UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08895

Voya Funds Trust

(Exact name of registrant as specified in charter)

| 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, AZ | 85258 |

| (Address of principal executive offices) | (Zip code) |

The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: March 31

Date of reporting period: April 1, 2024 to September 30, 2024

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

This semi-annual shareholder report contains important information about Voya Floating Rate Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class A | $48 | 0.94% |

Fund Statistics

- Total Net Assets$215,284,613

- # of Portfolio Holdings390

- Portfolio Turnover Rate49%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| Focus Financial Partners LLC, 08/08/31 | 0.9% |

| Acrisure LLC, 8.211%, 11/06/30 | 0.7% |

| Broadstreet Partners Inc, 8.095%, 06/16/31 | 0.7% |

| Sedgwick Claims Management Services Inc, 8.250%, 07/31/31 | 0.7% |

| Peraton Corp, 8.953%, 02/01/28 | 0.7% |

| AssuredPartners Inc., 8.345%, 02/14/31 | 0.6% |

| UKG Inc, 8.555%, 02/10/31 | 0.6% |

| Great Outdoors Group LLC, 9.110%, 03/06/28 | 0.6% |

| Medline Borrower LP, 7.595%, 10/23/28 | 0.6% |

| AthenaHealth Group Inc, 8.497%, 02/15/29 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (3.2)% |

| Preferred Stock | 0.0% |

| Common Stock | 0.1% |

| Corporate Bonds/Notes | 6.7% |

| Loans | 96.4% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Floating Rate Fund

Class A: IFRAX

92913L791-SAR

This semi-annual shareholder report contains important information about Voya Floating Rate Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class C | $86 | 1.69% |

Fund Statistics

- Total Net Assets$215,284,613

- # of Portfolio Holdings390

- Portfolio Turnover Rate49%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| Focus Financial Partners LLC, 08/08/31 | 0.9% |

| Acrisure LLC, 8.211%, 11/06/30 | 0.7% |

| Broadstreet Partners Inc, 8.095%, 06/16/31 | 0.7% |

| Sedgwick Claims Management Services Inc, 8.250%, 07/31/31 | 0.7% |

| Peraton Corp, 8.953%, 02/01/28 | 0.7% |

| AssuredPartners Inc., 8.345%, 02/14/31 | 0.6% |

| UKG Inc, 8.555%, 02/10/31 | 0.6% |

| Great Outdoors Group LLC, 9.110%, 03/06/28 | 0.6% |

| Medline Borrower LP, 7.595%, 10/23/28 | 0.6% |

| AthenaHealth Group Inc, 8.497%, 02/15/29 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (3.2)% |

| Preferred Stock | 0.0% |

| Common Stock | 0.1% |

| Corporate Bonds/Notes | 6.7% |

| Loans | 96.4% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Floating Rate Fund

Class C: IFRCX

92913L817-SAR

This semi-annual shareholder report contains important information about Voya Floating Rate Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class I | $35 | 0.69% |

Fund Statistics

- Total Net Assets$215,284,613

- # of Portfolio Holdings390

- Portfolio Turnover Rate49%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| Focus Financial Partners LLC, 08/08/31 | 0.9% |

| Acrisure LLC, 8.211%, 11/06/30 | 0.7% |

| Broadstreet Partners Inc, 8.095%, 06/16/31 | 0.7% |

| Sedgwick Claims Management Services Inc, 8.250%, 07/31/31 | 0.7% |

| Peraton Corp, 8.953%, 02/01/28 | 0.7% |

| AssuredPartners Inc., 8.345%, 02/14/31 | 0.6% |

| UKG Inc, 8.555%, 02/10/31 | 0.6% |

| Great Outdoors Group LLC, 9.110%, 03/06/28 | 0.6% |

| Medline Borrower LP, 7.595%, 10/23/28 | 0.6% |

| AthenaHealth Group Inc, 8.497%, 02/15/29 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (3.2)% |

| Preferred Stock | 0.0% |

| Common Stock | 0.1% |

| Corporate Bonds/Notes | 6.7% |

| Loans | 96.4% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Floating Rate Fund

Class I: IFRIX

92913L825-SAR

This semi-annual shareholder report contains important information about Voya Floating Rate Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class R | $61 | 1.19% |

Fund Statistics

- Total Net Assets$215,284,613

- # of Portfolio Holdings390

- Portfolio Turnover Rate49%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| Focus Financial Partners LLC, 08/08/31 | 0.9% |

| Acrisure LLC, 8.211%, 11/06/30 | 0.7% |

| Broadstreet Partners Inc, 8.095%, 06/16/31 | 0.7% |

| Sedgwick Claims Management Services Inc, 8.250%, 07/31/31 | 0.7% |

| Peraton Corp, 8.953%, 02/01/28 | 0.7% |

| AssuredPartners Inc., 8.345%, 02/14/31 | 0.6% |

| UKG Inc, 8.555%, 02/10/31 | 0.6% |

| Great Outdoors Group LLC, 9.110%, 03/06/28 | 0.6% |

| Medline Borrower LP, 7.595%, 10/23/28 | 0.6% |

| AthenaHealth Group Inc, 8.497%, 02/15/29 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (3.2)% |

| Preferred Stock | 0.0% |

| Common Stock | 0.1% |

| Corporate Bonds/Notes | 6.7% |

| Loans | 96.4% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Floating Rate Fund

Class R: IFRRX

92913L841-SAR

This semi-annual shareholder report contains important information about Voya Floating Rate Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class W | $35 | 0.69% |

Fund Statistics

- Total Net Assets$215,284,613

- # of Portfolio Holdings390

- Portfolio Turnover Rate49%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| Focus Financial Partners LLC, 08/08/31 | 0.9% |

| Acrisure LLC, 8.211%, 11/06/30 | 0.7% |

| Broadstreet Partners Inc, 8.095%, 06/16/31 | 0.7% |

| Sedgwick Claims Management Services Inc, 8.250%, 07/31/31 | 0.7% |

| Peraton Corp, 8.953%, 02/01/28 | 0.7% |

| AssuredPartners Inc., 8.345%, 02/14/31 | 0.6% |

| UKG Inc, 8.555%, 02/10/31 | 0.6% |

| Great Outdoors Group LLC, 9.110%, 03/06/28 | 0.6% |

| Medline Borrower LP, 7.595%, 10/23/28 | 0.6% |

| AthenaHealth Group Inc, 8.497%, 02/15/29 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (3.2)% |

| Preferred Stock | 0.0% |

| Common Stock | 0.1% |

| Corporate Bonds/Notes | 6.7% |

| Loans | 96.4% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Floating Rate Fund

Class W: IFRWX

92913L833-SAR

This semi-annual shareholder report contains important information about Voya GNMA Income Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class A | $43 | 0.84% |

Fund Statistics

- Total Net Assets$1,256,593,383

- # of Portfolio Holdings850

- Portfolio Turnover Rate238%

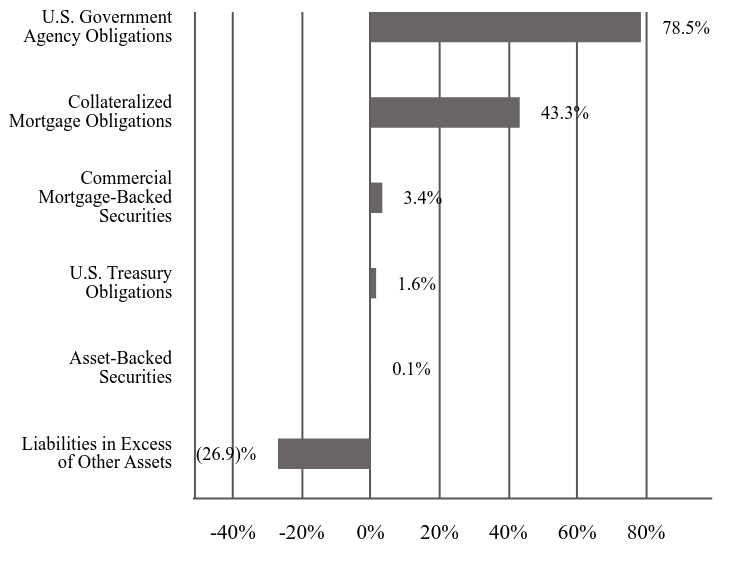

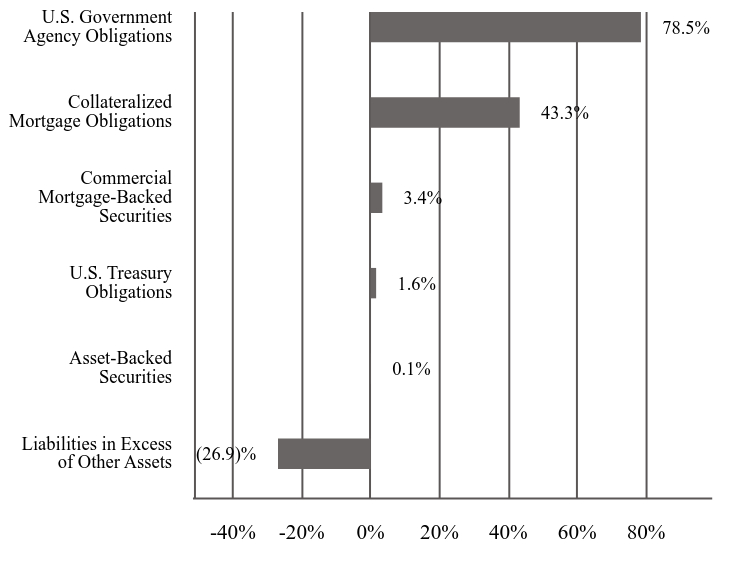

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| Ginnie Mae, 5.500%, 10/20/54 | 8.6% |

| Ginnie Mae, 5.000%, 10/20/54 | 6.8% |

| Ginnie Mae, 3.500%, 10/20/54 | 5.8% |

| Ginnie Mae, 2.000%, 03/20/52 | 3.9% |

| Ginnie Mae, 2.500%, 10/20/51 | 2.7% |

| Ginnie Mae, 4.500%, 10/20/54 | 2.4% |

| Ginnie Mae, 2.500%, 03/20/51 | 2.3% |

| Ginnie Mae, 2.000%, 12/20/50 | 2.1% |

| Ginnie Mae, 2.500%, 11/20/51 | 2.0% |

| Ginnie Mae, 2.500%, 09/20/51 | 1.9% |

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (26.9)% |

| Asset-Backed Securities | 0.1% |

| U.S. Treasury Obligations | 1.6% |

| Commercial Mortgage-Backed Securities | 3.4% |

| Collateralized Mortgage Obligations | 43.3% |

| U.S. Government Agency Obligations | 78.5% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya GNMA Income Fund

