OMB:3235-0288

Expires: July 31, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THESECURITIES EXCHANGE ACT OF 1934

OR

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedMarch 31, 2019

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________.

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

Commission file number000-29870

FIRST ENERGY METALS LIMITED

(Exact name of Registrant as specified in its charter)

BRITISH COLUMBIA, CANADA

(Jurisdiction of incorporation or organization)

#1206– 588 Broughton Street Vancouver, British Columbia, Canada, V6G 3E3

(Address of principal executive offices)

Gurminder Sangha, President, CEO, and Director, (604) 375-6005, Suite 1206-588 Broughton Street, Vancouver, British Columbia, Canada, V6G 3E3

(Name, telephone, e-mail and/or facsimile number and address of Company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| |

None

Title of Each Class | Not applicable

Name of each exchange on which registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act

Common Shares without Par Value

(Title of Class)

1

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.None

Number of outstanding shares of First Energy’s only class of issued capital stock as at March 31, 2019:

17,631,003 Common Shares Without Par Value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [ X ]

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes [ ] No [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of theSecurities Exchange Act of 1934during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

N/AYes [ ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or an emerging growth company

| | | |

| Large Accelerated Filer [ ] | Accelerated Filer [ ] | Non-Accelerated Filer [ X ] | Emerging growth company [ ] |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | |

| U.S. GAAP [ ] | International Financial Reporting Standards

as issued by the International Accounting Standards Board [ X ] | Other [ ] |

If other has been checked in response to the previous question, indicate by check mark which financial statement item Registrant has elected to follow:

Item 17 [ ] Item 18 [ ]

If this report is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [ X ]

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of theSecurities Exchange Act of 1934subsequent to the distribution of securities under a plan confirmed by a court.

N/AYes [ ] No [ ]

2

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION

Certain statements in this Annual Report on Form 20-F (this “Annual Report”) under the captions “Item 3 - Risk Factors”, “Item 4 – “Business Overview”, Item 5 - “Operating and Financial Review and Prospects” and “Item 11 -Quantitative and Qualitative Disclosures about Market Risk” and elsewhere in this Annual Report and the documents incorporated herein by reference constitute “forward-looking statements” within the meaning of the U.S. Securities Litigation Reform Act of 1995 and "forward-looking information” under applicable Canadian securities legislation. Some forward-looking statements may be identified by such terms as “believes”, “anticipates”, “intends” or “expects” collectively “forward-looking statements”. Forward-looking information in this Annual Report include statements regarding the Company's plans for its projects, statements relating to mineral resources, as they are based on various assumptions that are inherently forward-looking, statements regarding the anticipated timing by which the Company will require additional funds. These forward-looking statements are based on the Company’s current expectations and projections about future events and financial trends affecting the financial condition of its business and the industry in which it operates. Such forward-looking statements are based on assumptions regarding future events and other matters and are subject to known and unknown risks, uncertainties and other factors including the factors set forth in other filings with the Canadian securities commissions and the United States Securities and Exchange Commission (the “Commission”), which may cause the actual results, performance or achievements of the Company or industry results to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Assumptions on which forward-looking statements are based include the assumptions underlying mineral resource estimates and in the technical reports supporting such estimates, the assumption that the Company will continue as a going concern and will continue to be able to access the capital required to advance its projects and continue operations. Such risks and the assumptions that accompany them, uncertainties and other factors include, among others, the following: general economic and business conditions, which will, among other things, impact the demand for gold and silver and other precious metals explored for by the Company; industry capacity; the ability of the Company to raise the capital required to implement its business strategy; changes in, or the unintentional failure to comply with, government regulations (especially safety and environmental laws and regulations); changes in the uses of gold, silver and other precious metals; silver and gold price volatility; increased competition; risks of the mining industry; exploration programs not being successful; inability to obtain financing; inability to obtain, or cancellation of, government permits; changes to regulations and mining law; increased reclamation obligations; title defects with respect to properties; risks associated with international operations; and foreign exchange and currency fluctuations. There can be no assurance that forward-looking statements in this Annual Report will prove to be accurate and actual results and future events could vary materially from those implied by such statements. Consequently, all of the forward-looking statements made in this Annual Report are qualified by these cautionary statements. The Company disclaims any obligation to update or revise any written forward-looking statements whether as a result of new information, future events or otherwise except as required by applicable laws.

Currency and Measurement

All currency amounts in this Annual Report on Form 20-F are stated inCanadian dollarsunless otherwise indicated. Conversion of metric units into imperial equivalents is as follows:

| | |

| Metric Units | Multiply by | Imperial Units |

| hectares | 2.471 | = acres |

| metres | 3.281 | = feet |

| kilometres (“km”) | 0.621 | = miles (5,280 feet) |

| grams | 0.032 | = ounces (troy) |

| tonnes | 1.102 | = tons (short) (2,000 lbs) |

| grams/tonne | 0.029 | = ounces (troy)/ton |

3

CAUTIONARY NOTE TO U.S. INVESTORS

This Annual Report may use the terms “measured resources” and “indicated resources.” We advise U.S. investors that while such terms are recognized and permitted under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them. U.S. investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves.

This Annual Report may use the terms “inferred resources.” We advise U.S. investors that while such term is recognized and permitted under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. “Inferred resources” have a great amount of uncertainty as to their existence, as well as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies. U.S. investors are cautioned not to assume that any part or all of an inferred resource exists or is economically or legally mineable.

4

TABLE OF CONTENTS

| | |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 6 |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | 6 |

| ITEM 3. | KEY INFORMATION | 6 |

| ITEM 4. | INFORMATION ON FIRST ENERGY METALS LIMITED | 13 |

| ITEM 4A. | UNRESOLVED STAFF COMMENTS | 21 |

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 21 |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 27 |

| ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 35 |

| ITEM 8. | FINANCIAL INFORMATION | 36 |

| ITEM 9. | THE OFFER AND LISTING | 36 |

| ITEM 10. | ADDITIONAL INFORMATION | 38 |

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 47 |

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 47 |

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 47 |

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 47 |

| ITEM 15. | CONTROLS AND PROCEDURES | 47 |

| ITEM 15T. | CONTROLS AND PROCEDURES | 48 |

| ITEM 16. | [RESERVED] | 48 |

| ITEM 16A. | AUDIT COMMITTEE FINANCIAL EXPERT | 48 |

| ITEM 16B. | CODE OF ETHICS | 48 |

| ITEM 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 49 |

| ITEM 16D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 49 |

| ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 49 |

| ITEM 16F. | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | 49 |

| ITEM 16G. | CORPORATE GOVERNANCE | 49 |

| ITEM 16H. | MINE SAFETY DISCLOSURE | 49 |

| ITEM 17. | FINANCIAL STATEMENTS | 49 |

| ITEM 18. | FINANCIAL STATEMENTS | 50 |

| ITEM 19. | EXHIBITS | 50 |

5

PART 1

| |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

A. Directors and Senior Management

This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934, as amended and as such, there is no requirement to provide any information under this item.

B. Advisors

This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934, as amended and as such, there is no requirement to provide any information under this item.

C. Auditor

This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934, as amended and as such, there is no requirement to provide any information under this item.

| |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934, as amended and as such, there is no requirement to provide any information under this item.

A. Selected Financial Data

The selected financial data of First Energy Metals Limited. (“First Energy” or the “Company” and formerly Agave Silver Corp.) for the years ended March 31, 2019, 2018 and 2017 was derived from the Company’s financial statements as audited by DeVisser Gray LLP, Chartered Professional Accountants, for the years ended March 31, 2019, March 31, 2018 and March 31, 2017, as indicated in the audit report included elsewhere in this Annual Report.

