UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

INFOSMART GROUP, INC.

(Exact name of registrant as specified in its charter)

California

(State or other jurisdiction of incorporation or organization)

3695

(Primary Standard Industrial Classification Code Number)

95-4597370

(I.R.S. Employer Identification Number)

5th Floor, QPL Industrial Building

126-140 Texaco Road

Tsuen Wan, Hong Kong

(852) 2944-9905

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Parker Seto, Chief Executive Officer

5th Floor, Texaco Building

126-140 Texaco Road,

Tsuen Wan, Hong Kong

(852) 2944-9905

COPY TO:

Kevin K. Leung, Esq.

Jamie H. Kim, Esq.

Richardson & Patel LLP

10900 Wilshire Blvd., Suite 500

Los Angeles, CA 90024

(310) 208-1183

(Name, address, including zip code, and telephone number, including area code, of agent for service)

EFFECTIVE DATE OF THIS REGISTRATION STATEMENT

(Approximate date of commencement of proposed sale to the public)If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | | Accelerated filer o |

Non-accelerated filer o | | Smaller reporting company þ |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | | Amount to be Registered | | Proposed Maximum Per Share Offering Price | | Proposed Maximum Aggregate Offering Price (1) | | Amount of Registration Fee | |

| Class A Warrants to purchase shares of common stock | | | 19,303,970 | | $ | — | (2) | $ | — | (2) | $ | — | (2) |

| | | | | | | | | | | | | | |

| Common Stock, no par value (issuable upon exercise of Class A Warrants) | | | | (3) | $ | 0.262 | | $ | | | $ | | |

| | | | | | | | | | | | | | |

| Total | | | | | | | | | | | $ | 198.77 | |

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act. |

| (2) | Pursuant to Rule 457(g) under the Securities Act of 1933, no registration fee is payable for warrants that are registered for distribution in the same registration statement as the securities to be offered pursuant thereto. |

| (3) | Issuable upon exercise of the Class A Warrants being registered hereunder. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and no offer to buy these securities is being solicited in any state where the offer or sale is not permitted.

Prospectus

INFOSMART GROUP, INC.

19,303,970 Class A Warrants

19,303,970 shares of Common Stock

This prospectus covers the resale by selling securityholders of up to 19,303,970 Class A Warrants and 19,303,970 shares of our common stock, no par value.

These securities will be offered for sale from time to time by the selling securityholders identified in this prospectus in accordance with the terms described in the section of this prospectus entitled “Plan of Distribution.” We will not receive any of the proceeds from the sale of the common stock by the selling securityholders.

Our securities are not listed on any national securities exchange. Our common stock is currently quoted on the OTC Bulletin Board under the symbol “IFSG.OB,” but our Class A Warrants are currently not quoted on the OTC Bulletin Board. The last reported per share price for our common stock was $0.165, as quoted on the OTC Bulletin Board on June 16, 2008.

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” BEGINNING ON PAGE 19.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is _________________, 2008

No offers to sell are made, nor are offers sought, to buy these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus is accurate as of the date in the front of this prospectus only. Our business, financial condition, results of operations and prospectus may have changed since that date.

TABLE OF CONTENTS

| | | Page | |

| | | | | |

| Prospectus Summary | | | 3 | |

| Summary Consolidated Financial Data | | | 7 | |

| Supplementary Financial Information | | | 8 | |

| Business | | | 9 | |

| Risk Factors | | | 19 | |

| Special Note Regarding Forward-Looking Statements | | | 30 | |

| Use of Proceeds | | | 30 | |

| Plan of Distribution | | | 30 | |

| Selling Securityholders | | | 32 | |

| Selected Consolidated Financial Data | | | 33 | |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | 34 | |

| Legal Proceedings | | | 43 | |

| Management | | | 43 | |

| Security Ownership of Certain Beneficial Holders and Management | | | 48 | |

| Certain Relationships and Related Party Transactions | | | 49 | |

| Description of Securities | | | 51 | |

| Dividends | | | 53 | |

| Securities Eligible for Future Sale | | | 53 | |

| Changes In and Disagreements with Accountants on Accounting and Financial Disclosure | | | 53 | |

| Legal Matters | | | 54 | |

| Experts | | | 54 | |

| Disclosure of Commission Position on Indemnification | | | 55 | |

| Additional Information | | | 55 | |

| Index to Consolidated Financial Information | | | F-1 | |

PROSPECTUS SUMMARY

This summary contains basic information about us and this offering. You should read the entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors.” Some of the statements contained in this prospectus, including statements under “Summary” and “Risk Factors” as well as those noted in the documents incorporated herein by reference, are forward-looking statements and may involve a number of risks and uncertainties. We note that our actual results and future events may differ significantly based upon a number of factors. You should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus.

References to “we,” “our,” “us,” the “Company,” or “Infosmart” refer to Infosmart Group, Inc., a California corporation, and its consolidated subsidiaries.

Our Business

Infosmart Group, Inc., through our wholly owned subsidiary Infosmart Group Limited (“Infosmart BVI”), is in the business of developing, manufacturing, marketing and sales of recordable digital versatile disc (“DVDR”) optical media, and manufacturing recordable compact discs (“CDR”). We manufacture DVDRs with 8x and 16x writable speeds as well as CDRs with 52x writable speed. We are also preparing for the manufacturing of Blu-Ray format DVDR discs. We have customers in Western Europe, Australia, China and South America. We manufacture and ship our products from Hong Kong where we operate state-of-the-art DVDR and CDR manufacturing facilities.

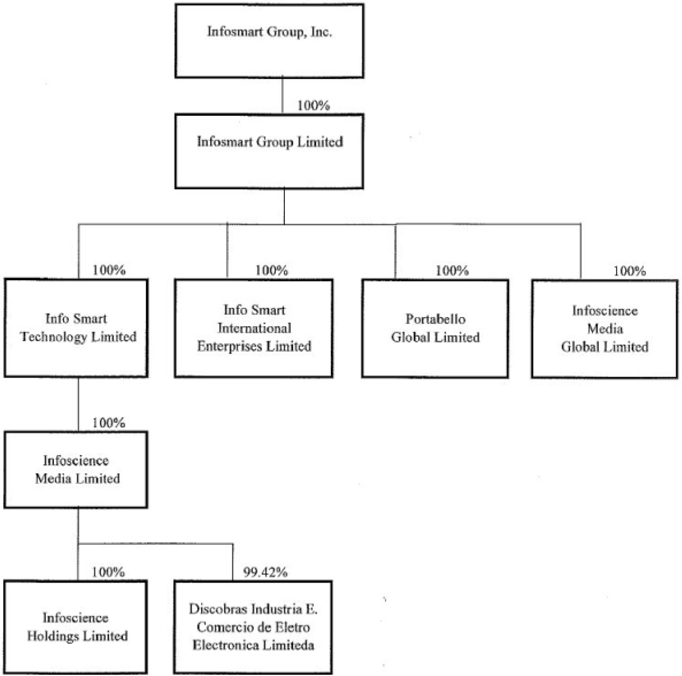

Corporate Structure

We own all of the capital stock of Infosmart BVI, a holding company incorporated in the British Virgin Islands. Infosmart BVI beneficially owns 100% of the issued and outstanding capital stock of: (i) Info Smart Technology Limited (“IS Technology”), a company incorporated under the laws of Hong Kong; (ii) Info Smart International Enterprises Limited (“IS International”), a company incorporated under the laws of Hong Kong; and (iii) Portabello Global Limited (“Portabello”), a company incorporated under the laws of the British Virgin Islands. IS Technology owns all of the issued and outstanding capital stock of Infoscience Media Limited (“IS Media”), a company incorporated under the laws of Hong Kong. IS Media owns 99.42% of the issued and outstanding capital stock of Discobras Industria E Comercio de Eletro Eletronica Ltda., a company incorporated under the laws of Brazil (“Discobras”), the remaining 0.58% ownership interest in Discobras is held by our local Brazilian partner. During the year 2006, the Company acquired all the issued and outstanding capital stock of Infoscience Holdings Limited (“IS Holdings”), a company incorporated under the laws of Hong Kong, through IS Media. IS Media has a Cooperation Agreement with IS Holdings wherein it manufactures its DVDRs using certain patent licenses and manufacturing licenses owned by IS Holdings. IS Media acquired IS Holdings to guarantee the continuation of this agreement and obtained the right to use the relevant patent licenses and manufacturing licenses.

