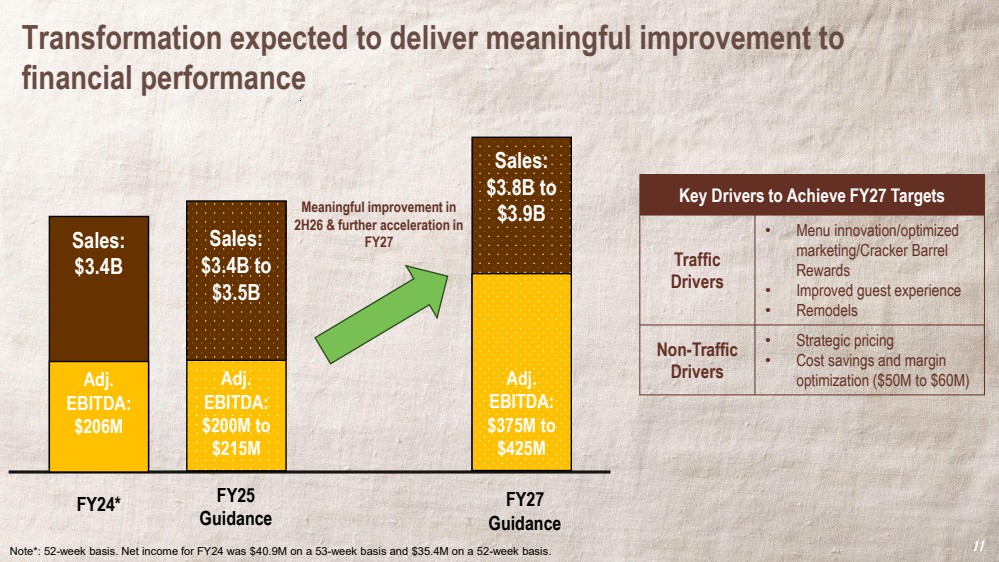

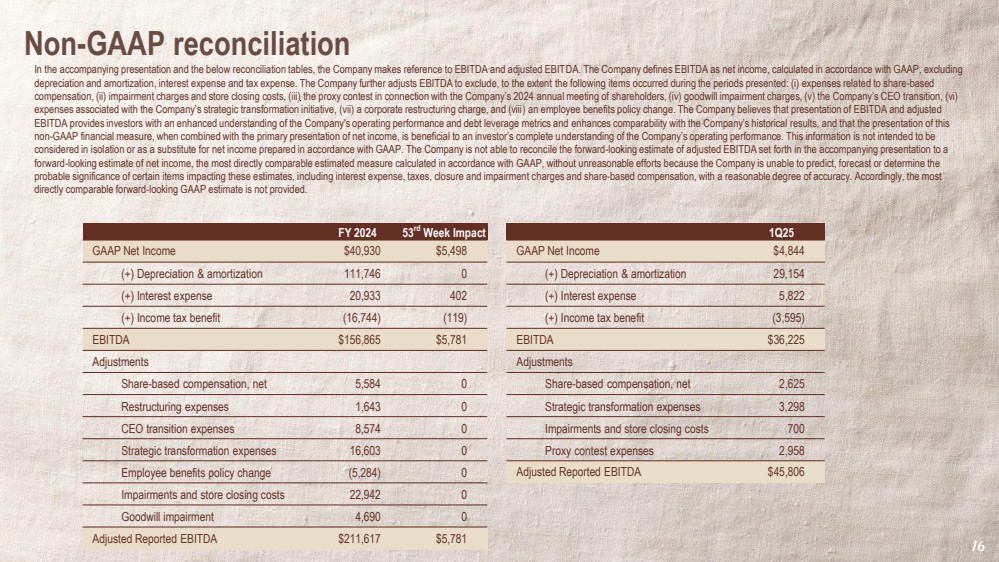

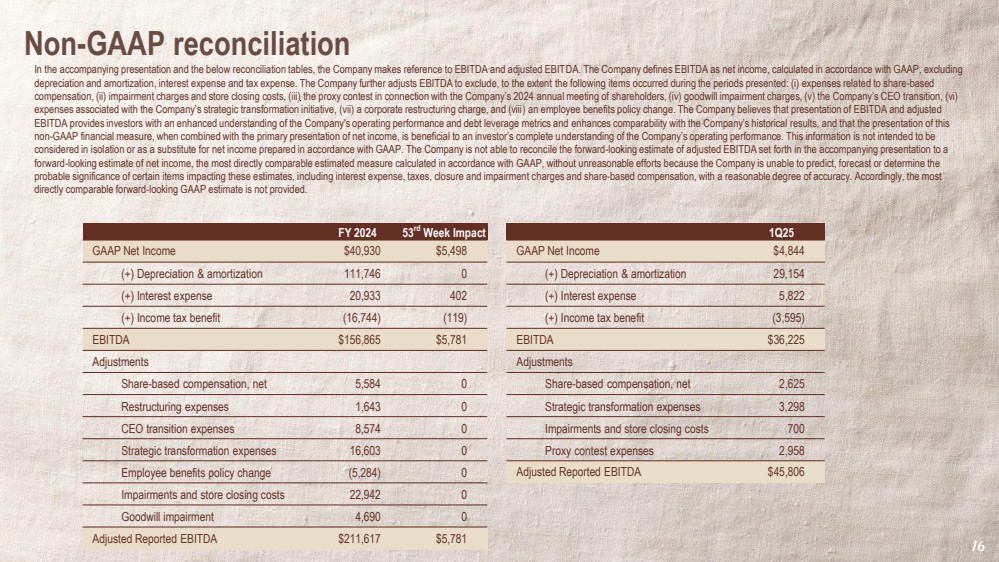

| DENTSU CREATIVE Non-GAAP reconciliation 16 In the accompanying presentation and the below reconciliation tables, the Company makes reference to EBITDA and adjusted EBITDA. The Company defines EBITDA as net income, calculated in accordance with GAAP, excluding depreciation and amortization, interest expense and tax expense. The Company further adjusts EBITDA to exclude, to the extent the following items occurred during the periods presented: (i) expenses related to share-based compensation, (ii) impairment charges and store closing costs, (iii) the proxy contest in connection with the Company’s 2024 annual meeting of shareholders, (iv) goodwill impairment charges, (v) the Company’s CEO transition, (vi) expenses associated with the Company’s strategic transformation initiative, (vii) a corporate restructuring charge, and (viii) an employee benefits policy change. The Company believes that presentation of EBITDA and adjusted EBITDA provides investors with an enhanced understanding of the Company's operating performance and debt leverage metrics and enhances comparability with the Company’s historical results, and that the presentation of this non-GAAP financial measure, when combined with the primary presentation of net income, is beneficial to an investor’s complete understanding of the Company’s operating performance. This information is not intended to be considered in isolation or as