT TABLE OF CONTENTS

| | |

Important Notice Regarding the Availability of Proxy Materials | | 1 |

Voting Information | | 1 |

Shareholders Entitled to Vote | | 1 |

Proposals You May Vote On | | 2 |

Votes Required to Conduct Business at the Annual Meeting | | 2 |

Voting of Proxies by Management Proxy Holders | | 2 |

Votes Required for Each Proposal | | 3 |

How to Vote | | 4 |

Revoking Your Proxy | | 5 |

Postponement or Adjournment of the Annual Meeting | | 5 |

Attendance at the Annual Meeting | | 5 |

Special Instructions Apply for Employee Plan Shares | | 5 |

Cost of Proxy Solicitation | | 6 |

PROPOSAL NO. 1: Election of Directors | | 6 |

Information about Director Nominees | | 6 |

Vote Required for Approval | | 12 |

Retiring and Retired Directors | | 12 |

Corporate Governance | | 12 |

Board Leadership Structure | | 12 |

Board of Directors Independence Determination | | 12 |

Director Nomination Process and Diversity | | 12 |

Board of Directors Meetings and Committees | | 13 |

Risk Oversight | | 16 |

Governance Guidelines and Policies | | 16 |

Officer Code and Corporate Code of Business Conduct | | 17 |

Executive Sessions of the Board of Directors | | 17 |

Director Attendance at Annual Meeting of Shareholders | | 18 |

Communications with the Board of Directors | | 18 |

Compensation Consultants to the Compensation Committee | | 18 |

Certain Relationships and Related Transactions | | 18 |

Director Compensation | | 20 |

Audit Committee Report | | 23 |

PROPOSAL NO. 2: Ratification of the Appointment of Deloitte & Touche LLP as Independent Auditor | | 25 |

Fees Incurred by Janus for Deloitte | | 26 |

Audit Committee Approval Policies and Procedures | | 26 |

Attendance at Annual Meeting | | 27 |

Vote Required for Approval | | 27 |

Stock Ownership of Certain Beneficial Owners and Management | | 27 |

Executive Officers of the Company | | 29 |

Compensation Discussion and Analysis | | 31 |

Letter to Shareholders | | 31 |

Analysis of Pay for Performance | | 33 |

Tying CEO Compensation to Company Performance | | 33 |

2015 CEO Compensation Structure | | 33 |

Compensation Committee Decisions about CEO Pay | | 34 |

Actual Total Compensation | | 40 |

Actual Total Variable Compensation | | 41 |

Other NEO Compensation | | 42 |

Other NEO Compensation Decisions | | 43 |

Tying Other NEO Compensation to Performance | | 44 |

Table of Contents

| | |

Elements of Executive Compensation | | 47 |

Compensation Program Objectives | | 47 |

Principal Components of the Janus Pay for Performance Approach | | 48 |

Future Executive Compensation Structure | | 49 |

Compensation Decision-Making Process | | 49 |

Risk Considerations | | 50 |

Peer Groups | | 50 |

Role of Compensation Consultants | | 52 |

Role of Executive Officers | | 52 |

Shareholder Outreach and Review of Compensation Practices | | 52 |

Additional Compensation Practices and Policies | | 53 |

Executive Compensation Practices | | 53 |

Ownership Guidelines | | 53 |

Severance Guidelines | | 54 |

Change in Control | | 54 |

Clawback Policy | | 54 |

Anti-Hedging and Anti-Pledging Policies | | 55 |

Grant Procedures for Long-Term Incentive Awards | | 55 |

Perquisites and Other Benefits | | 55 |

Section 162(m) Compliance | | 55 |

Compensation Committee Report on Executive Compensation | | 56 |

Executive Compensation | | 57 |

Summary Compensation Table | | 57 |

Grants of Plan-Based Awards in 2015 | | 60 |

Employment Arrangements with Named Executive Officers | | 60 |

Equity and Other Incentive Compensation Arrangements with Named Executive Officers | | 61 |

Outstanding Equity Awards at 2015 Year-End | | 64 |

2015 Restricted Stock Vested | | 65 |

Pension Benefits | | 65 |

Non-Qualified Deferred Compensation | | 66 |

Termination and Change in Control Arrangements with Named Executive Officers | | 66 |

PROPOSAL NO. 3: Non-Binding Advisory Vote to Approve Executive Compensation (Say on Pay Vote) | | 69 |

Effect of Say on Pay Vote | | 70 |

Vote Required for Approval | | 70 |

PROPOSAL NO. 4: Non-Binding Advisory Vote to Adopt an Amendment to the Amended and Restated Bylaws Designating Delaware as the Exclusive Forum for Certain Legal Actions | | 70 |

Background and Reasons for the Bylaw Amendment | | 71 |

Effect of the Non-Binding Advisory Vote to Adopt the Bylaw Amendment | | 72 |

Vote Required for Approval | | 72 |

Equity Compensation Plan Information | | 73 |

Section 16(a) Beneficial Ownership Reporting Compliance | | 73 |

Shareholder Proposals for the 2017 Annual Meeting | | 74 |

Householding | | 74 |

Important Notice Regarding Internet Availability of Proxy Materials for the Annual Meeting | | 75 |

APPENDIX A – Second Amendment to the Amended and Restated Bylaws for Janus Capital Group Inc. | | 76 |

ii

Table of Contents

JANUS CAPITAL GROUP INC.

151 Detroit Street

Denver, Colorado 80206 |

PROXY STATEMENT

This Proxy Statement, available to shareholders as of March 11, 2016, is provided in connection with the solicitation of proxies by the Board of Directors of Janus Capital Group Inc. ("Board" or "Board of Directors") for the 2016 Annual Meeting of Shareholders ("Annual Meeting") to be held on Friday, April 22, 2016, at 10:00 a.m., local time in Denver, Colorado. In this Proxy Statement, we may refer to Janus Capital Group Inc. as the "Company," "Janus," "we," "us," or "our."

Important Notice Regarding the Availability of Proxy Materials |

In accordance with rules and regulations of the U.S. Securities and Exchange Commission ("SEC"), instead of mailing a printed copy of the proxy materials to each shareholder of record or beneficial owner, we are furnishing proxy materials, which include this Proxy Statement, to our shareholders over the Internet. If you have received a Notice of Internet Availability of Proxy Materials ("Notice") by mail, you will not receive a printed copy of the proxy materials unless you have previously made a permanent election to receive these materials in hard copy. Instead, the Notice will instruct you as to how you may access and review all of the important information contained in the proxy materials. The Notice also instructs you as to how you may submit your proxy over the Internet. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions in the Notice for requesting such materials.

The Notice will be available to shareholders on or before March 11, 2016.

Holders of the Company's common stock, par value $0.01 per share ("common stock"), at the close of business on February 26, 2016 ("Record Date"), are entitled to one vote for each share owned on that date on each matter presented at the Annual Meeting. On the Record Date, 185,699,881 shares of common stock were outstanding and entitled to vote at the Annual Meeting.

1

Table of Contents

| | | | |

| | | | | |

| Voting Matters |

| Board Vote Recommendation |

| Page Reference

(for more details) |

| | | | | |

| Election of ten directors | | FOR EACH DIRECTOR NOMINEE | | 5 |

| | | | | |

| Ratification of Deloitte & Touche LLP as independent auditor for 2016 | | FOR | | 21 |

| | | | | |

| Non-binding advisory vote to approve the Company's 2015 executive compensation | | FOR | | 57 |

| | | | | |

| Non-binding advisory vote to adopt an amendment to the Company's Amended and Restated Bylaws designating Delaware as the exclusive forum for certain legal actions | | FOR | | 58 |

| | | | | |

| Transact other business that properly comes before the meeting | | N/A | | N/A |

| | | | | |

In order to take any action at the Annual Meeting, a majority of the Company's outstanding shares of common stock as of the Record Date must be present in person or by proxy and entitled to vote at the Annual Meeting, or any adjournment or postponement thereof. This is called a quorum.

The voting results will be tallied by the Inspectors of Election: Broadridge Financial Solutions, Inc. and two members of management. A Current Report on Form 8-K will be filed with the SEC within four business days following the Annual Meeting to report the voting results.

