- VIV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Telefônica Brasil (VIV) 6-KCurrent report (foreign)

Filed: 25 Apr 18, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2018

Commission File Number: 001-14475

TELEFÔNICA BRASIL S.A.

(Exact name of registrant as specified in its charter)

TELEFONICA BRAZIL S.A.

(Translation of registrant’s name into English)

Av. Eng° Luís Carlos Berrini, 1376 - 28º andar

São Paulo, S.P.

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F | X |

| Form 40-F |

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes |

|

| No | X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes |

|

| No | X |

GROWTH OF 4.2% IN NET MOBILE REVENUE, ALLIED TO THE NINTH CONSECUTIVE QUARTER OF |

| o | Total accessescame to 97.8 million in March 2018, of which 75.1 million in the mobile business (+1.5% y-o-y) and 22.7 million in the fixed business (-2.3% y-o-y), maintaining the pace of net postpaid additions, partially offset by fixed voice disconnections; |

| o | Mobile market shareof31.9% in March 2018 (+1.4 p.p. vs. Mar-17); | |

| o | Postpaid mobile accessesincreased 10.9% y-o-y, leading us to amarket shareof 41.4% in March 2018 (17.9 p.p. higher than the second player); | |

| o | Mobile ARPU2recorded growth of 2.1% y-o-y in 1Q18, reaching R$ 28.6, due to the higher share of postpaid clients in themixand to the constant increase of Data consumption, whose ARPU grew 15.8% y-o-y in the quarter; | |

| o | Broadband accessestotaled 7.4 million customers in 1Q18 (+1.5% y-o-y), with UBB¹ connections accounting for 62.4% of the base, which grew 9.9% y-o-y, with 122 thousand new FTTH net additions in the quarter. Broadband ARPU climbed 13.7% y-o-y in the first quarter of the year; | |

| o | Net Operating Revenueincreased 1.6% y-o-y in 1Q18, maintaining the positive trajectory presented in the previous quarters; | |

| o | Net Operating Mobile Revenuecontinued to increase above inflation, reaching 4.2% y-o-y in 1Q18 (versus 3.9% y-o-y in 4Q17).Data and Digital Services Revenuegrew 17.4% y-o-y in 1Q18 and already represents 77.8% of Mobile Services Revenue; | |

| o | Operating costsdeclined 1.2% y-o-y in 1Q18 (IPCA-12M: +2.7%), demonstrating the Company's commitment to control and optimize costs through simplification, efficiency and digitization initiatives; | |

| o | EBITDAtotaled R$ 3,765.3 million in the quarter, an increase of 7.2% y-o-y, withEBITDA marginof 35.0% (+1.8 p.p. y-o-y).ReportedEBITDA, already including IFRS 15 effects, totaled R$ 3,794.5 (+8.0% y-o-y), reaching aReported EBITDA marginof 35.2%; | |

| o | Capexof R$ 1,547.4 million in 1Q18, representing 14.4% of Net Operating Revenue.Operating Cash Flow (EBITDA - Capex)reached R$ 2,217.9 million in the quarter, increasing 1.5% y-o-y; | |

| o | Free Cash Flow from Business Activitiesgrew 48.1% in 1Q18 to R$ 1,003.8 million, driven by cost efficiency and improved financial results; | |

| o | Accelerated 4G+ coverage, launching 250 new cities in the first quarter of the year, totaling 364 cities by the end of March; | |

| o | We reached 89 cities with FTTH, achieving the mark of 216 cities with fiber in Brazil in 1Q18; | |

| o | Reported Net Incomein 1Q18 was R$ 1,098.0 million, an increase of 10.2% compared to the same period last year. |

1) UBB includes customers in FTTH (Fiber to the Home) and FTTC (Fiber to the Cabinet) technologies, as well as cable customers

2) Pro forma numbers, excluding IFRS 15 effects

1

Telefônica Brasil SA (B3: VIVT3 and VIVT4, NYSE: VIV) discloses today its results for the first quarter of 2018, presented in accordance with the International Financial Reporting Standards (IFRS) and the pronouncements, interpretations and guidelines issued by the Accounting Pronouncements Committee. Totals are subject to differences due to rounding up or down.

The net operating revenues and operating costs of the 1st quarter of 2018 are presented under the adoption of IFRS 151.

For better understanding of the evolution of our business, we are presenting the following consolidated results for the periods of three months ended in March 31, 2018 and 2017 in two scenarios, as described below:

Pro-forma: excluding the effects of the adoption of IFRS 151 in our financial statements of 2018 (comparable to 2017).

Reported: considering the effects of the adoption of IFRS 151 in our financial statements (referred to the new methodology of revenue allocation of customer contracts), only for the financial statements of 2018.

For comparison purposes, the text explanations will refer to the pro forma financial statements, except in cases where we mention IFRS 151 adoption.

HIGHLIGHTS

Consolidated in R$ million | 2018 Pro forma (ex-IFRS 15)¹ | 2018 Data (Reported) | ||||

1Q18 | 1Q17 | ∆% | 1Q18 | 1Q17 | ∆% | |

| ||||||

Net Operating Revenues | 10,759.0 | 10,590.1 | 1.6 | 10,789.0 | 10,590.1 | 1.9 |

| ||||||

Net Operating Service Revenues | 10,449.8 | 10,334.2 | 1.1 | 10,403.1 | 10,334.2 | 0.7 |

| ||||||

Net Mobile Service Revenues | 6,425.7 | 6,208.0 | 3.5 | 6,379.0 | 6,208.0 | 2.8 |

Net Operating Fixed Revenues | 4,024.1 | 4,126.2 | (2.5) | 4,024.1 | 4,126.2 | (2.5) |

| ||||||

Net Handsets Revenues | 309.1 | 255.9 | 20.8 | 385.9 | 255.9 | 50.8 |

| ||||||

Operating Costs | (6,993.8) | (7,076.2) | (1.2) | (6,994.5) | (7,076.2) | (1.2) |

| ||||||

EBITDA | 3,765.3 | 3,513.9 | 7.2 | 3,794.5 | 3,513.9 | 8.0 |

EBITDA Margin % | 35.0% | 33.2% | 1.8 p.p. | 35.2% | 33.2% | 2.0 p.p. |

| ||||||

Net Income | 1,078.8 | 996.2 | 8.3 | 1,098.0 | 996.2 | 10.2 |

|

|

|

|

|

|

|

| ||||||

Capex (ex-Licenses) | 1,547.4 | 1,328.2 | 16.5 | 1,547.4 | 1,328.2 | 16.5 |

|

|

|

|

|

|

|

| ||||||

Operational Cash Flow | 2,217.9 | 2,185.8 | 1.5 | 2,247.1 | 2,185.8 | 2.8 |

|

|

|

|

|

|

|

| ||||||

Total Accesses (thousand) | 97,812 | 97,236 | 0.6 | 97,812 | 97,236 | 0.6 |

Total Mobile Accesses | 75,098 | 73,997 | 1.5 | 75,098 | 73,997 | 1.5 |

Total Fixed Accesses | 22,714 | 23,239 | (2.3) | 22,714 | 23,239 | (2.3) |

|

|

|

|

|

|

|

| ||||||

1) New accounting standard in force since January 2018, which requires revenue to be recognized based on the contract with the customer, not necessarily aligned with billing. For Vivo, revenue recognition of mobile offers with handset subsidy will change, as the subsidy will now be distributed between services and handset. In addition, certain costs to acquire a customer through a contract will now have to be capitalized if the amortization period is >12 months.

