BUSINESS PLAN

Company: Intrepid World Communications Corp.

555 S. Old Woodward, Suite 1109

Birmingham, MI 48009

Contact: Jim Fischbach

Office: (248) 642-7000

Fax: (248) 642-9885

E-mail: jcf@intrepidworld.com

Type of Business: 3D Product Developer and Licensor

A hologram is to a photograph as a photograph is to a

line drawing. It contains millions of times more information.

January 2007

DISCUSSION DRAFTTable of Contents

| I | Executive Summary | 1 |

| | Funding | |

| | Opportunity | |

| | Company Background | |

| | Product | |

| | Market | |

| | Management | |

| | Management Team | |

| | Advisory Team | |

| | Financial Highlights | |

| | Financial Performance and Projections | |

| II | Company Overview | 9 |

| | History and Current Status | |

| | Markets and Products | |

| | Entertainment | |

| | Medical | |

| | Other Markets | |

| III | Product | 11 |

| | Product Description | |

| | Technology and History | |

| IV | Marketing and Sales | 12 |

| | Market Analysis | |

| | | |

| | Sports-Entertainment | |

| | Market Size | |

| | Key Market Applications | |

| | Additional Marketing Opportunities | |

| | Additional Entertainment Applications | |

| | Life Sciences | |

| | Market Size | |

| | Key Medical Market Applications | |

| | Imaging | |

| | Telepresence-based Surgery and Telesurgery | |

| | Market Strategy | |

| | Competition | |

| | State of Technology | |

| | Competitive Advantage | |

| V | Operations | 21 |

| | Facilities | |

| VI | Management | 22 |

| | Management Team | |

| | Advisory Team | |

| VII | Summary of Financials | 25 |

| | Forecast | |

| | Capital Requirements | |

| | Application of Funds | |

| | Potential Return on Investment | |

| | Financial Assumptions | |

I. EXECUTIVE SUMMARY

FUNDING

The Opportunity:

Intrepid World Communications (Intrepid) has developed and intends to license and produce a full-color three-dimensional dynamic holographic computer projection technology, called LifeVision.. LifeVision has immediate applications in the Government, Entertainment and Healthcare industries. Intrepid seeks funds to allow the production and of LifeVision to these industries. The company is now on the verge of market release of its technology and expects to manufacture and ship over 70,000 systems within the next five years. Profits are projected to reach $80 million on sales in excess of $321 million during that time. The company intends to reach its goals primarily through its licensing program to include OEMs, Systems Integrators, Resellers and in-house sales programs. The company has a target ROI of 45-60% compounded per annum over the next three to five years. Intrepid is poised to meet the market need and requires approximately $9.9 million, over the next 12 – 18 months to complete, produce and license its proprietary product line. The company plans to release this technology in the second quarter.

Company Background:

Intrepid was incorporated in Delaware in 1994, and has been in pure development since its inception. The company has offices in Birmingham, Michigan.

Product:

LifeVision is source neutral. Information can be sent from live stereo cameras, stereo videotape, or computer. Source information is projected through the holographic screen volumetrically with images appearing to “float” up to 30 inches in front of the viewing screen. The system requires no special glasses or eyewear and the image is seen clearly regardless of the surrounding light. Recent advances in technology have enabled Intrepid to reduce system size significantly, increase performance and resolution and lower cost. Intrepid controls the intellectual property covering a range of important technological advances.

Management Team:

Jim Fischbach-Chairman/CEO

Dr. Hans Bjelkhagen-Exec. VP, Product Development

Sales & Profit Goals: First Five Years:

Sales: $321 Million

Profit: $ 80 Million

Projected Market Capitalization

$300Million, within 3 – 5 Years

Product:

Advanced Three-Dimensional Systems Solution Provider

Target Market:

Entertainment

Amount of Financing Sought:

$10,000,000

Use of Funds:

| · | Product Completion |

| · | Marketing |

| · | Licensing, Patents, Copyrights |

| · | Working Capital |

| · | Equipment |

| · | Loan Payments |

| · | Accounts Payable |

| · | Cash Reserve |

Investment to Date:$9.5 Million

Number of Employees:9

Intrepid’s Key Licensing Advantages

| 1 | Bold Vision – a product with large sales potential |

| | |

| 2 | A product that fits the company’s overall product strategy |

| | |

| 3 | A clear path to producing a final design at a profitable cost |

| | |

| 4 | Clear evidence that consumers want the product |

| | |

| 5 | Clear evidence that a distribution channel will take the product |

Licensing Focus:

| 1 | Government (Homeland Security & Defense) |

| | |

| 2 | Sports Entertainment |

| | |

| 3 | Medical Healthcare |

Market Background:

Entertainment

The electronic game arcade business, a multi-billion dollar market annually, is constantly looking for ways to enhance the player’s experience. Ever larger processors are developed to give the player more reality, choices, and difficulty. True three-dimensional games could rocket the business to a level two to three times higher than where it is today. For years, the industry has incorporated multi-dimensionality into its machines and sales have continued to grow. Thus, it is anticipated that demand for a three-dimensional platform will be very high right from the start. Intrepid estimates potential demand for its technology in the Entertainment industry to be $2-5 billion within three to five years.

The appeal and wealth of sports is at an all- time high. The industry employs over 5 million people and generates enough international commerce to be the twenty-second largest industry in the world. Auto racing is the fastest growing spectator sport in the world. The nation is living in an age of experiences, with everyone wanting to climb mountains, race speedboats and drive fast cars. The sports entertainment industry is well over $125 billion annually, with the interactive game segment expected to surpass $19 billion by 2006. Other revenues from the industry range from $7 billion in spectator sports ticket

purchases (excluding pay-per-view) to $7 billion in television fees. To take advantage of these captive audiences, over 4,500 different companies invested over $ 9 billion in 2004 for event sponsorship opportunities.

