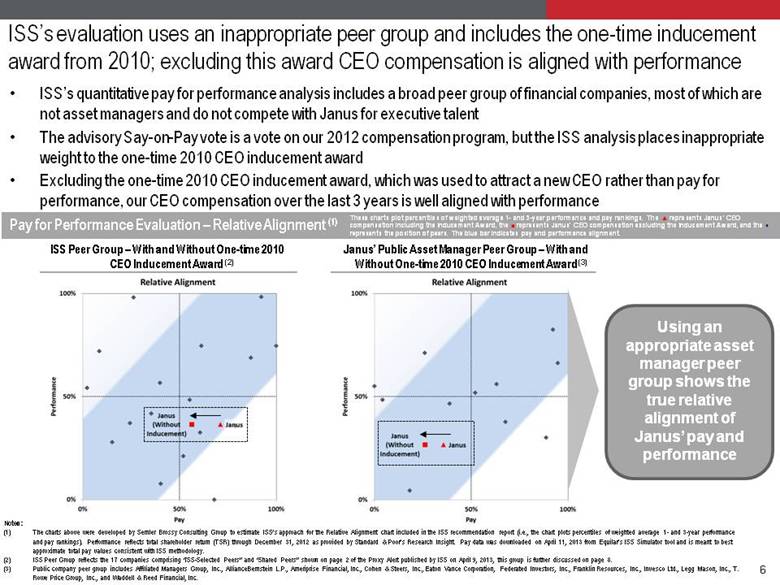

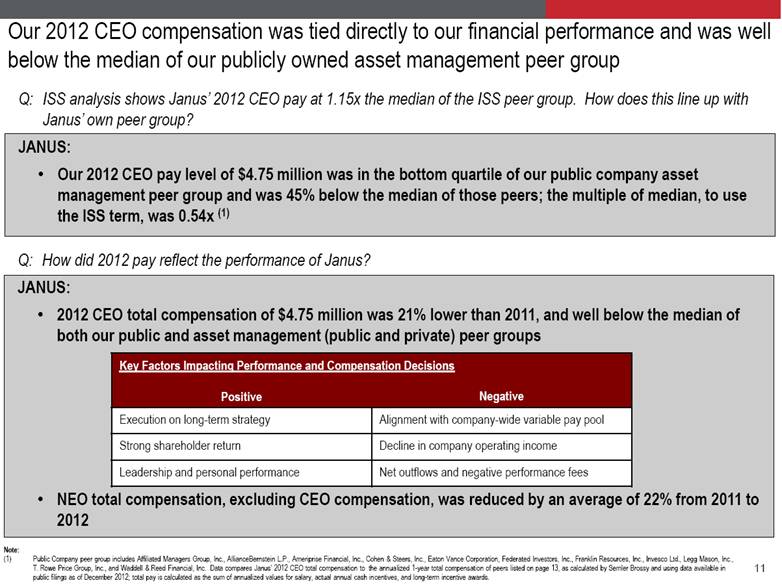

| ISS has used an inappropriate peer group in evaluating Janus’ CEO compensation JANUS: We are a pure asset management firm and the peers our Compensation Committee considers for our executive pay programs and levels are also asset management firms Based on feedback received in 2012, we added a new peer group to include only publicly owned Asset Managers in an effort to provide adequate comparative data for analyses conducted by our shareholders 8 of the 11 companies in this group use Janus as a peer for their compensation practices (1) In addition, the Compensation Committee considers compensation levels from a peer group of both publicly and privately owned Asset Managers when determining executive compensation (2) ISS has used 17 companies in their analysis, most of whom have little relevance to what we do; only 3 of the 17 companies listed in ISS’s peer group use Janus as a peer for their compensation practices (3) Notes: Companies who list Janus as a peer for compensation purposes include Affiliated Managers Group, Inc., AllianceBernstein Holding L.P., Cohen & Steers, Inc., Eaton Vance Corp., Federated Investors, Inc., Franklin Resources, Inc., T. Rowe Price Group, Inc. and Waddell & Reed Financial, Inc. Private and public company peer group includes AllianceBernstein L.P., American Century Investments, Delaware Investments, Eaton Vance Management, Franklin Templeton Investments, Invesco plc., MFS Investment Management, Morgan Stanley Investment Management, Neuberger Berman Group, Nuveen Investments, Oppenheimer Funds, Inc., Putnam Investments, T. Rowe Price Associates, Inc., and Western Asset Management Co. Franklin Templeton Investments and T. Rowe Price Associates, Inc. are considered in pay analysis for all NEOs, except for the CEO position. The two exclusions are due to potential compensation distortions for the CEO role due to the applicable CEO's large equity ownership levels. Companies that list Janus as part of their peer group in most recent proxy statements include Affiliated Managers Group, Inc., Eaton Vance Corp. and Waddell & Reed Financial, Inc. ISS’s Peer Group Affiliated Managers Group, Inc. Ladenburg Thalmann Financial Services Inc American Capital, Ltd. Lazard Ltd Duff & Phelps Corporation Och-Ziff Capital Management Group LLC Eaton Vance Corp. Piper Jaffray Companies Evercore Partners, Inc. SEI Investment Company Fortress Investment Group LLC Stifel Financial Corp. GFI Group Inc. Waddell & Reed Financial, Inc. Investment Technology Group, Inc. Walter Investment Management Corp Knight Capital Group, Inc. Q: ISS has used a peer group to analyze Janus CEO pay and performance that includes 17 companies. How do these differ from the peers you considered in your proxy statement? Janus Public Company Peer Group Affiliated Managers Group, Inc. Franklin Resources, Inc. AllianceBernstein Holding L.P. Invesco Ltd. Ameriprise Financial, Inc. Legg Mason, Inc. Cohen & Steers, Inc. T. Rowe Price Group, Inc. Eaton Vance Corp. Waddell & Reed Financial, Inc. Federated Investors, Inc. |