New Brazilian Facility

In March 2006, IS Media formed Discobras, a Brazilian company, with a local partner, with registered capital of US$8 million for our new Brazilian DVDR production facility. We relocated some of our DVDR manufacturing equipment to Brazil in November 2006 and installed them in January 2007. Trial production in Brazil began in March 2007, and is currently producing at full capacity. In addition, the owners of the technologies and intellectual property necessary for the production of our products require that we obtain separate Patent Licenses for the use of intellectual property in our new DVDR manufacturing facility in Brazil. We are currently in the process of obtaining these Patent Licenses.

$5 Million Commercial Secured Loan

On April 30, 2008, we closed a $5,000,000 commercial secured lending transaction (the “Loan”) with two institutional investors (the “Lenders”). We entered into a Securities Purchase Agreement, pursuant to which the Lenders loaned to us an aggregate of $4,000,000 at a 20% original issue discount from the aggregate $5,000,000 principal amount. The proceeds of this financing were marked for our development of Blu-Ray Disc (DB) sales and marketing efforts in local and international markets.

Class A Warrant Offering

On June 12, 2008, we closed a private offering of Class A Warrants exercisable for an aggregate 220,000 shares of our common stock and received an aggregate purchase price of $220.00. We entered into a Securities Purchase Agreement with each Class A Warrant-holder from this offering. The proceeds of this financing shall be used for working capital.

Financial Results

Our consolidated financial statements for the years ended December 31, 2007, 2006, and 2005 are included in this prospectus. In 2005, 2006, and 2007, we had approximately $24.6 million, $27.1 million, and $105 million in sales, respectively. In 2005, 2006, and 2007, we had approximately $4.2 million, $1.1 million and $10.2 million in net income, respectively.

We have also included our unaudited consolidated financial statements for the three months ended March 31, 2008, during which time we had approximately $7.6 million in sales and $833,000 in net income.

See “Index of Financial Statements” on page F-1.

Risks Affecting Our Business

We are subject to a number of risks, which you should be aware of before deciding to purchase the securities in this offering. These risks are discussed in the summary below and in the section titled “Risk Factors” beginning on page 19 of this prospectus.

Summary of Risk Factors

This document contains certain statements of a forward-looking nature. Such forward-looking statements, including but not limited to growth and strategies, future operating and financial results, financial expectations and current business indicators are based upon current information and expectations and are subject to change based on factors beyond our control. Forward-looking statements typically are identified by the use of terms such as “look,” “may,” “will,” “should,” “might,” “believe,” “plan,” “expect,” “anticipate,” “estimate” and similar words, although some forward-looking statements are expressed differently. The accuracy of such statements may be impacted by a number of business risks and uncertainties that could cause actual results to differ materially from those projected or anticipated, including but not limited to:

| | · | our ability to timely and accurately complete orders for our products; |

| | · | our dependence on a limited number of major customers; |

| | · | political and economic conditions within the PRC; |

| | · | our ability to expand and grow our distribution channels; |

| | · | general economic conditions which affect consumer demand for our products; |

| | · | the effect of terrorist acts, or the threat thereof, on consumer confidence and spending; |

| | · | acceptance in the marketplace of our new products and changes in consumer preferences; |

| | · | foreign currency exchange rate fluctuations; |

| | · | our ability to identify and successfully execute cost control initiatives; and |

| | · | other risks outlined above and in our other public filings. |

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this document. We undertake no obligation to update this forward-looking information.

While our management fully intends to make concerted efforts to manage these risks, we cannot assure you that we will be able to do so successfully. See “Risk Factors” beginning on page 19 of this prospectus.

Strategic Financing

On April 30, 2008 (the “Closing Date”), we entered into a Securities Purchase Agreement (“Purchase Agreement”) pursuant to we which we agreed to issue Debentures with an aggregate principal amount of $5,000,000 (the “Debentures”) and 5-year warrants exercisable for 19,083,970 shares of our common stock (the “Class A Warrants”) to two institutional investors (the “Lenders”) for an aggregate purchase price of $4,000,000 at a 20% original issue discount (the “Loan”).

The Debentures are secured by all of our assets subordinate only to bank debt, whether existing as of the Closing Date or accumulated in the future but not to exceed the aggregate amount of $12,000,000. The Debentures accrue interest at a rate of 12% per annum, payable monthly in cash or in registered shares of our common stock, at the Company’s sole option. All principal and any accrued but unpaid interest on the Debentures is due in full on April 30, 2009.

In the event of a default under the Debentures, the Lenders may accelerate the maturity of the Debentures and demand immediate payment in full, and the interest rate will increase to 18% per annum until we repay in full all outstanding principal, interest, and fees. We may from time to time, on 10 trading days’ notice, prepay all or any portion of the Debentures, provided however, that the prepayment amount paid shall be 125% of the prepaid principal plus any accrued interest.

The Class A Warrants are exercisable for an aggregate 19,083,970 shares of our common stock at an exercise price of $0.262 and contain a cashless exercise provision that the Lenders may utilize after six months from the Closing Date. Within 180 days of the Closing Date (“Quotation Deadline”), we must obtain a ticker symbol for the Class A Warrants and have the Class A Warrants quoted on the Over-the-Counter Bulletin Board (or similar exchange). If the Class A Warrants are not quoted on the OTCBB by the Quotation Deadline, then we must pay the Lenders the equivalent of 1.5% of the principal amount of the Loan per month, which amount shall not exceed a total amount of 18%.

In connection with the Loan, we paid placement agent fees of $283,000 and issued 4-year warrants to purchase up to an aggregate 1,335,878 shares of our common stock with an exercise price of $0.328 and must pay placement agent fees of 7% of any cash proceeds we receive upon exercise of the Class A Warrants. Use of the net proceeds of the loan is for general corporate practices.

In connection with the Loan, we must apply to have our common stock listed on either Nasdaq, the American Stock Exchange, or the New York Stock Exchange by May 29, 2009 (“New Listing Deadline”). If we do not meet the New Listing Deadline, then we must pay to the Lenders the equivalent of 1% of the principal amount of the Loan, not to exceed a total amount of 10%.

Upon the earlier of (i) September 1, 2008, or (ii) the date that 100% of our outstanding and unconverted Series B Convertible Preferred Stock is mandatorily converted into shares of our common stock pursuant to the terms of our Certificate of Determination of Rights, Preferences, Privileges and Restrictions of Series B Convertible Preferred Stock, we have the option to restructure the loan by canceling the Debentures and issuing to the Lenders secured convertible debentures for an aggregate principal amount of $5,000,000 (the “Restructure Debentures”). Our option to restructure the loan expires on September 10, 2008. If we do not opt to restructure the loan, then on September 11, 2008, the exercise price of the Class A Warrants will automatically adjust to $0.01 per share.

We agreed to register for resale the 19,393,970 Class A Warrants and the shares of common stock underlying the Class A Warrants on a registration statement on Form S-1, of which this prospectus forms a part. In the event that our registration statement is not declared effective by the Securities and Exchange Commission (“SEC”) within 120 days after the Closing Date, or 150 days after the Closing Date in the case of a “full review” by the SEC, we will owe liquidated damages to the Lenders of 2% of the principal amount of the Debentures in cash until the registration statement is declared effective. The liquidated damages payable to the Lenders in the event of non-registration or late effectiveness is subject to a maximum limit of 10% of the total principal amount of the Debentures, or $500,000. The Lender’s registration rights and our registration obligations are set forth in a registration rights agreement that we entered into in connection with the Loan.

The securities were offered and sold in the transaction described above to accredited investors in reliance on an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), under Regulation D.

On June 12, 2008, we closed the sale of additional Class A Warrants for an aggregate purchase price of $190. We entered into a Securities Purchase Agreement with each Class A Warrant-holder from this offering. The Class A Warrants from this offering are exercisable for an aggregate 190,000 shares of our common stock at an exercise price of $0.262 and contain a cashless exercise provision that the Class A Warrant-holders may utilize after six months from the issuance date of such warrants. These securities were offered and sold in the offering described above to accredited and/or sophisticated investors in reliance on an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), under Regulation D.

General Information

Our principal executive offices are located at 5th Floor, Texaco Building, 126-140 Texaco Road, Tsuen Wan, Hong Kong, and our telephone number is (852) 2944-9905.