The Board has appointed Mr. Richard M. Weil, our Chief Executive Officer, and Mr. Bruce Koepfgen, our President, as the management proxy holders for the Annual Meeting. Your shares will be voted by the management proxy holders in accordance with the instructions on the proxy card that you properly execute and submit. For shareholders who return their proxy card without indicating how to vote their shares, the proxy will be voted as the Board recommends, which is:

- •

- FOR the election of each director nominee;

- •

- FOR the ratification of Deloitte & Touche LLP ("Deloitte") as independent auditor for 2016;

- •

- FOR the non-binding advisory vote to approve the Company's 2015 executive compensation; and

- •

- FOR the non-binding advisory vote to adopt an amendment to the Company's Amended and Restated Bylaws designating Delaware as the exclusive forum for certain legal actions.

All of the matters we knew about as of the Record Date to be brought before the Annual Meeting are described in this Proxy Statement. If any other matters come before the Annual Meeting to be voted on, the management proxy holders will vote, act, and consent on those matters at their discretion.

2

Table of Contents

A "broker non-vote" occurs when a bank, broker, or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have authority to vote on that particular proposal without receiving voting instructions from the beneficial owner. Under the current rules for the New York Stock Exchange ("NYSE"), brokers have discretionary authority to vote on "routine" matters, which includes the ratification of Deloitte as the Company's independent auditor for 2016. Brokers do not have discretionary authority to vote on "non-routine" proposals, including the election of directors, the non-binding advisory vote concerning the Company's 2015 executive compensation, and the non-binding advisory vote concerning an amendment to our Bylaws.

The following chart describes the proposals to be considered at the meeting, the vote required to elect directors and to adopt each of the other proposals, and the manner in which votes will be counted:

| | | | | | | | |

| | | | | | | | | |

| Proposal |

| Voting Options |

| Vote Required to Adopt the Proposal |

| Effect of Abstentions |

| Effect of "Broker Non-Votes" |

| | | | | | | | | |

| Election of ten directors | | For, against, or abstain on each nominee | | A nominee for director will be elected if the votes cast for such nominee exceed the votes cast against such nominee (see "– Majority Voting Policy" below for more information) | | No effect | | No effect |

| | | | | | | | | |

| Ratification of Deloitte & Touche LLP as independent auditor for 2016 | | For, against, or abstain | | The affirmative vote of a majority of the shares of common stock represented at the Annual Meeting and entitled to vote thereon | | Treated as votesagainst | | Brokers have discretion to vote |

| | | | | | | | | |

| Non-binding advisory vote to approve the Company's 2015 executive compensation | | For, against, or abstain | | The affirmative vote of a majority of the shares of common stock represented at the Annual Meeting and entitled to vote thereon | | Treated as votesagainst | | No effect |

| | | | | | | | | |

| Non-binding advisory vote to adopt an amendment to the Company's Amended and Restated Bylaws designating Delaware as the exclusive forum for certain legal actions | | For, against, or abstain | | The affirmative vote of a majority of the shares of common stock represented at the Annual Meeting and entitled to vote thereon | | Treated as votesagainst | | No effect |

| | | | | | | | | |

3

Table of Contents

If a current director does not receive a majority of the votes cast, the director shall offer to tender his or her resignation to the Board. The Nominating and Corporate Governance Committee will make a recommendation to the Board on whether to accept or reject the offer of resignation, or whether other action should be taken. The Board will act on the recommendation of the Nominating and Corporate Governance Committee and publicly disclose its decision within 90 days from the date of the certification of the election results.

As described in the Notice, you may vote by proxy or in person at the Annual Meeting. You may vote by proxy even if you plan to attend the Annual Meeting.

If you hold shares of common stock in your name as a holder of record ("registered shareholder"), you can vote your shares by one of the following methods:

- •

- By Internet – You may submit a proxy electronically via the Internet atwww.proxyvote.com until 11:59 p.m. EDT on April 21, 2016. Please have your proxy card or Notice in hand when you log on to the website.

- •

- By Telephone – You may submit a proxy by telephone, toll-free, at 1-800-690-6903 until 11:59 p.m. EDT on April 21, 2016. Please have your proxy card or Notice in hand when you call.

- •

- By Mail – You may request a paper proxy card in accordance with the instructions contained in the Notice and then complete, sign and date the proxy card and return it so that it is received by 11:59 p.m. EDT on April 21, 2016.

If your shares are held in a stock brokerage account or by a bank, or other holder of record, you are considered the "beneficial owner" of shares held in street name. The Notice has been forwarded to you by your broker, bank or other holder of record who is considered the registered shareholder with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank, or other registered shareholder on how to vote your shares by using the voting instruction form included in the mailing or by following their instructions for voting by telephone or on the Internet.

Submitting your proxy prior to the Annual Meeting does not limit your right to vote in person at the Annual Meeting if you decide to do so. If you wish to vote in person at the Annual Meeting, we will pass out written ballots for such purpose as requested; however, if you are a beneficial owner, you must obtain a legal proxy from your broker, bank, or other holder of record and bring it to the Annual Meeting to vote in person at the Annual Meeting. Directions to the Annual Meeting from Denver International Airport are as follows:

- •

- Take Pena Boulevard to I-70 westbound.

- •

- Take the Colorado Boulevard exit (Exit 276B).

4

Table of Contents

- •

- Turn left (south) onto Colorado Boulevard.

- •

- Turn right (west) onto East 1st Avenue.

- •

- Turn right (north) onto Clayton Lane; go1/2 block to the JW Marriott at 150 Clayton Lane.

Revoking Your Proxy

If you are a registered shareholder, you may revoke your proxy at any time before your shares are voted at the Annual Meeting by one of the following methods:

If the Annual Meeting is postponed or adjourned, your proxy will still be valid and may be voted at the postponed or adjourned meeting in the manner described in this Proxy Statement. You will still be able to revoke your proxy until it was voted at the postponed or adjourned meeting.

You will need proof of ownership to enter the Annual Meeting. If you are a beneficial owner of shares and you plan to attend the Annual Meeting, you must present proof, such as a bank or brokerage account statement, of your ownership of Janus common stock as of the Record Date to be admitted to the Annual Meeting.

If you are a registered shareholder, representatives of Janus will confirm your shareholder status at the Annual Meeting. You must present a form of personal identification to be admitted to the Annual Meeting.NO CAMERAS, RECORDING EQUIPMENT, ELECTRONIC DEVICES, BAGS, BRIEFCASES, PACKAGES, OR SIMILAR ITEMS WILL BE PERMITTED AT THE ANNUAL MEETING.

Each participant in the Employee Stock Ownership Plan ("ESOP") of Janus and the Kansas City Southern ("KCS") 401(k) Plan may instruct the respective trustee of these plans on how to vote the shares of Janus common stock held on behalf of the participant. The trustee of each plan must receive your voting instructions for the common stock allocated to your ESOP or 401(k) account before April 20, 2016. If the trustee for the Janus ESOP or the KCS 401(k) Plan does not receive your voting instructions before April 20, 2016, it will vote those shares, subject to the requirements of the Employee Retirement Income Security Act of 1974, as amended, in the same proportion as the

5

Table of Contents

voting instructions that it receives from other Janus ESOP or KCS 401(k) plan account holders (as applicable). You may vote your shares (i) over the Internet atwww.proxyvote.com until 11:59 p.m. EDT on April 20, 2016; (ii) by telephone, toll-free at 1-800-690-6903 until 11:59 p.m. EDT on April 20, 2016; or (iii) by requesting a paper proxy card from Janus in accordance with the instructions contained in the Notice and completing, signing, and dating the proxy card and returning it so that it is received by April 20, 2016.

On February 26, 2016, there were 1,284,074 outstanding Janus shares in the Janus ESOP and 181,336 outstanding Janus shares in the KCS 401(k) Plan.

Cost of Proxy Solicitation |

We will pay the expenses of preparing the Notice and other proxy materials and the solicitation by the Board of Directors of your proxy. Our directors, officers and employees (who will receive no additional compensation for soliciting), and Georgeson Inc., our proxy solicitation agent, may solicit your proxy by telephone or other means. We will pay Georgeson Inc. a fee of $12,000 plus expenses and will reimburse brokers for costs they incur in mailing the Notice and any other proxy materials.

