Exhibit 99.01

Exhibit 99.01

Forward Looking Statements

Statements in this Press Release relating to plans, strategies, economic performance and trends, projections of results of specific activities or investments, expectations or beliefs about future events or results, and other statements that are not descriptions of historical facts, may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking information is inherently subject to risks and uncertainties, and actual results could differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, risk factors discussed in the Company’s Annual Report on Form 10-K and in other documents filed by the Company with the Securities and Exchange Commission from time to time. Forward-looking statements may be identified by terms such as “may”, “will”, “should”, “could”, “expects”, “plans”, “intends”, “anticipates”, “believes”, “estimates”, “predicts”, “forecasts”, “potential” or “continue,” or similar terms or the negative of these terms, or other statements concerning opinions or judgments of the Company’s management about future events. Factors that could influence the accuracy of such forward-looking statements include, but are not limited to pressures on the earnings, capital and liquidity of financial institutions in general, resulting from current and future conditions in the credit and equity markets, the financial success or changing strategies of the Company’s customers, actions of government regulators, the level of market interest rates, weather and similar conditions, particularly the effect of hurricanes on the Company’s banking and operations facilities and on the Company’s customers and the communities in which it does business, changes in general economic conditions and the real estate values in our banking market (particularly changes that affect our loan portfolio, the abilities of our borrowers to repay their loans, and the values of loan collateral). Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievements. All forward-looking statements attributable to the Company are expressly qualified in their entirety by the cautionary statements in this paragraph. The Company has no obligations, and does not intend to update these forward-looking statements. 2

Corporate Headquarters

Engelhard, North Carolina

Circa 1920

2009

Overview

Who are we

Business Strategy & Growth Opportunities

Financial Highlights

Building Shareholder Value

Summary

5

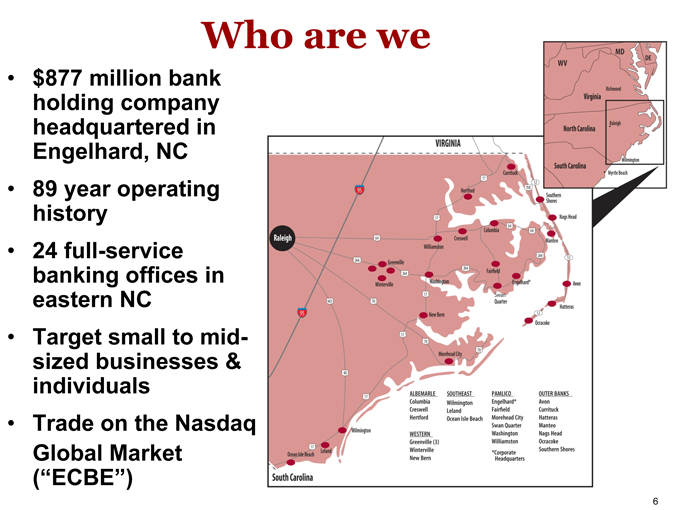

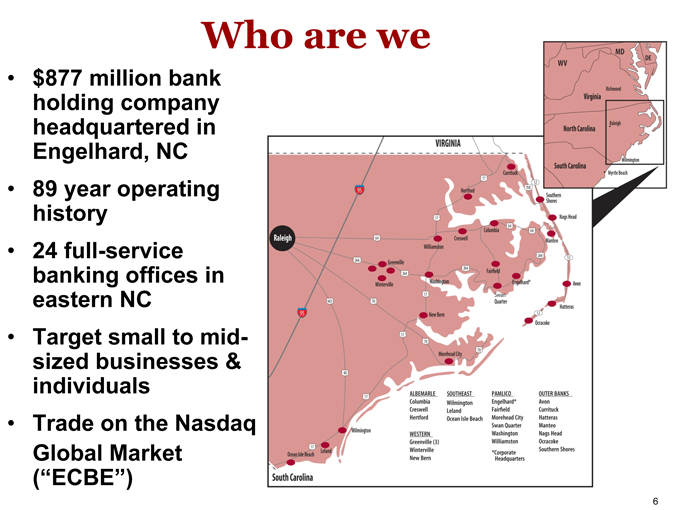

Who are we

$877 million bank holding company headquartered in Engelhard, NC

89 year operating history

24 full-service banking offices in eastern NC

Target small to mid-sized businesses & individuals

Trade on the Nasdaq Global Market (“ECBE”)

