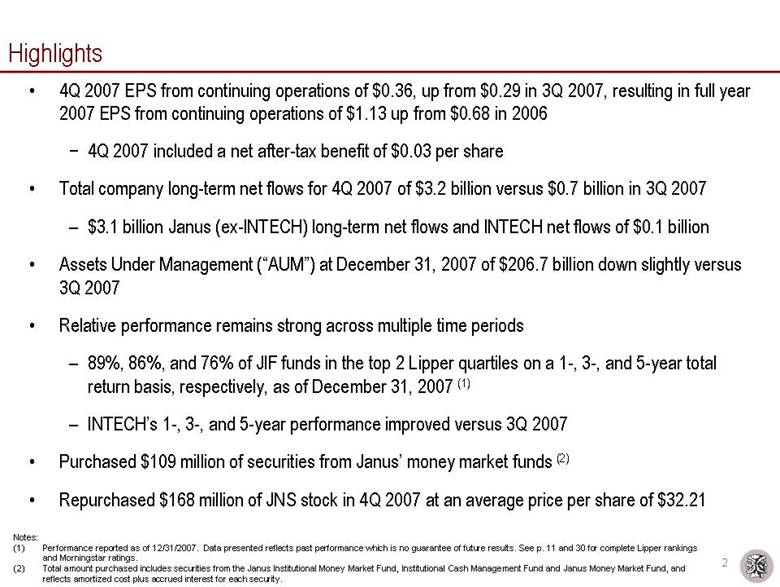

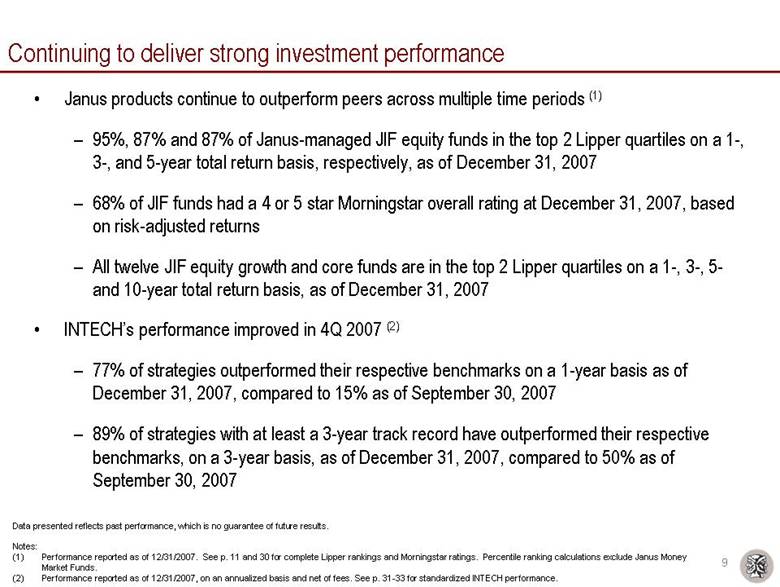

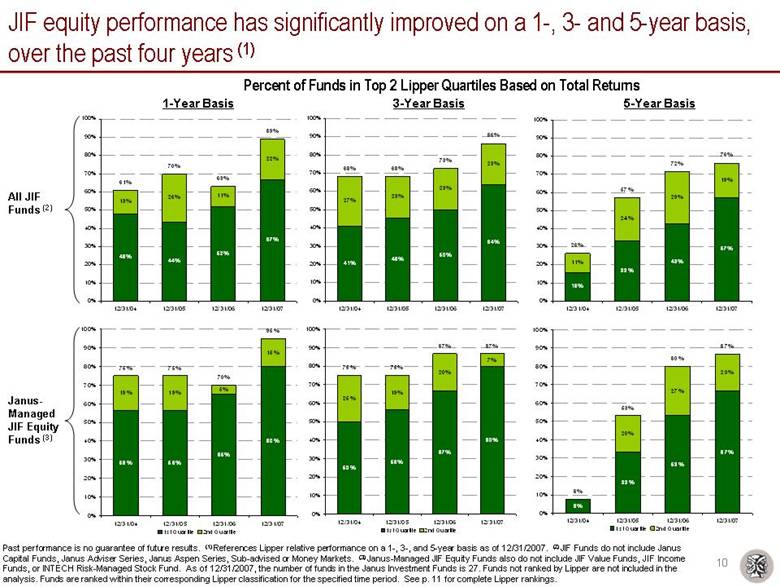

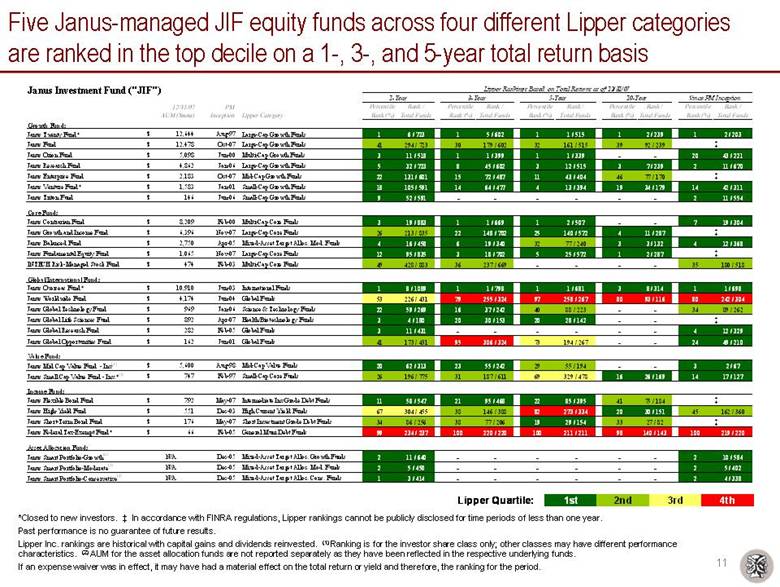

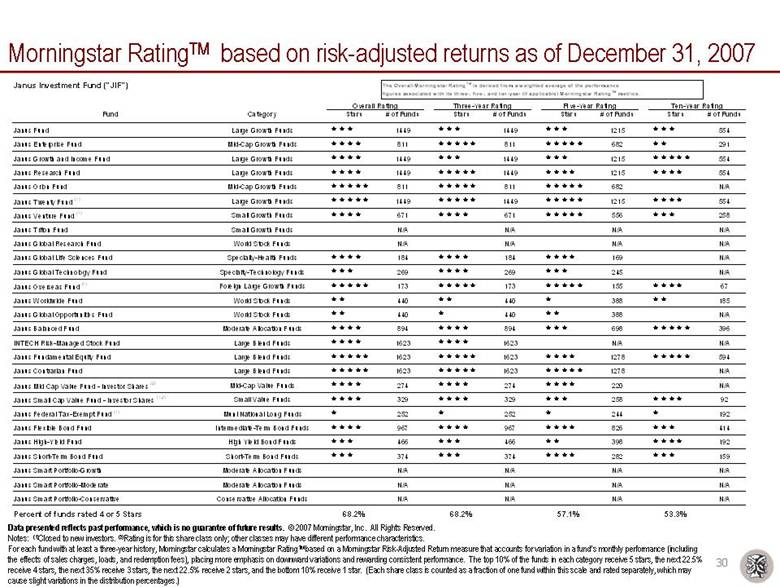

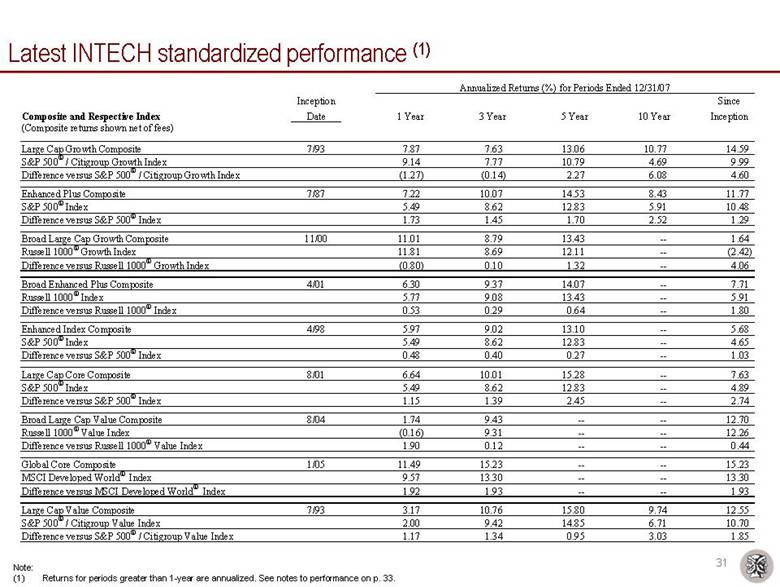

| 9 Continuing to deliver strong investment performance • Janus products continue to outperform peers across multiple time periods (1) – 95%, 87% and 87% of Janus-managed JIF equity funds in the top 2 Lipper quartiles on a 1-, 3-, and 5-year total return basis, respectively, as of December 31, 2007 – 68% of JIF funds had a 4 or 5 star Morningstar overall rating at December 31, 2007, based on risk-adjusted returns – All twelve JIF equity growth and core funds are in the top 2 Lipper quartiles on a 1-, 3-, 5- and 10-year total return basis, as of December 31, 2007 • INTECH’s performance improved in 4Q 2007 (2) – 77% of strategies outperformed their respective benchmarks on a 1-year basis as of December 31, 2007, compared to 15% as of September 30, 2007 – 89% of strategies with at least a 3-year track record have outperformed their respective benchmarks, on a 3-year basis, as of December 31, 2007, compared to 50% as of September 30, 2007 Data presented reflects past performance, which is no guarantee of future results. Notes: (1) Performance reported as of 12/31/2007. See p. 11 and 30 for complete Lipper rankings and Morningstar ratings. Percentile ranking calculations exclude J anus Money Market Funds. (2) Performance reported as of 12/31/2007, on an annualized basis and net of fees. See p. 31-33 for standardized INTECH performance. |