UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| | | | | | | | |

| ☒ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | | | | |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission file number 1-3932

WHIRLPOOL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | 38-1490038 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

| | | |

| 2000 North M-63 | | |

| Benton Harbor, | Michigan | | 49022-2692 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code (269) 923-5000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $1 per share | | WHR | | Chicago Stock Exchange | and | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: NONE

| | | | | | | | | | | | | | |

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes | ☒ | No | ☐ |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. | Yes | ☐ | No | ☒ |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes | ☒ | No | ☐ |

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | Yes | ☒ | No | ☐ |

| | | | | | | | | | | |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. | | |

| (Check one) | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | Yes | ☒ | No | ☐ |

| If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. | Yes | ☐ | No | ☒ |

| Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). | Yes | ☐ | No | ☒ |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | Yes | ☐ | No | ☒ |

The aggregate market value of voting common stock of the registrant held by stockholders not including voting stock held by directors and executive officers of the registrant and certain employee plans of the registrant (the exclusion of such shares shall not be deemed an admission by the registrant that any such person is an affiliate of the registrant) at the close of business on June 30, 2024 (the last business day of the registrant's most recently completed second fiscal quarter) was $5,419,952,977.

On February 7, 2025, the registrant had 55,382,815 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents are incorporated herein by reference into the Part of the Form 10-K indicated:

| | | | | |

| Document | Part of Form 10-K into which incorporated |

| Portions of the registrant's proxy statement for the 2025 annual meeting of stockholders (the "Proxy Statement") to be filed pursuant to Regulation 14A within 120 days after the registrant's fiscal year end of December 31, 2024 are incorporated by reference into Part III of this Annual Report on From 10-K. | Part III |

WHIRLPOOL CORPORATION

ANNUAL REPORT ON FORM 10-K

For the fiscal year ended December 31, 2024

TABLE OF CONTENTS

| | | | | | | | |

| | | PAGE |

| |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| |

| Item 15. | | |

| Item 16. | | |

| | |

| |

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by us or on our behalf. Certain statements contained in this annual report, including those within the forward-looking perspective section within the Management's Discussion and Analysis section, do not relate strictly to historical or current facts and may contain forward-looking statements that reflect our current views with respect to future events and financial performance. Such statements can be identified by the use of terminology such as "may," "could," "will," "should," "possible," "plan," "predict," "forecast," "potential," "anticipate," "estimate," "expect," "project," "intend," "believe," "may impact," "on track," "guarantee," "seek," and the negative of these words and words and terms of similar substance. These forward-looking statements should be considered with the understanding that such statements involve a variety of risks and uncertainties, known and unknown including those identified below under “Item 1A. Risk Factors,” and elsewhere herein. Unless otherwise indicated, the terms "Whirlpool," "the Company," "we," "us," and "our" refer to Whirlpool Corporation and its consolidated subsidiaries.

| | | | | |

Our Company

Improving life at home has been at the heart of our business for 113 years – it is why we exist and why we are passionate about what we do. |

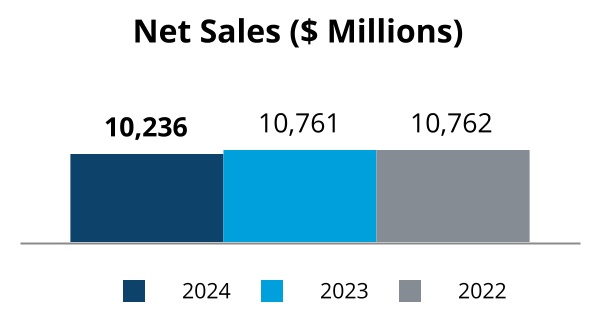

Whirlpool Corporation ("Whirlpool"), committed to being the best kitchen and laundry company, in constant pursuit of improving life at home, was incorporated in 1955 under the laws of Delaware and was founded in 1911. Whirlpool manufactures products in six countries and markets products in nearly every country around the world. We have received worldwide recognition for accomplishments in a variety of business and social efforts, including leadership, diversity, innovative product design, business ethics, environmental sustainability, social responsibility and community involvement. Whirlpool had approximately $17 billion in annual net sales and 44,000 employees in 2024.

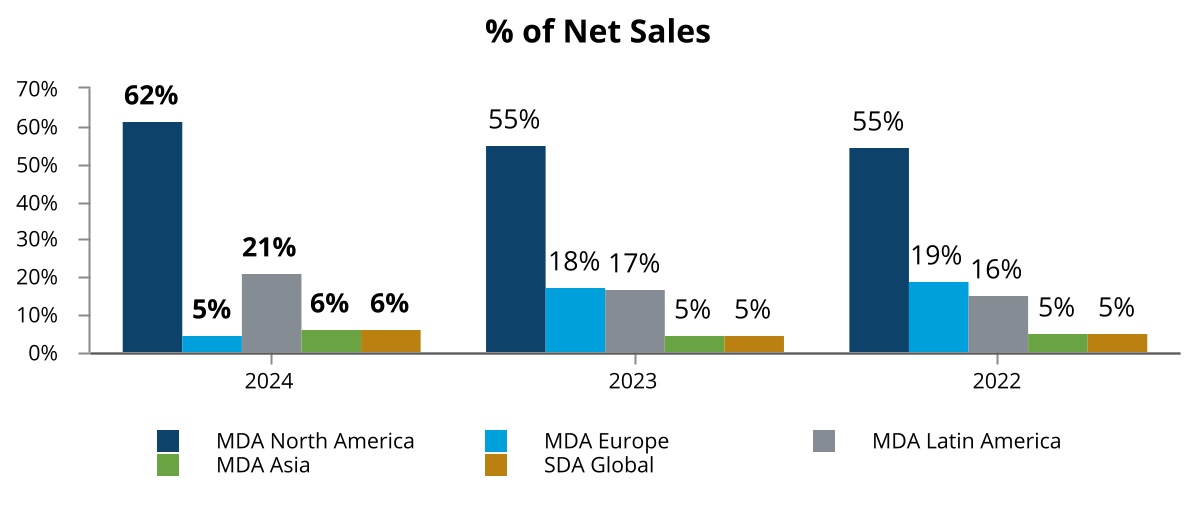

We conduct our business through four operating segments: Major Domestic Appliances (“MDA”) North America; MDA Latin America; MDA Asia; and Small Domestic Appliances (“SDA”) Global. The MDA Europe segment, which is presented within our results through the first quarter of 2024, was deconsolidated as of April 1, 2024. For additional information, see Note 15 and Note 16 to the Consolidated Financial Statements.

As used herein, and except where the context otherwise requires, "Whirlpool," "the Company," "we," "us," and "our" refer to Whirlpool Corporation and its consolidated subsidiaries.

