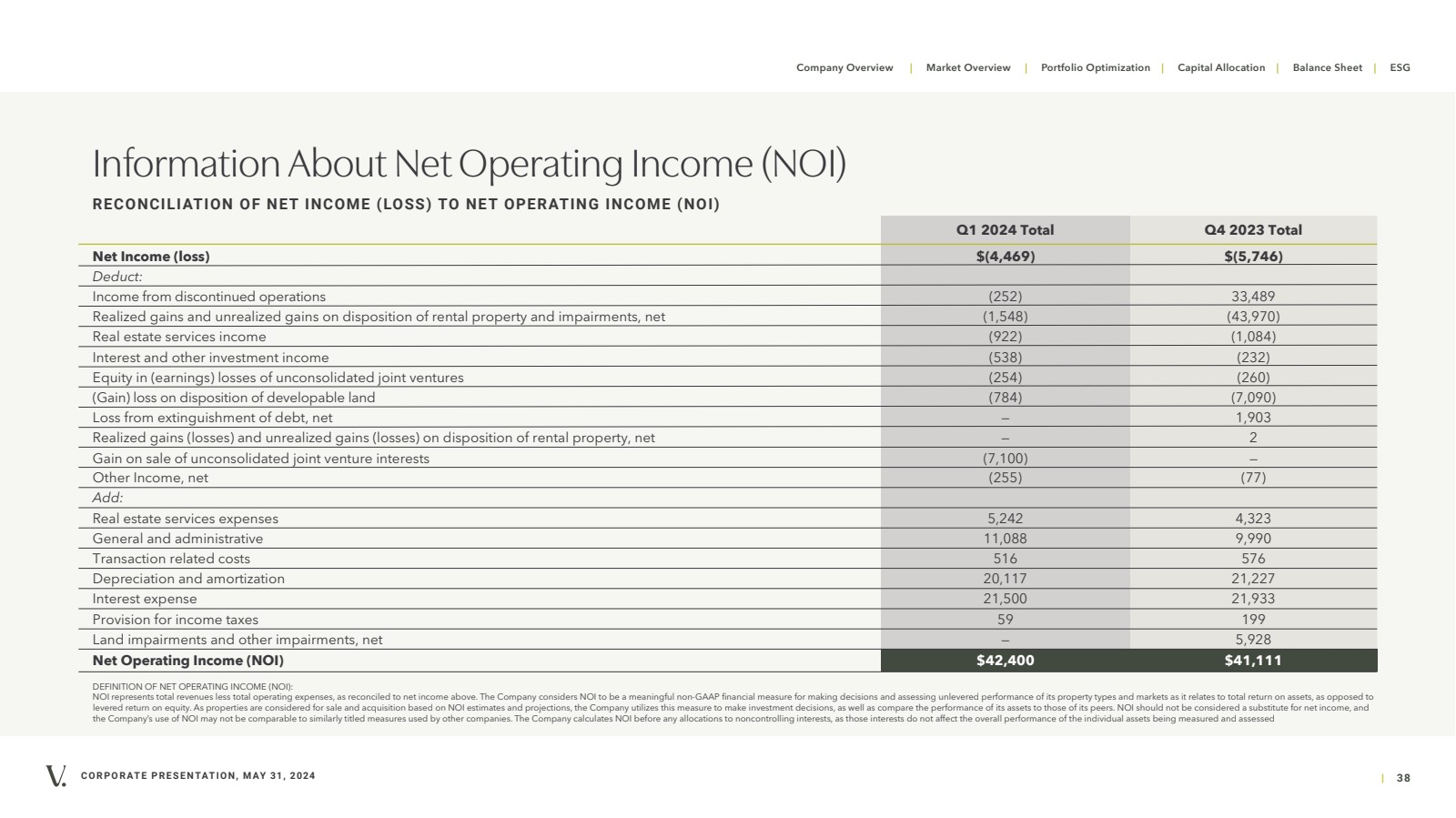

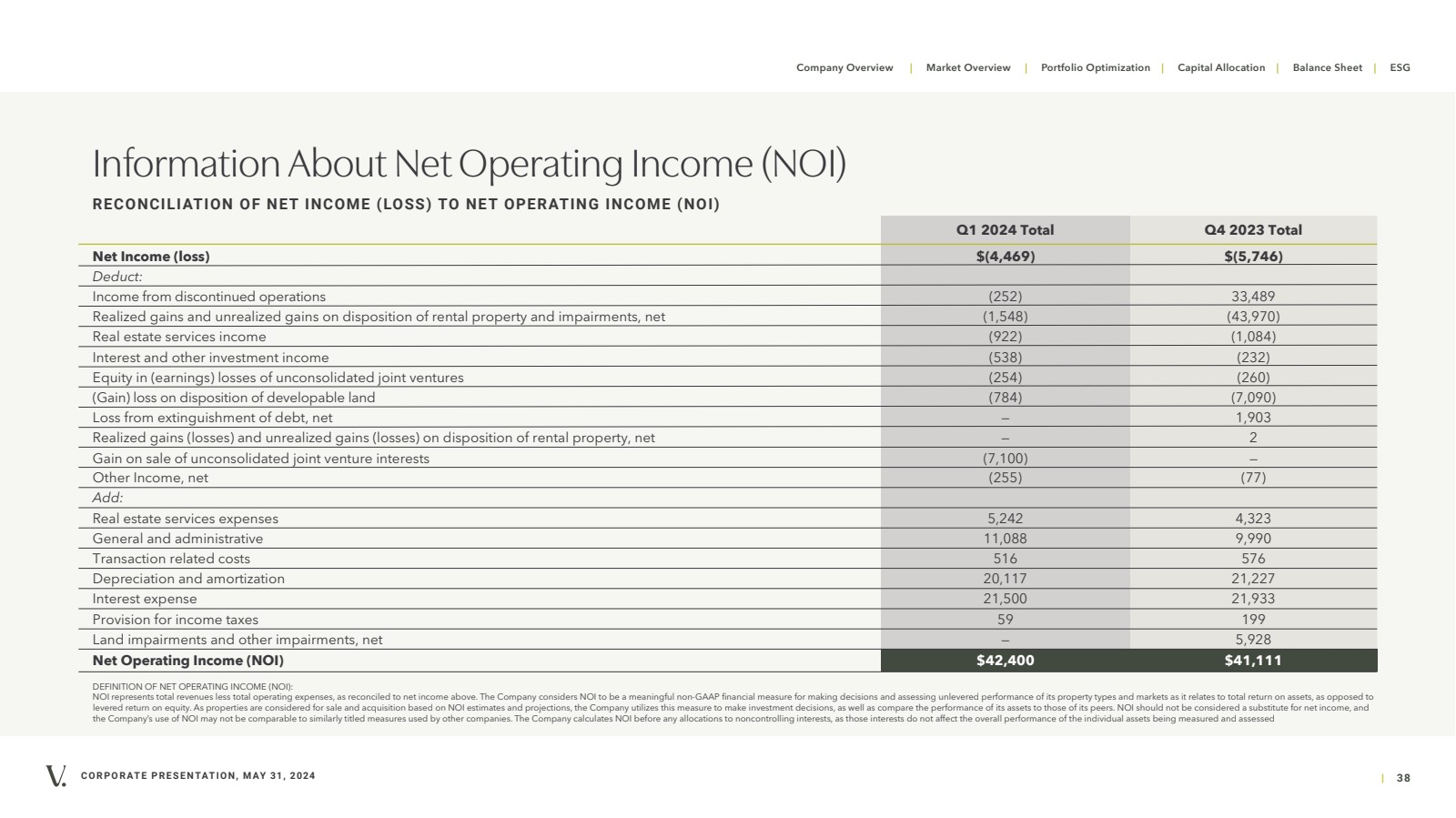

| COR PORATE P RESE N TATIO N, MAY 31, 2024 | 38 Q1 2024 Total Q4 2023 Total Net Income (loss) $(4,469) $(5,746) Deduct: Income from discontinued operations (252) 33,489 Realized gains and unrealized gains on disposition of rental property and impairments, net (1,548) (43,970) Real estate services income (922) (1,084) Interest and other investment income (538) (232) Equity in (earnings) losses of unconsolidated joint ventures (254) (260) (Gain) loss on disposition of developable land (784) (7,090) Loss from extinguishment of debt, net — 1,903 Realized gains (losses) and unrealized gains (losses) on disposition of rental property, net — 2 Gain on sale of unconsolidated joint venture interests (7,100) — Other Income, net (255) (77) Add: Real estate services expenses 5,242 4,323 General and administrative 11,088 9,990 Transaction related costs 516 576 Depreciation and amortization 20,117 21,227 Interest expense 21,500 21,933 Land impairments and other impairments, net — 5,928 Net Operating Income (NOI) $42,400 $41,111 Information About Net Operating Income (NOI) RECONCILIATION OF NET INCOME (LOSS) TO NET OPERATING INCOME (NOI) Provision for income taxes 59 199 DEFINITION OF NET OPERATING INCOME (NOI): NOI represents total revenues less total operating expenses, as reconciled to net income above. The Company considers NOI to be a meaningful non-GAAP financial measure for making decisions and assessing unlevered performance of its property types and markets as it relates to total return on assets, as opposed to levered return on equity. As properties are considered for sale and acquisition based on NOI estimates and projections, the Company utilizes this measure to make investment decisions, as well as compare the performance of its assets to those of its peers. NOI should not be considered a substitute for net income, and the Company’s use of NOI may not be comparable to similarly titled measures used by other companies. The Company calculates NOI before any allocations to noncontrolling interests, as those interests do not affect the overall performance of the individual assets being measured and assessed Company Overview | Market Overview | Portfolio Optimization | Capital Allocation | Balance Sheet | ESG |