2

Mobile Business

OPERATING PERFORMANCE

Thousand | 1Q18 | 1Q17 | ?% | 4Q17 | ?% |

|

|

|

|

|

|

Total Mobile Accesses | 75,098 | 73,997 | 1.5 | 74,940 | 0.2 |

Postpaid | 37,499 | 33,825 | 10.9 | 36,772 | 2.0 |

M2M | 6,674 | 5,279 | 26.4 | 6,321 | 5.6 |

Prepaid | 37,599 | 40,171 | (6.4) | 38,168 | (1.5) |

Market Share | 31.9% | 30.5% | 1.4 p.p. | 31.7% | 0.2 p.p. |

Postpaid | 41.4% | 42.0% | (0.7) p.p. | 41.8% | (0.4) p.p. |

M2M | 41.6% | 39.8% | 1.8 p.p. | 41.5% | 0.1 p.p. |

Net Additions | 158 | 219 | (27.6) | 378 | (58.1) |

Postpaid | 727 | 435 | 67.4 | 1,107 | (34.3) |

Market Share of Postpaid Net Additions | 27.4% | 39.3% | (30.3) | 34.0% | (19.4) |

Market Penetration | 113.0% | 116.9% | (3.9) p.p. | 113.4% | (0.4) p.p. |

Monthly Churn | 3.1% | 3.3% | (0.2) p.p. | 3.3% | (0.2) p.p. |

Postpaid ex. M2M | 1.6% | 1.7% | (0.0) p.p. | 1.7% | (0.1) p.p. |

Prepaid | 4.5% | 4.7% | (0.2) p.p. | 4.8% | (0.3) p.p. |

ARPU (R$/month)1 | 28.6 | 28.0 | 2.1 | 29.2 | (2.2) |

Voice | 6.4 | 8.8 | (27.6) | 7.3 | (12.8) |

Data | 22.2 | 19.2 | 15.8 | 21.9 | 0.4 |

Postpaid ex. M2M ARPU1 | 52.6 | 52.0 | 1.1 | 52.9 | (0.6) |

Prepaid ARPU1 | 12.9 | 13.6 | (5.5) | 13.6 | (5.6) |

M2M ARPU1 | 2.6 | 3.0 | (13.9) | 2.8 | (6.3) |

|

|

|

|

|

|

1) Pro forma figures, excluding the effects of IFRS 15

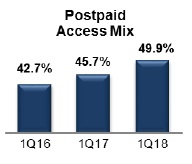

| o | Total accessesreached 75,098 thousand at the close of the first quarter of the year, representing an increase of 1.5% over 1Q17. The postpaid segment continued to grow steadily, reaching 37,499 thousand accesses (+10.9% y-o-y), equivalent to approximately half of the mobile accesses, an increase of 4.2 percentage points year-on-year. | |

Growth of | ||

| o | Total market sharereached 31.9% in March 2018 (+1.4 p.p. y-o-y). In thepostpaidsegment, Telefônica Brasil accounted for 27.4% of total net additions in the quarter, reaching a market share of 41.4% in March. The Company continues to lead the 4G-technology terminals, with market share of 33.5% in March 2018 (6.7 percentage points higher than the second player), maintaining the quality of the customer base and the Company's strategy focused on data and digital services. | |

3

| o | In 1Q18,net postpaid mobile additions reached 727 thousand accesses, representing an increase of 67.4% y-o-y, while net prepaid disconnections totaled 569 thousand accesses, thus continuing the migration of prepaid customers to postpaid plans (hybrid and pure postpaid). | |

| ||

| o | Theprepaidcustomer base declined 6.4% in March when compared to the same period last year, due to the Company’s ongoing strategy focused on the migration of prepaid clients to hybrid plans and the strict policy of disconnection of inactive clients within the criteria established by ANATEL. | |

Mobile ARPU recorded | o | In theMachine-to-Machine (M2M)market, the access base continued to expand and reached 6.7 million customers in March 2018, an increase of 26.4% when compared to the same period of last year. Telefônica Brasil is a leading company in this business, with a market share of 41.6% in March 2018. |

| o | Total ARPUrose 2.1% y-o-y in 1Q18, fueled by the performance ofData ARPU, which grew 15.8% in 1Q18 over the same period last year. | |

NET OPERATING MOBILE REVENUES

Consolidated in R$ million | 2018 Pro forma (ex-IFRS 15) | 2018 Data (Reported) | ||||

1Q18 | 1Q17 | ∆% | 1Q18 | 1Q17 | ∆% | |

| ||||||

Net Operating Mobile Revenues | 6,734.9 | 6,464.0 | 4.2 | 6,764.8 | 6,464.0 | 4.7 |

|

| |||||

Net Mobile Service Revenues | 6,425.7 | 6,208.0 | 3.5 | 6,379.0 | 6,208.0 | 2.8 |

Outgoing Voice | 1,159.7 | 1,672.2 | (30.6) | 1,165.4 | 1,672.2 | (30.3) |

Interconnection | 265.1 | 272.7 | (2.8) | 265.1 | 272.7 | (2.8) |

Data and Digital Services | 5,000.4 | 4,258.7 | 17.4 | 4,947.9 | 4,258.7 | 16.2 |

Messaging P2P | 307.2 | 372.8 | (17.6) | 307.2 | 372.8 | (17.6) |

Internet | 3,127.8 | 3,394.2 | (7.8) | 3,075.3 | 3,394.2 | (9.4) |

Digital Services | 1,565.4 | 491.8 | 218.3 | 1,565.4 | 491.8 | 218.3 |

Other Services | 0.6 | 4.5 | (86.5) | 0.6 | 4.5 | (86.5) |

Net Handset Revenues | 309.1 | 255.9 | 20.8 | 385.9 | 255.9 | 50.8 |

| ||||||

% Data and Digital Services Revenues / MSR | 77.8% | 68.6% | 9.2 p.p. | 77.6% | 68.6% | 9.0 p.p. |

|

|

|

|

|

|

|

In 1Q18, Net Mobile Revenue increased 4.2% y-o-y, due to higher Mobile Service Revenues, which registered a positive variation of 3.5% y-o-y in the quarter, driven by the growing evolution of Data and Digital Services revenue, and by the performance of Net Handset Revenues, which increased 20.8% y-o-y in 1Q18. This increase was partially offset by Outgoing Voice and Interconnection Revenues, the latter impacted by a further MTR reduction in February 2018, negatively influencing Mobile Revenue growth.