The Selected Financial Data should be read in conjunction with the financial statements and other financial information included elsewhere in this Annual Report.

The Company has not declared any dividends on its common shares since incorporation and does not anticipate that it will do so in the foreseeable future. The present policy of the Company is to retain future earnings for use in its operations and the expansion of its business.

The following table sets forth selected financial information with respect to the Company for the periods indicated and is extracted from the more detailed financial statements included herein. The following constitutes selected financial data for the Company for the last five fiscal years ended March 31, 2019, in Canadian dollars, presented in accordance with International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”) for the years 2019, 2018, 2017, 2016 and 2015. The following table should be read in conjunction with “Item 5: Operating and Financial Review and Prospects”, and the financial statements included in Item 18.

| | | | | | | | | | | | | | | |

| (Canadian Dollars in Thousands Except Per Share Amounts) | | | | | | | | | | | | | |

| (Cdn$) | | | | | | | | As at March 31, | | | | | | | |

| Statement of Financial Position Data | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| Total assets according to financial statements | $ | 327 | | $ | 413 | | $ | 602 | | $ | 48 | | $ | 94 | |

| Total liabilities | | 120 | | | 255 | | | 92 | | | 252 | | | 381 | |

| Share capital | | 35,713 | | | 35,189 | | | 34,723 | | | 33,974 | | | 33,755 | |

| Warrant reserve, share-based payment reserve, share subscriptions (Restated) | | 683 | | | 491 | | | 447 | | | 126 | | | 1,407 | |

| Deficit (IFRS) (Restated) | (36,189 | ) | | (35,522 | ) | | (34,660 | ) | | (34,303 | ) | | (35,448 | ) |

6

| | | | | | | | | | | | | | | |

| (Cdn$) | | | | | | | | As at March 31, | | | | | | | |

| Period End Balances (as at) | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| Working capital (deficiency) | $ | 107 | | $ | 137 | | $ | (31 | ) | $ | (237 | ) | $ | (355 | ) |

| Mineral property interests | | 83 | | | - | | | 514 | | | - | | | - | |

| Shareholders’ equity | | 201 | | | 158 | | | 510 | | | (204 | ) | | (286 | ) |

| Number of outstanding shares | | 17,631,003 | | | 12,236,638 | | | 8,903,308 | | | 6,396,166 | | | 5,166,666 | |

| | | | | | | | | | | | | | | |

| No cash or other dividends have been declared. | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| (Cdn$) | | | | | | | | As at March 31 | | | | | | | |

| Statement of Operations Data | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| Investment and other income | $ | - | | $ | - | | $ | - | | $ | (129 | ) | $ | - | |

| General and administrative expenses (including Share-based payments) | | 521 | | | 307 | | | 350 | | | 243 | | | 405 | |

| Exploration costs (recoveries) | | 152 | | | 41 | | | 7 | | | (2 | ) | | 1 | |

| Net loss (income) from discontinued operations | | - | | | - | | | - | | | - | | | (408 | ) |

| Write-down of mineral property interests | | - | | | 514 | | | - | | | - | | | - | |

| Future income tax recovery | | - | | | - | | | - | | | - | | | - | |

| Net income (loss) according to financial statements (IFRS) | | (673 | ) | | (862 | ) | | (357 | ) | | (112 | ) | | 2 | |

Note:

| (1) | Under IFRS applicable to junior mining exploration companies, mineral exploration expenditures can be deferred on prospective properties until such time as it is determined that further exploration is not warranted, at which time the property costs are written off. During the year ended March 31, 2009, the Company retrospectively changed its accounting policy for exploration expenditures to more appropriately align itself with policies adopted by other exploration companies at a similar stage in the mining industry. Prior to the year ended March 31, 2009, the Company capitalized all such costs to mineral property interests held directly or through an investment, and only wrote down capitalized costs when the property was abandoned or if the capitalized costs were not considered to be economically recoverable. Exploration expenditures are now charged to earnings as they are incurred until the mineral property interest reaches the development stage. Significant costs related to mineral property acquisitions, including allocations for undeveloped mineral property interests, are capitalized until the viability of the mineral property interest is determined. When it has been established that a mineral deposit is commercially mineable and an economic analysis has been completed, the costs subsequently incurred to develop a mine on the property prior to the start of mining operations are capitalized. The expensing of exploration costs as incurred is now consistent with US GAAP, whereby all exploration expenditures are expensed until an independent feasibility study has determined that the property is capable of economic commercial production. |

The tables below include the quarterly results for the years ended March 31, 2019 and 2018.

| | | | | | | | | | | | | | | |

| (Canadian Dollars in Thousands Except Per Share Amounts) | | | | | | | | | | |

| (Cdn$) | Year Ended March 31, 2019 |

| Statement of Operations Data | | Quarter 1 | | | Quarter 2 | | | Quarter 3 | | | Quarter 4 | | | Total | |

| Investment and other income | $ | - $ | | | - $ | | | - $ | | | - | | $ | - | |

| General and administrative expenses | | 206 | | | 69 | | | 77 | | | 170 | | | 522 | |

| Share-based payments | | - | | | - | | | - | | | - | | | - | |

| Write-down of mineral property interests | | - | | | - | | | - | | | - | | | - | |

| Exploration costs | | 74 | | | - | | | 2 | | | 75 | | | 151 | |

| Loss (gain) on sale of discontinued operations | | - | | | - | | | - | | | - | | | - | |

| Net loss (income) according to financial statements | | 280 | | | 69 | | | 79 | | | 245 | | | 673 | |

| Net loss from continuing operations per common share | | 0.02 | | | 0.00 | | | 0.01 | | | 0.05 | | | 0.05 | |

7

| | | | | | | | | | | | | | | |

| (Cdn$) | | | | | Year Ended March 31, 2018 | | | | | | | |

| Statement of Operations Data | | Quarter 1 | | | Quarter 2 | | | Quarter 3 | | | Quarter 4 | | | Total | |

| Investment and other income | $ | - | | $ | - | | $ | - | | $ | - | | $ | | |

| General and administrative expenses | | 32 | | | 54 | | | 32 | | | 145 | | | 263 | |

| Share-based payments | | - | | | 44 | | | - | | | - | | | 44 | |

| Write-down of mineral property interests | | - | | | - | | | - | | | 514 | | | 514 | |

| Exploration costs | | 1 | | | 7 | | | - | | | 33 | | | 41 | |

| Loss (gain) on sale of discontinued operations | | - | | | - | | | - | | | - | | | - | |

| Net loss (income) according to financial statements | | 33 | | | 105 | | | 32 | | | 692 | | | 862 | |

| Net loss from continuing operations per common share | | 0.00 | | | 0.02 | | | 0.00 | | | 0.07 | | | 0.09 | |

B. Capitalization and Indebtedness

This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934, and as such, there is no requirement to provide any information under this item.

C. Reasons for the Offer and Use of Proceeds

This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934, and as such, there is no requirement to provide any information under this item.

D. Risk Factors

The following is a brief discussion of those distinctive or special characteristics of the Company’s operations and industry which may have a material impact on First Energy’s financial performance.

Readers should carefully consider the risks and uncertainties described below before deciding whether to invest in shares of the Company’s common stock.

