Exhibit 99.1

HEIDRICK & STRUGGLES

Baird Small Cap Conference August 4, 2004

Safe Harbor Statement

This presentation contains forward-looking statements. The forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry in which we operate and management’s beliefs and assumptions. Forward-looking statements may be identified by the use of words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” and similar expressions. Forward-looking statements are not guarantees of future performance and involve certain known and unknown risks, uncertainties and assumptions that are difficult to predict. Actual outcomes and results may differ materially from what is expressed, forecasted or implied in the forward-looking statements. Factors that may affect the outcome of the forward-looking statements include, among other things, our ability to attract and retain qualified executive search consultants; the condition of the economies in the United States, Europe, or elsewhere; social or political instability in markets where we operate; price competition; an inability to achieve the planned cost savings from our cost-reduction initiatives; an inability to sublease or assign unused office space; our ability to realize our tax loss carry forwards; the mix of profit or loss by country; an impairment of our goodwill and other intangible assets; and delays in the development and/or implementation of new technology and systems. Our reports filed with the U.S. Securities and Exchange Commission also include information on factors that may affect the outcome of forward-looking statements. We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Heidrick & Struggles

World’s premiere executive search and leadership consulting firm

Global network of approximately 300 consultants working from 51 offices in principal cities of the world

Global Presence

North America

Europe

Latin America

Asia Pacific

Atlanta

Boston

Chicago

Cleveland

Dallas

Denver

Greenwich

Houston

Los Angeles

Menlo Park

New York

Philadelphia

San Francisco

Toronto

Tyson’s Corner

Wall Street (NY)