a substitute for net income prepared in accordance with GAAP. The Company is not able to reconcile the forward-looking estimate of adjusted EBITDA set forth in the accompanying presentation to a forward-looking estimate of net income, the most directly comparable estimated measure calculated in accordance with GAAP, without unreasonable efforts because the Company is unable to predict, forecast or determine the probable significance of certain items impacting these estimates, including interest expense, taxes, closure and impairment charges and share-based compensation, with a reasonable degree of accuracy. Accordingly, the most directly comparable forward-looking GAAP estimate is not provided. FY 2024 53rd Week Impact GAAP Net Income $40,930 $5,498 (+) Depreciation & amortization 111,746 0 (+) Interest expense 20,933 402 (+) Income tax benefit (16,744) (119) EBITDA $156,865 $5,781 Adjustments Share-based compensation, net 5,584 0 Restructuring expenses 1,643 0 CEO transition expenses 8,574 0 Strategic transformation expenses 16,603 0 Employee benefits policy change (5,284) 0 Impairments and store closing costs 22,942 0 Goodwill impairment 4,690 0 Adjusted Reported EBITDA $211,617 $5,781 1Q25 GAAP Net Income $4,844 (+) Depreciation & amortization 29,154 (+) Interest expense 5,822 (+) Income tax benefit (3,595) EBITDA $36,225 Adjustments Share-based compensation, net 2,625 Strategic transformation expenses 3,298 Impairments and store closing costs 700 Proxy contest expenses 2,958 Adjusted Reported EBITDA $45,806 |