EXHIBIT 99.1

A TECHNICAL REVIEW

OF THE

NUEVO MILENIO PROJECT, TEPIC AREA, NAYARIT STATE, MEXICO

FOR

CREAM MINERALS LIMITED

prepared by

Dr. Derek E. McBride P. Eng.

Senior Associate Geologist

and

Al Workman, P.Geo.

Vice President and Senior Geologist

20 March, 2013 Toronto, Canada |  |

TABLE OF CONTENTS

| | | Page |

| 1. | SUMMARY | 1 |

| | | |

| 2. | INTRODUCTION | 5 |

| | 2.1 | General | 5 |

| | 2.2 | Terms of Reference | 5 |

| | 2.3 | Sources of Information | 5 |

| | 2.4 | Reliance on Other Experts and Site Visits | 5 |

| | 2.5 | Units and Currency | 6 |

| | 2.6 | Risk Factors | 7 |

| | | |

| 3. | PROPERTY DESCRIPTION AND LOCATION | 9 |

| | 3.1 | Location | 9 |

| | 3.2 | Property Description | 10 |

| | 3.3 | Nature of CMA’s Interest | 10 |

| | | |

| 4. | ACCESS, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 12 |

| | 4.1 | Access | 12 |

| | 4.2 | Climate | 12 |

| | 4.3 | Local Resources and Infrastructure | 12 |

| | 4.4 | Physiography and Agriculture | 13 |

| | | |

| 5. | HISTORY | 15 |

| | | |

| 6. | GEOLOGICAL SETTING AND MINERALIZATION | 17 |

| | 6.1 | Regional, Local and Property Geology | 17 |

| | 6.2 | Setting of Mineralization | 25 |

| | | |

| 7. | DEPOSIT TYPES | 27 |

| | | |

| 8. | MINERALIZATION | 28 |

| | | |

| 9. | EXPLORATION | 30 |

| | 9.1 | Procedures/Parameters of Surveys and Investigation | 30 |

| | 9.2 | Sampling Methods and Sample Quality | 30 |

| | 9.3 | Relevant Information | 31 |

| | 9.4 | Results and Interpretation of Exploration | 31 |

| | | |

| 10. | DRILLING | 47 |

| | 10.1 | Introduction | 47 |

| | 10.2 | Dos Hornos 1 | 47 |

| | 10.3 | Dos Hornos 2 | 50 |

| | 10.4 | Veta Tomas | 52 |

| | 10.5 | Once Bocas North | 54 |

| | 10.6 | Once Bocas South | 56 |

| | 10.7 | Chacuaco | 56 |

| | 10.8 | La Cafetal Veta Olvidada Prospect | 57 |

| | | |

| 11. | SAMPLING METHOD, ANALYSIS AND SECURITY | 59 |

| | 11.1 | Sample Preparation and Assaying | 59 |

| | 11.2 | Quality Assurrance / Quality Control | 60 |

| | 11.3 | Security | 61 |

| 12. | DATA VERIFICATION | 62 |

| | 12.1 | General | 62 |

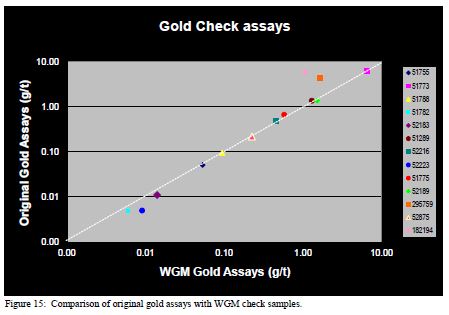

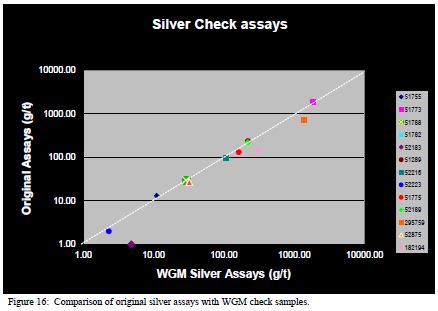

| | 12.2 | Check Sampling and Assaying | 62 |

| | | |

| 13. | MINERAL PROCESSING AND METALLURGICAL TESTING | 65 |

| | | |

| 14. | MINERAL RESOURCE ESTIMATES | 66 |

| | 14.1 | Definitions | 66 |

| | 14.2 | Previous Resource Estimates | 68 |

| | 14.3 | Current Wgm 2013 Mineral Resources Estimates | 70 |

| | 14.4 | General Mineral Resource Estimation Procedures | 72 |

| | 14.5 | Database | 72 |

| | 14.6 | Geological Modelling Procedures | 74 |

| | 14.7 | Geological Interpretation | 75 |

| | 14.8 | Topographic Surface Creation | 76 |

| | 14.9 | Statistical Analysis, Compositing, Grade Capping and Specific Gravity | 76 |

| | 14.10 | Polygonal Model Parameters, Grade Interpolation and Classification of Mineral Resources | 82 |

| | 14.11 | Dos Hornos 1 and 2 Current Mineral Resources Estimates | 85 |

| | 14.12 | Veta Tomas Current Mineral Resources Estimates | 93 |

| | 14.13 | Once Bocas Current Mineral Resources Estimates | 98 |

| | 14.14 | Discussion of Current Nuevo Milenio Mineral Resources | 106 |

| | | |

| 15. | MINERAL RESERVE ESTIMATES | 109 |

| | | |

| 16. | MINING METHODS | 109 |

| | | |

| 17. | RECOVERY METHODS | 110 |

| | | |

| 18. | PROJECT INFRASTRUCTURE | 110 |

| | | |

| 19. | MARKET STUDIES AND CONTRACTS | 110 |

| | | |

| 20. | ENVIRONMENTAL STUDIES, PERMIT, AND SOCIAL OR COMMUNITY IMPACT | 111 |

| | | |

| 21. | CAPITAL AND OPERATING COSTS | 111 |

| | | |

| 22. | ECONOMIC ANALYSIS | 111 |

| | | |

| 23. | ADJACENT PROPERTIES | 112 |

| | | |

| 24. | OTHER RELEVANT DATA AND INFORMATION | 113 |

| | | |

| 25. | INTERPRETATION AND CONCLUSIONS | 114 |

| | | |

| 26. | RECOMMENDATIONS | 118 |

| | | |

| 27. | DATE AND SIGNATURE PAGE | 122 |

| | | |

| 28. | REFERENCES | 123 |

| | |

| CERTIFICATE | 124 |

LIST OF TABLES

| | | Page |

| Table 1 | Summary of CMA’s Nuevo Milenio Project Mineral Exploration Concessions | 10 |

| Table 2 | Condition of Spanish Colonial Mine Workings, Nuevo Milenio Project | 32 |

| Table 3 | Summary of Selected Dos Hornos 1 Drill Hole Intersections | 33 |

| Table 4 | Summary of Selected Dos Hornos 2 Intersections | 35 |

| Table 5 | Summary of Selected Veta Tomas Drill Hole Intersections | 37 |

| Table 6 | Summary of Selected Once Bocas North Drill Hole Intersections | 41 |

| Table 7 | Summary of Selected Once Bocas South Drill Hole Intersections | 44 |

| Table 8 | Summary of Selected Chacuaco Prospect Drill Hole Intersections | 45 |

| Table 9 | Summary of Selected La Cafetal Veta Olvidada Prospect Drill Hole Intersections | 46 |

| Table 10 | Dos Hornos Segment 1 Drill hole Data | 48 |

| Table 11 | Dos Hornos Segment 2 Drill Hole Data | 50 |

| Table 12 | Veta Tomas Drill Hole Data | 52 |

| Table 13 | Once Bocas North Drill Hole Data | 54 |

| Table 14 | Once Bocas South Drill Hole Data | 56 |

| Table 15 | Chacuaco Prospect Drill Hole Data | 57 |

| Table 16 | Cafetal Veta Olvidada Prospect Drill Hole Data | 58 |

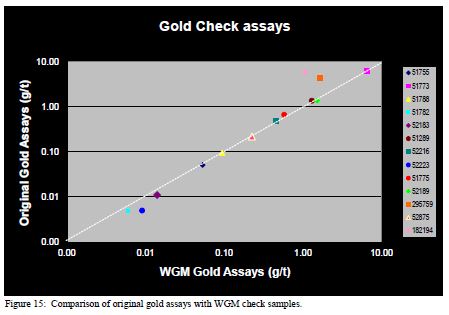

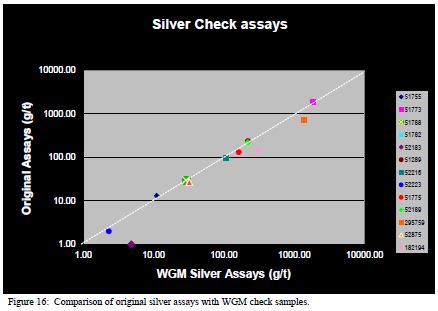

| Table 17 | Comparison of Original Assay Data and New Data Derived from WGM Check Samples | 63 |

| Table 18 | Summary of Metallurgical Test Sample Information | 65 |

| Table 19 | Summary of Metallurgical Test Results | 65 |

| Table 20 | Summary of Previous Resource Estimates (after Holcapek, 2008a) | 69 |

| Table 21 | Frequency of Host Rocks in Sample Population from Major Zones | 77 |

| Table 22 | Frequency of Host Rocks in Sample Population | 79 |

| Table 23 | Dos Hornos 1 Mineral Resource Estimates | 85 |

| Table 24 | Dos Hornos 2 Mineral Resource Estimates | 91 |

| Table 25 | Distribution of Raw Ag and Au Assays in Various Rock Types, Dos Hornos 1 and 2 Zones | 92 |

| Table 26 | Dos Hornos 1 and 2 Mineral Resource Estimates – Sensitivity Analysis | 93 |

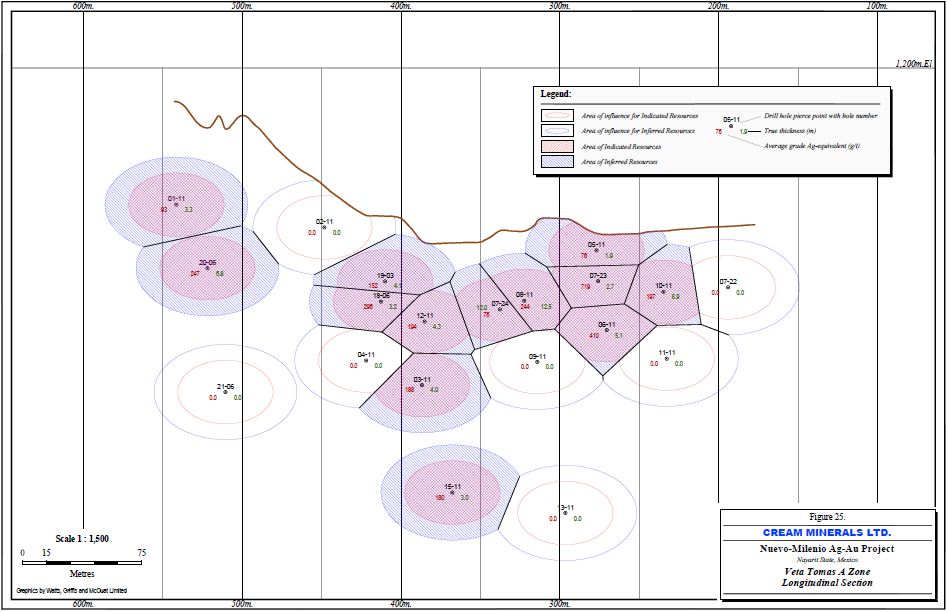

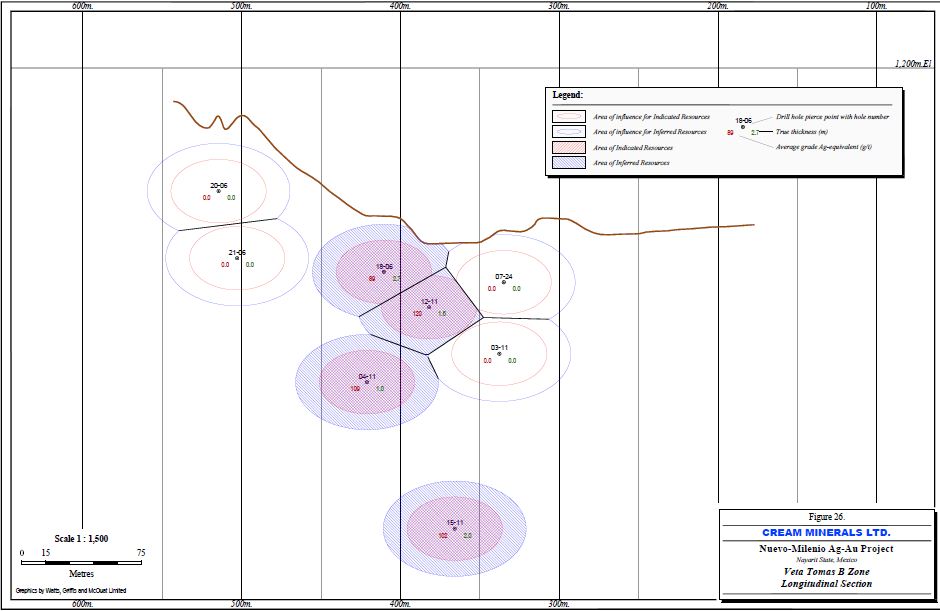

| Table 27 | Veta Tomas Mineral Resource Estimates | 94 |

| Table 28 | Distribution of Raw Ag and Au Assays in Various Rock Types, Veta Tomas Zone | 95 |

| Table 29 | Veta Tomas Mineral Resource Estimates – Sensitivity Analysis | 98 |

| Table 30 | Once Bocas North Mineral Resource Estimates | 100 |

| Table 31 | Distribution of Raw Ag and Au Assays in Various Rock Types, Once Bocas North Zone | 104 |

| Table 32 | Once Bocas North Mineral Resource Estimates - Sensitivity Analysis | 105 |

| Table 33 | Summary of Nuevo Milenio Mineral Resource Estimates | 106 |

| Table 34 | Comparison of Previous and Current Nuevo Milenio Mineral Resource Estimates | 107 |

| Table 35 | Summary of Nuevo Milenio Mineral Resource Estimates | 116 |

| Table 36 | Recommended Exploration Program for the Nuevo Milenio Project | 121 |

