UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 11-K

ANNUAL REPORT

PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One):

x | | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED, EFFECTIVE OCTOBER 7, 1996) |

For the fiscal year ended: December 31, 2004

OR

| o | | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED) |

For the transition period from to

Commission file number: 1-14365

| | A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: |

EL PASO CORPORATION

RETIREMENT SAVINGS PLAN

(Full title of the Plan)

(herein referred to as the "Plan")

| | B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

EL PASO CORPORATION

(Name of the issuer of the securities held pursuant to the Plan)

(herein referred to as the "Company")

1001 Louisiana Street

Houston, Texas 77002

EL PASO CORPORATION

RETIREMENT SAVINGS PLAN

_________________

FINANCIAL STATEMENTS AND

SUPPLEMENTAL SCHEDULE WITH

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

December 31, 2004 and 2003

RETIREMENT SAVINGS PLAN

____________

FINANCIAL STATEMENTS AND SUPPLEMENTAL SCHEDULES

WITH REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

INDEX

| | Page |

| | |

| Report of Independent Registered Public Accounting Firm | 2 |

| | |

Financial Statements: Statement of Net Assets Available for Plan Benefits as of December 31, 2004 and 2003 | 3 |

| | |

Statement of Changes in Net Assets Available for Plan Benefits for the year ended December 31, 2004 | 4 |