Amsterdam

Barcelona

Berlin

Brussels

Copenhagen

Dusseldorf

Frankfurt

Hamburg

Helsinki*

Istanbul*

Johannesburg*

Lisbon

London

Madrid

Milan

Munich

Paris

Rome

Stockholm

Vienna

Warsaw

Zurich

Bogota*

Buenos Aires

Caracas*

Lima*

Mexico City

Miami

Santiago

Sao Paulo

Beijing

Hong Kong

Melbourne

Mumbai

New Delhi

Seoul

Shanghai

Singapore

Sydney

Taipei

Tokyo

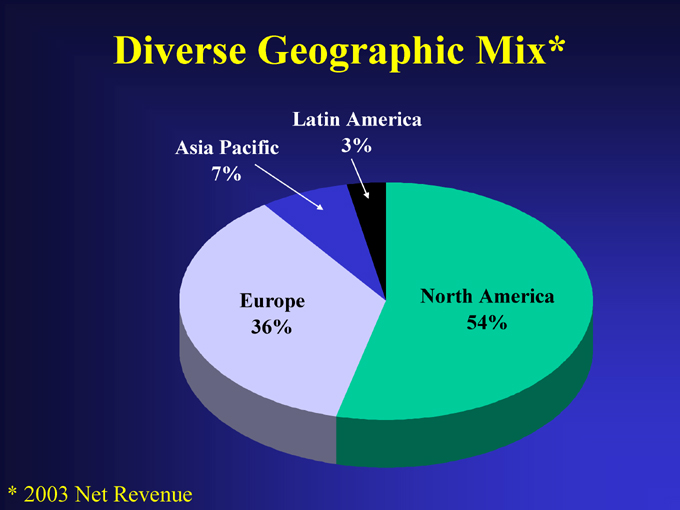

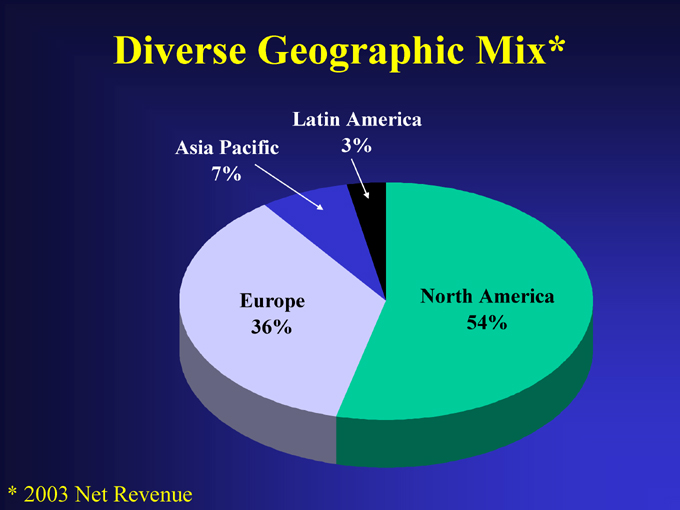

Diverse Geographic Mix*

Latin America 3%

Asia Pacific 7%

Europe 36%

North America 54%

* 2003 Net Revenue

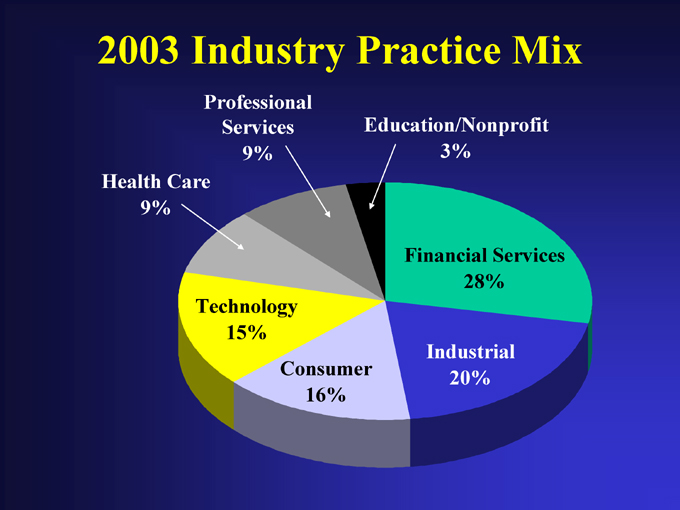

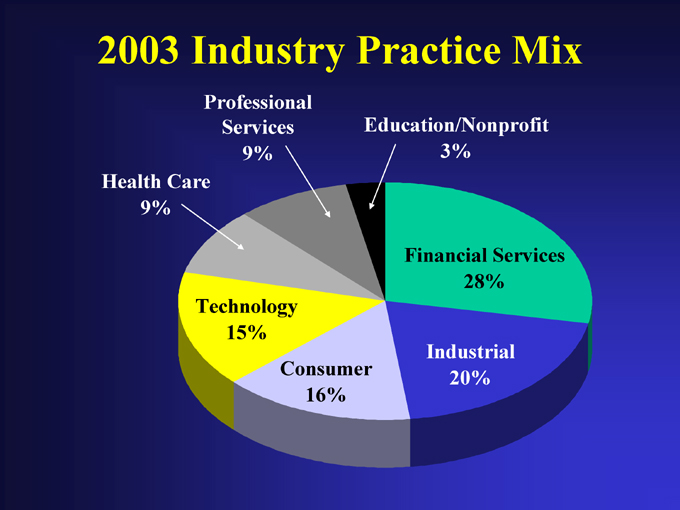

2003 Industry Practice Mix

Professional Services 9%

Education/Nonprofit 3%

Health Care 9%

Technology 15%

Consumer 16%

Industrial 20%

Financial Services 28%

World’s Largest Search Firms

Firm 2003 Revenue

Heidrick & Struggles $317.9 M

Korn/Ferry 316.9 M

Spencer Stuart 306.7 M

Egon Zehnder 271.9 M

Russell Reynolds 202.8 M

Ray & Berndtson 126.2 M

Amrop Hever Group 112.5 M

Whitehead Mann 101.9 M

Highland Partners 60.1 M

I.I.C. Partners 60.0 M

Source: Kennedy Information

Focus on Top-Level Services

Board, CEO and other senior-level searches generate the majority of our revenue Advantages of top-level services

Provides access and influence with decision makers Increases probability of downstream work Strengthens the Heidrick & Struggles brand Generates higher fees per search Establishes barriers to entry Attracts and retains high-caliber consultants