6

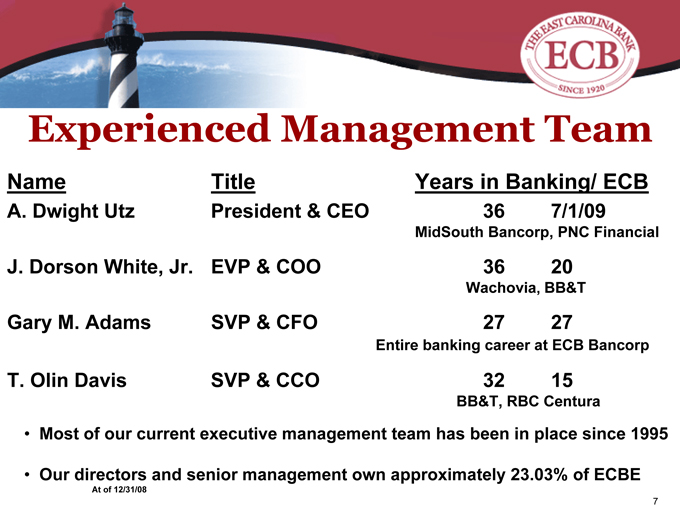

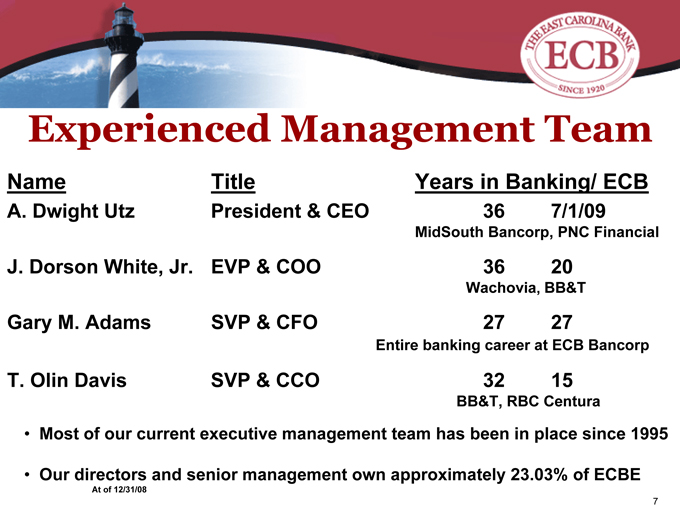

Experienced Management Team

Name A. Dwight Utz

J. Dorson White, Jr. Gary M. Adams T. Olin Davis

Title

President & CEO EVP & COO SVP & CFO SVP & CCO

Years in Banking/ ECB

36 7/1/09

MidSouth Bancorp, PNC Financial

36 20

Wachovia, BB&T

27 27

Entire banking career at ECB Bancorp

32 15

BB&T, RBC Centura

Most of our current executive management team has been in place since 1995

Our directors and senior management own approximately 23.03% of ECBE

At of 12/31/08

7

Business Strategy & Growth Opportunities

8

Business Strategy

Grow market share in existing markets

Grow through de novo branching and select acquisitions

Expand our product and services to meet the needs of customers and communities

Maintain strong asset quality, strong capital and prudent reserves

Brand the Logo ECB: Excellence in Community Banking

9

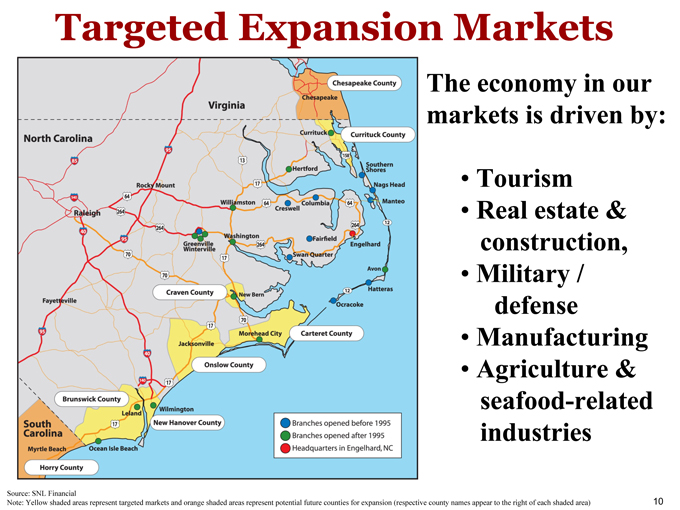

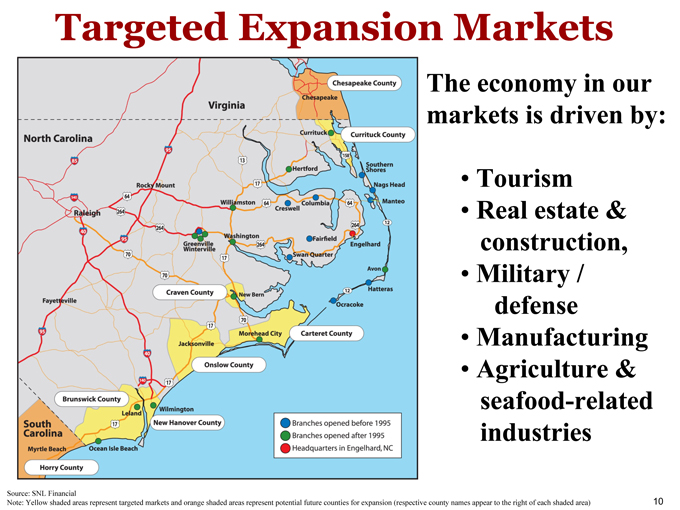

Targeted Expansion Markets

The economy in our markets is driven by:

Tourism

Real estate & construction,

Military / defense

Manufacturing

Agriculture & seafood-related industries

Source: SNL Financial 10 Note: Yellow shaded areas represent targeted markets and orange shaded areas represent potential future counties for expansion (respective county names appear to the right of each shaded area)

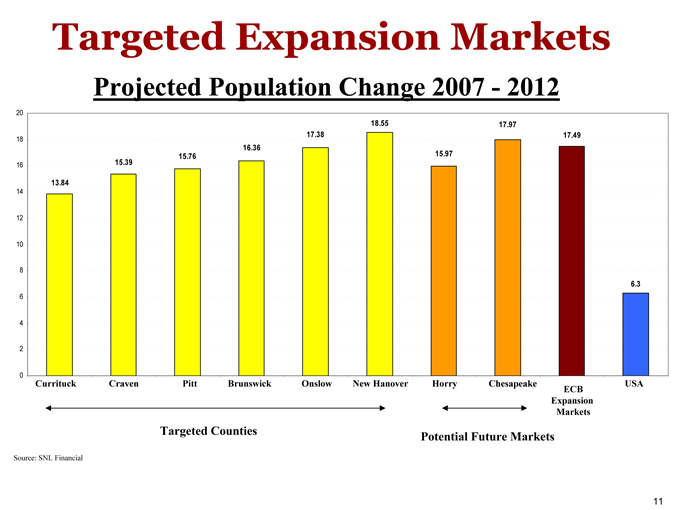

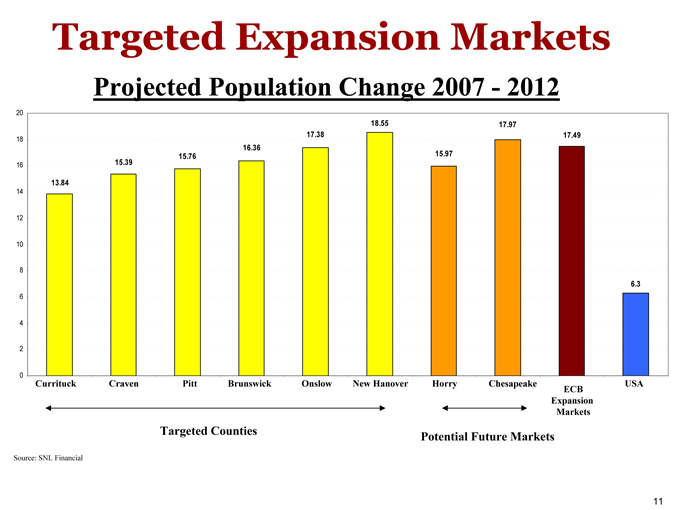

Targeted Expansion Markets

Projected Population Change 2007 - 2012

20 18 16 14 12 10 8 6 4 2 0

13.84

15.39

15.76

16.36

17.38

18.55

15.97

17.97

17.49

6.3

Currituck Craven Pitt Brunswick Onslow New Hanover Horry Chesapeake USA

ECB

Expansion Markets

Targeted Counties

Potential Future Markets

Source: SNL Financial

11

De Novo Expansion Strategy

We pursue expansion in high growth markets contiguous to our current franchise and generally open a LPO prior to a full-service branch

We seek opportunities to secure seasoned bankers with strong market knowledge, experience, and contacts

2009 One (1) branch under construction (Porters Neck: 2010

- New Hanover County)

2008 One (1) additional branch opened (Leland: 3Q’08)

2007 Three (3) additional branches opened {Greenville (2) and Ocean Isle Beach}

Two (2) Loan Production Offices (LPO) opened {Grandy (Currituck County) and Leland (Brunswick County)}

12

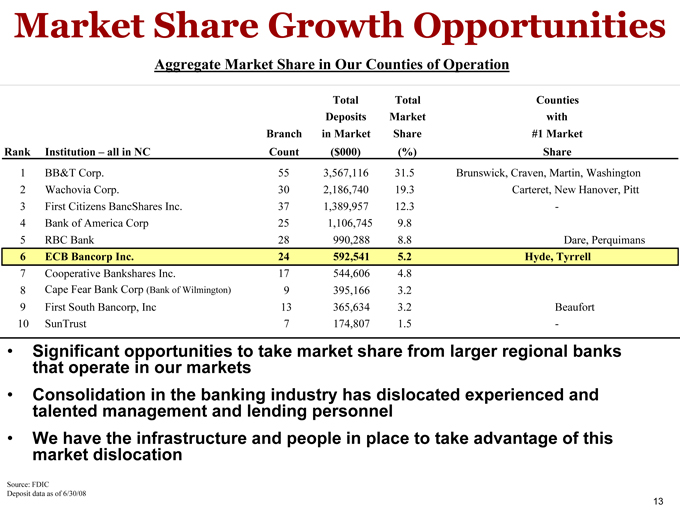

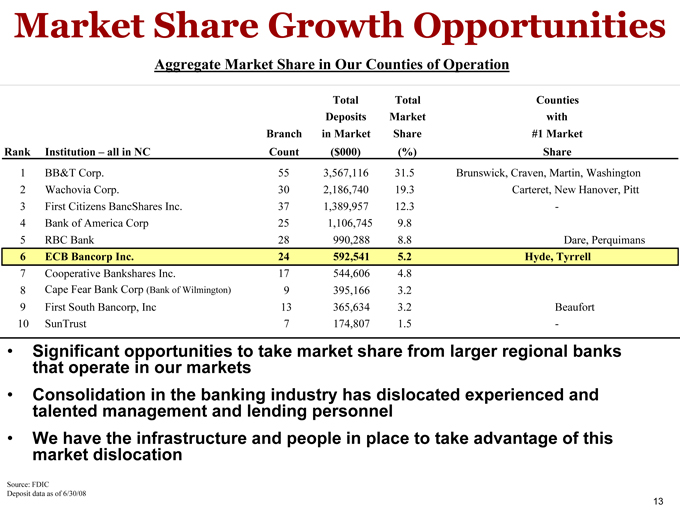

Market Share Growth Opportunities

Aggregate Market Share in Our Counties of Operation

Total Total Counties

Deposits Market with

Branch in Market Share #1 Market

Rank Institution – all in NC Count ($000) (%) Share

1 BB&T Corp. 55 3,567,116 31.5 Brunswick, Craven, Martin, Washington

2 Wachovia Corp. 30 2,186,740 19.3 Carteret, New Hanover, Pitt

3 First Citizens BancShares Inc. 37 1,389,957 12.3 -

4 Bank of America Corp 25 1,106,745 9.8

5 RBC Bank 28 990,288 8.8 Dare, Perquimans

6 ECB Bancorp Inc. 24 592,541 5.2 Hyde, Tyrrell

7 Cooperative Bankshares Inc. 17 544,606 4.8

8 Cape Fear Bank Corp (Bank of Wilmington) 9 395,166 3.2

9 First South Bancorp, Inc 13 365,634 3.2 Beaufort

10 SunTrust 7 174,807 1.5 -

Significant opportunities to take market share from larger regional banks that operate in our markets

Consolidation in the banking industry has dislocated experienced and talented management and lending personnel

We have the infrastructure and people in place to take advantage of this market dislocation

