Exhibit 99.1

NOTICE OF UNIFIED OFFER TO PURCHASE COMMON SHARES AND PREFERRED SHARES ISSUED BY

NET SERVIÇOS DE COMUNICAÇÃO S.A.

Publicly Held Corporation

Corporate Taxpayer Identification Number CNPJ/MF 00.108.786/0001-65

Company Registration Number NIRE 35.300.177.240

ISIN Code BRNETCACNPR3BRNETCACNPR3 and

BRNETCACNOR6

FOR AND ON BEHALF OF

EMBRATEL PARTICIPAÇÕES S.A.

EMPRESA BRASILEIRA DE TELECOMUNICAÇÕES S.A. – EMBRATEL

GB EMPREENDIMENTOS E PARTICIPAÇÕES S.A.

CNPJ/MF 33.530.486/0001-29

NIRE 333.0000340-1

BANCO ITAÚ BBA S.A., a financial institution with its principal place of business in the City and State of São Paulo, at Av. Brigadeiro Faria Lima 3400, 3rd to 8th, 11th and 12th floors, CNPJ/MF No. 17.298.092/0001-30, as intermediary agent in Brazil (the “Intermediary Agent”), throughITAÚ CORRETORA DE VALORES S.A., a financial institution with its principal place of business in the City and State of São Paulo, at Avenida Brigadeiro Faria Lima 3400, 10th Floor, CNPJ/MF No. 61.194.353/0001-64 (“Itaú Corretora”), for and on behalf ofEMBRATEL PARTICIPAÇÕES S.A., a publicly held corporation with its principal place of business in the City and State of Rio de Janeiro, at Rua Regente Feijó, 166, suite 1687-B, Centro, CNPJ/MF No. 02.558.124/0001-12 (“Embrapar”);EMPRESA BRASILEIRA DE TELECOMUNICAÇÕES S.A. – EMBRATEL, a corporation with its principal place of business in the City and State of Rio de Janeiro, at Av. Presidente Vargas 1012, Centro, CNPJ/MF No. 33.530.486/0001-29 (“Embratel”); andGB EMPREENDIMENTOS E PARTICIPAÇÕES S.A., a corporation with its principal place of business in the City and State of Rio de Janeiro, at Avenida Afrânio de Melo Franco, 135, 5th floor, part occupancy, Leblon, CNPJ/MF No. 04.527.900/0001-42 (“GB”) (Embrapar, Embratel and GB are hereinafter collectively referred to as the “Offerors”), hereby present to the holders of common shares and preferred shares (“Shareholders”) issued byNET SERVIÇOS DE COMUNICAÇÃO S.A., a publicly held corporation with its principal place of business in the City and State of São Paulo, at Rua Verbo Divino 1356, 1st floor, Chácara Santo Antônio, (“NET” or the “Company”) a unified offer to purchase all of the common shares and preferred shares issued by NET, including, following the procedures described herein and those procedures specific to each jurisdiction, preferred shares underlying the American Depositary Shares (“ADSs”) and preferred shares listed on theMercado de Valores Latinoamericanos(“Latibex”), pursuant to the terms of Instruction No. 361/02 issued by the Brazilian Securities and Exchange Commission (“CVM”), as amended (“CVM Instruction 361/02”), and in

1

accordance with the following terms (the “Offer”). The Offer is being made in Brazil and in the United States of America to all holders of common shares and preferred shares issued by NET, including preferred shares underlying the ADSs. Separate Offer materials are being published in English in the United States of America, including an offer to purchase (“Offer to Purchase”), and such materials are intended for all holders of common shares and preferred shares issued by NET who are U.S. holders (within the meaning of Rule 14d-1(d) of the U.S. Securities Exchange Act of 1934, as amended) and all holders of ADSs. U.S. holders of common and preferred shares and all holders of ADSs must read carefully through such materials before reaching a decision with regard to the Offer. Holders of preferred shares traded on Latibex (“Latibex Shareholders”) may, at their own risk, participate in the Offer. For more information about the participation of Latibex Shareholders in the Offer, see Item 2.12 below.

1.Events Leading to the Tender Offer

1.1.Background. NET is directly controlled by GB, a special purpose company that solely owns an amount of common shares issued by NET that is equivalent to GB’s total outstanding share capital.

On March 5, 2012, the direct controlling interest in GB and, consequently, the indirect control of the Company, was transferred to Embrapar by Globo Comunicações e Participações S.A., a closely held corporation with its principal place of business in the City and State of Rio de Janeiro, at Avenida Afrânio de Melo Franco 135, Leblon, CNPJ/MF No. 27.865.757/0001-02 (“Globopar”). The transfer had been previously approved by the Brazilian National Agency for Telecommunications – ANATEL under Act 612, in a decision published on February 1, 2012.

The acquisition by Embrapar of indirect control of NET was made through the exercise of the call option Embrapar held under the Shareholders’ Agreement of GB, dated March 21, 2005, to purchase one million seventy-seven thousand, five hundred and twenty (1,077,520) common shares issued by GB, at the price of R$ 5.97607720 per share.

The exercise of this option, and the resulting change in control of the Company, made it necessary for Embrapar to launch a mandatory offer for all the shares issued by the Company, with the minority shareholders being assured a price at least equivalent to the price paid per common share of NET owned by Globopar, pursuant to Article 254-A of Law No. 6404/76 (“Business Corporation Act”), of CVM Instruction 361/02 and of Section VIII of Bovespa Segment of BM&FBOVESPA S.A. - Bolsa de Valores, Mercadorias e Futuros, the Brazilian Stock, Commodities and Futures Exchange (“BM&FBOVESPA”) Corporate Governance Level 2 Listing Regulation (“Level 2” and “Level 2 Regulation”, respectively).

1.2.Delisting from Level 2 and Deregistration. As previously disclosed by Embrapar to the market under a Statement of Material Fact issued on March 6, 2012, Embrapar wishes to make, along with the mandatory offer for change in control of the Company, voluntary offers in connection with the delisting of NET from Level 2 and in connection with its deregistration as a public company in Brazil. Both the Level 2 delisting and the Brazilian deregistration were approved by means of a special shareholders’ meeting of NET, held on April 5, 2012, with the resolution thereof being subject to the completion and results, respectively, of this Offer.

2

1.2.1. The Brazilian deregistration is subject to acceptance of the Offer by Shareholders holding at least 2/3 of the outstanding shares of the Company, in the manner set forth in Item 7.1.1 below.

1.2.2. The Level 2 delisting shall occur regardless of the number of outstanding shares of the Company tendered in the Offer and of the Brazilian deregistration.

2.Offer

2.1.Legal Basis. The legal basis for this Offer to purchase the Target Shares (as defined in Item 2.4 below) consists of (i) Article 254-A of the Business Corporation Act, Articles 29 and 30 and other articles relating to the general procedures, as provided in CVM Instruction 361/02, Section VIII of the Level 2 Regulation and Article 27 of the Bylaws of the Company, with respect to the change in control of the Company; (ii) Section XI of the Level 2 Regulation and Article 35 of the Bylaws of the Company, with respect to discontinuance by the Company of the Level 2 corporate governance practices; and (iii) Article 4, Paragraph 4 of the Business Corporation Act, Articles 16 through 25 of CVM Instruction 361/02 and Section X of the Level 2 Regulation and Article 32 of the Bylaws of the Company, with respect to deregistration of the Company as a publicly held corporation in Brazil.

2.2.Registration with the CVM and Authorization by BM&FBOVESPA. Pursuant to Article 2, Paragraph 1 of CVM Instruction 361/02, the Offer was registered with CVM under No. [—], on [—] [—], 2012, and the Auction (as defined in Item 2.7. below) was authorized by the BM&FBOVESPA on [—] [—], 2012.

