SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| | | |

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2008

OR

| | | |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-27147

CELLYNX GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | |

| Nevada | | 95-4705831 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

25910 Acero, Suite 370 Mission Viejo, California | | 92691 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number: (949) 305-5290

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, no par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained herein, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer o Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

At December 31, 2007, the end of our second fiscal quarter, the aggregate market value of common stock held by non-affiliates of the registrant was approximately $7,265,557 based on the closing price of $0.21 as reported on the Over-the-Counter Bulletin Board.

Number of shares of common stock outstanding as of October 10, 2008: 80,552,812.

TABLE OF CONTENTS

TO ANNUAL REPORT ON FORM 10-K

FOR YEAR ENDED JUNE 30, 2008

| | | | | Page |

| PART I | | | | 1 | |

| Item 1. | | Business | | 1 | |

| Item 1A. | | Risk Factors | | | |

| Item 1B. | | Unresolved Staff Comments | | 8 | |

| Item 2. | | Properties | | 8 | |

| Item 3. | | Legal Proceedings | | 9 | |

| Item 4. | | Submission of Matters to a Vote of Security Holders | | 9 | |

| | | | | | |

| PART II | | | | 9 | |

| Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | 9 | |

| Item 6. | | Selected Financial Data | | 9 | |

| Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 10 | |

| Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | 13 | |

| Item 8. | | Financial Statements and Supplementary Data | | 13 | |

| Item 9. | | Disagreements With Accountants on Accounting and Financial Disclosure | | 13 | |

| Item 9A. | | Controls and Procedures | | 13 | |

| Item 9B. | | Other Information | | | |

| | | | | | |

| PART III | | | | 15 | |

| Item 10. | | Directors, Executive Officers and Corporate Governance | | 15 | |

| Item 11. | | Executive Compensation | | 18 | |

| Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 22 | |

| Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | 23 | |

| Item 14. | | Principal Accounting Fees and Services | | 24 | |

| | | | | | |

| PART IV | | | | 25 | |

| Item 15. | | Exhibits, Financial Statement Schedules | | 25 | |

| Signatures | | | | 26 | |

| | | | | | |

EXPLANATORY NOTE

As previously reported in our Current Report on Form 8-K dated July 30, 2008, the Company, under its predecessor name NorPac Technologies, Inc. (“NorPac”), completed a share exchange transaction with CelLynx, Inc. a California corporation (“CelLynx”) and CelLynx’s shareholders (the “Share Exchange”) that resulted in CelLynx becoming a wholly-owned subsidiary of NorPac and also resulted in a change of control of the Company. The Share Exchange was accounted for as a reverse acquisition and recapitalization and, as a result, NorPac’s (the legal acquirer) consolidated financial statements will, in substance, be those of CelLynx (the accounting acquirer), with the assets and liabilities, and revenues and expenses, of CelLynx being included effective from the date of the Share Exchange. However, the Share Exchange was not completed until after the end of Company’s current fiscal year, June 30, 2008, and thus the Company was required to file this Annual Report on Form 10-K for NorPac’s business activities prior to the Share Exchange and as of June 30, 2008. Although this Annual Report on Form 10-K includes descriptions of the Share Exchange and the business of the combined entity after the Closing of the Share Exchange, the financial statements and information included are only those of NorPac, the legal acquirer. The financial statements for CelLynx for the years ended September 30, 2006 and September 30, 2007 and the unaudited financial statements for the six-months ended March 31, 2008 were included with the Form 8-K filed on July 30, 2008 in connection with the Share Exchange. Further, the Company has also decided to adopt the fiscal year end of CelLynx, its operating business after the share exchange transaction, and thus the Company will be filing an annual report on Form 10-K for its new fiscal year ending September 30th, commencing with the Company’s annual report for the year ending September 30, 2008.

FORWARD LOOKING STATEMENTS AND CERTAIN TERMINOLOGY

Some of the statements made by us in this Annual Report on Form 10-K are forward-looking in nature, including but not limited to, statements relating to our future revenue, product development, demand, acceptance and market share, gross margins, levels of research and development, our management's plans and objectives for our current and future operations, and other statements that are not historical facts. Forward-looking statements include, but are not limited to, statements that are not historical facts, and statements including forms of the words "intend", "believe", "will", "may", "could", "expect", "anticipate", "plan", "possible", and similar terms. Actual results could differ materially from the results implied by the forward looking statements due to a variety of factors. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly release any revisions to these forward-looking statements that may reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Factors that could cause actual results to differ materially from those expressed in any forward-looking statement made by us include, but are not limited to:

● our limited operational history;

● our ability to finance our activities and maintain our financial liquidity;

● our ability to attract and retain qualified, knowledgeable employees;

● the impact of general economic conditions on our business;

● the ability to bring our technology to commercialization;

● market acceptance of our products;

● dependence on suppliers, third party manufacturers and other key vendors;

● our ability to design and market new products successfully;

● our failure to acquire new customers in the future;

● continued enforceability of patent and trademark rights;

● deterioration of business and economic conditions in our markets;

● intensely competitive industry conditions with increasing price competition; and

● the rate of growth in the cellular amplifier market.

In this document, the words "we," "our," "ours," "us," “CelLynx” and “Company” refer to CelLynx Group, Inc. and our subsidiary.

PART I

ITEM 1. BUSINESS

Corporate Background

CelLynx Group, Inc. (“CelLynx” or the “Company”) was originally incorporated under the laws of the State of Minnesota on April 1, 1998, under the name “Cool Can Technologies, Inc.” Effective July 12, 2004, the Company merged (the “Merger”) with NorPac Technologies, Inc., its wholly owned subsidiary (“Nevada Sub”), for the purpose of reincorporating the Company in Nevada. The Merger was completed effective July 12, 2004, with Nevada Sub as the surviving corporation. Upon completion of the Merger, the Company’s name was changed to NorPac Technologies, Inc. (“NorPac”).

The Company had originally been in the business of developing and marketing a proprietary technology for self-chilling beverage containers (the “Cool Can Technology”). However, the Company’s patents for the Cool Can Technology expired, and, as a result, the Company’s management decided to abandon the development of the Cool Can Technology and seek alternative business opportunities. To that end, as more fully explained below, on July 24, 2008, the Company closed a transaction with shareholders of CelLynx, Inc., a California corporation ("CelLynx-California"), by which it newly issued shares to the CelLynx-California shareholders in exchange for all outstanding shares of CelLynx-California. Through this transaction, the Company acquired a cellular amplifier business as its wholly owned subsidiary. This transaction has been considered a "reverse take-over" for accounting purposes.

Effective August 5, 2008, the Company changed its name to CelLynx Group, Inc. by merging another wholly owned subsidiary, CelLynx Group, Inc., a Nevada corporation, into the Company and assuming the subsidiary’s name.

The Reverse Take-Over

On July 24, 2008, the Company closed a reverse take-over transaction by which it acquired a cellular amplifier business pursuant to a Share Exchange Agreement, as amended (the “Exchange Agreement”), by and among the Company, CelLynx, Inc., a California corporation (“CelLynx-California”), and twenty-three (23) CelLynx-California shareholders who, immediately prior to the closing of the transactions contemplated by the Exchange Agreement, collectively held 100% of CelLynx-California’s issued and outstanding shares of capital stock (the “CelLynx Owners”).