Class A: LEXNX

92913L692-SAR

This semi-annual shareholder report contains important information about Voya GNMA Income Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class C | $82 | 1.59% |

Fund Statistics

- Total Net Assets$1,256,593,383

- # of Portfolio Holdings850

- Portfolio Turnover Rate238%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| Ginnie Mae, 5.500%, 10/20/54 | 8.6% |

| Ginnie Mae, 5.000%, 10/20/54 | 6.8% |

| Ginnie Mae, 3.500%, 10/20/54 | 5.8% |

| Ginnie Mae, 2.000%, 03/20/52 | 3.9% |

| Ginnie Mae, 2.500%, 10/20/51 | 2.7% |

| Ginnie Mae, 4.500%, 10/20/54 | 2.4% |

| Ginnie Mae, 2.500%, 03/20/51 | 2.3% |

| Ginnie Mae, 2.000%, 12/20/50 | 2.1% |

| Ginnie Mae, 2.500%, 11/20/51 | 2.0% |

| Ginnie Mae, 2.500%, 09/20/51 | 1.9% |

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (26.9)% |

| Asset-Backed Securities | 0.1% |

| U.S. Treasury Obligations | 1.6% |

| Commercial Mortgage-Backed Securities | 3.4% |

| Collateralized Mortgage Obligations | 43.3% |

| U.S. Government Agency Obligations | 78.5% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya GNMA Income Fund

Class C: LEGNX

92913L726-SAR

This semi-annual shareholder report contains important information about Voya GNMA Income Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class I | $28 | 0.54% |

Fund Statistics

- Total Net Assets$1,256,593,383

- # of Portfolio Holdings850

- Portfolio Turnover Rate238%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| Ginnie Mae, 5.500%, 10/20/54 | 8.6% |

| Ginnie Mae, 5.000%, 10/20/54 | 6.8% |

| Ginnie Mae, 3.500%, 10/20/54 | 5.8% |

| Ginnie Mae, 2.000%, 03/20/52 | 3.9% |

| Ginnie Mae, 2.500%, 10/20/51 | 2.7% |

| Ginnie Mae, 4.500%, 10/20/54 | 2.4% |

| Ginnie Mae, 2.500%, 03/20/51 | 2.3% |

| Ginnie Mae, 2.000%, 12/20/50 | 2.1% |

| Ginnie Mae, 2.500%, 11/20/51 | 2.0% |

| Ginnie Mae, 2.500%, 09/20/51 | 1.9% |

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (26.9)% |

| Asset-Backed Securities | 0.1% |

| U.S. Treasury Obligations | 1.6% |

| Commercial Mortgage-Backed Securities | 3.4% |

| Collateralized Mortgage Obligations | 43.3% |

| U.S. Government Agency Obligations | 78.5% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya GNMA Income Fund

Class I: LEINX

92913L734-SAR

This semi-annual shareholder report contains important information about Voya GNMA Income Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class R6 | $26 | 0.50% |

Fund Statistics

- Total Net Assets$1,256,593,383

- # of Portfolio Holdings850

- Portfolio Turnover Rate238%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| Ginnie Mae, 5.500%, 10/20/54 | 8.6% |

| Ginnie Mae, 5.000%, 10/20/54 | 6.8% |

| Ginnie Mae, 3.500%, 10/20/54 | 5.8% |

| Ginnie Mae, 2.000%, 03/20/52 | 3.9% |

| Ginnie Mae, 2.500%, 10/20/51 | 2.7% |

| Ginnie Mae, 4.500%, 10/20/54 | 2.4% |

| Ginnie Mae, 2.500%, 03/20/51 | 2.3% |

| Ginnie Mae, 2.000%, 12/20/50 | 2.1% |

| Ginnie Mae, 2.500%, 11/20/51 | 2.0% |

| Ginnie Mae, 2.500%, 09/20/51 | 1.9% |

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (26.9)% |

| Asset-Backed Securities | 0.1% |

| U.S. Treasury Obligations | 1.6% |

| Commercial Mortgage-Backed Securities | 3.4% |

| Collateralized Mortgage Obligations | 43.3% |

| U.S. Government Agency Obligations | 78.5% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya GNMA Income Fund

Class R6: VGMBX

92913L577-SAR

This semi-annual shareholder report contains important information about Voya GNMA Income Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class W | $31 | 0.59% |

Fund Statistics

- Total Net Assets$1,256,593,383

- # of Portfolio Holdings850

- Portfolio Turnover Rate238%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| Ginnie Mae, 5.500%, 10/20/54 | 8.6% |

| Ginnie Mae, 5.000%, 10/20/54 | 6.8% |

| Ginnie Mae, 3.500%, 10/20/54 | 5.8% |

| Ginnie Mae, 2.000%, 03/20/52 | 3.9% |

| Ginnie Mae, 2.500%, 10/20/51 | 2.7% |

| Ginnie Mae, 4.500%, 10/20/54 | 2.4% |

| Ginnie Mae, 2.500%, 03/20/51 | 2.3% |

| Ginnie Mae, 2.000%, 12/20/50 | 2.1% |

| Ginnie Mae, 2.500%, 11/20/51 | 2.0% |

| Ginnie Mae, 2.500%, 09/20/51 | 1.9% |

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (26.9)% |

| Asset-Backed Securities | 0.1% |

| U.S. Treasury Obligations | 1.6% |

| Commercial Mortgage-Backed Securities | 3.4% |

| Collateralized Mortgage Obligations | 43.3% |

| U.S. Government Agency Obligations | 78.5% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya GNMA Income Fund

Class W: IGMWX

92913L767-SAR

This semi-annual shareholder report contains important information about Voya Government Money Market Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class A | $18 | 0.35% |