2.3.Offer Procedure. Pursuant to Article 34, Paragraph 2 of CVM Instruction 361/02, in a meeting held on [—] 2012, the Board of CVM approved the adoption of a procedure to unify, by means of this Offer, the offers in connection with (i) the indirect change in control of the Company; (ii) the discontinuance, by the Company, of the corporate governance practices of the Level 2 Regulation; and (iii) the deregistration of the Company as a publicly held corporation.

2.4.Shares. The Intermediary Agent, through Itaú Corretora, is willing to purchase, at the Auction, for and on behalf of the Offerors, all of the common shares and preferred shares of NET, with all their underlying rights, including those shares owned by officers and directors of the Company as well as those shares held by persons related to the Offerors (although shares owned by officers and directors of the Company and shares held by persons related to the Offerors are not considered outstanding shares for purposes of the Brazilian deregistration, as defined in Item 7.1.1 below), except only for those shares held by Embrapar, Embratel and by GB (such common shares and preferred shares hereinafter collectively referred to as “Target Shares”). For the avoidance of doubt, on the date of publication of this Offer document, the number of Target Shares was 17,999,657, representing 5.2% of the total capital stock of NET, with 12,576,189 common shares, representing 10.99% of the total common shares issued by the Company, and 5,423,468 preferred shares, representing 2.37% of the total preferred shares issued by NET. The Company does not have any treasury shares.

3

2.5.No Restrictions to the Exercise of the Ownership Interest in the Shares. To be tendered in this Offer, the Shares must be free and clear of any and all liens, security interests, usufruct or other encumbrances or restrictions of any kind to the free transfer thereof, or which prevent the immediate exercise by the Offerors of the full ownership rights of the Shares or full compliance with the rules for the trading of shares set forth in the trading regulations of the BM&FBOVESPA .

2.6.Dividends and/or Interest on Equity. Should NET declare the payment of dividends or interest on equity by the Auction Date (as defined below), the Shareholders registered as owners or usufructuaries of the shares of NET on the date on which the dividends or the interest on equity are declared shall be entitled to the payment of declared dividends or interest on equity.

2.7.Auction. The Offer shall be conducted by means of an auction (“Auction”) through the Bovespa Segment of BM&FBOVESPA. For further information on Shareholder qualification, see Item 4.1 below.

2.8.Effectiveness of the Offer. The Offer shall commence on [DATE CONDITIONAL UPON REGISTRATION WITH THE CVM], 2012 (exclusive), and shall expire on the Auction Date (inclusive), as defined in Item 5.1 below.

2.9.Consequences of Acceptance of the Offer. By accepting this Offer, pursuant to Item 4.9 below, each Shareholder agrees to dispose of and effectively transfer the Shares it owns, including all underlying rights.

2.10.Irrevocability of the Offer. The Offer is irrevocable as from the date hereof. However, the Offerors may request that the CVM, pursuant to Article 5, Paragraph 3 of CVM Instruction 361/02, approve the amendment or revocation of the Offer upon occurrence of a significant, subsequent and unpredictable change in the facts or circumstances existing on the date hereof that results in a significant increase in the risks assumed by the Offerors in the Offer. Any amendment to the terms and conditions of the Offer or the revocation thereof shall be publicly disclosed by means of publication of a Statement of Material Fact.

2.11.ADSs. The Offer will also be directed to the holders of preferred shares issued by the Company represented by ADSs (“ADS Holders”). For such purpose, the Offerors will publish offer materials in English in the United States of America, establishing the procedures for such ADS Holders to participate in the Offer, it being understood that the Shares underlying the ADSs shall be detached from the corresponding ADSs for tendering purposes. These procedures shall be detailed in an Offer to Purchase (which is part of the Combined Schedule TO and Schedule 13E-3) to be presented in accordance with U.S. regulations, and shall be available, after disclosure, at the following addresses:http://ri.netservicos.com.br;www.sec.gov;www.cvm.gov.br; andwww.embratel.com.br). The ADS Holders who wish to participate in the Offer may (a) deliver their ADSs to The Bank of New York Mellon (the “Receiving Agent”), so that it may detach the Shares from the ADSs and perform the required actions for qualification in the Auction; or (b) participate directly in the Auction, as Shareholders, after observing all the procedures necessary to detach the Shares from the ADSs with the depositary of the ADSs, JP Morgan Chase Bank,in both cases pursuant to the terms set forth in the Offer to Purchase. ADS Holders will have the option to agree or disagree with the Brazilian deregistration, pursuant to Item 4.1.1 below, provided that they have their ADSs detached from the Shares and participate in the Offer as Shareholders.

4

2.12Latibex. Latibex Shareholders may, for their own account and at their own risk, participate in the Offer, following the procedures disclosed by the Offerors to Latibex in Spain. Similarly, pursuant to the procedures disclosed by the Offerors to Latibex, Latibex Shareholders may, for their own account and at their own risk, agree or disagree with the Brazilian deregistration, as describe in Item 4.1.1 below.

2.13No Responsibility Regarding Procedures to be Followed by ADS Holders and Latibex Shareholders. The Intermediary Agent will not undertake any action outside of Brazil related to the Offer. The Intermediary Agent and/or the Brokerage Firm, as defined in Item 4.1 below, shall not be involved in and/or responsible for the procedures to be adopted so that ADS Holders and/or the Latibex Shareholders may participate in the Offer. The Intermediary Agent and/or the Brokerage Firm will also not be responsible for the feasibility of the sale, in the Offer, of the Shares represented by the ADSs or the Shares held by Latibex Shareholders. The Intermediary Agent and/or the Brokerage Firm do not accept responsibility for the time limits that may be set by the depositary and/or receiving agent of the ADSs, or for the transfer of custody of the Shares held by Latibex Shareholders, for purposes of participating in the Offer. In addition, any applicable taxes that are or become due in connection with the Offer, including, without limitation, those related to cancellation fees for the withdrawal of the ADSs from the depositary, the transfer of the Shares held by Latibex Shareholders, the sale of the Shares in the Auction and the remittance, if any, of funds overseas, shall not be the responsibility of the Intermediary Agent and/or the Brokerage Firm and/or the Offerors.

2.14Joint and Several Obligations of the Offerors. This Offer is being collectively made by the Offerors, and each Offeror reserves the right to acquire all or a portion of the Shares in the Auction within the period referred to in Item 7.7 below. The Offerors warrant that all Shares offered in the Auction within the period referred to in Item 7.7 below will be acquired. Any and all obligations resulting from the Offer are jointly and severally undertaken by the Offerors, regardless of the number of Shares effectively acquired by each Offeror.

3.Price of the Offer

3.1.Purchase Price. The purchase price for each Share is R$ 26.64, (i) less the amount of the dividends and/or interest on equity per Share that may come to be declared by NET between the date of publication hereof and the Auction Date, to which its Shareholders are entitled pursuant to Item 3.1.3 below and/or (ii) adjusted in accordance with the provisions of Item 3.1.4 below (“Purchase Price”). This Purchase Price is (i) approximately 28% higher than the weighted average price per volume of common shares and preferred shares of NET traded on the BM&FBOVESPA in the 60 days prior to March 5, 2012 (the date immediately prior to the disclosure of the intent to make the Offer), (ii) approximately 112% higher than the net asset value of the Shares of NET as of March 31, 2012; and (iii) greater than the price ascribed to each common share of NET acquired indirectly from Globopar – equivalent to R$ 5.97607720 per Share of issue of the Company on March 5, 2012, plus interest at the overnight weighted average and adjusted rate, pegged to federal public securities, of the Special Settlement and Custody System (Sistema Especial de Liquidação e Custódia) (“SELIC”), until the Auction Settlement Date (as defined below), as per the statement of justification furnished to CVM.

5

3.1.1. The Offerors consider the Purchase Price to be fair, in accordance with Article 16, I of CVM Instruction 361/02, because it is within the range of fair pricing established by the Appraiser (as defined in Item 9.1 below), determined based on a calculation of discounted cash flow, such method being, in the Appraiser’s opinion, the most appropriate to determine a fair price.