| | |

Notes to Financial Statements | 5 |

| | |

| Supplemental Schedule: | |

| | |

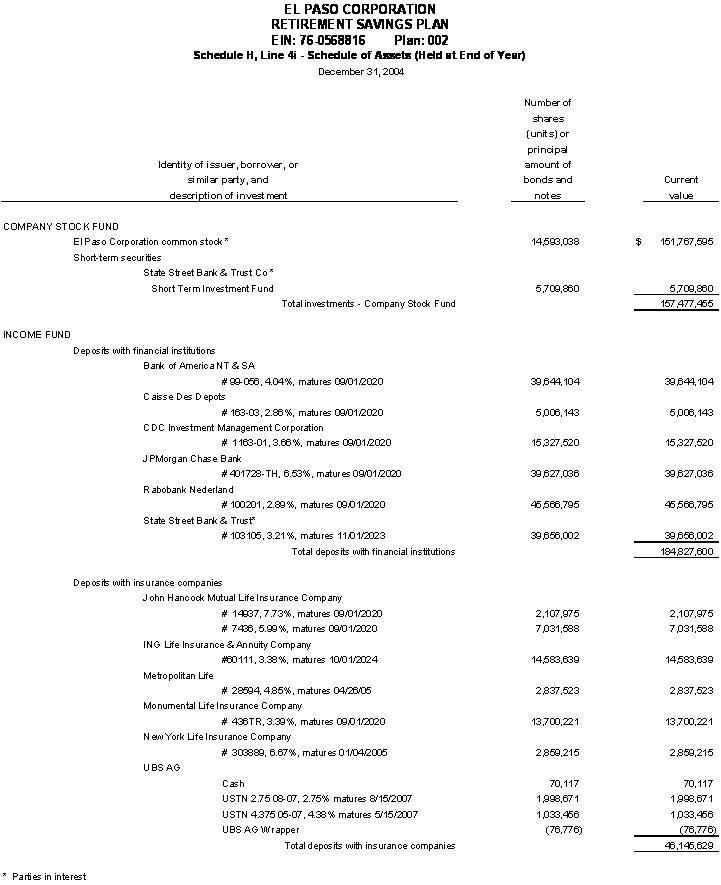

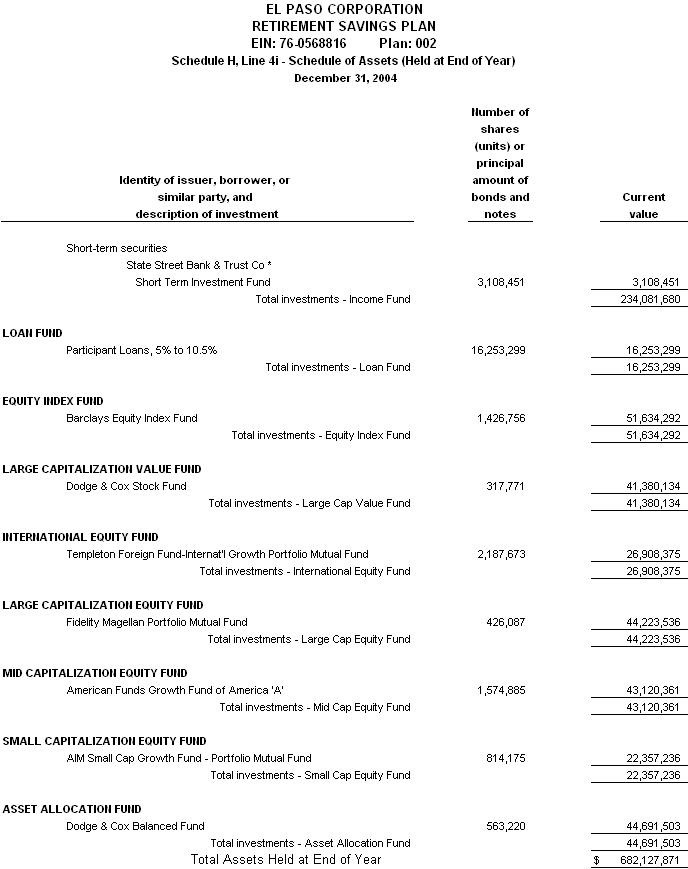

Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2004 | 17 |

| | |

| Consent of Independent Registered Public Accounting Firm | 19 |

Report of Independent Registered Public Accounting Firm

To the Participants and Administrator of

The El Paso Corporation Retirement Savings Plan:

In our opinion, the accompanying statement of net assets available for plan benefits and the related statement of changes in net assets available for benefits present fairly, in all material respects, the net assets available for benefits of the El Paso Corporation Retirement Savings Plan (the “Plan”) at December 31, 2004 and 2003, and the changes in net assets available for benefits for the year ended December 31, 2004 in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

Our audits were conducted for the purpose of forming an opinion on the basic financial statements taken as a whole. The supplemental schedule listed in the index on page 1 is presented for the purpose of additional analysis and is not a required part of the basic financial statements but is supplementary information required by the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental schedule is the responsibility of the Plan's management. The supplemental schedule has been subjected to the auditing procedures applied in the audits of the basic financial statements and, in our opinion, is fairly stated in all material respects in relation to the basic financial statements taken as a whole.

Houston, Texas

June 27, 2005

EL PASO CORPORATION |

RETIREMENT SAVINGS PLAN |

| |

STATEMENT OF NET ASSETS AVAILABLE FOR PLAN BENEFITS |

( In thousands ) |

| |

| |

| |

| | December 31, |

| | | 2004 | | | 2003 |

| | | | | | |

ASSETS | | | | | |

| |

| | Investments (See Note 3) | $ | 682,128 | | $ | 671,622 |

| | | | | | | |

| | Receivables | | | | | |

| | | Interest | | 51 | | | 61 |

| | | Dividends | | 573 | | | 776 |

| | | Participant contributions | | 1,201 | | | 1,611 |

| | | Employer contributions | | 12,790 | | | 583 |

| | | Total receivables | | 14,615 | | | 3,031 |

| | | | | | | | |

| | | Total assets | | 696,743 | | | 674,653 |

| |

LIABILITIES |

| |

| | Accrued expenses | | 438 | | | 581 |

| | Amounts due to others | | 2,281 | | | 912 |

|

| | | Total liabilities | | 2,719 | | | 1,493 |

| |

NET ASSETS AVAILABLE FOR PLAN BENEFITS | $ | 694,024 | | $ | 673,160 |

The accompanying notes are an integral part of these financial statements.

ELPASO CORPORATION |

RETIREMENT SAVINGS PLAN |

| |

STATEMENT OF CHANGES IN NET ASSETS |

AVAILABLE FOR PLAN BENEFITS |

( In thousands ) |

| |

| |

| | For the |

| | year ended |

| | December 31, 2004 |

| | | |

ADDITIONS | | |

| | | | | |

| | Dividends | $ | 7,134 |

| | Interest | | 10,180 |

| | Net appreciation in fair value of | | |

| | investments | | 56,254 |

| | | Net investment income | | 73,568 |

| | | | | |

| | Contributions | | |

| | | Employer | | 28,315 |

| | | Participants | | 40,972 |

| | | Total contributions | | 69,287 |

| | | Total additions | | 142,855 |

| | | | | |

DEDUCTIONS | | |

| | | | | |

| | Benefits paid to participants | | 120,629 |

| | Administrative fees | | 1,362 |

| | | Total deductions | | 121,991 |

| | Net increase | | 20,864 |

| | | | | |

| | Net assets available for Plan benefits | | |

| | | Beginning of period | | 673,160 |

| | | | | |

| | | End of period | $ | 694,024 |

The accompanying notes are an integral part of these financial statements.