Fund Statistics

- Total Net Assets$384,025,662

- # of Portfolio Holdings29

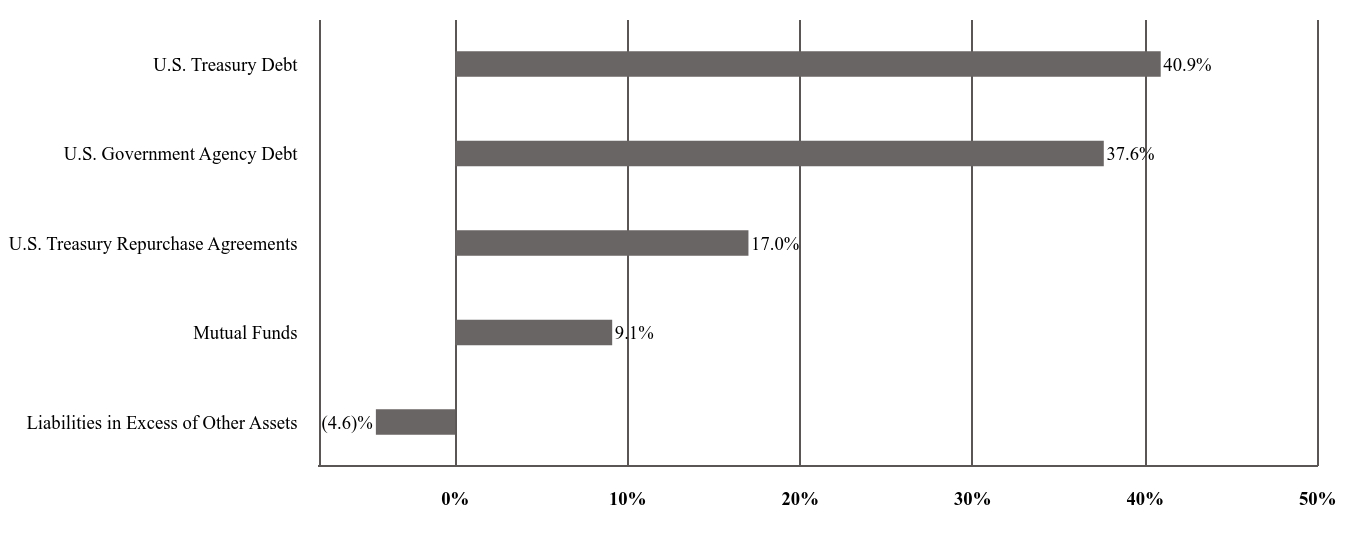

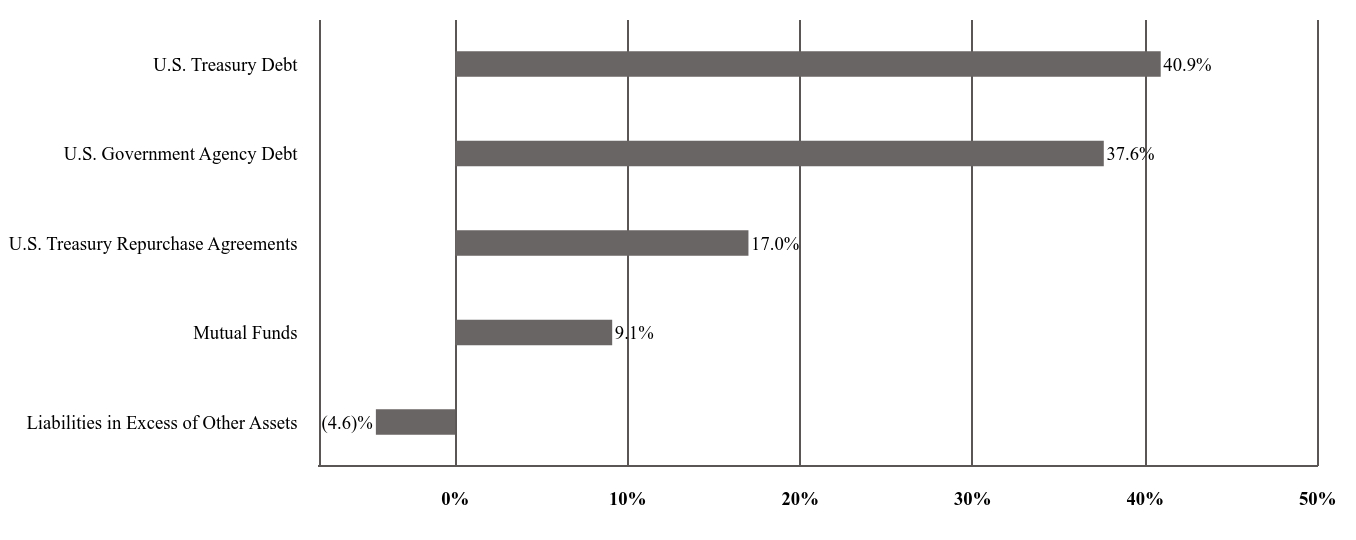

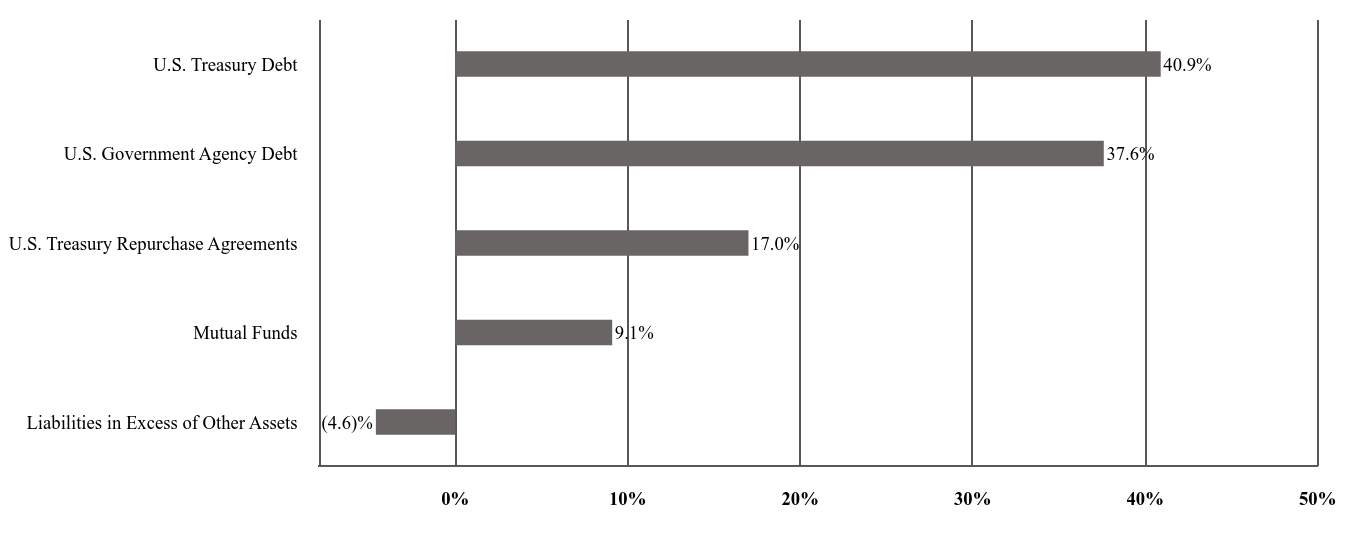

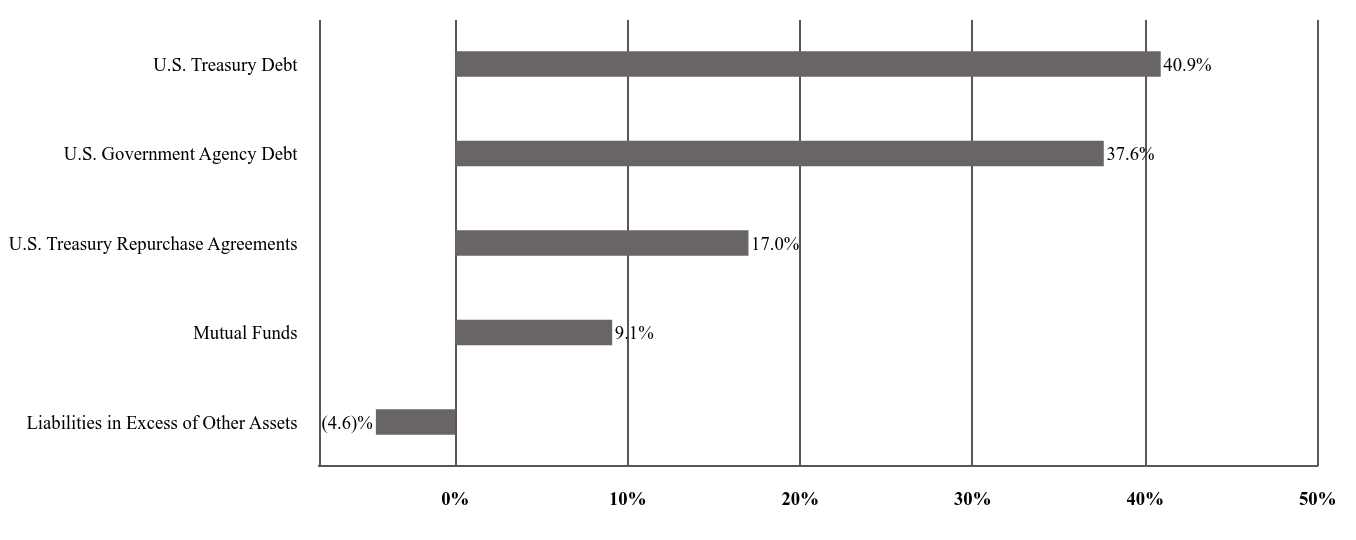

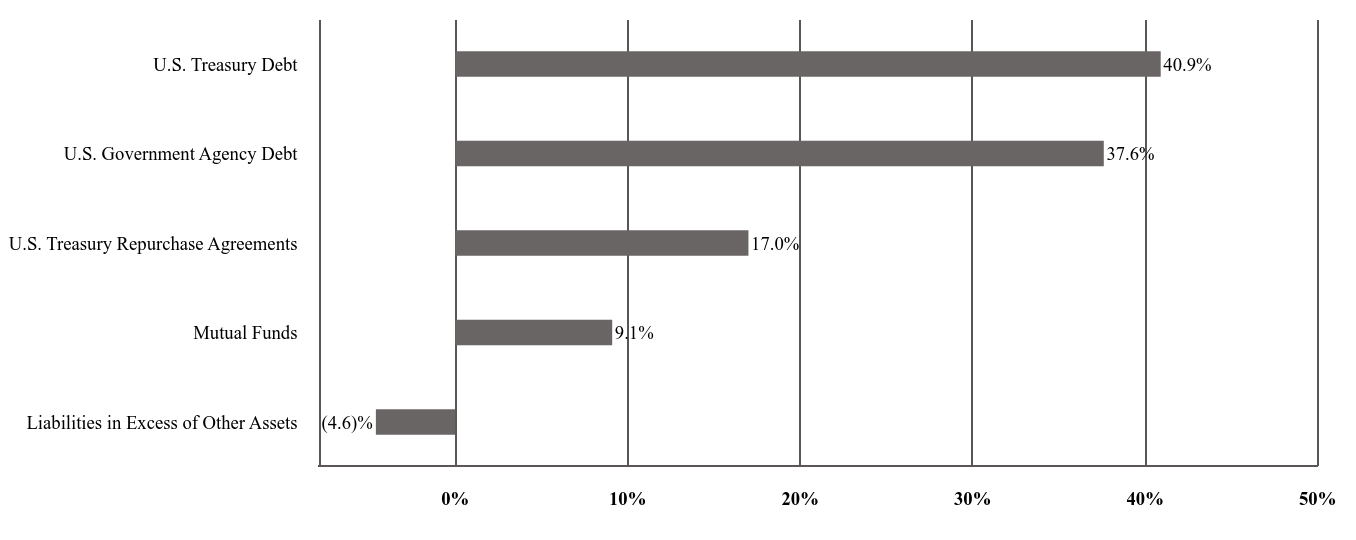

What did the Fund invest in?

The table below reflects the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (4.6)% |

| Mutual Funds | 9.1% |

| U.S. Treasury Repurchase Agreements | 17.0% |

| U.S. Government Agency Debt | 37.6% |

| U.S. Treasury Debt | 40.9% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Government Money Market Fund

Class A: VYAXX

92913L379-SAR

This semi-annual shareholder report contains important information about Voya Government Money Market Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class C | $68 | 1.35% |

Fund Statistics

- Total Net Assets$384,025,662

- # of Portfolio Holdings29

What did the Fund invest in?

The table below reflects the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (4.6)% |

| Mutual Funds | 9.1% |

| U.S. Treasury Repurchase Agreements | 17.0% |

| U.S. Government Agency Debt | 37.6% |

| U.S. Treasury Debt | 40.9% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Government Money Market Fund

Class C: VYBXX

92913L361-SAR

This semi-annual shareholder report contains important information about Voya Government Money Market Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class I | $18 | 0.35% |

Fund Statistics

- Total Net Assets$384,025,662

- # of Portfolio Holdings29

What did the Fund invest in?

The table below reflects the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (4.6)% |

| Mutual Funds | 9.1% |

| U.S. Treasury Repurchase Agreements | 17.0% |

| U.S. Government Agency Debt | 37.6% |

| U.S. Treasury Debt | 40.9% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Government Money Market Fund

Class I: VYCXX

92913L353-SAR

This semi-annual shareholder report contains important information about Voya Government Money Market Fund for the period of June 11, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

Class R6Footnote Reference* | $11 | 0.35% |

| Footnote | Description |

Footnote* | Expenses are for the period from June 11, 2024, commencement of operations, to September 30, 2024. Expenses for the full reporting period would be higher. |

Fund Statistics

- Total Net Assets$384,025,662

- # of Portfolio Holdings29

What did the Fund invest in?

The table below reflects the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (4.6)% |

| Mutual Funds | 9.1% |

| U.S. Treasury Repurchase Agreements | 17.0% |

| U.S. Government Agency Debt | 37.6% |

| U.S. Treasury Debt | 40.9% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Government Money Market Fund

Class R6: VYHXX

92913L213-SAR

This semi-annual shareholder report contains important information about Voya Government Money Market Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class W | $18 | 0.35% |

Fund Statistics

- Total Net Assets$384,025,662

- # of Portfolio Holdings29

What did the Fund invest in?