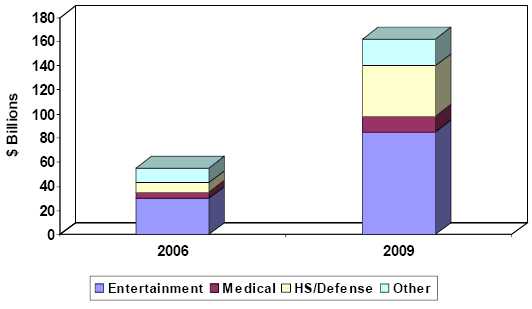

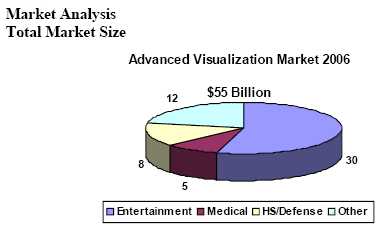

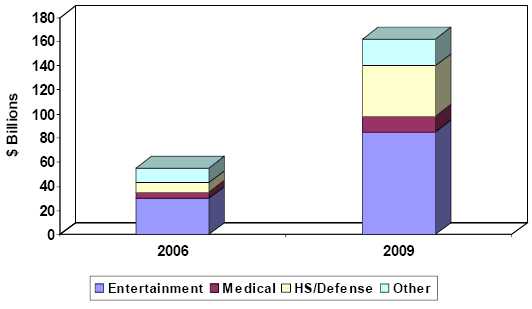

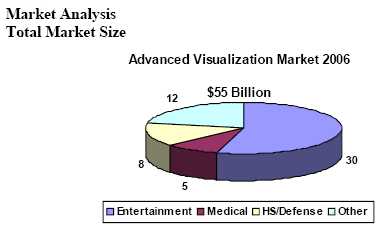

Advanced Visualization Systems Total Market

Five-Year Growth

Government (Homeland Security & Defense)

Intrepid initially designed its system with three industries in mind: Entertainment, Sports, and Medical Imaging. The company has recognized the immediate need for improved homeland security and the ability of its LifeVision technology to make an important contribution to the Federal Government’s efforts. In recent months, Intrepid has configured its system to meet standard specifications of both government and industry. Because of this work, Intrepid recently reached an agreement with a government systems integrator who will serve as a key value-added reseller to the security and defense industry.

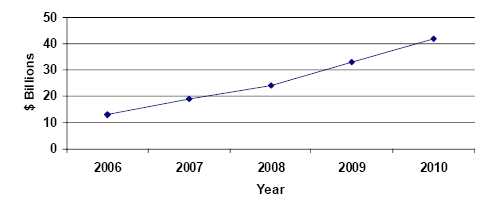

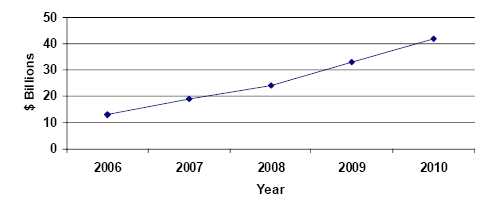

Intrepid presented its technology to legislators (including Senator Carl Levin, Senior Senator from Michigan, Minority Leader of the Committee on Armed Services) and military and civil leaders in the Pentagon, as well as other government agencies, and the White House Office of Homeland Security. Legislators and Directors of these agencies quickly recognized the technology’s value to national defense, identified critical applications for Intrepid’s technology and urged the company to deploy it as soon as possible. These discussions, as well as additional research, led to identification of applications and market opportunities totaling $42 billion in homeland security and defense alone over the next five years. This includes areas such as vehicle inspection, mapping, facial recognition, surveillance, and reconnaissance. Potential demand is estimated to be 400,000 systems during that time.

Homeland Security and Defense Market

Management Team:

Experienced managers, with significant accomplishments in their fields of expertise support the technology team and will lead the company as it enters into the commercialization phase.

James C. Fischbach, Founder, Chairman and CEO -has been the chief engineer and driving force in the development of Intrepid’s full-motion holographic technology for over 12 years. He designed and co-developed the nation’s first fiber optic, multi-processor, high-speed network device that enables multi-streams of graphics information to communicate.

Dr. Hans Ingmar Bjelkhagen, Executive Vice President, Product Development –

He has been involved with Intrepid since 1994 in the development of this technology and is generally recognized as a leader in color holography and pioneer in holographic emulsions. He has published over 100 scientific papers on holographic technology.

Edward J. Wesly,s Engineering Manager – Mr. Wesly has been working in the fields of Optics and Holography for over twenty years. He has extensive corporate, consulting and teaching experience, and has published several text books and scientific papers related to creating holograms. Mr. Wesly spent the last several years preparing holographic images for mass production at CFC International.

Advisory Team:

Key technical team members include leaders in the development of holographic displays, color holography, holographic emulsions and reflection holography. All key participants will continue with the company and expand their time and contributions as the company moves into full scale operations.

John O. Merritt, Senior Consulting Scientist– Internationally recognized expert in stereoscopic video systems. Formerly Naval Air Intelligence Officer and currently three-dimensional display system consultant. Serves as consultant to industry in vision research and human factors engineering issues in stereoscopic three- dimensional systems.

Jack Byrne, Director of Marketing–graduate of Columbia College, served in Marine Corps and Army Intelligence. Winner of 15 CLIOs, he has been owner, principal, or consultant to over 20 advertising and marketing firms. Project Director for Bell Data Seminar, which introduced AT&T’s capabilities in data communications to industry and credited with increasing business-to-business volume to over $5 billion in four years. Created strategy to reverse downward trend in cotton and regain cotton’s dominance in the fiber market. Conceived of first optical superstore and established a $5 billion retail industry now led by LensCrafters and totaling over 3000 stores worldwide.

Financial Highlights:

Intrepid’s financial objective is to create a $300 million or higher market capitalization and a 45-60% ROI, within the next three years. During its first 12 operating months, Intrepid plans to ship approximately 250 units into the defense-security, entertainment and healthcare industries, increasing to 1,925 units in year two. Intrepid expects to sell over 70,000 total systems over the next five years. Profits are expected to reach $70 million on sales of $275 million – a conservative estimate of this developing market.