Prior to the closing, on July 23, 2008, the Company entered into a Regulation S Subscription Agreement (the “Subscription Agreement”) pursuant to which the Company agreed to issue and sell 10,500,000 shares of its common stock and warrants to purchase 10,500,000 shares of common stock at an exercise price of $0.20 per share to non-U.S. persons (the “Investors”) for an aggregate purchase price of $1,575,000 (the “Financing”).

Prior to the closing, on July 22, 2008, CelLynx-California entered into a Master Global Marketing and Distribution Agreement (the “Distribution Agreement”) with Dollardex Group Corp., a company organized under the laws of Panama (“Dollardex”), whereby Dollardex shall act as CelLynx-California’s exclusive distributor of CelLynx-California’s products and related accessories in the following regions: Canada, South America, Europe, Middle East, China, India, Australia, Africa and South East Asia.

Immediately following the closing, on July 24, 2008, two of the new officers and directors, one of the new employees and one of the new non-officer directors of the Company entered into a Lock-Up Agreement (the “Lock-Up Agreement”) whereby they agreed not to transfer their the Company shares for a period of 24 months following the closing of the reverse take-over transaction.

As a result of the closing of the reverse take-over transaction, the CelLynx Owners became our controlling shareholders, CelLynx-California became our wholly-owned subsidiary, and CelLynx-California’s business became our business.

The following is a brief description of the terms and conditions of the Exchange Agreement, Subscription Agreement and Distribution Agreement, and the transactions contemplated thereunder that are material to the Company.

Share Exchange

Under the Exchange Agreement, the Company was to acquire all of the equity interests of CelLynx-California in exchange for issuing restricted common stock to the CelLynx Owners in an aggregate amount equal to approximately 70% of the total issued and outstanding shares of common stock immediately after the closing of the reverse take-over, taking into account certain derivative shares held by certain CelLynx Owners and a CelLynx-California noteholder, but exclusive of the shares issued in the Financing and to certain CelLynx-California investors. As a result, the CelLynx Owners were to receive 77,970,956 shares of the Company’s common stock in exchange for 100% of CelLynx’s common stock. However, the Company had only 41,402,110 authorized, unissued and unreserved shares of common stock available, after taking into account the shares of common stock issued and reserved in the Financing described below. Pursuant to the Exchange Agreement, in the event that there were an insufficient number of authorized but unissued and unreserved common stock to complete the transaction, the Company was to issue all of the available authorized but unissued and unreserved common stock to the CelLynx Owners in a pro rata manner and then establish a class of Series A Convertible Preferred Stock (“Series A Preferred Stock”) and issue that number of shares of Series A Preferred Stock such that the common stock underlying the Series A Preferred Stock plus the common stock actually issued to the CelLynx Owners would equal the total number of shares of common stock due to the CelLynx Owners under the Exchange Agreement. As a result, the Company issued to the CelLynx Owners an aggregate of 32,454,922 shares of common stock and 45,516,034 shares of Series A Preferred Stock. The Series A Preferred Stock automatically converts into common stock on a one-to-one ratio upon the authorized capital stock of the Company being increased to include not less than 150,000,000 shares of common stock.

The Exchange Agreement also provided that all options, warrants and convertible notes to purchase or acquire shares of CelLynx-California be converted into options, warrants or convertible notes to purchase or acquire shares of the Company in the same proportion at which the CelLynx-California shares were converted into Company shares (the “Conversion Ratio”) under the Exchange Agreement. The exercise or conversion price for such options, warrants or convertible notes shall be the exercise price or conversion price of the CelLynx-California options, warrants or convertible notes divided by the Conversion Ratio. As a result, 750,000 CelLynx-California options with an exercise price of $0.018 per share were converted into 943,447 Company options with an exercise price of $0.014 per share; 375,000 CelLynx-California options with an exercise price of $0.02 per share were converted into 471,723 Company options with an exercise price of $0.016 per share; 23,394,133 CelLynx-California options with an exercise price of $0.09 per share were converted into 29,428,164 Company options at an exercise price of approximately $0.0715 per share; 18,330,574 CelLynx-California options with an exercise price of $0.099 per share were converted into 23,058,565 Company options with an exercise price of approximately $0.0787 per share, and, with the exception of the Palomar Note described below, $40,000 of CelLynx-California convertible notes with a conversion price of $0.01 per share were converted into $40,000 of Company convertible notes with a conversion price of approximately $0.0079 per share, and $20,000 of CelLynx-California convertible notes with a conversion price of $0.10 per share were converted into $20,000 of Company convertible notes with a conversion price of approximately $0.0795 per share. There were no CelLynx-California warrants issued and outstanding at the time of the closing of the Exchange Agreement.

In connection with the reverse take-over transaction, Palomar Ventures III, L.P. (“Palomar”), holder of a certain amended and restated convertible promissory note dated November 10, 2007 (the “Palomar Note”) executed by CelLynx-California in the principal amount of $262,356.16, is entitled to convert the Palomar Note into that number of shares of common stock of CelLynx-California such that immediately following the closing of the reverse take-over transaction, the Palomar Note would be convertible into 4.8% of the issued and outstanding common stock of the Company, exclusive of unvested options. As a result, the Palomar Note is convertible into 6,340,029 shares of the Company's common stock.

As a condition to closing the Exchange Agreement, John P. Thornton resigned as the Company’s President, Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer, and the following officers were appointed:

| | § | Daniel R. Ash, President, Chief Executive Officer, Chief Operating Officer and Secretary; |

| | § | Kevin Pickard, Chief Financial Officer and Treasurer, and |

| | § | Tareq Risheq, Chief Strategy Officer. |

In addition, Mr. Thornton agreed to resign as a director of the Company and Mr. Ash, Mr. Risheq, Norman W. Collins, and Robert J. Legendre were appointed directors of the Company. Mr. Ash’s appointment was effective immediately. The appointment of the other directors became effective upon the Company’s compliance with the provisions of Section 14(f) of the Securities Act of 1933, as amended, and Rule 14(f)-1 thereunder.

$1,575,000 Financing

Under the Subscription Agreement, the Company issued 10,500,000 shares of its common stock and warrants (the “Warrants”) to purchase 10,500,000 shares of common stock at an exercise price of $0.20 per share to the Investors for an aggregate purchase price of $1,575,000, or $0.15 per share, payable in cash and through the cancellation of debt. The proceeds from the Financing were allocated as follows: $100,000 to pay current obligations of NorPac, $225,000 as cancellation of current debt of NorPac and the remaining $1,250,000 for working capital. The Warrants expire on July 22, 2010 except in the event that at any time CelLynx has manufactured 25 or more of its mobile or home repeater units, then the Company may, at its option, accelerate the expiry of the Warrants by giving notice (“Notice of Acceleration”) to the holder thereof. If the holder does not exercise the Warrant within 30 days of the giving of the Notice of Acceleration, the Warrants will expire and the holder will have no further rights to acquire any shares of the Company under the Warrants.

As a result of the closing of the Exchange Agreement and Subscription Agreement, the CelLynx Owners now own 40.3%, and the investors in the Financing own 13.0%, of the issued and outstanding common stock of the Company, and the CelLynx Owners own 100% of the issued and outstanding Preferred Stock, which are convertible into 45,516,034 shares of common stock. At the closing of the Exchange Agreement, the Company had a total of 80,552,812 shares of its common stock issued and outstanding.

