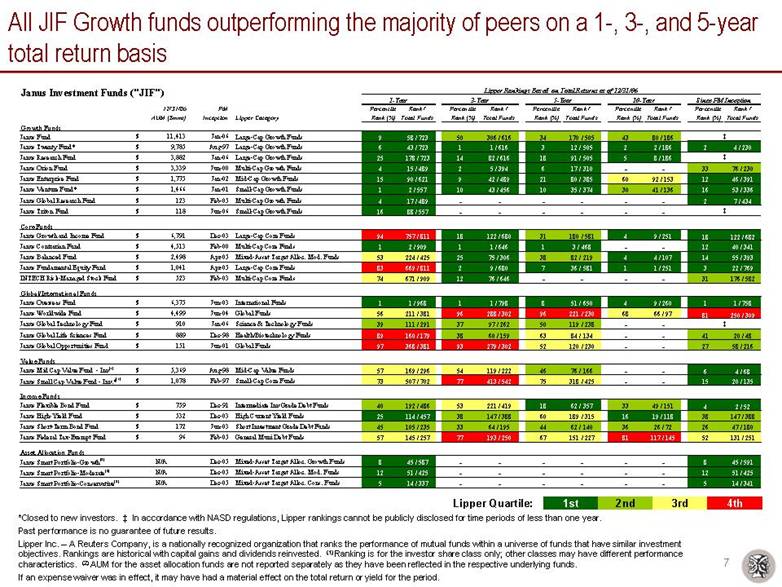

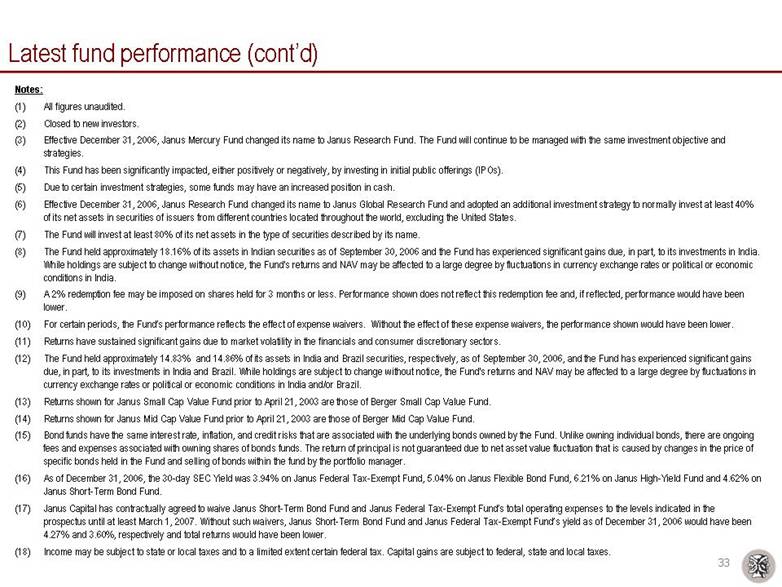

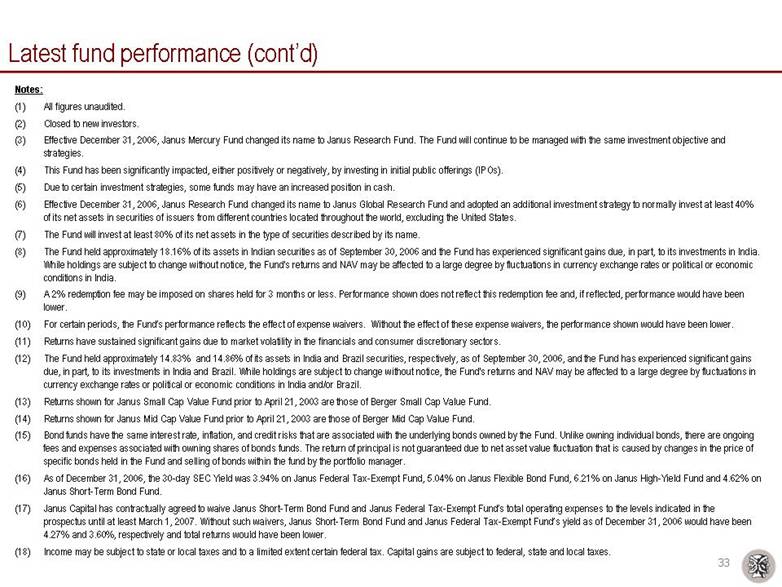

| Notes: All figures unaudited. Closed to new investors. Effective December 31, 2006, Janus Mercury Fund changed its name to Janus Research Fund. The Fund will continue to be managed with the same investment objective and strategies. This Fund has been significantly impacted, either positively or negatively, by investing in initial public offerings (IPOs). Due to certain investment strategies, some funds may have an increased position in cash. Effective December 31, 2006, Janus Research Fund changed its name to Janus Global Research Fund and adopted an additional investment strategy to normally invest at least 40% of its net assets in securities of issuers from different countries located throughout the world, excluding the United States. The Fund will invest at least 80% of its net assets in the type of securities described by its name. The Fund held approximately 18.16% of its assets in Indian securities as of September 30, 2006 and the Fund has experienced significant gains due, in part, to its investments in India. While holdings are subject to change without notice, the Fund's returns and NAV may be affected to a large degree by fluctuations in currency exchange rates or political or economic conditions in India. A 2% redemption fee may be imposed on shares held for 3 months or less. Performance shown does not reflect this redemption fee and, if reflected, performance would have been lower. For certain periods, the Fund’s performance reflects the effect of expense waivers. Without the effect of these expense waivers, the performance shown would have been lower. Returns have sustained significant gains due to market volatility in the financials and consumer discretionary sectors. The Fund held approximately 14.83% and 14.86% of its assets in India and Brazil securities, respectively, as of September 30, 2006, and the Fund has experienced significant gains due, in part, to its investments in India and Brazil. While holdings are subject to change without notice, the Fund's returns and NAV may be affected to a large degree by fluctuations in currency exchange rates or political or economic conditions in India and/or Brazil. Returns shown for Janus Small Cap Value Fund prior to April 21, 2003 are those of Berger Small Cap Value Fund. Returns shown for Janus Mid Cap Value Fund prior to April 21, 2003 are those of Berger Mid Cap Value Fund. Bond funds have the same interest rate, inflation, and credit risks that are associated with the underlying bonds owned by the Fund. Unlike owning individual bonds, there are ongoing fees and expenses associated with owning shares of bonds funds. The return of principal is not guaranteed due to net asset value fluctuation that is caused by changes in the price of specific bonds held in the Fund and selling of bonds within the fund by the portfolio manager. As of December 31, 2006, the 30-day SEC Yield was 3.94% on Janus Federal Tax-Exempt Fund, 5.04% on Janus Flexible Bond Fund, 6.21% on Janus High-Yield Fund and 4.62% on Janus Short-Term Bond Fund. Janus Capital has contractually agreed to waive Janus Short-Term Bond Fund and Janus Federal Tax-Exempt Fund’s total operating expenses to the levels indicated in the prospectus until at least March 1, 2007. Without such waivers, Janus Short-Term Bond Fund and Janus Federal Tax-Exempt Fund’s yield as of December 31, 2006 would have been 4.27% and 3.60%, respectively and total returns would have been lower. Income may be subject to state or local taxes and to a limited extent certain federal tax. Capital gains are subject to federal, state and local taxes. Latest fund performance (cont’d) |