The Holding Company is the result of the merger of Tele Nordeste Celular Participações S.A. (“TND”), then the controlling shareholder of TIM Nordeste Telecomunicações, with and into Tele Celular Sul Participações S.A. (“TSU”), then the controlling shareholder of TIM Sul, on August 30, 2004 (the “TND/TSU Merger”).

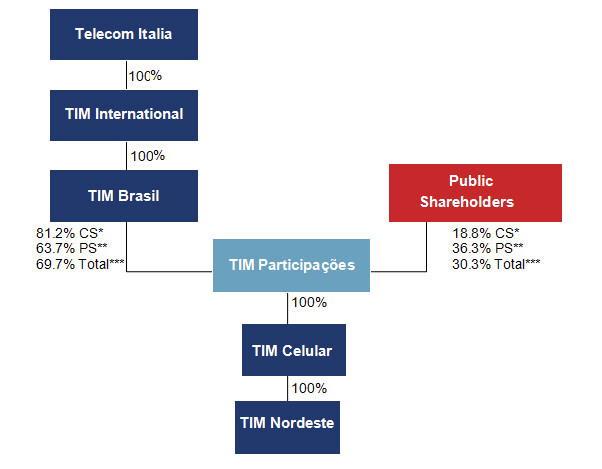

On March 16, 2006, we acquired all of the share capital of TIM Celular, a wholly-owned subsidiary of our controlling shareholder, TIM Brasil Serviços e Participações S.A. (“TIM Brasil”), to integrate the two companies’ operations, seeking to optimize the group’s financial structure and management, creating one of the largest Brazilian wireless companies in terms of market capitalization presenting an attractive investment for shareholders. As a result, TIM Celular and its operating subsidiary TIM Maxitel became our subsidiaries. On March 16, 2006, the acquisition (“TIM Celular Acquisition”) was approved by Extraordinary Shareholders’ Meetings of our shareholders and the shareholders of TIM Celular and became effective on such date.For accounting purposes, the acquisition was treated as if it had occurred on January 1, 2006. Except where specifically noted, information in this annual report does not account for the effects of such acquisition.

On June 30, 2006, at their respective Extraordinary Shareholders’ Meetings, TIM Celular, TIM Maxitel , TIM Nordeste Telecomunicações and TIM Sul approved the merger of TIM Nordeste Telecomunicações into TIM Maxitel and of TIM Sul into TIM Celular. On the same date, Maxitel’s name changed to TIM Nordeste S.A. (“TIM Nordeste”).

References in this annual report to the “preferred shares” and the “common shares” are, respectively, to the preferred shares, which have no voting rights, other than in the limited circumstances described in “Item 10B. Additional Information—Memorandum and Articles of Association—Rights Relating to our Shares—Voting Rights”, and common shares, of TIM. References to the “American Depositary Shares” or “ADSs” are to TIM’s American Depositary Shares, each representing 10 preferred shares. The ADSs are evidenced by American Depositary Receipts, or ADRs, which are listed on the New York Stock Exchange, or the NYSE, under the symbol “TSU”. The common shares and preferred shares are listed on the São Paulo Stock Exchange under the symbols “TCSL3” and “TCSL4”, respectively.

Therefore, the consolidated financial statements included in this annual report reflect the merger as follows:

Certain figures included in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

The “Technical Glossary” at the end of this annual report provides definitions of certain technical terms used in this annual report and in the documents incorporated in this annual report by reference.

This annual report contains statements in relation to our plans, forecasts, expectations regarding future events, strategies and projections, which are forward-looking statements and involve risks and uncertainties and are therefore, not guarantees of future results. Forward looking statements speak only as of the date they were made, and we undertake no obligation to update publicly or revise any forward-looking statements after we file this annual report because of new information, future events and other factors. We, and our representatives, may also make forward-looking statements in press releases and oral statements. Statements that are not statements of historical fact, including statements about the beliefs and expectations of our management, are forward-looking statements. Words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “plan,” “predict,” “project” and “target” and similar words are intended to identify forward-looking statements, which necessarily involve known and unknown risks and uncertainties. Our actual results and performance could differ substantially from those anticipated in our forward-looking statements. These statements appear in a number of places in this annual report, principally in “Item 4. Information on the Company” and “Item 5. Operating and Financial Review and Prospects,” and include, but are not limited to, statements regarding our intent, belief or current expectations with respect to:

Because forward-looking statements are subject to risks and uncertainties, our actual results and performance could differ significantly from those anticipated in such statements and the anticipated events or circumstances might not occur. The risks and uncertainties include, but are not limited to:

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

The selected financial data presented below should be read in conjunction with our consolidated financial statements, including the notes thereto. Our consolidated financial statements have been audited by Ernst & Young Auditores Independentes S.S. The report of Ernst & Young Auditores Independentes S.S. on the consolidated financial statements appears elsewhere in this annual report.

The following table represents a summary of our selected financial data for the five years ended December 31, 2007. The data are derived from our consolidated financial statements, audited by Ernst & Young Auditores Independentes S.S, and should be read in conjunction with our consolidated financial statements, related notes, and other financial information included herein. For a discussion of the 2005 pro forma and 2004 data included herein, see the section captioned “Presentation of Information—Presentation of Financial Information.”

| | | | Year Ended December 31, | |

| | | | 2007 U.S.$ | | | | 2007 R$ | | | | | | | | | 2005 (1) (2) pro forma as adjusted R$ | | | | | | 2004 (1) (2) pro forma as adjusted R$ | | | | 2003 R$ | |

| | | (millions of reais or U.S. dollars, unless otherwise indicated) | |

| Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Brazilian GAAP | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net operating revenue | | | 7,024.0 | | | | 12,441.6 | | | | 10,138.2 | | | | 2,918.2 | | | | 8,368.1 | | | | 2,564.6 | | | | 6,253.8 | | | | 1,088.3 | |

| Cost of goods and services | | | (3,800.5 | ) | | | (6,731.8 | ) | | | (5,530.0 | ) | | | (1,383.1 | ) | | | (4,650.8 | ) | | | (1,302.5 | ) | | | (3,971.9 | ) | | | (578.0 | ) |

| Gross profit | | | 3,223.5 | | | | 5,709.8 | | | | 4,608.2 | | | | 1,535.1 | | | | 3,717.3 | | | | 1,262.1 | | | | 2,281.9 | | | | 510.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selling expenses | | | (2,196.6 | ) | | | (3,890.9 | ) | | | (3,250.9 | ) | | | (798.1 | ) | | | (3,067.7 | ) | | | (647.3 | ) | | | (2,191.5 | ) | | | (230.5 | ) |

| General and administrative expenses | | | (583.1 | ) | | | (1,032.8 | ) | | | (954.9 | ) | | | (185.9 | ) | | | (795.2 | ) | | | (182.4 | ) | | | (613.8 | ) | | | (94.9 | ) |

| Other net operating expense | | | (135.4 | ) | | | (239.9 | ) | | | (200.3 | ) | | | (25.3 | ) | | | (255.5 | ) | | | 1.6 | | | | (322.8 | ) | | | (27.3 | ) |

| Equity investment | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (3.3 | ) |

| Operating income (loss) before financial income (expenses) | | | 308.4 | | | | 546.2 | | | | 202.1 | | | | 525.8 | | | | (401.1 | ) | | | 434.0 | | | | (846.2 | ) | | | 154.3 | |

| Net financial income (expense) | | | (157.5 | ) | | | (278.9 | ) | | | (287.0 | ) | | | 63.3 | | | | (350.1 | ) | | | 51.1 | | | | (201.5 | ) | | | 25.8 | |

| Operating income (loss) | | | 150.9 | | | | 267.3 | | | | (84.9 | ) | | | 589.1 | | | | (751.2 | ) | | | 485.1 | | | | (1,047.7 | ) | | | 180.1 | |

| Net non-operating income (expense) | | | (13.8 | ) | | | (24.4 | ) | | | 2.5 | | | | (2.2 | ) | | | (5.5 | ) | | | (4.6 | ) | | | (12.1 | ) | | | 12.9 | |

| Income (loss) before taxes and minority interests | | | 137.1 | | | | 242.9 | | | | (82.4 | ) | | | 586.9 | | | | (756.7 | ) | | | 480.5 | | | | (1,059.8 | ) | | | 193.0 | |

| Income and social contribution taxes | | | (94.2 | ) | | | (166.8 | ) | | | (203.1 | ) | | | (140.5 | ) | | | (176.1 | ) | | | (153.8 | ) | | | (157.1 | ) | | | (42.4 | ) |

| Minority interests | | | - | | | | - | | | | - | | | | (21.5 | ) | | | (21.5 | ) | | | (70.1 | ) | | | (70.1 | ) | | | (29.8 | ) |

| Net income (loss) | | | 42.9 | | | | 76.1 | | | | (285.5 | ) | | | 424.9 | | | | (954.3 | ) | | | 256.6 | | | | (1,287.0 | ) | | | 120.8 | |