The Offering

We are registering 19,303,970 Class A Warrants and 19,303,970 shares of our common stock for sale by the selling securityholders identified in the section of this prospectus entitled “Selling Securityholders.” Information regarding our Class A Warrants and common stock is included in the section of this prospectus entitled “Description of Securities.”

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize consolidated financial data regarding our business and should be read together with “Management’s Discussion and Analysis of Financial Condition or Plan of Operations” and our consolidated financial statements and the related notes included in this prospectus. The summary consolidated financial information as of March 31, 2008 and December 31, 2007, 2006, and 2005 have been derived from our consolidated financial statements included in this prospectus. All monetary amounts are expressed in U.S. dollars unless otherwise indicated.

| | | Three Months Ended March 31, | | Twelve Months Ended December 31, | |

| | | 2008 (unaudited) | | 2007 (audited) | | 2006 (audited) | | 2005 (audited) | |

Consolidated Statements of Operations Data: | | | | | | | | | |

| Sales | | | 7,560,447 | | | 104,969,899 | | | 27,102,441 | | | 24,577,206 | |

| Cost of Sales | | | (6,498,617 | ) | | (90,186,253 | ) | | (19,570,525 | ) | | (17,911,674 | ) |

| Gross Profit | | | 1,061,830 | | | 14,783,646 | | | 7,531,916 | | | 6,665,532 | |

| Operating Expenses | | | (853,091 | ) | | (5,659,546 | ) | | (2,697,053 | ) | | (1,672,183 | ) |

| Income from Operations | | | 208,739 | | | 9,124,100 | | | 4,834,863 | | | 4,993,349 | |

| Other Income Expense, net | | | 813,960 | | | 1,710,408 | | | 449,985 | | | 302,903 | |

| Income Before Taxes | | | 884,292 | | | 10,172,449 | | | 2,020,136 | | | 5,172,783 | |

| Income Taxes | | | (51,309 | ) | | (52,506 | ) | | (955,592 | ) | | (958,022 | ) |

| Net Income | | | 832,983 | | | 10,237,205 | | | 1,064,544 | | | 4,214,761 | |

| Foreign Currency Translation | | | 5,681 | | | 1,497,766 | | | (12,421 | ) | | 28,028 | |

| Comprehensive Income (Loss) | | | 754,356 | | | 11,281,207 | | | (1,447,103 | ) | | 4,242,789 | |

| Basic Net Income (Loss) Per Share (in US$) | | | 0.01 | | | 0.07 | | | (0.01 | ) | | 0.04 | |

| Diluted Net Income (Loss) Per Share (in US$) | | | 0.01 | | | 0.07 | | | (0.01 | ) | | 0.04 | |

| Basic Weighted Average Number of Shares Outstanding | | | 142,175,630 | | | 140,025,108 | | | 119,188,957 | | | 110,236,841 | |

| Diluted Weighted Average Number of Shares Outstanding | | | 176,116,942 | | | 140,622,119 | | | 119,188,957 | | | 100,236,841 | |

| | | As of March 31, | | As of December 31, | |

| | | 2008 (unaudited) | | 2007 (audited) | | 2006 (audited) | | 2005 (audited) | |

Balance Sheet Data: | | | | | | | | | |

| Total Assets | | | 56,511,829 | | | 76,608,031 | | | 44,721,505 | | | 24,920,741 | |

| Current Liabilities | | | 19,437,589 | | | 40,041,198 | | | 16,818,096 | | | 9,415,083 | |

| Long Term Liabilities | | | 5,778,568 | | | 6,045,735 | | | 8,707,480 | | | 6,464,239 | |

| Stockholders’ Equity | | | 29,791,527 | | | 28,786,915 | | | 16,614,003 | | | 9,041,419 | |

SUPPLEMENTARY FINANCIAL INFORMATION

The supplementary financial information presented below summarizes certain financial data which has been derived from and should be read in conjunction with our consolidated financial statements and footnotes thereto included in the section beginning on page F-1.

| | | First Quarter | | Second Quarter | | Third Quarter | | Fourth Quarter | | Total | |

| | | | | | | | | | | | |

2008 | | | | | | | | | | | |

| Sales | | $ | 7,560,447 | | | - | | | - | | | - | | $ | 7,560,447 | |

| Gross Profit | | | 1,061,830 | | | - | | | - | | | - | | | 1,061,830 | |

| Net Income | | | 832,983 | | | - | | | - | | | - | | | 832,983 | |

| Basic Earnings Per Share | | $ | 0.01 | | | - | | | - | | | - | | $ | 0.01 | |

| Diluted Earnings Per Share | | $ | 0.01 | | | - | | | - | | | - | | $ | 0.01 | |

| Basic Weighted Average Shares | | | 142,175,630 | | | - | | | - | | | - | | | 142,175,630 | |

| Diluted Weighted Average Shares | | | 176,116,942 | | | - | | | - | | | - | | | 176,116,942 | |

2007 | | | | | | | | | | | |

| Sales | | $ | 7,698,415 | | $ | 19,608,031 | | $ | 25,615,603 | | $ | 52,047,850 | | $ | 104,969,899 | |

| Gross Profit | | | 1,965,268 | | | 5,101,553 | | | 4,573,611 | | | 3,143,214 | | | 14,783,646 | |

| Net Income | | | 905,284 | | | 3,296,691 | | | 3,478,041 | | | 2,557,189 | | | 10,237,205 | |

| Basic Earnings Per Share | | $ | 0.01 | | $ | 0.02 | | $ | 0.02 | | $ | 0.02 | | $ | 0.07 | |

| Diluted Earnings Per Share | | $ | 0.01 | | $ | 0.02 | | $ | 0.02 | | $ | 0.02 | | $ | 0.07 | |

| Basic Weighted Average Shares | | | 136,252,633 | | | 137,224,640 | | | 142,294,295 | | | 144,248,709 | | | 140,025,108 | |

| Diluted Weighted Average Shares | | | 159,936,810 | | | 138,083,549 | | | 142,964,178 | | | 144,845,720 | | | 140,622,119 | |

2006 | | | | | | | | | | | | | | | | |

| Sales | | $ | 6,231,518 | | $ | 6,330,486 | | $ | 7,560,552 | | $ | 6,979,885 | | $ | 27,102,441 | |

| Gross Profit | | | 1,672,893 | | | 1,893,721 | | | 2,155,275 | | | 1,810,027 | | | 7,531,916 | |

| Net Income | | | 919,506 | | | 1,093,906 | | | (1,437,371 | ) | | 488,503 | | | 1,064,544 | |

| Basic Earnings (Loss) Per Share | | $ | 0.01 | | $ | 0.01 | | $ | (0.03 | ) | $ | 0.00 | | $ | (0.01 | ) |

| Diluted Earnings (Loss) Per Share | | $ | 0.01 | | $ | 0.01 | | $ | (0.03 | ) | $ | 0.00 | | $ | (0.01 | ) |

| Basic Weighted Average Shares | | | 110,236,841 | | | 110,236,841 | | | 119,986,624 | | | 136,003,606 | | | 119,188,957 | |

| Diluted Weighted Average Shares | | | 110,236,841 | | | 110,236,841 | | | 119,986,624 | | | | | | 119,188,957 | |

| | | | | | | | | | | | | | | | | |

2005 | | | | | | | | | | | | | | | | |

| Sales | | $ | 5,840,909 | | $ | 8,648,450 | | $ | 3,990,318 | | $ | 6,097,529 | | $ | 24,577,206 | |

| Gross Profit | | | 1,744,902 | | | 2,274,582 | | | 1,087,560 | | | 1,558,488 | | | 6,665,532 | |

| Net Income | | | 1,303,203 | | | 2,136,083 | | | 342,516 | | | 432,959 | | | 4,214,761 | |

| Basic Earnings Per Share | | $ | 0.01 | | $ | 0.02 | | $ | 0.00 | | $ | 0.00 | | $ | 0.04 | |

| Diluted Earnings Per Share | | $ | 0.01 | | $ | 0.02 | | $ | 0.00 | | $ | 0.00 | | $ | 0.04 | |

| Weighted Average Shares | | | 110,236,846 | | | 110,236,846 | | | 110,236,846 | | | 110,236,841 | | | 110,236,841 | |

| Diluted Weighted Average Shares | | | 110,236,846 | | | 110,236,846 | | | 110,236,846 | | | 110,236,841 | | | 110,236,841 | |

BUSINESS

We are in the business of developing, manufacturing, marketing and sales of recordable digital versatile disc (“DVDR”) media and recordable compact discs (“CDR”). We manufacture DVDRs with 8x and 16x writable speeds as well as CDRs with 52x writable speeds, and have been developing our DVD-R manufacturing basis in both Hong Kong and Brazil to capture the worldwide market. As the “war” between high density format DVDR (“HD-DVD”) and Blu-ray DVD formats has ended with the Blu-ray DVD format surviving in the marketplace to become the latest format of DVD recordable media, we have a new perspective in business development in the world market for the next 5 years. We have acquired the first set of Blu-ray DVD replication systems in the China/Hong Kong region and will devote more resources to developing the market for Blu-ray DVD replication systems. We have customers in Western Europe, Australia, China and South America.