Dollardex Distribution Agreement

Under the Distribution Agreement, Dollardex shall act as CelLynx’s exclusive distributor of the CelLynx’s 5BARz™ products and related accessories (the “Products”) in the following nine regions: Canada, South America, Europe, Middle East, China, India, Australia, Africa, and South East Asia (the “Territory”). The Distribution Agreement supersedes a prior Joint Venture Agreement, as amended, dated January 3, 2008 entered into between the parties.

In accordance with the terms of the Distribution Agreement, Dollardex will sell and distribute the Products directly to resellers (whether wholesales or retailers) or end users of the Products in the Territory as well as sell and distribute the Products to its agents in the Territory (the “Dealers”). The Dealers will be located and appointed by Dollardex but their appointment will be subject to CelLynx’s approval.

In accordance with the terms of the Distribution Agreement, CelLynx also granted Dollardex an exclusive non-transferrable license to use the tradenames, trademark, logos, and designations in or associated with the Products during the term of the Distribution Agreement in connection with the promotion and distribution of the Products in the Territory. The Distribution Agreement is otherwise subject to customary intellectual property protections, including, without limitation, all of the processes, know-how, and related material proprietary of CelLynx to manufacture the Products.

The term of the Distribution Agreement is perpetual though the Distribution Agreement may be terminated, in the event of, among other events, a material breach, upon a change of control of Dollardex, or by mutual agreement of the parties. The Distribution Agreement further provides that CelLynx shall have the exclusive right of first refusal to acquire Dollardex in the event that Dollardex considers such transaction. In addition, effective December 31, 2011, CelLynx shall have the option to acquire Dollardex in accordance with a certain appraisal method as further described in the Distribution Agreement.

In accordance with the terms of the Distribution Agreement, CelLynx and Dollardex, prior to Dollardex entering into a contractual relationship with a Dealer or commencing distribution of the Product in a given Territory, will develop a business plan for deployment of the distribution and marketing of the Products in the specific Territory. CelLynx will have approval rights over the business plan and Dollardex is obligated to conduct business and ensure that Dealers conduct their business substantially in accordance with the terms of the business plan.

As consideration for the rights granted under the Distribution Agreement, Dollardex will provide funding to the Company as follows: (i) $1,000,000 due and payable after the pilot production run for the first commercial Product is completed (the “Initial Roll Out”); (ii) $4,000,000 due and payable 90 days from the commencement of the Initial Roll Out; and (iii) $5,000,000 due and payable 180 days from the commencement of the Initial Roll Out. In addition, the parties agreed that the Company will sell products to Dollardex at 10% over cost of goods sold and Dollardex will pay the Company 50.1% of its Net Earning (as defined in the Distribution Agreement) on a quarterly basis with payments to be made within 45 days following the end of each quarter.

Lock-Up Agreements

Under the Lock-Up Agreement, Robert J. Legendre, Chairman of the Board of Directors of the Company, Daniel R. Ash, Chief Executive Officer and a director of the Company, Tareq Risheq, Chief Strategy Officer and a director of the Company, and Anthony DeMarco, a senior employee of the Company, agreed not to transfer, sell, assign, pledge, hypothecate, give, create a security interest in or lien on, place in trust (voting trust or otherwise), or in any other way encumber or dispose of, directly or indirectly and whether or not voluntarily, without express prior written consent of the Company, any common stock or options to purchase common stock of the Company for a period of 24 months.

The descriptions of the Exchange Agreement, Subscription Agreement, Warrants, Distribution Agreement, Palomar Note, and Lock-Up Agreement are qualified in their entirety by the contents of such agreements, which are attached to this report as Exhibits 2.1, 2.2, 2.3, 10.1, 10.2, 10.3, 10.4 and 10.8, respectively, and are incorporated herein by reference.

Recent Events

On September 22, 2008, shareholders owning in the aggregate 26,441,554 shares of the Company’s common stock and 40,411,544 shares of the Company’s Series A Preferred Stock, outstanding as of September 10, 2008 (the “Record Date”), consented in writing to amend the Company’s articles of incorporation to increase the number of shares of the Company’s authorized common stock from 100,000,000 to 400,000,000. On October 8, 2008, the Company filed and mailed a Definitive Information Statement notifying its shareholders of this action. This action will become effective on or about October 28, 2008, at which time the Company with file a Certificate of Amendment to its Articles of Incorporation.

Overview of CelLynx

CelLynx is developing and plans to produce and market a next generation of cell phone amplifiers (also known as repeaters or boosters) for the small office, home office (“SOHO”) and vehicle. This next generation product, CelLynx 5BARz™, is the first single piece unit that strengthens weak cellular signals to deliver higher quality signals for voice, data and video reception on cell phones being used indoors or in vehicles. CelLynx plans to develop its products for use in North America, Europe and Asia. The CelLynx product line is intended to be manufactured by top tier contract manufacturers located in South East Asia. These manufacturers will allow CelLynx to capitalize on the full advantages of multiple manufacturing locations with a trained and experienced technical work force, state of the art facilities and knowledge of all aspects of supply chain management, operational execution, global logistics and reverse logistics. The marketing and sales functions will be handled in-house incorporating a multi-channel strategy that includes distribution partners, wireless service providers, retail outlets and international joint ventures.

The CelLynx Solution

Most SOHO cellular amplifiers currently on the market require a receiving tower or antenna, usually placed in an attic or on a rooftop, and a transmitting tower or antenna to be placed at least 35 feet from the other antenna with each connected to the amplifier by cable. CelLynx’s patent pending technology eliminates the need to distance the receiving and transmitting towers, allowing the two towers to be placed directly inside the amplifier, resulting in a more affordable, one piece unit sometimes referred to as ‘plug & play’, i.e. requiring no installation other than plugging the unit into a power source.

| CelLynx has recently completed a prototype of the SOHO unit which delivers 45 decibel (dB) of gain in a Single Band PCS environment providing up to 1,500 square feet of indoor coverage. This unit measures 6.5 X 7.5 X 2.5 inches, weighs approximately one pound and does not require the installation of antennas or cables in order to function. In order to optimize marketability, CelLynx is developing an improved model which it expects to operate in a dual band, PCS and Cellular, environment delivering 65 dB of gain thereby allowing for coverage of 2,500 to 3,000 square feet. This dual band unit would work with all current wireless carriers in the U.S. and Canada except Nextel, which operates on its own frequency. The PCS network is generally used by the older carriers such as AT&T at 850MHz while the newer carriers such as T-Mobile operate on the Cellular network at 1900 MHz. Management is confident that all of the critical functions required for this dual band unit have been identified and that their engineering team has the capability to accomplish development leading to commercialization. | |  |

We believe the CelLynx product line, when commercialized, will also offer an advantage over other repeater such as the Femtocell architecture being developed by wireless service providers such as AT&T and Verizon. This Femtocell technology requires a small cellular base station which connects to the service provider’s network via a broadband such as DSL or cable. As such, Femtocell will be carrier specific and subject to a monthly subscription fee. CelLynx products, on the other hand, will be compatible with all wireless carriers in the U.S. and Canada with the exception of Nextel, will not require a broadband internet connection and will not entail a monthly service fee.