Net income (loss) per share in 2007 and per 1,000 shares outstanding in 2006 to 2003 (reais) | | | 0.0 | | | | 0.03 | | | | (0.12 | ) | | | 0.48 | | | | n/a | | | | 0.38 | | | | n/a | | | | 0.34 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Number of shares outstanding: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common shares (in millions) | | | n/a | | | | 795 | | | | 793,544 | | | | 299,611 | | | | n/a | | | | 264,793 | | | | n/a | | | | 134,453 | |

| Preferred shares (in millions) | | | n/a | | | | 1,539 | | | | 1,536,171 | | | | 579,965 | | | | n/a | | | | 437,712 | | | | n/a | | | | 222,025 | |

| Dividends per share in 2007 and per 1,000 shares in 2006 to 2003 – reais(3) | | | n/a | | | | 0.14 | | | | 0.19 | | | | 0.14 | | | | n/a | | | | 0.10 | | | | n/a | | | | 0.10 | |

| Dividends per share in 2007 and per 1,000 shares in 2006 to 2003 – in U.S. dollars (4) | | | n/a | | | | 0.08 | | | | 0.09 | | | | 0.06 | | | | n/a | | | | 0.04 | | | | n/a | | | | 0.03 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

U.S. GAAP(5) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net operating revenues | | | 7,053.6 | | | | 12,494.0 | | | | 10,165.4 | | | | 8,329.9 | | | | - | | | | 6,114.8 | | | | - | | | | 2,110.3 | |

| Operating income (expense) | | | 265.1 | | | | 469.6 | | | | 127.6 | | | | (510.4 | ) | | | - | | | | (983.0 | ) | | | - | | | | 420.0 | |

| Net income (loss) | | | 51.9 | | | | 92.0 | | | | (217.9 | ) | | | (950.7 | ) | | | - | | | | (1,303.1 | ) | | | - | | | | 318.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Brazilian GAAP | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property, plant and equipment, net | | | 3,964.2 | | | | 7,021.8 | | | | 7,185.9 | | | | 1,872.7 | | | | 7,815.9 | | | | 1,663.5 | | | | 6,807.4 | | | | 696.0 | |

| Total assets | | | 8,212.2 | | | | 14,546.3 | | | | 14,200.1 | | | | 4,457.4 | | | | 15,233.9 | | | | 3,665.5 | | | | 13,083.3 | | | | 1,636.7 | |

| Loans, financing and debentures | | | 1,194.9 | | | | 2,116.6 | | | | 2,173.7 | | | | 129.0 | | | | 1,819.6 | | | | 104.1 | | | | 593.5 | | | | 82.2 | |

| Shareholders’ equity | | | 4,375.6 | | | | 7,750.5 | | | | 7,886.4 | | | | 2,714.8 | | | | 8,622.7 | | | | 1,999.0 | | | | 7,575.8 | | | | 927.0 | |

| Capital stock | | | 4,262.7 | | | | 7,550.5 | | | | 7,512.7 | | | | 1,472.1 | | | | 7,455.9 | | | | 884.5 | | | | 6,503.7 | | | | 369.2 | |

U.S. GAAP(5) | | | | | | | | | | | | | | | | | | | | | | | | |

| Property, plant and equipment, net | | | 3,904.9 | | | | 6,916.9 | | | | 7,028.8 | | | | 7,714.0 | | | | - | | | | 6,766.2 | | | | - | | | | 1,449.6 | |

| Total assets | | | 8,267.8 | | | | 14,644.8 | | | | 14,271.9 | | | | 15,417.2 | | | | - | | | | 13,060.7 | | | | - | | | | 3,436.9 | |

| Loans and financing | | | 1,180.0 | | | | 2,090.1 | | | | 2,140.9 | | | | 1,808.8 | | | | - | | | | 592.0 | | | | - | | | | 178.6 | |

| Shareholders’ equity | | | 4,452.4 | | | | 7,886.6 | | | | 8,154.9 | | | | 8,665.5 | | | | - | | | | 7,420.1 | | | | - | | | | 1,964.6 | |

| (1) | The pro forma information 2005 and 2004 reflects the TIM Celular Acquisition as if it had occurred on January 1, 2004 for Statement of Operations information, and on December 31, 2004 for balance sheet information. For an explanation on how pro forma amounts have been calculated, including the adjustments made, see “Presentation of Information—Presentation of Financial Information.” |

| (2) | The 2006, 2005, 2005 pro forma, 2004 and 2004 pro forma as adjusted, recorded when applicable: reclassification of the amortization of the tax benefit related to the goodwill paid in the privatization from other net operating expense to income and social contribution taxes, reclassification of PIS/COFINS tax credit, previously recorded as other net operating expenses, to credit in deductions from revenues and credit net financial income, reclassification of income tax on remittance from net financial expense to cost of services and adjustment of income tax incentive (Adene) to the net income (loss), resulting from the change in accounting principles, see note 3-b and d to our consolidated financial statements. |

| (3) | Dividends per share have been computed as the sum of dividends and interest on shareholders’ equity (“juros sobre capital próprio,” according to Brazilian law), an alternative under Brazilian Corporations Law to the distribution of dividends to shareholders. The distribution of dividends and interest on shareholders’ equity, in each year, proceeded according to the terms set forth by our common shareholders, at the relevant annual general meeting. Dividends per share have been determined as the sum of declared dividends and interest on shareholders’ equity, divided by the total number of common shares and preferred shares outstanding as of the common shareholders’ meeting date. See “Item 10.E. Additional Information—Taxation—Brazilian Tax Considerations―Distribution of Interest on Capital.” |

| (4) | Amounts expressed in U.S. dollars, according to the exchange rate applicable at the date of the relevant shareholders’ general meeting that approved the distribution of dividends and interest on shareholders’ equity. |

| (5) | The U.S. GAAP amounts of TIM Participações S.A. reflect the TIM Celular Acquisition considered a business combination under common control similar to a pooling-of-interest. Accordingly, such exchange of shares was accounted for at historical carrying values. |

Brazilian Economic Environment

Our business, prospects, financial condition and results of operations are dependent on general economic conditions in Brazil.

The Brazilian economy has shown greater stability since the current federal administration took office in January 2003. Overall, the Federal Government continues the macroeconomic policy of the previous administration by giving priority to fiscal responsibility.

Between December 31, 2004 and 2005, the real appreciated 11.8% against the U.S. dollar. Despite this appreciation, the country had a positive current account balance of US$44.8 billion for 2005, its highest surplus ever. The average unemployment rate decreased from 9.6% as of December 31, 2004 to 8.3% as of December 31, 2005 in the country’s main metropolitan regions, in accordance with estimates disclosed by the IBGE. In 2005, the average inflation rate, as measured by the IPCA, was 5.7%, and the average TJLP interest rate was 9.8%. In the same year, the GDP grew 3.2%.

In 2006, this trend was maintained and the real appreciated 8.7% against the U.S. dollar between December 31, 2005 and 2006. Despite this appreciation, the country had a positive current account balance of US$6.3 billion. For the fourth consecutive year, the Current Transactions/PIB ratio, an indicator of vulnerability to international financial crises, was positive, showing the country’s lower exposure to risk. The average unemployment rate increased to 10.0% as of December 31, 2006 in the country’s main metropolitan regions, in accordance with estimates disclosed by the IBGE. In 2006, the inflation rate, as measured by the IPCA, was 3.1%, and the average TJLP interest rate was 6.8%. International reserves also reached record levels and the highest quality thus far, reducing the presence of short-term capital.