Financial Risk Factors

First Energy has no source of operating cash flow, has a history of operating losses and has no assets of any significance with positive financial statement carrying values.In addition, all of the Company’s projects have a financial statement value of zero. The Company has no revenues from operations and all of its mineral property interests are in the exploration stage. The Company will not receive revenues from operations at any time in the near future, and the Company has no prior years’ history of earnings or cash flow. The Company has not paid dividends on its shares at any time since incorporation and does not anticipate doing so in the foreseeable future. The Company’s financial statements have been prepared assuming it will continue on a going-concern basis. Should funding not be obtained, this assumption will change and the Company’s assets may be written down to realizable values. The Company has incurred losses since inception (deficit at March 31, 2019, is $36,195,065), which casts doubt on the ability of the Company to continue as a going concern. The Company has no revenue other than interest income. A mining project can typically require ten years or more between discovery, definition, development and construction and as a result, no production revenue is expected from any of the Company’s exploration properties in the near future. All of the Company’s short to medium-term operating and exploration expenses must be paid from its existing cash position or external financing. At March 31, 2019, the Company had working capital of $107,333, compared to a working capital of $136,728 at March 31, 2018. Working capital is defined as current assets less current liabilities.

First Energy may be unable to obtain the funds necessary to expand exploration.The Company’s operations consist, almost exclusively, of cash consuming activities given that all of its mineral projects are in the early exploration stage. The Company will need to receive additional equity capital or other funding from the joint venture of one or more properties or the sale of one or more properties for the next year, and failing that, may cease to be economically viable. To date, the only sources of funds that have been available to the Company are the sale of equity capital or the offering by the Company of an interest in its properties to be earned by another party or parties carrying out further development thereof.

8

The Company does not have sufficient financial resources to fund operations for the balance of fiscal 2020. The Company has been successful in the past in obtaining financing through the sale of equity securities but as an exploration stage company, it is often difficult to obtain adequate financing when required, and it is not necessarily the case that the terms of such financings will be favourable. If the Company fails to obtain additional financing on a timely basis, the Company could forfeit its mineral property interests, dilute its interests in its properties, sell one or more properties and/or reduce or terminate operations.

The Company is continuously reviewing strategies for private placement equity financings as well as other forms of financing that would carry the Company through the next fiscal year. If a private equity financing were to be completed, it is expected that warrants may be included in the securities offered. Any such financings will result in dilution of existing shareholders.

Volatile metal prices and external market conditions can cause significant changes in the Company’s share price because as the prices of metals increase or decrease, the economic viability of the mineral properties is affected.

The Company has no history of mining or current source of revenue. The Company is exploring for metals and historically, the prices of the common shares of junior exploration companies are very volatile. This volatility may be partly attributed to the volatility of metal prices, and also to the success or failure of the Company’s exploration programs. Market, financial and economic factors not directly related to mining activities can also affect the Company’s ability to raise equity financing.

Fluctuations in financial markets can negatively impact the Company’s ability to achieve sufficient funding.

Over the last decade there have been periods of significant volatility in world financial markets. The volatility can negatively impact the Company’s ability to raise sufficient equity financing to sustain operations. Future financial market volatility is likely and it should not be assumed that adequate funding will be available to the Company in amounts or at times when it is required.

Risks Associated with Mineral Exploration

First Energy’s exploration efforts may be unsuccessful in locating viable mineral resources.Resource exploration is a speculative business, characterized by a number of significant risks, including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but also from finding mineral deposits, which, though present, are insufficient in quantity and/or quality to return a profit from production.

There is no certainty that expenditures to be made by the Company on the exploration of its properties and prospects as described herein will result in discoveries of mineralized material in commercial quality and quantities.

Mineral Resource Estimates Are Only Estimates and May Not Reflect the Actual Deposits or the Economic Viability of Extraction.Although the Company carefully prepares its mineral resource figures, such figures are estimates only and no assurance can be given that the indicated tonnages and grade will be achieved. There is significant uncertainty in any mineral resource estimate. Estimates of inferred resources are the least certain of the resource categories and there is no assurance that such resources can or will be upgraded to another category of resource, or that further exploration will confirm or validate such estimates. Actual deposits encountered and the economic viability of, and returns from, a deposit (if mined) may differ materially from estimates disclosed by the Company or implied by estimates of mineral resources. The estimating of mineral resources is a subjective process and the accuracy of mineral resource estimates is a function of the quantity and quality of available data, the accuracy of statistical computations, and the assumptions used and judgments made in interpreting engineering and geological information. Mineral resource estimates are based on many things, including assumed commodity prices, continuity of mineralization, tonnage and grade of mineralization, metallurgy, estimated mineral recovery rates, cost of capital, mine development costs, operating costs and exchange rates. Changes in assumptions may result in a significant reduction in the reported mineral resources and thereby have a material adverse effect on the Company's results of operations and financial condition.

Estimated mineral resources may also require downward revisions based on changes in metal prices and further exploration or development activity. This could materially and adversely affect estimates of the tonnage or grade of mineralization, estimated recovery rates or other important factors that influence mineral resource and reserve of estimates. Any reduction in estimated mineral reserves or estimated resources as a result could require material write downs in investment in the affected mining property, which could have a material and adverse effect on the Company's results of operations and financial condition.

The Company has not established the presence of any proven and probable reserves at any of its mineral properties. There can be no assurance that subsequent testing or future studies will establish proven and probable reserves on the

9

Company's properties. The failure to establish proven and probable reserves could severely restrict the Company's ability to successfully implement its strategies for long-term growth.

There is Uncertainty Relating to Mineral Resources.Mineral resources that are not mineral reserves do not have demonstrated economic viability. Due to the uncertainty, which may attach to inferred mineral resources, there is no assurance that inferred mineral resources will be upgraded to indicated and measured mineral resources as a result of continued exploration. If mineral resources are not upgraded to proven and probable mineral reserves, it could materially and adversely affect and/or restrict the Company's ability to successfully implement its strategies for long-term growth.

First Energy may not be able to market minerals if any are acquired or discovered by the Company due to factors beyond the control of the Company.The marketability of minerals that could in the future be acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and such other factors as government regulation, including regulation relating to royalties, allowable production, importing and exporting of minerals and environmental protection, the combination of which factors may result in the Company not receiving an adequate return on investment capital.

Environmental and Regulatory Risk Factors

Compliance with environmental regulations could affect future profitability and timeliness of operations.The current and anticipated future operations of the Company require permits from various federal, territorial and local governmental authorities. Companies engaged in the exploration and development of mines and related facilities must comply with applicable laws, regulations and permits.

The Company’s exploration activities are subject to various laws governing land use, the protection of the environment, prospecting, development, commodity prices, exports, taxes, labour standards, occupational safety and health, waste disposal, toxic substances, mine safety and other matters. The Company believes it is in substantial compliance with all material laws and regulations which currently apply to its activities. The Company may be unable to obtain all permits required for exploration and development, and the costs of obtaining these permits may not be commercially reasonable. Existing laws and regulations may be modified, which could have an adverse effect on any exploration project that the Company might undertake.

Failure to comply with environmental and reclamation rules could result in penalties.The Company’s activities are subject to laws and regulations controlling not only mineral exploration and exploitation activities but also the possible effects of such activities upon the environment. Environmental legislation may change and make mining uneconomic or result in significant environmental or reclamation costs. Environmental legislation provides for restrictions and prohibitions and a breach of environmental legislation may result in the imposition of fines and penalties or the suspension or closure of operations. In addition, certain types of operations require the submission of environmental impact statements and approval thereof by government authorities. Environmental legislation is evolving in a manner that may mean stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their directors, officers and employees. Permits from a variety of regulatory authorities are required for many aspects of mineral exploitation activities, including closure and reclamation. Future environmental legislation could cause additional expense, capital expenditures, restrictions, liabilities and delays in the development of the Company’s properties, the extent of which cannot be predicted. In the context of environmental permits, including the approval of closure and reclamation plans, the Company must comply with standards and laws and regulations that may entail costs and delays, depending on the nature of the activity to be permitted and how stringently the regulations are implemented by the permitting authority. The Company does not maintain environmental liability insurance.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. The Company has been involved in the exploration of mineral properties for many years. Currently, the operations of the Company have been limited to exploration, and no mining activity has yet been undertaken. The mining industry is heavily regulated in North America, where the Company has its operations, so that permitting is required before any work is undertaken where there is any form of land disturbance. To date, land disturbance has been minimal and all required reclamation has been completed.