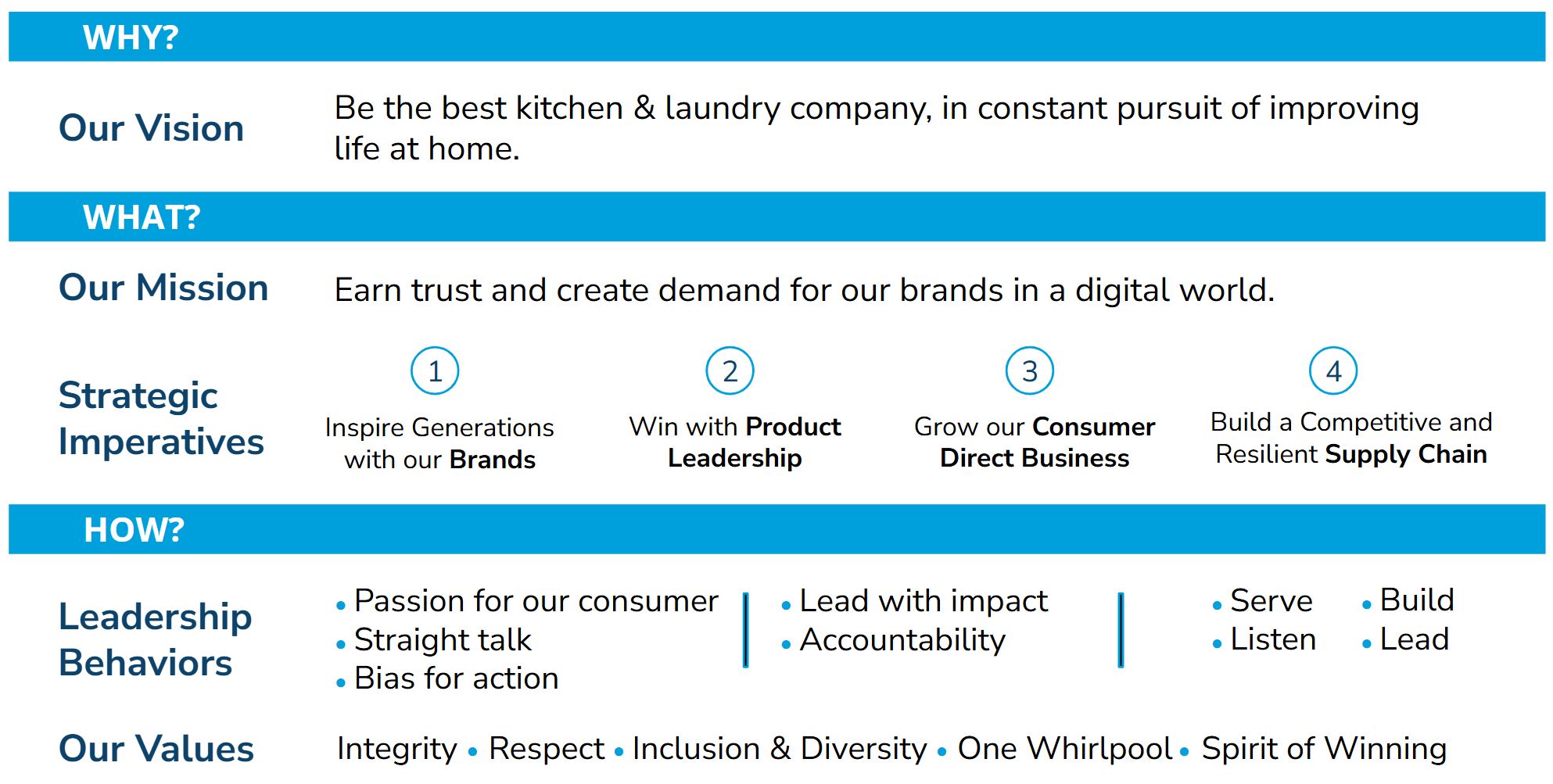

Our Strategic Architecture

Our strategic architecture is the foundational component that drives our shareholder value creation strategy. Below are the key components of our strategic architecture for 2024.

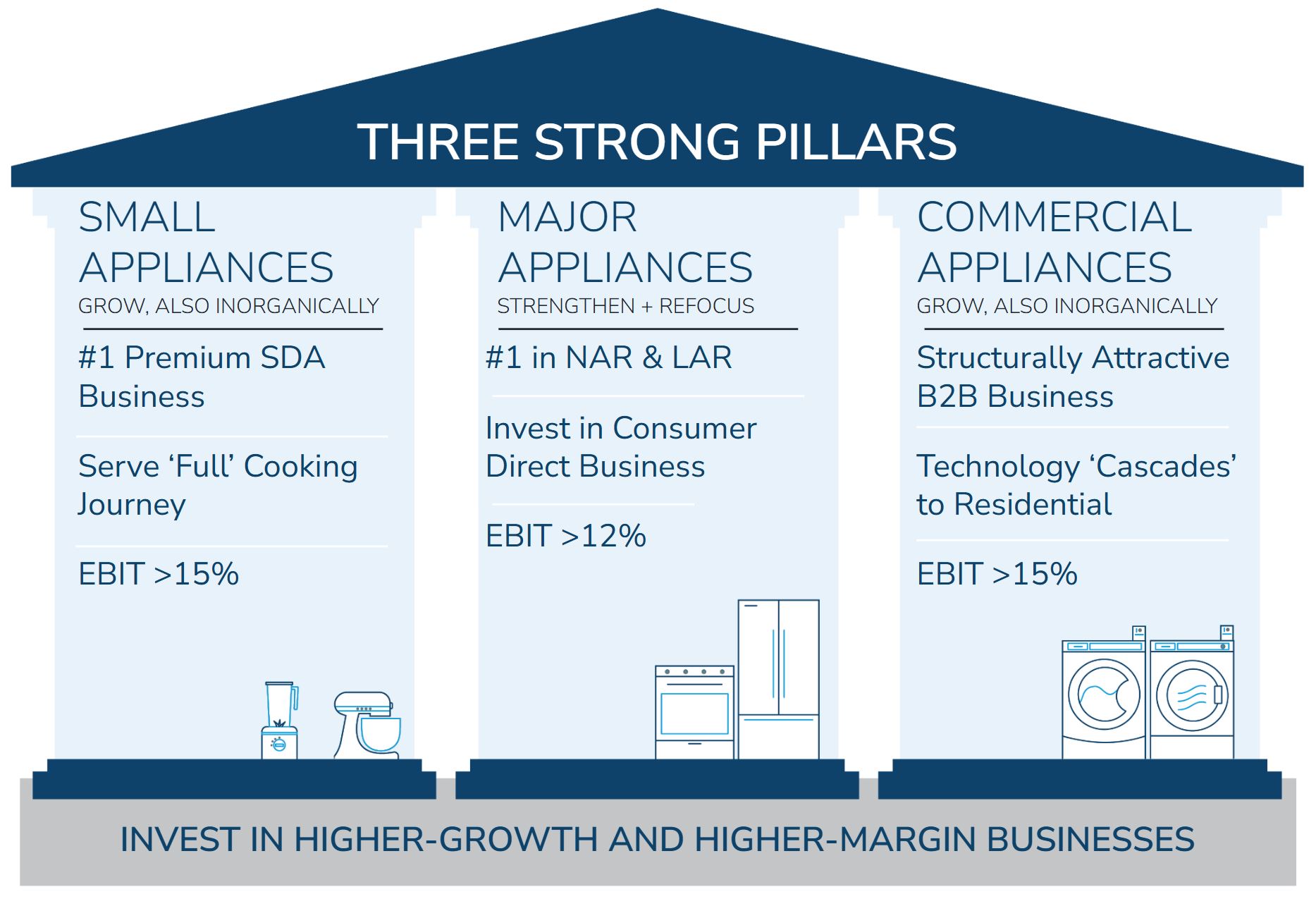

Portfolio Transformation

Whirlpool Corporation is committed to delivering significant, long-term value to both our consumers and our shareholders. In 2024, we completed a transaction to contribute our European major domestic appliance business into a newly formed company with Arcelik. Additionally, we sold our Middle East and North Africa business to Arcelik. These transactions marked a major milestone in our portfolio transformation to becoming a higher growth and higher margin business, unlocking significant value creation opportunities for the Company. Our value creation approach is enabled by three strong pillars: small appliances, major appliances, and commercial appliances. In recognition of our portfolio transformation, we reorganized our operating segments effective January 1, 2024, including presenting our SDA Global business as a separate operating segment.

Reconciliations to equivalent GAAP net earnings measures are not provided as EBIT percentages presented above represent our expectations for these business lines and are not provided with respect to results for any specific period.

We are committed to being the best kitchen and laundry company. Our global footprint includes developed countries and emerging markets, including a leading position in many of the key countries in which we operate. In 2025 and beyond, we expect to continue to win in the Americas with our leading position in multiple countries and leading U.S. builder share.

Our Sustained Investment in Innovation

Whirlpool Corporation has been responsible for a number of first-to-market innovations. These include the first electric wringer washer in 1911, the first residential stand mixer in 1919, the first countertop microwave in 1967, the first energy and water efficient top-load washer in 1998 and the first top-load clothes washer with a removable agitator in 2021. In 2024, we launched more than 100 new products throughout the world, demonstrating our commitment to innovation. These include the KitchenAid Espresso collection of semi-automatic and fully-automatic espresso machines, the KitchenAid rice and grain cooker, and our Spin & Load dishwasher rack accessory designed with accessibility in mind. We also expanded our award-winning Pet Pro laundry technology to front load washers and dryers and we introduced the FreshFlow Vent System in our Whirlpool brand, the first fan-powered system with antimicrobial protection designed to help keep both clothes and washing machines fresh.

We are committed to continue innovating for a new generation of consumers. Our world-class innovation pipeline has driven consistent innovation, enabled by a passionate culture of employees focused on bringing new technologies to market.

Throughout the past year, we have remained committed to delivering connected appliances that seamlessly integrate into the evolving smart home ecosystem. Our focus has been on enhancing the consumer experience through key features such as voice control compatibility with popular smart home assistants and WiFi connectivity that make life at home easier, faster and better. Additionally, we have continued to provide over-the-air updates to help ensure optimal performance and

functionality for qualified connected appliances. These advancements, coupled with our highly-rated mobile app platform, demonstrate our dedication to providing consumers with a superior connected appliance experience.