Macroeconomic results for 2007 indicate accelerated economic growth and monetary stability. An exchange rate depreciation of 17.2% over the year contributed to an even higher reduction in the inflation rate, as measured by the IPCA. The inflation rate for 2007 reached 4.6%, being within the target range established by the Comitê de Política Monetária (Brazilian Monetary Policy Committee), or COPOM. Externally, the accumulated trade surplus as of December 31, 2007, having reached US$40 billion, was relatively lower than that recorded for both 2005 and 2006; however, the country’s international reserves continued to increase. The average unemployment rate decreased to 7.4% as of December 31, 2007 in the country’s main metropolitan regions, in accordance with estimates disclosed by the IBGE. Accelerated economic growth towards the end of 2006 continued throughout 2007. Among the factors contributing for a stronger economic growth in 2007 are the continuing reduction in the basic interest rate, which stabilized at 11.25% in September, and the evolution of the credit supply.

The table below sets forth data regarding GDP growth, inflation, interest and real/U.S. dollar exchange rates in the periods indicated:

| | | For the Year Ended December 31, | |

| | | 2005 | | | 2006 | | | 2007 | |

GDP growth (1) | | | 3.2% | | | | 3.8% | | | | 5.4% | |

Inflation (IGP-M) (2) | | | 1.2% | | | | 3.9% | | | | 7.8% | |

Inflation (IPCA) (3) | | | 5.7% | | | | 3.1% | | | | 4.6% | |

DI Rate (4) | | | 18.2% | | | | 13.1% | | | | 11.8% | |

TJLP (5) | | | 9.8% | | | | 6.8% | | | | 6.2% | |

| Appreciation (devaluation) of the Real against the U.S. dollar | | | 11.8% | | | | 8.7% | | | | 17.2% | |

| Exchange rate (closing)—R$ per US$1.00 | | | R$2.341 | | | | R$2.138 | | | | R$1.771 | |

Average exchange rate—R$ per US$1.00 (6) | | | R$2.435 | | | | R$2.177 | | | | R$1.948 | |

| (1) | The Brazilian GDP for 2005, 2006 and 2007 was calculated using the new procedures adopted by the IBGE |

| (2) | Inflation (IGP-M) is the general market price index as measured by FGV, and represents data accumulated over the 12 months in each year ended December 31, 2005, 2006 and 2007. |

| (3) | Inflation (IPCA) is a consumer price index measured by IBGE, and represents data accumulated over the 12 months in each year ended December 31, 2005, 2006 and 2007. |

| (4) | The DI rate is the average inter-bank deposit rate performed during the day in Brazil (accrued as of the last month of the period, annualized). |

| (5) | Represents the interest rate applied by BNDES in long-term financings (end of the period). |

| (6) | Average exchange rate on the last day of each year. |

Sources: BNDES, Central Bank, FGV and IBGE.

Exchange Rates

We pay any cash dividends, interest on shareholders’ equity and any other cash distributions with respect to our preferred shares in reais. Accordingly, exchange rate fluctuations will affect the U.S. dollar amounts received by the holders of ADSs on conversion by the Depositary of dividends and other distributions in Brazilian currency on our preferred shares represented by ADSs. Fluctuations in the exchange rate between Brazilian currency and the U.S. dollar will affect the U.S. dollar equivalent price of our preferred shares on the Brazilian stock exchanges. In addition, exchange rate fluctuations may also affect our dollar equivalent results of operations. See “Item 5. Operating and Financial Review and Prospects.”

Prior to March 14, 2005, there were two principal legal foreign exchange markets in Brazil:

| | · | the commercial rate exchange market; and |

| | · | the floating rate exchange market. |

Most trade and financial foreign-exchange transactions were carried out on the commercial rate exchange market. These transactions included the purchase or sale of shares or payment of dividends or interest with respect to shares. Foreign currencies could only be purchased in the commercial exchange market through a Brazilian bank authorized to operate in these markets. In both markets, rates were freely negotiated and could be influenced by Central Bank intervention.

Resolution No. 3.265 by the National Monetary Council, dated March 4, 2005, consolidated the foreign exchange markets into one single foreign exchange market, effective as of March 14, 2005. All foreign exchange transactions are now carried out through institutions authorized to operate in the consolidated market and are subject to registration with the Central Bank’s electronic registration system. Foreign exchange rates continue to be freely negotiated, but may be influenced by Central Bank intervention.

Since 1999, the Central Bank has allowed the real/U.S. dollar exchange rate to float freely, and during that period, the real/U.S. dollar exchange rate has fluctuated considerably. In the past, the Central Bank has intervened occasionally to control unstable movements in foreign exchange rates. We cannot predict whether the Central Bank or the Brazilian government will continue to let the real float freely or will intervene in the exchange rate market through a currency band system or otherwise. The real may depreciate or appreciate against the U.S. dollar substantially in the future. For more information on these risks, see “—D. Risk Factors—Risks Relating to Brazil.”

The following table shows the selling rate for U.S. dollars for the periods and dates indicated. The information in the “Average” column represents the annual average of the exchange rates during the periods presented.

| | | | |

| | | | | | | | | | | | |

| 2003 | | | 3.5637 | | | | 2.8219 | | | | 3.0711 | | | | 2.8892 | |

| 2004 | | | 3.2051 | | | | 2.6544 | | | | 2.9257 | | | | 2.6544 | |

| 2005 | | | 2.7621 | | | | 2.1633 | | | | 2.4341 | | | | 2.3407 | |

| 2006 | | | 2.3711 | | | | 2.0586 | | | | 2.1771 | | | | 2.1380 | |

| 2007 | | | 2.1520 | | | | 1.7325 | | | | 1.9483 | | | | 1.7713 | |

| | | | |

| | | | | | |

| November 2007 | | | 1.8501 | | | | 1.7325 | |

| December 2007 | | | 1.8233 | | | | 1.7616 | |

| January 2008 | | | 1.8301 | | | | 1.7414 | |

| February 2008 | | | 1.7674 | | | | 1.6660 | |

| March 2008 | | | 1.7597 | | | | 1.6625 | |

| April 2008 | | | 1.7399 | | | | 1.6548 | |

| May 2008(through May 27, 2008) | | | 1.6968 | | | | 1.6410 | |

Source: Central Bank/Bloomberg

Brazilian law provides that, whenever there is a serious imbalance in Brazil’s balance of payments or serious reasons to foresee such imbalance, temporary restrictions may be imposed on remittances of foreign capital abroad. For approximately six months in 1989, and early 1990, for example, the Federal Government froze all dividend and capital repatriations that were owed to foreign equity investors. These amounts were subsequently released in accordance with Federal Government directives. There can be no assurance that similar measures will not be taken by the Federal Government in the future.

B. Capitalization and Indebtedness

Not applicable

C. Reasons for the Offer and Use of Proceeds

Not applicable

D. Risk Factors

This section is intended to be a summary of more detailed discussions contained elsewhere in this annual report. The risks described below are not the only ones we face. Our business, results of operations or financial condition could be harmed if any of these risks materializes and, as a result, the trading price of our shares and our ADSs could decline.

Risks Relating to our Business

We face increasing competition, which may adversely affect our results of operations.

The opening of the Brazilian market to competition for telecommunications services has adversely affected the industry’s historical margins. Due to additional Personal Communication Services (“PCS”) providers that have commenced operations in recent years, we are facing increased competition throughout Brazil. We compete not only with companies that provide wireless services and trunking, but also with companies that provide fixed-line telecommunications and Internet access services, because of the trend toward the convergence and substitution of mobile services for these and other services and a trend of bundling PCS services with Internet and other services. As a result, the cost of maintaining our market share has increased and in the future we may incur higher advertising and other costs as we attempt to maintain or expand our presence in the market. Claro and Vivo received authorization to provide PCS in the same regions as TIM, completing their national coverage. Also Oi received authorization to provide PCS service in São Paulo State.