RETIREMENT SAVINGS PLAN

____________

NOTES TO FINANCIAL STATEMENTS

1. DESCRIPTION OF PLAN

The following description of the El Paso Corporation Retirement Savings Plan (the “Plan”) provides general information about the Plan’s provisions in effect for the plan year ended December 31, 2004. Participants should refer to the Plan documents and summary plan description for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution plan covering eligible employees of El Paso Corporation (the “Company”) and its participating employers, except leased employees, certain nonresident aliens, certain foreign nationals, and members of any unit covered by a collective bargaining agreement. The Committee for the Retirement Savings Plan (the “Committee”) is responsible for the general administration of the Plan as described in the Plan document. Until September 1, 2003, Deutsche Bank Trust Company Americas (“Deutsche Bank”) was the trustee for the Plan. Effective September 1, 2003, State Street Bank and Trust Company (“State Street”) became the trustee of the Plan. Hewitt Associates is the recordkeeper for the Plan. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

Contributions

Prior to May 1, 2003, a participant could elect to make basic contributions from 2 percent to 15 percent on a before or after tax basis. Effective May 1, 2003, a participant may elect to make basic contributions from 2 percent to 25 percent on a before tax basis and 2 percent to 15 percent on an after tax basis of his or her eligible compensation. The Company will make matching contributions in the same manner as that of participant contributions. Until July 1, 2004, the matching contribution was equal to 50 percent of a participant’s basic contribution up to a maximum level of 6 percent of eligible compensation. Effective July 1, 2004, the matching contribution was increased to 75 percent of a participant’s basic contribution up to a maximum level of 6 percent of eligible compensation.

In addition, if a participant has elected the maximum basic contribution eligible for a matching contribution, he or she may make after-tax supplemental contributions to the Plan from 1 percent to 5 percent of his or her eligible compensation. A participant may also elect to have the amount of available cash under the Company’s FlexPlan transferred to the Plan as a flex contribution or may make an approved rollover contribution of a distribution received or direct transfer from another qualified retirement plan. There are certain legal limitations, as provided by the Plan, applicable to contributions to the Plan. Federal income taxes on before-tax contributions, company matching contributions, and the earnings from the investments in the Plan are deferred until amounts are withdrawn from the Plan by participants.

Effective June 25, 2004, the Plan temporarily suspended future investments in the Company Stock Fund until the Company became current on its SEC filings. The temporary suspension was lifted December 22, 2004.

RETIREMENT SAVINGS PLAN

_____________

NOTES TO FINANCIAL STATEMENTS

(Continued)

1. DESCRIPTION OF PLAN (Continued)

Participant Accounts

Each participant's account is credited with the participant's contributions, the Company's matching contributions, the participant's share of net earnings or losses of his or her respective elected investment funds under the Plan and charged with an allocation of administrative expenses. Net investment gains and losses in a particular investment fund and administrative expenses are allocated in proportion to the respective participant account balances in that fund.

Vesting

A participant’s interest in the balance credited to his or her account is fully vested at all times.

Payment of Benefits

Upon separation from service with the Company, a participant whose account balance exceeds $5,000 may elect to receive either a lump-sum or installment distribution equal to the value of his or her account or to defer the distribution. A deferred distribution may take the form of either a lump-sum distribution payable within, or installments payable over, a period that ends on or before April 1 of the year following the calendar year in which the participant attains age 70-1/2. A participant whose account balance does not exceed $5,000 will receive an immediate lump-sum distribution of the amount equal to his or her account balance. Certain in-service withdrawals may also be available, as provided by the Plan.