10

Other Risk Factors

First Energy is dependent on its ability to recruit and retain key personnel.The success of the activities of the Company is dependent to a significant extent on the efforts and abilities of its management. Investors must be willing to rely to a significant extent on their discretion and judgment. The Company has relied on and will continue to rely on consultants and others for exploration, development and technical expertise. The ability of the Company to retain key personnel and its ability to continue to pay for services are dependent upon the ability of the Company to obtain adequate financing to continue operating as a going concern.

First Energy’s title to mineral property interests may be challenged.Although the Company has done a review of titles to its mineral interests, it has not obtained title insurance with respect to its properties and there is no guarantee of title. The Company’s mineral properties may be subject to prior unregistered agreements or transfers or native land claims, and title may be affected by undetected defects. The Company’s Canadian mineral property interests consist of mineral claims, which have not been surveyed, and therefore the precise area and location of such claims or rights may be in doubt. As there are unresolved native land claim issues in British Columbia, the Company’s properties and prospects in this jurisdiction may be affected in the future. The Company’s mineral properties in British Columbia are early stage exploration and have no known mineral resources or reserves.

First Energy’s directors and officers serve as directors and/or officers of other publicly traded junior resource companies.Some of the directors and officers of the Company serve as officers and/or directors of other resource exploration companies and are engaged and will continue to be engaged in the search for additional resource opportunities on their own behalf and on behalf of other companies, and situations may arise where these directors and officers will be in direct competition with the Company. Such potential conflicts, if any, will be dealt with in accordance with the relevant provisions of British Columbia corporate and common law. In order to avoid the possible conflict of interest which may arise between the directors’ and officers’ duties to the Company and their duties to the other companies on whose boards they serve, the directors and officers of the Company expect that participation in exploration prospects offered to the directors or officers will be allocated among or between the various companies that they serve on the basis of prudent business judgement and the relative financial abilities and needs of the companies.

First Energy may not be able to insure certain risks which could negatively impact the Company’s operating results.In the course of exploration, development and production of mineral properties, certain risks, and in particular unanticipated geological and operating conditions as well as fires, explosions, flooding, earthquakes, power outages, labour disruptions, and the inability to obtain suitable or adequate machinery, equipment or labour may occur. It is not always possible to fully insure against such risks and the Company may decide not to take out insurance against such risks as a result of high premiums or other reasons. Should such liabilities arise, they could reduce or eliminate any future profitability and result in increasing costs and a decline in the value of the securities of the Company.

U.S. investors may not be able to enforce their civil liabilities against the Company or its directors, controlling persons and officers. It may be difficult for U.S. investors to bring and enforce suits against the Company. The Company is a corporation incorporated in British Columbia under the Business Corporations Act (British Columbia) and, consequently, there is a risk that Canadian courts may not enforce judgements of U.S. courts or enforce, in an original action, liabilities directly predicated upon the U.S. federal securities laws. The Company’s directors and officers are residents of Canada or other countries other than the United States and all of the Company’s assets are located outside of the United States. Consequently, it may be difficult for United States investors to affect service of process upon those directors or officers who are not residents of the United States, or to realize in the United States upon judgements of United States courts predicated upon civil liabilities under United States securities laws. It is unlikely that an original action could be brought successfully in Canada against any of such persons or the Company predicated solely upon such civil liabilities under U.S. securities laws.

Risks Relating to an Investment in the Securities of the Company

First Energy could be deemed a Passive Foreign Investment Company which could have negative consequences for U.S. Holders.Potential investors who are U.S. Holders (defined below) should be aware that the Company expects to be a passive foreign investment company (“PFIC”) for the current fiscal year, may have been a PFIC in prior fiscal years and may continue to be a PFIC in subsequent years. If the Company were to be treated as a PFIC, U.S. Holders of the Company’s common shares would be subject to adverse U.S. federal income tax consequences, including a substantially increased U.S. income tax liability and an interest charge upon the sale or disposition of the Company’s common shares and upon the receipt of distributions on the Company’s common shares to the extent such distributions are treated as “excess distributions” under the U.S. federal income tax rules relating to PFICs. U.S. Holders could potentially mitigate such consequences by making certain elections with respect to the Company’s common shares. U.S. Holders are urged to consult their tax advisors regarding the Company’s PFIC classification, the consequences to

11

them if the Company is a PFIC, and the availability and the consequences of making certain elections to mitigate such consequences. (See Item 10 Taxation -United States Tax Consequences).

First Energy’s stock price may limit its ability to raise additional capital by issuing common shares.The low price of the Company’s common shares also limits the Company’s ability to raise additional capital by issuing additional shares. There are several reasons for this effect. First, the internal policies of certain institutional investors prohibit the purchase of low-priced stocks. Second, many brokerage houses do not permit low-priced stocks to be used as collateral for margin accounts or to be purchased on margin. Third, some brokerage house policies and practices tend to discourage individual brokers from dealing in low-priced stocks. Finally, broker’s commissions on low-priced stocks usually represent a higher percentage of the stock price than commissions on higher priced stocks. As a result, the Company’s shareholders pay transaction costs that are a higher percentage of their total share value than if the Company’s share price were substantially higher.

The liquidity of First Energy’s shares in the United States markets may be limited or more difficult to effectuate because First Energy is a “Penny Stock” issuer. The Company’s stock is subject to U.S. “Penny Stock” rules which make the stock more difficult for U.S. shareholders to trade on the open market. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in “penny” stocks. Penny stocks are equity securities with a price of less than US$5.00 per share, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system provided that current prices and volume information with respect to transactions in such securities is provided by the exchange or system.

The Penny Stock Rules require a broker-dealer, prior to effecting a transaction in a penny stock not otherwise exempt from such rules, to deliver a standardized risk disclosure document prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market.

In addition, the Penny Stock Rules require that prior to a transaction in a penny stock not otherwise exempt from such rules the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. At the present market prices, the Company’s common shares will (and in the foreseeable future are expected to continue to) fall within the definition of a penny stock. Accordingly, United States broker-dealers trading in First Energy’s shares will be subject to the Penny Stock Rules. Rather than complying with those rules, some broker-dealers may refuse to attempt to sell penny stocks. As a result, shareholders and their broker-dealers in the United States may find it more difficult to sell their shares of the Company, if a market for the shares should develop in the United States.