We also expect to face increased competition from other wireless telecommunications services, such as digital trunking, because these services are generally less expensive than cellular telecommunications services. In addition, technological changes in the telecommunications field, such as the development of 3G and VOIP, are expected to introduce additional sources of competition.

This increasing competition may increase the rate of customer turnover and could continue to adversely affect our market share and margins. Our ability to compete successfully will depend on the effectiveness of our marketing and our ability to anticipate and respond to developments in the industry, including new services that may be introduced, changes in consumer preferences, demographic trends, economic conditions and discount pricing strategies by competitors. Additionally, we may face competitors with greater access to financial resources and capital markets than ours. We cannot predict which of many possible factors will be important in maintaining our competitive position or what expenditures will be required to develop and provide new technologies, products or services. If we are unable to compete successfully, our business, financial condition and results of operations will be materially adversely affected.

There is a perspective of changing the current rules for service exploration may cause an unbalanced competition between fixed incumbent and other players. Example the merger project between the two concessionaires Oi and Brasil Telecom would represent a step back from the liberalization architecture and would hamper competition if not counterbalanced by appropriate regulatory measures (like Local Loop Unbundling obligations).

Anatel is expected to auction bandwidths in the 3.5 and 10.5 GHZ (WI-MAX) spectrum to provide broadband wireless and fixed telephony services. Anatel cancelled the auction scheduled to take place in 2006. New bidding terms have not yet been made public and according to information currently available from Anatel, the new auction will take place probably in the second half of 2008. Purchasers of these bandwidths may offer services that could compete with our services. TIM intends to bid for this band.

We may be unable to respond to the recent trend towards consolidation in the Brazilian wireless telecommunications market.

The Brazilian telecommunication market has been consolidating and we believe such trend is likely to continue. Additional joint ventures, mergers and acquisitions among telecommunications service providers are possible in the future. If such consolidation occurs, it may result in increased competition within our market. We may be unable to adequately respond to pricing pressures resulting from consolidation in our market, adversely affecting our business, financial condition and results of operations.

We may not receive as much interconnection revenue as we receive today.

Beginning in July 2004, interconnection charges became freely negotiated by cellular telecommunications service providers in Brazil, pursuant to rules issued by Anatel. As a result, the interconnection fees we are able to charge in the past have decreased, after adjustment for inflation. The interconnection fees we charge may continue to decrease and as a result, we may receive less interconnection revenue than we presently do, which may have an adverse effect on our business, financial condition and results of operations.

We may face difficulties responding to new telecommunications technologies.

The Brazilian wireless telecommunications market is experiencing significant technological changes, as evidenced by, among other factors:

| | · | the changing regulatory environment, such as the introduction of numbering portability; |

| | · | shorter time periods between the introduction of new telecommunication products and their required enhancements or replacements; |

| | · | ongoing improvements in the capacity and quality of digital technology available in Brazil; |

| | · | the introduction of Third Generation (“3G”) mobile telephony services; and |

| | · | the anticipated auction of licenses for the operation of 3.5 GHz and 10.5 GHz with limited mobility. |

Our business is dependent on our ability to expand our services and to maintain the quality of the services provided.

Our business, as a cellular telecommunications services provider, depends on our ability to maintain and expand our cellular telecommunications services network. We believe that our expected growth will require, among other things:

| | · | continuous development of our operational and administrative systems; |

| | · | increasing marketing activities; and |

| | · | attracting, training and retaining qualified management, technical and sales personnel. |

These activities are expected to place significant demand on our managerial, operational and financial resources. Failure to manage successfully our expected growth could reduce the quality of our services, with adverse effects on our business, financial condition and results of operations.

Our operations are dependent upon our ability to maintain and protect our network. Damage to our network and backup systems could result in service delays or interruptions and limit our ability to provide customers with reliable service over our network. The occurrence of any such events may adversely affect our business, financial condition or operating results.

Our operations depend on our ability to maintain, upgrade and efficiently operate accounting, billing, customer service, information technology and management information systems.

Sophisticated information and processing systems are vital to our growth and our ability to monitor costs, render monthly invoices for services, process customer orders, provide customer service and achieve operating efficiencies. There can be no assurance that we will be able to successfully operate and upgrade our accounting, information and processing systems or that they will continue to perform as expected. Any failure in our accounting, information and processing systems could impair our ability to collect payments from customers and respond satisfactorily to customer needs, which could adversely affect our business, financial condition and operating results.

We may experience a high rate of customer turnover which could increase our costs of operations and reduce our revenue.

Churn reflects the number of customers who have their service terminated during a period, expressed as a percentage of the simple average of customers at the beginning and end of the period. Our high churn rates are primarily a result of our competitors’ aggressive subsidization of handset sales, adverse macroeconomic conditions in Brazil and our strict policy of terminating customers who do not continue to use our services or do not pay their bills. As indicated by our past rates of customer churn, we may experience a high rate of customer turnover which could increase our cost of operations and reduce our revenue.

Our controlling shareholder may exercise its control in a manner that differs from the interests of other shareholders.

Telecom Italia, through its indirect full ownership of TIM Brasil, our controlling shareholder, and TIM Brasil, each have the ability to determine actions that require shareholder approval, including the election of a majority of our directors and, subject to Brazilian law, the payment of dividends and other distributions. Telecom Italia or TIM Brasil may exercise this control in a manner that differs from the best interests of other shareholders.

Certain debt agreements of our subsidiaries contain financial covenants, and any default under such debt agreements may have a material adverse effect on our financial condition and cash flows.

Certain of our subsidiaries’ existing debt agreements contain restrictions and covenants and require the maintenance or satisfaction of specified financial ratios and tests. The ability of our subsidiaries to meet these financial ratios and tests can be affected by events beyond our and their control, and we cannot assure that they will meet those tests. Failure to meet or satisfy any of these covenants, financial ratios or financial tests could result in an event of default under these agreements. As of December 31, 2007, our subsidiaries, had approximately R$2.1 billion in consolidated outstanding indebtedness. If we are unable to meet these debt service obligations, or comply with the debt covenants, we could be forced to restructure or refinance this indebtedness, seek additional equity capital or sell assets.

In addition, because of our net debt position in 2007 of R$973.2 million (change from 2006 to 2007 in loans plus accrued interests less cash and cash equivalents and short term investments), we may need additional funding to meet our obligations and to conduct our activities and in the event public or private financial is unavailable, our financial condition and results and, consequently, the market price for our shares may be adversely affected.

We face risks associated with litigation.

We and our subsidiaries are party to a number of lawsuits and other proceedings. An adverse outcome in, or any settlement of, these or other lawsuits could result in significant costs to us. In addition, our senior management may be required to devote substantial time to these lawsuits, which they could otherwise devote to our business. See “Item 8.A. Financial Information—Consolidated Statements and Other Financial Information—Legal Proceedings.”

Any modification or termination of our ability to use the “TIM” tradename may adversely affect our business and operating results.

Telecom Italia owns the property rights to the “TIM” tradename. Telecom Italia may stop us from using the TIM trade name any time. The loss of the use of the “TIM” trade name could have a material adverse effect on our business and operating results.

The shareholding structure of our parent company, Telecom Italia S.p.A, has undergone relevant changes.

On April 28, 2007, Assicurazioni Generali S.p.A, Intesa San Paolo S.p.A, Mediobanca S.p.A., Sintonia S.p.A and Telefónica S.A. entered into an agreement to acquire the entire share capital of Olimpia S.p.A., a company which, at the time, held approximately 18% of the voting capital of Telecom Itália S.p.A., our indirect parent company. This acquisition was made through Telco S.p.A. (“Telco”). With the conclusion of the transaction and the subsequent merger of Olimpia S.p.A. with and into Telco (December 2007), Telco came to hold 23.6% and it presently holds 24.5% of the voting capital of Telecom Italia S.p.A., the indirect parent company of TIM Participações.

The Brazilian telecommunications regulator, Anatel, approved the acquisition of Olimpia by Telco, but imposed certain restrictions to guarantee the total segregation of the business and operations of the two groups, Telefónica and TIM, in Brazil. We cannot guarantee that Anatel will approve the measures we have either taken or proposed to comply with its ruling.