LIST OF FIGURES

| | | Page |

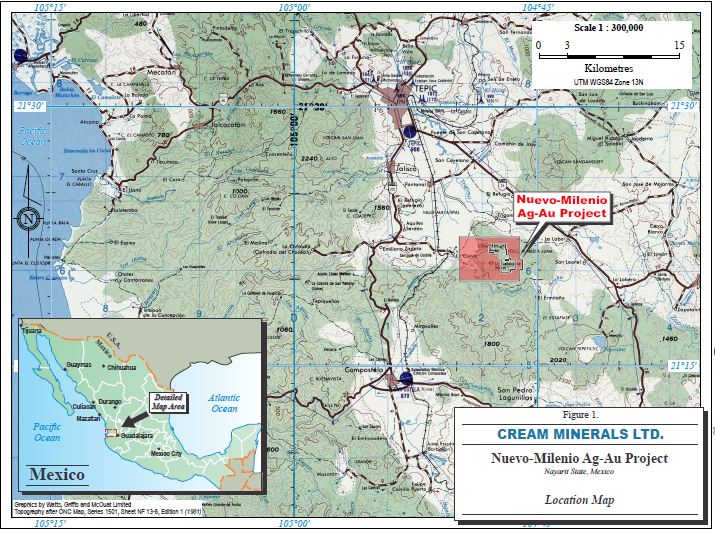

| Figure 1: | General Location of the CMA Project | 8 |

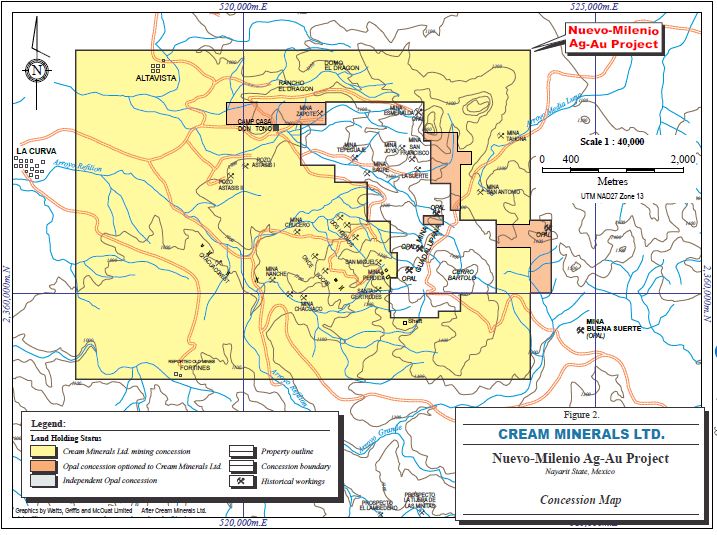

| Figure 2: | Map Showing Boundaries of CMA’s Mineral Concessions for the Nuevo Milenio Project | 14 |