3.1.2. The Offerors clarify that the Purchase Price, as defined above, does not depend on the type or class of Share.

3.1.3. Any dividends or interest on equity declared by NET by the Auction Date shall be deducted from the Purchase Price if the Shares become “ex-dividend” or “ex-interest on equity” by the Auction Date.

3.1.4. In the event of bonuses, stock splits or reverse splits, the Purchase Price shall be adjusted in accordance with the number of shares of NET resulting from the bonus, stock split or reverse split, as the case may be. In such case, the Offerors shall disclose the new values for the Offer by means of a Statement of Material Fact.

3.1.5 The total value of the Offer on June 12, 2012 is R$ 479,870,855.62, to be adjusted by the variation in the Interbank Deposit Certificates rate (“CDI”) through the Auction Date.

3.2.Adjustment of the Purchase Price. The Purchase Price to be paid for each Share shall be adjusted by the variation of the CDI rate assessed from June 8, 2012 until and including the Auction Date.

3.3.Payment of the Purchase Price. The Purchase Price shall be paid in cash, in Brazilian currency, to the Shareholders accepting the Offer, on the Auction Settlement Date, as defined below.

3.4.Price Variation. At the Auction, procedures to ensure the Offerors’ right to increase the Purchase Price during the Auction shall be adopted, and the new price shall extend to all respective Shareholders that accepted the preceding bids.

3.5.Information to BM&FBOVESPA. The Intermediary Agent shall inform the Chief Operating Officer of BM&FBOVESPA in writing, at least two (2) business days before the Auction Date, the total amount of the Offer calculated to two decimal points and adjusted until the Auction Settlement Date.

4.Tender Offer Procedures

4.1.Qualification of Shareholders. The Shareholders who wish to participate in the Auction shall qualify by 6:00 p.m. (Brasília time) on [—] [—], 2012, authorizing Itaú Corretora or any other brokerage firm authorized to operate in the BOVESPA Segment of BM&FBOVESPA (individually referred to, including Itaú Corretora, as “Brokerage Firm”, and collectively, “Brokerage Firms”), so that the Brokerage Firm can represent the Shareholders in the Auction.

6

4.1.1. The Shareholders holding Shares who wish to expressly agree or disagree with the Brazilian deregistration must also qualify at Itaú Corretora or any other Brokerage Firm.

4.1.2.Documents Required for Authorization. The Shareholders who wish to authorize Itaú Corretora and/or other Brokerage Firm to represent them at the Auction (except for the ADS Holders and the Latibex Shareholders, who must follow the specific procedures set forth in Items 2.11 and 2.12 above) shall perform all required actions to become duly qualified on the Auction Date. For such purpose, these Shareholders must present themselves at Itaú Corretora or another Brokerage Firm, by the date set forth in Item 4.1, either personally or by a duly appointed attorney, and bring certified copies of the following documents: (a) Identity Card (RG); (b) Individual Taxpayer Identification Card (CPF); (c) proof of residence and (d) any other documents requested by Itaú Corretora or another Brokerage Firm. Representatives of legal entities, estates and other universalities of rights, minors, interdicted persons and attorneys-in-fact shall further present original counterparts or certified copies of the documents granting representation powers (including corporate documents, CNPJ/MF cards and the aforementioned personal documents listed above with respect to the persons authorized to act on behalf of the Company, as the case may be), without prejudice to other documents requested by any Brokerage Firm.

4.1.3.Additional Documents Necessary for Qualifying Investments Made Under Resolution No. 2689 of the National Monetary Council (“CMN Resolution 2689”) for the Auction. In addition to the documents described above in Items (a) and (b), Shareholders who have invested in Shares through any of the mechanisms established by CMN Resolution 2689 (“CMN Resolution 2689 Investors”) must provide the Brokerage Firm they contact prior to the Auction Date with (i) documents attesting to their registration number with the CVM and with the Central Bank of Brazil (in the latter case, the RDE-Portfolio number), as well as (ii) their legal custody statement declaring the number of Shares they hold and the number of Shares they will offer in the Auction. Should the CMN Resolution 2689 Investors be foreign individuals, they shall present a certified copy of their Individual Taxpayer Identification Card (CPF), in addition to the documents listed herein.

4.1.4.Shareholders that fail to Present the Documents Requested for Qualification. The Shareholders who fail to deliver all documents requested for qualification in the Auction in a timely manner or who do not to transfer their Shares for custody at the asset depositary center of BM&FBOVESPA, as provided in this Offer document, will not be qualified to participate in the Auction.

4.1.5.Qualified Shareholders. Shareholders who qualify to participate in the Auction pursuant to Item 4.1 above shall be hereinafter referred to as “Qualified Shareholders”.

4.2.Shares held in Custody at Banco Bradesco S.A. Shareholders who hold Shares held in custody at Banco Bradesco S.A., which is the depositary of the book-entry shares of the

7

Company, shall qualify for the Auction, authorizing Itaú Corretora and/or any other Brokerage Firm, pursuant to the provisions of Item 4.1. above, and shall perform the required actions for those Shares to be transferred from the custody of Banco Bradesco S.A. and deposited with the asset depositary center of BM&FBOVESPA, in accordance with the rules, terms and procedures of BM&FBOVESPA, which shall be completed by 6:00 p.m. of the business day immediately preceding the Auction Date.

4.3.Shares held in Custody at the Asset Depositary Center of BM&FBOVESPA. Shareholders that hold Shares already held in custody at the asset depositary center of BM&FBOVESPA shall qualify with one of the Brokerage Firms of their choice by 6:00 p.m. of the business day immediately preceding the Auction Date.

4.4.Transfer of Shares to a Specific Portfolio. Shareholders who wish to sell Shares deposited at the asset depositary center of BM&FBOVESPA shall, by means of their custody agent at the asset depositary center of BM&FBOVESPA, transfer the Shares to portfolio 7105-6, opened in its name and kept by the asset depositary center of BM&FBOVESPA exclusively for such purpose, by 12 p.m. on the Auction Date.

4.5. Registered sale orders, the corresponding Shares of which have not been deposited at the portfolio kept by the asset depositary center of BM&FBOVESPA, shall be cancelled.

4.6. The Qualified Shareholders shall be solely and exclusively responsible for performance of all applicable actions for transfer to the custody to the asset depositary center of BM&FBOVESPA to be made in a timely manner in order to allow them to be qualified at the Auction in the form and within the terms contemplated herein.

4.7. The Offerors advise NET’s Shareholders, the ADS Holders and the Latibex Shareholders that the procedures for verification of documents and transfer of the Shares described above are subject to the internal rules and procedures of the Brokerage Firms, of depositary institutions (including of the ADSs and of the Shares of the Latibex Shareholders) and of the asset depositary center of BM&FBOVESPA, so that each Shareholder shall perform all actions in a timely manner in order to be qualified to participate in the Auction, and they shall also meet all requirements for the trading of Shares set forth in the Trading Regulations of BM&FBOVESPA.

4.8.Interferences. Those persons interested in presenting an interfering offer in the Auction shall disclose to the market, ten (10) days in advance, their wish to present an interfering offer in the Auction, subject to the provisions of Article 12, Paragraph 4 of CVM Instruction 361/02.

4.9.Acceptance and Withdrawal of the Offer. The Offer shall be accepted by the corresponding Brokerage Firms, for and on behalf of a Qualified Shareholder who wishes to accept the Offer and who has met all qualification requirements set forth in Item 4.1 and subitems hereof, by means of the registration of the order to sell at the Auction on behalf of the corresponding Shareholder.

4.9.1. Until the beginning of the Auction, the Brokerage Firms representing Qualified Shareholders may cancel or reduce the sale orders registered in accordance with the

8

provisions of Item 4.9, by means of a letter addressed to the Chief Operating Officer of BM&FBOVESPA. After the Auction begins, the sale orders not cancelled and not reduced shall be deemed irrevocable and irreversible.

4.9.2. Acceptance of the Offer shall result in the obligation to sell to the Offerors the Shares owned by the corresponding Shareholder, in the manner and under the terms set forth in this offer document, free and clear of any and all liens or restrictions of any kind.