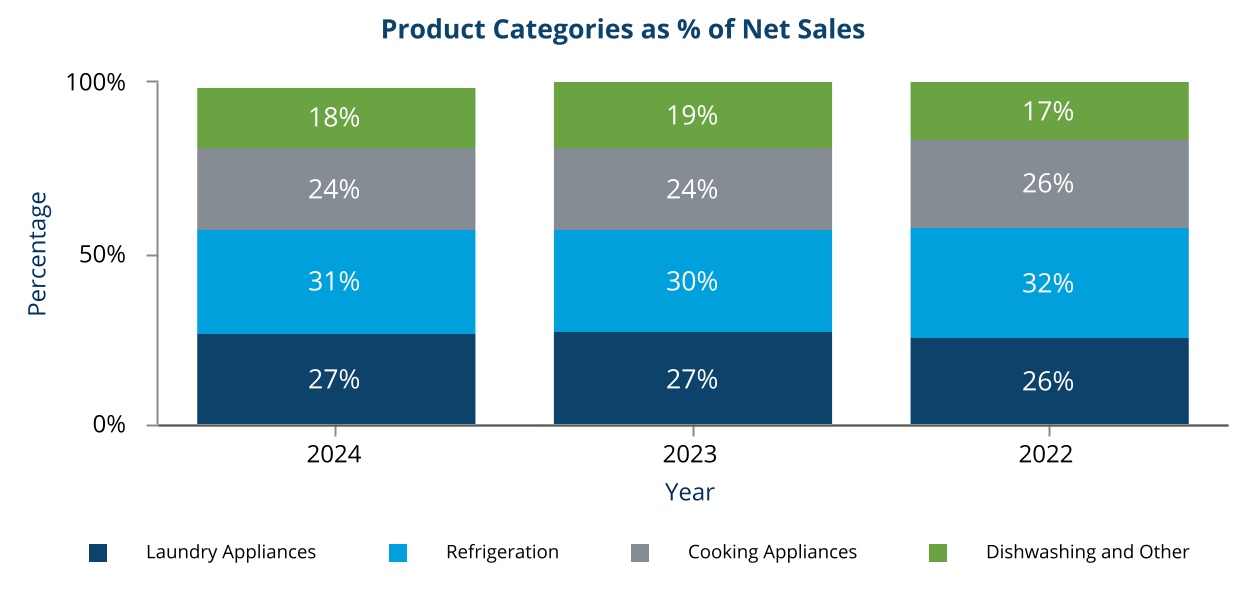

Whirlpool manufactures and markets a full line of major home appliances and related products. Our principal products are laundry appliances, refrigerators and freezers, cooking appliances, and dishwashers. Additionally, the Company has a strong portfolio of small domestic appliances, including the KitchenAid stand mixer, and a strong line of commercial laundry appliances. We have successfully integrated the InSinkErator business into our North America operations, expanding our portfolio of products to include food waste disposers and instant hot water dispensers for home and commercial use. InSinkErator product net sales are reported under the 'Other' product category which are aggregated under the 'Dishwashing and Other' category on the chart below. KitchenAid Small Domestic Appliance net sales are reported under the 'Cooking Appliances' product category.

The following chart provides the percentage of net sales for each of our product categories which accounted for 10% or more of our consolidated net sales over the last three years:

Best Brand Portfolio

We have the best brand portfolio in the industry, with multiple brands with more than $1 billion in revenue. The Company is driving purposeful innovation to meet the evolving needs of consumers through its iconic brand portfolio, demonstrating our commitment to being the best kitchen and laundry company improving life at home for our consumers.

We aim to position our brands as essential to many consumer segments by meeting their wide-ranging needs and aspirations. Our sales are led by two global iconic brands: Whirlpool and KitchenAid. Whirlpool is a trusted partner for families worldwide, making it easier to provide the care and support loved ones need to thrive every day. From innovative laundry solutions to intuitive kitchen appliances, Whirlpool ensures that care is simple, reliable, and always within reach. KitchenAid, on the other hand, inspires a deeper connection to the culinary experience. With its seamless blend of innovation and design, KitchenAid products were designed for personalization and empowering the maker. Together, these brands deliver differentiated products that combine exceptional performance and desirable features while remaining accessible to consumers everywhere.

Additionally, we have a number of strong regional and local brands, including Maytag, Brastemp, Consul, Amana, InSinkErator and JennAir. These brands add to our impressive depth and breadth of kitchen and laundry product offerings and help us provide products that are tailored to local consumer needs and preferences. Our best brand portfolio in the industry, paired with our robust investment in research and development and consumer insights, position us well to meet trends in consumer preferences and demand.

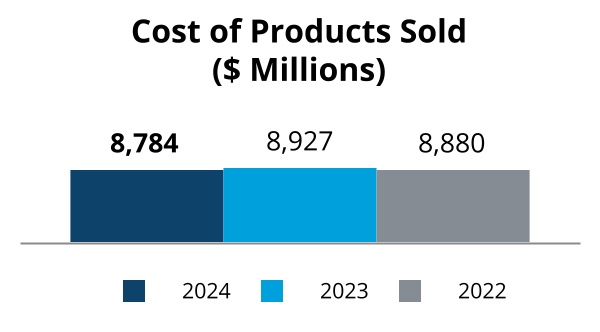

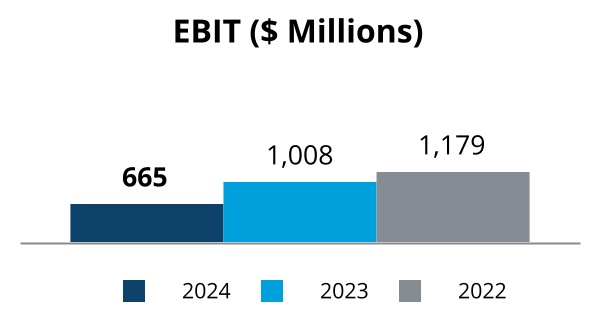

Strong Cost Position

We have a culture of cost optimization and productivity, which we call productivity for growth, and it includes continuous focus on cost efficiency. We have a history of delivering substantial gains through reduced complexity in all aspects of our business: research, design, reduced architectures, and reduced footprint. Our regional scale enables our local-for-local production model as we continue to focus on producing as efficiently as possible.

As the macro environment continues to change, we believe our demonstrated ability to execute cost takeout allows us to effectively cope with macroeconomic challenges, and we see additional opportunities to further streamline our cost structure in the years ahead. Throughout 2024 we continued to manage our fixed cost base across manufacturing, logistics and selling, general and administrative expenses while at the same time continuing our portfolio transformation journey. We also continue our journey to reduce the complexity of our design and product platforms. We believe this initiative, among many others, will enable us to utilize increased modular production and improved scale in procurement.

We are committed to even further cost improvement, creating strong levels of value for our shareholders, regardless of the external environment.

Value Creation Framework

Our long-term value creation framework is built upon the strong foundation we have in place: our industry-leading brand portfolio and robust product innovation pipeline, supported by our leading regional scale and executed by our exceptional employees throughout the world.

Our long-term value-creation goals reflect our agile and resilient business model, which we believe enables us to succeed in any operating environment with profitable growth, margin expansion, and cash conversion.

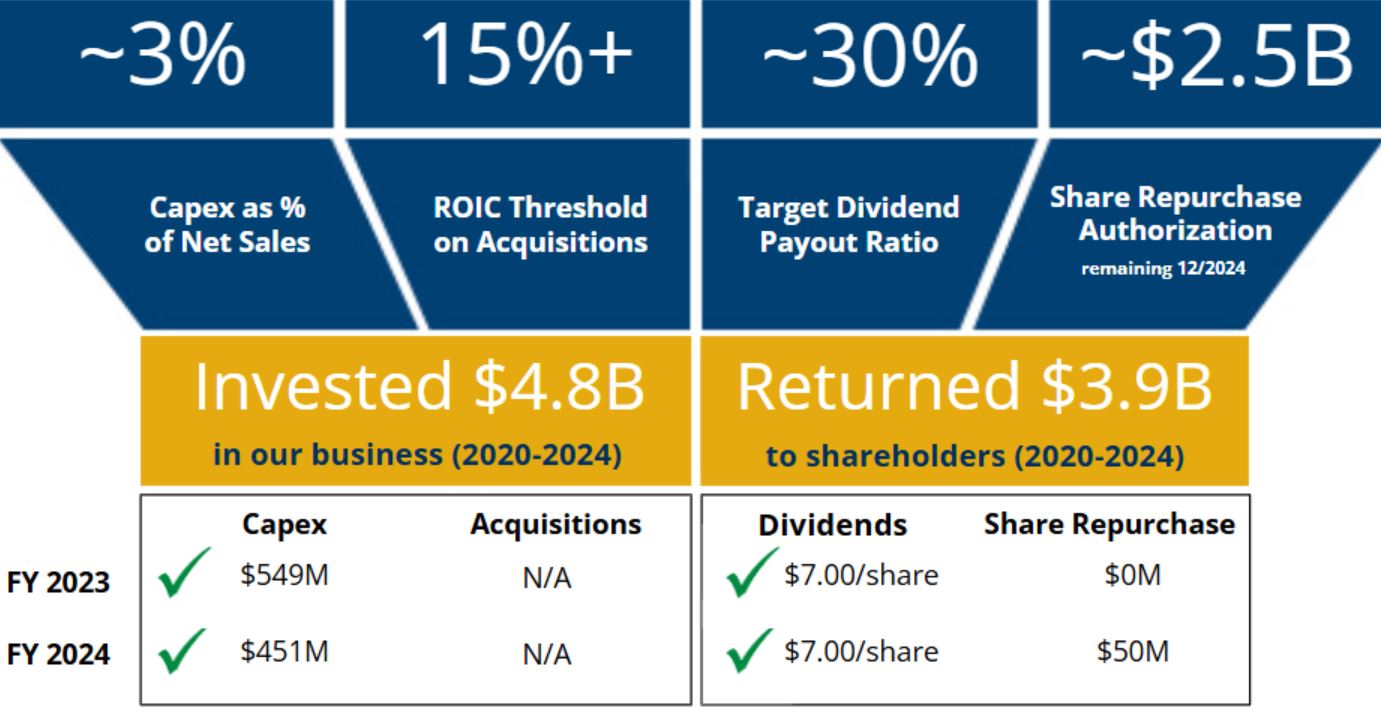

Capital Allocation Strategy

We take a balanced approach to capital allocation by focusing on the following key metrics:

In 2024, we continued our 69th year of quarterly dividends, with $384 million in dividends paid. We continue to prioritize debt repayments, with approximately $500 million of debt repayment in the second quarter of 2024. We remain committed to funding innovation and growth and are confident in our ability to generate strong free cash flow. Our free cash flow generation, coupled with our balance sheet strength, provides us the flexibility to support our commitment to returning cash to shareholders.

Business Summary by Segment

As of January 1, 2024, we reorganized our operating segments. The MDA Europe segment was deconsolidated as of April 1, 2024. For additional information, see Note 15 and Note 16 to the Consolidated Financial Statements.

| | | | | |

| MDA North America | •In the United States and Canada, we market and distribute major home appliances and other consumer products primarily under the Whirlpool, KitchenAid, Maytag, Amana, InSinkErator, JennAir, affresh, Swash, everydrop and Gladiator brand names primarily to retailers, distributors and builders, as well as directly to consumers.

•We sell some products to other manufacturers, distributors, and retailers for resale in North America under those manufacturers' and retailers' respective brand names. |

|

| |

|

| MDA Latin America | •In Latin America, we produce, market and distribute our major home appliances and other consumer products primarily under the Consul, Brastemp, Whirlpool, KitchenAid, Acros, Maytag and Eslabon de Lujo brand names primarily to retailers, distributors and directly to consumers.

•We serve the countries of Brazil, Mexico, Bolivia, Paraguay, Uruguay, Argentina, Colombia, Chile, and certain Caribbean and Central America countries, via sales and distribution through accredited distributors. |

|

| MDA Asia | •In Asia, we market and distribute our major home appliances in multiple countries, notably in India.

•We market and distribute our products in Asia primarily under the Whirlpool, Elica, Maytag, and KitchenAid brand names through a combination of direct sales to appliance retailers and chain stores and through full-service distributors to a large network of retail stores.

•In May 2021, we sold our majority interest in Whirlpool China and subsequently retained a non-controlling interest. Whirlpool China continues to sell Whirlpool-branded products through a licensing agreement in China. In September 2021, we acquired a majority interest in Elica PB India and increased our interest by 10% in the third quarter of 2024.

•In 2024, we reduced our ownership in Whirlpool of India from 75% to 51%, and we recently announced our intent to reduce our ownership stake to ~20% in 2025 via market sale.

|

|

| SDA Global |

•We market small domestic appliances under the KitchenAid brand name to retailers, distributors and directly to consumers.

•We serve the countries of United States, Canada, Germany, Australia, and France, among others. |

|

Competition

Competition in the major home appliance industry is intense, including competitors such as BSH (Bosch), Electrolux, Haier, Hisense, LG, Mabe, Midea, Panasonic and Samsung, many of which are increasingly expanding beyond their existing manufacturing footprint. Competitors in the small domestic appliance industry include Breville, DeLonghi, Ninja, Groupe SEB, and Cuisinart, among others. The competitive environment includes the impact of a changing retail environment, including the shifting of consumer purchase practices towards e-commerce and other channels. Moreover, our customer base includes large, sophisticated trade customers who have many choices and demand competitive products, services and prices, and many of whom have their own brands which compete with our products. We believe that we can best compete in the current environment by focusing on introducing new and innovative products, building strong brands, enhancing trade customer and consumer value with our product and service offerings, meeting or exceeding our emissions and product efficiency commitments, optimizing our regional footprint and trade distribution channels, increasing productivity, improving quality, lowering costs, and taking other efficiency-enhancing measures.

Seasonality

The Company's quarterly revenues have historically been affected by a variety of seasonal factors, including holiday-driven promotional periods. In each fiscal year, the Company's total revenue and operating margins are typically highest in the third and fourth quarter, and this pattern is more pronounced in our SDA Global operating segment.

Raw Materials and Purchased Components

Our supplier performance is essential to our business. Some supply disruptions and unanticipated costs have been and may be incurred in transitioning to a new supplier if a prior single supplier relationship was abruptly interrupted or terminated. In the event of a disruption, we have been able and believe that we would be able to leverage our scale to qualify and use alternate materials, though sometimes at premium costs. In 2022, our industry was impacted by supply constraints with our suppliers, factories, and logistics providers, based in significant part on geopolitical developments and macroeconomic factors beyond our control. Throughout 2023 and 2024, supply chain constraints and inflation moderated, while geopolitical and macroeconomic factors remained volatile in certain countries.

Working Capital

The Company maintains varying levels of working capital throughout the year to support business needs and customer requirements through various inventory management techniques, including demand forecasting and planning. See the Financial Condition and Liquidity section of the “Management's Discussion and Analysis” section of this Annual Report on Form 10-K for additional information on our working capital requirements and processes.

Trademarks, Licenses and Patents

We consider the trademarks, copyrights, patents, and trade secrets we own, and the licenses we hold, in the aggregate, to be a valuable asset. Whirlpool is the owner of a number of trademarks in the United States and foreign countries. Whirlpool has a strong presence in North America with the Whirlpool, Maytag, JennAir, KitchenAid, InSinkErator, and Amana brands; in Latin America with Consul, Brastemp, Whirlpool, KitchenAid and Acros brands; and in Asia with Whirlpool brand.

We receive royalties from licensing our trademarks to third parties who manufacture, sell and service certain products bearing the Whirlpool, Maytag, KitchenAid and Amana brand names. As part of the transaction with Arcelik involving the contribution of our European major domestic appliance business, we agreed to a multi-year licensing of the Whirlpool brand to the newly formed company for sales in Europe. We continually apply for and obtain patents globally. The primary purpose in obtaining patents is to protect our designs, technologies, products and services.

Government Regulation and Protection of the Environment

We know that an environmentally sustainable Whirlpool is a more competitive Whirlpool - a company better positioned for long-term success. Our Environmental, Social and Governance (ESG) strategy is an integral part of our long-term, globally aligned strategic imperatives and operating priorities. It is deeply embedded in our vision, mission and values as an organization. We seek opportunities to broaden and deepen our ESG commitments and to continue making life at home, in our communities and in our operations better today and in the future.

We are committed to developing innovative products that drive efficiencies in water and energy use and save our consumers’ time. From the initial design phase to packaging and end of life, we leverage new technologies, materials and processes, embedding sustainability throughout as we work to minimize the environmental impact of our products while upholding our commitment to excellence in quality and performance. We are also committed to a 20 percent reduction in emissions linked to the use of our products (scope 3 category 11) across the globe by 2030, compared to 2016 levels. This target has been approved by the Science Based Targets initiative, and builds on the Company's reduction in emissions across all scopes since 2005.

In 2021, the Company announced a global commitment to reach a net zero emissions target in its plants and operations (scopes 1 and 2) by 2030, which is expected to cover Whirlpool Corporation's manufacturing sites and its large distribution centers around the world. We expect to achieve this target by generating and consuming renewable energy, including installation of wind turbines, solar panels and investing in off-site renewables through virtual power purchase agreements, improvements in energy efficiency, electrification and leveraging carbon removal to offset emissions that cannot be avoided.

We comply with all laws and regulations regarding protection of the environment, and in many cases where laws and regulations are less restrictive, we have established and are following our own standards, consistent with our commitment to environmental responsibility. These compliance requirements pair well with our ESG focus and we believe that we are in compliance, in all material respects, with presently applicable governmental provisions relating to environmental protection in the countries in which we have manufacturing operations. Compliance with these environmental laws and regulations did not have a material effect on capital expenditures, earnings, or our competitive position during 2024 and is not expected to be material in 2025.