The table below reflects the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Investment Type Allocation

| Value | Value |

|---|---|

| Liabilities in Excess of Other Assets | (4.6)% |

| Mutual Funds | 9.1% |

| U.S. Treasury Repurchase Agreements | 17.0% |

| U.S. Government Agency Debt | 37.6% |

| U.S. Treasury Debt | 40.9% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Government Money Market Fund

Class W: VYGXX

92913L320-SAR

This semi-annual shareholder report contains important information about Voya High Yield Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class A | $52 | 1.01% |

Fund Statistics

- Total Net Assets$420,795,566

- # of Portfolio Holdings370

- Portfolio Turnover Rate40%

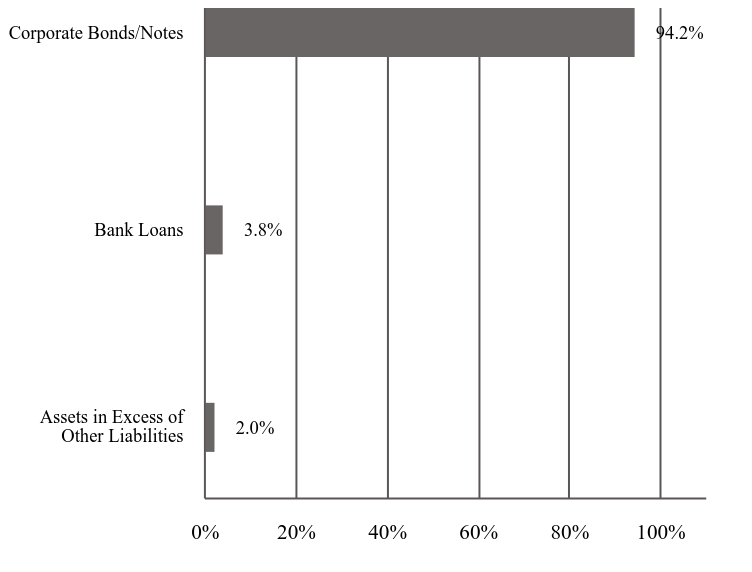

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| CSC Holdings LLC, 11.250%, 05/15/28 | 0.8% |

| Royal Caribbean Cruises Ltd., 5.375%, 07/15/27 | 0.8% |

| Sirius XM Radio, Inc., 5.000%, 08/01/27 | 0.8% |

| HUB International Ltd, 8.255%, 06/20/30 | 0.7% |

| Cloud Software Group, Inc., 6.500%, 03/31/29 | 0.7% |

| CCO Holdings LLC / CCO Holdings Capital Corp., 4.500%, 08/15/30 | 0.7% |

| Carvana Co., 12.000%, 12/01/28 | 0.6% |

| Viking Cruises Ltd., 5.875%, 09/15/27 | 0.6% |

| Allied Universal Holdco LLC/Allied Universal Finance Corp./Atlas Luxco 4 Sarl, 4.625%, 06/01/28 | 0.6% |

| CHS/Community Health Systems, Inc., 5.250%, 05/15/30 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 2.0% |

| Bank Loans | 3.8% |

| Corporate Bonds/Notes | 94.2% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya High Yield Bond Fund

Class A: IHYAX

92913L627-SAR

This semi-annual shareholder report contains important information about Voya High Yield Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class C | $91 | 1.76% |

Fund Statistics

- Total Net Assets$420,795,566

- # of Portfolio Holdings370

- Portfolio Turnover Rate40%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| CSC Holdings LLC, 11.250%, 05/15/28 | 0.8% |

| Royal Caribbean Cruises Ltd., 5.375%, 07/15/27 | 0.8% |

| Sirius XM Radio, Inc., 5.000%, 08/01/27 | 0.8% |

| HUB International Ltd, 8.255%, 06/20/30 | 0.7% |

| Cloud Software Group, Inc., 6.500%, 03/31/29 | 0.7% |

| CCO Holdings LLC / CCO Holdings Capital Corp., 4.500%, 08/15/30 | 0.7% |

| Carvana Co., 12.000%, 12/01/28 | 0.6% |

| Viking Cruises Ltd., 5.875%, 09/15/27 | 0.6% |

| Allied Universal Holdco LLC/Allied Universal Finance Corp./Atlas Luxco 4 Sarl, 4.625%, 06/01/28 | 0.6% |

| CHS/Community Health Systems, Inc., 5.250%, 05/15/30 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 2.0% |

| Bank Loans | 3.8% |

| Corporate Bonds/Notes | 94.2% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya High Yield Bond Fund

Class C: IMYCX

92913L643-SAR

This semi-annual shareholder report contains important information about Voya High Yield Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class I | $35 | 0.68% |

Fund Statistics

- Total Net Assets$420,795,566

- # of Portfolio Holdings370

- Portfolio Turnover Rate40%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| CSC Holdings LLC, 11.250%, 05/15/28 | 0.8% |

| Royal Caribbean Cruises Ltd., 5.375%, 07/15/27 | 0.8% |

| Sirius XM Radio, Inc., 5.000%, 08/01/27 | 0.8% |

| HUB International Ltd, 8.255%, 06/20/30 | 0.7% |

| Cloud Software Group, Inc., 6.500%, 03/31/29 | 0.7% |

| CCO Holdings LLC / CCO Holdings Capital Corp., 4.500%, 08/15/30 | 0.7% |

| Carvana Co., 12.000%, 12/01/28 | 0.6% |

| Viking Cruises Ltd., 5.875%, 09/15/27 | 0.6% |

| Allied Universal Holdco LLC/Allied Universal Finance Corp./Atlas Luxco 4 Sarl, 4.625%, 06/01/28 | 0.6% |

| CHS/Community Health Systems, Inc., 5.250%, 05/15/30 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 2.0% |

| Bank Loans | 3.8% |

| Corporate Bonds/Notes | 94.2% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya High Yield Bond Fund

Class I: IHYIX

92913L783-SAR

This semi-annual shareholder report contains important information about Voya High Yield Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class R | $65 | 1.26% |

Fund Statistics

- Total Net Assets$420,795,566

- # of Portfolio Holdings370

- Portfolio Turnover Rate40%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| CSC Holdings LLC, 11.250%, 05/15/28 | 0.8% |

| Royal Caribbean Cruises Ltd., 5.375%, 07/15/27 | 0.8% |

| Sirius XM Radio, Inc., 5.000%, 08/01/27 | 0.8% |

| HUB International Ltd, 8.255%, 06/20/30 | 0.7% |

| Cloud Software Group, Inc., 6.500%, 03/31/29 | 0.7% |

| CCO Holdings LLC / CCO Holdings Capital Corp., 4.500%, 08/15/30 | 0.7% |

| Carvana Co., 12.000%, 12/01/28 | 0.6% |

| Viking Cruises Ltd., 5.875%, 09/15/27 | 0.6% |

| Allied Universal Holdco LLC/Allied Universal Finance Corp./Atlas Luxco 4 Sarl, 4.625%, 06/01/28 | 0.6% |

| CHS/Community Health Systems, Inc., 5.250%, 05/15/30 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 2.0% |

| Bank Loans | 3.8% |

| Corporate Bonds/Notes | 94.2% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya High Yield Bond Fund

Class R: IRSTX

92913L544-SAR

This semi-annual shareholder report contains important information about Voya High Yield Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class R6 | $32 | 0.62% |

Fund Statistics

- Total Net Assets$420,795,566

- # of Portfolio Holdings370

- Portfolio Turnover Rate40%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| CSC Holdings LLC, 11.250%, 05/15/28 | 0.8% |

| Royal Caribbean Cruises Ltd., 5.375%, 07/15/27 | 0.8% |

| Sirius XM Radio, Inc., 5.000%, 08/01/27 | 0.8% |

| HUB International Ltd, 8.255%, 06/20/30 | 0.7% |

| Cloud Software Group, Inc., 6.500%, 03/31/29 | 0.7% |

| CCO Holdings LLC / CCO Holdings Capital Corp., 4.500%, 08/15/30 | 0.7% |

| Carvana Co., 12.000%, 12/01/28 | 0.6% |

| Viking Cruises Ltd., 5.875%, 09/15/27 | 0.6% |

| Allied Universal Holdco LLC/Allied Universal Finance Corp./Atlas Luxco 4 Sarl, 4.625%, 06/01/28 | 0.6% |

| CHS/Community Health Systems, Inc., 5.250%, 05/15/30 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 2.0% |

| Bank Loans | 3.8% |

| Corporate Bonds/Notes | 94.2% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya High Yield Bond Fund

Class R6: VHYRX

92913L528-SAR

This semi-annual shareholder report contains important information about Voya High Yield Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class W | $39 | 0.76% |

Fund Statistics

- Total Net Assets$420,795,566

- # of Portfolio Holdings370

- Portfolio Turnover Rate40%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| CSC Holdings LLC, 11.250%, 05/15/28 | 0.8% |

| Royal Caribbean Cruises Ltd., 5.375%, 07/15/27 | 0.8% |

| Sirius XM Radio, Inc., 5.000%, 08/01/27 | 0.8% |

| HUB International Ltd, 8.255%, 06/20/30 | 0.7% |

| Cloud Software Group, Inc., 6.500%, 03/31/29 | 0.7% |

| CCO Holdings LLC / CCO Holdings Capital Corp., 4.500%, 08/15/30 | 0.7% |

| Carvana Co., 12.000%, 12/01/28 | 0.6% |

| Viking Cruises Ltd., 5.875%, 09/15/27 | 0.6% |

| Allied Universal Holdco LLC/Allied Universal Finance Corp./Atlas Luxco 4 Sarl, 4.625%, 06/01/28 | 0.6% |

| CHS/Community Health Systems, Inc., 5.250%, 05/15/30 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 2.0% |

| Bank Loans | 3.8% |

| Corporate Bonds/Notes | 94.2% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya High Yield Bond Fund

Class W: IHYWX

92913L866-SAR

This semi-annual shareholder report contains important information about Voya Intermediate Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class A | $36 | 0.70% |

