All other exemptions / exceptions provided for in IFRS 1 were observed, analyzed and produced no effects in relation to the accounting practices adopted in Brazil.

The following discussion of the Company’s financial condition and operating results should be read in conjunction with the Company’s audited consolidated financial statements as of December 31, 2010, 2009 and 2008 included in this Annual Report that have been prepared in accordance with IFRS, issued by IASB as well as with the information presented under “Item 3A. Key Information—Selected Financial Data.”

Merger of TIM Nordeste S.A. into TIM Celular

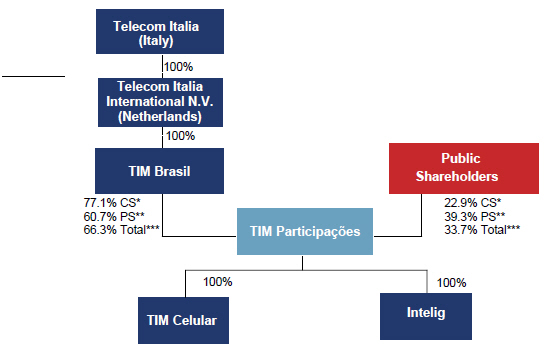

On October 30, 2009, the Board of Directors of TIM Participações approved the corporate reorganization of its subsidiaries, whereby TIM Nordeste S.A. would be merged into TIM Celular. On December 17, 2009 Anatel granted its approval of this proposal through Decision No. 7.477, and on December 31, 2009, the shareholders of TIM Nordeste S.A. and of TIM Celular S.A. approved the reorganization at their respective Extraordinary General Meetings.

The purpose of this reorganization was to optimize the companies’ organization structure by further consolidating and rationalizing their businesses and operations by leveraging tax and financial synergies and cutting costs associated with having separate legal entities. No impact on TIM Participações’s previous financial statements is expected.

Acquisition of Holdco/Intelig

At a meeting of the Board of Directors on April 16, 2009, the Company executed a Merger Agreement with Holdco, a subsidiary of JVCO, pursuant to which through a merger of Holdco into the Company, the Company would acquire indirect control of Intelig.

Anatel approved the merger on August 11, 2009 in Decision No. 4634, and decided to eliminate the overlapping geographic licenses held by TIM Celular and Intelig for Fixed Switched Telephone Services (STFC) within 18 months.

On December 30, 2009, the shareholders of TIM Participações approved the merger of Holdco into TIM Participações. As a result of this operation, the Company issued 127,288,023 shares (43,356,672 common and 83,931,352 preferred) for a book value of R$516,725, to JVCO. The acquisition date fair value of the consideration transferred totaled R$739,729. Holdco’s assets and liabilities acquired are, respectively, R$517,128 and R$403 on November 30, 2009.

The results of Intelig’s operations have not been included in the 2009 consolidated financial statements since the acquisition date was December 30, therefore only the balance sheet has been consolidated. Intelig is a provider of long distance and fixed line telecommunication services in Brazil. As a result of the acquisition, the Company will expand its long distance and fixed line services in Brazil.

The table below includes the fair value of the identified assets acquired and liabilities assumed on the date of acquisition.

| Assets | | | R$ | |

Cash and cash equivalents | | | 132,816 | |

Accounts receivable | | | 126,353 | |

Taxes recoverable | | | 23,074 | |

Court deposits | | | 33,453 | |

Property, plant and equipment | | | 780,845 | |

Intangible assets | | | 135,850 | |

Other assets | | | 25,114 | |

| Total identifiable assets purchased | | | 1,257,505 | |

| | | | | |

Liabilities | | | (342,431 | ) |

Loans | | | (118,402 | ) |

Contingencies | | | (140,107 | ) |

| Long-term taxes and contributions | | | (101,311 | ) |

Other liabilities | | | (25,540 | ) |

Total liabilities assumed | | | (727,791 | ) |

| | | | | |

Net identifiable assets acquired | | | 529,714 | |

`

As result of the adjustment to fair value of the identified assets acquired and liabilities assumed from Intelig upon the acquisition of the company, the fair value of the net assets purchased totaled R$529,714. Thus, we concluded that the amount of R$ 739,729, paid upon the acquisition of Intelig on December 30, 2009, exceeded the fair value of the net assets by R$210,015. Said surplus amount was recorded as goodwill and is based on expectations of future profitability of Intelig, supported by the projections prepared by the Company together with investment banks.

As result of the adjustment to fair value of the identified assets acquired and liabilities assumed from Intelig upon the acquisition of the company, the fair value of the net assets purchased totaled R$529,714. Thus, we concluded that the amount of R$ 739,729, paid upon the acquisition of Intelig on December 30, 2009, exceeded the fair value of the net assets by R$210,015. Said surplus amount was recorded as goodwill and is based on expectations of future profitability of Intelig, supported by the projections prepared by the Company together with investment banks.

If such transaction had occurred as of January 1, 2009, the net revenue and net income for the period ended December 31, 2009, considering the combination of TIM Participações and its subsidiaries with Intelig, would have been R$ 13,747,028 and R$ 801,223, respectively.

Pro forma information considers that our acquisition of 100.00% of Holdco/Intelig as if it was completed at January 1, 2009.

| | | Year ended December 31, | | | Percentage change | |

| | | 2010 | | | 2009 | | | 2010 - 2009 Pro-forma | | | | 2010 - 2009 | |

| | TIM Partic (1) | | | Intelig | | | Pro-forma (2) | |

| Net Operating Revenues | | | 14,457,450 | | | | 13,158,134 | | | | 588,894 | | | | 13,747,028 | | | | 5.20 | % | | | 9.90 | % |

| Cost of services and goods | | | -7,305,767 | | | | -6,672,369 | | | | -470,558 | | | | -7,142,927 | | | | 2.30 | % | | | 9.50 | % |

| Gross profit | | | 7,151,682 | | | | 6,485,765 | | | | 118,336 | | | | 6,604,101 | | | | 8.30 | % | | | 10.30 | % |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

| Selling expenses | | | -4,494,608 | | | | -4,436,751 | | | | -65,157 | | | | -4,501,908 | | | | -0.20 | % | | | 1.30 | % |

| General and administrative expenses | | | -1,008,694 | | | | -1,033,438 | | | | -100,366 | | | | -1,133,804 | | | | -11.00 | % | | | -2.40 | % |

| Other operating expenses | | | -448,247 | | | | -462,114 | | | | 1,321 | | | | -460,793 | | | | -2.70 | % | | | -3.00 | % |

| Total operating expenses | | | -5,951,549 | | | | -5,932,303 | | | | -164,202 | | | | -6,096,505 | | | | -2.40 | % | | | 0.30 | % |

| Operating income before financial results | | | 1,200,134 | | | | 553,462 | | | | -45,866 | | | | 507,596 | | | | 136.40 | % | | | 116.80 | % |

| Net financial income | | | -245,457 | | | | -245,115 | | | | 505,716 | | | | 260,601 | | | | -194.20 | % | | | 0.10 | % |

| Operating income before interest | | | 954,677 | | | | 308,347 | | | | 459,850 | | | | 768,197 | | | | 24.30 | % | | | 209.60 | % |

| Income and social contribution tax benefit | | | 1,257,038 | | | | 33,026 | | | | 0 | | | | 33,026 | | | | 3706.30 | % | | | 3706.30 | % |

| Net income | | | 2,211,715 | | | | 341,373 | | | | 459,850 | | | | 801,223 | | | | 176.00 | % | | | 547.90 | % |

The merger with Holdco Participações Ltda. and acquisition of control of Intelig has strategic and operational significance to the Company. Intelig’s strong network of optical fibers in Brazil’s major metropolitan areas and extensive long-distance network will enable the Company to enhance its capabilities in the corporate and data transmission segments, reduce costs and promote the development of the 3G network.

Merger of TIM Nordeste Telecomunicações into Maxitel and of TIM Sul into TIM Celular

On May 4, 2006, the Board of Directors of TIM Participações authorized the merger of TIM Nordeste Telecomunicações into Maxitel and the merger of TIM Sul into TIM Celular, each a wholly owned subsidiary of TIM Participações.

On June 30, 2006, the mergers of TIM Nordeste Telecomunicações into Maxitel and TIM Sul into TIM Celular were approved at the General Shareholders’ Meetings of TIM Celular, Maxitel, TIM Nordeste Telecomunicações and TIM Sul. On the same date, Maxitel was renamed TIM Nordeste S.A.

Acquisition of TIM Celular by TIM Participações

On March 16, 2006, we acquired all of the share capital of TIM Celular, a wholly-owned subsidiary of our controlling shareholder, TIM Brasil, pursuant to a transaction in which TIM Brasil received shares issued by TIM. As a result, TIM Celular and its operating subsidiary, TIM Maxitel, became our subsidiaries. The acquisition became effective following approval in the respective Extraordinary Shareholders’ Meetings of our shareholders and the shareholders of TIM Celular on March 16, 2006.