Participant Loans

To obtain a loan, the participant must have a total account balance of at least $2,000 excluding any amounts held in an “IRA Rollover Account” under the Plan. Loan amounts may be from $1,000 to $50,000 but may not be more than 50 percent of the total balance in the participant's account, excluding any IRA Rollover Account balance. The 50 percent limit is reduced by the participant's highest outstanding loan balance(s) during the prior 12-month period. Each loan is made from, and repaid to, the borrowing participant's account so as not to affect the accounts of other participants. Loan transactions are treated as a transfer from the participant’s account to the Loan Fund. A participant may not obtain more than one loan during any 12-month period and may not have more than two loans outstanding. The interest rate on a loan is 1 percent above the prime rate, which is determined on the last business day of the month preceding the quarter in which the loan is taken. The interest rate is fixed for the term of the loan. Interest rates on participants’ loans ranged from 5% to 10.5% in 2004 and 2003. The repayment period may be from 1 to 5 years. When a participant terminates employment with the Company, the unpaid balance of the participant's loan(s) will be deducted from any distributions to the participant. If the participant elects to defer the distributions, the loan must be repaid within 60 days after separation from service. If the loan is not repaid, it will be automatically treated as a distribution to the participant.

RETIREMENT SAVINGS PLAN

____________

NOTES TO FINANCIAL STATEMENTS

(Continued)

1. DESCRIPTION OF PLAN (Continued)

Investment Options

With exceptions as described below, a participant could direct the investment of his or her contributions to the Plan or reallocate the existing balance in his or her account among any one or more of the following investment funds during 2004. The diversification of securities within each investment fund is at the discretion of the fund manager with the exception of the Company Stock Fund. For a more complete description of the investment objectives, general information and performance history of the funds, participants should refer to the individual mutual fund prospectus and the summary plan description.

1) Income Fund - invests primarily in a diversified portfolio of investment contracts offered by major insurance companies, banks and other financial institutions. The objective of the fund is to provide liquidity and safety of principal while providing a higher return over time than offered by money market funds. An investment contract is an agreement whereby the issuing entity promises a specific rate of return for a period of time. The contracts provide that a reduction in principal will not occur due to a change in interest rates. These contracts usually have maturity dates and interest rates that fluctuate to reflect the investment performance and activity of bonds that underlie the contract. However, like all of the Plan's investment funds, there is an element of risk. Some of the contracts are direct obligations of the issuing entity. To reduce the risk of the fund, most of the investment contracts are collateralized by fixed-income securities held in a separate account of an insurance company, or in a trust fund, to protect them from the general creditors of the contract issuer. The fund may also hold cash or other short-term fixed income securities, although these are expected to be a small percentage of the Income Fund. PRIMCO Capital Management, Inc. manages the Income Fund.

2) Company Stock Fund - invests primarily in common stock of the Company (NYSE:EP). As with investments in any single stock, this fund may be more volatile (that is, subject to larger swings in value, both up and down) than a fund that is diversified among the stocks of many companies. Participants who invest in the Company Stock Fund may instruct the trustee regarding the voting of the Company's common stock allocated to the participant's account. The fund may also hold cash or other short-term fixed income securities, although these are expected to be a small percentage of the Stock Fund.

3) Equity Index Fund - invests in an index fund designed to match the performance of the Standard and Poor’s (S&P) Index by investing in stock of most of the 500 largest U.S. companies comprising that Index. This fund currently invests in a commingled fund for institutional investors known as the Daily Equity Index Fund T managed by Barclays Global Investors.

EL PASO CORPORATION

RETIREMENT SAVINGS PLAN

_____________

NOTES TO FINANCIAL STATEMENTS

(Continued)

1. DESCRIPTION OF PLAN (Continued)

Investment Options (Continued)

4) International Equity Fund - invests in the publicly traded mutual fund known as the Templeton Foreign Fund managed by Templeton Global Advisors Limited. The purpose of this fund is to invest in companies in locations and businesses around the world where economic conditions are favorable for growth. Because of global monetary exchange, economic and political conditions, the risks and returns for this fund can vary significantly from investments in domestic stocks.

5) Large Capitalization Equity Fund - invests in the publicly traded mutual fund known as the Fidelity Magellan Fund managed by Fidelity Management & Research Company.

6) Mid Capitalization Equity Fund - invests in the publicly traded mutual fund known as the American Funds Growth Fund of America (Class A) managed by Capital Research and Management Company.

7) Small Capitalization Equity Fund - invests in the publicly traded mutual fund known as the AIM Small Cap Growth Fund “A” managed by AIM Capital Management.

8) Asset Allocation Fund - invests in the publicly traded mutual fund known as the Dodge & Cox Balanced Fund managed by Dodge & Cox.