4

| Outgoing Voicerevenuefell 30.6% in comparison to 1Q17, mainly reflecting the migration to data services. In addition, the prepaid segment continued to be influenced by a year-over-year decline in the volume of top-ups, mainly due to macroeconomic conditions, whose improvement has not yet been reflected in the segment, and to the customer migration to hybrid plans. Interconnectionrevenue was 2.8% lower than in 1Q17, mainly due to the MTR tariff reduction, which took place in February 2018. Data and Digital Servicesrevenue grew 17.4% y-o-y in 1Q18 and continued to be the Company’s main source of revenue growth, as a result of our data-centric strategy. This performance was influenced by upselling, particularly in postpaid offers, growth in family plans and a strong upturn in our Digital Services revenue. In the quarter, Data and Digital Services revenue rose to 77.8% of net mobile services revenue, up 9.2 p.p. y-o-y. SMS (P2P Messaging)revenue registered a reduction of 17.6% y-o-y in 1Q18, reflecting the lower consumption of this service due to its maturity. Mobile Internetrevenue recorded a decline of 7.8% in the annual comparison, accounting for 62.6% of Data and Digital Services revenue in 1Q18. This performance was directly related to the higher usage and migration to digital services. In 1Q18,Digital Servicesrevenue increased 218.3% when compared to the same period last year, due to the inclusion of value-added services in the hybrid and prepaid segments during the second quarter of 2017 and in the postpaid segment in the fourth quarter of 2017, fully reflected in the first quarter of this year. Other Servicesrevenue registered a reduction of approximately R$ 4.0 million in the annual comparison, mainly as a result of a higher consumption of benefits in the period, related to the usage of our loyalty program, Vivo Valoriza. Mobile Handsetrevenueincreased 20.8% compared to the same quarter of the previous year, due to the change in the Company’s strategy, which has been placing greater emphasis on handset sales since 4Q17. | |

Mobile Services | ||

Data and Digital |

5

FIXED LINE BUSINESS

OPERATING PERFORMANCE

Thousand | 1Q18 | 1Q17 | ∆% | 4Q17 | ∆% |

Total Fixed Accesses | 22,714 | 23,239 | (2.3) | 22,857 | (0.6) |

Fixed Voice Accesses | 13,679 | 14,242 | (4.0) | 13,837 | (1.1) |

Residential | 8,728 | 9,237 | (5.5) | 8,899 | (1.9) |

Corporate | 4,510 | 4,561 | (1.1) | 4,498 | 0.3 |

Others | 442 | 444 | (0.6) | 441 | 0.3 |

Fixed Broadband | 7,443 | 7,336 | 1.5 | 7,432 | 0.1 |

UBB | 4,643 | 4,227 | 9.9 | 4,541 | 2.3 |

FTTC | 3,231 | 3,268 | (1.1) | 3,251 | (0.6) |

FTTH | 1,412 | 959 | 47.2 | 1,290 | 9.5 |

Others | 2,800 | 3,109 | (9.9) | 2,891 | (3.2) |

Pay TV | 1,591 | 1,661 | (4.2) | 1,588 | 0.2 |

IPTV | 430 | 281 | 52.9 | 381 | 12.9 |

DTH | 1,161 | 1,380 | (15.8) | 1,207 | (3.8) |

Voice ARPU (R$/month) | 37.4 | 41.9 | (10.8) | 38.7 | (3.4) |

Broadband ARPU (R$/month) | 55.2 | 48.6 | 13.7 | 56.1 | (1.7) |

Pay TV ARPU (R$/month) | 99.1 | 94.7 | 4.6 | 98.3 | 0.7 |

|

|

|

|

|

|

FTTH accesses | o | Total Fixed accessesreached 22,714 thousand in 1Q18, a decrease of 2.3% compared to the first quarter of the previous year, mainly influenced by the performance of voice, due to the maturity of this service, and the strategic decision of deprioritizing growth in pay TV with DTH technology. |

| o | Fixed Voice accessestotaled 13,679 thousand in 1Q18, a reduction of 4.0% when compared to the previous year, mainly due to the fixed-to-mobile substitution and the voice-to-data migration. Voice ARPU decreased by 10.8% year-over-year, reflecting the negative impact caused by lower interconnection tariffs. | |

| o | Fixed Broadband accessesrecorded 7.4 million customers in 1Q18, 1.5% more than in 1Q17. In 1Q18, the UBB customer base grew 9.9% y-o-y and recorded 4.6 million accesses, 1.4 million of which using FTTH technology, 47.2% more than in the previous year. UBB customers already represent 62.4% of total broadband accesses, fueling ARPU, which grew 13.7% y-o-y in the quarter. | |

Broadband ARPU | ||

6

o Pay TV accesses decreased 4.2% y-o-y (-7.3% in 4Q17), closing the first quarter with 1.6 million subscribers, due to the strategic decision of the Company to deprioritize DTH. The improvement in the trend, when compared to the last quarter, is due to the 52.9% y-o-y growth in IPTV accesses in 1Q18, due to the higher take-up of this product in FTTH customer acquisitions. TV ARPU increased by 4.6% y-o-y this quarter, reflecting the Company's strategy of focusing on higher-value customers.