Source: FDIC

Deposit data as of 6/30/08 13

Financial Highlights

14

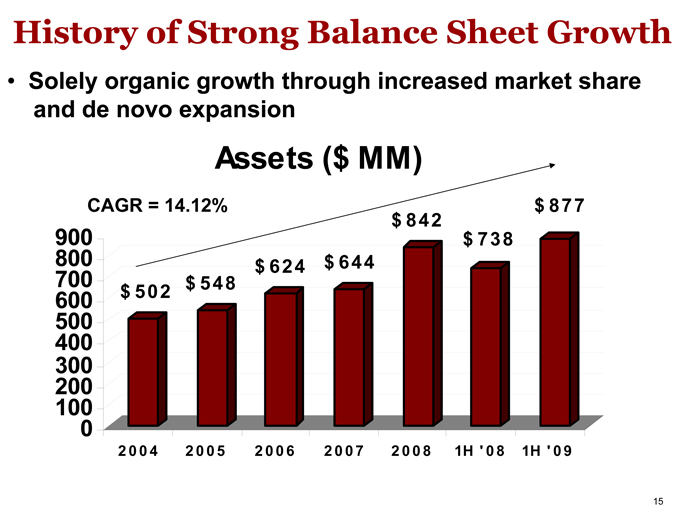

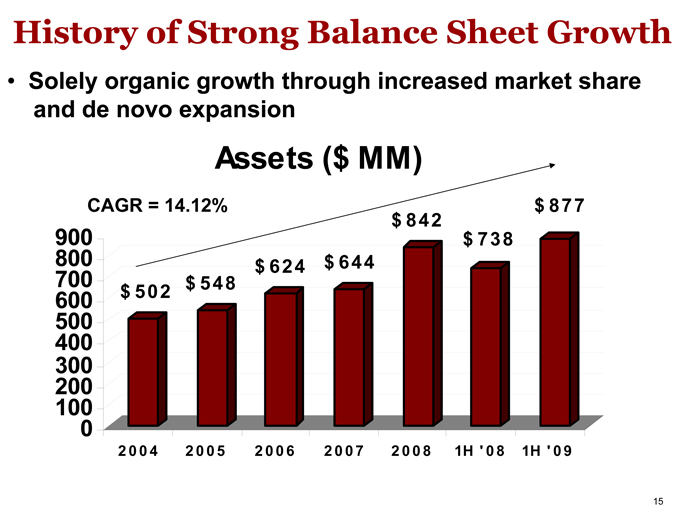

History of Strong Balance Sheet Growth

Solely organic growth through increased market share and de novo expansion

Assets ($ MM)

CAGR = 14.12%

$ 502

$ 548

$ 624

$ 644

$ 842

$ 738

$ 877

900 800 700 600 500 400 300 200 100 0

2004 2005 2006 2007 2008 1H ‘ 08 1H ‘ 09

15

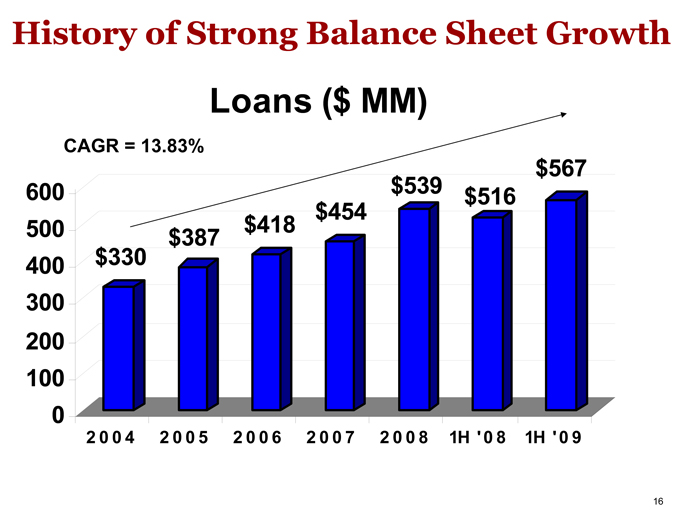

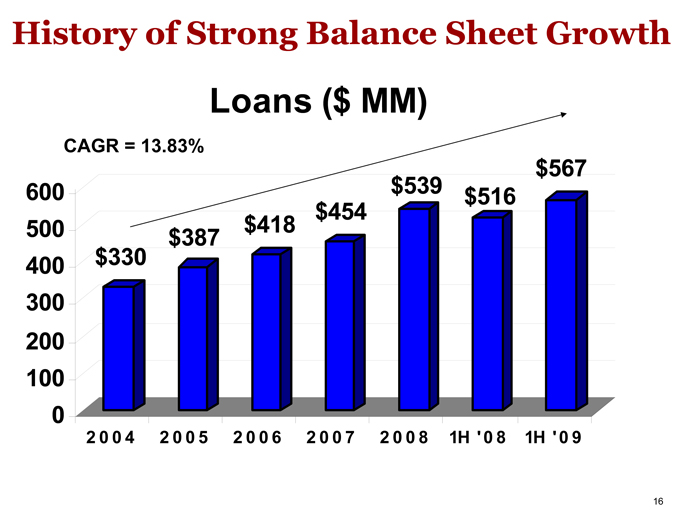

History of Strong Balance Sheet Growth

Loans ($ MM)

CAGR = 13.83%

$330

$387

$418

$454

$539

$516

$567

600 500 400 300 200 100 0

2004 2005 2006 2007 2008 1H ‘ 08 1H ‘ 09

16

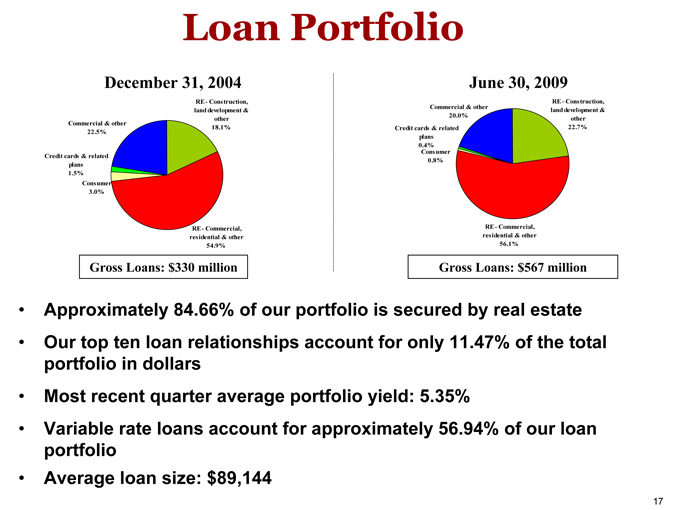

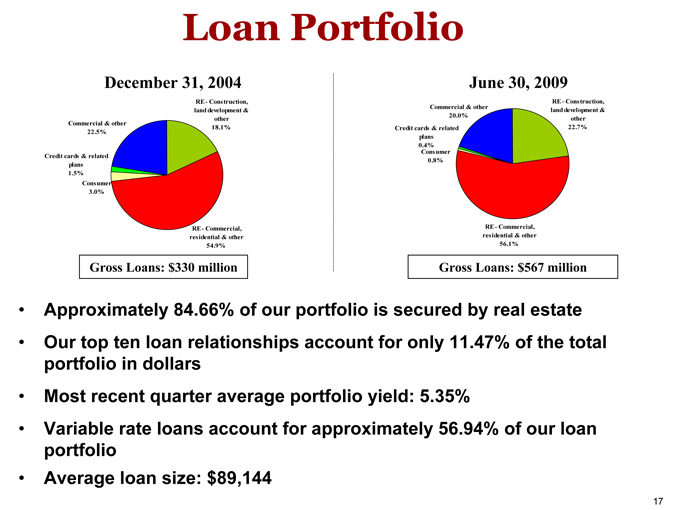

Loan Portfolio

December 31, 2004

RE - Construction, land development & other Commercial & other 18.1% 22.5%

Credit cards & related plans 1.5% Consumer 3.0%

RE - Commercial, residential & other 54.9%

Gross Loans: $330 million

June 30, 2009

Commercial & other RE - Construction, 20.0% land development & other Credit cards & related 22.7% plans 0.4% Consumer 0.8%

RE - Commercial, residential & other 56.1%

Gross Loans: $567 million

Approximately 84.66% of our portfolio is secured by real estate

Our top ten loan relationships account for only 11.47% of the total portfolio in dollars

