VOYA INVESTMENT MANAGEMENT

7337 EAST DOUBLETREE RANCH ROAD, SUITE 100 SCOTTSDALE, AZ 85258

February 1, 2023

VIA EDGAR

Ms. Jaea F. Hahn, Esq.

Staff Counsel

U.S. Securities and Exchange Commission

Division of Investment Management

100 F Street, N.E.

Washington, DC 20549

RE: | Voya Funds Trust (the "Registrant") |

| (File Nos. 333-59745; 811-08895) |

Dear Ms. Hahn:

This letter responds to comments provided by telephone on January 10, 2023, by the Staff (the "Staff") of the U.S. Securities and Exchange Commission (the "SEC") with respect to Post-Effective Amendment No. 122 (the "Amendment") to the Registrant's Registration Statement on Form N-1A (the "Registration Statement"). This Amendment was filed with the SEC, via the EDGAR system, pursuant to Rule 485(a) under the Securities Act of 1933, as amended (the "1933 Act"), on November 22, 2022. Our summary of the comments and our responses thereto are provided below. Capitalized terms used but not defined herein have the meanings assigned to them in the Registration Statement. The Registrant intends to file a future post-effective amendment pursuant to Rule 485(b) under the 1933 Act to, as applicable: (i) reflect the revisions discussed herein in response to the Staff's comments; (ii) make certain non-material changes, as appropriate; and (iii) file exhibits to the Registration Statement.

GENERAL

1.Comment: The Staff requested that the Registrant confirm that the Secretary for the Trust (the "Secretary") is authorized to sign the Registration Statement on behalf of the Registrant.

Response: The Registrant confirms that the Secretary is authorized to sign the Registration Statement on behalf of the Registrant. Section 3.7 of the Amended and Restated By-Laws for the Registrant state that "[t]he Secretary shall perform such additional duties as the Trustees may from time to time designate." In addition, the Board of Trustees of the Registrant took the following action at its meeting held on September 30, 2022:

RESOLVED, that the officers of Voya Funds Trust ("VFT"), on behalf of Voya Short Duration High Income Fund (the "Fund"), be, and each hereby is, authorized and directed to take all acts which such officers deem, in their discretion, necessary or desirable to prepare, execute, and file with the U.S. Securities and Exchange Commission a post-effective amendment to VFT's Registration Statement filed on Form N-1A under the Investment Company Act of 1940, for the purpose of registering shares of the Fund; and to take such other actions as may be deemed necessary or desirable by such officers or on the advice of counsel in connection with the registration of the Fund and its shares under such laws.

Based on the foregoing, the Registrant believes that the Secretary is authorized to sign the Registration Statement consistent with their duties as Secretary.

Ms. Jaea Hahn, Esq.

U.S. Securities and Exchange Commission

February 1, 2023

Page | 2

FEES AND EXPENSES OF THE FUND

2.Comment: The Staff requested that the Registrant confirm that if estimated acquired fund fees and expenses for Voya Short Duration High Income Fund (the "Fund") are over one basis point, the Fund will include a line item for acquired fund fees and expenses in the Fund's Annual Fund Operating

Expenses table.

Response: The Registrant confirms that the Fund does not expect acquired fund fees and expenses to be over one basis point and therefore a line item for acquired fund fees and expenses in the Fund's Annual Fund Operating Expenses table will not be included.

PRINCIPAL INVESTMENT STRATEGIES

3.Comment: The Staff requested that the Registrant explain the significance of the following

sentence: "The Fund may invest up to 10% of its net assets in securities rated CCC or below (or the equivalent) by S&P, Moody's, or Fitch, or in unrated securities determined by the Sub-Adviser to be of comparable quality."

Response: As disclosed in the Principal Investment Strategies, under normal market conditions, the Fund will invest at least 80% of its net assets (plus borrowings for investment purposes) in debt securities issued by public and private companies, which, at the time of purchase, are rated below investment grade. Although the investments cited by the Staff are also rated below investment grade, the Registrant believes it is appropriate to disclose that those investments may include securities in the lowest rating categories and that those investments are limited to 10% of the Fund's net assets.

4.Comment: The Staff requested that the Registrant supplementally explain how the Fund's investment strategy is appropriate for an open-end fund. The Staff noted that the response may include information regarding the relevant factors referenced in the Investment Company Liquidity Risk Management Programs, Release Nos. 33-10233; IC-32315 (Oct. 13, 2016) and may also include general market data with respect to the types of investments the Fund intends to hold.