| Figure 3: | Regional Geology Map for the Nuevo Milenio Project | 19 |

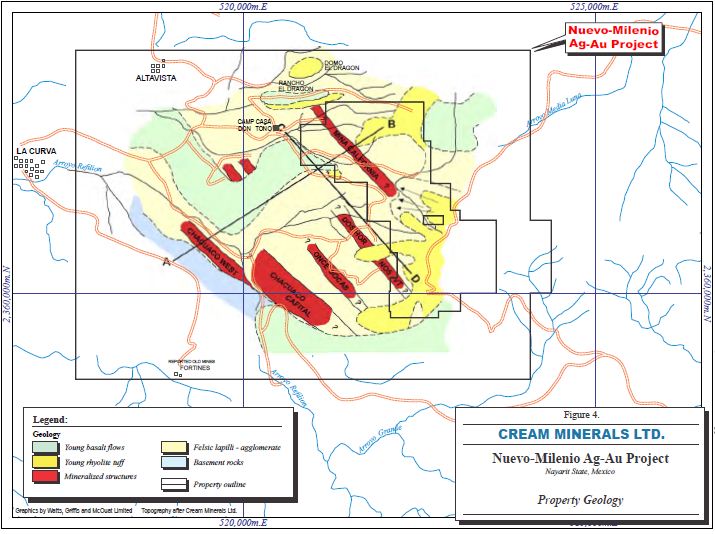

| Figure 4: | Property Geology | 23 |

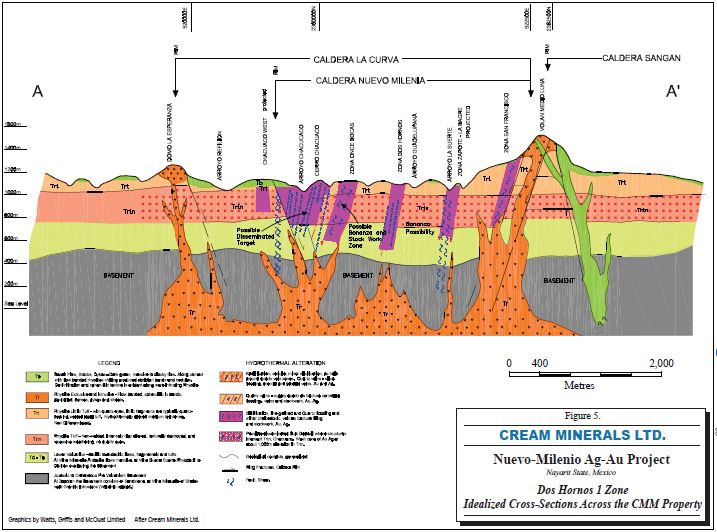

| Figure 5: | Idealized Cross-sections Across the CMA Property | 24 |

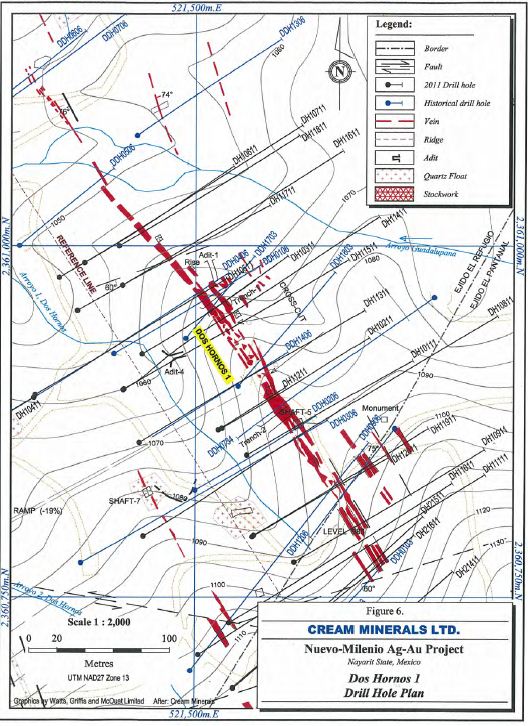

| Figure 6: | Surface Plan of Dos Hornos 1 Area | 34 |

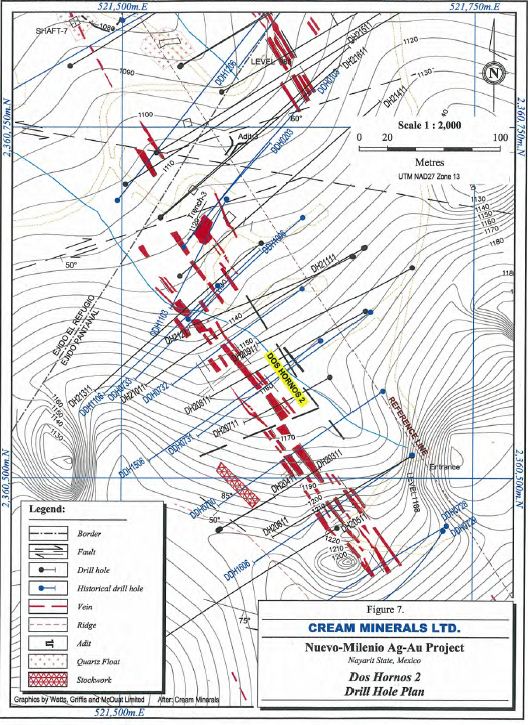

| Figure 7: | Surface Plan of the Dos Hornos 2 Area | 36 |

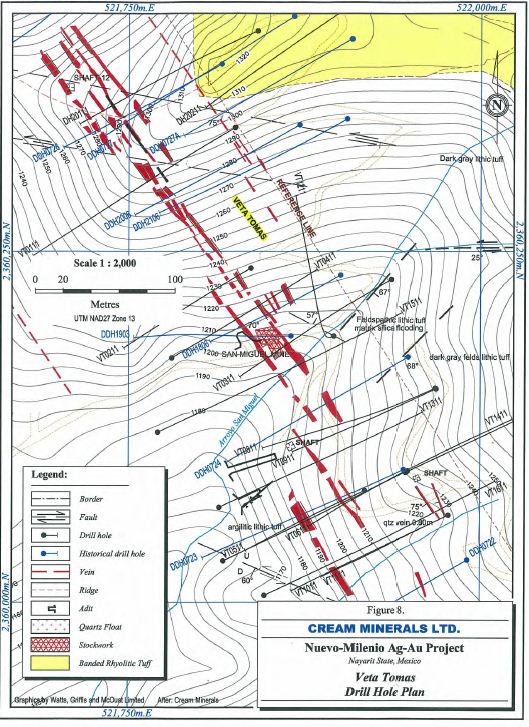

| Figure 8: | Surface Plan of the Veta Tomas Area | 39 |

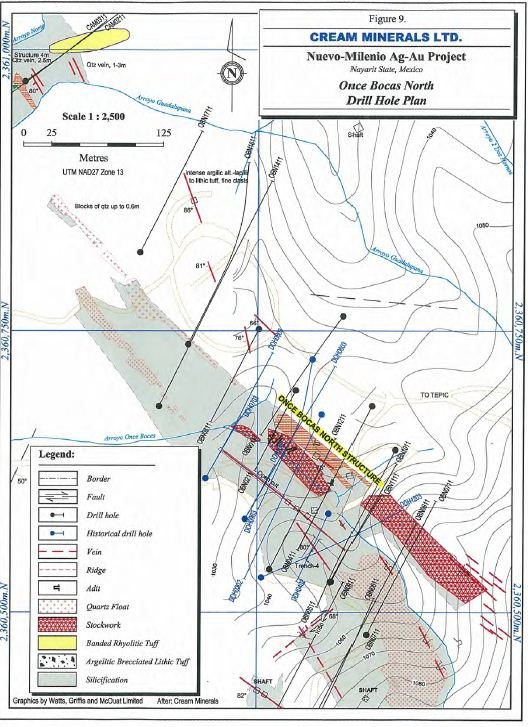

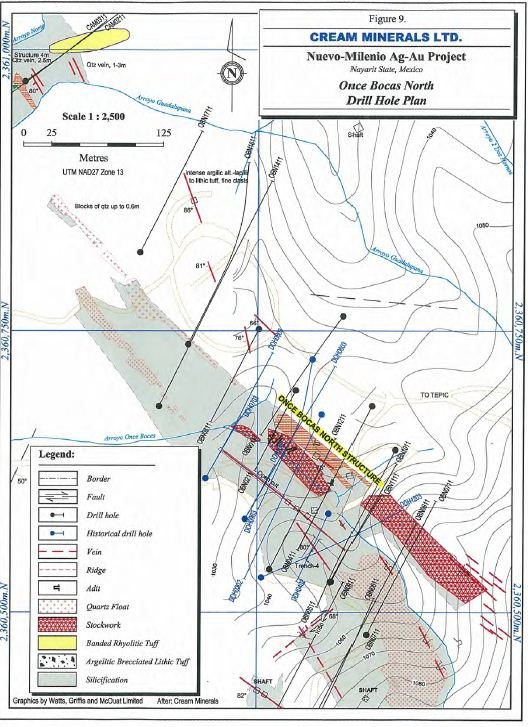

| Figure 9: | Surface Plan of the Once Bocas North Area | 42 |

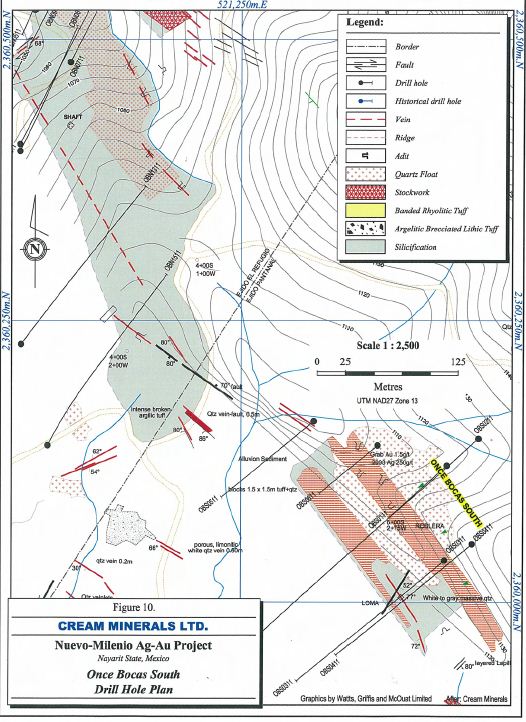

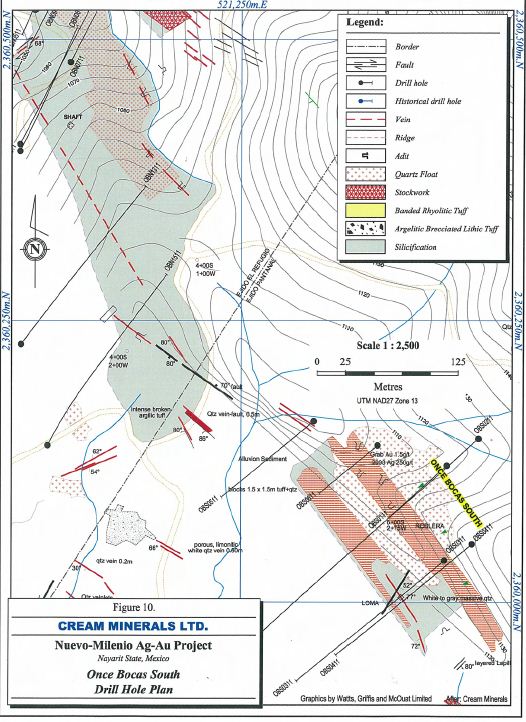

| Figure 10: | Surface Plan of the Once Bocas South Area | 43 |

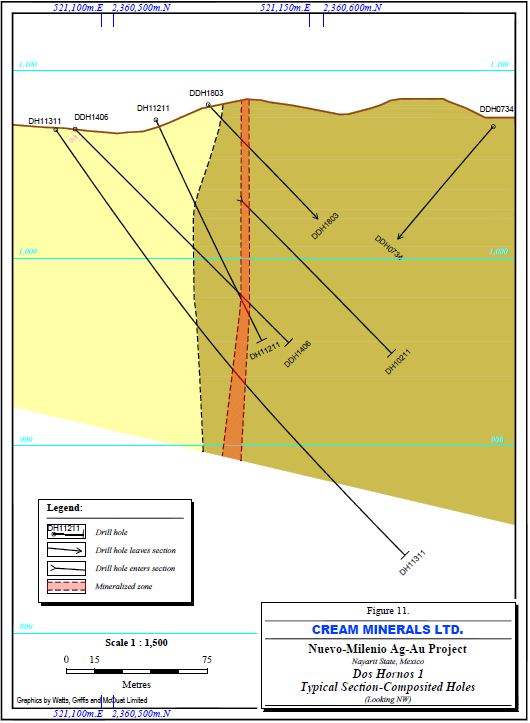

| Figure 11: | Typical Dos Hornos 1 Drill Section | 49 |

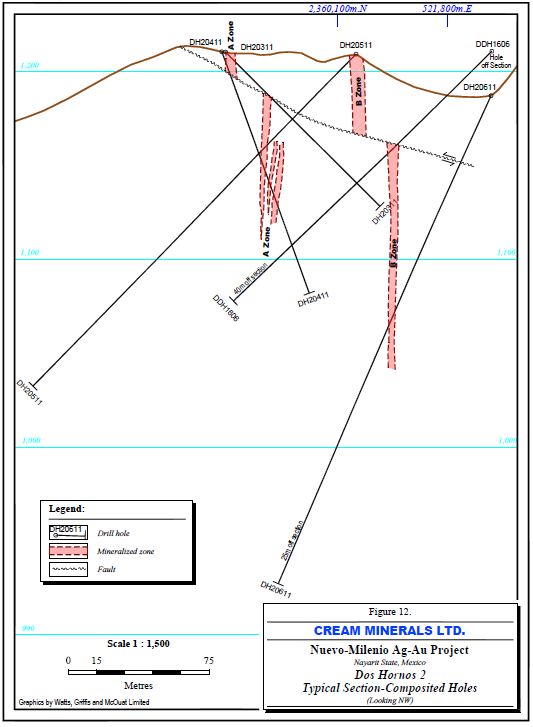

| Figure 12: | Typical Dos Hornos 2 Drill Section | 51 |

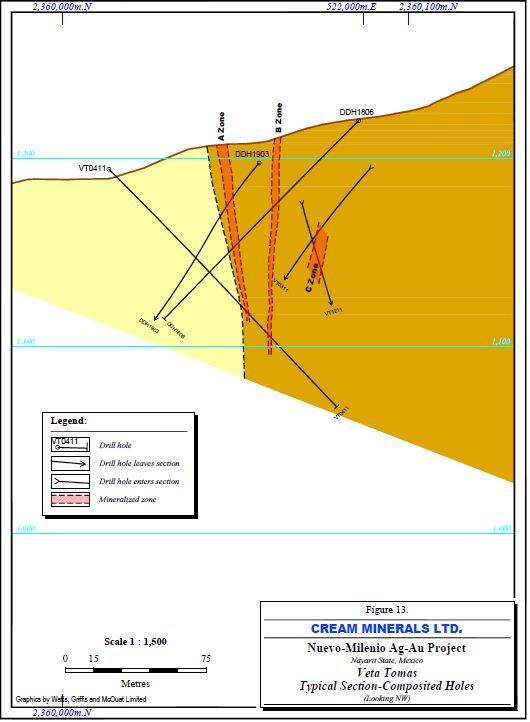

| Figure 13: | Typical Veta Tomas Drill Section | 53 |

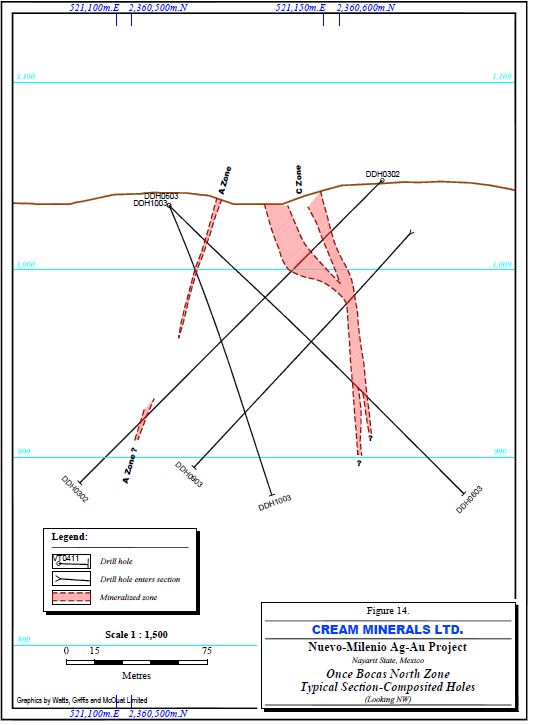

| Figure 14: | Typical Once Bocas North drill section | 55 |

| Figure 15: | Comparison of Original Gold Assays with WGM Check Samples | 63 |

| Figure 16: | Comparison of Original Silver Assays with WGM Check samples | 64 |

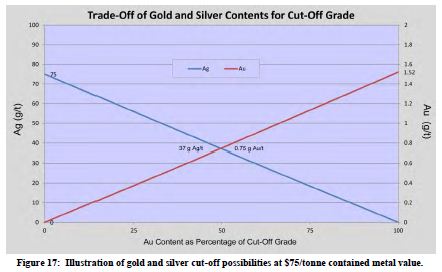

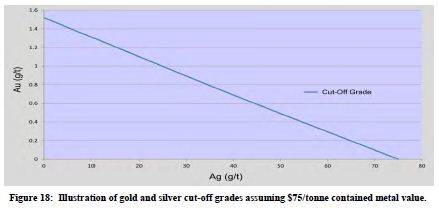

| Figure 17: | Illustration of Gold and Silver Cut-off Possibilities at $75/tonne Contained Metal Value | 78 |

| Figure 18: | Illustration of Gold and Silver Cut-off Grades Assuming $75/tonne Contained Metal Value | 79 |

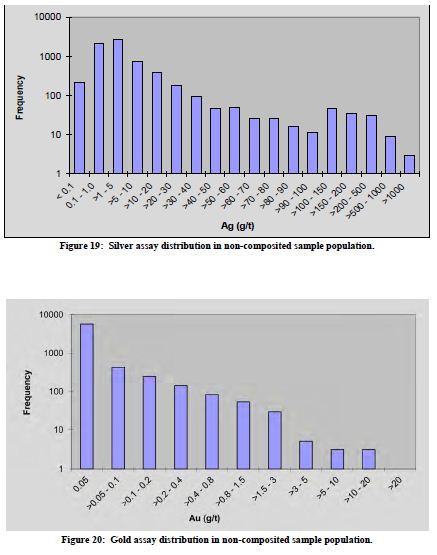

| Figure 19: | Silver Assay Distribution in Non-composited Sample Population | 80 |

| Figure 20: | Gold Assay Distribution in Non-composited Sample Population | 80 |

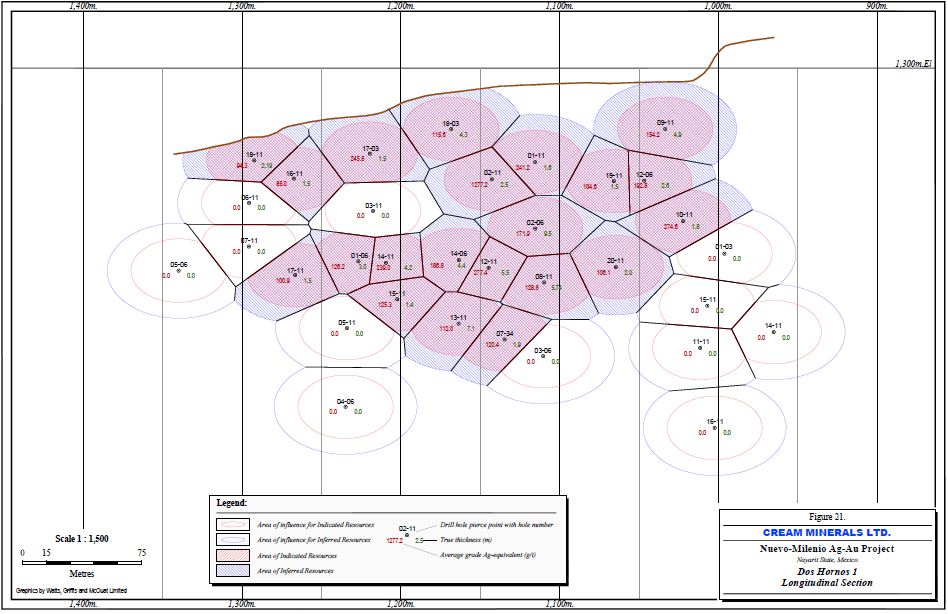

| Figure 21: | Dos Hornos 1 - Longitudinal Section Showing Polygonal Model with Grade and Thickness Data | 87 |

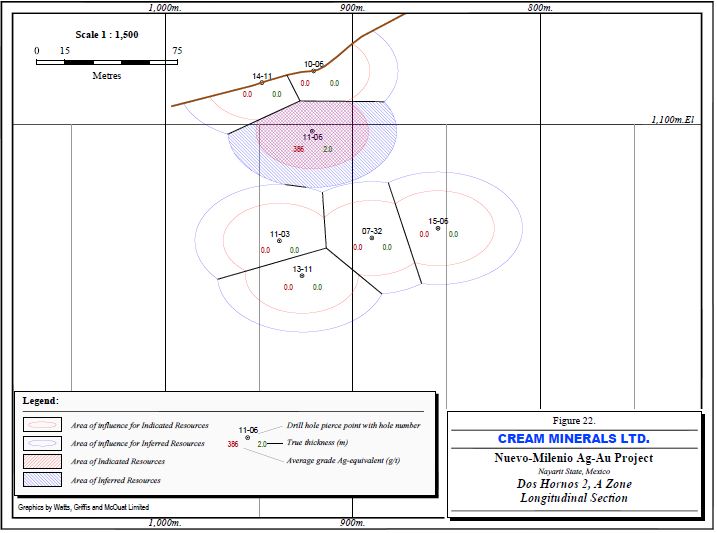

| Figure 22: | Dos Hornos 2 - Longitudinal Section of the ‘A’ Sub-zone Showing Polygonal Model with Grade and Thickness Data | 88 |

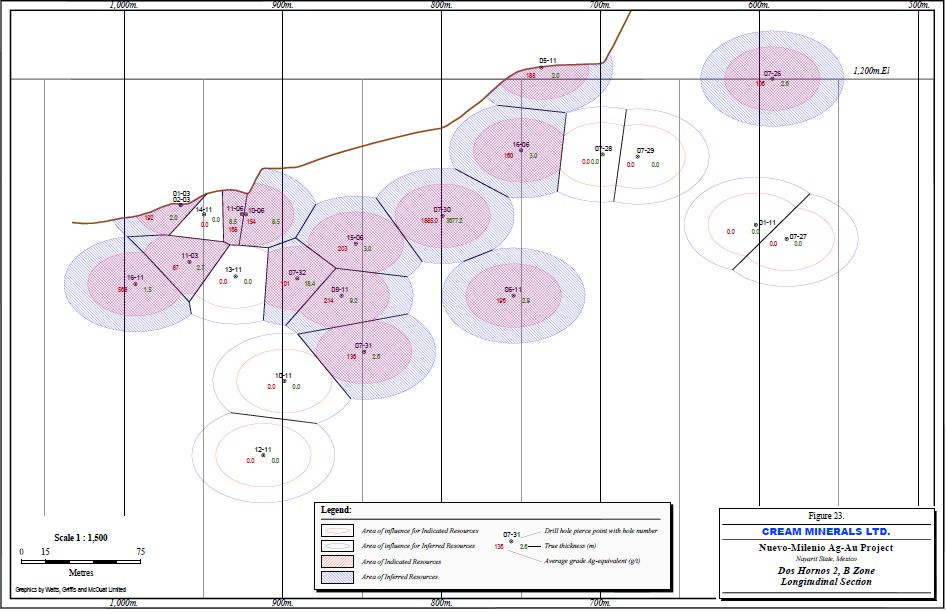

| Figure 23: | Dos Hornos 2 - Longitudinal Section of the ‘B’ Sub-zone Showing Polygonal Model with Grade and Thickness data | 89 |

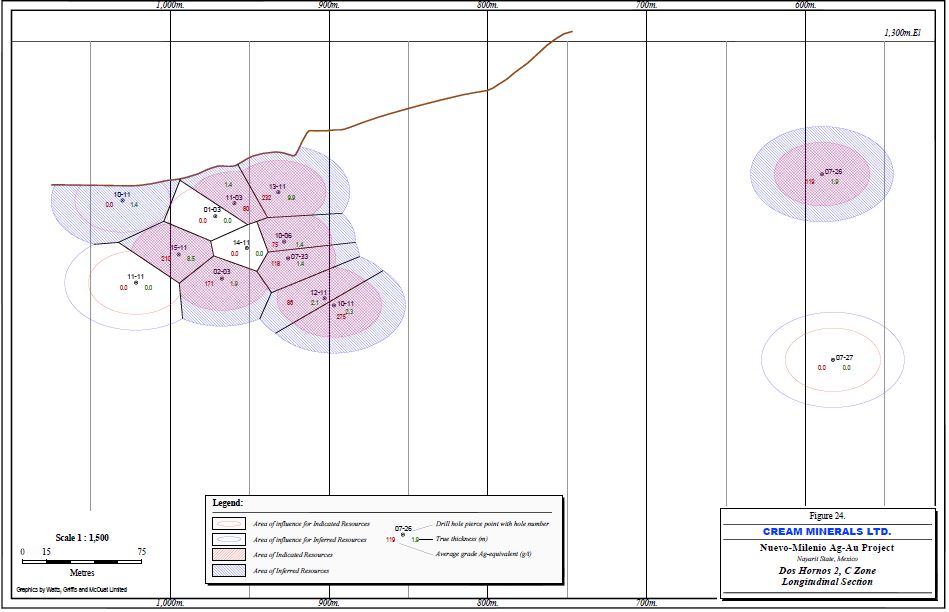

| Figure 24: | Dos Hornos 2 - Longitudinal Section of the ‘C’ Sub-zone Showing Polygonal Model with Grade and Thickness data | 90 |

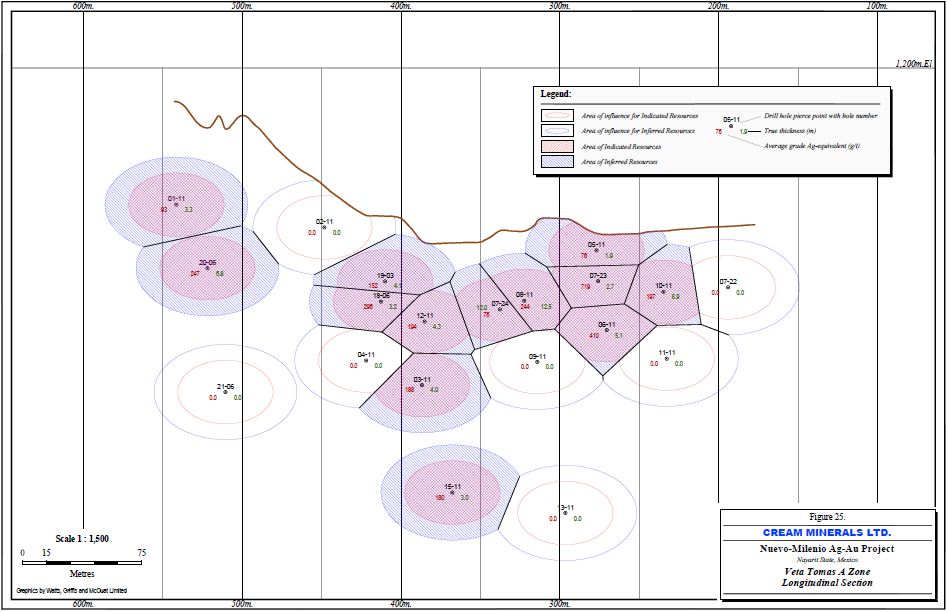

| Figure 25: | Veta Tomas - Longitudinal Section of the ‘A’ Sub-zone Showing Polygonal Model with Grade and Thickness data | 96 |