Most recent quarter average portfolio yield: 5.35%

Variable rate loans account for approximately 56.94% of our loan portfolio

Average loan size: $89,144

17

Loan Totals By Region

Southeast Region

13.0%

OBX Region

28.2%

Western Region

21.9%

Pamlico Region

21.4%

Albemarle Region

15.5%

18

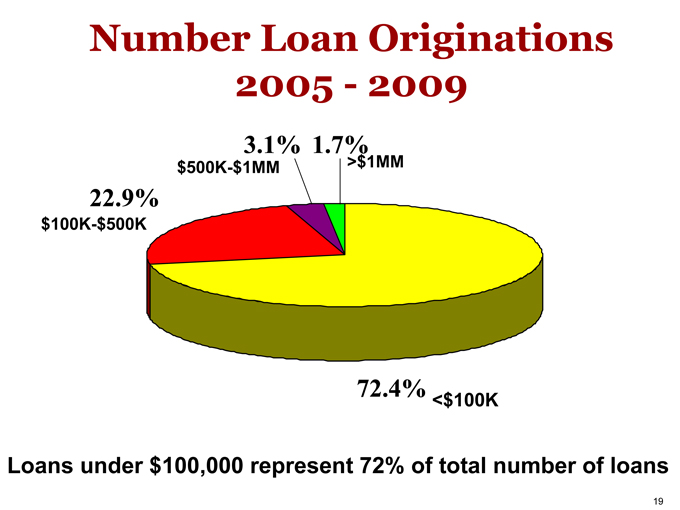

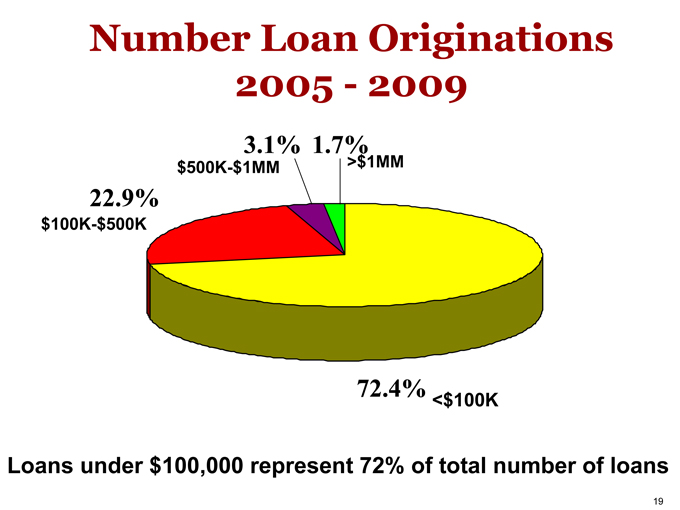

Number Loan Originations 2005 - 2009

3.1% 1.7%

$500K-$1MM >$1MM

22.9%

$100K-$500K

72.4%

<$100K

Loans under $100,000 represent 72% of total number of loans

19

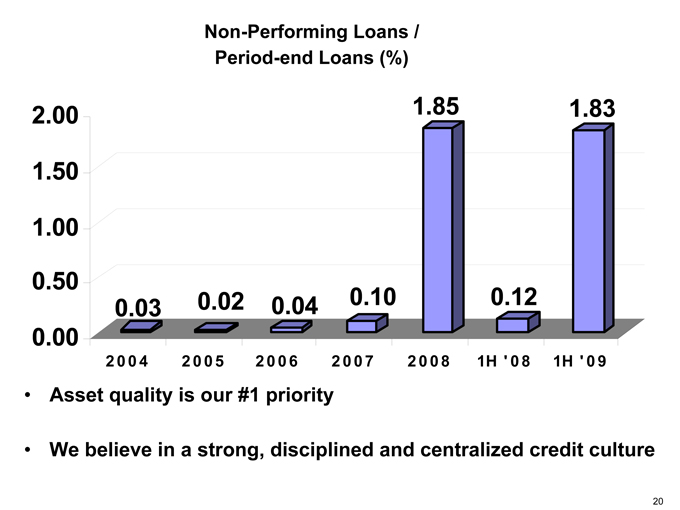

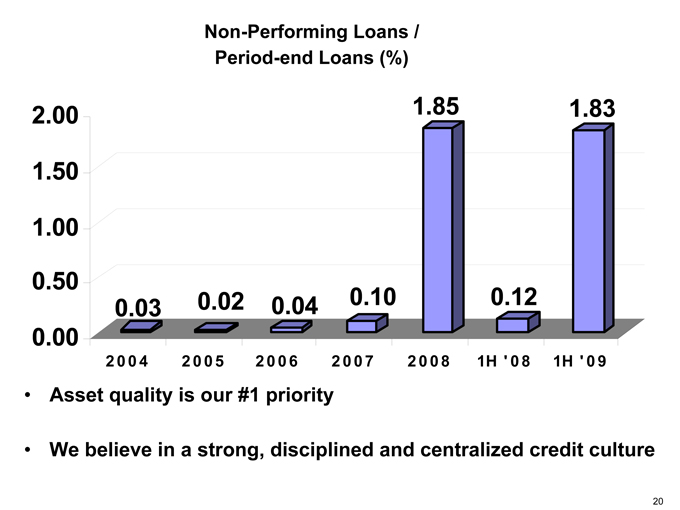

Non-Performing Loans / Period-end Loans (%)

1.85 1.83

0.02 0.04 0.10 0.12 0.03

2004 2005 2006 2007 2008 1H ‘ 08 1H ‘ 09

2.00 1.50 1.00 0.50 0.00

Asset quality is our #1 priority

We believe in a strong, disciplined and centralized credit culture

20

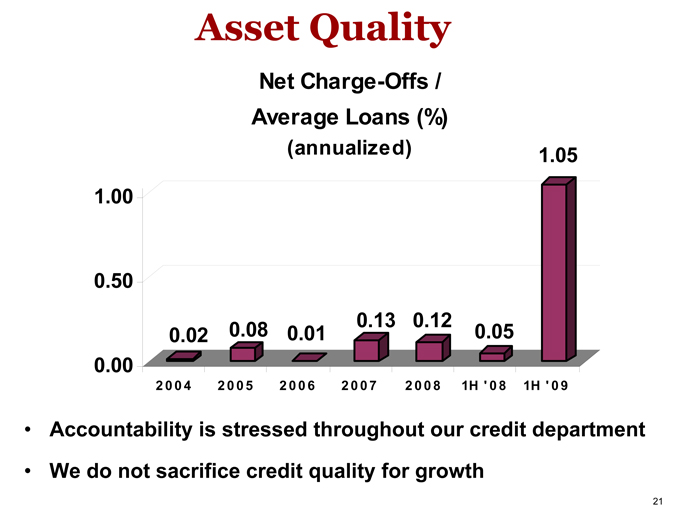

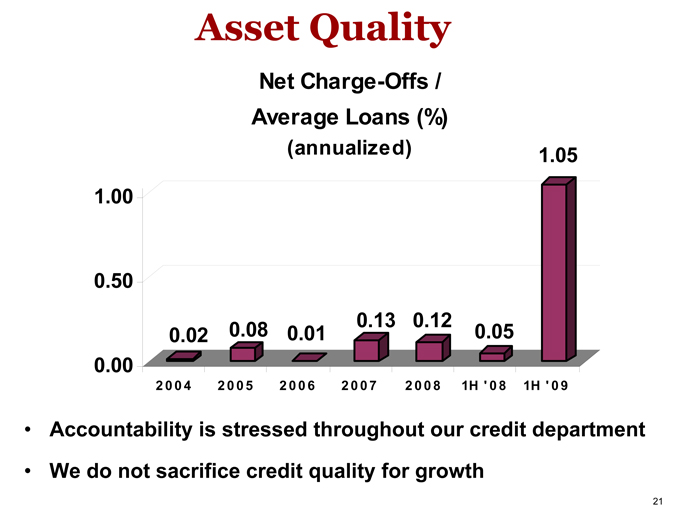

Asset Quality

Net Charge-Offs / Average Loans (%) (annualized)