Proceeds will be used to complete the product, purchase necessary equipment and inventory, finish the build-out of its development, testing and assembly facility, execute marketing plans, establish licensing offices in Washington DC, Los Angeles, New York, Detroit and Las Vegas, increase equity, and provide cash reserves to service accounts receivable requirements and for unforeseen contingencies. The principal objective is to increase revenue growth and produce earnings to finance that growth.

Exit Strategy:

Industry specialists state their belief that Intrepid may be in the unique position of having the premier three-dimensional display system available on the market. Intrepid can quickly become established in the government defense and security industry and exploit opportunities to establish a strong presence in the medical, entertainment and industrial markets. Intrepid intends to pursue a public offering and listing of its stock when revenues reach a level sufficient to ensure realization of the full value of the company. Acquisition is also an option. Intrepid believes its technology will be attractive to companies such as Northrop Grumman, Hewlett Packard, Panasonic, Raytheon, Boeing, NEC, and Sony.

Proprietary/Confidential

D I S C U S S I O N D R A F T

II. Company Overview

History and Current Status

Intrepid initially developed LifeVision to focus on three primary industries: Entertainment, Sports and Medical Imaging. Government defense and security applications were low on Intrepid’s list of Target Markets. The immediate aftermath of the events of September 11, 2001 changed America’s focus. Homeland Security became a goal of every American and the responsibility of every government body. An important contribution to security is information. Visualization is a major source of information of a face passing through an airport

baggage check and of the contents of his baggage. It provides better information on the underpinnings of a car crossing the border, or of the dimensions of caves viewed by the Global Hawk. Topography of a planned battle site is more accurately defined and movement around the tarmac clearly seen. The quality of such information is critical to its effectiveness in the War with Terrorism. Visualization through Holography improves the ability to analyze information in the way a photograph adds dimension not captured in a line drawing.

Intrepid turned its focus to defense. The company invited Senator Carl Levin, the Senior Senator from Michigan and then Chairman of the Senate Committee for the Armed Services to view the present stage of LifeVision’s development. Senator Levin was impressed with the development and immediately provided the company with introductions to the defense community. Intrepid presented its technology to military and civil leaders in several agencies, including the Pentagon, the National Geospatial Agency, the Department of Justice, the Department of Transportation, the Bureau of Immigration and Citizenship, the Federal Aviation Agency, Intelligence agencies and the White House Office of Homeland Security. Directors of these agencies identified several critical applications for Intrepid’s technology, and urged the company to deploy it as soon as possible, “for the good of the nation.”

Intrepid has now focused LifeVision development on compressing and immobilizing all components and enclosing the entire system into a protective casing that can withstand the manhandling and jolting experiences of a system at “the front”. What was once a super sensitive system requiring high precision adjustment to optimize its holographic viewing is now ready to sit in a field tent and display the information from Remote Operated Vehicles (ROV) on land and in air probing for land mines and weapons caches. Today, some of these ROV probes are being reviewed in fixed “CAVES,” virtual reality rooms that cost $2 million, in which as many as 10 technicians wearing V-R Goggles view the information projected. Viewing through V-R goggles for an extended length of time can be disturbing to the neural system causing headaches and damage that is more permanent. Technicians are presently limited to twenty minutes of viewing through

Proprietary/Confidential

D I S C U S S I O N D R A F T

V-R goggles. Use of ten personal, portable LifeVision systems at a total cost of $250,000 can replace one fixed $2 million CAVE, and eliminate the need for technicians to use V-R Goggles. The Space and Naval Warfare Command System (SPAWAR), for example, employs fifty CAVES.

Markets and Products

Defense and Security

The size of this market is impressive. The need for better information and increased security are driving demand for three-dimensional imaging. Total demand identified by federal agencies interviewed ranges from 350,000 to 500,000 units. Assuming an average price of $20,000 for visualization systems, the market potential is conservatively estimated at nearly $10 billion. Opportunities in this market include such things as: airport security; facilities security; biometrics; Intelligence/Surveillance/Reconnaissance; Homeland Security; telemedicine and training and simulation.

LifeVision systems sold to this market are designed to be rugged and are 19-inch rack mountable to comply with standard requirements of government and industry specifications. The urgent need for security has resulted in consideration of performance and delivery over price. Intrepid’s plan to first serve the defense/security industry will enable the company to reach economies of scale in production and transition its technology to additional markets at prices below $10,000 per unit within five years.

In 2002, Intrepid began a combined activity with Raytheon, the $24 billion systems integrator and defense contractor. The companies explored in detail the needs of the various arms of government and law enforcement for LifeVision technology, and the benefits to both of Raytheon serving as a key value-added reseller to the defense industry, as well as a systems integrator. In the last week of July 2002, the distribution contract was signed.

Entertainment

The Sports and Entertainment industry is the largest opportunity for Intrepid. Intrepid estimates that LifeVision has application to 25 percent of this $500 billion market. Primary uses for LifeVision in this market are: interactive gaming; simulation and sports training; arcade games; and casino games. Product designed for the government and defense markets meets specifications for the entertainment industry.

Medical

Following successful penetration of the Defense/Security and Entertainment markets, Intrepid intends to focus on the Medical market. The medical visualization market that can be served by Intrepid is forecast to reach an estimated $13 billion within the next five years, excluding telemedicine applications for the military. Other uses for three-dimensional visualization in medicine include telesurgery, MRI, CT, Ultrasound, training/simulation, and diagnostics. This market is not as

price sensitive as others, and has fewer design configuration constraints, enabling Intrepid to sell its current product with little or no design changes.

Another developing medical application is in the Pharmaceutical segment. Molecular structure, for example, can be seen and understood better in three dimensions. The size of the opportunity is not yet defined; however, pharmaceutical companies invested $32 billion in research and development in 2002.

Other

Other markets will demand three-dimensional visualization, the next major expansion of information. The industrial market place includes segments such as automotive design, dealer service centers, and showrooms. Industrial security, training, distance education, and research are also potential segments. According to Insight Media and CyberEdge Information Services, the total Visualization Simulation and VR market in 2006 totaled $36.2 billion, and is projected to grow to over $60 billion by 2009. This growth reflects growing global acceptance of Visual Simulation/Virtual Reality as a mainstream technology in 69 specific applications in industry, education, training, and research. Intrepid serves segments accounting for approximately $22 billion of these other markets.