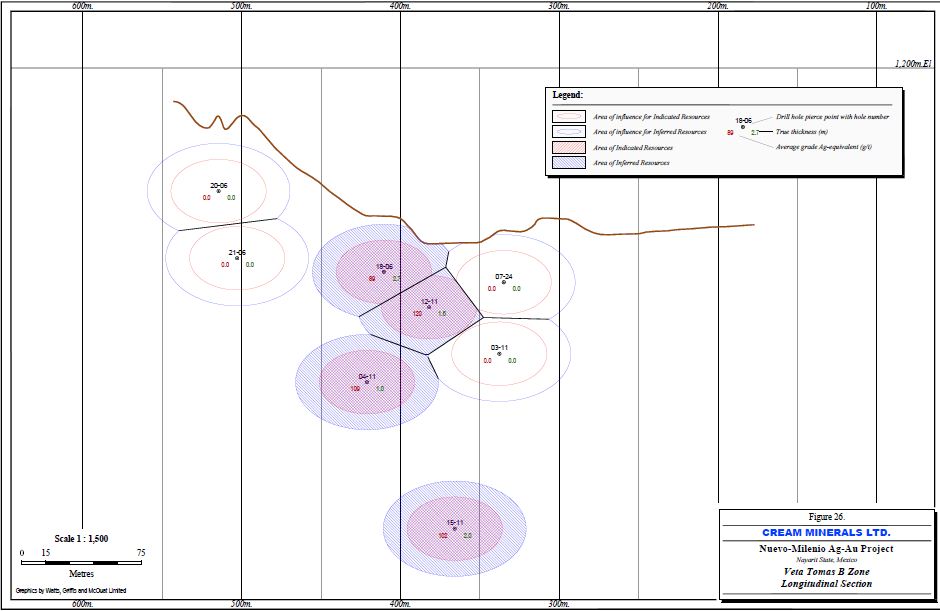

| Figure 26: | Veta Tomas - Longitudinal Section of the ‘B’ Sub-zone Showing Polygonal Model with Grade and Thickness Data | 97 |

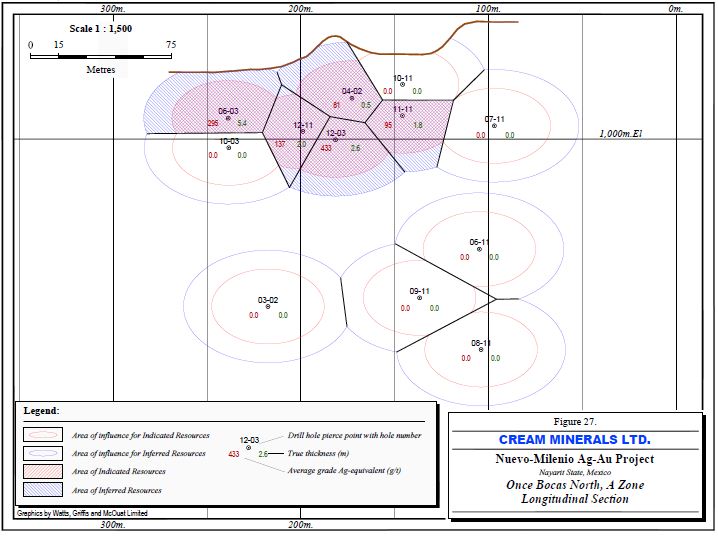

| Figure 27: | Once Bocas North - Longitudinal section of the ‘A’ Sub-zone Showing Polygonal Model with Grade and Thickness Data | 101 |

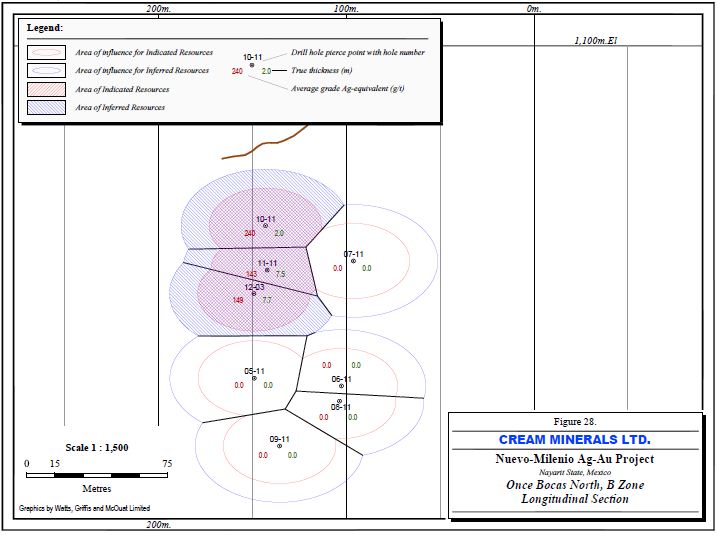

| Figure 28: | Once Bocas North - Longitudinal section of the ‘B’ Sub-zone Showing Polygonal Model with Grade and Thickness Data | 102 |

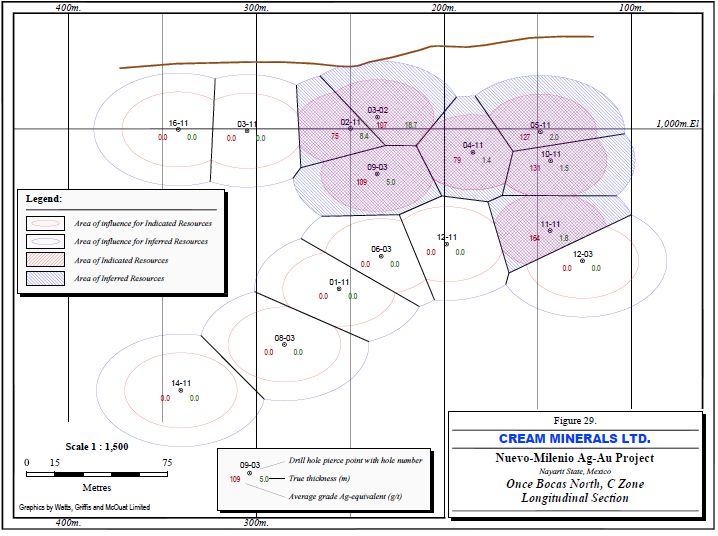

| Figure 29: | Once Bocas North - Longitudinal section of the ‘C’ Sub-zone Showing Polygonal Model with Grade and Thickness Data | 103 |

LIST OF PHOTOGRAPHIC PLATES

| | | Page |

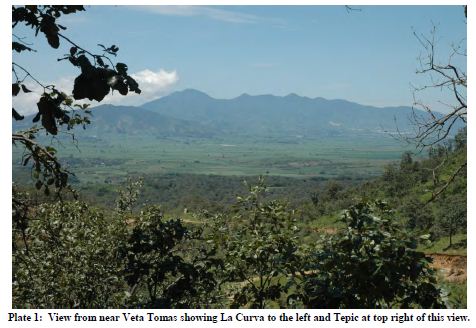

| Plate 1: | View from near Veta Tomas showing La Curva to the left and Tepic at top right of this view | 9 |

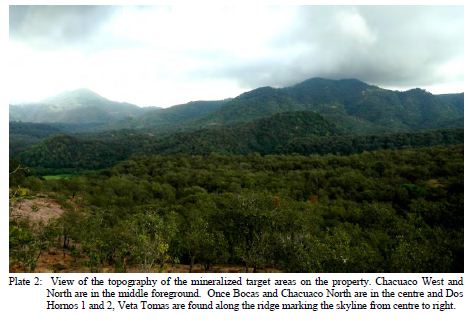

| Plate 2: | View of the topography of the mineralized target areas on the property | 13 |

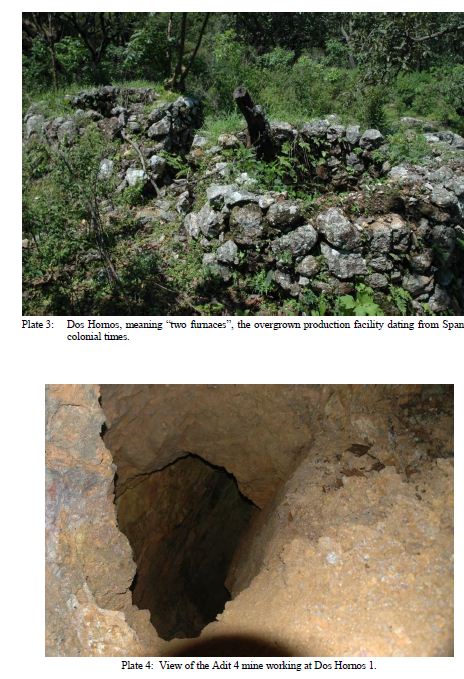

| Plate 3: | Dos Hornos, meaning “two furnaces”, the overgrown production facility dating from Spanish colonial times | 16 |

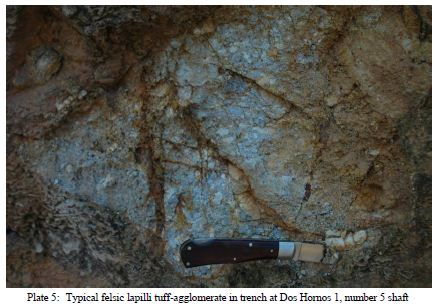

| Plate 4: | View of the Adit 4 mine working at Dos Hornos 1 | 16 |

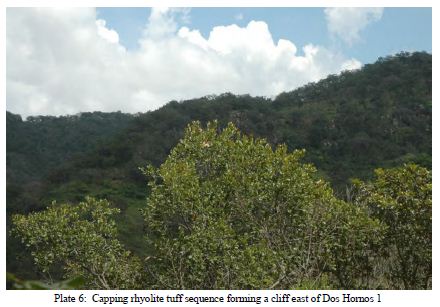

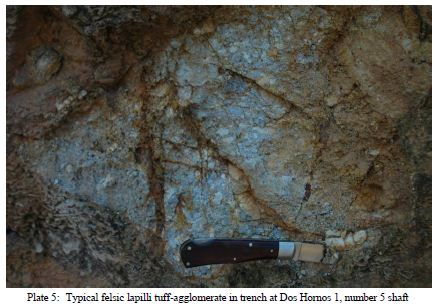

| Plate 5: | Typical felsic lapilli tuff-agglomerate in trench at Dos Hornos 1, Number 5 shaft | 20 |

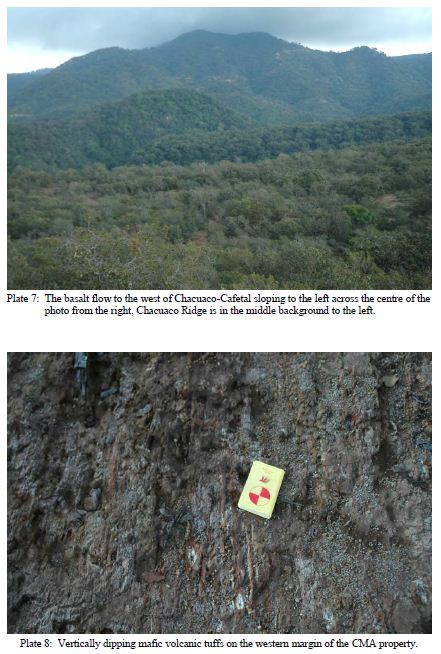

| Plate 6: | Capping rhyolite tuff sequence forming a cliff east of Dos Hornos 1 | 21 |

| Plate 7: | The basalt flow to the west of Chacuaco-Cafetal sloping to the left across the centre of the photo from the right, Chacuaco Ridge is in the middle background to the left | 22 |

| Plate 8: | Vertically dipping mafic volcanic tuffs on the western margin of the property | 22 |

| Plate 9: | Main vein in Dos Hornos 1 system | 25 |

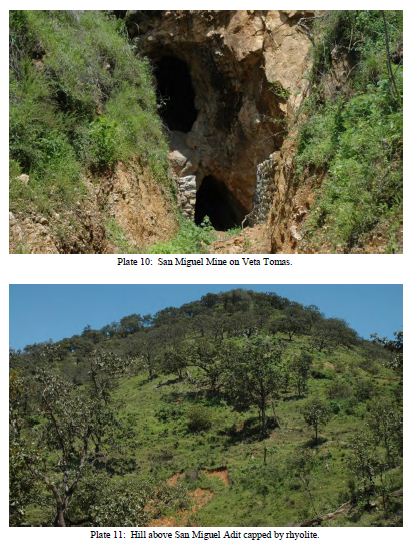

| Plate 10: | San Miguel Mine on Veta Tomas | 38 |

| Plate 11: | Hill above San Miguel Adit capped by rhyolite | 38 |

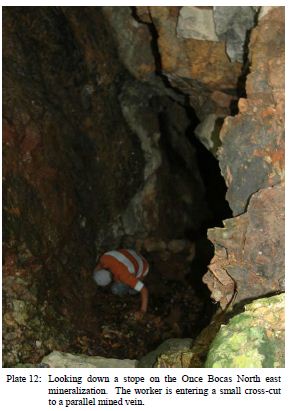

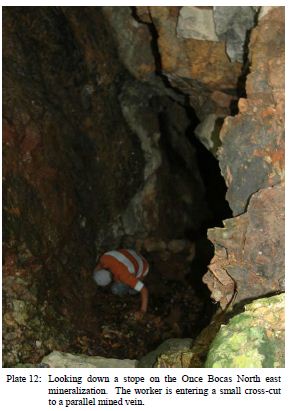

| Plate 12: | Looking down a stope on the Once Bocas North east mineralization. The worker is entering a small cross-cut to a parallel mined vein | 40 |

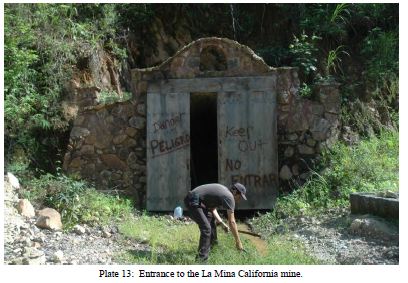

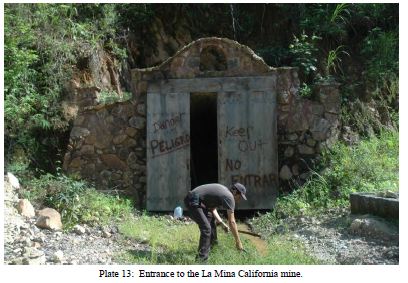

| Plate 13: | Entrance to the La Mina California mine | 112 |

1. SUMMARY

Watts, Griffis and McOuat Limited (“WGM”) was retained by Cream Minerals Limited (“CMA”), to complete this technical report for its Nuevo Milenio Property located south of Tepic, Nayarit State, Mexico (Photo 1, Figure 1) in compliance with Canadian securities rule National Instrument 43-101 (“NI 43-101”). A major component of the assignment is the Mineral Resource estimate that is contained herein.

CMA holds its mineral titles through its wholly-owned Mexican subsidiary Cream Minerals de Mexico S.A. de C.V. which owns 100% of the 2,612.5 ha Nuevo Milenio Gold-Silver Property. Together these companies are referenced interchangeably as CMA in this report. The Nuevo Milenio property is not subject to royalty payments or any other underlying encumbrances, and is maintained in good standing under the prevailing mineral licensing system. Property taxes of approximately US $33,000 are paid semi-annually.