9) Large Capitalization Value Fund - invests in the publicly traded mutual fund known as the Dodge & Cox Large Cap Value Fund managed by Dodge & Cox.

EL PASO CORPORATION

RETIREMENT SAVINGS PLAN

_____________

NOTES TO FINANCIAL STATEMENTS

(Continued)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Accounting Basis

The financial statements of the Plan are prepared on the accrual basis of accounting.

Use of Estimates

The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of net assets available for plan benefits at the date of the financial statements, the reported changes in net assets available for plan benefits during the reporting period and disclosures related to the Plan. Actual results could differ from those estimates.

Valuation of Investments

For the Plan years ending December 31, 2004 and 2003, the Plan’s investment contracts with financial institutions and insurance companies are reported at contract value, as they are benefit responsive investment contracts. The Income Fund includes certain guaranteed investment contracts (“GICs”) which are stated at contract value, which approximates fair value, representing the original cost, plus interest (based upon the crediting rates of the underlying contracts) reduced by administration fees, transfers out, and withdrawals. Short-term securities and participant loans are carried at cost which approximates fair value. All other investments are carried at fair value as determined by quoted market prices. Purchases and sales of securities are reflected on a trade-date basis. The basis of securities sold is determined by average cost.

Amounts Due To Others

Amounts due to others reflect the unsettled securities bought at year end.

EL PASO CORPORATION

RETIREMENT SAVINGS PLAN

_____________

NOTES TO FINANCIAL STATEMENTS

(Continued)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Investment Income

Dividend income is recorded on the ex-dividend date. Interest income is recorded as earned on an accrual basis. Dividend and interest income are allocated to participants' accounts based upon each participant's proportionate share of assets in each investment fund. Dividend income represents income for those funds holding individual equity securities. Interest income represents income received from deposits with insurance companies, short-term securities and funds invested in commingled equity or mutual funds.

Payment of Benefits

Benefits are recorded when paid.

Expenses

Administrative expenses include participant recordkeeping and custodial fees, and certain professional fees incurred and paid by the Plan. In addition, any expenses directly relating to the purchase, sale, or transfer of the Plan's investments are charged to the particular investment fund to which the expense relates.

Net Appreciation in Fair Value of Investments

The Plan presents in the statement of changes in net assets available for plan benefits the net appreciation in the fair value of its investments which consists of the realized gains or losses and the unrealized appreciation (depreciation) on those investments.

Risks and Uncertainties

The Plan provides for various investment options in any combination of stocks, bonds, fixed income securities, mutual funds, and other investment securities. Investment securities are exposed to various risks, such as interest rate risk, market risk and credit risk. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and those changes could materially affect the amounts reported in the statement of net assets available for plan benefits.

Since November 2002, El Paso has undergone a series of credit rating downgrades. However, on November 12, 2004 the Company’s credit rating improved with Moody’s Investor Service increasing the Company’s senior unsecured debt rating to a “Caa1 (stable outlook)” from a “Caa1 (negative outlook)”. In addition, on March 3, 2005, Standard and Poor’s Rating Services also increased the Company’s senior unsecured debt rating to a “CCC+ (stable outlook)” from a “CCC+ (negative outlook)”.

EL PASO CORPORATION

RETIREMENT SAVINGS PLAN

_____________

NOTES TO FINANCIAL STATEMENTS

(Continued)

3. INVESTMENTS

Investments representing 5 percent or more of the Plan’s net assets are as follows:

| | December 31, | |

| | (In thousands) | |

| | 2004 | | 2003 | |

| El Paso Corporation common stock, | | | | |

14,593,038 and 19,097,744 shares, respectively | $ 151,768 | | $156,411 | |

| | | | | |

| Barclays Daily Equity Index Fund T, 1,426,756 and | | | | |

1,661,945 shares, respectively | 51,634 | | 54,263 | |

| | | | | |

| Fidelity Magellan Fund, 426,087 and 498,700 | 44,224 | | 48,743 | |

shares, respectively | | | | |

| | | | | |

| Dodge & Cox Stock Fund, 317,771 and 216,285 | 41,380 | | 24,609 | * |

shares, respectively | | | | |

| | | | | |

| American Funds Growth Fund of America “A”, | | | | |

1,574,885 and 1,628,933 shares, respectively | 43,120 | | 39,974 | |

| | | | | |

| Dodge & Cox Balanced Fund, 563,220 and 541,859 | | | | |

shares, respectively | 44,692 | | 39,577 | |

| | | | | |

| PRIMCO Income Fund, 234,081,677 and | | | | |

236,370,906 shares, respectively | 234,082 | | 236,371 | |

* Not 5% in 2003

EL PASO CORPORATION

RETIREMENT SAVINGS PLAN

_____________

NOTES TO FINANCIAL STATEMENTS

(Continued)