The market for the Company’s stock has been subject to volume and price volatility which could negatively affect a shareholder’s ability to buy or sell the Company’s shares.The market for the common shares of the Company may be highly volatile for reasons both related to the performance of the Company or events pertaining to the industry (e.g. mineral price fluctuation/high production costs/accidents) as well as factors unrelated to the Company or its industry. Market demand for products incorporating minerals in their manufacture fluctuates over time, resulting in a change of demand for the mineral and an attendant change in the price for the mineral. The Company’s common shares can be expected to be subject to volatility in both price and volume arising from market expectations, announcements and press releases regarding the Company’s business, and changes in estimates and evaluations by securities analysts or other events or factors. In the last decade, securities markets in the United States and Canada and internationally have experienced periods of high price and volume volatility, and the market prices of securities of many companies, particularly small-capitalization companies such as the Company, have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values, or prospects of such companies. For these reasons, the Company’s common shares can also be expected to be subject to volatility resulting from purely market forces over which the Company will have no control. Further, despite the existence of a market for trading the Company’s common shares in Canada, shareholders of the Company may be unable to sell significant quantities of common shares in the public trading markets without a significant reduction in the price of the stock.

| |

| ITEM 4. | INFORMATION ON THE COMPANY |

A. History and Development of the Company

The Company’s executive office is located at:

Suite 1206- 588 Broughton Street

Vancouver, British Columbia, Canada, V6B 1N2

Telephone: (604) 375-6005

Email: info@firstenergymetals.com

Website: www.firstenergymetals.com

12

The mailing address of the Company is the Company’s executive office at the address noted above. The Company’s fiscal year end is March 31.

The Company’s common shares are listed on the Canadian Securities Exchange (“CSE” or the “Exchange”) under the symbol “FE”. Prior to March 1, 2019, the Company’s common shares were trading on the TSX Venture Exchange (“TSX-V”) under the symbol “FE” and prior to December 20, 2016 under the symbol “AGV”. The Company was quoted on the Over the Counter Bulletin Board in the United States under the symbol “CRMXF”, until July 26, 2012 at which time the Company’s shares began being exclusively quoted on the OTCQB, (also under the symbol “CRMXF”), an electronic trading platform operated by the OTC Markets Group Inc. On October 3, 2013 the symbol was changed to “ASKDF” and effective May 1, 2014 the Company was listed on OTC “Pink”. The Company’s common shares are also quoted on the Frankfurt market under the symbol “A2JC89”.

The Company was incorporated under the laws of the Province of British Columbia, Canada on October 12, 1966. Effective March 29, 2004, theCompany Act(British Columbia) was replaced by theBusiness Corporations Act(British Columbia). TheBusiness Corporations Act(British Columbia) does not require a company’s Notice of Articles to contain a numerical limit on the authorized capital with respect to each class of shares. Effective September 21, 2004, the Company altered the authorized capital of the Company from 50,000,000 shares without par value to an unlimited number of shares without par value. By Special Resolution effective June 23, 2011, shareholders approved the adoption of new articles for the Company. See Item 10B – Memorandum and Articles of Association.

Since its incorporation in 1966, the Company has been in the business of acquiring and exploring mineral properties. For most of the past three completed years, the Company has been principally attempting to locate deposits of precious metals in the Provinces of British Columbia, Ontario and Quebec, Canada and Nevada, USA.

Canada

Ontario

Phyllis Cobalt Property

On January 29, 2018, the Company entered into an option agreement to acquire a 100% interest in certain mineral claims (the “Phyllis Property”) covering 1,750 hectares located in the Kenora Mining District in northwestern Ontario, Canada.

On January 29, 2019, and again on March 15, 2019, the Company entered into an amended option agreement (the “Phyllis Amendment Agreement”) which amended the due dates for certain cash payments, share issuances and exploration expenditure requirements of the Phyllis Cobalt Agreement, as noted below.

Under the terms of the Phyllis Amendment Agreement, the Company has the option to acquire a 100% interest in the Phyllis Property by completing the following option payments, common share issuances and exploration expenditures:

| | | | |

| | | | Minimum | Cumulative |

| Due Dates | Option payments | Issuance of First Energy | exploration | exploration |

| | ($) | common shares | expenditures | expenditure |

| | | | ($) | ($) |

On signing

(paid and issued) | 20,000 | 100,000 | Nil | Nil |

| September 30, 2019 | - | - | 75,000 | 75,000 |

| January 31, 2020 | 35,000 | 150,000 | 25,000 | 100,000 |

| March 15, 2020 | 35,000 | 150,000 | - | 100,000 |

| January 31, 2021 | 50,000 | - | - | 100,000 |

| March 1, 2021 | - | 200,000 | 25,000 | 125,000 |

Under the Phyllis Amendment Agreement, the Phyllis Property is subject to a 3% Net Smelter Return (“NSR”) royalty upon commencement of commercial production. The Company will have the option to reduce the NSR to 2.0% by paying $1,000,000.

During the year ended March 31, 2019, the Company issued 100,000 common shares and made the $20,000 option payment due on signing.

13

Quebec

Russel Graphite Property

On May 3, 2018, the Company entered into an option agreement to acquire a 100% interest in the Russel Graphite Property which is comprised of 30 mineral tenures covering a contiguous block of 1,798 hectares of land located in the Gatineau area of Quebec, Canada.

On January 28, 2019, and again on March 15, 2019, the Company entered into an amended option agreement (the “Russel Amendment Agreement”) which amended the due dates for certain cash payments, share issuances and exploration expenditure requirements of the Russel Option Agreement as noted below.

Under the terms of the Russel Amended Agreement, the Company has the right to acquire a 100% interest in Russel Graphite Property by completing the following option payment, common share issuances and exploration expenditures:

| | | | |

| Due Dates | Option payments

($) | Issuance of

First Energy

common shares | Minimum

exploration

expenditures

($) | Cumulative

exploration

expenditure

($) |

September 1, 2019

(issued) | 7,500 | 75,000 | Nil | Nil |

| December 31, 2019 | 30,000 | 225,000 | 150,000 | 150,000 |

As at March 31, 2019, the Company had issued 75,000 common shares due on September 1, 2019.

British ColumbiaThe Kaslo Property

The 100% owned 4,000 Ha Kaslo Silver Property (“Kaslo”), a silver target, hosts eleven historic high-grade silver mineralized zones within 14 kilometres of favourable horizon. Nine high-grade silver-lead-zinc mines operated on Kaslo at various times from 1895 to 1966. The property is located 12 kilometres west of Kaslo in southern British Columbia. The Company has no plans to conduct exploration work at this time.

The Kootenay Lithium Project

On October 7, 2016, the Company entered into an agreement to purchase (the “Kootenay Agreement”) a 100% interest in certain mineral claims (the “Kootenay Property”) covering 4,050 hectares located in the Revelstoke and Nelson Mining Divisions of southeastern British Columbia, Canada.

Under the terms of the Kootenay Agreement, the Company has purchased a 100% interest in the Kootenay Property by issuing 1,200,000 common shares at a value of $0.40 per share. The Kootenay Property is subject to a 2.0% NSR royalty and a 24% Gross Overriding Royalty (“GOR”) on gemstones produced from the Kootenay Property. The Company will have the option to reduce the NSR to 1.0% by paying $2,500,000 and to purchase one half (50%) of the GOR for $2,000,000.

A vendor of certain claims within the Kootenay Property also reserves the exclusive right (the “Back In Right”) to produce gemstones for its own account from those claims as mutually agreed upon, in return for a 24% GOR payable to the Company. The Company will have the option to purchase 100% of the Back In Right for $1,000,000.

The Company also issued finder’s fee totaling 84,000 common shares in connection with the transaction. This amount has also been capitalized as an acquisition cost.

During the year ended March 31, 2018, the Company wrote down the carrying value of Kootenay Lithium Property to $Nil as the Company does not plan to complete further exploration on the property. As such, the Company let lapse the mineral property’s claims by not paying the related annual mineral claim maintenance fees.

Under the Kootenay Agreement, the Company is required to keep the Kootenay Property claims in good standing. As the Company had allowed certain claims to lapse, it is in default of the Kootenay Agreement. The Company has since filed certain annual maintenance fees related to the Kootenay Property claims and intends to restore the remainder of the claims to good standing.