Most of the field work carried out on the Nuevo Milenio Property has been under the direction of Mr. Fred Holcapek P. Eng. who managed the exploration project for CMA and Ing. G. Fransisco, the Nuevo Milenio Project Geologist, both of whom provided valuable information and insights into the geoscience aspects of the project. WGM’s review of the property included a 5-day site visit by its senior Associate Geologist, Dr. Derek McBride, who visited all the mineralized zones described in this report. The present interpretation of the geology is based on this visit and Dr. McBride’s previous experience working on other epithermal deposits in the Sierra Madre Occidental of Mexico.

Spanish dominance of the project area commenced in 1534 with the arrival of Captain Francisco Cortez de San Buena Ventura at Tepic. Over the next few years the Spanish conquistadores consolidated their position and learned of gold and silver from the local indigenous peoples. Mining and exploration spread throughout the area. Today, the remnants of this work are seen in pits, trenches and small shafts and adits.

In the project area, bedrock exposure is poor despite the youthful topography. Most exposures are found along creeks and roads constructed for drilling. Veins can be traced by residual quartz float, pits, trenches and mine workings. Most of the property is covered by a felsic lapilli tuff-agglomerate assemblage that is distinguished by lapilli-sized clasts, some larger clasts up to 5 centimetres, and clasts locally including agglomerate sized (20 cm) fragments. No bedding was seen, but the unit’s distribution suggests a gentle north-westerly dip. This unit hosts all of the known mineralization. Rhyolite, including flow-banded rhyolite is seen elsewhere but it is generally younger in age and devoid of mineralization.

Economically interesting gold-silver mineralization occurs in steeply dipping veins and stockworks that are exclusively hosted in the felsic lapilli tuff-agglomerate formation. Numerous vein systems (zones) have been identified, the major ones being Dos Hornos 1 and 2, Veta Tomas, Once Bocas North and South, Cafetal and Chacuaco. These zones define segments of what is thought to be a single, continuous structure that crosses the property from northwest to southeast. Surface mapping, quartz vein float and diamond drilling has demonstrated good structural continuity within each segment. The segments themselves are composed of multiple, closely spaced parallel veins and/or shears all of which contain nodes of economically interesting silver and gold mineralization. The structure(s) that control mineralization extend beyond their explored length, and pass under the younger volcanic tuffs and flows – these covered extensions have not been explored in any detail.

The disseminated mineralization in the host rocks suggest fluids passing through the porous felsic lapilli tuff-agglomerate unit. Deposition is in the form of fine-grained sulphides which give the rock a bluish or greyish colouration. The alteration minerals and the presence of silica show the influence of the hydrothermal solutions. These textures are interpreted as the product of a combination of near surface vein formation coupled with simultaneous sinter formation at the surface. Metallic minerals are deposited throughout this process, but become scarcer in the upper portions of the geothermal system, especially above the mean elevation of the water table, and gradually decrease with depth as PT conditions increase.

Recent drilling at Dos Hornos 1 demonstrates that the mineralized system can be traced for as much as 200 metres vertically and on sections spaced approximately 50 metres apart for the full length of the zone. This mineralization is composed of a high grade linear core, usually a quartz vein(s) and flanking halo. It is poorly exposed on surface and was traced by the Spanish by a series of shallow shafts, pits and locally by more extensive workings. Inspection of the lower mine workings showed that they followed high grade pods of mineralization which was concentrated in two parallel veins. These workings are only a metre wide and do not consider the potential beyond the veins. For that reason, they are not included in the resource calculation if a drill hole or cross cut is in proximity. Similar mineralization is found in the other zones, many of which include multiple parallel structures (shears).

The current WGM Mineral Resource estimates for CMA’s Nuevo Milenio property includes individual estimates for the Dos Hornos 1, Dos Hornos 2, Veta Tomas and Once Bocas North zones. These estimates incorporate both gold and silver mineralization and are based on the entire drill hole database which spans approximately 10 years of drilling. The estimates were prepared from a polygonal model using a C$:US$ exchange rate of par (1:1) and on the following metal prices in US dollars per ounce: Au at $1635.00 and Ag at $31.50 as established at the close of trading on 7 February, 2013. Gold and silver assays and metal

prices were also used to calculate equivalent-silver grades. WGM’s review of the assay data indicates that extreme high-grade assays (nuggets) are rare in the assay database. High grade silver assays were cut to 1,000 g Ag/t. No assay cutting was required for gold values. A minimum true thickness of 1.5 metres (5.7 feet) was imposed on intersections to qualify as Mineral resources. WGM’s base case estimate of the Mineral Resources used a minimum cut-off grade of $75 contained value in silver + gold. The resources were estimated without consideration for metal recoveries and were classified in compliance with NI 43-101. The Mineral Resources for the project in accordance with WGM’s base case cut-off are summarized as follows. Detailed sub-divisions of the zones appear in the Mineral resources section of this report.

SUMMARY OF NUEVO MILENIO PROJECT MINERAL RESOURCE ESTIMATES

(using grade cut-off equivalent to US $75/tonne Au-Ag value)

Zone and Resource Class | | Tonnes | | | Thickness (avg. m.) | | | Average Grade | | | Equivalent Silver Grade | |

| | | | | | g Ag/t | | | g Au/t | | | Ageq (g/t) | |

| Dos Hornos 1 | | | | | | | | | | | | | | | |

| Indicated Resources | | | 268,116 | | | | 4.80 | | | | 164 | | | | 0.66 | | | | 198 | |

| Inferred Resources | | | 80,594 | | | | 4.60 | | | | 155 | | | | 0.75 | | | | 194 | |

| Dos Hornos 2 | | | | | | | | | | | | | | | | | | | | |

| Indicated Resources | | | 335,887 | | | | 7.92 | | | | 124 | | | | 1.00 | | | | 175 | |

| Inferred Resources | | | 183,107 | | | | 5.79 | | | | 107 | | | | 1.00 | | | | 164 | |

| | | | | | | | | | | | | | | | | | | | | |

| Veta Tomas | | | | | | | | | | | | | | | | | | | | |

| Indicated Resources | | | 278,967 | | | | 5.70 | | | | 173 | | | | 0.87 | | | | 199 | |

| Inferred Resources | | | 156,185 | | | | 4.76 | | | | 126 | | | | 0.82 | | | | 166 | |

| Once Bocas North | | | | | | | | | | | | | | | | | | | | |

| Indicated Resources | | | 223,783 | | | | 8.95 | | | | 112 | | | | 0.63 | | | | 145 | |

| Inferred Resources | | | 117,949 | | | | 9.68 | | | | 119 | | | | 0.70 | | | | 155 | |

| All Zone Segments | | | | | | | | | | | | | | | | | | | | |

| Indicated Resources | | | 1,106753 | | | | 6.81 | | | | 144 | | | | 0.81 | | | | 181 | |

| Inferred Resources | | | 537,835 | | | | 6.17 | | | | 122 | | | | 0.84 | | | | 167 | |

| | 1. | Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. |

| | 2. | The quantity and grade of reported Inferred Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as an Indicated or Measured Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category. |

| | 3. | The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council December 11, 2005. |

| | 4. | S.G. of 2.65 tonnes/m3 was used. |

| | 5. | Tonnage and contained Ag and Au are rounded to nearest thousand or thousandth. Totals may not add up due to rounding. |

Sensitivity analysis demonstrates that the resources are not greatly affected by $10 value changes in the cu-off grade. This is a consequence of general lack of shoulders to the mineralization on most sections. It is possible that a substantial reduction of the cut-off grade to, for example $50 of gold and silver value would bring additional sub-zones into Mineral Resources, however WGM believes that it would be difficult to mine such grades at a profit. Additional resources might be forthcoming if those portions of the deposit amenable to open- cut mining were modelled separately, however it is WGM’s view that such operations would not substantially alter the current resource total because the average true thickness of all zones contributing to the base case Mineral Resources is in excess of 6 metres.

Additional drilling is recommended. WGM has commented herein on the quality of core recovered from past programs – in general it has been less than optimum. WGM understands that CMA pressure on the former drilling contractor (2003 and 2006-07 programs) to provide more experienced drillers was resisted. A change in contractors for the 2011 drilling program resulted in better core recoveries, commonly averaging 90%. In WGM’s opinion, it is vital for future drilling programs that core recovery be improved and that penalty clauses be built into the drilling contract to ensure that the drillers have a vested interest in maximizing recovery.

2. INTRODUCTION

Watts, Griffis and McOuat Limited (“WGM”) was retained by Cream Minerals Limited (“CMA”), to complete this technical report in compliance with Canadian securities rule National Instrument 43-101 (“NI 43-101”) for CMA’s Nuevo Milenio Property located south of Tepic, Nayarit State, Mexico (Photo 1, Figure 1). A major component of the assignment is the Mineral resource estimate that is contained herein.

The request to complete this NI 43-101 compliant report was made to support the August 12th, 2012, resource estimate made on the property. The initial resource estimate was not prepared by WGM which considers all previous resource estimates to be of a non-compliant nature.

2.3 SOURCES OF INFORMATION

Mr. Fred Holcapek, P.Eng. has managed the project since its inception in 2000 and has been responsible for the geological interpretations as represented by plans and sections contained in a previous report written in 2008. Following the 2011 drilling program, Mr. Holcapek updated this technical information with an internal CMA report that served as a key reference document for the locations of drill holes and intersections of mineralization in this report. The field observations reported herein as well as WGM’s resource estimate were made independently and subject to WGM’s internal due diligence process.

2.4 RELIANCE ON OTHER EXPERTS AND site visits

The authors have relied on Mr. Fred Holcapek P. Eng. who managed the exploration project for CMA and Ing. G. Fransisco, the Nuevo Milenio Project Geologist, both of whom provided valuable information and insights into the geoscience aspects of the project.

Ing. G. Fransisco, the field geologist for the Nuevo Milenio Project during the last 8 years guided Dr. McBride on WGM’s site visit. His knowledge of the property was extremely helpful. Dr. McBride spent five days on the site and visited all the mineralized zones described in this report. He took UTM coordinates of selected mine workings and drill holes

which were compared with Company maps and confirmed their accuracy. Selected samples were collected from sample pulps, drill core and underground workings for confirmation purposes and to test the accuracy and precision of the original sampling and assaying techniques. Two key visits were made to investigate the extent of the underground workings, the first at Dos Hornos 1 and the second at Chacuaco. The present interpretation of the geology is based on this visit and Dr. McBride’s previous experience working on three other epithermal deposits in the Sierra Madre Occidental of Mexico.

All dollar figures are reported in United States Dollars (US $) which at the time of this report was trading approximately at par with the Canadian dollar. Expenditure requirements are reported in Dollars as well as Pesos (MXN $) which at the time of this reports was trading at approximately 12.71 Pesos to the Canadian Dollar and 12.76 to the US Dollar.

Measurements in this report are stated in the SI (metric) system. In keeping with norms in the industry, gold and silver contents are reported as grams per metric tonne (g Au/t or g Ag/t). Assay data may also be reported as parts per million (ppm). In some cases, both metric and Imperial units are measure are stated for reasons of clarity.

The classification of Mineral Resources and Mineral Reserves in Canada follows the codification established by the Canadian Institute for Mining and Metallurgy (“CIM”). The CIM system must be followed in order to assure compliance with the Canadian security regulator’s rule named National Instrument 43-101 (“NI 43-101”). The CIM system ranks Mineral Resources and Mineral Reserves in terms of confidence level which in turn is a reflection of the types and amounts of exploration work completed. The conversion of resources to reserves is based on a study of mineral economics, a Feasibility Study, that establishes the economic viability of the existing resources under a specific set of conditions. The Mineral Resources estimated by WGM are based on drilling programs and are in compliance with NI 43-101.

Any previous resources or resource estimates mentioned herein this report cannot be precisely confirmed by the authors and are not compliant with NI 43-101, and as such should not be used by the reader for investment decisions.

As is generally the case in the world at large, natural resources including mineral commodities are the property of the sovereign State, and the right to develop and exploit mineral deposits is conveyed to private interests via permitting and licensing procedures and agreements. Mineral projects must therefore meet certain conditions and pass certain statutory requirements to be permitted to go into production. Due to a combination of legitimate concerns and irrational fears, projects can sometime receive special attention which can prolong the permitting process. This is especially true for mining projects that are located close to settlements or are highly visible from existing roadways. The CMA project has suffered from some delays in the past due to uncooperative landowners, however at this time WGM understands from its site visit and from various conversations that the local person(s) involved have left the area some time ago and are not returning. Although the CMA project is located in an area that should not attract special attention, care should be taken to ensure that local residents are generally informed insofar as exploration activities are concerned. Land access rights should always be executed with the degree of sensitivity needed to ensure local support.

Subject to the foregoing caution, however, which is not in any way a fatal flaw to the project, there are no land use restrictions of which WGM is aware which might restrict the ability of CMA to access the project areas, or which might restrict its ability to bring its gold-silver property into production. CMA will eventually need to negotiate a surface rights agreement with land-owners as it does not own such rights at this time.

Balancing the forgoing caution are several factors which are favourable for the CMA project:

| | — | new mine infrastructure development would be in an areas already affected by historical mining activity; |

| | — | electrical, transportation and communications infrastructure is close at hand; |

| | — | the mineralization is amenable to conventional processing; and, |

| | — | the impact of mining activities will likely be reduced through underground mining. |

As far as WGM knows, all of the claims that are the subject of this report are presently held by CMA without legal encumbrances by the Government which would relate to previous mining activities. The reader is also directed to the section in this report entitled “Other Relevant Data and Information”.

3. PROPERTY DESCRIPTION AND LOCATION

CMA’s Nuevo Milenio Property is owned though its wholly-owned Mexican subsidiary, Cream Minerals de Mexico S.A. de C.V. It is situated approximately 20 kilometres south-southeast of Tepic in the Municipality of Xalisco, Mexico.

The CMA property consists of a group of Mining Concessions which are in good standing as of the date of this report (Table 1). The group has a total area of 2,612.5 ha. Within the concession are several opal leases which have the same mineral rights as the Mining Concession and are excluded. Some have expired and the land they cover has been absorbed into Cream’s mining lease (Figure 2).

TABLE 1

SUMMARY OF CMA’S NUEVO MILENIO PROJECT MINERAL EXPLORATION CONCESSIONS

| Mining Lot | Title No. | Type | Area (Hectares) | Expiry Date |

| Nuevo Milenio Fracc. 1 | 225967 | Mining Concession | 2,560.063 | 19 Feb., 2051 |

| Nuevo Milenio Fracc. II | 212959 | Mining Concession | 4.1459 | 19 Feb., 2051 |

| Pancho Fracc. I | 234832 | Mining Concession | 23.6754 | 27 Aug., 2059 |

| Pancho Fracc. II | 234833 | Mining Concession | 23.4476 | 27 Aug., 2059 |

| Pancho Fracc. III | 234834 | Mining Concession | 1.2160 | 27 Aug., 2059 |

| | | Total | 2,612.5479 | |

3.3 NATURE OF CMA’s INTEREST

CMA holds its mineral titles through its wholly-owned Mexican subsidiary Cream Minerals de Mexico S.A. de C.V. (“CMA”) which owns 100% of the 2,612.5 ha Nuevo Milenio Gold- Silver Property. The Nuevo Milenio property is not subject to royalty payments or any other underlying encumbrances.