During 2004, the Plan’s investments (including gains and losses on investments bought and sold, as well as held during the year) appreciated in value by approximately $56,254 thousand as follows:

| | | (In thousands) |

| Company Stock Fund | | $ 30,872 |

| Mid Capitalization Equity Fund | | 4,616 |

| Equity Index Fund | | 5,193 |

| Large Capitalization Equity Fund | | 2,695 |

| Asset Allocation Fund | | 3,625 |

| International Equity Fund | | 3,457 |

| Large Capitalization Value Fund | | 4,526 |

| Small Capitalization Equity Fund | | 1,270 |

| | | |

| Net appreciation in fair value of investments | | $ 56,254 |

4. INVESTMENT CONTRACTS

The Plan invests in a diversified portfolio of investment contracts as described in Note 1. The contracts are included in the financial statements at contract value as reported to the Plan by State Street. On December 31, 2004 and 2003, the average yield for these investment contracts was 4.61 percent and 4.66 percent, respectively, while the average crediting interest rate was 4.63 percent and 4.65 percent, respectively. Crediting interest rates are normally reset quarterly for contracts with underlying investments to reflect the investment experience of that asset. There are no reserves against contract value for credit risk of the contract issuer or otherwise.

5. CONCENTRATION OF CREDIT RISK

The Plan invests in various investment funds, as described in Note 1, based upon participant instructions. The Income Fund held approximately 34 percent and 35 percent of the invested assets of the Plan at December 31, 2004 and 2003, respectively. The Company Stock Fund held approximately 23 percent and 24 percent of the invested assets of the Plan at December 31, 2004 and 2003, respectively. The Company believes that it offers sufficient investment options to allow participants to avoid any significant concentration of credit risk, although the ultimate control of investment diversification across the funds is up to the individual participant.

6. RELATED PARTY TRANSACTIONS

During the period January 1, 2004 through December 31, 2004, approximately $148 million and $146 million were purchased and sold, respectively, with State Street Bank and Trust Company in the State Street Directed Account Cash Fund. During this period, approximately 47 percent and 40 percent of the Plan's purchase and sale transactions, respectively, were related to these assets. Fees incurred by the Plan for recordkeeping services and Trustee services amounted to $1.3 million for the year ended December 31, 2004.

EL PASO CORPORATION

RETIREMENT SAVINGS PLAN

_____________

NOTES TO FINANCIAL STATEMENTS

(Continued)

7. TAX STATUS

The Plan is intended to be a qualified plan pursuant to Section 401(a) of the Internal Revenue Code of 1986, as amended (the "Code") and, accordingly, the trust established under the Plan to hold the Plan's assets is intended to be exempt from federal income taxes pursuant to Section 501(a) of the Code. The Company received a favorable tax determination letter from the IRS on June 20, 2003 stating that the Plan, as designed, was in compliance with the applicable requirements of the Code. The Plan has been amended since receiving the determination letter.

At various times during the 2000 through 2004 Plan years, Hewitt Associates, as the recordkeeper, failed to commence payroll deduction loan repayments, or incorrectly suspended payroll deduction loan repayments for certain participants who had taken qualified Plan loans. On May 25, 2005, the Plan Administrator submitted a request for a compliance statement pursuant to the Voluntary Correction Program (VCP) procedures of the Employee Plans Compliance Resolution System of the IRS with a proposed correction program for the qualification failure that occurred in the operation of the Plan.

Notwithstanding the VCP filing, the Company believes that the Plan is currently designed and being operated in compliance with the applicable requirements of the Code. Therefore, no provision for income taxes has been included in the Plan's financial statements.

8. AMENDMENTS AND FILINGS

Effective March 1, 2003, the Plan was amended to suspend Company matching contributions. On May 14, 2003, the Company announced its intention to reinstate effective July 1, 2003 the Company’s matching contribution in an amount equal to 50 percent of a participant’s basic contribution up to a maximum level of 6 percent of eligible compensation.