Recent Representative CEO/Board Searches

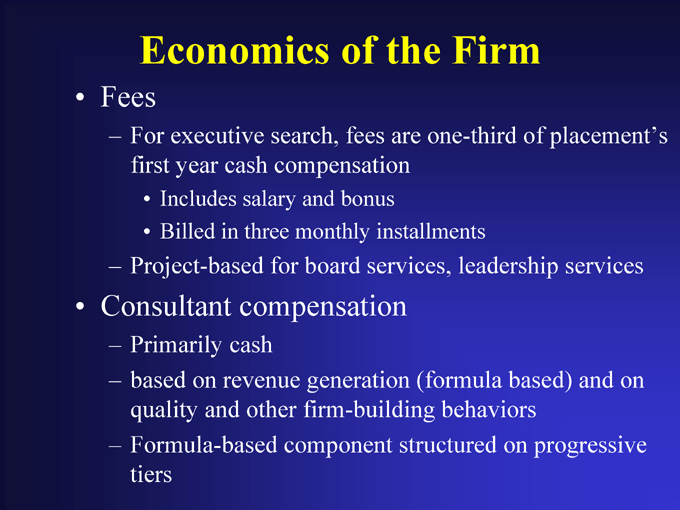

Economics of the Firm

Fees

For executive search, fees are one-third of placement’s first year cash compensation

Includes salary and bonus

Billed in three monthly installments

Project-based for board services, leadership services

Consultant compensation

Primarily cash based on revenue generation (formula based) and on quality and other firm-building behaviors Formula-based component structured on progressive tiers

HEIDRICK & STRUGGLES

Client Needs

Searches and services for Boards (including CEO searches)

Searches and services supporting CEOs and the entire C-level executive group

A range of services for key client accounts to help them build effective leadership teams

2004 Investments

After several years of contraction, we have resumed some investment spending Planning for operating margin expansion despite investments Investing in business-building activities

Strategic marketing Target account development Research / knowledge management Training Select “investment hires”

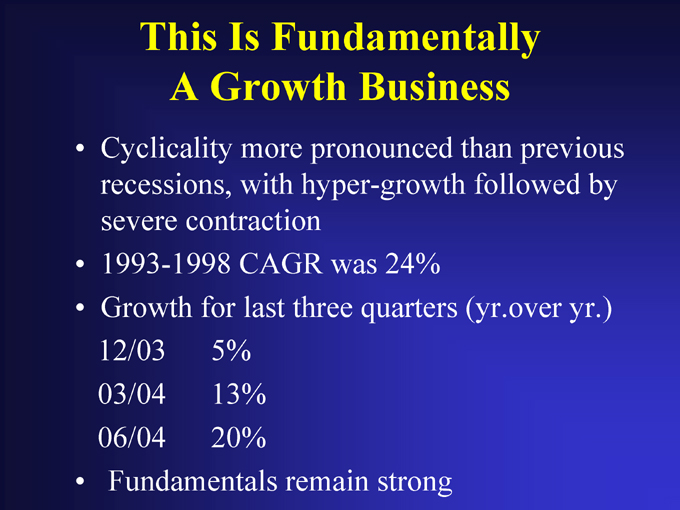

This Is Fundamentally A Growth Business

Cyclicality more pronounced than previous recessions, with hyper-growth followed by severe contraction 1993-1998 CAGR was 24% Growth for last three quarters (yr.over yr.)

12/03 5% 03/04 13% 06/04 20%

Fundamentals remain strong

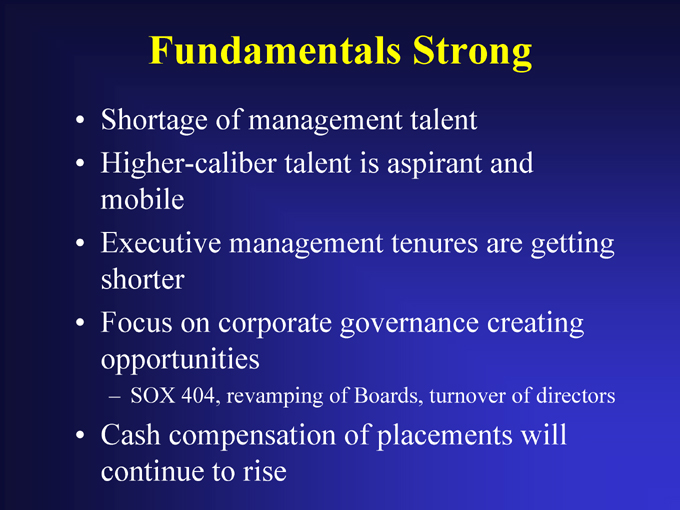

Fundamentals Strong

Shortage of management talent Higher-caliber talent is aspirant and mobile Executive management tenures are getting shorter Focus on corporate governance creating opportunities