Response: Consistent with Rule 22e-4 under the Investment Company Act of 1940, as amended, the Fund will adopt a liquidity risk management program to govern its approach to managing liquidity risk (the "Program"). The Board of Trustees of the Registrant has approved the designation of the Fund's investment adviser, Voya Investments, LLC (the "Investment Adviser"), as the program administrator (the "Program Administrator"). The Program Administrator will be responsible for implementing and monitoring the Program and the Program Administrator has formed a Liquidity Risk Management Committee (the "Committee") that will assess and review, on an ongoing basis, the Fund's liquidity risk. The Program will include a number of elements that support the management and assessment of liquidity risk, including an annual assessment of liquidity risk factors and the periodic classification (or re-classification, as necessary) of the Fund's investments into buckets (highly liquid, moderately liquid, less liquid and illiquid) that reflect the Committee's assessment of the investments' liquidity under current market conditions. The Committee also will utilize fund-specific data, including information regarding the Fund's shareholder base, characteristics of its investments, access to borrowing arrangements and anticipated redemptions in considering the Fund's ability to meet its redemption obligations in a timely manner.

It is anticipated that the Fund's investments will be readily tradeable and generally consist of non- investment grade debt securities issued by public companies with relatively short maturities. As a general matter, these types of investments are relatively standardized and settle on a T+2 basis. The Investment Adviser believes that the Fund's principal investment strategies are appropriate for an open-

Ms. Jaea Hahn, Esq.

U.S. Securities and Exchange Commission

February 1, 2023

Page | 3

end fund (and the liquidity of the Fund's portfolio is consistent with the Fund's status as an open-end fund) when viewed in light of the above and, among other things, the terms and operation of the Program and other factors that mitigate the Fund's liquidity risk, including the Fund's ability to honor redemptions through distribution of securities in kind.

5.Comment: The Staff requested that, in reference to the following sentence, the Registrant

describe in greater detail the types of loans in which the Fund expects to invest: "[t]he Fund may invest up to 20% of its assets in bank loans and floating rate secured loans, which may be included among the Fund's high-yield securities for purposes of the 80% policy described above." The Staff further requested that the Registrant add risk disclosure to the extent the Fund intends to invest in collateralized loan obligations or covenant lite loans as part of its principal investment strategies.

Response: The Registrant appreciates the Staff's comment but respectfully declines to make the requested disclosure changes to the Fund's principal investment strategies because the Registrant believes that references to "bank loans and floating rate secured loans" adequately describe potential investments for the Fund. The Registrant confirms that the Fund will not invest in collateralized loan obligations as part of its principal investment strategies. The Registrant confirms that the Fund may invest in loans that are considered "covenant-lite" loans and notes the following disclosure is included in the Fund's Statement of Additional Information and also will be added to the "Principal Risks" and "Additional Information About the Principal Risks" sections in the summary and statutory portions, respectively, of the Fund's Prospectus:

Covenant-Lite Loans: Loans in which the Fund may invest or to which the Fund may gain exposure indirectly through its investments in collateralized debt obligations, CLOs or other types of structured securities may be considered "covenant-lite" loans. Covenant-lite refers to loans which do not incorporate traditional performance-based financial maintenance covenants. Covenant-lite does not refer to a loan's seniority in the borrower's capital structure nor to a lack of the benefit from a legal pledge of the borrower's assets, and it also does not necessarily correlate to the overall credit quality of the borrower. Covenant-lite loans generally do not include terms which allow the lender to take action based on the borrower's performance relative to its covenants. Such actions may include the ability to renegotiate and/or re-set the credit spread on the loan with the borrower, and even to declare a default or force a borrower into bankruptcy restructuring if certain criteria are breached. Covenant-lite loans typically still provide lenders with other covenants that restrict a company from incurring additional debt or engaging in certain actions. Such covenants can only be breached by an affirmative action of the borrower, rather than by a deterioration in the borrower's financial condition. Accordingly, the Fund may have fewer rights against a borrower when it invests in or has exposure to covenant-lite loans and, accordingly, may have a greater risk of loss on such investments as compared to investments in or exposure to loans with additional or more conventional covenants.

6.Comment: The Staff noted that the Fund may invest up to 20% of its assets in foreign (non-U.S.) securities and requested that the Registrant disclose if the Fund may also invest in issuers of emerging market countries.