In order to maintain the titles in good standing, CMA must pay annual taxes on its exploration holdings in two instalments, the first due on 31 January and the second on 31 July. Taxes are calculated on a per hectare basis and therefore depend on the size of the property and the duration the property is held. In January, 2013, CMA paid the first semester instalment of MN$ 320,710 or approximately US$ 25,134 which is 99.6% attributable to the size of the Nuevo Milenio Fracc. 1 block. In July, 2013 the second instalment will be greater unless the property is reduced by that time. All filings and tax payments must be performed by CMA’s legal representative who has an official licence number (“RUPA”) without which the filing will not be accepted for confidentially and security reasons.

Mineral properties are also subject to annual work expenditure (severance) requirements. The amount of expenditure required is posted in the official Gazette every year and is determined on a hectare basis depending on the age and size of the licence. The following is an excerpt from the 2012 work application filed May 9, 2012:

| Excess Work from 2010 Expenditures | MN$ 27,824,255.00 | (approx. US$ 2,180,584) | |

| Actual Credit Received | MN$ 28,734,108.00 | (approx. US$ 2,251,889) | (a) |

| Total Expenditures in 2011 | MN$ 42,811,613.00 | (approx. US$ 3,355,142) | (b) |

| Total Credits Carried Forward | MN$ 71,545,721.00 | (approx. US$ 5,607,031) | (a+b) |

The minimum required expenditure for 2012 is MN$ 1,192,246 (US $93,436) or approximately MN$ 465 (US $36.44) per hectare. A credit in the amount of MN$ 70,353,475 (approx. US$ 5,513,595) remains for future use. Any exploration carried out during 2013 must be reported by 31 May, 2014 and documented in a standard format report detailing the types of work completed and the expenditures associated with each. Any expenditures in excess of the basic requirements will be banked and drawn on to meet future obligations, however the obligation structures change should the properties be put into production.

In January of each year two additional reports (questionnaires concerning company activities) must be filed by CMA’s subsidiary office in Durango, a statistical report with the Secretariate of the Economy and a technical report with the Department of Mines.

In respect to the Mexican authorities, as long as all obligations are met and the prescribed land use permits are obtained for any mining activities, there are no additional requirements that impact exploration or mine development activities. In any case whereby a concession-holder is in default of its obligations, the Mining Department advices the owner and he has 60 days to correct the default before the concession is cancelled. These notices of default can happen periodically for a variety of reasons including perceived defaults such as a failure to up-date company records, errors in the records or reports, and loss of documents. At this time, WGM understands that the CMA records are complete and in good standing.

4. ACCESS, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND

PHYSIOGRAPHY

The Property is reached by travelling south on highway 200 from Tepic towards Puerto Vallarta and taking a secondary local road to La Curva. The property lies 3 kilometres east of La Curva along a dirt road on the eastern side of a northwest-southeast trending valley. Historical mine workings on the low hills outline the areas of mineralization. La Curva is named for a large curve in the main railway line from Guadalajara to Tepic, located approximately 6 km west of the CMA property.

The climate in the project area is temporal and is made up of a dry (winter and spring) season and a wet season which extends from June to October. Annual precipitation is approximately 900 millimetres. Working in the hills can be difficult during the rainy season due to landslides, flooding and severe weather incidents.

Temperatures average 32°C in the day time. In the dry period; daytime temperatures can reach the mid-40s°. Temperatures at night typically fall to 20° C in mid-winter and may reach freezing at higher elevations. This visit was made during the rainy season, but was not hindered because of the continuous road maintenance by CMA.

4.3 LOCAL RESOURCES AND INFRASTRUCTURE

Tepic is the major local commercial centre with a population of approximately 300,000. It is the capital of the State of Nayarit. It serves the large farming industry which is the main source of income for the local residents. The city is serviced by excellent highways including the autopista from Guadalajara to Mazatlan, a railway line and airport. The local business community can supply most requirements for an exploration project including heavy earth-moving machinery and construction equipment. Assaying services are available through ALS Chemex in Guadalajara or the Inpsectorate Exploration and Mining Services preparation laboratory in Durango. Drilling services are available in Guadalajara and in other centres in the Mexican northwest.

4.4 PHYSIOGRAPHY AND AGRICULTURE

The concessions are situated in youthful topography between 1000 and 1500 m above sea level. Geologically the rocks are very young, flat-lying mafic to felsic volcanic sequences that provide a rolling to rugged landscape (Plate 2). About 25 km to the south is the volcano Ceboruco which was last active approximately 200 years ago. Many other volcanic cones dot the nearby countryside. These represent eruptions much later than the host rocks and their mineralization.

The property is well vegetated with an open forest composed of small trees and shrubs. More moderate slopes are used as grazing land for cattle. In the wet season (June to October), the growth becomes quite dense. It subsequently slowly dries out during the long dry period becoming more open and accessible.

The lower elevations in the area are farmed for a variety of crops. As measured from the centre of the prospect area, the closest cultivated fields are approximately 1.5 km to the north and 2.5 km to the west.

5. HISTORY

Spanish dominance of the project area commenced in 1534 with the arrival of Captain Francisco Cortez de San Buena Ventura at Tepic. Over the next few years the Spanish conquistadores consolidated their position and learned of gold and silver from the local indigenous peoples. Mining and exploration spread throughout the area. Today, the remnants of this work are seen in pits, trenches and small shafts and adits which show pick marks from the hand excavation of these tunnels indicating that they predate the use of blasting powder. The workings likely date from the sixteenth century. No buildings remain, but two old furnaces (hornos) are present (Plate 3). The ruins of a smelting complex are reported in the north-western corner of the property. Mining activity was extensive throughout this part of Mexico from the very early days of colonization, yet few records exist of these activities. CMA believes that the boundaries of the active mining areas have likely changed (migrated) over the years due to changing conditions and the limited ability of the miners to overcome engineering challenges.

The mine workings are similar to those seen in other nearby mining centres in the Sierra Madre Occidental. The extensive workings at Stroud Resources Property near Santo Domingo de Guzman approximately 70 kilometres to the southeast in the same rock sequence, were the subject of Dr. McBride’s presentation in Guadalajara during February, 2007. There, many hundreds of metres of underground workings followed four parallel mineralized structures. On CMA’s Nuevo Milenio property, Spanish exploration workings follow each of the mineralized structures continuously for over 1000 metres. There is no evidence that systematic exploration has taken place from that time until the work of CMA.

A photo of a Dos Hornos working is shown in Plate 4. During the last 20 years, local people have attempted the mining of a vein on the CMA property between Dos Hornos 1 and 2 in a “transition zone”. Locals have also tried to exploit the La Mina California which is situated on an opal concession within CMA’s Mining Concession, east of the Dos Hornos-Veta Tomas structure. A mill was set up circa 2007 to process mineralization from La Mina California. The operation lasted two years, following which the mill sat idle until early 2012 when it was removed.

6. GEOLOGICAL SETTING AND MINERALIZATION

6.1 REGIONAL, LOCAL AND PROPERTY GEOLOGY

6.1.1 Regional Geology

The Nuevo Milenio Project is located in a part of Mexico that is included in the Sierra Madre Occidental Geological Province which extends from the American border to Guadalajara. Magmatic activity, which includes the emplacement of intrusions into the upper crust as well as eruptive volcanic activity, occurs as the result of the subduction of the Pacific (Faralon) Plate under the North American Plate. The Faralon Plate has been shown to be descending on an angle of approximately 50 degrees at a rate of approximately 3-4 cm per year. The province is adjoined on its south-western flank by the Jalisco Block, a segment of crust bordered by the Pacific Plate to the west and a series of pull-apart basins (grabens or rifts) to the northeast and southeast. This pull-apart activity has been responsible for detaching the Jalisco Block from the North American Plate, and it now acts as a separate floating segment of crust bordered by the Colima rift to the east and the Tepic-Zacoalco rift to the north. The grabens are controlled by steeply dipping normal faults. These faults and related structures act as important controls on the development of gold and silver-bearing vein systems.

Two major volcanic-magmatic periods occur in this area of western Mexico: an older sequence of granodiorite intrusions and approximately coeval rhyolitic ash-flow tuffs ranging in age from 114 Ma to 70 Ma (Cretaceous to Eocene), and a younger bimodal sequence which is 37 Ma to 18 Ma (Oligocene to mid-Miocene). The younger sequence is primarily rhyolitic with lesser basalt. Some volcanic activity continues today as recent explosive calc-alkaline rhyolitic eruptions related to Pacific Plate subduction and alkaline basalt to basaltic-andesite eruptions related to rifting.

Recently a paper in National Geographic considered this part of western Mexico a super volcano similar to that under Yellowstone National Park in the United States and the North Island of New Zealand. Evidence included the presence of thick and widely spread volcanic units up to 100 m thick. These volcanic sequences consist of a series of young flat-lying volcanic rocks varying from basalts to rhyolites. They are well exposed in the deep valleys such as the Grand Valley of the Rio Santiago which passes about 20 km east of the project area and on the mountain slopes of the Nuevo Milenio Mining Concession. Most were deposited on land and preserve depositional textures; obsidian is common. In the project area, rock compositions include rhyolites, basalts and possibly some ultramafic rocks.

The Sierra Madre Occidental Geological Province ends a short distance south against the east-west trending Trans-Mexican volcanic belt of similar age (Figure 3). It hosts many silver-gold deposits including the Minefinder’s, Deloro, the Gammon Lake, O’Campo and Stroud Resources Ltd.’s Santo Domingo deposits. The co-author, McBride, has worked on all these deposits and managed the Stroud exploration project for two years from 2006 to 2008. In all these deposits, the old mine workings have demonstrated tops and bottoms; the main mined areas are hosted by one rock type above or below a major change in rock type. This pattern is present on the Nuevo Milenio property. McBride sees many common features between these deposits and the present property which lies about 70 km northwest of the Stroud Deposit.

Regionally, the basement rocks seem to be vertically dipping, well bedded, deeply weathered mafic tuffs which are exposed along the western margin of the property and are probably part of the Jalisco Block. They can be traced to within 200 m of the flat lying Nuevo Milenio sequence of felsic volcanic rock and appear to continue beneath it. The contact should be a deeply weathered angular unconformity.

The Nuevo Milenio mineralized lapilli tuff-agglomerate terminates in a sinter zone and is capped by finely bedded ignimbritic units of fine-grained felsic welded, ash fall tuffs. These two units make up the Nuevo Milenio sequence which is surrounded by volcanic rocks of the San Pedro-Ceboruco Graben. These rocks are much younger and were deposited in a graben within the Sierra Madre Occidental rocks. They have been studied in detail (Ferrari. L. et al, 2003).

Major faulting has been identified in the graben, in north-south and west-northwest directions, and may be present in the mineralized sequence. East-northeast faulting has been reported from the property and appears to offset sections of the mineralized structures. The extent of these faults and their displacements is unknown, but the thick ash fall tuff unit that forms the hanging wall of the deposits does not seem to be significantly displaced.

Major faulting has been postulated in the area, but the thick ash fall tuff unit that forms the hanging wall of the deposits does not seem to be displaced. To produce a fault pattern would require complicated cross-faulting that is not observed in the surrounding well-exposed mountain ridges on the edges of the valley. Similarly the fresh, flat-lying volcanic sequence eliminates the possibility of shear zones which would be easily seen.

6.1.2 Property Geology and Mineralization

In the project area, bedrock exposure is poor in spite of the youthful topography. Most exposures are found along creeks and roads constructed for drilling. Veins can be traced by residual quartz float, pits, trenches and mine workings. McBride spent three days on the property mapping outcrops, examining mine workings, and outlining the major rock units. The geological interpretation in Figures 4 and 5 is derived from the author’s examination of the property and revises the map of Holcapek (2008). Most of the property is covered by a felsic lapilli tuff-agglomerate unit which is diagnostic by its lapilli-sized clasts and some larger clasts up to 5 cm in size (Plate 5). Locally clasts to 20 cm were seen in the Once Bocas North area. Bedding was not seen in this unit, but its overall distribution suggests a gentle north to north-westerly dip. This unit hosts all the known mineralization.

The felsic lapilli tuff-agglomerate unit is capped by a rhyolitic welded tuff unit with 4 to 5 cm long fragments that are highly flattened parallel to bedding which itself is well developed on a 4 or 5 mm scale. In many areas the rhyolitic tuff unit is resistive and forms cliffs (Plate 6). This unit is barren of mineralization, but hosts opals. It is restricted to the eastern part of the property and at the higher elevations. Its distribution suggests that it dips gently to the north and covers the favourable felsic lapilli tuff-agglomerate which is present at lower elevations.

North of Dos Hornos 1, the rhyolitic tuff is capped by a thin younger basalt flow that extends north for a couple of kilometres.

West of Cafetal, a similar basaltic sequence of flow, tuffs and agglomerates forms a ridge that marks the limit of the Cafetal and Once Bocas South mineralized zones (Plate 7). Large blocks on the front of the ridge suggest that the last activity was a debris flow. Two drill holes at Cafetal contain weathered basaltic agglomerate at depth which appears to be inter-bedded with the felsic lapilli-agglomerate.

A barren, low-lying ridge marks the western limit of the property. It consists of thinly bedded, mafic tuffs and flows that have been folded into a vertical position (Plate 8). These rocks were deformed and deeply weathered prior to the deposition of the recent volcanic mineralized sequence described above. It probably forms the basement rocks in the Nuevo Milenio area. The cross-sections in Figure 5 demonstrate these relationships as observed by the author in the field.

6.2 SETTING OF MINERALIZATION

Mineralization is restricted to the felsic lapilli tuff-agglomerate unit. Steeply dipping quartz veins and quartz stockworks are concentrated within these rocks (Plate 9). The known structures and their extensions were shown in Figures 4 and 5. Question marks indicate possible extensions based on the author’s observations.

In general, mineralization is restricted to the felsic lapilli-agglomerate, the base of which has not been defined by drilling. The weathered surface of the deformed basement seems to dip gently under the younger rocks to the east. Each of the known mineralized zones can be traced for more than 1000 m in a northwest-southeast direction and consists of narrow high grade veins with lower grade halos made up of quartz veinlets forming a stockwork. The three known mineralized zones, the Dos Hornos-Veta Tomas, the Once Bocas and the Chacuaco-Cafetal, are known to have lengths of over a kilometre and widths of up to 200 m; only part of the width is of economic interest and seems be continuous for the length of the zone. The unexplored Chacuaco West suggests that additional mineralization may be found in the lower sequences under the younger rocks.