0.02

0.08

0.01

0.13

0.12

0.05

1.05

1.00 0.50 0.00

2004 2005 2006 2007 2008 1H ‘ 08 1H ‘ 09

Accountability is stressed throughout our credit department

We do not sacrifice credit quality for growth

21

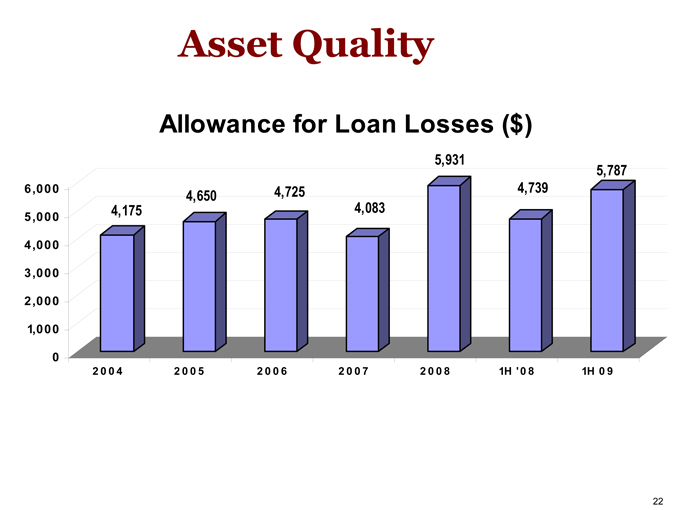

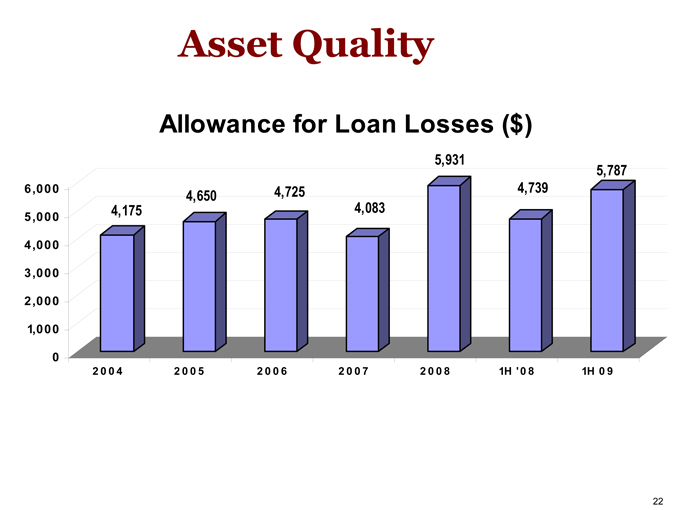

Asset Quality

Allowance for Loan Losses ($)

6,000 5,000 4,000 3,000 2,000 1,000 0

4,175

4,650

4,725

4,083

5,931

4,739

5,787

2004 2005 2006 2007 2008 1H ‘08 1H 09

22

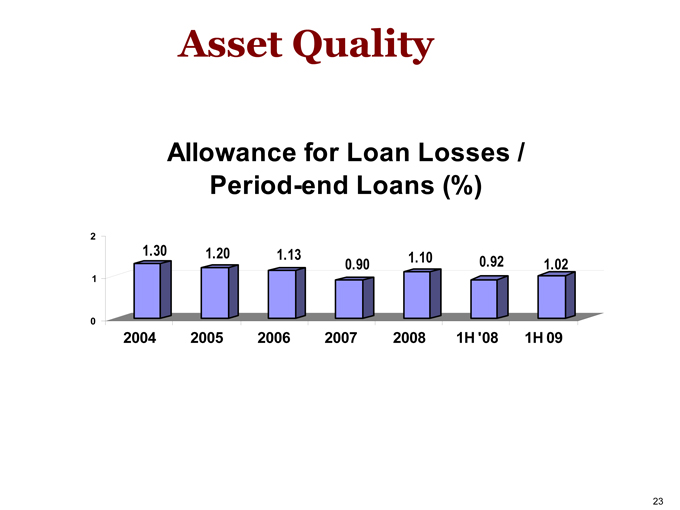

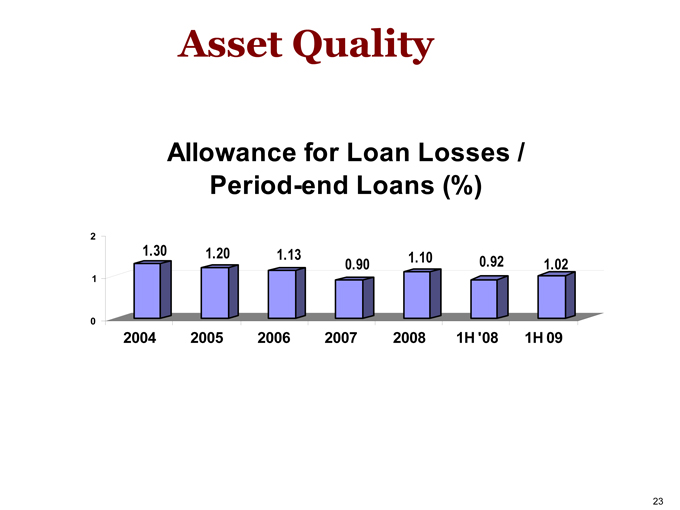

Asset Quality

Allowance for Loan Losses / Period-end Loans (%)

1.30

1.20

1.13

1.10

0.90

0.92

1.02

2 1 0

2004 2005 2006 2007 2008 1H ‘08 1H 09

23

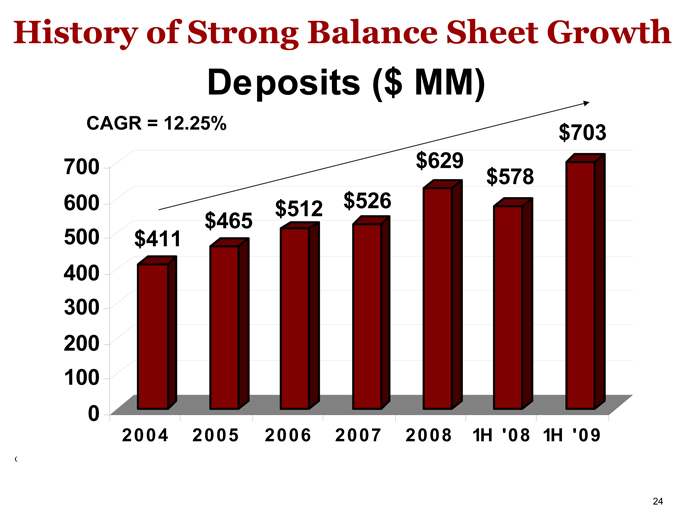

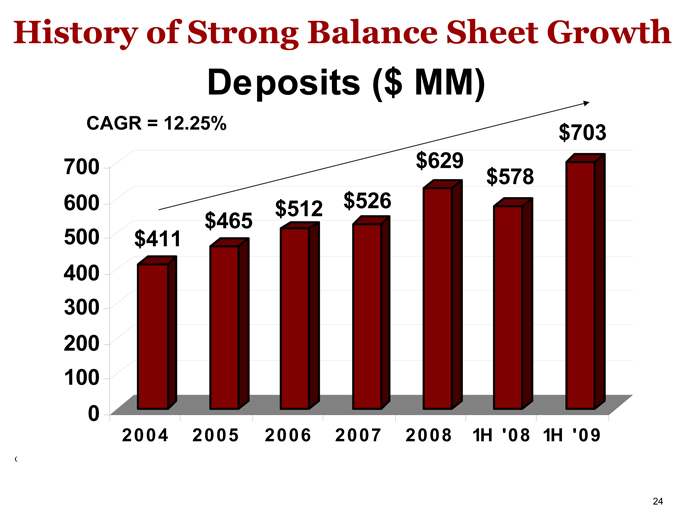

History of Strong Balance Sheet Growth

Deposits ($ MM)