14

USA

Nevada,

Highway 95 Property

On June 20, 2018, the Company entered into an option agreement (the “Highway 95 Agreement”) to acquire a 100% interest in the Highway 95 Property by making certain option payments of cash and shares. The property is comprised of 2,400 acres located in Nye County Nevada, USA.

On November 9, 2018 the Company and the optionor mutually agreed to terminate the Highway 95 Agreement, with no option payments having been issued or owing.

B. Business Overview

General

The Company has historically been a junior resource company engaged in the exploration and development of mineral properties. It currently maintains early stage exploration properties in Canada.

| (ii) | Principal Markets: Not Applicable. |

| | |

| (iii) | Seasonality: Not Applicable. |

| | |

| (iv) | Raw Materials: Not Applicable. |

| | |

| (v) | Marketing Channels: Not Applicable. |

| | |

| (vi) | Dependence: Not Applicable. |

| | |

| (vii) | Competitive Position: Not Applicable. |

| | |

| (viii) | Material Effect of Government Regulation: The Company’s exploration activities and its potential mining and processing operations are subject to various laws governing land use, the protection of the environment, prospecting, development, production, contractor availability, commodity prices, exports, taxes, labour standards, occupational safety and health, waste disposal, toxic substances, safety and other matters. The Company believes it is in substantial compliance with all material laws and regulations which currently apply to its activities. There is no assurance that the Company will be able to obtain all permits required for exploration, any future development and construction of mining facilities and conduct of mining operations on reasonable terms or that new legislation or modifications to existing legislation, would not have an adverse effect on any exploration or mining project which the Company might undertake. |

C. Organizational Structure

Not Applicable.

D. Property, Plant and Equipment

Data disclosed in this Annual Report on Form 20-F, including sampling, analytical and test data, have been reviewed and verified by the Company’s V.P. of Exploration, Dr. Muzaffer Sultan, Ph.D - Geology and Qualified Person as defined by National Instrument 43-101.

The Company’s mineral property interests in Canada are in good standing and all payments on the properties are up to date, except as noted above under Item 4 A.

None of the Company’s projects have known reserves, and exploration work is exploratory in nature.

Exploration Projects - British Columbia, Ontario and Quebec Properties

The Company has three early-stage exploration properties located in Canada. The Kaslo Property and Kootenay Lithium Project are located in British Columbia, the Phyllis Property is located in Ontario and the Russel Graphite Property is located in Quebec.

15

(1) Phyllis Cobalt Property, OntarioDescription

Located in the Kenora Mining District of Ontario, the property consists of 112 mineral claim units totalling 1,750 hectares in Grummett and Cathcart townships. The property has year-round access 192km northwest of Thunder Bay, ON via Hwy 17 and 9km south on a gravel forestry road.

Geology

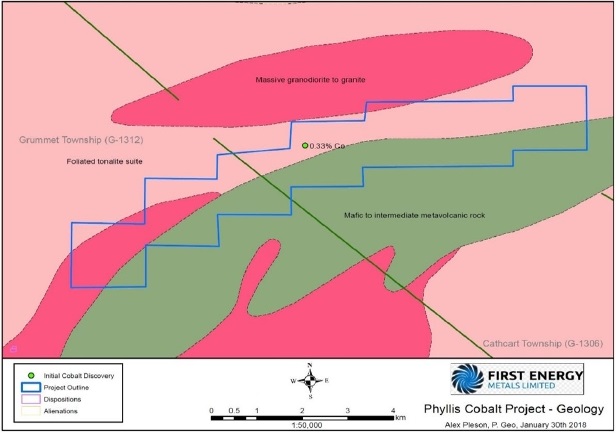

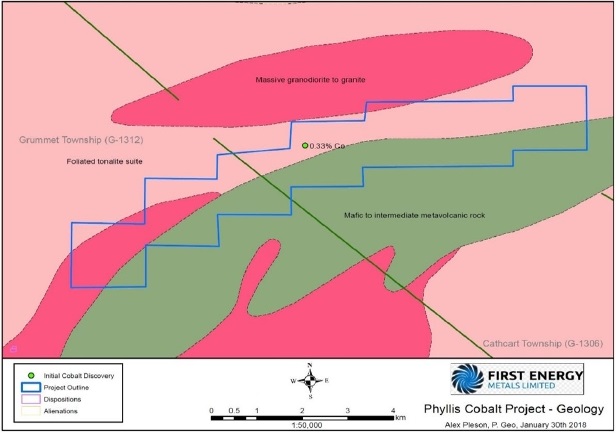

The Phyllis Property claim block occupies the central portion of an ENE-WSW trending greenstone belt, consisting of Mesoarchean to Neoarchean age mafic to ultramafic rocks. These are bound by granite of varying composition -ranging from tonalite to biotite-granodiorite (Atikokan-Lakehead Sheet Map 2065) as shown in Figure 1. Recent mapping undertaken by the Ontario Geological Survey (Gulliver River Sheet, Map 3370), which includes a small portion of the Phyllis claims, suggests that there is a greater abundance of ultramafic metavolcanics than previously indicated. The regional foliation follows the general trend of the greenstone belt.

Mineralization

The initial cobalt discovery was made in 2010 by Don Dobransky, named the “Phyllis Central” occurrence. This discovery is characterized by an 80m x 60m outcrop and appears as a fairly structureless gabbro, with the exception of an array of narrow quartz veins and veinlets, which have sharp contacts with the country rock and trend roughly NE-SW, and appear to have been intruded relatively recently. The gabbro itself is fine-to medium grained and appears highly altered. The exposed outcrop follows the northern flank of a gentle hill. Earlier excavations focussed in the uppermost parts of the topographic profile. The sampling as seen in Figure 2. This worked confirmed the presence of economic grades of cobalt mineralization up to 0.33% Co (including 1.2% Cu and 0.39% Ni).

Assay results from recent drill program in March 2019 for two drill holes had the following results: Drill hole PC-19-02 intersected 12.1m with 0.10% Cobalt (Co), 0.79% Copper (Cu), and 0.08% Nickel (Ni); and the second drill hole PC-19-01 intersected 4.4m with 0.09% Co, 0.54% Cu, 0.16% Ni.

16

(2) Russel Graphite, Quebec

Description

Consists of 30 mineral claims in one contiguous block totaling 1,798.06 hectares land on NTS map 31G13, located in Gatineau area of Quebec Province, approximately 50 kilometres to the north of Ottawa, Canada.

Historical

Historical geological work carried out by Gatineau Graphite Company, during 1916-1919 period, included prospecting and diamond drilling 30 short holes (reference report GM13866). Historical data from North Low showing indicate a bulk sample of 30 tons of rock produced 1,500 kilograms of high quality graphite at 38.18% graphitic carbon (Cg); 3,670 kilograms at 18.10% Cg; and 22,169 kilograms at 4.33%% Cg. Mineralization is mostly associated with irregular bands of graphite along the contact of gabbro dikes in crystalline limestone. It is also found in small graphite veins within gabbroic rocks.

Location and Access

The Property has excellent infrastructure support, is road accessible via Provincial Highway 105 from Ottawa, located 150 kilometres from Montreal; water, power and manpower available locally. Village of North Low is a small community located one kilometers to the east of the Property. It is located in a very active graphite exploration and production area, about 50 kilometres to the southwest of TIMCAL’s Lac des Iles graphite mine in Quebec which is a world class deposit with a production capacity of 25,000 tonnes of graphite annually. There are several other graphite showings and past producing mines in its vicinity.