Response: The Registrant appreciates the Staff's comment. Although, at times, the Fund may invest in issuers of emerging market countries, it does not have a strategy to principally invest in such issuers. However, the Registrant will update the "Asset Class/Investment Technique" table in the

Statement of Additional Information to indicate that "Emerging Market Investments" is appliable to the Fund.

Ms. Jaea Hahn, Esq.

U.S. Securities and Exchange Commission

February 1, 2023

Page | 4

7.Comment: The Staff noted that the Fund may invest in bank loans and requested that the Registrant supplementally explain how the Fund intends to meet short term liquidity needs resulting from lengthy settlement periods of these types of investments.

Response: The Registrant notes that the Fund intends to keep adequate cash and other liquid assets the Investment Adviser considers adequate to meet shareholder redemptions.

PRINCIPAL RISKS

8.Comment: The Staff requested that, pursuant to ADI 2019 08 – Improving Principal Risks

Disclosure, the "Principal Risks" section be prioritized in order of those most likely to adversely affect the Fund's net asset value, yield, and total return first, followed by the remaining risks placed in alphabetical order.

Response: The Registrant believes that the current risk disclosure, including the alphabetical ordering of the list of the Fund's principal risks, is appropriate and consistent with Item 4 of Form N-1A, which requires that a fund summarize, based on disclosure in Item 9, the principal risks of investing in the fund, including the risks to which the fund's portfolio "as a whole" is subject. Form N-1A does not contemplate any particular ordering of the risks summarized in Item 4. Additionally, the Registrant believes that rank-ordering risks as the Staff suggests could create the risk that investors would mistakenly minimize or ignore risks that appear at the end or near the end of such a rank-ordered list of risks and is concerned that such a circumstance could cause an investor not to appreciate fully all of the principal risks to which the Fund's portfolio, as a whole, is subject.

Notwithstanding the foregoing, the Registrant notes that the following disclosure is included at the beginning of the "Principal Risks" and "Additional Information About the Principal Risks" sections in the summary and statutory portions, respectively, of the Fund's Prospectus:

The principal risks are presented in alphabetical order to facilitate readability, and their order does not imply that the realization of one risk is more likely to occur or have a greater adverse impact than another risk.

9.Comment: The Staff noted that the Fund may invest in derivatives including "credit default swaps, interest rate swaps, and futures contracts" and requested that the Fund include principal risk disclosure as to interest rate swaps and futures contracts, similar to that provided in the principal risk titled "Credit

Default Swaps."

Response: The Registrant notes that the Fund includes the following principal risk, which the Registrant believes adequately discloses the risks attributable to the Fund's investments in derivatives, including interest rate swaps and futures contracts. Accordingly, the Registrant respectfully declines to make the requested disclosure changes:

Derivative Instruments: Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the underlying asset, reference rate, or index credit risk with respect to the counterparty, risk of loss due to changes in market interest rates, liquidity risk, valuation risk, and volatility risk. The amounts required to purchase certain derivatives may be small relative to the magnitude of exposure assumed by the Fund. Therefore, the purchase of certain derivatives may have an economic leveraging effect on the Fund and exaggerate any increase or decrease in the net asset value. Derivatives may not perform as expected, so

Ms. Jaea Hahn, Esq.

U.S. Securities and Exchange Commission

February 1, 2023

Page | 5

the Fund may not realize the intended benefits. When used for hedging purposes, the change in value of a derivative may not correlate as expected with the asset, reference rate, or index being hedged. When used as an alternative or substitute for direct cash investment, the return provided by the derivative may not provide the same return as direct cash investment.

10.Comment: The Staff noted that the Fund includes "Focused Investing" as a principal risk and

requested that the Registrant do the following: (i) confirm this is a principal risk for the Fund; and (ii) if so, add corresponding disclosure to the Fund's principal investment strategies.

Response: The Fund has removed the referenced principal risk.

11.Comment: The Staff noted that the principal risk titled "Interest in Loans" states that "[a]lthough loans may be fully collateralized when purchased, such collateral may become illiquid or decline in value." The Staff requested that the Registrant clarify whether the Fund is required to sell its interest in a loan if the collateral of such loan becomes illiquid following its purchase or if the Fund is permitted to retain such an investment.