Telco's acquisition of Olimpia is also being analyzed by the Brazilian antitrust authority (CADE) in a proceeding to which TIM is not a party filed by Telco's shareholders, and is subject to CADE's approval.

The consequences in case (i) Anatel understands that the measures being taken or proposed to segregate the businesses of TIM and Vivo in Brazil are not sufficient; or (2) the Brazilian antitrust authority does not approve the transaction, are currently unpredictable and may have adverse effects on TIM's business and results. See "Item 4.A. Information on the Company — A History and Development of the Company — Recent Developments — Acquisition of Olimpia S.p.A."

Risks Relating to the Brazilian Telecommunications Industry

We may be classified by Anatel as an economic group with significant market power, which will subject us to increased regulation.

In 2005, Anatel issued specific regulations regarding telecommunications service providers with significant market power. Anatel has indicated that it will establish more stringent regulation for economic groups with significant market power in order to ensure competition. We cannot give assurance that we will not be deemed to have significant market power, and thus be subject to increased regulatory requirements.

In July 2006, Anatel issued regulation regarding the remuneration of mobile operators network and brought to the mobile industry the concept of significant market power. Under such regulation, the VU-M value is freely negotiated between operators, but in case of no successful negotiation from a future date to be established by Anatel, as an arbitration procedure, the Agency will determine, based on a fully allocated cost model, a reference value for a network usage fee (VU-M) of companies that are deemed to hold significant market power. Such value will be reassessed every 3 years. In order to determine the companies that have a significant market power in the mobile interconnection market, Anatel will consider: market share in the mobile interconnection market and in the mobile services market, economies of scope and scale, dominance of infrastructure that is not economically viable to duplicate, existence of negotiation power to acquire equipments and services, existence of vertical integration, existence of barriers to entry, access to financing sources. For purposes of the mobile network remuneration rules until Anatel defines which groups have significant market power, all groups that include a SMP provider will be considered as having a significant market power in the offer of mobile interconnection in their respective services areas.

We are subject to various obligations in the performance of our activities with which we may be unable to comply.

In the performance of our telecommunications services, we are subject to compliance with various legal and regulatory obligations including, but not limited to, the obligations arising from the following:

| | · | the rules set forth by Anatel, the primary telecommunications industry regulator in Brazil; |

| | · | the PCS authorizations under which we operate our cellular telecommunications business; |

| | · | the fixed authorizations (local, national long distance and international long distance under and multimedia service which we operate our telecommunications business; |

| | · | the Consumer Defense Code; and |

| | · | the General Telecommunications Law (Lei No. 9,472/97, as amended). |

We believe that we are currently in material compliance with our obligations arising out of each of the above referenced laws, regulations and authorizations. However, in light of the administrative proceedings for breach of quality standards brought since December 2004 by Anatel against TIM Celular and TIM Nordeste we cannot provide any assurance that we are in full compliance with our quality of service obligations under the PCS authorizations. In fact, there are some administrative proceedings regarding non compliance with quality goals and regulatory obligations that resulted in fees applied by Anatel on TIM Celular and TIM Nordeste. For more information, see “Item 8.A. Financial Information—Consolidated Statements and Other Financial Information—Legal Proceedings”. In addition, we cannot assure that we will be able to fully comply with each of the above referenced laws, regulations and authorizations or that we will be able to comply with future changes in the laws and regulations to which we are subject. These regulatory developments or our failure to comply with them could have a material adverse effect on our business, financial condition and results of operations.

Extensive government regulation of the telecommunications industry may limit our flexibility in responding to market conditions, competition and changes in our cost structure.

Our business is subject to extensive government regulation, including any changes that may occur during the period of our concession to provide telecommunication services. Anatel, which is the main telecommunications industry regulator in Brazil, regulates, among others:

| | · | industry policies and regulations; |

| | · | rates and tariffs for telecommunications services; |

| | · | telecommunications resource allocation; |

| | · | interconnection and settlement arrangements; and |

| | · | universal service obligations. |

This extensive regulation and the conditions imposed by our authorization to provide telecommunication services may limit our flexibility in responding to market conditions, competition and changes in our cost structure.

Our authorizations may be terminated by the Brazilian government under certain circumstances or we may not receive renewals of our authorizations.

We operate our business under authorizations granted by the Brazilian government. As a result, we are obligated to maintain minimum quality and service standards, including targets for call completion rates, geographic coverage and voice channel traffic rates, user complaint rates and customer care call completion rates. Our ability to satisfy these standards, as well as others, may be affected by factors beyond our control. We cannot assure you that, going forward, we will be able to comply with all of the requirements imposed on us by Anatel or the Brazilian government. Our failure to comply with these requirements may result in the imposition of fines or other government actions, including, in an extreme situation, the termination of our authorizations in the event of material non-compliance.

Our radio frequency authorizations for the 800 MHz, 900 MHz and 1800 MHz bands that we use to provide PCS services started to expire in September 2007 (under the Term of Authorization for the State of Paraná except the Londrina and Tamarana municipalities) and are renewable for one additional 15-year period, requiring payment at every two-year period of the equivalent to 2% (two percent) of the prior year’s revenue net of taxes, by way of investment under the Basic and Alternative Service Plans.

The TIM Celular’s authorization to operate in the State of Paraná, except in Londrina and Tamarana municipalities, was extended to September 3, 2022, in accordance with Act 57.551 of April 13, 2006. The first payment under this authorization is due on April 30, 2009.

The radiofrequencies authorizations for the 800 MHz, 900 MHz and 1800 MHz that will expire in 2008 are the following:

September 03, 2008 - TIM Celular (Santa Catarina)

November 28, 2008 - TIM Nordeste (Ceará)

December 15, 2008 - TIM Nordeste (Alagoas)

December 31, 2008 - TIM Nordeste (Paraíba and Rio Grande do Norte)

We have already requested Anatel the renewal of such authorizations whose approvals should occur closely to the dates mentioned above.

Any partial or total revocation of our authorizations or failure to receive renewal of such authorizations when they expire would have a material adverse effect on our financial condition and results of operations.

The telecommunications industry is subject to rapid technological changes and these changes could have a material adverse effect on our ability to provide competitive services.

The telecommunications industry is subject to rapid and significant technological changes. For example, the telecommunications industry is preparing the introduction of Third Generation (“3G”) mobile telephone services which may be accomplished through the offer of additional radiofrequencies or new licenses by Anatel or a combination of both. Our future success depends, in part, on our ability to anticipate and adapt in a timely manner to technological changes. We expect that new products and technologies will emerge and that existing products and technologies will be further developed.

The advent of new products and technologies could have a variety of consequences for us. New products and technologies may reduce the price of our services by providing lower-cost alternatives, or they may also be superior to, and render obsolete, the products and services we offer and the technologies we use, thus requiring investment in new technology. If such changes do transpire, our most significant competitors in the future may be new participants in the market without the burden of any installed base of older equipment. The cost of upgrading our products and technology to continue to compete effectively could be significant.

Due to the nature of our business we are exposed to numerous consumer claims and tax-related proceedings.

Our business exposes us to a variety of lawsuits brought by or on behalf of consumers that are inherent in the mobile telecommunications industry in Brazil. Currently, we are subject to a number of public civil actions and class actions that have been brought against mobile telecommunications providers in Brazil relating principally to the expiration of prepaid usage credits, minimum term clauses, subscription fees and the use of land to install our network sites. These suits include claims contesting certain aspects of the fee structure of our prepaid and postpaid plans which are commonplace in the Brazilian telecommunications industry.

In addition, federal and state tax authorities in Brazil have brought actions challenging the tax treatment of certain components of the service revenues earned by mobile telecommunications providers, such as the application of ICMS to activation fees and monthly subscription charges. As of December 2007, we are subject to approximately 801 tax-related lawsuits and administrative proceedings with an aggregate value of approximately R$1,211.1 billion. See “Item 8.A. Financial Information—Consolidated Statements and Other Financial Information—Legal Proceedings”.