Diamond drilling has demonstrated the continuity of the aforementioned zones, and the Dos Hornos-Veta Tomas and Once Bocas zones are now recognized as being located on a single

controlling structure. As such, Dos Hornos 1, Dos Hornos 2, Veta Tomas, Once Bocas North and Once Bocas South are individual segments along the structure which are defined by economically interesting silver and gold mineralization. Locally some breaks in the continuity of the mineralization can be seen and barren quartz vein float is commonly found between the structures. The reason for this break may be due to localization or metal values within the structure or erosion that has cut through the potentially economic section of the main controlling structure. The structure extends beyond its explored length and passes under the younger volcanic tuffs and flows, where it has not been explored in any detail. The known mineralized segments and their extensions are shown on Figures 4 and 5. Question marks indicate possible extensions based on the McBride’s observations.

Observations of the vein textures show that they are commonly laminated and vuggy. The disseminated mineralization in the host rocks suggests that fluids passed through the porous felsic lapilli tuff-agglomerate. Metals were deposited in the form of fine-grained sulphides which gives the rock a bluish or greyish colouration. The alteration minerals and the presence of silica show the influence of the hydrothermal solutions. These textures are interpreted as the product of a combination of near-surface vein formation coupled with simultaneous sinter formation at the proximal surface.

Mr. Holcapek and Ing. Francisco have reported faulting in drill core and surface exposures. A significant fault offset along an east, northeast fault is apparent between Dos Hornos 1 and Dos Hornos 2 with an apparent lateral offset of approximately 60 m. Faulting has also truncated a vein at the north end of the Chacuaco; its displacement is unknown. Mr Holcapek shows extensive faulting in his sections, including reverse (thrust) faulting which causes repetition of the mineralized zones on section and resultant thickening of the mineralized zone. Most of these faults are steeply dipping east-northeast structures. WGM was not able to corroborate these interpreted faults during its site visit. Although there is substantial faulting in some drill holes, the fault orientations are unclear.

7. DEPOSIT TYPES

Vein development is restricted to the felsic lapilli tuff-agglomerate unit. The underlying deformed basaltic tuffs in the basement are not considered to be a viable source for the economic metals because they were deposited, deformed and metamorphosed prior to the deposition of the flat-lying host rocks. Geological evidence indicates that metallic minerals were deposited in the porous host rocks in a vertical range extending from near-surface to well below the top of the existing volcanic surface. The mineralization was blocked by the rapid deposition of impermeable welded tuff deposits that form the tops of the hills.

The origin of this mineralization is not clear. It may be related to fluids channelled by pre-existing faults in the basement rocks, however no evidence supporting this interpretation has been seen. The lack of mineralization in the footwall rocks at the other deposits quoted, suggests that these rocks had little or nothing to do with the mineralizing event. Similarly, the hanging wall rocks lack mineralization even in fractures. The obvious conclusion is that they were not present when the silver-gold mineralization was deposited.

The host felsic lapilli tuff-agglomerate was clearly the preferred host rock and the mineralizing systems were confined to this formation. The source of the fluids is likely from the same volcanic source that may have earlier produced the host rocks. The mineralizing solutions circulated within the volcanic pile and were forced up permeable structures by hydraulic pressure, serving to focus outflow and creating zones of concentrated vein-hosted mineralization. This model provides an effective guide for explorationists who should simply trace the favourable host rocks and test areas where they are cut by deeply rooted fault/shear zones. Exploration targets can especially be extended to zones which may occur under the capping rhyolite tuff.

8. MINERALIZATION

Economically interesting gold-silver mineralization occurs in steeply dipping veins and stockworks that are exclusively hosted in the felsic lapilli tuff-agglomerate formation. The known structures and their extensions were shown in Figures 4 and 5.

Numerous vein systems have been identified and have been given names such as Dos Hornos 1 and 2, Veta Tomas, Once Bocas, Cafetal and Chacuaco. They define three continuous structures across the property from northwest to southeast (Figure 6) which are termed the Dos Hornos-Veta Tomas, Once Bocas and Chacuaco-Cafetal Structures. Surface mapping, quartz vein float and drilling has demonstrated the continuity of these structures

Locally, minor breaks in the continuity of the mineralization can be seen on surface. Barren quartz vein float can be found between the structures. The reason for these breaks may be the localization of metal values within the structure, or alternatively, erosion that has cut through the potentially economic section of the structures. It is important to keep in mind that the vertical range exposed is only a small component of the mineralized system, and that discontinuities on surface do not necessarily represent discontinuities in the overall zone. The structures that control mineralization extend beyond their explored length and pass under the younger volcanic tuffs and flows – these have not been explored in any detail.

Observations of the vein textures show that they are commonly laminated and vuggy. The disseminated mineralization in the host rocks suggest fluids passing through the porous felsic lapilli tuff-agglomerate unit. Deposition is in the form of fine-grained sulphides which give the rock a bluish or greyish colouration. The alteration minerals and the presence of silica show the influence of the hydrothermal solutions. These textures are interpreted as the product of a combination of near surface vein formation coupled with simultaneous sinter formation at the surface. Metallic minerals are deposited throughout this process, but become scarcer in the upper portions of the geothermal system due to its acidic, vapour-dominated geochemistry.

Oxide mineralization was observed in float at Dos Hornos 1. Similar oxide mineralization was seen by the author at the top of veins at Delores (Minefinders Corporation Ltd.) and at Santo Domingo (Stroud Resources Ltd.). It is thought to be the result of acidic, oxidizing groundwaters encroaching on the top of the mineralized system near surface causing destruction of sulphide mineral phases combined with the downwards ingress of subsequent weathering processes.

Precious metal and sulphide mineralization are lacking in the overlying rhyolite tuffs which were either deposited after hydrothermal activity had ceased, or they were well above the level of the fluid-dominated epithermal system. However, opal is common in the overlying sequence and it probably represents the product of cool, silica-saturated solutions depositing opal as they pass through these rocks. A similar relationship is seen near the Stroud Deposit and the opal production is significant making the town of Magdelena an important opal mining centre.

Recent drilling at Dos Hornos 1 demonstrates that the mineralized system can be traced for 200 metres vertically and on sections spaced approximately 50 metres apart for the full length of the zone. This mineralization is composed of a high grade linear core, usually a quartz vein(s) and flanking halo. It is poorly exposed on surface and was traced by the Spanish by a series of shallow shafts, pits and locally by more extensive workings. Inspection of the lower mine workings showed that they followed high grade pods of mineralization which was concentrated in two parallel veins. At Dos Hornos 1, these workings are only a metre wide and do not show evidence for potential mineralization beyond the vein margins. For that reason, they are not included in the resource calculation if a drill hole or cross-cut is in proximity.

The parallel veins mined by the Spanish may correspond to or give evidence for the subparallel sub-zones defined by multiple, mineralized quartz veins in the CMA drilling at Dos Hornos 2, Veta Tomas and Once Bocas North. In the spatial context of the mine workings, it may be impossible to determine whether the parallel veins/vein structures are separate veins, or are the same vein simply repeating across a thrust fault as interpreted by Holcapek. Clearly this has important implications insofar as the estimation of mineral resources. In the absence of irrefutable proof of thrust faulting, which seems unlikely to WGM in an extensional environment, WGM believes that the simpler of the two explanations is most likely. In this case, WGM believes that the parallel veins are the product of bifurcation along the host structure, a very common feature of most fault and shear zones.

9. EXPLORATION

9.1 PROCEDURES/PARAMETERS OF SURVEYS AND INVESTIGATION

During 2002, Ing. G. Francisco, completed geological mapping along creeks hill sides and roads in the project area. This work formed the basis for the geological map shown on Figure 4. Prior to his work, extensive sampling of old showings, mine workings and surface outcrops had been carried out. Chip samples were collected throughout the accessible mine workings, along trenches cut across the known zones near old pits and surface mine workings. Many grab samples had been taken of the extensive quartz float.

Soil geochemical sampling was carried out over most of the property during 2002 except to the west of Chacuaco West where safety concerns relating to an uncooperative landowner limited the program. This survey outlined anomalies that correlate with the known mineralized zones. To the east the usefulness of geochemical sampling is impaired due to the presence of the barren “capping” welded rhyolitic tuff.

9.2 SAMPLING METHODS AND SAMPLE QUALITY

The sampling mentioned in the foregoing sections has effectively outlined the mineralized trends and provided an indication of the grade of ore mined by the Spanish colonial operators. This information remains useful in locating the mineralized zones. It is the view of WGM, however, that this analytical data is excessively based on grab samples or irregular chip samples to be useful for resource modelling purposes other than to confirm the extensions to surface of drilled mineralization. To date there has been a general lack of systematic channel sampling of outcrops and underground workings. This is not to say that the sample data is not representative, but only a cut channel sample can ensure a level of uniform sampling similar to that attained by diamond drilling.

Drill core was sampled using a conventional approach whereby zones thought to be mineralized in each hole were identified and marked for sampling. In general, samples were delimited by changes in the geology. WGM did not determine whether there was a clear goal in maintaining a maximum sample length, as geologists normally strive to ensure sample lengths do not exceed one metre for precious metal analyses. It is clear that the sample lengths on the Nuevo Milenio Project were compromised by poor core recovery in many sections, and that this forced the geologist to sample continuously between known depths, often exceeding several metres. The core was cut in half with a diamond saw, with one half of the core bagged for analysis and the remaining half returned to the core tray. In some

instances, the majority of the core in poorly recovered sections may have been consumed in order to maintain as representative a sample as possible.

The Spanish colonial workings clearly offer the potential for CMA geologists to acquire 3D geological and geochemical data, however this is not always possible due to the condition of the various underground mine openings. The condition of the various mine areas is summarized as follows in Table 2.

Where possible, and safe access can be assured through improvements by CMA, the sampling of the upper portions of the mineralized zones could be increased in workings not previously entered.

9.4 RESULTS AND INTERPRETATION OF EXPLORATION

9.4.1 General

CMA’s initial surveys confirmed the mineralization worked by the Spanish and allowed the exploration to progress directly to diamond drilling. CMA drilled Nuevo Milenio in four campaigns from 2002 to 2011 - 149 holes were drilled for a total of 31,537 m. Five holes were drilled in 2002, and 2003-04 saw the drilling of 19 holes. An additional 36 holes were drilled in 2006-07. All of the holes were surveyed. The discussion of this drilling is included under the section on drilling as they tested the same mineralized structures.

Strong structural controls define the strike of the main silver and gold bearing zones which are actually segments of a single mineralized structure. Each zone or segment commonly comprises multiple, closely spaced mineralized splays that seem to have a converging downwards geometry in some instances. The mineralized zones are generally more complex than initially realized. Lateral continuity of the splays is good over distances of many hundreds of metres, however in some cases the lesser splays only appear on one or two drill sections over a strike of less than 200 m. In terms of thickness and silver-gold content, most zones appear to weaken downwards, however this is not a universal feature at this time, and good potential exists in some areas for the discovery of additional mineralization below the levels currently drill-tested.

TABLE 2

CONDITION OF SPANISH COLONIAL MINE WORKINGS, NUEVO MILENIO PROJECT

| Mining Area | Mine Working | Comments |

| Dos Hornos 1 | Shaft 1 | Shallow and slumped |

| | Shaft 2 | Open – was sampled previously |

| | Shafts 3 & 4 | Collar was sampled previously |

| | Shaft 5 | Collar plus all 3 sub-levels were mapped and sampled |

| | Shaft 6 | Open but water filled |

| | Shaft 7 | Shallow and closed at this time |

| | Adits 1 & 2 | Open – were sampled previously |

| | Adit 4 | Cross-cut on level 0 sampled; Levels 1, 2 & 3 sampled |

| | NW and NE Shafts | sampled |

| Dos Hornos 1 | Shaft 8 | Water-filled (in Transition Zone) |

| | Shaft 9 | In Fault Zone |

| | Shaft 10 | In Fault Zone – vein adjacent to shaft sampled |

| | Adit 3 | Opened and sampled |

| Veta Tomas | Shaft 12 | Open and sampled – carries high-grade Au |

| | San Miguel Adit | Cleaned, surveyed and sampled |

| | Shafts 13 to 15 | Very small workings – not opened/not sampled |

| | South Area | Shafts & trenches opened and sampled in 2012 |

| Once Bocas | Shafts 1 & 2 | Open – workings mapped and sampled |

| | Shaft 3 | Access to workings possible |

| | Shaft 4 | Surface samples taken |

| | Shaft 5 | Workings sampled |

| | Shaft 6 | Workings were opened, but were not sampled |

| | Shaft 7 | Not opened |

| | Shaft 8 | Inclined shaft – opened and sampled; Cross-cut not |

| | Adits 1 & 2 | Opened,mapped any sampled |

| | Adit 3 | Cross-cuts into workings from Shaft 2 |

| Chacuaco | Shaft Nanche | Opened, mapped and sampled |

| | Mina Nanche | Adits 1 and 2 collapsed |

| | Mina Chacuaco | Mapped and sampled |

| | Mina Peridido 1 | Mapped and sampled |

| | Mina Peridido 2 | Mapped and sampled |

| | Mina Peridido 3 | Mapped and sampled,, plus 3 sub-levels |

| Arroyo Chacuaco | Incline | Not opened |

| Chacuaco West | Adit Site ? | Possible adit buried in slide area, not open |

| Astasis 1 | Shaft | Shaft and trenches sampled |

| Astasis 2 | Shaft | Shaft and trenches sampled |

| Mina Sabalo | Mine | inaccessible |

| Pozo Antonio | __ | Area mapped and sampled |

| Dos Pinos | Adit | Portal area mapped with some sampling |

| Veta de Arroyo | Trenches | Mapped with some sampling |

| Mina San Francisco | Shaft & Adit | Shaft is caved; Sampling at Portal |

| Mina Joya | Adit | Sampled at the portal only |

| Mina la Suerte | | Mapped and sampled |

9.4.2 Dos Hornos 1 and 2 Zones

The results from the Dos Hornos 1 drilling are summarized in Table 3 which shows the most economically significant intersections. A surface plan of the drilling is shown in Figure 6. In this figure, the boundary shown delineates surface rights holders, Ejido eo Refugio and Ejido Pantanal. An apparent offset of hole DH1-13-11 is probably due to hole collar and deviation because this hole was measured from the others, but not surveyed.