CAGR = 12.25%

700 600 500 400 300 200 100 0

$411

$465

$512

$526

$629

$578

$703

2004 2005 2006 2007 2008 1H ‘08 1H ‘09

24

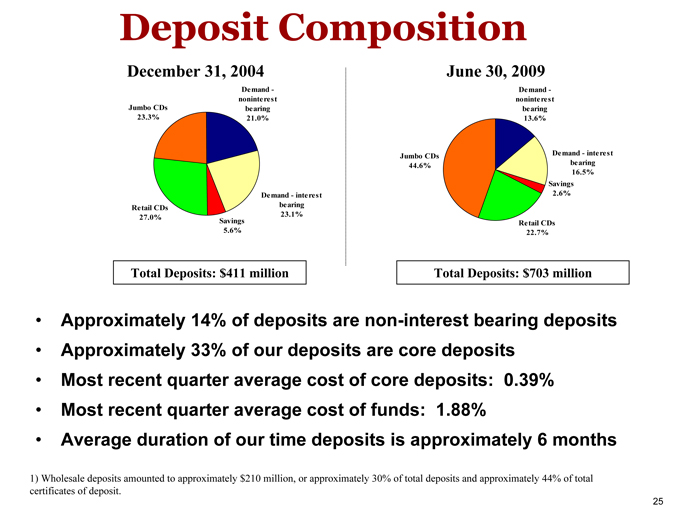

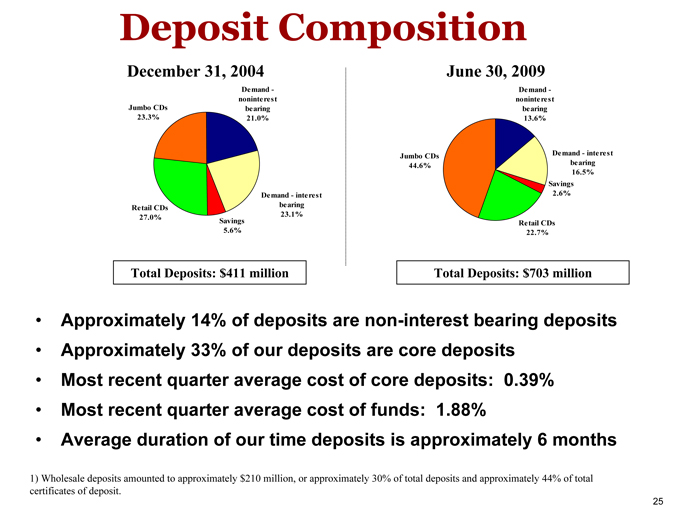

Deposit Composition

December 31, 2004

Demand - noninterest Jumbo CDs bearing 23.3% 21.0%

Demand - interest Retail CDs bearing 27.0% Savings 23.1% 5.6%

Total Deposits: $411 million

June 30, 2009

Demand - noninterest bearing

13.6%

Jumbo CDs Demand—interest

44.6% bearing

16.5% Savings 2.6%

Retail CDs

22.7%

Total Deposits: $703 million

Approximately 14% of deposits are non-interest bearing deposits

Approximately 33% of our deposits are core deposits

Most recent quarter average cost of core deposits: 0.39%

Most recent quarter average cost of funds: 1.88%

Average duration of our time deposits is approximately 6 months

1) Wholesale deposits amounted to approximately $210 million, or approximately 30% of total deposits and approximately 44% of total certificates of deposit.

25

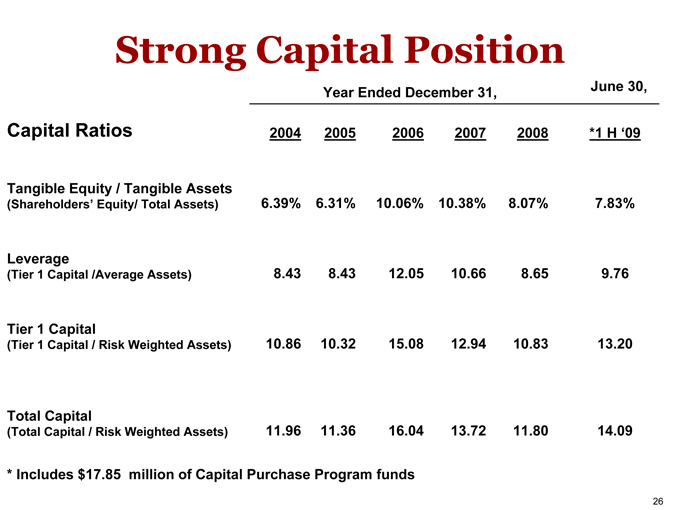

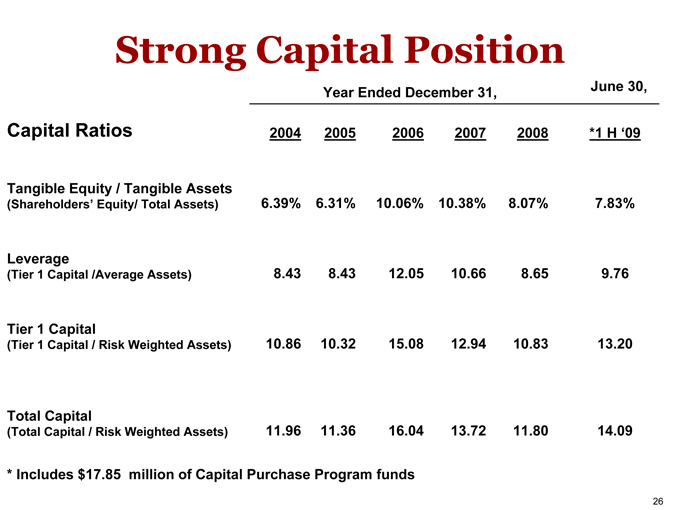

Strong Capital Position

Year Ended December 31, June 30,

Capital Ratios 2004 2005 2006 2007 2008 *1 H ‘09

Tangible Equity / Tangible Assets

(Shareholders’ Equity/ Total Assets) 6.39% 6.31% 10.06% 10.38% 8.07% 7.83%

Leverage

(Tier 1 Capital /Average Assets) 8.43 8.43 12.05 10.66 8.65 9.76

Tier 1 Capital

(Tier 1 Capital / Risk Weighted Assets) 10.86 10.32 15.08 12.94 10.83 13.20

Total Capital

(Total Capital / Risk Weighted Assets) 11.96 11.36 16.04 13.72 11.80 14.09

* Includes $17.85 million of Capital Purchase Program funds

26

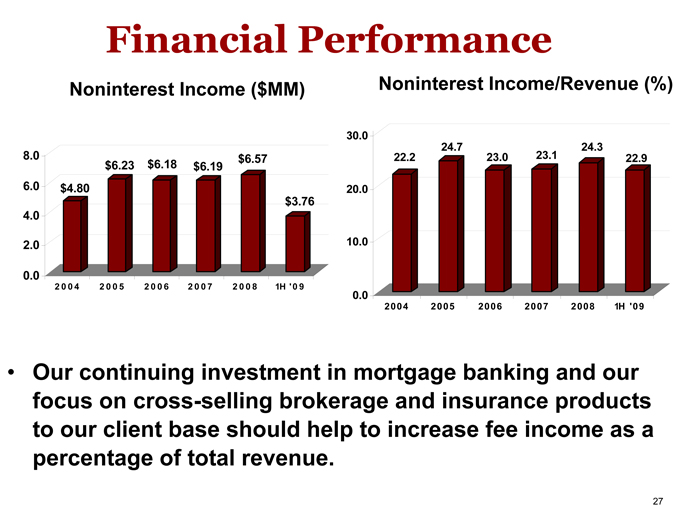

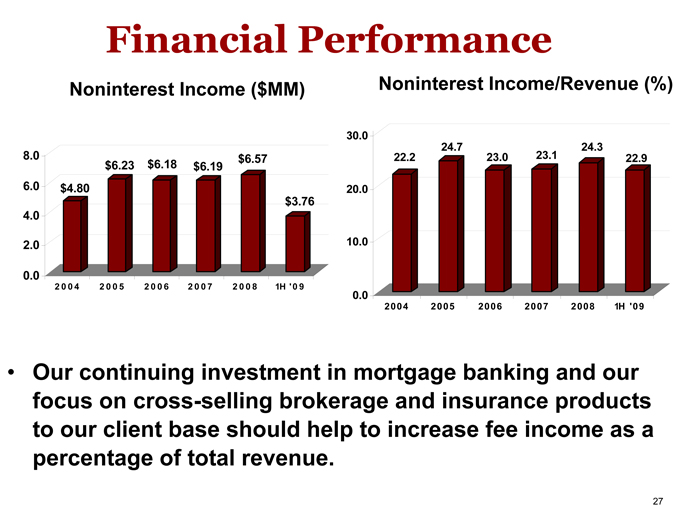

Financial Performance

Noninterest Income ($MM)

Noninterest Income/Revenue (%)

8.0 6.0 4.0 2.0 0.0

$4.80

$6.23

$6.18

$6.19

$6.57

$3.76

30.0 20.0 10.0 0.0

2004 2005 2006 2007 2008 1H ‘09

22.2

24.7

23.0

23.1

24.3

22.9

2004 2005 2006 2007 2008 1H ‘09

Our continuing investment in mortgage banking and our focus on cross-selling brokerage and insurance products to our client base should help to increase fee income as a percentage of total revenue.