Although many of these consumer and tax claims relate to general business practices in the Brazilian mobile telecommunications industry, adverse determinations could have an adverse affect on our business practices and results of operations.

The mobile industry, including us, may be harmed by reports suggesting that radio frequency emissions cause health problems and interfere with medical devices.

Media and other reports have suggested that radio frequency emissions from wireless handsets and base stations may cause health problems. If consumers harbor health-related concerns, they may be discouraged from using wireless handsets. These concerns could have an adverse effect on the wireless communications industry and, possibly, expose wireless providers, including us, to litigation. We cannot assure you that further medical research and studies will refute a link between the radio frequency emissions of wireless handsets and base stations and these health concerns.

Government authorities could increase regulation of wireless handsets and base stations as a result of these health concerns or wireless companies, including us, could be held liable for costs or damages associated with these concerns, which could have an adverse effect on our business, financial condition and results of operation. The expansion of our network may be affected by these perceived risks if we experience problems in finding new sites, which in turn may delay the expansion and may affect the quality of our services. On July 2, 2002, Anatel published Resolution No. 303 that limits emission and exposure for fields with frequencies between 9 kHz and 300 GHz. In addition, the Brazilian government is developing specific legislation for the deployment of radio frequency transmission stations that will supersede the existing state and municipal laws. The new laws may create additional transmission regulations which, in turn, could have an adverse effect on our business.

The new index applied for the remuneration for the use of SMP’s network may not be adequate.

As of 2006, Anatel uses IST index (Índice de Serviços de Telecomunicações) to adjust STFC Concessionaries’ rates, Industrial Exploration of Dedicated Lines (“Exploração Industrial de Linha Dedicada” or “EILD”) and remuneration for the use of Personal Communication Service (“Serviço Móvel Pessoal” or “SMP”), which substitutes the General Price Index, or the IGP-DI (the Índice Geral de Preços Disponibilidade Interna), an inflation index developed by the Fundação Getulio Vargas, a private Brazilian foundation. Thus, the prices we may charge for our services may be indirectly impacted by such new index. Anatel begins to regulate the telecommunications industry based on a model that analyzes companies costs based on a hypothetical company’s costs and other factors. If this new adjustment mechanism, or any other mechanism chosen by the Anatel in the future, does not adequately reflect the true effect of inflation on our prices, our results of operations could be adversely affected.

Anatel’s proposal regarding the consolidation of prices could have an adverse effect on our results.

Anatel issued new regulations on interconnection rules, some of which could have an adverse effect on our results. The rules that may adversely affect our results are (1) Anatel had defined clearly that same SMP provider with different authorization areas receive only one instead of two interconnection charges (VU-M) for long distance calls originated and terminated in their networks, and (2) if the free-market negotiation of prices for VU-M does not reach success, Anatel can, as from April 2010, apply the Full Allocated Cost model. These regulations can have an adverse effect on our results of operations because (1) our interconnection charges would drop significantly, thereby reducing our revenues, and (2) Anatel may allow more favorable prices for economic groups without significant market power.

Anatel´s new regulation on number portability could have an adverse effect on our results.

Anatel issued in March 2007 regulation regarding the implementation of number portability in Brazil for fixed telephony and mobile services providers (SMP). Portability is limited to migration between providers of the same telecommunications services. For SMP providers, portability can take place when customer changes services provider within the same Registration Area as well as when customer changes the service plan of the same service provider. We expect number portability to increase competition between services providers and we are confident that due to our quality levels the implementation of such regulation will help us increase our customer base. If we are unable to maintain our quality levels, number portability could have an adverse effect on our client´s base and our results.

Risks Relating to Brazil

The Brazilian government has exerted significant influence over the Brazilian economy and continues to do so. This involvement, like local political and economic conditions, may have an adverse effect on our activities, our business, or the market prices of our shares and ADSs.

The Brazilian government has frequently intervened in the Brazilian economy and occasionally made drastic changes in economic policy. To influence the course of Brazil’s economy, control inflation and implement other policies, the Brazilian government has taken various measures, including the use of wage and price controls, currency devaluations, capital controls and limits on imports and freezing bank accounts. We have no control over, and cannot predict what measures or policies the Brazilian government may take or adopt in the future. Our business, financial condition, revenues, results of operations, prospects and the trading price of our units may be adversely affected by changes in government policies and regulations, as well as other factors, such as:

| | · | fluctuating exchange rates; |

| | · | liquidity in domestic capital and credit markets; |

| | · | reductions in salaries or income levels; |

| | · | rising unemployment rates; |

| | · | exchange controls and restrictions on remittances abroad; and |

| | · | other political, diplomatic, social or economic developments in or affecting Brazil. |

In the past, the performance of the Brazilian economy was affected by its political situation. Historically, political crises and scandals have affected the confidence of investors and the public in general, and have adversely affected the development of the economy and the market price of securities issued by Brazilian companies. We cannot predict what policies will be adopted by the Brazilian government and whether these policies will negatively affect the economy or our business or financial performance. We cannot predict whether the Brazilian government will intervene in the Brazilian economy in the future. Governmental actions may adversely affect our business by reducing demand for our services, increasing our costs, or limiting our ability to provide services. In addition, political uncertainties and scandals, social instability and other political or economic developments may have an adverse effect on us.

Tax reforms may affect our prices.

The Brazilian government has proposed tax reforms that are currently being considered by the Brazilian Congress. If we experience a higher tax burden as a result of the tax reform, we may have to pass the cost of that tax increase to our customers. This increase may have a material negative impact on the dividends paid by our subsidiaries to us and on our revenues and operating results.

Inflation, and government measures to curb inflation, may adversely affect the Brazilian economy, the Brazilian securities market, our business and operations and the market prices of our shares or the ADSs.

Historically, Brazil has experienced high rates of inflation. Inflation and some of the Brazilian government’s measures taken in an attempt to curb inflation have had significant negative effects on the Brazilian economy generally. Inflation, policies adopted to contain inflationary pressures and uncertainties regarding possible future governmental intervention have contributed to economic uncertainty and heightened volatility in the Brazilian securities market.

Since the introduction of the real in 1994, Brazil’s inflation rate has been substantially lower than in previous periods. According to the General Market Price Index (Índice Geral de Preços do Mercado, or IGP-M), a general price inflation index developed by Fundação Getulio Vargas, a private Brazilian foundation, the inflation rates in Brazil were 8.7% in 2003, 12.4% in 2004, 1.2% in 2005, 3.8% in 2006 and 7.7% in 2007. In addition, according to the National Extended Consumer Price Index (Índice Nacional de Preços ao Consumidor Amplo, or IPCA), published by the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística, or IBGE), the Brazilian price inflation rates were 12.5% in 2002, 9.3% in 2003, 7.6% in 2004, 5.7% in 2005, 3.1% in 2006 and 4.6% in 2007. The Brazilian government’s measures to control inflation have often included maintaining a tight monetary policy with high interest rates, thereby restricting availability of credit and reducing economic growth. Inflation, actions to combat inflation and public speculation about possible additional actions have also contributed materially to economic uncertainty in Brazil and to heightened volatility in the Brazilian securities markets.

Brazil may experience high levels of inflation in future periods. Periods of higher inflation may slow the rate of growth of the Brazilian economy, which could lead to reduced demand for our products in Brazil and decreased net sales. Inflation also is likely to increase some of our costs and expenses, which we may not be able to pass on to our customers and, as a result, may reduce our profit margins and net income. In addition, high inflation generally leads to higher domestic interest rates, and, as a result, the costs of servicing our debt may increase, resulting in lower net income. Inflation and its effect on domestic interest rates can, in addition, lead to reduced liquidity in the domestic capital and lending markets, which could affect our ability to refinance our indebtedness in those markets. Any decline in our net sales or net income and any deterioration in our financial condition would also likely lead to a decline in the market price of our shares and the ADSs.

Exchange rate movements may adversely affect our financial condition and results of operations.

