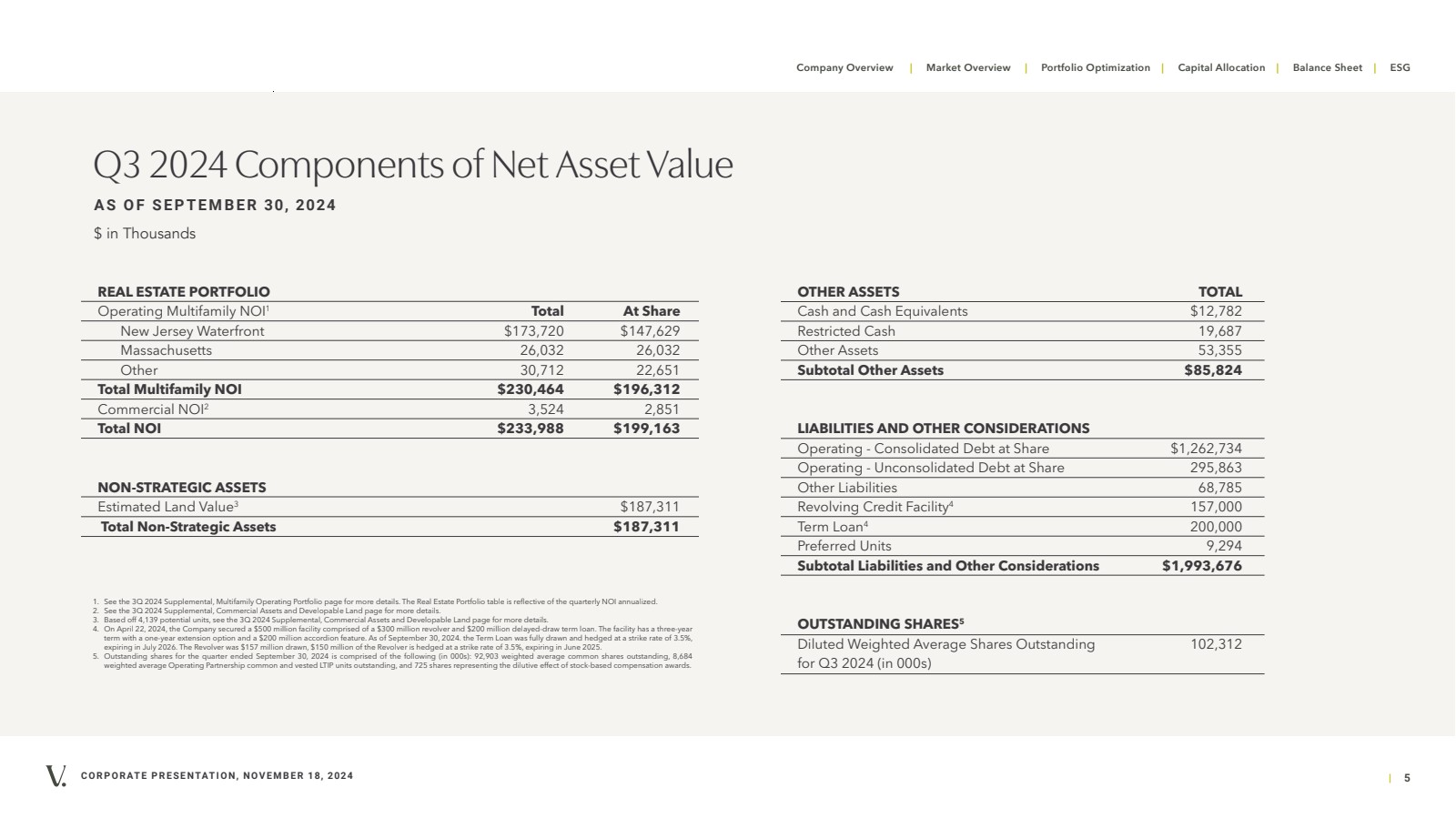

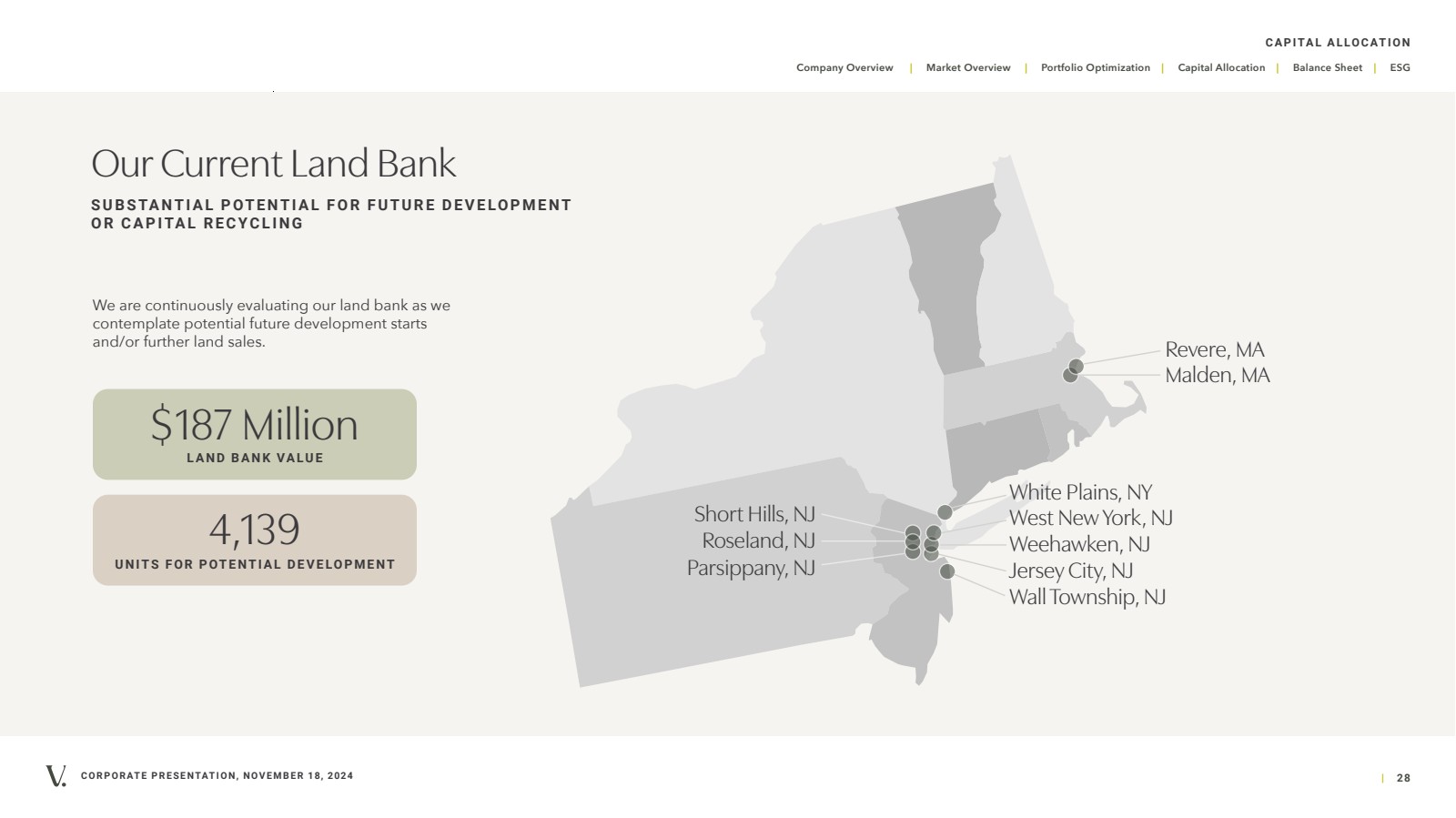

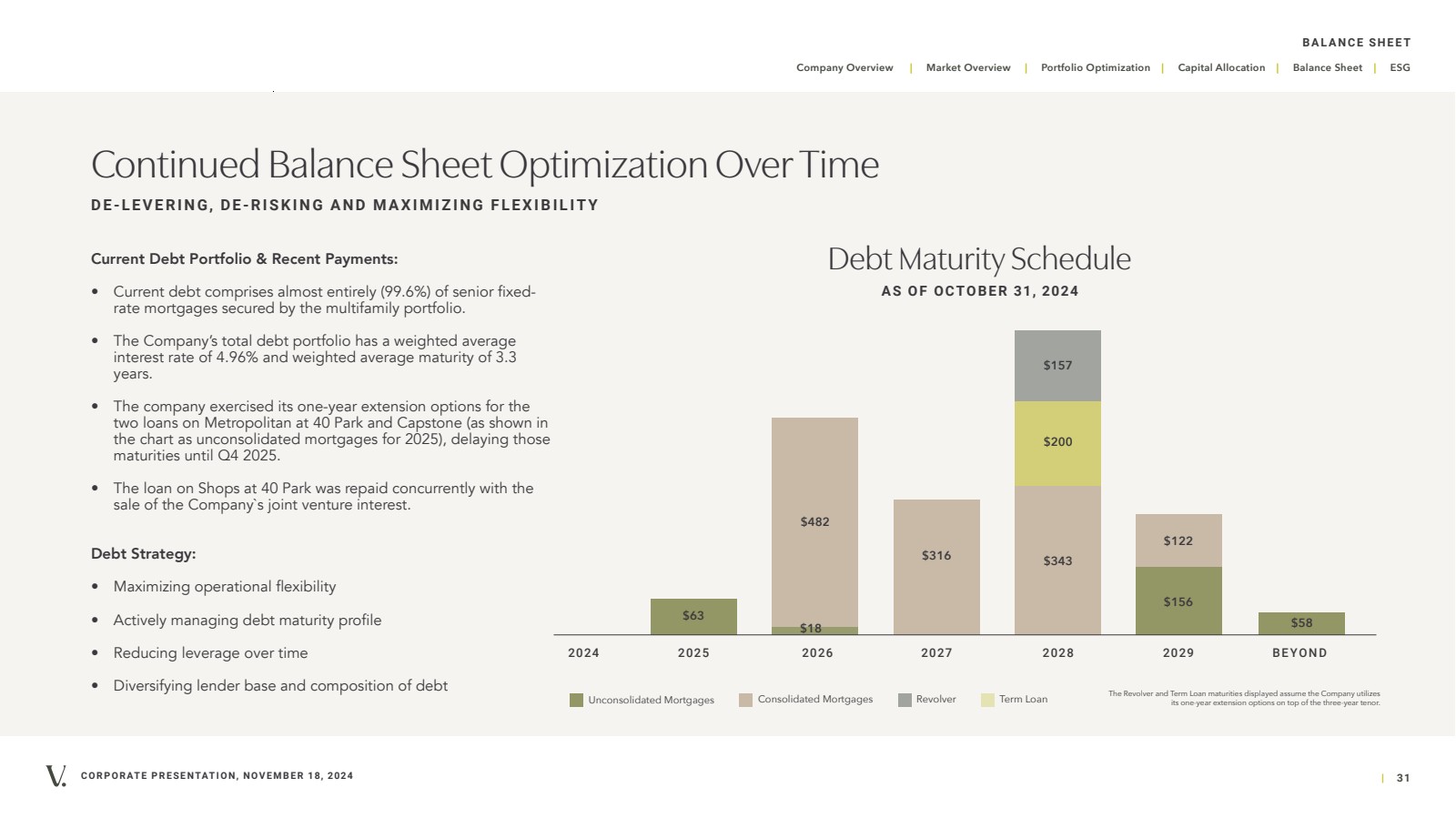

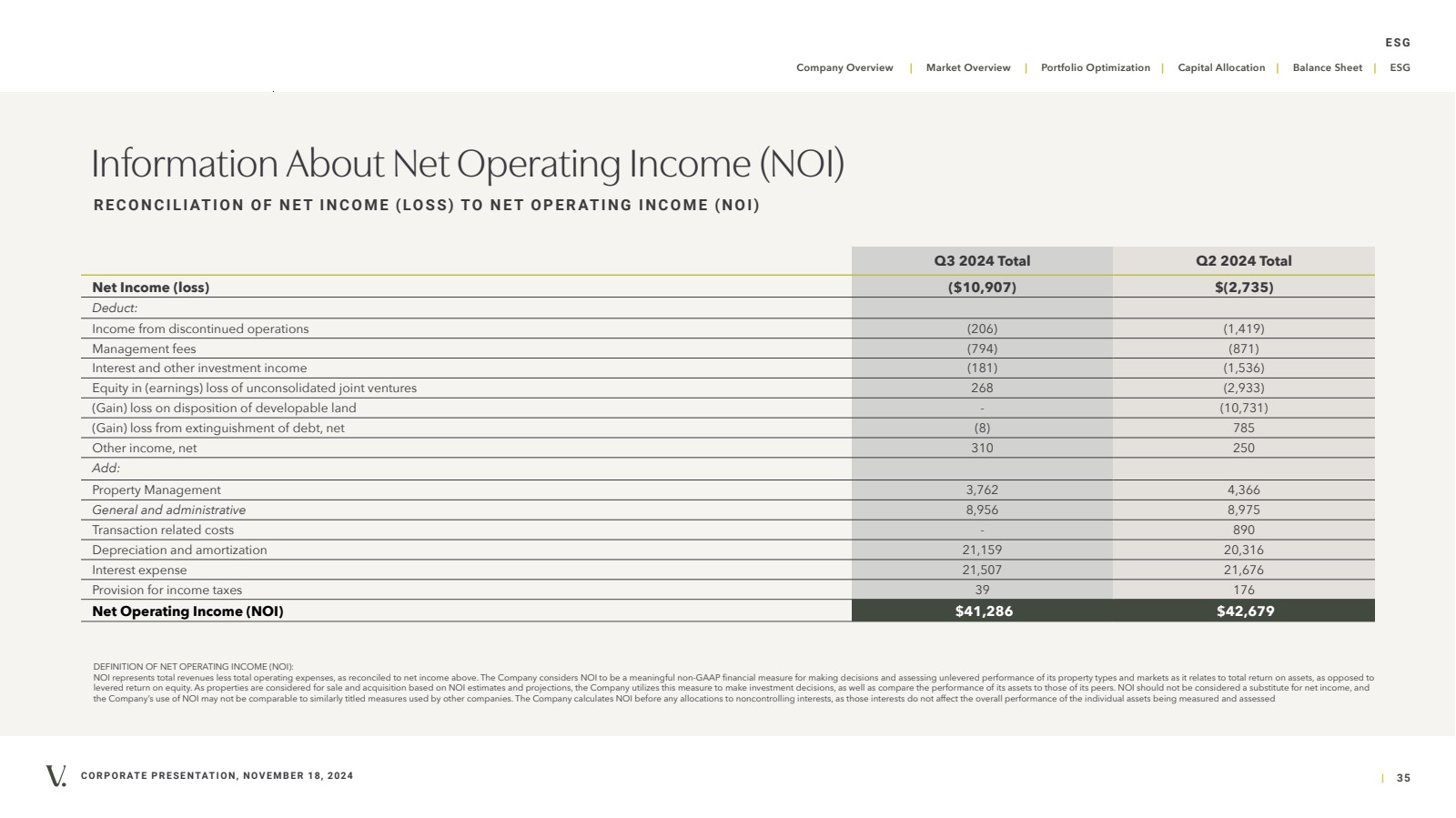

| CORPORATE PRESENTATION, NOVEMBER 18, 2024 | 5 Company Overview | Market Overview | Portfolio Optimization | Capital Allocation | Balance Sheet | ESG Q3 2024 Components of Net Asset Value REAL ESTATE PORTFOLIO Operating Multifamily NOI1 Total At Share New Jersey Waterfront $173,720 $147,629 Massachusetts 26,032 26,032 Other 30,712 22,651 Total Multifamily NOI $230,464 $196,312 Commercial NOI2 3,524 2,851 Total NOI $233,988 $199,163 NON-STRATEGIC