Geology

The property is underlain by suitable geological environment for flake graphite type mineralization, consisting of

17

Metasedimentary Belt of the Grenville Province which includes quartzofeldspathic rocks, quartzite, biotite gneiss, limestone/marble, gabbro dikes, and plagioclase pyroxene. The graphite mineralization is in the form of bands and irregular veins along the contact of gabbro dikes in the crystalline limestone indicating a skarn type mineralization related to contact metamorphism and metasomatism. There are two main large flake graphite showings on the Property i.e., North Low and Russel showings.

At the Russel showing, the graphite mineralization is in the form of lenticular bands less than 1 metre thick mostly occurring as skarn type deposit at the contact of gabbro and crystalline limestone / dolomite. Historical drilling data indicates 15% Cg of 0.91 m thick (see survey in 28 paper MNR, GM- 13866). Several sections of drill holes completed for water resource down to 245 feet deep (105 feet of overburden) intersected graphite and phlogopite in marble.

Recent exploration work completed in June 2018, included 8 grab mineralized rock samples indicating graphite in the range of 2.73% Cg to 26.90% Cg, with an average 10.96% Cg.

(3) Kaslo Property, British ColumbiaIntroduction

The Kaslo property is without known mineral resources and reserves and previous exploration programs were exploratory in nature. In fiscal 2012, the Company wrote down the value of the property to $nil.

Location and Access

The 4,000-hectare property is located 12 km west of the town of Kaslo in southern British Columbia. Access to the property is via Highway 31A for seven km west from Kaslo, then 4.5 km southwest along Keen Creek Road to the property boundary. The property lies along the Keen Creek Road for approximately 10 km. Logging roads and numerous old mining roads and trails, some of which are heavily overgrown, bisect the property. Power lines come to within 4 km of the property boundary, and water is abundant throughout.

Physiography

Kaslo is located in an area of rugged mountainous terrain. Topography on the property is steep with elevations ranging from 1,050 metres along the Keen Creek valley to 2,200 metres on the Gold Cure ridge.

The Keen Creek valley runs along the northwest boundary of the property, with numerous tributaries crossing the property and emptying into Keen Creek. The major tributaries, from northeast to southwest are Ben Hur, Briggs, Klawala, Kyawats and Desmond Creeks.

History

Kaslo includes nine former, small mines, which were originally discovered and worked for high-grade silver ores during the heyday of the Slocan Mining Camp at the end of the 19th century. Intermittent exploration, development and production have taken place at various locations on the property since that time, most notably in the 1920s and 1950s. The Cork-Province Mine was consolidated in 1914 and was the longest-lived producer in the camp when it closed in 1966. Five former workings, the Silver Bear, Hartford, Gibson, Gold Cure, and Bismark are situated along the Gold Cure Shear zone, which has been traced northeast across the property for 7.1 km. Five additional workings, the Black Bear, Cork, Province, Dublin and Black Fox workings lie along the parallel 4.1 km long Cork Shear zone,

18

located in the Keen Creek valley approximately 1 km north of the Gold Cure Shear zone. Both shears are open along strike to the north and at depth.

Geophysics

Since the Company’s acquisition, the Company has completed 51.7 km of VLF-EM geophysical coverage over the mineralized Cork and Gold Cure Shear zones. The geophysical surveys clearly define the location and extent of the controlling shears, as they are very conductive by nature.

In 1999, a gravity geophysical survey was conducted over the Cork North zone to define which of the several limestone beds have the best potential to host massive sulphide mineralization. Targets generated by the gravity survey have not been drill tested.

Geochemistry

Soil geochemical surveys have been completed over the length of the Cork and Gold Cure Shear zones. Linear trends of anomalous values for silver, lead and zinc in soil have been found running coincident with the shear zones. Occasionally gold, arsenic, cadmium and other elements occur with the silver, lead and zinc anomalies.

Amounts Expensed

Exploration expenses in the five fiscal years ended March 31:

| | | | | | |

| Year | Nuevo

Milenio | Kaslo Silver

Property,

British

Columbia | Kootenay

Lithium,

British

Columbia | Phyllis Cobalt,

Ontario | General

Exploration | Total |

| 2019 | $ Nil | $ Nil | $ 5,038 | $ 119,813 | $ 5,995 | $ 151,846 |

| 2018 | Nil | 260 | 868 | 32,929 | 6,910 | 40,967 |

| 2017 | Nil | 260 | 6,892 | Nil | Nil | 7,152 |

| 2016 | Nil | (1,890) | Nil | Nil | Nil | (1,890) |

| 2015 | 275,778 | 1,465 | Nil | Nil | Nil | 277,243 |

The Company’s sole source of funding has been the issuance of equity securities for cash, primarily through private placements to sophisticated investors and institutions. The Company has issued common shares in each of the past few years, pursuant to private placement financings and the exercise of warrants and options.

| |

| ITEM 4A. | UNRESOLVED STAFF COMMENTS |

Not applicable.

| |

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

Management’s discussion and analysis is presented in relation to the consolidated financial statements of First Energy, which statements are prepared as a going concern in accordance with IFRS.

The Company is a mineral exploration company with no producing properties and consequently has no current operating income or cash flow. All of the Company’s short to medium-term operating and exploration cash flow must be derived from external financing.

The consolidated financial statements referred to in this Annual Report have been prepared in accordance with IFRS issued by the International Accounting Standards Board ("IASB") and Interpretations of the International Financial Reporting Interpretations Committee ("IFRIC"). The policies applied in the consolidated financial statements are based on the IFRS issued and outstanding as at March 31, 2019.

A. Operating Results

Year ended March 31, 2019 compared to year ended March 31, 2018

The net loss for the year ended March 31, 2019 (the “Current Year”) was $673,097 compared to a net loss for the year ended March 31, 2018 (the “Comparative Year”) of $862,352. The decrease in net loss of $189,255 was primarily due to the following:

19

The Company had a $513,600 exploration and evaluation write-down of its Kootenay Lithium Property in the Comparative Year, while the Current Year had $Nil write-downs occurring;

Share-based compensation was $Nil for the Current Year while the Comparative Year had share-based compensation expense of $44,193. The decrease in expense is due to the Company not issuing stock options in the Current Year;

Salaries, fees and benefits decreased by $40,136 to $39,614 in the Current Year from $79,750 in the Comparative Year. The decrease is due primarily to a decrease in salaries being paid to the CEO and CFO;

General administrative decreased by $12,196 from $26,601 in the Comparative Year to $14,405 in the Current Year.

The decreases in net loss noted above were offset by increases in other operating expenses which were consistent with the Company’s activities. Notable increases were realized on the following expense items:

Consulting fees increased by $181,2609 from $57,570 in the Comparative Year to $239,839 in the Current Year. The increase was primarily due to consulting fees incurred with respect to corporate development and potential transactions and acquisitions;

Exploration and evaluations expenditures increased by $110,879 from $40,967 in the Comparative Year to $151,846 in the Current Year. The increase was primarily due to $119,813 of exploration expenditures incurred as part of the Phyllis Cobalt property exploration program; and

Shareholder communications increased by $117,644 from $47,734 in the Comparative Year to $165,378 in the Current Year. The increase was primarily due to costs associated with moving to the Canadian Securities Exchange, the increase of the Company’s online and digital media presence the updating the Company’s website as well as exploring other shareholder communication initiatives.