4.10.Qualification of ADS Holders. The ADS Holders must carefully read the Offer to Purchase, which shall contain a detailed description of the specific terms and procedures to be followed by ADS Holders for qualification for the Auction.

4.11.Qualification of Shareholders who hold Shares traded on Latibex. Latibex Shareholders must follow the procedures established by the Offerors as disclosed to Latibex in Spain.

5.Auction

5.1.Auction. The Auction shall take place on [—] [—], 2012 (the “Auction Date”), at [—] (Brasília time), in the trading system of the Bovespa segment of the BM&FBOVESPA.

5.2.Interference in the Auction. An interfering offer shall be allowed in the Auction, provided (i) such interference is in the form of a competing tender offer; (ii) the competing tender offer is registered with the CVM, pursuant to Article 13 of CVM Instruction 361/02; (iii) the competing tender offer follows the same criteria and procedures set forth in this Offer; (iv) the first competing tender offer bid is made at a price at least five percent (5%) higher than the Purchase Price, is extended to all Shareholders that accepted the preceding bids, as established in Article 12, Paragraph 2, Item I of CVM Instruction 361/02; and (v) the competing tender offer is for any and all shares, pursuant to Article 12, §2, II, of CVM Instruction 361/02.

5.3.Procedures to be Followed by the Brokerage Firms. By 12 p.m. on the Auction Date, the Brokerage Firms representing Qualified Shareholders in the form of Item 4.1 hereof, shall inform BM&FBOVESPA of the number of Shares held by the Qualified Shareholders that shall be represented by them at the Auction, registering the sale order, if applicable, in theMegaBolsa System, codes NETC3L and NETC4L.

5.4.Representation at the Auction. The Offerors shall be represented at the Auction by the Intermediary Agent, which shall act through Itaú Corretora.

5.5.Costs, Brokerage Commissions and Fees. All costs, brokerage commissions and fees with respect to the sale of the Shares shall be borne by the corresponding Shareholders, and those costs related to the purchase shall be borne by the Offerors or corresponding third parties. The expenses incurred for carrying out the Auction, such as brokerage commissions and fees charged by BM&FBOVESPA, shall comply with the fee schedule in force at the time of the Auction and all other applicable legal provisions. Pursuant to Item 2.13, the Intermediary Agent and/or Itaú Corretora shall not be responsible for paying any applicable taxes directly or indirectly related to the Offer.

9

5.6Purchase of Shares by the Offerors. The Offerors may disclose by way of a Statement of Material Fact, no later than two days before the Auction is held, the percentage of the total quantity of Shares offered in the Auction that each Offeror will acquire.

6.Settlement of the Auction

6.1.Settlement of the Auction. Settlement of the Auction shall be carried out on the third (3rd) business day following the Auction Date (“Auction Settlement Date”).

6.2.Form of Settlement of the Purchase Price. Financial settlement of the Auction shall be made in accordance with the rules set forth by BM&FBOVESPA’s Custody and Settlement House, in accordance with the gross settlement procedures, as defined in Chapter VII of the Operating Procedures of BM&FBOVESPA’s Custody and Settlement House. BM&FBOVESPA’s Custody and Settlement House shall not operate as a central counterparty that guarantees settlement of the Auction. BM&FBOVESPA’s Custody and Settlement House shall facilitate settlement of the Auction, including (i) receipt of the funds of the Offerors and of the Shares from the Shareholders that sell their Shares at the Auction through their custody agents; (ii) the transfer of the funds from the Offerors to the Shareholders that sell their Shares at the Offer; and (iii) the transfer of the Shares to the Offerors.

6.3.Obligations of the Offerors. Pursuant to the provisions of the agreement entered into between the Intermediary Agent and the Offerors (“Intermediary Agent Agreement”), the settlement obligations of the Offerors set forth herein shall be directly complied with by the Offerors, and the Offerors shall remain fully liable for compliance with all its obligations with respect to the Offer and other obligations set forth herein.

6.4.Guarantee. Pursuant to the provisions of Paragraph 4 of Article 7 of CVM Instruction 361/02 and to the Intermediary Agent Agreement, the Intermediary Agent shall guarantee the financial settlement of the Offer.

7.Deregistration

7.1.Deregistration as a Publicly Held Corporation. Deregistration of the Company shall be subject to acceptance of the Offer by Qualified Shareholders representing two-thirds (2/3) of the Outstanding Shares for Deregistration (as defined in Item 7.1.1 below). This limitation requiring agreement of two-thirds (2/3) of the Outstanding Shares for Deregistration (as defined in Item 7.1.1 below) shall not apply to the discontinuance, by the Company, of the governance practices of the Level 2 Regulation, which shall take place regardless of the number of Shares sold at the Offer and of the deregistration of NET as a publicly held corporation.

7.1.1. The sum of the Shares of Qualified Shareholders as disclosed by the Brokerage Firms, except for the Shares offered by managers of NET and by individuals related to the Offerors, as defined in CVM Instruction 361/02, shall be taken into consideration for determination of the total number of Outstanding Shares for Deregistration (as defined

10

herein). Therefore, for purposes hereof, “Outstanding Shares for Deregistration” mean Shares held by Qualified Shareholders represented by the Brokerage Firms at that Auction, except for the Shares offered by managers of NET and by individuals related to the Offerors that (i) wish to sell their Shares at the Auction; (ii) do not wish to sell their Shares at the Auction and expressly agree with the deregistration; and (iii) do not wish to sell their Shares at the Auction and do not expressly agree with the deregistration, in each case after they qualify for the Auction. For reference, the total quantity of Shares that may be Outstanding Shares for Deregistration, if qualified for the Auction, is 6,142,710 Shares representing 1.79% of the capital stock of the Company.

7.2.Cancellation of the ADSs program. Immediately after the conclusion of the Offer, the Offerors shall cause the Company to take the necessary steps to stop the trading of ADSs on the NASDAQ, terminate the ADSs deposit agreement (the “Deposit Agreement”) and, if the applicable requirements are met, cancel the registration of the preferred shares and the ADSs representing such preferred shares under the U.S. Securities Exchange Act of 1934, as amended.

7.3Latibex Delisting. Immediately after the conclusion of the Offer, the Offerors shall cause the Company to request the cancellation of the trading of the shares of the Company on the Latibex, in accordance with the procedures applicable to the cancellation of such program.

7.4Cancellation of the registration with CVM. After (i) receiving the relevant information about the Auction; (ii) verifying that the requirements set forth in CVM Instruction 361/02 have been satisfied; and (iii) receiving NET’s request for cancelling its registration as a publicly held corporation, the CVM will cancel NET’s registration as a publicly held corporation, announcing that fact to BM&FBOVESPA and to the Company.

7.5Holders of Shares Not Offered at the Auction. The holders of Outstanding Shares for Deregistration that do not wish to sell their Shares at the Auction may sign the appropriate form, by means of which they will expressly agree with the deregistration of the Company as a publicly held corporation. For that purpose, such holders shall fill out two (2) copies of the form, in which they shall declare to be aware that: (i) their Shares shall be unavailable for trading until the financial settlement of the Offer; and (ii) after the Brazilian deregistration, they may no longer be able to trade their shares on BM&FBOVESPA. Such form may be obtained by any Shareholder on the websites of the Intermediary Agent or BM&FBOVESPA, as they appear in Item 14.9 below and, after it is filled out, it shall be delivered to a Brokerage Firm in accordance with the provisions of Item 4.1 above.

7.6.Shareholders Who Do Not Consent to the Brazilian Deregistration as a Publicly Held Corporation. Pursuant to Articles 21 and 22 of CVM Instruction 361/02, the holders of Outstanding Shares for Deregistration who qualify for the Auction but who fail to sell their Shares at the Auction and/or who do not expressly agree with the deregistration of NET (pursuant to the provisions of Item 7.1 above) shall be deemed to disagree with the deregistration of NET.