CelLynx has also developed a mobile unit particularly designed for use in vehicles. This unit currently is an adaptation of the SOHO unit described above. However, CelLynx is currently improving the mobility of that model by developing an amplifier which will measure 3.5 X 5 inches including one built in antenna and another antenna measuring 4 to 6 inches to be connected to the amplifier by a micro-coax cable and attached to any of the windows by suction cup or other portable means. The unit will produce up to 45 dB of gain offering higher performance than the competition within the interior of the vehicle cabin while minimizing the signal degrading effects of cabling. The mobile unit will feature built in caller ID and Bluetooth speaker phone for hands free driving and will operate in a dual band environment. It will require no installation other than placing the antennae within the cabin of the vehicle and inserting the cigarette lighter power adapter. Unlike the other products on the market, the CelLynx product will not require the installation of a roof top mounted antenna. As a result, management believes that this consumer friendly product, will surpass the competition in market acceptance thereby creating the potential for a mass market distribution channel.

History and Development of CelLynx

CelLynx assembled a veteran engineering team with extensive cellular radio frequency (RF) experience headquartered in Sacramento, California. Within eight months, this team, with more than 80 years of combined experience in building RF products, developed working prototypes of an affordable consumer friendly single piece plug & play amplifier with a minimum of 45dB of gain in both up and down paths. By late 2007, a pre-production prototype had been developed. At that time, CelLynx entered into a merger agreement with NorPac Technologies, Inc., a Nevada corporation trading on the Over The Counter Bulletin Board (OTC BB).

Since the closing of the reverse take-over, CelLynx has continued the development of the product while working toward the development of the dual band unit, improving the design and is currently adapting the SOHO unit into a mobile amplifier for vehicle use. Meanwhile management is focusing on the manufacturing process and a sales and marketing plan to ensure the delivery of a quality low cost product into the market place.

The CelLynx Product Line

5Barz™ Home Unit

The 5Barz™ home unit is designed to eliminate cell phone dead spots in an area similar to the size of a single family home (2,000 to 3,000 square feet). Expected to retail at about $299.00, the 5Barz™ home unit is lightweight, aesthetically pleasing and designed to sit on a table near a window in the direction of the nearest cell tower. There is an indicator light to determine the best placement. This product requires no assembly: simply place the unit on a table and plug in the power chord. Product introduction is expected to occur near the beginning of second quarter 2009 for the North American model. The European and Asian models are expected to be introduced in the fall of 2009.

5Barz™ Mobile Unit

The 5Barz™ mobile unit is designed to eliminate cell phone dead spots while in a vehicle, moving or stationary. Simply place the unit in a convenient location within the vehicle, place the antenna close to the windshield on the dash board or attached to the inside windshield with the supplied suction cup, and plug in the cigarette lighter power adapter. The 5Barz™ mobile unit includes a Blue Tooth speaker phone with caller ID to offer the user the convenience of hands free phone conversation while driving, which is mandated by law in many areas. This product is also expected to retail at about $299.00 and to be introduced in North American in the beginning of 2009. The European and Asian models are expected to be introduced mid-year 2009.

5Barz Product Launch

The 5Barz product launch schedule is coordinated with the marketing plan to first introduce the 5Barz home unit and 5Barz mobile unit in the United States and Canada, operating at the Cellular and PCS frequencies (800/1900MHz). To allow for the marketing of the 5Barz products in Europe and Asia, new models will be launched next that are designed to operate at the ETSI defined frequencies for GSM (900/1800MHz). The development requirement for the new models is primarily limited to the tuning of the US based units for the change of frequency assignments, including replacement of frequency sensitive components such as band pass filters and antennas.

Industry Overview

Given the nature of the CelLynx product line, CelLynx is within the overall cellular telephone market as well as two sub-segments of that market, i.e. the in-building wireless systems marketplace and the vehicle amplifier marketplace.

The overall cellular telephone marketplace

Statistics from the 3GSM World Congress in Barcelona, Spain this year indicate that the number of worldwide mobile subscribers has surpassed the two billion mark and is predicted to reach three billion by the end of this year and four billion by 2011. Demand for cellular applications beyond voice, such as video, SMS, email and internet access have created a multi-billion dollar market for accessorial cellular network products such as CelLynx amplifiers. “Certain user segments have an almost insatiable appetite for connectivity and enhanced access to critical productivity applications while at work, at home and on the move,” according to Cliff Raskind, Strategy Analytics’ director of Wireless Strategies. These early adopters are already driving the market for products that will improve connectivity. Business users are twice as likely to carry a mobile phone as a notebook when away from their desk and are keenly interested in expanding email and internet access to the phone. This increase in bandwidth demand on the cellular network decreases signal strength and increases the need for CelLynx’s 5BARzÔ products.

In spite of the overall proliferation of cell phones, the carriers themselves are suffering from a high rate of customer defections sometimes referred to as churn. According to CITA, The Wireless Association, 40% of those customers switching networks are searching for a better signal. Considering that it costs the average carrier almost $400 to acquire a new subscriber, this global churn rate is the most serious problem affecting the cellular industry and CelLynx is directly addressing this problem through improving indoor and vehicle coverage while diminishing interference. It is also noteworthy that according to First Research, a D & B Company providing Industry Intelligence, 85% of the U.S. Wireless industry revenues are generated by the four major wireless companies, AT&T, Verizon, Sprint and T-Mobile. In the US market, CelLynx will concentrate on adapting its products to the frequencies being used by those carriers, in particular the Dual Band 850/1900MHz. In the International market, CelLynx will focus on the Dual Band 900/1800MHz being used in Europe, Africa, Asia, Australia, New Zealand and most of South America.

CelLynx believes that all of the above market conditions indicate the potential for the success of The CelLynx product line within the general cell phone market. The CelLynx products will seek to attract virtually all cell phone users including those who will come by the product through their cellular and Wi-MAX carriers, enterprise employers, government agencies or military service organizations.

The ‘In Building’ wireless systems marketplace

According to ABI Research, ‘In-building wireless systems, forecasted to exceed $15 billion in revenues in 2013, are a key enabler for delivering on the potential of cellular mobile services.’ Total Telecom, a leading communications periodical, reports that the role of the traditional office is no longer essential for day-to-day productivity as people increasingly work wherever the technology is available, generally at home if not in the office. The US Department of Labor reports that over 20 million workers work at home and this does not include those who work out of a home office to conduct personal business or those who work at home to finish uncompleted tasks from their regular employment or use their home office for outside or after hours employment. More and more workers are adopting the trend toward work-life balance that results in them spending more time at home. These factors reinforce the need for improved signal in the Small Office Home Office. That need is expected to be met by the CelLynx SOHO unit.

The ‘In-Vehicle’ wireless systems marketplace

Three trends are noteworthy when discussing this sub sector: the growth of the number of motor vehicles on the road, the trend indicating the increased number of mobile workers and the trend toward legislation requiring hands free cell phone operation while driving.

According to Plunkett Research, Ltd. there were 806 million automobiles and light trucks on the roads of the world in 2007. That number is expected to increase to one billion by the year 2020. Not so surprisingly, predictions by Analyst House IDC indicate that the number of mobile workers is set to reach one billion by 2011. It is reasonable to assume that as the number of vehicles increase and the number of cell phones increase that the number of drivers using cell phones will also increase.