We produce our products through our three main operational business subsidiaries, Info Smart Technology Limited (“IS Technology”), Info Smart International Enterprises Limited (“IS International”) and Infoscience Media Limited (“IS Media”) at our state-of-the-art DVDR manufacturing facilities in Hong Kong.

In December 2006, IS Media acquired 100% of the issued and outstanding common stock of Infoscience Holdings Limited (“IS Holdings”). IS Media has a cooperation agreement with IS Holdings wherein it manufactures its DVDRs using certain patent licenses owned by IS Holdings. IS Media acquired IS Holdings to guarantee the continuation of this cooperation agreement. We also have a Brazilian subsidiary, Discobras Industria E Comercio de Electro Eletronica Limiteda (“Discobras”), which was formed in March 2006 by IS Media and a local partner, with registered capital of US$8 million for our new Brazilian DVDR production facility. IS Media currently holds a 99.42% ownership interest in Discobras, and the local partner holds the remaining 0.58% ownership interest in Discobras. In addition, we incorporated a new subsidiary, Portabello Global Limited (“Portabello”), for distributing and reselling our recordable digital versatile discs and media to customers in South America.

History and Development of the Company

History

We were incorporated on July 16, 1996 in the State of California under the name Cyber Merchants Exchange, Inc. In July 1999, we raised approximately $3.2 million through an initial public offering. On June 30, 2000, we raised an additional $6.3 million in a private placement offering subscribed by 30 high net-worth Chinese investors. Prior to our reorganization, as described below, we were an intermediary to global suppliers and buyers in the manufacturing, wholesaling and retailing apparel business. Effective October 12, 2006, we changed our name from Cyber Merchants Exchange, Inc. to Infosmart Group, Inc. (the “Company”).

Company Reorganization

On May 16, 2004, our shareholders of record on March 25, 2005 approved a reorganization of the Company (the "Company Reorganization"). The Company Reorganization is summarized as follows:

| | · | We transferred of all of our assets and liabilities (the "Transfer") to ASAP Show Inc., a then wholly owned subsidiary ("ASAP"), effective May 31, 2005 pursuant to a Transfer and Assumption Agreement (“Transfer Agreement”), with ASAP continuing to operate the trade show business previously carried on by us; |

| | · | We issued a stock bonus to certain directors and key employees of 120,862 shares of our common stock, on a post-reverse split basis, effective May 31, 2005 (the “Stock Bonus”); |

| | · | We effected a one for eight and one-half (1-for-8.5) reverse stock split of our common stock (the "Reverse Split") with special treatment to preserve round lot stockholders, effective July 18, 2005; |

| | · | On or about August 25, 2005, we distributed 8,626,480 shares of common stock of ASAP, representing all of the outstanding shares of ASAP, to our shareholders of record on August 18, 2005 on a pro rata basis (the "Distribution"), with such distributed shares being held by our transfer agent as depository agent until such time as the Form 10-SB filed by ASAP became effective with all comments from the SEC cleared (certificates representing such shares were issued by the transfer agent to the shareholders on or about March 27, 2006); |

| | · | We entered into an amended and restated Securities Purchase Agreement (“SPA”) with KI Equity effective as of August 25, 2005; and |

| | · | On September 30, 2005, we completed the sale of 7,104,160 shares of our common stock to KI Equity for $415,000 (the "Investment"), with the net proceeds of the Investment being paid to ASAP pursuant to the terms of the Transfer Agreement. |

In connection with the closing of the Investment, our then current directors and officers resigned, and Kevin Keating was appointed the sole director and officer of the Company. We accounted for the Company Reorganization as a reverse spinoff in accordance with the Emerging Issues Task Force Issue No. (“EITF”) 02-11, “Accounting for Reverse Spinoffs.” In a reverse spinoff, the legal spinnee (ASAP) is treated as though it were the spinnor for accounting purposes. Reverse spinoff accounting is appropriate as the treatment of the legal spinnee as the accounting spinnor results in the most accurate depiction of the substance of the transaction for shareholders and other users of the consolidated financials statements. Under this treatment, the historical financial statements of the Company became the historical financial statements of ASAP. In making its determination, the Company considered the following indicators, among others: (i) the accounting spinnor (legal spinnee, ASAP) is larger than the accounting spinnee (legal spinnor, the Company); (ii) the fair value of the accounting spinnor (legal spinnee) is greater than that of the accounting spinnee (legal spinnor); (iii) the accounting spinnor (legal spinnee) retains the senior management of the formerly combined entity; and (iv) the accounting spinnor (legal spinnee) retains senior management. As a result of the Company Reorganization, the Company became a shell company with nominal assets and operations, with a business purpose being to identify, evaluate and complete a business combination with an operating company.

Brazilian Facility

In March 2006, IS Media formed Discobras, a Brazilian company, with a local partner, with registered capital of US$8 million for our new Brazilian DVDR production facility. We relocated some of our DVDR manufacturing equipment to Brazil in November 2006 and installed them in January 2007. Trial production in Brazil began in March 2007, and is currently producing at full capacity. In addition, the owners of the technologies and intellectual property necessary for the production of our products require that we obtain separate Patent Licenses for the use of intellectual property in our new DVDR manufacturing facility in Brazil. We are currently in the process of obtaining these Patent Licenses.

Change in Control Transaction

On July 7, 2006, the Company entered into an Exchange Agreement with KI Equity Partners LLC, Prime Fortune Enterprises Ltd. (“Prime”), the equity owners of Prime, namely, Mr. Chung Kwok, Ms. Po Nei Sze and Prime Corporate Developments Limited (the “Prime Shareholders”), and Hamptons Investment Group Ltd. (“Hamptons”) (collectively the “Infosmart BVI Shareholders”) to acquire all of the equity ownership of Infosmart Group Limited, a British Virgin Islands company (“Infosmart BVI”) through the acquisition of Prime, the former 100% direct equity owner and holding company of Infosmart BVI. Under the terms of the Exchange Agreement, immediately prior to the closing of the share exchange transaction, Hamptons was to receive 58.82352 shares of Prime’s capital stock as payment for its services as a finder in connection with the exchange transaction.

On August 11, 2006, however, and prior to the closing of the share exchange transaction, Prime’s and Infosmart BVI’s board of directors and their respective shareholders agreed to restructure the ownership of Infosmart BVI’s issued capital stock, resulting in the transfer of the entire equity ownership of Infosmart BVI directly to Mr. Chung Kwok, Ms. Po Nei Sze and Prime Corporate Developments Limited. On August 14, 2006, the Company entered into a First Amendment to the Exchange Agreement with KI Equity, Prime, the equity owners of Prime, Infosmart BVI, the equity owners of Infosmart BVI (which also consisted of Mr. Chung Kwok, Ms. Lui Sau Wan and Prime Corporate Developments Limited), and Hamptons, whereby Infosmart BVI and the Infosmart BVI Shareholders replaced Prime and the Prime Shareholders as a parties to the Exchange Agreement, and they assumed all of Prime’s and the Prime Shareholders’ obligations, representations, warranties, liabilities and responsibilities under the Exchange Agreement, including Prime’s obligation to issue the shares of stock to compensate Hamptons for its services immediately prior to the closing of the share exchange transaction. Pursuant to the Exchange Agreement, as amended by the First Amendment, the Company acquired all of the outstanding shares of Infosmart BVI’s capital stock from the equity owners of Infosmart BVI and Hamptons, and the Infosmart BVI Shareholders transferred and contributed all of their Infosmart BVI shares to the Company. In exchange, the Company issued to the Infosmart BVI Shareholders 1,000,000 shares of the Company’s Series A Preferred Stock, which were convertible into 116,721,360 shares of the Company’s common stock.