ASSETS Estimated Land Value3 $187,311 Total Non-Strategic Assets $187,311 OTHER ASSETS TOTAL Cash and Cash Equivalents $12,782 Restricted Cash 19,687 Other Assets 53,355 Subtotal Other Assets $85,824 LIABILITIES AND OTHER CONSIDERATIONS Operating - Consolidated Debt at Share $1,262,734 Operating - Unconsolidated Debt at Share 295,863 Other Liabilities 68,785 Revolving Credit Facility4 157,000 Term Loan4 200,000 Preferred Units 9,294 Subtotal Liabilities and Other Considerations $1,993,676 OUTSTANDING SHARES5 Diluted Weighted Average Shares Outstanding 102,312 for Q3 2024 (in 000s) 1. See the 3Q 2024 Supplemental, Multifamily Operating Portfolio page for more details. The Real Estate Portfolio table is reflective of the quarterly NOI annualized. 2. See the 3Q 2024 Supplemental, Commercial Assets and Developable Land page for more details. 3. Based off 4,139 potential units, see the 3Q 2024 Supplemental, Commercial Assets and Developable Land page for more details. 4. On April 22, 2024, the Company secured a $500 million facility comprised of a $300 million revolver and $200 million delayed-draw term loan. The facility has a three-year term with a one-year extension option and a $200 million accordion feature. As of September 30, 2024. the Term Loan was fully drawn and hedged at a strike rate of 3.5%, expiring in July 2026. The Revolver was $157 million drawn, $150 million of the Revolver is hedged at a strike rate of 3.5%, expiring in June 2025. 5. Outstanding shares for the quarter ended September 30, 2024 is comprised of the following (in 000s): 92,903 weighted average common shares outstanding, 8,684 weighted average Operating Partnership common and vested LTIP units outstanding, and 725 shares representing the dilutive effect of stock-based compensation awards. AS OF SEPTEMBER 30, 2024 $ in Thousands |