III.

Product

Holography has unique capabilities that are being increasingly translated into useful and much needed products. The principal attribute of the hologram is that it captures the entirety of the information contained in a light beam, including intensity, polarization, color, and of course, that important but elusive quality called the phase. This results in holograms that are strikingly realistic, with all the observable properties and variation of perspective with viewing position. This completeness of the hologram recording process also leads to optical devices of considerable versatility, including ghost-free diffraction gratings, as well as optical elements that can make highly sophisticated transformations on light beams. Such devices include three-dimensional navigational displays, under-vehicle inspection systems, and facial recognition displays.

Description

The company’s primary product is LifeVision a full-motion, laser-based optical system that displays interactive, stereoscopic images, in real time. The heart of

LifeVision is a “screen” technically described as a Holographic Optical Engine (Engine). The engine is itself a holographic diffuser, which enables images transmitted through it to be perceived in three dimensions. It is produced in a vibration-free environment utilizing a combination of lasers, optical lenses and mirrors, which record a diffusion pattern upon special film. Potentially, the engine can define 225,000 lines per inch, more than 200 times the definition of high-resolution HDTV and 50 times more definition than the human eye can distinguish. LifeVision is independent of format, brand, or software issues. Any source that provides a stereoscopic output and can provide a video standard output (NTSC, video, S-video, RGB, VGA, etc.) can be viewed, including computers, stereoscopic VCRs and cameras, DVD and Laserdisc and information can even be broadcast or sent over the Internet. LifeVision combines advanced technology in electronics and optics with readily available computers to provide a three- dimensional image whose light source appears to come from the model or subject and can be viewed in “free space” without special glasses.

The system is composed of the following subsystems:

| a. | Processing subsystem composed of the requisite hardware |

| | |

| b. | Interface software module |

| | |

| c. | Projection subsystem composed of multiple projectors |

| | |

| d. | Lens subsystem composed of a series of lenses that interface the projection system and the imaging system. |

| | |

| e. | Input/output subsystem composed of operator/system interfaces and system/network interfaces. |

Cabinet/chassis subsystem includes the enclosure and support structure to contain other subsystems.

Technology and History

The most potent force of the information explosion experienced in the last part of the 20th century has been communication through visualization via televideo and computer screens, transmitting everything from entertainment to education, from technical design to the conduct of world financial markets. Generally, this expansion of information through visualization has been limited to two-dimensional viewing of three-dimensional information. A number of breakthroughs have now made it possible that the next major expansion of information will be based on three-dimensional visualization. Some of these breakthroughs have bearing specifically to laser-driven visualizations, such as LifeVision, which are the most sophisticated and potentially the most useful of all three-dimensional imaging.

LifeVision is the culmination of a decade of development. Initially system components were large, unwieldy, and expensive. When first presented to industry, it took a room 16 feet by 14 feet to house the components, and cost $1 million.

Today the system, designed to be 19-inch rack mountable, is contained in a fraction of the cubic space, requiring only 6.33 cubic feet, and can generate profit at a price of $24,000. LifeVision uses a true, passive stereo. Media developers currently have the tools necessary (polarization, multiplexing) to generate stereo.

IV. Marketing and Sales

Intrepid’s marketing strategy encompasses an early stage focus on the U.S. Government defense and security systems, specifically the Department of Homeland Security, Department of Defense, the Transportation Safety Administration and the Department of Transportation FAA Operations. Other markets include Entertainment, Medical, and Other Industrial Applications. Specific marketing objectives include:

| 1 | Position the Company as a leader, innovator, and aggressive marketer of full motion, interactive, three-dimensional display systems in the world. |

| 2 | Leverage its initial success in the sports entertainment industry, specifically |

| | |

| 3 | The racing simulator market, to quickly gain significant revenue from relevant applications of its laser-based technology in the other markets it will subsequently enter. |

| | |

| 4 | Maintain gross margins for the Company’s products and services that will be adequate to provide strong marketing support funds and profit- before-tax. |

| | |

| 5 | Efficiently and effectively utilize the Company’s resources and at all times to provide a high ROI for shareholders. |

Government Defense/Security

The U.S. Government is faced with an unprecedented need to upgrade airport, building, and sensitive site security intelligence gathering, and analysis. Efficient and effective visualization of spatial information is vital in disparate fields such as security, defense, telemedicine, training, and simulation. For example, a multidimensional situational awareness display in military command centers, cockpits, satellites, or ground vehicles can integrate terrain, environment, target and threat data into an easily visualized representation of the battlefield, enabling rapid formation of sound tactical decisions. Three-dimensional baggage scanners and under vehicle inspection systems are critically needed to protect against terrorist attacks.

Similarly, the design and development time for new security and defense products could be significantly reduced using a high-quality, multi-dimensional imaging system in conjunction with computer-aided design and engineering software packages. Multi-dimensional air traffic control systems may significantly lessen collision risks at high volume airports. Finally, a new generation of training and simulation devices able to present and manipulate images could approach realism so close to the actual event as to be acceptable as a substitute for field training.

Market Size

Intrepid estimates that the current size of the entertainment market is approximately $8 billion, rocketing to $42 bill

Estimated Demand in Dollars (Assuming ASP of $20,000 over 5 year period): 8.25B

Intrepid expects to achieve first year sales to the Entertainment market of 150 systems. In Year Two, Intrepid anticipates sales to this market to reach 350 systems. Over the first twenty-four months, Intrepid will work to achieve brand equity and establish profit margin. Although it is difficult to project cost improvements that can affect the average selling price, Intrepid expects that cost and price will decline over Years Three through Five.

Market Strategy

In response to the need for better ways to secure our homeland, the company focused its energies upon the requirements of defense technology. The system was downsized to fit 19 inch rack mounts, standard to many governmental and industrial visualization systems. The company accelerated its acquisition of manufacturing facilities, one in California for production of its holographic optical engine and the other in Michigan for the assembly of its portable LifeVision and its casing.