SOX 404, revamping of Boards, turnover of directors

Cash compensation of placements will continue to rise

HEIDRICK & STRUGGLES

Financial Performance

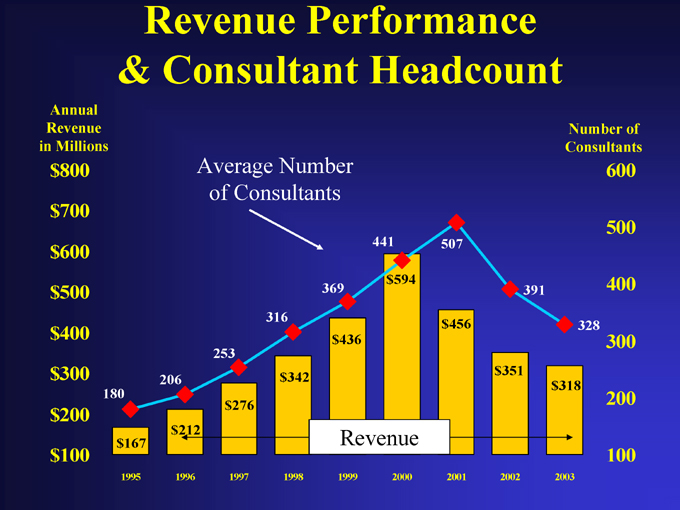

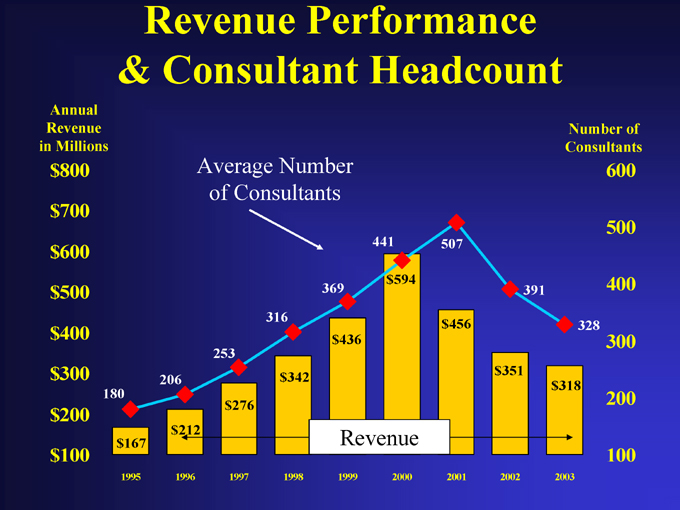

Revenue Performance & Consultant Headcount

Average Number of Consultants

Annual Revenue in Millions $800 $700 $600 $500 $400 $300 $200 $100

1995 1996 1997 1998 1999 2000 2001 2002 2003

Number of Consultants

600 500 400 300 200 100

180

206

253

316

369

441

507

391