The Brazilian currency has been devalued frequently over the past four decades. Throughout this period, the Brazilian government has implemented various economic plans and exchange rate policies, including sudden devaluations, periodic mini-devaluations (during which the frequency of adjustments has ranged from daily to monthly), exchange controls, dual exchange rate markets and a floating exchange rate system. From time to time, there have been significant fluctuations in the exchange rate between the Brazilian currency and the U.S. dollar and other currencies. For example, the real depreciated against the U.S. dollar by 15.7% in 2001 and 34.3% in 2002. Notwithstanding the fact that the real has appreciated 8.1%, 11.5%, 8.7% and 17.2%, in 2004, 2005, 2006 and 2007, respectively, there can be no guarantees as to whether the real will depreciate or appreciate against the U.S. dollar in the future.

Continuing appreciation of the real against the U.S. dollar may lead to a deterioration of the country’s current account and the balance of payments, as well as to a dampening of export-driven growth. Any such appreciation could reduce the competitiveness of our exports and adversely affect our net sales and our cash flows from exports. Devaluation of the real relative to the U.S. dollar could create additional inflationary pressures in Brazil by increasing the price of imported products which may result in the adoption of deflationary government policies. The sharp depreciation of the real in relation to the U.S. dollar may generate inflation and governmental measures to fight possible inflationary outbreaks, including the increase in interest rates. Devaluations of the real would reduce the U.S. dollar value of distributions and dividends on our preferred shares and ADSs and may also reduce the market value of such securities. Any such macroeconomic effects could adversely affect our net operating revenues and our overall financial performance.

We acquire our equipment and handsets from global suppliers, the prices of which are denominated in U.S. dollars. Depreciation of the real against the U.S. dollar may result in a relative increase in the price of our equipment and handsets. Thus, we are exposed to foreign exchange risk arising from our need to make substantial dollar-denominated expenditures, particularly for imported components, equipment and handsets, that we have limited capacity to hedge.

Fluctuations in interest rates may have an adverse effect on our business and the market prices of our shares or the ADSs.

The Central Bank establishes the basic interest rate target for the Brazilian financial system by reference to the level of economic growth of the Brazilian economy, the level of inflation and other economic indicators. From February to July 17, 2002, the Central Bank reduced the basic interest rate from 19% to 18%. From October 2002 to February 2003, the Central Bank increased the basic interest rate by 8.5 percentage points, to 26.5% on February 19, 2003. The basic interest rate continued to increase until June 2003 when the Central Bank started to decrease it. Subsequently, the basic interest rate suffered further fluctuations, and, in December 2007, the basic interest rate was 11.25%.

On December 31, 2007, all of our indebtedness was either denominated in reais and subject to Brazilian floating interest rates or subject to currency swaps that are tied to Brazilian floating interest rates, such as the Long-Term Interest Rate (Taxa de Juros de Longo Prazo, or TJLP), the interest rate used in our financing agreements with Brazilian National Bank for Economic and Social Development (Banco Nacional de Desenvolvimento Econômico e Social – BNDES, or BNDES), and the Interbank Deposit Certificate Rate (Certificado de Depositário Interbancário, or CDI rate), an interbank certificate of deposit rate that applies to our foreign currency swaps and some of our other real-denominated indebtedness. On December 31, 2007, R$2,145.9 million of our total consolidated indebtedness was subject to floating interest rates. Any increase in the CDI rate or the TJLP rate may have an adverse impact on our financial expenses and our results of operations.

Brazilian government exchange control policies could adversely affect our ability to make payments on foreign currency-denominated debt.

The purchase and sale of foreign currency in Brazil is subject to governmental control. In the past, the Central Bank has centralized certain payments of principal on external obligations. Many factors could cause the Brazilian government to institute a more restrictive exchange control policy, including, without limitation, the extent of Brazilian foreign currency reserves, the availability of sufficient foreign exchange, the size of Brazil’s debt service burden relative to the economy as a whole, Brazil’s policy towards the International Monetary Fund, or IMF, and political constraints to which Brazil may be subject. A more restrictive policy could affect the ability of Brazilian debtors (including us) to make payments outside of Brazil to meet foreign currency-denominated obligations.

Adverse changes in Brazilian economic conditions could cause an increase in customer defaults on their outstanding obligations to us, which could materially reduce our earnings.

Our operations are significantly dependent on our customers’ ability to make payments on their accounts. If the Brazilian economy worsens because of, among other factors, the level of economic activity, devaluation of the real, inflation or an increase in domestic interest rates, a greater portion of our customers may not be able to make timely payments for services, which would increase our past due accounts and could materially reduce our net earnings. In addition, the growth of our postpaid base makes us more vulnerable to any increases in customer defaults.

Events in other countries may have a negative impact on the Brazilian economy and the market value of our units.

Economic conditions and markets in other countries, including United States, Latin American and other emerging market countries, may affect the Brazilian economy and the market for securities issued by Brazilian companies. Although economic conditions in these countries may differ significantly from those in Brazil, investors’ reactions to developments in these other countries may have an adverse effect on the market value of securities of Brazilian issuers. Crises in other emerging market countries could dampen investor enthusiasm for securities of Brazilian issuers, including ours, which could adversely affect the market price of our shares and ADSs.

In addition, the Brazilian economy is affected by international economic and market conditions generally, especially economic conditions in the United States. Share prices on Bovespa, for example, have historically been sensitive to fluctuations in U.S. interest rates and the behavior of the major U.S. stock indexes. An increase in the interest rates in other countries, especially the United States, may reduce global liquidity and investors’ interest in the Brazilian capital markets, adversely impacting the price of our shares and ADSs.

Risks Relating to Our ADSs

Holders of our preferred shares, including preferred shares in the form of ADSs, have no voting rights except under limited circumstances.

Of our two classes of capital stock outstanding, only our common shares have full voting rights. Except in certain limited circumstances, our preferred shares will be entitled to vote only in the event that we fail to pay minimum dividends for a period of three consecutive years. As a result, holders of our preferred shares generally will not be able to influence any corporate decision requiring a shareholder vote, including the declaration of dividends.

Holders of our preferred shares or ADSs may not receive any dividends.

According to Brazilian Corporations Law and our bylaws, we must generally pay dividends to all shareholders of at least 25% of our annual net income, as determined and adjusted under the Brazilian Corporations Law. These adjustments to net income for purposes of calculating the basis for dividends include allocations to various reserves that effectively reduce the amount available for the payment of dividends. However, we are not required and may be unable to pay minimum dividends if we have losses.

Since we are a holding company, our income consists of distributions from our subsidiaries in the form of dividends or other advances and payments. We do not generate our own operating revenues, and we are dependent on dividends and other advances and payments for our cash flow, including to make any dividend payments or to make payments on our indebtedness.

Holders of our ADSs are not entitled to attend shareholders' meetings and may only vote through the Depositary.

Under Brazilian law, only shareholders registered as such in our corporate books may attend shareholders' meetings. All preferred shares underlying our ADSs are registered in the name of the Depositary. A holder of ADSs, accordingly, is not entitled to attend shareholders' meetings. Holders of our ADSs may exercise their limited voting rights with respect to our preferred shares represented by the ADSs only in accordance with the deposit agreement relating to the ADSs. There are practical limitations upon the ability of ADS holders to exercise their voting rights due to the additional steps involved in communicating with ADS holders. For example, we are required to publish a notice of our shareholders’ general meetings in certain newspapers in Brazil. Holders of our shares can exercise their right to vote at a shareholders’ general meeting by attending the meeting in person or voting by proxy. By contrast, holders of our ADSs will receive notice of a shareholders’ general meeting by mail from the ADR depositary following our notice to the ADR depositary requesting the ADR depositary to do so. To exercise their voting rights, ADS holders must instruct the ADR depositary on a timely basis. This noticed voting process will take longer for ADS holders than for direct holders of our shares. If it fails to receive timely voting instructions from a holder for the related ADSs, the ADR depositary will assume that such holder is instructing it to give a discretionary proxy to a person designated by us to vote your ADSs, except in limited circumstances.

We cannot assure you that holders will receive the voting materials in time to ensure that such holders can instruct the depositary to vote the shares underlying their respective ADSs. In addition, the depositary and its agents are not responsible for failing to carry out holder’s voting instructions or for the manner of carrying out your voting instructions. This means that holders may not be able to exercise their right to vote and may have no recourse if our shares held by such holders are not voted as requested.