The closing of the Exchange Agreement was contingent on a minimum of $7,000,000 being subscribed for, and funded into escrow, by certain accredited and institutional investors (“Investors”) for the purchase of shares of the Company’s Series B Preferred Stock promptly after the closing of the Exchange Agreement under terms and conditions approved by the Company’s board of directors immediately following the Exchange Agreement (the “Financing”). The closing of the Financing was contingent on the closing of the Exchange Agreement, and the Exchange Agreement was contingent on the closing of the Financing.

$7.65 Million Financing

Immediately following the closing of the Exchange Agreement, we received gross proceeds of approximately $7.65 million in connection with the Financing from the Investors. Pursuant to Subscription Agreements entered into with these Investors, we sold 1,092,857.143 shares of our Series B Preferred Stock at a price per share of $7.00. Each share of Series B Preferred Stock is convertible into shares of our common stock. We registered the common stock underlying the Series B Preferred Stock issued in the Financing with the SEC for resale by the Investors. After commissions and expenses, we received net proceeds of approximately $6.89 million in the Financing.

In connection with the issuance of the Series B Preferred Stock to the Investors, the Company issued warrants to the Investors to purchase an aggregate of 29,310,345 shares of common stock, on as-converted basis, of the Company. The warrants have an exercise price of $0.326 per share, subject to adjustments.

Keating Securities, LLC and Axiom Capital Management, Inc. (“Placement Agents”) acted as placement agent in connection with the Financing. For their services, the Placement Agents received a commission equal to 8% of the gross proceeds from the Financing and a non-accountable expense allowance equal to 2% of the gross proceeds. In addition, the Placement Agents received, for nominal consideration, five-year warrants to purchase 10% of the number of shares of common stock into which the Series B Preferred Stock issued in the Financing may be converted (“Placement Agent Warrants”). The Placement Agent Warrants are exercisable at any time at a price equal 125% of the conversion price, on a net-issuance or cashless basis. The Placement Agent Warrants have registration rights similar to the registration rights afforded to the holders of Series B Preferred Stock and Warrants. The Company also paid for the out-of-pocket expenses incurred by the Placement Agent and all purchasers in the amount of $25,000.

Upon completion of the exchange transaction, and after giving effect to the Financing, the Infosmart BVI Shareholders owned 1,000,000 shares of the Company’s Series A Preferred Stock, and the Investors in the aggregate received 1,092,857.143 shares of our Series B Preferred Stock. The Series A Preferred Stock automatically converted into 116,721,360 shares of common stock upon the filing and approval of a Certificate of Amendment to the Company’s Articles of Incorporation with the Secretary of State of the State of California on October 12, 2006. Immediately after the exchange transaction, the Infosmart BVI Shareholders and the Investors owned, in the aggregate, 91.84% of our issued and outstanding shares of common stock after giving effect to the conversion of the Series A and Series B Preferred Stock into common stock, and the Company’s stockholders immediately prior to the exchange transaction owned 8.16% of the outstanding common stock (or, 12,969,040 shares of our common stock) after giving effect to the conversion of the Series A and Series B Preferred Stock into common stock.

The issuance of the Series A Preferred Shares to the Infosmart BVI Shareholders and, upon conversion, the shares of the Company’s common stock underlying the Series A Preferred Shares, was intended to be exempt from registration under the Securities Act, pursuant to Regulation S promulgated thereunder. The issuance of the Series B Preferred Shares to Investors was intended to be exempt from registration under the Securities Act pursuant to Section 4(2) thereof and such other available exemptions. As such, the Series A Preferred Shares and the Series B Preferred Shares, and upon conversion thereof, the Company’s common stock, may not be offered or sold in the United States unless they are registered under the Securities Act, or an exemption from the registration requirements of the Securities Act is available.

Name Change and Increase in Authorized Shares of Common Stock

On October 12, 2006, the Company effected an increase in the number of authorized shares of the Company’s common stock from 40,000,000 shares to 300,000,000 shares and also effected a change of the Company’s corporate name (the “Name Change”) to “Infosmart Group, Inc.” (the “Amendments”) through the filing of a Certificate of Amendment to the Company’s Articles of Incorporation with the State of California’s Secretary of State. Per the conversion rights set forth in the Certificate of Determination for the Series A Preferred Stock, upon filing and acceptance of the Amendments to the Company’s Articles of Incorporation, all of the Series A Preferred Stock were automatically converted into approximately 116,721,360 shares of the Company’s Common Stock. The Company’s Name Change and its trading symbol (OTCBB: IFSG) became effective on the OTC Bulletin Board on October 18, 2006.

$5 Million Commercial Secured Loan

On April 30, 2008, we closed a $5,000,000 commercial secured lending transaction (the “Loan”) with two institutional investors (the “Lenders”). We entered into a Securities Purchase Agreement, pursuant to which the Lenders loaned to us an aggregate of $4,000,000 at a 20% original issue discount from the aggregate $5,000,000 principal amount. The proceeds of this financing were marked for our development of Blu-Ray Disc (DB) sales and marketing efforts in local and international markets.

Class A Warrant Offering

As described more fully above, on June 12, 2008, we also closed a private warrant offering in which we sold Class A Warrants exercisable for an aggregate 220,000 shares of our common stock and received an aggregate purchase price of $220. We entered into a Securities Purchase Agreement with each Class A Warrant-holder from this offering.

Infosmart BVI

Infosmart Group Limited (“Infosmart BVI”) was incorporated in the British Virgin Islands on August 23, 2005 under the International Business Companies Act of the British Virgin Islands. Prior to the Restructuring (as described above), Prime Fortune Enterprises Limited, a British Virgin Islands company (“Prime”), was the sole equity owner and shareholder of 100% of Infosmart BVI’s issued capital shares. In August 2006, the board of directors of both Prime and Infosmart BVI decided to restructure certain shareholdings in Infosmart BVI so that after the Restructuring, Prime would no longer own 100% of Infosmart BVI’s issued capital shares and so that Prime Corporate Developments Ltd. (“Prime Corporate”), Mr. Chung Kwok and Ms. Sau Wan Lui would replace Prime as the direct owners of 100% of the issued capital shares and equity ownership of Infosmart BVI.

Prior to the Restructuring, Prime owned 100% of the issued capital shares of Infosmart BVI, which consisted of one (1) issued capital share, and Prime’s issued capital shares were owned as follows: 713 shares held by Prime Corporate, 212 shares held by Mr. Chung Kwok, and 75 shares held by Lui Sau Wan. On August 11, 2006, in connection with the Restructuring, Prime’s board of directors approved resolutions for Prime to transfer the one (1) issued capital share of Infosmart BVI owned by Prime to Prime shareholder Chung Kwok in exchange for a cash payment of $1.00 (the “Prime Transfer”), and that pursuant to such resolutions, Prime transferred the one Infosmart BVI share to Chung Kwok on August 11, 2006 in exchange for the $1.00 cash payment.

Further, on August 11, 2006 and concurrent with the Prime Transfer, Infosmart BVI’s Board approved resolutions for the issuance of 999 new shares in Infosmart BVI to Prime Corporate Developments Limited (“Prime Corporate”), Chung Kwok and Lui Sau Wan, as follows: 713 shares to Prime Corporate, 211 shares to Chung Kwok, and 75 shares to Lui Sau Wan, in exchange for a cash payment by Prime Corporate, Chung Kwok and Lui Sau Wan of $1.00 per Infosmart BVI share that each receives (the “Infosmart BVI Share Issuance”) or an aggregate total payment of $999 for such shares. On August 11, 2006, Infosmart BVI issued the 999 Infosmart BVI shares, in amounts as described above, to Prime Corporate, Chung Kwok and Lui Sau Wan and, in exchange, received the $999 cash payment, pursuant to such resolutions.

As a result of and immediately after the Prime Transfer and the Infosmart BVI Share Issuance, Prime Corporate, Mr. Chung Kwok and Ms. Sau Wan Lui became the owners of 100% of the issued capital shares of Infosmart BVI, with each of them owning the same number of Infosmart BVI shares as the number of Prime shares that each currently owns. Pursuant to a group reorganization completed in October 2005 (the “Infosmart BVI Reorganization”), Infosmart BVI is the holding company (directly and indirectly) of IS Technology, IS International, IS Media, and Discobras.