7.7.End of Trading and Three-Month Put-Right following the Auction. If the Company’s registration as a publicly held corporation with the CVM is cancelled as a result of the Offer, the Shares shall no longer be traded on the BM&FBOVESPA. Notwithstanding the above, the

11

Offerors shall be required to acquire all remaining Shares held by the Shareholders who wish to sell them, for a period of three (3) months after the Auction Date, at the same Purchase Price, which shall be adjusted in accordance with the variation of the SELIC Rate in proportion to the period incurred (pro rata temporis) from the Auction Settlement Date to the date of actual payment. Payment shall be made within fifteen (15) days after the exercise of this put right by any selling Shareholder.

8.Mandatory Redemption of Shares and Delisting from Level 2

8.1.Mandatory Redemption. Should the Offer be successful, considering that the quantity of NET’s outstanding shares is already less than five percent (5%) of the total number of shares issued by the Company (see the shareholding composition provided in Item 10.3 below), the Offerors may cause NET, as permitted by Article 4, Paragraph 5 of the Business Corporation Act, to hold a special shareholders’ meeting to decide on the mandatory redemption of the Shares that remain outstanding. Such mandatory redemption will be made at the same Purchase Price as that paid in the Offer, duly adjusted by the SELIC rate in proportion to the period incurred (pro rata temporis) from the Auction Settlement Date to the date of actual payment of the redemption amount. Within fifteen (15) days of the resolution in favor of a mandatory redemption at NET’s shareholders’ meeting, the amount paid for such redemption shall be deposited with a financial institution that has branches available to Shareholders in the place of the principal place of business of NET, of BM&FBOVESPA, and in the capital cities of all Brazilian states. Further information on the financial institution where these funds shall be deposited, the service centers for Shareholders, and the documents required for withdrawal of the deposited amounts shall be disclosed by means of Statement of Material Fact at the time of redemption.

8.2.Delisting from Level 2. Pursuant to the provisions of Item 11 of the Level 2 Regulation, the special shareholders’ meeting of NET held on April 5, 2012 approved the delisting of the Company from the Level 2 Regulation, which shall occur on the business day following the date of the Auction, regardless of the number of Shares actually acquired at the Auction and of the deregistration of the Company as a publicly held corporation.

9.Valuation Report

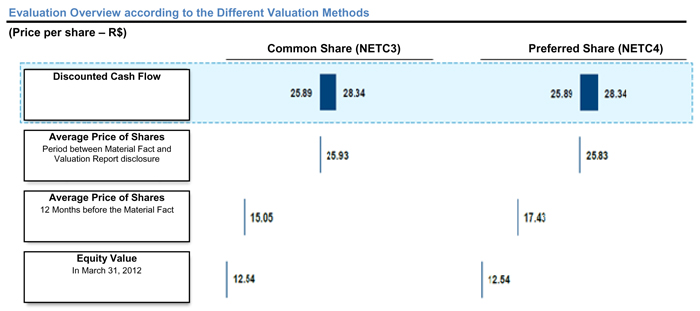

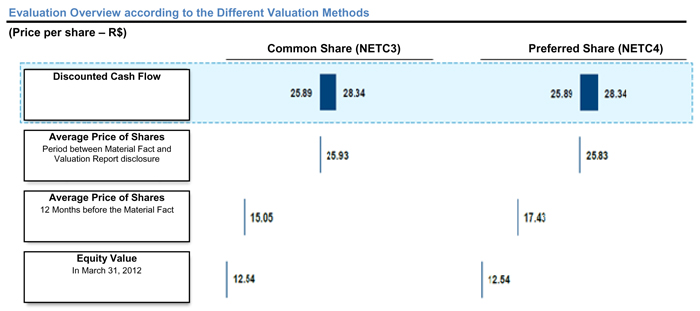

9.1.Valuation. Subject to the provisions of Schedule III to CVM Instruction 361/02, Banco BTG Pactual S.A., with its principal place of business in the City and State of Rio de Janeiro, at Praia de Botafogo no. 501, 6th floor, registered as taxpayer under CNPJ/MF no. 30.306.294/0001-45 (the “Appraiser”) prepared and delivered on June 6, 2012 a valuation report with respect to the Company (“Valuation Report”). Pursuant to Item 10.1.1 of the Level 2 Regulation, the choice of Appraiser was approved by the special shareholders’ meeting of the Company held on April 5, 2012, selected from a list of three (3) specialized companies presented by the Board of Directors of the Company. The corresponding resolution was passed by unanimous vote of the Shareholders representing the outstanding shares issued by the Company. The table below shows the methodologies used in the Valuation Report and the corresponding prices per share of the Company.

12

9.2.Availability of the Valuation Report. The Valuation Report mentioned in Item 9.1 above, containing all the premises and information used for its preparation, is available for review by interested parties at the principal places of business of the Offerors, the Company, the Intermediary Agent, BM&FBOVESPA and the CVM, and it may be accessed in Portuguese on the following websites:http://ri.netservicos.com.br,www.embratel.com.br,www.itaubba.com.br, www.cvm.gov.br andwww.bmfbovespa.com.br.

9.3.Representations of the Appraiser. The Appraiser, which shall be exclusively responsible for the preparation of the Valuation Report, has declared in the Valuation Report that (i) it has no conflicts of interest that diminish the independence required for the performance of its duties; (ii) it, its controlling shareholder and related parties do not own any Shares on their behalf or under their discretionary management; (iii) it has no business or credit information of any nature that could have an impact on the Valuation Report; (iv) it has received fees in the amount of R$ 600,000.00 to prepare the Valuation Report; and (v) except for the preparation of the Valuation Report, it has not received from the Offerors or from the Company any remuneration for consulting, appraisal, audit or similar services for the twelve (12) months preceding the request for the registration of the Offer. Additionally, in the Valuation Report, the Appraiser declared that a price per Share at the level of the Purchase Price would be fair.

9.4.Independent Valuation. Before they decide to participate in the Offer, the Shareholders should perform all actions deemed necessary to ensure their understanding of the transaction in all respects and conduct an independent valuation of the convenience thereof and of their purposes, especially with respect to the risks and benefits of accepting the Offer. They should also request the assistance of their specialized consultants (financial, tax, legal among others) for such valuation.

9.5.Review of the Purchase Price. Pursuant to Article 4-A of the Business Corporation Act, Shareholders who individually or collectively hold ten percent (10%) of the outstanding shares of the Company had the right to request the managers of the Company, within fifteen (15) days after

13

the date on which the Valuation Report was provided, to call a special shareholders’ meeting to decide on having a new valuation of the Company carried out, using the same criteria or different criteria, subject to the procedures set forth in Articles 23 and 24 of CVM Instruction 361/02. The 15-day period for requesting this new appraisal began on June 8, 2012 and ended on June 25, 2012.

10.Information on NET

The Offerors advise that the information on NET included in this Item 10 corresponds to information provided by NET itself on its website and on the CVM’s website.

10.1.Principal Place of Business, Jurisdiction and Purpose. The principal place of business of NET is in the City and State of São Paulo, at Rua Verbo Divino, 1356, 1st floor, Chácara Santo Antônio. The purpose of the Company is to directly engage or to hold equity interest in other companies that engage in: (i) the local distribution of paid television signals, as well as in the provision of access to value-added services by its subscribers; (ii) the provision of other telecommunications services; (iii) any other form of distribution of signals of any kind by means of its local network; and (iv) the production of its own local channels, as well as to directly engage in these activities. The purpose of NET also includes the provision of all services to its subsidiaries, within the context of corporate, administrative, financial and consulting support. The Company may also hold equity interest in other companies that engage in the same activities, as well as in ancillary import, export and representation activities.