Response: The Registrant notes that the Fund is not required to divest an interest in a loan (or other investment) if the collateral of such loan becomes illiquid or declines in value. The Registrant notes further that the Fund includes the following principal risk that discusses the risks associated with illiquid securities:

Liquidity: If a security is illiquid, the Fund might be unable to sell the security at a time when the Fund's manager might wish to sell, or at all, which could cause the Fund to lose money. Further, the lack of an established secondary market may make it more difficult to value illiquid securities, exposing the Fund to the risk that the prices at which it sells illiquid securities will be less than the prices at which they were valued when held by the Fund. The prices of illiquid securities may be more volatile than more liquid securities, and the risks associated with illiquid securities may be greater in times of financial stress.

PERFORMANCE INFORMATION

12.Comment: The Staff requested that the Registrant supplementally name the broad-based securities market index the Fund intends to use for performance comparisons in the future.

Response: The Fund intends to use the ICE BoA 1-3 Year U.S. Treasury Index as the Fund's benchmark for comparative performance.

MANAGEMENT OF THE FUND

13.Comment: The Staff requested that the Registrant revise the heading "Related Performance Information" to more clearly describe the source of the prior performance provided.

| Response: | The Registrant has revised the heading to "Performance of Other Accounts". |

14. | Comment: | The Staff requested that the Registrant supplementally confirm that the composite |

performance presented in the section previously titled "Related Performance Information" (now titled "Performance of Other Accounts") includes all accounts substantially similar to the Fund and include in the disclosure the number of accounts managed by the sub-adviser ("Voya IM").

Ms. Jaea Hahn, Esq.

U.S. Securities and Exchange Commission

February 1, 2023

Page | 6

Response: The Registrant confirms that the performance presented in the section previously titled "Related Performance Information" (now titled "Performance of Other Accounts") includes all accounts substantially similar to the Fund and comprised of a range of two to four accounts managed by Voya IM. See response to Comment 16, below.

15.Comment: The Staff requested that the Registrant supplementally explain the source of the prior performance information and the no-action letter on which the Fund is relying to present such prior performance.

Response: The prior performance information is provided by Voya IM. Voya IM acquired certain assets and teams comprising the substantial majority of the U.S. business of Allianz Global Investors

U.S. ("AllianzGI") in July 2022. The prior performance is attributable to AllianzGI. The Fund is relying on Growth Stock Outlook Trust, Inc., SEC No-Action Letter (pub. avail. Apr. 15, 1986), to present the Short Duration Composite performance. The Fund is relying on Bramwell Growth Fund, SEC No-Action Letter (pub. avail. Aug. 7, 1996), to present the prior performance of the Virtus Newfleet Short Duration High Income Fund, a series of Virtus Strategy Trust.

16.Comment: The Staff requested that the Fund's disclosure under the section previously titled "Related Performance Information" (now titled "Performance of Other Accounts") clarify if the named portfolio managers managed all of the accounts in the AllianzGI's short duration high income strategy and whether all accounts in the Short Duration Composite employed the same strategy.

Response: In response to the Staff's comments, the Registrant has revised the Fund's disclosure under the section previously titled "Related Performance Information" (now titled "Performance of Other Accounts") to state as follows:

Performance of Other Accounts

Voya Short Duration High Income Fund (the "Voya Fund") was recently organized and has no performance history of its own at the date of this Prospectus. Voya IM's short duration high income strategy (the "Strategy") was previously implemented by Allianz Global Investors U.S. ("AllianzGI"). In July 2022, AllianzGI transferred certain assets and teams comprising the substantial majority of its U.S. business to Voya IM. Presented below is historical performance information for all of the investment accounts managed by AllianzGI during the periods shown that had investment objectives, policies, strategies, and investment restrictions that are substantially similar to those of the Voya Fund (the "Short Duration Composite"). The number of accounts in the Short Duration Composite ranged from two to four over the periods, including the Virtus Fund described below.

Prior to joining Voya IM in July 2022, James Dudnick, CFA and Steven Gish, CFA, portfolio managers for the Voya Fund, were employed by AllianzGI, where they served as portfolio managers for the Strategy. Mr. Dudnick and Mr. Gish have represented to the Voya Fund that they became portfolio managers of the Strategy during January 2014 and that, for the period from that time through July 22, 2022, they were portfolio managers for all of the accounts in the Short Duration Composite, including the Virtus Fund described below for the period April1, 2014 through July 22, 2022.