Infosmart BVI started in the DVDR manufacturing business with the establishment of IS Technology. Founded in Hong Kong in August of 2002, IS Technology was the first company in Hong Kong to manufacture recordable digital versatile discs. With the continual growth in DVDR demand, the initial shareholders of IS Technology took in other shareholders to form two other companies, IS International and IS Media Limited, to produce DVDRs. , In December 2006, IS Media acquired 100% of the issued and outstanding common stock of Infoscience Holdings Limited (“IS Holdings”). IS Media has a Cooperation Agreement with IS Holdings wherein it manufactures its DVDRs using certain patent licenses owned by IS Holdings. IS Media acquired IS Holdings to guarantee the continuation of this agreement. These four companies and Discobras now form the Company’s main operational business in Hong Kong and Brazil respectively.

Organizational Structure

As a result of the share exchange transaction, the Company Reorganization, the Infosmart BVI Reorganization, the Restructuring, and subsequent acquisitions of new subsidiaries, our current organizational structure is as follows (the percentages depict the current equity interests):

Our Business

We develop, manufacture, market and sell 8x and 16x writable speed DVDRs and 52x writable speed CDRs, and we are preparing for manufacturing of Blu-Ray format DVDR discs. In order to act as a one-stop-shop for the optical storage media needs for our customers, we also outsource orders for products we do not produce ourselves, such as DVD±RW discs and DVD-RAM discs and other low margin DVDR items. We have customers in Western Europe, China, South America and Australia. To capture the South American market, we have established a sales and distribution network in Brazil and set up a DVDR production facility in Brazil, and we have a subsidiary, Portabello, that distributes and resells our recordable digital versatile discs and media to customers in South America.

Current Products

We currently develop, manufacture, market and sell recordable digital versatile discs (“DVDRs”). A DVDR is an optical disc storage media format that can be used for data storage, including movies with high video and sound quality. DVDRs are manufactured with different writable speed ratings. The writable speed ratings of blank DVDRs match the speed at which the recording lasers in digital versatile disc (“DVD”) drives (such as those found in DVD players or the DVD disc drives in computers) can write or “burn” data onto the DVDRs. Currently, most DVD drives are able to write or “burn” data onto DVDRs at 8 times (“8x”) or 16 times (“16x”) the industry set standard speed for writing or “burning” data onto a DVDR disc. We manufacture discs with 8x and 16x writable speed ratings. We estimate that our sales of our 8x writable speed DVDRs account for approximately 60% of our output, while 16x writable speed DVDRs make up approximately 40% of our output.

In December 2007, we stopped producing CDRs in Hong Kong and began producing DVDRs due to higher margins from DVDRs as compared to CDRs. However, in order to ensure “one-stop” shopping to our customers in our distribution channels, we outsource the production of our CDRs and devote more resources to the manufacture of DVDRs. According to Techno Systems Research Co., Ltd. (Japan), total global production volume of CD media in 2007 was 14,024,200,000 discs. We currently outsource CDRs with a standard capacity of 700MB for data and 80MIN for music.

We have also distributed flash drives and memory cards through the channels of distributions in both Asia and South American that we have established. Therefore, we have started procuring flash drives and memory cards from outside manufacturers for distribution within our current channels which has proven to be very successful.

The following is a segment analysis of our products:

| | | Flash drive and memory card Twelve months ended December 31, | | DVDR and Related Products Twelve months ended December 31, | | CDR Twelve months ended December 31, | | Total Twelve months ended December 31, | |

| | | 2007 | | 2006 | | 2007 | | 2006 | | 2007 | | 2006 | | 2007 | | 2006 | |

| Revenue from external customers | | $ | 52,345,020 | | | - | | $ | 49,540,084 | | | 25,622,351 | | $ | 3,084,795 | | | 1,480,090 | | $ | 104,969,899 | | | 27,102,441 | |

| Segment profit | | | 3,281,250 | | | - | | | 6,891,841 | | | 4,512,839 | | | 67,895 | | | 260,687 | | | 10,240,986 | | | 4,773,526 | |

Research and Development

We plan to invest at least $10 million in the upcoming year for Blu-ray replication production lines in the upcoming year, with the first Blu-ray replication systems being purchased at about $1.4 million. This move is in line with our strategy of keeping ourselves as the leader and forerunner of recordable media manufacturers in the world. We foresee inputting additional resources in purchasing and installing more production lines in 2008 and in Brazil by 2009 as the market for Blu-ray DVD players and writers become more mature.

Manufacturing

We currently operate two factories in both Hong Kong and Brazil, with a combined production capacity of approximately 15 million 8x, 16x writable speed, single layer DVDRs and CDRs per month. Currently, our product mix is approximately 60% of 8x DVDRs, approximately 40% of 16x DVDRs, and approximately 60% of CDRs. We have the flexibility to switch production easily between the two product types. After manufacturing the DVDRs and CDRs, we put our products through a rigorous quality assurance process. Our Quality Management System complies with ISO9001:2000 requirements, and we are ISO 9000 certified. As a result of the Blu-ray format DVD prevailing over the HD-DVD in the battle of dominating the future format of DVDR, we purchased the first set of Blu-ray DVD production replication systems in the China/Hong Kong region in order to meet the demands in the high definition media storage market

Intellectual Properties and Licenses

Our subsidiary, Infoscience Media Limited (“IS Media”) entered into a cooperation agreement (“Cooperation Agreement”) with Infoscience Holdings Limited, a then independent third party and currently a subsidiary of IS Media (“IS Holdings”), on December 1, 2005. Under the Cooperation Agreement, the parties agreed to operationally combine their production facilities so that both IS Media and IS Holdings could both produce DVDRs at their combined facilities using certain intellectual properties for the production of DVDRs for which IS Holdings holds patent licenses (the “Patent License”) for use from the DVDR developer (the “License Agreement”) and also a right to manufacture DVDRs under a government manufacturing license (the ”Manufacturing License”) held by IS Holdings. IS Holdings also agreed that IS Media shall have full legal and beneficial ownership of the first 5,000,000 DVDR discs (the “Second Minimum Quantity”) produced in both IS Media’s and IS Holding’s production facilities (the “Combined Facilities”) for each whole month during the one year term of the Cooperation Agreement.

In exchange, IS Media agreed: (1) IS Holdings shall receive full legal and beneficial ownership of all DVDRs produced in the Combined Facilities that are in excess of the Second Minimum Quantity; and (2) to provide IS Holdings with stand-by credit of not more than HK$30,000,000 from IS Media’s own sources or indirectly from any third party including any licensed Hong Kong bank. Under the Cooperation Agreement, IS Holdings is responsible for paying all the relevant licensee fees, and IS Media is responsible for all the recurrent costs and expenses (except for rent and public utilities, for which each party is responsible for the costs they incur in their own production facility) incurred for the production of all DVDR products manufactured in the Combined Facilities during the one year term of the Cooperation Agreement.

IS Media purchased 100% of the outstanding stock of IS Holdings on December 1, 2006 by entering into a Sale and Purchase Agreement with New Passion Investments Limited. Thus, the Company now indirectly owns the Manufacturing License and Patent License. The Cooperation Agreement was extended for a further 2 years until December 31, 2008.

The patent license held by IS Holdings was obtained through a joint patent licensing program (the “DVDR Patent License Program”) that is administered by Koninklijke Philips Electronics, N.V. (“Philips”). Parties acquiring the patent licenses through this DVDR Patent License Program are allowed to use patents owned (or for which these companies have patent applications pending) by participating companies including Philips, Sony, Hewlett Packard and/or Pioneer that are essential in the DVDR manufacturing process. The patent license offered through Philips’ DVDR Patent Licensing Program is offered under non-discriminatory terms and conditions and, in principle, is available to all manufacturers.

In connection with the completion of the Discobras DVDR production facility in Brazil, we started the process of obtaining the required patent license for use of intellectual property. Discobras has satisfied the relevant governmental requirements in Brazil to produce DVDRs in its production facility. The patent license, however, is currently being negotiated with the relevant owners of the patent which are overseas companies located outside of Brazil, and the Brazilian government must approve the patent license.

Sources and Availability of Raw Materials and Principal Suppliers

Raw material costs constitute approximately 60% of the production costs for DVDR and CDR discs. Key materials used in DVDR production are polycarbonate, silver target, organic dye, printing oil and bonding glue. The most important cost item is polycarbonate, which accounts for about half of cost of goods sold.