We accounted for the acquisition under Brazilian GAAP as a purchase at book value, generating no goodwill, pursuant to which the results of TIM and TIM Celular were combined with effect from January 1, 2006. For more information regarding the acquisition of TIM Celular by TIM, see “Presentation of Information.”

Due to the TIM Celular Acquisition, our 2007 consolidated financial statements are not comparable with our historical financial statements. In addition, we are unable to distinguish clearly between internal growth in 2007 and growth due to the TIM Celular Acquisition.

Critical Accounting Policies

Critical accounting policies are those that are important to the presentation of our financial condition and results of operations and require management’s most subjective, complex judgments, often requiring management to make estimates about the effect of matters that are inherently uncertain. As the number of variables and assumptions affecting the possible future resolution of the uncertainties increases, those judgments become more complex. We base our estimates and assumptions on historical experience, industry trends or other factors that we believe to be reasonable under the circumstances. Actual results may vary from what we anticipate, and different assumptions or estimates about the future could change our reported financial results. In order to provide an understanding about how our management has estimated the potential impact of certain uncertainties, including the variables and assumptions underlying the estimates, we have identified the critical accounting policies discussed below. We describe our significant accounting policies, including the ones discussed below, in note 3 to our consolidated financial statements.

Depreciation and Impairment of Long-Lived Assets

Property, plant and equipment are stated at cost of acquisition or construction. Depreciation is calculated using the straight-line method based on the estimated useful lives of the underlying assets. See notes 4.g and 10 to our consolidated financial statements. We currently depreciate automatic switching, transmission and other equipment

based on an estimated useful life of seven years. Free handsets for corporate customers (comodato) are depreciated over two years.

We review our long-lived assets, such as goodwill, for impairment whenever events or circumstances indicate the carrying value of an asset may not be recoverable from estimated future cash flows expected to result from its use and eventual disposition. At least annually, the Company applies the recoverability test on the recorded goodwill. The calculations were performed based on the discounted cash flow using as parameters the assumptions included in the Company’s 10 years Industrial Plan, growth rate compatible with our market conditions and a discount rate of 10% per year. The results of such tests indicated no need for an accounting provision.

The fair value of the cash generating units, as of the latest impairment testing date, is substantially in excess of their carrying value.

However, asset impairment evaluations are, by nature, highly subjective. If our projections are not met, we may have to record impairment charges not previously recognized. In analyzing potential impairments, we use projections based on our view of growth rates for our business, anticipated future economic, regulatory and political conditions and changes in technology. Such projections are subject to change, including as a result of technological developments that may render long-lived assets obsolete sooner than anticipated. See note 3.i to our consolidated financial statements.

Allowance for Doubtful Accounts

We maintain an allowance for doubtful accounts for estimated losses resulting from the failure of our customers to make required payments. We revise our estimated percentage of losses on a regular basis, taking into account our most recent experience with non-payments (i.e. average percentage of receivables historically written-off, economic conditions and the length of time the receivables are past due). The provision for doubtful accounts for 2010 was based on the following estimates of percentages of receivables, classified by the number of days such receivables are overdue, that it projected to be uncollectible. These estimates were based on historical experience of write-offs and future expectations of conditions that might impact the collectability of accounts. The amount of the loss, if any, that we actually experience with respect to these accounts may differ from the amount of the allowance maintained in connection with them.

| | Percentage estimated to be uncollectible | |

Current* | | | 2.75% - 3.5 | % |

Receivables overdue 1 to 90 days* | | | 5.5% - 7 | % |

Receivables overdue 91 to 120 days | | | 50 | % |

Receivables overdue 121 to 150 days | | | 56 | % |

Receivables overdue 151 to 180 days | | | 90 | % |

Receivables overdue more than 180 days | | | 100 | % |

| * | Percentage varies based on area and customer composition. |

Deferred Income Tax and Social Contribution

We compute and pay income taxes based on results of operations under IFRS.

We regularly review deferred tax assets for recoverability. If, based on historical taxable income, projected future taxable income and expected timing of reversals we determine that it is more likely than not that the deferred tax assets will not be realized, we establish a valuation allowance. When performing such reviews, we are required to make significant estimates and assumptions about future taxable income.

In order to determine future taxable income, we need to estimate future taxable revenues and deductible expenses, which are subject to different external and internal factors such as economic conditions, industry trends, interest rates, shifts in our business strategy and changes in the type of services we offer. The use of different assumptions and estimates could significantly change our financial statements. A change in assumptions and

estimates with respect to our expected future taxable income could result in the recognition of a valuation allowance on deferred income tax assets, which would decrease our results of operations and shareholders’ equity.

If we operate at a loss or are unable to generate sufficient future taxable income, if there is a material change in the actual effective tax rates, if the time period within which the underlying temporary differences become taxable or deductible, or if there is any change in our future projections, we could be required to establish a valuation allowance against all or a significant portion of our deferred tax assets, resulting in a substantial increase in our effective tax rate and a material adverse impact on our operating results.

The taxable income projections used in determining the recoverability of our deferred tax assets as of December 31, 2009 were derived from our 2010-2012 Industrial Plan. At that time, our Industrial Plan forecasted our income for the next three fiscal years, with assumptions reflecting conditions we expected to exist and the course of actions we expect to take. Based on the three-year projections included in the Industrial Plan, we projected income out for a further seven years (i.e. to 2019). However, we did not extend the Industrial Plan projections beyond the basic three years for the valuation allowance of our deferred tax assets because we believe that the uncertainties described below made any extension of our projections beyond year three difficult to support at the more likely-than-not level, required for projections in this context. We limited our projections to three years in determining the amount of the valuation allowance for deferred tax assets at December 31, 2009.

The principal uncertainties underlying our decision to limit the projections to three years at December 31, 2009 were:

| | · | TIM Celular had a history of losses. |

| | · | at the end of 2009, Brazil was expecting a presidential election in 2010, generating uncertainties in relation to longer future projections and taxation. |

| | · | at the end of 2009, the economy was still recovering from the worldwide financial crises, generating a strong level of uncertainties in longer term future projections. In addition, we believed there remained fundamental uncertainties regarding the Brazilian economy, including with respect to domestic inflation and commodities prices. |

| | · | in 2009, compared to 2008, the subsidiary TIM Celular did not experience growth in revenues and had a modest growth in profitability. Further, as described before in this Form, the Company lost approximately five hundred thousand clients from its average post-paid customer during 2009 when compared to 2008, and had a deterioration in its brand awareness and customers satisfaction. As a result, substantial efforts were made to turn around the Company (including the subsidiary TIM Celular) starting in the second half of 2009, including: i) a substantial change in management (e.g CEO, COO, CTO); ii) re-launching of the strategy and positioning of TIM in the market; iii) new and innovative services and products (‘Infinity’, and ‘Liberty’). |

In addition to the above uncertainties, we also considered the inherent subjectivity of the positive evidence underlying our projections of future taxable income in the next three years, such as the expectation that new management and a new business plan at TIM Celular would lead to a turnaround at that business. In evaluating the negative and positive evidence in assessing the likelihood of predicable earnings after 2012, we believed that the negative evidence outweighed the positive evidence. As a result, of all of the foregoing, we believed that the valuation allowance as at December 31, 2009 was necessary because our projections showed that the deferred tax assets were not recoverable to the extent of the allowance.

By the end of 2010, TIM Celular had clear evidence of the success of the strategy implemented during the 2009. Accordingly, our actual 2010 results were significantly better than those we considered in our projections prepared in the end of 2009. The main positive factors that lead TIM Celular to better results were:

| | · | 2010 final customer base of 51 million, resulting in an additional 4.6 million of new customer when compared to the projected customer base. Revenues were higher by approximately R$200 million in comparison to .projected revenues; |

| | · | efficiency plans effectiveness. During 2010, our costs and expenses were lower by approximately R$250 million in comparison to the projected amounts, partially due to cost saving programs and partially due to synergies from Tim Nordeste merging process; |

| | · | success of the new products (‘Infinity’, and ‘Liberty’) launched during 2009; |

| | · | progressive exit from the handset subsidy; |

| | · | significant reduction of handsets classified as property, plant and equipment (handsets owned by the Company and provided free of charge to corporate customers) with consequent reduction in depreciation (actual depreciation amount in 2010 was lower by R$300 million in relation to projected one); |

| | · | increase in cash generation, resulting in reduced indebtedness and lower net financial expenses (financial expenses were approximately R$100 million lower than the expected in the projections). |

Considering the reduction in the uncertainties we had at the end of 2009, we updated our Industrial Plan for years 2011-2013 and following projections and we believe the future income generation will be much higher than we expected in the end of 2009. Based on the expected taxable income to be generated in future years, the reduction of uncertainties mentioned there were in place in the end of 2009, at the end of 2010 we released in its entirety the valuation allowance for tax loss carryforwards related to our subsidiary TIM Celular that was recorded at December 31, 2009.