328 $167 $212 $276 $342 $436 $594 $456 $351 $318

Revenue

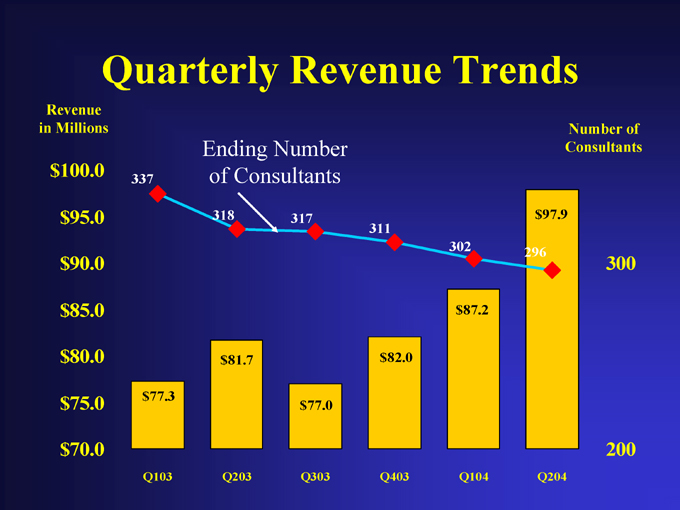

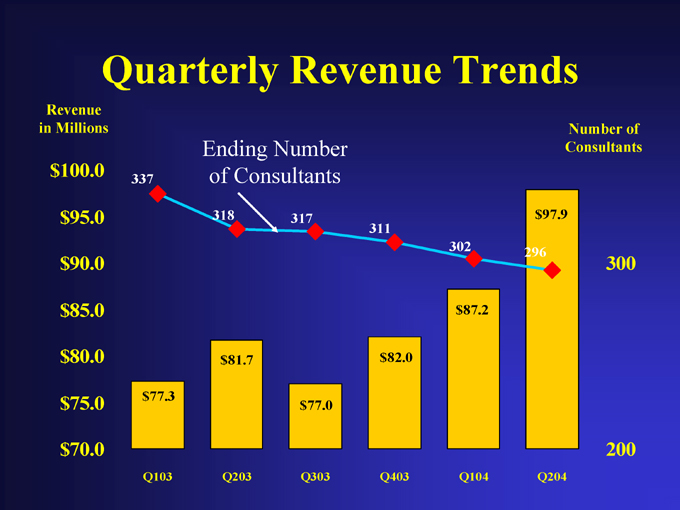

Quarterly Revenue Trends

Revenue in Millions $100.0 $95.0 $90.0 $85.0 $80.0 $75.0 $70.0

Q103 Q203 Q303 Q403 Q104 Q204

Number of Consultants

300

200

Ending Number of Consultants

337

318

317

311

302

296 $77.3 $81.7 $77.0 $82.0 $87.2 $97.9

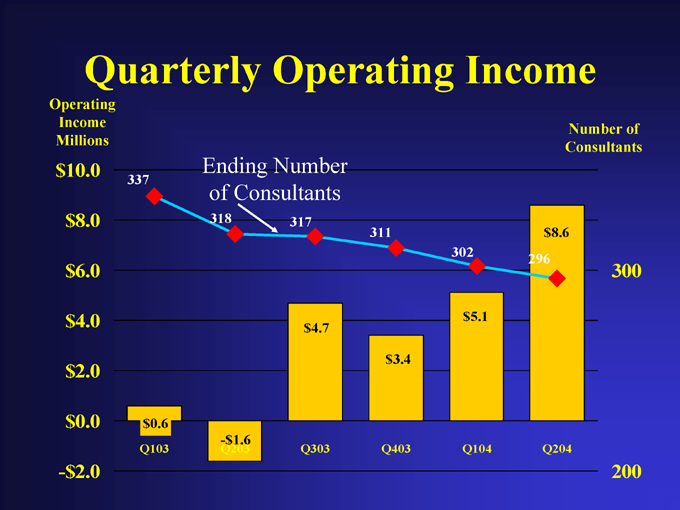

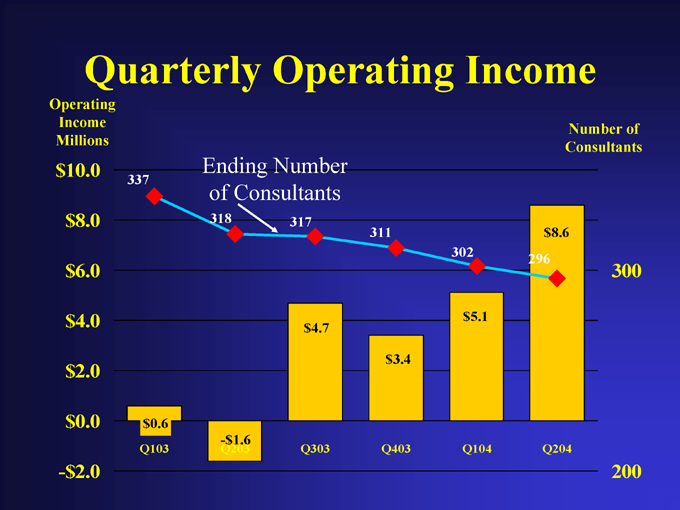

Quarterly Operating Income

Operating Income Millions

$ 10.0

$ 8.0

$ 6.0

$ 4.0