The supply market for polycarbonate is competitive. Major polycarbonate suppliers include Teijin Chemicals, Dow Chemical, General Electric, Bayer, and Mitsubishi. We order polycarbonate from a variety of sources depending on price and availability. Since polycarbonate is a petroleum byproduct, its price is affected by crude oil prices and can be volatile. We place three (3) month supply contracts with polycarbonate vendors. These supply contracts guarantee quantity but leave pricing to be determined by the market.

Polycarbonate prices increased from $1.90 - 2.50/kg in 2004 to around $2.80/kg - $3.50/kg in 2005 because of surging oil prices and supply constraints, thereby seriously cutting the profit margins of disc manufacturers worldwide. Capacity was hit in 2004 by the explosion of GE’s PCB factory in Spain. At the end of 2005, worldwide polycarbonate capacity expanded as a major new factory came online in Shanghai, and two other large factories in Japan and the U.S. expanded output in response to higher market prices. Polycarbonate prices were approximately $3.00/kg - $3.10/kg at the beginning of 2006 and dropped into the $2.80-$3.10 range at the end of 2006. We have worked closely with polycarbonate suppliers as we are a bulk volume purchaser for production in Hong Kong and Brazil, and we were able to negotiate prices to about $2.618/kg at the end of 2007 and about $2.6/kg for early 2008.

Marketing and Distribution

More than 90% of our sales are to wholesalers and distributors who resell to retailers. We have increased our exposure in Europe, USA, South America, the Middle East, Asia and China through our marketing efforts and attendance at trade shows such as:

| | · | CeBIT (Hannover, Germany) 2003, 2004, 2005 |

| | · | Comdex (Las Vegas, USA) 2003 |

| | · | Computex (Taipei, Taiwan) 2004 |

| | · | Gitex (Dubai, UAE) 2004 and 2005 |

| | · | China Sourcing Fairs 2004 |

| | · | Hong Kong Electronics Show 2004, 2005, 2006 |

During 2007, and as a result of our operations in Brazil, we established our brands “LASERLINE” and “HONGTEK” in the Brazilian and South American markets. We will continue direct sales efforts into these markets in 2008 as such efforts have proven effective even though we outsource products from other suppliers.

We also anticipate the increased use of Portabello and Infoscience Media Global Limited in marketing to small-scale distributors in South America and the China/Hong Kong region, respectively.

Current Customers

We have established a wide client base and distribution network covering Europe/United Kingdom, the Middle East, Australia, South America and Asia.

Our top three customers by value, who accounted for 23.07% of our revenue in 2007, are as follows:

| | · | Laser Corporation markets our DVDR blank media in Australia. Laser Corporation obtains almost 100% of its DVDR blank media supplies from us. Sales to Laser Corporation account for approximately 8.76% of our revenue. |

| | · | China Trade Group Limited markets our SD card in China and obtains about 80% of its SD card supplies from us. Sales to China Trade Group account for approximately 8.07% of our revenue. |

| | · | Yesgee Trading Limited markets our SD card in China. Yesgee obtains about 80% of its SD card supplies from us. Sales to Yesgee account for approximately 6.24% of our revenue. |

Management expects that the proportion of revenue accounted for by these customers will decrease as its markets develop in South America. We will be careful to maintain relationships with existing customers in developed countries because they are expected to be volume buyers of our Blu-ray discs in the future. During 2007, we considered the products competing with DVDRs such as flash cards and took a pro-active approach in marketing our own brand of flash cards with core technology patented by a Taiwan company.

Our pricing and payment terms are flexible. Our objective is to build a strong base of loyal customers, and management will offer competitive prices to capture market share in specific markets that have strong growth prospects. Our payment terms are more stringent for new customers and more flexible for long-term customers and established businesses.

Competition

Products

We currently produce Single Layer (“SL”) DVDR discs of two writable speeds (8x and 16x) and CDR discs of 52x writable speed, but we are preparing to launch production of DVDR discs in either High Density or Blu-Ray formats. The table and discussion below describe some competitor products:

Computer Storage Media Comparison

| Product | | Media Type | | Storage Capacity* | | Unit Price ($) | | Approximate Price per MB (¢/MB) | |

| Floppy Disc | | | Non- optical | | | 1.44 MB | | | 0.22 | | | 23.75 | |

| | | | | | | | | | | | | | |

| USB Drive | | | Non- optical | | | 2 GB | | | 70 - 140 | | | 7-12 | |

| | | | | | | | | | | | | | |

| Flash Memory | | | Non- optical | | | 1 GB | | | 76 - 120 | | | 7.4-11.7 | |

| | | | | | | | | | | | | | |

| Hard Disc | | | Non- optical | | | 200 GB | | | 130 | | | 0.06 | |

| | | | | | | | | | | | | | |

| CD-R | | | Optical | | | 700 MB | | | 0.18-0.30 | | | 0.026-0.043 | |

| | | | | | | | | | | | | | |

| DVD±R* | | | Optical | | | 4.7 GB | | | 0.6-0.8 | | | 0.012-0.017 | |

| | | | | | | | | | | | | | |

| HD DVD** | | | Optical | | | 15-30 GB | | | 10-15 | | | 0.05-0.07 | |

| | | | | | | | | | | | | | |

| Blu-Ray | | | Optical | | | 25-50 GB | | | 25-30 | | | 0.06-0.10 | |

*Note: 1GB = 1024 MB

Optical storage media, hard discs, USB drives and flash memory are the most commonly used computer storage media. Hard discs have up to 500GB of capacity, cost around $0.75/GB and are the most economical choice for large storage needs. The hard disc, however, is less versatile, more fragile and harder to install than optical storage media; it is also bulky and has poor portability.

Both USB drives and flash memory are compact in size, provide great portability and reusability, but are relatively expensive and have limited storage capacity (maximum only 1-2 GB). These devices are mainly used to store computer and music/home video files where portability is required. Floppy disc capacity is too small for multimedia or today’s software files.

For full movies or computer file backups recordable compact discs and DVDRs offer large (from 750MB to 9.4GB) and economical (from $0.18 to $0.80 per disc) storage solutions. Rewritable DVDR discs (“DVD±RW”) are reusable but are more expensive, and therefore less popular, than write-once DVDR discs that we produce.

The victory of the Blu-ray DVD over the HD-DVD means that the market is looking for highly-compact data storage media and higher resolutions for entertainment content. This means that consumers are willing to pay higher prices for a better entertainment experience. We are exploring this opportunity in order to establish a product with higher margins for the Company. We do, however, foresee that the DVDR market will continue to contribute significantly to our revenue and profits, particularly in the South American markets. The strategy of having a whole array of storage media products distributed in our channels enables our own distribution network to have a “one-stop” product source with the Company as a way to mitigate competition in the same channels.

Competitor Companies

Our competitors are numerous and include companies such as CMC Magnetics, Ritek, NBI and UME Disc Group. Some of our competitors have significantly larger manufacturing market share, but that is not necessarily indicative of greater profitability. We believe that we have achieved optimal capacity and can match the lowest single layer DVDR production costs anywhere in the industry.

Government Regulation and Probability of Affecting Business

The development of our products is generally not subject to government regulation. However, because we market and sell our products in other countries, importation and exportation regulations may impact our activities. A breach of these laws or regulations may result in the imposition of penalties or fines, suspension or revocation of licenses. We are not currently involved in any such judicial or administrative proceedings and believe that we are in compliance with all applicable regulations.

Although it is impossible to predict with certainty the effect that additional importation and exportation requirements and other regulations may have on future earnings and operations, we are presently unaware of any future regulations that may have a material effect on our financial position, but cannot rule out the possibility.

Employees

As of June 12, 2008, we have approximately 180 full-time employees, including management. None of these employees are represented by any collective bargaining agreements. Neither we nor any of our subsidiaries have experienced a work stoppage. Management believes that our relations with our employees are good.

Bankruptcy, Receivership, or Similar Proceedings

On March 7, 2006, a complaint was filed against the Company in a Chapter 7 bankruptcy proceeding in U.S. Bankruptcy Court in the District of Delaware in the matter captioned In Re: Factory 2-U Stores, Inc. The complaint sought to recover from the Company $91,572 in alleged preferential transfers made to the Company by the debtor during the ninety-day period prior to the filing of the debtor's bankruptcy petition. The Company defended against the preference claim by asserting that such transfers were made in the ordinary course of business. On May 22, 2007, all parties entered into a settlement agreement, subject to the bankruptcy court’s approval. The bankruptcy court approved the settlement and dismissed the complaint with prejudice on June 21, 2007.