Intrepid also initiated an aggressive marketing strategy to the federal government. Today, the company has working relationships with dozens of departments and agencies of the Department of Defense and other governmental bodies. In addition to its distribution agreement with Raytheon, Intrepid has also signed a non-exclusive agreement with Dai Nippon Printing Company (DNP) to serve as its US distributor of Secure ImageTM security holograms. DNP is a leader in developing innovative holographic processes. Secure ImageTMis a holographic security label that is difficult to counterfeit and can be easily authenticated by visual inspection. The Government Defense/Security market is an important application for DNP security holograms.

Relationships developed over the past three years have helped direct product development efforts and laid the foundation for Intrepid to begin marketing LifeVision to the federal government. The first launch event will take place in April 2005 at the Force Protection Equipment Demonstration V (FPED V) at Quantico Marine Corps Base in Quantico, Virginia. This demonstration is conducted biannually, and is an invitation only event for current and potential government defense vendors who have innovative technology and equipment for force protection. The demonstration, sponsored by the Department of Defense and

other federal agencies, is the only place where decision makers at the DOD and federal state and local governments can see live demonstrations of new technology. FPED V will give Intrepid an opportunity to show how the LifeVision system can display information volumetrically, in real time, which results in better decision making. FPED V is an excellent venue for Intrepid to launch LifeVision. Companies such as General Dynamics, BAE Systems, Lockheed Martin, l3 Communications, and Honeywell will demonstrate equipment at the show that obtains information via unmanned vehicles, under vehicle inspection systems, satellites, and X-ray scanners. LifeVision can add value to the systems developed by thee prime contractors through better visualization of input. FPED V is open to a broad range of companies and technologies that can benefit from LifeVision. Robots manufactured by iRobot for reconnaissance can be equipped with stereo cameras or sensors and transmit data to command centers that will be seen in three dimensions. Viisage, specializing in biometrics can use LifeVision to enhance accuracy of facial recognition.

FPED V will expose LifeVision to potential customers in the Department of Defense, federal state and local governments as well as potential strategic partners. FPED V will be the starting point for implementing a strategy for marketing to the defense and security markets. In addition to the demonstration launch, strategy includes a number of important elements:

Sports-Entertainment Industry

Target Market - NASCAR Community

Market Size

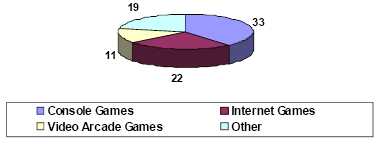

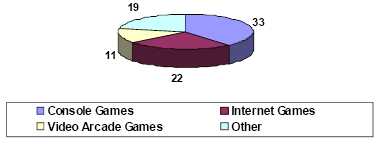

Potentially, the largest industry for Intrepid’s LifeVision is the entertainment industry. According to the Wall Street Journal, the video game market is expected to reach $85 billion by 2006, with game revenue from the internet representing 27% or $22 billion and console games reaching $33 billion. Video arcades represent the third largest segment, slipping to $11 billion. Although the general arcade market is down, the racing simulation niche is growing, with the NASCAR licensed racing simulators as the dominant force. The interactive video game industry is forecast to surpass $110 billion by 2008.

Projected Video Game Market Revenues

2008

$ 85 Billion

Intrepid’s ultimate objective is to be the global leader in the home internet and video game market within two years. The company plans to sell at least 75,000 systems into this market by 2009. Intrepid will launch its initial marketing efforts into the arcade segment. Three qualifying factors lead to the selection.

| 1 | Low Barriers to Entry |

| 2 | Immediate Need/Opportunity |

| 3 | Price Point |

Low Barriers to Entry- Hardware and software requirements have been met and successful demonstrations were given to owners, operators and game players, who expressed strong interest in the technology and its capability.

Immediate Need/Opportunity- The arcade market, which includes12,500 locations in the United States and 14,900 in Japan, is slipping and in critical need of a “breakthrough” technology to pull the gamers of their home consoles, such as Sony’s Play Station 3, Microsoft’s Xbox 360, and Nintendo’s Game Boy Advance & Wii. Intrepid’s LifeVision technology can deliver the “breakthrough” technology that could not only reverse the current trend and begin drawing gamers back into the arcades, but dramatically increase the location’s sales and profits.

Price Points- Location-based-entertainment centers equipment price ranges $15,000 - $75,000 per game, while arcades equipment ranges from $7,500 -$35,000 per game. At $15,000 - $25,000 per system, LifeVision is priced competitively and is poised to compete in both niches.

Intrepid’s immediate action plan includes securing an agreement with the exclusive licensee of NASCAR’S national racing simulator program. Such a relationship will provide Intrepid with the most ideal strategic and tactical approach to enter the arcade industry. Teaming with the established leader enables Intrepid to hit the street running and incorporate LifeVision into existing relationships and contracts and provides enormous exposure into the NASCAR community.

The phenomenal success of the NASCAR rests largely on the fact that the sport has three primary revenue providers, race fans, sponsors, and television networks. The genius of NASCAR lies in this financial structure. All three elements are strikingly in balance, supporting NASCAR like a solid three-legged stool.

NASCAR is roaring into its 2006 season with no signs of slowing down. By capitalizing on new opportunities in technology, and licensing, it will continue to be the strong economic force it is today. NASCAR fans are among the most active on the Internet, receiving over 23,500,000 hits per week from 625,000 weekly users. 145 million will watch NASCAR racing, and 140 million will watch the NFL. With so much interest in competition, shrewd sponsors pay to interrupt the action to promote their products and services.

Companies such as Disney, Dreamworks, Ontario Mills, and Burroughs & Chapin are investing in destination and region-related entertainment. Their efforts incorporate regional entertainment centers such as Broadway at the Beach, Disney, Quest and The Block at Orange, entertainment centers at malls, casino and resort game super arcades, including Dave and Buster’s.