Asset Retirement Obligations

Our subsidiaries are contractually obligated to dismantle their cellular towers from various sites they lease. We must record as asset retirement obligations the present value of the estimated costs to be incurred for dismantling

and removing cellular towers and equipment from leased sites. The offset to this provision is recorded as property, plant and equipment, and the depreciation is calculated based on the useful lives of the corresponding assets.

Contingent Liabilities

The accrual for a contingency involves considerable judgment on the part of management. A contingency is “an existing condition, situation, or set of circumstances involving uncertainty as to possible gain or loss to an enterprise that will ultimately be resolved when one or more future events occur or fail to occur.”

We are subject to various claims, including regulatory, legal and labor proceedings covering a wide range of matters that arise in the ordinary course of business. We adopted a policy of analyzing each such proceeding and making a judgment as to whether a loss is probable, possible or remote. We make accruals for proceedings that we are party to when we determine that losses are probable and can be reasonably estimated. Our judgment is always based on the opinion of our legal advisors. Accrual balances are adjusted to account for changes in circumstances for ongoing matters and the establishment of additional accruals for new matters. While we believe that the current level of accruals is adequate, changes in the future could impact these determinations.

Revenue Recognition and Customer Incentive Programs

Revenues are recorded when services are rendered. As a result of our billing cycle cut-off times, we are required to make estimates for services revenue earned but not yet billed. These estimates, which are based primarily upon unbilled minutes of use, could differ from our actual experience. See note 3 to our consolidated financial statements.

Political, Economic, Regulatory and Competitive Factors

The following discussion should be read in conjunction with “Item 4. Information on the Company.” As set forth in greater detail below, our financial condition and results of operations are significantly affected by Brazilian telecommunications regulation, including the regulation of rates. See “Item 4B. Information on the Company—Business Overview—Regulation of the Brazilian Telecommunications Industry—Rate Regulation.” Our financial condition and results of operations have also been, and are expected to continue to be, affected by the political and economic environment in Brazil. See “Item 3D. Key Information—Risk Factors—Risks Relating to Brazil.” In particular, our financial performance will be affected by:

| | · | general economic and business conditions, including the price we are able to charge for our services and prevailing foreign exchange rates; |

| | · | our ability to generate free cash flow in the coming years; |

| | · | competition, including expected characteristics of network, offers, customer care and from increasing consolidation in our industry and nationwide presence of Claro, Vivo and Oi; |

| | · | our ability to secure and maintain telecommunications infrastructure licenses, rights-of-way and other regulatory approvals; |

| | · | our ability to anticipate trends in the Brazilian telecommunications industry, including changes in market size, demand and industry price movements, and our ability to respond to the development of new technologies and competitor strategies; |

| | · | our ability to expand and maintain the quality of the services we provide; |

| | · | the rate of customer churn we experience; |

| | · | changes in official regulations and the Brazilian government’s telecommunications policy; |

| | · | political economic and social events in Brazil; |

| | · | access to sources of financing and our level and cost of debt; |

| | · | our ability to integrate acquisitions; |

| | · | regulatory issues relating to acquisitions; |

| | · | the adverse determination of disputes under litigation; and |

| | · | inflation, interest rate and exchange rate risks. |

Overview

The international financial crisis had an adverse impact on the Brazilian economy in 2009. However, economic indicators in Brazil were less affected than in other areas including the United States and Europe, partially due to a combination of the positive effects of prior adjustments and a prompt fiscal, monetary and economic response by the Federal Government. During this period, the SELIC basic interest rate reached a historical level of 10.66% p.a. Low interest rates contributed to an increase of 1.1% in the Ibovespa during 2010. A strong inflow of foreign capital contributed to an approximately 4.4% appreciation of the Brazilian Real to the U.S. dollar.

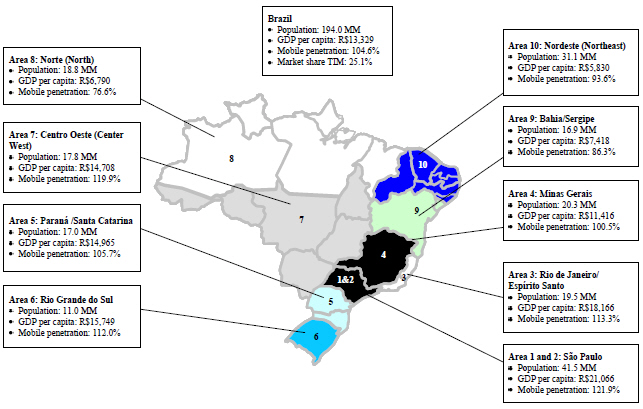

The Brazilian mobile market reached 202.9 million lines nationwide at the end of December 2010, corresponding to a penetration ratio of 104.7% (compared to 90.6% in 2009) and an annual growth rate of 16.7% (compared to 15.5% in 2009). Brazil is the fifth largest mobile telephony market in the world, and telephony is currently the most common means of communication in Brazilian households among all social classes. According to Anatel (Brazil’s National Telecommunications Agency), mobile market net adds reached 29.0 million in 2010 which represents a 24.3% upturn from 2009. The prepaid mix continues to represent the greatest part of total subscriber base, 82.3%.

TIM’s subscriber base ended the year of 2010 with 51.0 million clients, 24.1% up from 2010, corresponding to a market share of 25.1%, while the service revenues share, our primary focus, reached 26.7% in 2009. The pre-paid segment reached 43.5 million (25.7% up from 2009) while the post-paid stood at 7.5 million users in the year (15.7% up from 2009). As for the client mix, post-paid accounted for 14.6% of the total subscriber base, compared to 15.7% from 2009, largely impacted by the increase of pre-paid base. In 2010, TIM added 9.9 million customers, up from 4.7 million in 2009. The increase reflects TIM’s success with Infinity and Liberty plans. TIM’s ARPU (average revenue per user) registered R$23.7 in 2010. On a yearly basis, ARPU dropped 10.8% which is partially attributed to an increase of 25.7% in the pre-paid segment (where the market growth is concentrated), and a lower incoming MOU.

ARPU is a key performance indicator which is calculated by the ratio between total net service revenue per average customer base per month. In 2010, our average customer base, calculated as the simple mean of monthly averages, increased 17.9% to 44.8 million, compared to 38.0 million customers in 2009.

The following table shows the total average number of customers during 2010 and 2009.

| | | | |

| | | | | | | |

Average number of customers using post-paid plans(1) | | | 6,916,279 | | | | 6,285,455 | |

Average number of customers using pre-paid plans(1) | | | 37,895,049 | | | | 31,708,947 | |

Total number of customers(1) | | | 44,811,328 | | | | 37,994,402 | |

| (1) | Average numbers are based on the number of customers at the end of each month during the relevant year. |

A. Operating Results

The following table shows certain components of our statement of operations for each year in the two-year period ended December 31, 2010, as well as the percentage change from year to year.

| | | | | | | |

| | | | | | | | | | | | | | | | 2010 - 2009 | |

Net Operating Revenues | | | 14,457,450 | | | | 13,158,134 | | | | 13,747,028 | | | | 5.2 | % | | | 9.9 | % |

Cost of services and goods | | | (7,305,767 | ) | | | (6,672,369 | ) | | | (7,142,927 | ) | | | 2.3 | % | | | 9.5 | % |

Gross profit | | | 7,151,682 | | | | 6,485,765 | | | | 6,604,101 | | | | 8.3 | % | | | 10.3 | % |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

Selling expenses | | | (4,494,608 | ) | | | (4,436,751 | ) | | | (4,501,908 | ) | | | -0.2 | % | | | 1.3 | % |

| General and administrative expenses | | | (1,008,694 | ) | | | (1,033,438 | ) | | | (1,133,804 | ) | | | -11.0 | % | | | -2.4 | % |

Other operating expenses | | | (448,247 | ) | | | (462,114 | ) | | | (460,793 | ) | | | -2.7 | % | | | -3.0 | % |

Total operating expenses | | | (5,951,549 | ) | | | (5,932,303 | ) | | | (6,096,505 | ) | | | -2.4 | % | | | 0.3 | % |

| Operating income before financial results | | | 1,200,134 | | | | 553,462 | | | | 507,596 | | | | 136.4 | % | | | 116.8 | % |

Net financial income | | | (245,457 | ) | | | (245,115 | ) | | | 260,601 | | | | -194.2 | % | | | 0.1 | % |

| Operating income before interest | | | 954,677 | | | | 308,347 | | | | 768,197 | | | | 24.3 | % | | | 209.6 | % |

| Income and social contribution tax benefit | | | 1,257,038 | | | | 33,026 | | | | 33,026 | | | | 3706.3 | % | | | 3706.3 | % |

Net income | | | 2,211,715 | | | | 341,373 | | | | 801,223 | | | | 176.0 | % | | | 547.9 | % |

| (1) | The 2009 Pro-forma information reflects the Intelig acquisition as if it had occurred on January 1st, 2009. See “Presentation of Financial Information”. |

Operating revenues

Our operating revenues consisted of:

| | · | monthly subscription charges; |

| | · | usage charges, which include roaming charges; |

| | · | interconnection charges; |

| | · | other service revenues; and |

| | · | proceeds from the sale of handsets and accessories. |

The composition of our operating revenues by category of service is presented in note 26 to our consolidated financial statements and discussed below. We do not determine net operating revenues or allocate cost by category of service.