The National Council of Legislators estimate that 73 % of drivers use their cell phones in the car. That being the case, twenty states and dozens of municipalities have passed legislation requiring hands free cell phones while driving. Anticipating the continuation of this legislative trend, the CelLynx vehicular model is equipped with Bluetooth for hands free, safe driving.

All of the above trends suggest the need for quality voice, data and media solutions in the mobile environment and that the market for user friendly amplifiers such as CelLynx will follow these trends in both growth and application.

Sales and Marketing Strategy

In the US, CelLynx will deploy a multi-channel sales strategy seeking to include: Distribution Partners such as Celluphone, QDI or Advantage; Stocking Partners such as Tesco, Hutton & Brightstar; Cellular Carriers such as AT&T & Verizon; Corporate Accounts such as Accenture, IBM, Remax, Roadway & Hertz; Retail Outlets such as Radio Shack, Comp USA & Best Buy and Web based direct sales.

CelLynx will address the international market place through a Master Global Marketing, Distribution and Service Agreement between CelLynx and Dollardex Group Corp. (“DGC”). DGC intends to build an international marketing and distribution dealer network through its existing relationships in its licensed territories.

Operating and Manufacturing Strategy

CelLynx’s management and engineering teams have extensive experience working with top-tier off shore manufacturers. In fact, this collective team has successfully launched over 150 complex RF products in the past seven years using off shore manufacturers.

Given their expertise in this area they have become acutely aware of the advantages of partnering with a reputable contract manufacturer (CM). In this case, CelLynx will immediately leverage manufacturing practices at minimal cost. In fact, the team has identified several CM candidates in South East Asia. Once a CM is selected CelLynx will immediately benefit from multiple manufacturing locations with a trained and experienced technical work force, state of the art facilities and knowledge of all aspects of supply chain management, operational execution, global logistics and reverse logistics.

An additional benefit to CelLynx is that the CM to be selected will have facilities in California which will produce the first 200 units in coordination with the Company’s engineering team. Once the team has approved these pre-production units, the manufacturing plan will be developed for one of the CM’s Southeast Asia facilities. The 200 units scheduled for the beginning of the second quarter of 2009 availability will then be used for UL testing and product demonstrations.

Competition by Market Segment

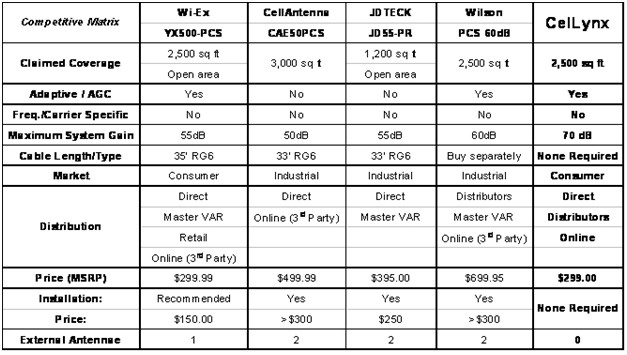

The SOHO or residential wireless amplifier competitors; Most of the companies in this industry do not offer Plug & Play single unit solutions such as CelLynx. In fact, companies such as Wilson, Wi-Ex and CellAntenna, offer two-piece, ‘cable connected amplifier-to-antenna’ solutions requiring complex installation enabled only by tech savvy users or professional installers and at considerably higher prices than CelLynx.

The mobile vehicle market competitors; A few companies such as Digital Antenna and Richardson (Call Capture) are focused on the vehicle market and others such as Wilson are entering that market. Again, however, these vehicle solutions require complex installation including roof top mounting of antenna and, in some cases, a direct connection between the cell phone and the roof top antenna.

The Wireless enterprise solution providers as competitors; While the equipment manufacturers in the enterprise market such as Wilson, EMS Wireless and Radioframe Networks are attempting to enter the the SOHO/residential market, their products are engineered for commercial enterprises requiring complex installation and as a result are expensive as compared to the CelLynx solution.

While each of the above competitors has solutions for certain market segments such as large buildings and warehouses, there is no dominant market leader in the SOHO and Vehicle segments of the Market. CelLynx believes that the total indoor and vehicle cell signal amplification market although now exceeding $300 million annually could experience continued growth through the commercialization of products such as those being offered by CelLynx. As compared to the current products in the marketplace, CelLynx’s key sustainable competitive advantage is in its patent pending technology providing for compact, plug & play, consumer friendly and affordable product lines. An overview of the competition is shown below.

Intellectual Property

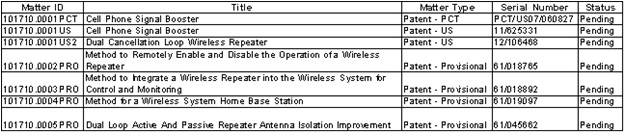

CelLynx has trademark protection for the brand name “5Barz” and has applied for trademark protection for its sales slogan, “Turning Weak Spots into Sweet Spots.” CelLynx has the following patent applications pending:

The CelLynx Technology

The plug-and-play aspects of the CelLynx cellular amplifier demanded complex algorithms and intuitive interfaces. Further complicating the challenge, the repeater required a full duplex linear amplifier providing up to 45db of gain in both RX and TX paths and directional antennae with one inch of separation and 70db of isolation between them. It further required an active feed-forward cancellation in both the RX and TX links with real time correction and an active Automatic Gain Control for both links running in sync with the active feed-forward cancellation. Typically, a repeater simply boosts off the air cell phone signals so operating performance of a repeater can be related to the amount of boost reliability delivered by the repeater.

System gain is the measure of boost in decibels or dB. The major obstacles to reliable gain in a repeater are isolation and linearity. Linearity is a function of the amplification in the active portion of the repeater. Generally, the amplifiers in a repeater are deigned to operate class A and the usable output power is de-rated from the maximum output power by 10dB or 90% below the saturated output of the amplifier. Isolation is the measure of separation of the input from the output of the repeater. If the separation is less than the system gain, the result will be similar to the feedback screech heard when a microphone is placed too close to a loud speaker. In practice, isolation has proven to be the Achilles heel of repeaters because unlike linearity, improvements in isolation have proven to be costly and unmanageable.

Traditionally the low tech approaches to achieving the isolation necessary for adequate repeater performance includes vertical and horizontal spacing of the two antennae, as with a speaker and microphone. In most cases this horizontal spacing requires approximately ten times the distance of vertical spacing. CelLynx has used a high tech approach to deal with the real world environment resulting in a superior product delivering high performance. Not only did the team meet the challenge, but in the process they developed a user friendly, affordable unit that is protected by five pending patents.

Government Regulation and Probability of Affecting Business

Our products are subject to Federal Communications Commission (FCC) and Underwriter Laboratories (UL) certifications. We will submit samples of our products to both agencies according to our product development process. We do not anticipate any difficulty in obtaining these certifications for our products.

In addition, because we plan to market and sell our products in other countries, importation and exportation regulations may impact our activities. A breach of these laws or regulations may result in the imposition of penalties or fines, suspension or revocation of licenses. We are not currently involved in any such judicial or administrative proceedings and believe that we are in compliance with all applicable regulations. Although it is impossible to predict with certainty the effect that additional importation and exportation requirements and other regulations may have on future earnings and operations, we are presently unaware of any future regulations that may have a material effect on our financial position, but cannot rule out the possibility.