Fund Statistics

- Total Net Assets$9,356,389,267

- # of Portfolio Holdings2,364

- Portfolio Turnover Rate77%

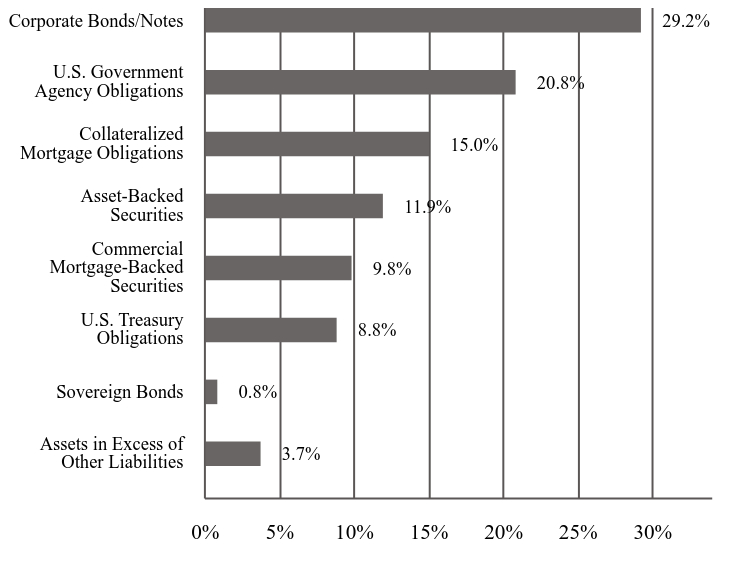

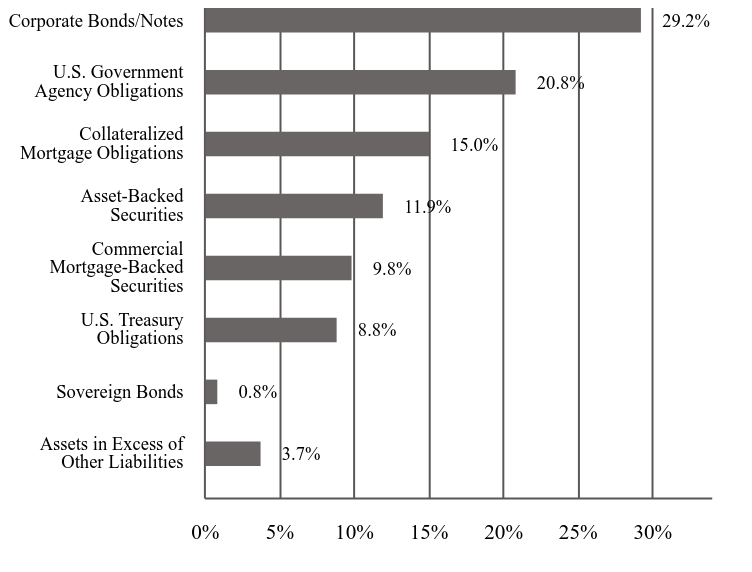

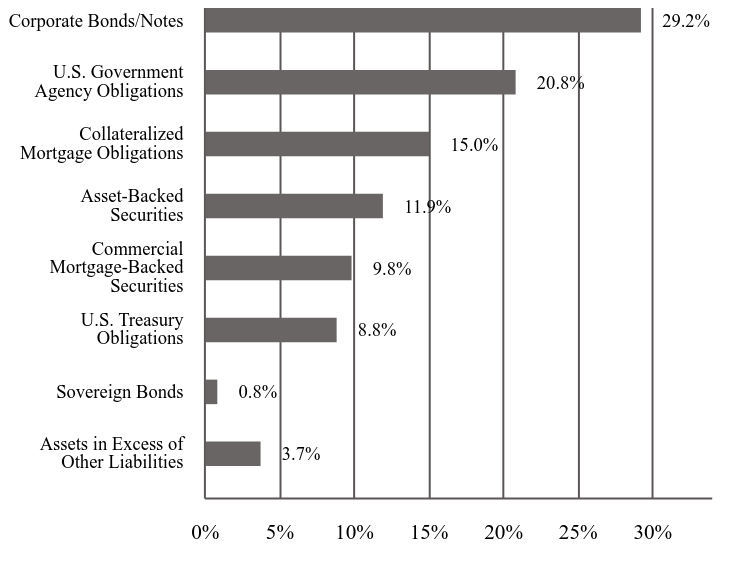

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| United States Treasury Bonds, 4.125%, 08/15/44 | 3.6% |

| Uniform Mortgage-Backed Securities, 2.500%, 02/01/52 | 1.3% |

| United States Treasury Notes, 4.350%, 05/15/54 | 1.2% |

| United States Treasury Notes, 3.625%, 09/15/27 | 1.2% |

| Ginnie Mae, 4.500%, 07/20/53 | 1.0% |

| Uniform Mortgage-Backed Securities, 2.000%, 02/01/52 | 0.9% |

| United States Treasury Notes, 3.500%, 09/30/26 | 0.7% |

| Uniform Mortgage-Backed Securities, 3.000%, 05/01/52 | 0.6% |

| Uniform Mortgage-Backed Securities, 2.000%, 05/01/51 | 0.6% |

| Uniform Mortgage-Backed Securities, 5.500%, 06/01/53 | 0.6% |

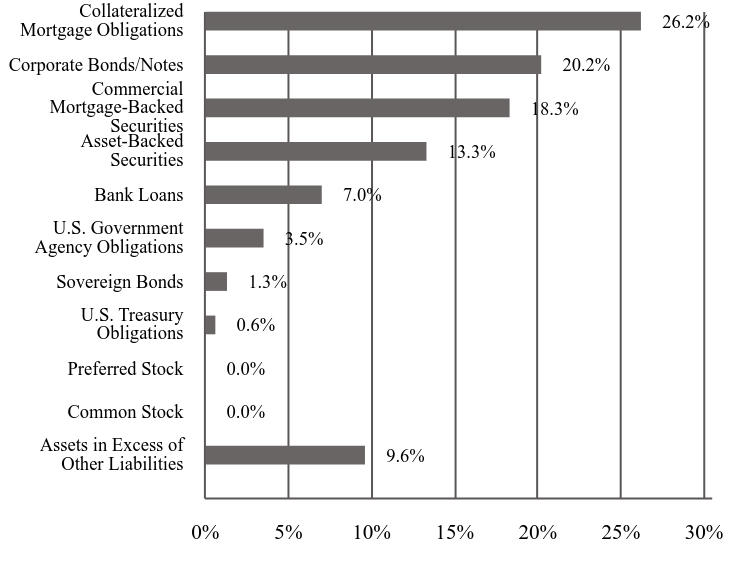

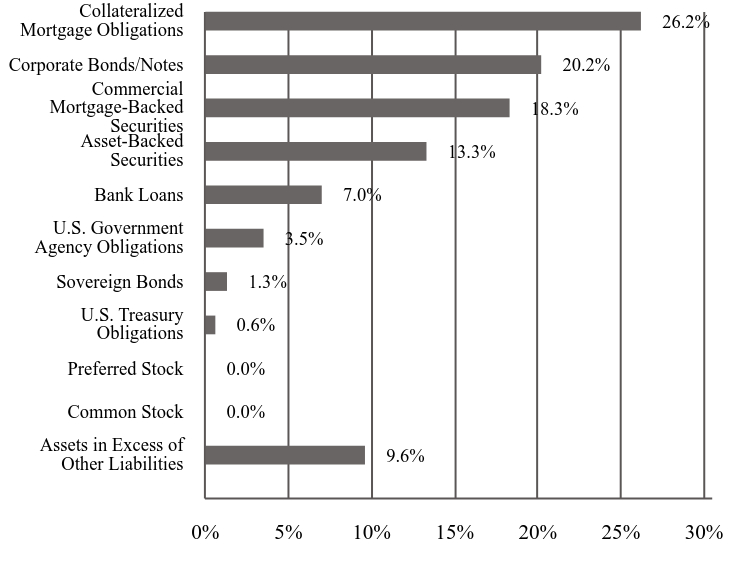

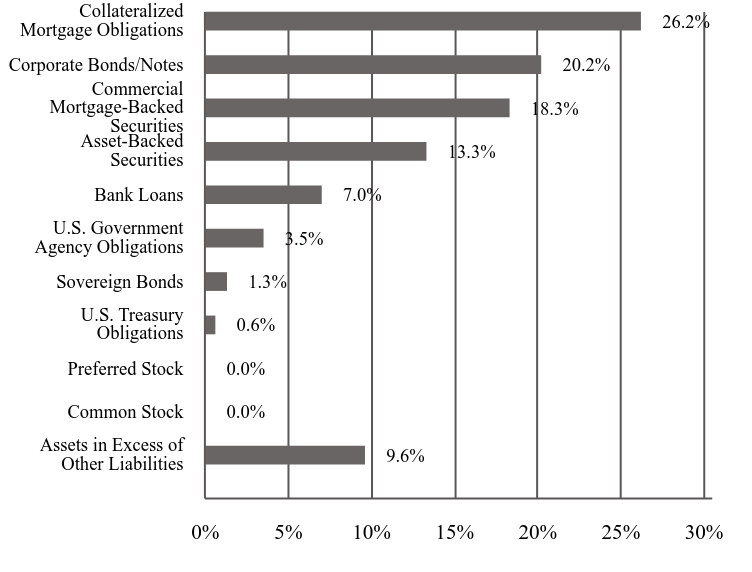

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 3.7% |

| Sovereign Bonds | 0.8% |

| U.S. Treasury Obligations | 8.8% |

| Commercial Mortgage-Backed Securities | 9.8% |

| Asset-Backed Securities | 11.9% |

| Collateralized Mortgage Obligations | 15.0% |

| U.S. Government Agency Obligations | 20.8% |

| Corporate Bonds/Notes | 29.2% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Intermediate Bond Fund

Class A: IIBAX

92913L650-SAR

This semi-annual shareholder report contains important information about Voya Intermediate Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class C | $74 | 1.45% |

Fund Statistics

- Total Net Assets$9,356,389,267

- # of Portfolio Holdings2,364

- Portfolio Turnover Rate77%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| United States Treasury Bonds, 4.125%, 08/15/44 | 3.6% |

| Uniform Mortgage-Backed Securities, 2.500%, 02/01/52 | 1.3% |

| United States Treasury Notes, 4.350%, 05/15/54 | 1.2% |

| United States Treasury Notes, 3.625%, 09/15/27 | 1.2% |

| Ginnie Mae, 4.500%, 07/20/53 | 1.0% |

| Uniform Mortgage-Backed Securities, 2.000%, 02/01/52 | 0.9% |

| United States Treasury Notes, 3.500%, 09/30/26 | 0.7% |

| Uniform Mortgage-Backed Securities, 3.000%, 05/01/52 | 0.6% |

| Uniform Mortgage-Backed Securities, 2.000%, 05/01/51 | 0.6% |

| Uniform Mortgage-Backed Securities, 5.500%, 06/01/53 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 3.7% |

| Sovereign Bonds | 0.8% |

| U.S. Treasury Obligations | 8.8% |

| Commercial Mortgage-Backed Securities | 9.8% |

| Asset-Backed Securities | 11.9% |

| Collateralized Mortgage Obligations | 15.0% |

| U.S. Government Agency Obligations | 20.8% |

| Corporate Bonds/Notes | 29.2% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Intermediate Bond Fund

Class C: IICCX

92913L676-SAR

This semi-annual shareholder report contains important information about Voya Intermediate Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class I | $18 | 0.35% |

Fund Statistics

- Total Net Assets$9,356,389,267

- # of Portfolio Holdings2,364

- Portfolio Turnover Rate77%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| United States Treasury Bonds, 4.125%, 08/15/44 | 3.6% |

| Uniform Mortgage-Backed Securities, 2.500%, 02/01/52 | 1.3% |

| United States Treasury Notes, 4.350%, 05/15/54 | 1.2% |

| United States Treasury Notes, 3.625%, 09/15/27 | 1.2% |

| Ginnie Mae, 4.500%, 07/20/53 | 1.0% |

| Uniform Mortgage-Backed Securities, 2.000%, 02/01/52 | 0.9% |

| United States Treasury Notes, 3.500%, 09/30/26 | 0.7% |

| Uniform Mortgage-Backed Securities, 3.000%, 05/01/52 | 0.6% |

| Uniform Mortgage-Backed Securities, 2.000%, 05/01/51 | 0.6% |

| Uniform Mortgage-Backed Securities, 5.500%, 06/01/53 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 3.7% |

| Sovereign Bonds | 0.8% |

| U.S. Treasury Obligations | 8.8% |

| Commercial Mortgage-Backed Securities | 9.8% |

| Asset-Backed Securities | 11.9% |

| Collateralized Mortgage Obligations | 15.0% |

| U.S. Government Agency Obligations | 20.8% |

| Corporate Bonds/Notes | 29.2% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Intermediate Bond Fund

