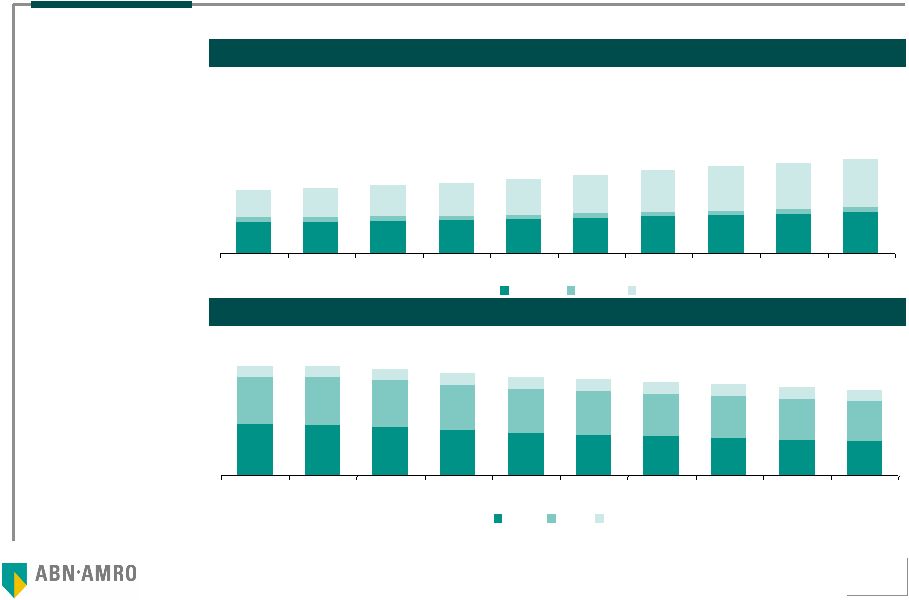

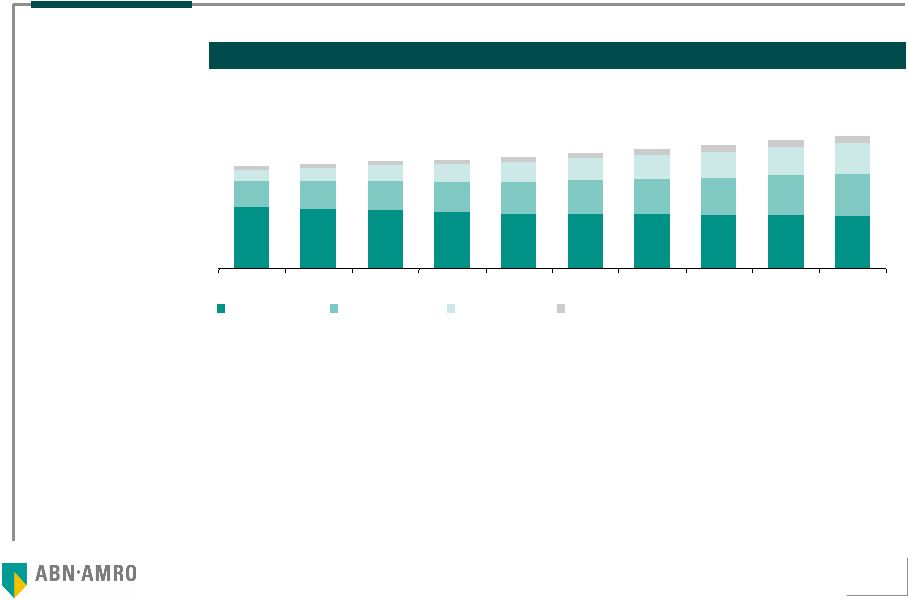

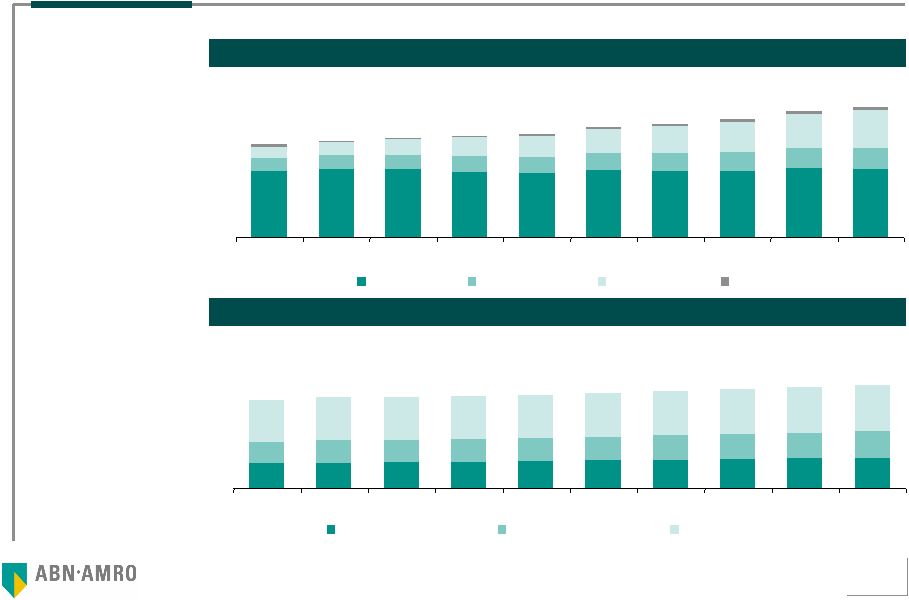

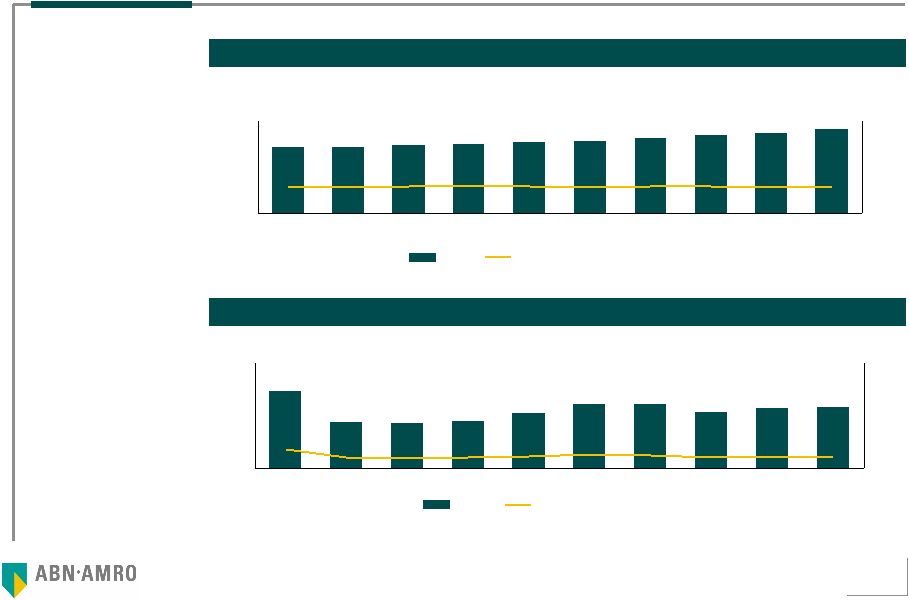

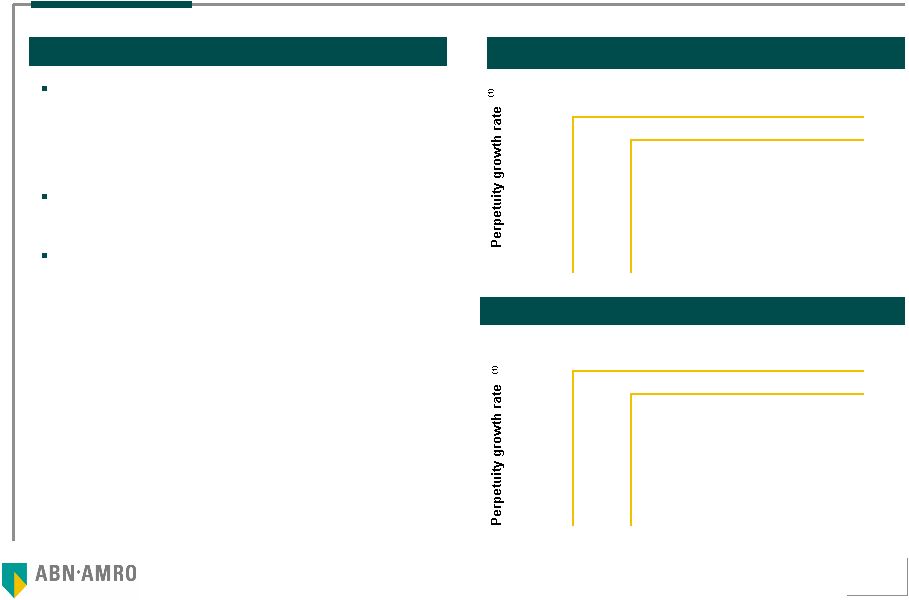

52 Embrapar: Results of Operations and Cash Flows Note: Simplified financial statements consider the integral consolidation of Star One. with the elimination of intercompany operations For the perpetuity calculation it was assumed: (i) an EBITDA adjustment to reflect a long term annual concession rate (1% per year versus 2% biannual) and (ii) an average Capex to reflect the maintenance and renovation of the current fleet of Star One satellites DRE (R$ nominal millions ) Free Cash Flow (R$ nominal millions) Ending on December 31 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Net revenues 8,235 8,431 8,644 8,754 8,942 9,310 9,590 9,918 10,341 10,673 Operational Costs and Expenses (5,808) (6,007) (6,143) (6,219) (6,330) (6,639) (6,819) (7,043) (7,382) (7,579) EBITDA 2,427 2,424 2,502 2,535 2,611 2,670 2,771 2,875 2,959 3,094 Margin (%) 29.5% 28.7% 28.9% 29.0% 29.2% 28.7% 28.9% 29.0% 28.6% 29.0% Earnings before Taxes 880 555 641 715 588 734 918 1,025 1,056 1,221 Net profit 852 532 629 698 570 710 884 966 992 1,142 Ending on December 31 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 EBIT 1,349 1,025 1,126 1,208 1,099 1,254 1,532 1,714 1,731 1,928 Taxes on EBIT (IR and CSLL) (459) (348) (383) (411) (374) (426) (521) (583) (589) (655) Depreciation and Amortization 1,078 1,399 1,375 1,327 1,512 1,417 1,239 1,161 1,228 1,166 Capex (1,464) (881) (864) (889) (1,054) (1,218) (1,219) (1,068) (1,140) (1,161) Changes in Working Capital (213) (83) (66) (20) (91) (116) (104) (111) (109) (108) Free Cash Flow of the Subsidiaries 291 1,112 1,189 1,216 1,092 909 927 1,113 1,121 1,169 |