PROPOSAL NO. 1: ELECTION OF DIRECTORS

The Board of Directors currently has 12 directors. Effective upon the retirement of Messrs. Armour and Cox on April 21, 2016, the Board will be reduced to ten directors with no vacancies.

The director nominees, Jeffrey J. Diermeier, Eugene Flood, Jr., J. Richard Fredericks, Deborah R. Gatzek, Lawrence E. Kochard, Arnold A. Pinkston, Glenn S. Schafer, Richard M. Weil, Billie I. Williamson, and Tatsusaburo Yamamoto are nominated for election as directors of the Company for one-year terms and, if elected, will hold office until the 2017 annual shareholders meeting or until their successors are elected and qualify. Mr. Yamamoto was appointed to the Board on July 24, 2015, and Mr. Pinkston was appointed to the Board on January 21, 2016. The director nominees are all current directors of the Company. Each nominee has indicated that he or she will serve if elected. We do not anticipate that any of the director nominees will be unable to stand for election, but if that were to happen, the Board of Directors may reduce the size of the Board, designate a substitute candidate or leave the vacancy unfilled. If a substitute candidate is designated, proxies cast for the original director candidate will be cast for the substituted candidate. Ages shown below are as of April 22, 2016.

6

Table of Contents

| | |

| | | |

| Director | | Skills and Qualifications |

| | | |

Jeffrey J.

Diermeier,

63 | | In determining that Mr. Diermeier should serve as a director of the Company, the Board of Directors identified Mr. Diermeier's extensive oversight experience related to financial reporting and corporate governance standards as a trustee of the Board of the Financial Accounting Foundation, CFA Institute experience, mutual fund and investment adviser oversight experience while at UBS, corporate oversight as a member of several boards of directors and committees, and his general executive management experience at UBS and its predecessor entity. |

| | | |

| | | Company • Director of the Company since March 2008 Other current experience • Director of the University of Wisconsin Foundation (a non-profit fundraising and endowment management organization) and former chairman of its investment committee • Director of Adams Street Partners (a private equity firm) since January 2011 • Co-owner and Chairman of L.B. White Company (a heating equipment manufacturer) since 2010 Previous experience • Trustee of the Board of the Financial Accounting Foundation (oversees the Financial Accounting Standards Board and the Government Accounting Standards Board) from January 2009 to December 2015, and Chairman of the Trustees from November 2012 to December 2015 • President and Chief Executive Officer of the CFA Institute (a non-profit educational organization for investment professionals) from 2005 to January 2009 • Advisory board member of Stairway Partners, LLC (a registered investment adviser) from March 2005 to December 2012 and currently a minority owner • Chief Investment Officer of UBS Global Asset Management from 2000 to 2004; prior to that, beginning in 1975, worked on the buy-side, principally overseeing asset allocations and running the fundamental equity team • Chartered Financial Analyst designation |

| | | |

| | |

| | | |

| Director | | Skills and Qualifications |

| | | |

Eugene

Flood, Jr.,

60 | | In determining that Mr. Flood should serve as a director of the Company, the Board of Directors identified Mr. Flood's extensive investment management, mutual fund and investment adviser experience as a trustee for CREF and TIAA-CREF, his senior management experience with Smith Breeden Associates and Morgan Stanley, and his economic-focused academic background. Mr. Flood has a Ph.D. in Economics from the Massachusetts Institute of Technology. |

| | | |

| | | Company • Director of the Company since January 2014 Other current experience • Director of Research Corporation for Science Advancement since 2015 • Member of Board of Trustees of the Financial Accounting Foundation since January 2016 • Chairman, Advisory Board, Institute for Global Health and Infectious Diseases, University of North Carolina, Chapel Hill Previous experience • Director of The Foundation for the Carolinas, a non-profit group, from 2012 to 2015 • Executive Vice President of TIAA-CREF from 2011 until his retirement in 2012 • Member of the CREF Board of Trustees and TIAA-CREF Mutual Fund Board of Trustees for seven years, chairing the investment committee • President and Chief Executive Officer of Smith Breeden Associates (a North Carolina-based fixed income asset manager) for 12 years • A range of trading and investment positions with Morgan Stanley from 1987 to 1999 • Assistant Professor of Finance at Stanford Business School from 1982 to 1987 |

| | | |

7

Table of Contents

| | |

| | | |

| Director | | Skills and Qualifications |

| | | |

J. Richard

Fredericks,

70 | | In determining that Mr. Fredericks should serve as a director of the Company, the Board of Directors identified Mr. Fredericks' extensive investment management, security analyst, and investment banking experience and his corporate oversight experience as a member of several boards of directors. |

| | | |

| | | Company • Director of the Company since October 2006 Other current experience • Managing Director of the money management firm Main Management LLC • Director of Cadence Bancorp LLC (a bank holding company formerly known as Community Bancorp LLC) • Member of the Library of Congress Trust Fund Board since 2004 • Director on the boards of several non-profit organizations Previous experience • International advisory board member of Komatsu Ltd. from 2003 to 2005 • Director of Chiron Corporation until it was acquired by Novartis International AG from February 2003 to April 2006 • U.S. Ambassador to both Switzerland and Liechtenstein from 1999 to 2001 • Director of BanCorp Hawaii in 1999 • Banc of America Securities (formerly Montgomery Securities), initially as a partner and later as Senior Managing Director, from 1977 to 1999 |

| | | |

| | |

| | | |

| Director | | Skills and Qualifications |

| | | |

Deborah R.

Gatzek, 67 | | In determining that Ms. Gatzek should serve as a director of the Company, the Board of Directors identified Ms. Gatzek's extensive experience in mutual fund, broker dealer, investment adviser, and corporate governance matters in her roles as the chief legal adviser at ING Americas and Franklin Resources; as a partner at Stradley, Ronan, Stevens & Young; and as special counsel for the SEC. The Board of Directors also considered her legal, academic, and general executive management experiences in senior and executive positions at ING Americas; Franklin Resources; and Stradley, Ronan, Stevens & Young. Ms. Gatzek's experience with public company filings, business practices, and strategies also benefits the Board. |

| | | |

| | | Company • Director of the Company since March 2004 Other current experience • Securities law attorney • Serves on the boards of three non-profit organizations • Principal, Oversight and Governance Solutions, LLC Previous experience • Chief Counsel to the Mutual Fund and Broker Dealer subsidiaries of ING Americas (an investment management firm) from 2001 to 2003 • Partner at the law firm of Stradley, Ronan, Stevens & Young from 2000 to 2001 • Senior Vice President and General Counsel of Franklin Resources, Inc. (an investment management firm) from 1983 through 1999 • Special Counsel for the SEC and Regional Counsel for FINRA |

| | | |

8

Table of Contents

| | |

| | | |

| Director | | Skills and Qualifications |

| | | |

Lawrence E.

Kochard, 59 | | In determining that Mr. Kochard should serve as a director of the Company, the Board of Directors identified Mr. Kochard's extensive experience related to investment management, investment adviser oversight, general executive management and his economic-focused academic background while a senior executive officer on the investment teams of University of Virginia, Georgetown University, Virginia Retirement System, Fannie Mae, and The Goldman Sachs Group. Mr. Kochard has a Ph.D. in Economics from the University of Virginia. |

| | | |

| | | Company • Director of the Company since March 2008 Other current experience • Chief Executive Officer of the University of Virginia Investment Management Company since January 2011 • Member of the Investment Advisory Committee of the Virginia Retirement System since March 2011 • Member of the Board and Chair of the Investment Committee for the Virginia Environmental Endowment since April 2013 • Member of the Board of the Virginia Commonwealth University Investment Management Company since May 2015 Previous experience • Chairman of the College of William & Mary Investment Committee from October 2005 to October 2011 • Chief Investment Officer for Georgetown University from 2004 to 2010 • Managing Director of Equity and Hedge Fund Investments for the Virginia Retirement System from 2001 to 2004 • Assistant Professor of Finance at the McIntire School of Commerce at the University of Virginia from 1999 to 2001 • Financial analysis and planning, corporate finance, and capital markets roles with DuPont de Nemours and Company, Fannie Mae, and The Goldman Sachs Group, Inc. • Chartered Financial Analyst designation |

| | | |

| | |

| | | |

| Director | | Skills and Qualifications |

| | | |

Arnold A.