Class I: IICIX

92913L684-SAR

This semi-annual shareholder report contains important information about Voya Intermediate Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class R | $49 | 0.95% |

Fund Statistics

- Total Net Assets$9,356,389,267

- # of Portfolio Holdings2,364

- Portfolio Turnover Rate77%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| United States Treasury Bonds, 4.125%, 08/15/44 | 3.6% |

| Uniform Mortgage-Backed Securities, 2.500%, 02/01/52 | 1.3% |

| United States Treasury Notes, 4.350%, 05/15/54 | 1.2% |

| United States Treasury Notes, 3.625%, 09/15/27 | 1.2% |

| Ginnie Mae, 4.500%, 07/20/53 | 1.0% |

| Uniform Mortgage-Backed Securities, 2.000%, 02/01/52 | 0.9% |

| United States Treasury Notes, 3.500%, 09/30/26 | 0.7% |

| Uniform Mortgage-Backed Securities, 3.000%, 05/01/52 | 0.6% |

| Uniform Mortgage-Backed Securities, 2.000%, 05/01/51 | 0.6% |

| Uniform Mortgage-Backed Securities, 5.500%, 06/01/53 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 3.7% |

| Sovereign Bonds | 0.8% |

| U.S. Treasury Obligations | 8.8% |

| Commercial Mortgage-Backed Securities | 9.8% |

| Asset-Backed Securities | 11.9% |

| Collateralized Mortgage Obligations | 15.0% |

| U.S. Government Agency Obligations | 20.8% |

| Corporate Bonds/Notes | 29.2% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Intermediate Bond Fund

Class R: IIBOX

92913L742-SAR

This semi-annual shareholder report contains important information about Voya Intermediate Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class R6 | $16 | 0.30% |

Fund Statistics

- Total Net Assets$9,356,389,267

- # of Portfolio Holdings2,364

- Portfolio Turnover Rate77%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| United States Treasury Bonds, 4.125%, 08/15/44 | 3.6% |

| Uniform Mortgage-Backed Securities, 2.500%, 02/01/52 | 1.3% |

| United States Treasury Notes, 4.350%, 05/15/54 | 1.2% |

| United States Treasury Notes, 3.625%, 09/15/27 | 1.2% |

| Ginnie Mae, 4.500%, 07/20/53 | 1.0% |

| Uniform Mortgage-Backed Securities, 2.000%, 02/01/52 | 0.9% |

| United States Treasury Notes, 3.500%, 09/30/26 | 0.7% |

| Uniform Mortgage-Backed Securities, 3.000%, 05/01/52 | 0.6% |

| Uniform Mortgage-Backed Securities, 2.000%, 05/01/51 | 0.6% |

| Uniform Mortgage-Backed Securities, 5.500%, 06/01/53 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 3.7% |

| Sovereign Bonds | 0.8% |

| U.S. Treasury Obligations | 8.8% |

| Commercial Mortgage-Backed Securities | 9.8% |

| Asset-Backed Securities | 11.9% |

| Collateralized Mortgage Obligations | 15.0% |

| U.S. Government Agency Obligations | 20.8% |

| Corporate Bonds/Notes | 29.2% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Intermediate Bond Fund

Class R6: IIBZX

92913L569-SAR

This semi-annual shareholder report contains important information about Voya Intermediate Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class W | $23 | 0.45% |

Fund Statistics

- Total Net Assets$9,356,389,267

- # of Portfolio Holdings2,364

- Portfolio Turnover Rate77%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| United States Treasury Bonds, 4.125%, 08/15/44 | 3.6% |

| Uniform Mortgage-Backed Securities, 2.500%, 02/01/52 | 1.3% |

| United States Treasury Notes, 4.350%, 05/15/54 | 1.2% |

| United States Treasury Notes, 3.625%, 09/15/27 | 1.2% |

| Ginnie Mae, 4.500%, 07/20/53 | 1.0% |

| Uniform Mortgage-Backed Securities, 2.000%, 02/01/52 | 0.9% |

| United States Treasury Notes, 3.500%, 09/30/26 | 0.7% |

| Uniform Mortgage-Backed Securities, 3.000%, 05/01/52 | 0.6% |

| Uniform Mortgage-Backed Securities, 2.000%, 05/01/51 | 0.6% |

| Uniform Mortgage-Backed Securities, 5.500%, 06/01/53 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 3.7% |

| Sovereign Bonds | 0.8% |

| U.S. Treasury Obligations | 8.8% |

| Commercial Mortgage-Backed Securities | 9.8% |

| Asset-Backed Securities | 11.9% |

| Collateralized Mortgage Obligations | 15.0% |

| U.S. Government Agency Obligations | 20.8% |

| Corporate Bonds/Notes | 29.2% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Intermediate Bond Fund

Class W: IIBWX

92913L775-SAR

This semi-annual shareholder report contains important information about Voya Short Duration Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class A | $33 | 0.64% |

Fund Statistics

- Total Net Assets$619,038,142

- # of Portfolio Holdings640

- Portfolio Turnover Rate121%

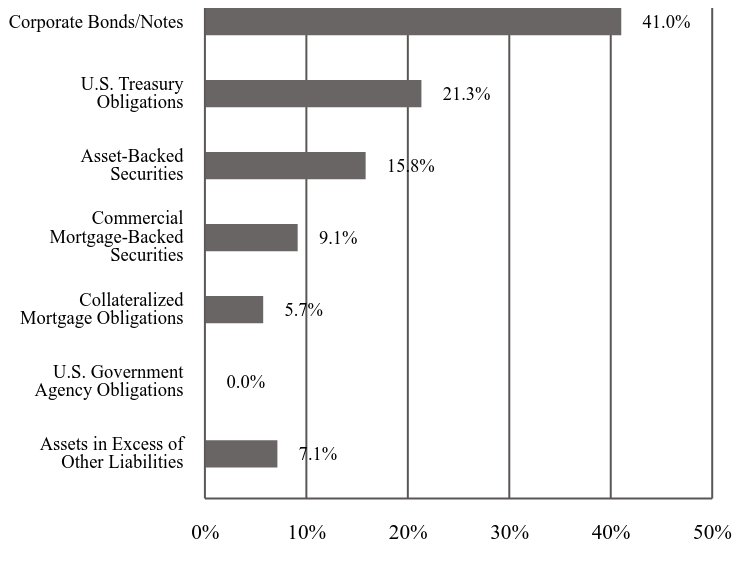

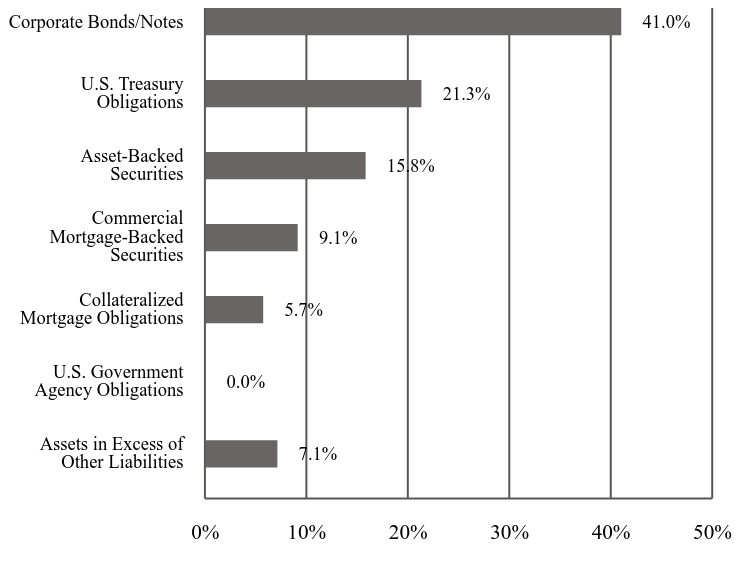

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| United States Treasury Notes, 3.625%, 09/15/27 | 15.4% |

| United States Treasury Notes, 2.000%, 08/15/25 | 4.7% |

| United States Treasury Notes, 3.500%, 09/30/26 | 0.9% |

| Freddie Mac REMIC Trust - Class FA, 6.007%, 04/15/36 | 0.8% |

| Freddie Mac Strips - Class F43, 6.080%, 10/25/53 | 0.7% |

| DC Commercial Mortgage Trust - Class A, 6.314%, 09/12/40 | 0.7% |

| ILPT Commercial Mortgage Trust - Class A, 7.342%, 10/15/39 | 0.6% |

| BRSP Ltd. - Class B, 6.979%, 08/19/38 | 0.6% |

| Freddie Mac Strips - Class F44, 6.280%, 10/25/53 | 0.6% |

| OHA Credit Partners XIII Ltd. - Class A1R2, 6.459%, 10/21/37 | 0.6% |

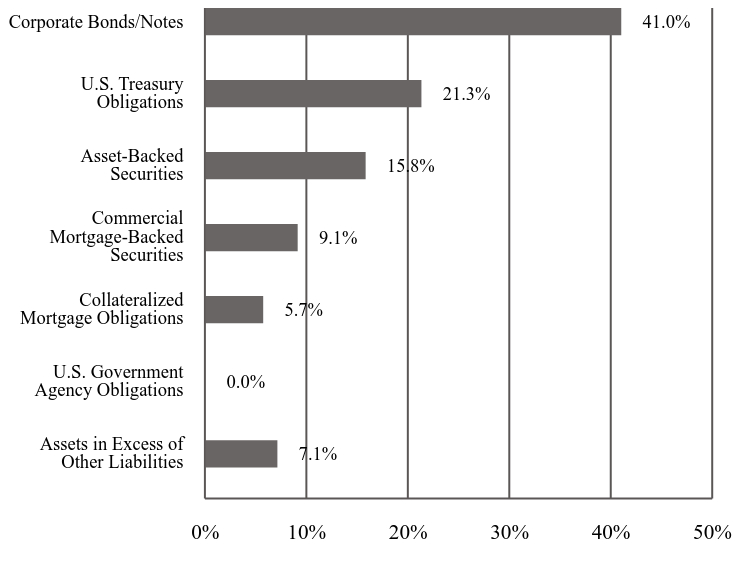

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 7.1% |

| U.S. Government Agency Obligations | 0.0% |

| Collateralized Mortgage Obligations | 5.7% |

| Commercial Mortgage-Backed Securities | 9.1% |

| Asset-Backed Securities | 15.8% |

| U.S. Treasury Obligations | 21.3% |

| Corporate Bonds/Notes | 41.0% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Short Duration Bond Fund