NET OPERATING REVENUE

Consolidated in R$ million | 2018 Pro forma (ex-IFRS 15) | 2018 Data (Reported) | ||||

1Q18 | 1Q17 | ∆% | 1Q18 | 1Q17 | ∆% | |

| ||||||

Net Operating Fixed Revenues | 4,024.1 | 4,126.2 | (2.5) | 4,024.1 | 4,126.2 | (2.5) |

Voice | 1,542.6 | 1,796.3 | (14.1) | 1,542.6 | 1,796.3 | (14.1) |

Interconnection | 42.7 | 50.4 | (15.4) | 42.7 | 50.4 | (15.4) |

Broadband¹ | 1,230.7 | 1,064.0 | 15.7 | 1,230.7 | 1,064.0 | 15.7 |

UBB | 792.1 | 646.5 | 22.5 | 792.1 | 646.5 | 22.5 |

xDSL | 438.6 | 417.5 | 5.1 | 438.6 | 417.5 | 5.1 |

Corporate Data and IT | 588.5 | 584.7 | 0.6 | 588.5 | 584.7 | 0.6 |

Pay TV | 471.5 | 478.6 | (1.5) | 471.5 | 478.6 | (1.5) |

Other Services | 148.2 | 152.2 | (2.6) | 148.2 | 152.2 | (2.6) |

| ||||||

% Non-Voice Revenues² / Net Operating Fixed Revenues | 60.6% | 55.2% | 5.4 p.p. | 60.6% | 55.2% | 5.4 p.p. |

|

|

|

|

|

|

|

1) Broadband Revenue includes residential customers and SMEs;

2) Non-voice revenue includes revenue from Broadband, Corporate Data and IT, Pay TV and Other Services.

Non-voice revenues |

Net Operating Fixed Revenues fell 2.5% in 1Q18 against the same period last year, impacted by lower voice revenue and fixed-to-mobile tariff (VC) and fixed interconnection tariff (TU-RL and TU-RIU) reductions in February 2018, partially offset by the increase in Broadband Revenue. Voicerevenue decreased 14.1% in the period against 1Q17, mainly due to service maturity and fixed-to-mobile substitution. Interconnectionrevenue presented a reduction of 15.4% when compared to 1Q17, due to the reduction in TU-RL (-35.5%) and TU-RIU (-54.4%) in February 2018. Broadbandrevenue grew 15.7% y-o-y in 1Q18, fueled by the increase of ultra-broadband revenues, which accounted for approximately 64.4% of this line in the period and increased by 22.5% y-o-y, reflecting the Company's efforts to expand the base and migrate customers to higher speeds, fueling higher ARPU, as well as the expansion of the FTTH network to 16 new cities in 2017 and 2 new cities by March 2018.

| |

UBB and IPTV | ||

7

Corporate Data and IT revenue increased by 0.6% y-o-y, boosted, mainly, by the growing adoption of Cloud and IT services.

In 1Q18,Pay TVrevenuerecorded a decrease of 1.5% in the annual comparison. The Company continued with its more selective strategy for this service, focusing on high value products such as IPTV, which presented revenue growth of 66.7% y-o-y, in order to provide the best customer experience and optimize the profitability of this business.

Consolidated Operating Costs

Consolidated in R$ million | 2018 Pro forma (ex-IFRS 15) | 2018 Data (Reported) | ||||

1Q18 | 1Q17 | ∆% | 1Q18 | 1Q17 | ∆% | |

| ||||||

Operating Costs | (6,993.8) | (7,076.2) | (1.2) | (6,994.5) | (7,076.2) | (1.2) |

| ||||||

Personnel | (964.2) | (911.9) | 5.7 | (959.3) | (911.9) | 5.2 |

Costs of Services Rendered | (2,776.8) | (2,911.2) | (4.6) | (2,776.8) | (2,911.2) | (4.6) |

Interconnection | (284.1) | (393.0) | (27.7) | (284.1) | (393.0) | (27.7) |

Taxes and Contributions | (413.7) | (457.4) | (9.6) | (413.7) | (457.4) | (9.6) |

Third-party Services | (1,369.1) | (1,415.7) | (3.3) | (1,369.1) | (1,415.7) | (3.3) |

Others | (709.9) | (645.1) | 10.0 | (709.9) | (645.1) | 10.0 |

Cost of Goods Sold | (484.4) | (472.7) | 2.5 | (484.4) | (472.7) | 2.5 |

Commercial Expenses | (2,222.0) | (2,245.4) | (1.0) | (2,227.7) | (2,245.4) | (0.8) |

Provision for Bad Debt | (390.0) | (357.7) | 9.0 | (398.0) | (357.7) | 11.3 |

Third-party Services | (1,738.1) | (1,806.3) | (3.8) | (1,735.8) | (1,806.3) | (3.9) |

Others | (93.9) | (81.4) | 15.4 | (93.9) | (81.4) | 15.4 |

General and Administrative Expenses | (374.0) | (367.7) | 1.7 | (374.0) | (367.7) | 1.7 |

Other Net Operating Revenue (Expenses) | (172.3) | (167.3) | 3.0 | (172.3) | (167.3) | 3.0 |

|

|

|

|

|

|

|

8

Personnel Costsrose 5.7% in 1Q18 over the same period last year. This increase is due to the inflation related to wages and benefits and the increase of variable remuneration, mainly attributed to our own salesforce. Cost of Services Renderedin 1Q18 decreased 4.6% in relation to 1Q17, mainly due to MTR/VC and TU-RL/TU-RIU reductions in February 2018, lower expenses with mobile content and installation and maintenance, due to the increasing digitalization of the latter, more than offsetting the costs related to the expansion of our mobile and fixed networks. Cost of Goods Soldin 1Q18 grew 2.5% over 1Q17, reflecting a change in the Company's strategy, with a greater focus on handset sales. Selling Expensesdecreased 1.0% y-o-y in 1Q18, reflecting the Company's evolution in its digitalization initiatives. Theprovision for doubtful accountsclosed 1Q18 at R$ 390.0 million, 9.0% higher than the 1Q17, due to the continued migration of prepaid clients to postpaid plans. Nonetheless, the level of defaults remained in line with 4Q17, representing 2.4% of the Gross Revenue in 1Q18. Third-party Servicesregistered a reduction of 3.8% in the annual comparison. The increase in the representativeness of e-commerce sales of products and services, combined with the expansion of e-billing,led to the reduction of commissioning and billing-related (preparation and mailing) costs. General and Administrative Expensesgrew 1.7% in 1Q18, mainly due to the correction of third-party service agreements. However, the evolution of expenses remained below the inflation for the period. Other Net Operating Revenues (Expenses)increased R$ 5 million (3.0% y-o-y), totaling R$ 172.3 million in the quarter. | ||

Operating Costs | ||

Cost of Services | ||

Selling Expenses |

9

EBITDA growth of | EBITDA(earnings before interest, taxes, depreciation and amortization) totaled R$ 3,765.3 million in 1Q18, 7.2% up on the same period last year, reachingEBITDA marginof 35.0%, 1.8 p.p. up on 1Q17. ReportedEBITDApresented a growth of 8.0% y-o-y in 1Q18 (R$ 3,794.5 million), withReported EBITDA marginof 35.2%. The growth in EBITDA is due to the expansion of mobile and ultra-broadband revenues, in addition to the cost-efficiency measures adopted by the Company in the period. | |