Pinkston, 57 | | In determining that Mr. Pinkston should serve as a director of the Company, the Board of Directors identified Mr. Pinkston's significant experience in the development, implementation, and coordination of business strategies, enterprise risk management, and corporate ethics practices, and his expertise in corporate and board of directors governance and corporate compliance in his roles as Executive Vice President and General Counsel at Allergan, Inc., Senior Vice President and General Counsel at Beckman Coulter, Inc., and Vice President and Deputy General Counsel of Eli Lilly and Company, and as a member of several boards of directors. |

| | | |

| | | Company • Director of the Company since January 2016 Other current experience • Director, Sustainability Accounting Standards Board since January 2016 Previous experience • Executive Vice President and General Counsel for Allergan, Inc. from October 2011 to March 2015 • Senior Vice President, General Counsel, and Secretary for Beckman Coulter from November 2005 to May 2011 • Vice President for Eli Lilly and Company from March 1994 to November 2005 • Deputy General Counsel for Eli Lilly and Company from January 1999 to November 2001 and February 2003 to November 2005 • Director of OneOC, a non-profit company, from 2008 to 2015 and Chairman from 2013 to 2014 • Director of St Vincent Health hospital system from 2003 to 2005 • Director of Indianapolis Local Public Improvement Bond Bank from 2002 to 2005 • Director of Innocentive, Inc., a crowd source innovative solutions company, from 2003 to 2005 • Director of Southwest Autism Research Center from 1998 to 1999 • Director of Valley Big Brothers and Big Sisters, a non-profit company, from 1996 to 1998 • Director of Bay Area Urban League, a non-profit company, from 1993 to 1995 |

| | | |

9

Table of Contents

| | |

| | | |

| Director | | Skills and Qualifications |

| | | |

Glenn S.

Schafer, 66 | | In determining that Mr. Schafer should serve as a director of the Company, the Board of Directors identified Mr. Schafer's extensive accounting and financial experience as a former Chief Financial Officer at Pacific Life, investment and capital management experience as a senior executive and board member of Pacific Life, corporate oversight experience as a member of several boards of directors and committees, and general executive management experience as a senior executive and board member of Pacific Life. |

| | | |

| | | Company • Director of the Company since December 2007 • Chairman of the Board of Directors since April 27, 2012 Other current experience • Director of Mercury General Corporation since October 2015 (a publicly traded insurance company) • Director of Genesis Healthcare, Inc. since 2006 (the successor company resulting from the combination of Skilled Healthcare Group, Inc., to which Mr. Schafer was a director, and Genesis Healthcare, LLC) (a nursing and assisted living facilities company) • Director of GeoOptics LLC (a weather satellite manufacturer) Previous experience • Director of the Michigan State University Foundation (a non-profit fundraising corporation) from 2004 to 2014 • Board of Directors for Scottish Re Group from 2006 to 2007 • Vice Chairman of Pacific Life Insurance Company from April 2005 until his retirement in December 2005 • Member of Pacific Life Insurance Company's board of directors and President of Pacific Life from 1995 to 2005 • Executive Vice President and Chief Financial Officer of Pacific Life from 1991 to 1995 • Non-executive Chairman of Beckman Coulter, Inc. (a biomedical testing products developer and manufacturer) from 2009 to 2011 |

| | | |

| | |

| | | |

| Director | | Skills and Qualifications |

| | | |

Richard M.

Weil, 52 | | In determining that Mr. Weil should serve as a director of the Company, the Board of Directors believes that the CEO of the Company should be a member of the Board of Directors and identified Mr. Weil's extensive business and legal experience in the investment management industry; his general executive management experience as a senior executive officer at PIMCO; and as a lawyer at Simpson Thacher & Bartlett LLP. The Board of Directors also considered his extensive experience in the development and oversight of global company operations. |

| | | |

| | | Company • Chief Executive Officer and a director of the Company since February 2010 • Member of the Company's executive committee • Member of the Board of Directors of the Company's subsidiaries, INTECH Investment Management LLC ("INTECH") and Perkins Investment Management LLC ("Perkins") Previous experience • Global head of Pacific Investment Management Company LLC ("PIMCO") Advisory (an investment management firm) from February 2009 until joining Janus in February 2010 • Member of the board of trustees for the PIMCO funds from February 2009 to February 2010 • PIMCO's Chief Operating Officer from 2000 to 2009, during which time he: • led the development of PIMCO's global business; • founded PIMCO's German operations; • was responsible for PIMCO's operations, technology, fund administration, finance, human resources, legal, compliance, and distribution functions; • managed PIMCO's non-U.S. offices; and • served on PIMCO's executive committee • General counsel for PIMCO Advisors LP from January 1999 to August 2000 • Bankers Trust Global Asset Management from 1994 to 1995 in their hedge fund business • Attorney with the law firm Simpson Thacher & Bartlett LLP in New York from September 1989 to 1994 • Member of Security Industry and Financial Markets Association's ("SIFMA") board of directors and chaired the SIFMA asset management industry group until 2010 |

| | | |

10

Table of Contents

| | |

| | | |

| Director | | Skills and Qualifications |

| | | |

Billie I.

Williamson,

63 | | In determining that Ms. Williamson should serve as a director of the Company, the Board of Directors identified Ms. Williamson's significant expertise in financial reporting and audit process. The Board also considered her understanding of technology control implementation and protocols for businesses dealing in foreign countries as a Senior Global Client Serving Partner at Ernst & Young L.L.P. and her corporate oversight, financial reporting, and controls experience as a member of several boards of directors and audit and financial committees. Ms. Williamson is a Certified Public Accountant. |

| | | |

| | | Company • Director of the Company since March 2015 Other current experience • Director and member of Audit Committee of Pentair plc (an industrial machinery company) since 2014 • Director and Chairman of the Audit Committee of Energy Future Holdings Corporation (the largest private utility in Texas) since February 2013 • Director and Chairman of the Audit Committee, and member of the Executive Committee of CSRA, Inc. (a software and technology company serving the public government sector) since November 2015 • Co-Chairman of the Dallas Chapter of Women Corporate Directors • Director of the North Texas Chapter of the National Association of Corporate Directors ("NACD") and a NACD Leadership Fellow • Director on the boards of several non-profit organizations Previous experience • Director and member of Audit and Nominating Corporate Governance Committees of Exelis Inc. (a global aerospace, defense, information and services company) from January 2012 to May 2015 • Senior Global Client Serving Partner at Ernst & Young L.L.P. from 1998 until retirement in December 2011, and served on the Americas Executive Board of Ernst & Young L.L.P. • Lead Independent Director and member of Audit, Compensation, and Transaction Committees of Annie's Inc. from March 2012 until completion of the sale of the company in October 2014 • Senior Vice President, Finance and Corporate Controller at Marriott International, Inc. from 1996 to 1998 • Chief Financial Officer of AMX Corporation from 1993 to 1996 |

| | | |

| | |

| | | |

| Director | | Skills and Qualifications |

| | | |

Tatsusaburo

Yamamoto,

51 | | In determining that Mr. Yamamoto should serve as a director of the Company, the Board of Directors identified Mr. Yamamoto's extensive experience in the financial services industry outside of the U.S. and his roles in management in the investment planning, asset management and international business management departments of The Dai-ichi Life Insurance Company, Limited ("Dai-ichi Life"), Deputy CEO of Dai-ichi Life Vietnam and Managing Director of Dai-ichi Life (Asia Pacific). The Board of Directors also considered his experience and familiarity with the Company's management team. |

| | | |

| | | Company • Director of the Company since July 2015 • Mr. Yamamoto was appointed director on July 24, 2015, after being designated by Dai-ichi Life as its representative for appointment to the Company's Board. This right was granted to Dai-ichi Life as a result of the Investment and Strategic Cooperation Agreement (the "Strategic Agreement") between Dai-ichi Life and the Company. In accordance with the Strategic Agreement, Dai-ichi Life was granted the right to designate a representative for appointment to the Company's Board after it acquired at least 15% of the issued and outstanding shares of the Company's stock, with such right continuing as long as Dai-ichi Life maintains ownership of at least 15% of the issued and outstanding shares of the Company's common stock or until the right is otherwise terminated in accordance with the terms of the Strategic Agreement. Before his appointment to the Board, the Nominating Committee met with Mr. Yamamoto, reviewed his background and business experience, and determined that Mr. Yamamoto possessed the membership criteria for non-employee directors as set forth in the Governance Guidelines. Other current experience • Joined Dai-ichi Life in 1988 supporting numerous key areas related to investment planning, asset management, and international business management • Executive Officer and General Manager, Investment Planning Department of Dai-ichi Life since 2015; General Manager, Investment Planning Department of Dai-ichi Life since 2014; Managing Director of Dai-ichi Life (Asia Pacific) from 2011 to 2014; Deputy CEO, Dai-ichi Life Vietnam from 2009-2011 |

| | | |

11

Table of Contents

For a nominee to be elected, the number of shares voted "for" the nominee must exceed the number of shares voted "against" the nominee. Abstentions and broker non-votes, if any, have no effect on this proposal.