The entire major home appliance industry, including Whirlpool, must contend with the adoption of stricter government energy and environmental standards. These standards have been phased in over the past several years and continue to be phased in, and include the general phase-out of ozone-depleting chemicals used in refrigeration, and energy and related standards for selected major appliances, regulatory restrictions on the materials content specified for use in our products by some jurisdictions and mandated recycling of our products and packaging materials at the end of their useful lives. Compliance with these various standards, as they become effective, will increase costs or require some product redesign. However, we believe, based on our understanding of the current state of proposed regulations, that we will be able to develop, manufacture, and market products that comply with these regulations.

Various municipal, state, and federal regulators have discussed, proposed, or sought to enact new regulations or bans on appliances that utilize natural gas. These regulations would impose transition costs and impact our product mix and product offerings, among other impacts. We also believe that transition to a lower-carbon economy presents opportunities for our business, given our broad-based product portfolio of resource-efficient appliances, including a full line of electric, natural gas and induction-based appliances.

Our operations are also subject to numerous legal and regulatory requirements concerning product energy usage, data privacy, cybersecurity, employment conditions and worksite health and safety, among others. These requirements often provide broad discretion to government authorities, and they could be interpreted or revised in ways that delay production or make production more costly. The costs to comply, or associated with any noncompliance, are, or can be, significant and vary from period to period.

Human Capital Management

At Whirlpool, our enduring values guide everything we do. We have created an environment where open and honest communication is the expectation, not the exception. We hold our employees to this standard and offer the same in return. Our Integrity Manual helps our employees follow our commitment to win the right way. Additionally, our Supplier Code of Conduct formalizes the key principles under which Whirlpool’s suppliers are required to operate.

Our Human Capital Strategy is built around three pillars:

Effective and Efficient Organization

Our employees are a critical driver of Whirlpool’s global business results. On December 31, 2024, Whirlpool employed approximately 44,000 employees across 27 countries, with 39% located within the United States. Outside of the United States, our largest employee populations were located within Brazil and Mexico.

Through our organizational effectiveness practices, we ensure that our organizational design, processes and governance are fit for purpose. For example, we evaluated and increased the average span of control for our people leaders to be aligned with best practice, reduced complexity and increased the speed of decision-making. We also changed reporting lines and the way work is accomplished to enable more autonomy, speed, and agility within our business units. Lastly, we identified and have begun implementing technology enhancements and process improvements needed to enable our strategic imperatives and operational priorities.

In 2024, as part of our organizational model, we introduced Accelerator Centers of Excellence, a more refined Strategic Center and Business Unit Services. During 2025, we will further evolve our business services model, transitioning certain functional processes to a third-party partner. This will allow us to optimize cross-functionally, leverage scale, and automate repeatable operational processes to capture efficiency gains and further enable speed and agility within our business units.

Best Talent and Leadership

We believe that our talent is a competitive advantage. We invest in attracting the best talent, developing employees’ skills and capabilities, and retaining top talent. We provide robust and challenging career opportunities for employees, which ensures that we build a deep succession bench for our leadership roles. We provide all employees with access to learning opportunities to improve critical skills in order to develop the capabilities required to succeed now and into the future.

Development of leadership acumen within Whirlpool Corporation is critical in ensuring people leaders at all levels are capable and confident in their ability to bring out the best in our people. At Whirlpool, we believe in “Leaders Teaching Leaders'' where our senior leaders are expected to embrace their role in developing our next generation of leaders. As a result, all of our leadership development programs are internally designed and facilitated by Whirlpool leaders. The benefits of this strategy are multifold; our senior leaders learn and grow by teaching others, our next-level leaders learn from their role models’ personal experiences and in turn, our organization builds a leadership engine. Leadership development is a crucial component of our overall organizational strategy, and will continue to be an area of focus in the coming years.

Winning Culture

We continually foster a “family feel” culture where we are accountable to each other. This means that we live our enduring values and conduct ourselves in a way that is consistent with the Whirlpool Leadership Model behaviors.

We leverage a multi-faceted employee listening strategy to better understand our employees’ experience and needs, including regular employee engagement pulse surveys that cover broad engagement, belonging and well-being topics. In 2024, we solicited feedback on topics related to the support that our employees needed, in light of our business strategy and portfolio transformation. We used this feedback to design “Leading Change” sessions to equip our senior leaders to drive ongoing change and empower their teams to deliver our portfolio transformation.

Our employees’ safety and well-being is of the utmost importance. Whirlpool has a proud history of providing our employees with comprehensive and competitive benefits packages and we continue to invest in our employees' health and well-being. Our global well-being strategy focuses on six main pathways: Be healthy; Be you; Be balanced; Be curious; Be prepared; and Be connected, to further empower and support our employees to “Be Well” in all aspects of their lives. We provide benefits, resources and tools, such as webinars and communications globally, to help employees explore each of the pathways. We also provide a global Employee Assistance Program to support employees and their families with confidential counseling, coaching and referral services to address personal or work concerns that affect their well-being.

Whirlpool offers a variety of programs globally to protect the health and safety of our employees. While we maintain targets for year-over-year reduction of the total recordable incident rate and serious injuries, our goal is always zero.

Whirlpool believes in creating a culture of inclusion where all employees feel a sense of belonging. Inclusion and Diversity has been an enduring value at Whirlpool for decades. Our efforts to appreciate all perspectives and backgrounds enable us to understand our diverse consumer base, improve our products so they can be used by everyone, and make our communities stronger.

For additional information, please see Whirlpool’s website (www.whirlpoolcorp.com), and forthcoming 2025 Proxy Statement and 2024 Sustainability Report. The contents of our Sustainability Report, Proxy Statement (except where noted herein), and the Company's website are not incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC.

Other Information

For information about the challenges and risks associated with our foreign operations, see "Risk Factors" under Item 1A.

Whirlpool is a major supplier of laundry, refrigeration, cooking and dishwasher home appliances to Lowe's, a North American retailer. Sales to Lowe's represented approximately 13%, 13%, and 14% of our consolidated net sales in 2024, 2023 and 2022, respectively. Lowe's represented approximately 38% and 38% of our consolidated accounts receivable as of December 31, 2024 and 2023, respectively. For additional information, see Note 15 to the Consolidated Financial Statements.

Information About Our Executive Officers

The following table sets forth the names and ages of our executive officers on February 13, 2025, the positions and offices they held on that date, and the year they first became executive officers:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Office | | First Became

an Executive

Officer | | Age |

| Marc R. Bitzer | | Chairman of the Board and Chief Executive Officer | | 2006 | | 60 |

| James W. Peters | | Executive Vice President and Chief Financial and Administrative Officer and President, Whirlpool Asia | | 2016 | | 55 |

| Carey Martin | | Executive Vice President and Chief Human Resources and Corporate Relations Officer | | 2023 | | 48 |

| Juan Carlos Puente | | Executive Vice President and President, Whirlpool Latin America | | 2023 | | 50 |

| Ludovic Beaufils | | Executive Vice President and President, KitchenAid Small Appliances | | 2024 | | 52 |

| Alessandro Perucchetti | | Executive Vice President and President, Whirlpool North America | | 2024 | | 49 |

The executive officers named above were elected by our Board of Directors to serve in the office indicated until the first meeting of the Board of Directors following the annual meeting of stockholders in 2025 and until a successor is chosen and qualified or until the executive officer's earlier resignation or removal.

Each of our executive officers has held the position set forth in the table above or has served Whirlpool in various executive or administrative capacities for at least the past five years.

Available Information

Financial results and investor information (including Whirlpool's Form 10-K, 10-Q, and 8-K reports) are accessible at Whirlpool's investor website: investors.whirlpoolcorp.com. Copies of our Form 10-K, 10-Q, and 8-K reports and amendments, if any, are available free of charge through our website on the same day they are filed with, or furnished to, the Securities and Exchange Commission.

We routinely post important information for investors on our website, whirlpoolcorp.com, in the "Investors" section. We also intend to update the Hot Topics Q&A portion of this website as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investors section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our website is not incorporated by reference into, and is not a part of, this document.

This report contains statements referring to Whirlpool that are not historical facts and are considered "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, which are intended to take advantage of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, are based on current projections about operations, industry conditions, financial condition and liquidity. Words that identify forward-looking statements include words such as "may," "could," "will," "should," "possible," "plan," "predict," "forecast," "potential," "anticipate," "determine," "estimate," "expect," "project," "intend," "believe," "may impact," "on track," "may affect," “guarantee”, “seek” and the negative of these words and words and terms of similar substance used in connection with any discussion of future operating or financial performance, an acquisition or merger, or our businesses. In addition, any statements that refer to expectations, projections, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Those statements are not guarantees and are subject to risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual results could differ materially and adversely from these forward-looking statements.

We have listed below what we believe to be the most significant strategic, operational, financial, legal and compliance, and general risks relating to our business.

STRATEGIC RISKS

We face intense competition in the home appliance industry and failure to successfully compete could adversely affect our business and financial performance.