Discussions are being held with management of Nextel, NASCAR’S Marquee sponsor, Burroughs & Chapin, NASCAR racing teams and sponsors regarding projects, and promotional joint ventures to bring forth the first true three-dimensional, without-glasses racing simulators. LifeVision will assure site operators of more productivity per foot by providing the added impact of true holographic imaging to the participating customer. Existing car racing action programs can be used or new programs created. Virtually any action arcade game can be enhanced in its appeal by three-dimensionality. On a more sophisticated level, this same technology can be used for professional driver training and even for “vivid enactment” re-training of drivers with accident or DUI records.

| Intrepid will immediately target the following: | |

| Hit List | Number of Units |

| | |

| 1 | NASCAR – Showcars (Nextel Cup & Busch Series) | 700 |

| 2 | NASCAR - Truck Series | 50 |

| 3 | NASCAR Silicon Motor Speedways | 350 |

| 4 | NASCAR Speed Parks | 150 |

| 5 | Location-Based-Entertainment Centers | 500 |

| 6 | | |

| 6) | Arcades in US (12,500 locations w/ average of 50 games) | 62,500 |

| 7 | NASCAR Sponsors | | |

| | Home Depot | Miller Brewer | |

| | Lowes | Auto Zone | |

| | Sears | Office Depot | |

| | Anheuser Busch | Circuit City | |

| 8 | Track Owners |

| 9 | Simulation Studio Services |

· Corporate Events, Marketing Focus Group

Key Market Applications – Simulator

Applications of the LifeVision simulator are not limited to sports-entertainment. Medical, Industrial and Education markets also provide opportunity for Intrepid:

| 10 | NASCAR – Showcars & Showtrucks |

| 11 | NASCAR Silicon Motor Speedways |

| 12 | NASCAR Speed Parks |

| 13 | Location Based Entertainment (LBE)s & Arcade Units |

| 14 | Simulation Studio Services |

- Corporate Events, Marketing Focus Group

- CFD (Computational Fluid Dynamics) for wind tunnel data

- CAD/CAM service

- Training/Educational Services

- Student driver & Simulation Citation Court Programs

- MADD Mothers Against Drunk Driving

- RADD Recording Artists Against Drunk Driving

- SADD Students Against Drunk Driving 15 Professional Services

- Vision Programs

- Medical, MRI, CAT, Ultrasound, Etc.

Additional Marketing Opportunities

| 1. | Using the simulator, Intrepid can provide clients with sponsorship space on the revolutionary first-of-its-kind touring racing simulator. Intrepid can market the space on the race car similar to the method that NASCAR and Formula 1 are marketing their cars. |

| 2. | Intrepid can sell three-dimensional billboards in the software race program, similar to the marketing of billboards at the major racetracks around the country and even the world. |

| 3. | Intrepid can provide customers, such as Interstate Battery, Pepsi, or other organizations with a three-dimensional advertising program that could be shown at the beginning of each race or at the intermission or even between races. |

| 4. | Intrepid can provide three-dimensional advertising to its customers on its web- site announcing the tour schedule of the world’s first three-dimensional racing simulator. It could inform the web browsers of special promotions that will take place at the upcoming venue. |

| 5. | The simulator can be rented for special events, such as tradeshows, conferences, company outings and new product introductions. |

| 6. | The simulator can become somewhat of a mascot for corporations. |

Life Sciences

Key Medical Market Applications

Imaging

Potential in the medical imaging market, incorporating telemedicine, MRI, CT, Ultrasound, and training/simulation is forecasted to surpass $13 billion within the next 5 years, excluding potential to apply Intrepid technology in the $32 billion pharmaceutical research market.

There are Magnetic Resonance Imaging (MRI) systems in some 20 percent of U.S. Hospitals and hundreds of independent locations throughout the country. There are three times as many Cat Scan (CT) systems. An even higher number of ultra-sound systems are in use. Each of these high-technology imaging systems cost hundreds of thousands of dollars. The images they produce are two-dimensional and on grayscale film. For an added investment under $25,000, the effectiveness of these imaging machines can be improved dramatically. The advantages of LifeVision to the medical community are many:

Diagnostic | Teaching/Research | Other Imaging

Applications |

Enhanced Imaging of

Tumors, etc | Gross Anatomy and

Pathology | Therapeutic

|

- 1 Accurate and precise delineation of anatomy (size, volume and composition)

| Problem:Variations in human anatomy require students to study many cadavers to understand normal and abnormal anatomy. Many students work on the same cadaver due to limited supply | - 1 Planning X-ray Dosimetry and Field size for radiation therapy; planning chemotherapy based upon tumor size

|

- 2 Accurate and precise delineation of spatial relationship to adjacent structures

| Solution:Holographic library of normal and abnormal anatomy developed from fresh | Surgical |

- 3 Ability to combine data from different modalities improves understanding of

| | - 2 Planning precise delineation of anatomy for curative surgery

|

| | | |

| spatial relationships between soft tissue, bone and nerves and blood vessels (e.g., CT & MR angiography) and between anatomy and physiology (e.g., MR & PET) | cadavers and living specimens. 3-D image projected by LifeVision | Guiding Laparascopic and Endoscopic surgery |

- 4 Does not require radiologist to serve as interpreter

| Surgical TechniquesProblem:Students must learn surgical approaches via books, 2-D videos, and “peeks” around other observers in overcrowded operating rooms.Solution:Holographic (stereo) recorded surgery, 3- D projected by LifeVision improves accuracy in understanding surgical approaches and techniques. | |

Telepresence-based surgery and telesurgery

Perhaps the most significant use of LifeVision will be in telemedicine and specifically telesurgery in which the surgeon views the live patient and anatomy in full three-dimensions as transmitted from a distant recording by stereo cameras. Through electronic gloves, the surgeon can perform the surgery using the distant electronically controlled instruments. This usage will apply in a number of situations. The first may be in cases where skilled surgeons are needed in many remote environments at the same time, as in the case of Base and Field hospitals during hostilities. The second is in the case where surgical specialists may be needed in procedures not normally faced by surgeons in the community requiring the specialist.

Market Strategy

Following successful penetration of the Defense/Security and Entertainment markets, Intrepid intends to focus on the Medical market.