10.2.NET’s Share Capital. On June 12, 2012, the share capital of NET was R$ 5,612,242,940.97, divided into 114,459,685 common shares and 228,503,916 preferred shares, all of which are registered, book-entry shares without par value.

| 10.3. | Shareholding Composition. On June 12, 2012, the shareholding composition of NET was the following: |

| | | | | | | | | | | | |

Shareholder | | Common | | | Preferred | | | Total | |

GB | | | 58,374,440 | | | | 0 | | | | 58,374,440 | |

Embrapar | | | 40,928,401 | | | | 12,242,351 | | | | 53,170,752 | |

Globopar | | | 11,855,947 | | | | 1,000 | | | | 11,856,947 | |

Embratel | | | 2,580,655 | | | | 210,838,097 | | | | 213,418,752 | |

Others | | | 720,242 | | | | 5,422,468 | | | | 6,142,710 | |

Treasury Stock | | | 0 | | | | 0 | | | | 0 | |

| | | | | | | | | | | | |

Total | | | 114,459,685 | | | | 228,503,916 | | | | 342,963,601 | |

| | | 33.4 | % | | | 66.6 | % | | | 100.0 | % |

14

| | | | | | | | | | | | |

Shareholder | | Common | | | Preferred | | | Total | |

GB | | | 51.0 | % | | | 0.0 | % | | | 17.0 | % |

Embrapar | | | 35.8 | % | | | 5.4 | % | | | 15.5 | % |

Globopar | | | 10.4 | % | | | 0.0 | % | | | 3.5 | % |

Embratel | | | 2.3 | % | | | 92.3 | % | | | 62.2 | % |

Others | | | 0.6 | % | | | 2.4 | % | | | 1.8 | % |

Treasury Stock | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % |

| | | | | | | | | | | | |

Total | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

10.4.Selected Financial Information of NET. The table below contains selected financial information of NET, based on Net’s consolidated financial statements for the periods indicated below:

| | | | | | | | | | | | |

| | | Fiscal year ended

on December 31,

2010 | | | Fiscal year ended

on December 31,

2011 | | | Quarter Period ended on March 31,

2012 | |

| | | (in millions of R$, except if indicated otherwise) | |

Share capital | | | 5,599.320 | | | | 5,599.320 | | | | 5,599.320 | |

Stockholders’ equity | | | 3,814.666 | | | | 4,187.839 | | | | 4,302.437 | |

Net revenues | | | 5,405.669 | | | | 6,695.885 | | | | 1,838.506 | |

Operating profit | | | 658.059 | | | | 879.929 | | | | 207.427 | |

Net income | | | 307.151 | | | | 373.173 | | | | 114.598 | |

Total liabilities and stockholders’ equity | | | 8,356.173 | | | | 8,894.897 | | | | 8,849.758 | |

Total current liabilities | | | 1,288.303 | | | | 1,856.970 | | | | 1,793.953 | |

Total non-current liabilities | | | 3,253.204 | | | | 2,850.088 | | | | 2,753.368 | |

Number of shares | | | 342,963,601 | | | | 342,963,601 | | | | 342,963,601 | |

Profit (loss) per share (R$) | | | 0.896 | | | | 1.088 | | | | 0.334 | |

Asset value per share (R$) | | | 11.123 | | | | 12.211 | | | | 12.545 | |

Total liabilities / Net equity (%) | | | 219.1 | % | | | 212.4 | % | | | 205.7 | % |

| | | |

Net profit / Net equity (%) | | | 8.1 | % | | | 8.9 | % | | | 2.7 | % |

| | | |

Net profits / Net income (%) | | | 5.7 | % | | | 5.6 | % | | | 6.2 | % |

| | | |

Net profits / Share capital (%) | | | 5.5 | % | | | 6.7 | % | | | 2.0 | % |

15

10.5.Financial Statements. The annual and interim consolidated financial statements of NET are available at the following addresses:http://ri.netservicos.com.br,www.cvm.gov.br andwww.bmfbovespa.com.br.

10.6.Historical Information on the Trading of Shares. The table below shows the traded volumes, the units and the weighted average prices in the trading on the spot market of the BOVESPA Segment of BM&FBOVESPA for preferred shares issued by NET over the last twelve (12) months:

| | | | | | | | | | |

Month | | Total Volume

Traded (in R$) | | | Number of

Shares Traded | | | Weighted

average price (in

R$) of Share

exchange quotes |

June 2012 | | | 889,884 | | | | 33,600 | | | 26.5 |

May 2012 | | | 7,153,684 | | | | 270,600 | | | 26.4 |

April 2012 | | | 4,033,549 | | | | 154,600 | | | 26.1 |

March 2012 | | | 22,077,032 | | | | 864,900 | | | 25.5 |

February 2012 | | | 12,404,509 | | | | 574,700 | | | 21.6 |

January 2012 | | | 13,290,039 | | | | 673,200 | | | 19.7 |

December 2011 | | | 7,456,402 | | | | 419,800 | | | 17.8 |

November 2011 | | | 1,500,445 | | | | 87,300 | | | 17.2 |

October 2011 | | | 6,625,905 | | | | 392,900 | | | 16.9 |

September 2011 | | | 3,627,859 | | | | 242,500 | | | 15.0 |

August 2011 | | | 6,255,239 | | | | 420,100 | | | 14.9 |

July 2011 | | | 3,202,782 | | | | 210,400 | | | 15.2 |

June 2011 | | | 1,858,937 | | | | 110,100 | | | 16.9 |

May 2011 | | | 3,160,274 | | | | 215,200 | | | 14.7 |

| | Source: | Bloomberg, June 4, 2012 |

10.7.NET Shareholder Rights. Each common share of NET grants its holder the right to one vote at the annual and special shareholders’ meetings. The preferred shares of NET grant their holders the right to vote exclusively with respect to the following matters: (i) conversion, merger, consolidation or spin-off of the Company; (ii) appraisal of assets for payment of increases of capital of the Company; (iii) choice of a specialized company to determine the economic value of the shares of the Company, pursuant to Article 9, iv, and 34 of the Bylaws of the Company; (iv) amendment to or revocation of provisions of the Bylaws of the Company that result in noncompliance, by the Company, with the requirements set forth in Section IV, Item 4.1 of the Level 2 Regulation; and (v) approval of agreements between the Company and its controlling shareholder, either directly or by third parties, as well as of other companies in which the controlling shareholder has an interest, whenever by operation of law or as established in the bylaws, approval of such contracts is deliberated on in shareholders’ meetings. In view of the fact that they do not have fixed or minimum dividends, preferred shares shall not acquire the exercise of the voting right if the Company fails to pay fixed or minimum dividends, it being understood that the provisions of Article 111, Paragraph 1 of the Business Corporation Act shall not apply.

Pursuant to the bylaws of NET and to the Business Corporation Act, the holders of shares shall have the right to receive a mandatory dividend of twenty-five percent (25%) of the net profit for

16

the fiscal year, adjusted pursuant to Article 202 of the Business Corporation Act. The holders of preferred shares are guaranteed: (i) the right to receive cash dividends ten percent (10%) higher than those paid to the preferred shares; (ii) priority with respect to reimbursement in the event of liquidation of the Company, without premium, at the book value; and (iii) equal treatment to that granted to the shareholders who exercise the actual power to conduct the corporate activities and to instruct the actual or legal operation of the bodies of the Company, directly or indirectly (“Controlling Power”), in the event of transfer of such Controlling Power, pursuant to the main provision of Article 27 of the By-Laws of the Company; and (iv) right to be included in the Offer in connection with the indirect change in the control of the Company at the same price and terms as those offered to the selling controlling shareholder. The preferred shares shall participate under the same conditions as the common shares in the distribution of bonuses, and they may represent up to two-thirds (2/3) of the total number of shares issued by the Company, it being understood that upon the issuance thereof, the previous proportion between common shares and preferred shares may be changed.