Year ended March 31, 2018 compared to year ended March 31, 2017

The net loss for the year ended March 31, 2018 (the “Current Year”) was $862,352 compared to a net loss for the year ended March 31, 2017 (the “Comparative Year”) of $356,861. The increase in net loss of $505,491 was primarily due to the following:

Consulting fees increased by $50,720 from $6,850 in the Comparative Year to $57,570 in the Current Year. The increase was primarily due to consulting fees incurred with respect to corporate development and potential transactions and acquisitions;

Exploration and evaluations expenditures increased by $33,815 from $7,152 in the Comparative Year to $40,967 in the Current Year. The increase was primarily due to $32,929 of exploration expenditures incurred as part of the Phyllis Cobalt property exploration program;

Salaries, fees and benefits increased by $23,323 to $80,750 in the Current Year from $57,427 in the Comparative Year. The increase is due primarily to an increase in salaries being paid to the CEO and CFO;

Shareholder communications increased by $8,878 from $38,856 in the Comparative Year to $47,734 in the Current Year. The increase was primarily due to costs associated with the Company’s completion of its share consolidation during the Current Year; and

In the Current Year, the Company had a $513,600 exploration and evaluation write-down of its Kootenay Lithium Property as the Company will not be completing further exploration work on the property and therefore will no longer maintain the property’s mineral claims.

The increases noted above were offset by decreases in other operating expenses which were consistent with the Company’s activities. Notable decreases were realized on the following expense items:

General and administrative decreased by $5,490 from $32,091 in the Comparative Year to $26,601 in the Current Year;

Professional fees decreased by $32,140 from $83,108 in the Comparative Year to $50,968 in the Current Year. The decrease was due primarily to a reduction in legal fees incurred for the Current Year as compared to the Comparative Year; and

Share-based payments decreased by $87,219 from $131,412 in the Comparative Year to $44,193 in the Current Year. The decrease in expense is due to both the Company issuing fewer stock options and the estimated fair value of the stock options granted being lower in the Current Year over the Comparative Year.

The Company’s projects are at the exploration stage and have not yet generated any revenue from production to date.

20

Readers should refer to the notes to the consolidated financial statements for details regarding all the mineral leases and option to joint venture agreements for each of the Company’s properties.

B. Liquidity and Capital Resources

Financial Conditions for the year ended March 31, 2019

The Company’s major source of funding has been the issuance of equity securities for cash, primarily through private placements to sophisticated investors and institutions. The Company has issued common shares during each of the last several years, pursuant to private placement financings and the exercise of warrants and options.

There is no assurance that the Company will be continue to be successful with any financing ventures. Please refer to Item 3 – Key Information – section D - Risk Factors in this document.

At March 31, 2019, the Company had working capital of $107,333 defined as current assets less current liabilities, compared with a working capital of $136,728 at March 31, 2018.

First Energy began the year ended March 31, 2019, with $376,375 in cash. During the year ended March 31, 2019, the Company expended $726,601 on operating activities, net of working capital changes, had net expenditures of $10,000 on investing activities, after recovery of a $10,000 reclamation bond, and generated $577,061 from financing activities which was attributable to $628,752 as net proceeds from share issuances, $24,950 share subscriptions received in advance and less $76,641 in loan repayments, to end at March 31, 2019 with $216,835 in cash.

The Company’s financial statements were prepared using IFRS applicable to a going concern. Several adverse conditions cast substantial doubt on the validity of this assumption – see “Going Concern” disclosure below. The Company holds its cash in bank accounts that earn interest at variable interest rates.

Operations for the year ended March 31, 2019, have been funded primarily from loans and share subscriptions made by insiders, officers and directors and through the issuance of equity.

Capital Resources

As discussed above, at March 31, 2019, the Company’s working capital was $107,333 compared to a working capital deficit of $136,728 at March 31, 2018. The Company’s continued operations are dependent upon the Company’s ability to obtain sufficient financing to carry on planned operations. The Company does not have sufficient working capital to meet its obligations in the ordinary course of business but is attempting to generate sufficient amounts of cash and cash equivalents in the short and long term, to maintain the Company’s operations and meet obligations by reviewing all options including the sale of one or more properties, a joint venture of one or more properties, or an equity financing. The Company will select whichever funding options are available and are in the best interest of the shareholders.

The Company had 17,631,003 common shares issued and outstanding as at March 31, 2019 (March 31, 2018 –12,236,638).

Share Capital

The Company’s continued operations are dependent upon the Company’s ability to obtain sufficient financing to carry on planned operations.

Fiscal 2019 and subsequent to July 30, 2019

On May 7, 2018, the Company issued 140,000 common shares pursuant to the exercise of stock options for total proceeds of $35,000.

On May 30, 2018, the Company issued 100,000 common shares valued at $36,000 pursuant to the Phyllis Agreement towards acquiring a 100% interest the Phyllis Cobalt Property.

On May 30, 2018, the Company issued 75,000 common shares valued at $27,000 pursuant to the Russel Agreement towards acquiring a 100% interest the Russel Graphite Property.

On October 22, 2018, the Company completed a non-brokered private placement, consisting of 3,555,556 non flow-through units (“NFT Units”) and 333,333 flow-through shares (“FT Share”) for gross proceeds of $350,000. Each

21

NFT Unit consists of one non flow-through common share and one transferable non flow-through common share purchase warrant ("Warrant") at a price of $0.09 per NFT Unit. Each Warrant entitles the holder to purchase an additional non flow-through common share of the Company at a price of $0.12 until October 22, 2020. The share purchase warrants were valued using the Black-Scholes pricing model with the following assumptions: weighted average risk-free interest rate of 2.29%, volatility factor of 201.5% and an expected life of two years. Each FT Share consists of one flow-through common share at a price of $0.09 per FT Share.

On December 22, 2018, the Company completed a non-brokered private placement, consisting of 1,190,476 non flow-through common shares for gross proceeds of $250,000. The Company also paid finder’s fees totaling $6,248 cash in connection with a portion of the Placement.

Fiscal 2018

On February 22, 2018, the Company completed a non-brokered private placement for gross proceeds of $500,000 by way issuing 2,666,665 common shares at a price of $0.15 per common share for gross proceeds of $400,000 and issuing an additional 666,665 flow-through shares at a price of $0.15 for gross proceeds $100,000. The Company paid finder’s fees of $11,175 and incurred additional cash share issue costs $22,844.

Fiscal 2017

On January 24, 2017, the Company closed the first and final tranche of its non-brokered private placement with the issuance of 1,189,142 units at a price of $0.35 per unit for gross proceeds of $416,200. Each unit is comprised of one common share of the Company and one non-transferable common share purchase warrant exercisable to purchase one additional common share of the Company at a price of $0.40 for a period of two years expiring January 24, 2019.

On January 4, 2017, the Company issued 20,000 common shares as part of a debt settlement agreement with the Company’s former CFO.

On October 28, 2016, the Company issued 1,200,000 common shares at a value of $0.40 per share pursuant to the Kootenay Agreement as well as issuing finder’s fee totaling 84,000 common shares in regards to the transaction, which amount has also been capitalized as an acquisition cost.

During the year end March 31, 2017, the Company issued 14,000 common shares pursuant the exercise of options at an exercise price of $0.35 per common share for total proceeds of $4,900.

The securities offered have not been registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an available exemption from the registration requirements.

Stock Options

During the year ended March 31, 2019, the Company did not issue any stock options.

During the year ended March 31, 2018, pursuant to the Company’s stock option plan and TSX-V approval, the Company granted 180,000 stock options to directors and officers at an exercise price of $0.25 per share, expiring on July 11, 2022.

During the year ended March 31, 2017, pursuant to the Company’s stock option plan and TSX-V approval, the Company granted 250,000 stock options to directors, officers and consultants of the Company at an exercise price of $0.55 per share, expiring on August 1, 2021.

Financing Activities

The Company estimates that it will require additional financing to carry out its exploration plans and operations through the next twelve months. This could involve joint venture, equity financing, or other forms of financing.

Going Concern