Ms. Jaea Hahn, Esq.

U.S. Securities and Exchange Commission

February 1, 2023

Page | 7

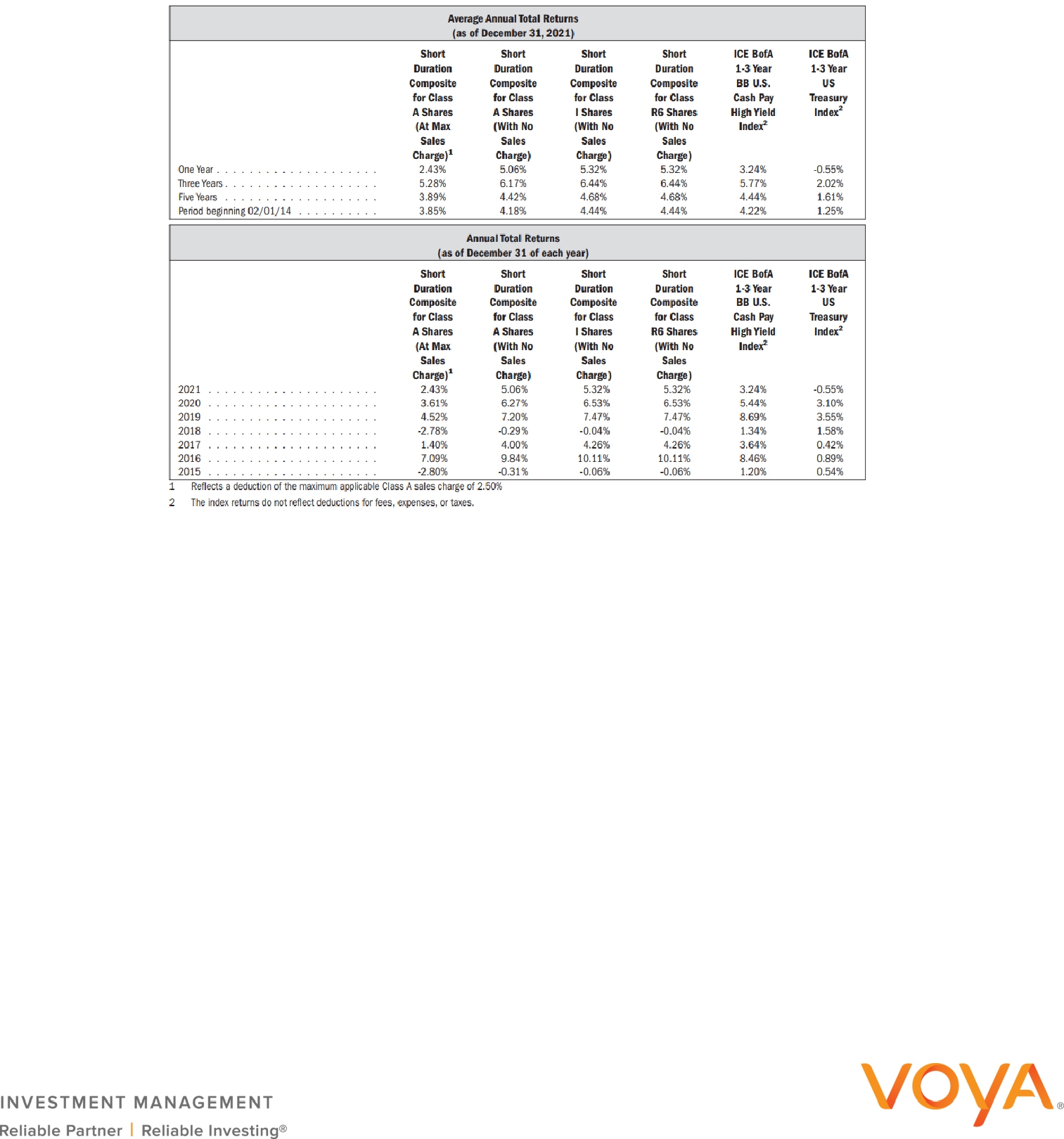

The Short Duration Composite performance data is provided to illustrate the past performance of the Strategy during the periods shown as measured against specified broad-based securities market indices.