Each of our operating segments operates in a highly competitive business environment and faces intense competition from a significant number of competitors, many of which have strong consumer brand equity. Several of these competitors, such as those set forth in the Business section of this Annual Report on Form 10-K, are large, well-established companies, ranking among the Global Fortune 500. We also face competition that may be able to quickly adapt to changing consumer preferences, particularly in the connected appliance space, or may be able to adapt more quickly to changes brought about by supply chain constraints, inflationary pressures, currency fluctuations, geopolitical uncertainty, epidemics or pandemics, increased interest rates or other factors. Moreover, our customer base includes large, sophisticated trade customers who have many choices and demand competitive products, services and prices, and which have and may in the future merge, consolidate, form alliances or further increase their relative purchasing scale. Competition in the global appliance industry is based on a number of factors including selling price, product features and design, consumer preference, performance, innovation, reputation, energy efficiency, service, quality, cost, distribution, and financial incentives, such as promotional funds, sales incentives, volume rebates and terms. Many of our competitors are increasingly expanding beyond their existing manufacturing footprints. Our competitors, especially global competitors with low-cost sources of supply, vertically integrated business models and/or highly protected home countries outside the United States (U.S.), have aggressively priced their products and/or introduced new products to increase market share and expand into new geographies. Many of our competitors have established and may expand their presence in the rapidly changing retail environment, including the continued shift of consumer purchasing practices towards e-commerce and other channels, and the increasing global prevalence of direct-to-consumer sales models. In addition, technological innovation is a significant competitive factor for our products, as consumers continually look for new product features that save time, effort, water and energy. We may further be exposed to competitive risks related to the adoption and application of new technologies by established participants or new entrants, and competitive risks from uncertainty driven by changes to trade laws, regulations and policies, including tariffs, sanctions, and import/export controls. If we are unable to successfully compete in this highly competitive environment, our business and financial performance could be adversely affected.

A loss of or substantial decline in volume of sales to any of our key trade customers, major buying groups, and/or builders could adversely affect our financial performance.

We sell to a sophisticated customer base of large trade customers, including large domestic and international trade customers, that have significant leverage as buyers over their suppliers. Most of our products are not sold through long-term contracts, allowing trade customers to change volume among suppliers like us. As the trade customers continue to become larger through merger, consolidation or organic growth, they have sought and may seek to use their position to improve their profitability by various means, including improved efficiency, lower pricing, and increased promotional programs. As has occurred in the past, if we are unable to meet their demand requirements, our volume growth and financial results could be adversely affected. We also continue to pursue direct-to-consumer sales globally, including the launch of direct-to-consumer sales on most of our brand websites in recent years, which may impact our relationships with existing trade customers. The loss or substantial decline in volume of sales to our key trade customers, major buying groups, builders, or any other trade customers to which we sell a significant amount of products, has adversely affected and in the future could adversely affect our financial performance. Additionally, the loss of share with these trade customers, or financial difficulties, including bankruptcy and financial restructuring, by these trade customers could have a material adverse effect on our financial statements.

Failure to maintain our reputation and brand image could adversely impact our business.

Our brands have worldwide recognition, and our success depends on our ability to maintain and enhance our brand image and reputation. Maintaining, promoting and growing our brands depends on our marketing efforts, including advertising and consumer campaigns, as well as product innovation. We could be adversely impacted if we fail in these efforts or if, whether or not justified, the reputation or image of our company or any of our brands is tarnished or receives negative publicity. In addition, adverse publicity about regulatory or legal action against us, product safety concerns, data privacy breaches or quality issues, inability to meet our net zero or other sustainability goals, or negative association with any brand could damage our reputation and brand image, undermine our customers' confidence in us and reduce long-term demand for our products, even if the regulatory or legal action is unfounded or not material to our operations.

In addition, our success in maintaining, extending and expanding our brand image depends on our ability to adapt to a rapidly changing media environment, including an ever-increasing reliance on social media and online dissemination of advertising campaigns. Inaccurate or negative posts, comments or reviews have been and may continue to be made about us or our products on social media and other websites that can spread rapidly through such forums, which could seriously damage our reputation and brand image. If we do not protect, maintain, extend and expand our brand image, then our financial statements could be materially and adversely affected.

An inability to effectively execute and manage our business objectives, strategic portfolio transformation and transition to an outsourced third-party business unit services model could adversely affect our financial performance.

The highly competitive nature of our industry requires that we effectively execute and manage our business objectives, including key strategic priorities and initiatives. In 2022, we announced a strategic portfolio transformation initiative with a goal of focusing our portfolio on higher-growth, higher-margin businesses. Since that time, we have divested our operations in Russia and the Middle East and North Africa (MENA), contributed our Europe major appliance business to a newly formed entity with Arcelik (“Beko Europe”), acquired InSinkErator, and increased Whirlpool India’s ownership in Elica PB India. We also resegmented our operating segments to provide more information on our small domestic appliance business, and undertook a reorganization of our salaried workforce focused on efficiency and empowering our business units.

The successful implementation of the initiative has and may in the future present challenges and we may not be able to fully realize all of the anticipated benefits from the initiative. Events and circumstances, such as financial or strategic difficulties, organizational and people transitions, delays

and unexpected costs may occur that could result in the Company not realizing all of the anticipated benefits or the Company not realizing such benefits on our expected timetable. If we are unable to fully realize the anticipated benefits from our portfolio transformation, including increased profitability driven by higher-growth, higher-margin businesses, our ability to fund other initiatives may be adversely affected. The failure to implement successfully this or our other important strategic initiatives may materially adversely affect our operating results, financial condition and liquidity.

In 2024, as part of our organizational model, we introduced Accelerator Centers of Excellence, a more refined Strategic Center and Business Unit Services. During 2025, we will further evolve our business services model, transitioning certain functional processes to a third-party provider. The reliance on external providers may increase the risk of service disruptions, data breaches, or non-compliance with regulatory requirements. Standardized processes may lead to a lack of flexibility, making it harder to respond to specific business unit needs. Additionally, inconsistent oversight of third-party operations could compromise the accuracy and integrity of financial reporting, while diminished internal control over key functions could result in errors, fraud, or regulatory penalties.

An inability to understand consumers’ preferences and to timely identify, develop, manufacture, market, and sell products that meet customer demand could adversely affect our business.

Our success is dependent on anticipating and appropriately reacting to changes in consumer preferences, including the shifting of consumer purchasing practices towards e-commerce, direct-to-consumer and other channels, and on successful new product development, including in the eco-efficiency space, the connected appliance space and the digital space, and process development and product relaunches in response to such changes. In addition, the adoption of generative artificial intelligence ("AI") technologies may bring challenges in terms of disruption to both our business model and our existing technology and products. We may further be exposed to competitive risks related to the adoption and application of new technologies by established participants or new entrants, and others. The speed of technological development may prove disruptive if we are unable to maintain the pace of innovation. To compete effectively we must also be responsive to technological change, potential regulatory developments, and public scrutiny. Our future results and our ability to maintain or improve our competitive position will depend on our capacity to gauge the direction of our key product categories and geographic regions and upon our ability to successfully and timely identify, develop, manufacture, market, and sell new or improved products in these changing environments.

Our intellectual property rights are valuable, and any inability to protect them could reduce the value of our products, services and brands.

We consider our intellectual property rights, including patents, trademarks, copyrights and trade secrets, and the licenses we hold, to be a significant and valuable aspect of our business. We attempt to protect our intellectual property rights through a combination of patent, trademark, copyright and trade secret laws, as well as licensing agreements and third-party nondisclosure and assignment agreements, as well as agreements and policies with our employees and other parties (including non-compete agreements which may become subject to future regulatory action impacting many companies). Our failure to secure and maintain protection for or adequately protect our trademarks, products, new features of our products, or our processes may diminish our competitiveness.

We have applied for intellectual property protection in the U.S. and other key jurisdictions with respect to certain innovations and new products, design patents, product features, and processes. We cannot be assured that the U.S. Patent and Trademark Office or any similar authority in other jurisdictions will approve any of our patent applications. Additionally, the patents we own could be challenged or invalidated, others could design around our patents or the patents may not be of sufficient scope or strength to provide us with any meaningful protection or commercial advantage. Further, the laws of certain foreign countries in which we do business do not recognize intellectual

property rights or protect them to the same extent as U.S. law. These factors could weaken our competitive advantage with respect to our products, services, and brands in foreign jurisdictions, which could adversely affect our financial performance.Moreover, while we do not believe that any of our products infringe on enforceable intellectual property rights of third parties, others have in the past and may in the future assert intellectual property rights that cover some of our technology, brands, products, or services. Any litigation regarding patents or other intellectual property could be costly and time-consuming and could divert the attention of our management and key personnel from our business operations. Claims of intellectual property infringement might also require us to enter into costly license agreements or modify our products or services. We also may be subject to significant damages, injunctions against the development and sale of certain products or services, or limited in the use of our brands.In addition, advances in and growing adoption of AI technology may exacerbate intellectual property risks, including the risk that existing intellectual property laws and rights may not provide adequate protection given advances in AI technology. AI may also increase the risk of inadvertent disclosure of Whirlpool's trade secrets and other confidential information as well as the risk that Whirlpool inadvertently infringes upon others' intellectual property rights.