11.Information about the Offerors

11.1.Information about Embrapar. The principal place of business of Embrapar is in the City and State of Rio de Janeiro, at Rua Regente Feijó 166/1687-B, Centro. The purpose of Embrapar includes: (i) exercising control of Embratel, as well as its other controlled companies: (ii) promoting, effecting or guiding the provision, from internal and external sources, of funds to be invested by Embrapar or by Embratel or by other of its controlled companies; (iii) promoting and stimulating activities of study and research with a view to the development of the long-distance telecommunications services sector within the national and international scope, including voice, text, data, images and telematic transmission services; (iv) performing, through Embratel or other controlled or associated companies, long-distance communications services, within the national and international scope, including voice, text, data, image and telematic transmission services; (v) promoting, stimulating and coordinating, through its controlled companies or associated companies, the formation and training of personnel necessary for the long-distance telecommunications services within the national and international scope, including transmission services of voice, text, data, image and telematic transmission services; (vi) effecting or promoting the importation of goods and services for EMBRATEL or its other controlled and associated companies; (vii) engaging in other activities similar or associated with its corporate purpose; and (viii) holding equity interest in other companies.

11.2Shareholding Composition. The shareholding composition of Embrapar, on June 12, 2012, was the following:

| | | | | | | | | | | | | | | | | | | | | | | | |

Shareholders | | Common | | | % | | | Preferred | | | % | | | Total | | | % | |

Consertel – Controladora de Serviços de Telecomunicaciones S.A. de C.V. | | | 245,035,493,313 | | | | 43.44 | % | | | 3,282,819,136 | | | | 0.63 | % | | | 248,318,312,449 | | | | 22.82 | % |

Telmex Solutions Telecomunicações Ltda. | | | 308,909,393,494 | | | | 54.77 | % | | | 510,584,659,952 | | | | 97.40 | % | | | 819,494,053,446 | | | | 75.30 | % |

Others | | | 10,099,660,482 | | | | 1.79 | % | | | 10,332,522,309 | | | | 1.97 | % | | | 20,432,182,791 | | | | 1.88 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 564,044,547,289 | | | | 100.00 | % | | | 524,200,001,397 | | | | 100.00 | % | | | 1,088,244,548,686 | | | | 100.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

17

11.3.Information about Embratel. The principal place of business of Embratel is in the City and State of Rio de Janeiro, at Avenida Presidente Vargas, 1012, Centro. The purpose of Embratel includes (i) to operate, exploit and provide fixed switched telephone services, subject to the terms and conditions of its concession agreements currently in force, as well as those implemented in the future; (ii) to operate, exploit and provide any and all telecommunications services within the parameters, terms and conditions of the authorizations then in force, as well as those implemented in the future; (iii) to implement, expand and operate, among others: (a) the interstate and intrastate trunk lines for the integrated transportation of telecommunications’ services and the related multiplex equipment, (b) the automatic long-distance telephone switch centers, (c) the land stations required for satellite communications and the related multiplex equipment, (d) the means that constitute Brazil’s international connections, (e) the international telephone, telex, telegram and data transmission switch centers (automatic or manual) and other service centers that use digital techniques, (f) the TV centers, (g) the coastal stations of the maritime mobile service, (h) the means that compose the Brazilian national telex network, and (i) the means that compose the Brazilian national data transmission network; (iv) to exploit: (a) the telecommunication means operated by it, as discriminated in “iii” above, under “a”, “b”, “c”, “d” and “e”, including satellite and dial-up lines in industrial bases, (b) the TV signal transmission services between the TV centers it operates, (c) the maritime mobile services from coastal stations, and (d) the Brazilian national and international telex services for leasing telegraphic circuits, data transmission and others that use digital techniques, except telegram services; (v) coordination of the activities related to the exploitation of the services and operations of Brazil’s international telecommunication media; (vi) import, export, commercialization, lease and rental of goods and equipment, and the provision of services related to the activities comprised in its corporate purpose, as well as of aggregated value services; and (vii) the holding of equity interest in other companies, entities, associations and/or consortiums, in Brazil and abroad.

11.4Shareholding Composition. The shareholding composition of Embratel, on June 12, 2012, was the following:

| | | | | | | | |

Shareholders | | Common | | | % | |

Embrapar | | | 7,618,092,714 | | | | 99.6 | % |

Others | | | 30,754,058 | | | | 0.4 | % |

Total | | | 7,648,846,772 | | | | 100.0 | % |

11.5.Information about GB. The principal place of business of GB is in the City and State of Rio de Janeiro, at Avenida Afrânio de Melo Franco, 135, part occupancy, Leblon. The sole corporate purpose of GB is to hold shares of NET.

11.6Shareholding Composition. The shareholding composition of GB, on June 12, 2012 was the following:

| | | | | | | | | | | | | | | | | | | | | | | | |

GB | | Common | | | Preferred | | | Total | |

Embratel | | | 105,870 | | | | 0.54 | % | | | 432,124 | | | | 1.11 | % | | | 537,994 | | | | 0.92 | % |

Embrapar | | | 10,506,141 | | | | 53.99 | % | | | 38,484,169 | | | | 98.89 | % | | | 48,990,310 | | | | 83.92 | % |

Globopar | | | 8,846,136 | | | | 45.46 | % | | | 0 | | | | 0.00 | % | | | 8,846,136 | | | | 15.15 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 19,458,147 | | | | 100.00 | % | | | 38,916,293 | | | | 100.00 | % | | | 58,374,440 | | | | 100.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

18

12.Notice to ADS Holders

12.1. The ADS Holders who wish to participate in the Offer must carefully read the Offer to Purchase, which contains a detailed description of the specific terms and procedures to be followed by ADS Holders for qualification at the Auction, and which requires the preferred shares underlying the ADSs to be detached from the respective ADSs for purposes of sale in the Offer. The Offer to Purchase shall be available at no cost, upon its release, on the SEC website,www.sec.gov, on CVM’s website,www.cvm.gov.br, on the Company’s website,http://ri.netservicos.com.br, and on Embratel’s website,www.embratel.com.br.

12.2. The Valuation Report was prepared in Portuguese and a version of such Report has been translated into English and is available on the SEC website.

12.3 For further information on the Offer to Purchase and on the procedures to be followed by ADS Holders, see Item 2.11.

13.Notice to Latibex Shareholders

13.1. The Offerors shall make further information available in Spain for the Latibex Shareholders, through independent means, as described in Item 2.12 above.

14.Other Information

14.1.Update of the Registration as a Publicly Held Corporation. The Offerors hereby declare that to their knowledge the registration of NET as a publicly held corporation is duly updated in accordance with Article 21 of Law No. 6385 of December 7, 1976.

14.2.No Undisclosed Material Facts or Circumstances. The Intermediary Agent and the Offerors declare that they are not aware of the existence of any fact or circumstance not disclosed to the public that could materially affect the results of NET or the quotations and market prices of the Shares.

14.3.Ownership of Shares of NET by the Intermediary Agent. The Intermediary Agent declares that it does not hold any shares of NET. As of June 12, 2012, companies that are part of the Intermediary Agent’s corporate group had 100 of the Company’s preferred shares under management, all of which may be tendered in the Offer.

14.4.Ownership of Shares of the Offerors and/or of Embrapar by the Intermediary Agent. The Intermediary Agent declares that it does not own any share issued by the Offerors. The Intermediary Agent declares that on June 12, 2012, companies that are part of its corporate group had 412,873 preferred shares issued by Embrapar under management.

19

14.5.Representations of the Offerors. The Offerors represent that: (i) they are liable for the truth, quality and sufficiency of the information supplied to the market, as well as for any eventual damage caused to NET, to its Shareholders or to third parties, by will or negligence, due to the untruth of such information; (ii) they have not adopted any measures aiming at (or which have caused or which may be expected to cause or result in) the stabilization or manipulation of the price of the shares issued by the Company; (iii) the acquisition of Shares by means of the Offer is not motivated by any material information on NET, its business, its controlled companies and subsidiaries that has not been disclosed to the market; (iv) the scope of the Offer is to fulfill the legal, regulatory and statutory provisions applicable to the mandatory tender offer in connection with the change in control of NET, its deregistration and its delisting from Level 2; (v) they jointly hold 101,883,496 preferred shares and 223,080,448 preferred shares issued by the Company; (vi) they have not distributed any material with respect to the Offer, except for this Offer document; (vii) they are not aware of the existence of any facts or circumstances not disclosed to the public that could significantly affect the results of the Company, its controlled companies and subsidiaries, and/or the quotation of shares issued by the Company; (viii) they are the controlling shareholders of the Company for all legal purposes; (ix) there is no contract or agreement regulating the exercise of voting rights or the purchase and sale of securities issued by the Company to which any of the Offerors is a party and which has not been disclosed to the public; and (x) there has been no material private negotiation among independent parties with respect to shares of the Company, involving the Offerors or related persons for the last twelve (12) months.