The Board of Directors recommends a vote "FOR" the election of

each of the above nominees.

G. Andrew Cox, age 72, has been a director of the Company since October 2002, and Timothy K. Armour, age 67, has been a director of the Company since March 2008. Messrs. Cox and Armour will retire from Board on April 21, 2016.

Mr. Schafer, an independent director, currently serves as Chairman of the Board of Directors. Mr. Weil serves as our CEO. The separation of the roles of Chairman and CEO has been in place since January 2006. We believe this structure positions our CEO as the leader of the Company and provides strong leadership for the Board by its Chairman. We also believe that the current Board leadership structure is appropriate given the industry-specific responsibilities of our CEO, which have increased in recent years as a result of the economic and regulatory climate. However, we recognize that a different board leadership structure may be appropriate under different business circumstances.

The Board of Directors conducts an annual self-evaluation to determine whether it and its committees are functioning effectively. As part of this annual process, the Board evaluates whether the current leadership structure continues to be optimal for the Company and its shareholders.

The Board of Directors has established criteria for determining if a director is independent from management. These criteria follow the director independence criteria contained in the NYSE Listing Standards and are identified in our Corporate Governance Guidelines ("Governance Guidelines") available on the Company's website atir.janus.com in the "Governance Documents" section. In determining the independence of the directors, the Board reviewed and considered all relationships between each director (and any member of his or her immediate family) and the Company. Based on that review and the Company's independence criteria, the Board affirmatively determined that all directors are independent directors except for Mr. Weil, our CEO. In addition, all members of the Audit, Compensation, and Nominating and Corporate Governance Committees are independent.

We believe that in order for the Board to effectively guide Janus to sustained, long-term success, it must be composed of individuals with sophistication and experience in the many disciplines that impact our business. We sell our products to intermediary, institutional, and self-directed clients. To best serve these clients and our shareholders, we seek to ensure that the Board consists of

12

Table of Contents

directors who are highly sophisticated in, among other disciplines, domestic and international investment and asset management, finance, economic policy, and the legal and accounting regulations that impact our business. We also believe that the Board should include directors with experience managing, overseeing or advising comparable companies in our industry at the chief executive officer and/or the director level.

The Nominating and Corporate Governance Committee ("Nominating Committee") does not have a formal ongoing process for identifying and evaluating director nominees; however, when vacancies on the Board are expected, or a need for a particular expertise has been identified, in the past the Nominating Committee has typically engaged search firms to assist in identifying director candidates. The Nominating Committee ensures that each director nominee satisfies at least the criteria set forth in the Governance Guidelines. The Nominating Committee considers and evaluates the individual background and qualifications of each director nominee and the extent to which such background and qualifications might benefit the Company based on the size and composition of the Board of Directors at the time. In identifying director nominees, the Nominating Committee seeks talented and experienced candidates with professional backgrounds who support a balance of knowledge, experience, skills, expertise, and diversity appropriate for the Board as a whole.

We believe that the current Board members collectively possess diverse knowledge and experience in the disciplines that impact our business. Prior to nominating a new director candidate, the Nominating Committee considers the collective experience of the existing Board members. Based on this evaluation, the Nominating Committee nominates individuals who it believes will strengthen the Board's ability to serve shareholders because of experience and expertise. Although the Board does not currently have a policy specifically addressing director diversity, the Nominating Committee, guided by the Nominating Committee's charter, generally assesses and considers the diversity of the Board and the effectiveness of its diversity prior to nominating any additional Board candidates.

The Nominating Committee also evaluates the current composition of the Board and reviews each Board member's and any Board candidate's experiences and professional background that may impact our business, including experience in domestic and international investment and asset management, finance, economic policy, legal and accounting regulations, and management oversight at the CEO and/or director level.

The Nominating Committee will consider director nominees recommended by shareholders under the same procedure used for considering director nominees recommended by management or other directors. See "Shareholder Proposals for the 2017 Annual Meeting" on page 60 for more information regarding shareholder recommendations for director nominees.

Including in-person and telephonic meetings, the Board of Directors met 11 times in 2015. Each director attended at least 75% of the combined total number of meetings of the Board and Board committees of which he or she was a member. The Board's committees are described below.

The Nominating Committee consists of five directors appointed by the Board of Directors to serve one-year terms. The members of the Nominating Committee are Deborah R. Gatzek, Timothy K. Armour, Eugene Flood, Jr., Arnold A. Pinkston, and Billie I. Williamson, each of whom is independent under the standards established by the Board and the NYSE. Ms. Gatzek is Chairman of the Nominating Committee. Mr. Pinkston was appointed to the Nominating Committee effective

13

Table of Contents

January 21, 2016. In connection with his retirement, Mr. Armour will step down as a member of the Nominating Committee on April 21, 2016.

The Nominating Committee assists the Board in promoting the best interests of the Company and its shareholders through the implementation of sound corporate governance principles and practices. The functions performed by the Nominating Committee include:

- •

- Identifying individuals qualified to become Board members and recommending the director nominees to the Board;

- •

- Reviewing the qualifications and independence of the members of the Board and various committees on a regular, periodic basis;

- •

- Recommending to the Board corporate governance guidelines and reviewing such guidelines on a regular basis to confirm that such guidelines and the Nominating Committee's charter remain consistent with sound corporate governance practices and legal, regulatory, and NYSE Listing Standards; and

- •

- Leading the Board in the annual review of the Board's performance.

The Nominating Committee met six times during the 2015 fiscal year including executive sessions without management. The Nominating Committee operates pursuant to a written charter that was adopted by the Board and is available on the Company's website atir.janus.com in the "Governance Documents" section.

The Audit Committee consists of four directors appointed by the Board of Directors to serve one-year terms. The members of the Audit Committee are Jeffrey J. Diermeier, Deborah R. Gatzek, Arnold A. Pinkston and Billie I. Williamson, each of whom is independent under the standards established by the Board and the NYSE. Mr. Diermeier is Chairman of the Audit Committee. Mr. Pinkston was appointed to the Audit Committee effective January 21, 2016. J. Richard Fredericks served as a member of the Audit Committee during 2015 and stepped down on January 19, 2016.

The Audit Committee assists the Board in monitoring the:

- •

- Integrity of the Company's financial statements;

- •

- Independent auditor's qualifications and independence;

- •

- Performance of the Company's internal audit function and independent auditors;

- •

- Company's compliance with legal and regulatory requirements;

- •

- Company's system of disclosure controls and system of internal controls over financial reporting; and

- •

- Company's major financial risk exposures.

14

Table of Contents

The Audit Committee has the authority to select, retain, and terminate, when appropriate, the Company's independent auditor. The Audit Committee may, in its discretion, seek a non-binding advisory vote of the Company's shareholders for the ratification of the appointment of the Company's independent auditor. The Audit Committee is responsible for setting the independent auditor's compensation and overseeing the work of the independent auditor. It also approves all audit services and all permitted non-audit services to be provided by the independent auditor. The Audit Committee oversees the resolution of any disagreements between management and the independent auditor.