Compliance with Environmental Laws

CelLynx is not required to comply with any environmental laws that are particular to the cellular amplifier industry. However, it is company policy to be as environmentally conscience in every aspect of our operations.

Employees

CelLynx has approximately seven (7) full-time employees. In addition, we have hired several consultants to assist with development of our cellular amplifier units. CelLynx is not affiliated with any union or collective bargaining agreement. There have been no adverse labor incidents or work stoppages in the history of CelLynx. Management believes that its relationship with our employees is good.

Corporate Information

CelLynx’s principal executive offices are located at 25910 Acero, Suite 370, Mission Viejo, California 92691. CelLynx’s main telephone number is (949) 305-5290, and our website address is www.CelLynx.com. Information provided on our website, however, is not part of this report and is not incorporated herein.

ITEM 1A. RISK FACTORS

Not applicable.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

We also lease office space in El Dorado Hills, California at 5047 Robert J Mathews Parkway, Suite 400, El Dorado Hills, California 95762. This facility is used for research, development and engineering. The facility is approximately 1,570 square feet. The lease has a one-year term that expires February 21, 2009 and the monthly base rent is $2,198.

We believe that the foregoing facilities are sufficient for our operational needs.

We are not currently involved in any material legal proceedings, nor have we been involved in any such proceedings that have had or may have a significant effect on the Company. We are not aware of any other material legal proceedings pending against us.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

The Company did not submit any matters to a vote of security holders during the fourth quarter of the fiscal year covered by this report.

Market Information

The Company’s common stock, par value $0.001 per share, is traded on the Over-The-Counter Bulletin Board ("OTCBB") under the symbol "CYNX." The following table sets forth, for each quarter within the last two fiscal years, the reported high and low bid quotations for the Company’s common stock as reported on the OTCBB. The bid prices reflect inter-dealer quotations, do not include retail markups, markdowns or commissions and do not necessarily reflect actual transactions.

| QUARTER | HIGH ($) | LOW ($) |

| 1st Quarter 2007 | $0.25 | $0.25 |

| 2nd Quarter 2007 | $0.62 | $0.25 |

| 3rd Quarter 2007 | $0.65 | $0.28 |

| 4th Quarter 2007 | $0.31 | $0.11 |

| 1st Quarter 2008 | $0.19 | $0.12 |

| 2nd Quarter 2008 | $0.23 | $0.12 |

| 3rd Quarter 2008 | $0.35 | $0.18 |

| 4th Quarter 2008 | $0.28 | $0.18 |

Holders

As of October 10, 2008, there were approximately 191 shareholders of record of our common stock based upon the shareholder list provided by our transfer agent. Our transfer agent is Signature Stock Transfer located at 2632 Coachlight Court, Plano, Texas 75093, and their telephone number is (972) 612-4120.

Dividends

We have not declared any dividends on our common stock since our inception. Our current policy is to retain any earnings in order to finance the expansion of our operations. Our board of directors will determine future declaration and payment of dividends, if any, in light of the then-current conditions they deem relevant and in accordance with applicable corporate law. There are no dividend restrictions that limit our ability to pay dividends on our common stock in our Articles of Incorporation or Bylaws. Chapter 78 of the Nevada Revised Statutes (the “NRS”), does provide certain limitations on our ability to declare dividends. Section 78.288 of Chapter 78 of the NRS prohibits us from declaring dividends where, after giving effect to the distribution of the dividend:

| (a) | we would not be able to pay our debts as they become due in the usual course of business; or |

| | |

| (b) | except as may be allowed by our Articles of Incorporation, our total assets would be less than the sum of our total liabilities plus the amount that would be needed, if we were to be dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution of stockholders who may have preferential rights and whose preferential rights are superior to those receiving the distribution. |

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Sales of Unregistered Securities

None.

Not applicable.

| Management’s Discussion and Analysis or Plan of Operation. |

FORWARD LOOKING STATEMENTS

The following discussion and analysis of our results of operations and financial condition for the years ended June 30, 2008 and 2007 should be read in conjunction with our financial statements and the notes to those financial statements that are included elsewhere in this Annual Report on Form 10-K. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors. We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, we do not undertake any obligation to update or keep current either (i) any forward-looking statement to reflect events or circumstances arising after the date of such statement, or (ii) the important factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or which are reflected from time to time in any forward-looking statement.

Overview

On July 24, 2008, the Company acquired all of the outstanding shares of CelLynx-California in exchange for the issuance by the Company of 32,454,922 restricted shares of our common stock to the CelLynx Owners, which represented approximately 40.3% of the then-issued and outstanding common stock of the Company (including the shares issued in the Financing), and 45,516,034 restricted shares of Preferred Stock of the Company, which automatically convert into 45,516,034 shares of common stock of the Company upon the filing of a Certificate of Amendment to the Company’s Articles of Incorporation increasing the number of authorized common stock to at least 150,000,000 shares. As a result of this reverse merger transaction, CelLynx-California became the Company’s wholly owned subsidiary, and the Company acquired the business and operations of CelLynx-California.

Just prior to the closing of the share exchange transaction, on July 23, 2008, we raised $1,575,000 in a private placement by issuing 10,500,000 shares of our common stock and warrants to purchase 10,500,000 shares of our common stock at an exercise price of $0.20 per share to investors. See Item 1.01 of our Form 8-K filed on July 30, 2008 for additional details regarding this equity financing.

We have not generated any revenue since the commencement of our operations on October 11, 2005.

Critical Accounting Policies and Estimates

Our management’s discussion and analysis of our financial condition and results of operations are based on our combined financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements as well as the reported net sales and expenses during the reporting periods. On an ongoing basis, we evaluate our estimates and assumptions. We base our estimates on historical experience and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

While our significant accounting policies are more fully described in Note 3 to our financial statements attached hereto as Exhibit 99.1, we believe that the following accounting policies are the most critical to aid you in fully understanding and evaluating this management discussion and analysis:

Fair Value of Financial Instruments

On January 1, 2008, CelLynx adopted SFAS No. 157, Fair Value Measurements. SFAS No. 157 defines fair value, establishes a three-level valuation hierarchy for disclosures of fair value measurement and enhances disclosures requirements for fair value measures. The carrying amounts reported in the balance sheets for receivables and current liabilities each qualify as financial instruments and are a reasonable estimate of fair value because of the short period of time between the origination of such instruments and their expected realization and their current market rate of interest. The three levels are defined as follows:

| | · | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| | · | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. |

| | · | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

CelLynx analyzes all financial instruments with features of both liabilities and equity under SFAS 150, “Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and Equity,” SFAS No 133, “Accounting for Derivative Instruments and Hedging Activities” and EITF 00-19, “Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company’s Own Stock.”

CelLynx’s share-based compensation liability is carried at fair value totaling $296,267 (unaudited), as of March 31, 2008. The Company used Level 2 inputs for its valuation methodology for the share-based compensation liability, and the fair values is determined by using the Black Scholes option pricing model based on various assumptions.

CelLynx recognized a $1,851 (unaudited) gain, on the change in the share-based compensation liability for the six months ended March 31, 2008, and compensation expense of $208,500 (unaudited) for the six month ended March 31, 2008.