$ 2.0

$ 0.0

- $ 2.0

Number of Consultants

337

Ending Number of Consultants

318

317

311

302

296 $0.6

Q103

Q203

Q303

Q403

Q104

Q204 $4.7 $3.4 $5.1

200

300 $8.6

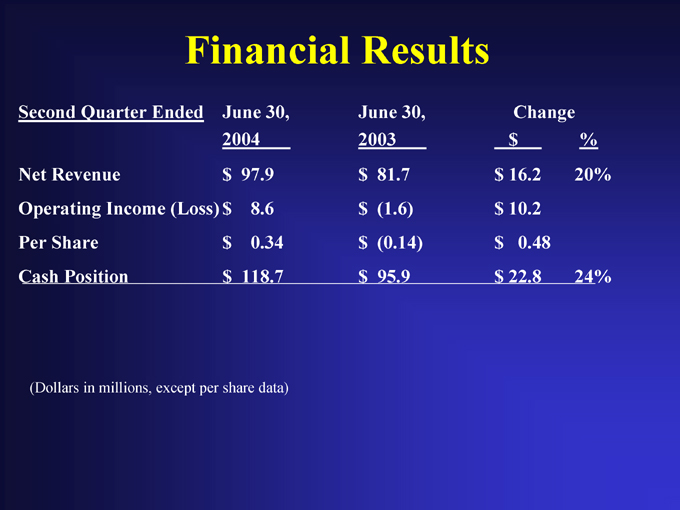

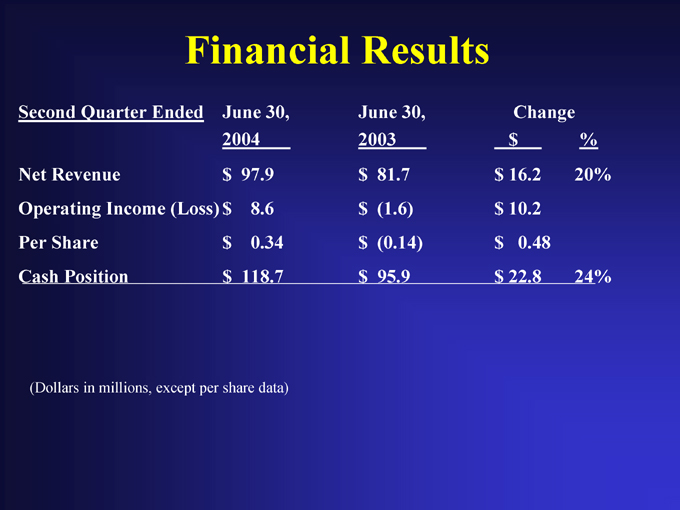

Financial Results

Second Quarter Ended

June 30, 2004

June 30, 2003

Change $

%

Net Revenue $97.9 $81.7 $16.2 20% Operating Income (Loss) $8.6 $(1.6) $10.2 Per Share $0.34 $(0.14) $0.48 Cash Position $118.7 $95.9 $22.8 24%

(Dollars in millions, except per share data)