Effective May 1, 2003, the Plan was amended to allow for before-tax basic contributions in whole percentages from 2 percent to 25 percent of eligible compensation. The after-tax basic contribution limit remained unchanged at 15 percent, and the supplemental after-tax contribution limit remained unchanged at 5 percent.

Effective July 1, 2004, the matching contribution was increased to 75 percent of a participant’s basic contribution up to a maximum level of 6 percent of eligible compensation.

Effective February 1, 2005, the Plan was amended to limit the amount of company stock that a participant can hold in their account. A participant can invest up to a maximum of 25 percent of new contributions to the Company Stock Fund, and is limited in the amount he or she can transfer from other investment funds into the Company Stock Fund if the transfer would cause the investment in the Company Stock Fund to exceed 25 percent of the participant’s total account balance. However, if on February 1, 2005, a participant has more than 25 percent of their total account balance in the Company Stock Fund, they will not be required to sell any of the stock in the Company Stock Fund.

Effective April 1, 2005, the Plan was amended to increase the basic after-tax contributions from 15 percent to 25 percent. Also, the automatic cash-out limit was reduced from $5,000 to $1,000.

Effective April 1, 2005, the Plan was amended to allow the Company to make additional Company matching contributions for any plan year for any participant who is eligible, which may be determined and contributed after the end of such plan year. With respect to the Company and any affiliate, all determinations required to be made regarding any such additional Company matching contributions shall be made in the sole discretion of the Board of Directors, or may be made by such party, committee or other official designated by the Board of Directors. In 2005, the Company made an additional matching contribution of approximately $12 million for the 2004 plan year.

EL PASO CORPORATION

RETIREMENT SAVINGS PLAN

_____________

NOTES TO FINANCIAL STATEMENTS

(Continued)

9. PLAN TERMINATION

The Company reserves the right under the Plan to discontinue contributions at any time and to terminate the Plan subject to the provisions of ERISA and the Code. Upon termination, the Plan's assets would be distributed to the participants, as directed by the Committee in accordance with the Plan and applicable law, on the basis of their account balances existing at the date of termination, as adjusted for investment gains and losses.

10. SUBSEQUENT EVENT

Effective September 1, 2005, JPMorgan Retirement Plan Services will become the recordkeeper for the Plan.

Effective September 1, 2005, JPMorgan Chase Bank, N.A. will become the trustee of the Plan.

EL PASO CORPORATION

RETIREMENT SAVINGS PLAN

_____________

NOTES TO FINANCIAL STATEMENTS

(Continued)

11. RECONCILIATION WITH FORM 5500

The following is a reconciliation of net assets available for Plan benefits per the financial statements to Form 5500:

| | December 31, |

| | (In thousands) |

| | 2004 | | 2003 |

| | | | |

| Net assets available for Plan benefits per the financial statements | $ 694,024 | | $ 673,160 |

less: final distributions and participant withdrawals that have been processed and approved but not paid by the Plan | 84 | | 205 |

| | | | |

| Net assets available for Plan benefits per the Form 5500 | $ 693,940 | | $ 672,955 |

The following is a reconciliation of the change in net assets available for Plan benefits per the financial statements to Form 5500:

| | | For the year ended |

| | | December 31, 2004 |

| | | (In thousands) |

| | | |

Net increase in net assets available for Plan benefits per the financial statements | | $ 20,864 |

add: change in distributions and participant withdrawals that have been processed and approved but not paid by the Plan | | 121 |

| Net increase in net assets available for Plan benefits per the Form 5500 | | $ 20,985 |

Final distributions and participant withdrawals that have been processed and approved but not paid by the Plan are not considered Plan obligations until paid under generally accepted accounting principles, and therefore, are not presented as liabilities or benefits paid in the accompanying financial statements.

SUPPLEMENTAL SCHEDULE

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Trustees (or other persons who administer the plan) have duly caused this annual report to be signed by the undersigned hereunto duly authorized.

| | El Paso Corporation Retirement Savings Plan |

| | | |

| | | |

| | | |

| | By: | /s/ D. Dwight Scott |

| | | D. Dwight Scott |

| | | Executive Vice President and Chief Financial Officer of El Paso Corporation |

Date: June 27, 2005

EXHIBIT INDEX

Exhibit Number | | Description |

| |

| 23.1 | | Consent of PricewaterhouseCoopers LLP. |