27

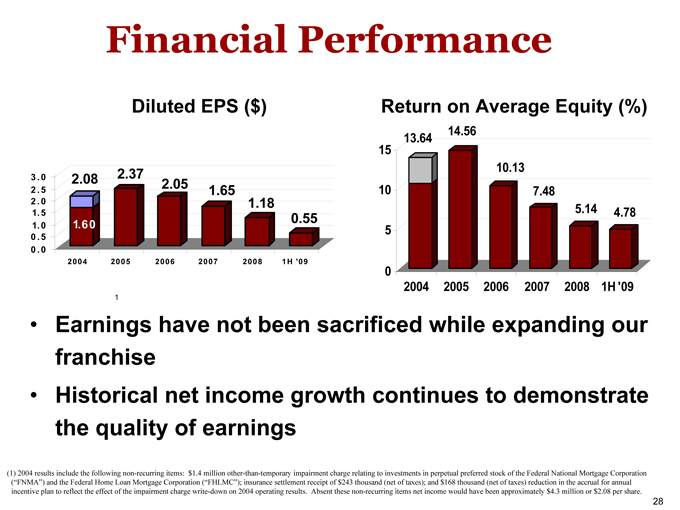

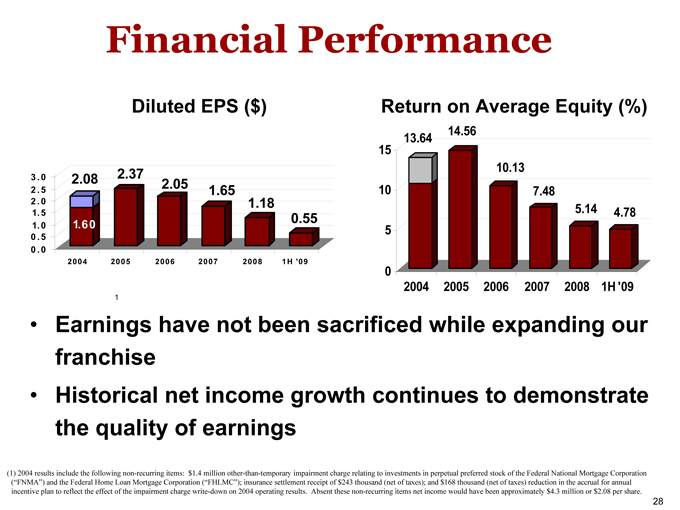

Financial Performance

Diluted EPS ($)

3.0 2.08 2.37 2.05

2.5 1.65

2.0 1.18

1.5 0.55

1.0 1.60

0.5

0.0

2004 2005 2006 2007 2008 1H ‘09

Return on Average Equity (%)

13.64 14.56

15

10.13

10 7.48

5.14 4.78

5

0

2004 2005 2006 2007 2008 1H ‘09

Earnings have not been sacrificed while expanding our franchise

Historical net income growth continues to demonstrate the quality of earnings

(1) 2004 results include the following non-recurring items: $1.4 million other-than-temporary impairment charge relating to investments in perpetual preferred stock of the Federal National Mortgage Corporation (“FNMA”) and the Federal Home Loan Mortgage Corporation (“FHLMC”); insurance settlement receipt of $243 thousand (net of taxes); and $168 thousand (net of taxes) reduction in the accrual for annual incentive plan to reflect the effect of the impairment charge write-down on 2004 operating results. Absent these non-recurring items net income would have been approximately $4.3 million or $2.08 per share.

28

Building Shareholder Value

29

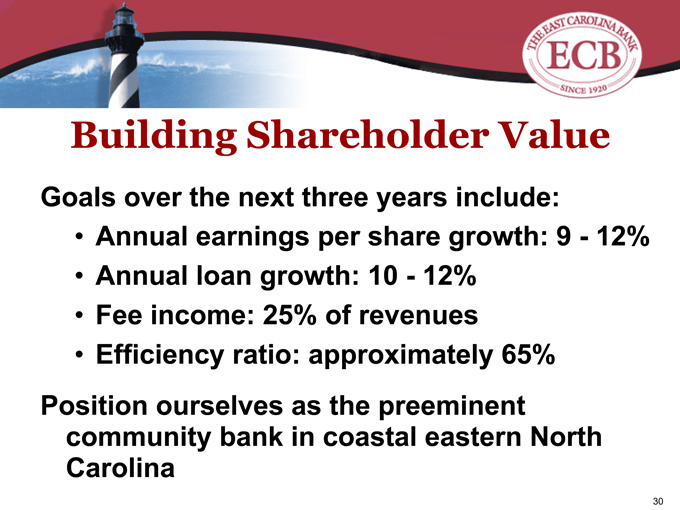

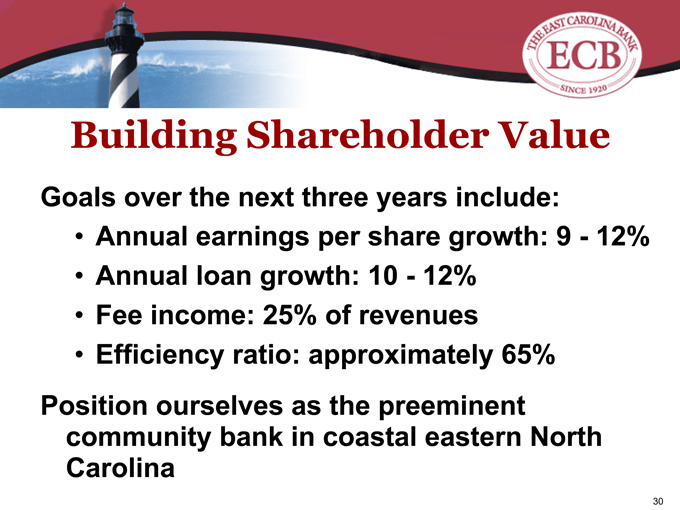

Building Shareholder Value

Goals over the next three years include:

Annual earnings per share growth: 9 - 12%

Annual loan growth: 10 - 12%

Fee income: 25% of revenues

Efficiency ratio: approximately 65% Position ourselves as the preeminent community bank in coastal eastern North Carolina

30

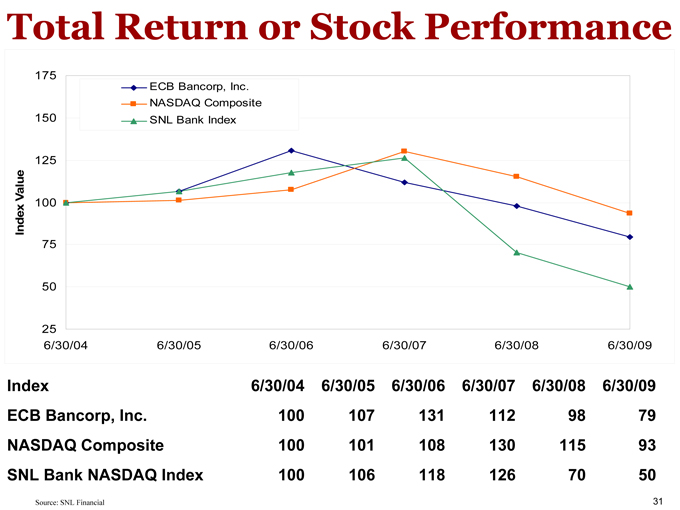

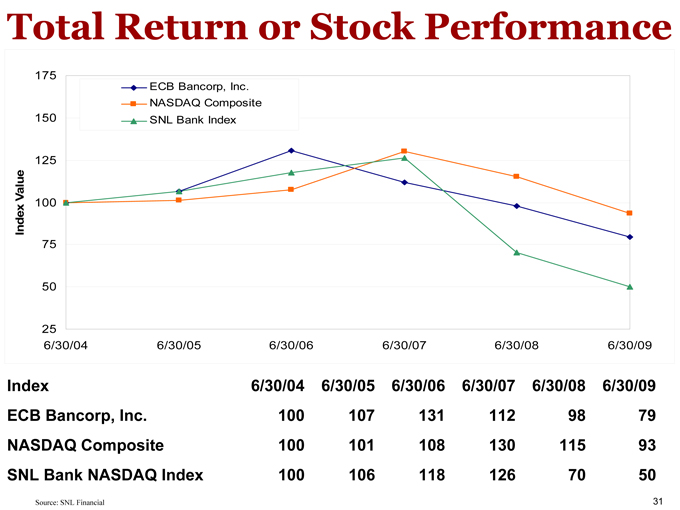

Total Return or Stock Performance

175

ECB Bancorp, Inc.