Class A: IASBX

92913L502-SAR

This semi-annual shareholder report contains important information about Voya Short Duration Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class C | $71 | 1.39% |

Fund Statistics

- Total Net Assets$619,038,142

- # of Portfolio Holdings640

- Portfolio Turnover Rate121%

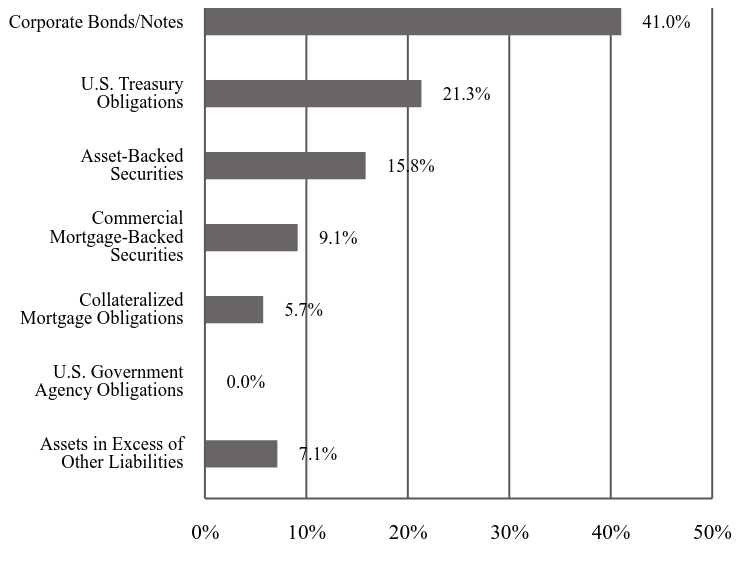

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| United States Treasury Notes, 3.625%, 09/15/27 | 15.4% |

| United States Treasury Notes, 2.000%, 08/15/25 | 4.7% |

| United States Treasury Notes, 3.500%, 09/30/26 | 0.9% |

| Freddie Mac REMIC Trust - Class FA, 6.007%, 04/15/36 | 0.8% |

| Freddie Mac Strips - Class F43, 6.080%, 10/25/53 | 0.7% |

| DC Commercial Mortgage Trust - Class A, 6.314%, 09/12/40 | 0.7% |

| ILPT Commercial Mortgage Trust - Class A, 7.342%, 10/15/39 | 0.6% |

| BRSP Ltd. - Class B, 6.979%, 08/19/38 | 0.6% |

| Freddie Mac Strips - Class F44, 6.280%, 10/25/53 | 0.6% |

| OHA Credit Partners XIII Ltd. - Class A1R2, 6.459%, 10/21/37 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 7.1% |

| U.S. Government Agency Obligations | 0.0% |

| Collateralized Mortgage Obligations | 5.7% |

| Commercial Mortgage-Backed Securities | 9.1% |

| Asset-Backed Securities | 15.8% |

| U.S. Treasury Obligations | 21.3% |

| Corporate Bonds/Notes | 41.0% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Short Duration Bond Fund

Class C: ICSBX

92913L403-SAR

This semi-annual shareholder report contains important information about Voya Short Duration Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class I | $18 | 0.35% |

Fund Statistics

- Total Net Assets$619,038,142

- # of Portfolio Holdings640

- Portfolio Turnover Rate121%

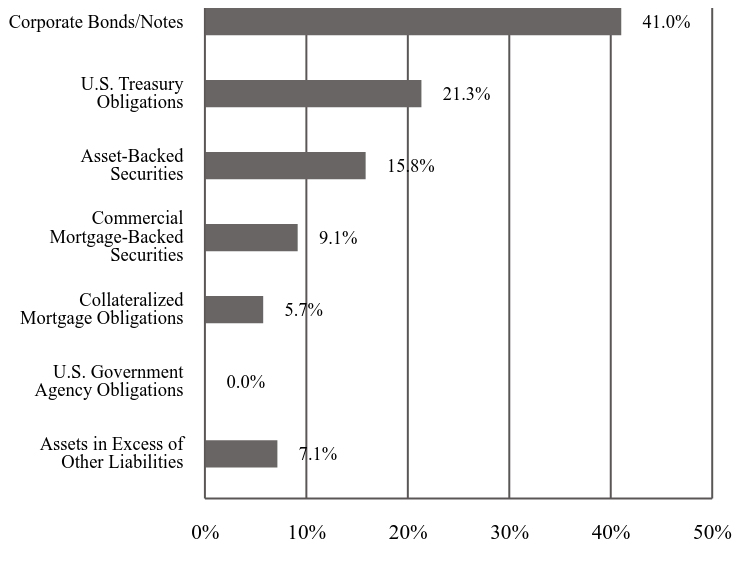

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| United States Treasury Notes, 3.625%, 09/15/27 | 15.4% |

| United States Treasury Notes, 2.000%, 08/15/25 | 4.7% |

| United States Treasury Notes, 3.500%, 09/30/26 | 0.9% |

| Freddie Mac REMIC Trust - Class FA, 6.007%, 04/15/36 | 0.8% |

| Freddie Mac Strips - Class F43, 6.080%, 10/25/53 | 0.7% |

| DC Commercial Mortgage Trust - Class A, 6.314%, 09/12/40 | 0.7% |

| ILPT Commercial Mortgage Trust - Class A, 7.342%, 10/15/39 | 0.6% |

| BRSP Ltd. - Class B, 6.979%, 08/19/38 | 0.6% |

| Freddie Mac Strips - Class F44, 6.280%, 10/25/53 | 0.6% |

| OHA Credit Partners XIII Ltd. - Class A1R2, 6.459%, 10/21/37 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 7.1% |

| U.S. Government Agency Obligations | 0.0% |

| Collateralized Mortgage Obligations | 5.7% |

| Commercial Mortgage-Backed Securities | 9.1% |

| Asset-Backed Securities | 15.8% |

| U.S. Treasury Obligations | 21.3% |

| Corporate Bonds/Notes | 41.0% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Short Duration Bond Fund

Class I: IISBX

92913L304-SAR

This semi-annual shareholder report contains important information about Voya Short Duration Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class R | $45 | 0.89% |

Fund Statistics

- Total Net Assets$619,038,142

- # of Portfolio Holdings640

- Portfolio Turnover Rate121%

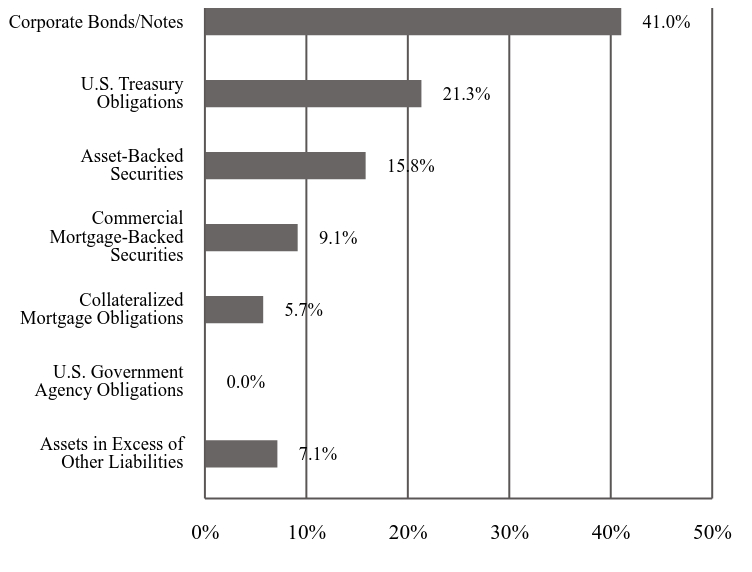

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| United States Treasury Notes, 3.625%, 09/15/27 | 15.4% |

| United States Treasury Notes, 2.000%, 08/15/25 | 4.7% |

| United States Treasury Notes, 3.500%, 09/30/26 | 0.9% |

| Freddie Mac REMIC Trust - Class FA, 6.007%, 04/15/36 | 0.8% |

| Freddie Mac Strips - Class F43, 6.080%, 10/25/53 | 0.7% |

| DC Commercial Mortgage Trust - Class A, 6.314%, 09/12/40 | 0.7% |

| ILPT Commercial Mortgage Trust - Class A, 7.342%, 10/15/39 | 0.6% |

| BRSP Ltd. - Class B, 6.979%, 08/19/38 | 0.6% |

| Freddie Mac Strips - Class F44, 6.280%, 10/25/53 | 0.6% |

| OHA Credit Partners XIII Ltd. - Class A1R2, 6.459%, 10/21/37 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 7.1% |

| U.S. Government Agency Obligations | 0.0% |

| Collateralized Mortgage Obligations | 5.7% |

| Commercial Mortgage-Backed Securities | 9.1% |

| Asset-Backed Securities | 15.8% |

| U.S. Treasury Obligations | 21.3% |

| Corporate Bonds/Notes | 41.0% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Short Duration Bond Fund

Class R: VSTRX

92913L205-SAR

This semi-annual shareholder report contains important information about Voya Short Duration Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class R6 | $15 | 0.30% |

Fund Statistics

- Total Net Assets$619,038,142

- # of Portfolio Holdings640

- Portfolio Turnover Rate121%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| United States Treasury Notes, 3.625%, 09/15/27 | 15.4% |

| United States Treasury Notes, 2.000%, 08/15/25 | 4.7% |

| United States Treasury Notes, 3.500%, 09/30/26 | 0.9% |

| Freddie Mac REMIC Trust - Class FA, 6.007%, 04/15/36 | 0.8% |

| Freddie Mac Strips - Class F43, 6.080%, 10/25/53 | 0.7% |

| DC Commercial Mortgage Trust - Class A, 6.314%, 09/12/40 | 0.7% |

| ILPT Commercial Mortgage Trust - Class A, 7.342%, 10/15/39 | 0.6% |

| BRSP Ltd. - Class B, 6.979%, 08/19/38 | 0.6% |

| Freddie Mac Strips - Class F44, 6.280%, 10/25/53 | 0.6% |

| OHA Credit Partners XIII Ltd. - Class A1R2, 6.459%, 10/21/37 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 7.1% |

| U.S. Government Agency Obligations | 0.0% |

| Collateralized Mortgage Obligations | 5.7% |

| Commercial Mortgage-Backed Securities | 9.1% |

| Asset-Backed Securities | 15.8% |

| U.S. Treasury Obligations | 21.3% |

| Corporate Bonds/Notes | 41.0% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Short Duration Bond Fund