Consolidated in R$ million | 1Q18 | 1Q17 | ∆% | 4Q17 | ∆% |

Depreciation and Amortization | (1,998.3) | (1,943.6) | 2.8 | (1,990.9) | 0.4 |

Depreciation | (1,343.2) | (1,292.1) | 4.0 | (1,303.1) | 3.1 |

Amortization of Intangibles¹ | (302.0) | (289.0) | 4.5 | (342.1) | (11.7) |

Other Amortizations | (353.1) | (362.5) | (2.6) | (345.7) | 2.1 |

|

|

|

|

|

|

|

|

|

|

|

|

1) Amortization of intangible assets generated by the incorporation of Vivo as of 2Q11 and GVT as of 2Q15

In 1Q18, theDepreciation and Amortization linepresented an increase of 2.8% in the y-o-y comparison, mainly due to the growth in the fixed asset base.

10

Consolidated in R$ million | 1Q18 | 1Q17 | ∆% | 4Q17 | ∆% |

Net Financial Income | (172.7) | (290.4) | (40.5) | (177.8) | (2.9) |

Income from Financial Investments | 72.0 | 190.2 | (62.1) | 111.6 | (35.5) |

Debt Interest | (157.3) | (294.1) | (46.5) | (157.3) | 0.0 |

Monetary and Exchange Variation | (87.5) | (125.5) | (30.3) | (79.8) | 9.6 |

Gains (losses) on Derivative Transactions | 7.7 | (49.3) | n.a. | 21.9 | (64.8) |

Other Financial Income (Expenses) | (7.6) | (11.7) | (35.0) | (74.2) | (89.8) |

|

|

|

|

|

|

Net Financial Expenses decreased 2.9% compared to 4Q17 (R$ 5.1 million) and, compared to the same period last year, the financial result registered a reduction of 40.5% (R$ 117.7 million).

This improved performance is due to reduced interest rates and lower average net debt.

Net Income | Net IncomerecordedR$ 1,098.0 million in 1Q18 and was 10.2% higher than in the same period of 2017. The growth was primarily influenced by increased EBITDA and improvement in financial results recorded in the period. | |

Capex

Consolidated in R$ million | 1Q18 | 1Q17 | ∆% | 4Q17 | ∆% |

Total | 1,547.4 | 1,328.2 | 16.5 | 2,664.7 | (41.9) |

|

|

|

|

|

|

Network | 1,383.1 | 1,193.4 | 15.9 | 2,067.8 | (33.1) |

Technology / Information System | 123.6 | 110.2 | 12.1 | 420.9 | (70.6) |

Products and Services, Channels, Adm. and Others | 40.8 | 24.6 | 66.0 | 176.0 | (76.8) |

Capex (ex-licenses) / Net Operating Revenue | 14.4% | 12.5% | 1.8 p.p. | 24.2% | (9.8) p.p. |

|

|

|

|

|

|

In 1Q18,Capex increased 16.5% y-o-y, reaching R$ 1,547.4 million, accounting for 14.4% of Net Operating Revenue for the period.

The investments were mainly focused in FTTH footprint expansion and adoption, and higher 4G coverage and capacity.

11

In a Material Fact published on March 12, 2018, the Company announced to its shareholders and the market in general that, in line with its strategy of offering the best experience for its clients and capturing existing growth opportunities in the country: (i) the Company will carry out an estimated investment of R$ 24,000.0 million for the 2018-2020 triennium, with a primary focus on expansion and quality of the mobile and fixed networks, excluding possible investments in licenses; and (ii) will also make an additional estimated investment of R$ 2,500.0 million, for the same period, exclusively aimed at accelerating the expansion of the optical fiber network.

We clarify that the amounts above are estimated, subject to variations in the face of possible changes in the business and macroeconomic environment.

Consolidated in R$ million | 2018 Pro forma (ex-IFRS 15) | 2018 Data (Reported) | ||||

1Q18 | 1Q17 | ∆% | 1Q18 | 1Q17 | ∆% | |

| ||||||

EBITDA | 3,765.3 | 3,513.9 | 7.2 | 3,794.5 | 3,513.9 | 8.0 |

|

|

| ||||

Investments (CAPEX) | (1,547.4) | (1,328.2) | 16.5 | (1,547.4) | (1,328.2) | 16.5 |

Payment of Interest, Taxes and Other Financial Exp (Rev) | (241.9) | (410.3) | (41.0) | (241.9) | (410.3) | (41.0) |

Working Capital Variation | (972.1) | (1,097.7) | (11.4) | (1,001.4) | (1,097.7) | (8.8) |

| ||||||

Free Cash Flow from Business Activity | 1,003.8 | 677.9 | 48.1 | 1,003.8 | 677.9 | 48.1 |

|

|

| ||||

Non-Recurring Items² | (100.3) | (655.1) | (84.7) | (100.3) | (655.1) | (84.7) |

| ||||||

Free Cash Flow after Extraordinaries | 903.6 | 22.8 | 3,866.3 | 903.6 | 22.8 | 3,866.3 |

|

|

|

|

|

|

|

1) The criterion used for cash flow excludes amounts paid as income tax from the allocation of interest on equity, which were previously included in the calculation.

2) Payment related to the cleaning of the 700 MHz 4G spectrum, totaling R$ 655.1 million in 1Q17 and R$ 100.3 million in 1Q18.

| Free Cash Flow from Business Activities grew 48.1% y-o-y in 1Q18 | Free cash flow from businessactivities reached R$ 1,003.8 million in 1Q18, an increase of R$ 326.0 million compared to the same period in 2017, reflecting the improvement in the operating result, partially offset by the increase in the investment volume. Free cash flow after non-recurring itemspresented an increase of R$ 880.8 million in 2018, influenced by the improvement in the operating result and by the extraordinary payment, in January 2017, of R$ 655.1 million referring to the installment of the EAD (Empresa Administradora de Digitalização) program, related to the disconnection of analog TV and the cleaning of the 700 MHz spectrum. In 2018, the last installment was paid in the amount of R$ 100.3 million. | |

12

Debt

Loans and Financing(R$ million)