OPERATIONAL RISKS

We face risks associated with our divestitures, acquisitions, other investments and joint ventures.

From time to time, we make strategic divestitures, acquisitions, investments and participate in joint ventures. For example, in 2021, we divested our majority interest in Whirlpool China (formerly Hefei Sanyo), and in 2022, we divested our operations in Russia and acquired our InSinkErator business from Emerson Electric Co. In April 2024, we closed the sale of our MENA major domestic appliance business and also contributed our European major domestic appliance business to Beko Europe, while retaining a 25% interest in Beko Europe. These transactions, and other transactions that we have entered into or which we may enter into in the future, involve significant challenges and risks, including that the transaction does not advance our business strategy or fails to produce a satisfactory return on our investment. We have encountered and may encounter difficulties in integrating acquisitions with our operations, separating divested businesses from our operations, undertaking post-acquisition restructuring activities, applying our internal control processes to these acquisitions, managing strategic investments, and in overseeing the operations, systems, and controls of acquired companies. We have also experienced and may in the future experience entity governance and management difficulties where we hold only a minority, as is the case with Beko Europe and Whirlpool China, or simple majority equity ownership position. Integrating acquisitions and carving out divestitures is often costly, may be dilutive to earnings and may require significant attention from management. There might also be differing or inadequate cybersecurity and data protection controls, which could impact our exposure to data security incidents and potentially increase anticipated costs or time to integrate the business, as well as inadequate protection and/or unauthorized usage of our intellectual property. In addition, our ability to apply our internal controls and compliance policies to our minority interest investments is limited and can expose us to additional financial and reputational risks. Furthermore, we may not realize the degree, or timing, of benefits we anticipate when we first enter into a transaction.

While our evaluation of any potential transaction includes business, legal, regulatory and financial due diligence with the goal of identifying and evaluating the material risks involved, our due diligence reviews have not always or consistently identified and may not always or consistently in the future identify all of the issues necessary to accurately estimate and address the cost, time and potential loss contingencies of a particular transaction, including potential exposure to regulatory actions and other potential compliance-related liabilities resulting from an acquisition target's previous activities, costs associated with any quality issues with an acquisition target's legacy products or difficulties and costs associated with obtaining necessary regulatory approvals. In addition, certain liabilities have in the past and may be in the future retained by Whirlpool when closing a facility, divesting an entity or selling physical assets, and certain of these retained liabilities have been material in the past and may be in the future. For example, we agreed to retain certain liabilities relating to legacy EMEA legal matters (see Note 7) in connection with the MENA sale and Europe contribution transactions which closed in April 2024. In addition, changes to the U.S. and

foreign regulatory approval process and requirements in connection with an acquisition have caused and may cause approvals to take longer than anticipated to obtain, not be forthcoming or contain burdensome conditions, which may jeopardize, delay or reduce the anticipated benefits of the transaction to us and could impede the execution of our business strategy.

The ability of our suppliers to deliver parts, components and manufacturing equipment to our manufacturing facilities according to schedule and quality required may impact our ability to manufacture without disruption and could affect product availability and sales.

We use a wide range of materials and components in the global production of our products, which come from numerous suppliers around the world. Because not all of our business arrangements provide for guaranteed supply, and our suppliers also are subject to the economic, social and political conditions in the countries in which they operate and, moreover, some key parts may be available only from single-source unaffiliated third-party suppliers or a limited group of suppliers, we are subject to supply chain risk. In addition, certain proprietary component parts used in some of our products are provided by single-source unaffiliated third-party suppliers. We would be unable to obtain these proprietary components for an indeterminate period of time if these single-source suppliers were to cease or interrupt production or otherwise fail to supply these components to us as agreed, which could adversely affect our product sales and operating results.

Our operations and those of our suppliers are subject to disruption for a variety of unexpected reasons, including, but not limited to, sudden changes in business conditions, plant shutdowns or slowdowns, transportation delays due to port delays or any disruption on the supply chain, work stoppages, epidemics and pandemics, labor shortages, labor relations, global geopolitical instability, foreign conflict or country invasion, price inflation, governmental regulatory and enforcement actions, intellectual property claims against suppliers, disputes with suppliers, distributors or transportation providers, financial issues such as supplier bankruptcy, information technology failures, hazards such as fire, earthquakes, flooding, or other natural disasters, including due to climate change, and increased homeland security requirements in the U.S. and other countries. For example, we have in the past and may in the future be significantly impacted by supply chain issues, due to factors largely beyond our control, including a global shortage of certain components, such as select semiconductors, a strain on raw materials and input cost inflation. These issues have delayed and could in the future delay importation and increase the cost of products and/or components or require us to locate alternative providers to avoid disruption to customers. These alternatives have not always been and in the future may not be available on short notice and have in the past and in the future could result in higher transit costs and stock availability, which could have an adverse impact on our business and financial statements. Additionally, we are subject to our suppliers’ capabilities to accurately forecast and manage their production and supply chains and consistently supply us with parts and raw materials, which can impact our operations given the combination of potential issues including sourcing thousands of parts globally from numerous suppliers in multiple countries.

The inability to timely convert our backlog due to supply chain disruptions subjects us to pricing and product availability risks and its conversion into revenue. If our suppliers are unable to effectively recover parts and components and we are unable to effectively manage the impacts of price inflation and timely convert our backlog, our financial statements could materially and adversely be affected.

The lack of availability of any parts, components or equipment has resulted and could in the future result in production delays and sales disruptions, as well as our ability to fulfill contractual obligations. Unexpected disruption risks as such cannot be completely eliminated due to our reliance on suppliers’ performance to consistently build and ship products to customers.

Insurance for certain disruptions may not be available, affordable or adequate. The effects of climate change, including extreme weather events, long-term changes in temperature levels and water availability may exacerbate these risks. Such disruption has in the past and could in the future interrupt our ability to manufacture certain products. Any significant supply chain disruption for the reasons stated above or otherwise could have a material adverse impact on our financial statements.

Risks associated with our international operations may decrease our revenues and increase our costs.

For the year ended December 31, 2024, sales outside the North America region represented a significant amount of our net sales. We expect that international sales will continue to account for a significant percentage of our net sales. Accordingly, we have faced and continue to face numerous risks associated with conducting international operations, any of which could negatively affect our financial performance. These risks include the following:

•Political, legal, and economic instability and uncertainty, including the ongoing conflict between Russia and Ukraine, Israel and Palestine, China and Taiwan tensions, the Red Sea conflict and its impact on shipping and logistics and other global conflicts, including tensions between China and the United States, economic instability in Argentina, as well as pandemic-related uncertainties in the countries in which we operate;

•Foreign currency exchange rate fluctuations;

•Changes in foreign tax rules, regulations and other requirements, including changes in tax rates and changes in statutory and judicial interpretations of tax laws which could result in significant tax disputes;

•Changes in diplomatic and trade relationships, including sanctions and related regulations resulting from the current political situation in countries in which we do business, and potential changes to the United States-Mexico-Canada Agreement (USMCA);

•Inflation and/or deflation, and changes in interest rates;

•Changes in foreign country regulatory requirements, including data privacy laws;

•Various import/export restrictions and disruptions and the availability of required import/export licenses;

•Imposition of tariffs and other trade barriers;

•Managing widespread operations and enforcing internal policies and procedures such as compliance with U.S. and foreign anti-bribery, anti-corruption regulations, and anti-money laundering regulations, such as the U.S. Foreign Corrupt Practices Act (FCPA), U.K. Bribery Act, and antitrust laws;

•Significant limitations in our ability to apply our internal controls over financial reporting to our minority interest investments;

•Labor disputes, labor shortages and work stoppages at our operations and suppliers;

•Government price controls;

•Trade customer insolvency and the inability to collect accounts receivable;

•Limitations on the repatriation or movement of earnings and cash; and

•Various U.S. and non-U.S. laws and regulations specific to and/or focused on requirements to ensure the non-use of forced labor and child labor within our supply chain, as well as compliance with various applicable human rights laws and regulations.

We are subject to the FCPA, U.K. Bribery Act, and other similar non-U.S. laws and regulations, which may place us at a competitive disadvantage to foreign companies that are not subject to similar regulations. Our internal controls may not always protect us from the improper conduct of our employees, suppliers, sub-suppliers or other contract parties, agents and business partners. Additionally, any suspicion or determination that we have violated the FCPA, U.K. Bribery Act, or other anti-bribery and/or anti-corruption laws could have a material adverse effect on us. We may incur unanticipated costs, expenses or other liabilities as a result of an acquisition target's violation of applicable laws, such as the FCPA, the U.K. Bribery Act, and/or similar anti-bribery/anti-corruption laws in non-U.S. jurisdictions. We may incur unanticipated costs or expenses, including post-closing asset impairment charges, expenses associated with eliminating duplicate facilities, litigation, and other liabilities.