TABLE 3

SUMMARY OF SELECTED DOS HORNOS 1 DRILL HOLE INTERSECTIONS

| Section | Hole Number | Interval (m) | True | Gold | Silver |

| | | from | to | Thickness (m) | (g/t) | (g/t) |

| 0 | DH-18-11 | 16.00 | | 19.00 | | 2.19 | 0.32 | 72.1 | |

| 1 | DH1-16-11 DH1-17-11 | 40.00 245.00 | | 42.00 247.00 | | 1.49 1.46 | 0.28 0.14 | 70.7 93.6 | |

| 2 | DDH-17-03 DDH-01-06 | 38.00 105.00 | | 48.00 109.00 | | 1.49 2.97 | 1.05 0.26 | 191.5 112.5 | |

| 3 | DH1-14-11 DH1-15-11 | 117.00 129.00 | | 123.00 131.00 | | 4.24 1.41 | 0.69 0.16 | 203.2 116.8 | |

| 4 | DDH-18-03 DDH-14-06 DH1-13-11 | 26.00 126.00 158.00 | | 32.00 132.00 160.00 | | 4.32 4.39 7.07 | 0.61 0.72 0.24 | 83.7 149.5 99.5 | |

| 5 | DH1-02-11 DH1-12-11 DDH-07-34 | 63.34 106.00 188.30 | | 66.82 118.00 190.30 | | 2.50 5.45 1.89 | 3.87 0.57 0.13 | 1076.2 247.0 113.5 | |

| 6 | DH1-01-11 DDH-02-06 DH1-08-11 | 53.00 108.50 169.70 | | 55.00 120.50 176.80 | | 1.58 9.46 5.74 | 1.50 0.47 0.29 | 163.6 147.8 114.0 | |

| 7 | DH1-19-11 DH1-20-11 | 74.70 117.50 | | 76.70 121.50 | | 1.51 2.00 | 0.90 0.23 | 57.8 94.1 | |

| 7.5 | DDH-12-06 DH1-09-11 DH1-10-11 | 109.60 35.50 144.50 | | 113.60 45.70 151.70 | | 2.57 4.88 1.84 | 0.69 0.85 1.31 | 157.0 110.3 206.7 | |

The mineralized zone in Dos Hornos 2 (Table 4, Figure 7) is continuous and the host rocks remain the same as in Dos Hornos 1. However, Dos Hornos 2 is different in that it comprises as many as four mineralized, parallel to slightly downwards-convergent splays. Generally the deeper intersections are lower grade than those nearer the hanging wall rhyolite tuff. Data on the Dos Hornos 2 sections indicates a vertical or very steep north-easterly dip. Dos Hornos 2 is separated from Veta Tomas, the next structural segment to the south, by an east-northeast trending fault. The justification for this fault is an apparent change in dip from steeply southwest to northeast. The Dos Hornos 2 and Veta Tomas segments are therefore the same mineralized structure as the Dos Hornos 1 segment, displaced by a post mineralization fault.

TABLE 4

SUMMARY OF SELECTED DOS HORNOS 2 INTERSECTIONS

| Section | Hole Number | Interval (m) | True | Gold | Silver |

| | | from | to | Thickness (m) | (g/t) | (g/t) |

| | | | | | | | | | | |

| 9 | DDH-02-03 | 84.00 | | 88.00 | | 1.88 | | 1.12 | 113.0 | |

| 9 | DH2-15-11 | 52.00 | | 64.00 | | 8.49 | | 0.93 | 162.1 | |

| 9 | DH2-16-11 | 44.00 | | 47.00 | | 1.50 | | 1.11 | 509.9 | |

| | | | | | | | | | | |

| 9A | DDH-02-03 | 0.00 | | 4.00 | | 2.00 | | 0.52 | 164.9 | |

| 9A | DDH-11-03 | 28.00 | | 30.00 | | 1.36 | | 0.22 | 68.0 | |

| 9A | DDH-11-03 | 50.00 | | 54.00 | | 2.73 | | 0.41 | 65.7 | |

| | | | | | | | | | | |

| 11 | DDH-10-06 | 12.50 | | 24.50 | | 8.49 | | 0.93 | 106.1 | |

| 11 | DDH-10-06 | 74.50 | | 76.50 | | 1.36 | | 0.46 | 51.0 | |

| 11 | DDH-07-33 | 86.00 | | 88.00 | | 1.41 | | 0.33 | 101.0 | |

| 11 | DDH-11-06 | 9.30 | | 23.30 | | 8.49 | | 0.86 | 123.7 | |

| 11 | DDH-11-06 | 58.20 | | 61.20 | | 1.97 | | 6.96 | 24.7 | |

| 11 | DH2-13-11 | 28.00 | | 42.00 | | 9.90 | | 0.92 | 183.8 | |

| | | | | | | | | | | |

| 12 | DDH-07-32 | 86.00 | | 113.50 | | 18.40 | | 0.55 | 72.5 | |

| 12 | DH2-10-11 | 144.50 | | 147.70 | | 2.26 | | 1.31 | 206.7 | |

| 12 | DH2-12-11 | 124.20 | | 128.20 | | 2.06 | | 0.12 | 80.0 | |

| | | | | | | | | | | |

| 13 | DDH-15-06 | 87.00 | | 91.00 | | 2.97 | | 0.83 | 159.8 | |

| | | | | | | | | | | |

| 14 | DDH-07-31 | 164.00 | | 168.00 | | 2.62 | | 0.66 | 101.5 | |

| | | | | | | | | | | |

| 15 | DDH-16-06 | 73.50 | | 77.20 | | 3.03 | | 0.85 | 116.3 | |

| 15 | DH2-05-11 | 1.00 | | 3.00 | | 1.97 | | 0.70 | 151.9 | |

| 15 | DH2-06-11 | 127.60 | | 133.60 | | 2.91 | | 0.95 | 146.3 | |

| | | | | | | | | | | |

| 19 | DDH-07-26 | 137.50 | | 140.50 | | 1.93 | | 1.22 | 55.8 | |

| 19 | DDH-07-26 | 161.50 | | 165.50 | | 2.57 | | 0.62 | 74.0 | |

Adit 3 was driven between Dos Hornos 1 and 2 on what is termed a “Transition Zone”, and there appears to be an additional vein structure of unknown extent situated between the two Dos Hornos zones. The Transition Zone could add significant potential to the structures, however, no attempt has been made at this time to trace the zone. It is thought to be parallel to the Dos Hornos structures, and it may be represented in some holes as a second intersection. In-fill drilling is needed to better define the Transition Zone.

9.4.3 Veta Tomas Zone

Near the portal of the San Miguel Mine on Veta Tomas (Plate 10), two parallel vein-structures comprising the Veta Tomas segment were tested by 20 drill holes. The results show the mineralization to be continuous over a strike length of 300 m, and from surface down to a vertical depth of 100 m. Below 100 m, the silver-gold values decrease and become spotty. The most economically significant intersections are summarized in Table 5. The host rocks remain the same felsic lapilli tuff-agglomerate as seen all along the Dos Hornos structure. A surface plan of the area shows drill hole locations (Figure 8).

TABLE 5

SUMMARY OF SELECTED VETA TOMAS DRILL HOLE INTERSECTIONS

| Section | Hole Number | Interval (m) | True | Gold | Silver |

| | | from | to | Thickness (m) | (g/t) | (g/t) |

| | | | | | | | | | | |

| 20 | VT-01-11 | 110.50 | | 114.84 | | 3.32 | | 0.97 | 42.8 | |

| | | | | | | | | | | |

| 21 | DDH-20-06 | 148.80 | | 156.80 | | 6.78 | | 1.66 | 160.9 | |

| | | | | | | | | | | |

| 23 | DDH-19-03 | 38.00 | | 44.00 | | 4.09 | | 0.50 | 125.7 | |

| 23 | DDH-18-06 | 61.10 | | 65.10 | | 2.73 | | 0.52 | 61.5 | |

| 23 | DDH-18-06 | 91.20 | | 95.20 | | 3.19 | | 1.78 | 203.2 | |

| 23 | VT-04-11 | 122.17 | | 123.50 | | 0.96 | | 0.47 | 84.9 | |

| | | | | | | | | | | |

| 24 | VT-12-11 | 57.26 | | 59.26 | | 1.64 | | 0.23 | 107.9 | |

| 24 | VT-12-11 | 69.26 | | 74.52 | | 4.31 | | 1.33 | 194.7 | |

| 24 | VT-03-11 | 144.05 | | 149.28 | | 4.01 | | 0.95 | 138.2 | |

| 24 | VT-15-11 | 195.00 | | 201.00 | | 3.00 | | 0.44 | 157.6 | |

| 24 | VT-15-11 | 213.00 | | 217.00 | | 2.00 | | 0.01 | 101.1 | |

| 24 | DDH-07-24 | 104.00 | | 122.00 | | 12.04 | | 0.13 | 69.3 | |

| | | | | | | | | | | |

| 25 | VT-08-11 | 108.64 | | 114.99 | | 4.49 | | 0.84 | 200.8 | |

| | | | | | | | | | | |

| 27 | VT-05-11 | 45.05 | | 47.02 | | 1.93 | | 0.17 | 67.7 | |

| 27 | DDH-07-23 | 95.25 | | 98.13 | | 2.74 | | 2.70 | 579.0 | |

| 27 | VT-06-11 | 78.60 | | 84.60 | | 5.09 | | 1.65 | 525.7 | |

| | | | | | | | | | | |

| 28 | VT-10-11 | 89.27 | | 98.80 | | 8.90 | | 0.49 | 172.1 | |

The Veta Tomas mineralization continues to the southeast into the St. Gertrudis Mine and the Dos Pinos area – these have not been investigated in any detail and were not visited by WGM. Although the mineralization appears to be continuous into this area from the Dos Hornos-Veta Tomas structure, there is insufficient drilling in this strike extension to demonstrate the presence of an economically interesting zone.

9.4.4 Once Bocas Zone

The Once Bocas structure, composed of the Once Bocas North and South Zones or segments is situated parallel to and southwest of the Dos Hornos - Veta Tomas structure. The North Zone has been explored with 30 drill holes over a strike length of 350 m. Two parallel, structurally controlled zone (splays) of mineralization, approximately 60 m apart, have been identified which are exposed on each side of an arroyo. The east one has been investigated by numerous shafts, adits and limited underground stoping (Plate 12). The western zone has seen some underground workings, but has mostly been traced by pits and some trenches. These veins strike approximately 120° Az which is more easterly than those at Dos Hornos and Veta Tomas. The reason for this change could not be determined during Dr. McBride’s site visit. The most significant intersections from the Once Bocas North drilling are summarized in Table 6.

In the Once Bocas area, the geochemical soil survey identified gold and silver anomalies coincident with this mineralization. Drilling has shown that the best intersections occur within 75 metres of surface, and that below this elevation the mineralization is quite weak. A surface plan of Once Bocas North is presented in Figure 9 which shows the mineralization about midpoint in the zone. Nineteen holes were drilled in this area during two drilling campaigns. They show the two zones with the eastern one being much wider and higher grade.

TABLE 6

SUMMARY OF SELECTED ONCE BOCAS NORTH DRILL HOLE INTERSECTIONS

| Section | Hole Number | Interval (m) | True | Gold | Silver |

| | | from | to | Thickness (m) | (g/t) | (g/t) |

| | | | | | | | | | | |

| OBN-2 | OBN-5-11 | 108.00 | | 114.00 | | 2.05 | | 0.64 | 94.3 | |

| OBN-2 | OBN-10-11 | 58.00 | | 60.00 | | 1.99 | | 1.05 | 185.4 | |

| OBN-2 | OBN-10-11 | 78.00 | | 80.00 | | 1.53 | | 1.51 | 52.6 | |

| OBN-2 | OBN-11-11 | 40.00 | | 42.00 | | 1.81 | | 0.31 | 78.7 | |

| OBN-2 | OBN-11-11 | 62.00 | | 70.00 | | 7.52 | | 0.55 | 114.4 | |

| OBN-2 | OBN-11-11 | 102.00 | | 104.00 | | 1.77 | | 0.50 | 138.3 | |

| OBN-2 | DDH-12-03 | 56.00 | | 60.00 | | 2.57 | | 1.39 | 360.5 | |

| OBN-2 | DDH-12-03 | 96.00 | | 108.00 | | 7.71 | | 0.56 | 120.4 | |

| | | | | | | | | | | |

| OBN-3 | DDH-12-11 | 46.50 | | 48.50 | | 1.97 | | 0.53 | 109.5 | |

| OBN-3 | DDH-04-02 | 79.50 | | 82.50 | | 0.52 | | 0.15 | 73.0 | |

| OBN-3 | OBN-04-11 | 91.00 | | 93.00 | | 1.39 | | 0.17 | 70.6 | |

| | | | | | | | | | | |

| OBN-4 | DDH-06-03 | 22.00 | | 28.00 | | 5.39 | | 1.93 | 194.8 | |

| OBN-4 | DDH-03-02 | 39.00 | | 60.00 | | 18.71 | | 0.38 | 87.8 | |

| OBN-4 | DDH-09-03 | 84.00 | | 90.00 | | 5.03 | | 0.34 | 91.1 | |

| | | | | | | | | | | |

| OBN-5 | OBN-02-11 | 40.50 | | 50.50 | | 8.39 | | 0.30 | 59.3 | |

The Once Bocas South Prospect occurs on the adjacent ridge to the southeast of Once Bocas North. The zone is shown in Figure 10 which is a surface plan also showing the drill hole traces. It is separated by an area that contains quartz-veining but lacks economically interesting gold and silver values on surface. The zone was tested with 6 drill holes in the 2011 drilling program. All of the holes were drilled from northeast to southwest. The holes returned numerous gold and silver values of interest over narrow widths. The most significant assay results from the drilling program are summarized in Table 7. These intersections were separated by background silver values in the range of a few grams per tonne.

Hole OBS-5-11 is the most northerly hole and it is approximately 400 m south of the most southerly hole in the Once Bocas North structure. This hole carried 0.325 g Au/t and 75.30 g Ag/t over a 20-metre core length near the top of the hole. Sampling was limited to the top section of the hole and no samples were taken below 59 m. Mineralization continues through Hole OBS-05-11, 100 m to the southeast where an 8 m length near the top of the hole carried only 0.06 g Au/t and 12.50 g Ag/t. Only a part of this hole was sampled. A further 100 m to the southeast, holes OBS-01-11 and OBS-02-11 tested the zone. The uppermost hole (01-11) contained anomalous values across a 16 m core length followed by 27.14 m averaging 0.30 g Au/t and 85.26 g Ag/t after a bonanza-grade silver value of 1,252 g/t had been intersected. Unfortunately in the deeper hole, OBS-02-11, situated approximately 60 m below, only geochemically anomalous gold and silver values were intersected. If the higher grading sections are correlated, they show a strike of 120° to 130°, similar to the strike of the Once Bocas North mineralization. No NI 43-101 compliant Mineral Resources have been credited to Once Bocas South, however WGM believes that in-fill drilling is likely to demonstrate sufficient continuity that Mineral Resources will be outlined in this area.

TABLE 7

SUMMARY OF SELECTED ONCE BOCAS SOUTH DRILL HOLE INTERSECTIONS

| Section | Hole Number | Interval (m) | True | Gold | Silver |

| | | from | to | Thickness (m) | (g/t) | (g/t) |

| | | | | | | | | | |

| 1 | OBS-05-11 | 5.50 | | 19.50 | | 9.90 | 0.40 | 91.6 | |

| 3 | OBS-01-11 | 42.02 | | 47.14 | | 3.62 | 3.39 | 371.5 | |

| | OBS-02-11 | | | | | low values | | | |

| 4 | OBS-03-11 | 187.2 | | 189.15 | | 1.38 | 0.17 | 42.6 | |

| | OBS-04-11 OBS-04-11 | 51.00 86.00 | | 53.00 88.00 | | 1.41 1.41 | 0.10 0.16 | 95.1 83.1 | |

The two most southerly holes, OBS-03-11 and OBS-04-11, had narrow intersections of low to moderate values which are difficult to correlate. These values are encouraging as they suggest that the Once Bocas structure extends further to the southeast.

9.4.5 Chacuaco Prospect

The Chacuaco Prospect is located along a prominent ridge west of the Once Bocas structure. The mineralization can be traced by quartz float along the ridge and by numerous small artisanal workings including four small mines that date to Spanish colonial times. The ridge has a very steep western face that impedes drilling unless drill sites are selected along the base