The following table shows certain components of our operating revenues, as well as the percentage change of each component from the prior year, for 2010 and 2009:

Statement of Operations Data:

IFRS

| | | Year ended December 31, | | | Percentage change | |

| | | | | | | | | | | | | | | | 2010 - 2009 | |

| | | (in million of reais) | | | | | | | | |

| Monthly subscription charges and usage charges | | | 8,912.0 | | | | 8,068.2 | | | | 8,068.2 | | | | 10.5 | % | | | 10.5 | % |

Fixed services | | | 1,281.2 | | | | 1,074.2 | | | | 89.9 | | | | 19.3 | % | | | 1325.9 | % |

Interconnection charges | | | 3,679.4 | | | | 4,006.9 | | | | 4,042.6 | | | | -8.2 | % | | | -9.0 | % |

Long distance charges | | | 2,374.3 | | | | 1,943.1 | | | | 1,943.1 | | | | 22.2 | % | | | 22.2 | % |

Value added services | | | 2,241.5 | | | | 1,897.2 | | | | 1,907.2 | | | | 18.2 | % | | | 17.5 | % |

Other service revenues | | | 272.9 | | | | 306.0 | | | | 306.0 | | | | -10.8 | % | | | -10.8 | % |

| Gross operating revenues from services | | | 18,761.4 | | | | 17,295.7 | | | | 16,357.0 | | | | 8.5 | % | | | 14.7 | % |

| Value added and other taxes relating to services | | | (4,143.6 | ) | | | (3,779.0 | ) | | | (3,615.4 | ) | | | 9.6 | % | | | 14.6 | % |

Discounts on services | | | (1,046.2 | ) | | | (728.9 | ) | | | (542.6 | ) | | | 43.5 | % | | | 92.8 | % |

| Net operating revenues from services | | | 13,571.6 | | | | 12,787.9 | | | | 12,199.0 | | | | 6.1 | % | | | 11.3 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Sales of cellular handsets and accessories | | | 1,557.9 | | | | 1,717.7 | | | | 1,717.7 | | | | -9.3 | % | | | -9.3 | % |

| Value added and other taxes on handset sales | | | (332.2 | ) | | | (301.1 | ) | | | (301.1 | ) | | | 10.3 | % | | | 10.3 | % |

Discounts on handset sales | | | (339.8 | ) | | | (457.4 | ) | | | (457.4 | ) | | | -25.7 | % | | | -25.7 | % |

Our gross service revenue for the year ended December 31, 2010 was R$18,761.4 million, representing a 14.7% increase from R$16,357.0 million in the year ended December 31, 2009, mainly due to the acquisition of Intelig, which significantly boosted our fixed services revenues in 2010, as well as organic growth. This increase primarily reflected a strong increase in our long distance charges (22.2% up from the year ended December 31, 2009, due to the Intelig acquisition), fixed service charges (1,325.1% up from the year ended December 31, 2009, due to the Intelig acquisition), and value added services (17.5% up from the year ended December 31, 2009). All of these increases reflect the excellent amount of client acquisitions by the Company, which reached over the 50 million figures. The gross handset revenue for the year ended December 31, 2010 was R$1,557.9 million, a 9.3% decrease over R$1,717.7 for the year ended December 31, 2009, resulting from a client acquisition approach focused mainly in discounted services, rather than discounted handsets offer. Gross revenues for the year ended December 31, 2010 totaled R$20,319.3 billion, a 12.4% increase from the year ended December 31, 2009.

Gross service revenues for the year ended December 31, 2010 increased by 8.5% compared to R$17,295.7 million on a pro forma basis in the year ended December 31, 2009. This increase primarily reflected a strong increase in our long distance charges (22.2% up from the year ended December 31, 2009), fixed service charges (19.3% up from the year ended December 31, 2009), and value added services (18.2% up from the year ended December 31, 2009). All of these increases reflect the excellent amount of client acquisitions by the company, that reached over the 50 million figure. The gross handset revenue for the year ended December 31, 2010 was R$1,557.9 million, a 9.3% decrease over R$1,717.7 for the year ended December 31, 2009, resulting from a client acquisition approach focused mainly in discounted services, rather than discounted handsets offer. Gross revenues for the year ended December 31, 2010 totaled R$20,319.3 billion, a 6.9% increase from the year ended December 31, 2009.

Net operating revenues increased 9.9% to R$14,457.5 million in the year ended December 31, 2010 from R$13,158.1 million in the year ended December 31, 2009, due primarily to the acquisition of Intelig, as well as organic growth. This organic growth was primarily due to the expansion in the number customers, reflecting better results in several revenue lines, such as fixed services, long distance charges and value added services.

Net operating revenues increased 5.2% from R$13,747.1 million on a pro forma basis in the year ended December 31, 2009. This was primarily due to the expansion in the number customers, reflecting better results in several revenue lines, such as fixed services, long distance charges and value added services.

Monthly subscription charges and usage charges

Revenue from monthly subscription charges and usage charges was R$8,912.0 million in the year ended December 31, 2010, a 10.5% increase from R$8,068.2 million in the year ended December 31, 2009, due primarily to post the increase in the proportion of post-paid subscribers.

The total average monthly minutes of billed use per customer (“MOU”) for 2010 and 2009 were as follows:

| | | | |

| | | | | | | |

Average incoming MOU | | | 16 | | | | 21 | |

Average outgoing MOU | | | 100 | | | | 62 | |

Average total MOU | | | 116 | | | | 83 | |

Fixed Services

Revenue from fixed services was R$1,281.2 million in the year ended December 31, 2010, a 1,325.1% increase from R$89.9 million in December 31, 2009, mainly due to the acquisition of Intelig.

Revenue from fixed services increased 19.3% from R$1,074.2 million on a pro forma basis in December 31, 2009. The main reason for this increase was since the beginning of the year, Intelig had its brand reshaped and corporate offers remodeled, supporting the yearly revenue growth

Interconnection charges

Interconnection revenues consist of amounts paid to us by other mobile and fixed line providers for completion of calls on our network of calls originating on their networks. Our interconnection revenues were R$3,679.4 in the year ended December 31, 2010, a 9.0% decrease from R$4,042.6 in 2009. Despite subscriber growth, this decrease was mainly attributable to the strong on-net calls (calls originated and received by terminals of the same cellular company) stimulated by our new subscription plans and a fixed to mobile traffic reduction trend. Interconnection as a percentage of total gross revenues of services stood at 19.6% in the year ended December 31, 2010 compared to 24.7% in the year ended December, 2009.

Interconnection revenues decreased 8.2% from R$4,006.9 in 2009 on a pro forma basis. Interconnection as a percentage of total gross revenues of services stood at 19.6% in the year ended December 31, 2010 compared to 23.2% on a pro forma basis in the year ended December, 2009.

Long distance charges

Revenues from long distance charges increased 22.2% to R$2,374.3 million in the year ended December 31, 2010 from R$1,943.1 million in the year ended December 31, 2009, the increase reflecting our efforts to facilitate the use of our long distance service through lower cost service packages such as Liberty and Infinity.

Value-added services

Value-added service revenues increased 17.5% to R$2,241.5 million in the year ended December 31, 2010 from R$1,907.2 million the year ended December 31, 2009, principally due to an increase in our customer base, both on voice and data, and an expansion of products and services.

Value-added service revenues increased 18.2% from R$1,897.2 million on a pro forma basis in the year ended December 31, 2009.

Value-added services include short messaging services (SMS), multimedia message services (MMS), data transmission, downloads (wallpaper and ringtones), television access, voicemail and chat. SMS revenues represent a significant portion of our total value-added service revenues. Data transmission, supported by our 3G network, is also a key component to our value-added service revenues, and we have focused on improving our position in this

area through expanding partnerships, enhancing our smart phone portfolio, including through the addition of the iPhone 3GS and 4, and promoting our mobile broadband service through TIM web broadband.