The Board has determined that each member of the Audit Committee meets the accounting or related financial management expertise requirements of the NYSE and that Mses. Gatzek and Williamson and Messrs. Diermeier and Pinkston qualify as "audit committee financial experts" under applicable SEC regulations. No member of the Audit Committee serves on an audit committee of more than two public companies in addition to Janus.

The Audit Committee met nine times in 2015, including executive sessions without management. The Audit Committee operates pursuant to a written charter that was adopted by the Board and is available on our website atir.janus.com in the "Governance Documents" section.

The Compensation Committee consists of five directors appointed by the Board to serve one-year terms. The members of the Compensation Committee are Timothy K. Armour, G. Andrew Cox, Eugene Flood, Jr., J. Richard Fredericks, and Lawrence E. Kochard, each of whom is independent under the standards established by the Board and the NYSE. Mr. Armour is Chairman of the Compensation Committee. Mr. Fredericks was appointed to the Compensation Committee effective January 19, 2016. In connection with their respective retirements, on April 21, 2016, Mr. Armour will step down as Chairman and as a member of the Compensation Committee and Mr. Cox will step down as a member of the Compensation Committee.

The Compensation Committee determines the compensation of certain executive officers and reviews and approves the compensation policies recommended by management with respect to other employees. The Compensation Committee has the authority to:

- •

- Determine all compensation and compensation plans for the senior executive officers;

- •

- Oversee and administer the incentive compensation plans of the Company in accordance with the authority granted under such plans;

- •

- Determine, subject to ratification by the majority of independent directors, the compensation package for non-employee directors; and

- •

- Identify and monitor compensation-related risks.

The Compensation Committee met eight times during 2015 including executive sessions without management. The Compensation Committee operates pursuant to a written charter that was adopted by the Board and is available on our website atir.janus.com in the "Governance Documents" section.

15

Table of Contents

The Board of Directors is responsible for overseeing Janus's risk management process. The Board reviews management's processes for identifying and managing risks that face the Company, which may include the financial markets, the asset management industry as a whole, and Company-specific risks. Based on its periodic reviews, the Board seeks to ensure that management has a robust program for identifying and managing risks and, as appropriate, implementing risk mitigation strategies.

In addition, the Board of Directors focuses on, in its judgment, the most significant risks facing Janus and management's mitigation strategies, and evaluates whether these risks are consistent with the Board's judgment as to the appropriate balance of risk and business objectives. The Board will consider with management the various ways in which these risks can be controlled and monitored, as well as the expected benefits to the Company. The Board also considers particular risk management matters in connection with its general oversight and approval of corporate transactions, such as acquisitions and capital usage.

The Audit Committee assists the Board of Directors in the oversight of Janus's risk management process. Among other activities, the Audit Committee discusses Company policies with respect to risk assessment and risk management and monitors: (i) the Company's financial statements; (ii) the independent auditor's independence and qualifications; (iii) the performance of the Company's internal and independent auditors; (iv) legal and regulatory compliance by the Company; and (v) the Company's system of disclosure controls and internal controls over financial reporting. The Audit Committee also reviews, with the assistance of management and counsel, legislative and regulatory developments that could materially affect the Company's compliance program and material contingent financial liabilities. In addition, the Audit Committee meets at least quarterly with, and receives regular reporting from, the Chief Compliance Officer, the Company's General Counsel and Head of Enterprise Risk Management, and the Chief Accounting Officer. The Audit Committee reports regularly to the full Board.

The Compensation Committee, in consultation with the Board and management, reviews the material terms of the Company's compensation policies and programs for all employees, and identifies compensation-related risks that are reasonably likely to have a material adverse impact on Janus, as well as features of the Company's compensation programs that could encourage excessive risk-taking. Our current compensation programs and policies are discussed in more detail in the "Compensation Discussion and Analysis" section beginning on page 25. The Compensation Committee reports regularly to the full Board.

We believe the risk management processes described above effectively address the risks facing the Company, our clients, and our shareholders. The Board supports this approach.

Consistent with the Board's commitment to observing strong corporate governance practices, the Board has policies and procedures concerning compliance with SEC rules and NYSE Listing Standards. In connection therewith, the Board regularly reviews and periodically revises the Company's Governance Guidelines and committee charters, and periodically amends or adopts other related policies and

16

Table of Contents

practices. Our Governance Guidelines are available on our website atir.janus.com in the "Governance Documents" section. These policies and procedures include the following:

- •

- At least a majority of the members of the Board must be independent. Currently, all of our directors other than the CEO are independent members. All members of the Nominating, Audit, and Compensation Committees must be independent.

- •

- The Board and each committee are required to undertake an annual self-evaluation.

- •

- No director may stand for election after serving for more than fifteen years.

- •

- Directors are prohibited from standing for re-election after reaching the age of 72.

- •

- No director may serve on the board of directors of more than four public companies in addition to Janus.

- •

- No member of the Audit Committee may serve on the audit committee of more than two public companies in addition to Janus.

- •

- The Board considers the rotation of committee chairs after a chairperson has served for three successive years.

- •

- Stock options issued by the Company may not be re-priced without approval of our shareholders.

- •

- Each non-executive director who receives compensation from the Company for Board service is expected to accumulate, within four years from appointment, and maintain thereafter while serving as a director, shares of Janus common stock with a value (based on the value of the shares at the time of acquisition) equal to $250,000. All of the non-employee directors who receive compensation from the Company for Board service currently satisfy this ownership guideline with the exception of Messrs. Flood and Pinkston, and Ms. Williamson, who were each appointed within the last four years and still have time to comply with the guidelines. Mr. Yamamoto does not receive compensation from the Company for his service on the Board, and therefore is not expected to meet the ownership guideline.

Our Officer Code of Ethics for the CEO and Senior Financial Officers (including our CEO, Chief Financial Officer ("CFO"), and Chief Accounting Officer) (the "Officer Code") and Corporate Code of Business Conduct for all employees are available on our website atir.janus.com in the "Governance Documents" section and are reviewed by the Nominating Committee. Any amendments to or waivers of the Officer Code or the Corporate Code of Business Conduct will be disclosed on our website atir.janus.com in the "Governance Documents" section.

The independent members of the Board of Directors have executive sessions at all regularly scheduled Board meetings. The purpose of these sessions is to promote open discussion among independent directors and provide an opportunity for them to address concerns about the Company, as well as the performance of the Board itself. The Chairman of the Board typically oversees these executive sessions.

17

Table of Contents

The Board of Directors requires its members to attend each annual meeting of shareholders. All of the directors serving at the time attended our 2015 annual shareholders meeting.

Individuals desiring to communicate with the Board of Directors, the Chairman of the Board, the independent directors as a group or any individual member of the Board should direct their communications to the attention of Glenn S. Schafer, Janus Capital Group Inc., 151 Detroit Street, Denver, Colorado 80206. All communications received, other than commercial solicitations or communications that are frivolous or deemed to be not relevant to corporate matters, will be forwarded to the Board or to the relevant Board member.

The Compensation Committee charter provides that the Compensation Committee may retain compensation consultants to assist in its determination of CEO or other senior executive compensation. In 2015, the Compensation Committee used two independent compensation consultants, McLagan Partners, Inc. ("McLagan") and Aon Hewitt LLC ("Aon Hewitt").

McLagan provided the Compensation Committee with market compensation data and pay trend information, primarily within the financial services industry, and assisted the Compensation Committee with analyses and recommendations related to Janus's various compensation programs, including the structure of the executive and director compensation programs. McLagan also provided Janus's Human Resources department with comparative compensation data that was used to evaluate and recommend compensation for certain employees. The vast majority of the services provided to our Human Resources department by McLagan consisted of published survey data. The Compensation Committee reviewed the published survey data that McLagan provided. Aon Hewitt primarily assisted the Compensation Committee in evaluating the CEO's compensation arrangements and provided services solely to the Compensation Committee. We may refer to McLagan and Aon Hewitt collectively as "Compensation Consultants".

The Compensation Consultants were engaged directly by the Compensation Committee and attended certain Compensation Committee meetings, as well as participated in discussions regarding executive compensation issues.

Based on the above information and other relevant factors, including the factors set forth under Rule 10C-1 of the Securities Exchange Act of 1934 ("Exchange Act") and the NYSE Listing Standards, the Compensation Committee assessed the independence of the Compensation Consultants and concluded that no conflict of interest exists that would prevent each consultant from independently advising the Compensation Committee.