The performance of the Short Duration Composite was calculated in accordance with recognized industry standards, consistently applied to all time periods. All returns presented were calculated on a total return basis, including accrued income, realized and unrealized gains or losses, and reinvestment of all dividends and interest, and are net of all brokerage commissions and execution costs. In addition, with the exception of the Virtus Fund described below, the accounts comprising the Short Duration Composite were not subject to the diversification requirements, tax restrictions, and investment limitations imposed on the Voya Fund by the 1940 Act or Subchapter M of the Internal Revenue Code. As a result, the investment portfolio of the Voya Fund, if it had been in operation during the periods shown, would likely have differed to some extent from those of the institutional private accounts and the unregistered funds included in the Short Duration Composite. No leverage was used in the accounts included in the Short Duration Composite.

The performance results shown have been calculated by reducing the Short Duration Composite gross return by the estimated net expenses of each class of the Voya Fund for its first year. The returns in the Short Duration Composite have not been adjusted to reflect the effect of federal or state income taxes. The effect of taxes on any investor will depend on such person's tax status and other factors. The Short Duration Composite includes performance of Virtus AllianzGI Short Duration High Income Fund, a series of Virtus Strategy Trust (the "Virtus Fund"), an investment company registered with the SEC under the 1940 Act, for the period from April 1, 2014 to July 22, 2022 (the "Virtus Fund Performance Period"). AllianzGI acted as investment sub-adviser to the Virtus Fund from February 1, 2021 through July 22, 2022, and as investment adviser to the Virtus Fund until January 31, 2021. (Prior to February 1, 2021, the Virtus Fund was known as the AllianzGI Short Duration High Income Fund; it is now known as Virtus Newfleet Short Duration High Income Fund.) Mr. Dudnick and Mr. Gish have represented to the Voya Fund that, for the Virtus Fund Performance Period, they were the portfolio managers primarily responsible for the day-to-day management of the Virtus Fund and that no other person played a significant role in managing the Virtus Fund's portfolio.

Additional information regarding the Short Duration Composite and the related policies for valuing the portfolios that comprise the Short Duration Composite, calculating performance, and preparing compliant presentations are available upon request. The SEC uses a methodology different from that used below to calculate performance which could result in different performance results.

Ms. Jaea Hahn, Esq.

U.S. Securities and Exchange Commission

February 1, 2023

Page | 8

The tables below show average annual total returns for the periods shown ending December 31, 2022 and calendar year total returns through calendar year 2021, along with returns for two broad-based market indices for corresponding periods. This information has not been audited. The performance data presented below for the Short Duration Composite does not represent the historical performance of the Voya Fund and should not be interpreted as being indicative of the past or future performance of the Voya Fund.

The table below shows the performance of Institutional Class, Class A and Class R6 shares of the Virtus Fund during the Virtus Fund Performance Period. The returns shown in the table reflect the different expenses of the share classes and, in the case of Class A shares, the deduction of an initial 2.25% sales charge. Class A shares were subject to the highest expenses, followed by Institutional Class shares and Class R6 shares. A share class with a relatively high expense ratio would be expected to experience less favorable performance than a share class with a lower expense ratio. The performance data presented below for the Virtus Fund does not represent the historical performance of the Voya Fund and should not be interpreted as being indicative of the past or future performance of the Voya Fund.

Ms. Jaea Hahn, Esq.

U.S. Securities and Exchange Commission

February 1, 2023

Page | 9

17.Comment: The Staff noted that the Morningstar Category Average is not a broad-based index and requested that the Registrant remove the corresponding column from the composite performance table.

Response: The Registrant has removed the Morningstar Category Average column from the composite performance table. See response to Comment 16, above.

18.Comment: The Staff requested that the Registrant supplementally represent that the Fund has the necessary records to support the calculation of the prior performance as required by Rule 204- 6(a)(16) under the Investment Advisers Act of 1940, as amended (the "Advisers Act").

Response: Voya IM has represented to the Registrant that it has all the necessary records to support the calculation of the prior performance as required by Rule 204-6(a)(16) under the Advisers Act.

* * * * * * * * * * * *

Should you have any questions or comments regarding this letter, please contact Angela Gomez at (480) 477- 2313 or the undersigned at (212) 309-6566.

Regards,

/s/ Nicholas C.D. Ward Nicholas C.D. Ward Counsel

Voya Investment Management

cc:Huey P. Falgout, Jr., Esq. Voya Investments, LLC

Elizabeth J. Reza, Esq.

Ropes & Gray LLP