Other service revenues

Revenues from other services decreased 10.8% to R$272.9 million in the year ended December 31, 2010 from R$306.0 million in the year ended December 31, 2009, principally reflecting revenues from other services consist mainly of site sharing and co-billing services, which occur when a customer is billed by his own operator on behalf of another long distance company for services provided by such carrier and contractual penalties.

Sales of mobile handsets

Sales of mobile handsets increased/decreased 9.3% to R$1,557.9 million in the year ended December 31, 2010 from R$1,717.7 million registered in the year ended December 31, 2009. This was mainly attributable to TIM´s strategy of SIM-only sales.

Value-added and other taxes relating to services

The principal tax on telecommunications services is ICMS tax, which is imposed at rates between 25% and 35%. ICMS is also the principal tax on sales of handsets, which is imposed at a rate between 7% and 17%. See “Item 4B. Information on the Company—Business Overview—Taxes on Telecommunications Goods and Services.” Two federal social contribution taxes, PIS and COFINS, are imposed at combined rates of 3.65% on gross revenues operating relating to telecommunications services and at combined rates of 9.25% on mobile telephone handset sales.

Our value-added and other taxes relating to services and handset sales was R$4,143.6 million in the year ended December 31, 2010 compared to R$3,615.4 million in the year ended December 31, 2009, an increase of 14.6% partly due to the acquisition of Intelig.

Value-added and other taxes relating to services and handset sales grew by 9.6% from R$3,779.0 million on a pro forma basis in the year ended December 31, 2009.

Discounts on services and handset sales increased 38.6% to R$1,386 million in the year ended December 31, 2010 compared to R$1,000 million in the year ended December 31, 2009. This increase was primarily due to the acquisition of Intelig and an effort to acquire and maintain clients based on innovation and prime services, rather than discounts.

Discounts on services and handset sales increased 16.8% from R$1,186.3 million on a pro forma basis in the year ended December 31, 2009.

Costs of services and goods

Costs of services and goods increased by 9.5% to R$7,305.8 in the year ended December 31, 2010 from R$6,672.4 in the year ended December 31, 2009, mainly due to the acquisition of Intelig, as well as organic growth. Cost of handsets and accessories sold increased 10.9% in the year ended December 31, 2010 due largely to campaigns to stimulate purchases of the TIM Chip alone, and the appreciation of the Brazilian Real.

Costs of services and goods increased by 2.3% from R$7,142.9 on a pro forma basis in the year ended December 31, 2009, due mainly to a increase in expenses related to interconnection, reflecting our campaigns to promote on-net calls and lower personnel expenses. The following table shows the composition of costs of services and sales of mobile handsets, as well as the percentage change from 2010 to 2009:

Statement of Operations Data:

IFRS

| | | | | | | |

| | | | | | | | | | | | | | | | 2010 - 2009 | |

| | | (in million of reais) | | | | | | | | |

Depreciation and amortization | | | (1,994.2 | ) | | | (1,906.3 | ) | | | (1,816.0 | ) | | | 4.6 | % | | | 9.8 | % |

Interconnection expenses | | | (3,603.0 | ) | | | (3,628.1 | ) | | | (3,351.8 | ) | | | -0.7 | % | | | 7.5 | % |

Circuit leasing and related expenses | | | (242.9 | ) | | | (212.0 | ) | | | (166.0 | ) | | | 14.6 | % | | | 46.3 | % |

Materials and services | | | (337.0 | ) | | | (338.4 | ) | | | (315.6 | ) | | | -0.4 | % | | | 6.8 | % |

Personnel | | | (58.4 | ) | | | (96.1 | ) | | | (60.8 | ) | | | -39.2 | % | | | -3.9 | % |

FISTEL tax and other | | | (44.2 | ) | | | (37.0 | ) | | | (37.0 | ) | | | 19.5 | % | | | 19.5 | % |

Total cost of services | | | (6,279.7 | ) | | | (6,217.7 | ) | | | (5,747.2 | ) | | | 1.0 | % | | | 9.3 | % |

| Cost of handsets and accessories sold | | | (1,026.1 | ) | | | (925.2 | ) | | | (925.2 | ) | | | 10.9 | % | | | 10.9 | % |

Total cost of services and goods | | | (7,305.8 | ) | | | (7,142.9 | ) | | | (6,672.4 | ) | | | 2.3 | % | | | 9.5 | % |

| (1) | The 2009 Pro-forma information reflects the Intelig acquisition as if it had occurred on January 1st, 2009. See “Presentation of Financial Information”. |

Depreciation and amortization

Depreciation and amortization expenses increased 9.8% to R$1,994.2 million in the year ended December 31, 2010 from R$1,816.0 million in the year ended December 31, 2009, mainly due to the acquisition of Intelig.

Depreciation and amortization expenses increased 4.6% from R$1,906.3 million on a pro forma basis in the year ended December 31, 2009. The increase in depreciation expenses was due largely to efforts by the Company to expand and improve its network and IT infrastructure.

Interconnection expenses

Interconnection expenses consist of the amount paid to fixed-line and other mobile service providers for termination of our outgoing calls on their networks. Interconnection costs increased 7.5% to R$3,603 million in the year ended December 31, 2010 from R$3,351.8 million in the year ended December 31, 2009, mainly due to the acquisition of Intelig

Interconnection costs decreased 0.7% from R$3,628.1 million on a pro forma basis in the year ended December 31, 2009, This decrease reflected the results of our campaign to encourage on-net usage through discounted fares and specific bundle plans (Liberty and Infinity Plans).

Circuit leasing and related expenses

Circuit leasing and related expenses represent lease payments to fixed carriers for the use of circuits, interconnecting our network and transporting our customer traffic through third-parties fixed infrastructure. Circuit leasing and related expenses increased 46.3% in the year ended December 31, 2010 to R$242.8 million from R$166.0 million in the year ended December 31, 2009, mainly due to the acquisition of Intelig

Circuit leasing and related expenses increased 14.6% from R$212.0 million on a pro forma basis in the year ended December 31, 2009. The increase was attributable to the growth in data traffic and value added services.

Materials and services

Materials and services costs were R$337 million in the year ended December 31, 2010, up 6.8% from R$315.6 million incurred in the year ended December 31, 2009, mainly due to the acquisition of Intelig,

Materials and services costs decreased 0.4% from R$338.4 million on a pro forma basis incurred in the year ended December 31, 2009. The decrease reflects reduced maintenance costs in the 3G and GSM network.

Personnel

Personnel costs decreased 0.9% to R$58.4 million in the year ended December 31, 2010 from R$60.8 million in the year ended December 31, 2009.

Personnel costs decreased 39.2% from R$96.1 million on a pro forma basis in the year ended December 31, 2009. The decrease was due principally to corporate restructuring, implementing a new administrative and commercial structure that led to headcount adjustment. During 2010, there has been a 1.6% decrease in our number of employees, from 9,231 in the year ended December 31, 2009 to 9,081 in the year ended December, 2010.

FISTEL tax and other

FISTEL tax and other costs increased 19.8% to R$44.2 million in the year ended December 31, 2010 from R$36.9 million in the year ended December 31, 2009, due to larger base obtained during 2010.

Costs of handsets and accessories sold

The cost of handsets and accessories sold in 2010 was R$1,206.1 million, representing a 10.9% of increase from R$925.2 million in the year ended December 31, 2009. This increase partially attributable to the effects of recent campaigns to stimulate the purchase of the TIM Chip alone, and the appreciation of the Real as most of our handset portfolio is imported.

Gross profit margins

The following table shows our gross profits, as well as the percentage change, from 2009 to 2010:

Statement of Operations Data:

IFRS

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | 2010 - 2009 | |

| | | (in million of reais) | | | | | | | | |

| Net operating revenues from services | | | 13,571.6 | | | | 12,787.9 | | | | 12,199.0 | | | | 6.1 | % | | | 11.3 | % |

Cost of services | | | (6,279.7 | ) | | | (6,217.7 | ) | | | (5,747.2 | ) | | | 1.0 | % | | | 9.3 | % |

Gross profit from services | | | 7,291.9 | | | | 6,570.1 | | | | 6,451.8 | | | | 11.0 | % | | | 13.0 | % |

| Net operating revenues from sales of cellular handsets and accessories | | | 885.8 | | | | 959.2 | | | | 959.2 | | | | -7.6 | % | | | -7.6 | % |

Cost of goods | | | (1,026.1 | ) | | | (925.2 | ) | | | (925.2 | ) | | | 10.9 | % | | | 10.9 | % |

| Gross loss from sales of cellular handsets and accessories | | | (140.3 | ) | | | 34.0 | | | | 34.0 | | | | -512.8 | % | | | -512.8 | % |

Gross profit | | | 7,151.7 | | | | 6,604.1 | | | | 6,485.8 | | | | 8.3 | % | | | 10.3 | % |

| (1) | The 2009 Pro-forma information reflects the Intelig acquisition as if it had occurred on January 1st, 2009. See “Presentation of Financial Information”. |

Our gross profit margin from services (gross profit as a percentage of net service revenues) increased from 52.9% in the year ended December 31, 2009 to 53.7% in the year ended December 31, 2010.