Certain Relationships and Related Transactions

Related Party Transaction Policy

Transactions between Janus and related parties can present potential or actual conflicts of interest and create the appearance that our decisions are based on considerations other than our best interests and the best interests of our shareholders. Related parties may include members of the

18

Table of Contents

Board of Directors, Janus executives, significant shareholders, and immediate family members and affiliates of such persons.

Several provisions of our Corporate Code of Business Conduct are intended to help us avoid the conflicts and other issues that may arise in transactions between Janus and related parties, including the following:

- •

- Employees have a duty to act in the best interest of the Company and its shareholders at all times;

- •

- Employees are to adhere to the highest standard of loyalty, candor, and care in all matters relating to our investors, shareholders, and the Company;

- •

- Employees are to perform their duties while observing the Company's goals and objectives;

- •

- Employees are to treat all customers, clients, suppliers, competitors, and employees with fairness and honesty; and

- •

- Employees are required to disclose actual or potential conflicts, such as outside employment, ownership interests in firms seeking to do business with Janus or in a competitor of Janus, and gifts and entertainment received by employees.

Our related party transaction approval policy provides that related party transactions must be pre-approved by the Audit Committee. Related party transactions include any financial transaction, arrangement, or relationship (including any indebtedness or guarantee of indebtedness) or any series of similar transactions, arrangements, or relationships in which the Company was or is to be a participant and the amount involved exceeds $120,000, and in which any related person had or will have a direct or indirect material interest. Our related party transaction approval policy is part of our Corporate Code of Business Conduct available on our website atir.janus.com in the "Governance Documents" section. While the Audit Committee does not have detailed written procedures concerning the approval of related party transactions, it would consider all relevant facts and circumstances in considering any such approval, including:

- •

- Whether the transaction is in, or not inconsistent with, the best interests of the Company and its shareholders;

- •

- The terms of the transaction and the terms of similar transactions available to unrelated parties or employees generally;

- •

- The availability of other sources for comparable products or services;

- •

- The benefits to the Company;

- •

- The impact on the director's independence, if the transaction is with a director or an affiliate of a director; and

- •

- The possibility that the transaction may raise questions about the Company's honesty, impartiality or reputation.

19

Table of Contents

Certain of the directors and executive officers, as well as their immediate family members, from time to time may invest their personal funds in Janus mutual funds on substantially the same terms and conditions as other similarly situated investors in these mutual funds who are neither directors nor employees of Janus.

Members of the Board of Directors who are employees of Janus or a designee of Dai-ichi Life do not receive any additional compensation for serving on the Board. All other members of the Board received the director compensation described below in 2015.

2015 non-employee director compensation consisted of:

- •

- An annual restricted stock grant valued on the grant date at approximately $100,000, which vests over three years, subject to immediate accelerated vesting upon voluntary separation from service, death, disability, or change in control of the Company;

- •

- An annual cash retainer of $100,000;

- •

- An additional cash retainer of $10,000 per committee;

- •

- An additional cash retainer of $25,000 to the Audit Committee chair;

- •

- An additional cash retainer of $15,000 if the director chairs the Compensation or Nominating Committee; and

- •

- An additional cash retainer of $125,000 to the non-executive Chairman of the Board.

All members of the Board of Directors are reimbursed for reasonable travel and lodging expenses in connection with attending Board and committee meetings. Janus also offers a matching gift program where every dollar contributed by a director to an eligible charity is matched dollar-for-dollar up to $2,500.

20

Table of Contents

The following chart shows the compensation that each non-employee director was paid for his or her services in calendar year 2015:

| | | | | | | | | | |

| | | | | | | | | | | |

Name (1)

|

| Fees Earned or Paid in Cash ($) (2)

|

| Stock Awards ($) (3)

|

| All Other Compensation ($) (4)

|

|

| Total ($)

| |

(a) |

| (b) |

| (c) |

| (g) |

|

| (h) | |

| | | | | | | | | | | |

Timothy K. Armour | | 135,000 | | 100,007 | | 15,530 | | | 250,537 | |

| | | | | | | | | | | |

G. Andrew Cox | | 110,000 | | 100,007 | | 34,165 | | | 244,172 | |

| | | | | | | | | | | |

Jeffrey J. Diermeier | | 135,000 | | 100,007 | | 10,128 | | | 245,135 | |

| | | | | | | | | | | |

Eugene Flood, Jr. | | 120,000 | | 100,007 | | 5,407 | | | 225,414 | |

| | | | | | | | | | | |

J. Richard Fredericks | | 110,000 | | 100,007 | | 22,213 | | | 232,220 | |

| | | | | | | | | | | |

Deborah R. Gatzek | | 135,000 | | 100,007 | | 30,093 | | | 265,100 | |

| | | | | | | | | | | |

Lawrence E. Kochard | | 110,000 | | 100,007 | | 24,620 | | | 234,627 | |

| | | | | | | | | | | |

Glenn S. Schafer | | 225,000 | | 100,007 | | 12,958 | | | 337,965 | |

| | | | | | | | | | | |

Billie I. Williamson | | 139,200 | | 116,006 | | 1,725 | | | 256,931 | |

| | | | | | | | | | | |

- (1)

- Mr. Pinkston was appointed an independent director effective January 21, 2016, and is therefore not included in this table.

- (2)

- Amounts represent the annual cash retainers for serving as members of the Board of Directors, including non-executive Chairman and committee membership retainers, which are paid in a lump sum on May 1 of each year.

- (3)

- The value of each restricted stock and restricted stock unit award is determined pursuant to FASB Accounting Standards Codification ("ASC") Topic 718 by multiplying the fair market value of our common stock (the average of the high and low trading prices) on the grant date by the number of shares granted. Amounts represent restricted stock and restricted stock units granted in 2015 for the 2015-2016 annual stock retainer, including restricted stock units received in connection with the Director Deferred Fee Plan (described below). The restricted stock and restricted stock units held by each independent director as of December 31, 2015, are as follows: Mr. Armour holds 13,029 shares of restricted stock and 30,900 restricted stock units; Mr. Cox holds 98,696 restricted stock units; Mr. Diermeier holds 13,029 shares of restricted stock and 15,229 restricted stock units; Mr. Flood holds 15,575 shares of restricted stock; Mr. Fredericks holds 4,416 shares of restricted stock and 61,209 restricted stock units; Ms. Gatzek holds 86,846 restricted stock units; Mr. Kochard holds 65,288 restricted stock units; Mr. Schafer holds 13,029 shares of restricted stock and 21,938 restricted stock units; and Ms. Williamson holds 6,388 shares of restricted stock.

21

Table of Contents

- (4)

- "All Other Compensation" includes the following:

| | | | | | | | | | |

| | | | | | | | | | | |

Name |

| Other (a) |

| Dividends on

Unvested Restricted

Stock ($) |

| Dividends on

Unvested Restricted

Stock Units ($) (b) |

|

| Total ($) | |

| | | | | | | | | | | |

Timothy K. Armour | | – | | 4,839 | | 10,691 | | | 15,530 | |

| | | | | | | | | | | |

G. Andrew Cox | | 510 | | – | | 33,655 | | | 34,165 | |

| | | | | | | | | | | |

Jeffrey J. Diermeier | | – | | 4,839 | | 5,289 | | | 10,128 | |

| | | | | | | | | | | |

Eugene Flood, Jr. | | – | | 5,407 | | – | | | 5,407 | |

| | | | | | | | | | | |

J. Richard Fredericks | | – | | 1,720 | | 20,493 | | | 22,213 | |

| | | | | | | | | | | |

Deborah R. Gatzek | | 510 | | – | | 29,583 | | | 30,093 | |

| | | | | | | | | | | |

Lawrence E. Kochard | | 2,500 | | – | | 22,120 | | | 24,620 | |

| | | | | | | | | | | |

Glenn S. Schafer | | 510 | | 4,839 | | 7,609 | | | 12,958 | |

| | | | | | | | | | | |

Billie I. Williamson | | – | | 1,725 | | – | | | 1,725 | |

| | | | | | | | | | | |

- (a)

- The amount represents Janus's matching gift in respect of a director's charitable contribution during 2015 under the Janus Matching Gift Program and includes Janus's match for director contributions made in 2014 but not matched until 2015. The amount also includes the membership fees for identity theft protection services (generally available to all employees) paid by the Company on behalf of the director.