Competition

State of Technology

The visualization industry is in its infancy. Several companies are engaged in the development of three-dimensional imaging and displays. Products include Auto Stereoscopic (requiring no glasses), Polarized, 180°/360° displays, Volumetric Displays and other types. The market is highly fragmented, with companies competing for leadership in specific niches with development of their own three-dimensional visualization solutions. No clear leader has emerged in this developing market. Intrepid is the only company with the ability to project a true three-dimensional image.

Aggressive forecasters predict that the three-dimensional visualization industry will become a trillion-dollar industry by 2012. Currently, Intrepid holds singular claim to being able to project for viewing without glasses a live, three-dimensional image with spatially correct information from any source, including satellite, aircraft or ground vehicle. To the best of the company’s knowledge, there is no product with that capability or anything near it. Others are investing in goggle-aided viewing and in theater sized projections of pre-prepared materials. Intrepid technology is far ahead in providing a personal and portable, glasses-free, spatially correct, holographic viewing system.

Competitive Advantage

Intrepid has several competitive advantages:

Scientific Leadership:Intrepid has on its Advisory Board a number of the top holographers in the world. This level of scientific expertise should ensure that Intrepid remains at the leading edge of technology development.

Superiority over other 3 D Technologies:Intrepid’s scientist evaluated each of the different holographic methods currently in use, identifying those with the greatest technological potential, Intrepid has moved to secure those technologies which offered the greatest hope of building a functional commercial holographic display.

Strong protection:Intrepid controls intellectual property covering a range of important technological advances. Further, the Intrepid team has achieved a number of advances in basic system construction, which Intrepid believes can also secure strong patent protection. Intrepid intends to file for additional patents upon completion of financing.

Lack of direct competition:Intrepid should be the first company on the market with a holography-enhanced computer display. To date, potential competitors attempting to utilize different technologies have been unable to achieve the quality required by industry.

An independent evaluation of three-dimensional visualization technologies reports that any system used to display three-dimensional images in real time must be of AutoStereoscopic or volumetric type, such as LifeVision. The inability for multiple viewers is seen as a drawback in some applications, but Intrepid recognizes that multi-viewer technology results in a reduced image resolution that cannot be considered for practical commercial applications.

Spin off products:Intrepid’s scientists have achieved major advances in a number of fields affecting holography, including optics and emulsion development. These advances may enjoy a market beyond their holographic use

The chart on the following page summarizes key three-dimensional technology currently on the market.

V. Operations

Facilities

Intrepid has sales and marketing offices in Birmingham, Michigan. Intrepid is contracting the balance of manufacture to subcontractors, most likely located in Michigan. Specific subcontracts have not been drawn but Intrepid is determining its selection from a list of the “most likely” (based upon reputation for quality, precision, reliability, price and proximity).

Intrepid’s final manufacturing then will be comprised of assembly and quality testing. This will not only reduce early-stage capital requirements but also reduce the number of workers and the level of skills paid for. Intrepid will maintain full control over quality through a vigorous, multi-phased test process at four assembly stages culminating with a 72-hour final quality test.

VI. Management

Intrepid’s development has been under the leadership of an exceptionally balanced team of executives and advisors for a start up company. All key participants will continue with the company and expand their time and contributions as the company moves into full-scale operations.

| | | Year 1 | | | Year 2 | | | Year 3 | | | Year 4 | | | Year 5 | | | Total | |

| SYSTEMSALES | | 500 | | | 2,225 | | | 9,900 | | | 25,000 | | | 44,000 | | | 81,625 | |

| INCOME | | | | | | | | | | | | | | | | | | |

| SYSTEMSALES | $ | 7,500,000 | | $ | 26,700,000 | | $ | 49,500,000 | | $ | 100,000,000 | | $ | 137,500,000 | | $ | 321,200,000 | |

| TOTALINCOME | $ | 7,500,000 | | $ | 26,700,000 | | $ | 49,500,000 | | $ | 100,000,000 | | $ | 137,500,000 | | $ | 321,200,000 | |

| COSTOFGOODSSOLD | $ | 2,625,000 | | $ | 8,968,750 | | $ | 17,325,000 | | $ | 35,000,000 | | $ | 48,125,000 | | $ | 112,043,750 | |

| GROSSPROFIT | $ | 4,875,000 | | $ | 17,731,250 | | $ | 32,175,000 | | $ | 65,000,000 | | $ | 89,375,000 | | $ | 209,156,250 | |

| EXPENSES | | | | | | | | | | | | | | | | | | |

| PRODUCTDEVELOPMENT | $ | 900,000 | | $ | 2,670,000 | | $ | 3,275,000 | | $ | 9,000,000 | | $ | 9,625,000 | | $ | 24,570,000 | |

| ADMINSTRATIVE | $ | 770,000 | | $ | 1,737,500 | | $ | 3,465,000 | | $ | 8,000,000 | | $ | 11,000,000 | | $ | 24,972,500 | |

| SELLING | $ | 330,000 | | $ | 2,095,000 | | $ | 5,940,000 | | $ | 8,000,000 | | $ | 11,000,000 | | $ | 27,365,000 | |

| MARKETING | $ | 380,000 | | $ | 1,793,750 | | $ | 4,950,000 | | $ | 7,000,000 | | $ | 10,000,000 | | $ | 24,123,750 | |

| OPERATIONS/MANUFACTURING | $ | 495,000 | | $ | 1,405,000 | | $ | 4,702,500 | | $ | 6,000,000 | | $ | 9,900,000 | | $ | 22,502,500 | |

| TOTALEXPENSES | $ | 2,875,000 | | $ | 9,701,250 | | $ | 22,332,500 | | $ | 38,000,000 | | $ | 51,525,000 | | $ | 123,533,750 | |

| Profit, EBIT | $ | 2,000,000 | | $ | 8,030,000 | | $ | 9,842,500 | | $ | 27,000,000 | | $ | 37,850,000 | | $ | 84,722,500 | |

VII. Summary of Financials

Forecast

Although the potential size of its markets numbers in the millions of units, Intrepid’s five-year plan is conservative. During its first 12 operating months, Intrepid plans to ship approximately 500 units for revenue of $7.5 million, at an average price of $15,000 per unit. In the second year, the company anticipates total sales of 2,225 units for revenue of $26.7 million. By the end of the fifth year, Intrepid estimates to have sold more than 80,000 units for cumulative sales of $320 million and EBIT of $80 million. Forecasts are far below the potential markets and volume sales and reflect the company’s caution to avoid excess re-investment in operating facilities in order to be able to demonstrate profitability as early and consistently as possible. Should the management and stockholders determine a

public offering is in order during this time, the ROI could be substantial and additional funds available to propel a much steeper growth curve.