Our gross profit margin from services increased from 51.4% on a pro forma basis in the year ended December 31, 2009 to 53.7% in the year ended December 31, 2010. The increase was mainly due to a decrease of 15.3% in interconnection expenses during the period while registering significant outgoing traffic increase

Our negative gross margin for sales of mobile handsets and accessories decreased from 3.5% in the year ended December 31, 2009 to 15.8% in the year ended December 31, 2010. TIM changed its subsidy policy, and launched the “TIM Chip Avulso” offer, pursuant to which the clients can choose between having handsets purchased at a discount, or discounted monthly fees for stand alone TIM chip alone purchases. This campaign caused 50% of our fourth quarter handset sales to be subsidy-free.

We continue to aim to offer a complete and exclusive handset portfolio, which also supports VAS usage.

Our overall gross profit margin increased, from 49.3% in the year ended December 31, 2009 to 49.5% in December 31, 2010. This resulted primarily from an increase in gross profit margin on services, despite negative gross margin for handset sales. Our overall gross profit margin increased, from 48.0% on a pro forma basis in the year ended December 31, 2009 to 49.5% in December 31, 2010.

Operating expenses

The following table shows our operating expenses, as well as the percentage change from year to year of each component, for the years ended December 31, 2010 and 2009:

Statement of Operations Data:

IFRS

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | 2010 - 2009 | |

| | | (in million of reais) | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | |

Selling expenses | | | (4,494.6 | ) | | | (4,501.9 | ) | | | (4,436.8 | ) | | | -0.2 | % | | | 1.3 | % |

General and administrative expenses | | | (1,008.7 | ) | | | (1,133.8 | ) | | | (1,033.4 | ) | | | -11.0 | % | | | -2.4 | % |

Other operating expenses, net | | | (448.2 | ) | | | (460.8 | ) | | | (462.1 | ) | | | -2.7 | % | | | -3.0 | % |

Total operating expenses | | | (5,951.5 | ) | | | (6,096.5 | ) | | | (5,932.3 | ) | | | -2.4 | % | | | 0.3 | % |

| (1) | The 2009 Pro-forma information reflects the Intelig acquisition as if it had occurred on January 1st, 2009. See “Presentation of Financial Information”. |

Our total operating expenses increased 0.3% to R$5,951.5 million in the year ended December 31, 2010 from R$5,932.3 million in December 31, 2009, mainly due to the acquisition of Intelig.

Our total operating expenses decreased 2.4% from R$6,096.5 million on a pro forma basis in December 31, 2009. This result was mainly attributable to a decrease in G&A expenses.

Selling expenses

Selling expenses increased 1.3% registering R$4,494.6 million in the year ended December 31, 2010 from R$4,436.8 million in the year ended December 31, 2009, mainly due to the acquisition of Intelig,

Selling expenses decreased 0.2% from R$4,501.9 million on a pro forma basis in the year ended December 31, 2009.

The allowance for doubtful accounts decreased from R$421.9 million in the year ended December 31, 2009 to R$310.5 million in the year ended December 31, 2010, as a result of rational go-to-market approach based on naked SIM-Card sales (which are sales of stand-alone SIM cards) and better customer credit scoring.

General and administrative expenses

General and administrative expenses decreased 2.4% to R$1,008.7 million in the year ended December 31, 2010 from R$1,033.4 million in the year ended December 31, 2009.

General and administrative expenses decreased 11.0% from R$1,133.8 million on a pro forma basis in the year ended December 31, 2009. This decrease was primarily attributable to lower maintenance and personnel costs for the year ended December 31, 2010.

Other operating expenses, net

Other net operating expenses decreased 3.0% to R$448.2 million in the year ended December 31, 2010 from R$462.1 million in the year ended December 31, 2009. This decrease was primarily due to a decrease of expense contingency.

Net financial expense

TIM registered a net financial expense of R$245.5 million in the year ended December 31, 2010, from a negative result of R$245.1 million in the year ended December 31, 2009 stable in a year over year comparison.

Net financial expense decreased from a positive result of R$260 million in the year ended December 31, 2009 on a pro forma basis. This decrease reflected a positive impact of FX revenues obtained in 2009 result from a non-hedged debt of Intelig.

Income and social contribution taxes

Income and social contribution taxes are calculated based on the separate income of each subsidiary, adjusted by the additions and exclusions permitted in the year ended December 31, 2010 under tax law. We recorded income and social contribution tax of R$1,257.0 million in the year ended December 31, 2010, compared to R$(33.0) million in the year ended December 31, 2009. The positive impact is largely due related to the release in its entirety of the valuation allowance for tax loss carryforwards related to our subsidiary TIM Celular in the end of 2010, reflecting a better judgment for utilization of such tax credit following expected improvements on earnings.

Net income

With the impact of the ‘tax credit’, our net income in the year ended December 31, 2010 was R$2,211.7 million, representing an increase of R$1,410.5 million or 176.0% from a net income of R$801.2 million in the year ended December 31, 2009.

B. Liquidity and Capital Resources

As of December 31, 2010, our cash equivalents was approximately R$2.4 billion and our working capital amounts to approximately R$0.7 million. Our cash flow from operations during 2010 was R$2.9 billion. Based on our business plan, we believe that our cash, cash equivalents, forecasted cash flows from operations and eventual new loans will be sufficient to meet our cash needs for working capital and capital expenditures for the next year.

We expect to finance our capital expenditures and other liquidity requirements for 2011 and 2013 with operating revenue, renewals of maturing indebtedness and new financing to be obtained from financial institutions.

In 2010, the Company disbursed new loans of R$433 million from (i) BNDES, for an amount of R$354.6 million; and (ii) European Investment Bank, or EIB, for an amount of R$78.7 million equivalent to € 34 million.

New financing obtained in 2010 included a long term soft loan (a loan with a below-market rate of interest) obtained from BNDES for an amount of R$716.9 million of which R$200 million have been disbursed until December 31, 2010.

The terms of our long term debt contain cross-default clauses, restrictions on our ability to merge with another entity and restrictions on our ability to prematurely redeem or repay such debt. We are currently not, and do not expect to be, in breach of any material covenants of our borrowings that would be construed as events of default under their terms.

In 2011, the Company plans to complete its current financing needs through its current long term facilities and partial renewal of its short term debt.

Sources of Funds

Cash from operations

Our cash flows from operating activities were R$1,372.0 million in the year ended December 31, 2010 compared to R$654.3 million in the year ended December 31, 2009. On December 31, 2010, we had positive working capital of R$14.1 million compared to negative working capital of R$142.2 million at December 31, 2009.

Financial Contracts

We and our subsidiaries are parties to the following material financial contracts:

| | · | Credit Agreement, dated as of June 28, 2004, among TIM Nordeste (incorporated by TIM Celular), as borrower, and Banco do Nordeste do Brasil S.A., as lender, in the principal amount of R$20 million. The amount outstanding as of December 31, 2010, including accrued interest, was R$5 million. The agreement, which matures on June 28, 2012, bears interest in the rate of 10.0% per annum. In connection with this agreement, Banco Bradesco S.A. issued a letter of guarantee, subject to the payment of fees corresponding to 1% per annum of the principal amount. The guarantee agreement executed by TIM Celular and Banco Bradesco S.A. provides for the issuance of a R$30 million promissory note by TIM Celular with TIM Participações as the guarantor of such promissory note. |

| | · | Credit Agreement, dated as of April 29, 2005, among TIM Nordeste (incorporated by TIM Celular), as borrower, and Banco do Nordeste do Brasil S.A., as lender, in the principal amount of approximately R$85.3 million. The amount outstanding as of December 31, 2010, including accrued interest, was R$33 million. The agreement, which matures on April 29, 2013, and bears interest at a rate of 10.0% per annum. In connection with this agreement, Banco Bradesco S.A. issued a letter of guarantee, subject to the payment of fees corresponding to 1% per annum of the principal amount. The guarantee agreement executed by TIM Celular and Banco Bradesco S.A. provides for the issuance of a R$128.0 million promissory note by TIM Celular with TIM Participações as the guarantor of such promissory note. |