- (b)

- This amount represents the value of dividend equivalents awarded in the form of Restricted Stock Units in 2015 on all grants deferred under the Director Deferred Fee Plan.

Under our Amended and Restated Director Deferred Fee Plan ("Director Deferred Fee Plan"), a non-employee director may elect to defer payment of all or any part of the above director monetary or stock fees until his or her service as a director is terminated. All monetary fees deferred under this plan are credited during the deferral period with the gains and losses of certain Janus mutual funds or Janus stock, as elected by the director. All Janus stock awards deferred under this plan are converted into restricted stock units at the time of grant. A director's interest in the deferred monetary fees is generally payable only in cash in a single payment or in installments upon termination of service as a director. Any restricted stock units granted in connection with the deferral of stock are paid in the form of Janus common stock in a single payment or in installments upon termination of service as a director. The Director Deferred Fee Plan is intended to comply with Section 409A of the Internal Revenue Code (the "Code"). Messrs. Cox, Fredericks, and Kochard and Ms. Gatzek elected to participate in this plan to defer monetary fees, stock fees, or a combination of both during the 2015 calendar year.

Notwithstanding anything to the contrary set forth in any of Janus's previous filings under the Securities Act of 1933, as amended, or the Exchange Act, as amended, that incorporated future filings, including this Proxy Statement, the following sections titled "Audit Committee Report" and "Compensation Committee Report on Executive Compensation" (on page 45) are not incorporated by reference into any such filings, except to the extent Janus specifically incorporates any of the reports by reference therein.

22

Table of Contents

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors is composed of four directors. The Board has determined that each Audit Committee member is independent under the listing standards of the NYSE and under the SEC standards relating to the independence of audit committees. The Board has also determined that each member is financially literate and is an audit committee financial expert as defined by the SEC.

The Audit Committee operates under a written charter adopted and approved by the Board. The Audit Committee annually reviews its written charter and our practices. The Audit Committee has determined that its charter and practices are consistent with the listing standards of the NYSE and the provisions of the Sarbanes-Oxley Act of 2002.

The purpose of the Audit Committee is to assist the Board in monitoring:

- •

- the integrity of the financial statements of the Company;

- •

- the independent auditor's qualifications and independence;

- •

- the performance of the Company's internal audit function and independent auditor, Deloitte;

- •

- compliance by the Company with legal and regulatory requirements;

- •

- the Company's system of disclosure controls and its system of internal controls over financial reporting; and

- •

- the Company's major financial risk exposures.

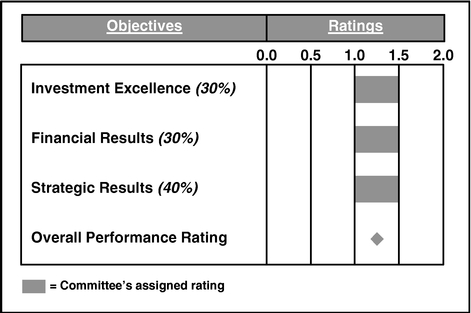

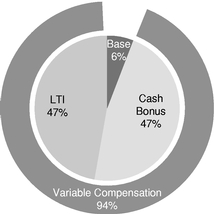

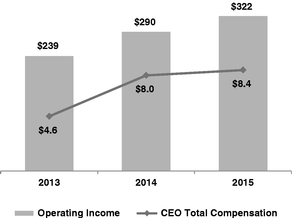

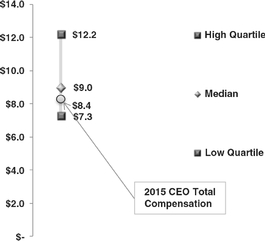

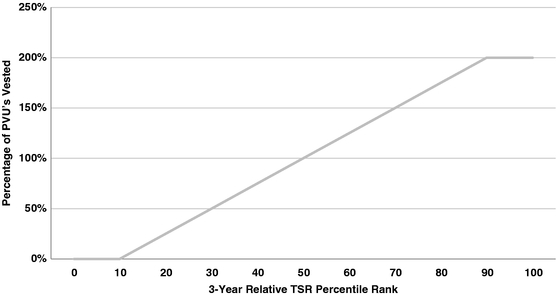

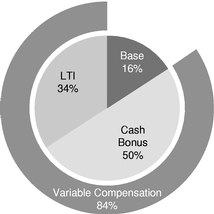

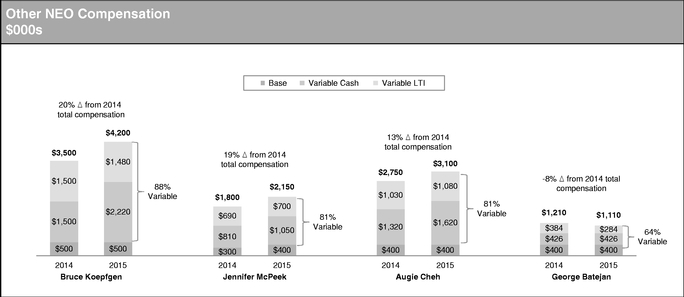

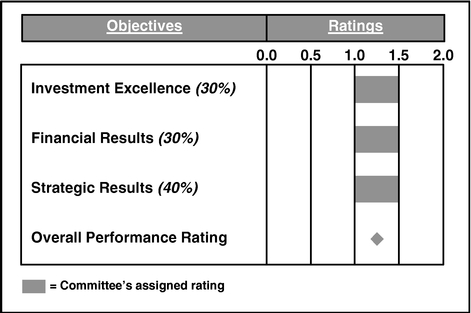

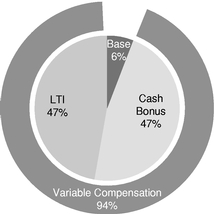

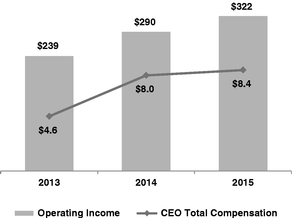

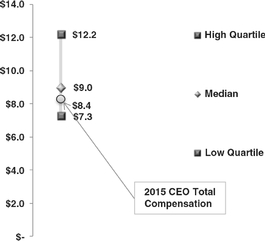

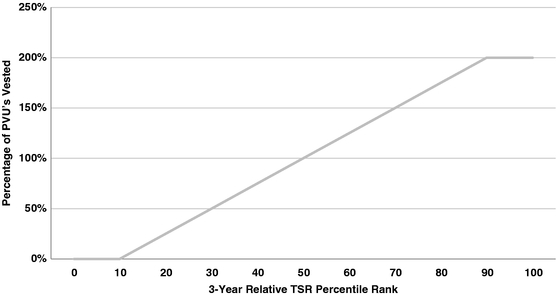

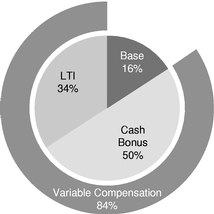

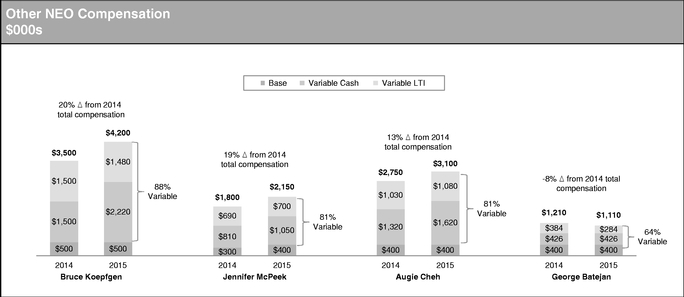

The Audit Committee also reviews (with assistance of management and outside counsel) major legislative and regulatory developments that could materially impact the Company's contingent liabilities and risks. In addition, the Audit Committee actively works with, and meets at least quarterly with, the General Counsel and Head of Enterprise Risk Management of the Company to oversee the identification of Company risks and potential risk management strategies. The Audit Committee reports regularly to the full Board.