Class R6: IGZAX

92913L551-SAR

This semi-annual shareholder report contains important information about Voya Short Duration Bond Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class W | $20 | 0.39% |

Fund Statistics

- Total Net Assets$619,038,142

- # of Portfolio Holdings640

- Portfolio Turnover Rate121%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| United States Treasury Notes, 3.625%, 09/15/27 | 15.4% |

| United States Treasury Notes, 2.000%, 08/15/25 | 4.7% |

| United States Treasury Notes, 3.500%, 09/30/26 | 0.9% |

| Freddie Mac REMIC Trust - Class FA, 6.007%, 04/15/36 | 0.8% |

| Freddie Mac Strips - Class F43, 6.080%, 10/25/53 | 0.7% |

| DC Commercial Mortgage Trust - Class A, 6.314%, 09/12/40 | 0.7% |

| ILPT Commercial Mortgage Trust - Class A, 7.342%, 10/15/39 | 0.6% |

| BRSP Ltd. - Class B, 6.979%, 08/19/38 | 0.6% |

| Freddie Mac Strips - Class F44, 6.280%, 10/25/53 | 0.6% |

| OHA Credit Partners XIII Ltd. - Class A1R2, 6.459%, 10/21/37 | 0.6% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 7.1% |

| U.S. Government Agency Obligations | 0.0% |

| Collateralized Mortgage Obligations | 5.7% |

| Commercial Mortgage-Backed Securities | 9.1% |

| Asset-Backed Securities | 15.8% |

| U.S. Treasury Obligations | 21.3% |

| Corporate Bonds/Notes | 41.0% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Short Duration Bond Fund

Class W: IWSBX

92913L106-SAR

This semi-annual shareholder report contains important information about Voya Short Duration High Income Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class A | $43 | 0.83% |

Fund Statistics

- Total Net Assets$183,968,656

- # of Portfolio Holdings100

- Portfolio Turnover Rate39%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| VistaJet Malta Finance PLC / Vista Management Holding, Inc., 9.500%, 06/01/28 | 3.6% |

| Asurion, LLC, 8.840%, 01/20/29 | 3.5% |

| Uber Technologies, Inc., 8.000%, 11/01/26 | 3.0% |

| HAT Holdings I LLC / HAT Holdings II LLC, 8.000%, 06/15/27 | 2.7% |

| Global Auto Holdings Ltd./AAG FH UK Ltd., 8.375%, 01/15/29 | 2.6% |

| LD Holdings Group LLC, 6.125%, 04/01/28 | 2.6% |

| Consensus Cloud Solutions, Inc., 6.500%, 10/15/28 | 2.6% |

| Freedom Mortgage Holdings LLC, 9.250%, 02/01/29 | 2.4% |

| Global Aircraft Leasing Co. Ltd., 8.750%, 09/01/27 | 2.4% |

| Sunnova Energy Corp., 11.750%, 10/01/28 | 2.3% |

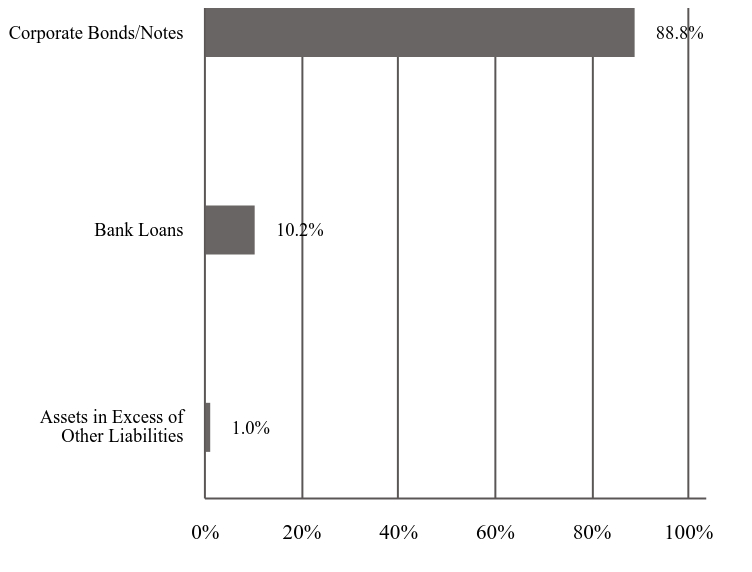

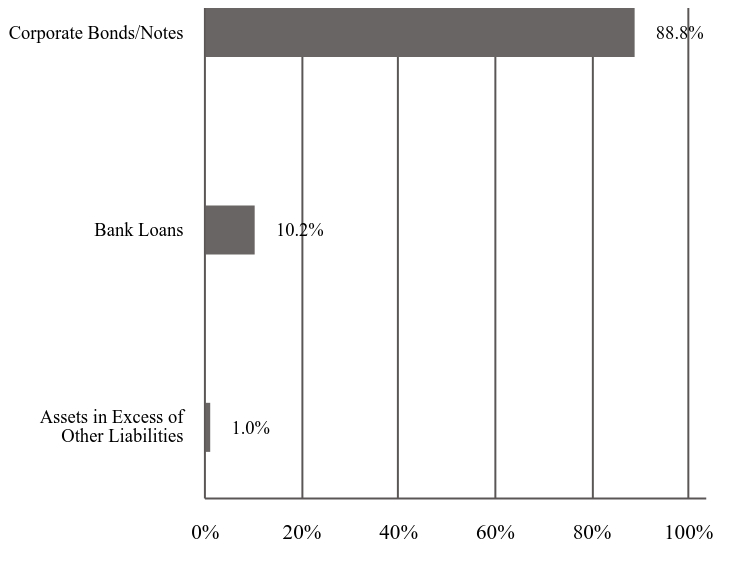

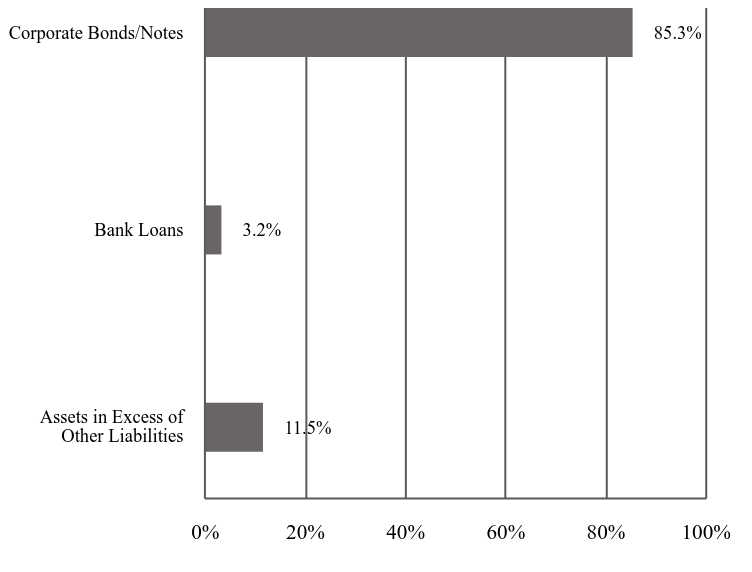

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 1.0% |

| Bank Loans | 10.2% |

| Corporate Bonds/Notes | 88.8% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Short Duration High Income Fund

Class A: VVJBX

92913L254-SAR

This semi-annual shareholder report contains important information about Voya Short Duration High Income Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class C | $81 | 1.58% |

Fund Statistics

- Total Net Assets$183,968,656

- # of Portfolio Holdings100

- Portfolio Turnover Rate39%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| VistaJet Malta Finance PLC / Vista Management Holding, Inc., 9.500%, 06/01/28 | 3.6% |

| Asurion, LLC, 8.840%, 01/20/29 | 3.5% |

| Uber Technologies, Inc., 8.000%, 11/01/26 | 3.0% |

| HAT Holdings I LLC / HAT Holdings II LLC, 8.000%, 06/15/27 | 2.7% |

| Global Auto Holdings Ltd./AAG FH UK Ltd., 8.375%, 01/15/29 | 2.6% |

| LD Holdings Group LLC, 6.125%, 04/01/28 | 2.6% |

| Consensus Cloud Solutions, Inc., 6.500%, 10/15/28 | 2.6% |

| Freedom Mortgage Holdings LLC, 9.250%, 02/01/29 | 2.4% |

| Global Aircraft Leasing Co. Ltd., 8.750%, 09/01/27 | 2.4% |

| Sunnova Energy Corp., 11.750%, 10/01/28 | 2.3% |

Investment Type Allocation

| Value | Value |

|---|---|

| Assets in Excess of Other Liabilities | 1.0% |

| Bank Loans | 10.2% |

| Corporate Bonds/Notes | 88.8% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings & proxy voting, scan the below QR code, visit https://individuals.voya.com/product/mutual-fund/prospectuses-reports or call us at 1-800-992-0180.

Voya Short Duration High Income Fund

Class C: VVJGX

92913L221-SAR

This semi-annual shareholder report contains important information about Voya Short Duration High Income Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://individuals.voya.com/product/mutual-fund/prospectuses-reports. You can also request this information by contacting us at 1-800-992-0180.

What were the Fund’s costs for the last six months? (based on a hypothetical $10,000 investment)

| Class Name | Costs of $10K investment | Costs paid as % of $10K investment |

|---|---|---|

| Class I | $31 | 0.60% |

Fund Statistics

- Total Net Assets$183,968,656

- # of Portfolio Holdings100

- Portfolio Turnover Rate39%

What did the Fund invest in?

The tables below reflect the investment makeup of the Fund, excluding derivatives unless otherwise noted, shown as percentage of Fund net assets. Portfolio holdings are subject to change daily.

Top 10 Holdings

| VistaJet Malta Finance PLC / Vista Management Holding, Inc., 9.500%, 06/01/28 | 3.6% |

| Asurion, LLC, 8.840%, 01/20/29 | 3.5% |

| Uber Technologies, Inc., 8.000%, 11/01/26 | 3.0% |

| HAT Holdings I LLC / HAT Holdings II LLC, 8.000%, 06/15/27 | 2.7% |

| Global Auto Holdings Ltd./AAG FH UK Ltd., 8.375%, 01/15/29 | 2.6% |

| LD Holdings Group LLC, 6.125%, 04/01/28 | 2.6% |

| Consensus Cloud Solutions, Inc., 6.500%, 10/15/28 | 2.6% |

| Freedom Mortgage Holdings LLC, 9.250%, 02/01/29 | 2.4% |