Corporate Information

Our principal executive offices are located at 5th Floor, Texaco Building, 126-140 Texaco Road, Tsuen Wan, Hong Kong. Our telephone number is (852) 2944-9905, and our fax number is (852) 2944-9909.

Description of Property

Hong Kong Offices and Facilities

Our main offices and manufacturing facilities are located in Hong Kong. We currently store and deliver products from our manufacturing facilities located in Chai Wan and Tsuen Wan, New Territories, Hong Kong. We have placed a high priority on operating a safe, clean, and well-maintained distribution facility, which is a key selling point for many of our customers. Our prime location provides excellent proximity for shipping products to a diverse customer base located in all regions of the world.

A summary description of our facilities, including the total approximate square footage of our facilities, is provided in the table below:

Location | | Principal Activities | | Area (sq. feet) | | Lease Expiration Date |

Workshops 9 & 10 on 3 rd Floor QPL Building, 126-140 Texaco Road, Tsuen Wan, New Territories, Hong Kong | | Warehouse | | 5,400 sq. ft. | | Expires on January 31, 2009 |

| | | | | | | |

5th Floor, Texaco Building, 126-140 Texaco Road, Tsuen Wan, New Territories, Hong Kong | | Administrative offices, Manufacturing facility | | 42,000 sq. ft. | | Originally expired on January 31, 2007 and March 14, 2007 for 4th and 5th floors, respectively, and subsequently renewed for 2 years to January 31, 2009 for both floors (entered into by Infoscience Media Limited) |

We lease office and factory premises under various non-cancelable operating lease agreements that expire at various dates through years 2008 to 2009. All leases are on a fixed repayment basis. None of the leases includes contingent rentals. Minimum future commitments under these agreements payable as of December 31, 2007 are as follows:

| Year ending December 31 | | | |

| | $ | 246,124 | |

| 2009 | | | 20,510 | |

| 2010 | | | - | |

Rental expense was $214,899, $169,221, and $518,967 during 2007, 2006, and 2005, respectively. We believe that our existing facilities are well maintained and in good operating condition. The tenancy agreement for our office and factory premises in Hong Kong will expire in 2009.

Brazil Production Facility

In the first quarter of 2006, we started the construction of the production facility in Brazil, which was completed in February 2007. In February 2007, we relocated twelve of our existing production lines from Factory 1 to our production facility in Brazil, and we also installed eight new production lines in that facility. Our Brazilian production facility is located in Camaçari, State of Bahia, close to Salvador. The factory is approximately 1,800 sq. meters and can accommodate 26 production lines. All licenses required for the facility have been obtained, an incentive program from the State of Bahia had been approved, and the factory and the warehouse have been leased.

A summary description of our facilities in Brazil, including the total approximate square footage of our facilities, is provided in the table below:

Location | | Principal Activities | | Area (sq. feet) | | Lease Expiration Date |

Loteamento Poloplast Quadra D lote 5,

galpoes C, D, and E, Camacari, State of Bahia,

Brazil - BA, CEP 41230-090 | | Manufacturing facility | | 20,000 sq. ft. | | April 14, 2010, with options for renewal. |

Our Brazilian operations have been fully operating since March 2007 and have been producing to full capacity since December 2007.

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this prospectus before making an investment decision with regard to our securities. The statements contained in or incorporated into this prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Our limited operating history makes evaluation of our business difficult.

We have a limited operating history. Infosmart BVI was incorporated in the British Virgin Islands on August 23, 2005, and IS Technology was founded in August of 2002. These limited operating histories and the unpredictability of our industry make it difficult for investors to evaluate our business and future operating results. An investor in our securities must consider the risks, uncertainties and difficulties frequently encountered by companies in new and rapidly evolving markets. The risks and difficulties we face include challenges in accurate financial planning as a result of limited historical data and the uncertainties resulting from having had a relatively limited time period in which to implement and evaluate our business strategies as compared to older companies with longer operating histories.

We continually seek to develop new products and standards, which may not be widely adopted by consumers or, if adopted, may reduce demand by consumers for our older products.

We continually seek to develop new products and standards and enhance existing products and standards with higher memory capacities and other enhanced features. We cannot assure you that our new products and standards will gain market acceptance or that we will be successful in penetrating the new markets that we target. As we introduce new products and standards, it will take time for these new products and standards to be adopted, for consumers to accept and transition to these new products and standards, and for significant sales to be generated from them, if this happens at all. Moreover, broad acceptance of new products and standards by consumers may reduce demand for our older products and standards. If this decreased demand is not offset by increased demand for our new products and standards, our results of operations could be harmed. We cannot assure you that any new products or standards we develop will be commercially successful.

Our future operating results may fluctuate and cause the price of our common stock to decline.

We expect that our revenues and operating results will continue to fluctuate significantly from quarter to quarter due to various factors, many of which are beyond our control. The factors that could cause our operating results to fluctuate include, but are not limited to:

| · | price competition; |

| | |

| · | general price increases by suppliers and manufacturers; |

| | | |

| · | our ability to maintain and expand our customer relationships; | |

| | | |

| · | the introduction of new or enhanced products and strategic alliances by us and our competitors; | |

| | | |

| · | the success of our brand-building and marketing campaigns; | |

| · | consumer acceptance of our products and general shifts in consumer behavior with respect to our industry; |

| · | our ability to maintain, upgrade, and develop our production facilities and infrastructure; |

| | |

| · | technical difficulties and system downtime; |

| · | the amount and timing of operating costs and capital expenditures relating to expansion of our business, operations and infrastructure; |

| · | general economic conditions as well as economic conditions specific to our industry; and |

| | |

| · | our ability to attract and retain qualified management and employees. |

If our revenues or operating results fall below the expectations of investors or securities analysts, the price of our common stock could significantly decline.

Our ability to manage our future growth is uncertain.

We are currently anticipating a period of growth as a result of our corporate growth strategy, which aims to, among other things, further develop our manufacturing capabilities, expand our product offerings, and reach new customers. In pursuing these objectives, the resulting strain on our managerial, operational, financial and other resources could be significant. Success in managing such expansion and growth will depend, in part, upon the ability of senior management to manage effectively. Any failure to manage the anticipated growth and expansion could have a material adverse effect on our business.

Increased product returns will decrease our revenues and impact profitability.

We do not make allowances for product returns in our financial statements based on the fact that we have not had a material historical return rate. In order to keep product returns low, we continuously monitor product purchases and returns and may change our product offerings based on the rates of returns. If our actual product returns significantly increase, especially as we expand into new product categories, our revenues and profitability could decrease. Any changes in our policies related to product returns may result in customer dissatisfaction and fewer repeat customers.

Our growth and operating results could be impaired if we are unable to meet our future capital needs.

We may need to raise additional capital in the future to:

| | · | fund more rapid expansion; |

| | | |

| | · | acquire or expand into new facilities; |

| | | |

| | · | maintain, enhance, and further develop our manufacturing systems; |

| | | |

| | · | develop new product categories or enhanced services; |

| | · | fund acquisitions; or |

| | | |

| | · | respond to competitive pressures. |

If we raise additional funds by issuing equity or convertible debt securities, the percentage ownership of our stockholders will be diluted. Furthermore, any new securities could have rights, preferences and privileges senior to those of our preferred shares and the common stock into which our preferred shares are convertible. We cannot be certain that additional financing will be available when and to the extent required or that, if available, it will be on acceptable terms. If adequate funds are not available on acceptable terms, we may not be able to fund our expansion, develop or enhance our products or services or respond to competitive pressures.

The loss of key senior management personnel could negatively affect our business.

We depend on the continued services and performance of our senior management and other key personnel, particularly Parker Seto, our Chief Executive Officer and President, and Sebastian Tseng, our Regional Director for South America and V.P. of Production and R&D. The loss of any of our executive officers or other key employees could harm our business. Infosmart BVI currently has employment agreements with its key personnel. Further, we expect to assume the employment agreements our executive officers currently have with Infosmart BVI that are described in more detail in the section titled “Executive Compensation - Employment Agreements” in this registration statement.

Rapid changes in technology could adversely affect our business and hurt our competitive position.