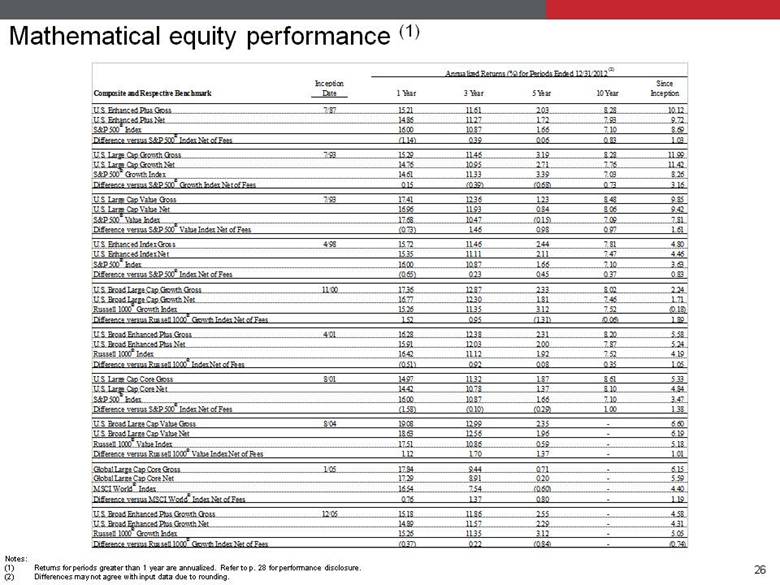

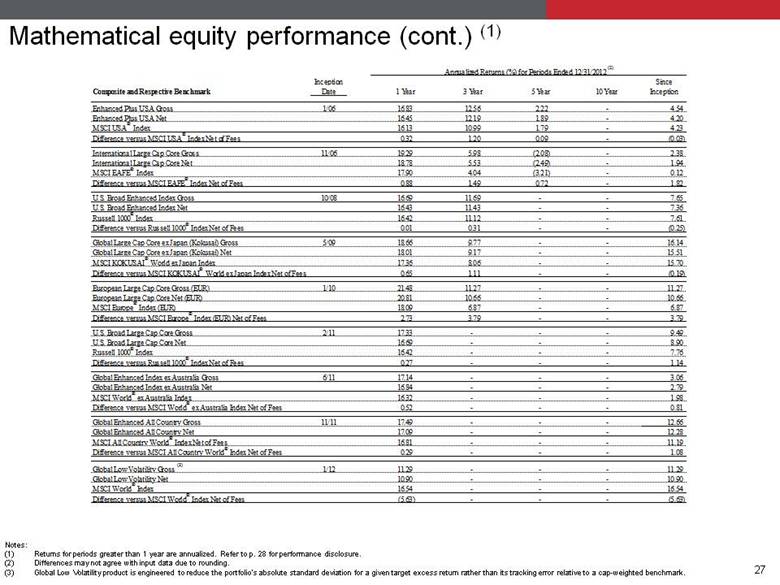

| Other important disclosures Data presented reflects past performance, which is no guarantee of future results. Due to market volatility, current performance may be higher or lower than the performance shown. Call 877.33JANUS (52687) or visit janus.com/advisor/mutual-funds for performance, rankings and ratings current to the most recent month-end. Janus Capital Group Inc. (“JCG”) provides investment advisory services through its primary subsidiaries, Janus Capital Management LLC (“Janus”), INTECH Investment Management LLC (“INTECH”) and Perkins Investment Management LLC (“Perkins”). “Complex-Wide Mutual Funds” means all affiliated mutual funds managed by Janus, INTECH and Perkins. “Fundamental Equity Mutual Funds” means all mutual funds managed by Janus or Perkins that invest in equity securities. “Fixed Income Mutual Funds” means all mutual funds managed by Janus that invest primarily in fixed income securities. “Mathematical Equity Strategies” means all discretionary managed accounts (not mutual funds) that are advised or sub-advised by INTECH. Mutual fund relative performance analysis shown is for each Fund's initial share class: Class T, S or I Shares in the Janus retail fund (“JIF”) trust and the Institutional or Service Shares in the Janus Aspen Series (“JAS”). These share classes may not be eligible for purchase by all investors. Other share classes may have higher sales and management fees, which can result in differences in performance. For both Lipper and Morningstar, performance on an asset-weighted basis is calculated by taking all funds and assigning the assets under management ("AUM") in each respective fund to either the 1st, 2nd, 3rd or 4th quartile bucket based on each fund's respective Lipper or Morningstar relative ranking. The total AUM of each quartile’s bucket is then divided by complex-wide total AUM to arrive at the respective percent of AUM in each bucket. Morningstar Comparative Performance The Morningstar percentile ranking is based on the fund’s total-return percentile rank relative to all funds that have the same category for the same time period. The highest (or most favorable) percentile rank is 1%, and the lowest (or least favorable) percentile rank is 100%. Morningstar total-return includes both income and capital gains or losses and is not adjusted for sales charges. The top-performing funds in a category will always receive a rank of 1. For the 1-, 3-, 5- and 10-year periods ending December 31, 2012, 62%, 45%, 63% and 76% of the 52, 42, 40 and 29 Complex-Wide mutual funds; 66%, 38%, 59% and 76% of the 41, 34, 32 and 25 Fundamental Equity mutual funds; and 50%, 75%, 100% and 75% of the 6,4,4 and 4 Fixed Income mutual funds outperformed the majority of their Morningstar peers based on total returns. On an asset-weighted basis, 80% of the Complex-Wide mutual fund assets, 80% of the