Revenue

Intrepid has created pro-forma financial information based on anticipated sales of its LifeVision technology. Although the volume of system sales will catapult Intrepid into the enviable position of producing its holographic displays at a price that permits mass-market commercialization, it represents a very small fraction of the multi-billion dollar advanced visualization display market.

Capital Requirements

To meet objectives set forth above, Intrepid requires a capital infusion of seven million nine hundred thousand dollars ($ 7,900,000). The capital infusion would finance the company’s needs for the next eighteen to twenty-four months while it reaches positive cash flows and increases equity to allow for future debt financing. Management has determined that a $9.9 million capital infusion will be sufficient to adequately meet cash requirements for the first eighteen months at projected levels of revenues. Intrepid is on schedule to fulfill its goals to introduce its technology in July 2006 and begin production in the second quarter of Year 1. The financing plan for Stage 1 will be accomplished in ideally two phases:

| Phase I | $ 2,500,000 | Months 1-6 |

| Phase II | $ 7,400,000 | Months 7-24 |

Proceeds will be used to complete the product, purchase necessary equipment and inventory, establish a development and assembly facility, execute marketing plans, including sales offices in Washington DC, Los Angeles, New York, Detroit and Las Vegas, increase equity to allow for debt financing, retire short-term debt, provide cash reserve to service accounts receivable requirements, and unforeseen contingencies. The principal objective is to increase revenue growth and produce earnings to finance that growth.

The Company is prepared to offer a significant share of its ownership to the provider of the necessary capital. The application of these funds outlined below shows the use of funds.

| Application of Funds | |

| | | |

| 1. | Research & Product Completion | $ 750,000 |

| 2. | Marketing | 1,350,000 |

| 3. | Manufacturing | 1,750,000 |

| 4. | Working Capital | 1,900,000 |

| 5. | Fees, Security & Deposits | 150,000 |

| 6. | Licensing, Patents & Copyrights | 250,000 |

| 7. | Payables | 250,000 |

| 8. | Loans | 750,000 |

| 9. | Equipment | 1,500,000 |

| 10 | Cash Reserve | 1,650,000 |

| | | |

| | Total | $9,900,000 |

Assumptions

| | (1) | Product development costs associated with build-out of the final design, system engineering, documentation and pre-production units. |

| | | |

| | (2) | The cost to build the marketing assets, including tradeshow properties, traveling units, beta units, sponsorship promotions, corporate identity package, and product literature. |

| | | |

| | (3) | Laboratory equipment, including lasers, optics, optical storage cabinets, computer equipment, testing & measurement, networking equipment, communications gear, office equipment, and production equipment. |

| | | |

| | (4) | Costs related to working capital |

| | | |

| | (5) | Security deposits for leases, deposits for future events, hotels & vehicles. |

| | | |

| | (6) | Current licenses in existence, fees for patent applications of new proprietary intellectual properties, and license agreement Costs associated during ramp-up, overhead, payables and financing of sales. |

| | | |

| | (7) | Current and past due payables |

| | | |

| | (8) | Loan Payments |

| | | |

| | (9) | Equipment |

| | | |

| | (10) | Cash reserve to service accounts receivable and unexpected cash needs. |

Potential Returns on Investment

Intrepid believes the essence of its plan is to target a return on investment or ROI of 45-60 percent, compounded per annum over a three to five year period.

Assumptions

Number of Systems Sold:Based on anticipated sales response by the Government defense and entertainment markets: Year 1- 500 systems, Year 2- 2225 systems.

Price per System:Sale price projected at $15,000 for production models

in Year 1, dropping to $ 3,000 by Year 5.

Maintenance Income:Intrepid expects to sign maintenance contracts covering the systems it sells. Yearly value by the maintenance contract is estimated at 7 to 10 percent of the sale price of the system. Growth in maintenance income reflects growing installed base of systems.

Cost of Goods:Cost of goods projected to be 35 percent in Year 1. Cost of goods for production systems, beginning in Year 2, is based 35 percent COGS.

Revenue Stream: Cash flow is anticipated to begin in month 5 of Year 1.Positive Cash Flow:Positive cash flow is expected by the end of Year 1.Accounts Receivable: Accounts receivable is expected to run 90 days to collection.

Deferred Compensation:Payroll expenses will be approximately 50 percent deferred through month 7, and then fulfilled in months 8 to 12, based on actual performance milestones.

Marketing: Marketing expenses are anticipated to be approximately 7-9 percent and triggered by milestones, accomplished through the first 24 months.

Selling Costs:Selling cost is expected to average 10 – 12 percent in Year 1, including outside commissions, and internal expenses.

Optical Development Laboratory: Intrepid is scheduled to complete its optical laboratory within the first six months following funding.

Depreciation & Amortization:Intrepid anticipates depreciation and amortization for equipment, furnishings, fixtures, and leasehold improvements will be calculated using the straight-line method over useful lives or lease periods.

Product Development:Product development costs are calculated to average 7 to 10 percent over the next 5 years.

Development Facilities:Intrepid will operate its optical laboratory in Los Angeles, California, its electronics development headquarters in Detroit, Michigan.

Sales Offices:Intrepid anticipates having sales offices in Detroit, Los Angeles, Washington DC, New York, and Las Vegas within 24 months.

Offices & Facilities Rent:Intrepid expects costs for offices and facilities will be approximately 5 percent in Year 1 and 2.5 percent in Year 2.