The value of our ADSs or shares may depreciate if our control is changed.

In the event there is a change of our control, our minority common shareholders are entitled to tag-along rights whereby they may choose to also sell their shares to the new controlling shareholder for at least 80% of the price paid by the new controlling shareholders for the shares of our former controlling shareholder. Accordingly, if such change of control happens, the market value of our common shares may appreciate while the market value of our preferred shares may depreciate.

Holders of our ADSs or preferred shares in the United States may not be entitled to participate in future preemptive rights offerings.

Under Brazilian law, if we issue new shares for cash as part of a capital increase, we generally must grant our shareholders the right to purchase a sufficient number of shares to maintain their existing ownership percentage. Rights to purchase shares in these circumstances are known as preemptive rights. We may not legally allow holders of our ADSs or preferred shares in the United States to exercise any preemptive rights in any future capital increase unless we file a registration statement with the SEC with respect to that future issuance of shares or the offering qualifies for an exemption from the registration requirements of the Securities Act. At the time of any future capital increase, we will evaluate the costs and potential liabilities associated with filing a registration statement with the SEC and any other factors that we consider important to determine whether to file such a registration statement. We cannot assure holders of our ADSs or preferred shares in the United States that we will file a registration statement with the SEC to allow them to participate in a preemptive rights offering. As a result, the equity interest of those holders in us may be diluted proportionately.

Enforcement of rights in Brazil may be difficult.

We and our directors and officers reside in outside the United States, and a substantial portion of the assets of these persons and our assets are located in Brazil. As a result, it may not be possible to effect service of process upon these persons within the United States or other jurisdictions outside of Brazil. Brazilian law provides that a final decision obtained against us in a foreign jurisdiction may be enforceable in Brazil without reconsideration of the merits upon confirmation of that judgment by the Superior Court of Justice, upon the fulfillment of some conditions. However, there can be no assurance that these conditions will be met and, consequently, that it will be possible to enforce judgments of non-Brazilian courts in Brazil, including judgments predicated on civil liability under the U.S. securities laws against us or our directors and officers.

Restrictions on the movement of capital out of Brazil may adversely affect your ability to receive dividends and distributions on, or the proceeds of any sale of, our shares and the ADSs.

Brazilian law permits the Brazilian government to impose temporary restrictions on conversions of Brazilian currency into foreign currencies and on remittances to foreign investors of proceeds from their investments in Brazil, whenever there is a serious imbalance in Brazil’s balance of payments or there are reasons to expect a pending serious imbalance. The Brazilian government last imposed remittance restrictions for approximately six months in 1989 and early 1990. In the event that the Brazilian government determines that the Brazilian foreign currency reserves need to be maintained, it may impose temporary charges on any overseas remittance of up to 50% of the value of the remittance. We cannot assure you that the Brazilian government will not take any such measures in the future.

Any imposition of restrictions on conversions and remittances could hinder or prevent holders of our shares or the ADSs from converting into U.S. dollars or other foreign currencies and remitting abroad dividends, distributions or the proceeds from any sale in Brazil of our shares. Exchange controls could also prevent us from making payments on our U.S. dollar-denominated debt obligations and hinder our ability to access the international capital markets. As a result, exchange controls restrictions could reduce the market prices of our shares and the ADSs.

Holders of ADSs may face difficulties in protecting their interests because we are subject to different corporate rules and regulations as a Brazilian company and our shareholders may have less extensive rights.

Holders of ADSs will not be direct shareholders of our company and will be unable to enforce the rights of shareholders under our by-laws and the Brazilian Corporation Law.

Our corporate affairs are governed by our by-laws and the Brazilian Corporation Law, which differ from the legal principles that would apply if we were incorporated in a jurisdiction in the United States, such as the state of Delaware or New York, or elsewhere outside Brazil. Even if a holder of ADSs surrenders its ADSs and becomes a direct shareholder, its rights as a holder of our shares under the Brazilian Corporation Law to protect its interests relative to actions by our Board of Directors or executive officers may be fewer and less well-defined than under the laws of those other jurisdictions.

Judgments seeking to enforce our obligations in respect of our shares or ADSs in Brazil will be payable only in reais.

If proceedings are brought in the courts of Brazil seeking to enforce our obligations in respect of our shares or ADSs, we will not be required to discharge our obligations in a currency other than reais. Under Brazilian exchange control limitations, an obligation in Brazil to pay amounts denominated in a currency other than reais may only be satisfied in Brazilian currency at the exchange rate, as determined by the Central Bank, in effect on the date the judgment is obtained, and such amounts are then adjusted to reflect exchange rate variations through the effective payment date. The then prevailing exchange may not afford non-Brazilian investors with full compensation for any claim arising out of or related to our obligations under our shares or the ADSs.

Volatility and lack of liquidity in the Brazilian stock market may substantially limit investors’ ability to sell shares at the price and time desired.

Investment in securities traded in emerging markets such as Brazil often involves more risk than other world markets, and such investments are in general considered more speculative. The Brazilian stock market is substantially smaller, less liquid and more concentrated, and may be more volatile than the world’s major stock markets, such as those in the United States. On December 31, 2007, Bovespa’s market capitalization was approximately R$2.5 trillion (US$1.4 trillion), and the average daily trading volume for the year ended December 31, 2007 was R$4.9 billion (US$2.5 billion). For comparative purposes, the market capitalization of the New York Stock Exchange (NYSE) on December 31, 2007 was US$27.1 trillion. The Brazilian capital market shows significant concentration. The top ten shares in terms of trading volume accounted for approximately 45.4% of all shares traded on the Bovespa in the year ended December 31, 2007. These characteristics of the Brazilian capital market may substantially limit the ability of investors to sell shares at the desired price and time, which may materially and adversely affect share prices.

Shares eligible for future sale may adversely affect the market value of our shares and ADSs.

Certain of our shareholders have the ability, subject to applicable Brazilian laws and regulations and applicable securities laws in the relevant jurisdictions, to sell our shares and ADSs. We cannot predict what effect, if any, future sales of our shares or ADSs may have on the market price of our shares or ADSs. Future sales of substantial amounts of such shares or ADSs, or the perception that such sales could occur, could adversely affect the market prices of our shares or ADSs.

Holders of ADSs or preferred shares could be subject to Brazilian income tax on capital gains from sales of ADSs or preferred shares.

According to Article 26 of Law No. 10,833 of December 29, 2003, which came into force on February 1, 2004, capital gains realized on the disposition of assets located in Brazil by non-Brazilian residents, whether or not to other non-residents and whether made outside or within Brazil, are subject to taxation in Brazil at a rate of 15%, or 25% if realized by investors resident in a “tax haven” jurisdiction (i.e., a country that does not impose any income tax or that imposes tax at a maximum rate of less than 20%). Although we believe that the ADSs will not fall within the definition of assets located in Brazil for the purposes of Law No. 10,833, considering the general and unclear scope of Law 10,833 and the absence of any judicial guidance in respect thereof, we are unable to predict whether such interpretation will ultimately prevail in the Brazilian courts.

Gains realized by non-Brazilian holders on dispositions of preferred shares in Brazil or in transactions with Brazilian residents may be exempt from Brazilian income tax, taxed at a rate of 15% or 25%, depending on the circumstances. Gains realized through transactions on Brazilian stock exchanges, if carried out in accordance with Resolution 2,689, of January 26, 2000 (“Resolution CMN 2,689”) of the National Monetary Council, or Conselho Monetário Nacional (“CMN”), as described below in “Item 10.E. Additional Information—Taxation—Brazilian Tax Considerations—Taxation of Gains,” are exempt from the Brazilian income tax. Gains realized through transactions on Brazilian stock exchanges are subject to tax at a rate of 15% and also to withholding income tax at a rate of 0.005% (to offset the tax due on eventual capital gain). Gains realized through transactions with Brazilian residents or through transactions in Brazil not on the Brazilian stock exchanges are subject to tax at a rate of 15%, or 25% if realized by investors resident in a tax haven jurisdiction.