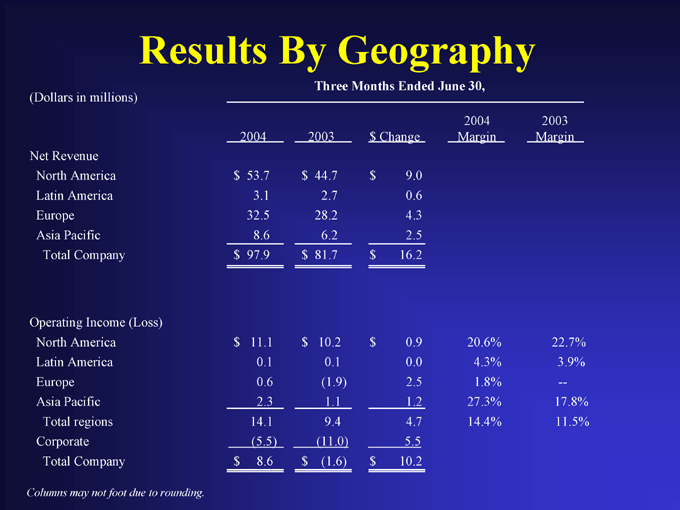

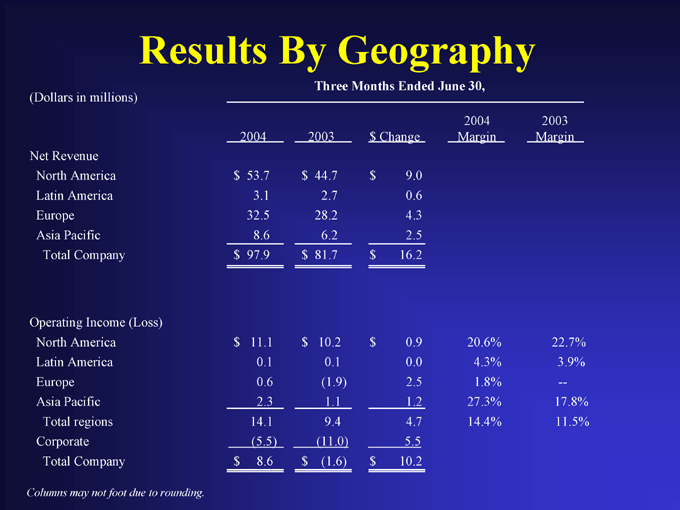

Results By Geography

Three Months Ended June 30,

(Dollars in millions)

2004

2003 $Change

2004 Margin

2003 Margin

Net Revenue

North America $53.7 $44.7 $9.0 Latin America 3.1 2.7 0.6 Europe 32.5 28.2 4.3 Asia Pacific 8.6 6.2 2.5 Total Company $97.9 $81.7 $16.2

Operating Income (Loss)

North America $11.1 $10.2 $0.9 20.6% 22.7% Latin America 0.1 0.1 0.0 4.3% 3.9% Europe 0.6 (1.9) 2.5 1.8% —Asia Pacific 2.3 1.1 1.2 27.3% 17.8% Total regions 14.1 9.4 4.7 14.4% 11.5% Corporate (5.5) (11.0) 5.5 Total Company $8.6 $(1.6) $10.2

Columns may not foot due to rounding.

Strong Balance Sheet

June 30 2004 $118.7 million cash and no debt Cash flow from operations Q204 $20.5 million Expect $125-135 million of cash at September 30, 2004

Outlook

(last updated 7/30/04)

2004

Expect net revenue growth in the low-mid teens

Assumes the economy continues to improve

Estimate operating margin in the 6-8% range

2004 Third Quarter

Anticipate net revenue in the $87-92 million range Expect diluted earnings per share of $0.20 to $0.25, using 21% tax rate

Summary

Strengths

Premier brand name in executive search Unparalleled group of consultants Outstanding client base