Risks associated with unanticipated social, political, economic and/or public health events, including epidemics and pandemics, may materially and adversely impact our business.

Terrorist attacks, cyber events, armed conflicts (including the war in Ukraine discussed elsewhere in Risk Factors and other global conflicts), bank failures, civil unrest, espionage, natural disasters, governmental actions, epidemics and pandemics have and could affect our domestic and international sales, disrupt our supply chain, and impair our ability to produce and deliver our products. Many of such events have impacted and could directly impact our physical facilities or those of our suppliers or customers.

Also, a resurgence or development of new strains of COVID-19, or other public health emergencies, epidemics or pandemics, could negatively impact our global operations, trade customers, suppliers, consumers, and each of their financial conditions.

We have been and may be subject to information technology system failures, cloud failures, network disruptions, cybersecurity attacks and breaches in data security, which may materially adversely affect our operations, financial condition and operating results.

We depend on information technology to improve the effectiveness of our operations, to interface with our customers, consumers and employees, to maintain the continuity of our manufacturing operations, and to maintain financial accuracy and efficiency. In addition, we collect, store, and process confidential or sensitive data, including proprietary business information, personal data or other information that is subject to privacy and security laws, regulations and/or customer-imposed controls. Our business processes and data sharing across suppliers and vendors is dependent on technology system availability. Our systems may depend, directly or indirectly, on software developed by third parties (such as open source libraries or vendor software) and we may have limited visibility into the robustness of the security practices followed during design, development, or remediation of this third party software. The failure of any such systems, whether internal, cloud-based or third-party, could disrupt our operations by causing transaction errors, processing inefficiencies, delays or cancellation of customer orders, the loss of customers, impediments to the manufacture or shipment of products, other financial and business disruptions, employee relations issues, the loss of or damage to intellectual property and the unauthorized disclosure or compromise of personal data of consumers and employees or of commercially sensitive information.

In addition, we have outsourced certain technology services and administrative functions to third-party service providers and may outsource additional functions in the future. If these service providers do not perform effectively or experience failures, we may experience similar issues depending on the function involved. In addition, we may not achieve expected cost savings of outsourcing and may incur additional costs to correct errors made by such service providers.

Our information systems, or those of our third-party service providers, have been in the past and could be in the future impacted by malicious activity of threat actors intent on extracting or corrupting information or disrupting business processes, or by unintentional data-compromising activities by our employees or service providers. The use of generative AI technologies could lead to the unauthorized disclosure of sensitive, proprietary, or confidential information, inadvertent

infringement of intellectual property owned by third parties, and could lead to new potential cyberattack methods for third parties.

Unauthorized access has in the past and could in the future disrupt our business, result in the loss of assets, expose the company to potential litigation and/or regulatory liability, and adversely affect our reputation. Cyber attacks are becoming more sophisticated and include ransomware attacks, attempts to gain unauthorized access to data, social engineering and other security breaches that have in the past and could in the future lead to disruptions in availability of critical systems, unauthorized release of confidential or otherwise protected information, and corruption of data. Our growth in the areas of direct-to-consumer sales and connected appliances (the "Internet of Things"), and increasingly advanced data processing capabilities, accompanied by increasing handling of consumer information has increased these risks. These events have in the past and could in the future impact our customers, consumers, employees, third parties and reputation and have in the past and could in the future lead to financial losses from remediation actions, loss of business or potential litigation or regulatory liability or an increase in expenses. While we have not yet experienced any material impacts from a cyber attack, any one or more future cyber attacks could have a material adverse effect on our financial statements. Further, market dynamics are increasingly driving heightened cybersecurity protections and mandating cybersecurity standards in our products, and we may incur additional costs to address these increased risks and to comply with such demands.

Product-related liability or product recall costs could adversely affect our business and financial performance.

We have been and may in the future be exposed to product-related liabilities, which in some instances result in product redesigns, product recalls, or other corrective action. In addition, any claim, product recall or other corrective action that results in significant adverse publicity, particularly if those claims or recalls cause customers to question the safety or reliability of our products, may adversely affect our financial statements. We maintain product liability insurance, but it may not be adequate to cover losses related to product liability claims brought against us. Product liability insurance could become more expensive and difficult to maintain or may not be available on commercially reasonable terms, if at all. We are now and may in the future be involved in class action litigation and may be involved in product recalls for which we generally have not purchased insurance, and may be involved in other litigation or events for which insurance products may have limitations.

We regularly engage in investigations of potential quality and safety issues as part of our ongoing effort to deliver quality products to our customers. We are currently investigating certain potential quality and safety issues globally, and as appropriate, we undertake to effect repair or replacement of appliances in the event that an investigation leads to the conclusion that such action is warranted. The actual costs incurred as a result of any future issues could have a material adverse effect on our financial statements.

Our ability to attract, develop and retain executives and other qualified employees is crucial to our results of operations and future growth.

We depend upon the continued services and performance of our key executives, senior management and skilled personnel, particularly professionals with experience in our business, operations, engineering, technology and the home appliance industry. While we strive to attract, develop and retain these individuals through execution of our human capital strategy, we cannot be sure that any of these individuals will continue to be employed by us. In the case of talent losses, significant time is required to hire, develop and train skilled replacement personnel. For additional information about our human capital strategy, see "Human Capital Management" in Item 1 of this Annual Report on Form 10-K. We must also attract, develop, and retain individuals with the requisite engineering and technical expertise to develop new technologies and introduce new products and services.

Like many other companies, we are subject to fluctuations in the availability of qualified labor in certain key positions. A shortage of key employees can jeopardize our ability to implement our business objectives and execute our portfolio transformation, and changes in key executives can result in loss of continuity, loss of accumulated knowledge, departures of other key employees, disruptions to our operations and inefficiencies during transition periods. In addition, if we are unable to enforce certain non-compete covenants and confidentiality provisions when key employees leave for a competitor, we may lose a competitive advantage arising from confidential and proprietary company information known to such former employees. An inability to hire, develop, transfer retained knowledge, engage and retain a sufficient number of qualified employees could materially hinder our business by, for example, delaying our ability to bring new products and services to market or impairing the success of our operations, which could adversely affect our results of operations.

A deterioration in labor relations could adversely impact our global business.

As of December 31, 2024, we had approximately 44,000 employees globally. We are subject to separate collective bargaining agreements with certain labor unions, as well as various other commitments regarding our workforce. We periodically negotiate with certain unions representing our employees and may be subject to work stoppages or may be unable to renew collective bargaining agreements on the same or similar terms, or at all. If we become subject to additional collective bargaining relationships in the future, it could adversely affect our labor costs, how we operate our business, and our operational results. In addition, our global restructuring activities have in the past and may in the future be received negatively by governments and unions and attract negative media attention, which may delay the implementation of such plans. A deterioration in labor relations may have a material adverse effect on our financial statements.

FINANCIAL RISKS

Fluctuations and volatility in the cost and availability of raw materials and purchased components could adversely affect our results of operation.

The sources and prices of the primary materials (such as steel, resins, and base metals) used to manufacture our products and components containing those materials are susceptible to significant global and regional price fluctuations or availability due to inflation, supply and demand trends, transportation and fuel costs, port and shipping capacity, labor costs or disputes, government regulations, including increased homeland security requirements, and tariffs, changes in currency exchange rates and interest rates, price controls, the economic climate, severe weather, climate change, pandemics, and other unforeseen circumstances. For example, we experienced significant raw material inflation in 2021 and 2022, respectively, in addition to many other cost increases throughout our business. In addition, we engage in contract negotiations and enter into commodity swap contracts to manage risk associated with certain commodities purchases, and we have in the past and may in the future experience losses based on commodity price changes. Significant increases in materials cost and availability and other costs now and in the future could have a material adverse effect on our financial statements. As an example, in recent years the company has experienced and may in the future experience significant levels of commodity, logistics and wage inflation across our businesses. We have responded to these inflationary factors with strong cost reduction initiatives and cost-based price increases. An inability to respond to inflationary pressures effectively could have a material adverse effect on our financial statements.

Foreign currency fluctuations may affect our financial performance.

We generate a significant portion of our revenue and incur a significant portion of our expenses in foreign currencies. Changes in the exchange rates of functional currencies of those operations affect the U.S. dollar value of our revenue and earnings from our foreign operations. We use currency forwards, net investment hedges, and other financial products to manage our foreign currency transaction exposures. We cannot completely eliminate our exposure to foreign currency fluctuations, which have in the past and may in the future adversely affect our financial performance. In addition, because our consolidated financial results are reported in U.S. dollars, as we generate sales or earnings in other currencies, the translation of those results into U.S. dollars