March 2018 | ||||||||

Consolidated | Currency | Interest Rate | Due Date | Short-Term | Long-Term | Total | ||

| ||||||||

Local Currency |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| |

BNDES | UR LTIR | LTIR + 0.00% to 3.38% | 2023 | 658.3 | 770.1 | 1,428.5 | ||

BNDES | R$ | 2.5% to 6.0% | 2023 | 71.4 | 147.3 | 218.7 | ||

BNDES | R$ | SELIC D-2 + 2.32% | 2023 | 76.5 | 291.8 | 368.3 | ||

BNB | R$ | 7.0% to 10.0% | 2022 | 15.1 | 51.0 | 66.1 | ||

Confirming | R$ | 101.4% to 109.7% of CDI | 2019 | 395.3 | - | 395.3 | ||

Debentures 4th Issue - Series 3 | R$ | IPCA + 4.0% | 2019 | 0.7 | 40.4 | 41.1 | ||

Debentures 1st Issue - Minas Comunica | R$ | IPCA + 0.5% | 2021 | 25.5 | 76.6 | 102.1 | ||

Debentures 4th Issue - Single Series | R$ | 100% of CDI + 0.68 spread | 2018 | 1,340.7 | - | 1,340.7 | ||

Debentures 5th Issue - Single Series | R$ | 108.25% of CDI | 2022 | 17.1 | 1,996.9 | 2,014.0 | ||

Debentures 6th Issue - Single Series | R$ | 100.00% of CDI + 0.24% | 2020 | 22.8 | 999.5 | 1,022.3 | ||

Financial Leases | R$ | - | 2033 | 52.9 | 338.2 | 391.1 | ||

Contingent Consideration | R$ | - | 2025 | - | 451.1 | 451.1 | ||

|

|

|

|

|

| |||

Foreign Currency |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

BNDES | UMBND | ECM + 2.38% | 2019 | 142.6 | 47.4 | 190.0 | ||

| ||||||||

Total |

|

|

|

|

| 2,818.8 | 5,210.3 | 8,029.2 |

|

|

|

|

|

|

|

|

|

NET DEBT |

|

| DEBT PROFILE | |||

|

|

|

|

| ||

Consolidated in R$ million | 31/03/2018 | 31/12/2017 | 31/03/2017 |

| March 2018 | |

Short-Term Debt | 2,818.8 | 3,033.4 | 4,455.1 |

| Year | Amount |

Long-Term Debt | 5,210.3 | 5,428.4 | 6,367.8 |

| (R$ miillion) | |

Total Debt | 8,029.2 | 8,461.8 | 10,822.9 |

| 2019 | 612.0 |

Cash and Cash Equivalents¹ | (4,366.4) | (4,062.1) | (6,296.1) |

| 2020 | 1,416.2 |

Net Derivatives Position | (127.9) | (143.8) | 22.3 |

| 2021 | 1,286.7 |

Contingent Consideration Guarantee Asset² | (451.1) | (446.1) | (424.3) |

| 2022 | 1,234.5 |

Net Debt | 3,083.8 | 3,809.9 | 4,124.8 |

| After 2022 | 660.9 |

Net Debt / EBITDA³ | 0.21 | 0.26 | 0.30 |

| Total | 5,210.3 |

|

|

|

|

|

| |

1) Includes the investment in BNB given as a guarantee for the loan from that bank.

2) Alignment of the classification criterion for the asset backing the contingent consideration to calculatepro-forma net debt.

3)LTM EBITDA.

| The Company closed 1Q18 with aGross Debt of R$ 8,029.2 million, 2.4% of which denominated in foreign currency. The decrease in gross debt is related to the settlement of loans and financing in the period. Currently, foreign exchange exposure of debt is covered by hedge operations.

Net debttotaled R$ 3,083.8 million at the end of 1Q18, representing 0.21x of LTM EBITDA. In regard to 1Q17 and 4Q17, net debt recorded a reduction of R$ 1,041.0 and R$ 726.1 million, respectively, mainly explained by the higher cash generation. |

13

Telefônica Brasil’s | Telefônica Brasil's common (ON) and preferred (PN) shares are traded on B3 under the tickers VIVT3 and VIVT4, respectively. The Company's ADRs are traded on the NYSE, under the ticker VIV. VIVT3 and VIVT4 shares closed the first quarter of 2018 at R$ 44.20 and R$ 50.40, respectively, appreciating 7.3% and 3.7% in the first three months of the year. Total shareholder return (TSR) in the last twelve months reached 30.9% for common shares and 13.1% for preferred shares. The Company's ADRs ended the quarter at US$ 15.36, appreciating 3.6% in the first three months of the year. The daily traded volume of VIVT3 and VIVT4 shares in 1Q18 averaged R$ 1,167.1 thousand and R$ 86,614.7 thousand, respectively. The daily traded volume of ADR averaged US$ 19,045.0 thousand in the same period. The chart below shows the Company's stock performance: | |

14

31-Mar-2018 | Common | Prefered | Total |

Controlling Company Shareholders | 540,033,264 | 704,207,855 | 1,244,241,119 |

94.47% | 62.91% | 73.58% | |

Minority Shareholders | 29,320,789 | 415,131,868 | 444,452,657 |

5.13% | 37.09% | 26.28% | |

Treasury | 2,290,164 | 983 | 2,291,147 |

0.40% | 0.00% | 0.14% | |

Total Number of Shares | 571,644,217 | 1,119,340,706 | 1,690,984,923 |

|

|

|

|

Book Value per Share: | R$ 41.70 |

| |

Subscribed/Paid-in Capital: | R$ 63,571.4 | million |

Dividends

Dividends and IOC | At a meeting held on February 16, 2018, the Board of Directors of Telefônica Brasil S.A. approved dividends related to the fiscal year 2017, in the gross amount of R$ 2,191.9 million. The amount was ratified by the Annual Shareholders' Meeting on April 12, 2018. Therefore, the Company ended the year of 2017 with a payout of approximately of 100% of earnings generated in the fiscal year. | |

Dividends declared | At a meeting held on April 18, 2018, the Management of Telefônica Brasil S.A. approved the payment dates related to the dividends of 2017. The dividends distributed as Interest on Capital, in the gross amount of R$ 2,416.6 million, will be paid on August 21, 2018, while the regular dividends, in the amount of R$ 2,191.9 million, will be paid on December 11, 2018, according to the information disclosed on the following page: | |

15

2017 | Deliberation | Shareholding Position | Gross Amount (BRL million) | Net Amount (BRL million) | Shares | Gross Amount per Share (BRL) | Net Amount per Share (BRL) | Payment Beginning Date |

Dividends | 04/12/2018 | 04/12/2018 | 2,191.9 | 2,191.9 | ON | 1.217277 | 1.217277 | 12/11/2018 |