Goals

Capitalize on our strengths Improve margins and cash flow

Continue to invest in people and initiatives

HEIDRICK & STRUGGLES

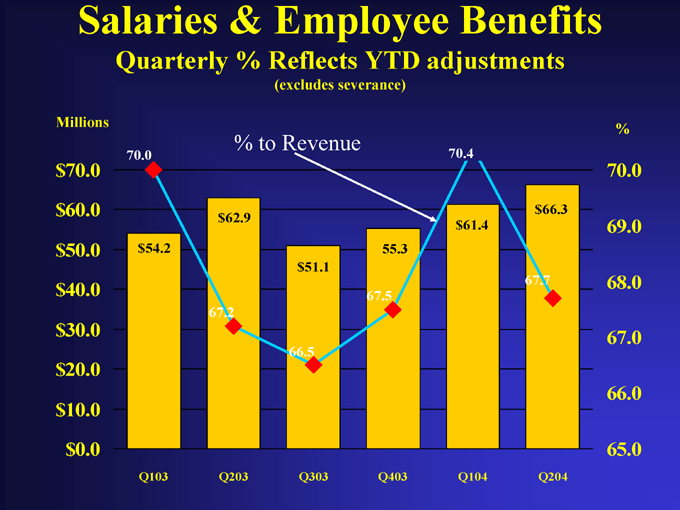

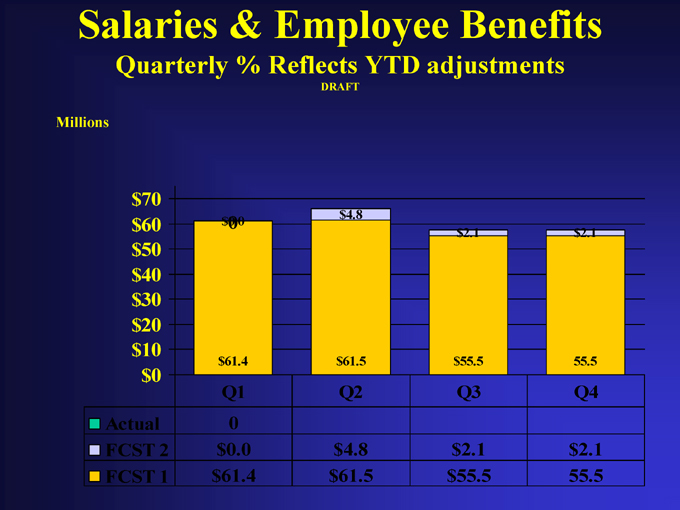

Salaries & Employee Benefits

Millions

% to Revenue

% of Revenue

$250.0

$200.0

$150.0

$100.0

$50.0

$0.0

69.1

70.3

69.0 $242.3 $223.5 $127.7

FY2002

FY2003

Jun 04 YTD

70 65 60 55 50 45

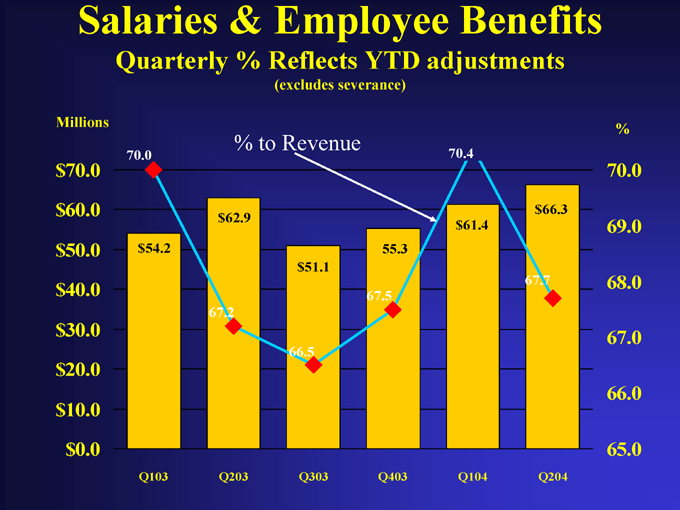

Salaries & Employee Benefits

Quarterly % Reflects YTD adjustments

(excludes severance)

Millions

$70.0

$60.0

$50.0

$40.0

$30.0

$20.0

$10.0

$0.0

% to Revenue

70.4

70.0

67.2

66.5

67.5

67.7 $54.2

Q103 $62.9

Q203 $51.1

Q303

55.3

Q403 $61.4

Q104 $66.3

Q204

%

70.0

69.0

68.0

67.0

66.0

65.0

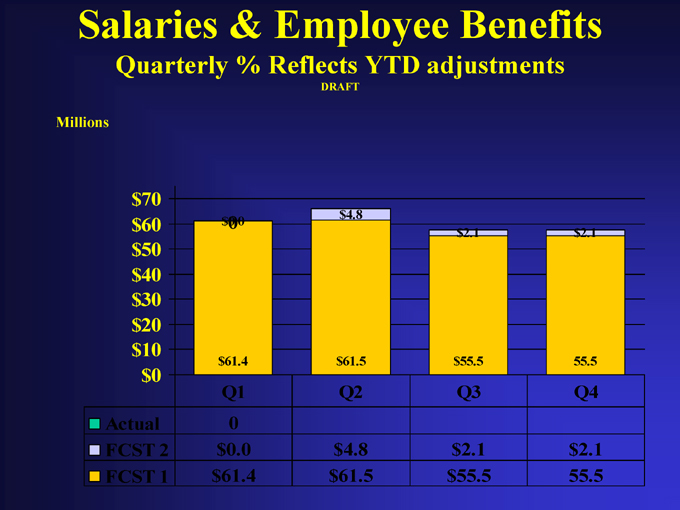

Salaries & Employee Benefits

Quarterly % Reflects YTD adjustments

DRAFT

Millions $70 $60 $50 $40 $30 $20 $10 $0 $0.0 $4.8 $2.1 $2.1 $61.4 $61.5 $55.5 55.5

Q1 Q2 Q3 Q4 Actual 0 FCST 2 $0.0 $4.8 $2.1 $2.1 FCST 1 $61.4 $61.5 $55.5 55.5