| | · | Credit Agreement, dated as of June 28, 2004, among TIM Nordeste (incorporated by TIM Celular), as borrower, and Banco do Nordeste do Brasil S.A., as lender, in the principal amount of R$99.9 million. The amount outstanding as of December 31, 2010, including accrued interest, was R$23 million. The agreement, which matures on June 28, 2012, bears interest in the rate of 10.0% per annum. In connection with this agreement, Banco Bradesco S.A. issued a letter of guarantee, subject to the payment of fees corresponding to 1% per annum of the principal amount. The guarantee agreement executed by TIM Celular and Banco Bradesco S.A. provides for the issuance of a R$149.8 million promissory note by TIM Celular with TIM Participações as the guarantor of such promissory note. |

| | · | Credit Agreement, dated as of January 28, 2008, among TIM Nordeste (incorporated by TIM Celular), as borrower, and Banco do Nordeste do Brasil S.A., as lender, in the principal amount of R$67.0 million. The amount outstanding as of December 31, 2010, including accrued interest, was R$57 million. The agreement, which matures on January 31, 2016, bears interest in the rate of 10.0% per annum. In connection with this agreement, Banco Votorantim S.A. issued a letter of guarantee, subject to the payment of fees corresponding to 0.575% per annum of the integral principal amount offered in the Credit Agreement. The guarantee agreement executed by TIM Celular and Banco Votorantim S.A. provides for the issuance of a R$87.1 million promissory note by TIM Celular. TIM Participações is not the guarantor in this promissory note. |

| | · | Credit Agreement, dated as of August 10, 2005, among BNDES, as lender, TIM Celular, as borrower, and TIM Brasil as guarantor, in the principal amount of R$1.252 million. The agreement, which matures on August 15, 2013, bears the average interest fixed rate of 4.2% plus the TJLP, which was 6% per annum on |

| | | December 31, 2010. On December 31, 2010, the outstanding amount under this credit agreement, including accrued interest, was R$583 million. |

| | · | Credit Agreement, dated as of October 14, 2005, among BNDES, as lender, TIM Celular, as borrower, and Itaú, as guarantor, in the principal amount of R$49.3 million. The agreement, which matures on October 17, 2011, bears interest at a fixed rate of 3% plus the TJLP, which was 6% per annum on December 31, 2010. On December 31, 2010, the outstanding amount under this credit agreement, including accrued interest, was R$11 million. In connection with this agreement, Itaú issued a letter of guarantee, subject to the payment of fees corresponding to 0.64% per annum of the principal amount. |

| | · | Credit Agreement, dated as of October 6, 2009, among BNDES, as lender, TIM Celular and TIM Nordeste (incorporated by TIM Celular), as borrowers, and TIM Participações as guarantor, in the principal amount of R$400 million. The agreement, which matures on October 15, 2012, bears interest at a fixed rate of 4.82% plus the TJLP, which was 6% per annum on December 31, 2010. On December 31, 2010, the outstanding amount under this credit agreement, including accrued interest, was R$407 million. |

| | · | Credit Agreement, dated as of November 19, 2008, among BNDES, as lender, TIM Celular, as borrower, and TIM Participações as guarantor, in the principal amount of R$592.9 million. The agreement, which matures on July 15, 2017, bears the average interest fixed rate of 2.17% plus the TJLP and the interest rate of 2.62% plus the IPCA which was 7.61% per annum on December 31, 2010. On December 31, 2010, the outstanding amount under this credit agreement, including accrued interest, was R$628 million. |

| | · | Credit Agreement, dated as of November 19, 2008, among BNDES, as lender, TIM Nordeste (incorporated by TIM Celular), as borrower, and TIM Participações as guarantor, in the principal amount of R$201. The agreement, which matures on July 15, 2017, bears the average interest at a fixed rate of 2.03% plus the TJLP and the interest rate of 2.62% plus IPCA which was 7.61% per annum on December 31, 2010. On December 31, 2010, the outstanding amount under this credit agreement, including accrued interest, was R$212 million. |

| | · | Credit Agreement, dated as of November 19, 2008 and amended on 29/06/2010, among BNDES, as lender, TIM Celular, as borrower, and TIM Participações as guarantor, in the principal amount of R$716.9 million, which R$200 million was already disbursed. The agreement, which matures on July 15, 2018 bears interest of i) fixed rate of 3,62% plus the TJLP and ii) fixed interest rate of 4.5% per annum. On December 31, 2010, the outstanding amount under this credit agreement, including accrued interest, was R$180 million. |

| | · | Credit Agreement, dated as of August 26, 2005 as amended in 2008 and 2009, among HSBC, ABN Amro, Bradesco, Banco do Brasil, Itaú, Santander, BNP Paribas, Unibanco, Banco Votorantim, Societé Generale, as lenders, TIM Celular, as borrower, and TIM Participações, as guarantor, in the principal amount of R$568.75 million. The Tranche A of R$300 million, which matured on August 5, 2010, bears interest at a variable rate of 1.8% above the CDI interest rate. The Tranche B, which matured on August 5, 2010, bears interest at a variable rate of 2.75% above the CDI interest rate. The total debt was fully repaid during 2010. Hence, on December 31, 2010, the outstanding amount under this credit agreement, including accrued interest, was R$0. |

| | · | Credit Agreement, dated as of April 18, 2008, among Santander as lender, and TIM Celular, as borrower, in the principal amount of R$150.0 million. The agreement, which matures on April, 2011, bears interest at a variable rate of 110% of the CDI interest rate. On December 31, 2010, the outstanding amount under this credit agreement, including accrued interest, was R$154 million. |

| | · | Credit Agreement, dated as of May 5, 2008, among Santander as lender, and TIM Celular, as borrower, in the principal amount of R$50.0 million. The agreement, which matures on April 25, 2011, bears interest at a variable rate of 109.6% of the CDI interest rate. On December 31, 2010, the outstanding amount under this credit agreement, including accrued interest, was R$51 million. |

| | · | Several facility agreements contracted under Resolution CMN n. 2.770 (Foreign currency denominated debt already swapped into local floating interest rate denominated currency). The outstanding amount as of |

| | | December 31, 201 was R$166 million, including accrued interest. The last tranche of which matures on June 2011, bear an average cost of 108% of the CDI. No guarantees were offered for these loans. |

| | · | Finance Contract, dated as of June 3, 2008, between European Investment Bank, as lender, TIM Celular S.A. and TIM Nordeste (incorporated by TIM Celular) S.A., as borrowers and TIM Participações as guarantor, in the total principal amount of 200 million euros fully disbursed, and fully swapped into local currency, between September 2009 and June 2010. The total outstanding amount as of December 31, 2010 is R$479 million, including accrued interest. The drawings, the last of which matures on June 2017, bear an average cost of 95.40% of the CDI after hedging. The Guarantee was provided by BBVA Milan Branch and BES Portugal for the principal amount of € 200 million. |

| | · | Facility Agreement, dated as of November 28, 2008, between BNP Paribas, as lender, and TIM Celular S.A., borrower and TIM Participações as guarantor, in the total principal amount of U.S. $ 143.6 million fully disbursed and swapped on January 15, 2009. The total outstanding amount as of December 31, 2010 is R$245 million, including accrued interest. The agreement matures on December 2017 and bears an average cost of 95.01% of the CDI after hedging. |

| | · | The amount of USD 68 million with Morgan Stanley Senior Fund registered at Intelig as a long term liability on December 31, 2009, was fully prepaid at January 4, 2010. Hence, on December 31, 2010, the outstanding amount under this credit agreement, including accrued interest, was zero. |

See notes 18 and 37 in our consolidated financial statements for a further description of such financing agreements.

Uses of Funds

Principal uses of funds during the three-year period ended December 31, 2010, were the Capital Expenditures, the payment of dividends to our shareholders and loan repayments.

Investments in Fixed Assets

Our capital expenditures in 2010 and 2009, related primarily to:

| | · | deployment of our third generation (3G) network |

| | · | implementation and maintenance of our GSM and TDMA networks; |

| | · | purchases of equipment relating to our migration to PCS operations; |

| | · | expanding network capacity, geographic coverage and digitalization; |

| | · | developing new operational systems to meet customers’ demands and information technology systems; and |

| | · | free handsets provided to corporate customers (comodato). |

The following table contains a breakdown of our investments in fixed assets for the years ended December 31, 2010 and 2009:

| | | | |

Capital Expenditures Categories | | | | | | |

| | | (in millions of reais) | |

Network | | | 1,701.0 | | | | 1,319.4 | |

Information technology | | | 607.1 | | | | 499.9 | |

Handsets provided to corporate customers (comodato) | | | 182.8 | | | | 351.9 | |

Handsets provided to consumer customers (subsidies) | | | 290.3 | | | | 483.4 | |

Other | | | 54.4 | | | | 47.6 | |

Total capital expenditures | | R$ | 2,835.7 | | | R$ | 2,702.1 | |

| (1) | The 2009 Pro-forma information reflects the Intelig acquisition as if it had occurred on January 1st, 2009. See “Presentation of Financial Information”. |

Our Board of Directors has approved our budget for capital expenditures from 2011 to 2013 in the total amount of R$8.5 billion and R$2.9 billion in 2011 for expenditures relating to our subsidiaries TIM Celular and TIM Nordeste. Most of the capital expenditures we budgeted for 2011 to 2013 relate to the expansion of the capacity and quality of our 3G technology and development of technology infrastructure. See “Item 4.A. Information on the Company—History and Development of the Company—Capital Expenditures.”