14.6.Representations of the Intermediary Agent. The Intermediary Agent declares that (i) it has taken all precautions and acted with high standards of diligence to ensure that the information provided by the Offerors is true, consistent, correct and sufficient; and (ii) it has provided in the past and may provide in the future, along with its affiliates, several investment banking services, financial assistance, credit operations and other related services to the Offerors, to the Company and to their affiliates, for which it was and intends to be remunerated; and (iii) it provides to the Offerors the intermediation services related to this Offer, for which it expects to receive R$ 550,000.00. The Intermediary Agent further represents that it does not have, nor does its controlling shareholder or related persons have (i) loans, on the date hereof, of securities issued by the Company; (ii) exposure in derivatives referenced in securities issued by the Company; or (iii) are they parties to agreements, preliminary contracts, options, letters of intent or other legal acts providing the acquisition or sale of securities issued by the Company.

14.7.Subsequent Offer. The Offerors, the Company or any person related thereto may not make a new tender offer for the shares of NET, except after the lapse of one (1) year after the Auction Date, except (i) if they are required to do so for any reason or (ii) if they extend the same terms of the new tender offer to those Shareholders accepting this Offer, paying them the adjusted price difference, if any.

14.8.Subsequent Commitment. The Offerors agree to pay the Shareholders accepting the Offer the difference, if any, between the Purchase Price, as adjusted by the changes in the number of shares resulting from bonuses, stock splits, reverse splits and conversions possibly occurred; and (i) the price that would be owed or that comes to be owed upon occurrence, within one (1) year after the Auction Date, of a fact imposing a mandatory tender offer for shares, from among those referred to in Items I through III of Article 2 of CVM Instruction 361/02; or (ii) the amount to

20

which they would be entitled if they were still shareholders of the Company and dissented from a resolution of the shareholders’ meeting of the Company approving any corporate event allowing the exercise of the right to dissent by the holders of shares, whenever such event occurs within one (1) year after the Auction Date.

14.8.1. The Offerors shall not be required to make the payment referred to in Item 14.8 above if the information on the future occurrence of a mandatory tender offer or of the relevant corporate event is already disclosed at the time of publication hereof, either by means of a Statement of Material Fact, an announcement to the market or a notice to shareholders.

14.9.Access to the Valuation Report, Offer Document and List of Shareholders. The Offerors confirm that a list of all shareholders of NET (including an electronic version), with their respective addresses and number of shares held identified by denomination and class, as well as this Offer document and the Valuation Report, are available to persons providing identification and confirming receipt, at the place of business of: the Offerors, the Company, the Intermediary Agent, the CVM and BM&FBOVESPA. Alternatively, the Valuation Report and the Offer document can be accessed on the Internet, at the websites listed below. WE ADVISE YOU TO CAREFULLY READ OVER THE IMPORTANT NOTES INCLUDED IN THE VALUATION REPORT.

EMBRATEL PARTICIPAÇÕES S.A.,

Rua Regente Feijó, nº 166, suite 1687-B, Centro, Rio de Janeiro – RJ

EMPRESA BRASILEIRA DE TELECOMUNICAÇÕES S.A. – EMBRATEL

Av. Presidente Vargas, n° 1012, Centro, Rio de Janeiro, RJ

www.embratel.com.br

GB EMPREENDIMENTOS E PARTICIPAÇÕES S.A.,

Avenida Afrânio de Melo Franco, nº 135, 5th floor, part, Leblon, Rio de Janeiro - RJ

NET SERVIÇOS DE COMUNICAÇÃO S.A.

Rua Verbo Divino, nº 1356, 1st floor, Chácara Santo Antônio, São Paulo, SP

http://ri.netservicos.com.br

COMISSÃO DE VALORES MOBILIÁRIOS

Rua Cincinato Braga, 340, 2nd floor, Centro, São Paulo, SP

Rua Sete de Setembro, 111, 2nd floor, “Centro de Consultas”, Rio de Janeiro, RJ

www.cvm.gov.br

BM&FBOVESPA S.A. – BOLSA DE VALORES MERCADORIAS E FUTUROS

Praça Antonio Prado, 48, 2nd floor, Centro, São Paulo, SP

www.bmfbovespa.com.br

BANCO ITAÚ BBA S.A.

Av. Brigadeiro Faria Lima, nº 3.400, 4th floor, part, São Paulo, SP

www.itaubba.com.br

21

14.11.Documents of the Offer. The Shareholders shall carefully read over this Offer document and other relevant documents related to the Offer published by the Offerors or filed with the CVM, in view of the fact that these documents contain important information.

14.12.Shareholders Domiciled Outside Brazil. The Shareholders of the Company domiciled outside Brazil may be subject to restrictions imposed by the law of their countries with respect to acceptance of this Offer, to participation in the Auction and to sale of the Shares. These Shareholders not resident in Brazil shall be solely liable for compliance with these applicable laws. Separate Offer materials are being published in English in the United States of America, intended for all the holders of common shares and preferred shares of NET who are U.S. holders and all ADS Holders. U.S. Holders of common and preferred shares and all ADS Holders must read carefully such materials before reaching a decision with regard to the Offer.

14.13.Tax Treatment of the Offer. The tax aspects of the Offer to the Shareholders have not been analyzed by the Intermediary Agent or by the Offerors, who shall not be liable for any possible expense and/or loss resulting therefrom. Before accepting this Offer, we advise the Shareholders to carefully analyze the tax treatment applicable thereto.

14.14.Identification of Legal Counsel.

XAVIER BRAGANÇA ADVOGADOS

Av. Rio Branco nº 1, 14th floor, Hall A

Rio de Janeiro, Brazil

14.15.Forward-Looking Statements and Estimates. Certain statements contained herein may be forward-looking statements or estimates related to future events. The purpose of any of the following words “believes”, “expects”, “may”, “could”, “wishes” and “estimates” and similar expressions is to identify forward-looking statements or estimates. However, forward-looking statements or estimates may not be identified by these expressions. In particular, this Offer document contains forward-looking statements and estimates related, without limitation, to the procedure to be adopted for completion of the Offer, to the terms of several steps to be followed within the context of the Offer and to the expected actions of the Offerors, the Company and certain third parties, including Brokerage Firms, within the context of the Offer. Forward-looking statements and estimates are subject to risks and uncertainties, including, but not limited to, the risk that the parties involved in the Offer fail to fulfill the necessary requirements for completion of the Offer. Forward-looking statements and estimates are also based on assumptions that, to the extent deemed reasonable by the Offerors, are subject to uncertainties with respect to the relevant business, economic and competition aspects. The assumptions of the Offerors contained in this Offer document, which can be proved incorrect, include, without limitation, assumptions that the capital market laws and rules applicable to the Offer will not be amended before completion of the Offer. Except to the extent required by law, the Offerors do not assume any obligation to update the forward-looking statements or estimates contained in this Offer document.

A GRANT OF THE REQUEST FOR REGISTRATION OF THIS OFFER DOES NOT IMPLY, ON THE PART OF THE CVM, A WARRANTY TO THE ACCURACY OF THE INFORMATION PROVIDED HEREIN, NOR JUDGMENT ON THE QUALITY OF THE SUBJECT COMPANY, OF OFFERORS OR OF THE PRICE OFFERED FOR THE SHARES SUBJECT TO THIS OFFER.

22