NASDAQ Composite

150 SNL Bank Index

125

Value 100

Index

75

50

25

6/30/04 6/30/05 6/30/06 6/30/07 6/30/08 6/30/09

Index 6/30/04 6/30/05 6/30/06 6/30/07 6/30/08 6/30/09

ECB Bancorp, Inc. 100 107 131 112 98 79

NASDAQ Composite 100 101 108 130 115 93

SNL Bank NASDAQ Index 100 106 118 126 70 50

Source: SNL Financial 31

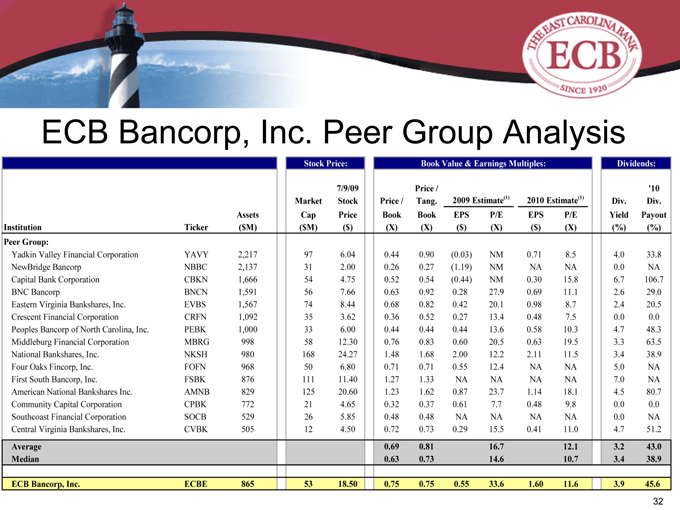

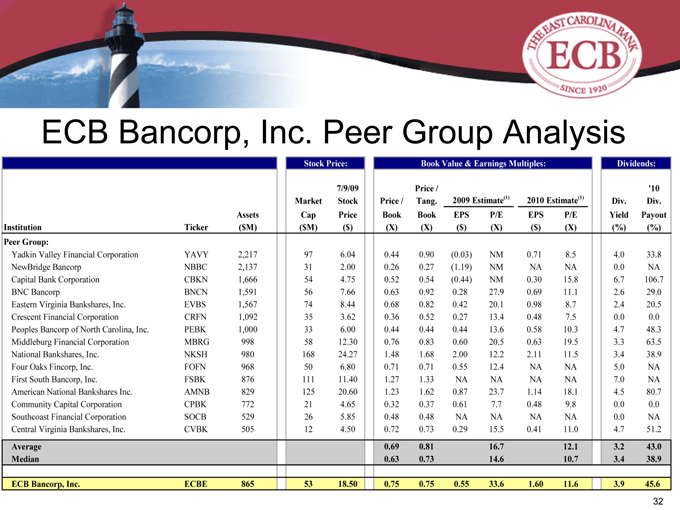

ECB Bancorp, Inc. Peer Group Analysis

Institution Peer Group:

Yadkin Valley Financial Corporation

NewBridge Bancorp

Capital Bank Corporation BNC Bancorp

Eastern Virginia Bankshares, Inc.

Crescent Financial Corporation

Peoples Bancorp of North Carolina, Inc.

Middleburg Financial Corporation

National Bankshares, Inc.

Four Oaks Fincorp, Inc.

First South Bancorp, Inc.

American National Bankshares Inc.

Community Capital Corporation

Southcoast Financial Corporation

Central Virginia Bankshares, Inc. Average

Median ECB Bancorp, Inc.

Ticker YAVY NBBC CBKN BNCN EVBS CRFN PEBK MBRG NKSH FOFN FSBK AMNB CPBK SOCB CVBK ECBE Assets

($M) 2,217 2,137 1,666 1,591 1,567 1,092 1,000 998 980 968 876 829 772 529 505 865 Market Cap ($M)

97 31 54 56 74 35 33 58 168 50 111 125 21 26 12 53 Stock Price: 7/9/09

Stock Price ($) 6.04 2.00 4.75 7.66 8.44 3.62 6.00 12.30 24.27 6.80 11.40 20.60 4.65 5.85 4.50 18.50

Price / Book (X) 0.44 0.26 0.52 0.63 0.68 0.36 0.44 0.76 1.48 0.71 1.27 1.23 0.32 0.48 0.72 0.69 0.63 0.75

Book Value & Earnings Multiples: Price / Tang. Book

(X) 0.90 0.27 0.54 0.92 0.82 0.52 0.44 0.83 1.68 0.71 1.33 1.62 0.37 0.48 0.73 0.81 0.73 0.75

2009 Estimate(1) EPS ($) (0.03) (1.19) (0.44) 0.28 0.42 0.27 0.44 0.60 2.00 0.55 NA 0.87 0.61 NA 0.29 0.55 P/E (X) NM NM NM 27.9 20.1

13.4 13.6 20.5 12.2 12.4 NA 23.7 7.7 NA 15.5 16.7 14.6 33.6

2010 Estimate(1) EPS ($) 0.71 NA 0.30 0.69 0.98 0.48 0.58 0.63 2.11 NA NA 1.14 0.48 NA 0.41 1.60 P/E (X) 8.5 NA 15.8 11.1 8.7 7.5 10.3 19.5 11.5

NA NA 18.1 9.8 NA 11.0 12.1 10.7 11.6

Dividends: Div. Yield (%) 4.0 0.0 6.7 2.6 2.4 0.0 4.7 3.3 3.4 5.0 7.0 4.5 0.0 0.0 4.7 3.2 3.4 3.9

‘10 Div. Payout (%) 33.8 NA 106.7 29.0 20.5 0.0 48.3 63.5 38.9 NA NA 80.7 0.0 NA 51.2 43.0 38.9 45.6

32

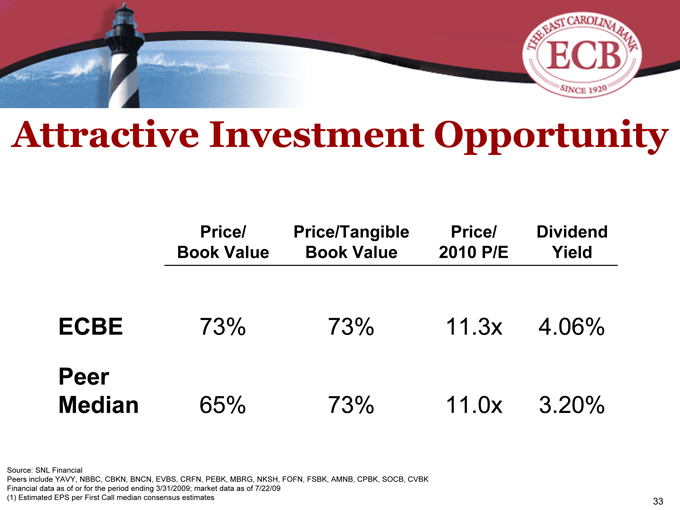

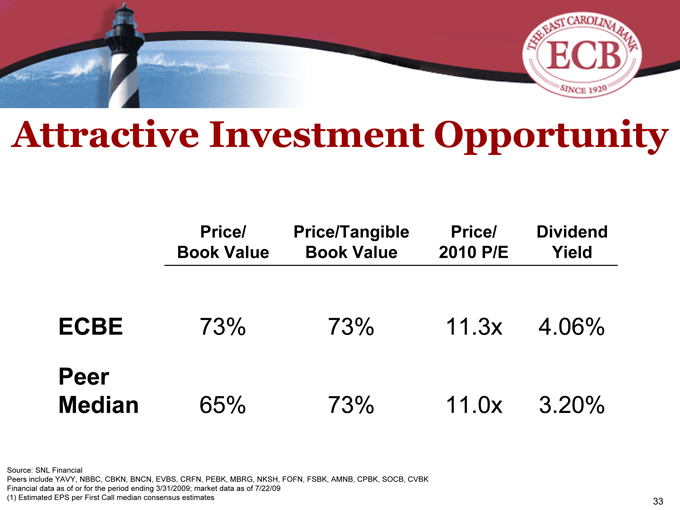

Attractive Investment Opportunity

Price/ Price/Tangible Price/ Dividend

Book Value Book Value 2010 P/E Yield

ECBE 73% 73% 11.3x 4.06%

Peer

Median 65% 73% 11.0x 3.20%

Source: SNL Financial

Peers include YAVY, NBBC, CBKN, BNCN, EVBS, CRFN, PEBK, MBRG, NKSH, FOFN, FSBK, AMNB, CPBK, SOCB, CVBK Financial data as of or for the period ending 3/31/2009; market data as of 7/22/09

(1) Estimated EPS per First Call median consensus estimates 33

Summary

34

Summary

Experienced management team

Attractive branch footprint

Strong balance sheet/ quality growth

Record of excellent asset quality

Solid financial performance/consistent dividend

Attractive valuation

35

ECB Contacts

President & CEO A. Dwight Utz

(252) 925-9411, ext. 55509 (252) 925-8491 – Fax Dwight.Utz@ecbbancorp.com

Chief Financial Officer & SVP Gary M. Adams (252) 925-5525 (252) 925-8491 – Fax Gary.Adams@ecbbancorp.com

Chief Operating Officer & EVP J. Dorson White, Jr. (252) 925-9411, ext. 53300 (252) 925-8491 – Fax Dorson.White@ecbbancorp.com

Chief Credit Officer & SVP T. Olin Davis (252) 925-5472 (252) 925-8491 – Fax Olin.Davis@ecbbancorp.com

Chief Risk Officer & SVP Thomas B. Heggie III (252) 925-5508 (252) 925-8491 – Fax Tom.Heggie@ecbbancorp.com

36

Member FDIC

37