(based on Dec-17) | PN | 1.339005 | 1.339005 | |||||

IOC | 12/14/2017 | 12/26/2017 | 1,486.6 | 1,263.6 | ON | 0.825623 | 0.701779 | 08/21/2018 |

(based on Nov-17) | PN | 0.908185 | 0.771957 | |||||

IOC | 09/18/2017 | 09/29/2017 | 305.0 | 259.3 | ON | 0.169385 | 0.143978 | 08/21/2018 |

(based on Aug-17) | PN | 0.186324 | 0.158375 | |||||

IOC | 06/19/2017 | 06/30/2017 | 95.0 | 80.8 | ON | 0.052759 | 0.044845 | 08/21/2018 |

(based on May-17) | PN | 0.058035 | 0.049330 | |||||

IOC | 03/20/2017 | 03/31/2017 | 350.0 | 297.5 | ON | 0.194377 | 0.165220 | 08/21/2018 |

(based on Feb-17) | PN | 0.213814 | 0.181742 | |||||

IOC | 02/13/2017 | 02/24/2017 | 180.0 | 153.0 | ON | 0.099965 | 0.084970 | 08/21/2018 |

(based on Jan-17) | PN | 0.109962 | 0.093467 | |||||

|

|

|

|

|

|

|

|

|

2016 | Deliberation | Shareholding Position | Gross Amount (BRL million) | Net Amount (BRL million) | Shares | Gross Amount per Share (BRL) | Net Amount per Share (BRL) | Payment Beginning Date |

Dividends | 04/26/2017 | 04/26/2017 | 1,914.0 | 1,914.0 | ON | 1.062955 | 1.062955 | 12/13/2017 |

(based on Dec-16) | PN | 1.169250 | 1.169250 | |||||

IOC | 12/19/2016 | 12/30/2016 | 604.1 | 513.5 | ON | 0.335519 | 0.285191 | 12/13/2017 |

(based on Nov-16) | PN | 0.369071 | 0.313710 | |||||

IOC | 09/19/2016 | 09/30/2016 | 650.0 | 552.5 | ON | 0.360985 | 0.306837 | 08/22/2017 |

(based on Aug-16) | PN | 0.397084 | 0.337521 | |||||

IOC | 06/17/2016 | 06/30/2016 | 161.0 | 136.9 | ON | 0.089413 | 0.076001 | 08/22/2017 |

(based on May-16) | PN | 0.098355 | 0.083601 | |||||

IOC | 04/18/2016 | 04/29/2016 | 220.0 | 187.0 | ON | 0.122180 | 0.103853 | 08/22/2017 |

(based on Mar-16) | PN | 0.134398 | 0.114238 | |||||

IOC | 03/18/2016 | 03/31/2016 | 337.0 | 286.5 | ON | 0.187157 | 0.159083 | 08/22/2017 |

(based on Feb-16) | PN | 0.205873 | 0.174992 | |||||

IOC | 02/19/2016 | 02/29/2016 | 200.0 | 170.0 | ON | 0.111072 | 0.094412 | 08/22/2017 |

(based on Jan-16) | PN | 0.122180 | 0.103853 |

16

INCOME STATEMENT (Reported)

Consolidated in R$ million | 1Q18 | 1Q17 | ∆% | 4Q17 | ∆% |

Gross Operating Revenue | 16,334.4 | 16,570.4 | (1.4) | 16,536.7 | (1.2) |

Mobile | 10,331.2 | 10,153.0 | 1.8 | 10,357.6 | (0.3) |

Fixed | 6,003.2 | 6,417.4 | (6.5) | 6,179.1 | (2.8) |

Net Operating Revenue | 10,789.0 | 10,590.1 | 1.9 | 11,033.5 | (2.2) |

| |||||

Mobile | 6,764.8 | 6,464.0 | 4.7 | 6,850.0 | (1.2) |

Fixed | 4,024.1 | 4,126.2 | (2.5) | 4,183.6 | (3.8) |

| |||||

Operating Costs | (6,994.5) | (7,076.2) | (1.2) | (7,266.9) | (3.7) |

| |||||

Personnel | (959.3) | (911.9) | 5.2 | (949.4) | 1.0 |

Costs of Services Rendered | (2,776.8) | (2,911.2) | (4.6) | (2,828.4) | (1.8) |

Interconnection | (284.1) | (393.0) | (27.7) | (371.5) | (23.5) |

Taxes and Contributions | (413.7) | (457.4) | (9.6) | (437.6) | (5.5) |

Third-party Services | (1,369.1) | (1,415.7) | (3.3) | (1,360.5) | 0.6 |

Others | (709.9) | (645.1) | 10.0 | (658.8) | 7.8 |

Cost of Goods Sold | (484.4) | (472.7) | 2.5 | (534.6) | (9.4) |

Commercial Expenses | (2,227.7) | (2,245.4) | (0.8) | (2,346.7) | (5.1) |

Provision for Bad Debt | (398.0) | (357.7) | 11.3 | (372.1) | 7.0 |

Third-party Services | (1,735.8) | (1,806.3) | (3.9) | (1,857.8) | (6.6) |

Others | (93.9) | (81.4) | 15.4 | (116.8) | (19.6) |

General and Administrative Expenses | (374.0) | (367.7) | 1.7 | (382.3) | (2.2) |

Other Net Operating Revenue (Expenses) | (172.3) | (167.3) | 3.0 | (225.5) | (23.6) |

| |||||

EBITDA | 3,794.5 | 3,513.9 | 8.0 | 3,766.6 | 0.7 |

EBITDA Margin % | 35.2% | 33.2% | 2.0 p.p. | 34.1% | 1.0 p.p. |

| |||||

Depreciation and Amortization | (1,998.3) | (1,943.6) | 2.8 | (1,990.9) | 0.4 |

Depreciation | (1,343.2) | (1,292.1) | 4.0 | (1,303.1) | 3.1 |

Amortization of Intangibles | (302.0) | (289.0) | 4.5 | (342.1) | (11.7) |

Others Amortizations | (353.1) | (362.5) | (2.6) | (345.7) | 2.1 |

| |||||

EBIT | 1,796.2 | 1,570.3 | 14.4 | 1,775.7 | 1.1 |

| |||||

Net Financial Income | (172.7) | (290.4) | (40.5) | (177.8) | (2.9) |

Income from Financial Investments | 72.0 | 190.2 | (62.1) | 111.6 | (35.5) |

Debt Interest | (157.3) | (294.1) | (46.5) | (157.3) | 0.0 |

Monetary and Exchange Variation | (87.5) | (125.5) | (30.3) | (79.8) | 9.6 |

Gains (Losses) on Derivative Transactions | 7.7 | (49.3) | n.a. | 21.9 | (64.8) |