CelLynx did not identify any other non-recurring assets and liabilities that are required to be presented on the balance sheet at fair value in accordance with SFAS No. 157.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Income Taxes

Income taxes are provided based upon the liability method of accounting in accordance with SFAS No. 109, “Accounting for Income Taxes.” Deferred income taxes are recognized for the tax effect of temporary differences between the basis of assets and liabilities for financial statement and income tax purposes. Pursuant to SFAS No. 109, we are required to compute deferred income tax assets for net operating losses carried forward. The potential benefits of net operating losses have not been recognized in these financial statements because the Company cannot be assured it is more likely than not it will utilize the net operating losses carried forward in future years.

We adopted FASB Interpretation 48, “Accounting for Uncertainty in Income Taxes”, during 2007. A tax position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the “more likely than not” test, no tax benefit is recorded. The adoption had no affect on our financial statements.

Stock-Based Compensation

We account for our stock-based compensation for employees in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 123R, "Share-Based Payment, an Amendment of Financial Accounting Standards Board (“FASB”) Statement No. 123." We recognize in the statement of operations the grant-date fair value of stock options and other equity-based compensation issued to employees and non-employees. We use the Black-Scholes option pricing model to value the options issued.

Shares Issued for Services

From time to time, we issued stock for services. Since we were a private company, we used the most recent stock issuance price to determine the value of the services performed.

Patents and Trademarks

Acquired patents and trademarks are capitalized at their acquisition cost or fair value. The legal costs, patent registration fees and models and drawings required for filing patent applications are capitalized if they relate to commercially viable technologies. Commercially viable technologies are those technologies that are projected to generate future positive cash flows in the near term. Legal costs associated with applications that are not determined to be commercially viable are expensed as incurred. All research and development costs incurred in developing the patentable idea are expensed as incurred. Legal fees from the costs incurred in successful defense to the extent of an evident increase in the value of the patents are capitalized.

Capitalized cost for pending patents are amortized on a straight-line basis over the remaining twenty year legal life of each patent after the costs have been incurred. Once each patent or trademark is issued, capitalized costs are amortized on a straight-line basis over a period not to exceed 20 years and 10 years, respectively.

Plan of Operations

Overview

CelLynx is an early stage developer of patent pending technology that allows for the production of the next generation of cell phone amplifiers (also known as repeaters or boosters) for the small office, home office (SOHO) and vehicle. This next generation product, CelLynx 5BARz, is a single piece unit that strengthens weak cellular signals to deliver higher quality signals for voice, data and video reception on cell phones being used indoors or in vehicles. CelLynx has recently completed a prototype SOHO unit which delivers 45 decibel (dB) of gain in a Single Band PCS environment providing up to 1,500 square feet of indoor coverage. This unit measures 6.5 X 7.5 X 2.5 inches, weighs approximately one pound and does not require the installation of antennas or cables in order to function. Most SOHO cellular amplifiers currently on the market require a receiving tower or antenna, usually placed in an attic or on a rooftop, and a transmitting tower or antenna to be placed at least 35 feet from the other antenna with each connected to the amplifier by cable. CelLynx’s patent pending technology eliminates the need to distance the receiving and transmitting towers, allowing the two towers to be placed directly inside the amplifier, resulting in a more affordable, one piece unit sometimes referred to as ‘plug & play’, i.e. requiring no installation other than plugging the unit into a power source. In order to optimize marketability, CelLynx is developing an improved model which it expects to operate in a dual band, PCS and Cellular, environment delivering 65 dB of gain thereby allowing for coverage of 2,500 to 3,000 square feet. This dual band unit would work with all current wireless carriers except Nextel which operates on its own frequency. The PCS network is generally used by the older carriers such as AT&T at 850MHz while the newer carriers such as T-Mobile operate on the Cellular network at 1900 MHz. Management is confident that all of the critical functions required for this dual band unit have been identified and that their engineering team has the capability to accomplish development leading to commercialization.

CelLynx has also developed a mobile unit particularly designed for use in vehicles. This unit currently is an adaptation of the SOHO unit described above. However, CelLynx is currently improving the mobility of that model by developing a single piece amplifier which will measure 3.5 X 5 inches including one built in antenna and another antenna measuring 4 to 6 inches to be attached to any of the windows by suction cup or other portable means. The unit will produce up to 45 dB of gain offering higher performance within the interior of the vehicle cabin while reducing the signal degrading effects of cabling. The mobile unit will feature built in caller ID and Bluetooth speaker phone for hands free driving and will operate in a dual band environment. It will require no installation other than placing the antennae within the cabin of the vehicle and inserting the cigarette lighter power adapter. Unlike the other products on the market, the CelLynx product will not require the installation of a roof top, garage mounted, antenna. As a result, management believes that this consumer friendly product will surpass the competition in market acceptance thereby creating the potential for a mass market distribution channel.

The CelLynx product line is expected to be manufactured by top tier contract manufacturers located in South East Asia. These manufacturers allow CelLynx to capitalize on the full advantages of multiple manufacturing locations with a trained and experienced technical work force, state of the art facilities and knowledge of all aspects of supply chain management, operational execution, global logistics and reverse logistics. The marketing and sales functions will be handled in house incorporating a multi-channel strategy that includes distribution partners, wireless service providers, retail outlets and international joint ventures.

Material Impact of Known Events on Liquidity

There are no known events that are expected to have a material impact on our short-term or long-term liquidity.

Capital Resources

We have financed our operations primarily through proceeds from the issuance of common stock. From January to June 2008, we received approximately $750,000 in equity financing. In July 2008, we also received proceeds of $1,575,000 from a private placement financing transaction. We believe that our current cash, anticipated cash flow from operations, and net proceeds from the private placement financing will be sufficient to meet our anticipated cash needs, including our cash needs for working capital and capital expenditures for at least the next four months. We will need to raise additional capital in order to remain operational beyond this point. We believe we will raise an additional $2,100,000 by the Investors exercising the warrants they were issued in the private placement financing transaction referenced above, however, the Investors are under no obligation to exercise their warrants and there can be no assurances that they will exercise their warrants. We also believe we will receive an additional $10,000,000 from the Distribution Agreement we entered into with Dollardex, however, this funding is contingent on our meeting certain milestones and there can be no assurances that we will meet those milestones. If we receive these funds, we believe we will have sufficient capital to meet our needs for the foreseeable future. If these funds do not materialize, we will need to seek additional financing elsewhere. In addition, we may require additional cash due to changes in business conditions or other future developments, including any investments or acquisitions we may decide to pursue. To the extent it becomes necessary to raise additional cash in the future, we may seek to raise it through the sale of debt or equity securities, funding from joint-venture or strategic partners, debt financing or loans, issuance of common stock or a combination of the foregoing. We currently do not have any binding commitments for, or readily available sources of, additional financing. We cannot provide any assurances that we will be able to secure the additional cash or working capital we may require to continue our operations, either now or in the future.

Contractual Obligations and Off-Balance Sheet Arrangements

Contractual Obligations

CelLynx has certain fixed contractual obligations and commitments that include future estimated payments. Changes in our business needs, cancellation provisions, changing interest rates, and other factors may result in actual payments differing from the estimates. We cannot provide certainty regarding the timing and amounts of payments. We have presented below a summary of the most significant assumptions used in our determination of amounts presented in the tables, in order to assist in the review of this information within the context of our financial position, results of operations, and cash flows.