Fundamental Equity mutual fund assets and 80% of the Fixed Income mutual fund assets outperformed the majority of their Morningstar peers based on total returns for the 10-year period. Lipper Comparative Performance Lipper, a wholly-owned subsidiary of Thomson Reuters, provides independent insight on global collective investments including mutual funds, retirement funds, hedge funds, fund fees and expenses to the asset management and media communities. Lipper ranks the performance of mutual funds within a classification of funds that have similar investment objectives. Funds not ranked by Lipper are not included in the analysis. For the 1-, 3-, 5- and 10-year periods ending December 31, 2012, 63%, 45%, 60% and 76% of the 52, 42, 40 and 29 Complex-Wide mutual funds; 71%, 38%, 56% and 76% of the 41, 34, 32 and 25 Fundamental Equity mutual funds; and 50%, 75%, 100% and 75% of the 6,4,4 and 4 Fixed Income mutual funds outperformed the majority of their Lipper peers based on total returns. On an asset-weighted basis, 80% of the Complex-Wide mutual fund assets, 79% of the Fundamental Equity mutual fund assets and 80% of the Fixed Income mutual fund assets outperformed the majority of their Lipper peers based on total returns for the 10-year period. The Overall Morningstar RatingTM for a fund is derived from a weighted average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar RatingTM metrics. For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of the funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) The Morningstar RatingTM may differ among share classes of a mutual fund as a result of different sales loads and/or expense structures. It may be based, in part, on the performance of a predecessor fund. Morningstar does not rank funds with less than a 3-year performance history. For the period ending December 31, 2012, 40%, 43% and 55% of Complex-Wide mutual funds had a 4- or 5-star Morningstar rating for the 3-, 5- and 10-year periods based on risk-adjusted returns for 42, 40 and 29 funds, respectively. 42 funds were included in the analysis for the Overall period. Investing involves risk, including the possible loss of principal. The value of your investment will fluctuate over time and you may gain or lose money. A fund’s performance may be affected by risks that include those associated with non-diversification, non-investment grade debt securities, high-yield/high-risk securities, undervalued or overlooked companies, investments in specific industries or countries and potential conflicts of interest. Additional risks to funds may include those associated with investing in foreign securities, emerging markets, initial public offerings, real estate investment trusts (REITs), derivatives, short sales and companies with relatively small market capitalizations. Each fund has different risks, please see a Janus prospectus for more information about risk, fund holdings and other details. |