Other Financial Income (Expenses) | (7.6) | (11.7) | (35.0) | (74.2) | (89.8) |

| |||||

Gain (Loss) on Investments | 0.5 | 0.8 | (37.5) | 0.2 | 150.0 |

| |||||

Taxes | (526.0) | (284.5) | 84.9 | (81.2) | 547.8 |

| |||||

Net Income | 1,098.0 | 996.2 | 10.2 | 1,516.9 | (27.6) |

17

BALANCE SHEET (Reported)

Consolidated in R$ million | 31/03/2018 | 31/12/2017 | ∆% |

ASSETS | 102,281.1 | 101,382.8 | 0.9 |

Current Assets | 17,910.4 | 16,731.7 | 7.0 |

Cash and Cash Equivalents | 4,354.5 | 4,050.3 | 7.5 |

Accounts Receivable from Customers | 10,363.5 | 9,955.2 | 4.1 |

Provision for Doubtful Accounts | (1,592.8) | (1,366.7) | 16.5 |

Inventories | 510.6 | 348.8 | 46.4 |

Recoverable Taxes | 2,573.1 | 2,564.0 | 0.4 |

Escrow Deposits and Frozen Assets | 339.7 | 324.6 | 4.7 |

Derivative Financial Instruments | 85.4 | 87.6 | (2.5) |

Prepaid Expenses | 912.0 | 446.4 | 104.3 |

Other Assets | 364.4 | 321.5 | 13.3 |

Non-Current Assets | 84,370.7 | 84,651.1 | (0.3) |

Accounts Receivable from Customers | 347.6 | 340.6 | 2.1 |

Provision for Doubtful Accounts | (61.8) | (66.7) | (7.3) |

Financial Investments | 87.6 | 81.4 | 7.6 |

Recoverable Taxes | 787.5 | 743.3 | 5.9 |

Deffered Taxes | 398.9 | 371.4 | 7.4 |

Escrow Deposits and Frozen Assets | 6,388.8 | 6,339.2 | 0.8 |

Derivative Financial Instruments | 65.9 | 76.8 | (14.2) |

Other Assets | 156.5 | 112.0 | 39.7 |

Investments | 102.1 | 98.9 | 3.2 |

Property, Plant and Equipment, Net | 33,113.9 | 33,222.3�� | (0.3) |

Intangible Assets, Net | 42,983.7 | 43,331.9 | (0.8) |

LIABILITIES AND SHAREHOLDERS' EQUITY | 102,281.1 | 101,382.8 | 0.9 |

LIABILITIES | 31,858.2 | 31,921.4 | (0.2) |

Current Liabilities | 17,713.5 | 17,862.5 | (0.8) |

Payroll and Related Charges | 584.9 | 723.4 | (19.1) |

Suppliers and Accounts Payable | 7,288.4 | 7,447.1 | (2.1) |

Taxes | 2,144.4 | 1,731.3 | 23.9 |

Loans and Financing | 1,412.1 | 1,621.0 | (12.9) |

Debentures | 1,406.7 | 1,412.5 | (0.4) |

Dividends and Interest on Shareholders Equity | 2,397.4 | 2,396.1 | 0.1 |

Provisions | 1,412.1 | 1,434.9 | (1.6) |

Derivative Financial Instruments | 5.4 | 5.2 | 3.8 |

Deferred Revenues | 515.5 | 372.6 | 38.4 |

Authorization Licenses | 0.0 | 141.3 | n.a. |

Other Liabilities | 546.6 | 577.1 | (5.3) |

Non-Current Liabilities | 14,144.7 | 14,058.9 | 0.6 |

Payroll and Related Charges | 0.7 | 23.3 | (97.0) |

Taxes | 50.1 | 49.4 | 1.4 |

Deferred Taxes | 882.3 | 709.3 | 24.4 |

Loans and Financing | 2,096.9 | 2,320.1 | (9.6) |

Debentures | 3,113.4 | 3,108.3 | 0.2 |

Provisions | 6,814.4 | 6,709.8 | 1.6 |

Derivative Financial Instruments | 18.0 | 15.4 | 16.9 |

Deferred Revenues | 380.8 | 350.6 | 8.6 |

Lincence of Authorization | 119.2 | 117.4 | 1.5 |

Other Liabilities | 668.9 | 655.3 | 2.1 |

SHAREHOLDERS' EQUITY | 70,422.9 | 69,461.4 | 1.4 |

Capital Stock | 63,571.4 | 63,571.4 | 0.0 |

Capital Reserve | 1,213.5 | 1,213.5 | 0.0 |

Profit Reserve | 2,466.0 | 2,463.2 | 0.1 |

Additional Proposed Dividends | 2,191.9 | 2,191.9 | 0.0 |

Other Comprehensive Income | 23.5 | 21.4 | 9.8 |

Accumulated Profits | 956.6 | 0.0 | n.a. |

|

|

|

|

18

Conference Call

English

Date: April 25, 2018 (Wednesday)

Time: 10:00 AM (Brasilia time) and 9:00 AM (New York time)

Telephone: +1 (412) 717-9224

Access code: Telefônica Brasil

Click here to access the webcast.

A replay of the conference call will be available one hour after the event, until May 7, 2018, at +1 (412) 317-0088 (Code: 10115930 #)

Telefônica Brasil - Investor Relations |

Eduardo Navarro David Melcon Luis Plaster João Pedro Carneiro

|

Av. Eng. Luis Carlos Berrini, 1376 - 28º Andar - Cidade Monções - SP - 04571-000

Telephone: +55 11 3430-3687 E-mail: ir.br@telefonica.com Information available on thewebsite: http://www.telefonica.com.br/ri

| |||

|

| |||

|

| |||

This document may contain forward-looking statements. Such statements do not constitute historical facts and merely reflect the expectations of the Company's management. Such terms as "anticipate", "believe", "estimate", "expect", "foresee", "intend", "plan", "project", "target" and similar, are intended to identify such statements, which evidently involve risks and uncertainties, both foreseen and unforeseen by the Company. Consequently, the Company's future operating results may differ from present expectations and readers should not place undue reliance on the information contained herein. These forward-looking statements express opinions formed solely on the date on which they were issued, and the Company is under no obligation to update them in line with new information or future developments. | |||

19

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| TELEFÔNICA BRASIL S.A. | |||

Date: | April 23, 2018 |

| By: | /s/Luis Carlos da Costa Plaster | |

|

|

|

| Name: | Luis Carlos da Costa Plaster |

|

|

|

| Title: | Investor Relations Director |