The following table summarizes CelLynx’s contractual obligations as of June 30, 2008, and the effect these obligations are expected to have on our liquidity and cash flows in future periods.

| Contractual Obligation | | Total | | | Less than 1 year | | | 1-3 years | |

| Note payable | | $ | 250,000 | | | $ | 250,000 | | | $ | - | |

| Stockholder notes | | | 60,000 | | | | - | | | | 60,000 | |

| Operating lease | | | 21,980 | | | | 21,980 | | | | - | |

| Total Contractual Obligations | | $ | 331,980 | | | $ | 271,980 | | | $ | 60,000 | |

Off-Balance Sheet Arrangements

We have not entered into any other financial guarantees or other commitments to guarantee the payment obligations of any third parties. We have not entered into any derivative contracts that are indexed to our shares and classified as stockholder’s equity or that are not reflected in our financial statements. Furthermore, we do not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity or market risk support to such entity. We do not have any variable interest in any unconsolidated entity that provides financing, liquidity, market risk or credit support to us or engages in leasing, hedging or research and development services with us.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

The financial statements are listed in the Index to Financial Statements on page F-1.

ITEM 9. DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURES

None.

Evaluation of Disclosure Controls and Procedures

Regulations under the Securities Exchange Act of 1934 (the "Exchange Act") require public companies to maintain "disclosure controls and procedures," which are defined to mean a company's controls and other procedures that are designed to ensure that information required to be disclosed in the reports that it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time periods specified in the Commission's rules and forms. Our Chief Executive Officer ("CEO") and Chief Financial Officer ("CFO") carried out an evaluation of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this report. Based on those evaluations, as of the Evaluation Date, our CEO and CFO believe that:

(i) our disclosure controls and procedures are designed to ensure that information required to be disclosed by us in the reports we file under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms and that such information is accumulated and communicated to our management, including the CEO and CFO, as appropriate, to allow timely decisions regarding required disclosure; and

(ii) our disclosure controls and procedures are not effective.

Management’s Annual Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as such terms are defined in Rules 13(a) – 15(f) promulgated under the Securities Exchange Act of 1934, as amended. The purpose of an internal control system is to provide reasonable assurance to the Company’s management and board of directors regarding the preparation and fair presentation of published financial statements.

An internal control material weakness is a significant deficiency, or aggregation of deficiencies, that does not reduce to a relatively low level the risk that material misstatements in financial statements will be prevented or detected on a timely basis by employees in the normal course of their work. An internal control significant deficiency, or aggregation of deficiencies, is one that could result in a misstatement of the financial statements that is more than consequential.

Management assessed the effectiveness of the Company’s internal control over financial reporting as of June 30, 2008 and this assessment identified the following material weaknesses in the company’s internal control over financial reporting:

| o | A system of internal controls (including policies and procedures) has neither been designed nor implemented. |

| o | A formal, internal accounting system has not been implemented. |

| o | Appropriate technology systems to ensure reliability of information and record-keeping have not been acquired. |

| o | Management has not organized an Audit Committee to supervise and monitor accounting and financial control initiatives. |

| o | Segregation of duties in the handling of cash, cash receipts, and cash disbursements is not formalized. |

It is Management’s opinion that the above weaknesses exist due to the small size of operating staff and the current R&D phase of operations (e.g., no current sales activity).

In making this assessment, Management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control – Integrated Framework. Because of the material weaknesses described in the preceding paragraph, Management believes that, as of June 30, 2008, the Company’s internal control over financial reporting was not effective based on those criteria.

This annual report does not include an attestation report of the Company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management's report in this annual report.

Changes in Internal Controls

There were no changes in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934, as amended) during the year ended June 30, 2008 that have materially affected, or are reasonably likely to materially affect, our international control over financial reporting.

On August 26, 2008, we entered into a lease agreement (the “Lease”) with Dolphinshire, L.P. for approximately 2,120 square feet of office space located at 25910 Acero, Suite 370, Mission Viejo, California 92691. The term of the Lease is for a period of one year and six months, commencing October 1, 2008 and ending March 31, 2010, with a base rent of $4,664.

The foregoing discussion provides only a brief description of the Lease and is qualified in its entirety by the full text of the Lease, which is attached to this Annual Report on Form 10-K as Exhibit 10.27.

Previous Executive Officers and Directors

As of June 30, 2008, John P. Thornton was the Chief Executive Officer, President, Chief Financial Officer, Secretary, Treasurer and sole Director of the Company.

| Name of Director | Age | Position |

| | | |

| John P. Thornton | 74 | Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer and Director |

John P. Thornton – Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer and Director

Effective April 18, 2006, John P. Thornton was appointed as a member of our board of directors. Mr. Thornton was appointed as our Chief Executive Officer, Chief Financial Officer, President, Secretary and Treasurer as of June 7, 2006. Mr. Thornton has been a self-employed businessman and consultant in the securities industry in the Vancouver, British Columbia area since 1986. During the past five years, Mr. Thornton served as a director of several U.S. and Canadian public companies listed on TSX Venture Exchange, Canadian Venture Exchange, and Over-the-Counter Bulletin Board (“OTCBB”) including:

| · | Bonaventure Enterprises Inc., TSX Venture Exchange; |

| · | Consolidated Odyssey Exploration Inc., TSX Venture Exchange; |

| · | Caesar’s Explorations Inc., Canadian Venture Exchange; |

| · | Goldnev Resources Inc., TSX Venture Exchange; |

| · | Knightsbridge Resources Inc., OTCBB; |

| · | Fairchild International Corp., OTCBB; and |

| · | Patch International Inc., OTCBB. |

In connection with the reverse take-over, Mr. Thornton resigned as our Chief Executive Officer, President, Chief Financial Officer, Secretary and Treasurer effective July 24, 2008, and as a director effective August 21, 2008.

Current Executive Officers and Directors

Our current directors and executive officers, their ages, their respective offices and positions, and their respective dates of election or appointment are as follows:

| Name | | Age | | Position | | Date of Appointment |

| Daniel R. Ash | | 47 | | President, Chief Executive Officer, Chief Operating Officer, Secretary and Director | | July 24, 2008 |

| Tareq Risheq | | 44 | | Chief Strategy Officer and Director | | July 24, 2008 |

| Kevin Pickard | | 44 | | Chief Financial Officer and Treasurer | | July 24, 2008 |

| Robert J. Legendre | | 51 | | Chairman of the Board | | July 24, 2008 |

| Norman W. Collins | | 69 | | Director | | July 24, 2008 |

Daniel R. Ash – President, Chief Executive Officer, Chief Operating Officer, Secretary and Director

Daniel R. Ash currently serves as a Director, President and Chief Executive Officer. Since July of 2006 he has devoted his full time efforts to the development of CelLynx and its products. Mr. Ash has more than 20 years experience in the wireless industry with senior management roles in new product development, engineering, off-shore manufacturing and global operations.

From 1999 to 2006 Mr. Ash held senior positions at Powerwave Technologies, a manufacturer of RF amplifiers and antennae, and was instrumental in its growth from $200M to more than $800M annual revenues. From 1991 to 1999, Mr. Ash held senior positions with Hewlett Packard and was responsible for the transfer of RF cell phone amplifier modules to high volume production in Malaysia ramping production to over one million amplifiers per month.