Dividends

Our Dividends are calculated in accordance with our bylaws and the Brazilian Corporations Law. Pursuant to our bylaws, we must distribute an amount equivalent to 25% of adjusted net income as minimum dividend each year ended December 31, provided that there are funds available for distribution.

For the purposes of the Brazilian Corporations Law and in accordance with our bylaws, “adjusted net income” is the amount equal to the net profit adjusted to reflect allocations to or from: (i) the legal reserve, and (ii) a contingency reserve for probable losses, if applicable.

Preferred shares are nonvoting but take priority on (i) capital reimbursement, at no premium; and (ii) payment of a minimum non-cumulative dividend of 6% p.a. on the total obtained from dividing the capital stock by the total number of shares issued by us.

Following the latest amendment to the Brazilian Corporations Law (Law No. 10,303/01), our bylaws have been amended by including the First Paragraph of Section 10, to give holders of preferred shares, the right to receive dividends corresponding to 3% (three percent) of shareholders equity every year, based on the balance sheet most recently approved, whenever the amount then resulting exceeds the dividend amount as calculated pursuant to the criteria, described in the preceding paragraph.

Our management proposed that the outstanding balance of the adjusted net profits, in the amount of R$204.1 million be fully distributed as dividends to our preferred shareholders.

The following table contains a breakdown of the dividends and interest on shareholders’ equity actually paid (net of income taxes) by us to our shareholders during the years ended December 31, 2010, 2009 and 2008:

Dividend Distribution (1) | | | |

| | | | | | | | | | |

| | | (in millions of reais) | |

Dividends | | | 201.2 | | | | R$168.1 | | | | R$207.6 | |

Interest on shareholders’ equity | | | - | | | | - | | | | - | |

Total distributions | | | 201.2 | | | | R$168.1 | | | | R$207.6 | |

On April 11, 2011 our shareholders approved the distribution of R$496.6 as dividends in accordance of the minimum required on Brazilian Law, with respect to our 2010 results. On April 27, 2010 our shareholders approved the distribution of R$204.1 million as dividends to our shareholders with respect to our 2009 results. On April 2, 2009 our shareholders approved the distribution of R$171.1 million as dividends to our shareholders with respect to our 2008 results.

The Company paid dividends or interest on shareholders’ equity for the years-ended December 31, 2007, 2008 and 2009 below the minimum levels requested by the Brazilian Corporations Law. As a result, the holders of our preferred shares are entitled, from 2010 on, to have the same voting rights as the holders of common shares. Pursuant to Brazilian law, the voting rights of the Preferred Shareholders automatically terminate as soon as the Minimum Dividend is paid to them. On June 10, 2011, the 2010 Dividend was paid to the Preferred Shareholders and consequently the Preferred Shareholders ceased to have voting rights in the Shares

C. Research and Development

We do not independently develop new telecommunications hardware and depend upon the manufacturers of telecommunications products for the development of new hardware. Accordingly, we do not expect to incur material research and development expenses in the future.

D. Trend Information

Customer Base and Market Share

In the year ended December 31, 2010, TIM’s subscriber base ended the year with 51.0 million clients, 24.1% from the year ended December 31, 2009. This represented a market share of 25.1%, while the service revenues share, our primary focus, reached 27% in the year ended December 31, 2010, compared to 26% in the year ended December 31, 2009. The pre-paid segment reached 43.5 million users in the year ended December 31, 201-, an increase of 25.7% from the year ended December 31, 2009. The number of post-paid users was 7.5 million in the year ended December 31, 2010, a 15.7% increase from the year ended December 31, 2009.

Although no assurances can be given as to the size of our subscriber base and market share in the future, we intend to focus on maintaining and improving our strong position in the mobile and fixed telecommunications market in Brazil in terms of number of subscribers and our high quality customer composition. To do so we intend to utilize sophisticated strategies and our customer segmentation approach, which we believe has contributed to an increased subscriber base and to retain our current customers and attract new customers. In 2011, we plan to improve our growth phase, driven by the increase in fixed-mobile substitution and the growth in data. We are aiming to become a leader in the telecommunications market by targeting customer satisfaction through improvement in service quality, expansion of capacity and integration with Intelig.

Change of Mix Between Postpaid and Prepaid Customers

With respect to the composition of our clients, our post-paid customers accounted for 14.6% of our total subscriber base in the year ended December 31, 2010, compared to 15.7% from a year ago, largely due to the increase of pre-paid base.

Average Revenue Per User (ARPU) Per Month

TIM’s ARPU registered R$23.7 in the year ended December 31, 2010, a decrease of -10.8% when compared to R$26.6 presented in the year ended December 31, 2009. The trend is partially attributed to an increase of 25.7% in the pre-paid segment and a lower incoming revenue contribution.

Revenues from value-added services had an important role in offsetting ARPU’s downward trend of the market as a whole. In 2010 we registered a value-added service revenue growth of 18.1% and accounted for 11.9% of total gross service revenue (compared to 10.6% registered in 2009). We anticipate that revenues from value-added services will continue to increase and become a larger component of our total service revenues, particularly after the launch of our 3G offers (such as our mobile broadband solution). As the provision of value added services has a relatively low marginal cost, we anticipate that value added services will contribute to the growth of our operating margins.

Competitive Environment

Brazil has a competitive scenario that is almost unique in the world. The competition in the country’s mobile telephony sector has become fiercer with the recent mergers and acquisitions. This market has been growing at significant rates compared not only to the telecom industry but also to other sectors of the economy. Brazil is one of the few markets with four nationwide competitors, each with a market share between 20% and 30%, which TIM believes, acts as the driver of growth and for the development of differentiated and quality services at fair and competitive prices.

In 2010, despite the competitive environment, our gross acquisition cost (per gross addition) was R$73 for the year ended December 31, 2010, compared to R$115 in the year ended December 31, 2009. The decrease of 36.6%

reflects our different approach regarding subsidy and commission. Our chip only strategy reduced sharply the expenses of handset subsidy and the restructuring of commission policy and the adoption of new alternative sales channels decreased commission expenses.

In addition to competition from other traditional mobile telecommunications service providers, the level of competition from fixed-line service providers has increased, and we expect will continue to increase, as fixed-line service providers attempt to attract subscribers away from mobile service based on price and package offers that bundle multiple applications such as voice services (mobile and fixed-line), broadband and other services. Technological changes in the telecommunications field, such as the development of third generation, and number portability are expected to introduce additional sources of competition. It is also expected that Anatel will auction licenses to provide mobile telecommunications services over additional bandwidth frequencies to accommodate these emerging technologies.

In 2010, despite the competitive environment, our gross acquisition cost (per gross addition) was R$54 for the year ended December 31, 2010, compared to R$85 in the year ended December 31, 2009. The decrease of 36.4% reflects the rational go to market approach, with a sharp drop in subsidies, commission and advertisement expenses per gross addition.

In addition to competition from other traditional mobile telecommunications service providers, the level of competition from fixed-line service providers has increased, and we expect will continue to increase, as fixed-line service providers attempt to attract subscribers away from mobile service based on price and package offers that bundle multiple applications such as voice services (mobile and fixed-line), broadband and other services. Technological changes in the telecommunications field, such as the development of third generation, and number portability are expected to introduce additional sources of competition. It is also expected that Anatel will auction licenses to provide mobile telecommunications services over additional bandwidth frequencies to accommodate these emerging technologies.

The year 2010 continued to be marked by both by the government’s programs to encourage digital inclusion and the maturing of convergent services, recently inaccessible to the majority of the population.

The Brazilian mobile telephony market is the fifth largest in the world and reached a penetration level of 104.6 telephone lines for every 100 inhabitants in 2010. This confirms that mobile telephony is the mean of communication with the widest presence in Brazilian homes and across all social classes, which we believe is a consequence of chip-only offers (offer of SIM cards without a handset).

The prepaid segment has the largest growth in 2010, reaching167.1 million accesses (+16.4% A/A), which represents 82.3% of total market. The postpaid segment reached the mark of 35.8 million lines, an 18.1% YoY expansion. The key growth drivers to both sectors were the favorable economic scenario in Brazil, with increased credit, better income distribution (with part of population migrating from the D and E class to C class), and competition in Brazil’s mobile telephony market.